Abstract

As an emerging e-commerce model, live streaming e-commerce integrates instant interaction, content marketing, and online sales to bring consumers a new shopping experience. However, there are many risks in the process of live e-commerce transactions. Identifying key risk factors and implementing targeted control measures are crucial for promoting the sustainable and healthy development of live streaming e-commerce. This paper firstly constructs a business model of live streaming e-commerce transactions according to the transaction scenario and summarizes 24 risk factors from the three dimensions of live streaming e-commerce platforms, merchants, and anchors based on relevant national standards and other relevant literature. Secondly, the Delphi method is employed to modify and optimize the initial risk factors. On this basis, the social network model of risk factors is constructed to determine the influence relationship among risk factors. By calculating the degree centrality, factor types are segmented, and key risk factors as well as influence paths are identified. Finally, corresponding countermeasures and suggestions are proposed. The results indicate that Credit Evaluation System Perfection, Service Evaluation System Perfection, Qualification Audit Mechanism Perfection, Dispute Complaint Handling Channels Perfection, Risk Identification Mechanism Perfection, Platform Qualification, Merchant Qualification, and Merchant Credit are the critical risk factors affecting live streaming e-commerce transactions.

1. Introduction

The profound application of the new generation of information and communication technologies in the business field has made the rapid development of e-commerce shopping possible. In 2025, retail e-commerce sales are estimated to exceed 4.3 trillion U.S. dollars worldwide, and this figure is expected to reach new heights in the coming years [1]. With the accelerating upgrading of online shopping consumption, novel scenarios, new formats, and innovative applications continue to emerge in the consumption field. In recent years, the emerging online shopping model of “live-streaming + e-commerce” has become popular.

Live streaming e-commerce, that is, livestreamers sell related products through live streaming platforms or live streaming software. Consumers can thereby understand the product performance and then make purchases. It is a new marketing approach that combines live streaming with e-commerce. Compared with the traditional e-commerce trading mode, live e-commerce emphasizes more real-time interaction, and consumers can enhance their purchase intention and strengthen their confidence in making purchase decisions through the performance and trust of anchors. Meanwhile, live e-commerce can integrate the shopping process with social interaction and enhance the fun and participation of shopping with social elements, such as bullet screens, likes, comments, etc., to promote the interaction and communication among consumers. In this mode, anchors sell related products while live streaming, which improves consumers’ understanding of merchants, interest in products, and participation in experience and interaction to varying degrees. More and more consumers shop by watching live streams. Live-streaming e-commerce continues to gain momentum globally and is gradually becoming a new driver for e-commerce consumption growth [2]. As of December 2023, the number of online live streaming users in China has reached 816 million, among whom there are 597 million e-commerce live streaming users, an increase of 82.67 million compared with December 2022, accounting for 54.7% of the total Internet users [3].

However, during the development of live streaming e-commerce, a series of risks have emerged that affect consumers’ normal shopping, such as exaggerated propaganda and induced consumption by anchors, dishonest operation of merchants, and difficulty for consumers to protect their rights. Moreover, compared with traditional e-commerce, live e-commerce transactions involve more subjects, more complex information flow, and more diverse implied risks. Given that live streaming e-commerce is an online transaction model that has emerged in recent years, the research on the risks of live streaming e-commerce is relatively rare. Therefore, summarizing the risk factors faced by consumers in the process of live streaming transactions and then identifying and evaluating key risk factors and taking targeted control are conducive to improving consumer satisfaction, creating a good environment for live streaming transactions, and promoting the stable and healthy development of live streaming e-commerce. This paper mainly studies the following questions: (1) Research the risk elements of the live streaming e-commerce transaction process and form the risk elements system of live streaming e-commerce; (2) Explore the interactive relationship between risk factors and identify key risk factors of live streaming e-commerce; (3) Explore the impact path of live e-commerce transaction risks.

In response to the above problems, we first built a live e-commerce transaction business model based on the live e-commerce transaction scenario, and the three main entities involved in the transaction are analyzed in combination with the relevant national standards and expert opinions of live e-commerce, and a risk factor system for live e-commerce transactions is established. Secondly, we use SNA to explore the relationship between risk factors. The risk network diagram of live streaming e-commerce transactions is constructed, and by calculating the degree centrality, closeness centrality, and betweenness centrality of each element, the key risk factors and influencing paths of live streaming e-commerce transactions are determined. Based on this, targeted control measures are developed to provide guidance for protecting the legitimate rights and interests of consumers and promoting the sustainable and healthy development of live streaming e-commerce transactions.

The remainder of this paper is organized as follows: Section 2 reviews and collates previous research results on the risks of live streaming e-commerce, online transactions, and social network analysis. Section 3 analyzes the risk sources of live streaming e-commerce transactions and summarizes the risk factor system of live streaming e-commerce transactions. Section 4 introduces the research method of this paper. Section 5 is empirical research, including the correction and optimization of the risk factor system based on the Delphi method, the identification of key risk factors based on SNA, and the identification of key influence paths. Section 6 is the countermeasures and suggestions. Section 7 is the conclusions.

2. Literature Review

With the rapid development of Internet and mobile communication technology, live e-commerce, as an innovative model integrating real-time live broadcasting, social interaction, and e-commerce functions, implies that the risks of live e-commerce transactions possess both common and distinctive characteristics with the risks of traditional online transactions. Based on this, the review of relevant literature on live streaming e-commerce trading patterns and online trading risks is conducive to a more systematic and comprehensive study of live streaming e-commerce risks.

2.1. Online Transaction Risk Related Research

Online transaction risk refers to the negative possibility that occurs in the process of online transaction, causing consumers to fail to achieve the expected shopping effect [4]. In the past, the research on the risk of online transactions mainly focused on the following three aspects.

First, the risk classification of online transactions. For example, Forsythe et al. identified six perceived risks that may have a negative impact on buyer experience, including financial risk, product performance risk, social risk, psychological risk, physical risk, and time loss risk [5]. Based on relevant research and empirical observations at home and abroad, Yao divides the perceived risks affecting consumers’ online shopping into eight dimensions, including economic risk, social risk, time risk, and information risk [6]. Wang et al. divided the risk indicators of overseas purchasing stores into five categories, including business hours, seller reputation, and sales volume, to study the transaction risks faced by consumers in cross-border online shopping [7].

The second is the single risk study of online transactions. Such as the supply chain risk [8] and logistics risk [9] of cross-border e-commerce, credit risk [10,11,12,13], privacy risk [14], network security risk [15,16] and so on. Song et al. proposed a quantitative semi-automatic assessment method of CBEC commodity risk based on text mining and fuzzy rule-based reasoning to improve the efficiency and accuracy of CBEC commodity risk assessment [17]. Liu et al. built an e-commerce product quality risk assessment model from massive unbalanced data to accurately identify e-commerce product quality risks [18]. Natalia et al. apply the fuzzy quality function deployment method to identify and map the e-commerce risks of the platform [4].

The third is how to reduce the risk of online transactions. With regard to how to reduce the impact of various types of risks in online transactions, Li et al. established e-commerce fraud detection models based on IFT, AI, and DM to solve the financial risks of e-commerce enterprises [19]. With the help of SEM, Elizabeth et al. found that the better consumers’ perception of online retail website design, the lower the perceived risk of online shopping [20]. Gwak et al. analyzed the effectiveness of e-commerce security and the relationship between common risks in digital business so as to reduce the impact of threats [21]. Different researchers start from their own research directions, based on relevant fields, and use different methods to identify, assess, and reduce e-commerce risks.

2.2. Live E-Commerce Transactions Related Research

Although the academic circles have gradually deepened the research on this emerging e-commerce format in recent years, there are still few studies in the field of live e-commerce risk. The existing research on live streaming business mainly focuses on the following aspects.

