The Role of the External Accountant in Business Planning for Starters: Perspective of the Self-Determination Theory

Abstract

:1. Introduction

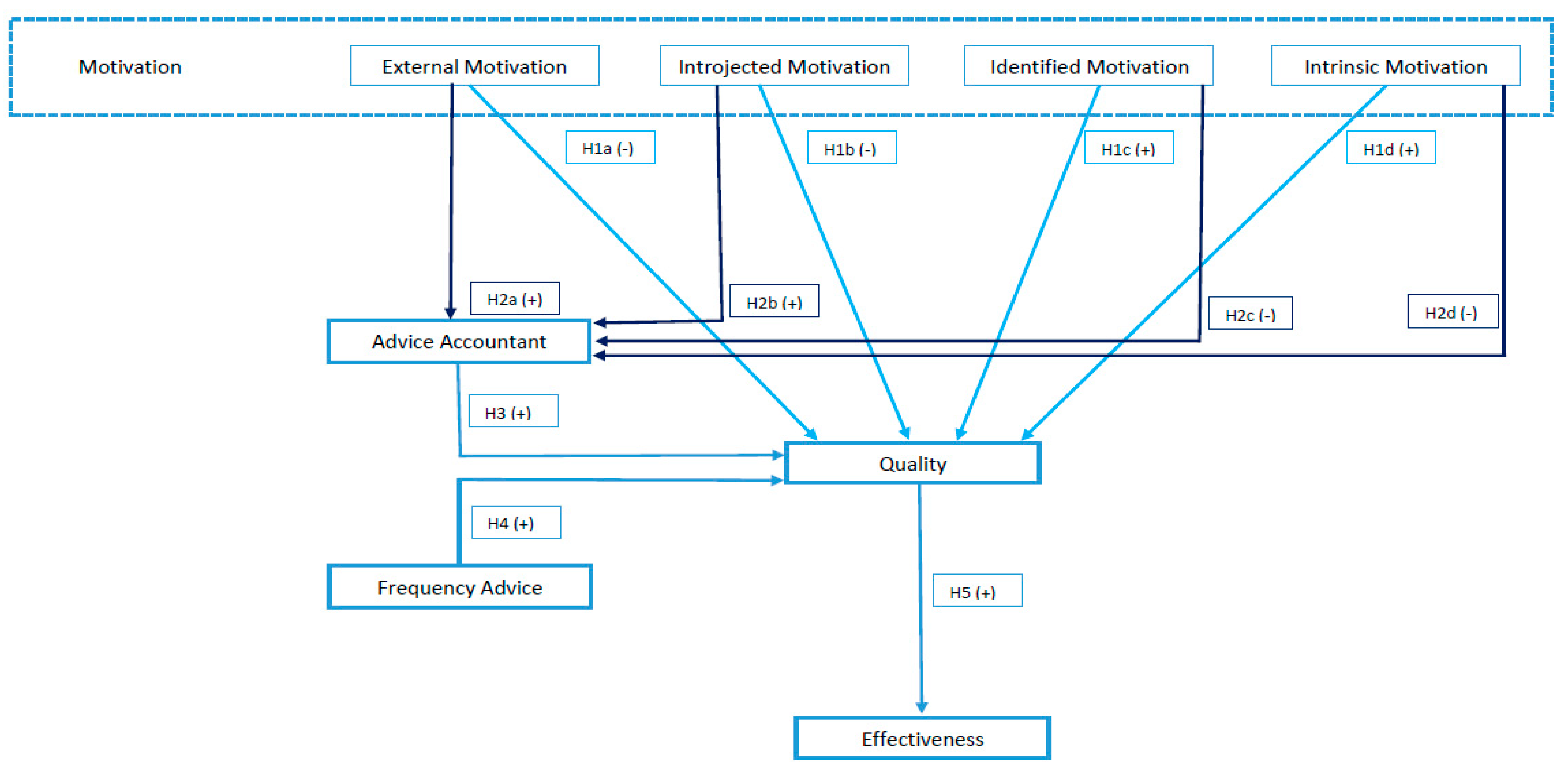

2. Literature Review and Development of Hypotheses

2.1. Self-Determination Theory and the Development of a Business Plan

2.2. The Role of the External Accountant as a Business Adviser

2.3. Business Planning and Effectiveness as a Planning Benefit

3. Methodology

3.1. Data Collection

3.1.1. Preliminary Interviews

- (1)

- How do entrepreneurs decide whether to develop a business plan?

- (2)

- Which topics are important to consider carefully when developing a business plan?

- (3)

- When is a business plan an effective tool for entrepreneurs?

- (4)

- Which role should service providers—particularly external accountants—play in guiding entrepreneurs during their start-up process?

