Blockchain Technology Adoption in Supply Chain Finance

Abstract

:1. Introduction

- RQ1: How does the perceived usefulness of blockchain technology resolve the issue of trust and transaction validity in the SCF process?

- RQ2: How does the perceived ease of use of blockchain technology solve the automation problem in SCF?

2. Literature Review

2.1. The Development of Supply Chain Finance

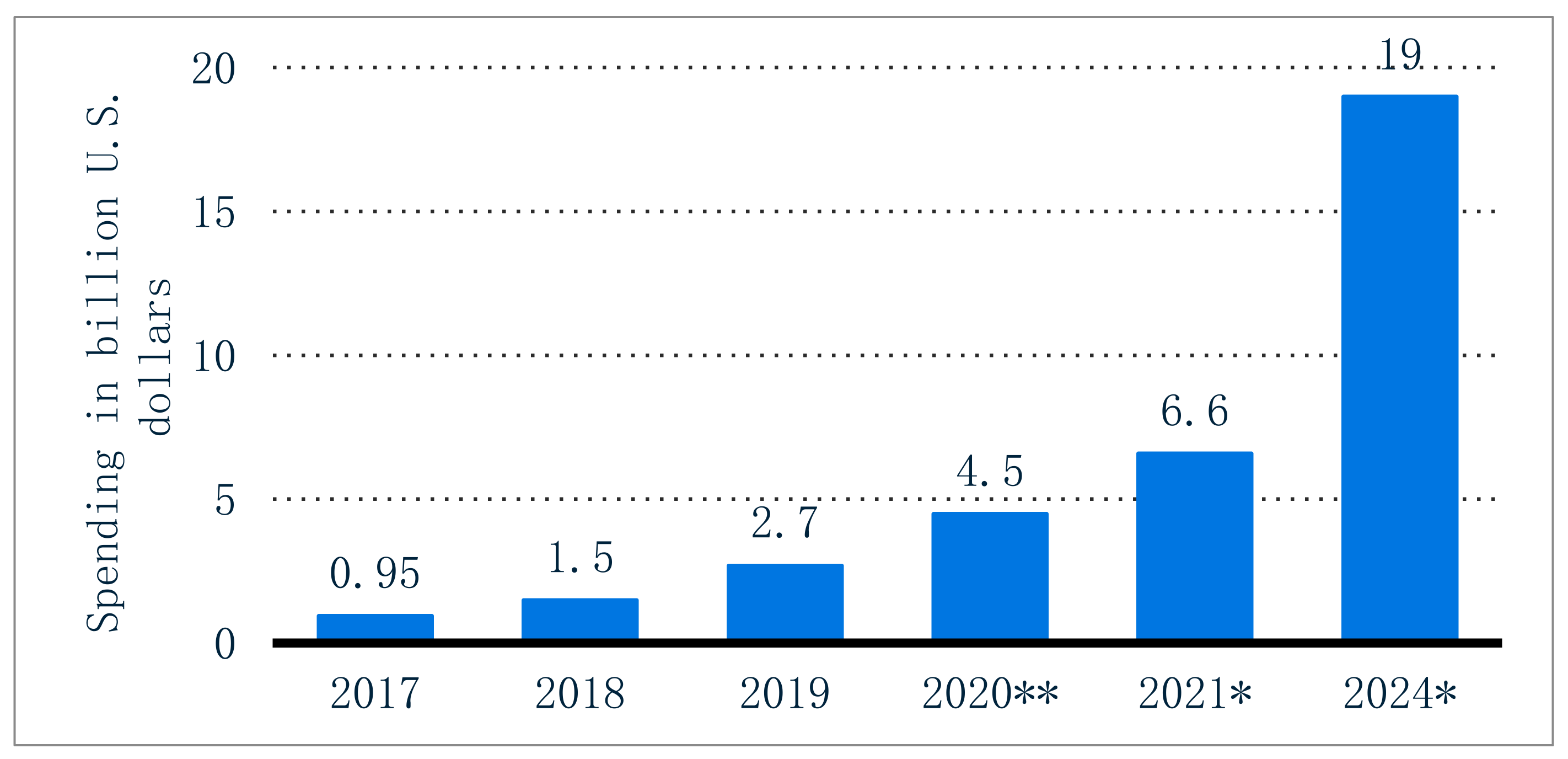

2.2. Blockchain Technology Potential Adoption in SCF

2.3. Technology Adoption Model of Blockchain Technology: TAM

3. Research Methodology

4. Results

4.1. Blockchain Technology Adoption in SCF: TAM

4.2. Perceived Usefulness: Blockchain Technology Overcomes SCF Problems

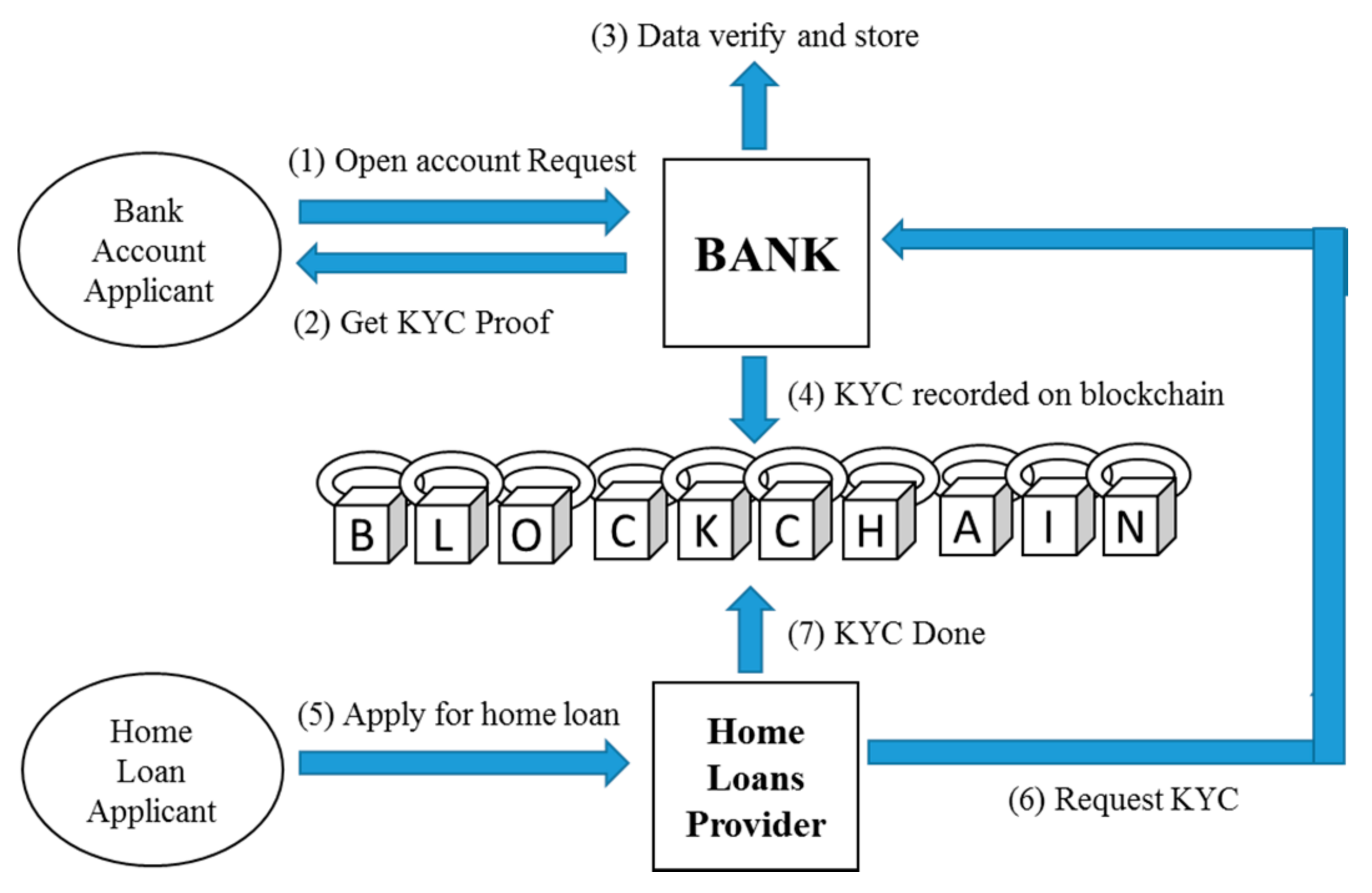

4.2.1. Blockchain Usefulness for Compliance Requirements (KYC) Problem

4.2.2. Blockchain Usefulness for Accounting Rules and Treatments Problem

