1. Introduction

The digitalization of the payment system, which refers to payment processes that are initiated, processed, and received electronically [

1], has emerged as a transformative force in the global financial sector. It enhances transactional efficiency, supports financial inclusion, and modernizes payment infrastructures across various economies [

2]. In Saudi Arabia, this transformation aligns closely with Vision 2030, the national initiative that seeks to reduce reliance on cash and foster a digitally enabled economy [

3]. The widespread adoption of financial technologies such as mobile wallets, contactless transactions, and Buy Now, Pay Later (BNPL) services has accelerated this shift [

4]. According to the Saudi Central Bank (SAMA), digital payments accounted for 70 percent of all transactions in 2022, indicating a substantial shift in consumer preferences and behavior [

5].

This rapid growth is shaped by multiple factors that can be examined through the Technology–Organization–Environment (TOE) framework [

6]. TOE proposes that the adoption of technological innovations is determined by three interconnected dimensions: technological readiness, organizational capabilities, and environmental influences. In the case of Saudi Arabia, all three dimensions are actively evolving in response to government policy, consumer demand, and infrastructural developments.

From the technological perspective, the adoption of digital payment systems is supported by strong consumer demand and high mobile technology penetration. According to a study by [

7], 75 percent of adults in Saudi Arabia have formal financial accounts, surpassing the global average of 69 percent. This growth is further driven by mobile banking, peer-to-peer lending, and other fintech applications supported by regulatory frameworks and supervisory initiatives. According to Fintech Saudi’s Survey, 74 percent of the population uses at least one digital payment service, with digital payments being the most common [

8]. Younger generations, particularly Gen Z and Millennials, are highly engaged with mobile-based solutions such as STC Pay and Alinma Pay, which offer integrated, secure, and convenient transaction experiences. The COVID-19 pandemic further increased the appeal of digital payment options, as contactless payments became associated with safety and hygiene. This period saw a 75 percent rise in digital payments and a 30 percent drop in cash withdrawals [

8], highlighting an accelerated technological shift.

At the organizational level, retailers are facing both opportunities and challenges in adopting digital payment systems. The perceived benefits include increased operational efficiency, faster transaction processing, and enhanced customer satisfaction. However, organizational constraints, particularly among small and medium-sized enterprises (SMEs), remain prominent. These include concerns about high transaction fees, technical complexity, cybersecurity risks, and the digital skills required to manage such systems effectively. As Royani et al. [

9] and UN-ESCAP [

10] suggest, these organizational limitations are especially pronounced in developing and emerging markets. Furthermore, existing research often fails to capture the operational realities and compliance demands faced by retailers, focusing predominantly on consumer behavior [

11,

12]. Arvidsson [

13] also emphasizes that merchant perspectives are largely overlooked in digital payment research, despite their central role in enabling cashless ecosystems.

The environmental context in Saudi Arabia is characterized by proactive regulatory policies and an expanding digital financial infrastructure. Initiatives such as the Open Banking Framework and the Regulatory Sandbox introduced by SAMA are designed to foster innovation and expand market access [

14]. Government partnerships with technology leaders like AWS and Google Cloud are also contributing to the development of fintech capabilities [

15]. These environmental factors position Saudi Arabia as a fintech leader in the GCC region [

16]. Nonetheless, challenges persist. Security concerns such as data breaches and fraud remain critical barriers to adoption [

17], and the regulatory landscape is not fully understood by many retailers. Saudi Arabia represents a distinctive setting for retailer adoption of digital payment systems because progress toward a cashless economy is a strategic national priority under Vision 2030, supported by national payment infrastructures and regulatory requirements for point-of-sale system usage in many retail sectors. These institutional conditions create adoption dynamics in which retailers engage digital payment technologies not only for perceived convenience and operational value, but also in response to regulatory expectations and competitive norms. However, much of the existing research focuses on consumer adoption, while retailer adoption in policy-mandated environments is comparatively underexplored. This study directly addresses this gap by focusing on retailer level adoption behavior within a policy driven digital economy where institutional mandates and trust play a central role. Our field evidence indicates that although digital payment usage is widespread, approximately 90 percent of retailers in the sample were unable to identify the specific compliance responsibilities associated with the systems they use. This suggests that adoption may occur through a mechanism of compliance without awareness, where institutional trust and mandate pressure support adoption even when regulatory understanding is limited. This gap between usage and regulatory knowledge also reflects a significant policy risk, where institutional trust may lead to adoption without adequate understanding of legal responsibilities.

Globally, the shift to digital payments has gained momentum in both developed and emerging economies, with countries like Sweden and Singapore advancing rapidly toward cashless models [

11,

13,

18,

19]. Regionally, Saudi Arabia’s digital payment evolution serves as a model for other GCC countries, such as the UAE and Qatar, which are also investing in cashless economies [

16]. Understanding Saudi Arabia’s successes and challenges can inform best practices for fostering digital payment ecosystems across the region. On a global scale, this study contributes to the discourse on the adoption of digital payment platforms in emerging economies. While developed markets have largely transitioned to digital-first payment systems, many developing nations still grapple with infrastructure and regulatory limitations [

20]. The Saudi case study offers valuable lessons for countries seeking to balance digital payment innovation with financial accessibility.

Recent studies on digital payment acceptance provide an important foundation for this work. A substantial body of consumer-focused research across Europe, Asia, and Africa demonstrates that perceived usefulness, ease of use, cost, trust, and perceived risk remain the central drivers of technology uptake in both mature and emerging markets [

13,

21,

22,

23,

24]. Merchant-oriented studies from contexts such as Ghana, Malaysia, and Sweden further show that transaction fees, network reliability, customer expectations, and operational integration strongly influence merchants’ willingness to adopt mobile- and card-based electronic payment systems [

9,

11,

25]. Collectively, this literature confirms the relevance of technological and organisational determinants, while also showing that merchants respond simultaneously to customer demand, infrastructure quality, and cost considerations.

More recent research conducted in Saudi Arabia begins to extend this line of inquiry toward firm- and system-level digital commerce environments. For example, Alawadh et al. [

26] applied big-data analytics within a large Saudi supermarket chain to cluster customer behavior and generate transaction-level insights, demonstrating the growing strategic role of digital payment data in retail operations. Attar [

27] examined artificial-intelligence-supported decision systems in Saudi electronic commerce environments and found significant performance improvements in sales forecasting, inventory control, and transaction efficiency. These studies offer valuable insight into the increasing operational sophistication of digital payment-enabled retail systems under national digital transformation initiatives. However, despite these advances, they do not directly examine how brick-and-mortar retailers themselves interpret regulatory obligations, manage compliance responsibilities, or negotiate institutional trust in state-backed payment infrastructures. Across the broader literature, three persistent limitations remain. First, regulation is typically treated as a contextual background condition rather than as an active and shaping determinant of adoption behavior. Second, most studies do not clearly distinguish between institutional trust rooted in state regulation and infrastructure, and interpersonal trust based on peer influence or user experience. Third, retailer-level empirical research remains limited in environments where digital payment infrastructures are not merely optional but increasingly mandated through public policy as part of national digital transformation agendas.

In the Gulf region, and in Saudi Arabia in particular, these gaps are especially salient. While prior studies have examined digital commerce platforms, consumer trust, and data-driven retail strategies under national programs, there is still limited empirical evidence on how retailers themselves interpret regulatory requirements, how organisational capacities and digital skills affect compliance behavior, and how trust in state-backed digital payment infrastructures shapes everyday adoption decisions. In particular, little is known about how retailers operate in settings where point-of-sale systems and national payment platforms are compulsory, yet formal regulatory literacy remains uneven. These gaps motivate the present study and position the Saudi retail sector as a critical case for extending existing models of digital payment acceptance. By explicitly integrating institutional trust and regulatory literacy within the Technology–Organization–Environment (TOE) framework, this study addresses underexplored contextual and firm-level dynamics and contributes new insights into how digital payment ecosystems evolve in policy-driven emerging markets.