3.1.2. Online Survey

3.2. Variables

3.2.1. Motivation to Develop a Business Plan

3.2.2. Quality of a Business Plan

3.2.3. Effectiveness of a Business Plan

3.2.4. Role of the External Accountant

3.2.5. Control Variables

4. Results

4.1. Descriptive Statistics

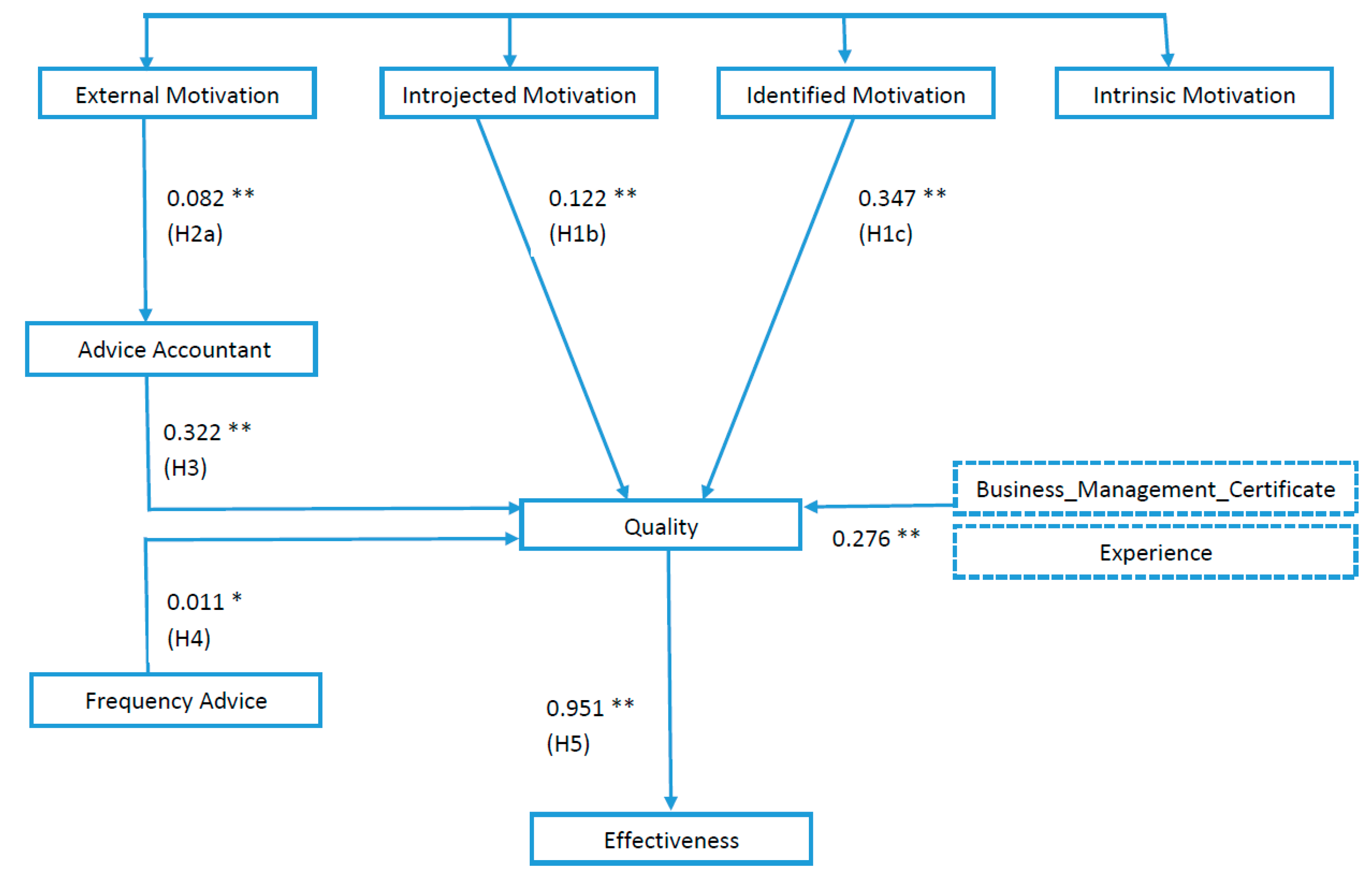

4.2. Hypothesis Testing

5. Discussion and Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- European Commission. Entrepreneurship and Small and Medium-Sized Enterprises (SMEs). Available online: https://ec.europa.eu/growth/smes_en (accessed on 1 December 2020).

- European Commission. Unleashing the Full Potential of EUROPEAN SMEs. Available online: https://ec.europa.eu/commission/presscorner/detail/en/fs_20_426 (accessed on 1 December 2020).

- SDG Compass. The Guide for Business Action on the SDGs. Available online: https://sdgcompass.org/ (accessed on 1 December 2020).

- European Commission. SME Performance Review (Annual Report on European SMEs). Available online: https://ec.europa.eu/growth/smes/business-friendly-environment/performance-review_en#annual-report (accessed on 20 November 2019).

- Gonzalez, G. Startup Business Plans: Do Academic Researchers and Expert Practitioners Still Disagree? Muma Bus. Rev. 2017, 1, 189–197. [Google Scholar] [CrossRef]

- Gonzalez, G. Risk Analysis for Initial Needs (RAIN): Improving a Time Zero Startup Plan through Resource Based Auditing (RBA) and a Launch Focused Strategy. Muma Bus. Rev. 2017, 1, 37–52. [Google Scholar] [CrossRef] [Green Version]

- Fernández-Geurrero, R.; Revuelto-Taboada, L.; Simón-Moya, V. The business plan as a project: An evaluation of its predictive capability for business success. Serv. Ind. J. 2012, 32, 2399–2420. [Google Scholar] [CrossRef]

- Dearman, D.T. Factors Influencing Managers’ Decisions to Prepare a Business Plan. 2012. Available online: https://ssrn.com/abstract=2133100 (accessed on 18 August 2016).