First, study the impact of live streaming e-commerce on consumers’ purchase intention. Representative results include Ma et al. and Zhang et al., who used the SOR framework to analyze how to use live streaming to increase consumers’ purchase intention [22,23]. Chen et al. discussed the impact of marketing elements of live streaming e-commerce on consumers’ purchase intention with the help of the reward-risk framework derived from the Yale model [24]. Shou et al. investigated the impact of government regulations on consumers’ willingness to use e-commerce live streaming [25]. Chen et al. discussed the influencers (live streamers) promoting consumers’ purchase intention in the live e-commerce environment [26]. Dong et al. investigated whether live streaming e-commerce won consumers’ trust and enhanced consumers’ willingness to buy green agricultural products [27]. Other studies have analyzed how live streaming e-commerce can improve consumers’ purchase intention by improving consumer engagement [28,29,30].

The second is the study of impulse buying behavior in live streaming e-commerce. The emergence of live streaming e-commerce has intensified the phenomenon of impulse buying [31]. Huo et al. adopted the SOR paradigm to construct the influence mechanism of impulse buying behavior in live shopping [31]. Based on the SOR framework, Li et al. discussed the impact of social presence in live streaming on consumers’ impulse buying [32]. Zhang et al. proposed a theoretical framework to study how live streaming affects consumers’ impulse buying [33]. Shi et al. studied the impact of e-commerce live streaming atmosphere cues on consumers’ impulse buying behavior [34].

The third is the study on the sales of merchants in live streaming e-commerce. Some researchers have studied the live streaming strategy of online retailers under multi-channel sales [35]. Wang et al. analyzed the issue of introducing live streaming into the supply chain of online manufacturers or retailers cooperating with streamers [36]. Zhang et al. found that the development of live streaming shopping sales channels would damage the profits of overseas online retail departments of multinational companies and third-party e-retailers [37].

2.3. Social Network Analysis Related Research

Previous research on the transaction risks of live streaming e-commerce has been scarce and mainly focused on risk quantification. For example, Li et al. proposed an analytical framework to assess consumers’ shopping risks on live streaming e-commerce platforms [2]. Su et al. proposed an improved risk evaluation method based on interval-valued intuitionistic fuzzy multi-criteria group decision making (MCGDM) and the VIKOR method to rate the risk of the alternative agricultural products live streaming e-commerce platforms [38]. However, these studies failed to comprehensively and systematically consider the complex correlations among various risk factors.

Social network analysis (SNA), as a powerful research tool, can analyze the connections and influence patterns among various nodes in a system from a relational perspective. SNA has demonstrated remarkable analytical capabilities in many fields. For instance, in the field of literature research, Zhang et al. constructed keyword co-occurrence networks and institution co-occurrence networks to understand the systematic approaches in artificial intelligence research and provided potential guidance for future research [39]. In the field of online health communities, Lu et al. took users as nodes and constructed an integrated social network and five separate health-related topic-specific networks. The empirical findings revealed that patients’ demographic attributes and online behavioral features have significant impacts on the formation of online health social networks, and there are significant differences in the impacts of patient characteristics on various social relationships in multiplex networks [40]. In the field of green consumption, Zhang et al. utilized SNA to identify the key factors influencing residents’ green consumption behaviors and discovered the key influencing factors and key influence paths [41]. In the field of project risk research, some scholars use SNA to investigate social risks in construction projects occurring in urban districts rife with historically and culturally significant tourism sites and then determine the relations between the social risks and stakeholders as well as the significance of each risk [42]. Some scholars construct the risk network model of a GRIB project based on three dimensions: process, subject, and system sources, and the software package UCINET is used to conduct social network analysis and determine the key risk factors and relationships, which are of immense significance for completing construction tasks and ensuring the planned benefits [43]. An et al. comprehensively considers the characteristics of hydropower project construction and identifies relevant stakeholders to build and improve the stakeholder behavior risk evaluation index system and use SNA to build an evaluation model of stakeholders’ behavioral risk transmission network, identify core factors and key relationships, and analyze the path of behavioral risk transmission [44].

To sum up, existing studies on live streaming e-commerce mainly focus on consumers and merchants, and few studies analyze the risks in this process. In order to fill this gap, on the basis of previous studies on e-commerce risk classification and analysis, consumer purchasing behavior, and merchant strategy in live streaming e-commerce, this study introduces SNA into the field of risk identification and assessment of live streaming e-commerce transactions, which can not only effectively analyze key risks and risk impact ways but also make up for existing research deficiencies. It can also provide theoretical support and practical guidance for the risk prevention and control and supervision of the live streaming e-commerce industry.

3. Construction of Live E-Commerce Risk Factor System

3.1. Risk Source Analysis

Live streaming e-commerce, as an e-commerce model that displays goods in real time through live streaming platforms, interacts with audiences, and makes sales, can enhance product marketing vitality and enhance user interaction experience. Live streaming e-commerce mainly includes the following three types: First, anchors sell goods for e-commerce enterprises live on the live streaming platform; second, anchors attract social media traffic to e-commerce enterprises on other platforms through live streaming; third, anchors attract consumers to other non-platform merchant transactions through live streaming. The types of live streaming e-commerce are different, and the risks are different. In this paper, the scope of the study is limited to the first type, and the anchor is different from the Internet celebrity and the influencer and is served by the commodity operator himself or his internal employees.

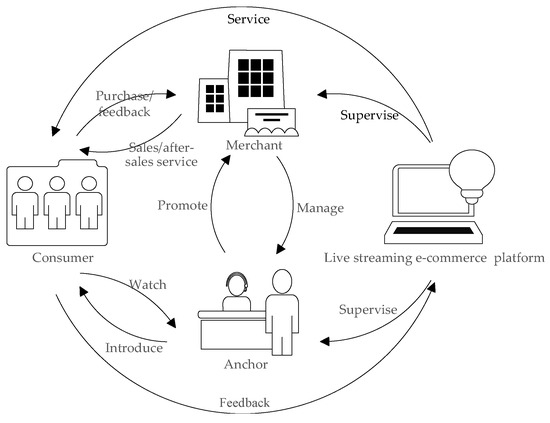

In the process of live streaming transactions, merchants provide commodities and promotional materials to live streaming marketers, who carry out sales promotion on the live streaming e-commerce platform, while the live streaming e-commerce platform connects merchants, anchors, and consumers to facilitate transactions and, at the same time, supervises the merchants and live streaming marketers on the platform. Consumers bear the purchase decision, confirm the receipt of goods, evaluate feedback and other content, and finally jointly build a complete live e-commerce transaction ecosystem. According to the above realistic scenario, the live e-commerce transaction business model is established, as shown in Figure 1.

Figure 1.

Live e-commerce transaction business model.

As can be seen from Figure 1, the subjects participating in live streaming e-commerce transactions include live streaming e-commerce platforms, merchants, anchors, and consumers. Therefore, in order to analyze the risks faced by consumers in the process of live streaming transactions and improve consumer satisfaction, this study will analyze the risks of live streaming e-commerce transactions from the perspective of participants.

Platform dimension. A live streaming e-commerce platform is an online platform that can display and sell goods through live streaming. It participates in many links, such as live streaming content supervision, merchant qualification review, transaction dispute settlement, etc. Therefore, its qualification and management level will directly lead to risks in the process of live streaming e-commerce transactions.

Merchant dimension. As the seller, the merchant not only needs to supervise the live streaming behavior of the affiliated anchors but also needs to comply with the regulations of the platform, ensure the quality of the product, and bear the responsibility for after-sales service. Therefore, the risk of live e-commerce cannot be separated from the role of merchants.

Anchor dimension. The explanation of anchors in the live streaming plays an important role in the purchase intention of consumers. If the anchor is not able to accurately describe and properly promote the product, it will not only mislead consumers but also affect their own credibility and that of the business. Therefore, the relevant qualifications and marketing behaviors of anchors will lead to risks in the process of live e-commerce transactions.

3.2. Risk Element System

On the basis of sorting out the process of live streaming e-commerce transactions and the dimensions of risk sources, this study combined the two national standards related to live streaming e-commerce [45,46] to analyze the possible risk factors of different entities.

