Strategic Business Mode Choices for E-Commerce Platforms under Brand Competition

Abstract

:1. Introduction

2. Literature Review

2.1. The Strategic Mode Selection

2.2. The Brand Competition

2.3. Platform Retailing

3. Model Description

4. Equilibrium Analysis

4.1. Retailer Mode

4.2. Online Marketplace Mode

4.3. Hybrid Mode with Platform Offering New Brand Marketplace

4.4. Hybrid Mode with Platform Offering Existing Brand Marketplace

5. Strategic Mode Choice

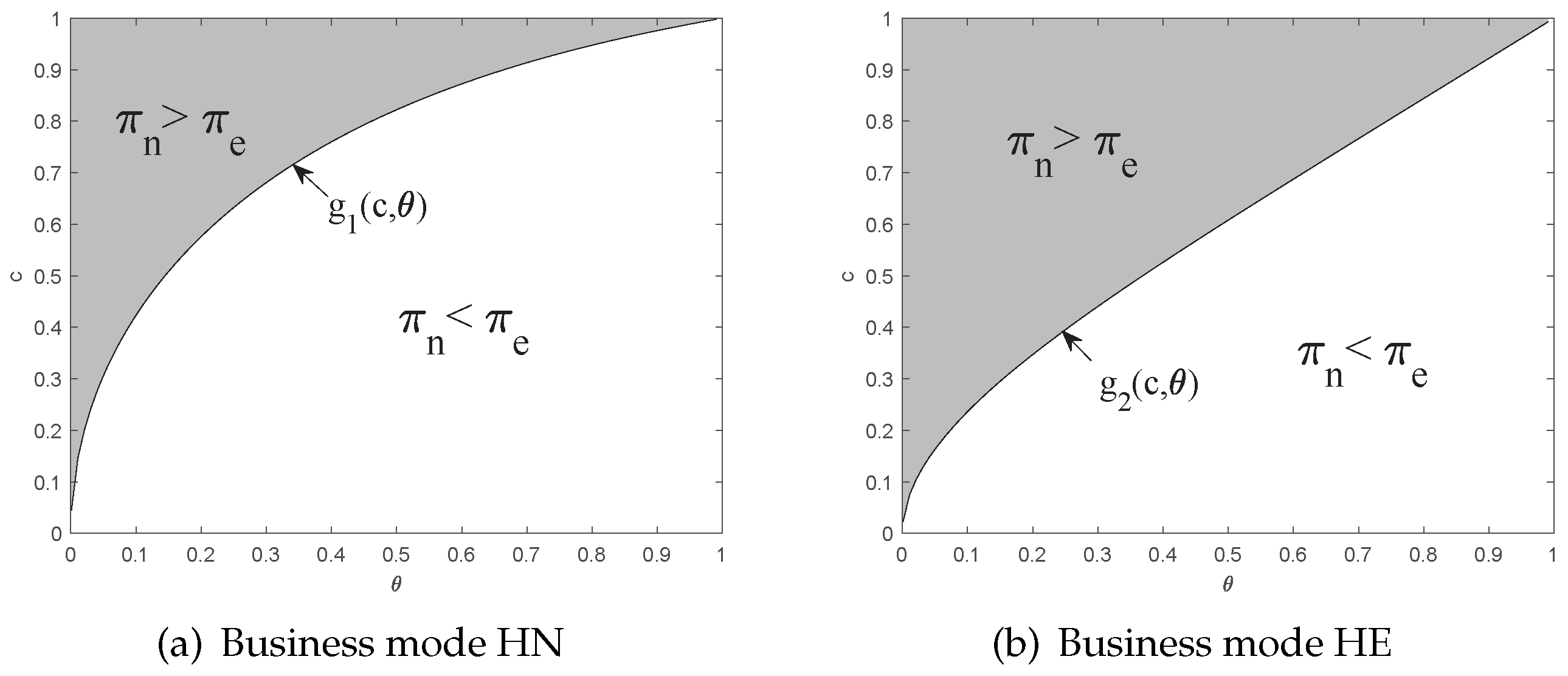

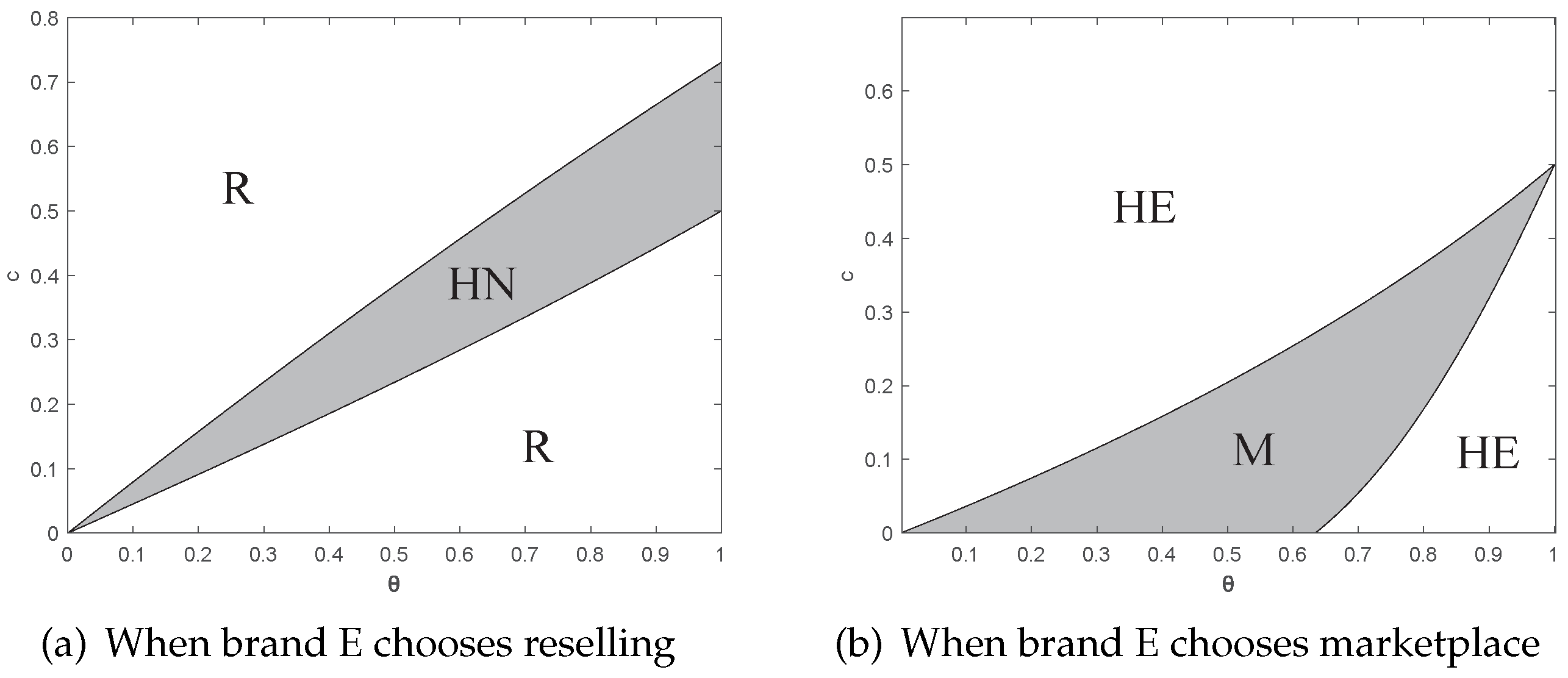

5.1. Comparison of Business Modes

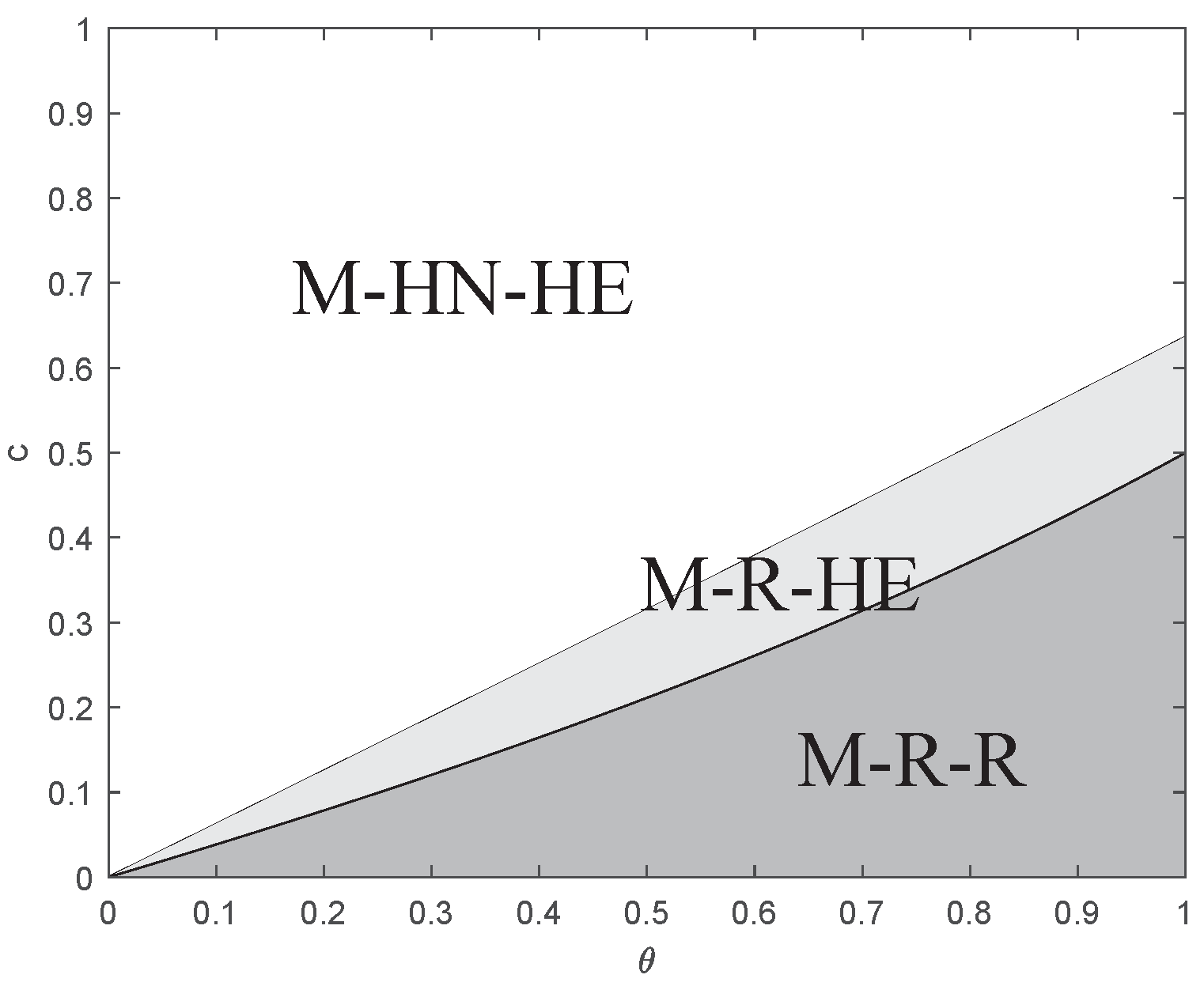

5.2. Strategy Selection