- Burke, A.; Fraser, S.; Greene, F.J. The Multiple Effects of Business Planning on New Venture Performance. J. Manag. Stud. 2010, 47, 391–415. [Google Scholar] [CrossRef]

- Karlsson, T.; Honig, B. Judging a business by its cover: An institutional perspective on new ventures and the business plan. J. Bus. Ventur. 2009, 24, 27–45. [Google Scholar] [CrossRef]

- Kirsch, D.; Goldfarb, B.; Gera, A. Form or substance: The role of business plans in venture capital decision making. Strateg. Manag. J. 2009, 30, 487–515. [Google Scholar] [CrossRef]

- Scott, J.M.; Irwin, D. Discouraged Advisees? The Influence of Gender, Ethnicity, and Education in the Use of Advice and Finance by UK SMEs. Environ. Plan. C Gov. Policy 2009, 27, 230–245. [Google Scholar] [CrossRef] [Green Version]

- Mazzarol, T. Do Formal Business Plans Really Matter? An Exploratory Study of Small Business Owners in Australia. Small Enterp. Res. 2001, 9, 32–45. [Google Scholar] [CrossRef]

- Delmar, F.; Shane, S. Does Business Planning Facilitate the Development of New Ventures? Strateg. Manag. J. 2003, 24, 1165–1183. [Google Scholar] [CrossRef]

- Botha, M.; Robertson, C.L. Potential entrepreneurs’ assessment of opportunities through the rendering of a business plan. S. Afr. J. Econ. Manag. Sci. 2014, 3, 249–265. [Google Scholar] [CrossRef] [Green Version]

- Barraket, J.; Furneaux, C.; Barth, S.; Mason, C. Understanding Legitimacy Formation in Multi-Goal Firms: An Examination of Business Planning Practices among Social Enterprises. J. Small Bus. Manag. 2016, 54, 77–89. [Google Scholar] [CrossRef]

- Zimmerman, J. Using Business Plans for Teaching Entrepreneurship. Am. J. Bus. Educ. 2012, 5, 727–742. [Google Scholar] [CrossRef] [Green Version]

- Mainprize, B.; Hindle, K. The Benefit: A Well-Written Entrepreneurial Business Plan is to an Entrepreneur What a Midwife is to an Expecting Mother. J. Priv. Equity 2007, 11, 40–52. [Google Scholar] [CrossRef]

- Hormozi, A.M.; Sutton, G.S.; McMinn, R.D.; Lucio, W. Business Plans for new or small businesses: Paving the path to success. Manag. Decis. 2002, 40, 755–763. [Google Scholar] [CrossRef]

- Bianchi, C.; Winch, G.; Grey, C. The business plan as a learning-oriented tool for small/medium enterprises: A business simulation approach. In Proceedings of the 16th International System Dynamics Society Conference, Québec City, QC, Canada, 20–23 July 1998. [Google Scholar]

- Karadag, H. Financial Management Challenges in Small and Medium-sized Enterprises: A Strategic Management Approach. Emerg. Mark. J. 2015, 5, 26–40. [Google Scholar] [CrossRef] [Green Version]

- Baker, W.H.; Addams, H.L.; Davis, B. Business Planning in Successful Small Firms. Long Range Plan. 1993, 26, 82–88. [Google Scholar] [CrossRef]

- Papazov, E.; Mihaylova, L. Linking accounting information with business planning in Bulgarian SMEs. In Proceedings of the 8th International Management Conference, Bucharest, Romania, 6–7 November 2014. [Google Scholar]

- Ferreira, J.J.; Azevedo, S.; Cruz, R. SME Growth in the Service Sector: A Taxonomy Combining Life—Cycle and Resource-Based Theories. Serv. Ind. J. 2011, 31, 251–271. [Google Scholar] [CrossRef]

- Bagire, V.; Namada, J. Managerial Skills, Financial Capability and Strategic Planning in Organizations. Am. J. Ind. Bus. Manag. 2013, 3, 480–487. [Google Scholar] [CrossRef] [Green Version]

- Brinckmann, J.; Salomo, S.; Gemuenden, H.G. Financial Management Competence of Founding Teams and Growth of New Technology-Based Firms. Entrep. Theory Pract. 2011, 217–243. [Google Scholar] [CrossRef]

- Halabi, A.K.; Barrett, R.; Dyt, R. Understanding Financial Information Used to Assess Small Firm Performance. An Australian qualitative study. Qual. Res. Account. Manag. 2010, 7, 163–179. [Google Scholar] [CrossRef]

- Gruber, M. Uncovering the value of planning in new venture creation: A process and contingency perspective. J. Bus. Ventur. 2007, 22, 782–807. [Google Scholar] [CrossRef]

- Honig, B.; Karlsson, A. Institutional forces and the written business plan. J. Manag. 2004, 30, 29–48. [Google Scholar] [CrossRef]

- Mason, C.; Stark, M. What do investors look for in a business plan? A comparison of the investment criteria of bankers, venture capitalists and business angels. Int. Small Bus. J. 2004, 22, 227–248. [Google Scholar] [CrossRef]

- Gorton, M. Use of Financial Management Techniques in the U.K.-Based Small and Medium-Sized Enterprises: Emperical Research Findings. J. Financ. Manag. Anal. 1999, 12, 56–64. [Google Scholar]

- Zinger, T.J.; LeBrasseur, R. The Benefits of Business Planning in Early Stage Small Enterprises. J. Small Bus. Entrep. 2003, 17, 1–15. [Google Scholar] [CrossRef]

- Ciemleja, G.; Lace, N. The Model of Sustainable Performing of SMEs in Context of Company’s Life Cycle. In Proceedings of the 15th World Multi-Conference on Systemics, Cybernetics and Informatics, Orlando, FL, USA, 19–22 July 2011. [Google Scholar]

- Hanlon, D.; Saunders, C. Marshaling Resources to Form Small New Ventures: Toward a More Holistic Understanding of Entrepreneurial Support. Entrep. Theory Pract. 2007, 31, 619–641. [Google Scholar] [CrossRef]

- Deakins, D.; Logan, D.; Steele, L. The Financial Management of the Small Enterprise; ACCA: London, UK, 2001. [Google Scholar]

- Vera-Colina, M.A.; Rodríguez-Medina, G.; Melgarejo-Molina, Z. Financial planning and access to financing in small and medium-sized companies in the Venezuelan manufacturing sector. Innovar 2011, 21, 99–112. [Google Scholar]