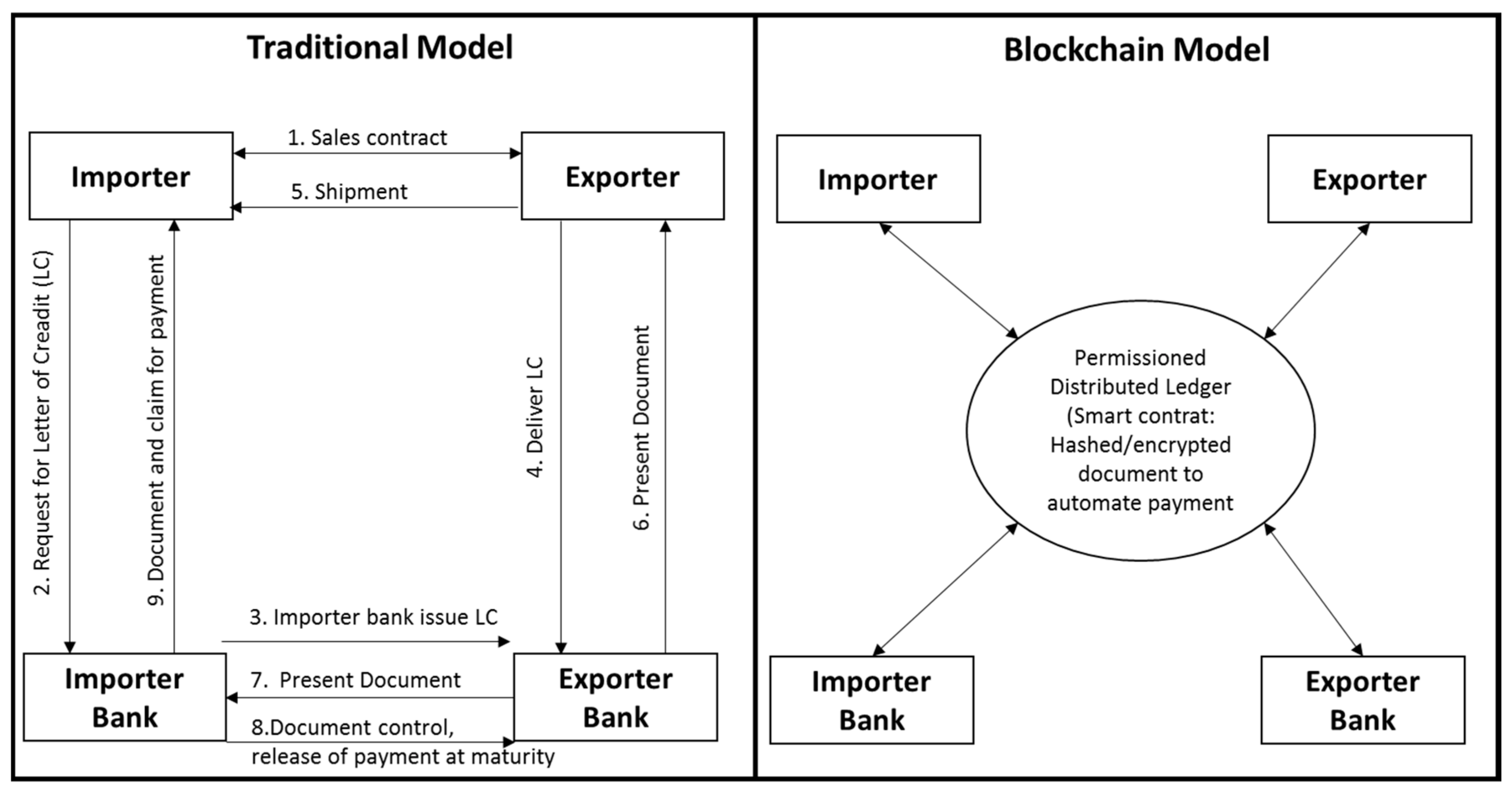

4.2.3. Blockchain Usefulness for Issuance, Clearing and Settlement Problem

4.3. Perceived Ease of Use: Blockchain Simplifies the Process of Inventory Financing, Purchase Order Financing and Receivables Financing

4.3.1. Blockchain Simplifies Inventory Financing

4.3.2. Blockchain Simplifies Purchase Order Financing

4.3.3. Blockchain Simplifies Receivables Financing

5. Discussion

6. Conclusions

Funding

Acknowledgments

Conflicts of Interest

References

- Hofmann, E. Supply Chain Finance—Some Conceptual Insights. In Logistik Management; Springer: Berlin, Germany, 2005; pp. 203–214. [Google Scholar] [CrossRef]

- Hofmann, E.; Belin, O. Supply Chain Finance Solutions; SpringerBriefs in Business; Springer: Berlin/Heidelberg, Germany, 2011; ISBN 978-3-642-17565-7. [Google Scholar]

