Digitalization and Supply Chain Carbon Performance: The Role of Focal Firms

Abstract

1. Introduction

2. Literature Review and Theoretical Analysis

2.1. Carbon Performance

2.2. Firm Digitalization

2.3. Dynamic Capabilities Theory

2.4. Internal Mechanisms

2.4.1. Digitalization and Resource Allocation

2.4.2. Digitalization and Collaborative Technological Upgrading

2.5. External Environment

3. Research Design

3.1. Sample Selection and Data Processing

3.2. Model Specification and Variable Definitions

4. Results and Analysis

4.1. Benchmark Regression Results

4.2. Robustness Checks

4.2.1. Alternative Measures of the Core Explanatory Variable

4.2.2. Robustness Check Through Group Regressions by Capital Intensity

4.2.3. Alternative Measures of the Dependent Variable

4.2.4. Including Industry Fixed Effects

4.2.5. Addressing Endogeneity: Instrumental Variable Approach

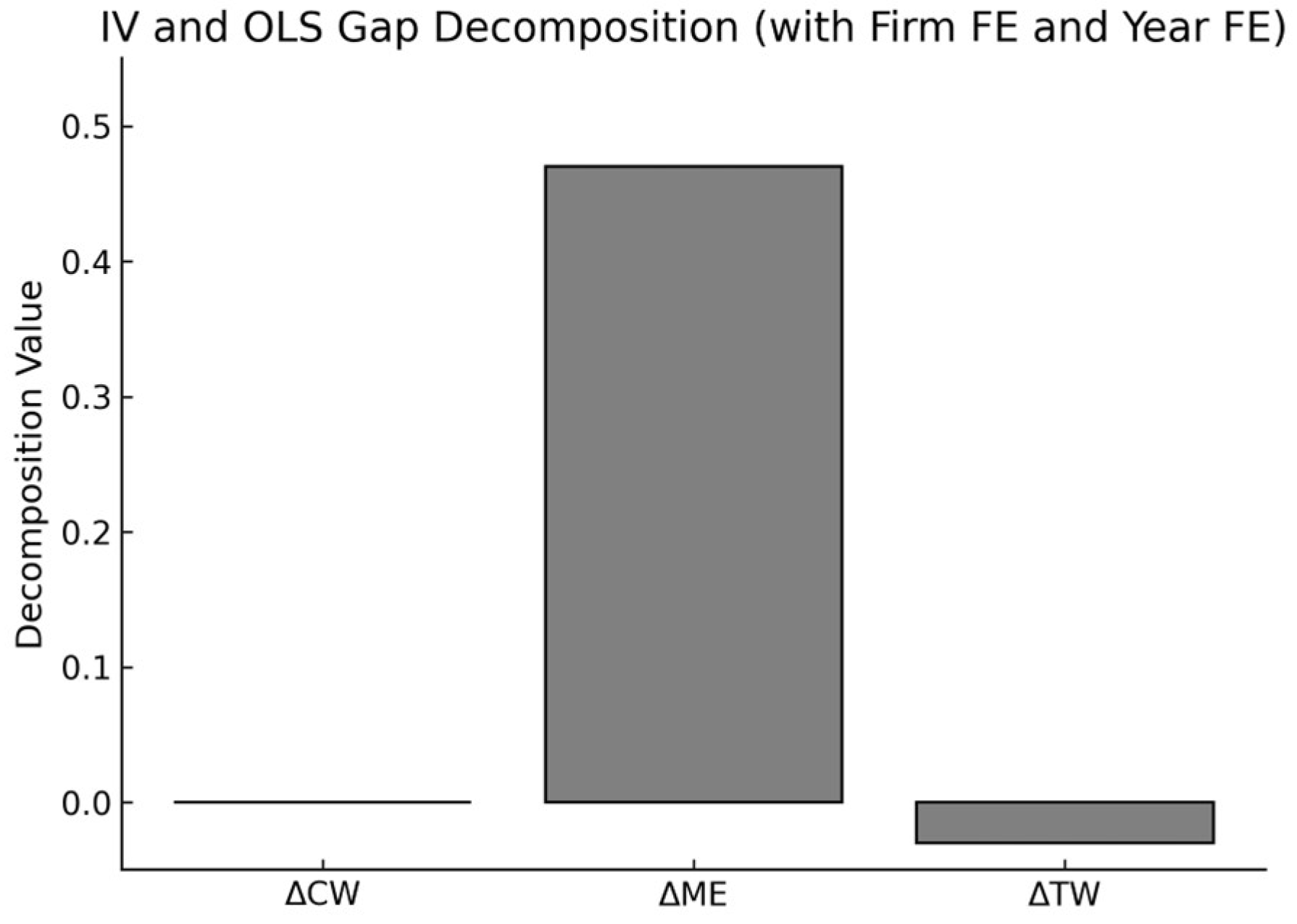

4.2.6. IV-OLS Decomposition Test

4.2.7. Kinky Least Squares (KLS) Test

4.3. Mechanism Analysis

4.3.1. Mechanism of Optimizing Resource Allocation

4.3.2. Mechanism of Collaborative Technological Upgrading

4.3.3. Robustness Check

