Combined Stochastic Process and Value at Risk: A Real-World Information System Decision Case

Abstract

1. Introduction

- (1)

- How can one design a formal evaluation framework for future studies and for practitioners to apply VaR in the IS/IT field?

- (2)

- Does the concept of “minimizing benefits at risk” behind VaR provide different results than the concept of “maximizing fluctuating benefits” behind real options?

2. Literature Review

3. The Electronic Commerce Decision

4. Empirical Analysis

5. Conclusions and Implications

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A. Supplementary Data (Variance = 75%)

| Pinpoint Prediction for Sales | Investment Cost | Operational Costs | Value at Risk Sales Uncertainty Modeled with Geometric Brownian Motion (Variance = 75%) | |||||

|---|---|---|---|---|---|---|---|---|

| 60% | 80% | 90% | 95% | 99% | ||||

| January 1987 | $0 | −$400,000 | - | $0 | $0 | $0 | $0 | $0 |

| July 1987 | $0 | - | - | $0 | $0 | $0 | $0 | $0 |

| January 1988 | $353 | - | −$20,000 | $353 | $353 | $353 | $353 | $353 |

| July 1988 | $861 | - | −$20,000 | $771 | $561 | $455 | $381 | $262 |

| January 1989 | $2097 | - | −$20,000 | $1812 | $1068 | $807 | $698 | $444 |

| July 1989 | $5109 | - | −$20,000 | $3524 | $2100 | $1386 | $1119 | $643 |

| January 1990 | $12,447 | - | −$20,000 | $8518 | $5073 | $3571 | $2773 | $1847 |

| July 1990 | $30,326 | - | −$20,000 | $20,963 | $10,958 | $7699 | $5314 | $3347 |

| January 1991 | $73,886 | - | −$20,000 | $46,811 | $22,175 | $15,785 | $11,624 | $7193 |

| July 1991 | $180,015 | - | −$20,000 | $120,899 | $51,472 | $32,159 | $23,189 | $13,769 |

| January 1992 | $438,588 | - | −$20,000 | $329,482 | $146,501 | $86,522 | $56,188 | $33,836 |

Appendix B. Supplementary Data (Variance = 100%)

| Pinpoint Prediction for Sales | Investment Cost | Operational Costs | Value at Risk Sales Uncertainty Modeled with Geometric Brownian Motion (Variance = 100%) | |||||

|---|---|---|---|---|---|---|---|---|

| 60% | 80% | 90% | 95% | 99% | ||||

| January 1987 | $0 | −$400,000 | - | $0 | $0 | $0 | $0 | $0 |

| July 1987 | $0 | - | - | $0 | $0 | $0 | $0 | $0 |

| January 1988 | $353 | - | −$20,000 | $353 | $353 | $353 | $353 | $353 |

| July 1988 | $861 | - | −$20,000 | $721 | $452 | $347 | $288 | $165 |

| January 1989 | $2097 | - | −$20,000 | $1661 | $1029 | $722 | $606 | $330 |

| July 1989 | $5109 | - | −$20,000 | $3181 | $1608 | $1065 | $723 | $409 |

| January 1990 | $12,447 | - | −$20,000 | $10,073 | $4317 | $2281 | $1427 | $777 |

| July 1990 | $30,326 | - | −$20,000 | $18,137 | $9420 | $5513 | $3924 | $1847 |

| January 1991 | $73,886 | - | −$20,000 | $33,807 | $14,523 | $8583 | $5563 | $3058 |

| July 1991 | $180,015 | - | −$20,000 | $122,061 | $42,459 | $22,216 | $15,233 | $8048 |

| January 1992 | $438,588 | - | −1$20,000 | $243,754 | $93,322 | $50,802 | $32,387 | $17,497 |

References

- Abu-Shanab, E.; Hammouri, Q.; Al-Sebae, M.T. Justifying IT Investment: Extension of a Model using a Case Study from Jordan. Orient. J. Comput. Sci. Technol. 2018, 12, 39–49. [Google Scholar] [CrossRef]

- Whisler, T.L.; Leavitt, H.J. Management in the 1980’s. Harv. Bus. Rev. 1958, 36, 41–48. [Google Scholar]

- Mehrotra, M.C. Ethics: It’s Importance, Role and Code in Information Technology. Int. J. Adv. Res. Comput. Sci. Softw. Eng. 2012, 2, 417–421. [Google Scholar]

- Drnevich, P.L.; Croson, D.C. Information technology and business-level strategy: Toward an integrated theoretical perspective. MIS Q. 2013, 37, 483–509. [Google Scholar] [CrossRef]

- Nascimento, D.C.; Barbosa, B.; Perez, A.M.; Caires, D.O.; Hirama, E.; Ramos, P.L.; Louzada, F. Risk Management in E-Commerce-A Fraud Study Case Using Acoustic Analysis through Its Complexity. Entropy 2019, 21, 1087. [Google Scholar] [CrossRef]