- Hofmann, E.; Zumsteg, S. Win-Win and No-Win Situations. In Supply Chain Finance: The Case of Accounts Receivable Programs; Taylor & Francis: London, UK, 2016; Volume 16, pp. 30–50. [Google Scholar] [CrossRef]

- Klapper, L. The Role of Factoring for Financing Small and Medium Enterprises. J. Bank. Financ. 2006, 30, 3111–3130. [Google Scholar] [CrossRef] [Green Version]

- Klapper, L.F.; Laeven, L.; Rajan, R. Trade Credit Contracts; Oxford University Press: Oxford, UK, 2011. [Google Scholar]

- Bryant, C.; Camerinelli, E. Supply Chain Finance European Market Guide Supply Chain Finance EBA European Market Guide; Euro Banking Association (EBA): Paris, France, 2013; Available online: https://www.abe-eba.eu/media/azure/production/1544/eba-market-guide-on-supply-chain-finance-version-20.pdf (accessed on 11 June 2021).

- Gelsomino, L.M.; Mangiaracina, R.; Perego, A.; Tumino, A. Supply Chain Finance: A Literature Review. Int. J. Phys. Distrib. Logist. Manag. 2016, 46, 348–366. [Google Scholar] [CrossRef]

- Pfohl, H.-C.; Gomm, M. Supply Chain Finance: Optimizing Financial Flows in Supply Chains. Logist. Res. 2009, 1, 149–161. [Google Scholar] [CrossRef]

- Kouvelis, P.; Zhao, W. Supply Chain Contract Design under Financial Constraints and Bankruptcy Costs. Manag. Sci. 2016, 62, 2341–2357. [Google Scholar] [CrossRef]

- Lekkakos, S.D.; Serrano, A. Supply Chain Finance for Small and Medium Sized Enterprises: The Case of Reverse Factoring. Int. J. Phys. Distrib. Amp Logist. Manag. 2016, 46, 367–392. [Google Scholar] [CrossRef]

- Carter, C.R.; Rogers, D.S.; Choi, T.Y. Toward the Theory of the Supply Chain. J. Supply Chain Manag. 2015, 51, 89–97. [Google Scholar] [CrossRef]

- Swan, M. Cryptocitizen: Smart Contracts, Pluralistic Morality, and Blockchain Society. 2015. Available online: https://e-learning-teleformacion.blogspot.com/2016/12/cryptocitizen-smart-contracts.html (accessed on 5 March 2021).