While consumer-focused studies dominate current research, there is limited scholarly attention on how retailers, particularly in emerging economies, manage the complexities of digital payment integration. Small and medium enterprises require context-specific insights that reflect their unique financial, technological, and regulatory challenges [

10]. Building on the gaps identified above, this study aims to fill that gap by exploring the trends, enablers, and challenges influencing the adoption of digital payment systems among retailers in Saudi Arabia. The study contributes to the literature by applying and extending the Technology, Organization, and Environment (TOE) framework to the Saudi retail context. Institutional trust is positioned within the environmental dimension and regulatory literacy within the organizational dimension. These constructs help explain how retailers may adopt confidently while holding uneven levels of regulatory awareness. By explicitly integrating institutional trust and regulatory literacy into the TOE framework, this study extends the framework beyond technology acceptance toward the quality and depth of compliance behavior. This theoretical refinement offers insight into how digital payment ecosystems expand rapidly in policy driven environments while regulatory understanding develops more gradually. Furthermore, by foregrounding retailer perspectives in a policy mandated, emerging market setting, the study addresses an underexplored contextual segment in the digital payment acceptance literature and demonstrates why the Saudi case is analytically and practically significant. Hence, the research question for this study is:

What are the trends, enablers, and challenges influencing the digitalization of payment systems among retailers in Saudi Arabia? Using the TOE framework, it provides a comprehensive view of the technological tools available, the organizational preparedness required, and the regulatory and environmental dynamics shaping adoption behavior. By situating the analysis within the TOE framework, this research contributes to the understanding of digital payment adoption in emerging economies. It also offers policy-relevant recommendations that support Saudi Arabia’s Vision 2030 agenda and provides comparative insights for other nations aiming to build inclusive and secure digital payment ecosystems.

The remainder of this study is organized as follows:

Section 2 provides a comprehensive literature review, exploring the theoretical frameworks and empirical studies relevant to digital payment adoption.

Section 3 outlines the research methodology, detailing the data collection and analysis techniques employed in this study.

Section 4 presents the findings and discusses their implications in the context of Saudi Arabia’s digital payment ecosystem. Finally,

Section 5 concludes the study by summarizing the key findings, highlighting their implications for policymakers and practitioners, and suggesting directions for future research.

2. Overview on Saudi Arabia’s Digital Payment Ecosystem

Saudi Arabia has pursued a coordinated national transformation of its retail payment landscape, with digital payment systems positioned as a core pillar of economic modernization under Vision 2030. Unlike broader financial technology initiatives, national policy has placed specific emphasis on retail transaction digitization through widely accessible point-of-sale (POS) deployment, the expansion of the Mada national payment network, and the promotion of digital wallets and instant transfer systems. These interventions directly target transaction-level behavior in retail environments, making Saudi Arabia a uniquely policy-driven case of digital payment system adoption rather than general financial innovation.

The future of Saudi Arabia’s digital payment sector looks promising, with ambitious national targets to expand cashless transactions and strengthen the digital payment infrastructure across retail, services, and public-sector transactions. Venture capital investments are expected to reach SAR 12.2 billion, contributing SAR 13.3 billion to the national GDP [

4]. The government’s focus on developing the King Abdullah Financial District in Riyadh as a financial and payment innovation hub, along with initiatives supporting digital transaction platforms, is attracting both local and international investors [

28]. Additionally, partnerships with global technology leaders like AWS and Google Cloud support the development of payment processing platforms, merchant settlement systems, and transaction security services, further enhancing the Kingdom’s competitiveness [

15]. While these developments form part of the broader financial services ecosystem, the present study focuses specifically on the digital payment infrastructure that supports retail transactions, including point-of-sale systems, card networks, digital wallets, settlement mechanisms, and regulatory enforcement structures.

As of 2023, the number of digital payment and transaction service providers exceeded 216, reflecting the success of regulatory frameworks implemented by the Saudi Central Bank (SAMA) and the Capital Market Authority (CMA) [

29]. Notably, point-of-sale (POS) transactions increased by 24%, reaching nine billion transactions valued at SAR 614 billion, while digital wallet users rose by 56% to 21.6 million. The adoption of Open Banking, introduced in 2022, has further accelerated data-enabled payment interoperability by allowing consumers to securely share financial data with third-party providers, promoting competition and personalized services [

4,

30]. These advancements support the Kingdom’s goal of achieving 70% cashless transactions by 2025, aligning with its broader economic diversification agenda. For retailers, these developments mean that digital payments are no longer optional innovations but increasingly embedded operational requirements for daily transactions.

A key driver of Saudi Arabia’s digital payment expansion is the widespread use of contactless payment methods, such as NFC technology and QR codes, which have revolutionized both consumer and business transactions. By the end of 2023, 94% of in-store transactions were contactless, positioning Saudi Arabia among the global leaders in this domain [

31,

32]. Digital wallets like STC Pay, Alinma Pay, and Apple Pay have become household names, reflecting changing consumer preferences for convenience and security. The adoption of instant payment systems such as “Sarie” has further accelerated the shift to digital payments, enabling real-time bank-to-bank transfers and reducing reliance on cash [

5,

14]. This ecosystem not only enhances transaction efficiency but also reshapes settlement speed, reconciliation practices, and liquidity management for retailers, particularly for small and medium-sized enterprises (SMEs). These developments place frontline merchants at the intersection of consumer demand, payment platform design, and regulatory mandates.

The country’s success in advancing digital payments is also attributed to its supportive regulatory environment, which encourages innovation while ensuring financial stability at the level of transaction infrastructure. The Regulatory Sandbox, introduced in 2018, has enabled the controlled testing of payment platforms, gateways, and transaction services, fostered creativity and accelerated market entry [

32,

33]. Additionally, the Open Banking Framework launched by SAMA supports the integration of third-party payment providers with bank-based infrastructures, promoting competition and enhancing service personalization [

4,

8]. The introduction of Buy Now Pay Later (BNPL) services, with user numbers rising by 32% to 13.2 million in 2023, reflects shifting consumer preferences toward more flexible financing options, further contributing to the growth of digital payments [

29]. For retailers, these regulatory initiatives shape both adoption incentives and compliance obligations, as payment platforms are increasingly tied to reporting, verification, and settlement rules.

The integration of advanced technologies such as artificial intelligence (AI), blockchain, and digital identity solutions is expected to drive the next phase of digital payment infrastructure in Saudi Arabia. These innovations are enhancing fraud detection, transaction authentication, identity verification, and cross-platform settlement efficiency [

34,

35]. Blockchain technology is particularly promising for cross-border payments, reducing transaction costs and improving transparency. Meanwhile, AI-driven solutions are being used to optimize credit assessments, personalize financial products, and detect fraudulent activities, thus strengthening consumer trust in digital financial services. As these technologies mature, they will further solidify Saudi Arabia’s position as a regional leader specifically in digital transaction processing and digital retail payments.

From the perspective of local retailers, the adoption of digital payment systems has transformed business operations by streamlining transactions and enhancing customer experiences. Retailers have increasingly embraced point-of-sale (POS) systems and mobile payment solutions, with 94% of in-store transactions now conducted via contactless methods [

36]. This shift has been accelerated by the COVID-19 pandemic, which heightened consumer demand for touch-free payment options. Retailers report that digital payment systems have not only improved operational efficiency but also expanded their customer base by catering to tech-savvy consumers who prefer cashless transactions [

37]. However, some smaller retailers, particularly in rural areas, face challenges in adopting these technologies due to limited access to digital infrastructure and higher transaction fees, which can hinder their ability to compete with larger businesses [

38]. These disparities underscore how organizational capacity conditions retailers’ ability to comply with rapidly expanding digital payment mandates.

