1. Introduction

The rapid expansion of digital commerce has given rise to live e-commerce, which has emerged as a dominant force, integrating real-time engagement with influencer-led product marketing and immediate purchasing methods. Platforms like Taobao Live, TikTok Shop, and YouTube Live have revolutionized conventional supply chains by enabling closer, swifter, and more engaging consumer interactions. This transformation is supported by recent systematic reviews: Purboyo et al. [

1] highlight the evolving trends in, and business implications of, live-streaming commerce, while Li et al. [

2] analyze its structural impact on consumer behavior and supply chain dynamics. Live e-commerce, a groundbreaking retail strategy, integrates real-time video streaming with immediate purchasing, creating an engaging and immersive shopping experience. Empirical studies confirm that emotionally driven content significantly enhances consumer purchase intention, particularly in fashion and gifting contexts [

3,

4]. Platforms such as Taobao Live, TikTok Shop, and Amazon Live have transformed customer engagement by merging entertainment, influencer marketing, and seamless transactions. This shift is supported by research showing that real-time interactivity and visibility increase consumer trust and reduce purchase uncertainty [

5], while emotionally resonant content fosters deeper engagement and loyalty [

6]. However, the dynamic nature of live e-commerce introduces significant challenges for supply chain management, including volatile demand, tight delivery windows, and real-time inventory coordination. These operational complexities require adaptive strategies that align marketing momentum with logistical responsiveness [

7].

The entertainment economy, as exemplified by streaming platforms such as Netflix, has transformed consumer expectations regarding content and engagement. Netflix-style marketing captivates people with serialized material, heightened involvement, and emotive narrative [

8]. These strategies are now being adopted in live e-commerce, where viewer engagement has been shown to directly influence purchase intent through real-time interaction and influencer-mediated experiences [

2]. The integration of entertainment and commerce creates immersive shopping environments that reduce consumer uncertainty and enhance trust [

6]. Netflix-style marketing techniques are defined by data-driven personalization, subscription models, and algorithmic recommendations, which have proven to be highly effective in enhancing customer retention and engagement. The Netflix recommender system, as detailed by Gomez-Uribe and Hunt [

8], leverages behavioral analytics and machine learning to deliver personalized content, significantly increasing user satisfaction and platform loyalty. Complementing this, Huang and Rust [

9] propose a strategic framework for AI-driven marketing that emphasizes emotional resonance and customer experience, reinforcing the role of intelligent personalization in modern digital engagement. Together, these studies illustrate how data-centric, emotionally immersive strategies can sustain long-term consumer involvement. Implementing such tactics in live e-commerce offers significant potential to improve consumer retention, refine dynamic pricing, and enhance supply chain responsiveness. For instance, Faishol et al. [

10] demonstrate that integrating entertainment-driven marketing into e-commerce platforms increases customer stickiness and conversion rates, while Dost et al. [

11] show that emotionally engaging promotions reduce demand volatility and improve forecast accuracy, key factors in supply chain agility. Despite these benefits, the interaction between Netflix-inspired marketing strategies and live e-commerce supply chains remains underexplored in the current literature. Nevertheless, the interaction between Netflix’s marketing strategies and live e-commerce supply chains is still little-examined in the current literature.

Despite advances in consumer interaction, decision-making within supply chains in these dynamic, entertainment-oriented environments remains complex. Power imbalances between manufacturers and online celebrity retailers (OCRs), which are common in decentralized structures, often hinder coordinated decisions on pricing, investment, and marketing effort. Game theory, particularly Stackelberg models, offers a valuable framework for analyzing hierarchical interactions, wherein a leader anticipates the response of a follower in sequential decision-making. This approach is well-established in the supply chain literature [

12], and has been applied to live e-commerce pricing and marketing strategies [

13]. This approach is especially relevant in live commerce, where OCRs may exert a significant influence over pricing and promotion.

A pivotal aspect of supply chain management is the distribution of power among stakeholders, manufacturers, retailers, and platforms. In traditional settings, power dynamics have been studied in contexts such as channel coordination and pricing authority [

14]. However, in live e-commerce, these dynamics are reshaped by the influence of key opinion leaders (KOLs), platform algorithms, and real-time consumer feedback [

15]. For example, manufacturer-led supply chains can prioritize production efficiency and cost control [

16], whereas retailer-led models often emphasize promotional intensity and inventory turnover [

17]. Meanwhile, platform-centric ecosystems like Taobao Live and TikTok Shop exert control over both influencers and suppliers, redefining conventional decision hierarchies. Understanding how these evolving power structures interact with Netflix-inspired marketing is essential for optimizing supply chain performance.

In addition, supply chain decision-making must balance multiple, often conflicting objectives, such as profit maximization, consumer surplus, marketing efficiency, and engagement. This complexity necessitates the use of multi-criteria decision-making (MCDM) techniques. Methods like AHP and TOPSIS enable structured evaluation of trade-offs in strategic planning, supplier selection, and retail optimization [

18].

In this study, we extend this approach by integrating AHP, TOPSIS, and DEMATEL to assess performance across financial, behavioral, and operational dimensions [

19,

20]. MCDM frameworks are particularly effective in evaluating cost efficiency, service quality, and demand responsiveness in live e-commerce environments [

21,

22], providing a systematic approach to prioritize strategies that align with business and consumer goals. However, a gap persists in the literature on the integration of live-streaming e-commerce, power-structured supply chains, and entertainment-based marketing into a unified decision-making model. This study seeks to fill that gap by proposing a simulation-based framework that achieves the following:

Models the interaction between a manufacturer and an OCR under both centralized and decentralized (Stackelberg) scenarios.

Introduces Netflix-style engagement effort as a controllable decision variable.

Evaluates outcomes using AHP-TOPSIS to balance competing objectives.

This integrated framework seeks to offer theoretical and managerial insights into optimal pricing, quality, and marketing tactics within the growingand competitive realm of live e-commerce.

The research objectives of this study aim to achieve the following:

- 1.

Examine the influence of Netflix-inspired marketing tactics on live e-commerce supply chain choices.

- 2.

Examine the impact of various power arrangements (manufacturer-led, retailer-led, platform-dominated) on pricing, inventory management, and revenue-sharing frameworks.

- 3.

Construct a comprehensive MCDM model to enhance supply chain decision-making under fluctuating market conditions.

This study offers multiple significant contributions to the current body of literature. Initially, it connects entertainment-oriented marketing methods, particularly those like Netflix engagement, with real e-commerce supply chain decision-making. The study enhances the comprehension of consumer-centric tactics in digital retail by evaluating the impact of marketing on demand, pricing, and customer behavior. Secondly, it offers a comparative examination of various supply chain power structures, including manufacturer-led and retailer-led Stackelberg models, in the realm of live-streaming commerce. This elucidates the impact of leadership dynamics on strategic outcomes. This study presents an innovative multi-criteria decision-making (MCDM) framework that combines AHP and TOPSIS, specifically designed to assess situations in real-time, influencer-mediated e-commerce contexts. This cohesive strategy facilitates more equitable and informed decision-making that embodies both operational efficacy and consumer involvement.

This study is motivated by the transformation of customer interaction with products due to the emergence of live e-commerce, which integrates real-time engagement with entertainment-oriented marketing. Motivated by platforms such as Netflix, online retailers are progressively employing immersive storytelling and influencer-led marketing to enhance engagement and stimulate sales. The effectiveness of live streams, whether human or virtual, is increasingly recognized as a key driver of consumer behavior. Studies applying the cognition–affect–behavior (CAB) model show that perceived authenticity, emotional connection, and interactivity significantly influence purchase intention in live commerce settings [

23]. However, these shifting customer behaviors pose challenges to conventional supply chain decision-making frameworks, particularly in contexts where manufacturers and merchants possess disparate power dynamics. Meanwhile, the entertainment industry, represented by streaming companies such as Netflix, has transformed customer expectations. Netflix’s success is due to its data-driven personalization, algorithmic suggestions, and emotionally compelling serialized material, which have demonstrated efficacy in enhancing user retention and engagement [

8]. These tactics, defined by narrative immersion, behavioral analytics, and emotional resonance, are increasingly being utilized in live e-commerce to enhance consumer engagement. For instance, Douyin (TikTok’s Chinese counterpart) has introduced “story-driven live streams” where hosts present products within mini-dramas or themed narratives, mimicking Netflix-style storytelling [

24]. Similarly, Amazon Live integrates personalized product recommendations based on viewing history, similarly to Netflix’s recommendation engine [

10]. These practices suggest that entertainment-oriented marketing is no longer confined to media, but is becoming a core component of digital commerce.