- Hitt, L.M.; Wu, D.J.; Zhou, X.G. Investment in Enterprise Resource Planning: Business impact and productivity measures. J. Manag. Inf. Syst. 2002, 19, 71–98. [Google Scholar] [CrossRef]

- Smithson, S.; Hirschheim, R. Analysing information systems evaluation: Another look at an old problem. Eur. J. Inf. Syst. 1998, 7, 158–174. [Google Scholar] [CrossRef]

- Hakkinen, L.; Hilmola, O.P. ERP evaluation during the shakedown phase: Lessons from an after-sales division. Inform. Syst. J. 2008, 18, 73–100. [Google Scholar] [CrossRef]

- Maresova, P.; Sobeslav, V.; Krejcar, O. Cost-benefit analysis-evaluation model of cloud computing deployment for use in companies. Appl. Econ. 2017, 49, 521–533. [Google Scholar] [CrossRef]

- Willcocks, L. Information Management: The Evaluation of Information Systems Investments; Springer: Berlin/Heidelberg, Germany, 2013. [Google Scholar]

- Cha, E.J.; Ellingwood, B.R. The relation between cost-benefit analysis and risk acceptance in regulatory decision-making. Int. J. Risk Assess. Manag. 2019, 22, 44–62. [Google Scholar] [CrossRef]

- Zhao, W.; Wang, A.; Chen, Y. How to Maintain the Sustainable Development of a Business Platform: A Case Study of Pinduoduo Social Commerce Platform in China. Sustainability 2019, 11, 6337. [Google Scholar] [CrossRef]

- Choi, E.; Lee, K.C. Effect of Trust in Domain-Specific Information of Safety, Brand Loyalty, and Perceived Value for Cosmetics on Purchase Intentions in Mobile E-Commerce Context. Sustainability 2019, 11, 6257. [Google Scholar] [CrossRef]

- Gupta, S. Theory of constraints unleashes product development. Ind. Manag. 2017, 59, 12–17. [Google Scholar]

- Laracy, J.R.; Marlowe, T. A Real Options Analysis of Spacecraft Software Product Line Architectures. Am. J. Eng. Technol. Manag. 2019, 4, 47–56. [Google Scholar] [CrossRef]

- Dos Santos, B.L. Justifying investment in new information technologies. J. Manag. Inf. Syst. 1991, 7, 71–89. [Google Scholar] [CrossRef]

- Benaroch, M.; Kauffman, R.J. Justifying electronic banking network expansion using real options analysis. MIS Q. 2000, 24, 197–225. [Google Scholar] [CrossRef]

- Kumar, R.L. Managing risks in IT projects: An options perspective. Inf. Manag. 2002, 40, 63–74. [Google Scholar] [CrossRef]

- Taudes, A.; Feurstein, M.; Mild, A. Options analysis of software platform decisions: A case study. MIS Q. 2000, 24, 227–243. [Google Scholar] [CrossRef]

- Svavarsson, D. Evaluation of Strategic IT Platform Investments. Available online: https://gupea.ub.gu.se/handle/2077/3054 (accessed on 26 December 2019).

- Wu, F.; Li, H.Z.; Chu, L.K.; Sculli, D.; Gao, K. An approach to the valuation and decision of ERP investment projects based on real options. Ann. Oper. Res. 2009, 168, 181–203. [Google Scholar] [CrossRef]

- Lee, I.; Lee, K. The Internet of Things (IoT): Applications, investments, and challenges for enterprises. Bus. Horiz. 2015, 58, 431–440. [Google Scholar] [CrossRef]

- Park, E.H.; Ramesh, B.; Cao, L. Emotion in IT investment decision making with a real options perspective: The intertwining of cognition and regret. J. Manag. Inf. Syst. 2016, 33, 652–683. [Google Scholar] [CrossRef]

- Benaroch, M. Real Options Models for Proactive Uncertainty-Reducing Mitigations and Applications in Cybersecurity Investment Decision Making. Inf. Syst. Res. 2018, 29, 315–340. [Google Scholar] [CrossRef]

- Jorion, P. Value at Risk; McGraw-Hill Education: New York, NY, USA, 2006; Available online: https://www.amazon.com/Value-Risk-Benchmark-Managing-Financial/dp/0071464956 (accessed on 26 December 2019).

- Song, H.; Zeng, X.; Chen, Y.; Hu, Y. Multivariate Shortfall and Divergence Risk Statistics. Entropy 2019, 21, 1031. [Google Scholar] [CrossRef]

- Han, K.; Kauffman, R.J.; Nault, B.R. Information exploitation and interorganizational systems ownership. J. Manag. Inf. Syst. 2004, 21, 109–135. [Google Scholar] [CrossRef]

- Benaroch, M.; Jeffery, M.; Kauffman, R.J.; Shah, S. Option-based risk management: A field study of sequential information technology investment decisions. J. Manag. Inf. Syst. 2007, 24, 103–140. [Google Scholar] [CrossRef]

