Abstract

Despite the growing popularity of digital artworks that use nonfungible tokens (NFTs), systematic frameworks for analyzing the content characteristics driving NFT artworks’ creation, sale, and collection remain underdeveloped. Drawing on key insights from a diffusion of innovations, social identity, and value-based adoption theories, this study constructed a conceptual model that identified six key factors: uniqueness, profitability, prestige, community engagement, collectability, and compatibility. These factors’ effects on consumer purchasing behavior were investigated using perceived value as a mediator. Empirical data were collected from 300 Chinese participants and analyzed using multiple regression analysis. The significant direct effects of profitability, community engagement, collectability, and compatibility on purchasing behavior were identified. Uniqueness and prestige were found to exert indirect effects mediated by perceived value. Furthermore, a fuzzy-set qualitative comparative analysis uncovered configurations of content characteristics sufficient for driving high purchasing behavior. It highlighted low community engagement as a necessary condition for low purchasing behavior and underscored multiple attributes’ synergistic interplay in shaping consumer decisions. By integrating these attributes into the conceptualization of NFT content characteristics and synthesizing theoretical insights, this study enhances the understanding of consumer behavior. Recommendations are provided for NFT creators and platforms to improve content quality, cater to diverse preferences, and enhance user experiences, thereby promoting adoption and sustainable growth.

1. Introduction

Nonfungible tokens (NFTs) are blockchain-based digital assets that have transformed traditional forms of ownership by enabling verifiable authenticity and provenance. Emerging in 2017, alongside pioneering projects like CryptoPunks and CryptoKitties and facilitated by platforms like OpenSea, NFTs have rapidly gained global prominence. However, this momentum peaked in 2021, characterized by unprecedented growth in market interest, transaction volumes, and pricing [1,2,3]. NFTs can be broadly categorized into the following six types: art, collectibles, gaming, the metaverse, utilities, and others [2]. The art sector spearheads the NFT market, accounting for approximately 49% of NFT trading activity, with transaction volumes reaching USD 429 million [4]. By leveraging blockchain technology, NFTs have reshaped the creation and trade of digital artworks, offering creators and consumers unprecedented opportunities for achieving economic and creative value [5,6]. As a transformative digital trend, they bridge content creation and blockchain applications, driving innovation in ownership and market engagement [7]. This study focuses on NFT digital artworks, encompassing blockchain-registered assets across various forms of media, including visual art, animations, and interactive designs.

As an emerging research field in a rapidly evolving market, it is essential to understand the content characteristics of NFT digital artworks to advance theoretical frameworks and develop strategies for enhancing user engagement and market sustainability. However, despite the significant attention NFTs have garnered for their potential [8,9], the specific content characteristics influencing consumer purchasing behavior remain underexplored. Particularly, the NFT digital artworks’ key factors span the creation, distribution, sales, and collection processes.

The existing research has identified several critical factors influencing the adoption and success of NFTs. Attributes such as uniqueness, profitability, prestige, and collectability have been recognized as key drivers of consumer interest in NFTs [10,11,12]. However, these attributes’ ability to predict purchasing behavior remains underexplored. Similarly, while compatibility—a core determinant in the adoption of innovative technologies [13]—and community engagement—a vital mechanism for fostering social value [14]—have been extensively examined in other domains, their specific roles within the NFT ecosystem warrant further investigation. Furthermore, perceived value—encompassing functional, monetary, emotional, and social dimensions—remains critically underexplored as a mediating mechanism. Although Yilmaz et al. [14] highlighted perceived value’s importance in the NFT domain, its integrative role in linking content characteristics to purchasing behavior has predominantly been overlooked. Therefore, this study attempts to answer the following three research questions (RQs):

- RQ1:

- What are the key content characteristics of NFT digital artworks that shape perceived value and purchasing behavior?

- RQ2:

- Does perceived value mediate the relationship between the content characteristics of and purchasing behavior toward NFT digital artworks?

- RQ3:

- What configurations of content characteristics lead to high purchasing behavior for NFT digital artworks?

To address these inquiries, this study developed a conceptual framework that identified the following six key determinants: uniqueness, profitability, prestige, community engagement, collectability, and compatibility. Drawing on the diffusion of innovations theory [15] and supported by a value-based adoption model [16] and social identity theory [17], the framework was used to explore how these determinants influence perceived value and, in turn, purchasing behavior. As the primary analysis method, a multiple regression analysis was conducted to assess the direct effects of each determinant. Complementarily, a fuzzy-set qualitative comparative analysis (fsQCA) was conducted, uncovering various configurational paths that lead to purchasing behavior and highlighting the synergistic interplay of multiple determinants.

This study makes three key contributions. First, it extends existing theories by conceptualizing and empirically validating the role of content features in shaping consumer behavior in the NFT digital art market. Second, in contrast to previous studies, we applied fsQCA in the context of NFT digital art research. A dual-method approach integrating both variance-based and configuration-based perspectives provides a precise and in-depth understanding of consumer motivations. Third, it offers actionable guidance for NFT creators and platforms to enhance content quality, foster community engagement, and design consumer-centered strategies to promote sustainable market growth.

2. Literature Review and Hypotheses

Prior research has analyzed the NFT market from multiple perspectives. First, from a macro perspective, studies have examined the NFT market’s development and relationship with cryptocurrencies [18,19,20]. Second, from an economic perspective, research has addressed NFT pricing mechanisms and potential price bubbles [1,3,21]. Third, from the perspective of market applications, numerous studies have highlighted the commercial opportunities associated with NFTs and their practical uses [22,23]. Lastly, a subset of studies has analyzed how specific NFT characteristics influence consumer intentions [24,25,26]. While these studies have provided valuable insights into NFTs’ economic and market aspects, focused research on the unique content characteristics of NFT digital artworks remains scant.

Unlike traditional art, NFT artworks possess distinctive attributes that incorporate artistic, functional, and social dimensions. These attributes, such as aesthetic uniqueness, market appeal, and community-driven value, shape NFTs’ desirability, enhance their social identity, and influence consumers’ purchasing decisions, particularly through collaborations with renowned brands and artists. Spanning the works’ creation, distribution, sale, and collection, these characteristics collectively drive user engagement and fuel market growth. Hence, this study emphasizes their critical role in influencing consumer behavior. Moreover, the following subsections introduce the research focus and hypotheses.

2.1. Content Characteristics of NFT Digital Artworks

NFTs’ content includes various forms of digital creation, such as text, images, audio, video, and 3D models. In this study, content characteristics were regarded as the unique attributes that emerge from NFT digital artworks. These characteristics reflect the artworks’ value through the joint participation of creators, buyers, and platforms in the creation, distribution, sales, and collection processes. These characteristics, spanning artistic, functional, and social dimensions, significantly influence consumer behavior and market outcomes.

Certain studies have highlighted the role of specific content attributes in driving consumer interest. The uniqueness and prestige associated with branded NFTs were demonstrated to positively influence brand attitudes [10], while profitability was demonstrated to enhance purchase intentions [11]. For example, in August 2022, a Bored Ape with rare gold fur sold for USD 1.5 million, which underscores the value of uniqueness in driving market demand [27,28]. Similarly, CryptoPunks’ NFTs, which were initially distributed for free, have reached prices as high as ETH 7500 (USD 7.5 million), which demonstrates the combined effects of scarcity and profitability [29]. Furthermore, social value has become a key driver of NFT adoption. Celebrity endorsements—such as those by Eminem and Snoop Dogg for the Bored Ape Yacht Club (BAYC)—have elevated NFTs to status symbols, fostering identity expression and enhancing social prestige [30]. Collectability further amplifies NFTs’ desirability, particularly in contemporary markets [12]. For instance, exclusive BAYC events like the “Ape Yacht Party” demonstrate how community engagement strengthens loyalty, shared identity, and active participation [14,31]. Another critical factor is compatibility, which reflects how well NFTs align with existing technological infrastructures and cultural systems. Drawing on innovation adoption studies, compatibility enhances user acceptance by seamlessly integrating into existing ecosystems [13].

Despite the growing interest in NFTs, significant research gaps exist. First, while compatibility has been extensively studied in terms of general technology adoption, its quantitative impact on NFT adoption has not been adequately explored. Second, although collectability is acknowledged as a key factor in NFTs’ desirability, its predictive effects on consumer behavior have yet to be thoroughly investigated. Third, while community engagement is often highlighted as a factor contributing to social value, systematic analyses of its direct influence on consumers’ purchasing decisions are lacking. To address these gaps in the literature, this study integrates the diffusion of innovations theory [15], a value-based adoption model, and social identity theory [17,32]. Moreover, it posits that content characteristics—such as uniqueness, profitability, prestige, collectability, community engagement, and compatibility—play crucial roles in shaping perceived value and social identity, which, in turn, influences consumers’ purchasing behavior. The following section presents the study’s theoretical framework.

2.2. Theoretical Framework

2.2.1. Purchase Behavior

Purchase behavior in the context of NFT digital artworks encompasses the intentions, motivations, and actions that drive consumers to acquire these unique blockchain-based assets. The diffusion of innovations theory is widely used to study how new technologies, products, ideas, or behaviors spread and are adopted within social groups [15]. Innovation diffusion theory has received substantial empirical support in explaining consumer acceptance in several disciplines, specifically online shopping [33,34]. Drawing on the diffusion of innovations theory, this study identifies uniqueness, profitability, collectability, and compatibility as key content characteristics influencing consumer adoption. First, uniqueness and profitability align with the theory’s emphasis on relative advantage, which highlights NFTs’ unique value as artistic and investment assets. Second, collectability reflects observability and emotional appeal, underscoring NFTs’ role in fostering desirability and engagement. Third, compatibility captures how well NFTs align with users’ preferences and cultural norms. These characteristics collectively frame this study’s analysis of consumer engagement and purchasing behavior in the NFT digital art market.

