The Impact of Government Behavior on the Development of Cross-Border E-Commerce B2B Export Trading Enterprises Based on Evolutionary Game in the Context of “Dual-Cycle” Policy

Abstract

1. Introduction

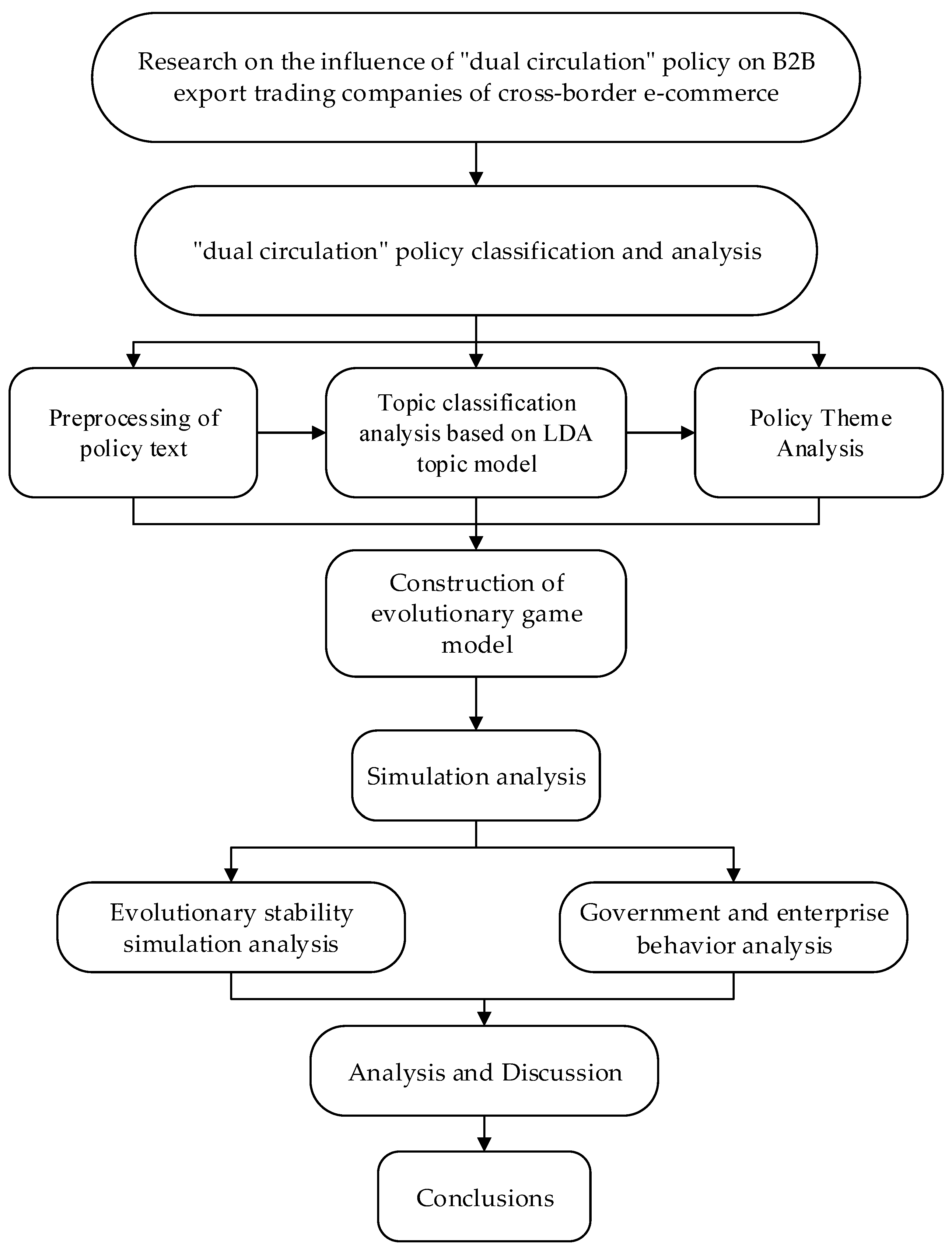

2. Research Framework

3. Analysis of Dual Circulation Policy Based on LDA Topic Model

3.1. Preprocessing of Policy Text

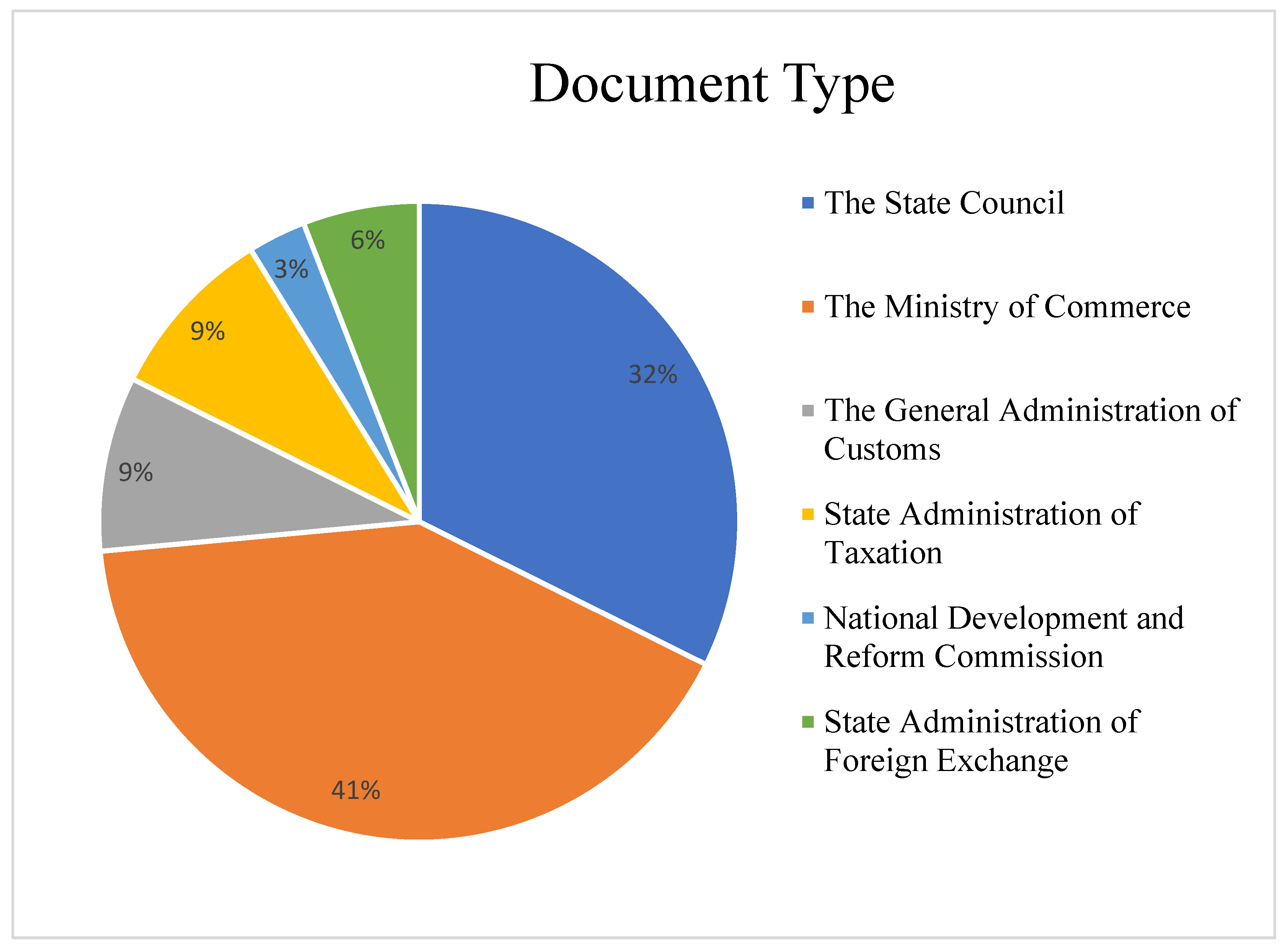

3.1.1. Data Source

3.1.2. Preprocessing Text

- (1)

- Clean the non-Chinese characters

- (2)

- Construct dictionary

- (3)

- Segment word

- (4)