- Fielder, A.; Panaousis, E.; Malacaria, P.; Hankin, C.; Smeraldi, F. Decision support approaches for cyber security investment. Decis. Support Syst. 2016, 86, 13–23. [Google Scholar] [CrossRef]

- Tsay, R.S. Analysis of Financial Time Series; Wiley: Hoboken, NJ, USA, 2014. [Google Scholar]

- Dixit, A.K.; Pindyck, R.S. Investment Under Uncertainty; Princeton University Press: Princeton, NJ, USA, 1994. [Google Scholar]

- Duffie, D.; Pan, J. An overview of value at risk. J. Deriv. 1997, 4, 7–49. [Google Scholar] [CrossRef]

- Calabrese, R.; Giudici, P. Estimating bank default with generalised extreme value regression models. J. Oper. Res. Soc. 2015, 66, 1783–1792. [Google Scholar] [CrossRef]

- Giudici, P.; Bilotta, A. Modelling operational losses: A Bayesian approach. Qual. Reliab. Eng. Int. 2004, 20, 407–417. [Google Scholar] [CrossRef]

- Figini, S.; Giudici, P. Statistical merging of rating models. J. Oper. Res. Soc. 2011, 62, 1067–1074. [Google Scholar] [CrossRef]

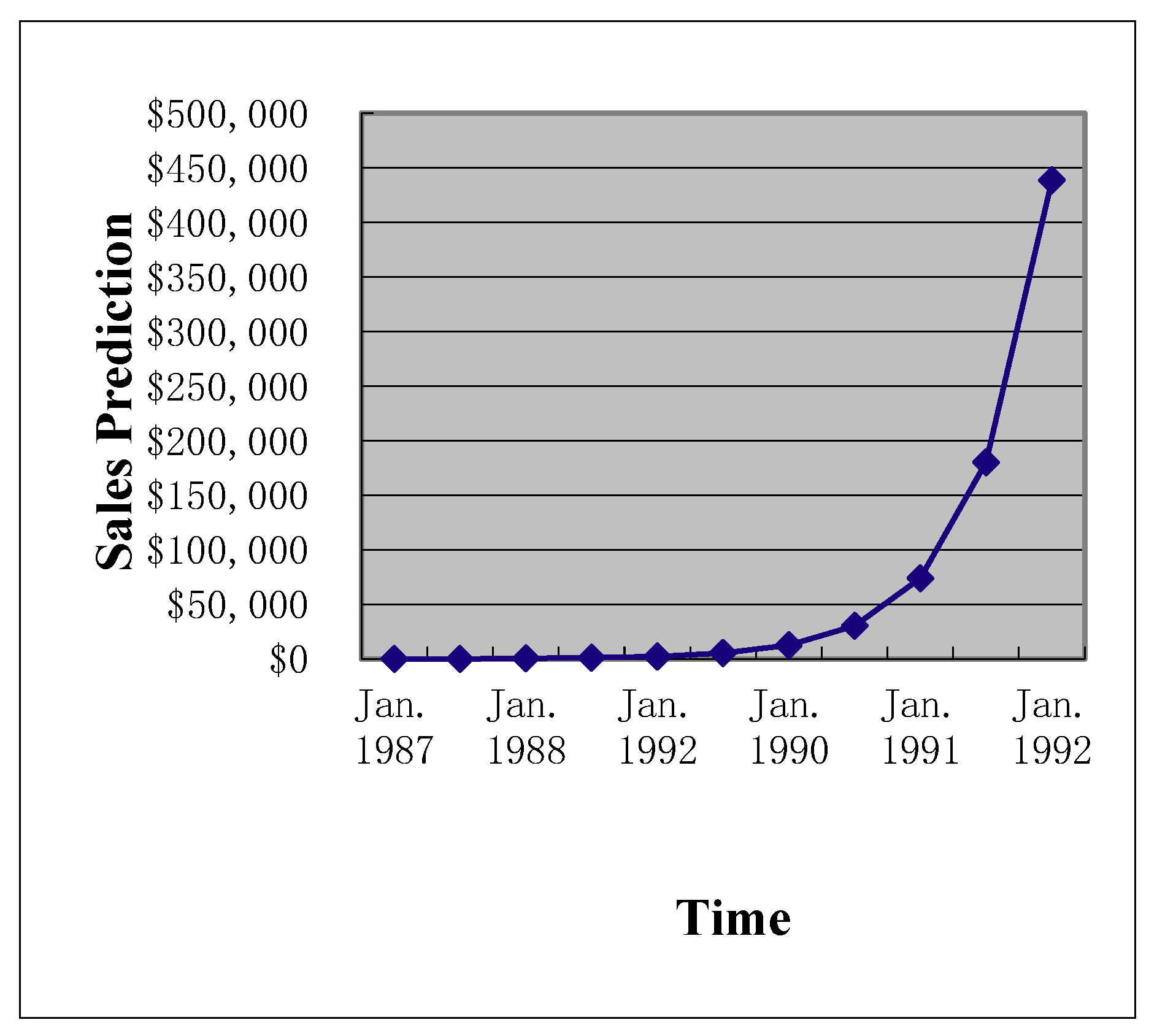

| Month | Year | Number of Transactions | Operational Revenues | Operational Costs | Net Revenues | Investment Costs | Cash Flows |