To complement this perspective, social identity theory was employed to highlight the importance of social belonging and identity in shaping purchasing decisions [16,35]. Consumers often align their choices with group norms to achieve social recognition, particularly in NFT ecosystems that enable identity expression. For example, BAYC owners display their NFTs on their social media accounts to showcase their unique identity and reinforce their social status in exclusive communities [36]. Similarly, the PhantaBear NFT project leverages celebrity endorsements to strengthen community engagement and foster social interaction [37]. These examples illustrate how prestige and community participation collectively add a social dimension to consumer motivations, thereby shaping purchasing behavior.

To provide a holistic understanding of these dynamics, this study also integrated a value-based adoption model, which posits that perceived value—encompassing functional, monetary, emotional, and social dimensions—strongly influences adoption decisions [17]. Together, these theories formed a cohesive framework for this study to analyze the factors that drive consumer behavior in NFT digital artwork transactions.

2.2.2. Perceived Value

Perceived value is defined as the trade-off between the sacrifices and benefits associated with a product or service [38]. In the marketing literature, perceived value is widely recognized as a multidimensional construct that encompasses functional, monetary, emotional, and social dimensions [39,40]. These dimensions align closely with NFTs’ content characteristics and play significant roles in shaping consumers’ purchasing behavior.

Functional value refers to the practical and economic benefits offered by NFTs, including blockchain-based authenticity, security, and utility. These attributes enhance NFTs’ uniqueness and improve compatibility by ensuring cost-effectiveness and increasing consumers’ confidence in digital ownership. Conversely, monetary value highlights NFTs’ financial benefits, such as profitability through investment potential and resale opportunities. Moreover, emotional value emerges from NFTs’ artistic and creative attributes, including their visual design, interactivity, and collectible rarity. These characteristics evoke positive emotional responses and elevate NFTs’ appeal as exclusive digital assets. Lastly, social value is derived from the relational and social benefits that are offered by NFTs. By fostering community engagement and enabling the expression of one’s identity, NFTs enhance their owners’ prestige and encourage active participation in exclusive ecosystems. For instance, NFT ownership offers social recognition and a sense of belonging, thus strengthening loyalty among users. Drawing on a value-based adoption model, this study positions perceived value as a critical mediating variable that links content characteristics to consumer purchasing behavior [30]. The following section develops the study’s hypotheses.

2.3. Hypotheses

2.3.1. Uniqueness

Uniqueness refers to consumers’ perception of a product as being unique, standing out from similar products, and not being a copy or an imitation [41]. In the context of NFTs, blockchain technology ensures the authenticity and immutability of digital assets by securely recording metadata, such as the creator and issuance date, which reinforces their uniqueness [28,42]. Uniqueness enhances NFTs’ perceived value by satisfying consumer needs for distinctiveness and exclusivity, a motivational factor strongly linked to the ownership of scarce or innovative products [43,44]. Furthermore, research has demonstrated that consumers with a greater need for uniqueness are more likely to perceive unique products positively, which would further drive their purchasing intentions and enhance their perceived value [45,46].

In this study, uniqueness is defined as the degree to which consumers perceive the uniqueness of NFT digital art content, reflecting the creative, aesthetic, or technological uniqueness of the artwork. Accordingly, it proposes the following hypotheses:

H1a.

Uniqueness positively influences the perceived value of NFT digital artworks.

H1b.

Uniqueness positively influences purchase behaviors toward NFT digital artworks.

2.3.2. Profitability

Profitability refers to users’ perception of the potential financial gains derived from engaging with a service [11]. In the context of NFTs, profitability reflects buyers’ expectations of receiving monetary rewards through the short-term resale or long-term appreciation of digital artworks’ value. As NFTs have gained traction as alternative investment vehicles that combine financial and aesthetic value [47], profitability has emerged as a crucial factor that influences consumers’ adoption behaviors toward NFTs [48,49]. Similar findings in cryptocurrency markets have further emphasized profitability’s role in driving engagement and enhancing economic returns [50,51]. Moreover, young investors are increasingly drawn to NFT platforms, motivated by perceived profitability, despite being aware of the associated risks [52]. Accordingly, this study proposes the following hypotheses:

H2a.

Profitability positively influences the perceived value of NFT digital artworks.

H2b.

Profitability positively influences purchase behaviors toward NFT digital artworks.

2.3.3. Prestige

Prestige has been shown to enhance mimicry desire and purchase intention in social media contexts [53]. It is also a critical determinant of perceived design quality on digital platforms [54]. Additionally, high prices, contributing to item scarcity and increased desirability, often provide consumers with a sense of status and prestige through ownership [55]. Moreover, in live-streaming commerce, the creation of perceived prestige proved to be an effective marketing strategy [56].

In the context of NFTs, prestige refers to the extent to which NFT digital artworks are perceived as a symbol of the owner’s high social status [10]. Consumers may leverage NFT ownership to display their social status, making prestige a critical factor in influencing their purchase decisions. Supporting evidence indicates that sales disparities between NFT buyers and high-reputation sellers, compared with those with lower reputations, highlight the significance of perceived status in purchasing behavior [57]. Based on these findings, this study proposes the following hypotheses:

H3a.

Prestige positively influences the perceived value of NFT digital artworks.

H3b.

Prestige positively influences purchase behaviors toward NFT digital artworks.

2.3.4. Community Engagement

NFT communities are defined as “social collectives or assemblages of actors that affect and are affected by others or by a specific object or situation” [58]. Their welcoming and positive nature was recognized as a key factor that contributed to NFTs’ initial popularity [59]. NFT ownership enhances community dynamics by allowing individuals to visually display their purchases online, thus signaling their desired identity to others [60]. These interactions foster a sense of belonging and collaboration, where individuals with shared interests unite to support collective activities [61]. Furthermore, social media and online communities offer platforms for resource sharing, value co-creation, and peer influence, significantly influencing consumers’ purchasing decisions [62].

In this study, community engagement was conceptualized as the perceived levels of interaction, participation, and connection within the NFT digital artwork community. It reflects the meaningfulness, professionalism, and attractiveness of community activities and their ability to facilitate connections among like-minded individuals. Therefore, this study proposes the following hypotheses:

H4a.

Community engagement positively influences the perceived value of NFT digital artworks.

H4b.

Community engagement positively influences purchase behaviors toward NFT digital artworks.

2.3.5. Collectability

NFTs serve as a system for collecting virtual objects, providing economic (e.g., investment opportunities) and noneconomic values (e.g., enjoyment, social status, or cultural significance) [63]. As unique digital identifiers, NFTs represent ownership of cryptocurrency assets and offer a traceable trajectory of ownership from creation to the present [64]. These features align with the growing demand for digital collectibles by ensuring an immutable record of ownership and origin [25]. Wu et al. [12] identified collectability as a primary factor in NFT artworks’ popularity, emphasizing how this feature has made NFTs one of the most sought-after digital products. Therefore, collectability is a fundamental characteristic that has driven NFTs’ popularity and success in contemporary markets.

In the context of NFT digital artwork trading, collectability refers to the degree to which such artworks are perceived as appealing or possessing collectible value. This characteristic enhances engagement and drives market activity by motivating collectors to acquire and complete collections. Hence, this study proposes the following hypotheses:

H5a.

Collectability positively influences the perceived value of NFT digital artworks.

H5b.

Collectability positively influences purchase behaviors toward NFT digital artworks.

2.3.6. Compatibility

Compatibility, a key construct from the diffusion of innovations theory, is defined as “the degree to which an innovation is perceived as being consistent with existing values, past experiences, and needs of potential adopters” [15]. When consumers are exposed to new technologies, they develop attitudes based on how well these technologies align with their existing habits, behaviors, thinking, value systems, and specific needs [33]. Research has consistently demonstrated a positive and significant relationship between compatibility and attitudes toward online shopping [33,65]. Additionally, Gong et al. [66] highlighted that perceived compatibility positively influences consumer engagement. In the current study, compatibility is defined as the degree to which users believe purchasing NFT content corresponds with their needs, lifestyle, and shopping preferences. When they perceive NFT transactions as compatible with their behaviors and values, they are more likely to view NFTs as valuable, thereby boosting engagement and driving purchasing behavior. Accordingly, this study proposes the following hypotheses:

H6a.

Compatibility positively influences the perceived value of NFT digital artworks.

H6b.

Compatibility positively influences purchase behaviors toward NFT digital artworks.

2.3.7. Mediating Effect of Perceived Value

Perceived value is widely regarded as a key determinant of consumer purchase intentions and behaviors [67]. According to Schmidt and Frieze [68], when the attributes of NFT digital artworks align with a consumer’s consumption motivations, they stimulate cognitive and emotional engagement, which, in turn, enhances their perception of the product and its relevance to their needs. When consumers perceive the benefits of purchasing a product to outweigh the associated costs or efforts, their perception of its value becomes positive, ultimately driving purchasing behavior. Based on these assumptions, this study proposes the following hypotheses:

H7.

