Abstract

Big data discriminatory pricing behavior of service platforms frequently occurs, which affects the legitimate rights and interests of consumers as well as the healthy development of the platform economy. The SD (System Dynamics) evolutionary game model characterizing the game relationship of a big platform, small platform, and government is constructed together with its equilibrium solutions in order to analyze the regulatory dilemma and governance mechanism against big data discriminatory pricing of service platforms. This paper finds that government punishment on the behavior of big data discriminatory pricing plays a decisive role. When the government punishment is large enough, both platforms tend towards fair pricing; when the government punishment is insufficient, the big platform always tends towards discriminatory pricing. The supply chain of the service platform falls into the regulatory dilemma of big data discriminatory pricing behavior. Due to the hidden characteristics of big data discriminatory pricing and technical challenges in authentication and proof, a third party is introduced for supervision, and an SD evolutionary game model with a collaborative supervision mechanism of the government and the third party is constructed. The results show that positive supervision of the third party can effectively regulate the big data discriminatory pricing behavior of the big platform, which has specific implications for the design of the supervision mechanism against big data discriminatory pricing of service platforms.

1. Introduction

With the support of cloud computing, blockchain, artificial intelligence, and big data, the service platform has entered a period of rapid development as a new business model. It has become a new driving force for economic growth [1,2]. However, due to the opacity of big data algorithms and rules, and the information asymmetry between service platforms and consumers, the big data discriminatory pricing behavior of service platforms frequently occurs, infringing on the legitimate rights and interests of consumers, reducing the reputation of service platforms, and further restricting the sustainable, healthy and stable development of the platform economy. For example, as early as 2000, Amazon in the United States was disclosed to use big data technology to set discriminatory pricing and use personal information to charge some consumers higher prices, which was considered as an irresponsible behavior by consumers and had a huge negative impact on Amazon [3]. In 2018, many service platforms, such as Fliggy.com, dynamically adjusted their prices according to users’ search behavior [4]. Didi and Tencent Video charged different prices according to user types, which aroused strong dissatisfaction among consumers [5]. Therefore, how to govern the big data discriminatory pricing behavior in the supply chain of service platforms has become a hot topic concerning the government, consumers, and academia.

In recent years, the government in China has successively promulgated and announced relevant policies such as the Anti-Unfair Competition Law, the Regulations on Administrative Penalties for Price Violations (Draft for Comments), and the Prohibition of Unfair Competition on the Internet (Draft for Comments), which have defined the identification standards and punishment regulations for big data discriminatory pricing. These measures show that it is imperative to strengthen government supervision to curb the big data discriminatory pricing behavior of service platforms. However, due to the information disadvantage of government agencies and the high cost of regulation implementation [6,7], it is difficult for government to achieve the expected effect [8]. Therefore, Lei et al. [9] believed that consumers, as the direct victims of interests, can cooperate with the government to supervise the big data discriminatory pricing behavior of service platforms through reporting, complaining, exposure, and other rights protection methods. However, due to the opacity of big data algorithms and rules, it is difficult for consumers to judge and prove the big data discriminatory pricing behavior, which leads to the frequent occurrence of this phenomenon. In 2019, Ctrip.com was accused of using big data for discriminatory pricing; when consumers frequently searched for air tickets from their online channel, the fares would become more expensive. With the development of the market economy, some scholars [10,11,12] pointed out the benefits of third-party supervision, such as sharing the heavy task of government supervision and alleviating its pressure and deficiencies, so their cooperation can effectively safeguard the legitimate rights and interests of consumers. Therefore, a reasonable and efficient supervision and governance mechanism is needed to govern the big data discriminatory pricing behavior of service platforms to strengthen the role of third-party supervision, which is of great significance for safeguarding the legitimate rights and interests of consumers, improving the standardization and compliance of the service platforms, and promoting the healthy, sustainable, and stable development of the platform economy.

There is a major gap and contribution in the theoretical research on the prevention of big data discriminatory pricing behavior in service platforms. On the one hand, many studies related to “the prevention of big data discriminatory pricing” focus on a single platform, the government, and consumers [9,13]; however, this paper considers two asymmetric service platforms, the government, and the third party, where asymmetric service platforms means that platforms have differences in user scale, capital, technical capabilities, etc. This paper is about two platforms of different sizes. On the other hand, there are many “big data discriminatory pricing” studies, which mostly study how companies use big data discriminatory pricing to maximize their benefits [14,15] or mostly consider the issue of big data discriminatory pricing supervision from the perspective of legal regulation [16,17] and put forward a government regulation strategy with consumer participation [9,13]. These studies do not consider the recurrence of big data discriminatory pricing of the big platform, the difficulty in safeguarding the rights and interests of consumers, or the ineffectiveness of government supervision. In this study, due to the game between subjects needing to consider the time factor, we will use time-related evolutionary game theory and System Dynamics. This paper firstly constructs an evolutionary game model characterizing the competition between two asymmetric platforms under the government supervision mechanism; and then uses System Dynamics to explore the impacts of government supervision and consumer conversion rate on the platform pricing strategy. The supply chain of service platforms falls into the regulatory dilemma of incurring the big data discriminatory pricing behavior of the big platform. Further, considering the difficulty and ineffectiveness of government supervision and the professionalism of the third party, a collaborative supervision mechanism of the government and the third party is proposed to improve the effectiveness of supervision on the big data discriminatory pricing behavior.

The remainder of this paper is organized as follows. Section 2 is the literature review. Section 3 puts forward the model assumptions and construction; and then derives equilibrium outcomes under government supervision. Based on System Dynamics, Section 4 provides a numerical simulation to analyze the system stability equilibrium and parameter sensitivity under government supervision. Section 5 further introduces a collaborative supervision mechanism of the government and the third party into the above model and obtains relevant outcomes. Section 6 gives some conclusions and management implications.

2. Literature Review

There exist two main research branches related to this paper. One is about big data discriminatory pricing. The other is about the governance and supervision of the big data discriminatory pricing of platforms.

Big data discriminatory pricing means that the service platform firstly uses big data technology to collect and analyze consumer information, such as browsing records, consumption preferences, income levels, and so on; then sells the same goods or services to different consumers at different prices to earn supernormal profit [9,18]. Its essence is a kind of “price discrimination based on behavior” or differentiated pricing [19]. Fudenberg and Tirole [20,21] first proposed the concept of “price discrimination based on behavior” and pointed out that enterprises implement price discrimination against consumers based on their historical information. Since then, the discriminatory pricing strategy of using big data as a new technical means has attracted widespread attention from scholars. For example, the rationality of discriminatory pricing behavior in the context of big data is discussed from the perspective of legislation [22,23]; the competitive pricing strategies of platform enterprises, such as discriminatory pricing and unified pricing are studied [24,25], and the impact of pricing strategy on platform enterprises’ profit is analyzed through optimization modeling from the perspective of microeconomics [14,15]. The relationship between differential pricing based on consumer purchase history is explored from the perspective of technological innovation [26]; the trade-off and choice between big data discriminatory pricing and targeted marketing are discussed from the perspective of marketing [27]; the impacts of information cost [28] and incomplete rationality [29] on enterprise income, based on the discriminatory pricing strategy, are considered.