|---|---|---|---|---|---|---|---|

| January | 1987 | 0 | $0 | $0 | $0 | $400,000 | −$400,000 |

| July | 1987 | 0 | $0 | $0 | $0 | $0 | $0 |

| January | 1988 | 3532 | $353 | $20,000 | −$19,647 | $0 | −$19,647 |

| July | 1988 | 8606 | $861 | $20,000 | −$19,139 | $0 | −$19,139 |

| January | 1989 | 20,969 | $2097 | $20,000 | −$17,903 | $0 | −$17,903 |

| July | 1989 | 51,088 | $5109 | $20,000 | −$14,891 | $0 | −$14,891 |

| January | 1990 | 124,470 | $12,447 | $20,000 | −$7553 | $0 | −$7553 |

| July | 1990 | 303,258 | $30,326 | $20,000 | $10,326 | $0 | $10,326 |

| January | 1991 | 738,857 | $73,886 | $20,000 | $53,886 | $0 | $53,886 |

| July | 1991 | 1,800,149 | $180,015 | $20,000 | $160,015 | $0 | $160,015 |

| January | 1992 | 4,385,877 | $438,588 | $20,000 | $418,588 | $0 | $418,588 |

| Month | Year | Number of Transactions | Operational Revenues (X) | Formula (1) Transformed by X = ln(x) | Value Return by X = e | |