Perceived value positively influences purchase behaviors toward NFT digital artworks.

H8.

Perceived value mediates the relationship between the content characteristics of and purchase behavior toward NFT digital artworks.

2.4. Research Model

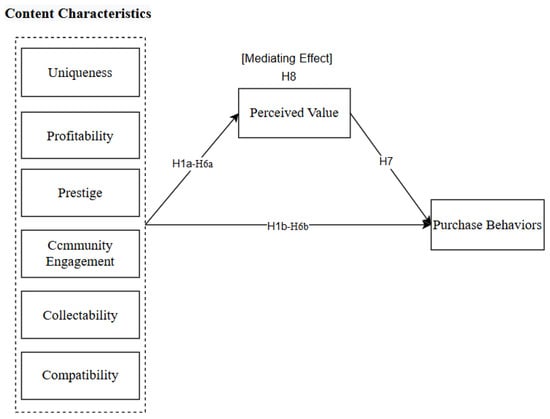

This study examines the influence of six content characteristics of NFT digital artworks—namely, uniqueness, profitability, prestige, community engagement, collectability, and compatibility—on customer perceived value and purchasing behavior. Additionally, it investigates the mediating role of perceived value in these relationships. The proposed research model integrates the study’s hypotheses and is visually presented in Figure 1.

Figure 1.

Research model.

3. Methodology

This section outlines the measurement procedures, data collection techniques, and statistical analysis methods employed to conduct this study.

3.1. Measurement

This study employed structured questionnaires to collect data. All questionnaire items were measured on a 5-point Likert scale that ranged from 1 = strongly disagree to 5 = strongly agree. The questionnaire was designed to examine the key variables of uniqueness, profitability, prestige, community engagement, collectability, compatibility, perceived value, and purchase behavior, as well as demographic characteristics such as the respondents’ gender, age, occupation, educational background, monthly income, purchase experience, and purchase frequency.

The measurement items were adapted or developed based on established scales to suit the research context of NFT digital artworks. Specifically, the concept of uniqueness was derived from studies by Lee et al. [10] and Casaló et al. [69], while profitability was assessed based on the frameworks of Lee and Kim [11] and Cheung et al. [48]. The items used to measure prestige were adapted from Lee and Kim [11] and Casaló et al. [69]. Since no established measurement scales exist for collectability and community engagement, particularly in the context of NFTs and similar digital domains, the measurement items for these constructs were developed based on conceptual definitions and insights derived from relevant studies. The community engagement items were derived from Yilmaz et al. [14] and Booth [61], while the collectability items were based on studies by Wu et al. [12] and Serada et al. [63]. Furthermore, the compatibility items were adapted from Agag and El-Masry [33], Amaro and Duarte [65], and Gong et al. [66]. Perceived value was measured using frameworks proposed by Zeithaml [38], Konuk [67], Sweeney and Soutar [40], and Sirdeshmukh et al. [70]. Finally, the purchase behavior scales were adapted from Hwang and Zhang [71] and Fortagne and Lis [25].

The questionnaire, initially developed in English, was adapted for this study to better align with Chinese consumers. To ensure its reliability and cultural suitability, it underwent refinement through a pilot test. A thorough process of translation and back translation [72] was undertaken to ensure the items’ clarity and accuracy. Table 1 presents a comprehensive summary of the constructs, including their operational definitions and literature sources.

Table 1.

Operational definitions of the constructs.

3.2. Data Collection

This study employed a purposive sampling strategy. Individuals with prior experience purchasing NFT digital artwork on the Xiaohongshu social e-commerce platform were recruited. Given Xiaohongshu’s extensive Chinese user base and highly active user communities, it was deemed an ideal platform for reaching this target population. Potential participants were identified using the platform’s search function to locate user-generated posts containing relevant keywords (e.g., “NFT digital art purchase” and “Xiaohongshu NFT transaction”). Users who authored these posts were then contacted via private messages and invited to participate. This recruitment approach ensured that all respondents had completed at least one NFT purchase on Xiaohongshu, thus satisfying the key inclusion criterion. In addition, a snowball sampling technique was adopted to further broaden the sample. Initial participants were encouraged to share the survey invitation with other eligible NFT enthusiasts in their social circles (for instance, via private group chats or public forums). This secondary recruitment step helped reach a wider range of individuals meeting the study criteria.

Before they completed the questionnaire, respondents were provided with clear information about the study, ensuring ethical compliance and transparency. Specifically, they were informed of the following:

- (a)

- The research motivation of this study was clearly articulated, specifically that the anonymity of participants was ensured, the collected data would be used solely for academic research, and all answers were nonunique, with no right or wrong responses;

- (b)

- The estimated time required to complete the questionnaire was communicated as 3–5 min, minimizing the burden on participants;

- (c)

- To express their gratitude for the respondents’ time and effort, the authors offered them a sum of RMB 3–5 upon completing the survey. This compensation was designed to respect the participants’ contributions without exerting undue influence, consistent with ethical research practices.

The questionnaire was distributed online using the Wenjuanxing platform (https://www.wjx.cn, accessed on 20 August 2024), one of China’s leading survey platforms. This ensured broad accessibility for participants.

The data collection occurred between September 1 and October 2, 2024, yielding 350 responses. A rigorous screening process excluded individuals who lacked prior NFT purchasing experience as well as those with inconsistent or incomplete answers. The platform records ensured that each respondent could submit only one survey, which was verified through IP address tracking. Responses completed in less than 100 s were deemed invalid. Following these procedures, 300 valid responses were retained for a valid response rate of 86%. The sample size was evaluated using the guidelines of Hair et al. [73], who recommended a minimum sample size-to-measurement item ratio of 10:1. It was further validated through G*Power analysis, which confirmed the adequacy of the sample for this study.

As this figure indicates, 63.7% (n = 191) of respondents were male and 36.3% (n = 109) were female. A majority (69.3%) were aged 20–29 years, and 71.3% (n = 214) held a college degree. In terms of their occupations, 37.3% (n = 112) were staff members, followed by 25.3% (n = 76) who were freelancers and 24.3% (n = 73) who were students. The largest income group (42.7%) reported earnings of RMB 5000–10,000, with 30.3% earning RMB 2000–5000. Additionally, 64% (n = 192) of the respondents had over 1 year of experience of purchasing NFT digital artworks, while the most common purchase frequency was five to eight times per month (33.3%). Table 2 summarizes the demographic characteristics of the respondents.

Table 2.

Demographic information about participants.

3.3. Analysis Methods

Given its exploratory nature, this study adopted multiple regression analysis and fsQCA to investigate the relationships between variables. This dual approach harnesses the complementary strengths of both methods. The multiple regression analysis, conducted using SPSS 27, assessed the simultaneous effects of independent variables on the dependent variable. Preliminary tests for normality and multicollinearity confirmed the appropriateness of the model. An ordinary least squares regression established causal relationships by identifying linear associations between predictors and outcomes. However, the regression’s focus on additive effects limited its ability to capture complex, interdependent relationships [74].

Conversely, fsQCA addressed this limitation by uncovering the configurations of factors that lead to specific outcomes. Grounded in recipe, equifinality, and the causal asymmetry principle, fsQCA examines how variable combinations jointly influence outcomes, offering insights beyond the linear scope of regression [75]. This approach is particularly relevant to the trading of NFT digital artworks, where purchase behavior arises from multiple interacting factors rather than isolated predictors [12,76].

This study evaluated the net effects of individual variables through the regression analysis as well as the configurational effects through fsQCA. This dual approach identified clusters of high purchase intentions, simultaneously explaining linear relationships and revealing intricate interdependencies. Thus, such an integration of methods provided a richer, more nuanced understanding of the mechanisms that shape consumer behavior in the NFT digital art market.

4. Analysis and Results

4.1. Reliability and Validity

The measurement items were primarily adapted from established scales, with certain variables measured using items specifically developed for NFT digital artworks. As a preliminary step, an exploratory factor analysis (EFA) was conducted using principal component analysis with varimax rotation. Items were retained if they satisfied the following thresholds: factor loadings ≥ 0.50, cross-loadings ≤ 0.38, and cross-loading differences ≥ 0.15 [77]. Items (uniqueness 1, 3; profitability 3, 4; prestige 4; community engagement 3; collectability 2, 5; compatibility 1, 5; perceived value 3, 4; and purchase behaviors 5) failing to meet these requirements were removed, resulting in the final set presented in Table 3. The EFA extracted six independent variables that explained 68.13% of the total variance, revealed significant results in Bartlett’s test of sphericity (p < 0.001), and obtained a KMO value of 0.880, all of which confirmed the data’s suitability. While the mediator and dependent variables accounted for 64.53%, significant results in Bartlett’s test of sphericity (p < 0.001) and a KMO value of 0.817 further confirmed the data’s suitability. Factor loadings exceeded the 0.5 threshold, and Cronbach’s alpha values ranged from 0.705 to 0.830, demonstrating good internal consistency [78].

Table 3.

Reliability and validity results.

To further confirm the factor structure identified via EFA, a confirmatory factor analysis (CFA) was performed. The model fit indices indicated a good fit (χ2/df = 2.061, RMSEA = 0.060, GFI = 0.867, AGFI = 0.830, CFI = 0.909, TLI = 0.892, SRMR = 0.047, PCLOSE = 0.01, Probability Level = 0.000, and NFI = 0.839). Table 3 summarizes the factor loadings, composite reliability (CR), and average variance extracted (AVE).