- Angelis, J.; Ribeiro da Silva, E. Blockchain Adoption: A Value Driver Perspective. Bus. Horiz. 2019, 62, 307–314. [Google Scholar] [CrossRef]

- Kim, H.M.; Laskowski, M. Toward an Ontology-Driven Blockchain Design for Supply-Chain Provenance. Intell. Syst. Account. Financ. Manag. 2018, 25, 18–27. [Google Scholar] [CrossRef]

- Crosby, M.; Pattanayak, P.; Verma, S.; Kalyanaraman, V. BlockChain Technology: Beyond Bitcoin. Applied Innovation Review; Sutardja Center for Entrepreneurship & Technology, Berkeley Engineering: Berkeley, CA, USA, 2016; pp. 6–10. Available online: https://www.appliedinnovationinstitute.org/blockchain-technology-beyond-bitcoin/ (accessed on 10 June 2021).

- Ganne, E. Can Blockchain Revolutionize International Trade? 2018th ed.; WTO Publications, World Trade Organization: Geneva, Switzerland, 2018; ISBN 978-92-870-4760-1. Available online: https://www.wto.org/english/res_e/publications_e/blockchainrev18_e.htm (accessed on 1 July 2021).

- Kamble, S.S.; Gunasekaran, A.; Sharma, R. Modeling the Blockchain Enabled Traceability in Agriculture Supply Chain. Int. J. Inf. Manag. 2020, 52, 101967. [Google Scholar] [CrossRef]

- Queiroz, M.M.; Fosso Wamba, S. Blockchain Adoption Challenges in Supply Chain: An Empirical Investigation of the Main Drivers in India and the USA. Int. J. Inf. Manag. 2019, 46, 70–82. [Google Scholar] [CrossRef]

- Xie, Z.; Dai, S.; Chen, H.-N.; Wang, X. Blockchain Challenges and Opportunities: A Survey. Int. Congr. Big Data 2018, 14, 352–375. [Google Scholar]

- Hofmann, E.; Strewe, U.M.; Bosia, N. Supply Chain Finance and Blockchain Technology; Springer International: Cham, Switzerland, 2018. [Google Scholar] [CrossRef]

- Folkinshteyn, D.; Lennon, M. Braving Bitcoin: A Technology Acceptance Model (TAM) Analysis. J. Inf. Technol. Case Appl. Res. 2017, 18, 220–249. [Google Scholar] [CrossRef]

- Venkatesh, V.; Davis, F.D. A Theoretical Extension of the Technology Acceptance Model: Four Longitudinal Field Studies. Manag. Sci. 2000, 46, 186–204. [Google Scholar] [CrossRef] [Green Version]

- Strieborny, M. Kukenova, M., Investment in Relationship-Specific Assets: Does Finance Matter? Rev. Financ. 2016, 20, 1487–1515. [Google Scholar] [CrossRef] [Green Version]

- Davis, F.D. Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Q. Manag. Inf. Syst. 1989, 13, 319–339. [Google Scholar] [CrossRef] [Green Version]

- Ajzen, I. Understanding Attitudes and Predicting Social Behavior; Prentice-Hall: Englewood Cliffs, NJ, USA, 1980. [Google Scholar]

- Ajzen, I.; Fishbein, M. A Bayesian Analysis of Attribution Processes. Psychol. Bull. 1975, 82, 261–277. [Google Scholar] [CrossRef]