(1) Platform dimension

Live streaming e-commerce platforms need to supervise live streaming content, manage merchants and anchors, and intervene in a timely manner in case of transaction conflicts between merchants and consumers. Therefore, we divide the dimensional risks of live streaming e-commerce platforms into 11 secondary risk indicators: Platform Qualification, Information Security and Maintenance Capabilities, Software and Hardware Environment Conditions, Technical Personnel Size, Service Evaluation System Perfection, Risk Identification Mechanism Perfection, Quality Control Management System perfection, Emergency Handling Mechanism Perfection, Qualification Audit Mechanism Perfection, Credit Evaluation System Perfection and Dispute Complaint Handling Channels Perfection.

(2) Merchant dimension

While managing anchors and complying with relevant management regulations of live streaming platforms, merchants also need to properly communicate with consumers and solve their problems, etc. Therefore, we subdivide the merchant dimension risk into nine secondary risk indicators: Merchant Qualification, Account Standardization, Merchant Credit, Logistics Distribution Service Quality, After-sales Service Quality, Product Quality, Transaction Order Processing Speed, Dispute Complaint Processing Speed and Purchase Inspection Mechanism Perfection.

(3) Anchor dimension

In the process of live streaming, the anchor needs to answer the questions raised by consumers in the live broadcast room and sell goods. Therefore, we subdivide the anchor dimension risk into four secondary risk indicators: Anchor Qualification, Anchor Credit, Marketing Service Standardization and Identity Authenticity.

To sum up, the risk factor system of live streaming e-commerce transactions constructed in this paper is shown in Table 1.

Table 1.

The initial risk factors of live streaming e-commerce transaction process.

4. Methodologies

In the existing literature on risks of live streaming e-commerce transactions, some scholars have used SEM to conduct empirical analysis of transaction risk [6] and analyze important factors affecting the overall risk. However, previous studies could not explore the interaction and influence relationship between risk factors and their influence paths and then identify key risk factors. Therefore, on the basis of building the initial risk factor system, the Delphi method was adopted to screen and optimize the initial risk factors. Then, based on the SNA method, the internal relationship between the factors is further discussed, and the key risk factors are finally identified.

4.1. Delphi Method

The Delphi method is an expert survey method that is usually applied to decision making, problem solving, demand analysis, and other fields [47]. It goes through multiple rounds of feedback and discussion by experts to reach consensus or predict future events. The key to using the Delphi method is first, to select experts who are familiar with and proficient in the decision problem under consideration; second, to ensure the anonymity of experts; and third, to provide them with adequate and accurate information [47].

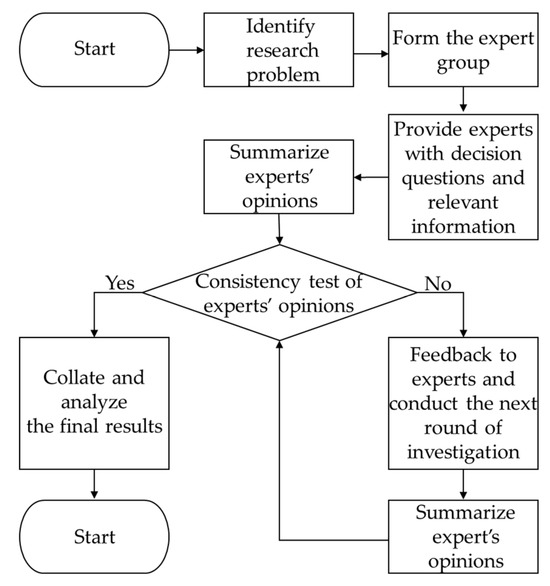

The specific implementation process of the Delphi method is shown in Figure 2.

Figure 2.

Implementation process of the Delphi method.

- Identify the problem: Identify the problem that needs to be solved. Questions should be clear and specific so that experts can provide meaningful feedback.

- Select experts: The expert group shall be composed of experts with rich experience and knowledge in the fields involved. The number and background of the experts shall be determined.

- Prepare a questionnaire: Develop a series of statements or questions that address the problem. The questionnaire design should be concise and clear so that experts can quickly understand and make sound judgments.

- Conduct investigations: Experts respond independently based on available information to assess the need for each element in the risk factor system.

- Aggregate analysis: Expert responses are collected and analyzed in aggregate to reflect consensus or disagreement among experts.

If the opinions of experts reach a consensus, the final result will be sorted out and analyzed according to the opinions of experts; if the opinions of experts do not reach a consensus, feedback and supplementary information will be provided to them, and the next round of investigation will be conducted until the opinions of experts reach a consensus [41].

4.2. Social Network Analysis

Social network analysis (SNA) is a method to study social phenomena such as interpersonal relationships, organizational structures, and information flow. By using graph theory and network analysis techniques, SNA can reveal the connection patterns and structural characteristics among individuals, which can help decision makers understand issues related to social organization structure, information transmission, and influence mechanisms [41]. On the basis of the adjacency matrix, Pajek is used to build a network diagram with various influencing factors as nodes, explore the relationship between the risk factors of live streaming e-commerce transactions through network characteristics, and identify key risk factors. The specific steps are as follows [41]:

- Step 1: Determine correlations between risk factors. After establishing the risk factor system, experts in the field are invited to score the correlation among risk factors and form an adjacency matrix.

- Step 2: Network visualization of risk factors. Use Pajek to visualize network analysis and plot a directed graph network.

- Step 3: Analyze the whole network to determine the network correlation degree. In this study, network density and clustering coefficient are used to describe the degree of correlation between factors, and global network analysis is carried out.

Network density represents the closeness of the relationship between nodes in the network. The closer the relationship between two nodes, the higher the network density. The calculation is shown in Equation (1).

where represents the overall network density value, represents the number of network edges, and represents the number of network nodes.

The clustering coefficient reflects the group characteristics of adjacent nodes. The calculation is shown in Equation (2).

where represents the aggregation degree when the number of adjacent nodes in the network is 1, represents the node directly connected to the node and the number of adjacent nodes is 1, represents the number of adjacent nodes of the node .

- Step 4: Individual network analysis to identify key risk factors. By calculating degree centrality and closeness centrality, the centrality of each risk factor in the whole network is obtained, and then the key risk factors are determined.

Degree centrality measures the importance of a node in the network and the number of connections it has. The higher the degree centrality of a node, the higher its influence or status in the network. The “in-degree” centrality measures the number of connections that other nodes point to this node. In the network, this can be understood as the amount of influence or attention that other nodes have on that node. The “out-degree” centrality measures the number of connections that this node points to other nodes. In the network, it can be understood as the influence or attention of this node to other nodes. By calculating centrality, the types of risk factors in this study were divided.

Closeness centrality is an indicator to measure the closeness between nodes and other nodes in the network. It can be used to identify key nodes and structures. The calculation is shown in Equation (3).

where denotes the closeness centrality of the node , represents the number of nodes in the network, and represents the distance from node to node .

- Step 5: Identify the critical impact path. Betweenness centrality measures the importance of a node in connecting other nodes in the network. The betweenness centrality of a node depends on how often or to what extent it acts as the shortest path between other nodes in the network. In other words, nodes with high betweenness centrality play an important role in connecting different parts or communities in the network. By analyzing the weights of the connected edges of nodes with high intermediate centrality, we can identify routes at key positions in the network to determine their influence on other paths in the network. The calculation is shown in Equation (4).

5. Empirical Study

First of all, this study adopts the Delphi method to revise and optimize the risk factor system of live streaming e-commerce transactions. Then, based on SNA, the network characteristics of the live streaming e-commerce transaction risk factor network are analyzed. The identification of key risk factors of live streaming e-commerce transactions is divided into overall network analysis and individual network analysis. The overall network analysis includes the construction of the overall influence network, the calculation of the overall network density, and the clustering coefficient. Individual network analysis includes degree centrality analysis, closeness centrality analysis, and critical influence path identification.

5.1. Risk Factor Framework Based on the Delphi Method

The initial set of risk factors for live streaming e-commerce summarized in this study includes 3 dimensions and 24 risk factors, as shown in Table 1. In order to verify the scientificity and effectiveness of the risk factor system, it is necessary to use the Delphi method to screen the initial risk factor system. Six experts with rich practical experience and theoretical backgrounds in the field of online trading were selected, as shown in Table 2. Combined with the practical experience of the industry field, the five-point scale questionnaire was used to screen and summarize the risk factors. In order to obtain a comprehensive understanding of the risk sources and factors of live streaming e-commerce transactions, the practical experience subjects selected by the research institute should be able to understand the main responsibilities of live streaming e-commerce transactions and have a certain grasp of the possible risk sources of existing live streaming e-commerce.