Some scholars have given suggestions on how to solve the problem of big data discriminatory pricing of the service platforms by legal regulation. Liu et al. [16] analyzed the legal regulation dilemma of big data discriminatory pricing from the Price Law, the Consumer Rights Protection Law, and other laws. Then, they put forward governance suggestions to regulate big data discriminatory pricing behavior from three ways of the current relief system in society, the applicability of the law, and the supervision on the platform. Steppe [23] analyzed whether and how the General Data Protection Regulation affects price discrimination based on the processing of personal data, and then provided a series of rights and obligations related to big data discriminatory pricing. Drechsler and Benito Sanchez [17] reviewed and compared the Data Protection Law and Anti-Discrimination Law which regulate big data discriminatory pricing, and then they put forward comprehensive recommendations to solve the problem of misalignments at the intersection of these two laws. Vedder and Naudts [30] focused on the opacity of big data algorithms and proposed an accountability mechanism to regulate the platform algorithm. However, due to the concealment of big data algorithms and the ambiguity of laws, it is difficult to achieve the expected effect by using laws to regulate big data discriminatory pricing behavior.

Evolutionary game theory combines game theory analysis with dynamic evolution process analysis [13]. The evolutionary game provides a new analytical paradigm for the study of multicycle dynamic game problems. With the development of game theory, some scholars have widely applied evolutionary games to the supervision of big data discriminatory pricing and put forward corresponding countermeasures. For example, Liu et al. [13] considered the risk aversion behavior of service platforms, established a tripartite evolutionary game model of the government, service platforms, and consumers, then studied the regulatory mechanism design to prevent the big data discriminatory pricing behavior of service platforms. Their results show that when the service platform is risk-averse, if the government does not supervise the platform, tax rates can play a good role; if the government chooses to supervise the platform, high penalties can restrain big data discriminatory pricing behavior. Wu et al. [31] established a tripartite evolutionary game model of the government, e-commerce platform, and consumers based on the prospect theory and psychological accounts considering the cooperative supervision of government and consumers, then they studied the supervision strategy of “deceptive pricing of acquaintances” used by the e-commerce platform. They found that increasing the cost reference point and government punishment and reducing the value reference point can effectively curb the “deceptive pricing of acquaintances” of the platform. Lei et al. [9] firstly discussed the game equilibrium between the big data discriminatory pricing behavior of e-commerce platforms and the choice of user consumption channels with government supervision. They pointed out that the e-commerce market would fall into the dilemma of big data discriminatory pricing and believed that consumers, as the victims of direct interests, can cooperate with the government to supervise the big data discriminatory pricing behavior of e-commerce platform. The results show that when the government punishment is insufficient, the big data discriminatory pricing behavior of the platform can be effectively restrained by the active supervision from consumers. However, the research scope is still limited. The difficulty in safeguarding the rights and interests of consumers has not yet been solved [32]. Especially when consider the opacity of big data algorithms and rules, it is difficult to identify and prove the big data discriminatory pricing behavior. The evolutionary game is an effective tool for clarifying the complex game relationship and strategy evolution path. The recurrent use of big data discriminatory pricing strategy by the service platform requires time-related research methods. Therefore, the evolutionary game tool will be used to solve the problem of regulating big data discriminatory pricing behavior of the service platform.

It can be seen that the issue of big data discriminatory pricing has been studied [14,15,20,21,22,23,24,25,26,27,28,29], its coping strategy has become the current research hotspots [16,17,30], and government supervision should be strengthened to regulate the big data discriminatory pricing of service platform [9,13,31]. However, the hidden characteristics of big data discriminatory pricing cause the difficulties in obtaining evidence, complaining, and safeguarding rights. The third-party supervision agency has more professional knowledge, technology, capital, human resources, etc., who could quickly identify the big data discriminatory pricing of the platform, and alleviate the shortage of government supervision [11]. This paper considers the difficulty in safeguarding the rights and interests of consumers, the ineffectiveness of government supervision, and the professionalism of the third party, a collaborative supervision mechanism of the government and the third party is proposed to improve the effectiveness of supervision on the big data discriminatory pricing behavior. The results show that compared with consumer participation in regulation [9], the positive supervision of the third party can effectively regulate the big data discriminatory pricing behavior of a big platform.

In summary, the innovations of this paper are given as follows. Previous studies have focus on a single platform, the government, and consumers; this paper studies two asymmetric service platforms, the government, and the third party in order to be closer to the actual situation that “the large-scale platform occupies a huge market share and the medium-sized platform occupies a minimal market share” and “the difficultly for consumers to judge and prove the big data discriminatory pricing behavior”, and explores the regulatory dilemma and governance mechanism for the platform’s big data discriminatory pricing. Moreover, the System Dynamics model is built to explore the impacts of government supervision and consumer conversion rate on the platform pricing strategy.

3. Evolutionary Game Model with Government Supervision

3.1. Model Assumptions and Construction

We consider two kinds of competition platforms, such as the large-scale service platform (referred to as “big platform”) A and the small and medium-sized service platform (referred to as “small platform”) B. The big platform has obvious advantages over the small platform in terms of user scale, capital, and technical capabilities. Both types of platforms have a certain moral hazard when making the optional pricing strategies, whether fair pricing or discriminatory pricing. The fair pricing strategy means that the service platform takes the market as the benchmark and takes the demand as the orientation to formulate a fair and reasonable price level without infringing on consumers’ legitimate rights and interests [9]. On the contrary, it is the discriminatory pricing strategy when the service platform makes discriminatory pricing against different consumers based on the big data analysis technology, the information opacity of online transaction, and its information resources [9].

Assumption 1.

The probabilities of the big platform A adopting the discriminatory pricing strategy and the fair pricing strategy, respectively, are and, satisfying; the probabilities of the small platform B adopting the discriminatory pricing strategy and the fair pricing strategy, respectively, areand, satisfying. The two platforms are rational and try to maximize their profits.

Assumption 2.

This study assumes that there are only two platforms in the market. The initial number of loyal consumers on the big platform and the small platform, respectively, areand; the total initial number of consumers who change randomly between the two platforms is, that is, the average initial number of non-loyal consumers on each platform is; the total number of potential consumers in the market is. It satisfies thatand.

Assumption 3.

Regardless of the pricing difference between the two platforms, this paper assumes that the fair pricing and the discriminatory pricing of the two platforms areand, respectively, whererepresents the marginal increase coefficient of the discriminatory pricing. The costs paid by the big platform and the small platform when adopting the discriminatory pricing strategy areandrespectively, and the costs paid by the big platform and the small platform when adopting the fair pricing strategy areand, respectively. Due to the fact that the platform adopts a discriminatory pricing strategy, it is necessary to evaluate the market, technology update, etc., and the big platform has more advantages than the small platform in terms of user scale and technical capabilities. Therefore,is satisfied.

Assumption 4.

