Abstract

Financial innovation and advances in payment systems are important not only to boost remittances but also to foster the successful development of electronic businesses around the world. As such, many leading companies in electronic commerce are putting a great deal of effort into the development of their payment system to attract more users and compete with other leading companies in the market. WeChat is a social communication tool that introduced a payment function widely adopted as a third-party payment in China nowadays. The purpose of this study was to adopt WeChat as a case study to identify the influential factors that impact consumers’ intention to adopt it as digital payment. We identified several core influential factors including service quality, perceived risk, perceived security, perceived ease of use, social influence, compatibility, and age. Qualitative and quantitative analyses were performed to investigate how influential factors affect the adoption of this third-party digital payment platform. The results revealed that all identified factors have a significant influence on consumer’s intention to use digital payment, except age. This study also provided useful advice for digital payment improvement and recommendations to enhance digital payment for the success of electronic business operations. The paper provides new insight into the factors influencing consumers’ intention to use mobile digital payment.

1. Introduction

In the 21st digital century, financial innovation impacts financial services, digital payment, banking, risk management, remittances, crowdfunding, etc., as well as social welfare and electronic business [1,2]. The application of innovative financial technologies enables a high level of competitiveness and risk management for the banking business in the market, ensuring the possibility of further customer expansion [3,4], as well as fostering the growth of other commercial activities and electronic business [5]. Among various financial technologies, one of the most important and widely adopted applications by the general public is digital payment [6]. Digital payment has several benefits to various financial service users and providers, governments, electronic businesses, and the city economy as a whole. It enhances the financial access of individuals, reducing transaction costs and aggregate expenditure, which is essential to the growth of electronic businesses nowadays [7]. In particular, due to the wider impact of the COVID-19 pandemic, electronic business has expanded significantly, and the number of transactions made by digital payment is experiencing unprecedented growth [8]. According to the digital payments report in 2020 [9], the digital payments segment has a global transaction value projected to reach nearly US$5,000,000 in 2020. It is anticipated that this total transaction value will show an annual growth rate of 13.4% from 2020 to 2024.

Nowadays, many different digital payment technologies exist, including PayPal, electronic payment cards, mobile payments, etc. [10] Among all these digital payment systems, mobile payment will be one of the major digital payment approaches in the coming decades. The total transaction value using mobile payment is projected to increase from around 40% in 2020 to almost half of overall digital commerce in 2024 [9]. The significant growth of mobile payment transactions is due to the leading role of mobile devices in future decades due to their convenience, connectivity, high penetration, functionality, and immediate availability to most of users. This cornerstone explains how financial innovation is important to the successful development of an electronic business.

Recently, many scholars have noticed that WeChat payment is widely used in China [11,12,13]. WeChat is China’s multi-purpose social media platform. Its mobile payment application, developed by Tencent, has been available since March 2014 [14]. As of 2019, the number of users is more than 1.2 million, and the average daily number of payment transactions exceeds 1 billion [15]. A huge number of electronic businesses, retailers in electronic commercial platforms, municipal services, peer-exchange, and instant messaging apps are relying on it for payment [16]. Compared with other digital payment platforms, WeChat is also is the most popular social network platform in China [17]. It is closer to the daily life of users, so it has a better user penetration and transaction rate. Therefore, investigating the underlying factors of mobile payment is important to give insight into the successful development of electronic business and commercial platforms. Nevertheless, most of the literature has made use of equation models to test the model structure based on the model fit data and to determine the correlation between each variable in relation to certain beliefs about the effects [18]. The major aim of this research is to determine the overall fit of the model and the relative contribution of each underlying factor in terms of the total variance explained [19], so as to predict and explain how much the intention to use digital payment can be explained by the underlying factors proposed in this study.

In view of the existing research on third-party mobile payment, most focuses on willingness to use. Slade et al. [20] found that the perceived usefulness, social impact, and perceived risk will significantly affect willingness to use mobile payments. Lu et al. [21] verified the influence of mobility, privacy protection, and social influence on the willingness to continue using mobile payments. Musa et al. [22] adopt the technology acceptance model to reveal that functional expectations, social impact, and perceived information security have a significant impact on consumers’ willingness to adopt mobile payments.