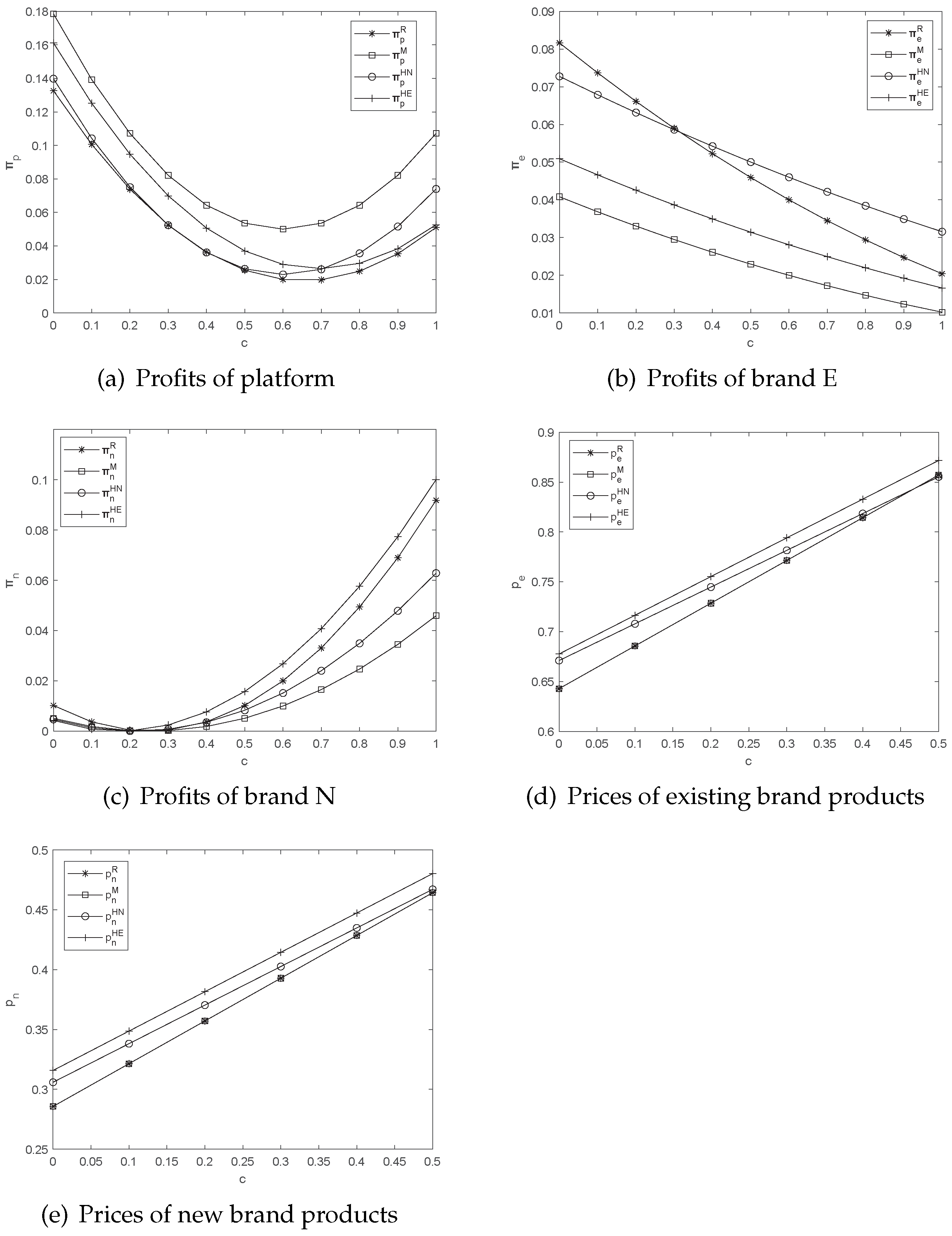

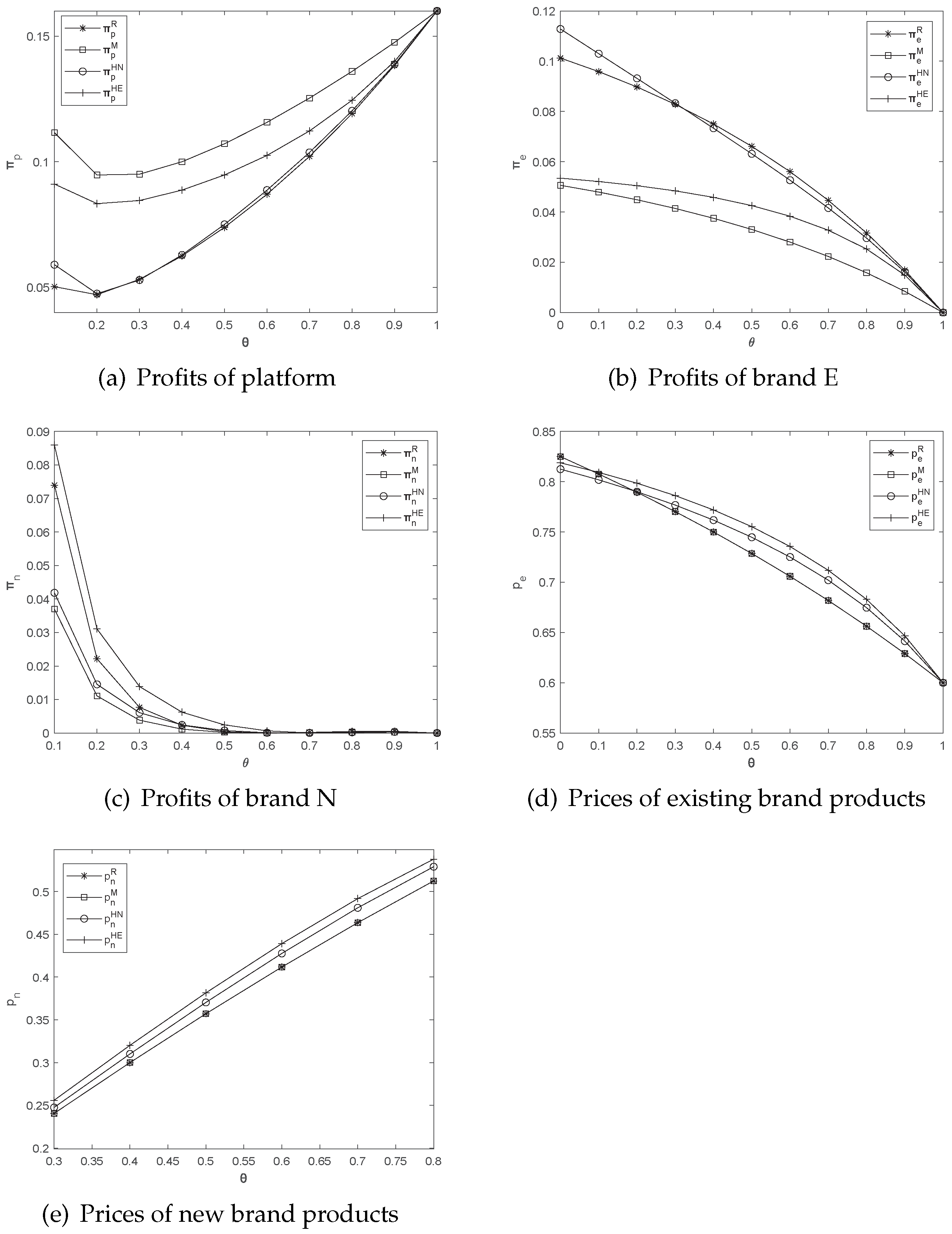

6. Sensitivity Analysis

6.1. The Impact of Production Cost c

6.2. The Impact of Consumers’ Acceptance of New Brand

7. Conclusions and Discussion

7.1. Conclusions

7.2. Discussion

7.3. Management Insights

7.4. Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

References

- Abhishek, V.; Jerath, K.; Zhang, Z.J. Agency selling or reselling? Channel structures in electronic retailing. Manag. Sci. 2016, 62, 2259–2280. [Google Scholar]

- Feng, N.; Chen, J.; Feng, H.; Li, M. Optimal product selection and pricing strategies for platform vendors under two-sided network effects. Electron. Commer. Res. Appl. 2020, 43, 1–15. [Google Scholar]