- Remove stop word

3.2. Topic Classification Analysis Based on LDA Topic Model

3.2.1. High Frequency Vocabulary and Its Distribution in Policy Texts

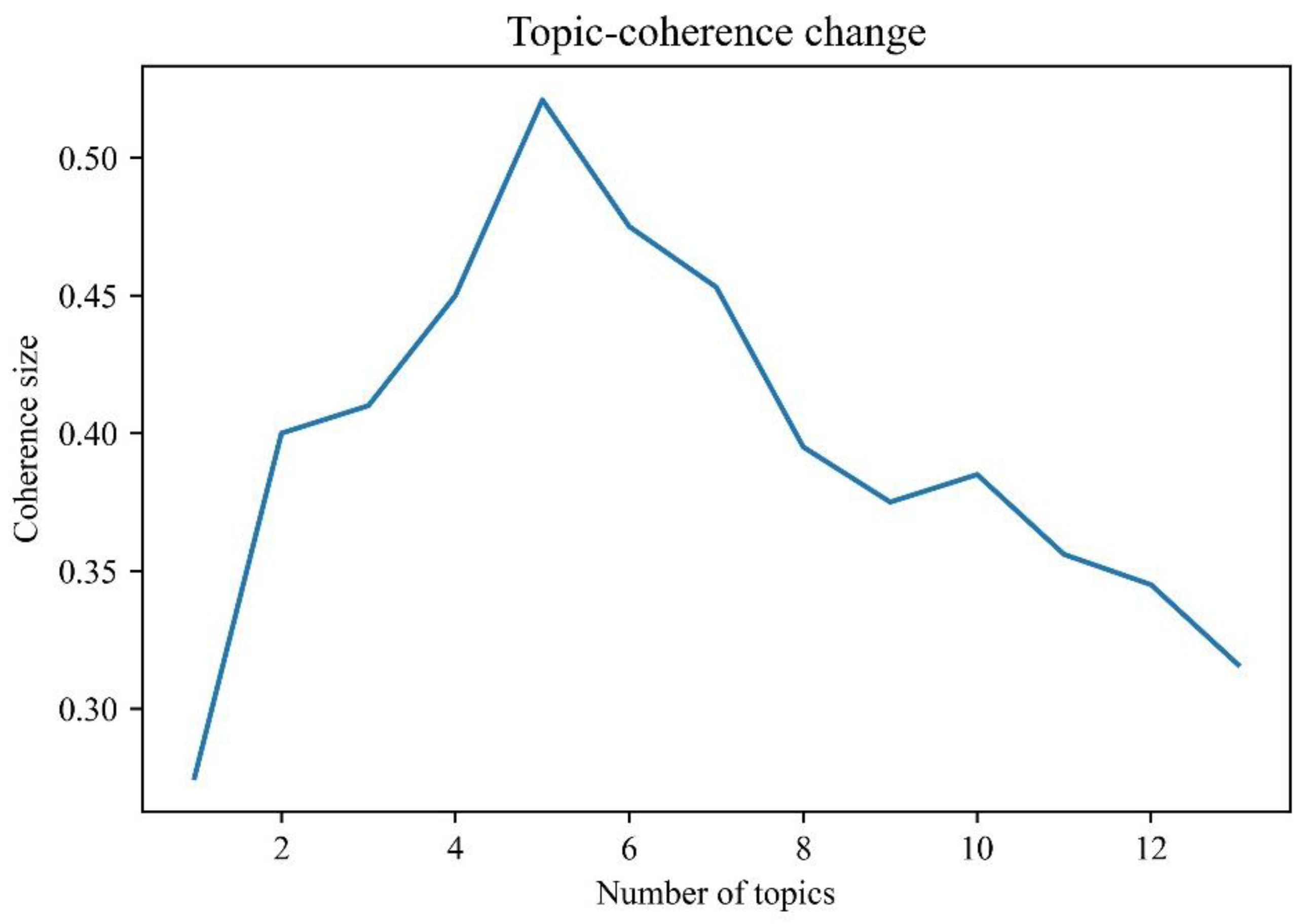

3.2.2. Determine the Optimal Number of Topics

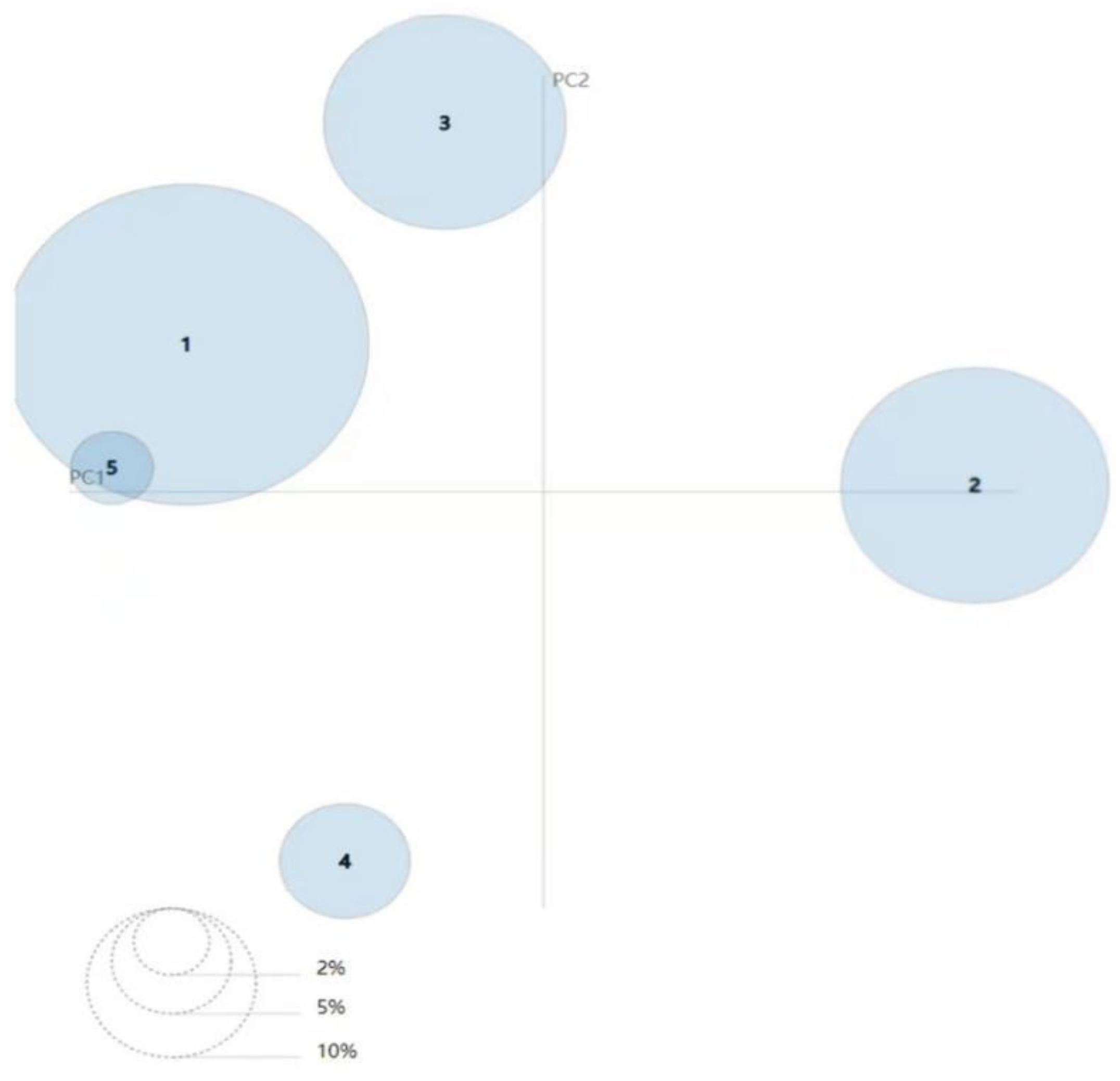

3.2.3. Determination of Topic Types

3.3. Policy Topic Analysis

4. Evolutionary Game Model between the Government and Enterprises

4.1. Analysis of the Game Relationship between Government and Enterprises

4.2. Evolutionary Game Model between Government and Enterprise

4.2.1. Basic Assumptions

4.2.2. Parameter Setting

4.2.3. Game Model Result

- (1)

- Expected benefits of the government’s choice of “support” strategy U11

- (2)

- Expected benefits of the enterprise’s choice of “participate” strategy

- (3)

- Expected benefits of the enterprise’s choice of “not participate” strategy

4.2.4. Equilibrium Point Results

- (1)

- Equilibrium point results

- (2)

- Jacobian Matrix Analysis

4.2.5. Evolutionary Stability Strategy Analysis

4.3. Simulation of the Evolutionary Game Model between Government and Enterprises

4.3.1. Evolutionary Stability Simulation Analysis

- (1)

