Using the Quantum Potential in Elementary Portfolio Management: Some Initial Ideas

Abstract

1. Introduction

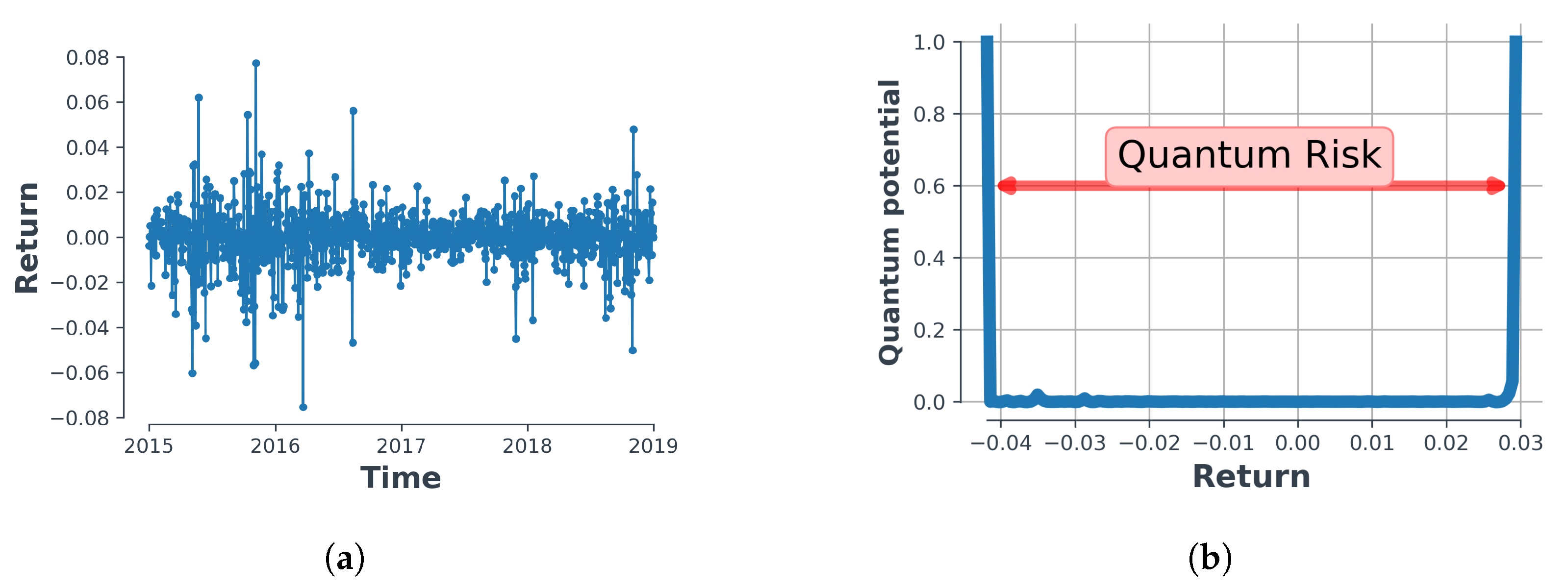

2. The Quantum Potential and a First Look at What We Call ‘Quantum Risk’

3. Portfolio Optimization

- I

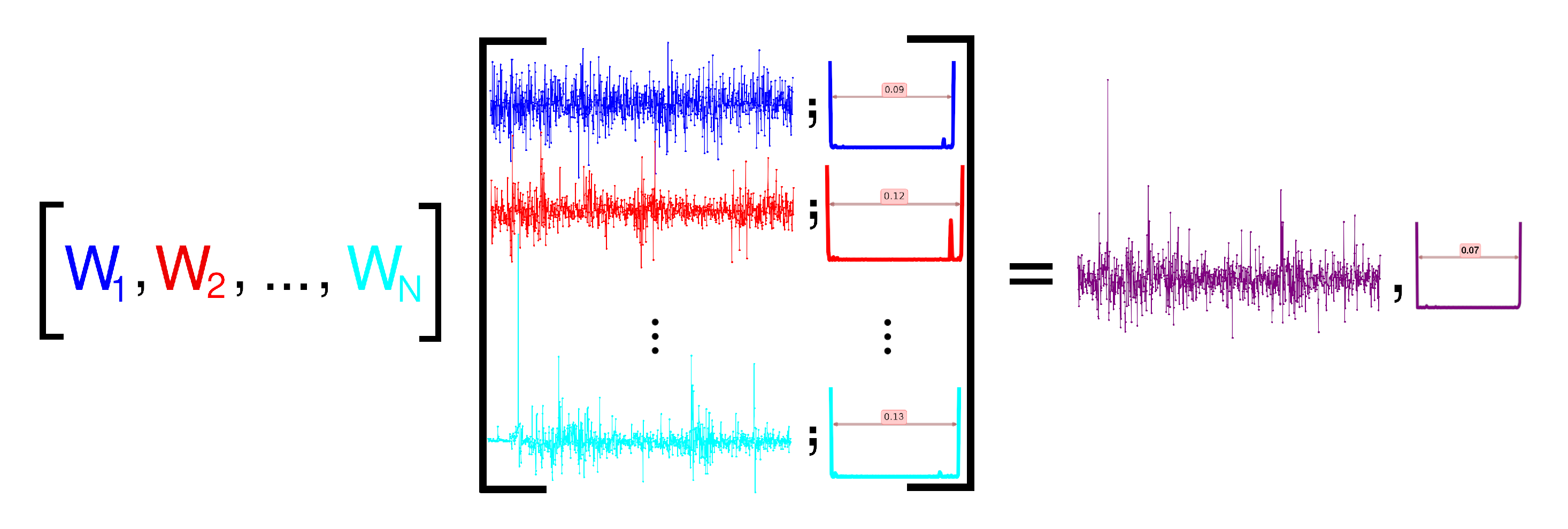

- Data input:In the process of optimization, the first step is to collect each component of the portfolio time series data and enter them into the program as input. The markets used in the following manuscript as input of the algorithm are Dow Jones industrial, S&P 500 composite, FTSE 100, TOPIX, DAX 30 performance, NIKKEI 225, Korea SE composite and the Shanghai SE A Share. Each of the aforementioned indices can be traded within stock exchange markets and hence, they can form any arbitrary portfolio.