While some AVE values fell slightly below 0.5, they remained acceptable given that the CR values were above 0.6 [79]. Table 4 presents the means, standard deviations, Pearson correlation coefficients, and square roots of the AVE for this study’s eight variables.

Table 4.

Correlation analysis results.

As this table indicates, no significant correlations existed among the variables. Furthermore, it confirms the discriminant validity, with the square root of the AVE exceeding the interconstruct correlations [80]. Overall, the measurement model demonstrated robust reliability and validity, which supported its use for hypothesis testing.

4.2. Common Method Bias

The authors recognize the potential impact of common method bias (CMB) on the validity of the findings. To address this concern, a combination of rigorous procedural measures and statistical controls was employed. Procedurally, as detailed in Section 3.2 (Data Collection), the respondents were assured of anonymity and confidentiality, with emphasis placed on the absence of correct or incorrect answers to encourage honest and unbiased feedback. Following the recommendations of Podsakoff et al. [81], these steps were designed to alleviate evaluation apprehension and minimize socially desirable or biased responses.

The statistical controls included Harman’s single-factor test and the marker variable technique. Harman’s test revealed that a single factor accounted for 32.57% of the variance, which is well below the 50% threshold, indicating no substantial evidence of CMB [81]. For the marker variable technique, an unrelated construct—“attitude toward the color blue”—was used, which was measured using three items (e.g., “Blue is a beautiful color”) on a 5-point Likert scale [82]. Correlations between the marker variable and latent variables ranged from 0.18 to 0.26; thus, they remained below the critical threshold of 0.3 [83]. Taken together, these procedural and statistical measures provide strong evidence that the validity of this study’s findings is not compromised by CMB.

4.3. Hypotheses Testing

This study employed regression analysis to evaluate the proposed hypotheses and ensured that all necessary assumptions were tested beforehand. Normality was confirmed through skewness (−1.656 to −0.852) and kurtosis (0.196 to 3.633) values for the 27 measurement items across eight constructs, which were all within Kline’s [84] thresholds of ±2 and ±7, respectively. Furthermore, multicollinearity was assessed using variance inflation factors (VIFs), which ranged from 1.334 to 1.875, well below the acceptable limit of 5.0 [85]. A one-way analysis of variance was used to analyze the linear relationship between each independent variable and the dependent variable. Moreover, homoscedasticity was validated through residual scatterplots, which did not show any noticeable funnel-shaped pattern, indicating no significant violations. Additionally, Durbin–Watson statistics (1.739–2.076) confirmed the independence of the residuals. Lastly, Cook’s D values indicated no high-influence points, with all observations being below the threshold of 1, which confirmed the absence of outliers.

The regression results (Table 5) reveal that the adjusted R² values ranged from 0.215 to 0.472, which indicates moderate explanatory power. F-values, ranging from 34.783 to 82.715, were statistically significant at p < 0.001, which further supported the linearity and validity of the regression models. These findings demonstrate that the models effectively captured the relationships among the variables, which provided strong evidence for the testing of the hypotheses.

Table 5.

Hypotheses testing results.

As Table 4 indicates, this study evaluated its 13 hypotheses, of which 9 were accepted and 4 were rejected. The key predictors of perceived value were found to include uniqueness (β = 0.164, p < 0.01), prestige (β = 0.261, p < 0.001), community engagement (β = 0.204, p < 0.001), and compatibility (β = 0.267, p < 0.001), which led to H1a, H3a, H4a, and H6a being accepted. By contrast, profitability (β = 0.018, p > 0.05) and collectability (β = −0.026, p > 0.05) did not demonstrate significant effects on perceived value, which resulted in H2a and H5a being rejected.

Regarding purchase behaviors, significant predictors were found to include profitability (β = 0.256, p < 0.001), community engagement (β = 0.353, p < 0.001), collectability (β = 0.193, p < 0.001), compatibility (β = 0.147, p < 0.05), and perceived value (β = 0.466, p < 0.001); thus, H2b, H4b, H5b, H6b, and H7 were supported. Conversely, uniqueness (β = −0.109, p > 0.05) and prestige (β = 0.013, p > 0.05) failed to have significant effects on purchase behaviors, which led to H1b and H3b being rejected.

Additionally, seven control variables—gender, age, occupation, educational background, monthly income, purchase experience duration, and purchase frequency—were included as dummy variables in the analysis. They were observed to have a minimal impact on the relationships between the independent and dependent variables, which suggested that they had little influence on the study outcomes.

4.4. Mediating Effect Analysis

This study employed mediation analysis using the bootstrap method to examine the mediating role of perceived value between independent factors and purchase behaviors. Using the PROCESS macro in SPSS (Model 4) [86] with 5000 bootstrap samples, significant indirect effects were identified where the confidence intervals excluded zero. Additionally, the effect size was calculated using the ratio of indirect effects to total effects, further indicating that perceived value functions as a mediating role to a certain extent.

As Table 6 shows, perceived value was found to significantly partially mediate the relationships between all content characteristics and purchase behaviors as follows: uniqueness (effect = 0.192, 95% CI [0.095, 0.307]), profitability (effect = 0.124, 95% CI [0.048, 0.223]), prestige (effect = 0.174, 95% CI [0.086, 0.280]), community engagement (effect = 0.123, 95% CI [0.037, 0.245]), collectability (effect = 0.119, 95% CI [0.048, 0.210]), and compatibility (effect = 0.195, 95% CI [0.090, 0.314]). These results confirm the significant mediating effect of perceived value, which led to H8 being fully accepted.

Table 6.

Mediating effect results.

4.5. fsQCA

Before the fsQCA was conducted, thresholds of 0.95, 0.50, and 0.05 were established to convert the raw data into fuzzy-set membership scores. This calibration process resulted in values ranging from 0 (indicating complete nonmembership) to 1 (indicating full membership). Following the guidance of Pappas and Woodside [87], an adjustment of 0.001 was applied to scores that were exactly 0.50 to minimize the potential loss of cases.

4.5.1. Necessary Conditions

A necessity test was performed to assess whether any antecedent variable qualified as a necessary condition for achieving a specific outcome—either high or nonhigh purchase behavior. Following criteria established by Ragin [88], a condition was deemed necessary if it exhibited a consistency threshold of 0.9 or above, which would signify a strong correlation with the presence of the outcome.

As Table 7 indicates, none of the antecedent variables that influence high purchase behavior exceeded the consistency threshold of 0.9, indicating that no single antecedent is a necessary condition. This suggests that the antecedents of high purchase behavior are complex, with no single factor exerting a decisive influence, and that the paths leading to high purchase behavior are diverse. For nonhigh purchase behavior, noncommunity engagement demonstrated a consistency coefficient of 0.912, which qualified it as a necessary condition.

Table 7.

Necessary conditions (purchase behavior).

4.5.2. Sufficient Conditions

Next, sufficient conditions leading to high consumer purchasing behavior were analyzed by examining combinations of conditions necessary for obtaining this outcome. The analysis of sufficient conditions was based on a truth table, consisting of 2k rows (k = the number of conditions). Each row represented a possible configuration of conditions. The table was analyzed for frequency and consistency (refer to Appendix A). Following the recommendations of Pappas and Woodside [87], a consistency threshold of 0.85 and a frequency threshold of 3 were applied, while combinations with proportional inconsistency below 0.75 were excluded.

Moreover, the analysis incorporated intermediate and parsimonious solutions to distinguish between core and peripheral conditions. In this context, the consistency index functioned similarly to a correlation coefficient, indicating the strength of the relationship between conditions and outcomes. Meanwhile, the coverage index was comparable to R2 in the multiple regression analysis, reflecting the explanatory power of the identified configurations. Table 8 presents the configurations of the content characteristics of NFT artworks influencing high purchase behavior.

Table 8.

Sufficiency conditions.

The overall solution consistency was 0.848, which indicates a high level of causal reliability for the outcome (purchase behavior). Additionally, the overall solution coverage was 0.883, which indicates that 65% of the cases exhibiting high purchase behavior corresponded to the 12 identified causal configurations. Notably, all configurations displayed a consistency above 0.8 and coverage above 0.2, underscoring their theoretical importance [89]. Additionally, the configurations associated with low purchase behavior were analyzed, and the results are detailed in Appendix A.

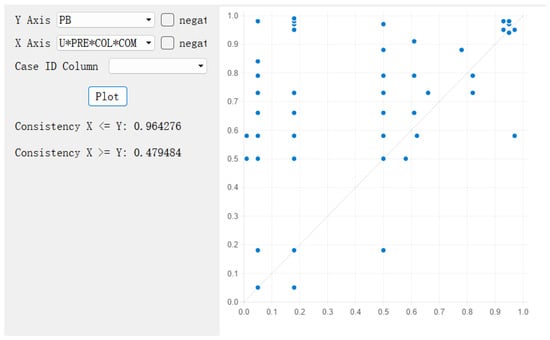

4.5.3. Predictive Validity and Robustness Check

A predictive validity test was conducted to ensure the accuracy of predictions, as high consistency and coverage alone do not guarantee good predictive performance [90]. The first step of the test involved randomly splitting the data set into a subsample and a holdout sample. The subsample data were analyzed using the same procedures to derive a solution, while the holdout sample was used to create an XY plot. As indicated in Figure 2, the predictive test results of the subsample solution applied to the holdout sample demonstrated high consistency (0.964) and coverage (0.479), indicating a strong predictive capability.

Figure 2.