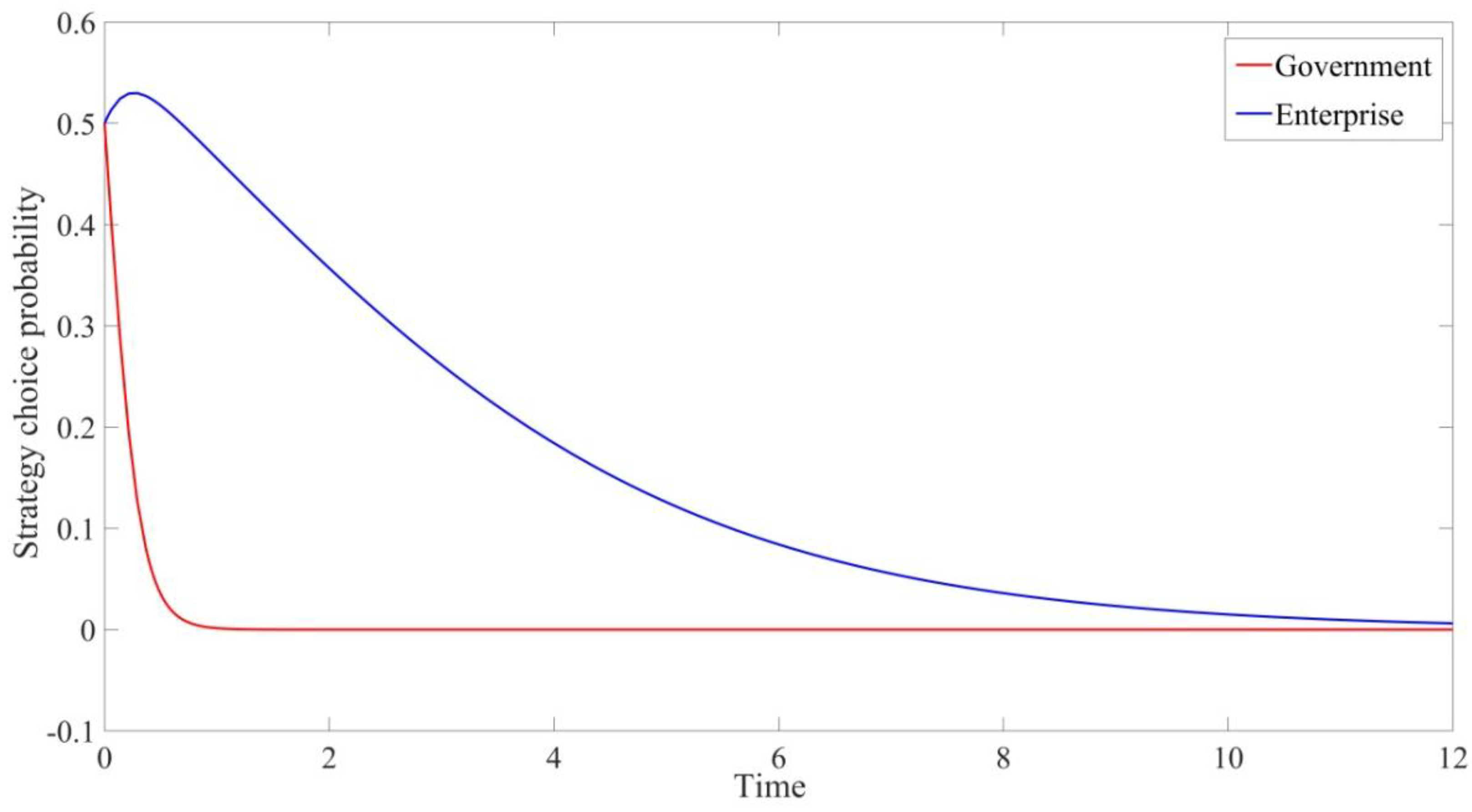

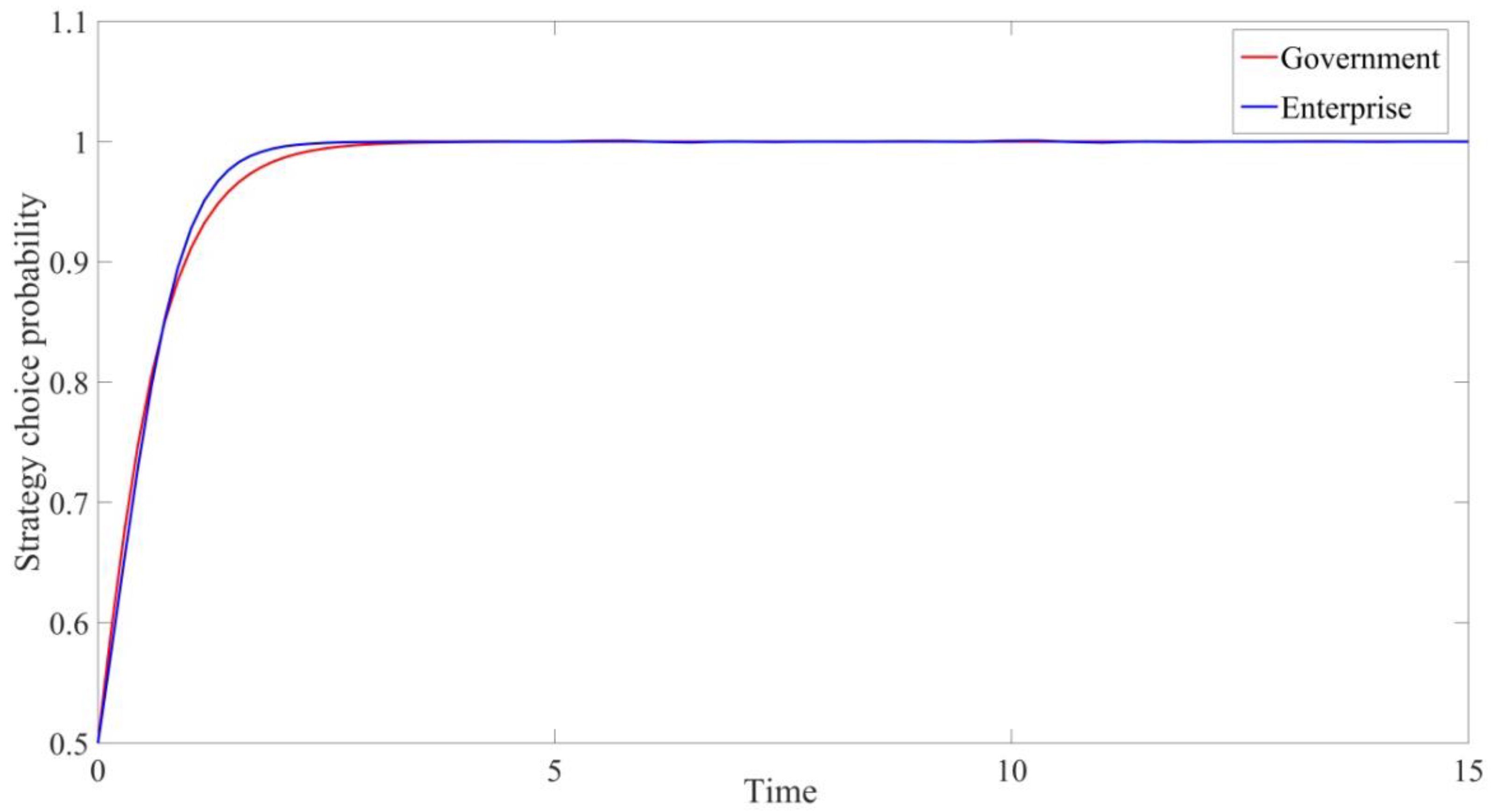

- Simulation of partial equilibrium point (0,0)

- (2)

- Simulation of partial equilibrium point (0,1)

- (3)

- Simulation of partial equilibrium point (1,0)

- (4)

- Simulation of partial equilibrium point (1,1)