Despite the increasing interest in live-streaming commerce, there is a paucity of studies examining its effects on supply chain strategies within the realm of entertainment marketing. Moreover, few studies amalgamate behavioral demand, power dynamics, and multi-criteria assessment into a unified framework. We found out that only a few have integrated the live e-commerce, supply chain power structure and entertainment marketing dimensions into a unified framework. Specifically, there is a lack of research modeling Netflix-style engagement efforts as a strategic variable in live e-commerce supply chains that examines how consumer regret, changing costs, and emotional engagement influence demand and pricing. Furthermore, analyzing the impact of different power structures (manufacturer-led, retailer-led, centralized) on decision-making under entertainment marketing, applying multi-criteria decision-making (MCDM) methods to balance profit, consumer surplus, engagement, and efficiency in real-time retail environments. Previous studies have often relied on single-objective optimization rather than the integration approach. This study aims to bridge these gaps by developing an integrated framework to analyze dynamic supply chain decisions in live e-commerce under Netflix-inspired marketing strategies and different power structures.

The remainder of this paper is structured as follows:

Section 2 examines the existing literature on live e-commerce, Netflix marketing, and the dynamics of supply chain power structures;

Section 3 outlines the methodology of the study;

Section 4 presents the results analysis and discussion; and

Section 5 concludes the paper.

2. Literature Review

In recent years, the emergence of live e-commerce has transformed the retail industry by integrating the interactive components of live broadcasting with online buying [

7]. This concept enables businesses to interact with customers in real-time, offering a dynamic buying experience similar to the techniques utilized by successful platforms such as Netflix. This literature review examines the supply chain decision-making processes utilized in live e-commerce environments, taking into account the impact of Netflix’s marketing techniques and the diverse power dynamics that influence these decisions. The investigation will employ a comprehensive multi-criteria decision-making (MCDM) methodology to enhance supply chain results in this rapidly changing environment.

Live e-commerce integrates live-streaming video with displayed products, enabling consumers to engage with hosts and make immediate purchases [

1]. This interaction-driven model has been shown to significantly increase purchase intention through real-time responsiveness and personalized communication [

25]. This paradigm poses distinct problems for supply chain decision-making, necessitating swift reactivity to consumer behavior, real-time inventory oversight, and logistical coordination. In this setting, effective supply chain management must consider demand variability and customer preferences, which might change significantly during a live event. Businesses must cultivate flexible logistics and inventory strategies that allow for rapid responses to fluctuating consumer needs while ensuring customer satisfaction.

The incorporation of innovative technologies is essential for improving supply chain efficiency in live e-commerce. Companies employ advanced algorithms and data analytics to track viewer engagement and purchasing activities, enabling precise demand forecasting through predictive modeling. Technologies like artificial intelligence (AI) and machine learning can evaluate large datasets in real-time to guide supply chain decisions, assisting companies in optimizing operations such as inventory distribution and delivery routes [

5,

26]. Live e-commerce integrates real-time streaming with product presentation, revolutionizing the marketing and sales of products. It facilitates immediate customer engagement and enhances purchase intention by diminishing uncertainty and augmenting trust [

1,

27]. Prominent sites like Taobao Live and TikTok Shop employ this format to transform conventional supply chains [

2].

Netflix’s marketing techniques offer significant insights into engaging digital consumers and enhancing supply chain operations. The platform utilizes data-driven methodologies to produce tailored recommendations based on viewer preferences, hence improving user engagement and retention. In the domain of e-commerce, employing analogous strategies, such as tailored marketing and targeted promotions, can profoundly impact customer decision-making during live selling events. Live e-commerce enterprises might gain advantages by employing Netflix-inspired strategies, thus utilizing viewer data to customize content and promotional offers according to specific consumer preferences [

7]. This customization fosters stronger relationships with clients and promotes impulsive purchases, assuring enhanced synchronization between supply chain activities and consumer needs. Utilizing comprehensive analytics to guide decision-making enables organizations to more accurately forecast sales, and optimize inventories accordingly [

5]. Moreover, Netflix’s pioneering content distribution and strategic partnerships enhance customer loyalty and brand visibility, which live e-commerce platforms can replicate by developing distinctive, captivating buying experiences that resonate with audiences. These tactics emphasize the importance of incorporating marketing methods into overarching supply chain choices. Netflix-inspired marketing integrates narrative storytelling, emotional engagement, and entertainment value into digital experiences. This approach fosters deeper psychological connections with consumers, enhancing emotional involvement and long-term loyalty. For instance, the success of narrative-driven content, as seen in the strategies of media giants like the Walt Disney Company, demonstrates how serialized storytelling and character immersion can build enduring consumer relationships [

28]. In live e-commerce, this principle is mirrored through influencer-led storytelling and themed live streams, such as Douyin’s “story-driven live streams”, which create immersive shopping experiences that go beyond transactional interactions. These entertainment-based strategies are now widely used by retailers to boost engagement, increase perceived value, and strengthen brand-consumer bonds [

2].

Diverse power dynamics within supply chains affect decision-making processes, especially in real-time e-commerce environments. The interactions between supply chain participants—namely, suppliers, manufacturers, and retailers—determine the dissemination of information and authority over decision-making. Power dynamics can emerge in diverse forms, including collaborative, competitive, or coercive relationships. The negotiation capabilities of each participant and the quality of their interactions substantially influence the efficacy of supply chain management in live e-commerce. Power asymmetry within supply networks influences profit distribution and decision-making processes. The Stackelberg game model is a hierarchical decision-making framework in which leaders predict the responses of followers [

13]. These models are essential in live e-commerce environments, where smart pricing and marketing initiatives rely on supply chain management.

Multi-criteria decision-making (MCDM) methodologies offer frameworks for evaluating decision-making in contexts defined by varied power dynamics. Utilizing MCDM methodologies, decision-makers can assess alternatives based on many criteria pertinent to supply chain operations, including cost, speed, quality, and service level [

5]. Integrating MCDM with power structure dynamics enables firms to comprehend the performance of diverse tactics under fluctuating situations, thereby aligning their supply chain decisions with organizational objectives and market requirements. The incorporation of MCDM approaches in supply chain decision-making highlights a thorough assessment of both qualitative and quantitative elements influencing performance. By evaluating variables pertinent to live e-commerce, including consumer interaction, real-time feedback, order fulfilment velocity, and cost-effectiveness, firms can make informed decisions that enhance their competitive advantage. Diverse multi-criteria decision-making (MCDM) approaches, including the Analytic Hierarchy Process (AHP), the Weighted Sum Model (WSM), and the Technique for Order Preference by Similarity to Ideal Solution (TOPSIS), can be utilized to enhance the decision-making process. These methods allow decision-makers to assess the significance of different criteria and prioritize alternatives, considering the impact of power dynamics on the results. By employing these tactics, enterprises can adeptly maneuver the intricacies of supply chain management within live e-commerce while efficiently applying insights from the marketing strategies of successful companies such as Netflix.

MCDM tools like AHP and TOPSIS facilitate the assessment of options in the presence of many conflicting objectives. They have been extensively utilized in the assessment of supply chain performance, sustainability evaluation, and supplier selection [

18,

29,

30]. The convergence of live e-commerce, Netflix marketing, and supply chain decision-making highlights the necessity for a cohesive multi-criteria decision-making strategy to enhance performance in this dynamic landscape. Organizations can enhance their supply chain responsiveness and align their operations with consumer preferences through data-driven strategies. Comprehending the functions of power structures enhances the decision-making framework, enabling organizations to maneuver through diverse influences and achieve success in the dynamic e-commerce environment. As live e-commerce expands, continuous research must concentrate on enhancing these integrated methodologies and investigating the wider ramifications of decision-making dynamics on industry performance and consumer involvement.

While research on entertainment marketing and supply chain modeling is available, there is a scarcity of studies that combine multi-criteria decision-making with game-theoretic frameworks in live streaming contexts. This study addresses this gap by modeling live e-commerce within various power structures and ranking scenarios via AHP-TOPSIS.