4.4. Further Analysis

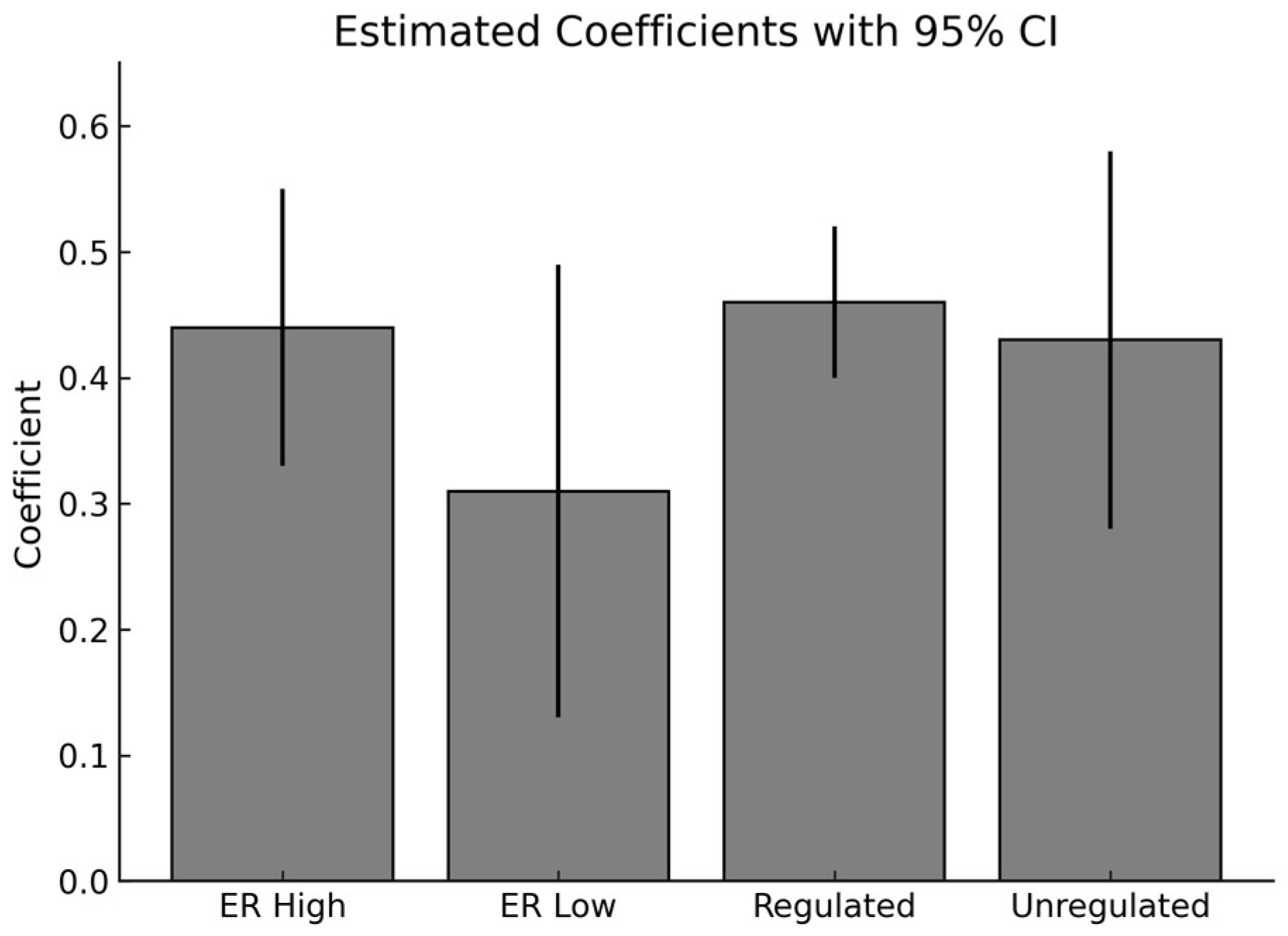

4.4.1. Heterogeneity in Regional Environmental Regulation

4.4.2. Heterogeneity Between Regulated and Unregulated Industries

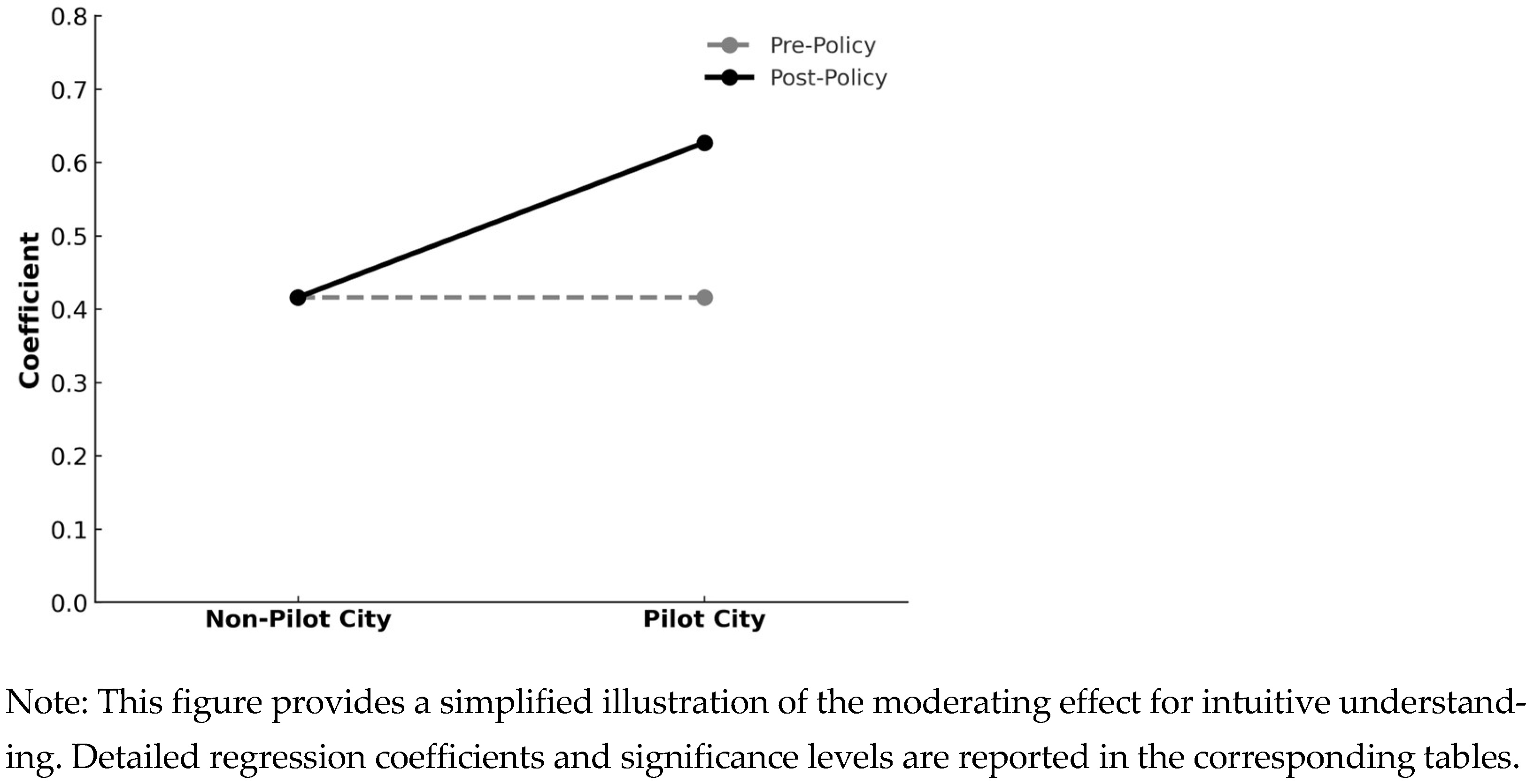

4.4.3. Moderating Role of the Supply-Chain Pilot-City Policy

5. Conclusions and Implications

5.1. Conclusions

5.2. Implications

5.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Chopra, S.; Meindl, P. Supply Chain Management: Strategy, Planning, and Operation, 6th ed.; Pearson Education: Harlow, UK, 2016. [Google Scholar]

- Jira, C.; Toffel, W.M. Engaging Supply Chains in Climate Change. Manuf. Serv. Oper. Manag. 2013, 15, 559–577. [Google Scholar] [CrossRef]

- Matthew, E.; Benjamin, G.V.M.L. Supply Network Formation and Fragility. Am. Econ. Rev. 2022, 112, 2701–2747. [Google Scholar] [CrossRef]

- Dauvergne, P.; Lister, J. Big brand sustainability: Governance prospects and environmental limits. Glob. Environ. Change Hum. Policy Dimens. 2012, 22, 36–45. [Google Scholar] [CrossRef]

- Ferreira, J.J.; Fernandes, I.C.; Ferreira, A.F. To Be or Not to Be Digital, That Is the Question: Firm Innovation and Performance. J. Bus. Res. 2019, 101, 583–590. [Google Scholar] [CrossRef]