Based on previous research, this study further identified the factors that affect consumers’ intention to use WeChat’s mobile payment. In the following article, seven hypotheses are proposed regarding seven factors (service quality, perceived risk, perceived security, perceived ease of use, social influence, compatibility and age) that may influence intention to use WeChat digital payment. The questionnaire survey and semi-structured interviews found that all the identified factors except age had a significant influence on consumer’s intention to use. In addition, this article also puts forward three competitive strategies based on the research conclusions.

The key contribution of this article is to identify the factors that affect consumers’ intention to use this digital payment function, to provide important insight into the development of financial innovation technology particularly in consideration of the development of digital payment systems, and to encourage customers to use digital payment, particularly in electronic commerce which is important for the success of an e-business. This article has both theoretical and practical significance. In theory, this study determines the overall fit of the model and the relative contribution of each underlying factor in terms of the total variance explained, and extends previous study by integrating the relationship between the factors and intentions to use digital payment using a regression model, so as to predict and explain how much the intention to use digital payment can be explained by the underlying factors proposed and provide a theoretical basis for future research. In practice, this research enables specific suggestions to be provided based on the regression model. The model can practically determine the core factors contributing to the intention to use digital payment in e-business in order to make improvements to the digital payment and electronic business platforms. Further, it can foster financial innovation by attracting more users, and promoting the development of other electronic business companies.

2. Literature Review and Hypothesis Development

2.1. Development of Third-Party Digital Payment Platforms

In the last decade, the emergence of mobile payment systems has enabled mobile users to pay through their mobile devices. Third-party payment platforms have been integrated into mobile payments, and mobile payments have become part of daily life nowadays, especially in China [23]. Several factors may influence the intention to use a mobile payment platform. These are described in the next few sections.

2.1.1. Service Quality

Rust and Olive [24] pointed out that service quality is a subjective concept. It contains three elements, customer satisfaction, service quality, and customer value, although some scholars consider these to be interchangeable [25,26]. Zeithaml et al. [27] established a measure of service quality (SERVQUAL) with five determinants: reliability, tangibles, responsiveness, assurance, and empathy. Customers perceive quality in multiple ways and may take several factors into account when assessing quality [28].

Different companies have different competitive service strategies, but all of them should focus on service quality [29]. Companies should therefore consider variations in customers’ needs, purchasing behavior, and consumption patterns. Service quality can be viewed as a competitive force, because it affects the improvement of service performance, enhancing market share and improving profits if it provides a sustainable competitive advantage [30]. This study therefore hypothesized:

Hypothesis 1 (H1).

There is a positive relationship between service quality and consumers’ intention to use WeChat Payment.

2.1.2. Perceived Ease of Use

Ease of use is a subjective issue [31], but contributes to the acceptance of new technology [32]. The Technology Acceptance Model suggests that consumers’ adaption behaviour prompts their intention to use a certain system, but actual use depends on the system’s usefulness and ease of use [31]. This model, therefore, links ease of use and usefulness and suggests that customers’ perceptions about the difficulty of using the system will affect their perception of its usefulness [33]. Perceived usefulness and perceived ease of use also influence users’ acceptance [34]. This study therefore hypothesized:

Hypothesis 2 (H2).

There is a positive relationship between perceived ease of use and consumers’ intention to use WeChat Payment.

2.1.3. Perceived Risk

Payment platforms expose users to several risks [35]. These include financial risk, network security risk, and seller credit risk. Previous studies have found that perceived risk and fee are two important factors that lead to consumers’ reluctance to use mobile financial services [36]. IResearch Group [37] found that 73.5% of consumers cared about transaction security and risks, and 60.5% were worried about the costs of using mobile payment devices. There are two components involved in perceived risk, uncertainty and negative consequences of the purchase [38]. People resist adopting mobile payment functions partly because of the risk of financial loss [39]. Risks have a critical influence on consumers’ trust in payment platforms, and therefore their intention to use them [40]. An empirical study among eBay users found that perceived risk can affect users’ decisions about payment solutions [41]. Perceived risk is also a crucial determinant of consumers’ decisions about which payment platform to use. This study therefore hypothesized:

Hypothesis 3 (H3).