4.3.2. Analysis on Government and Enterprise Behavior

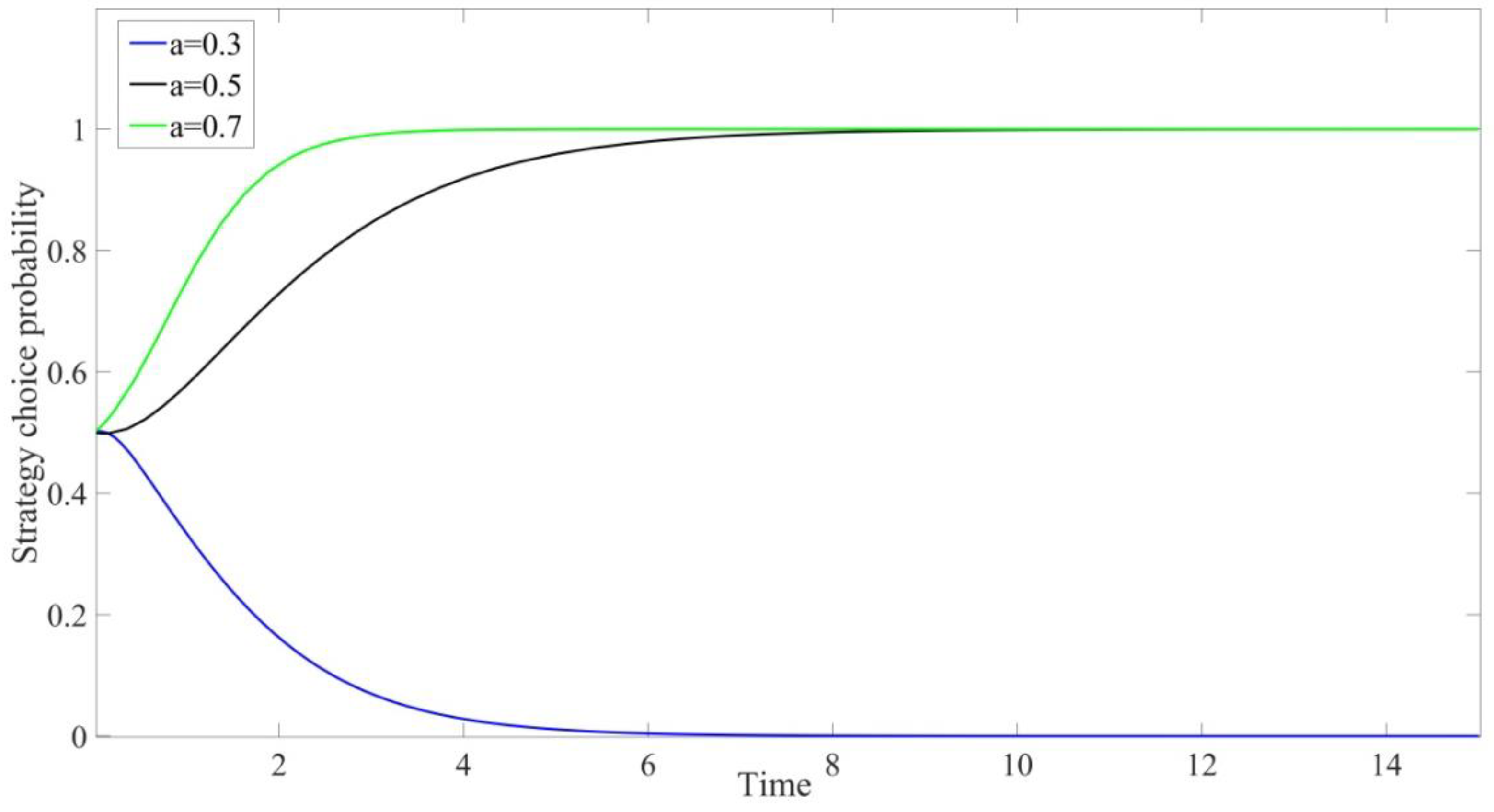

- (1)