- Meng, B.; Zang, Q.; Li, G. Study on the Impact of Corporate Social Responsibility on Carbon Performance in the Background of Carbon Peaking and Carbon Neutrality. Bus. Ethics Environ. Responsib. 2023, 33, 416–430. [Google Scholar] [CrossRef]

- Li, J.; Ji, L.; Zhang, S.; Zhu, Y. Digital Technology, Green Innovation, and the Carbon Performance of Manufacturing Enterprises. Front. Environ. Sci. 2024, 12, 1384332. [Google Scholar] [CrossRef]

- Qiao, W.; Xie, Y.; Liu, J.; Huang, X. The Impacts of Urbanization on Carbon Emission Performance: New Evidence from the Yangtze River Delta Urban Agglomeration, China. Land 2024, 14, 12. [Google Scholar] [CrossRef]

- Zhao, Z.; Zhao, Y.; Shi, X.; Zheng, L.; Fan, S.; Zuo, S. Green Innovation and Carbon Emission Performance: The Role of Digital Economy. Energy Policy 2024, 195, 114344. [Google Scholar] [CrossRef]

- Hua, J.; Wang, K.; Lin, J.; Qian, Y. Carbon Tax vs. Carbon Cap-and-Trade: Implementation of carbon border tax in cros890s-regional production. Int. J. Prod. Econ. 2024, 274, 109317. [Google Scholar] [CrossRef]