- Smeltzer, L.R.; Van Hook, B.L.; Hutt, R.W. Analysis of the Use of Advisers as Information Sources in Venture Startups. J. Small Bus. Manag. 1991, 29, 10–20. [Google Scholar]

- Blackburn, R.; Jarvis, R. The Role of Small and Medium Practices in Providing Business Support. to Small-and Medium-Sized Enterprises; Information Paper; International Federation of Accountants: Geneva, Switzerland, 2010. [Google Scholar]

- Oosthuizen, A.; van Vuuren, J.; Botha, M. Compliance or management: The benefits that small business owners gain from frequently sourcing accounting services. S. Afr. J. Entrep. Small Bus. Manag. 2020, 12, 2071–3185. [Google Scholar] [CrossRef]

- Carey, P.; Tanewski, G. The Provision of Business Advice to SMEs by External Accountants. Manag. Audit. J. 2016, 31, 290–313. [Google Scholar] [CrossRef]

- Lybaert, N.; Zeelmaekers, N. De rol van de externe accountant binnen de Vlaamse micro-onderneming. Account. Bedrijfskd. 2016, 15, 38–54. [Google Scholar]

- Catto, C. Role of Strategic Planning, Accounting Information and Advisors in the Growth of Small to Medium Enterprises. Asia-Pac. Manag. Account. J. 2016, 11, 59–78. [Google Scholar]

- Barbera, F.; Hasso, T. Do We Need to Use an Accountant? The Sales Growth and Survival Benefits to Family SMEs. Fam. Bus. Rev. 2013, 26, 271–292. [Google Scholar] [CrossRef] [Green Version]

- Carey, P.J. External accountants’ business advice and SME performance. Pac. Account. Rev. 2015, 27, 166–188. [Google Scholar] [CrossRef] [Green Version]

- Berry, A.J.; Sweeting, R.; Goto, J. The effect of business advisers on the performance of SMEs. J. Small Bus. Enterp. Dev. 2006, 13, 33–47. [Google Scholar] [CrossRef]

- Accounting Standards Commission—Commissie Voor Boekhoudkundige Normen. Financieel Plan Voor Besloten Vennootschappen, Coöperatieve Vennootschappen en Naamloze Vennootschappen, Technische Nota van 4 maart 2020 (TN 2020/04). Available online: https://www.cbn-cnc.be/nl/adviezen/technische-nota-financieel-plan-voor-besloten-vennootschappen-cooperatieve-vennootschappen (accessed on 12 April 2020).

- Ooghe, H.; Vander Bauwhede, H.; Van Wymeersch, C. Financiële Analyse van de Onderneming—Deel 1, 5th ed.; Intersentia: Antwerp, Belgium, 2017; pp. 1–630. [Google Scholar]

- Ryan, R.M.; Deci, E.L. A self-determination theory approach to psychotherapy: The motivational basis for effective change. Can. Psychol. Psychol. Can. 2008, 49, 186–193. [Google Scholar] [CrossRef] [Green Version]

- Gagné, M.; Deci, E.L. Self-Determination Theory and Work Motivation. J. Organ. Behav. 2005, 26, 331–362. [Google Scholar] [CrossRef] [Green Version]

- Ryan, R.M.; Deci, E.L. Intrinsic and Extrinsic Motivations: Classic Definitions and New Directions. Contemp. Educ. Psychol. 2000, 25, 54–67. [Google Scholar] [CrossRef]

- Ryan, R.M.; Deci, E.L. Self-Determination Theory and the Facilitation of Intrinsic Motivation, Social Development and Well-Being. Am. Psychol. 2000, 55, 68–78. [Google Scholar] [CrossRef]

- Deci, E.L.; Ryan, R.M. The general causality orientations scale: Self-determination in personality. J. Res. Personal. 1985, 19, 109–134. [Google Scholar] [CrossRef]

- Vansteenkiste, M.; Sierens, E.; Soenens, B.; Luyckx, K.; Lens, W. Motivational Profiles from a Self-Determination Perspective: The Quality of Motivation Matters. J. Educ. Psychol. 2009, 101, 671–688. [Google Scholar] [CrossRef] [Green Version]

- Delanoë, S. From intention to start-up: The effect of professional support. J. Small Bus. Enterp. Dev. 2013, 20, 383–398. [Google Scholar] [CrossRef]

- Hagger, M.S.; Chatzisarantis, N.L.; Biddle, S.J. The influence of autonomous and controlling motives on physical activity intentions within the Theory of Planned Behaviour. Br. J. Health Psychol. 2002, 7, 283–297. [Google Scholar] [CrossRef]

- Dearman, D.T.; Bell, J.R. Context and Person Characteristics Associated with the Decision to Prepare a Business Plan. Small Bus. Inst. J. 2012, 8, 1–15. [Google Scholar]

- Karlsson, T.; Honig, B. Norms surrounding business plans and their effect on entrepreneurial behavior. Front. Entrep. Res. 2007, 27, 1–11. [Google Scholar]

- Ryan, R.M.; Connell, J.P. Perceived Locus of Causality and Internalization: Examining Reasons for Acting in Two Domains. J. Personal. Soc. Psychol. 1989, 57, 749–761. [Google Scholar] [CrossRef]

- Vansteenkiste, M.; Sheldon, K.M. There’s nothing more practical than a good theory: Integrating motivational interviewing and self-determination theory. Br. J. Clin. Psychol. 2006, 45, 63–82. [Google Scholar] [CrossRef] [Green Version]