- Guo, X.; Zheng, S.; Yu, Y.; Zhang, F. Optimal bundling strategy for a retail platform under agency selling. Prod. Oper. Manag. 2022, 30, 2273–2284. [Google Scholar]

- Ha, A.Y.; Luo, H.; Shang, W. Supplier encroachment, information sharing, and channel structure in online retail platforms. Prod. Oper. Manag. 2022, 31, 1235–1251. [Google Scholar]

- Li, X.; Ai, X. A choice of selling format in the online marketplace with cross-sales supply chain: Platform selling or traditional reselling? Electron. Commer. Res. 2021, 21, 393–422. [Google Scholar]

- Zhang, Z.; Song, H.; Gu, X.; Shi, V.; Zhu, J. How to compete with a supply chain partner: Retailer’s store brand vs. manufacturer’s encroachment. Omega 2021, 103, 1–16. [Google Scholar]

- He, Y.; Xu, Q.; Shao, Z. “Ship-from-store” strategy in platform retailing. Transp. Res. Part Logist. Transp. Rev. 2021, 145, 1–17. [Google Scholar]

- Shen, Y.; Willems, S.P.; Dai, Y. Channel selection and contracting in the presence of a retail platform. Prod. Oper. Manag. 2019, 28, 1173–1185. [Google Scholar]

- Tian, L.; Vakharia, A.J.; Tan, Y.; Xu, Y. Marketplace, reseller, or hybrid: Strategic analysis of an emerging e-commerce model. Prod. Oper. Manag. 2018, 27, 1595–1610. [Google Scholar]

- Wang, C.; Leng, M.; Liang, L. Choosing an online retail channel for a manufacturer: Direct sales or consignment? Int. J. Prod. Econ. 2018, 195, 338–358. [Google Scholar]

- Li, W.; Chen, J. Pricing and quality competition in a brand-differentiated supply chain. Int. J. Prod. Econ. 2018, 202, 97–108. [Google Scholar]

- Luo, Z.; Chen, X.; Kai, M. The effect of customer value and power structure on retail supply chain product choice and pricing decisions. Omega 2018, 77, 115–126. [Google Scholar]

- Amrouche, N.; Pei, Z.; Yan, R. Mail-in-rebate and coordination strategies for brand competition. Int. J. Prod. Econ. 2022, 247, 1–13. [Google Scholar]