When the platform adopts the discriminatory pricing strategy, that is, charges loyal consumer and non-loyal consumer P

, a proportion of loyal consumers will be transferred to the competitive platform, denoted as the conversion rate. When the platform adopts the fair pricing strategy, that is, charges consumers , a proportion of potential consumers will be transferred to this platform. Because the two platforms are in the same market, and the potential consumers can choose either platform if both platforms charge a fair price, so here assume that as the conversion rate, since the total conversion rate of both platforms can’t exceed one hundred percent.

Assumption 5.

Since it is difficult and infeasible for the government to punish a platform based on the quantity of consumers, similar to paper [9], assume that the government punishment on the platform for its big data discriminatory pricing behavior is, whererepresents the coefficient of government punishment andis the excess fees on loyal consumers according to the discriminatory pricing.

The big platform and the small platform compete against each other. The payment matrix of their pricing evolutionary game with the government supervision mechanism is shown in Table 1.

Table 1.

Payment matrix of the big platform and the small platform.

3.2. Evolutionary Game Equilibrium

According to the payment matrix in Table 1, the expected payoffs of the big platform when choosing the discriminatory pricing strategy and the fair pricing strategy are obtained together with the average payoff, respectively.

where represents the expected payoff of the big platform when choosing the discriminatory pricing; represents the expected payoff of the big platform when choosing the fair pricing; represents the average payoff of the big platform’s pricing behavior.

Then, the replicator dynamic equation for the big platform to choose the discriminatory pricing strategy is:

Similarly, we can obtain the expected payoffs and the average payoff of the small platform (similarly denoted as , and ), then build the replicator dynamic equation for the small platform to choose the discriminatory pricing strategy. Since the payment matrix has a symmetrical structure, we can obtain from , when substitute for , for , for , and for . We have:

Denoted as the additional profit obtained by the big platform adopting the discriminatory pricing strategy from the loyal consumers who still choose the big platform. Denoted as the profit loss of the big platform that compares to the fair pricing, the discriminatory pricing strategy leads to the loss of some loyal consumers and potential consumers. When considering the small platform, we can denote and , which have a similar meaning of the big platform. Then, the replicator dynamic equations of the discriminatory pricing strategy for the big platform and the small platform are as follows:

Proposition 1.

There exist four partial equilibrium points, which are,,,and no mixed strategy in the evolutionary game.

Proof of Proposition 1.

According to the stability theorem of differential equations, the replicator dynamic Equation (6) should be satisfied that and . Obviously, , , and are the partial equilibrium of the system.

3.3. Evolutionary Game Stability Analysis

The replicator dynamic Equation (6) are analyzed by the analysis of the Jacobian matrix. Firstly, solve the partial derivatives of Equation (6) about and in turn, then the Jacobian matrix is obtained as:

According to the theory proposed by Friedman [33], the following two conditions must be satisfied simultaneously: ① the trace of the Jacobian matrix is less than 0, that is, ; ② the determinant of the Jacobian matrix is greater than 0, that is, . Then, the equilibrium point of replicator dynamic equation is the system evolutionary stability strategy (ESS). Therefore, the four partial equilibrium points , (0,1), , and are substituted into , , and respectively, and the results are shown in Table 2.

Table 2.

Specific values at the partial equilibrium point.

Proposition 2.

There are four cases: ① If and , the system exists evolutionary stability strategy , namely (fair pricing, fair pricing); ② If and , the system exists evolutionary stability strategy , namely (fair pricing, discriminatory pricing); ③ If and , the system exists evolutionary stability strategy , namely (discriminatory pricing, fair pricing); ④ If and , the system exists evolutionary stability strategy , namely (discriminatory pricing, discriminatory pricing).

Proof of Proposition 2.

According to the theory proposed by Friedman [33], only the equilibrium point of the system satisfies both and is the evolutionary stability strategy (ESS). Based on and , it can be seen from Table 2 that only when and , there is an ESS in the system. Consider four cases in Proposition 2, there exist four system evolutionary stability strategies , , , and respectively. Thus, the stability analysis of the system equilibrium point in four cases can be obtained, as shown in Table 3.

Table 3.

Stability analysis of the system equilibrium point under different cases.

The above stability analysis shows that the different value of additional profit and the sum of profit loss and government punishment when the platform adopts the discriminatory pricing strategy has a decisive influence on the evolutionary game equilibrium, i.e., the price-decision of the big platform and the small platform. The specific results are as follows:

- (1)

- When the additional profit brought by the discriminatory pricing of both platforms is less than the sum of their profit loss and government punishment, that is, and , the system evolves towards a stable point . At this time, the big platform chooses to charge consumers a fair price. Since the small platform does not have obvious advantages in user scale, capital, and technical capacities compared with the big platform, the small platform will also choose a fair price.

- (2)

- When the additional profit brought by the discriminatory pricing of the big platform is less than the sum of its profit loss and government punishment, and the additional profit brought by the discriminatory pricing of the small platform is greater than the sum of its profit loss and government punishment, that is, and , the system evolves towards a stable point . The big platform chooses to price consumers fairly, and the small platform chooses to price consumers discriminatively.

- (3)

- When the additional profit brought by the discriminatory pricing of the big platform is greater than the sum of its profit loss and government punishment, and the additional profit brought by the discriminatory pricing of the small platform is less than the sum of its profit loss and government punishment, that is, and , the system evolves towards a stable point . At this time, because both platforms will weigh the gains and losses, the big platform chooses to price consumers discriminatively, and the small platform chooses to price consumers fairly.

- (4)

- When the additional profit brought by the discriminatory pricing of both platforms is greater than the sum of their profit loss and government punishment, that is, and , the system evolves towards a stable point . Both platforms will choose the discriminatory pricing strategy for profit-maximization.

4. Numerical Simulation under Government Supervision

4.1. Simulation Analysis of System Stability Equilibrium

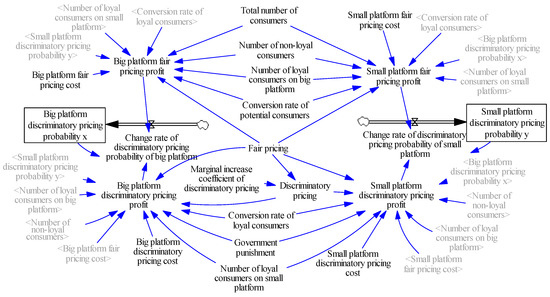

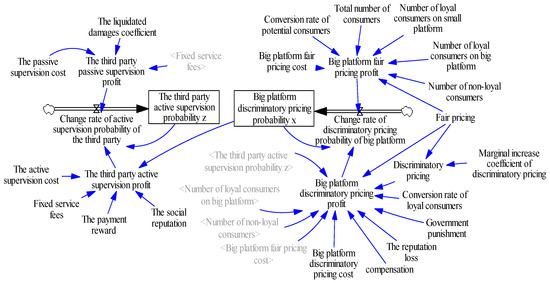

System Dynamics is an effective tool to analyze the complex system of evolutionary game. With the help of the Vensim software analysis tool, the System Dynamics model for pricing behavior of two asymmetric service platforms under the government supervision mechanism is constructed based on the above evolutionary game system analysis, as shown in Figure 1.