XY plot for predictive validity.

Additionally, adjusting the frequency thresholds to 0.9, 0.5, and 0.1 while maintaining a consistency threshold of 0.8 revealed no significant differences from the initial results. Thus, the robustness and reliability of the fsQCA were confirmed.

5. Discussion

This study employed multiple regression analysis and fsQCA to investigate the relationship between the content characteristics of NFT digital artworks and purchase behavior. The following sections provide a detailed discussion of the research findings.

The results of the multiple regression analysis offer crucial insights into the relationships between content characteristics, perceived value, and purchase behavior. Notably, community engagement and collectability—although extensively discussed in qualitative NFT research—have rarely been examined as variables in quantitative studies. Thus, this study identifies them as key drivers of purchase behavior. Moreover, profitability was found to align with prior research [11], highlighting its role as a critical economic consideration, particularly for consumers who view NFTs as investment opportunities. Community engagement was identified as a key social factor that enhances value perception and user experience within NFT ecosystems. Furthermore, collectability, an important determinant of NFT desirability, directly influences consumer behavior by emphasizing scarcity and exclusivity. Moreover, compatibility is significant in facilitating NFTs’ seamless integration into consumers’ technological and lifestyle ecosystems, thereby increasing the likelihood of their adoption. Overall, these empirical findings provide support for previous views [11,12,13,14].

However, uniqueness and prestige were not found to exhibit significant direct effects on purchase behavior, which diverges from previous studies’ findings. One possible explanation is that as NFT digital artworks continue to evolve and proliferate, consumers may no longer regard uniqueness or prestige—when each is considered individually—as indispensable attributes. Nevertheless, the fsQCA results reveal that certain configurations, such as those integrating high uniqueness or high prestige with other complementary factors (e.g., Solutions 2, 3, 5, and 7), can still drive strong purchase behavior. This implies that while uniqueness and prestige do not independently dictate purchasing decisions, they remain influential when embedded within broader decision-making frameworks.

Additionally, the role of perceived value as a mediator is critical, linking characteristics such as uniqueness, prestige, and compatibility with purchasing behavior. This reinforces the centrality of perceived value in integrating diverse attributes into consumer decision-making processes. By addressing gaps in prior studies, this study’s findings expand the understanding of value-driven behavior in digital art markets.

Finally, this study employed fsQCA to address the limitations of traditional quantitative methods commonly used in behavioral and information systems research. Unlike regression models, which typically isolate the net effects of individual predictors, fsQCA illuminates the recipe principle of consumer decision-making, particularly in complex environments such as the NFT market. For instance, high profitability, high collectability, and high compatibility can jointly drive elevated purchase behavior (e.g., Solution 4). Furthermore, the principle of equifinality becomes evident, as multiple distinct configurations can yield similar outcomes. By identifying 12 demand configurations that lead to high purchase behavior and 9 configurations that result in low purchase behavior, the analysis underscores the synergistic and nonlinear dynamics shaping purchasing decisions. In addition, fsQCA effectively addresses the inherent causal asymmetry in consumer behavior. For example, high profitability, low prestige, and strong community engagement may yield high purchase behavior (e.g., Solution 1), just as high prestige, high collectability, and high compatibility—combined with low community engagement—can also generate high purchase behavior (e.g., Solution 8). By integrating these findings, fsQCA offers deeper insights into the causal complexity underpinning consumer behavior in the NFT market and mitigates the limitations of conventional regression analyses, which focus solely on net effects [75].

6. Conclusions

This study identified six key content characteristics of NFT digital artworks—namely, uniqueness, profitability, prestige, community engagement, collectability, and compatibility—as well as their effects on perceived value and purchasing behavior. Using multiple regression analysis and fsQCA, our research reveals net and configurational effects, thereby providing a comprehensive understanding of consumers’ purchase behavior in the NFT ecosystem. This section summarizes this study’s theoretical implications, practical implications, and limitations to guide future research.

6.1. Theoretical Implications

This study enhances the theoretical understanding of consumer behavior in the NFT digital art market through its examination of the following six key content characteristics: uniqueness, profitability, prestige, community engagement, collectability, and compatibility. These characteristics are framed within the diffusion of innovations theory as well as social identity theory. The diffusion of innovations theory explains how NFTs’ functional, economic, and social attributes drive their adoption through relative advantage and compatibility with user needs, whereas the social identity theory highlights the influences of group dynamics and social belonging in digital markets. By positioning these content characteristics within this theoretical framework, this study offers a comprehensive analysis of how these factors drive NFTs’ perceived value and consumers’ purchasing behavior toward them.

Methodologically, this study highlights the practical value of fsQCA in unraveling complex causal relationships in emerging markets, such as the NFT digital artwork market. Unlike traditional approaches, fsQCA reveals how multiple factors interact to influence consumer decision-making, aligning with Woodside et al. [91], who emphasized the configurational nature of purchasing behavior. Through the application of fsQCA, this study introduced a novel method for examining the configurational effects in NFTs and other digital ecosystems.

Moreover, perceived value was identified as a critical mediator linking content characteristics to purchasing behavior. By demonstrating how it integrates the diverse attributes of NFT content into significant purchasing decisions, this study provides empirical evidence that contributes to the existing body of research. Additionally, it advances a cohesive framework for understanding value-driven behavior in digital markets, thereby offering new insights into how consumers perceive and adopt digital products in dynamic environments like the NFT marketplace.

Overall, this research contributes specifically to the study of NFTs within e-commerce domains, emphasizing the unique interplay of content features in shaping consumer behavior.

6.2. Practical Implications

This study provides substantial strategic guidance and actionable insights for key stakeholders in the NFT ecosystem, including creators, platforms, and marketers. First, creators should prioritize designing content with attributes such as uniqueness, profitability, prestige, community engagement, collectability, and compatibility to enhance consumers’ perceived value. Addressing these multidimensional needs could elevate consumers’ purchase intentions and foster enduring relationships with them. Second, platforms and marketers can leverage these insights by implementing strategies like gamified experiences, exclusive events, and social recognition programs to strengthen community engagement and enhance user experiences. These initiatives would boost initial purchase rates, drive repeat transactions, and inspire peer recommendations, ultimately fostering loyalty and brand advocacy.

This study further underscores the pivotal role of community engagement. Platforms should focus on building vibrant and interconnected ecosystems that foster trust and social connections among users, thus enabling active participation and value-sharing within the NFT ecosystem. For creators, delivering content that comprehensively addresses consumers’ emotional and functional needs would significantly enhance perceived value and stimulate purchasing behavior.

Setting itself apart from prior research, this study employed fsQCA to reveal the complexity and diversity of consumer demands in the NFT market. By identifying 12 distinct paths through fsQCA, platforms and creators can leverage these pathways to enhance consumer purchasing behavior. In light of these key insights, content creators are encouraged to tailor their strategies by emphasizing the specific attributes associated with the most effective pathways, thereby maximizing their impact on consumers. These findings highlight the importance of consumer segmentation for ensuring precise market positioning. Platforms and marketers should align campaigns and product offerings with consumers’ core motivations, whether they are driven by prestige, profitability, or social engagement. This targeted approach would enable stakeholders to effectively address the distinct needs of segmented consumer groups. By adopting these strategies, NFT platforms and creators could dynamically adapt to the rapidly evolving market environment as well as shifting consumer expectations, thereby fostering deeper user engagement while maintaining a competitive edge.

6.3. Limitations and Future Research

Despite its contributions, this study has several limitations. First, this work relied on cross-sectional data, capturing consumer behavior at a single point in time. Future research should adopt longitudinal designs to track changes in consumer preferences over time. Additionally, integrating mixed-methods approaches, such as combining survey data with qualitative interviews or behavioral experiments, could provide a more comprehensive understanding of consumer motivations. Expanding datasets to include transactional and regional data from diverse sources would further enhance the robustness and generalizability of findings. Given the exploratory nature of this study, regression analysis was primarily employed, which may limit the confirmation of more complex theoretical relationships. Therefore, future research may benefit from using structural equation modeling to increase analytical depth and rigor.

Second, this research focused exclusively on Chinese consumers, which limits the generalizability of its findings to a global context. NFT markets vary significantly across countries due to cultural differences, regulatory environments, and platform accessibility. Future research should incorporate international samples to examine cross-cultural differences in NFT adoption and engagement. Additionally, with 69% of participants aged 20–29 years, the sample was skewed toward younger consumers, potentially introducing bias in the findings. Future research should set a broader age range to explore generational differences in NFT-related motivations and preferences.

Finally, this research emphasized six content characteristics while excluding external factors like market volatility and regulatory changes, which may also influence consumer behavior. Therefore, future research should incorporate these market factors to comprehensively understand consumer behavior in the NFT market and examine the multidimensional aspects of perceived value—including emotional, functional, and social dimensions—to provide deeper insights into the adoption of NFTs.

Author Contributions

Conceptualization, S.-E.C.; Methodology, Z.-H.B., C.X. and S.-E.C.; Formal analysis, Z.-H.B. and C.X.; Data curation, Z.-H.B. and C.X.; Writing—original draft, Z.-H.B.; Writing—review & editing, Z.-H.B., C.X. and S.-E.C.; Supervision, S.-E.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Given the content and methodologies of this study, and in accordance with the Bioethics and Safety Act and Enforcement Decree of the Bioethics Act in South Korea, this type of research does not typically require ethical approval.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The authors will make the raw data available upon request.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Table A1.