Therefore, to sustain the Kingdom’s aspiration to become a regional leader in digital payments, several structural challenges remain. One of the most critical challenges is cybersecurity risks, which have become increasingly prevalent as digital transactions rise. With non-cash transactions accounting for 70% of retail payments, the protection of sensitive financial data is paramount. Despite the introduction of regulations such as the National Cybersecurity Authority’s (NCA) Data Cybersecurity Controls, the evolving nature of cyber threats requires continuous adaptation and robust security measures [

15,

33]. Without addressing these cybersecurity concerns, consumer trust in digital payment systems may erode, potentially slowing down the transition to a cashless economy. For retailers, cybersecurity exposure is directly linked to liability risk, chargeback disputes, and dependence on platform-level security controls.

Another major challenge is the digital divide, which disproportionately affects rural populations and older adults. These groups often face limited access to digital infrastructure and lower levels of digital literacy, creating barriers to the adoption of digital payment systems. While urban areas have seen widespread adoption of digital wallets and contactless payments, rural regions lag behind due to inadequate technological infrastructure and a lack of awareness about digital financial services. Efforts such as Fintech Saudi’s Internship Program and the Financial Sector Academy aim to equip individuals with the necessary skills to navigate the digital economy, but more targeted initiatives are needed to bridge this gap [

39,

40]. Additionally, cultural factors, such as the gender gap in financial account ownership, further complicate efforts to achieve comprehensive financial inclusion, particularly among women and low-income individuals [

7]. From a retailer standpoint, uneven customer and staff payment literacy affects onboarding efficiency, transaction errors, refund handling, and trust in digital systems.

Regulatory complexities also pose a significant challenge for payment service providers and foreign companies seeking to enter the Saudi market. While initiatives such as the Regulatory Sandbox support testing of transaction services, full licensing approval can be time-consuming, often taking between three to nine months [

14,

41]. Foreign firms must often establish local entities before offering transaction services [

42]. Simplifying regulatory processes and enhancing stakeholder dialogue could foster greater innovation and attract more international players, thereby accelerating the growth of the digital payment ecosystem in Saudi Arabia. The growing reliance on cloud computing and big data analytics raises questions about data sovereignty and the ethical use of personal information. The Cyber Security Framework of SAMA in this case suggests the company use cloud services that are located in Saudi Arabia. Additionally, the concentration of market power among large technology firms offering super apps may limit competition and consumer choice. Regulatory authorities face the dual challenge of fostering innovation while ensuring financial stability and safeguarding user rights [

43]. These regulatory complexities translate into platform dependence and procedural compliance for retailers without necessarily fostering detailed regulatory understanding of transaction-level obligations.

Talent shortages represent another critical challenge to the adoption of digital payment systems. The sector requires professionals with expertise in cybersecurity, data analytics, and digital payments, but the current talent pool in Saudi Arabia is insufficient to meet this demand. Initiatives such as the Saudi Unicorn Program and Fintech Saudi’s Makken program aim to nurture local talent, while collaborations with universities seek to align educational curricula with industry needs [

4,

44]. However, more efforts are needed to attract global talent and develop specialized fintech courses to address the skills gap. Without a skilled workforce, the scalability and reliability of national payment systems may be constrained.

The competitive landscape presents challenges for both traditional banks and platform-based payment providers. As local startups offer more agile, customer-centric services through digital wallets and installment-based transaction services, such as, Buy Now Pay Later (BNPL), established banks must modernize their legacy systems and enhance their digital offerings to remain competitive [

28,

36]. Collaboration between traditional financial institutions and digital payment platforms offered by the new merchants is essential to overcoming these challenges, as it can drive innovation while ensuring compliance with regulatory requirements. By fostering partnerships and investing in digital infrastructure, Saudi Arabia can create a more inclusive and competitive fintech ecosystem, aligning with the goals of Vision 2030.

While Saudi Arabia’s digital payment ecosystem has advanced rapidly, addressing barriers related to cybersecurity, digital literacy, regulatory compliance, and talent development is essential to sustaining long-term growth. By continuing to invest in digital infrastructure, financial literacy programs, and regulatory enhancements, Saudi Arabia can achieve its Vision 2030 goal of becoming a global fintech hub. Collaboration between government bodies, financial institutions, and fintech companies will be key to overcoming these challenges, ensuring that digital payment systems are secure, inclusive, and accessible to all. The Kingdom has pursued coordinated national efforts to accelerate digital retail payments through POS deployment, contactless acceptance, and mobile wallets. Despite this progress, the evidence in this study indicates that retailer awareness of procedural compliance remains uneven. This suggests that adoption reflects not only technological and operational transaction factors but also institutional trust and regulatory practices, which directly motivates the TOE-based analytical approach used in this study.

3. Literature Review—Towards a Conceptual Framework

The adoption of digital payment systems by retailers involves a complex set of factors that can be systematically examined using the Technology–Organization–Environment (TOE) framework. The TOE framework explains how technological innovation adoption is influenced by three interconnected dimensions: the characteristics of the technology, the readiness of the adopting organization, and the external environment in which the organization operates. Applying this framework to the context of digital payment adoption in Saudi Arabia allows for a structured analysis of the enablers and barriers that retailers face. Furthermore, the TOE framework is particularly well suited to this context because, unlike models such as TAM and UTAUT that emphasize individual-level decision-making, TOE enables examination of how institutional conditions shape adoption at the firm level.

This study identifies six key factors that collectively shape adoption behavior. These include cost, trust, perceived risk and security, convenience and ease of use, perceived usefulness, and social influence. Each of these factors can be situated within the three TOE domains, offering a comprehensive understanding of the drivers and challenges influencing the adoption of digital payment platforms among retailers. The analytical structure of this study is explicitly grounded in the Technology–Organization–Environment (TOE) framework, which enables systematic classification of the determinants of digital payment adoption at the firm level. To strengthen conceptual clarity and analytical transparency, the key constructs examined in this study are mapped directly onto the three TOE dimensions as follows.

Within the technological dimension, this study includes perceived usefulness, ease of use, and perceived risk and security. Perceived usefulness captures the extent to which digital payment systems enhance transaction speed, operational efficiency, and customer service. Ease of use reflects the simplicity and usability of payment interfaces and point of sale systems. Perceived risk and security represent retailers’ exposure to fraud, technical failure, data breaches, and transaction errors, which directly condition confidence in digital payment technologies. These constructs together define how the technical attributes of payment systems shape adoption decisions.

The organizational dimension captures internal firm level capabilities, constraints, and preparedness. This study classifies cost, digital skills and technical capacity, and regulatory literacy under this domain. Cost reflects transaction fees, setup expenses, and operational charges associated with digital payment systems. Digital skills and technical capacity represent the ability of retailers and staff to operate, troubleshoot, and manage payment infrastructure. Regulatory literacy refers to retailers’ knowledge and understanding of formal compliance requirements such as tax reporting, zakat obligations, and settlement procedures. By situating regulatory literacy within the organizational dimension, this study emphasizes that compliance is not only a legal condition but also an internal capability that differentiates informed adoption from procedural usage.

The environmental dimension captures external institutional and market forces that shape adoption. This study places institutional trust, government support, and market and social influence within this domain. Institutional trust reflects retailer confidence in state backed payment platforms, regulatory authorities, and banking infrastructure. Government support captures the role of national mandates, policy enforcement, and public sector promotion of digital payments. Market and social influence include competitive pressure, customer expectations, and prevailing transaction norms. Together, these factors explain how adoption is shaped by external legitimacy, policy pressure, and normative behavior.