Figure 1.

The System Dynamics model with the government supervision mechanism.

In Figure 1, two rate equations (change rate of discriminatory pricing probability of big platform and small platform) are the same as Equations (4) and (5), two profit functions (big platform discriminatory pricing profit and small platform discriminatory pricing profit) are the same as , and . The magnitude selection of initial parameter values does not affect the results of the evolutionary game. Under the premise of satisfying , , , , and , this paper analyzes the impact of different values of the additional profit (), the profit loss (), and the government punishment on the system stability. The initial proportion pair has nothing to do with the result of equilibrium. Consider two situations corresponding to two pairs of the initial proportions of big platforms and small platforms that choose discriminatory pricing as . Then the numerical simulation is carried out using Vensim software to explore and verify the evolution trend for the pricing behavior of the two platforms under the government supervision mechanism in four cases mentioned in Section 3.3. Therefore, the government punishment is mainly changed here.

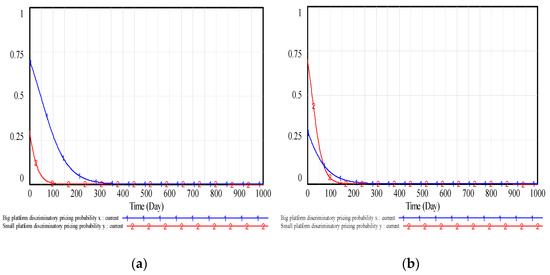

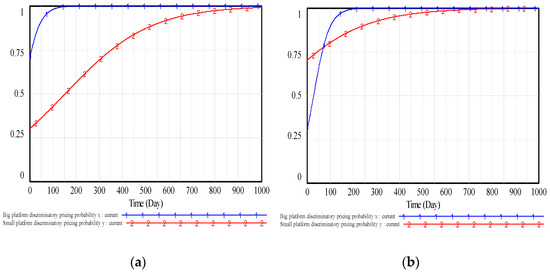

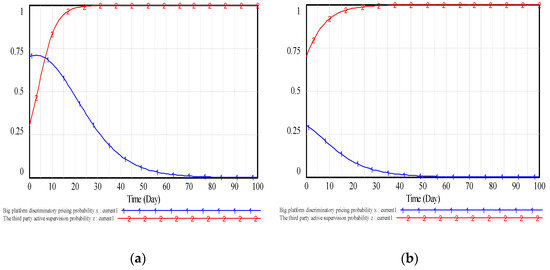

(1) Let the initial values of model parameters as , , , , , , , , , , , and , and then it can be calculated that , , , and . So, the conditions of and (i.e., case ①) are satisfied, the meaning and formulas are the same as those in Section 3. The dynamic evolution paths of the game are shown in Figure 2. It shows that the evolutionary equilibrium of the game tends to , i.e., both types of platforms will choose a fair pricing strategy.

Figure 2.

The dynamic evolution paths of case ①. (a) The initial proportion pair of both types of platforms is . (b) The initial proportion pair of both types of platforms is .

In this case, the government penalty for discriminatory pricing is higher than the net profits brought by both types of platforms adopting discriminatory pricing. The equilibrium result has reached an ideal evolutionary stable state, that is, both types of platforms will choose the fair pricing strategy. In addition, the convergence rate of the small platform choosing fair pricing is faster than that of the big platform, that is, as long as the big data discriminatory pricing behavior of the big platform is curbed, the big data discriminatory pricing behavior of the small platform can be prevented. Therefore, the government urgently needs to improve the corresponding laws and regulations to restrict big data discriminatory pricing behavior, improve its recognition rate, then impose severe punishment on the platform. The punishment for big data discriminatory pricing should exceed the extra net profits that the platform obtains from discriminatory pricing; then the discriminatory pricing will not happen. It will protect the legitimate rights and interests of consumers, and promote the healthy development of the platform economy.

(2) Let the initial values of model parameters as , , , , , , , , , , , and , and then it can be calculated that , , , and . Without loss generality, in order to obtain stable evolutionary equilibrium in this case, the and is also changed here. Now, the conditions of and (i.e., case ②) are satisfied. The dynamic evolution paths of the game are shown in Figure 3. It shows that the evolutionary equilibrium of the game is , which means that the big platform chooses a fair pricing strategy and the small platform chooses a discriminatory pricing strategy.

Figure 3.

The dynamic evolution paths of case ②. (a) The initial proportion pair of both types of platforms is . (b) The initial proportion pair of both types of platforms is .

This does not usually happen because the positive network externality in the platform economy results in “the head platform occupies a huge market share and the general competitive platform occupies a minimal market share”. For example, according to the market data in 2019, the combined market share of Internet delivery platforms “Meituan” and “Ele.me “ was 92.8%, and the combined market share of online retail platforms “Alibaba” and “JD “ was 72.6%. The market concentration is relatively high, and the market is highly oligopolistic. The big platform has apparent advantages over the small platform in user scale, capital, and technical capabilities. Therefore, if the small platform makes a discriminatory price higher than the fair price of its competitive big platform, the loyal consumers and potential consumers of the small platform will transfer to the big platform. It will significantly reduce the scale and profit of the small platform, which takes a discriminatory pricing strategy. Compared with case ①, only when government punishment is reduced to a certain threshold and the number of loyal consumers on the small platform increases to a certain threshold, the fair pricing of the big platform and the discriminatory pricing of the small platform will appear. Case ② is a special case.

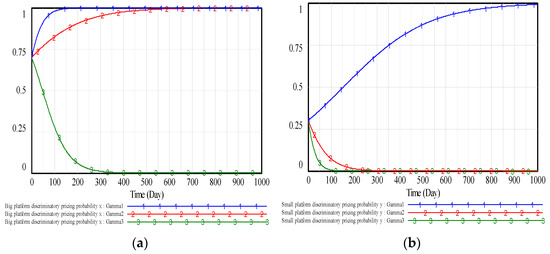

(3) Let the initial values of model parameters as , , , , , , , , , , , and , and then it can be calculated that , , , and . So, the conditions of and (i.e., case ③) are satisfied. The dynamic evolution paths of the game are shown in Figure 4. It shows that the evolutionary equilibrium of the game is . Finally, the big platform chooses a discriminatory pricing strategy and the small platform chooses a fair pricing strategy.

Figure 4.

The dynamic evolution paths of case ③. (a) The initial proportion pair of both types of platforms is . (b) The initial proportion pair of both types of platforms is .

Currently, this case is a common phenomenon in the service platform market. On the one hand, the conversion rate of loyal consumers is low (), consumers have high stickiness to the platform, and consumption habits have been formed. Moreover, due to the opacity of big data algorithms and rules, the behavior of discriminatory pricing based on big data is difficult to be found. On the other hand, when the government penalty is higher (lower) than the extra net profits that the small (big) platform obtains from the discriminatory pricing, the big data discriminatory pricing behavior of a big platform, that has a large user base and positive network externality, will become rampant. It damages the legitimate rights and interests of consumers and hinders fair competition in the market.