Truth table analysis (purchase behaviors).

Table A1.

Truth table analysis (purchase behaviors).

| U | PRO | PRE | CE | COL | COM | Frequency | PB | Raw Consist | PRI Consist | SYM Consist |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 1 | 1 | 0 | 1 | 1 | 14 | 1 | 0.993 | 0.947 | 0.947 |

| 0 | 1 | 1 | 0 | 1 | 1 | 6 | 1 | 0.987 | 0.895 | 0.899 |

| 1 | 0 | 1 | 0 | 1 | 0 | 3 | 1 | 0.987 | 0.838 | 0.838 |

| 0 | 1 | 1 | 1 | 1 | 1 | 10 | 1 | 0.986 | 0.904 | 0.904 |

| 1 | 1 | 1 | 0 | 1 | 0 | 5 | 1 | 0.986 | 0.867 | 0.886 |

| 0 | 0 | 1 | 0 | 1 | 1 | 3 | 1 | 0.985 | 0.839 | 0.839 |

| 0 | 1 | 1 | 1 | 0 | 1 | 5 | 1 | 0.985 | 0.874 | 0.874 |

| 1 | 1 | 1 | 1 | 1 | 1 | 59 | 1 | 0.985 | 0.949 | 0.951 |

| 1 | 0 | 1 | 0 | 1 | 1 | 6 | 1 | 0.985 | 0.859 | 0.865 |

| 1 | 1 | 0 | 1 | 1 | 1 | 6 | 1 | 0.984 | 0.837 | 0.837 |

| 1 | 1 | 1 | 1 | 0 | 1 | 12 | 1 | 0.983 | 0.872 | 0.886 |

| 1 | 1 | 1 | 0 | 0 | 1 | 7 | 1 | 0.982 | 0.804 | 0.843 |

| 0 | 1 | 1 | 1 | 1 | 0 | 4 | 1 | 0.980 | 0.833 | 0.833 |

| 1 | 1 | 0 | 1 | 0 | 1 | 3 | 1 | 0.978 | 0.773 | 0.773 |

| 0 | 1 | 1 | 0 | 1 | 0 | 3 | 1 | 0.978 | 0.806 | 0.806 |

| 1 | 1 | 0 | 0 | 1 | 1 | 8 | 1 | 0.978 | 0.758 | 0.758 |

| 1 | 1 | 1 | 1 | 1 | 0 | 8 | 1 | 0.977 | 0.822 | 0.822 |

| 0 | 1 | 0 | 1 | 1 | 1 | 4 | 1 | 0.977 | 0.767 | 0.767 |

| 1 | 1 | 0 | 0 | 1 | 0 | 4 | 1 | 0.973 | 0.707 | 0.707 |

| 1 | 0 | 1 | 1 | 1 | 1 | 8 | 1 | 0.966 | 0.741 | 0.750 |

| 0 | 1 | 1 | 1 | 0 | 0 | 3 | 1 | 0.966 | 0.701 | 0.701 |

| 0 | 1 | 0 | 0 | 1 | 1 | 7 | 1 | 0.965 | 0.646 | 0.646 |

| 1 | 1 | 0 | 0 | 0 | 1 | 5 | 1 | 0.963 | 0.589 | 0.589 |

| 1 | 0 | 0 | 0 | 1 | 1 | 5 | 1 | 0.962 | 0.592 | 0.592 |

| 0 | 1 | 0 | 0 | 0 | 1 | 7 | 1 | 0.962 | 0.596 | 0.596 |

| 0 | 1 | 0 | 0 | 1 | 0 | 5 | 1 | 0.961 | 0.631 | 0.642 |

| 0 | 1 | 0 | 1 | 0 | 0 | 3 | 1 | 0.960 | 0.628 | 0.645 |

| 0 | 0 | 1 | 1 | 0 | 0 | 4 | 1 | 0.954 | 0.477 | 0.477 |

| 0 | 0 | 0 | 0 | 1 | 0 | 3 | 1 | 0.943 | 0.459 | 0.459 |

| 1 | 0 | 0 | 0 | 0 | 1 | 3 | 1 | 0.939 | 0.398 | 0.398 |

| 0 | 0 | 1 | 0 | 0 | 0 | 4 | 1 | 0.936 | 0.384 | 0.398 |

| 0 | 0 | 0 | 0 | 0 | 1 | 6 | 1 | 0.934 | 0.394 | 0.394 |

| 1 | 1 | 0 | 0 | 0 | 0 | 9 | 1 | 0.924 | 0.409 | 0.425 |

| 0 | 1 | 0 | 0 | 0 | 0 | 7 | 1 | 0.908 | 0.381 | 0.381 |

| 1 | 0 | 0 | 0 | 0 | 0 | 6 | 1 | 0.887 | 0.227 | 0.227 |

| 0 | 0 | 0 | 0 | 0 | 0 | 9 | 0 | 0.816 | 0.162 | 0.170 |

Table A2.

Truth table analysis (~purchase behaviors).

Table A2.

Truth table analysis (~purchase behaviors).

| U | PRO | PRE | CE | COL | COM | Frequency | ~PB | Raw Consist | PRI Consist | SYM Consist |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 0 | 0 | 0 | 0 | 0 | 6 | 1 | 0.967 | 0.773 | 0.773 |

| 1 | 0 | 0 | 0 | 0 | 1 | 3 | 1 | 0.960 | 0.602 | 0.602 |

| 0 | 0 | 1 | 1 | 0 | 0 | 4 | 1 | 0.958 | 0.523 | 0.523 |

| 0 | 0 | 0 | 0 | 0 | 1 | 6 | 1 | 0.957 | 0.606 | 0.606 |

| 0 | 0 | 1 | 0 | 0 | 0 | 4 | 1 | 0.956 | 0.581 | 0.602 |

| 0 | 0 | 0 | 0 | 0 | 0 | 9 | 1 | 0.954 | 0.792 | 0.830 |

| 0 | 0 | 0 | 0 | 1 | 0 | 3 | 1 | 0.952 | 0.541 | 0.541 |

| 1 | 1 | 0 | 0 | 0 | 1 | 5 | 1 | 0.946 | 0.411 | 0.411 |

| 1 | 0 | 0 | 0 | 1 | 1 | 5 | 1 | 0.945 | 0.408 | 0.408 |

| 0 | 1 | 0 | 0 | 0 | 1 | 7 | 1 | 0.944 | 0.404 | 0.404 |

| 0 | 1 | 0 | 0 | 0 | 0 | 7 | 1 | 0.943 | 0.619 | 0.619 |

| 1 | 1 | 0 | 0 | 0 | 0 | 9 | 1 | 0.942 | 0.553 | 0.575 |

| 0 | 1 | 0 | 0 | 1 | 1 | 7 | 1 | 0.936 | 0.354 | 0.354 |

| 1 | 1 | 0 | 0 | 1 | 0 | 4 | 1 | 0.934 | 0.293 | 0.293 |

| 0 | 1 | 0 | 0 | 1 | 0 | 5 | 1 | 0.931 | 0.352 | 0.358 |

| 1 | 0 | 1 | 0 | 1 | 0 | 3 | 1 | 0.931 | 0.162 | 0.162 |

| 0 | 1 | 0 | 1 | 0 | 0 | 3 | 1 | 0.930 | 0.346 | 0.355 |

| 1 | 1 | 0 | 0 | 1 | 1 | 8 | 1 | 0.930 | 0.242 | 0.242 |

| 1 | 1 | 0 | 1 | 0 | 1 | 3 | 1 | 0.926 | 0.227 | 0.227 |

| 0 | 0 | 1 | 0 | 1 | 1 | 3 | 1 | 0.924 | 0.161 | 0.161 |

| 1 | 1 | 1 | 0 | 0 | 1 | 7 | 1 | 0.923 | 0.149 | 0.157 |

| 0 | 1 | 0 | 1 | 1 | 1 | 4 | 1 | 0.923 | 0.233 | 0.233 |

| 0 | 1 | 1 | 1 | 0 | 0 | 3 | 1 | 0.920 | 0.299 | 0.299 |

| 1 | 1 | 0 | 1 | 1 | 1 | 6 | 1 | 0.917 | 0.163 | 0.163 |

| 0 | 1 | 1 | 0 | 1 | 0 | 3 | 1 | 0.908 | 0.194 | 0.194 |

| 1 | 1 | 1 | 0 | 1 | 0 | 5 | 1 | 0.907 | 0.112 | 0.114 |

| 1 | 0 | 1 | 0 | 1 | 1 | 6 | 1 | 0.905 | 0.134 | 0.135 |

| 1 | 0 | 1 | 1 | 1 | 1 | 8 | 1 | 0.901 | 0.246 | 0.250 |

| 0 | 1 | 1 | 1 | 1 | 0 | 4 | 1 | 0.898 | 0.167 | 0.167 |

| 0 | 1 | 1 | 1 | 0 | 1 | 5 | 1 | 0.897 | 0.126 | 0.126 |

| 1 | 1 | 1 | 1 | 1 | 0 | 8 | 1 | 0.893 | 0.178 | 0.178 |

| 0 | 1 | 1 | 0 | 1 | 1 | 6 | 1 | 0.892 | 0.100 | 0.101 |

| 1 | 1 | 1 | 1 | 0 | 1 | 12 | 1 | 0.881 | 0.112 | 0.114 |

| 1 | 1 | 1 | 0 | 1 | 1 | 14 | 1 | 0.877 | 0.053 | 0.053 |

| 0 | 1 | 1 | 1 | 1 | 1 | 10 | 1 | 0.873 | 0.096 | 0.096 |

| 1 | 1 | 1 | 1 | 1 | 1 | 59 | 0 | 0.716 | 0.049 | 0.049 |

Note: ~Purchase Behavior = nonhigh purchase behavior.