- Vansteenkiste, M.; Lens, W.; De Witte, H.; Feather, N.T. Understanding unemployed people’s job search behavior, unemployment experience and well-being: A comparison of expectancy-value theory and self-determination theory. Br. J. Soc. Psychol. 2005, 44, 269–287. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Al-Jubari, I.; Hassan, A.; Liñán, F. Entrepreneurial intention among University students in Malaysia: Integrating self-determination theory and the theory of planned behavior. Int. Entrep. Manag. J. 2018, 15, 1323–1342. [Google Scholar] [CrossRef] [Green Version]

- Hardre, P.L.; Reeve, J. A motivational modal of rural students’ intentions to persist in, versus drop out of, high school. J. Educ. Psychol. 2003, 95, 347–356. [Google Scholar] [CrossRef] [Green Version]

- Pelletier, L.G.; Fortier, M.S.; Vallerand, R.J.; Brière, N.M. Associations among perceived autonomy support, forms of self-regulation, and persistence: A prospective study. Motiv. Emot. 2001, 25, 279–306. [Google Scholar] [CrossRef]

- Yusoff, N.M.H. Supporting the Development of SMEs: Bridging the Services Gap. Account. Today 2006, 19, 12–14. [Google Scholar]

- Chrisman, J.J. The Influence of Outsider-Generated Knowledge Resources on Venture Creation. J. Small Bus. Manag. 1999, 37, 42–58. [Google Scholar]

- Dyer, L.M.; Ross, C.A. Seeking Advice in a Dynamic and Complex Business Environment: Impact on the Success of Small Firms. J. Dev. Entrep. 2008, 13, 133–149. [Google Scholar] [CrossRef]

- Sian, S.; Roberts, C. UK small owner-managed businesses: Accounting and financial reporting needs. J. Small Bus. Enterp. Dev. 2009, 16, 289–305. [Google Scholar] [CrossRef]

- Blackburn, R.; Carey, P.; Tanewski, G.A. Business Advice to SMEs: Professional Competence, Trust and Ethics; ACCA: London, UK, 2010. [Google Scholar]

- Everaert, P.; Sarens, G.; Rommel, J. Using Transaction Cost Economics to Explain Outsourcing of Accounting. Small Bus. Econ. 2010, 35, 93–112. [Google Scholar] [CrossRef]

- Chrisman, J.J.; McMullan, E.; Hall, J. The influence of guided preparation on the long-term performance of new ventures. J. Bus. Ventur. 2005, 20, 769–791. [Google Scholar] [CrossRef]

- Bennett, R.J.; Robson, P.J.A. The Advisor-SME Client Relationship: Impact, Satisfaction and Commitment. Small Bus. Econ. 2005, 25, 255–271. [Google Scholar] [CrossRef]

- Mole, K. (Seeking, Acting on and Appreciating) the Value of Business Advice; ERC Research Paper No.44; Enterprise Research Center: Birmingham, UK, 2016. [Google Scholar]

- Mole, K.; North, D.; Baldock, R. Which SMEs Seek External Support? Business characteristics, Management Behaviour and External Influences in a Contingency Approach. Environ. Plan. C Gov. Policy 2016, 35, 1–48. [Google Scholar] [CrossRef] [Green Version]

- Cassar, G.; Ittner, C.D. Initial Retention of External Accountants in Startup Ventures. Eur. Account. Rev. 2009, 18, 313–340. [Google Scholar] [CrossRef]

- Chrisman, J.J.; McMullan, W.E. Outsider Assistance as a Knowledge Resource for New Venture Survival. J. Small Bus. Manag. 2004, 42, 229–244. [Google Scholar] [CrossRef]

- Vansteenkiste, M.; Lens, W.; Deci, E.L. Intrinsic versus extrinsic goal-contents in self-determination theory: Another look at the quality of academic motivation. Educ. Psychol. 2006, 41, 19–31. [Google Scholar] [CrossRef]

- Mole, K.; Hart, M.; Roper, S.; Saal, D. Assessing the effectiveness of business support services in England: Evidence from a theory based evaluation. Int. Small Bus. J. Res. Enterp. 2009, 27, 557–582. [Google Scholar] [CrossRef] [Green Version]

- Veskaisri, K.; Chan, P.; Pollard, D. Relationship between Strategic Planning and SME Success: Empirical Evidence from Thailand. In Proceedings of the 12th Annual Conference Joined with the 9th International DSI Conference, Bangkok, Thailand, 11–15 July 2007. [Google Scholar]

- Blackburn, R.; Carey, P.; Tanewski, G. Business Advice by Accountants to SMEs: Relationships and Trust. Qual. Res. Account. Manag. 2018, 15, 1–42. [Google Scholar] [CrossRef] [Green Version]

- Brinckmann, J.; Dew, N.; Read, S.; Mayer-Haug, K.; Grichnik, D. Of those who plan: A meta-analysis of the relationship between human capital and business planning. Long Range Plan. 2019, 52, 173–188. [Google Scholar] [CrossRef]

- Pansiri, J.; Temtime, Z.T. Linking Firm and Managers’ Characteristics to perceived critical success factors for innovative entrepreneurial support. J. Small Bus. Enterp. Dev. 2010, 17, 45–59. [Google Scholar] [CrossRef]

- Cook, R.G.; Belliveau, P.; Sandberg, M.E. Training and learning as drivers of US microenterprise business plan quality. Educ. Train. 2004, 46, 398–405. [Google Scholar] [CrossRef]

- Chwolka, A.; Raith, M.G. The value of business planning before start-up—A decision-theoretical perspective. J. Bus. Ventur. 2012, 27, 385–399. [Google Scholar] [CrossRef]

- Brews, P.J.; Hunt, M.R. Learning to Plan and Planning to Learn: Resolving the Planning School/Learning School Debate. Strateg. Manag. J. 1999, 20, 889–913. [Google Scholar] [CrossRef]