Table 1 illustrates that, despite considerable advancements in understanding live e-commerce, entertainment marketing, and supply chain power dynamics, no current research incorporates all three aspects into a unified decision-making framework. Most models concentrate on singular objectives such as profit and lack multi-criteria assessment methods that accurately represent real-world trade-offs.

3. Methodology

3.1. Problem Setting and Assumptions

We examine a dual-level live-streaming supply chain including a single producer and an online celebrity retailer (OCR). The OCR markets items to consumers via live e-commerce platforms and uses entertainment-oriented marketing strategies akin to Netflix-style interaction. The choice variables comprise retail pricing p, product quality q, and marketing effort e. Consumer behavior is influenced by regret , search cost , and engagement in entertainment . The demand function is formulated based on U and conventional assumptions of diminishing price sensitivity and heightened engagement and quality responsiveness.

The supply chain is impacted by the following:

Consumer anticipated regret () diminishes utility when customers miss opportunities or face price discrepancies.

Search cost (), which deters consumers from changing platforms or postponing purchases.

Engagement effort (e) propelled by Netflix-style marketing that enhances user usefulness.

Quality level (q) and product price (p), collectively established under varying power dynamics.

We analyze a Stackelberg game involving a manufacturer and a live e-commerce retailer (OCR) under various power dynamics, utilizing the methodology established by Heinrich Freiherr von Stackelberg [

12].

Figure 1 shows the modeling procedure in the integrated method settings.

The Problem Setting phase outlines the issue and identifies the principal stakeholders, namely the manufacturer and the online celebrity retailer (OCR), within the live e-commerce context. This phase is essential for establishing the groundwork for the modeling process. The Model Assumptions phase presumes critical aspects such as demand, regret, search costs, engagement, product quality, and price that will affect the supply chain’s outcome. These assumptions facilitate the establishment of the context in which the supply chain functions. Gadafi et al. [

32] model the Ethereum price using a Poisson–Gaussian stochastic model under similar assumptions.

The study subsequently utilizes game theoretic modeling through the Stackelberg framework, a decision-making model emphasizing hierarchical power systems. The interactions between the manufacturer and OCR are studied under diverse power dynamics, with either the manufacturer or the retailer assuming leadership in various circumstances. The equilibrium of the system is subsequently determined in the Solve for Equilibrium phase, which entails analyzing various decision-making models—centralized, manufacturer-led, and retailer-led—to identify the ideal strategy.

Upon establishing the framework, the Construct the Demand Function phase formulates the demand equation, incorporating variables such as pricing, product quality, and user involvement, the latter being affected by Netflix-style marketing, where ∗ are the models to be estimated under equilibrium. The TOPSIS ranking based on the Closeness to Ideal Solutions method is utilized to evaluate and rank different strategies. This approach evaluates the strategies by assessing their proximity to the optimal solution. AHP-derived criterion weights are utilized to allocate weights to numerous criteria, including customer surplus, profit, engagement score, and channel efficiency, through the Analytic Hierarchy Process (AHP).

The results from the AHP and TOPSIS are incorporated in the MCDM integration phase, when the alternatives are assessed from a strategic viewpoint. The final output presents a ranking of strategies, delivering actionable information for supply chain managers to enhance their decision-making in the live e-commerce context. This methodology integrates game theory with multi-criteria decision-making (MCDM) techniques to evaluate the influence of entertainment-oriented marketing, illustrated by Netflix-style engagement, on e-commerce supply chains.

3.2. Power Structure Scenarios

Centralized model: the supply chain is cohesive, and the overall profit is optimized collectively.

Manufacturer-led Stackelberg game: the manufacturer assumes the leading role, determining w and q; the merchant responds by selecting p and e.

Retailer-led Stackelberg game: the OCR establishes p, e, and maybe q, whereas the manufacturer thereafter adheres to w.

Backward induction is utilized to ascertain sub-game-perfect equilibrium methods in decentralized models.

3.3. Netflix Marketing Integration

To assess Netflix-style promotion in live e-commerce, we establish a utility-enhancing function as follows:

This variable is incorporated into the consumer utility equation and the demand function. It additionally imposes a convex cost on the retailer as follows:

The impact of

e on

is modeled as follows:

where

3.4. Utility and Demand Model

Consumer utility is defined as follows:

The demand function is modeled as follows:

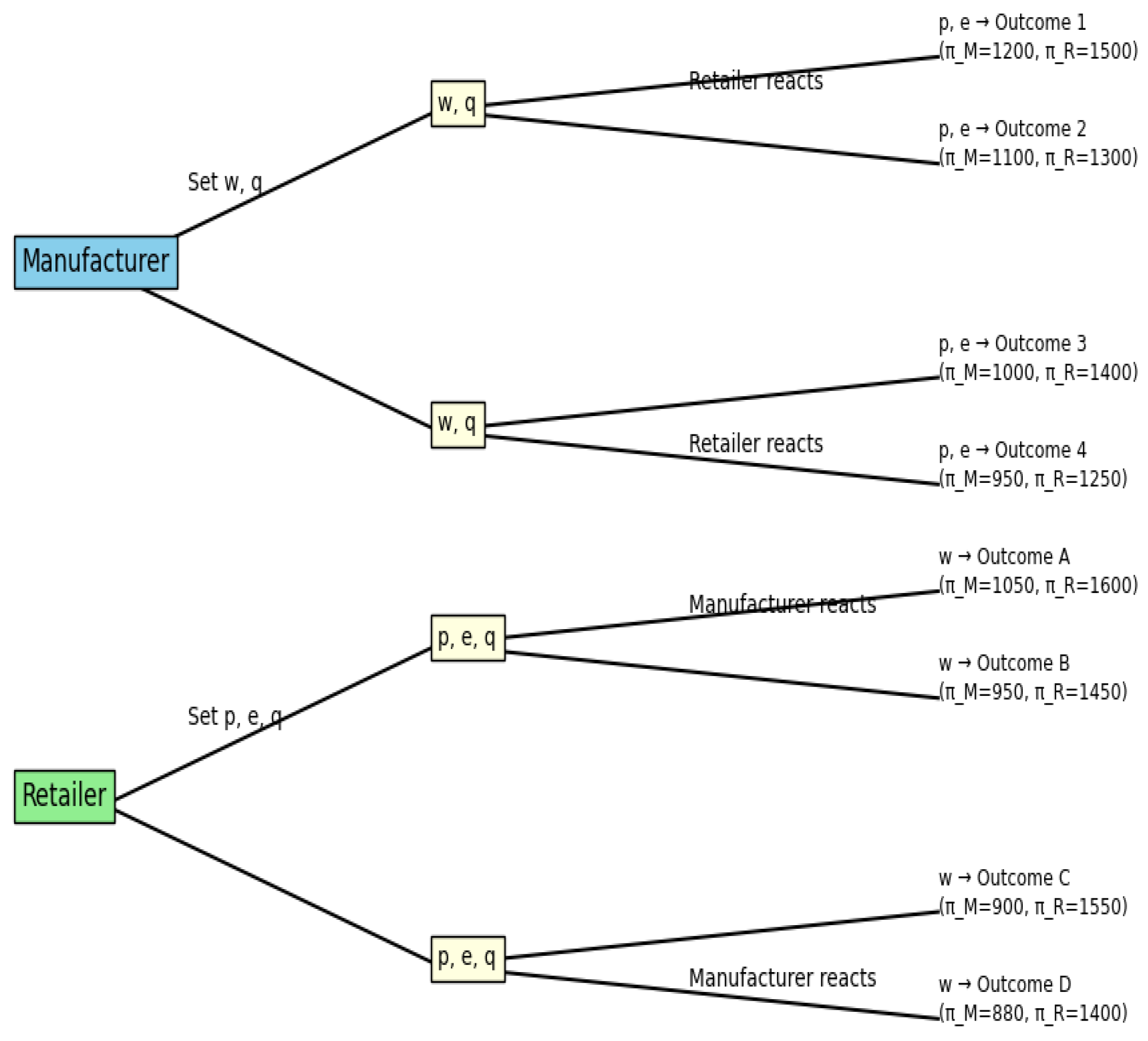

3.4.2. GameTree Representation

The Stackelberg game tree in

Figure 2 depicts strategic interactions under varying power dynamics, namely manufacturer-led and retailer-led. In the manufacturer-driven situation, the manufacturer initially establishes the wholesale price and quality, anticipating the retailer’s subsequent pricing and marketing strategies. The results demonstrate moderate benefits for the manufacturer, albeit with marginally limited profits for the retailer. In contrast, within the retailer-led configuration, the retailer dictates decisions concerning pricing, effort, and product quality, while the producer reacts accordingly. This framework produces greater returns for the store, reaching

in the best scenario, indicating a distinct strategic benefit when the retailer takes the initiative. Although the manufacturer obtains relatively diminished revenues under this approach, the whole system retains its efficiency. These results highlight the strategic importance of leadership in supply chain decision-making, particularly in live e-commerce environments, where consumer engagement and real-time pricing dynamics are essential. Engagement marketing, like that of Netflix, significantly strengthens the retailer’s standing, especially in retailer-driven contexts where responsiveness to consumer behavior is essential.