|---|---|---|---|---|---|---|

| 0 | January | 1987 | 0 | $0 | 0 | $0 |

| 1 | July | 1987 | 0 | $0 | 0 | $0 |

| 2 | January | 1988 | 3532 | $353 | 5.8 | $353 |

| 3 | July | 1988 | 8606 | $861 | 6.8 | $860 |

| 4 | January | 1989 | 20,969 | $2097 | 7.6 | $2095 |

| 5 | July | 1989 | 51,088 | $5109 | 8.5 | $5105 |

| 6 | January | 1990 | 124,470 | $12,447 | 9.4 | $12,438 |

| 7 | July | 1990 | 303,258 | $30,326 | 10.3 | $30,305 |

| 8 | January | 1991 | 738,857 | $73,886 | 11.2 | $73,834 |

| 9 | July | 1991 | 1,800,149 | $180,015 | 12.1 | $179,890 |

| 10 | January | 1992 | 4,385,877 | $438,588 | 13.0 | $438,283 |

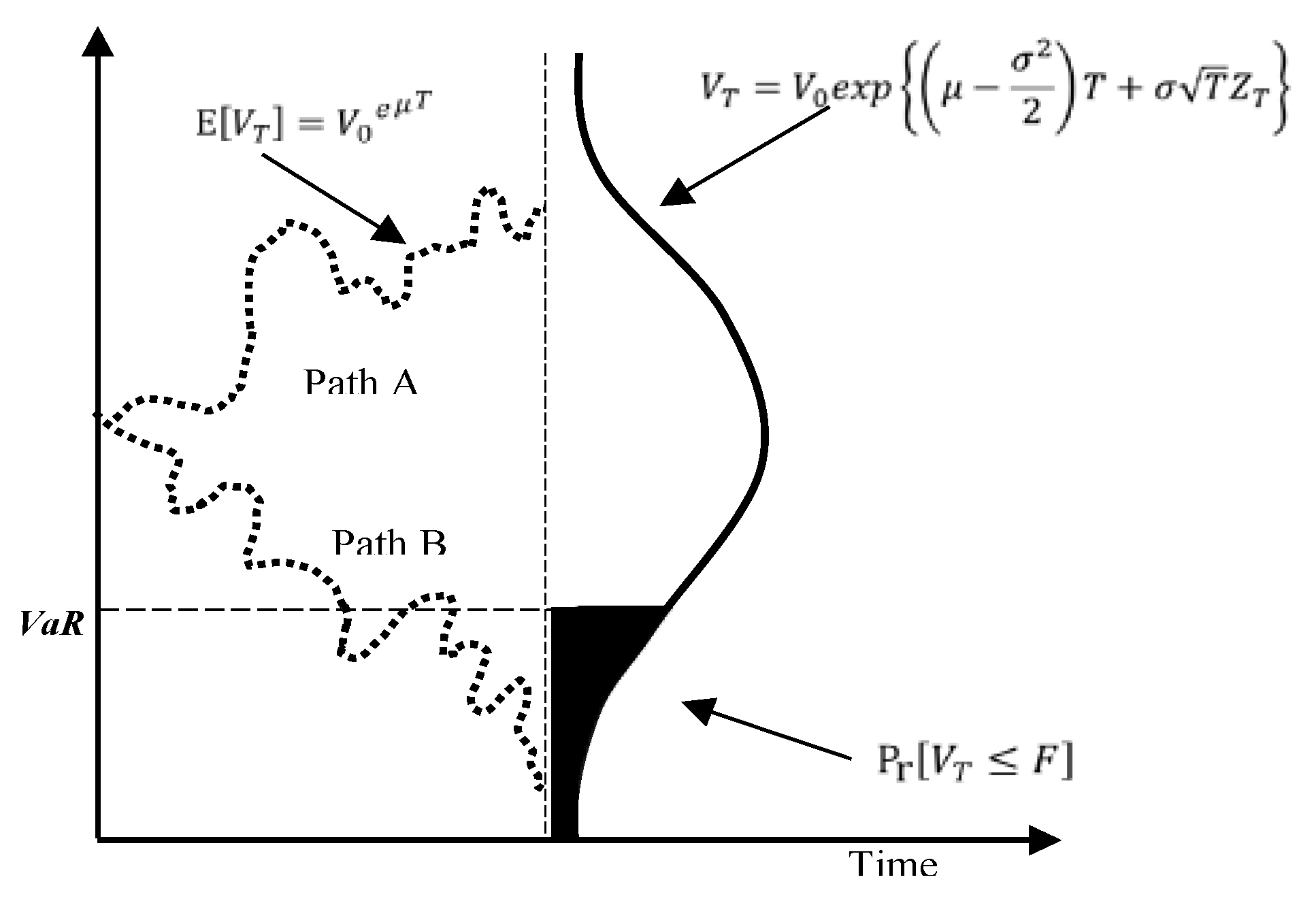

| Source of Uncertainty Pinpoint Prediction for Sales | Sensitivity Analysis (50% Fluctuations) | Value at Risk Sales Uncertainty Modeled with Geometric Brownian Motion (Variance = 50%) | ||||||

|---|---|---|---|---|---|---|---|---|

| Sales Prediction | Operational Revenues | Pinpoint Max/Min Value | Upper/Lower Bound of Continuous Value | |||||

| 60% | 80% | 90% | 95% | 99% | ||||

| January 1987 | 0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| July 1987 | 0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| January 1988 | 3532 | $353 | $353 | $353 | $353 | $353 | $353 | $353 |

| July 1988 | 8606 | $861 | $1292 | $1046 | $1323 | $1543 | $1828 | $2239 |

| $431 | $855 | $685 | $545 | $477 | $393 | |||

| January 1989 | 20,969 | $2097 | $3147 | $2362 | $3221 | $4184 | $4804 | $7377 |

| $1049 | $1781 | $1346 | $1112 | $942 | $798 | |||

| July 1989 | 51,088 | $5109 | $7664 | $5857 | $8860 | $13,093 | $16,133 | $25,615 |

| $2555 | $4449 | $2843 | $2305 | $1891 | $1223 | |||

| January 1990 | 124,470 | $12,447 | $18,671 | $13,386 | $25,867 | $39,602 | $54,920 | $97,905 |

| $6224 | $9446 | $6595 | $4672 | $3732 | $2542 | |||

| July 1990 | 303,258 | $30,326 | $45,489 | $36,207 | $57,569 | $90,295 | $126,856 | $226,619 |

| $15,163 | $23,638 | $15,743 | $10,946 | $9034 | $5836 | |||

| January 1991 | 738,857 | $73,886 | $110,829 | $75,116 | $137,576 | $193,056 | $287,976 | $658,149 |

| $36,943 | $46,319 | $31,977 | $22,249 | $15,476 | $11,090 | |||

| July 1991 | 1,800,149 | $180,015 | $270,023 | $236,519 | $473,823 | $832,029 | $1,209,168 | $2,294,620 |

| $90,008 | $137,739 | $78,261 | $52,939 | $43,052 | $28,289 | |||

| January 1992 | 4,385,877 | $438,588 | $657,882 | $606,452 | $1,179,795 | $2,000,229 | $3,103,931 | $15,808,640 |

| $219,294 | $365,787 | $235,577 | $168,381 | $95,609 | $58,988 | |||

| Pinpoint Prediction for Sales | Investment Cost | Operational Costs | Value at Risk Sales Uncertainty Modeled with Geometric Brownian Motion (Variance = 50%) | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 60% | 80% | 90% | 95% | 99% | |||||

| Sales | Net Cash Flows | ||||||||

| January 1987 | $0 | −$400,000 | - | $0 | −$40,000 | $0 | $0 | $0 | $0 |

| July 1987 | $0 | - | - | $0 | $0 | $0 | $0 | $0 | $0 |

| January 1988 | $353 | - | −$20,000 | $353 | −$19,647 | $353 | $353 | $353 | $353 |

| July 1988 | $861 | - | −$20,000 | $855 | −$19,145 | $685 | $545 | $477 | $393 |

| January 1989 | $2097 | - | −$20,000 | $1781 | −$18,219 | $1346 | $1112 | $942 | $798 |

| July 1989 | $5109 | - | −$20,000 | $4449 | −$15,551 | $2843 | $2305 | $1891 | $1223 |