Table A3.

Sufficiency conditions (~purchase behaviors).

Table A3.

Sufficiency conditions (~purchase behaviors).

| Solution (~Purchase Behaviors) | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | |

| Uniqueness | |||||||||

| Profitability | |||||||||

| Prestige | |||||||||

| CE | |||||||||

| Collectability | |||||||||

| Compatibility | |||||||||

| Consistency | 0.879 | 0.910 | 0.859 | 0.878 | 0.897 | 0.946 | 0.912 | 0.872 | 0.893 |

| Raw Coverage | 0.793 | 0.729 | 0.381 | 0.427 | 0.408 | 0.439 | 0.380 | 0.341 | 0.597 |

| Unique Coverage | 0.033 | 0.005 | 0.002 | 0.004 | 0.004 | 0.007 | 0.003 | 0.007 | 0.001 |

| Solution Coverage | 0.929 | ||||||||

| Solution Consistency | 0.776 | ||||||||

Note: Black circles () and crossed-out circles () represent the presence and absence (negation) of a condition, respectively. Large circles indicate core conditions, small circles represent peripheral conditions, and blank spaces denote “do not care” conditions, where the presence or absence of a condition does not influence the outcome. ~Purchase Behavior = nonhigh purchase behavior.

References

- Dowling, M. Fertile LAND: Pricing non-fungible tokens. Financ. Res. Lett. 2022, 44, 102096. [Google Scholar] [CrossRef]

- Nadini, M.; Alessandretti, L.; Di Giacinto, F.; Martino, M.; Aiello, L.M.; Baronchelli, A. Mapping the NFT revolution: Market trends, trade networks, and visual features. Sci. Rep. 2021, 11, 20902. [Google Scholar] [CrossRef] [PubMed]

- Wang, Y.; Horky, F.; Baals, L.J.; Lucey, B.M.; Vigne, S.A. Bubbles all the way down? Detecting and date-stamping bubble behaviours in NFT and DeFi markets. J. Chin. Econ. Bus. Stud. 2022, 20, 415–436. [Google Scholar] [CrossRef]

- Sestino, A.; Guido, G.; Peluso, A.M. Eterna Capital Non-fungible Tokens (NFTs)—The New Paradigm Medium; Springer: Berlin/Heidelberg, Germany, 2022. [Google Scholar]

- Park, A.; Kietzmann, J.; Pitt, L.; Dabirian, A. The evolution of nonfungible tokens: Complexity and novelty of NFT use-cases. IT Prof. 2022, 24, 9–14. [Google Scholar] [CrossRef]

- Regner, F.; Urbach, N.; Schweizer, A. NFTs in practice–non-fungible tokens as core component of a blockchain-based event ticketing application. In Proceedings of the Fortieth International Conference on Information Systems, Munich, Germany, 15–18 December 2019. [Google Scholar]

- Wu, C.H.; Liu, C.Y. Educational applications of non-fungible token (NFT). Sustainability 2022, 15, 7. [Google Scholar] [CrossRef]

- Pinto-Gutiérrez, C.; Gaitán, S.; Jaramillo, D.; Velasquez, S. The NFT hype: What draws attention to non-fungible tokens? Mathematics 2022, 10, 335. [Google Scholar] [CrossRef]

- Bao, H.; Roubaud, D. Non-fungible token: A systematic review and research agenda. J. Risk Financ. Manag. 2022, 15, 215. [Google Scholar] [CrossRef]

- Lee, C.T.; Ho, T.Y.; Xie, H.H. Building brand engagement in metaverse commerce: The role of branded non-fungible tokens (BNFTs). Electron. Com. Res. Appl. 2023, 58, 101248. [Google Scholar] [CrossRef]

- Lee, S.H.; Kim, S.Y. An empirical study on factors affecting NFT purchase intention. J. Korea Ind. Inf. Syst. Res. 2022, 27, 93–104. [Google Scholar]

- Wu, C.H.; Liu, C.Y.; Weng, T.S. Critical factors and trends in NFT technology innovations. Sustainability 2023, 15, 7573. [Google Scholar] [CrossRef]

- Lu, Y.; Yang, S.; Chau, P.Y.K.; Cao, Y. Dynamics between the trust transfer process and intention to use mobile payment services: A cross-environment perspective. Inf. Manag. 2011, 48, 393–403. [Google Scholar]

- Yilmaz, T.; Sagfossen, S.; Velasco, C. What makes NFTs valuable to consumers? Perceived value drivers associated with NFTs liking, purchasing, and holding. J. Bus. Res. 2023, 165, 114056. [Google Scholar]

- Rogers Everett, M. Diffusion of Innovations; Routledge: New York, NY, USA, 1995; p. 576. [Google Scholar]

- Ashforth, B.E.; Mael, F. Social identity theory and the organization. Acad. Manag. Rev. 1989, 14, 20–39. [Google Scholar]

- Kim, H.W.; Chan, H.C.; Gupta, S. Value-based adoption of mobile internet: An empirical investigation. Decis. Support Syst. 2007, 43, 111–126. [Google Scholar] [CrossRef]

- Ante, L. Non-fungible token (NFT) markets on the Ethereum blockchain: Temporal development, cointegration and interrelations. Econ. Innov. New Technol. 2023, 32, 1216–1234. [Google Scholar]

- Ali, O.; Momin, M.; Shrestha, A.; Das, R.; Alhajj, F.; Dwivedi, Y.K. A review of the key challenges of non-fungible tokens. Technol. Forecast. Soc. Change 2023, 187, 122248. [Google Scholar]

- Wang, Q.; Li, R.; Wang, Q.; Chen, S. Non-fungible token (NFT): Overview, evaluation, opportunities and challenges. arXiv 2021, arXiv:2105.07447. [Google Scholar]

- Maouchi, Y.; Charfeddine, L.; El Montasser, G. Understanding digital bubbles amidst the COVID-19 pandemic: Evidence from DeFi and NFTs. Financ. Res. Lett. 2022, 47, 102584. [Google Scholar] [CrossRef]

- Bamakan, S.M.H.; Nezhadsistani, N.; Bodaghi, O.; Qu, Q. Patents and intellectual property assets as non-fungible tokens; key technologies and challenges. Sci. Rep. 2022, 12, 2178. [Google Scholar]

- Chalmers, D.; Fisch, C.; Matthews, R.; Quinn, W.; Recker, J. Beyond the bubble: Will NFTs and digital proof of ownership empower creative industry entrepreneurs? J. Bus. Ventur. Insights 2022, 17, e00309. [Google Scholar]

- Wu, C.H.; Dong, T.P.; Liu, C.H.; Vu, H.T. Discovering the critical factors of affecting non-fungible tokens (NFT) purchase intention. Int. Rev. Econ. Financ. 2024, 96, 103660. [Google Scholar] [CrossRef]

- Fortagne, M.A.; Lis, B. Determinants of the purchase intention of non-fungible token collectibles. J. Consum. Behav. 2024, 23, 1032–1049. [Google Scholar] [CrossRef]

- Kumar, A.; Shankar, A.; Behl, A.; Wamba, S.F. Do you believe in the metaverse NFTs? Understanding the value proposition of NFTs in the metaverse. Technol. Forecast. Soc. Change 2025, 210, 123880. [Google Scholar] [CrossRef]

- Alexander, C. Generative Avatar Non-fungible Token Collections, version 1; University of Sussex: Brighton, UK, 2022. [Google Scholar]

- Hofstetter, R.; de Bellis, E.; Brandes, L.; Clegg, M.; Lamberton, C.; Reibstein, D.; Rohlfsen, F.; Schmitt, B.; Zhang, J.Z. Crypto-marketing: How non-fungible tokens (NFTs) challenge traditional marketing. Mark. Lett. 2022, 33, 705–711. [Google Scholar] [CrossRef]

- Balashova, N. Making Money with NFT Art. Bachelor’s Thesis, Aalto University, Espoo, Finland, 2023. [Google Scholar]

- Sestino, A.; Guido, G.; Peluso, A.M. The interplay of consumer innovativeness and status consumption orientation when buying NFT-based fashion products. In Non-Fungible Tokens (NFTs) Examining the Impact on Consumers and Marketing Strategies; Springer International Publishing: Cham, Germany, 2022; pp. 63–75. [Google Scholar]

- Cho, M.; Ko, E.; Taylor, C.R. Do non-fungible tokens create long-term value for luxury brands? The effect of NFT promotions on customer equity. Comput. Hum. Behav. 2024, 159, 108347. [Google Scholar] [CrossRef]

- Tausch, N.; Schmid, K.; Hewstone, M. The Social Psychology of Intergroup Relations. In Handbook on Peace Education; Routledge: London, UK, 2010; pp. 75–86. [Google Scholar]

- Agag, G.; El-Masry, A.A. Understanding consumer intention to participate in online travel community and effects on consumer intention to purchase travel online and WOM: An integration of innovation diffusion theory and TAM with trust. Comput. Hum. Behav. 2016, 60, 97–111. [Google Scholar] [CrossRef]

- Al-Rahmi, W.M.; Yahaya, N.; Aldraiweesh, A.A.; Alamri, M.M.; Aljarboa, N.A.; Alturki, U.; Aljeraiwi, A.A. Integrating technology acceptance model with innovation diffusion theory: An empirical investigation on students’ intention to use E-learning systems. IEEE Access 2019, 7, 26797–26809. [Google Scholar] [CrossRef]

- Zhang, Z.; Li, W. Customer engagement around cultural and creative products: The role of social identity. Front. Psychol. 2022, 13, 874851. [Google Scholar] [CrossRef]

- Hobson, N. Available online: https://www.inc.com/nick-hobson/bored-ape-yacht-club-nfts.html (accessed on 9 July 2024).