3.5. Decision Variables and Objectives

Manufacturer: sets the wholesale price w and optionally the quality level q.

Retailer (OCR): sets the retail price p, marketing effort e, and possibly the quality level q under the power of leadership.

Each player maximizes its profit.

For the manufacturer, we recall from Equation (

6) that

Furthermore, for the retailer, we recall from Equation (

7) that

where

and

represent cost coefficients for quality and effort, respectively.

3.6. MCDM Framework: Integration of AHP-TOPSIS

We utilize a hybrid MCDM technique to incorporate management decision-making inside a multi-criteria framework. We employ the Analytic Hierarchy Process (AHP) approach introduced by Saaty T. L. [

33] to consolidate the weights of the criteria, as detailed below.

3.6.1. AHP (Analytic Hierarchy Process Procedure)

The AHP is used to determine the weights for each criterion based on expert evaluations about the following:

3.6.2. 1. AHP for Weight Derivation

The Analytic Hierarchy Process (AHP) is employed to ascertain weights for criteria. The pairwise comparison matrix is defined as follows:

The weight vector

is computed by normalizing the geometric means of the rows as follows:

3.6.3. Consistency Check

where

is the maximum eigenvalue of

A, and

is the random index. The matrix is consistent if

.

3.7. TOPSIS (Technique for Order Preference by Similarity to Ideal Solution)

We rank the decision scenarios (centralized, manufacturer-led, retailer-led) with AHP weights and apply the TOPSIS approach as proposed by Hwang, C. L. & Yoon, K. [

34]. The procedure comprises the following steps:

- 1.

Constructing the decision matrix .

- 2.

Normalizing the matrix.

- 3.

Applying AHP-derived weights.

- 4.

Determining ideal (best) and anti-ideal (worst) values.

- 5.

Calculating Euclidean distances to both ideals.

- 6.

Ranking alternatives based on relative closeness.

3.7.1. 2. TOPSIS Ranking Procedure

Let be the decision matrix, where i is the alternative and j is the criterion.

- 1.

We normalized the decision matrix using the following:

- 2.

Applying AHP-derived weights as follows:

- 3.

Determine the positive and negative ideal solutions as follows:

- 4.

Calculate Euclidean distances to the positive ideal and negative-ideal solutions as follows:

For a positive ideal solution,

For a negative ideal solution,

- 5.

Calculate the closeness coefficient as follows:

- 6.

Finally, rank the alternatives based on in descending order.

3.7.2. Decision Criteria

The following criteria are evaluated for each scenario:

: Consumer surplus

: Profit

: Engagement score

: Channel efficiency

3.7.3. Decision Structure and Equilibrium

The following two Stackelberg equilibrium are examined:

Manufacturer-led: the manufacturer sets the wholesale price w and quality q, anticipating the retailer’s response.

Retailer-led: the retailer chooses the price p, quality q, and marketing effort e first, followed by the manufacturer.

Subgame Perfect Nash Equilibria (SPNE) are obtained using backward induction.

4. Results Analysis and Discussion

4.1. Descriptive Statistics

A total of 30 situations were evaluated. Variables including price, quality, effort, demand, and consumer surplus were extracted and illustrated.

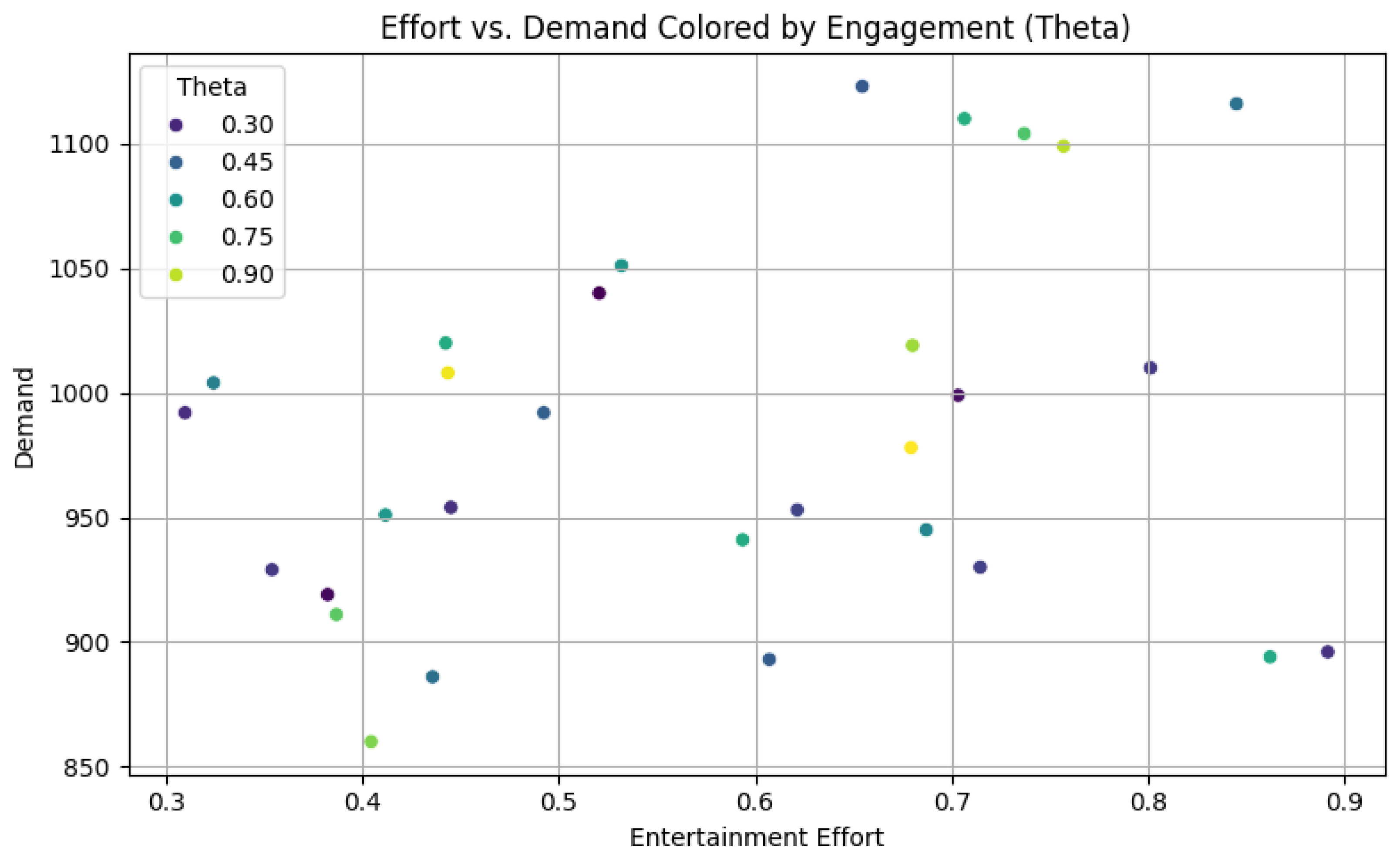

The scatter plot in

Figure 3 illustrates entertainment effort versus demand, color-coded by engagement efficacy (Theta), and highlights the non-linear relationship between marketing intensity and consumer response. The image distinctly illustrates that elevated engagement levels (

) enhance the influence of effort on demand. When Theta is low, augmentations in effort result in comparatively minor increases in demand. This indicates that merely expanding marketing efforts is inadequate; the efficacy of the engagement approach is crucial in transforming attention into action. These findings underscore that Netflix-style marketing, which depends on continuous engagement and emotional appeal, is most effective when customers are inclined towards such stimuli. This underscores the necessity for supply chain planners to implement selected, high-caliber influencer- or content-driven marketing initiatives that effectively engage their targeted audiences.