Table 2.

Professional backgrounds of the selected six experts for the Delphi survey.

Then, according to the average score and consensus deviation index (CDI), the necessity of risk factors is determined [41]. The calculation is shown in Equation (5).

where represents the experts’ ratings on the necessity of each influencing factor, represents the number of experts, represents the standard deviation of experts’ ratings, and represents the average of experts’ ratings.

In the first round of the Delphi questionnaire, we provided experts with a preliminary risk factor system for live streaming e-commerce transactions, and the experts judged whether the factors in the system were suitable for the risk factor assessment of live streaming e-commerce transactions according to their experience and checked the accuracy of the definition of indicators.

In the second round of the Delphi questionnaire, experts rated risk factors on a scale of 1 to 5. A score of 1 indicates that the risk factor is completely unnecessary, and a score of 5 indicates that the risk factor is completely necessary. Taking into account the average score of each risk factor, if the average score is below a specific threshold, it indicates that the factor is less necessary and should be excluded from the risk factor system. The CDI is used to calculate the degree of consensus of the expert group. If the CDI value is too high, it indicates that there is significant disagreement among the experts on the necessity of the factor. If there is no consensus among the experts, the next round of questionnaire filling is required until the experts have reached a consensus on all factors. In this study, the critical value of necessity is set to 3, and the critical value of CDI is set to 0.2. A panel composed of six experts and scholars in the field of live streaming e-commerce evaluated the necessity of various risk factors for live streaming e-commerce transactions.

The factor necessity analysis of the second round of the Delphi questionnaire is shown in Table 3. Experts agreed that the Emergency Handling Mechanism Perfection of the live streaming e-commerce platform dimension is unnecessary and can be directly removed because the average score of this factor is lower than 3 and the CDI value is lower than 0.2. In addition, 18 risk factors had an average score greater than 3 and a CDI value less than 0.2, on which experts agreed. The CDI values of the other five influencing factors were all greater than 0.2. In order to reach a consensus among the experts, a third round of the Delphi questionnaire was conducted.

Table 3.

Necessity analysis of risk factors in the second round of the Delphi questionnaire.

Before the start of the third round of the Delphi questionnaire survey, in order to avoid errors caused by unnecessary factors, experts whose second-round score is outside the average (plus or minus one standard deviation) are asked to provide reasons for the second-round score. The third round of expert ratings is shown in Table 4. After statistical analysis of the questionnaire survey results, it was found that the CDI value of each risk factor in this round was less than 0.2, indicating that each risk factor passed the consistency test of experts. Among them, the average score of the Quality Control Management System Perfection is less than 3 points, and the factor that experts agree is not needed is finally eliminated.

Table 4.

Necessity analysis of risk factors in the third round of the Delphi questionnaire.

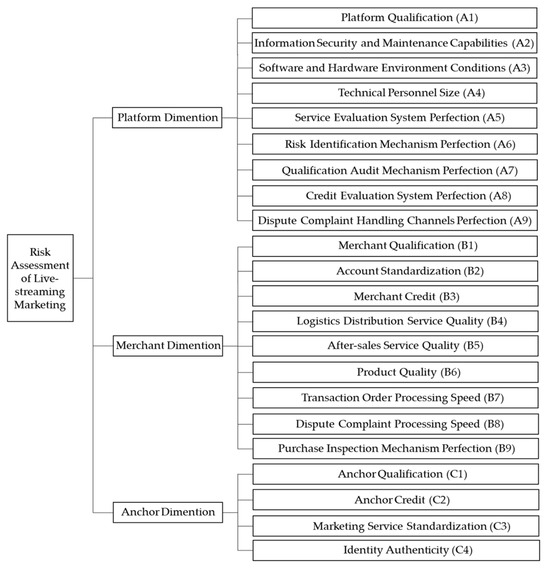

After three rounds of the Delphi questionnaire survey, the formal research framework of this study was obtained. Finally, the risk factor system of live streaming e-commerce transactions includes 3 dimensions and 22 factors, as shown in Figure 3.

Figure 3.

Live streaming e-commerce transaction risk factor system.

5.2. Identification and Analysis of Key Risk Factors Based on SNA

5.2.1. Construction of the Network Diagram of the Risk Factors

With the risk factors of live streaming e-commerce transactions as the node and the related influence relationship between nodes as the side, a complex network of live streaming e-commerce transaction risks is constructed. This study used an expert questionnaire to determine the effect of pairwise comparisons between factors. The questionnaire is designed as a paired comparison with a scale of 0 to 3, where 0 indicates no effect between the two factors. A score from 1 to 3 indicates that factor i has an influence on factor j, and a higher score indicates a higher degree of influence between factors. The questionnaire was filled in by experts and scholars in the field of live e-commerce transactions, as shown in Table 2. The question is, “what is the impact of Platform Qualification on Information Security and Maintenance Capabilities?”. Some of the questionnaires are shown in Table A1 in Appendix A.

When processing data, we treat the opinions of each expert equally. Experts calculate the average score as the final effect between the various factors. We set the average below 1.000 to 0.000. We assume that there is no effect between these two factors. Thus, the adjacency matrix of risk factors of live e-commerce transactions can be obtained. Since the 22 × 22 matrix involves a lot of data, only the adjacency matrix of the previous 10 risk factors is taken as an example, as shown in Table 5.

Table 5.

Partial adjacency matrix of risk factors for live streaming e-commerce transactions.

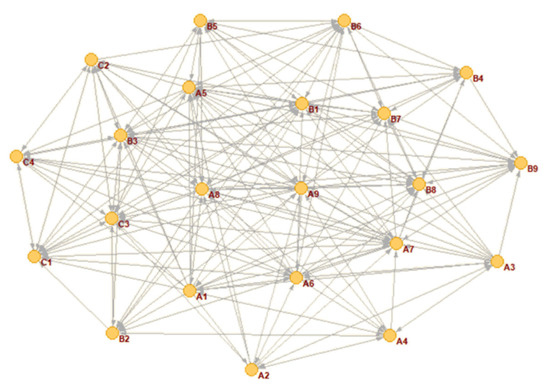

Based on the adjacency matrix of risk factors, we use Pajek to build the initial network, as shown in Figure 4.

Figure 4.

Network diagram of risk factors on live streaming e-commerce transaction.

5.2.2. Identification of the Critical Influencing Factors

First, analyze the overall network. The density of the network is 0.496, and the clustering coefficient is 0.548, indicating that the relationship between various factors in the social network is relatively close. From the network diagram of the impact of risk factors, we can observe the impact relationship between different risks and have a deeper understanding of the primary and secondary risk factors of live streaming e-commerce transaction risks. For example, we can identify problems in the trading process by monitoring key risk factors. The research results also show that the platform dimension risk, merchant dimension risk, and anchor dimension risk all have different degrees of influence on the consumer transaction behavior.

Then, analyze the individual network. In this paper, three indexes of in-degree centrality, out-degree centrality, and closeness centrality are used to find out the key risk factors and key influencing ways. The degree centrality of a node is the number of edges directly connected to the node. In-degree centrality measures the number of incoming edges, and out-degree centrality measures the number of outgoing edges. For nodes with higher in-degree centrality, the corresponding risks may be caused by multiple risks. A node with high out-degree centrality indicates that its corresponding risk may cause many consequences. The closeness centrality of a node measures the speed at which information travels through the node. When a node is very close to other nodes in the network, information can travel faster through that node. Therefore, when a risk has a high closeness centrality, that risk can reach other risks within a shorter distance and has a higher impact on the spread of the risk.

The analysis data of specific nodes are shown in Table 6.

Table 6.

Risk factor related network indicators.