- Shi, W.; Sang, J.; Zhou, J.; Ding, X. Can carbon emission trading improve carbon emission performance? Evidence from a quasi-natural experiment in China. Environ. Sci. Pollut. Res. Int. 2023, 30, 124028–124040. [Google Scholar] [CrossRef]

- Soosay, C.A.; Hyland, P. A decade of supply chain collaboration and directions for future research. Supply Chain. Manag. Int. J. 2015, 20, 613–630. [Google Scholar] [CrossRef]

- Gupta, A.K. Innovation dimensions and firm performance synergy in the emerging market: A perspective from Dynamic Capability Theory & Signaling Theory. Technol. Soc. 2021, 64, 101512. [Google Scholar] [CrossRef]

- Vial, G. Understanding digital transformation: A review and a research agenda. J. Strateg. Inf. Syst. 2019, 28, 118–144. [Google Scholar] [CrossRef]

- Lin, B.; Du, K. Energy and CO2 emissions performance in China’s regional economies: Do market-oriented reforms matter? Energy Policy 2015, 78, 113–124. [Google Scholar] [CrossRef]

- Narsa, G.N. Corporate governance: Does it matter management of carbon emission performance? An empirical analyses of Indian companies. J. Clean. Prod. 2022, 379, 134485. [Google Scholar] [CrossRef]

- Li, H.; Yang, Z.; An, J. Green finance, new infrastructure, and carbon emission performance in Chinese cities. Front. Environ. Sci. 2024, 12, 1352869. [Google Scholar] [CrossRef]

- Wang, H.; Zhang, Z. Construction and Application of Regional Carbon Performance Evaluation Index System: The Case of Chinese Provinces. Sustainability 2024, 16, 4460. [Google Scholar] [CrossRef]

- Srivastava, S.K. Green Supply-Chain Management: A State-of-the-Art Literature Review. Int. J. Manag. Rev. 2007, 9, 53–80. [Google Scholar] [CrossRef]

- Wu, S.; Wang, H.; Guo, Y.; Fan, Y. Supply Chain Concentration, Financing Constraints, and Carbon Performance. Sustainability 2024, 16, 1354. [Google Scholar] [CrossRef]

- Fang, L.; Li, Z. Corporate digitalization and green innovation: Evidence from textual analysis of firm annual reports and corporate green patent data in China. Bus. Strategy Environ. 2024, 33, 3936–3964. [Google Scholar] [CrossRef]

- Luo, Y.; Lu, Z.; Wu, C. Can internet development accelerate the green innovation efficiency convergence: Evidence from China. Technol. Forecast. Soc. Change 2023, 189, 122352. [Google Scholar] [CrossRef]

- Yu, F.; Jiang, D.; Zhang, Y.; Du, H. Enterprise digitalisation and financial performance: The moderating role of dynamic capability. Technol. Anal. Strateg. Manag. 2023, 35, 704–720. [Google Scholar] [CrossRef]

- Li, N.; Wang, X.; Zhang, S. Effects of digitization on enterprise growth performance: Mediating role of strategic change and moderating role of dynamic capability. Manag. Decis. Econ. 2022, 44, 1040–1053. [Google Scholar] [CrossRef]

- Wang, J.; Wang, J. “Booster” or “Obstacle”: Can digital transformation improve energy efficiency? Firm-level evidence from China. Energy 2024, 296, 131101. [Google Scholar] [CrossRef]

- Nayal, K.; Raut, D.R.; Yadav, S.V.; Priyadarshinee, P.; Narkhede, B.E. The impact of sustainable development strategy on sustainable supply chain firm performance in the digital transformation era. Bus. Strategy Environ. 2024, 33, 4974–4975. [Google Scholar] [CrossRef]

- Lee, L.H.; Padmanabhan, V.; Whang, S. Information Distortion in a Supply Chain: The Bullwhip Effect. Manag. Sci. 2004, 50, 1875–1886. [Google Scholar] [CrossRef]

- Li, M.; Zhang, Z. Digital technology adoption and the latecomer firms’ catch-up: An empirical study on Chinese manufacturing enterprises. Technol. Anal. Strateg. Manag. 2024, 1–15. [Google Scholar] [CrossRef]

- Teece, J.D. Explicating dynamic capabilities: The nature and micro foundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Ferreira, J.; Coelho, A.; Moutinho, L. Dynamic capabilities, creativity and innovation capability and their impact on competitive advantage and firm performance: The moderating role of entrepreneurial orientation. Technovation 2020, 92–93, 102061. [Google Scholar] [CrossRef]

- He, Q.; Meadows, M.; Angwin, D.; Gomes, E.; Child, J. Strategic adaptation to environmental jolts: The role of corporate headquarters in a crisis. Br. J. Manag. 2020, 31, 456–474. [Google Scholar] [CrossRef]

- Chowdhury, M.; Quaddus, M. Supply chain resilience: Conceptualization and scale development using dynamic capability theory. Int. J. Prod. Econ. 2017, 188, 185–204. [Google Scholar] [CrossRef]

- Qiu, X.; Holmen, E.; Havenvid, M.; De Boer, L.; Hermundsdottir, F. Open for business: Towards an interactive view on dynamic capabilities. Ind. Mark. Manag. 2022, 107, 148–160. [Google Scholar] [CrossRef]