- Venkatesh, V.; Davis, F.D. A Model of the Antecedents of Perceived Ease of Use: Development and Test. Decis. Sci. 1996, 27, 451–481. [Google Scholar] [CrossRef]

- Jain, G.; Singh, H.; Chaturvedi, K.R.; Rakesh, S. Blockchain in Logistics Industry: In Fizz Customer Trust or Not. J. Enterp. Inf. Manag. 2020, 33, 541–558. [Google Scholar] [CrossRef]

- Singh, H.; Jain, G.; Munjal, A.; Rakesh, S. Blockchain Technology in Corporate Governance: Disrupting Chain Reaction or Not? Corp. Gov. Int. J. Bus. Soc. 2019, 20, 67–86. [Google Scholar] [CrossRef]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User Acceptance of Information Technology: Toward a Unified View. MIS Q. Manag. Inf. Syst. 2003, 27, 425–478. [Google Scholar] [CrossRef] [Green Version]

- van Raaij, E.M.; Schepers, J.J.L. The Acceptance and Use of a Virtual Learning Environment in China. Comput. Educ. 2008, 50, 838–852. [Google Scholar] [CrossRef]

- Kamble, S.S.; Gunasekaran, A.; Kumar, V.; Belhadi, A.; Foropon, C. A Machine Learning Based Approach for Predicting Blockchain Adoption in Supply Chain. Technol. Forecast. Soc. Chang. 2021, 163, 120465. [Google Scholar] [CrossRef]

- Eisenhardt, K.M. Agency Theory: An Assessment and Review. Acad. Manag. Rev. 1989, 14, 57. [Google Scholar] [CrossRef]

- Yin, R.K. The Case Study Crisis: Some Answers. Adm. Sci. Q. 1981, 26, 58. [Google Scholar] [CrossRef] [Green Version]

- Yin, R.K. Designing Case Studies. In Case Study Research and Applications: Design and Methods; SAGE Publications: Thousand Oaks, CA, USA, 2017; Volume 5, p. 414. [Google Scholar]

- Yin, R.K. Case Study Methodology. In Case Study Research Design and Methods, 3rd ed.; Sage: Thousand Oaks, CA, USA, 2003; Volume 19–39, pp. 96–106. [Google Scholar]

- Seawright, J.; Gerring, J. Case Selection Techniques in Case Study Research: A Menu of Qualitative and Quantitative Options. Political Res. Q. 2008, 61, 294–308. [Google Scholar] [CrossRef]

- Persistent Digital Banking Solution. Available online: https://www.persistent.com/industries/banking-financial-services-and-insurance/digital-banking/ (accessed on 26 September 2021).

- Ferri, L.; Spanò, R.; Ginesti, G.; Theodosopoulos, G. Ascertaining Auditors’ Intentions to Use Blockchain Technology: Evidence from the Big 4 Accountancy Firms in Italy. Meditari Account. Res. 2020. [Google Scholar] [CrossRef]

- Pandl, K.D.; Thiebes, S.; Schmidt-Kraepelin, M.; Sunyaev, A. On the Convergence of Artificial Intelligence and Distributed Ledger Technology: A Scoping Review and Future Research Agenda. IEEE Access 2020, 8, 57075–57095. [Google Scholar] [CrossRef]

- Lahkani, M.J.; Wang, S.; Urbański, M.; Egorova, M. Sustainable B2B E-Commerce and Blockchain-Based Supply Chain Finance. Sustainability 2020, 12, 3968. [Google Scholar] [CrossRef]

- Global Spending on Blockchain Solutions. 2024. Available online: https://www-statista-com.upm.remotlog.com/statistics/800426/worldwide-blockchain-solutions-spending/ (accessed on 26 September 2021).