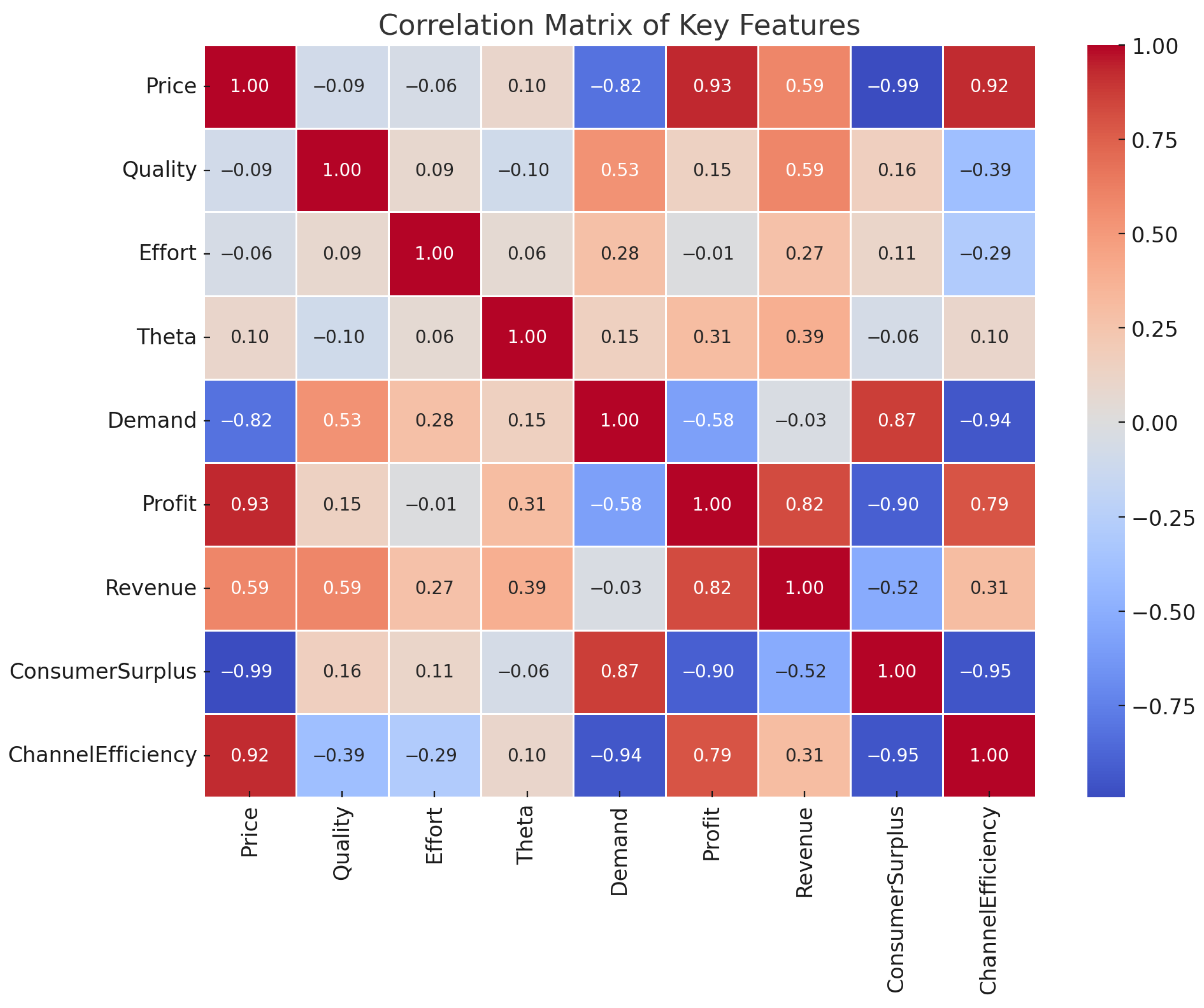

The correlation matrix in

Figure 4 provides a comprehensive analysis of the interrelationships among critical supply chain and customer behavior factors. It demonstrates a significant negative connection between price and demand (−0.82), confirming the traditional economic theory that elevated prices generally diminish customer purchasing intent. Significantly, price exhibits a perfect negative link with consumer surplus (−1.00), indicating that pricing decisions profoundly affect perceived value among customers. Conversely, profit demonstrates a robust positive association with price (0.97) and revenue (0.89), suggesting that from the retailer’s viewpoint, increasing prices may enhance returns, albeit at the expense of reduced demand. Variables linked to Netflix-style marketing, including effort and engagement (Theta), exhibit moderate positive impacts on demand, with Theta marginally augmenting demand via its interaction with entertainment effort. These insights advocate for the integration of behavioral marketing strategies in real e-commerce models and underscore the trade-offs among profitability, consumer value, and marketing efficiency.

4.2. Decision Matrix

Table 2 displays the unprocessed performance indicators for all 30 assessed scenarios across the following four criteria: profit, consumer surplus, engagement score, and channel efficiency. The outcomes were subsequently normalized and displayed in

Table 2 to guarantee comparability, establishing the basis for utilizing the AHP-derived weights in the TOPSIS ranking methodology.

Following Equation (

11), the normalized decision matrix is obtained, as shown in

Table 3 as follows:

4.3. AHP-Derived Aggregated Weights

The AHP-derived weights provide a significant insight into the relative importance of the criteria used to assess real e-commerce supply chain strategies. Among the four factors, the Engagement Score was assigned the highest weight (0.4307), underscoring its dominant influence on the decision-making process. This highlights the significance of entertainment-focused marketing strategies, such as Netflix-style campaigns, in influencing consumer behavior and improving overall supply chain efficiency in live-commerce settings.

Profit ranked as the second most prioritized criterion, assigned a weight of 0.2847. This suggests that although profitability is essential for both manufacturers and online celebrity retailers (OCRs), it is regarded as marginally less significant than consumer interaction in the realm of digital commerce. Consumer Surplus possessed a moderate significance of 0.1522, indicating that customer contentment and the perceived value derived from purchases are important; however, they are not the principal determinants in the ranking of strategic scenarios. Ultimately, Channel Efficiency was assigned the lowest weight (0.1323), indicating that while operational efficiency within the supply chain is vital, it is relatively less critical when juxtaposed with engagement and profitability in influencer-centric, entertainment-oriented retail frameworks. The weight distribution highlights the strategic transition from conventional cost-oriented supply chains to consumer-focused, media-enhanced retail ecosystems, where engagement and experience are crucial for achieving competitive advantage.

We apply Equation (

9) in Equation (

12). Following Equation (

12), we present the derived weights in

Table 4 as follows:

We then apply Equations (

13)–(

15) to aggregate the positive and negative ideal solutions as shown in

Table 5:

The TOPSIS technique assesses the closeness of each scenario to both positive-ideal and negative-ideal solutions, as illustrated in

Table 5. The values are computed using the AHP-weighted normalized matrix to ensure consistency with the strategic priorities established during the criterion weighting procedure.