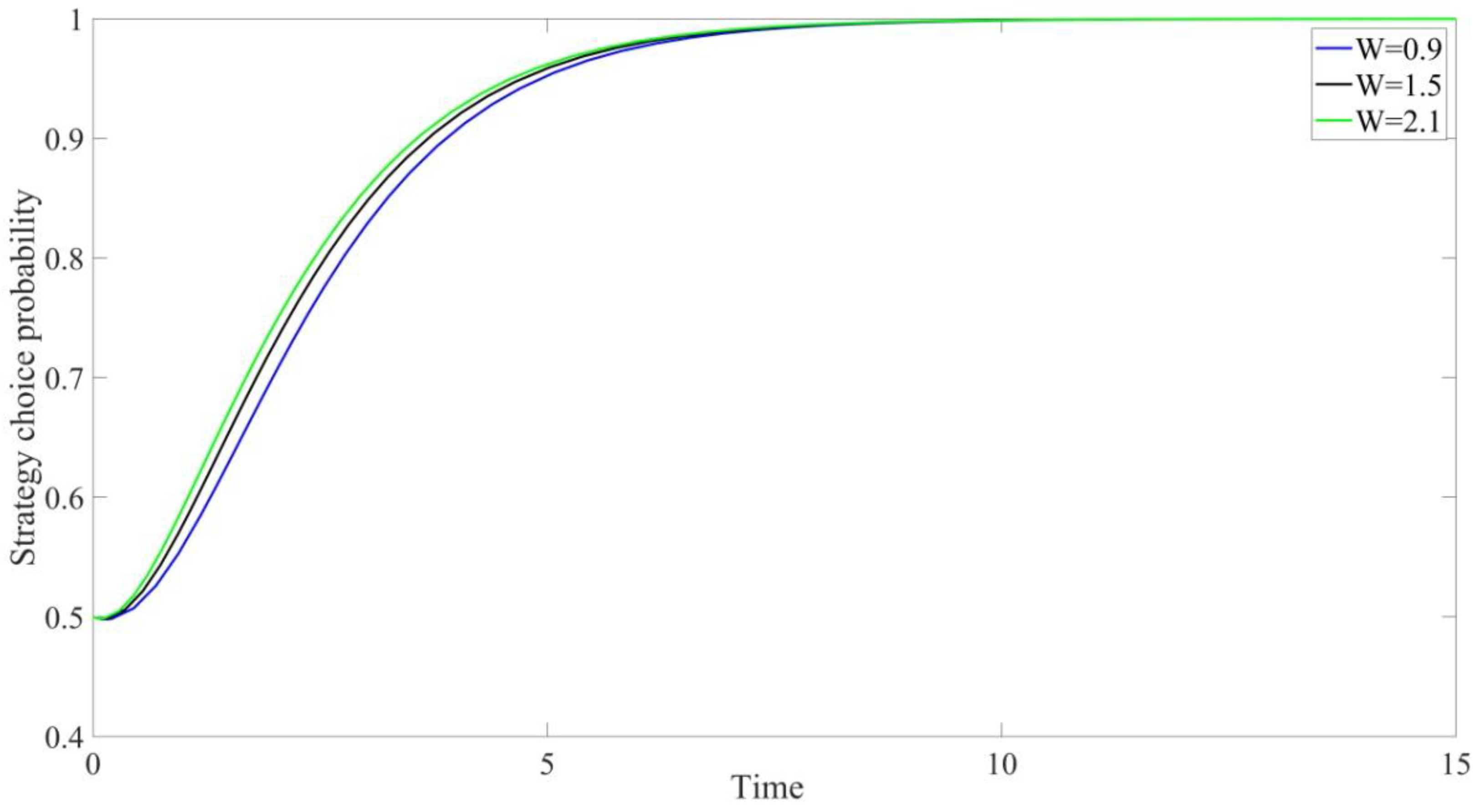

- Intensity of subsidies

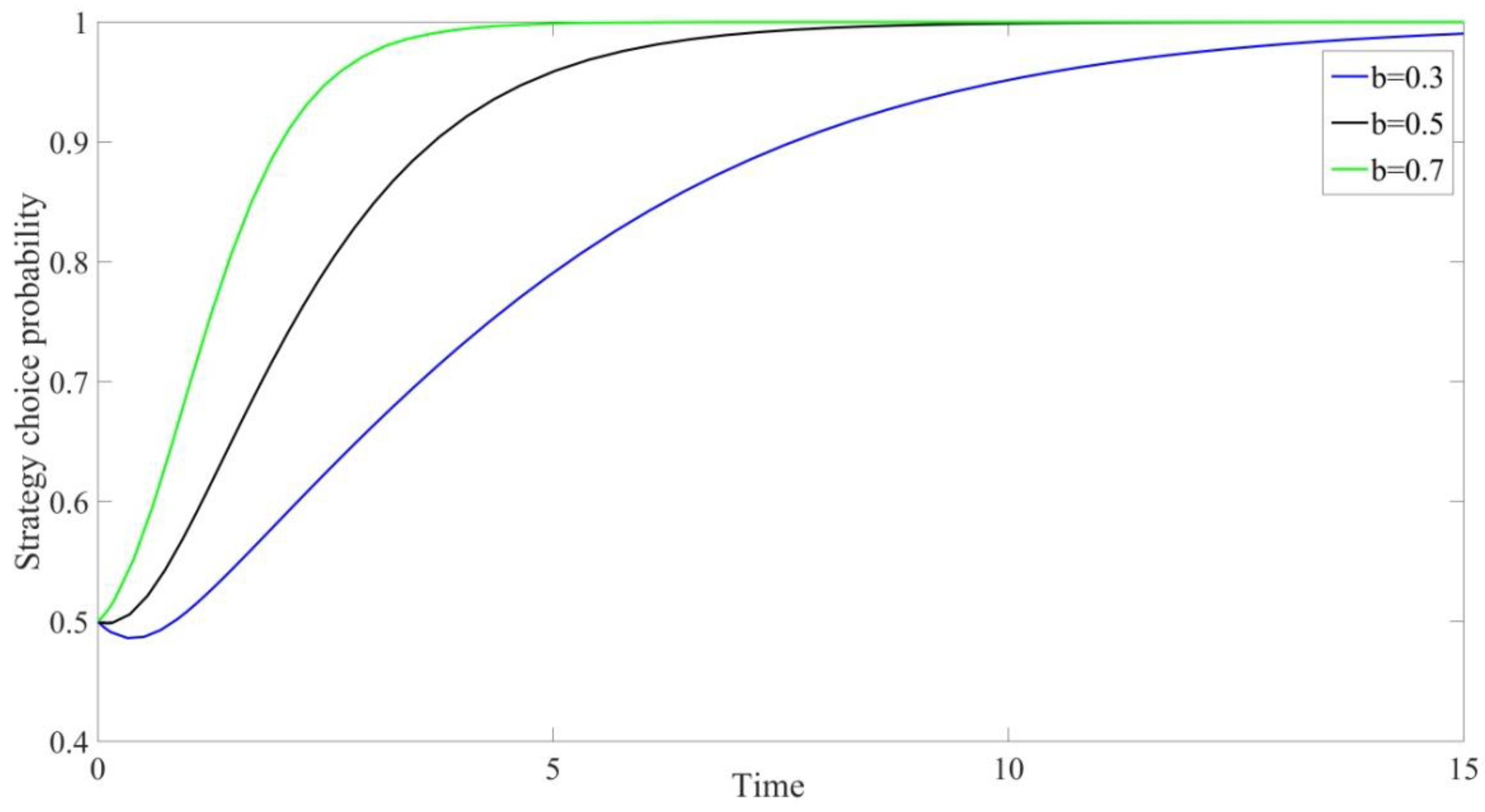

- (2)

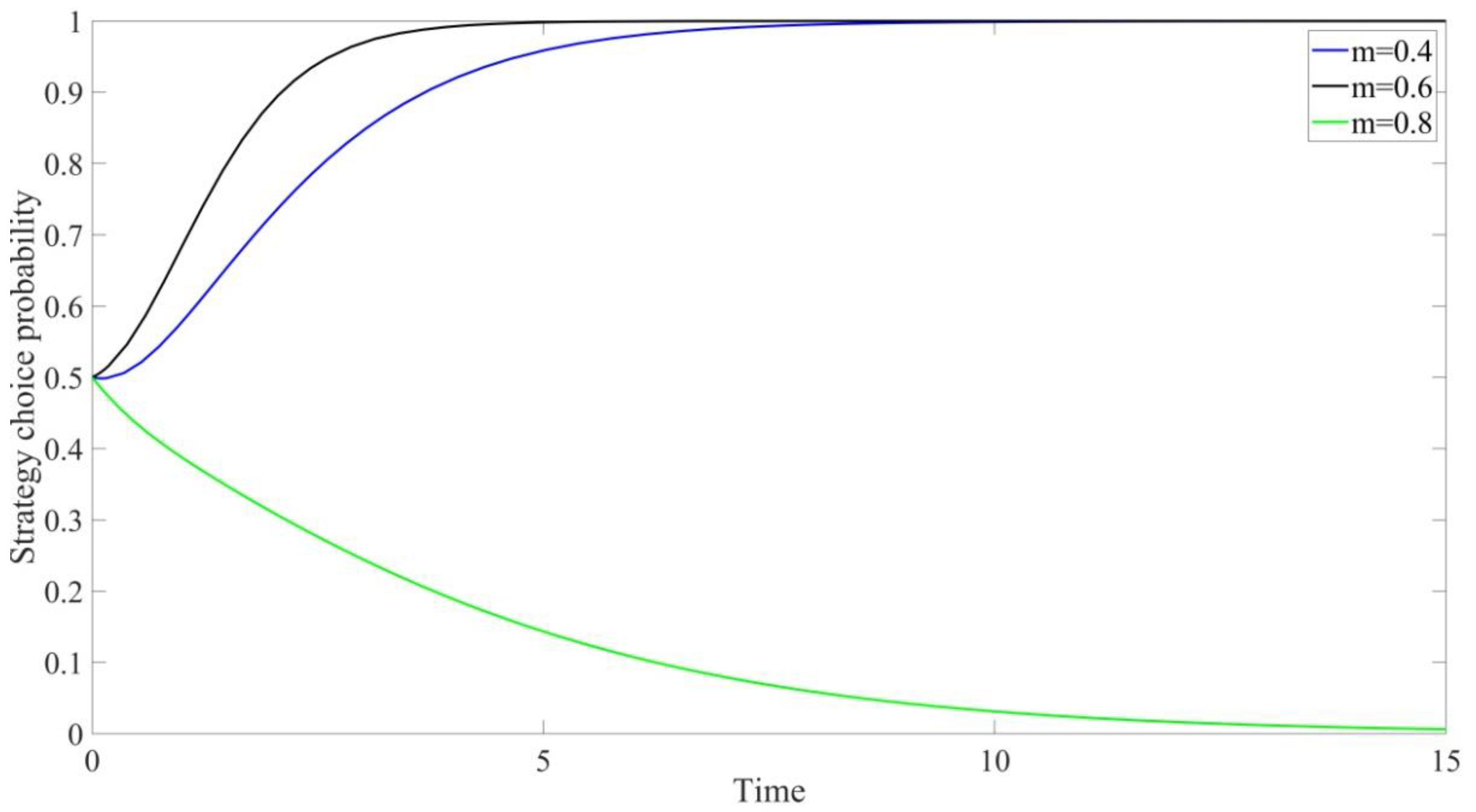

- Intensity of tax incentives

- (3)

- Intensity of investment

- (4)

- Efforts to introduce and cultivate cross-border e-commerce talent

- (5)