There is a negative relationship between perceived risk and consumers’ intention to use WeChat mobile Payment.

2.1.4. Perceived Security

Several studies have found that security is important in the acceptance of on-line banking [42]. Chen and Barnes [43] noted that poor privacy and security are important barriers to the use of on-line banking. Previous studies found that perceived security and trust were crucial determinants of mobile commerce success [44]. As e-services have developed, the concept of security has mainly focused on privacy and has attracted considerable attention [45]. This study therefore hypothesized:

Hypothesis 4 (H4).

There is a positive relationship between the perceived high level of security and consumers’ intention to use WeChat Payment.

2.1.5. Social Influence

Venkatesh et al. [46] defined social influence as the extent to which individuals accept new systems on others’ recommendations. It has also been defined as personal perceived pressures from communication networks towards the adoption of new technology [40]. Zhou et al. [47] suggested that this would positively influence consumers’ behavioral intentions. Hong and Tam [48] believed social influences would directly or indirectly affect consumer adoption intention through perceived usefulness. Lu et al. [49] found a positive relationship between social influences and consumers’ intention to use technology. Rogers [50] stated that social image is a critical part of social influence. He noted that it is very important in introducing new products, and is often the main driving force after advertising. Bao et al. [51] defined social image as people’s willingness to improve, maintain, and prevent the loss of their image associated with social activities. The study therefore hypothesized:

Hypothesis 5 (H5).

There is a positive relationship between social influence and consumers’ intention to use WeChat Payment.

2.1.6. Compatibility

Compatibility describes the consistency between innovations and potential users’ values and lifestyle. Tornatzky and Klein [52] claimed that perceived compatibility is a critical innovation aspect that drives consumers’ acceptance. According to Lee et al. [53], an important aspect of compatibility is consumers’ capacity to integrate mobile payment systems into their daily routine. Wu and Wang [54] found that compatibility is a significant determinant of mobile technology adoption. Chen [55] claimed that mobile technology would positively influence service adoption. The study therefore hypothesized:

Hypothesis 6 (H6).

There is a positive relationship between compatibility and consumers’ intention to use WeChat Payment.

2.1.7. Age

Arning and Ziefle [56] considered that the age of consumers was an important variable affecting the use of new products. Phang et al. [57] claimed that age was crucial for technology acceptance. Young people are significantly more likely to upload information to a social network. Dean [58] noted that young people had a higher level of trust in self-service systems. Age could, therefore be an important influence on consumer intention to use third-party payment platforms. The study therefore hypothesized:

Hypothesis 7 (H7).

There is a correlation between age and consumers’ intention to use WeChat Payment.

3. Methodology

3.1. Conceptual Framework

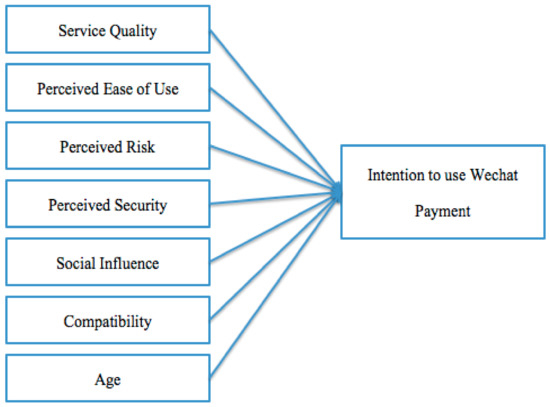

The main objective of this study was to identify the factors that affect consumers’ intention to use WeChat’s payment function. The adoption of digital payment relies on customers’ perception of several key factors, therefore we summarized seven core factors to determine how these factors are related to the intention of usage based on a regression model. Particularly, this study refers to the study of [59,60,61] and incorporates feedback from interviews to summarize seven factors that directly contribute to the intention to use digital payment, including not only performance expectations, ease of use expectations, social influence, and convenience performance, but also the predisposing factors which refer to the basic characteristic of age. The current study extends the previous study by integrating the relationship between these factors and intentions to use digital payment by making use of a regression model. It not only enables this significant relationship to be quantified but also indicates the strength of the impacts of multiple factors. The primary purpose of this study was to identify the factors affecting consumers’ intention to use WeChat’s payment function. This study references the Unified Theory of Acceptance and Use of Technology (UTAUT) model proposed by [46], and summarizes seven factors that directly contribute to the intention to use digital payment, not only including performance expectations, ease of use expectations, social influence, and convenience performance, but also introducing adjustment variables such as gender and age. The proposed research model is shown in Figure 1.