- Hannon, P.D.; Atherton, A. Small firm success and the art of orienteering: The value of plans, planning, and strategic awareness in the competitive small firm. J. Small Bus. Enterp. Dev. 1998, 5, 102–119. [Google Scholar] [CrossRef]

- Haag, A.B. Writing a successful Business Plan: An Overview. Workplace Health Saf. 2013, 61, 19–29. [Google Scholar] [CrossRef]

- Drucker, P.F. The Age of Discontinuity: Guidelines to Our Changing Society, 2nd ed.; Routledge: New York, NY, USA, 1992; pp. 1–420. [Google Scholar]

- Salazar, A.L.; Soto, R.C.; Mosqueda, R.E. The impact of financial decisions and strategy on small business competitiveness. Glob. J. Bus. Res. 2012, 6, 93–103. [Google Scholar]

- Jasra, J.; Hunjra, A.I.; Rehman, A.U.; Azam, R.I.; Khan, M.A. Determinants of Business Success of Small and Medium Enterprises. Int. J. Bus. Soc. Sci. 2011, 2, 274–280. [Google Scholar]

- Masurel, E.; Van Montfort, K. Life Cycle Characteristics of Small Professional Service Firms. J. Small Bus. Manag. 2006, 44, 461–473. [Google Scholar] [CrossRef]

- Picken, J.C. From startup to scalable enterprise: Laying the foundation. Bus. Horiz. 2017, 60, 587–595. [Google Scholar] [CrossRef]

- Teddlie, C.; Yu, F. Mixed Methods Sampling. A Typology with Examples. J. Mix. Methods Res. 2007, 1, 77–100. [Google Scholar] [CrossRef]

- Neckebroeck, C.; Vanderstraeten, I.; Verhaeghe, M. Onderzoeksvaardigheden. Voor Onderwijs, Zorg en Welzijn, 2nd ed.; Uitgeverij VAN IN: Wommelgem, Belgium, 2018. [Google Scholar]

- Baltar, F.; Brunet, I. Social research 2.0: Virtual snowball sampling method using Facebook. Internet Res. 2012, 22, 57–74. [Google Scholar] [CrossRef]

- Alberti, F.G.; Pizzurno, E. Oops, I did it again! Knowledge leaks in open innovation networks with start-ups. Eur. J. Innov. Manag. 2017, 20, 50–79. [Google Scholar] [CrossRef]

- Ghee, W.Y.; Ibrahim, M.D.; Abdul-Halim, H. Family Business Succession Planning: Unleashing the Key Factors of Business Performance. Asian Acad. Manag. J. 2015, 20, 103–126. [Google Scholar]

- De Bruyckere, S.; Verplancke, F.; Everaert, P.; Sarens, G.; Coppens, C. The Importance of Mutual Understanding Between External Accountants and Owner–Managers of SMEs. Aust. Account. Rev. 2020, 30, 4–21. [Google Scholar] [CrossRef]

- Deci, E.L.; Ryan, R.M. Facilitating Optimal Motivation and Psychological Well-Being Across Life’s Domains. Can. Psychol. 2008, 49, 14–23. [Google Scholar] [CrossRef] [Green Version]

- Quinn, R.E.; Cameron, K. Organizational Life Cycles and Shifting Criteria of Effectiveness: Some Preliminary Evidence. Manag. Sci. 1983, 29, 33–51. [Google Scholar] [CrossRef] [Green Version]

- Zammuto, R.F. A Comparison of Multiple Constituency Models of Organizational Effectiveness. Acad. Manag. Rev. 1984, 9, 606–616. [Google Scholar] [CrossRef]

- Ramanujam, V.; Venkatraman, N. Planning System Characteristics and Planning Effectiveness. Strateg. Manag. J. 1987, 8, 453–468. [Google Scholar] [CrossRef]

- Churchill, N.; Lewis, V. The Five Stages of Small Business Growth. Harv. Bus. Rev. 1983, 61, 30–50. [Google Scholar]

- Frková, J.; Kaderábková, B. SME life cycle model under globalization. In Proceedings of the 9th International Days of Statistics and Economics, Prague, Czech Republic, 10–12 September 2015. [Google Scholar]

- Illés, C.B.; Hurta, H.; Dunay, A. Efficiency and profitability along the lifecycle stages of small enterprises. Int. J. Manag. Enterp. Dev. 2015, 14, 56–69. [Google Scholar] [CrossRef]

- Zinger, T.J.; Lebrasseur, R.; Zanibbi, L.R. Factors Influencing Early Stage Performance in Canadian Microenterprises. J. Dev. Entrep. 2001, 6, 129–150. [Google Scholar]

- Gonzalez, G. What factors are causal to survival of a start-up? Muma Bus. Rev. 2017, 1, 97–114. [Google Scholar] [CrossRef] [Green Version]

- Albuquerque, A.F.; Filho, E.E.; Nagano, M.S.; Philippsen, L.A. A change in the importance of mortality factors throughout the life cycle stages of small businesses. J. Glob. Entrep. Res. 2016, 6, 1–18. [Google Scholar] [CrossRef] [Green Version]

- Schreiber, J.B.; Nora, A.; Stage, F.K.; Barlow, E.A.; King, J. Reporting Structural Equation Modeling and Confirmatory Factor Analysis Results: A Review. J. Educ. Res. 2006, 99, 323–337. [Google Scholar] [CrossRef]

- Honig, B.; Samuelsson, M. Business planning by intrapreneurs and entrepreneurs under environmental uncertainty and institutional pressure. Technovation 2021, 99, 1–12. [Google Scholar] [CrossRef]