- Babich, V.; Hilary, G. OM Forum—Distributed Ledgers and Operations: What Operations Management Researchers Should Know About Blockchain Technology. MSOM 2020, 22, 223–240. [Google Scholar] [CrossRef] [Green Version]

- Sternberg, H.S.; Hofmann, E.; Roeck, D. The Struggle Is Real: Insights from a Supply Chain Blockchain Case. J. Bus. Logist. 2021, 42, 71–87. [Google Scholar] [CrossRef] [Green Version]

- Bonsón, E.; Bednárová, M. Blockchain and Its Implications for Accounting and Auditing. Meditari Account. Res. 2019, 27, 725–740. [Google Scholar] [CrossRef]

| Code | Blockchain Project | Keywords and Description |

|---|---|---|

| C1 | AZHOS | Production, inventory, transparency, payment of the supplier’s claim by the financier, repayment to the financier by the customer. |

| C2 | B2P | Procurement, invoicing, supply chain, tracking, approval, payments and eTax. |

| C3 | Cargo | Smart bill of lading, document for global trade. |

| C4 | ChainNova | L/C, bill of lading, invoice traceability. |

| C5 | citrusxchange | Receivables financing and factoring. |

| C6 | Contour (Voltron) | Digital document, tracking, exchange documents, L/C, trade finance cycle, trust, automation, supply chain process. |

| C7 | Digiledge | Invoice factoring, audit trail, smart contract automation, legacy credit scoring, ERPs, purchase order financing. |

| C8 | ecomchain | Financial asset transactions, digital credit records, inquiry, payments, asset issuance, pricing inventory |

| C9 | etradeconnect | Financing trade, sharing data, security, and effective, cost-efficient. |

| C10 | Gatechain | Electronic trade, automated export, smart factoring solution. |

| C11 | Geora | Trusted records, integrated, IoT, asset backed finance, smart contracts. |

| C12 | Hijro | Financial operating network for global trade. |

| C13 | Hyperchain | Financing and splitting accounts receivable, low cost, traceability. |

| C14 | India Trade Connect | Banking trade finance, L/C, transactions, bill collection, exchange, C2C, B2C, PO financing, invoice financing, bank guarantee, and factoring. |

| C15 | Komgo | KYC, L/C, simplifying, interoperability, optimization, security, exchange, banks, traders, inspection, certification, receivable discounting. |

| C16 | MarcoPolo | Secure, distributed, bookkeeping, automated, identity, verification, tracking, receivable finance, factoring, payment commitment, risk mitigation. |

| C17 | MonetaGo | Fraud mitigation, supply chain finance, factoring receivables, corporate certificates of deposits. |

| C18 | Persitent Systems | Audit trail, bill of lading, invoicing, document verification. |

| C19 | phlo | P2P lending based on receivables, tracking, letter of credit, bill of lading, digitization, provenance, trade automation. |

| C20 | Skuchain | Buyers and parties related to the supply chain are given access to tight control of procurement and inventory. |

| C21 | TangoTrade | US based importers can borrow, payment assurance, suppliers global. |

| C22 | TradeCloud | KYC procedure, contracts, services, shipping documents, Letter of credit (L/C). |

| C23 | TradeFinanceMarket | Invoice fraud mitigation, double-financing checking, trade finance market. |

| C24 | TradeFinex | Invoice factoring. |

| C25 | Tradelens | Trust, transparent supply chain, transportation, shipment, tracking, permission-based sharing. |

| C26 | TradeLine | L/C, Pre and Post trade workflow for commodity trading. |

| C27 | Tradewind | Digital trading, settlement, ownership, integration, invoice financing. |

| C28 | Trado | Direct purchase order financing, savings from an end-buyer to smallholders. |

| C29 | We.Trade | KYC, order-to-payment, invoice financing, trade deal, SMEs trading, invoice financing, bank payment undertaking, shareholders bank. |

| C30 | Zeor1 | Funding with the production cycle, adjusting price, suppliers leverage credit worthiness. |