(4) Let the initial values of model parameters as , , , , , , , , , , , and , and then it can be calculated that , , , and . So, the conditions of and (i.e., case ④) are satisfied. The dynamic evolution paths of the game are shown in Figure 5. The final evolutionary stability strategy of the system is . Therefore, both types of platforms will tend to choose a discriminatory pricing strategy.

Figure 5.

The dynamic evolution paths of case ④. (a) The initial proportion pair of both types of platforms is . (b) The initial proportion pair of both types of platforms is .

As we know, different consumers have different preferences to the platform used, and there exists cost when consumers switch from one platform to another. If there lacks an adequate supervision mechanism such as inaction or lower punishment of the government () on the discriminatory pricing of the platform, both types of platforms have an opportunistic tendency to carry out discriminatory pricing for extra profits. It will damage the legitimate rights and interests of consumers and affect the healthy development of the platform economy. Fortunately, in recent years, more and more actions and policies have been taken to curb the big data discriminatory pricing behavior in the Internet platform market. Governments have announced the Anti-Unfair Competition Law, the Prohibition of Unfair Competition on the Internet (Draft for Comments), and the Regulations on Administrative Penalties for Price Violations (Draft for Comments), and so on, which define the identification standards and punishment regulations for big data discriminatory pricing behavior and safeguard the legitimate rights and interests of counterparties in the transaction. To a certain extent, the big data discriminatory pricing behaviors have been effectively restrained.

4.2. Sensitivity Analysis of System Parameters

Similar to Section 4.1, we can take the parameter sensitivity analysis by fixing the value of other parameters and only changing the value of one parameter based on Vensim software simulation in different cases. Simply, we only consider the initial proportion pair , and let the initial values of model parameters be the same as those in case ④ for Figure 5a, so the stable equilibrium point of the system is . Since the main factors which affect whether the platform adopts the discriminatory pricing strategy are the government punishment coefficient, the conversion rate of loyal consumers, and the conversion rate of potential consumers, we change the value of the government punishment coefficient , the conversion rate of loyal consumers , and the conversion rate of potential consumers respectively, so as to analyze their affection on the system equilibrium.

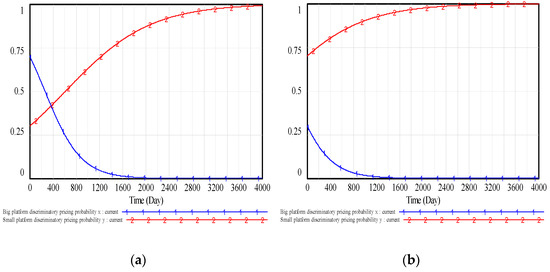

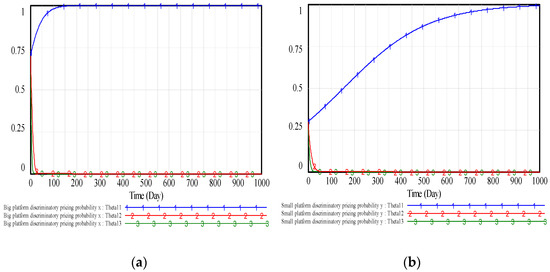

(1) Fix the value of other parameters, let the government punishment coefficient , and , then take the System Dynamic simulation of evolutionary game, respectively. The results are shown in Figure 6.

Figure 6.

System simulation results of the sensitivity analysis to . (a) The impact of on the big platform discriminatory pricing probability . (b) The impact of on the small platform discriminatory pricing probability .

Figure 6 shows that with the increase of the government punishment coefficient , the rate of both types of platforms choosing discriminatory pricing is slowed down and will finally be zero, so the government punishment has important affection on discriminatory pricing. Combine (a) with (b), the results show that both types of platforms will finally choose a fair pricing strategy (discriminatory pricing strategy) when the government punishment coefficient is large enough (too small), corresponding to the case (), that is, the government punishment on the discriminatory pricing of the platform is greater (less) than the extra net profit that each platform obtains from the discriminatory pricing. When the government punishment coefficient is moderate, corresponding to the case , that is, the government punishment on the discriminatory pricing of the platform is greater than the extra net profit that the small platform obtains from the discriminatory pricing but less than the extra net profit that the big platform obtains, the big platform will choose discriminatory pricing strategy, and the small platform will choose fair pricing strategy.

(2) Fix the value of other parameters, let the conversion rate of loyal consumers , and , then take the System Dynamic simulation of the evolutionary game, respectively. The results are shown in Figure 7.

Figure 7.

System simulation results of the sensitivity analysis to . (a) The impact of on the big platform discriminatory pricing probability . (b) The impact of on the small platform discriminatory pricing probability .

Figure 7 shows that with the increase in the conversion rate of loyal consumers, more and more initial loyal consumers of the platform who performs discriminatory pricing will turn to the competitive platform, which will significantly affect the profit and pricing behavior of the platform; therefore, the system equilibrium will evolve to fair pricing.

(3) Fix the value of other parameters, let the conversion rate of potential consumers , and , then take the System Dynamic simulation of the evolutionary game, respectively. The results are shown in Figure 8.

Figure 8.

System simulation results of the sensitivity analysis to . (a) The impact of on the big platform discriminatory pricing probability . (b) The impact of on the small platform discriminatory pricing probability .

Figure 8 shows that with the increase in the conversion rate of potential consumers, more and more potential consumers in the market will choose the platform that adopts a fair pricing strategy, along with the loss of the platform that performs discriminatory pricing. So, the system equilibrium will involve to fair pricing strategy.

5. Evolutionary Game Model with Collaborative Supervision of the Government and Third-Party

According to the aforementioned analysis, improving the conversion rate of consumers and government punishment can curb the big data discriminatory pricing behavior of platforms. The Chinese government has promulgated and announced relevant policies such as the Anti-Unfair Competition Law, the Prohibition of Unfair Competition on the Internet, and the Regulations on Administrative Penalties for Price Violations. But it has not achieved the expected effect in some ways because of the hidden characteristics of big data discriminatory pricing behavior due to the difficulties in safeguarding consumers’ rights and obtaining the evidence needed for government punishment. Therefore, there is a regulatory dilemma. Lei et al. [9] have studied the cooperation of consumers and the government to supervise the big data discriminatory pricing behavior of platforms. But consumers have disadvantage in information about the platform, and it is difficult for them to safeguard their rights. The third-party supervision agency has more professional knowledge, technology, capital, human resources, etc. Some scholars [10,11,12] have pointed out the benefits of introducing third-party supervision, such as sharing the heavy task of government supervision, alleviating the pressure and deficiency of government supervision, and cooperating with the government to safeguard the rights and interests of consumers. Thus, a third-party supervision agency is introduced to the evolutionary game model with the government mentioned in Section 3; the collaborative supervision mechanism of the government and the third party is studied as follows.