- Honig, B.; Samuelsson, M. Planning and the entrepreneur: A longitudinal examination of nascent entrepreneurs in Sweden. J. Small Bus. Manag. 2012, 50, 365–388. [Google Scholar] [CrossRef]

- Mansoori, Y.; Lackéus, M. Comparing effectuation to discovery-driven planning, prescriptive entrepreneurship, business planning, lean start-up and design thinking. Small Bus. Econ. 2020, 54, 791–818. [Google Scholar] [CrossRef] [Green Version]

- Blank, S. Why the Lean Start-Up Changes Everything. Harv. Bus. Rev. 2013, 91, 63–72. [Google Scholar]

- Hopp, C.; Greene, F.J. In pursuit of time: Business plan sequencing, duration and intraentrainment effects on new venture viability. J. Manag. Stud. 2018, 55, 320–351. [Google Scholar] [CrossRef]

- Ries, E. The Lean Startup: How Today’s Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses, 1st ed.; Crown Business: New York, NY, USA, 2011. [Google Scholar]

- Honig, B.; Hopp, C. Learning orientations and learning dynamics: Understanding heterogeneous approaches and comparative success in nascent entrepreneurship. J. Bus. Res. 2019, 94, 28–41. [Google Scholar] [CrossRef]

- Mazzarol, T.; Reboud, S. Entrepreneurship and Innovation. Theory, Practice and Context, Springer Texts in Business and Economics, 4th ed.; Singapore Pte Ltd.: Singapore, Singapore, 2020; pp. 191–225. [Google Scholar]

- De Bruyckere, S.; Verplancke, F.; Everaert, P.; Sarens, G.; Coppens, C. The Role of External Accountants as Service Providers for SMEs: A Literature Review. Account. Bedrijfskd. 2017, 4, 49–62. [Google Scholar]

| Variable Name | Measurement Scale | Factor Loadings |

|---|---|---|

| Motivation (1) | Indicate how important the following reasons were for writing a business plan when preparing the launch of your business? Means based on the following items: I developed my business plan because… (1 = not important at all; 5 = very important) | |

| External_Motivation Kaiser–Meyer–Olkin = 0.683 Bartlett’s test = 0.000 Cronbach’s alpha = 0.735 | 1. I was supposed to do so (developing a business plan when launching a new business; that is how it should be). | 0.556 |

| 2. The government forced me to do so (developing a business plan was a legal obligation). | 0.733 | |

| 3. Others (external accountant, banker/investor, consultant) obliged me to do so (e.g., developing a business plan was a prerequisite to obtain financing). | 0.838 | |

| 4. Others (government, external accountant, banker) expected me to do so. | 0.843 | |

| Introjected_Motivation Kaiser–Meyer–Olkin = 0.774 Bartlett’s test = 0.000 Cronbach’s alpha = 0.879 | 1. Others would perceive me as a committed and engaged entrepreneur. | 0.841 |

| 2. I would feel guilty if I did not develop a business plan. | 0.758 | |

| 3. I would feel ashamed if I did not develop a business plan. | 0.806 | |

| 4. Others would perceive me as an intelligent, capable entrepreneur. | 0.864 | |

| 5. Others would appreciate me as an entrepreneur. * | 0.841 | |

| Identified_Motivation Kaiser–Meyer–Olkin = 0.873 Bartlett’s test = 0.000 Cronbach’s alpha = 0.902 | 1. I really wanted to understand the content of the business plan. * | 0.863 |

| 2. I wanted to learn new things. | 0.791 | |

| 3. I wanted to gain insight into the feasibility of my business project. * | 0.840 | |

| 4. For me, it was personally important to carefully reflect on the commercial, legal, and financial aspects of my project before launching my business. | 0.830 | |

| 5. This represented a meaningful choice to me and was congruent with my personal values. | 0.806 | |

| 6. This was an important life goal for me. Launching a new business successfully requires careful consideration. A business plan is a necessary tool to monitor the figures during the first months after start-up. | 0.804 | |

| Intrinsic_Motivation Kaiser–Meyer–Olkin = 0.500 Bartlett’s test = 0.000 Cronbach’s alpha = 0.919 | 1. It was fun to develop a business plan. | 0.962 |

| 2. It was exciting to develop a business plan. | 0.962 | |

| Quality_Business_Plan | How important was it for you as an entrepreneur to reflect thoroughly on the following items of a business plan (1 = not important at all; 5 = very important)? The quality was calculated as the means of 22 different subjects captured in a business plan (sector analysis; customer analysis; market analysis, including analysis of competitors; pricing policy; mission and vision; competencies (of yourself and, if applicable, the competences of your business partner(s)); personnel (recruitment, human resources); legal form of the business; formation expenses; necessary investments; inventories; payment conditions and receivables from customers; value added tax (VAT); financing/(extra) funding; turnover; costs; monthly income for the entrepreneur; margins; break-even; financial analysis (liquidity, profitability, solvency, cash flow); cash planning; taxes (e.g., income taxes)). | |

| Variable name | Measurement Scale | Factor Loadings |

| Effectiveness Kaiser–Meyer–Olkin = 0.854 Bartlett’s test = 0.000 Cronbach’s alpha = 0.874 | During the first year after the start-up of your business, to what extent was the business plan important to... (1 = not important at all; 5 = very important) | |

| 1. Monitor financial needs (e.g., extra funding). | 0.795 | |

| 2. Monitor (and understand the development of) the manager’s income (allowance/fee) from the company. | 0.773 | |

| 3. Monitor sales figures. | 0.813 | |

| 4. Prevent liquidity shortage. | 0.877 | |

| 5. Make decisions to ensure the viability of the company. | 0.815 | |

| Advice_Accountant | Before launching my business, … (0 = I did not rely on an external accountant for advice concerning the development of my business plan; 1 = I relied on an external accountant for advice concerning the development of my business plan) | |