- II

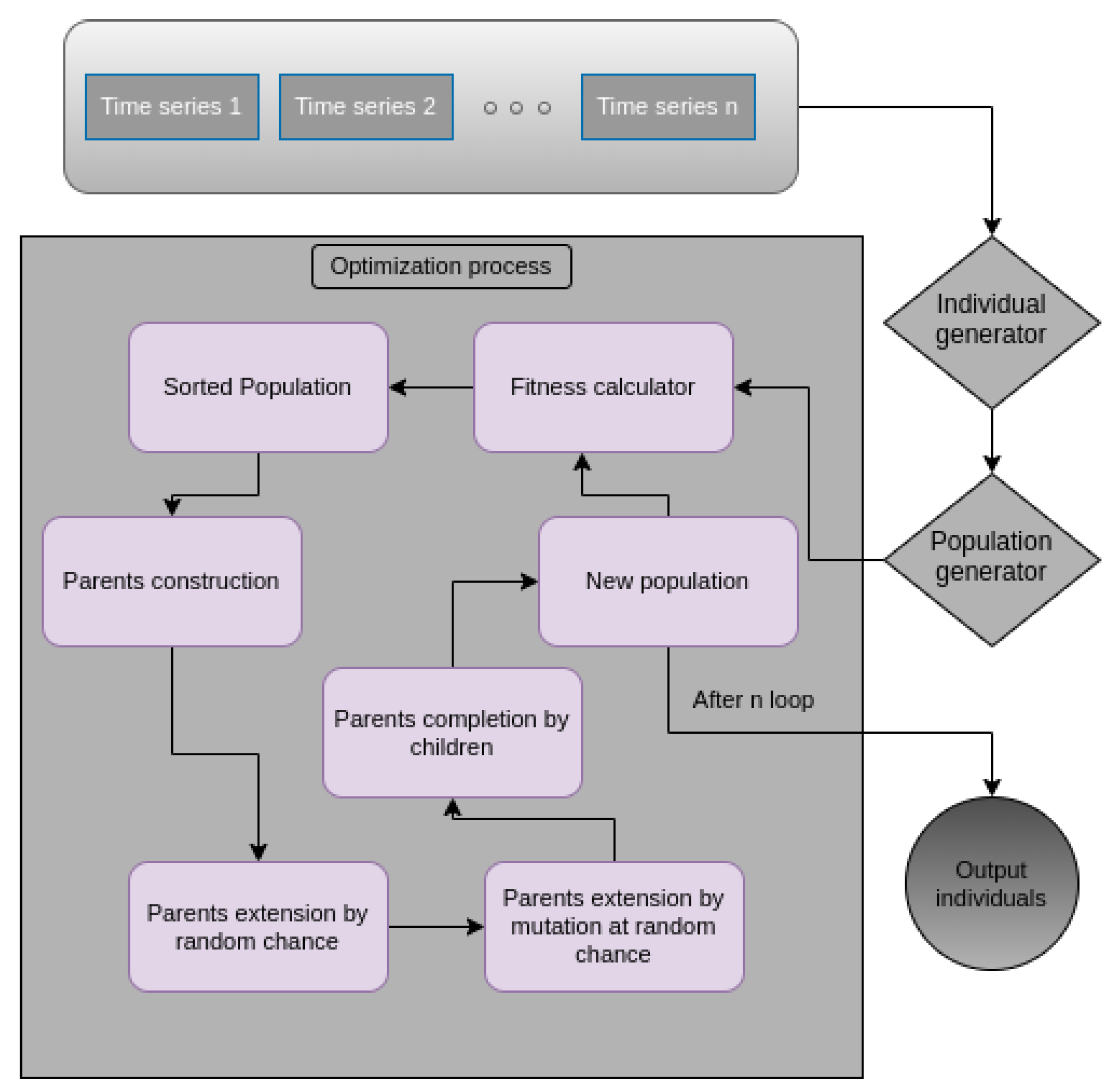

- Constructing weight population:After the given set of market series, we need an individual set of weights to initialize portfolio construction as indicated in Equation (2). In the genetic algorithm, a group of randomly generated individuals, called population, will be generated. The populations as well as the set of markets series will be the input of the evolving genetic algorithm. The Pseudo-code of the process is presented in the Appendix A.