- Abbas, J. Does the nexus of corporate social responsibility and green dynamic capabilities drive environmental innovation? Technol. Forecast. Soc. Change 2024, 180, 121557. [Google Scholar] [CrossRef]

- Balci, G. Digitalization in Container Shipping: Do Perception and Satisfaction regarding Digital Products in a Non-technology Industry Affect Overall Customer Loyalty? Technol. Forecast. Soc. Change 2021, 172, 121016. [Google Scholar] [CrossRef]

- Tommaso, C.; Martin, K.; Silvia, M. Digital technologies, innovation, and skills: Emerging trajectories and challenges. Res. Policy 2021, 50, 104289. [Google Scholar] [CrossRef]

- Sun, L.; Ong, T.S.; Teh, B.H.; Di Vaio, A. Sustainable performance measurement through digital transformation within the sustainable development framework: The mediating effect of supply chain concentration. Sustain. Dev. 2024, 32, 5895–5912. [Google Scholar] [CrossRef]

- Chen, Q.; Gong, Z.; Wu, J.; Wang, T. Does Digital Transformation Affect Carbon Performance Through Talent? The Moderating Role of Employee Structure. J. Clean. Prod. 2024, 435, 140581. [Google Scholar] [CrossRef]

- Li, J.; Wang, L.; Tan, X. Sustainable design and optimization of coal supply chain network under different carbon emission policies. J. Clean. Prod. 2019, 250, 119548. [Google Scholar] [CrossRef]

- Lu, Q.; Qin, W.; Yan, R.; Zhang, S.; Ma, L. The Effect of SMEs’ Digitalization on Supply Chain Financing Performance: Based on the Resource Orchestration Theory. J. Theor. Appl. Electron. Commer. Res. 2025, 20, 20. [Google Scholar] [CrossRef]

- Li, N.; Wu, D. Green supply chain, financing constraints and carbon emission reduction. Financ. Res. Lett. 2025, 80, 107382. [Google Scholar] [CrossRef]

- Qin, J.; Lyu, X.; Fu, H.; Wang, Z. Carbon emission reducing and financing strategies of capital-constrained supply chains using equity financing under different power structures. Ann. Oper. Res. 2024, 1–37. [Google Scholar] [CrossRef]

- Syverson, C. What Determines Productivity? J. Econ. Lit. 2011, 49, 326–365. [Google Scholar] [CrossRef]

- Wang, S.; Chen, F. Can New Quality Productivity Promote the Carbon Emission Performance—Empirical Evidence from China. Sustainability 2025, 17, 567. [Google Scholar] [CrossRef]

- Zhou, X.; Zhou, D.; Wang, Q. How does information and communication technology affect China’s energy intensity? A three-tier structural decomposition analysis. Energy 2018, 151, 748–759. [Google Scholar] [CrossRef]

- Sun, H.; Zhang, Z.; Liu, Z. Regional differences and threshold effect of clean technology innovation on industrial green total factor productivity. Front. Environ. Sci. 2022, 10, 985591. [Google Scholar] [CrossRef]

- Daron, A.; Philippe, A.; Leonardo, B.; David, H. The Environment and Directed Technical Change. Am. Econ. Rev. 2012, 102, 131–166. [Google Scholar] [CrossRef]

- Li, P. The Impact of Digital Transformation on Total Factor Productivity. J. Appl. Econ. Policy Stud. 2024, 13, 55–68. [Google Scholar] [CrossRef]

- Bresnahan, F.T.; Brynjolfsson, E.; Hitt, M.L. Information Technology, Workplace Organization, and the Demand for Skilled Labor: Firm-Level Evidence. Q. J. Econ. 2002, 117, 339–376. [Google Scholar] [CrossRef]

- Bertani, F.; Raberto, M.; Teglio, A. The productivity and unemployment effects of the digital transformation: An empirical and modelling assessment. Rev. Evol. Political Econ. 2020, 1, 329–355. [Google Scholar] [CrossRef]

- Ceccagnoli, M.; Forman, C.; Huang, P.; Wu, D.J. Co-Creation of Value in a Platform Ecosystem: The Case of Enterprise Software. MIS Q. 2012, 36, 263–290. [Google Scholar] [CrossRef]

- Liu, Y.; Hu, S.; Wang, C. The green innovation spillover effect of enterprise digital transformation: Based on supply chain perspective. Econ. Anal. Policy 2024, 84, 1381–1393. [Google Scholar] [CrossRef]

- Chen, Y.; Cai, Q.; Wang, Z.; Xu, Z. Has digital transformation enhanced the corporate resilience in the face of COVID-19? Evidence from China. Int. Rev. Financ. Anal. 2024, 96, 103709. [Google Scholar] [CrossRef]

- Zhou, A.; Li, J. Impact of policy combinations on carbon emission performance: Evidence from China. Clean Technol. Environ. Policy 2024, 26, 3069–3088. [Google Scholar] [CrossRef]

- Nie, G.; Zhu, Y.; Wu, W.; Xie, W.; Wu, K. Impact of Voluntary Environmental Regulation on Green Technological Innovation: Evidence from Chinese Manufacturing Enterprises. Front. Energy Res. 2022, 10, 889037. [Google Scholar] [CrossRef]