- SEKKEI Digital Group. Available online: https://sekkeidigitalgroup.com/attracting-chinese-nft-investors-in-2022/ (accessed on 20 July 2024).

- Zeithaml, V.A. Consumer perceptions of price, quality, and value: A means-end model and synthesis of evidence. J. Mark. 1988, 52, 2–22. [Google Scholar] [CrossRef]

- Sánchez-Fernández, R.; Iniesta-Bonillo, M.Á. The concept of perceived value: A systematic review of the research. Mark. Theor. 2007, 7, 427–451. [Google Scholar] [CrossRef]

- Sweeney, J.C.; Soutar, G.N. Consumer perceived value: The development of a multiple item scale. J. Retail. 2001, 77, 203–220. [Google Scholar]

- Dwivedi, A.; Nayeem, T.; Murshed, F. Brand experience and consumers’ willingness-to-pay (WTP) a price premium: Mediating role of brand credibility and perceived uniqueness. J. Retail. Consum. Serv. 2018, 44, 100–107. [Google Scholar]

- Chandra, Y. Non-fungible token-enabled entrepreneurship: A conceptual framework. J. Bus. Ventur. Insights 2022, 18, e00323. [Google Scholar]

- Tian, K.T.; Bearden, W.O.; Hunter, G.L. Consumers’ need for uniqueness: Scale development and validation. J. Consum. Res. 2001, 28, 50–66. [Google Scholar]

- Snyder, C.R. Product scarcity by need for uniqueness interaction: A consumer catch-22 carousel? Basic Appl. Soc. Psychol. 1992, 13, 9–24. [Google Scholar]

- Chieng, F.; Sharma, P.; Kingshott, R.P.; Roy, R. Interactive effects of self-congruity and need for uniqueness on brand loyalty via brand experience and brand attachment. J. Prod. Brand Manag. 2022, 31, 870–885. [Google Scholar] [CrossRef]

- Trautman, L.J. Virtual art and non-fungible tokens. Hofstra L. Rev. 2021, 50, 361. [Google Scholar] [CrossRef]

- Cao, Y.; Xia, M.; Shigyo, K.; Cheng, F.; Yu, Q.; Yang, X.; Wang, Y.; Zeng, W.; Qu, H. NFTeller: Dual-centric visual analytics for assessing market performance of NFT collectibles. In Proceedings of the International Symposium on Visual Information Communication and Interaction, Guangzhou, China, 22–24 September 2023; ACM: New York, NY, USA, 2023; pp. 1–8. [Google Scholar]

- Cheung, H.; Baumber, A.; Brown, P.J. Barriers and enablers to sustainable finance: A case study of home loans in an Australian retail bank. J. Clean. Prod. 2022, 334, 130211. [Google Scholar]

- Lee, H.J.; Kim, H.J. A study on cryptocurrency market in china. J. Digit. Contents Soc. 2019, 20, 537–545. [Google Scholar]

- Ahmad, I.; Ahmad, M.O.; Ahmad, M.O.; Almazroi, A.A.; Khan Khalil, M.I.; Alqarni, M.A. Using algorithmic trading to analyze short term profitability of Bitcoin, Peer. J. Comput. Sci. 2021, 7, e337. [Google Scholar]

- De Angelis, P.; De Marchis, R.; Marino, M.; Martire, A.L.; Oliva, I. Betting on bitcoin: A profitable trading between directional and shielding strategies. Decis. Econ. Financ. 2021, 44, 883–903. [Google Scholar]

- Lamosa, R.G.; Muammil, S.S. Exploring the accountancy students’ perception on the profitability of non-fungible token (NFT) games. Neuroquantology 2022, 20, 8049. [Google Scholar]

- Ki, C.W.; Kim, Y.K. The mechanism by which social media influencers persuade consumers: The role of consumers’ desire to mimic. Psychol. Mark. 2019, 36, 905–922. [Google Scholar]

- Cebi, S. A quality evaluation model for the design quality of online shopping websites. Electron. Com. Res. Appl. 2013, 12, 124–135. [Google Scholar]

- Neunhoeffer, F.; Teubner, T. Between enthusiasm and refusal: A cluster analysis on consumer types and attitudes towards peer-to-peer sharing. J. Consum. Behav. 2018, 17, 221–236. [Google Scholar] [CrossRef]

- Lo, P.S.; Dwivedi, Y.K.; Wei-Han Tan, G.; Ooi, K.B.; Cheng-Xi Aw, E.; Metri, B. Why do consumers buy impulsively during live streaming? A deep learning-based dual-stage SEM-ANN analysis. J. Bus. Res. 2022, 147, 325–337. [Google Scholar]

- Vasan, K.; Janosov, M.; Barabási, A.L. Quantifying NFT-driven networks in crypto art. Sci. Rep. 2022, 12, 2769. [Google Scholar]

- Breidbach, C.F.; Tana, S. Betting on Bitcoin: How social collectives shape cryptocurrency markets. J. Bus. Res. 2021, 122, 311–320. [Google Scholar] [CrossRef]

- Sinnott, A.; Zhou, K.Z. How NFT collectors experience online NFT communities: A case study of bored ape. arXiv 2023, arXiv:2309.09320. [Google Scholar]

- Jensen Schau, H.; Gilly, M.C. We are what we post? Self-presentation in personal web space. J. Consum. Res. 2003, 30, 385–404. [Google Scholar] [CrossRef]

- Booth, P. Digital Fandom: New Media Studies; Peter Lang Publishing: Lausanne, Switzerland, 2010. [Google Scholar]

- Wu, Y.; Nambisan, S.; Xiao, J.; Xie, K. Consumer resource integration and service innovation in social commerce: The role of social media influencers. J. Acad. Mark. Sci. 2022, 50, 429–459. [Google Scholar] [CrossRef]

- Serada, A.; Sihvonen, T.; Harviainen, J.T. CryptoKitties and the new ludic economy: How blockchain introduces value, ownership, and scarcity in digital gaming. Games Cult. 2021, 16, 457–480. [Google Scholar] [CrossRef]

- White, B.; Mahanti, A.; Passi, K. Characterizing the OpenSea NFT marketplace. In Proceedings of the Companion Proceedings of the Web Conference, Virtual Event, Lyon, France, 25–29 April 2022; ACM: New York, USA, 2022; pp. 488–496. [Google Scholar]

- Amaro, S.; Duarte, P. An integrative model of consumers’ intentions to purchase travel online. Tour. Manag. 2015, 46, 64–79. [Google Scholar] [CrossRef]

- Gong, T.; Wang, C.Y.; Lee, K. Effects of characteristics of in-store retail technology on customer citizenship behavior. J. Retail. Consum. Serv. 2022, 65, 102488. [Google Scholar] [CrossRef]

- Konuk, F.A. The role of store image, perceived quality, trust and perceived value in predicting consumers’ purchase intentions towards organic private label food. J. Retail. Consum. Serv. 2018, 43, 304–310. [Google Scholar] [CrossRef]

- Schmidt, L.C.; Frieze, I.H. A mediational model of power, affiliation and achievement motives and product involvement. J. Bus. Psychol. 1997, 11, 425–446. [Google Scholar] [CrossRef]

- Casaló, L.V.; Flavián, C.; Ibáñez-Sánchez, S. Influencers on Instagram: Antecedents and consequences of opinion leadership. J. Bus. Res. 2020, 117, 510–519. [Google Scholar] [CrossRef]

- Sirdeshmukh, D.; Singh, J.; Sabol, B. Consumer trust, value, and loyalty in relational exchanges. J. Mark. 2002, 66, 15–37. [Google Scholar] [CrossRef]

- Hwang, K.; Zhang, Q. Influence of parasocial relationship between digital celebrities and their followers on followers’ purchase and electronic word-of-mouth intentions, and persuasion knowledge. Comput. Hum. Behav. 2018, 87, 155–173. [Google Scholar] [CrossRef]

- Brislin, R.W. Expanding the role of the interpreter to include multiple facets of intercultural communication. Int. J. Intercult. Relat. 1980, 4, 137–148. [Google Scholar] [CrossRef]

- Hair Joseph, F.; Black William, C.; Babin Barry, J.; Anderson Rolph, E. Multivariate Data Analysis: A Global Perspective; Pearson: London, UK, 2010. [Google Scholar]

- Woodside, A.G. Moving beyond multiple regression analysis to algorithms: Calling for adoption of a paradigm shift from symmetric to asymmetric thinking in data analysis and crafting theory. J. Bus. Res. 2013, 66, 463–472. [Google Scholar] [CrossRef]

- Woodside, A.G. Embrace•perform•model: Complexity theory, contrarian case analysis, and multiple realities. J. Bus. Res. 2014, 67, 2495–2503. [Google Scholar]