This explicit classification strengthens the theoretical contribution of the study in two ways. First, it ensures a transparent and internally consistent application of the TOE framework to the context of digital payment adoption among retailers. Second, it demonstrates the novelty of extending the organizational dimension to include regulatory literacy and the environmental dimension to emphasize institutional trust. This refined mapping allows the study to explain the observed phenomenon of compliance without awareness, where retailers adopt state supported digital payments due to institutional trust and policy pressure, yet remain weakly informed about their formal compliance obligations.

3.1. Cost

Cost is a central element in the technological and organizational contexts of the TOE framework. It refers to the financial outlay required for implementing and maintaining digital payment systems. These costs may include hardware installation, software licensing, transaction fees, employee training, and system maintenance. For many small and medium-sized enterprises (SMEs), high costs can act as a barrier to adoption.

Mallat and Tuunainen [

45] found that SMEs are less likely to adopt mobile payment systems when initial setup costs are high. In the Saudi context, Altwairesh and Aloud [

46] observed that merchants were more willing to adopt payment systems when the perceived costs were lower. Zhao et al. [

47] also highlighted that transaction fees negatively impact users’ intention to adopt digital payment platforms, especially in environments with frequent and low-margin transactions. Boateng et al. [

25] reported similar concerns among Ghanaian merchants, who felt that transaction fees directly affected their profit margins.

Despite these concerns, the perception of long-term economic benefits can offset cost-related barriers. Moghavvemi et al. [

22] noted that Malaysian merchants were more inclined to adopt mobile payment solutions when they recognised cost savings in cash handling and improved sales efficiency. Liébana-Cabanillas and Lara-Rubio [

48] further confirmed that perceived cost benefits positively influence adoption intentions. Still, for resource-constrained businesses, the initial financial burden remains a significant factor. Sharma et al. [

49] also reported that small businesses frequently cite cost-related issues as a key obstacle in considering fintech tools. However, government support and market competition can alleviate this pressure. For example, the World Bank [

43] discussed how regulatory incentives can reduce adoption costs, while Chaudhuri et al. [

50] noted that merchants often adopt digital payments to remain competitive. Higgins [

51] emphasized that technological innovations that lower infrastructure costs also help accelerate adoption. Overall, cost plays a dual role, representing both a hurdle and an enabler depending on the broader regulatory and technological landscape.

3.2. Trust

Trust lies at the intersection of the technological and environmental dimensions of the TOE framework. It reflects a retailer’s confidence in the security, reliability, and integrity of digital payment systems and their providers. Trust can be divided into institutional trust, which is based on regulatory support and system governance, and interpersonal trust, which relates to user experience and peer recommendations.

Esawe [

21] emphasized that trust is a critical factor in digital payment adoption. Nguyen and Huynh [

23], along with Khando et al. [

11], showed that trust reduces perceived risks and increases the perceived benefits of adoption. In Ghana, Yeboah et al. [

24] found that merchants’ willingness to use mobile payment systems depended heavily on their trust in the service providers and perceived protection from fraud. Esawe [

21] extended the Unified Theory of Acceptance and Use of Technology (UTAUT) by including trust as a determinant of behavioral intention.

The inverse relationship between trust and risk has also been widely documented. Abebe and Lessa [

52] noted that higher trust levels reduce concerns about system reliability and data security. Stepcic and Kabanda [

53] provided further evidence by showing that trust in systems like M-Pesa in Kenya was based on robust regulation and widespread adoption. Context also plays a key role. Boateng et al. [

25] observed that merchants’ lack of confidence in telecom providers’ expertise in financial services created adoption barriers. Nuryyev et al. [

54] identified that organizational culture and customer expectations significantly influenced levels of trust in the hospitality sector.

To build trust, service providers must ensure system security, transparency, and customer service reliability. Liébana-Cabanillas and Lara-Rubio [

48] stressed that secure data handling and prompt customer support contribute to institutional trust. Seamless transactions and effective dispute resolution mechanisms are essential for building interpersonal trust. These insights suggest that trust is not a static factor but a dynamic outcome influenced by institutional structures, technical performance, and user interaction.

3.3. Perceived Risk, Security, Privacy, and Regulatory Compliance

Perceived risk represents the possibility of financial loss, fraud, or data breaches associated with digital payment usage. It directly affects the technological and environmental domains of the TOE framework. Retailers often hesitate to adopt digital payments due to fears over system reliability, unauthorized access, and misuse of sensitive information [

55,

56]. Security and privacy, therefore, are closely tied to risk perception.

Moghavvemi et al. [

22] and Esawe [

21] demonstrated that heightened perceived risk discourages adoption, particularly in environments with limited cybersecurity infrastructure. On the other hand, robust security features and privacy controls help build trust and encourage uptake. Altounjy et al. [

57] found that Malaysian retailers were more likely to adopt mobile payment systems when they believed the platforms had strong security protocols. Similarly, Koul et al. [

58] observed that Indian retailers in rural areas adopted digital payments when risk and privacy concerns were addressed.

The privacy–risk paradox also adds complexity. Thoumrungroje and Suprawan [

59] described how consumers want seamless digital solutions but fear information breaches potentially by the merchants, underscoring the need for a balance between convenience and safety. Regulatory compliance further influences risk perception. Akanfe et al. [

60] stressed that compliance with regulations such as GDPR plays a role in managing privacy risks. Dubey and Galhotra [

61] added that AI-driven payment systems must adhere to industry standards to prevent fraud and enhance consumer trust. Omotubora and Basu [

62] noted that compliance mechanisms help enforce digital security and close the governance gap in developing markets. Without such measures, digital innovations may lead to exposure to cybercrime and consumer mistrust.

3.4. Convenience and Ease of Use

Convenience and ease of use are key technological factors within the TOE framework. They refer to the reduction in time, effort, and complexity required for conducting financial transactions. Perceived ease of use is also a core construct in the Technology Acceptance Model (TAM), where user-friendly systems are more likely to be adopted.

Altwairesh and Aloud [

46] confirmed that Saudi retailers prefer systems that require minimal training and cognitive effort. Altounjy et al. [

57] noted that Malaysian merchants transitioned to mobile payment systems because they were faster and required less physical interaction, particularly during the COVID-19 pandemic. Jiang et al. [

63] showed how QR-based payment systems gained popularity due to their ease of use and hygiene-related advantages.

Convenience improves customer satisfaction and boosts business efficiency. In the hospitality industry, simplified checkouts have been linked to better service outcomes [

54]. Yeboah et al. [

24] reported that Ghanaian merchants favored mobile payment platforms with intuitive interfaces. In Hyderabad, India, retailers adopted digital systems more readily when these technologies could be integrated with existing operations [

22]. Nguyen and Huynh [

23] found that usability also reinforces trust, creating a positive feedback loop.

However, ease of use can be undermined by technical barriers. Moghavvemi et al. [

22] warned that glitches, network failures, and lack of support systems may discourage sustained use. Venmadathayil [

64] found that even tech-savvy workers in Dubai avoided digital wallets if they lacked basic instruction or support. While platforms like Bitcoin offer convenience in theory, Echchabi et al. [

65] argued that volatility and security concerns may deter broader use. Overall, simplicity and convenience are essential for both adoption and continued engagement.

3.5. Perceived Usefulness

Perceived usefulness, a central component of both TAM and TOE frameworks, refers to the degree to which a system enhances operational performance. For retailers, this includes faster transactions, reduced overheads, and better customer service. Altwairesh and Aloud [

46] demonstrated that Saudi merchants are more likely to adopt systems that clearly improve business functions.

Altounjy et al. [

57] found that Malaysian merchants valued mobile payment systems for their speed and flexibility. Yeboah et al. [

24] and García-Merino et al. [

66] confirmed that improvements in customer experience and transaction security increase perceived usefulness. In highly digitalized markets, the perception that fintech tools are essential for staying competitive further motivates adoption [

67,

68]. In contexts where cash remains prevalent, digital tools can offer strategic advantages by attracting digitally literate customers [

69].