- III

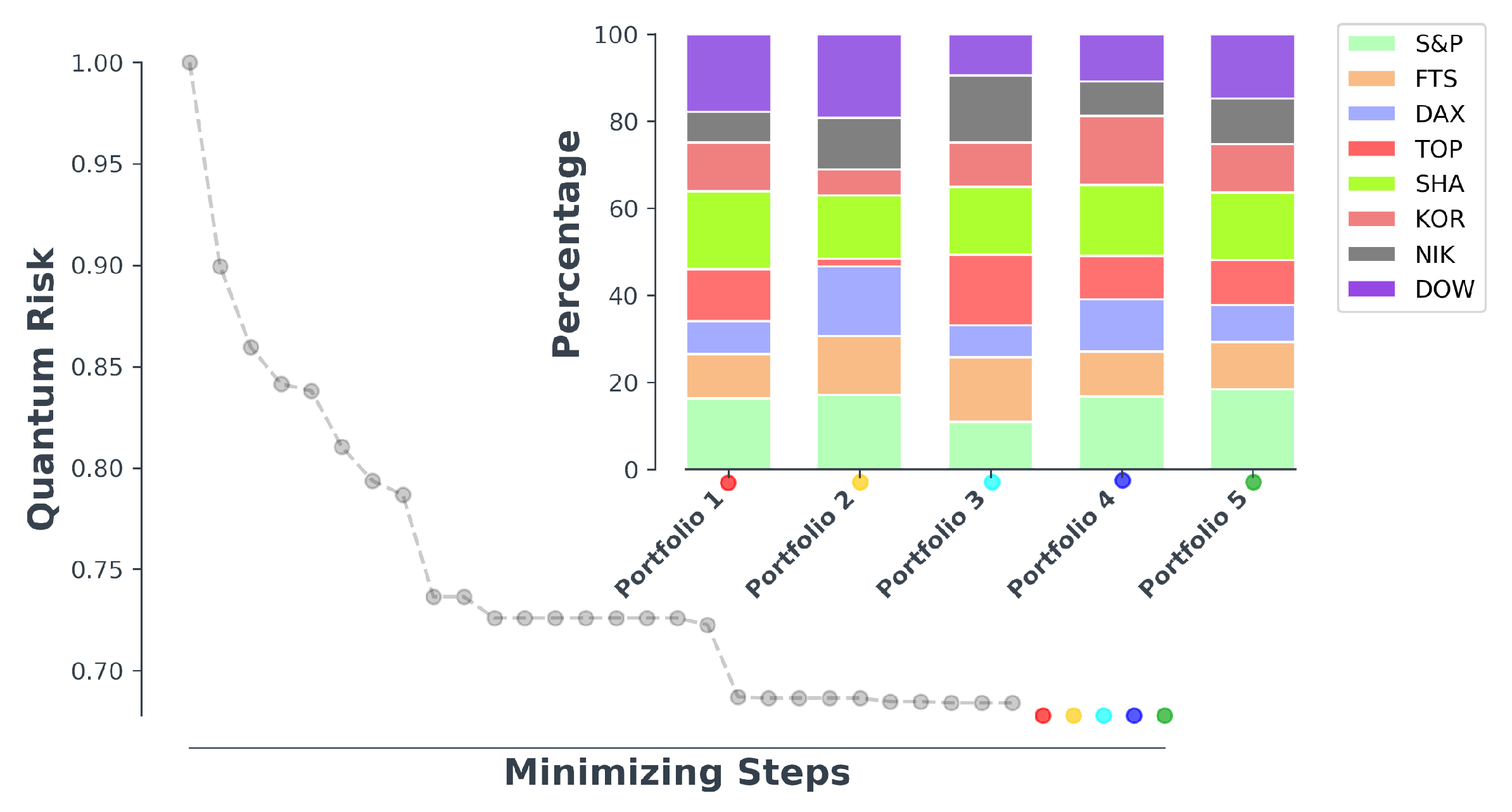

- Optimization of population:Once we have the initial random populations to start with, we can evolve the population using genetic algorithm techniques and generate new populations with lower risks. The Pseudo-code of the optimization process using genetic algorithm as well as the flowchart of the process is provided for you at the end of the paper.In the above Pseudo-code, data is a list composed of all the markets time-series in which, data[i] would be the time-series of i’th market. At each step of the optimization process, the minimum fitness would be saved in order to be an indication of that step. The next paragraph will depict the results of optimization process discussed in here.

4. Comparing Standard and Quantum Risk

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. Flowchart of the Optimization Process

References

- Jorion, P. International portfolio diversification with estimation risk. J. Bus. 1985, 58, 259–278. [Google Scholar] [CrossRef]

- Markowitz, H.M. Foundations of portfolio theory. J. Financ. 1991, 46, 469–477. [Google Scholar] [CrossRef]

- Markowitz, H.M. The early history of portfolio theory: 1600–1960. Financ. Anal. J. 1999, 55, 5–16. [Google Scholar] [CrossRef]

- Best, M.J.; Grauer, R.G. Positively weighted minimum–variance portfolios and the structure of asset expected returns. J. Financ. Quant. Anal. 1992, 27, 513–537. [Google Scholar] [CrossRef]