| Frequency_Advice | How many times did you consult your external accountant concerning the development of your business plan before actually launching your business? | |

| Experience | Was the establishment of this new company a conversion of an existing legal entity? (0 = no; 1 = yes) | |

| Business_Management_ Certificate | Did you obtain a business management certificate before launching your business? (0 = no; 1 = yes) | |

| N | Min. | Max. | Mean | SD | |

|---|---|---|---|---|---|

| External_Motivation | 283 | 1 | 5 | 2.64 | 1.09 |

| Introjected_Motivation | 283 | 1 | 5 | 2.07 | 1.08 |

| Identified_Motivation | 283 | 1 | 5 | 3.71 | 1.08 |

| Intrinsic_Motivation | 283 | 1 | 5 | 3.03 | 1.40 |

| Advice_Accountant | 283 | 0 | 1 | 0.79 | 0.407 |

| Quality_Business_Plan | 254 | 1 | 5 | 3.26 | 0.79 |

| Effectiveness | 235 | 1 | 5 | 2.85 | 1.23 |

| Frequency_Advice | 224 | 1 | 100 | 4.68 | 8.75 |

| Experience | 283 | 0 | 1 | 0.16 | 0.36 |

| Business_Management_Certificate | 283 | 0 | 1 | 0.51 | 0.50 |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | |

|---|---|---|---|---|---|---|---|---|---|---|

| 1. External_Motivation | 1 | |||||||||

| 2. Introjected_Motivation | 0.042 | 1 | ||||||||

| 3. Identified_Motivation | −0.280 ** | 0.344 ** | 1 | |||||||

| 4. Intrinsic_Motivation | −0.341 ** | 0.306 ** | 0.601 ** | 1 | ||||||

| 5. Advice_Accountant | 0.240 ** | 0.005 | 0.020 | −0.047 | 1 | |||||

| 6. Quality_Business_Plan | −0.053 | 0.339 ** | 0.564 ** | 0.365 ** | 0.186 ** | 1 | ||||

| 7. Effectiveness | −0.154 * | 0.303 ** | 0.451 ** | 0.351 ** | 0.119 | 0.598 ** | 1 | |||

| 8. Frequency_Advice | 0.005 | −0.039 | 0.051 | 0.038 | c. | 0.142 * | 0.060 | 1 | ||

| 9. Experience | 0.170 ** | 0.001 | −0.071 | −0.112 | 0.148 * | 0.015 | 0.042 | 0.131 * | 1 | |

| 10. Business_Management_Certificate | −0.066 | −0.001 | 0.032 | 0.041 | −0.034 | 0.194 ** | 0.089 | −0.040 | −0.047 | 1 |

| Variables | Model 1 Dependent Variable: Quality_Business_Plan (a) | Model 2 Dependent Variable: Advice_Accountant (b) | Model 3 Dependent Variable: Quality_Business_Plan (a) | Model 4 Dependent Variable: Effectiveness (a) |

|---|---|---|---|---|

| External_Motivation | 0.033 | 0.637 ** | 0.062 | −0.092 |

| (0.822) | (0.170) | (1.422) | (−1.428) | |

| Introjected_Motivation | 0.117 ** | −0.102 | 0.098 * | 0.113 |

| (2.990) | (0.154) | (2.151) | (1.758) | |

| Identified_Motivation | 0.353 ** | 0.274 | 0.328 ** | 0.098 |

| (7.699) | (0.185) | (6.479) | (1.171) | |

| Intrinsic_Motivation | 0.018 | −0.019 | 0.041 | 0.062 |

| (0.493) | (0.144) | (0.983) | (1.039) | |

| Advice_Accountant | 0.315 ** | 0.114 | ||

| (3.120) | (0.675) | |||

| Quality_Business_Plan | 0.758 ** | |||

| (7.258) | ||||

| Frequency_Advice | 0.011 * | |||

| (2.252) | ||||

| Experience | 0.099 | 1.194 | 0.053 | 0.292 |

| (0.884) | (0.629) | (0.460) | (1.586) | |

| Business_Management_ | 0.269 ** | −0.048 | 0.251 ** | −0.088 |

| Certificate | (3.439) | (0.309) | (2.875) | (−0.659) |

| Constant | 1.161 ** | −1.067 | 1.423 ** | −0.233 |

| (5.765) | (0.783) | (6.257) | (−0.658) | |

| Observations | 254 | 283 | 202 | 235 |

| Nagelkerke R-squared | 0.132 | |||

| Adjusted R-squared | 0.388 | 0.352 | 0.382 | |

| F-statistic | 23.960 ** | 16.582 ** | 19.062 ** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

De Bruyckere, S.; Everaert, P. The Role of the External Accountant in Business Planning for Starters: Perspective of the Self-Determination Theory. Sustainability 2021, 13, 3014. https://doi.org/10.3390/su13063014

De Bruyckere S, Everaert P. The Role of the External Accountant in Business Planning for Starters: Perspective of the Self-Determination Theory. Sustainability. 2021; 13(6):3014. https://doi.org/10.3390/su13063014

Chicago/Turabian StyleDe Bruyckere, Stefanie, and Patricia Everaert. 2021. "The Role of the External Accountant in Business Planning for Starters: Perspective of the Self-Determination Theory" Sustainability 13, no. 6: 3014. https://doi.org/10.3390/su13063014

APA StyleDe Bruyckere, S., & Everaert, P. (2021). The Role of the External Accountant in Business Planning for Starters: Perspective of the Self-Determination Theory. Sustainability, 13(6), 3014. https://doi.org/10.3390/su13063014