| Code | Blockchain Project | Supply Chain Finance (Barriers) | ||

|---|---|---|---|---|

| KYC | Accounting | Clearing and Settlement | ||

| C1 | AZHOS | V | - | - |

| C2 | B2P | V | V | - |

| C3 | Cargo | - | V | - |

| C4 | ChainNova | V | V | - |

| C5 | citrusxchange | - | V | - |

| C6 | Contour (Voltron) | V | V | V |

| C7 | Digiledge | V | V | V |

| C8 | ecomchain | V | V | V |

| C9 | etradeconnect | V | - | - |

| C10 | Gatechain | V | - | - |

| C11 | Geora | V | V | - |

| C12 | Hijro | V | V | - |

| C13 | Hyperchain | V | V | - |

| C14 | India Trade Connect | V | V | - |

| C15 | Komgo | V | V | - |

| C16 | MarcoPolo | V | V | V |

| C17 | MonetaGo | V | V | - |

| C18 | Persitent Systems | V | V | - |

| C19 | phlo | V | V | - |

| C20 | Skuchain | V | - | - |

| C21 | TangoTrade | V | V | - |

| C22 | TradeCloud | V | - | - |

| C23 | TradeFinanceMarket | V | V | - |

| C24 | TradeFinex | - | V | - |

| C25 | Tradelens | V | V | - |

| C26 | TradeLine | V | V | - |

| C27 | Tradewind | V | V | V |

| C28 | Trado | V | - | - |

| C29 | We.Trade | V | V | V |

| C30 | Zeor1 | V | V | - |

| Total: | 27 | 24 | 6 | |

| No | Blockchain Project | Supply Chain Finance (Financing) | ||

|---|---|---|---|---|

| Inventory | Purchase Order | Receivables | ||

| C1 | AZHOS | V | - | V |

| C2 | B2P | V | - | V |

| C3 | Cargo | - | V | - |

| C4 | ChainNova | - | - | V |

| C5 | citrusxchange | - | - | V |

| C6 | Digiledgde | - | V | V |

| C7 | ecomchain | V | - | - |

| C8 | etradeconnect | - | - | V |

| C9 | Gatechain | - | - | V |

| C10 | Geora | V | - | - |

| C11 | Hijro | - | - | V |

| C12 | Hyperchain | - | - | V |

| C13 | India Trade Connect | - | V | V |

| C14 | Komgo | - | V | V |

| C15 | MarcoPolo | - | V | V |

| C16 | MonetaGo | - | V | V |

| C17 | Persitent Systems | - | - | V |

| C18 | phlo | - | - | V |

| C19 | Skuchain | V | - | - |

| C20 | TangoTrade | - | V | - |

| C21 | TradeCloud | - | V | - |

| C22 | TradeFinanceMarket | - | - | V |

| C23 | TradeFinex | - | - | V |

| C24 | Tradelens | - | V | - |

| C25 | TradeLine | - | V | - |

| C26 | Tradewind | V | V | V |

| C27 | Trado | V | V | - |

| C28 | Voltron | - | V | V |

| C29 | We.Trade | - | V | V |

| C30 | Zeor1 | V | V | V |

| Total: | 8 | 15 | 21 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rijanto, A. Blockchain Technology Adoption in Supply Chain Finance. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 3078-3098. https://doi.org/10.3390/jtaer16070168

Rijanto A. Blockchain Technology Adoption in Supply Chain Finance. Journal of Theoretical and Applied Electronic Commerce Research. 2021; 16(7):3078-3098. https://doi.org/10.3390/jtaer16070168

Chicago/Turabian StyleRijanto, Arief. 2021. "Blockchain Technology Adoption in Supply Chain Finance" Journal of Theoretical and Applied Electronic Commerce Research 16, no. 7: 3078-3098. https://doi.org/10.3390/jtaer16070168

APA StyleRijanto, A. (2021). Blockchain Technology Adoption in Supply Chain Finance. Journal of Theoretical and Applied Electronic Commerce Research, 16(7), 3078-3098. https://doi.org/10.3390/jtaer16070168