- Jia, S.; Zhu, X.; Gao, X.; Yang, X. The influence of carbon emission trading on the optimization of regional energy structure. Heliyon 2024, 10, e31706. [Google Scholar] [CrossRef]

- Wu, G.; Feng, C.; Ling, S. The Synergistic Effect of the Dual Carbon Reduction Pilot on Corporate Carbon Performance: Empirical Evidence from Listed Manufacturing Companies. Sustainability 2025, 17, 4409. [Google Scholar] [CrossRef]

- Cui, H.; Cao, Y. China’s cities go carbon neutral: How can new-type urbanization policies improve urban carbon performance? Sustain. Prod. Consum. 2023, 42, 74–94. [Google Scholar] [CrossRef]

- Chu, Y.; Tian, X.; Wang, W. Corporate Innovation Along the Supply Chain. Manag. Sci. 2018, 65, 2445–2466. [Google Scholar] [CrossRef]

- Clarkson, M.P.; Li, Y.; Richardson, D.G.; Vasvari, P.F. Does It Really Pay to Be Green? Determinants and Consequences of Proactive Environmental Strategies. J. Account. Public Policy 2010, 30, 122–144. [Google Scholar] [CrossRef]

- Shen, H.; Huang, N. Will the Carbon Emission Trading Scheme Improve Firm Value? Financ. Trade Econ. 2019, 40, 144–161. [Google Scholar]

- Huang, B.; Li, H. Digital Technology Innovation and The High-quality Development of Chinese Enterprises: Evidence from Enterprise’s Digital Patents. Econ. Res. J. 2023, 58, 97–115. [Google Scholar]

- Zhou, L.; Wu, H. Supply Chain Finance and Product Market Performance. Financ. Econ. Res. 2022, 37, 99–112. [Google Scholar]

- Wu, F.; Hu, H.; Lin, H.; Ren, X. Enterprise Digital Transformation and Capital Market Performance: Empirical Evidence from Stock Liquidity. J. Manag. World 2021, 37, 130–144+10. [Google Scholar] [CrossRef]

- Zhang, Y.; Li, X.; Xing, M. Enterprise Digital Transformation and Audit Pricing. Audit. Res. 2021, 03, 62–71. [Google Scholar]

- Ishimaru, S. Empirical decomposition of the IV-OLS gap with heterogeneous and nonlinear effects. Rev. Econ. Stat. 2024, 106, 505–521. [Google Scholar] [CrossRef]

- Kiviet, J.F. Instrument-free inference under confined regressor endogeneity. Econ. Lett. 2020, 196, 109567. [Google Scholar] [CrossRef]

- Benedikt, S.; Christopher, M.; Markus, B. Developing net-zero carbon supply chains in the European manufacturing industry—A multilevel perspective. Supply Chain. Manag. Int. J. 2024, 29, 164–181. [Google Scholar] [CrossRef]

| Type | Variable | Definition |

|---|---|---|

| Dependent Variable | Digital | ln (digital technology patent applications + 1) |

| Independent Variable | CP | Operating Revenue/Total Carbon Emissions |

| Control Variable | Size | ln (Total Assets) |

| Lev | Total Liabilities/Total Assets | |

| ROA | Return on Assets = Net Profit/Total Assets | |

| TobinQ | Market Value of Equity + Debt Value)/ Asset Replacement Cost | |

| FirmAge | ln (Current Year − Establishment Year + 1) | |

| AgC2 | The second type of agency cost | |

| Cap1 | Capital intensity = ln (Total Assets/Number of Employees) | |

| Cap2 | Alternative capital intensity = Total Assets/Operating Revenue | |

| PGDP | Provincial Nominal GDP per Capita | |

| Mediating Variables | SCE | Supply Chain Efficiency |

| SCF | Supply Chain Finance | |

| TFPLP up | TFP of upstream by LP method | |

| TFPOP up | TFP of upstream by OP method | |

| TFPLP down | TFP of downstream by LP method | |

| TFP OP down | TFP of downstream by OP method |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| Digital | 3070 | 3.044 | 1.973 | 0 | 7.791 |

| Digital_2 | 3070 | 2.715 | 1.557 | 0 | 6.865 |

| Digital_3 | 3070 | 0.049 | 0.065 | 0 | 0.511 |

| CP | 3070 | 4.7137 | 3.36 | 0.334 | 32.944 |

| Size | 3070 | 22.093 | 1.331 | 19.277 | 28.109 |

| Lev | 3070 | 0.443 | 0.36 | 0.033 | 8.612 |

| ROA | 3070 | 0.032 | 0.101 | −1.859 | 0.37 |

| TobinQ | 3070 | 2.011 | 1.752 | 0.744 | 24.495 |

| FirmAge | 3070 | 2.923 | 0.34 | 1.099 | 3.784 |

| AgC2 | 3070 | 0.016 | 0.031 | 0 | 0.337 |

| Cap1 | 3070 | 14.504 | 0.863 | 12.035 | 17.854 |

| Cap2 | 3070 | 2.584 | 8.063 | 0.095 | 310.094 |

| PGDP | 3070 | 57,272.851 | 20,201.968 | 19,858 | 190,313 |

| SCF | 3070 | 0.339 | 0.869 | 0 | 7.765 |

| SCE | 3070 | 4.334 | 1.4201 | −4.820 | 8.632 |

| TFP LP up | 3070 | 9.565 | 1.224 | 5.913 | 12.986 |

| TFP OP up | 3070 | 8.782 | 1.111 | 5.716 | 12.242 |

| TFP LP down | 3070 | 9.913 | 1.08 | 6.166 | 12.853 |

| TFP OP down | 3070 | 9.073 | 0.96 | 5.672 | 12.172 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Variables | CP | CP | CP | CP Mid | CP Up and Down |