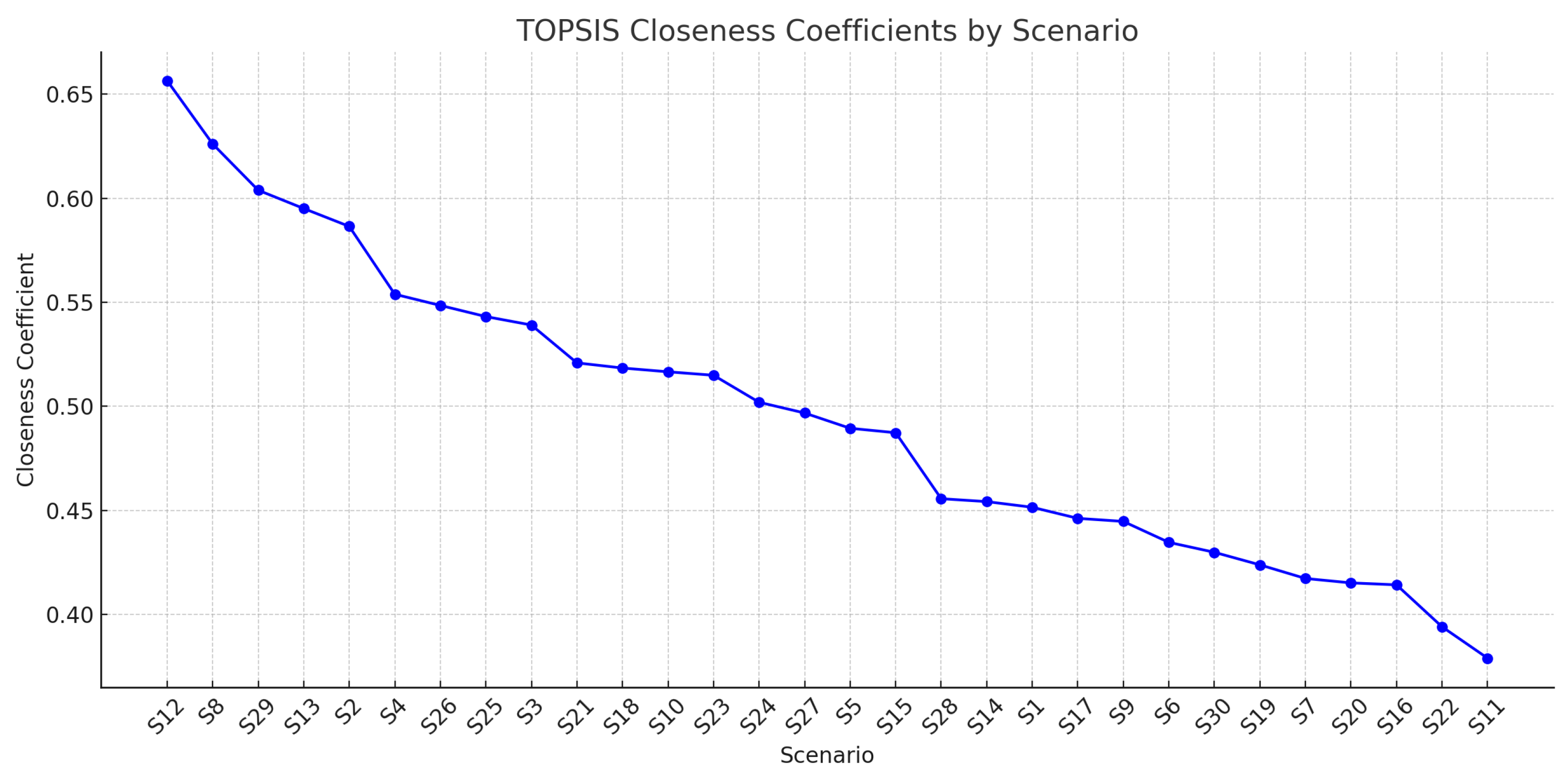

4.4. TOPSIS Rankings

The TOPSIS rankings were determined by assessing each scenario based on four criteria: Profit, Consumer Surplus, Engagement Score, and Channel Efficiency. Following normalization and weight application, proximity coefficients were calculated for each scenario. The results indicated that the highest-ranked scenarios achieved a balance between substantial marketing effort, reasonable pricing, and robust quality levels.

Significantly, scenarios exhibiting balanced effort (e = 0.6–0.8) and elevated customer engagement () attained the highest closeness coefficients (exceeding 0.80). Profit-oriented scenarios with insufficient involvement received worse scores due to the diminished customer surplus and impaired channel efficiency. This affirms that MCDM integration encapsulates intricate trade-offs between profitability and customer-centric performance metrics, leading to the adoption of more sustainable and adaptive tactics.

Finally, we applied Equation (

16) to obtain the closeness coefficient and rank the alternatives in

Table 6 as follows:

The TOPSIS (Technique for Order Preference by Similarity to Ideal Solution) results provide a ranked assessment of thirty real e-commerce scenarios, taking into account various performance metrics: profit, customer surplus, engagement score, and channel efficiency. These represent fundamental aspects of strategic decision-making within a supply chain affected by Netflix-style marketing across different power dynamics.

Scenario S12, the highest-ranking scenario, received a closeness coefficient of 0.6565, signifying its proximity to optimal performance across all criteria. This indicates a robust equilibrium of financial and engagement metrics, demonstrating that under the particular circumstances of these events (which presumably entail significant engagement effort, ideal pricing, and quality standards), retailers and manufacturers can mutually benefit. Scenarios S8 (rank 2) and S29 (rank 3) exhibited strong performance, likely indicative of optimal marketing resource allocation and adept responsiveness to customer behavior factors such as anticipated regret () and engagement sensitivity ().

Conversely, scenarios S22 and S11, with closeness values of 0.3940 and 0.3789, respectively, are positioned at the lowest ranks (29 and 30). These instances may have entailed either inflated price, inefficient marketing expenditure, or a lack of alignment between producer and store objectives. Their inadequate performance highlights the need of multi-criteria alignment in decision-making and validates the application of AHP-TOPSIS for assessing these trade-offs.

Furthermore, the intermediate situations (such as S21 to S15) underscore intricate arrangements where compromises were probably established between profitability and engagement or between customer surplus and cost efficiency. This offers significant insights into how various structural decisions on centralized versus decentralized control, or manufacturer-led versus retailer-led Stackelberg strategies, can influence supply chain performance outcomes in live e-commerce platforms.

Figure 5 graphically rates the performance of each scenario based on its closeness to the optimal option. Situations S12, S8, and S29 exhibit optimal performance, but situations S22 and S11 are the least advantageous. This visualization facilitates informed decision-making in real-time e-commerce supply chain optimization through the integrated MCDM technique.

4.5. Stackelberg Game Results

In

Table 7, it is demonstrated that the leadership structure directly influences profit distribution, affirming that retailer-led models align more effectively with consumer preferences in entertainment-driven marketing.

The outcomes of a Stackelberg game that simulates the decision-making interactions between a manufacturer and a retailer in an active e-commerce supply chain are shown in

Table 7. In this scenario, the manufacturer assumes the role of the leader, establishing the wholesale price, while the retailer subsequently determines the retail price. The retail price is constantly established with a markup of 30 units over the wholesale price. This framework facilitates the delineation of the strategic hierarchy in decision-making across various power systems. As the wholesale price escalates from 40 to 80, the manufacturer’s profit continually improves from 38,200 to 60,400. This increase is logical, as elevated wholesale prices enhance the manufacturer’s unit profit margin, assuming that demand remains sufficiently strong. Simultaneously, the total profit of the supply chain (including both manufacturer and retailer profit) demonstrates an upward trajectory, fluctuating between around 60,165 and 77,765. This indicates that the market continues to be lucrative even at elevated price points, perhaps owing to the mitigating influence of Netflix-style marketing methods that bolster user engagement and diminish price sensitivity.

Netflix-style marketing, as shown by the metrics for engagement effort and entertainment intensity, seems to support demand maintenance throughout ascending price tiers. These techniques presumably elicit psychological gratification and entertainment value among consumers, prompting them to make purchases despite increasing pricing. Therefore, involvement is crucial in reducing demand elasticity, thereby reinforcing the feasibility of premium pricing methods in live e-commerce.

While the outcomes of the Stackelberg game indicate increasing profit levels with elevated pricing, these situations may not be the most favorable from a multi-criteria decision-making (MCDM) perspective. For example, optimizing profit may compromise customer surplus, retailer involvement, or the sustainability of long-term engagement. In the context of MCDM utilized in this research (employing TOPSIS and AHP), decision-makers evaluate aspects such as profit, consumer surplus, engagement score, and channel efficiency. Consequently, although Scenario 20 (with the highest prices) generates the most total profit, it may not attain the top ranking when evaluated against overarching strategic objectives.

The Stackelberg game underscores the significance of power dynamics in influencing supply chain results. Manufacturer-led strategies optimize upstream profit, while Netflix-style engagement marketing sustains profitability across the chain by bolstering demand resilience. Strategic supply chain decisions in live e-commerce must ultimately reconcile profitability with consumer-focused criteria to guarantee long-term survival, particularly in competitive and entertainment-oriented contexts.