- Zhou, C.; Leng, M.; Liu, Z.; Cui, X.; Yu, J. The impact of recommender systems and pricing strategies on brand competition and consumer search. Electron. Commer. Res. Appl. 2022, 53, 1–15. [Google Scholar]

- Li, Y.; Bai, X.; Xue, K. Business modes in the sharing economy: How does the OEM cooperate with third-party sharing platforms? Int. J. Prod. Econ. 2020, 221, 1–17. [Google Scholar]

- Wei, J.; Lu, J.; Chen, W.; Xu, Z. Distribution contract analysis on e-Platform by considering channel role and good complementarity. J. Theor. Appl. Electron. Commer. Res. 2020, 16, 445–465. [Google Scholar]

- Chen, L.; Nan, G.; Liu, Q.; Peng, J.; Ming, J. How do consumer fairness concerns affect an e-commerce platform’s choice of selling scheme? J. Theor. Appl. Electron. Commer. Res. 2022, 17, 1075–1106. [Google Scholar]

- Wang, X.; Chaolu, T. The impact of offline service effort strategy on sales mode selection in an e-commerce supply chain with showrooming effect. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 893–908. [Google Scholar]

- Luo, Z.; Chen, X.; Chen, J.; Wang, X. Optimal pricing policies for differentiated brands under different supply chain power structures. Eur. J. Oper. Res. 2017, 259, 437–451. [Google Scholar]

- Yang, L.; Ji, J.; Chen, K. Advertising games on national brand and store brand in a dual-channel supply chain. J. Ind. Manag. Optim. 2018, 14, 105–134. [Google Scholar]

- Wang, R.; Nan, G.; Chen, L.; Li, M. Channel integration choices and pricing strategies for competing dual-channel retailers. IEEE Trans. Eng. Manag. 2020, 69, 2260–2274. [Google Scholar]

- Zhou, C.; Ma, N.; Cui, X.; Liu, Z. The impact of online referral on brand market strategies with consumer search and spillover effect. Soft Comput. 2020, 24, 2551–2565. [Google Scholar]

- Wang, L.; Chen, J.; Song, H. Manufacturer’s channel strategy with retailer’s store brand. Int. J. Prod. Res. 2021, 59, 3042–3061. [Google Scholar]

- Zhang, Y.; Huang, M.; Tian, L.; Jin, D.; Cai, G. Build or join a sharing platform? The choice of manufacturer’s sharing mode. Int. J. Prod. Econ. 2021, 231, 1–14. [Google Scholar]

- Lin, X.; Zhou, Y.W.; Xie, W.; Zhong, Y.; Cao, B. Pricing and Product-bundling Strategies for E-commerce Platforms with Competition. Eur. J. Oper. Res. 2020, 283, 1026–1039. [Google Scholar]

- Xu, Q.; He, Y. Optimal information disclosure strategies for a retail platform in the blockchain technology era. Int. J. Prod. Res. 2021, 9, 1–12. [Google Scholar]

- Yu, J.; Zhou, C.; Wang, Y.; Liu, Z. Incentive contract design for supply chain enterprise’s pollution abatement with carbon tax. Math. Probl. Eng. 2021, 2021, 5556796. [Google Scholar]

- Yu, J.; Song, Z.; Zhou, C. Self-supporting or third-party? The optimal delivery strategy selection decision for e-tailers under competition. Kybernetes 2022. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yu, J.; Zhao, J.; Zhou, C.; Ren, Y. Strategic Business Mode Choices for E-Commerce Platforms under Brand Competition. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 1769-1790. https://doi.org/10.3390/jtaer17040089

Yu J, Zhao J, Zhou C, Ren Y. Strategic Business Mode Choices for E-Commerce Platforms under Brand Competition. Journal of Theoretical and Applied Electronic Commerce Research. 2022; 17(4):1769-1790. https://doi.org/10.3390/jtaer17040089

Chicago/Turabian StyleYu, Jing, Jingjing Zhao, Chi Zhou, and Yufei Ren. 2022. "Strategic Business Mode Choices for E-Commerce Platforms under Brand Competition" Journal of Theoretical and Applied Electronic Commerce Research 17, no. 4: 1769-1790. https://doi.org/10.3390/jtaer17040089

APA StyleYu, J., Zhao, J., Zhou, C., & Ren, Y. (2022). Strategic Business Mode Choices for E-Commerce Platforms under Brand Competition. Journal of Theoretical and Applied Electronic Commerce Research, 17(4), 1769-1790. https://doi.org/10.3390/jtaer17040089