Since the big platform has more possibility and willingness to choose discriminatory pricing strategy than the small platform, we only consider the collaborative supervision mechanism of the government and third-party on the big platform. The third-party supervision agency has two alternative strategies: active supervision and passive supervision. Active supervision means that the third-party supervision agency actively investigates and supervises the big data discriminatory pricing behavior of the big platform by using its technology and professional knowledge, and accepts the entrustment of consumers to protect their rights through media exposure and legal prosecution. Passive supervision means that the third-party supervision agency holds a passive and inactive attitude towards the big data discriminatory pricing behavior of the big platform, and gets no initiative and insufficient resources in supervision. When the third-party supervision agency performs passive supervision, only government regulation will have an impact on the big data discriminatory pricing behavior of the big platform. When the third-party supervision agency performs active supervision, the big platform, which chooses the big data discriminatory pricing strategy, has to pay a certain amount of compensation to consumers and face a specific reputation loss . The mechanism of fixed fee plus reward and punishment is performed between the consumers (principal) and the third party (agent), which means consumers need to pay fixed service fees (or commissions) to the third party for the entrustment, who will also get the reward after successful supervision. The cost of active supervision is , including the purchase cost of advanced cloud technology and survey equipment, labor costs of professional supervision, and rights protection personnel, and so on; the cost of passive supervision is , satisfying because the resource investment and supervision action are insufficient. In addition, the active supervision will bring a certain social reputation to the third party. However, if the passive supervision is carried out, the liquidated damage will be paid to consumers by the third party, where is the ratio to characterize the degree of punishment on the third party because of its passive supervision behavior. Similar to Section 3.1 and Table 1, we obtain the payment matrix of the big platform and the third party under the collaborative supervision mechanism of the government and the third-party, which is shown in Table 4, where there is no in the payment equation of the big platform since represents loyal consumers who have transferred from the small platform to the big platform, and no loyal consumers will transfer from the small platform to the big platform because the small platform performs the fair pricing strategy.

Table 4.

Payment matrix of the big platform and the third party.

Similar to Section 3.2, the final replicator dynamic equations of the discriminatory pricing strategy for the big platform and the active supervision strategy for the third party can be obtained from Table 4:

According to Equations (8), the Jacobian matrix of the evolutionary game is:

Proposition 3.

Under the premise of strong government punishment (), only whenandhold, there exists unique evolutionary stability equilibriumof the system.

Proof of Proposition 3.

When and hold, substitute and in Equation (9), we have: , , and , it can be obtained that and , so is the evolutionary stability equilibrium. The stability analysis of other equilibrium points under these conditions is shown in Table 5.

Table 5.

Stability analysis of each equilibrium point.

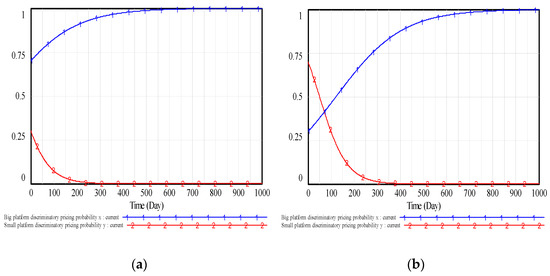

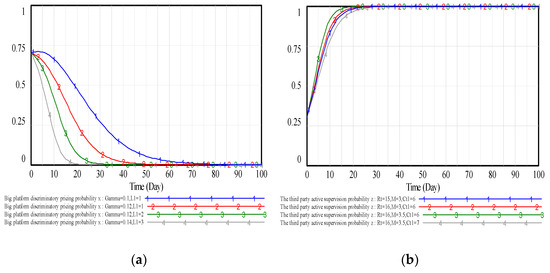

Similarly, the System Dynamics model with the collaborative supervision of the government and the third party is constructed, as shown in Figure 9, and numerical simulation is carried out to explore the evolution process of the big platform.

Figure 9.

The System Dynamics model with the collaborative supervision mechanism of the government and the third party.

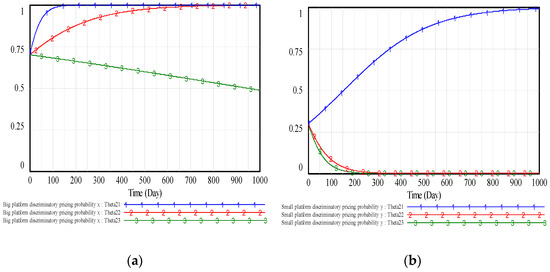

According to Proposition 2, when , the big platform will choose the discriminatory pricing strategy if there only exists government punishment. Now, further consider the supervision of the third party. According to Proposition 3, and should be held. In order to compare with case ③ in Section 4.1, let , , , , , , , , , , , , , , , , , , , and . Set two pairs of the initial proportions of the big platform who chooses discriminatory pricing and the third party who chooses active supervise behavior as . The dynamic evolution paths are shown in Figure 10.

Figure 10.

The evolution paths of stability point . (a) The initial proportion pair of the big platform and the third party is . (b) The initial proportion pair of the big platform and the third party is .

As can be seen from Figure 10, in the early stage, there exist some big platforms implementing big data discriminatory pricing because the government punishment is not large enough to offset the extra net profits brought by the discriminatory pricing. But when the more third-party supervision agencies adopt the active supervision strategy, the more the big data discriminatory pricing behaviors of the big platform will be frequently exposed and reported by the third party, and more big platforms will turn to adopt the fair pricing strategy in consideration of the loss of reputation and profits. Finally, the system evolution stability equilibrium tends to , which means that the big platform will choose the fair pricing strategy, and the third party will adopt the active supervision strategy.

Next, perform the parameter sensitivity analysis. Fix the value of other parameters, let the government punishment coefficient and reputation loss , firstly analyze government punishment coefficient and reputation loss , which affect the decision of big platform; let the fixed service fee, social reputation and active supervision cost , then analyze fixed service fee (or commission) , social reputation and active supervision cost , which affect the decision of the third party. The evolution stability trend of the big platform and the third party is shown in Figure 11.

Figure 11.

The parameter sensitivity analysis. (a) The impact of and on the strategy choice of the big platform. (b) The impact of , , and on the strategy choice of the third party.

As can be seen from Figure 11a, the government punishment coefficient and reputation loss are both negatively correlated with the probability of the big platform who perform the big data discriminatory pricing, so the combined effect of government punishment and reputation loss accelerates the evolution speed of the big platform from discriminatory pricing to fair pricing. As can be seen from Figure 11b, the probability of the third party who choose active supervision is promoted by fixed service fees and social reputation , while bearing the negative affects of the active supervision cost . The difference between positive effect and negative effect affects the behavior of the third party. There exists one positive feedback that the more motivated the third party is to supervise and expose the big data discriminatory pricing behavior of big platform, which actively safeguards the legitimate rights and interests of consumers, then the third party improves its image and obtains more benefits, which in turn promotes the third party to supervise big platform actively.