Risk nodes with high out-degree centrality in the network are likely to cause other risk nodes, which are called driving factors. Risk nodes with higher in-degree centrality are easily affected by other risk factors, which are called result factors. For risk nodes with similar in-degree and out-degree centrality, we call them intermediate factors. As can be seen from the results in Table 6, the Platform Qualification (A1), Credit Evaluation System Perfection (A8), Qualification Audit Mechanism Perfection (A7), and other factors have a high out-degree centrality, indicating that they are easy to cause other risks and are driving factors. However, Merchant Credit (B3), Dispute Complaint Processing Speed (B8), Marketing Service Standardization (C3), and other factors have a high in-degree centrality, indicating that they are easy to be triggered and are the result factors. The in-degree and out-degree centrality of Service Evaluation System Perfection (A5), Merchant Qualification (B1), After-sales Service Quality (B5), and Product Quality (B6) is similar, which is the intermediate factor. The risk of live streaming e-commerce can be effectively controlled by controlling the driving factors.

According to the closeness centrality ranking results in Table 6, we consider that the top 8 factors are the key risk factors, namely, the Credit Evaluation System Perfection (A8, 1.000), Service Evaluation System Perfection (A5, 0.955), Qualification Audit Mechanism Perfection (A7, 0.955), Dispute Complaint Handling Channels Perfection (A9,0.955), Platform Qualification (A1,0.875), Risk Identification Mechanism Perfection (A6,0.875), Merchant Qualification (B1,0.875), and Merchant Credit (B3,0.875).

The key risk factors of the live e-commerce transaction process are shown in Table 7.

Table 7.

Key risk factors of the live e-commerce transaction.

5.2.3. Identification of the Critical Influencing Paths

After determining the key risk factors and their types, we further calculated the betweenness centrality of each factor, as shown in Table 6. The top 5 risk factors with betweenness centrality are called key intermediate nodes. Service Evaluation System Perfection (A5, 0.093), Risk Identification Mechanism Perfection (A6, 0.074), Merchant Credit (B3, 0.074), Credit Evaluation System Perfection (A8, 0.070), and Qualification Audit Mechanism Perfection (A7, 0.061) are the key intermediate nodes.

Then, the betweenness centrality of each edge to the key intermediate node is further calculated. According to edge betweenness centrality, the influence path with edge betweenness centrality higher than 0.15 is regarded as the key influence path. The results are shown in Table 8.

Table 8.

The critical influencing paths of live streaming e-commerce transactions.

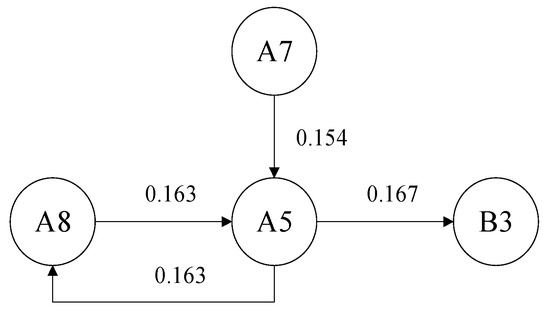

In order to further explore the internal correlation between key influence paths, a network diagram is drawn, as shown in Figure 5.

Figure 5.

Network diagram of critical influencing paths.

As shown in Figure 5, Credit Evaluation System Perfection (A8) and Qualification Audit Mechanism Perfection (A7) are the key driving factors. As a key intermediate factor, Service Evaluation System Perfection (A5) not only directly affects the Merchant Credit (A5→B3) but also plays a role in the process of the Credit Evaluation System Perfection and Qualification Audit Mechanism Perfection affecting the Merchant Credit (A8→A5→B3, A7→A5→B3). At the same time, Service Evaluation System Perfection (A5) can also react to the Credit Evaluation System Perfection (A8).

5.3. Summary

Different from traditional hypothesis testing and other methods, social network analysis can not only identify the key risk factors of live streaming e-commerce transactions but also identify the key impact paths of live streaming e-commerce transactions. The results show that the Credit Evaluation System Perfection (A8), Service Evaluation System Perfection (A5), Qualification Audit Mechanism Perfection (A7), Dispute Complaint Handling Channels Perfection (A9), Platform Qualification (A1), Risk Identification Mechanism Perfection (A6), Merchant Qualification (B1), and Merchant Credit (B3) are the key risk factors for live streaming e-commerce transactions. A5→B3, A5→A8, A8→A5, and A7→A5—these four paths need attention.

Credit Evaluation System Perfection (A8) can reflect the soundness of the platform’s credit evaluation mechanism for users, anchors, merchants, and other participants. At the same time, this factor is a driving factor, indicating that the platform’s credit evaluation system perfection can affect other factors, such as Merchant Credit (B3) and Anchor Credit (C2), to a certain extent. It can be seen from the key influence path that the Credit Evaluation System Perfection (A8) has a relatively important influence on the Service Evaluation System Perfection (A5). If the live streaming e-commerce trading platform has a perfect credit evaluation system, the user’s transaction records, evaluations, and credit scores of merchants can accurately reflect their actual performance, which will promote the buyer and seller to be more honest and trustworthy, improve the overall transaction quality and service level, and promote the improvement of the platform service evaluation system.

The Service Evaluation System Perfection (A5) is the perfection of the evaluation and feedback mechanism of the platform to measure and improve the quality of after-sales service. At the same time, this factor is an intermediate factor, which indicates that this factor can not only affect other factors to a certain extent but also be easily affected by other factors. From the key influence path, it can be seen that the Service Evaluation System Perfection (A5) has a significant impact on Merchant Credit (B3). At the business level, a perfect service evaluation system can let businesses understand the real feedback of consumers on products and services and help businesses find and solve existing problems so as to continuously improve the service level. At the level of anchors, a sound service evaluation system can make anchors realize whether their service behavior is professional and reliable, thus helping to adjust their service attitude and helping them to continuously improve their professional ability and competitiveness in content creation and live streaming services.

The Qualification Audit Mechanism Perfection (A7) plays an important role in reviewing the qualifications of merchants and anchors. It can be seen from the key influence path that its influence on the Service Evaluation System Perfection (A5) is also more important. A perfect qualification audit can avoid the existence of unqualified merchants and fraud, thereby reducing the fluctuation of service quality caused by the existence of the above situation. This contributes to the stability and predictability of the overall platform service and creates a good environment for the establishment and improvement of the platform service evaluation system.

The Dispute Complaint Handling Channels Perfection (A9) can reflect the importance of the platform to the rights and interests of users and the fairness of the platform operation. The platform’s complaint handling channels can help merchants quickly receive feedback on product quality, help merchants identify and solve problems related to products or services, and effectively avoid various risks caused by consumer complaints.

Risk Identification Mechanism Perfection (A6) can effectively monitor and prevent risks on the platform. A sound risk identification mechanism can monitor the live streaming content and interactive behavior of anchors to ensure compliance with the platform’s service norms and code of conduct. At the same time, anchors are usually more cautious and self-disciplined to avoid violations under the strict risk identification mechanism.

Merchant Qualification (B1) can reflect whether the registration information and business license of the business meet the requirements of laws and regulations so as to reduce the subsequent problems caused by product quality or service of consumers. Through strict business qualification audits, we can screen out businesses with guaranteed quality and legal compliance, thereby reducing the inflow of low-quality or fake and shoddy products. At the same time, the qualification of merchants also affects the qualification of anchors to a certain extent, and merchants with good qualifications themselves have higher requirements for the qualification of anchors.

Merchant Credit (B3) can reflect the accumulated reputation of the merchant. As a result factor, it is affected by various factors. For example, the Service Evaluation System Perfection (A5), the Logistics Distribution Service Quality (B4), Product Quality (B6), Anchor Qualification (C1), Anchor Credit (C2), and Identity Authenticity (C4) will all affect Merchant Credit (B3).