Perceived usefulness is also shaped by related constructs such as trust and ease of use. Mallat and Tuunainen [

45], Yang et al. [

70], and Jisha [

71] found that these interconnected variables jointly influence adoption decisions. Among smaller retailers, usefulness is often linked to the system’s ability to simplify transactions and provide reliable service.

3.6. Social Influence

Social influence captures the impact of external social pressures on adoption decisions. It falls under the environmental component of the TOE framework and is often studied through UTAUT. It reflects how peers, customers, and industry norms shape perceptions and behaviors.

Ariffin et al. [

72] showed that in Malaysia, merchants adopt mobile payment systems partly because others in their network do so. Esawe [

21] extended this insight by linking social influence with perceived risk. Khando et al. [

11] reported that peer recommendations and customer expectations played a significant role in Sweden’s retail sector. Raj et al. [

69] found that during the pandemic, social influence reinforced contactless payment norms.

Cultural factors also amplify these effects. In collectivist societies, adoption is strongly influenced by community behavior. Observational learning, where businesses follow the lead of more successful peers, reinforces confidence [

53]. Xie et al. [

67] emphasized that positive feedback from industry players reduces perceived risk and encourages adoption.

Together, these six factors form an integrated framework that explains digital payment adoption in Saudi Arabia. By aligning them with the TOE model, this study provides a structured basis for understanding the interplay between technological characteristics, organizational readiness, and external environmental pressures in shaping adoption decisions. Existing research identifies technological factors such as usefulness, convenience, and security; organizational factors such as skills, cost considerations, and workflow integration; and environmental influences such as market competition, customer expectations, and regulatory requirements. The field evidence in this study shows that many retailers adopt digital payment systems while demonstrating limited awareness of the compliance obligations associated with their use. To account for this pattern, the TOE framework is extended by introducing institutional trust as a factor that reduces the perceived importance of risk, and regulatory literacy as an organizational capability that distinguishes informed compliance from procedural adherence. As presented above, most existing studies focus either on consumers or on mature digital economies, leaving limited empirical attention to retailer perspectives in emerging markets and limited consideration of regulatory knowledge as a determinant of adoption. By incorporating institutional trust and regulatory literacy into the TOE framework, this study explains the observed phenomenon of compliance without awareness, where adoption is driven more by institutional and normative pressures than by informed understanding of regulatory requirements.

5. Results and Discussion

The following section presents the results in line with the key factors influencing the adoption of digital payment systems, including cost, trust, perceived risk, security, and regulatory compliance. It explores how perceived usefulness and social influences shape merchant perspectives, while highlighting challenges such as high transaction fees, technical issues, and limited regulatory awareness. The analysis highlights how technological attributes, organisational characteristics, and environmental conditions shape the adoption of digital payment systems among retailers in Saudi Arabia. The findings reflect both enabling factors and key barriers to adoption, with clear implications for practice and policy.

Overall, the trend towards digitalization is clear, with the government’s push for a cashless society and the growing penetration of smartphones and internet services driving the transition. The survey reveals (

Table 4) that 100% of businesses still accept cash, reflecting its continued importance, especially among older demographics and for smaller transactions. However, the adoption of digital payment methods is rapidly increasing, with 100% of businesses accepting Mada, Saudi Arabia’s national payment system, which is now mandatory for most businesses. International card payment systems like Visa and Mastercard are also widely accepted, with 95% of businesses supporting these methods, highlighting their popularity among both locals and expats. Mobile payment solutions are gaining traction, with 90% of businesses accepting STCPay, a popular local mobile payment app, and 85% accepting Apple Pay, which is increasingly favored due to the high penetration of smartphones. Google Pay is also widely used, though slightly less common, with 70% of businesses supporting it. The rise in Buy Now, Pay Later (BNPL) services, such as Tabby and Tamara, is another notable trend, with 60% of businesses offering these options. These services are particularly popular among younger consumers and in sectors like fashion and electronics, where they provide flexibility by allowing customers to pay in installments. Amex (American Express) is less common, accepted by only 50% of businesses, and bank transfers are used by 30%, primarily for larger transactions in high-value sectors like furniture and appliances. Additionally, insurance-based payments are prevalent in the healthcare and pharmacy sectors, with 20% of businesses utilizing this method. The shift towards digital payments is driven by the convenience they offer, such as faster checkout times, reduced queues, and enhanced security. The integration of digital payment systems with Point of Sale (PoS) machines has further streamlined the payment process, making it easier for both businesses and customers.

5.1. The Key Factors Influencing the Adoption of Digital Payment Systems

5.1.1. Cost

The study had three questions related to cost. The results reveal that cost is a significant factor influencing the adoption of digital payment systems among merchants in Saudi Arabia. While many respondents perceive the costs as reasonable and the payment process as efficient, there are still concerns about high transaction fees and slow processing times (

Table 5). These findings align with the theoretical background, which highlights cost as a critical determinant of adoption. However, the perceived benefits of digital payment systems, such as increased efficiency and customer satisfaction, can offset these costs, making them more attractive to merchants.

The majority of respondents (60%) did not mention any specific financial costs, which could indicate a lack of awareness or transparency regarding the costs associated with digital payment systems. This is a significant issue, as merchants need to be fully informed about the financial implications of adopting these systems. The 25% who found the fees reasonable suggest that these merchants are more likely to adopt digital payment systems, as they perceive the costs as manageable. However, the 10% who highlighted high transaction cost as a concern align with the findings of Zhao et al. [

47] and Boateng et al. [

25], who identified transaction cost as a barrier to adoption. The 5% who found the system cost-effective indicate that these merchants perceive the benefits of digital payment systems as outweighing the costs, which is consistent with the findings of Moghavvemi et al. [

22] and Liébana-Cabanillas and Lara-Rubio [

48].

The 40% of respondents who indicated that processing fees influence their choice of payment methods suggest that cost considerations are a significant factor in their decision-making process. This aligns with the findings of Zhao et al. [

47] and Boateng et al. [

25], who identified transaction fees as a barrier to adoption. However, the 60% who stated that processing fees do not influence their choice of payment methods indicate that other factors, such as convenience or customer preference, may be more important. This suggests that while cost is a significant factor, it is not the only consideration for merchants when choosing payment methods.

The 70% of respondents who viewed the payment process as fast and efficient indicate that they perceive digital payment systems as improving business efficiency. This aligns with the findings of Moghavvemi et al. [

22] and Liébana-Cabanillas and Lara-Rubio [

48], who found that perceived benefits, such as increased efficiency, positively influence adoption intentions. However, the 20% who mentioned slow processing times as an issue suggest that this could negatively impact customer satisfaction and business operations. The 10% who had no opinion on the payment process and processing time indicate a lack of engagement or awareness, which could be a barrier to adoption.

5.1.2. Trust

The analysis of trust in digital payment methods among respondents reflects a predominantly positive outlook, with 93% expressing trust in their current systems, while only 7% reported negative perceptions (

Table 6). This aligns with the assertion by Khando et al. [

11] that trust is a key determinant in the adoption of digital payments, as higher trust levels reduce perceived risks. Additionally, Yeboah et al. [

24] noted that trust alleviates merchants’ concerns about fraud and transaction failures, which appears consistent with the high positive response rate observed in this dataset. However, the 7% of respondents indicating negative perceptions suggests lingering concerns about system reliability and potential errors, supporting the inverse relationship between trust and perceived risk as described by Abebe and Lessa [

52].