Figure 1.

The proposed research model.

3.2. Research Methodology

Direct interviews were used to capture any additional factors that might influence adoption decisions. A questionnaire was then designed to measure each factor. Both paper-based questionnaires and web-based questionnaires were distributed randomly. A self-administered on-line survey was carried out through a professional third-party questionnaire platform and convenience sampling was used to distribute the questionnaire. Both Chinese and English versions were used to ensure the completion of the questionnaire. It was suggested that the data collected using the online approach could still reduce biases compared with traditional approaches [62].

This study makes use of a semi-structured individual interview strategy for determining personal experience and acquiring necessary information [63] on digital payment. In this study, five semi-structured individual interviews were carried out among three men and two women of different ages. The interviews were conducted in Mandarin and lasted about 20 minutes each. The individual interviews included open-ended and closed-ended questions as shown in Table 1.

Table 1.

Questions for Individual Interview.

A screening question was included at the beginning of the questionnaire. Any respondents with experience of using WeChat were considered eligible to participate. The questionnaire covered all possible factors, and relationships to consumer intention to use the mobile payment platform were tested using correlation analysis.

3.3. Questionnaire Development

Quantitative research primarily uses methods such as questionnaires and surveys with settled questions and options so that participants are able to tick from identified boxes. In this paper, a questionnaire was selected to test the proposed hypotheses. The questionnaire was categorized into three parts; the first part was designed to screen respondents in order to prevent invalid questionnaires. The second part was used to measure customer selection criteria regarding each factor mentioned above, whereas the third part was designed to gain respondents’ basic information. The questionnaire items are shown in Table 2. The form of research was carried out via both web-based and paper-based questionnaires. The answers measured strength of feelings from ‘strongly agree’ to ‘strongly disagree’ in terms of 1–5 Likert scales. Finally, the data were collected in a statistical form so as to be further analyzed by statistical tools.

Table 2.

Questionnaire.

To measure WeChat service quality, we drew on work by [64]. Their original scale included five items, with three using a positive scale and two a negative scale. A lengthy questionnaire may decrease the response rate, so just two items were selected for this study. The scale developed by [65] covered four types of perceived risk: financial risk, privacy risk, service risk, and psychological risk. We revised the questions to focus on average perceived risk. We included two items to measure perceived security, trust, and security risks. To measure consumers’ intention to use WeChat Payment, we used the consumer intention to use scale developed by [31,66].

Considering the feasibility of implementing a research project on consumers’ willingness to use digital payment via WeChat, this study selected Shenzhen as the target city from Guangdong Province, which has the highest number of WeChat city service users in China, and we selected participants from Shenzhen to join this study. The reasons for this are, on the one hand, because Shenzhen is the city with the highest resident population in Guangdong Province and, on the other hand, because WeChat belongs to Tencent, which is located in Shenzhen, one of the first cities to adopt WeChat as a digital payment. As a result, WeChat payments are prevalent in Shenzhen, and people have lengthy experience of using WeChat.

3.4. Demographic Factors

The final section of the questionnaire included five nominal-scaled questions about the respondents’ personal information including gender, age, occupation, education level, and monthly income.

3.5. Regression Model

In order to determine the apparent relationship between the independent and dependent variables, and allow the comparison of interactions between variables that measure different scales (Wright, 1960), a regression model was developed with one dependent variable and seven independent variables:

A hypothesis was then established to test the overall importance of the regression model:

Hypothesis 8 (H8).

+ + + + + + = 0

Hypothesis 9 (H9).

At least one coefficient is not zero [67].

The F-test was used to inspect the overall significance of the regression model with a confidence level of 95%. The regression model is considered efficient if the result shows that the regression coefficient is not equal to zero.

3.6. Correlation Analysis

Correlation analysis is a way to discover groups of strongly related data objects in very large databases [68]. The correlation coefficient, indicated by r, can range from −1.0 to +1.0. Correlation analysis was used to identify the relationship between seven independent variables and the dependent variable and test the proposed hypotheses.