6. Discussion and Implications

Previous research on live streaming e-commerce has certain limitations, mostly focusing on the consumer and merchant dimensions. Regarding the transaction risks of live streaming e-commerce, although some scholars have established risk factor systems [2], some of the risk factors have something in common with this paper, such as “Lack of credit” in the risk dimension of anchors and “Poor service feedback” in the platform dimension [2]. However, there is still a lack of research on the complex interactions and synergistic effects among the risks of the three key entities in the live streaming e-commerce ecosystem, namely the platform, merchants, and anchors. Given that previous studies have used SNA to identify key risk factors and key relationships [42,43,44] and analyze the risk propagation paths [44]. Therefore, based on the identification of the risk factors in live streaming e-commerce transactions, this paper uses SNA to determine the influencing relationships among various risk factors so as to achieve a comprehensive and multi-level analysis of live streaming e-commerce risks and put forward the following management implications:

6.1. Management Implications for Live Streaming E-Commerce Platforms

Strengthening Platform Qualification Management: Live streaming e-commerce platforms should strictly abide by relevant laws and regulations to ensure the legitimacy and compliance of their own operational qualifications. Regularly conduct self-inspections of the platform’s business scope, operation mode, etc., actively apply for and update necessary business licenses, and ensure that the platform conducts live streaming e-commerce business within the legal framework to provide users with a reliable trading environment.

Improving Service Evaluation System: Establish a comprehensive and objective service evaluation mechanism and encourage consumers to evaluate the service quality of merchants and live streamers. Evaluation indicators should cover multi-dimensional contents. The platform conducts hierarchical management of merchants and live streamers based on the evaluation results, provides incentive measures such as traffic support and rewards to high-quality service providers, and issues warnings, requires rectification, or even removes those with substandard services to urge the improvement of service levels.

Optimizing Risk Identification Mechanism: Utilize technical means such as big data and artificial intelligence to monitor various types of data in the live streaming e-commerce transaction process in real time. Analyze abnormal transaction behaviors, such as false transactions of a large number of the same commodity in a short period and abnormal price fluctuations; pay attention to changes in the credit data of merchants and live streamers to timely discover potential risks. At the same time, establish a risk early warning system and classify risks according to the degree of risk to facilitate the platform taking timely response measures.

Perfecting Qualification Audit Mechanism: In the entry link of merchants and live streamers, strictly review their qualifications. Merchants are required to provide relevant documents such as business licenses and product quality certifications, while live streamers’ identity certificates and professional qualifications are reviewed. Regularly conduct qualification re-examinations of the already entered merchants and live streamers to prevent situations such as expired or false qualifications. For live streaming involving special industries or commodities, such as food and medicine, additional reviews of relevant special licenses are required.

Enhancing Credit Evaluation System: Construct a scientific and reasonable credit evaluation model, comprehensively consider various factors such as the transaction history, violation records, and consumer evaluations of merchants and live streamers to form a quantitative credit score. Conduct credit classification based on the credit score; give more trust and support to those with high credit levels, such as priority recommendation and reduction in deposit; and strengthen supervision and restrictions on those with low credit levels, such as restricting promotion and increasing the frequency of review.

Broadening Dispute Complaint Handling Channels: Provide consumers and merchants with convenient and diverse dispute complaint channels, such as online customer service and complaint hotlines. Ensure the smoothness of complaint channels and timely accept and handle various complaints. Establish a standardized complaint handling process, clarify the processing time limit and responsible departments, and track and feedback the complaint handling results to protect the legitimate rights and interests of all parties.

6.2. Management Implications for Merchants

Ensuring Merchant Qualification Compliance: Merchants must ensure the completeness and legality of their own business qualifications. They should strictly follow the requirements of relevant industry norms and laws and regulations and timely apply for and update various necessary business licenses and other qualification documents. Regularly conduct self-checks on the validity period of qualifications to avoid business disruptions due to expired or non-compliant qualifications and establish the foundation for legal operation.

Attaching Importance to Merchant Credit Building: Establish a long-term credit awareness. During the transaction process, strictly abide by the platform rules and agreements with consumers, deliver goods on time, and describe commodity information truthfully. Actively handle consumer feedback and avoid credit-damaging behaviors such as breach of contract and fraud. By accumulating a good credit record, improve the credit rating on the platform and obtain more traffic support and consumer trust.

Improving Logistics Distribution Services Quality: Select high-quality and reliable logistics partners and establish a close cooperative relationship with them. Jointly formulate reasonable distribution timeliness standards and strictly supervise implementation. Optimize commodity packaging to ensure that commodities are not damaged during transportation. At the same time, provide logistics information to consumers in a timely manner to facilitate them to track the order status and enhance the shopping experience of consumers.

Strengthening After-sales Services Quality: Establish a professional and efficient after-sales service team and formulate a complete after-sales service process. Respond promptly and handle properly consumers’ after-sales inquiries and complaints. When providing services such as return and exchange and repair, simplify the process and improve processing efficiency. Regularly analyze after-sales service data to identify problems and deficiencies and continuously improve service quality.

Ensuring Product Quality: Establish a full-process quality control system from product selection and procurement to warehousing and sales. Strictly screen suppliers and require them to provide relevant certification documents such as product quality inspection reports. Conduct spot checks on inbound commodities to ensure that product quality meets the standards.

Accelerating Transaction Orders Processing Speed: Optimize the internal order processing process and improve the degree of automation of order processing. Establish an efficient order allocation and processing mechanism to ensure that orders are processed and shipped in the shortest time. Strengthen collaborative cooperation with the warehousing and logistics departments to avoid order processing delays due to poor information flow.

Perfecting Purchase Inspection Mechanism: Establish and improve a strict purchase inspection system. When purchasing commodities, carefully inspect the qualifications of suppliers, product qualification certificates, inspection reports, and other documents. Make detailed records of each batch of purchases, including purchase time, quantity, supplier information, etc. Regularly conduct quality spot checks on purchased commodities and communicate and solve problems with suppliers in a timely manner to ensure commodity quality from the source.

6.3. Management Implications for Anchors

Strict Control of Anchor Qualification: Anchors should possess corresponding professional qualifications, such as professional certificates in related industries or certificates of completion of anchor training recognized by the platform. Continuously enhance their professional qualities. For selling specific commodities, such as medical devices and beauty products, they need to deeply master relevant professional knowledge, meet the professional threshold requirements stipulated by the industry, and ensure the accurate transmission of product information during live streaming.

Strengthening Credit Management of Anchors: Establish the awareness of honest live streaming. During the live streaming process, strictly abide by the agreements with the platform, merchants, and consumers; truthfully introduce the characteristics, quality, and usage methods of the commodities; and do not exaggerate the efficacy or make false promises. Actively handle consumer feedback, and do not shirk responsibilities when encountering problems. Win the trust of the platform and the favor of consumers with a good credit record, and thereby obtain more high-quality cooperation opportunities.

Regulating Marketing Service Behaviors: Be fully familiar with and strictly abide by the marketing rules and service norms formulated by the platform, and ensure that the live streaming content complies with laws, regulations, social public order, and good customs. During marketing, reasonably control the rhythm to avoid consumers’ aversion caused by excessive marketing. During the live streaming, the language expression should be civilized and accurate, the service attitude should be enthusiastic and patient, professional shopping consultation services should be provided for consumers, and a good live streaming shopping atmosphere should be created.

7. Conclusions

In order to effectively improve consumer satisfaction and promote the development of the live streaming e-commerce industry, this study adopts the SNA method to identify key risks and key impact paths. First of all, the risk factor system of live streaming e-commerce transactions is constructed by contacting relevant national standards of live streaming e-commerce, and three subjects participating in live streaming e-commerce transactions are considered, namely, the platform dimension of live streaming e-commerce, the merchant dimension, and the anchor dimension. Second, the Delphi method was used to determine a formal set of risk factors, including 3 dimensions and 22 risk factors. Thirdly, the network diagram of risk factors is constructed. Eight key factors, namely, Credit Evaluation System Perfection, Service Evaluation System Perfection, Qualification Audit Mechanism Perfection, Dispute Complaint Handling Channels Perfection, Platform Qualification, Risk Identification Mechanism Perfection, Merchant Qualification, and Merchant Credit, are determined by calculating the in-degree centrality and out-degree centrality, and then four key influence paths are determined by calculating the betweenness centrality, including A5→B3, A5→A8, A8→A5, and A7→A5. Finally, some managerial implications were put forward accordingly.