6. Conclusions

6.1. Main Conclusions

The problem of big data discriminatory pricing has affected the development of the platform economy. This paper firstly constructs an evolutionary game model with a government supervision mechanism to characterize the competition and pricing decisions of the big platform and the small platform. Then, we analyze its system stable equilibrium and carry out a numerical simulation combined with System Dynamics to explore the choice of pricing strategies of both types of platforms under four cases. The sensitivity analysis of parameters is performed. There exists a regulatory dilemma for the government because of high supervision cost and hidden information of the platform. On this basis, different from the previous studies on the big data discriminatory pricing of platforms based on consumers cooperating with the government [9,13,31], this paper puts forward the collaborative supervision mechanism of the government and the third party to solve the regulatory dilemma. Through the analysis of the equilibrium, the following important conclusions are obtained.

Firstly, under the government supervision mechanism, we find that the government punishment has a deterrent effect on big data discriminatory pricing behavior of the service platform and curbs it partly. However, if the government punishment is insufficient, the deterrent effect of the government punishment on the big service platform is unsuccessful in some way because of its large user base and positive network effect, the big service platform often chooses not to immediately engage in big data discriminatory pricing and waits for the right time to carry out big data discriminatory pricing. Therefore, the big data discriminatory pricing of big service platform frequently occurs.

Secondly, under the government supervision mechanism, improving the conversion rate of consumers from the discriminatory pricing platform to fair pricing platform can also effectively regulate the big data discriminatory pricing behavior of the platform. Some scholars [9,13,31] have proposed that consumers should participate in the supervision of platforms. However, there exists a regulatory dilemma that it is difficult for consumers to collect evidence and prove the big data discriminatory pricing behavior of platforms during their reporting and safeguarding rights [32]. Therefore, the third-party supervision agency should be introduced to cooperate with the government to supervise the big data discriminatory pricing behavior of big platforms. The results show that compared with consumer participation in regulation [9], the positive supervision of the third party can effectively regulate big data discriminatory pricing behavior of the big platform.

Thirdly, the combined effect of government punishment and reputation loss of a platform can significantly inhibit the big data discriminatory pricing behavior of a big platform. So, when the third party actively participates in the supervision, it will relieve the pressure on the government and cover the inadequate capability of consumers, thus solving the regulatory dilemma. At the same time, the pressure from public opinion and reputation loss will force the big platform to choose a fair pricing strategy.

Finally, whether the third party performs active supervision depends on the supervision cost and its revenue, such as service fees and social reputation. The greater the revenue is than the supervision cost, the more motivated the third party is to choose active supervision.

6.2. Main Contributions

The main contributions of this study are shown in the following three aspects. Firstly, from a theoretical perspective, unlike previous studies [9,13,31] on preventing the big data discriminatory pricing behavior in service platforms, which advocated consumers to participate in government supervision of platforms, this study gives a new perspective by considering that the third party cooperates with the government to supervise the big data discriminatory pricing of platforms. Compared with consumers, the third-party supervision agency has more professional knowledge, technology, capital, and human resources, etc. In addition, this study provides theoretical support under a new situation, including two asymmetric service platforms, the government, and the third party, where asymmetric service platform means that platforms have differences in user scale, capital, technical capabilities, etc. This study is about two platforms of different sizes.

Secondly, unlike the previous evolutionary game studies [9,13,31], this study considers consumer transfer behavior and carries out an analysis of pricing behavior on two asymmetric service platforms. Combined with System Dynamics, this study provides a numerical simulation to analyze the system stability equilibrium and parameter sensitivity.

Thirdly, from the practical perspective, on the one hand, the research under the government supervision mechanism in this study can provide the government with an effective reference for policy decisions. This study finds that the deterrence of the government punishment can push the service platform not to choose the big data discriminatory pricing, however, when the government punishment is insufficient, the big platform always tends to discriminatory pricing. The supply chain of service platforms falls into the dilemma of incurring the big data discriminatory pricing behavior of the big platform when only relying on government punishment; other measures are required. On the other hand, the research under the collaborative supervision of the government and the third party in this study can provide some references for the supervision mechanism design of the big data discriminatory pricing behavior in service platforms. This study shows that compared with consumer participation in regulation [9], the positive supervision of the third party can effectively regulate big data discriminatory pricing behavior of the big platform. Therefore, a new mode of collaborative supervision between the government and the third party should be formed to cope with the difficulty in safeguarding the rights and interests of consumers, the ineffectiveness of government supervision, and fully apply the professionalism of the third party.

6.3. Main Implications and Research Limitations

In brief, the governance of big data discriminatory pricing behavior requires the joint participation of the government, platforms, the third party, and consumers, so as to ensure the healthy, sustainable and stable development of the platform economy. Firstly, the punishment can be used under government supervision. A high punishment can prevent the service platform from using big data discriminatory pricing, but it is not always the higher the better. Excessive punishment cannot significantly shorten the time spent for the service platform to choose fair pricing, and the small platform may be squeezed out of the market, giving the big platform a competitive advantage. Thus, the measures taken by the government should make the platform think that the government is not too harsh, which is conducive to the development of platform enterprises. Specifically, the government should improve the laws, regulations, and regulatory regimes constantly, adjust the economic punishment mechanism in a timely and appropriate manner, increase the punishment on the platform for its big data discriminatory pricing behavior, and improve the deterrence of law enforcement. Appropriate positive publicity should be offered to the platforms that operate in compliance to formulate the platform’s industry benchmark. Secondly, the platform must establish a correct business philosophy, eliminate price fraud consciously and maintain a fair competitive environment. Furthermore, the supply chain of service platforms can establish the integrity of the system and form an industry convention for reasonable collection and utilization of big data and algorithm technology, and encourage the platforms to supervise each other for joint compliance. Finally, consumers should raise their awareness of rights protection, entrust the third party to supervise the big data discriminatory pricing behavior of the platform with an appropriate reward and punishment mechanism. The cooperation of the government and the third party can overcome the regulatory dilemma. All these measures and suggestions will promote the standardization and compliance of a platform operation, and safeguard the legitimate rights and interests of consumers.

Certainly, the essence of the game model constructed in this paper is a two-party evolutionary game, and the design of the supervision mechanism is relatively simple. The game model of multi parties, including the big platform, the small platform, the third party, the government, and consumers, and the merchants on the platform need further studying in the future. Since the simulation values are carried out under simulated conditions, there may be deviations in the effectiveness of the behavior analysis of the game participants of the platform’s “big data discriminatory pricing”. Future research should collect relevant data and carry out empirical analysis to further improve the relevant research on the prevention of big data discriminatory pricing behavior in service platforms. In addition, future work can also study the impact of behaviors, such as the consumer’s fairness concern behavior, on platform decisions. The supervision mechanism should be further detailed into practical operation.