Trust in digital payment systems is influenced by a combination of institutional trust, interpersonal trust, security and reliability, and transparency and customer support. Regarding how trust is built, the majority of respondents mentioned institutional trust. Institutional trust, which refers to confidence in regulatory frameworks and government backing, emerged as the most significant factor in building trust, with 45% of respondents highlighting its importance. This aligns with Esawe [

21], who emphasized that institutional trust is crucial for reducing perceived risks in digital payment systems. Many respondents mentioned that they trust digital payment systems because they are “required by law” or “backed by the government.” This suggests that strong regulatory oversight and government support play a pivotal role in fostering trust among merchants. In the context of Saudi Arabia, where the government has been actively promoting digital payment systems as part of its Vision 2030 initiative, this finding is particularly relevant. The government’s involvement not only ensures compliance but also reassures users that the systems are secure and reliable. This institutional trust is essential for overcoming initial skepticism and encouraging widespread adoption of digital payment technologies.

Interpersonal trust, which includes peer influence and user experience, was the second most important factor, mentioned by 30% of respondents. This finding is consistent with Boateng et al. [

25], who found that certain contextual elements, such as risk, legal challenges, and skills of the merchants, significantly influence trust in digital payment systems. Respondents often cited that they trust digital payment systems because “everyone is using it” or “it is widely accepted.” This highlights the role of social influence and community behavior in shaping individual trust. In a collectivist culture like Saudi Arabia, where peer behavior and social norms strongly influence decision-making, the widespread adoption of digital payment systems by others can significantly enhance trust. This interpersonal trust is particularly important in the early stages of adoption, where users may rely on the experiences of their peers to overcome initial hesitations.

Security and reliability were cited by 15% of respondents as key factors in building trust. This aligns with Liébana-Cabanillas and Lara-Rubio [

48], who emphasized the importance of data protection and secure transactions in fostering trust. Respondents mentioned that they trust digital payment systems because they are “secure” and “reliable,” with some noting that transactions are “tracked” and “monitored by banks.” This indicates that users place a high value on the security features of digital payment systems. In an era where concerns about fraud, data breaches, and transaction failures are prevalent, robust security measures are essential for reducing perceived risks and building user confidence. The assurance that financial transactions are protected and monitored by trusted institutions like banks further enhances trust in digital payment systems.

Transparency and customer support were highlighted by 10% of respondents as important factors in building trust. This is consistent with Nuryyev et al. [

54], who found that clear terms of service and reliable customer assistance are essential for fostering trust. Respondents mentioned that they trust digital payment systems because they offer “responsive technical support” and “clear transaction records.” This suggests that transparency in operations and effective customer support is critical in building trust among users. In the context of digital payments, where users need assurance that their transactions are secure and that any issues will be promptly resolved, transparency and customer support play a vital role. The ability to quickly address concerns and provide clear information about transactions helps to reduce uncertainty and build long-term trust in the system.

5.1.3. Perceived Risk, Security, Privacy and Regulatory Compliances

The analysis highlights that while a majority of merchants report that they do not experience problems and generally perceive digital payment systems as secure, there are significant gaps in awareness of regulatory compliance and actions taken to mitigate risks (

Table 7). The high percentage of merchants unaware of regulatory requirements and those taking no action to mitigate risks underscores the need for better education and support from payment service providers and regulatory bodies. Additionally, the prevalence of fraud and technical issues as primary risks emphasizes the importance of continuous improvement in cybersecurity measures and user training. By addressing these challenges, stakeholders can foster trust and encourage wider adoption of digital payment systems among merchants.

Risks Associated with Digital Payment Methods

The data shows that 60% of respondents do not perceive any risks associated with digital payment methods, indicating a high level of trust in the security measures provided by payment systems. However, this could also reflect a lack of awareness of potential risks. On the other hand, 40% of respondents acknowledged risks such as fraud, stolen cards, and technical glitches. This aligns with the theoretical discussion that perceived risk, particularly financial loss and security breaches, can act as a barrier to adoption [

21,

22]. Merchants who have experienced or are aware of these risks may be more cautious in their use of digital payment systems. The findings highlight the need for continuous education and awareness campaigns to help merchants understand and mitigate these risks effectively.

Types of Risks

The types of risks identified by respondents include fraud (50%), such as stolen cards and chargebacks; technical issues (30%), such as connection problems; and human error (20%), such as incorrect input of transaction amounts. Fraud is the most significant concern, consistent with the literature that highlights fraud as a major issue, especially in regions with less robust cybersecurity infrastructure [

56,

58]. Technical issues, such as system failures, can disrupt transactions and lead to customer dissatisfaction, while human error underscores the need for better training and user-friendly interfaces to minimize mistakes [

24]. Addressing these risks through enhanced security measures and employee training is crucial for building trust and encouraging adoption.

Perception of Payment Security at Point of Sale

The perception of payment security at Point of Sale (PoS) is largely positive, with 70% of respondents considering the systems secure. This high level of trust is consistent with studies showing that trust in security measures is a key driver of digital payment adoption [

24,

25]. However, 20% of respondents expressed that the systems are mostly secure but have some concerns, particularly regarding technical issues and fraud. This reflects the “perceived risk–privacy paradox,” where merchants desire convenience but remain wary of potential breaches [

77]. Additionally, 10% of respondents felt that the systems are not secure, which could be a significant barrier to adoption for these merchants. Addressing these concerns through enhanced security measures, transparent communication, and user education is crucial for fostering trust and encouraging wider adoption of digital payment systems [

57,

72].

Regulatory Compliance

The analysis of regulatory compliance reveals that 90% of respondents are not aware of any regulatory requirements related to digital payment systems. This indicates a significant knowledge gap among merchants regarding the legal and regulatory frameworks governing digital payments. Only 10% of respondents mentioned awareness of specific compliance requirements, such as Zakat and taxes. This lack of awareness could lead to non-compliance and potential legal issues for merchants. The findings suggest that regulatory bodies and payment service providers need to improve communication and education about compliance requirements to ensure merchants operate within legal boundaries. This aligns with studies by Putrevu and Mertzanis [

78], which emphasize the importance of regulatory awareness in fostering trust and adoption of digital payment systems.

Actions Taken to Mitigate Risks

The analysis reveals that 40% of respondents take no action to mitigate risks, which is concerning given the potential for financial loss and security breaches. This could be due to a lack of awareness or resources to address these issues. Thirty percent of respondents rely on contacting the bank or payment provider when issues arise, indicating dependence on external support. Twenty percent of respondents focus on educating employees to reduce human error and improve transaction accuracy, while 10% report updating systems or software to enhance security. These findings align with the theoretical emphasis on the importance of robust cybersecurity measures and continuous improvement in system security [

48,

54]. The lack of proactive risk mitigation strategies among a significant portion of respondents highlights the need for greater support and resources to help merchants address these challenges effectively.

5.1.4. Convenience and Ease of Use

The findings reveal (

Table 8) that speed, regulatory compliance, competitive pressure, and cost-effectiveness are the primary drivers behind the adoption of digital payment systems among retailers in Saudi Arabia. Notably, 45% of respondents emphasized transaction speed as a key factor, highlighting its role in reducing processing time and improving customer satisfaction. This aligns with the Technology Acceptance Model (TAM), which posits that perceived usefulness—often driven by efficiency improvements—significantly influences technology adoption [

46]. Similar trends have been observed in Malaysia, where merchants transitioned to mobile payment systems due to their ability to facilitate faster transactions with minimal physical contact, catering to evolving consumer preferences [

57]. Additionally, the acceleration of QR-based payments during the COVID-19 pandemic underscores the critical role of speed in enhancing user experience and promoting digital payment adoption [

63].

Regulatory compliance emerged as the second most influential factor, cited by 40% of respondents. This finding reflects the growing legal mandate for digital payment integration in Saudi Arabia’s retail sector, as policymakers push for increased financial transparency and reduced cash dependency. Similar patterns are evident in Ghana, where merchants prioritize mobile payment platforms to ensure regulatory adherence while benefiting from quick and straightforward transaction processing [

24]. However, while compliance is a strong motivator, it does not necessarily translate to ease of use, suggesting that businesses may adopt digital payments out of necessity rather than preference. This insight aligns with previous research in India, where retailers were more likely to adopt cashless payment systems when they perceived the technology as simple to integrate into existing business processes, minimizing infrastructure and training costs [

79].