- Green, R.C.; Hollifield, B. When will mean–variance efficient portfolios be well diversified? J. Financ. 1992 7, 1785–1809. [CrossRef]

- Jagannathan, R.; Ma, T. Risk reduction in large portfolios: Why imposing the wrong constraints helps. J. Financ. 2003, 58, 1651–1683. [Google Scholar] [CrossRef]

- Ledoit, O.; Wolf, M. Improved estimation of the covariance matrix of stock returns with an application to portfolio selection. J. Empir. Financ. 2003, 10, 603–621. [Google Scholar] [CrossRef]

- Laloux, L.; Cizeau, P.; Bouchaud, J.P.; Potters, M. Noise dressing of financial correlation matrices. Phys. Rev. Lett. 1999, 83, 1467. [Google Scholar] [CrossRef]

- Plerou, V.; Gopikrishnan, P.; Rosenow, B.; Amaral, L.A.N.; Stanley, H.E. Universal and nonuniversal properties of cross correlations in financial time series. Phys. Rev. Lett. 1999, 83, 1471. [Google Scholar] [CrossRef]

- Rosenow, B.; Plerou, V.; Gopikrishnan, P.; Stanley, H.E. Portfolio optimization and the random magnet problem. Europhys. Lett. 2002, 59, 500. [Google Scholar] [CrossRef]

- Potters, M.; Bouchaud, J.P.; Laloux, L. Financial applications of random matrix theory: Old laces and new pieces. arXiv 2005, arXiv:0507111. [Google Scholar]

- Anderberg, M.R. Cluster Analysis for Applications. A Volume in Probability and Mathematical Statistics: A Series of Monographs and Textbooks; Academic Press: New York, NY, USA, 1973. [Google Scholar]