| Digital | 0.474 *** | 0.475 *** | 0.473 *** | 0.396 *** | 0.493 *** |

| (0.049) | (0.049) | (0.049) | (0.088) | (0.051) | |

| Size | −1.140 *** | −1.154 *** | −1.953 *** | −1.130 *** | |

| (0.265) | (0.265) | (0.479) | (0.279) | ||

| Lev | −0.200 | −0.198 | 0.823 | −0.207 | |

| (0.309) | (0.310) | (0.561) | (0.327) | ||

| ROA | 1.306 | 1.301 | 7.033 *** | 1.315 | |

| (1.044) | (1.048) | (1.899) | (1.106) | ||

| FirmAge | 0.225 | 0.209 | −1.554 | 0.285 | |

| (1.206) | (1.212) | (2.197) | (1.279) | ||

| AgC2 | −1.201 | −1.551 | −5.416 | −1.082 | |

| (2.298) | (2.303) | (4.174) | (2.430) | ||

| Cap1 | 0.120 | 0.124 | 0.703 | 0.157 | |

| (0.248) | (0.248) | (0.450) | (0.262) | ||

| Cap2 | 0.016 | 0.019 | 0.167 | −0.018 | |

| (0.072) | (0.072) | (0.131) | (0.076) | ||

| TobinQ | −0.381 *** | −0.382 *** | −0.554 *** | −0.397 *** | |

| (0.065) | (0.065) | (0.118) | (0.069) | ||

| ER | −8.353 | −42.698 | −9.068 | ||

| (72.066) | (130.580) | (76.038) | |||

| PGDP | −0.000 * | −0.000 | −0.000 * | ||

| (0.000) | (0.000) | (0.000) | |||

| Constant | 2.417 *** | 24.167 *** | 25.111 *** | 38.394 *** | 24.693 *** |

| (0.871) | (5.941) | (5.992) | (10.858) | (6.323) | |

| Observations | 3070 | 3070 | 3070 | 3070 | 3070 |

| R-squared | 0.109 | 0.142 | 0.144 | 0.121 | 0.143 |

| Firm FE | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | |

|---|---|---|---|---|---|---|---|---|---|

| Variables | CP | CP | CP | CP | CP | CP | CP | CP2 | CP |

| Digital | 0.460 *** | 0.505 *** | 2.183 *** | 0.480 *** | |||||

| (0.064) | (0.087) | (0.394) | (0.049) | ||||||

| Digital total | 0.010 *** | ||||||||

| (0.001) | |||||||||

| Digital 2 | 0.288 *** | ||||||||

| (0.072) | |||||||||

| Digital 3 | 8.304 *** | ||||||||

| (1.906) | |||||||||

| Digital 4 | 0.193 *** | ||||||||

| (0.019) | |||||||||

| Digital lag | 0.179 ** | ||||||||

| (0.071) | |||||||||

| Constant | 26.543 *** | 29.364 *** | 30.074 *** | 32.716 *** | 31.219 *** | 13.253 * | 35.875 *** | −8.040 | 30.175 *** |

| (5.919) | (6.155) | (6.136) | (5.947) | (6.175) | (6.798) | (12.154) | (16.660) | (7.127) | |

| Obs | 3070 | 3070 | 3070 | 3070 | 3070 | 1535 | 1535 | 1081 | 3070 |

| R-squared | 0.160 | 0.093 | 0.095 | 0.148 | 0.082 | 0.145 | 0.196 | 0.139 | 0.173 |

| Firm FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry FE | No | No | No | No | No | No | No | No | Yes |

| (1) | (2) | |

|---|---|---|

| Variables | 1st Stage | 2nd Stage |

| IV | 0.024 *** | |

| (0.010) | ||

| Digital | 0.902 *** | |

| (0.089) | ||

| Constant | 13.589 *** | 11.866 *** |

| (4.117) | (1.369) | |

| Observations | 3070 | 3070 |

| R-squared | 0.139 | 0.208 |

| KP rk Wald F | 386.8 | |

| Firm Year FE | Yes | Yes |

| Industry FE | Yes | Yes |

| (1) | (2) | (3) | |

|---|---|---|---|

| Variables | Step 1:CP | Step 2: SCE | Step 3: CP |

| Digital | 0.473 *** | 0.0339 ** | 0.462 *** |

| (0.0485) | (0.0135) | (0.0485) | |

| SCE | 0.319 *** | ||

| (0.100) | |||

| Constant | 25.11 *** | −2.903 * | 26.04 *** |

| (5.992) | (1.663) | (5.978) | |

| Observations | 3070 | 3070 | 3070 |

| R-squared | 0.144 | 0.044 | 0.151 |

| Controls | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| (1) | (2) | (3) | |