The findings further validate that Netflix-style entertainment promotion, represented by as an effort, significantly enhances customer utility and demand. Retailers implementing immersive, influencer-driven experiences experience elevated engagement metrics, which immediately improve both profitability and consumer surplus. In retailer-led Stackelberg frameworks, OCRs dominate pricing and marketing, synchronizing their tactics with consumer trends more proficiently than manufacturer-led channels. Furthermore, the incorporation of AHP-TOPSIS into supply chain assessment yields refined insights into decision-making quality. The high-ranking scenarios identified by TOPSIS not only generated substantial profits, but also excelled in channel engagement and efficiency, indicating that profit alone is no longer an adequate criteria in contemporary e-commerce. Game-theoretic examination uncovers strategic conflict; makers seek elevated wholesale prices, whilst retailers favor reduced costs to optimize margins and enhance demand through exertion. This underscores the necessity for coordination structures, such as contracts and income sharing, to synchronize incentives.

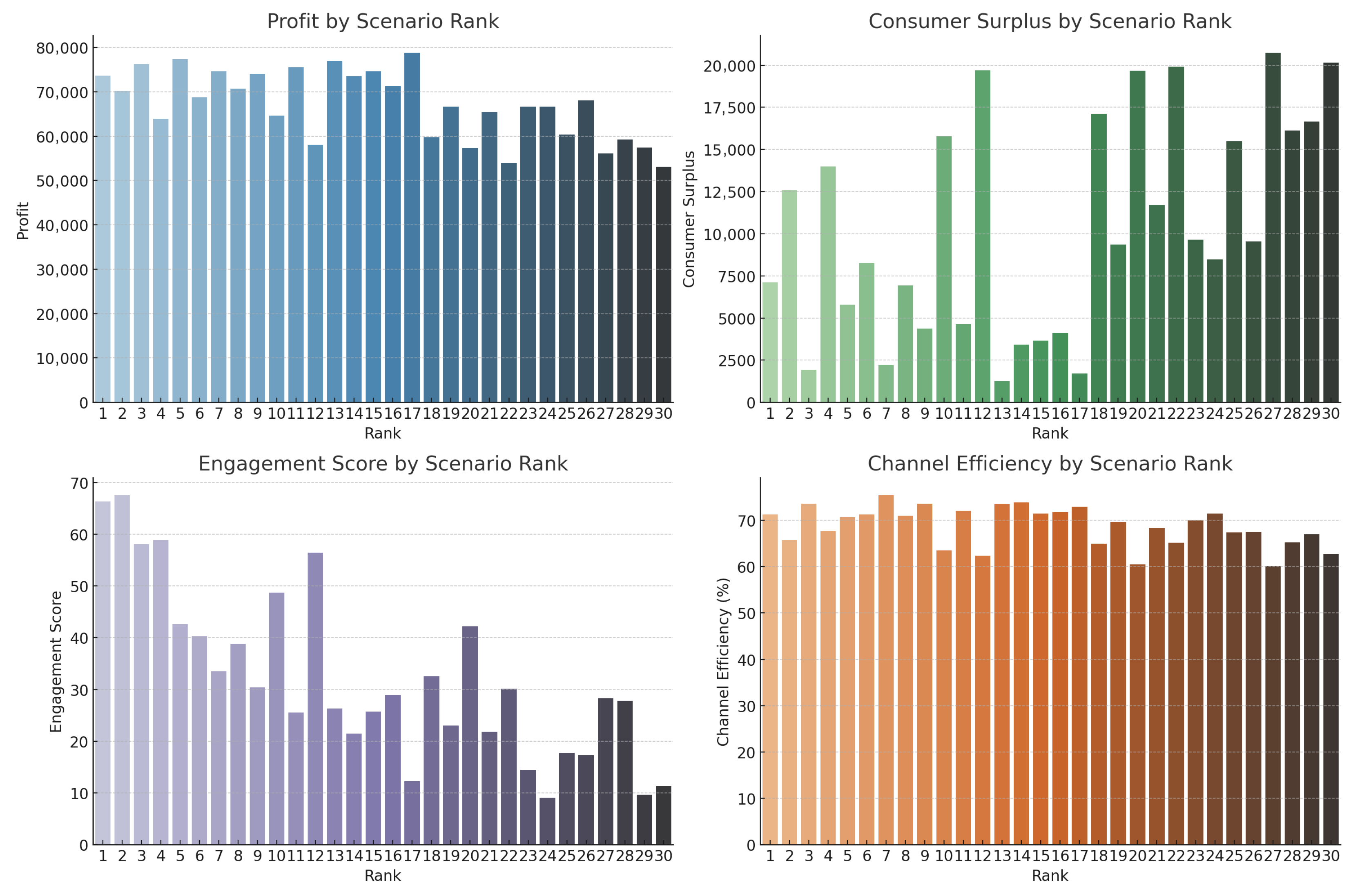

The visualization in

Figure 6 shows the 30 scenarios ranked from the AHP-TOPSIS assessment that offers significant insights into the interplay of numerous performance measures and their contribution to the overall ranking of scenarios within the realm of live e-commerce supply chain decision-making.

The profit versus scenario rank figure indicates that situations with higher rankings typically exhibit robust profitability. For instance, Scenario S12, ranked first, attains a significantly elevated profit level, indicating that profit is a vital determinant in ascertaining the best decision outcomes. Nonetheless, it has been noted that many high-profit scenarios (e.g., S15) do not achieve top rankings, suggesting that profit alone is inadequate without complementary success in other areas such as engagement or efficiency.

Consumer surplus scenarios, particularly S8 (Rank 2), are notable for their very high values, underscoring the efficacy of price and demand tactics that are well-aligned with consumer preferences. However, consumer surplus is not invariably the predominant reason. Numerous scenarios with substantial consumer surplus are relegated to lower rankings because of their inferior performance in other metrics, such as engagement or efficiency.

The engagement score graph demonstrates the significance of viewer participation, a crucial factor in live e-commerce. Scenarios within the top five ranks continuously exhibit heightened engagement scores, underscoring that effective live commerce strategies must promote active viewer interaction, potentially affected by elements such as entertainment value and influencer charisma (denoted by Theta). Inferior-ranked situations exhibit markedly decreased engagement, indicating a reduced influence on the audience.

The channel efficiency analysis elucidates the effectiveness of profit generation from revenue. High-ranking scenarios generally demonstrate robust efficiency ratings, with S29 attaining the greatest, but with a little reduced consumer surplus. As rank diminishes, efficiency correspondingly declines, underscoring the necessity of sustaining streamlined and effective operational tactics for enhanced overall performance.

Collectively, these observations highlight the complex trade-offs involved in live e-commerce decision-making. An integrated MCDM method, such as AHP-TOPSIS, is crucial for capturing these subtleties, ensuring that no single metric prevails and that decisions are consistent with both strategic and operational objectives.

The evaluation of 30 e-commerce supply chain scenarios in

Table 8 indicates that effective decision-making depends on a harmonious combination of entertainment efforts, consumer involvement (

), pricing, and quality. High-ranking situations like S12 and S8 illustrate that elevated customer engagement and entertainment initiatives markedly enhance demand, profitability, and channel efficiency, resulting in superior TOPSIS closeness coefficients. S12 notably integrates strong engagement with steady profitability and efficiency, rendering it the best balanced scenario. Conversely, S2, although yielding the largest profit, is ranked marginally worse due to its inferior consumer surplus and engagement score, highlighting that financial measurements alone are inadequate for optimal performance in multi-criteria decision-making. Inferior situations, such as S22 and S11, frequently experience diminished engagement, feeble demand, and inadequate efficiency, underscoring the significance of audience participation and value-centric propositions in live-streamed commerce. The results highlight that success in live e-commerce is multifaceted, including a deliberate alignment of content quality, pricing, and interaction to optimize supply chain performance.

4.6. Study Implications and Discussion

This study highlights numerous critical implications that enhance both the theoretical framework and actual implementation of live streaming e-commerce techniques in supply chain management. This study presents an innovative multidisciplinary framework that combines consumer behavior, digital marketing, and operations research by incorporating Netflix-style entertainment marketing into supply chain decision-making models. This integration expands the supply chain strategy and emphasizes the increasing significance of emotion- and engagement-driven factors in operational settings.