4. Results and Analysis

4.1. Individual Interviews

The five individual interviewees were all from the engineering industry but were of different ages. They all had experience of using WeChat Payment. They provided information about other influential factors and suggestions to improve the platform. The respondents’ profiles are shown in Table 3.

Table 3.

Summary of the individual interviewees.

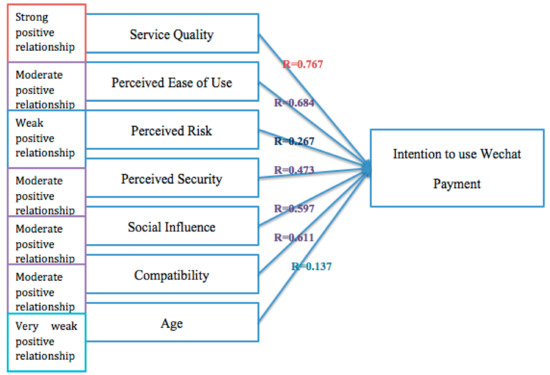

Due to the difficulty of collecting a large number of questionnaires, regression analysis was used in this study. A total of 238 questionnaires were collected, of which 161 were valid, which means the number of valid questionnaires was approximately 67%. Those customers without experience in using WeChat payment are counted as invalid questionnaires, of which most come from the older age group (31 or above). The descriptive statistics are shown in Table 4. The correlation analysis using the Pearson Correlation coefficient is used to determine the correlation of intention to use corresponding to each of the underlying factors and is illustrated in Table 3. The results revealed that most of the factors have a highly significant correlation at the 0.01 level (p = 0.000) to intention of use, except age (p = 0.051 > 0.05). Figure 2 summarizes the results of the correlation analysis.

Table 4.

Demographic data of respondents.

Figure 2.

Simplified results of correlation analysis.

These results show that all factors were significantly correlated with intention to use WeChat Payment. However, the correlation between age and consumer intention to use was relatively weak. This result is surprising because previous studies have suggested that older people are less likely to accept innovative technology. However, the respondents’ profiles show that the study included just 16 people over 30 years old, which may have affected the results.

4.2. Regression Analysis

The next step was to use regression analysis to test whether the dependent variable (intention to use WeChat Payment) is significantly influenced by the seven independent variables (service quality, perceived ease of use, perceived risk, perceived security, social influence, compatibility and age). The model summary (Table 5) shows that R-squared was 0.679, meaning that 67.9% of consumers’ intention to use WeChat Payment can be explained by the seven independent variables. Only 33.3% of the variation, therefore, cannot be explained by the seven independent variables.

Table 5.

Model summary of the regression analysis.

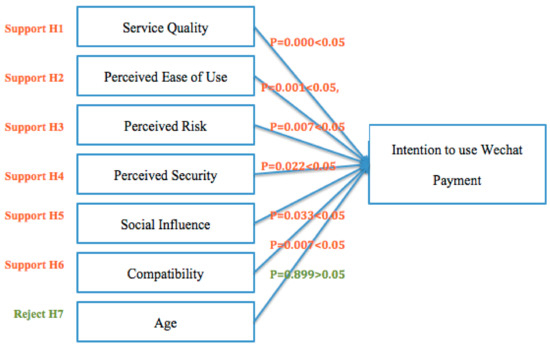

Following ANOVA (Table 6), the result of the F-test was F = 59.099, with a p-value of 0.000, which is less than 0.05. Hypothesis H0 can therefore be rejected, and we can conclude that the F-test is significant at the 0.05 level. β0 was 0.095 (Table 7), meaning that when the other seven independent variables are equal to 0, the predicted adoption intention is 0.095. This shows that the six independent variables have a considerable impact on the dependent variable and only one independent variable does not have much effect at all.

Table 6.

Results of the ANOVA analysis.

Table 7.

Results of the regression analysis.

Regarding the discrimination validity tests illustrated in Table 8, it was found that the values of Cronbach’s alpha were greater than 0.7 for four out of seven items. Only one item has a value less than 0.5, while all of the other alpha values were not too high, meaning the items have no redundancy. The AVE of each variable was greater than 0.5, which means the validity was acceptable.