Competitive pressure was another significant factor, with 30% of respondents indicating that they adopted digital payments because other merchants were doing so. This finding is consistent with diffusion of innovation theory, which suggests that businesses are more likely to adopt new technologies when they see peers benefiting from them [

80]. Retailers in Hyderabad, India, have exhibited similar behavior, recognizing that digital payments provide a competitive advantage by attracting tech-savvy consumers [

79]. However, this factor raises concerns about whether merchants are adopting digital payments out of strategic intent or merely to conform to industry trends. If the latter, this could indicate potential resistance to long-term adoption if merchants perceive digital payment systems as complex or unreliable.

Cost-effectiveness also played a significant role, with 20% of respondents citing lower transaction fees as a key benefit. This finding aligns with previous research indicating that financial costs influence technology adoption decisions [

22]. In Saudi Arabia, where many small businesses operate on tight margins, minimizing processing fees can be a crucial incentive. Similar concerns have been raised in discussions about cryptocurrency payments, where merchants remain hesitant despite the ease of Bitcoin transactions due to concerns about volatility and hidden costs [

65].

Despite these advantages, ease of use was cited by only 5% of respondents, suggesting that while speed and compliance drive adoption, the perceived simplicity of digital payment systems is not a primary consideration. This contrasts with findings from Dubai, where blue-collar workers preferred digital wallets with intuitive interfaces requiring minimal technical knowledge [

64]. The low emphasis on ease of use indicates that businesses may still experience technical or cognitive barriers when adopting these systems, reinforcing concerns that usability challenges could hinder widespread adoption [

22]. Cultural or infrastructural factors could also be behind such an observation, which needs to be further explored in depth.

Finally, 10% of respondents mentioned additional factors such as convenience, safety, and flexibility, reinforcing the psychological dimension of digital payment adoption. Research indicates that trust plays a crucial role in technology adoption, as merchants are more likely to embrace digital payment platforms when they perceive them as secure and reliable [

23]. The psychological comfort associated with digital transactions, including fraud prevention measures and seamless refund processes, can significantly impact adoption rates [

70].

Regarding the handling of technical issues, the analysis of the data reveals (

Table 9) that while a significant majority of merchants (65%) report satisfaction with the prompt resolution of technical issues, which aligns with the Technology Acceptance Model’s emphasis on perceived ease of use and usefulness [

46], several critical challenges persist that hinder the full potential of digital payment systems. Approximately 25% of respondents highlighted frequent connection issues, particularly during peak hours, which disrupt transaction processes and reduce operational efficiency. This issue is consistent with findings by Moghavvemi et al. [

22], who identified network instability as a major barrier to digital payment adoption. Additionally, 15% of merchants reported POS machine malfunctions, such as battery life issues, printing errors, and declined transactions, which create friction in the payment process and undermine customer trust. These technical glitches can significantly reduce the perceived convenience of digital payment systems. Furthermore, 10% of respondents expressed dissatisfaction with delayed technical support, which exacerbates operational disruptions and erodes confidence in the system. A smaller but notable 5% of merchants cited a lack of technical expertise, particularly among older or less digitally literate users, as a barrier to troubleshooting minor issues independently. While the majority of merchants appreciate the convenience and efficiency of digital payment systems, addressing these technical challenges—through improved network infrastructure, reliable POS machines, responsive support systems, and targeted training programs—is essential to sustain and expand adoption, particularly in regions where digital literacy and infrastructure limitations pose additional hurdles.

In conclusion, the adoption of digital payment systems among Saudi retailers is primarily driven by speed, regulatory compliance, competitive pressure, and cost-effectiveness, with ease of use playing a surprisingly minor role. While these factors align with global trends, the low emphasis on usability suggests a potential area for improvement. Addressing technical challenges, enhancing user-friendly interfaces, and reinforcing trust in digital payment security could further encourage long-term adoption. As research indicates, successful digital payment systems must balance speed, compliance, affordability, and ease of use to achieve widespread and sustained adoption in the retail sector [

81].

5.1.5. Perceived Usefulness

The analysis focusing on Perceived Usefulness (PU) reveals (

Table 10) that retailers in Saudi Arabia largely view digital payment systems as beneficial for enhancing business performance, aligning with the theoretical framework of Davis [

82] and subsequent studies. A significant majority (85%) of respondents highlighted that digital payments increase transaction speed, reducing queues and improving customer satisfaction. This finding is consistent with Altounjy et al. [

57], who emphasized that faster transactions are a key driver of PU. Additionally, 60% of retailers noted that digital payments reduce operational costs, such as cash handling and frequent bank deposits, which aligns with Yeboah et al. [

24], who identified cost reduction as a major benefit of digital payment adoption. However, 40% of respondents expressed concerns about security, particularly regarding fraud and stolen card information, echoing Mallat and Tuunainen [

45], who highlighted that security concerns can negatively impact PU. These findings suggest that while retailers recognize the efficiency and cost-saving benefits of digital payments, security remains a critical barrier to full adoption.

From the perspective of customer convenience, retailers overwhelmingly (90%) acknowledged that digital payments make checkouts faster for customers, which is a key factor in PU [

57]. Furthermore, 80% of respondents emphasized that digital payments are easier for customers to use, eliminating the need to carry cash, which aligns with Yang et al. [

70], who identified ease of use as a critical component of PU. Retailers also noted that customers perceive digital payments as more secure (70%), reducing the risk of theft and loss of cash, consistent with García-Merino et al. [

66]. However, 30% of respondents mentioned that customers sometimes face technical issues, such as connection problems or declined transactions, which can negatively impact PU [

71]. These findings indicate that while digital payments are seen as convenient and secure by both retailers and customers, technical reliability remains a concern that could hinder broader adoption.

Overall, the data underscores the pivotal role of Perceived Usefulness in driving the adoption of digital payment systems among retailers in Saudi Arabia. Retailers perceive tangible benefits such as increased transaction speed, reduced operational costs, and enhanced customer convenience, which align with the findings of Le [

67] and Xie et al. [

68]. However, security concerns and technical issues present significant challenges that need to be addressed to fully realize the potential of digital payments.

5.1.6. Social Influence

The findings highlight varying degrees of influence from competitors, customers, friends and family, and merchants’ ability to shape customer payment preferences (

Table 11). The analysis reveals that social influence, while present, plays a secondary role compared to technological and regulatory drivers in shaping digital payment adoption in this context. Competitive practices and customer preferences play a moderate role, while personal networks and merchant influence on customer behavior are relatively limited. These findings suggest that other factors, such as regulatory requirements, system reliability, and ease of use, may be more critical in shaping adoption trends. This aligns with the broader literature, particularly the work of Venkatesh et al. [

83] and Esawe [

21], which highlights the multifaceted nature of technology adoption.

The majority of respondents (70%) reported no pressure from competitors, indicating that competitive pressure is not a primary driver of digital payment adoption. However, 20% of respondents did feel pressure, particularly in industries where competitors offered advanced payment options like Tabby and Tamara. This aligns with Khando et al. [

11], who found that competitive practices can accelerate adoption in highly competitive markets. Similarly, customer pressure was reported by 30% of respondents, particularly in industries where cashless transactions are expected. This suggests that customer preferences, especially for specific payment methods, can influence adoption, as noted by Esawe [

21]. However, 60% of respondents reported no customer pressure, indicating that customer demand alone is not a dominant factor in this context.