- Imre, K.; Szilard, P.; Gabor, N. Noise sensitivity of portfolio selection under various risk measures. J. Bank. Financ. 2007, 31, 1545–1573. [Google Scholar]

- Szilard, P.; Imre, K. Noisy covariance matrices and portfolio optimization II. Phys. A 2003, 319, 487–494. [Google Scholar]

- Coelho, R.; Gilmore, C.G.; Lucey, B.; Richmond, P.; Hutzler, S. The evolution of interdependence in world equity markets: Evidence from minimum spanning trees. Phys. A 2007, 376, 455–466. [Google Scholar] [CrossRef]

- Bolgorian, M.; Shirazi, A.H.; Jafari, G.R. Portfolio selection using level crossing analysis. Int. J. Mod. Phys. 2011, 22, 841–848. [Google Scholar] [CrossRef]

- Khrennikov, A. Classical and quantum mechanics on information spaces with applications to cognitive, psychological, social, and anomalous phenomena. Found. Phys. 1999, 29, 1065–1098. [Google Scholar] [CrossRef]

- Khrennikov, A. Ubiquitous Quantum Structure: From Psychology to Finance; Springer Nature: Berlin, Germany, 2010. [Google Scholar]

- Segal, W.; Segal, I.E. The Black–Scholes pricing formula in the quantum context. Proc. Natl. Acad. Sci. USA 1998, 95, 4072–4075. [Google Scholar] [CrossRef]

- Bagarello, F. Quantum Dynamics for Classical Systems; J. Wiley: Hoboken, NJ, USA, 2013. [Google Scholar]

- Bagarello, F. An operatorial approach to stock markets. J. Phys. A 2006, 39, 6823. [Google Scholar] [CrossRef]

- Haven, E.; Khrennikov, A.; Ma, C.; Sozzo, S. Special section on “Quantum Probability Theory and its Economic Applications”. J. Math. Econ. 2018, 78, 127–197. [Google Scholar] [CrossRef]

- Choustova, O. Quantum probability and financial market. Inform. Sci. 2009, 179, 478–484. [Google Scholar] [CrossRef]

- Tahmasebi, F.; Meskinimood, S.; Namaki, A.; Farahani, S.V.; Jalalzadeh, S.; Jafari, G. Financial market images: A practical approach owing to the secret quantum potential. Eur. Phys. Lett. 2015, 109, 30001. [Google Scholar] [CrossRef]

- Shen, C.; Haven, E. Using empirical data to estimate potential functions in commodity markets: Some initial results. Int. J. Theor. Phys. 2017, 56, 4092–4104. [Google Scholar] [CrossRef]

- Nasiri, S.; Bektas, E.; Jafari, G. Risk information of stock market using quantum potential constraints. In Emerging Trends in Banking and Finance; Springer: Berlin, Germany, 2018; pp. 132–138. [Google Scholar]

- Nasiri, S.; Bektas, E.; Jafari, G. The impact of trading volume on the stock market credibility: Bohmian quantum potential approach. Physica A 2018, 512, 1104–1112. [Google Scholar] [CrossRef]

- Holland, P. The Quantum Theory of Motion: An Account of the de Broglie–Bohm Causal Interpretation of Quantum Mechanics; Cambridge University Press: Cambridge, UK, 1995. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Khaksar, H.; Haven, E.; Nasiri, S.; Jafari, G. Using the Quantum Potential in Elementary Portfolio Management: Some Initial Ideas. Entropy 2021, 23, 180. https://doi.org/10.3390/e23020180

Khaksar H, Haven E, Nasiri S, Jafari G. Using the Quantum Potential in Elementary Portfolio Management: Some Initial Ideas. Entropy. 2021; 23(2):180. https://doi.org/10.3390/e23020180

Chicago/Turabian StyleKhaksar, Hossein, Emmanuel Haven, Sina Nasiri, and Gholamreza Jafari. 2021. "Using the Quantum Potential in Elementary Portfolio Management: Some Initial Ideas" Entropy 23, no. 2: 180. https://doi.org/10.3390/e23020180

APA StyleKhaksar, H., Haven, E., Nasiri, S., & Jafari, G. (2021). Using the Quantum Potential in Elementary Portfolio Management: Some Initial Ideas. Entropy, 23(2), 180. https://doi.org/10.3390/e23020180