- Intensity of improving the payment system

- (6)

- Intensity of government supervision

5. Analysis and Discussion

5.1. Simulation Result

5.2. Limitations

6. Conclusions

- (1)

- Implement fiscal policies to promote trade growth

- (2)

- Improving the social service environment

- (3)

- Optimize supervision measures

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Yang, Y.; Ge, R. Studies on the Transformation and Upgrading of China’s Foreign Trade under the Development of Cross-border E-commerce. Front. Econ. Manag. 2021, 2, 186–191. [Google Scholar]

- Xie, G. Research on Optimizing the Business Model of Cross-border E-commerce Based on Blockchain Technology. Acad. J. Bus. Manag. 2021, 3, 71–74. [Google Scholar]

- He, Y.; Wu, R.; Choi, Y.J. International logistics and cross-border E-commerce trade: Who matters whom? Sustainability 2021, 13, 1745. [Google Scholar] [CrossRef]

- He, C.; He, W. An Empirical Analysis of the Level of Cross-border E-commerce Development on China’s Export Trade: 11 Countries in Southeast Asia as an Example. J. Simul. 2021, 9, 65. [Google Scholar]

- Ma, S.; Lin, Y.; Pan, G. Does Cross-Border E-Commerce Contribute to the Growth Convergence? An Analysis Based on Chinese Provincial Panel Data. J. Glob. Inf. Manag. JGIM 2021, 29, 86–111. [Google Scholar] [CrossRef]

- Ortiz, A.L.; Rodríguez, J.C.; Gómez, M. E-commerce Development in Europe: A Panel Data Analysis 2003–2017. Econ. Manag. 2020, 23, 89–101. [Google Scholar] [CrossRef]

- Dospinescu, O.; Dospinescu, N.; Bostan, I. Determinants of e-commerce satisfaction: A comparative study between Romania and Moldova. Kybernetes 2021, 51, 1–17. [Google Scholar] [CrossRef]

- Li, W. The Impact of Cross-Border E-Commerce Development on China’s International Trade and Economic Development. Int. J. New Dev. Educ. 2020, 2, 4–7. [Google Scholar]

- Yin, Z.H.; Choi, C.H. The effects of China’s cross-border e-commerce on its exports: A comparative analysis of goods and services trade. Electron. Commer. Res. 2021, 21, 1–32. [Google Scholar] [CrossRef]

- Du, Q.; Deng, D.; Wood, J. Differences in distance and spatial effects on cross-border e-commerce and international trade: An empirical analysis of China and One-Belt One-Road countries. J. Glob. Inf. Manag. 2021, 30, 1–24. [Google Scholar] [CrossRef]

- Chen, T.; Qiu, Y.; Wang, B.; Yang, J. Analysis of effects on the dual circulation promotion policy for cross-border e-commerce B2B export trade based on system dynamics during COVID-19. Systems 2022, 10, 13. [Google Scholar] [CrossRef]

- Weng, S.; Hao, H.; Zhang, K.; Xiao, X.; Zhong, J. The Impact of Government Policies on Small and Medium-sized Cross-border E-commerce Companies in Xiamen in the Post-epidemic Era. In Proceedings of the 1st International Symposium on Innovative Management and Economics (ISIME2021), Moscow, Russia, 2–3 June 2021; Atlantis Press: Paris, France, 2021; pp. 381–386. [Google Scholar]

- Sun, Q.; Wu, B. Evaluation on Performance of Domestic A-Share Listed Cross-Border E-Commerce Export Enterprises Based on Hierarchy Process and Grey Correlation. Math. Probl. Eng. 2022, 2022, 5902202. [Google Scholar] [CrossRef]

- Elia, S.; Giuffrida, M.; Mariani, M.M.; Bresciani, S. Resources and digital export: An RBV perspective on the role of digital technologies and capabilities in cross-border e-commerce. J. Bus. Res. 2021, 132, 158–169. [Google Scholar] [CrossRef]

- Ma, S.; Liang, Q. Industry competition, life cycle and export performance of China’s cross-border e-commerce enterprises. Int. J. Technol. Manag. 2021, 87, 171–204. [Google Scholar] [CrossRef]

- Zuo, Y. Research on China’s export cross-border e-commerce ecosystem: A case study of Dunhuang Network. In Proceedings of the IOP Conference Series: Materials Science and Engineering, Wuhan, China, 10–12 October 2019; IOP Publishing: Bristol, UK, 2019; Volume 677, p. 022012. [Google Scholar]

- Dai, H.; Wang, G. Study on the Impact of Customs and Internal Taxation Policies on Cross-border E-commerce Orientation. In Proceedings of the 2019 3rd International Conference on Education Technology and Economic Management (ICETEM2019), 30–31 July; Francis Academic Press: London, UK, 2019; pp. 637–643. [Google Scholar]

- Xu, F. Research on the Operation Mode and Optimization Strategy of Chinese Enterprises’ Cross-border E-commerce. World Sci. Res. J. 2021, 7, 178–184. [Google Scholar]

- Sandhu, K.; Duan, C.; Kotey, B. The Effects of Cross-Border E-Commerce Platforms on Transnational Digital Entrepreneurship: Case Studies in the Chinese Immigrant Community. J. Glob. Inf. Manag. 2021, 30, 1–19. [Google Scholar]

- Chen, N.; Yang, Y. The impact of customer experience on consumer purchase intention in cross-border E-commerce-Taking network structural embeddedness as mediator variable. J. Retail. Consum. Serv. 2021, 59, 102344. [Google Scholar] [CrossRef]

- Chen, N.; Yang, J. Mechanism of government policies in cross-border e-commerce on firm performance and implications on m-commerce. Int. J. Mob. Commun. 2017, 15, 69–84. [Google Scholar] [CrossRef]

- Wang, X.; Xie, J.; Fan, Z.P. B2C cross-border E-commerce logistics mode selection considering product returns. Int. J. Prod. Res. 2021, 59, 3841–3860. [Google Scholar] [CrossRef]

- Bao, Y.; Cheng, X.; Zarifis, A. Exploring the Impact of Country of Origin Image and Purchase Intention in Cross-Border E-Commerce. J. Glob. Inf. Manag. 2021, 30, 1–20. [Google Scholar] [CrossRef]

- Taherdoost, H.; Madanchian, M. Empirical Modeling of Customer Satisfaction for E-Services in Cross-Border E-Commerce. Electronics 2021, 10, 1547. [Google Scholar] [CrossRef]

- Goldman SP, K.; van Herk, H.; Verhagen, T.; Weltevreden, J.W. Strategic orientations and digital marketing tactics in cross-border e-commerce: Comparing developed and emerging markets. Int. Small Bus. J. 2021, 39, 350–371. [Google Scholar] [CrossRef]