In terms of risk identification methods, consider that the transaction risks in live streaming e-commerce are characterized by complexity and diversity. Meanwhile, the industry is developing rapidly, with new transaction models and marketing methods emerging continuously, which leads to the constant evolution of risks. Moreover, the transaction risks of live streaming e-commerce vary in different regions and scales. For instance, the live streaming e-commerce of agricultural products may encounter risks such as inconvenient logistics and difficulties in maintaining the freshness of agricultural products. Therefore, similar to previous research [2], this study sorts out the risks by integrating live streaming e-commerce transaction scenarios with the literature analysis method. Subsequently, the Delphi method is employed to modify and optimize the initial risk factors, effectively reducing subjective biases.

Regarding the determination of key risk factors, although previous studies have listed the risks existing in live streaming e-commerce transactions, there is a lack of scientific means to define the interactive relationships and influence paths among these risks. This paper adopts the SNA method, introduces quantitative indicators such as degree centrality, clarifies the importance of each risk factor within the network structure, and thereby identifies the key risk factors and risk influence paths, providing a scientific and effective decision-making basis for the risk management and control of live streaming e-commerce.

On the theoretical level, the live streaming e-commerce transaction risk factor system constructed in this paper systematically sorts out various risk factors existing in the live streaming e-commerce transaction process and clarifies the sources of risks. This risk factor system not only helps to deeply understand the internal mechanism of live streaming e-commerce transactions, making the theoretical system of live streaming e-commerce more complete and enriching the connotation of live streaming e-commerce theory, but also enables subsequent scholars to deeply analyze the newly emerging risk factors in the development of live streaming e-commerce transactions on this basis and explore the root causes and propagation laws of risks in different links, thus promoting the continuous improvement and development of the live streaming e-commerce theoretical system. In addition, the SNA adopted in this paper opens up a new research paradigm for the field of live streaming e-commerce transaction risk identification and analysis, broadens the application boundary of traditional risk analysis methods in the e-commerce field, and provides new ideas for solving complex e-commerce risk problems. On the knowledge level, this paper identifies 22 risk factors through analysis and uses the SNA method to identify key risk factors and risk influence paths, enriching the research achievements in the field of live streaming e-commerce risks. It helps all parties to deeply understand the diversity and complexity of live streaming e-commerce risks so as to more pertinently formulate risk prevention strategies. On the literature level, this paper contributes new research achievements to the literature system of live streaming e-commerce risk research through empirical research. The empirical evidence collected during the research process fills some gaps in the research methods and empirical data of existing literature. On the practical level, this paper proposes corresponding management measures for the three subjects and key risk factors, providing certain guiding significance for the sustainable, stable, and healthy development of the live streaming e-commerce industry.

There are still some limitations in this study. Although we have subdivided the risk factors of the live streaming e-commerce transaction process into three dimensions according to the existing research results, a total of 22, we still cannot exhaust all the factors one by one in an in-depth study. With the development of live streaming e-commerce and the publication of related studies, the selection of risk factors should be further expanded. In addition, live streaming transactions involve many subjects and complex links. This study only considers the case that the livestreamer is the commodity operator himself or his internal employees. Therefore, in the follow-up research, different types of anchors can be classified and discussed to explore whether the risk factors change under different types of anchors. Finally, in the data processing of this study, each expert is treated equally, while in reality, the importance of each expert may be different. At the same time, the ambiguity and uncertainty of each index are ignored. Identifying and assessing risk factors and key impact paths will help the live streaming e-commerce industry thrive.

Author Contributions

Conceptualization, C.Z. and J.Z.; methodology, Y.W.; software, C.Z. and Y.W.; validation, C.Z., Y.W. and J.Z.; formal analysis, C.Z. and Y.W.; investigation, Y.W.; resources, J.Z.; data curation, Y.W.; writing—original draft preparation, Y.W.; writing—review and editing, C.Z.; visualization, Y.W.; supervision, J.Z.; project administration, J.Z.; funding acquisition, J.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Characteristics of Illegal Online Transactions and Intelligent Supervision Mode [Grant Number: No. 2023YFC3304901] and Beijing Key Lab of Big Data Decision Making for Green Development.

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki and approved by the Institutional Review Board of the School of Management Science & Engineering, Beijing Information Science and Technology University (protocol code 11010810838114 and 27 September 2024).

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

All data that support the findings of this study are available from the corresponding author upon reasonable request.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Table A1.

Part of the questionnaire.

Table A1.

Part of the questionnaire.

|

|

|

References

- Koen van Gelder. E-Commerce Worldwide—Statistics & Facts. Statista 2024. Available online: https://www.statista.com/topics/871/online-shopping/#topicOverview (accessed on 26 March 2024).

- Li, H.; Wang, Z.; Yuan, Z.; Yan, X. Multidimensional Evaluation of Consumers’ Shopping Risks under Live-Streaming Commerce. Sustainability 2023, 15, 14060. [Google Scholar] [CrossRef]

- CNNIC (China Internet Network Information Center). 2024. Available online: https://www.cnnic.net.cn/n4/2024/0321/c208-10962.html (accessed on 26 March 2024).

- Urrea, N.T.; Vishkaei, B.M.; De Giovanni, P. Operational Risk Management in E-Commerce: A Platform Perspective. IEEE Trans. Eng. Manag. 2024, 71, 3807–3819. [Google Scholar] [CrossRef]

- Forsythe, S.M.; Shi, B. Consumer patronage and risk perceptions in Internet shopping. J. Bus. Res. 2003, 56, 867–875. [Google Scholar] [CrossRef]

- Yao, X. Study on Risk and Consumption Behavior Model of Chinese Consumers’ Online Shopping. Master’s Thesis, Beijing University of Posts and Telecommunications, Beijing, China, 2010. [Google Scholar]

- Wang, C.; Wang, X.; Zhuang, W. The Research on Cross-border Online Shopping Transaction Risk Based on Online Data Access. In Proceedings of the 2019 IEEE International Conference on Big Data (Big Data), Los Angeles, CA, USA, 9–12 December 2019; pp. 5331–5335. [Google Scholar]

- Zhou, L.; Wang, J.; Li, F.; Xu, Y.; Zhao, J.; Su, J. Risk Aversion of B2C Cross-Border e-Commerce Supply Chain. Sustainability 2022, 14, 8088. [Google Scholar] [CrossRef]

- Mu, W. Analysis and Warning Model of Logistics Risks of Cross-Border E-Commerce. Discret. Dyn. Nat. Soc. 2022, 2022, 5140939. [Google Scholar] [CrossRef]

- Yang, W.; Gao, L. A Study on RB-XGBoost Algorithm-Based e-Commerce Credit Risk Assessment Model. J. Sens. 2021, 2021, 7066304. [Google Scholar] [CrossRef]

- Xu, Y.; Zhang, J.; Hua, Y.; Wang, L. Dynamic Credit Risk Evaluation Method for E-Commerce Sellers Based on a Hybrid Artificial Intelligence Model. Sustainability 2019, 11, 5521. [Google Scholar] [CrossRef]

- Zhang, N.; Wei, X.; Zhang, Z. Game theory analysis on credit risk assessment in E-commerce. Inf. Process. Manag. 2022, 59, 102763. [Google Scholar]

- Wang, L.; Song, H. E-Commerce Credit Risk Assessment Based on Fuzzy Neural Network. Comput. Intell. Neurosci. 2022, 2022, 3088915. [Google Scholar] [CrossRef]

- Maseeh, H.I.; Jebarajakirthy, C.; Pentecost, R.; Arli, D.; Weaven, S.; Ashaduzzaman, M. Privacy concerns in e-commerce: A multilevel meta-analysis. Psychol. Mark. 2021, 38, 1779–1798. [Google Scholar] [CrossRef]

- Karoui, K. Security novel risk assessment framework based on reversible metrics: A case study of DDoS attacks on an E-commerce web server. Int. J. Netw. Manag. 2016, 26, 553–578. [Google Scholar] [CrossRef]