| January 1990 | $12,447 | - | −$20,000 | $9446 | −$10,554 | $6595 | $4672 | $3732 | $2542 |

| July 1990 | $30,326 | - | −$20,000 | $23,638 | $3638 | $15,743 | $10,946 | $9034 | $5836 |

| January 1991 | $73,886 | - | −$20,000 | $46,319 | $26,319 | $31,977 | $22,249 | $15,476 | $11,090 |

| July 1991 | $180,015 | - | −$20,000 | $137,739 | $117,739 | $78,261 | $52,939 | $43,052 | $28,289 |

| January 1992 | $438,588 | - | −$20,000 | $365,787 | $345,787 | $235,577 | $168,381 | $95,609 | $58,988 |

| NPV (Pinpoint Estimation)) | −$76,766 | NPV (in Terms of Maximum Possible Loss, under 1−α% Confidence) | −$172,465 | −$305,877 | −$373,573 | −$429,936 | −$467,659 | ||

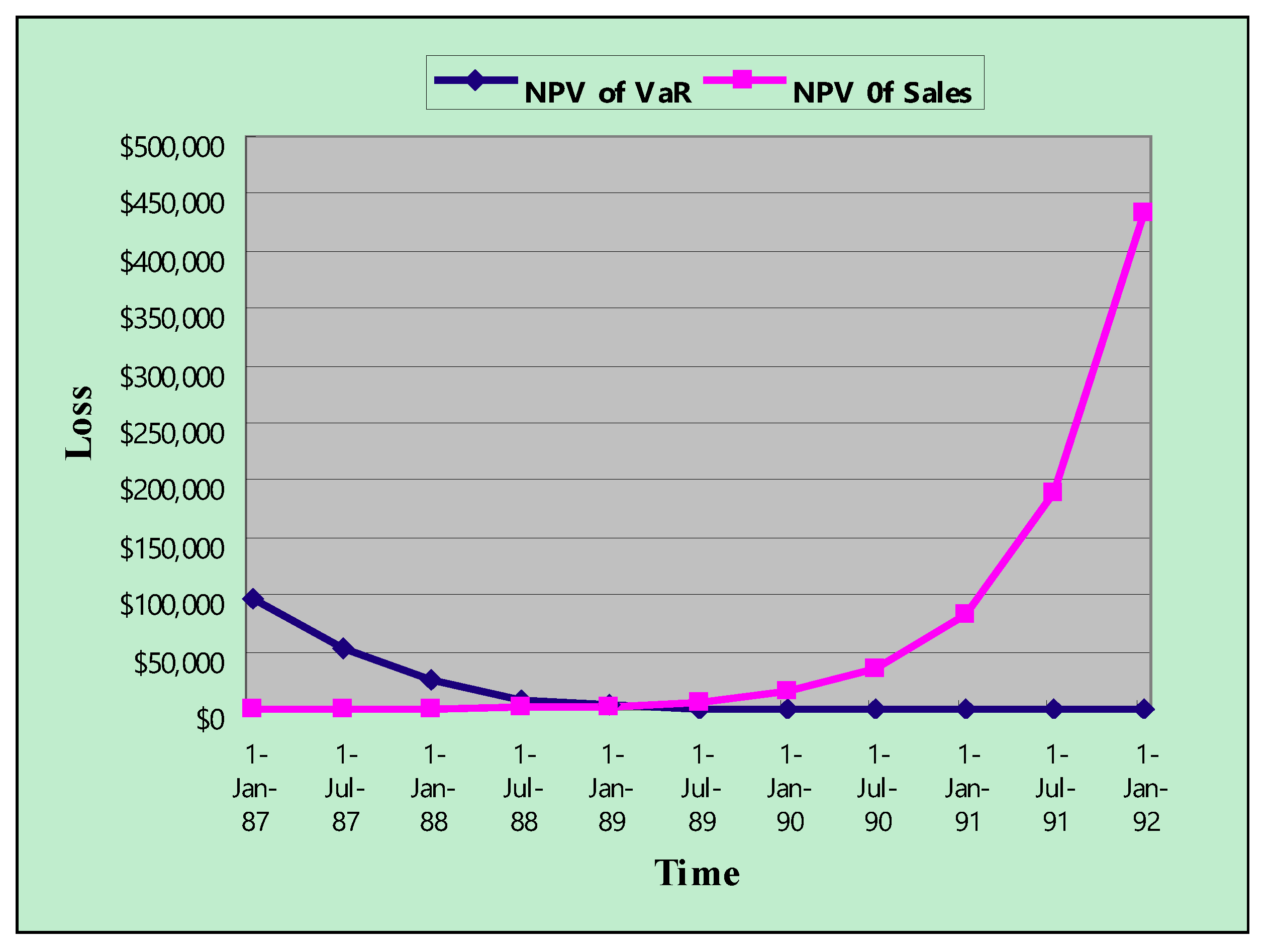

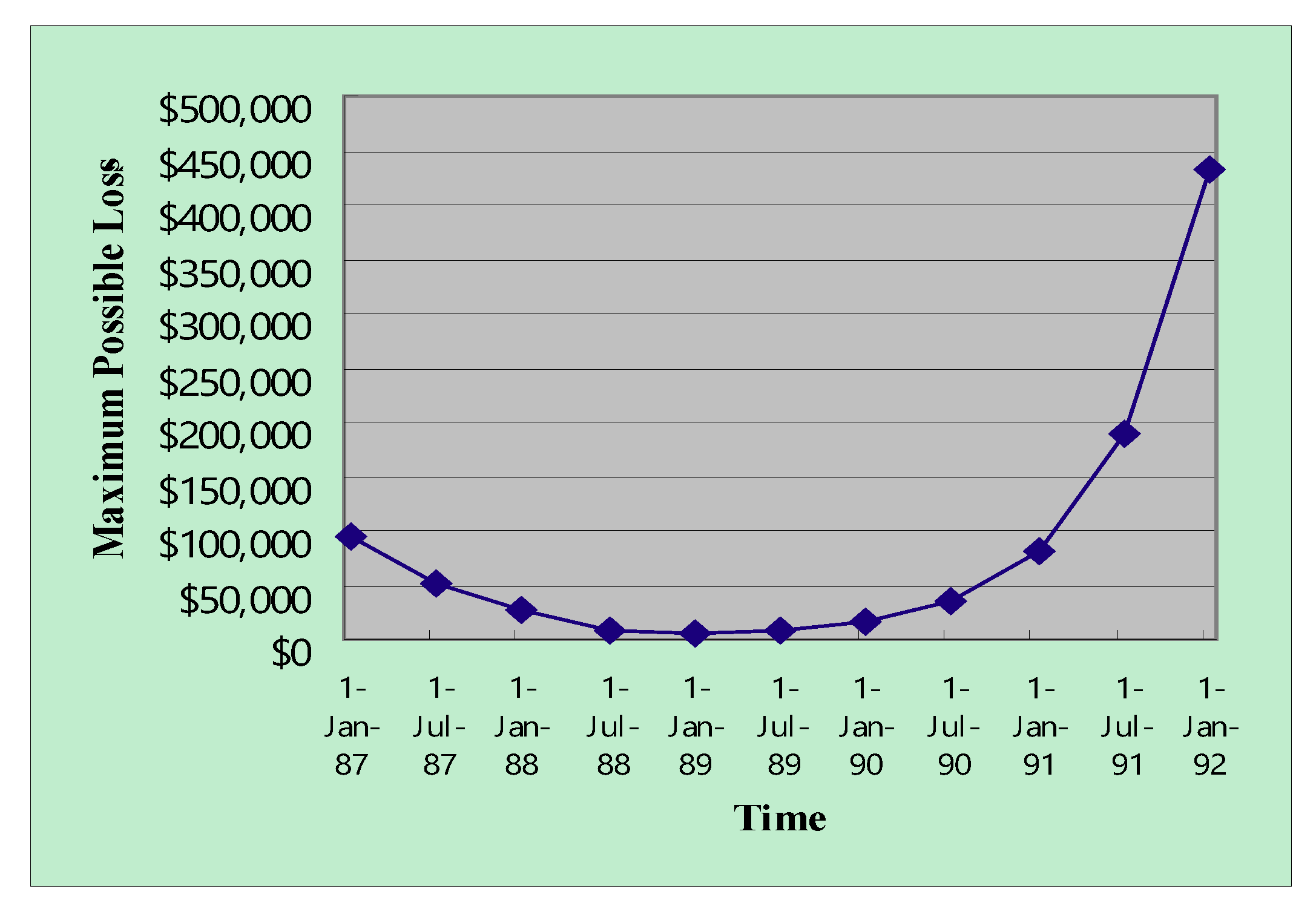

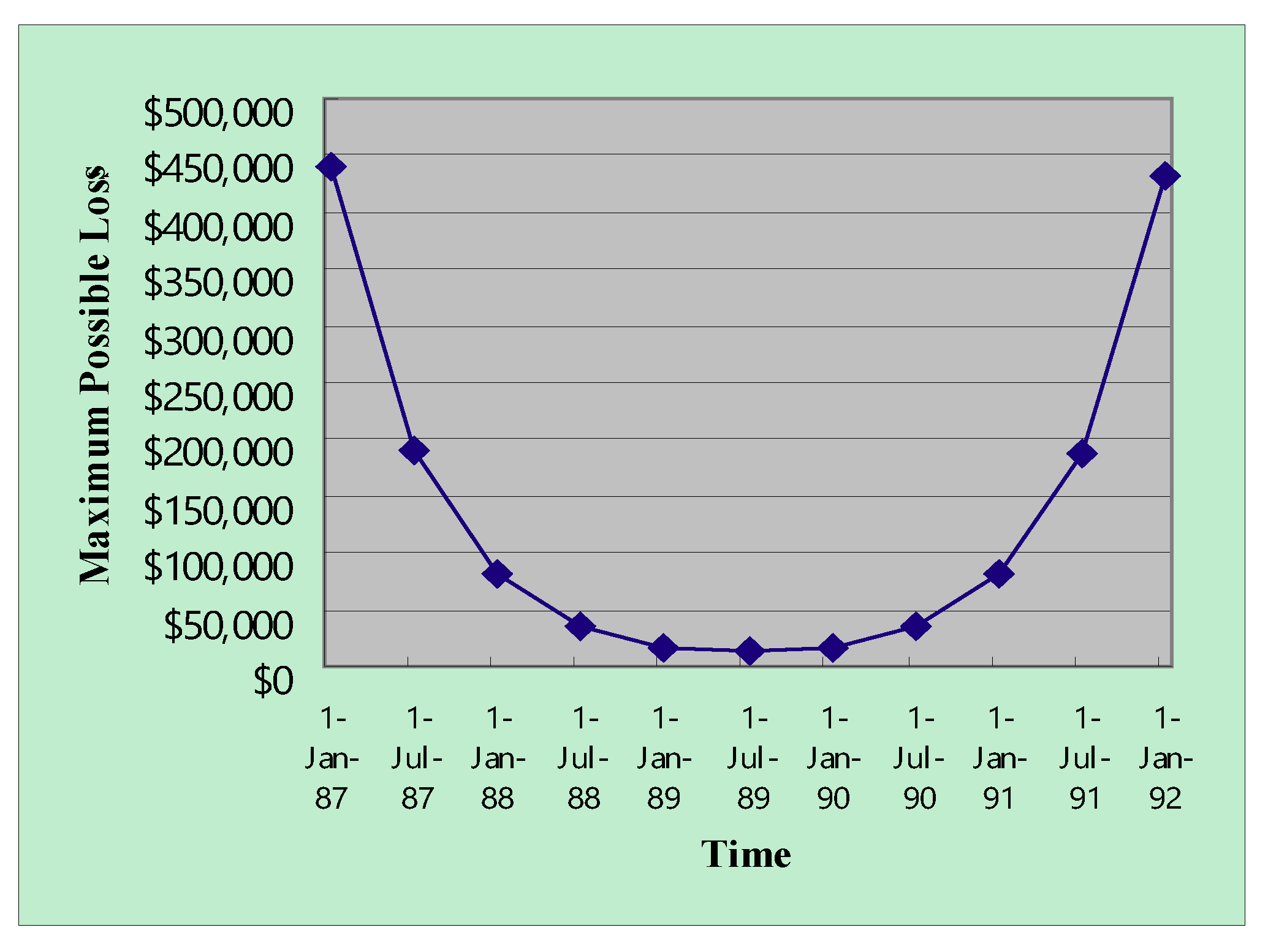