A significant majority (80%) of respondents reported no influence from friends and family, suggesting that personal networks play a minimal role in the adoption of digital payment systems. This contrasts with Ariffin et al. [

72], who emphasized the importance of social networks in technology adoption. Only 15% of respondents reported some influence, typically in cases where friends or family recommended specific payment methods like STCPay. This indicates that while personal recommendations can play a role, they are not a major driver of adoption in this context. The limited influence of personal networks may be due to the strong regulatory push and widespread availability of digital payment systems in Saudi Arabia, reducing the need for social validation.

Half of the respondents (50%) reported no influence on customer payment methods, suggesting that merchants do not actively shape customer preferences. However, 40% reported some influence, particularly when merchants encouraged the use of digital payments over cash. This aligns with Nuryyev et al. [

54], who found that merchants can promote digital payment adoption through observational learning and positive reinforcement. Only 10% of respondents reported strong influence, typically in cases where merchants actively promoted specific payment options like Tabby or Tamara. This indicates that while merchants can influence customer behavior, their role is often limited to encouraging existing trends rather than driving significant shifts in payment preferences. A synthesis of the empirical results and their corresponding theoretical contributions, covering institutional trust, regulatory compliance, perceived risk, payment modality preferences, and the moderate role of social influence, is provided in

Table 12.

The survey conducted among 100 retailers in Riyadh provides a comprehensive picture of how digital payment systems are adopted and understood in the retail sector. The results highlight several influential factors, including perceived usefulness, trust, perceived risk, cost sensitivity, security, regulatory compliance, convenience, ease of use, and social influence. These findings reflect both the opportunities and frictions shaping the shift toward a cashless economy under Saudi Arabia’s Vision 2030. As shown in

Table 13, perceived risk is positively associated with cost sensitivity and social influence, while institutional trust is negatively associated with perceived risk. In contrast, regulatory awareness shows only weak associations with other variables, indicating that many retailers comply with digital payment mandates without a clear understanding of the regulatory framework, a pattern we refer to as

compliance without awareness. Taken together, these relationships suggest that adoption in this context is shaped by a blend of operational benefits, institutional assurance, and normative pressure, rather than by informed regulatory understanding alone.

Table 13 presents exploratory association patterns among key retailer adoption factors using phi (Φ) coefficients derived from binary cross-tabulations. The positive association between perceived risk and cost sensitivity (Φ = +0.44) suggests that retailers who perceive higher security or fraud-related risks also become more attentive to transaction fees and financial exposure. This aligns with behavioral risk theory, which suggests that perceived uncertainty increases financial cautiousness in decision-making. The moderate positive association between social influence and trust (Φ = +0.22) indicates that competitive practices and customer expectations reinforce system confidence. Retailers tend to trust digital payment systems more when they observe widespread use among peers and customers, reflecting diffusion and observational learning dynamics. The weak positive association between cost sensitivity and trust (Φ = +0.15) suggests that trust does not eliminate financial evaluation but may encourage selective acceptance of payment platforms rather than outright rejection. Conversely, the weak negative association between cost sensitivity and perceived usefulness (Φ = −0.18) indicates that strong concern over transaction fees may reduce the perceived operational benefits of digital payments, particularly among small retailers operating on thin margins. The near-zero association between trust and perceived risk (Φ ≈ 0.00) suggests that institutional confidence and perceived technical vulnerabilities coexist rather than cancel each other out. Retailers may trust state-backed systems while simultaneously recognizing exposure to fraud, errors, or technical disruptions. The weak and mixed association between social influence and perceived risk (Φ = −0.09) suggests that retailers uncertain about risks may rely modestly on peer behavior when forming risk judgments. Most notably, regulatory awareness shows no measurable association with any other variable (Φ ≈ 0.00). This supports the central empirical claim of this study, namely, the existence of compliance without awareness—where retailers use digital payment systems due to institutional pressure and infrastructural mandate rather than informed understanding of regulatory obligations.

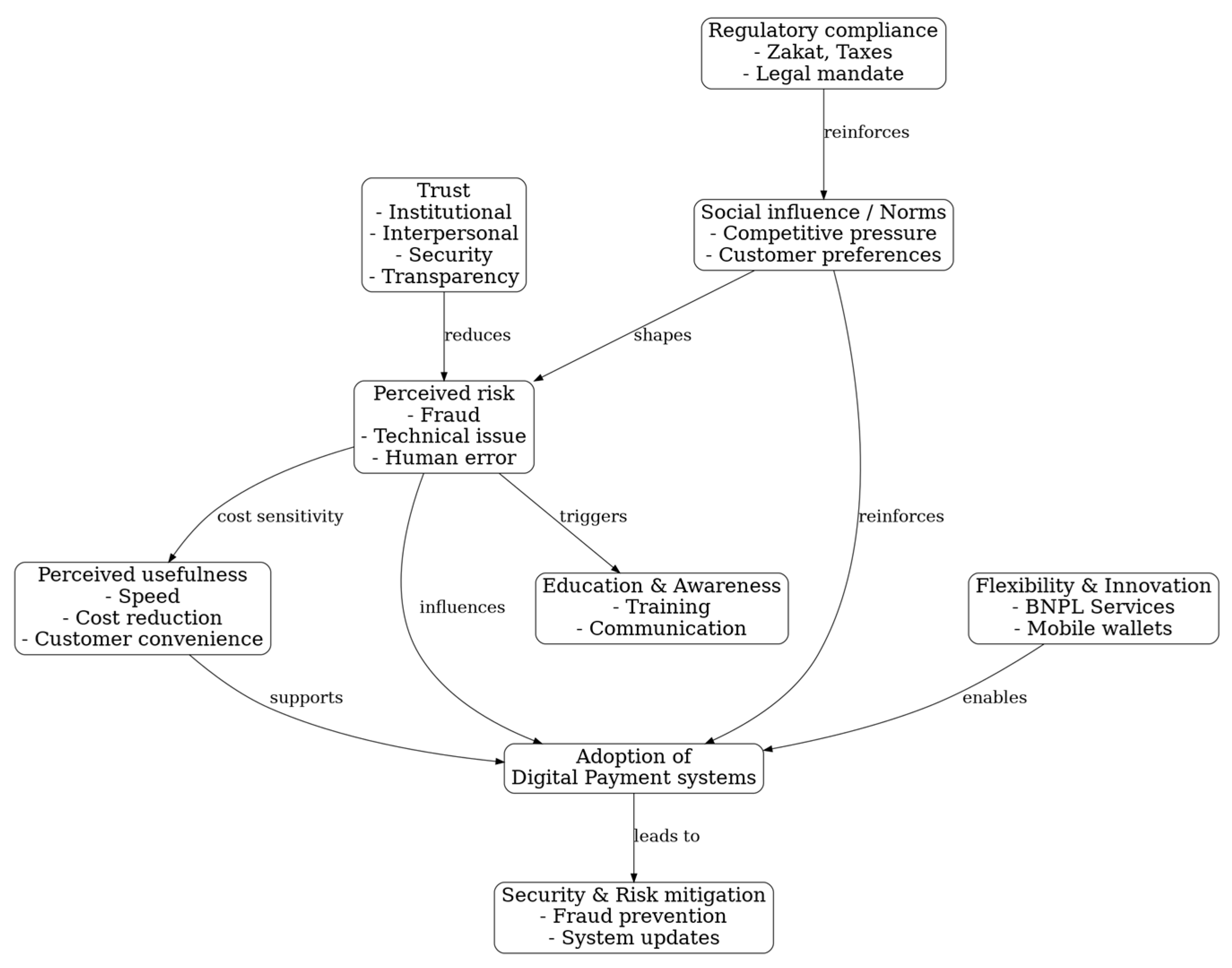

Figure 1 illustrates how these factors interact to influence the adoption of digital payment systems. The relationships shown in the figure are derived from the empirical findings and exploratory association patterns presented in