- Liu, X.; Ahmad, S.F.; Anser, M.K.; Ke, J.; Irshad, M.; Ul-Haq, J.; Abbas, S. Cyber security threats: A never-ending challenge for e-commerce. Front. Psychol. 2022, 13, 927398. [Google Scholar] [CrossRef] [PubMed]

- Song, B.; Yan, W.; Zhang, T. Cross-border e-commerce commodity risk assessment using text mining and fuzzy rule-based reasoning. Adv. Eng. Inform. 2019, 40, 69–80. [Google Scholar] [CrossRef]

- Liu, Y.; Lu, J.; Tong, K. The Product Quality Risk Assessment of E-commerce by Machine Learning Algorithm on Spark in Big Data Environment. J. Intell. Fuzzy Syst. 2019, 37, 4705–4715. [Google Scholar] [CrossRef]

- Li, J. E-Commerce Fraud Detection Model by Computer Artificial Intelligence Data Mining. Comput. Intell. Neurosci. 2022, 2022, 8783783. [Google Scholar] [CrossRef]

- García-Salirrosas, E.; Rondon-Eusebio, R. Influence of Retail e-Commerce Website Design on Perceived Risk in Online Purchases. In Proceedings of the 2022 7th International Conference on Business and Industrial Research (ICBIR), Bangkok, Tailand, 19–20 May 2022; pp. 732–737. [Google Scholar]

- Gwak, J.; Jan, N.; Maqsood, R.; Nasir, A. Analysis of Risks and Security of E-Commerce by Using the Novel Concepts of Complex Cubic Picture Fuzzy Information. J. Funct. Spaces 2022, 27, 2022. [Google Scholar] [CrossRef]

- Ma, L.; Gao, S.; Zhang, X. How to Use Live Streaming to Improve Consumer Purchase Intentions: Evidence from China. Sustainability 2022, 14, 1045. [Google Scholar] [CrossRef]

- Zhang, L.; Chen, M.; Zami, A.M.A. Live stream marketing and consumers’ purchase intention: An IT affordance perspective using the S-O-R paradigm. Front. Psychol. 2023, 14, 1069050. [Google Scholar] [CrossRef]

- Chen, C.; Zhang, D. Understanding consumers’ live-streaming shopping from a benefit–risk perspective. J. Serv. Mark. 2022, 37, 973–988. [Google Scholar] [CrossRef]

- Shou, M.; Yu, J.; Dai, R. Identify the effect of government regulations on the live streaming e-commerce. Ind. Manag. Data Syst. 2023, 123, 2909–2928. [Google Scholar] [CrossRef]

- Chen, N.; Yang, Y. The Role of Influencers in Live Streaming E-Commerce: Influencer Trust, Attachment, and Consumer Purchase Intention. J. Theor. Appl. Electron. Commer. Res. 2023, 18, 1601–1618. [Google Scholar] [CrossRef]

- Dong, X.; Zhao, H.; Li, T. The Role of Live-Streaming E-Commerce on Consumers’ Purchasing Intention regarding Green Agricultural Products. Sustainability 2022, 14, 4374. [Google Scholar] [CrossRef]

- Sun, Y.; Shao, X.; Li, X.; Guo, Y.; Nie, K. How live streaming influences purchase intentions in social commerce: An IT affordance perspective. Electron. Commer. Res. Appl. 2019, 37, 100886. [Google Scholar] [CrossRef]

- Ma, X.; Zou, X.; Lv, J. Why do consumers hesitate to purchase in live streaming? A perspective of interaction between participants. Electron. Commer. Res. Appl. 2022, 55, 101193. [Google Scholar] [CrossRef]

- He, Y.; Li, W.; Xue, J. What and how driving consumer engagement and purchase intention in officer live streaming? A two-factor theory perspective. Electron. Commer. Res. Appl. 2022, 56, 101223. [Google Scholar] [CrossRef]

- Huo, C.; Wang, X.; Sadiq, M.W.; Pang, M. Exploring Factors Affecting Consumer’s Impulse Buying Behavior in Live-Streaming Shopping: An Interactive Research Based Upon SOR Model. SAGE Open 2023, 13, 21582440231172678. [Google Scholar] [CrossRef]

- Li, M.; Wang, Q.; Cao, Y. Understanding Consumer Online Impulse Buying in Live Streaming E-Commerce: A Stimulus-Organism-Response Framework. Int. J. Environ. Res. Public Health 2022, 19, 4378. [Google Scholar] [CrossRef]

- Zhang, X.; Cheng, X.; Huang, X. “Oh, My God, Buy It!” Investigating Impulse Buying Behavior in Live Streaming Commerce. Int. J. Hum.-Comput. Interact. 2023, 39, 2436–2449. [Google Scholar] [CrossRef]

- Shi, W.; Li, F.; Hu, M. The influence of atmospheric cues and social presence on consumers’ impulse buying behaviors in e-commerce live streaming. Electron. Commer. Res. 2023. [Google Scholar] [CrossRef]

- Li, Z.; Liu, D.; Zhang, J.; Wang, P.; Guan, X. Live streaming selling strategies of online retailers with spillover effects. Electron. Commer. Res. Appl. 2024, 63, 101330. [Google Scholar] [CrossRef]

- Wang, S.; Guo, X. Strategic introduction of live-stream selling in a supply chain. Electron. Commer. Res. Appl. 2023, 62, 101315. [Google Scholar] [CrossRef]

- Zhang, T.; Tang, Z.; Han, Z. Optimal online channel structure for multinational firms considering live streaming shopping. Electron. Commer. Res. Appl. 2022, 56, 101198. [Google Scholar] [CrossRef]

- Su, J.; Wang, D.; Xu, B.; Zhang, F.; Ling, X. An Improved Interval-valued Intuitionistic Fuzzy MCGDM for the Evaluation of Agricultural Products Live-streaming E-commerce Platform. J. Intell. Fuzzy Syst. 2023, 45, 9591–9604. [Google Scholar] [CrossRef]

- Zhang, G.; Liang, Y.; Wei, F. Combining Bibliometric and Social Network Analysis to Understand the Scholarly Publications on Artificial Intelligence. J. Sch. Publ. 2023, 54, 552–568. [Google Scholar] [CrossRef]

- Lu, Y.; Wang, X.; Su, L.; Zhao, H. Multiplex Social Network Analysis to Understand the Social Engagement of Patients in Online Health Communities. Mathematics 2023, 11, 4412. [Google Scholar] [CrossRef]

- Zhang, C.; Tang, L.; Zhang, J.; Wang, Z. Using Social Network Analysis to Identify the Critical Factors Influencing Residents’ Green Consumption Behavior. Systems 2023, 11, 254. [Google Scholar] [CrossRef]

- Jokar, S.; Shojaei, P.; Askarifar, K.; Haqbin, A. Investigating social risks of construction projects in historic tourism sites in urban districts of developing countries: Social network analysis approach. Int. J. Contemp. Hosp. Manag. 2024, 36, 358–378. [Google Scholar] [CrossRef]

- Zhang, Y.; Wang, S.; Wang, C.; Luo, X. Risk identification and analysis for the green redevelopment of industrial brownfields: A social network analysis. Environ. Sci. Pollut. Res. 2023, 30, 30557–30571. [Google Scholar] [CrossRef]

- An, M.; Xiao, W.; An, H.; Huang, J. Stakeholder Behavior Risk Evaluation of Hydropower Projects Based on Social Network Analysis—A Case Study from a Project. Buildings 2022, 12, 2064. [Google Scholar] [CrossRef]

- SB/T 11240-2023; Specification for Management & Service of Live-Streaming E-Commerce Platform. Ministry of Commerce of the People’s Republic of China: Beijing, China, 2023.

- GB/T 41247-2023; Specification for Quality Management of E-Commerce Live-Streaming Sales. State Administration for Market Regulation, Standardization Administration of the People’s Republic of China: Beijing, China, 2023.

- Zhang, C.; Zhang, J.; Yang, Q. Identifying Critical Risk Factors in Green Product Certification Using Hybrid Multiple-Criteria Decision-Making. Sustainability 2022, 14, 4513. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).