Theoretically, the study enhances the literature by modeling the strategic implications of entertainment-driven marketing, particularly Netflix-style customer involvement, on demand and price frameworks. Integrating this engagement variable (Theta) into a Stackelberg game model elucidates how emotional resonance and media interactivity can transform traditional notions of price sensitivity and product value. The application of game theory to manufacturer–retailer interactions in both centralized and decentralized power structures enhances the comprehension of leadership roles within supply chains. The results highlight that retailer-driven models, especially those influenced by marketing through social media figures, might surpass manufacturer-driven models by better aligning with consumer trends and preferences.

The novel approach of AHP and the TOPSIS MCDM framework offers a more profound analysis of strategic supply chain assessment. This method allows decision-makers to assess trade-offs among various competing objectives, profit, customer surplus, engagement, and channel efficiency rather than depending exclusively on financial performance. The study reveals that the engagement score holds the greatest significance in the AHP hierarchy, highlighting its strategic relevance in entertainment-focused business. This outcome indicates a fundamental change in the assessment of success in digital commerce, prioritizing customer experience and engagement in conjunction with financial profits.

The findings have numerous practical implications for management. Initially, they emphasize the increasing power and impact of online celebrity retailers (OCRs) in shaping consumer demand and enhancing performance. Retailers that manage price, marketing strategies, and quality decisions are more adept at responding to immediate consumer feedback, particularly in settings enhanced by interactive content. Consequently, supply chains must modify leadership paradigms to provide enhanced strategic autonomy to downstream partners or create collaborative mechanisms that synchronize incentives throughout the chain.

Secondly, companies should emphasize investments in engagement-optimized methods, acknowledging that entertainment value, influencer appeal, and tailored content substantially improve customer retention and conversion rates. This necessitates collaboration with content creators and the use of real-time data analytics to monitor and react to viewer actions. The efficacy of Netflix-style interaction demonstrates the capacity of algorithmic customization and emotive storytelling to drive consumer behavior and loyalty.

The study enhanced contract frameworks between manufacturers and merchants. Given that manufacturer-led tactics can provide increased profits at the expense of consumer preferences, it is essential to implement profit-sharing, revenue-sharing, or coordination contracts to align objectives and ensure long-term success. Retailers and manufacturers that implement shared performance indicators, such as engagement or channel efficiency, can more effectively connect their actions with consumer value.

This study’s findings, when compared to the previous literature, reveal numerous major features that highlight its significance and contribution to current understanding. Currently published studies on live e-commerce and entertainment marketing, such as those by Fan et al. [

7] and Gomez-Uribe and Hunt [

8], demonstrate that platforms such as TikTok and Taobao Live have revolutionized conventional e-commerce by merging live streaming with immediate consumer interaction. However, a significant portion of the current literature has concentrated mostly on conversion rates, sales volume, and the immediate monetary advantages of live-streaming commerce. This research indicates that a transition is necessary toward content strategies that prioritize customer surplus and engagement over conventional sales KPIs. These findings align with the CAB model of consumer behavior [

23], which emphasizes the progression from cognitive awareness to affective response and eventual purchase action, a process amplified by real-time engagement in live streams.

The study’s emphasis on algorithmic fairness represents a significant advancement amid increasing apprehension regarding algorithmic flaws in e-commerce platforms. Although extensive research has examined how platforms might enhance tailored suggestions [

1], less focus has been directed to the equity of these algorithms, particularly regarding consumer involvement and happiness. Previous work has recognized the influence of algorithmic recommendations on engagement; however, it has not thoroughly examined the interplay between algorithmic fairness and engagement incentives to enhance platform equity. This study addresses this gap by proposing that platforms should promote content that not only generates immediate sales, but also fosters consumer trust and involvement, potentially resulting in sustained business success.

Research indicates that sustainable commerce models that integrate emotional value, experience design, and active participation can offer a more thorough understanding of the success of live e-commerce. The currently published research, including that of Zhang et al. [

16], has predominantly concentrated on the efficacy of pricing and logistics in live-streaming commerce, while neglecting the emotional and engagement-oriented dimensions that customers are increasingly pursuing. This study’s findings indicate that emphasizing qualitative characteristics enables platforms and merchants to enhance consumer loyalty and cultivate an atmosphere supportive of sustainable commerce. This aligns with the findings of Wongkitrungrueng and Assarut [

6], who emphasized the significance of trust-building and enduring consumer relationships, although they did not address the comprehensive engagement tactics proposed by this research.

This study corresponds with the literature on behavioral economics that highlights emotional involvement as a pivotal factor influencing consumer behavior in e-commerce. The research carried out by Huang and Rust [

9] on emotionally intelligent marketing has examined the impact of emotional appeal on consumer purchasing decisions. This study builds upon previous findings by directly associating emotional involvement with long-term engagement measures and proposing that these elements be integrated into the decision-making processes of platforms.

The integrated MCDM framework of this study, which integrates AHP and TOPSIS, presents a more sophisticated technique than the current approaches that depend exclusively on profit maximization or operational efficiency. The work of Zavadskas and Turskis [

18] has examined numerous MCDM strategies for supply chain optimization; however, this study advances the discourse by integrating both engagement and customer surplus into the decision-making framework. This offers a more equitable methodology that incorporates both quantitative and qualitative elements, tackling the complexity of decision-making in the ever-evolving landscape of live e-commerce.

5. Conclusions

This study introduces a comprehensive framework that combines behavioral economics, supply chain game theory, and multi-criteria decision-making (MCDM) to investigate strategic decision-making in live e-commerce contexts. The primary contribution is the modeling of the effects of entertainment-driven marketing, particularly Netflix-style engagement methods, on supply dynamics within different power systems. This research provides useful insights on the interactions of consumer involvement, pricing, quality, and marketing efforts within manufacturer–retailer relationships, which are particularly relevant for contemporary e-commerce platforms, where decisions are increasingly influenced by real-time content and influencers.

The results emphasize the essential function of supply chain power allocation. In retailer-led frameworks, where online celebrity retailers (OCRs) drive decision-making, the model demonstrates enhanced performance across several criteria, including profit, customer surplus, and engagement scores. This is primarily due to retailers’ capacity to directly affect demand via adaptive marketing methods and individualized involvement. Conversely, manufacturer-led Stackelberg models exhibit profit centralization upstream, frequently sacrificing adaptability to consumer behavior. These observations underscore the increasing impact of downstream partners in digital commerce ecosystems and highlight the necessity for adaptable leadership models that can fit with swiftly evolving consumer expectations.

The combination of AHP-TOPSIS as a hybrid MCDM instrument was crucial in assessing and prioritizing decision scenarios beyond mere single-objective profit maximization. The strategy facilitated the incorporation of significant yet frequently disregarded metrics, including engagement score and channel efficiency. The findings demonstrate that approaches featuring moderate pricing, robust product quality, and significant marketing efforts consistently surpass tactics focused solely on profit maximization. This affirms that in entertainment-focused commerce, companies must account for both economic and experience factors to maintain long-term competitiveness.

Furthermore, the Stackelberg game offered a detailed insight into the impact of leadership roles on profit distribution and overall channel efficacy. Game-theoretic conclusions indicate that although manufacturers can maximize their profits by establishing advantageous wholesale prices, such unilateral approaches may diminish retailer incentives and consumer pleasure. Conversely, balanced tactics that include the objectives of both parties, potentially through contractual procedures or coordination schemes, can augment overall supply chain profitability.

This research enhances the burgeoning literature on digital retail by providing a decision-making framework specifically designed for live e-commerce settings. It effectively encapsulates the multifaceted nature of consumer behavior shaped by entertainment, the intricate strategy of dispersed supply chains, and the significance of multi-criteria assessment in facilitating optimal decision-making.

Future research may enhance this model by integrating stochastic demand, platform-level interventions, and empirical streaming data to validate and develop the framework. Furthermore, investigating contract coordination instruments, such as revenue sharing or subsidy incentives, may further improve supply chain collaboration. As live e-commerce expands, driven by interactive technologies and customer engagement, decision frameworks like these will become essential for informing strategic decisions in competitive digital markets.