- Kaynak, E.; Tatoglu, E.; Kula, V. An analysis of the factors affecting the adoption of electronic commerce by SMEs: Evidence from an emerging market. Int. Mark. Rev. 2005, 22, 623–640. [Google Scholar] [CrossRef]

- Gomez-Herrera, E.; Martens, B.; Turlea, G. The drivers and impediments for cross-border e-commerce in the EU. Inf. Econ. Policy 2014, 28, 83–96. [Google Scholar] [CrossRef]

- Valarezo, Á.; Pérez-Amaral, T.; Garín-Muñoz, T.; García, I.H.; López, R. Drivers and barriers to cross-border e-commerce: Evidence from Spanish individual behavior. Telecommun. Policy 2018, 42, 464–473. [Google Scholar] [CrossRef]

- Liu, L.; Peng, Q. Evolutionary Game Analysis of Enterprise Green Innovation and Green Financing in Platform SupplyChain. Sustainability 2022, 14, 7807. [Google Scholar] [CrossRef]

- Li, J.; Xu, C.; Huang, L. Evolutionary Game Analysis of the Social Co-governance of E-Commerce Intellectual Property Protection. Front. Psychol. 2022, 13, 832743. [Google Scholar] [CrossRef]

- Mimno, D.; Wallach, H.; Talley, E.; Leenders, M.; McCallum, A. Optimizing semantic coherence in topic models. In Proceedings of the 2011 Conference on Empirical Methods in Natural Language Processing, Edinburgh, UK, 27–31 July 2011; pp. 262–272. [Google Scholar]

- Akhtar, N.; Sufyan Beg, M.M.; Hussain, M. Extractive multi-document summarization using relative redundancy and coherence scores. J. Intell. Fuzzy Syst. 2020, 38, 6201–6210. [Google Scholar] [CrossRef]

- Chen, T.; Song, W.; Song, J.; Ren, Y.; Dong, Y.; Yang, J.; Zhang, S. Measuring Well-being of Blue-collar Groups in New Manners of Employment: Exampled as Hangzhou City in China. Behavioral Sciences 2022, 12, 365. [Google Scholar] [CrossRef]

- Chen, T.; Jin, Y.; Yang, J.; Cong, G. Identifying Emergence Process of Group Panic Buying Behavior under the COVID-19 Pandemic. Journal of Retailing and Consumer Services 2022, 67, 102970. [Google Scholar] [CrossRef]

- Chen, T.; Hou, P.; Wu, T.; Yang, J. The Impacts of the COVID-19 Pandemic on Fertility Intentions of Women with Childbearing age in China. Behavioral Sciences 2022, 12, 335. [Google Scholar] [CrossRef] [PubMed]

| Word Segmentation Results | Word Segmentation Results | Word Segmentation Results |

|---|---|---|

| Market regulation | cross-border | The electronic commerce |

| State Food and Drug Administration | retail | import |

| drug | The pilot | The Ministry of Finance |

| The Ministry of Commerce | The General Administration of Customs | Administration of Taxation |

| Market regulation | Import and export | regulatory |

| Customs clearance | management | audited |

| The tax policy | tariffs | rate |

| The consumption tax | The tax payable | pay |

| The State Council | data | Infrastructure construction |

| Vocabulary | Frequency | Vocabulary | Frequency |

|---|---|---|---|

| E-commerce | 1739 | Infrastructure | 558 |

| Commerce | 946 | Ministry of Finance | 551 |

| Customs | 932 | Tariff | 543 |

| Payment | 851 | Consumption | 536 |

| Logistics | 843 | Fiscal | 532 |

| Enterprise | 838 | Export | 529 |

| Cross-border | 791 | Employment | 517 |

| Talent | 752 | Information | 461 |

| State Council | 573 | Pilot zone | 438 |

| Supervision | 565 | Trade | 427 |

| Topic | Intensity |

|---|---|

| Fiscal policy | 0.36 |

| Tax policy | 0.2633 |

| Customs clearance policy | 0.24 |

| Payment policy | 0.093 |

| Talent policy | 0.0433 |

| Parameter | Definition |

|---|---|

| Financial subsidies to enterprise given by government | |

| subsidy coefficient | |

| Government’s tax incentive to enterprise | |

| Tax incentive coefficient | |

| Government’s investment in cross-border e-commerce infrastructure | |

| Government’s investment in talent introduction and cultivation | |

| Government’s investment in optimizing the payment system | |

| Government’s punishment for enterprises that engage in fraud, tax evasion, and sales of counterfeit and shoddy products | |

| Government’s supervision intensity | |

| Enterprise’s additional benefits by government’s regulation | |

| Cost when the government chooses “ignore” strategy | |

| the income obtained by the enterprise relying on the original business method | |

| Enterprise’s benefits when enterprise participate in the cross-border e-commerce B2B export trading trade | |

| Government’s benefit from participating in the cross-border e-commerce B2B export trading | |

| The cost of the enterprise participating in the cross-border e-commerce B2B export trading | |

| opportunity cost for not participating in cross-border B2B export |

| Objects | Enterprise | ||

|---|---|---|---|

| Participate (y) | not Participate (1 − y) | ||

| government | support | ||

| () | |||

| ignore | |||

| () | |||

| Partial Equilibrium Points | ||

|---|---|---|

| (0,0) | ||

| (1,0) | ||

| (0,1) | ||

| (1,1) | ||

| (, ) | 0 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Qiu, Y.; Chen, T.; Cai, J.; Yang, J. The Impact of Government Behavior on the Development of Cross-Border E-Commerce B2B Export Trading Enterprises Based on Evolutionary Game in the Context of “Dual-Cycle” Policy. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 1741-1768. https://doi.org/10.3390/jtaer17040088

Qiu Y, Chen T, Cai J, Yang J. The Impact of Government Behavior on the Development of Cross-Border E-Commerce B2B Export Trading Enterprises Based on Evolutionary Game in the Context of “Dual-Cycle” Policy. Journal of Theoretical and Applied Electronic Commerce Research. 2022; 17(4):1741-1768. https://doi.org/10.3390/jtaer17040088

Chicago/Turabian StyleQiu, Yiwen, Tinggui Chen, Jun Cai, and Jianjun Yang. 2022. "The Impact of Government Behavior on the Development of Cross-Border E-Commerce B2B Export Trading Enterprises Based on Evolutionary Game in the Context of “Dual-Cycle” Policy" Journal of Theoretical and Applied Electronic Commerce Research 17, no. 4: 1741-1768. https://doi.org/10.3390/jtaer17040088

APA StyleQiu, Y., Chen, T., Cai, J., & Yang, J. (2022). The Impact of Government Behavior on the Development of Cross-Border E-Commerce B2B Export Trading Enterprises Based on Evolutionary Game in the Context of “Dual-Cycle” Policy. Journal of Theoretical and Applied Electronic Commerce Research, 17(4), 1741-1768. https://doi.org/10.3390/jtaer17040088