Author Contributions

Conceptualization, Q.L.; data curation, Q.L.; formal analysis, Q.L.; supervision, B.X.; validation, Q.L.; writing-original draft, Q.L.; writing-review and editing, B.X. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Natural Science Foundation of China (grant number 72161028), by the 2017 Major Projects of the Key Research Base of Humanities and Social Sciences of the Ministry of Education (grant number 17JJD790012), by the 2021 Nanchang University Degree and Postgraduate Education and Teaching Reform Research Project (NCUYJSJG-2021-014), and by the 2020 Jiangxi Provincial Postgraduate Innovation Special Fund Project (grant number YC2020-B018).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

The authors are grateful to the editors and the anonymous referees for their constructive and thorough comments, which helps to improve our paper.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Mair, J.; Reischauer, G. Capturing the dynamics of the sharing economy: Institutional research on the plural forms and practices of sharing economy organizations. Technol. Forecast. Soc. Chang. 2017, 125, 11–20. [Google Scholar] [CrossRef]

- Eisenmann, T.; Parker, G.; Van Alstyne, M.W. Strategies for two-sided markets. Harv. Bus. Rev. 2006, 84, 92–101. [Google Scholar]

- Streitfeld, D. On the web price tags blur: What you pay could depend on who you are. The Washington Post, 27 September 2000. [Google Scholar]

- Sina Technology. Available online: https://tech.sina.com.cn/i/2018-10-08/doc-ifxeuwws1971869.shtml (accessed on 11 May 2022).

- CSDN Information. Available online: https://www.huxiu.com/article/266330.html?h_s=f4 (accessed on 11 May 2022).

- Gino, F.; Gu, J.; Zhong, C.B. Contagion or restitution? When bad apples can motivate ethical behavior. J. Exp. Soc. Psychol. 2009, 45, 1299–1302. [Google Scholar] [CrossRef]

- Shen, L.; Chen, Y.; Fan, R.; Wang, Y. Government supervision on explosive enterprises’ immoral behaviors in e-commerce enterprises: An evolutionary game analysis. Complexity 2021, 2021, 6664544. [Google Scholar] [CrossRef]

- Anic, I.D.; Škare, V.; Milaković, I.K. The determinants and effects of online privacy concerns in the context of e-commerce. Electron. Commer. Res. Appl. 2019, 36, 100868. [Google Scholar] [CrossRef]

- Lei, L.C.; Gao, S.; Chen, R.X. How to solve the problem of big data killing: Evolutionary game in e-commerce market based on collaborative supervision of government and consumers. J. Syst. Manag. 2021, 30, 664–675. [Google Scholar]

- Deaton, B.J. A theoretical framework for examining the role of third-party certifiers. Food Control 2004, 15, 615–619. [Google Scholar] [CrossRef]

- Fu, S.H.; Shi, K.R. Evolutionary game analysis of regulatory dilemma in online car-hailing and optimizing policy. Econ. Probl. 2019, 12, 8–15+51. [Google Scholar]

- Xu, R.; Wang, Y.; Wang, W.; Ding, Y. Evolutionary game analysis for third-party governance of environmental pollution. J. Ambient Intell. Humaniz. Comput. 2019, 10, 3143–3154. [Google Scholar] [CrossRef]

- Liu, W.H.; Long, S.S.; Xie, D.; Liang, Y.J.; Wang, J.K. How to govern the big data discriminatory pricing behavior in the platform service supply chain? An examination with a three-party evolutionary game model. Int. J. Prod. Econ. 2021, 231, 107910. [Google Scholar] [CrossRef]

- Li, F.; Du, T.C.T.; Wei, Y. Offensive pricing strategies for online platforms. Int. J. Prod. Econ. 2019, 216, 287–304. [Google Scholar] [CrossRef]

- Liang, L.; Tian, L.; Xie, J.P.; Xu, J.H.; Zhang, W.S. Optimal pricing model of car-sharing: Market pricing or platform pricing. Ind. Manag. Data Syst. 2021, 121, 594–612. [Google Scholar] [CrossRef]

- Liu, Z.X.; He, W.D.; Chen, W.C.; Zhu, Z.R.; Zhou, Y. Legal dilemma and way out in the environment of “Big data discriminatory pricing”. Adv. Soc. Sci. Educ. Humanit. Res. 2022, 631, 639–642. [Google Scholar]

- Drechsler, L.; Benito Sanchez, J.C. The price is (not) right: Data protection and discrimination in the age of pricing algorithms. Eur. J. Law Technol. 2018, 9, 1–23. [Google Scholar]

- Gillis, T.B.; Spiess, J.L. Big data and discrimination. Univ. Chic. Law Rev. 2019, 86, 459–488. [Google Scholar]

- Botta, M.; Wiedemann, K. To discriminate or not to discriminate? Personalized pricing in online markets as exploitative abuse of dominance. Eur. J. Law Econ. 2020, 50, 381–404. [Google Scholar] [CrossRef]

- Fudenberg, D.; Tirole, J. Upgrades, tradeins, and buybacks. RAND J. Econ. 1998, 29, 235–258. [Google Scholar] [CrossRef]

- Fudenberg, D.; Tirole, J. Customer poaching and brand switching. RAND J. Econ. 2000, 31, 634–657. [Google Scholar] [CrossRef]

- Woodcock, R.A. Big data, price discrimination, and antitrust. Hastings Law J. 2016, 68, 1371–1420. [Google Scholar] [CrossRef]

- Steppe, R. Online price discrimination and personal data: A General Data Protection Regulation perspective. Comput. Law Secur. Rev. 2017, 33, 768–785. [Google Scholar] [CrossRef]

- Kodera, T. Discriminatory pricing and spatial competition in two-sided media markets. BE J. Econ. Anal. Policy 2015, 15, 891–926. [Google Scholar] [CrossRef]

- Chen, Y.J.; Zenou, Y.; Zhou, J. Competitive pricing strategies in social networks. RAND J. Econ. 2018, 49, 672–705. [Google Scholar] [CrossRef]

- Nuccio, M.; Guerzoni, M. Big data: Hell or heaven? Digital platforms and market power in the data-driven economy. Compet. Chang. 2019, 23, 312–328. [Google Scholar] [CrossRef]

- De Corniere, A.; De Nijs, R. Online advertising and privacy. RAND J. Econ. 2016, 47, 48–72. [Google Scholar] [CrossRef]

- Esteves, R.B.; Cerqueira, S. Behavior-based pricing under imperfectly informed consumers. Inf. Econ. Policy 2017, 40, 60–70. [Google Scholar] [CrossRef]

- Xiao, M. Supervision strategy analysis on price discrimination of e-commerce company in the context of big data based on four-party evolutionary game. Comput. Intell. Neurosci. 2022, 2022, 2900286. [Google Scholar] [CrossRef]

- Vedder, A.; Naudts, L. Accountability for the use of algorithms in a big data environment. Int. Rev. Law Comput. Technol. 2017, 31, 206–224. [Google Scholar] [CrossRef]

- Wu, B.; Cheng, J.; Qi, Y.Q. Tripartite evolutionary game analysis for “Deceive acquaintances” behavior of e-commerce platforms in cooperative supervision. Phys. A Stat. Mech. Its Appl. 2020, 550, 123892. [Google Scholar] [CrossRef]

- Xing, G.S.; Lu, F.; Luo, D.T. An evolution simulation analysis of e-commerce big data-based price discrimination under government supervision. J. Hunan Univ. Technol. 2021, 35, 65–72. [Google Scholar]

- Friedman, D. Evolutionary games in economics. Econom. J. Econom. Soc. 1991, 59, 637–666. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).