|---|---|---|---|

| Variables | Step 1:CP | Step 2: SCF | Step 3: CP |

| Digital | 0.473 *** | 0.0433 *** | 0.465 *** |

| (0.0485) | (0.0166) | (0.0486) | |

| SCF | 0.174 ** | ||

| (0.0814) | |||

| Constant | 25.11 *** | 7.668 *** | 23.78 *** |

| (5.992) | (2.052) | (6.017) | |

| Observations | 3070 | 3070 | 3070 |

| R-squared | 0.144 | 0.088 | 0.147 |

| Controls | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | TFPLP Up | TFPOP Up | TFPLP Down | TFPOP Down |

| Digital | 0.116 *** | 0.076 *** | 0.250 *** | 0.188 *** |

| (0.019) | (0.018) | (0.016) | (0.015) | |

| Constant | −5.299 ** | −4.725 ** | 8.654 *** | 7.996 *** |

| (2.346) | (2.184) | (2.016) | (1.820) | |

| Observations | 3070 | 3070 | 3070 | 3070 |

| R-squared | 0.147 | 0.132 | 0.227 | 0.205 |

| Controls | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | CP | CP | CP | CP |

| Digital | 0.454 *** | 0.457 *** | 0.421 *** | 0.435 *** |

| (0.0497) | (0.0493) | (0.0530) | (0.0518) | |

| TFPLP up | 0.120 * | |||

| (0.0708) | ||||

| TFPOP up | 0.135 * | |||

| (0.0760) | ||||

| TFPLP down | 0.197 ** | |||

| (0.0824) | ||||

| TFPOP down | 0.190 ** | |||

| (0.0917) | ||||

| Constant | 25.63 *** | 25.61 *** | 23.35 *** | 23.58 *** |

| (5.996) | (5.994) | (6.027) | (6.031) | |

| Observations | 3070 | 3070 | 3070 | 3070 |

| R-squared | 0.146 | 0.137 | 0.148 | 0.147 |

| Controls | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | 2nd Stage: SCE | 2nd Stage: SCF | 2nd Stage: TFPOP | 2nd Stage: TFPOP |

| Digital | 0.091 * | 0.045 * | 0.129 *** | 0.154 *** |

| (0.047) | (0.028) | (0.029) | (0.037) | |

| Constant | 8.664 *** | 7.237 *** | 7.286 *** | 6.022 *** |

| (1.000) | (0.452) | (0.495) | (0.612) | |

| Observations | 3070 | 3070 | 3070 | 3070 |

| R-squared | 0.089 | 0.030 | 0.148 | 0.134 |

| Controls | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | ER High | ER Low | Regulated | Unregulated |

| Digital | 0.441 *** | 0.313 *** | 0.456 *** | 0.430 *** |

| (0.060) | (0.088) | (0.033) | (0.078) | |

| Constant | 0.677 | 49.139 *** | 3.792 | 50.431 *** |

| (9.266) | (12.055) | (4.274) | (10.848) | |

| Observations | 1533 | 1537 | 1197 | 1873 |

| R-squared | 0.170 | 0.237 | 0.380 | 0.167 |

| Controls | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variables | Benchmark | Interaction | SD City = 1 | SD City = 0 |

| Digital | 0.473 *** | 0.416 *** | 0.577 *** | 0.363 *** |

| (0.049) | (0.067) | (0.099) | (0.054) | |

| DID_ Digital | 0.211 * | |||

| (0.160) | ||||

| DID | −1.635 ** | |||

| (0.780) | ||||

| Constant | 25.111 *** | 25.978 *** | 39.750 * | 15.606 ** |

| (5.992) | (9.466) | (20.418) | (6.324) | |

| Observations | 3070 | 3070 | 859 | 2211 |

| R-squared | 0.144 | 0.157 | 0.180 | 0.113 |

| Controls | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Firm FE | Yes | Yes | Yes | Yes |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, Z.; Wu, J.; Yang, X.; Ni, G. Digitalization and Supply Chain Carbon Performance: The Role of Focal Firms. J. Theor. Appl. Electron. Commer. Res. 2025, 20, 289. https://doi.org/10.3390/jtaer20040289

Chen Z, Wu J, Yang X, Ni G. Digitalization and Supply Chain Carbon Performance: The Role of Focal Firms. Journal of Theoretical and Applied Electronic Commerce Research. 2025; 20(4):289. https://doi.org/10.3390/jtaer20040289

Chicago/Turabian StyleChen, Zhenling, Jiaxi Wu, Xiaoting Yang, and Guohua Ni. 2025. "Digitalization and Supply Chain Carbon Performance: The Role of Focal Firms" Journal of Theoretical and Applied Electronic Commerce Research 20, no. 4: 289. https://doi.org/10.3390/jtaer20040289

APA StyleChen, Z., Wu, J., Yang, X., & Ni, G. (2025). Digitalization and Supply Chain Carbon Performance: The Role of Focal Firms. Journal of Theoretical and Applied Electronic Commerce Research, 20(4), 289. https://doi.org/10.3390/jtaer20040289