| Periods Deferrable | Date | Opportunity Cost (NPV of Sales) | VaR | Total Possible Maximum Loss |

|---|---|---|---|---|

| 0 | January 1987 | $95,700 | $0 | $95,700 |

| 0.5 | July 1987 | $52,609 | $0 | $52,609 |

| 1 | January 1988 | $26,084 | $314 | $26,399 |

| 1.5 | July 1988 | $7751 | $1037 | $8788 |

| 2 | January 1989 | $3036 | $2698 | $5734 |

| 2.5 | July 1989 | $793 | $6516 | $7309 |

| 3 | January 1990 | $271 | $15,290 | $15,561 |

| 3.5 | July 1990 | $5 | $35,459 | $35,464 |

| 4 | January 1991 | $0 | $81,816 | $81,816 |

| 4.5 | July 1991 | $0 | $188,367 | $188,367 |

| 5 | January 1992 | $0 | $433,272 | $433,272 |

| Benefit Variance 50% | Benefit Variance 75% | Benefit Variance 100% | |

|---|---|---|---|

| VaR (Confidence Level: 60%) | January 1989 | January 1989 | January 1989 |

| VaR (Confidence Level: 99%) | ↑ July 1989 ↓ | ↑ July 1989 ↓ | ↑ July 1989 ↓ |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wu, L.-C.; Wu, L.-H.; Pai, F.-Y. Combined Stochastic Process and Value at Risk: A Real-World Information System Decision Case. Entropy 2020, 22, 47. https://doi.org/10.3390/e22010047

Wu L-C, Wu L-H, Pai F-Y. Combined Stochastic Process and Value at Risk: A Real-World Information System Decision Case. Entropy. 2020; 22(1):47. https://doi.org/10.3390/e22010047

Chicago/Turabian StyleWu, Liang-Chuan, Liang-Hong Wu, and Fan-Yun Pai. 2020. "Combined Stochastic Process and Value at Risk: A Real-World Information System Decision Case" Entropy 22, no. 1: 47. https://doi.org/10.3390/e22010047

APA StyleWu, L.-C., Wu, L.-H., & Pai, F.-Y. (2020). Combined Stochastic Process and Value at Risk: A Real-World Information System Decision Case. Entropy, 22(1), 47. https://doi.org/10.3390/e22010047