Table 8.

Results of the Cronbach’s alpha and AVE.

4.3. Service Quality

There was a strong and significant positive relationship between service quality and consumers’ intention to use WeChat Payment (coefficient = 0.514, β = 0.481, p = 0.000 < 0.05). Hypothesis H1 was therefore strongly supported, suggesting that service quality positively affected customers’ intention to use WeChat Payment. The first step in improving the platform should, therefore, be to improve service quality.

4.4. Perceived Ease of Use

There was a strong and significant positive relationship between perceived ease of use and consumers’ intention to use WeChat Payment (coefficient = 0.242, β = 0.237, p = 0.001 < 0.05). Hypothesis H2 was therefore supported, and perceived ease of use positively influenced customer intention to use the platform. This is consistent with [69,70], who noted that ease of use is a crucial acceptance driver of mobile applications and in determining consumers’ adoption intention.

4.5. Perceived Risk

There was a strong significant negative correlation between perceived risk and consumers’ intention to use WeChat Payment (coefficient = −0.182, β = −0.144, p = 0.007 < 0.05). Hypothesis H3 (a high level of perceived risk has a negative effect on customers’ intention to use the platform) was therefore strongly supported. Luarn and Lin [36] noted that perceived risk was an important factor in consumers’ reluctance to use finance-related mobile services. This suggests that WeChat needs to acquire consumers’ trust and enhance their confidence to decrease the perceived risk, as an essential part of attracting more users.

4.6. Perceived Security

There was a strong and significant positive relationship between perceived security and customers’ intention to use the payment platform (coefficient = 0.244, β = 0.162, p = 0.022 < 0.05). Hypothesis H4 was therefore strongly supported, showing that higher levels of security result in greater consumer intention to use WeChat Payment.

This finding confirms several previous studies. Chen and Barnes [43] found that the lack of privacy and security could be significant barriers to the adoption of on-line banking. Siau et al. [44] noted that perceived security and trust are crucial determinants of mobile commerce success. Most users are not very worried about the security of the online bank payment system; On the contrary, they are more worried about the security of mobile payment [71]. As a social network, the perceived security of WeChat is far from that of online banking or other professional third-party online platforms [72]. As with other communication tools, there is a possibility that the account could be stolen. An account being stolen will pose a great threat to the security of the money that connects with WeChat. Therefore, ensuring the security of WeChat payment could be one of the significant factors that WeChat needs to focus on.

4.7. Social Influence

There was a strong significant positive correlation between social influence and customers’ intention to use WeChat Payment (coefficient = 0.125, β = 0.133, p = 0.033 < 0.05). Hypothesis H5, that social influence has a positive effect on the intention to use the payment platform, was therefore strongly supported. Zhou et al. [45] found a positive relationship between social influence and users’ behavioral intention. Social image is a critical element of social influence affecting the introduction of new products. WeChat Payment may therefore need to improve its social image, and enhancing its social influence may stimulate consumers’ intention to use it.

4.8. Compatibility

There was a strong significant positive correlation between compatibility and customers’ intention to use the mobile payment platform (coefficient = 0.154, β = 0.171, p = 0.007 < 0.05). Hypothesis H6 was therefore strongly supported, and a high level of compatibility has a positive effect on customers’ intention to use WeChat Payment. Roger [48] emphasized that acceptance required that products be compatible with users’ values and lifestyles. Lee et al. [53] found that an important symbol of compatibility was consumers’ ability to integrate mobile payment systems into their everyday life. We found a significant relationship between compatibility and consumers’ intention to use WeChat Payment. This suggests that, for ongoing acceptance, the platform must stay abreast of changes in people’s lives and continue to remain relevant.

4.9. Age

There was no significant correlation between age and customers’ intention to use WeChat Payment (coefficient = 0.005, β = 0.006, p = 0.899 > 0.05). Hypothesis H7 was therefore not supported, and we concluded that age does not have any effect on customers’ intention to use the platform. Unlike the other six factors, the result for age was unexpected. It emerged during the regression analysis when combining the factors to see their relative impact on consumers’ intention to use, and may, therefore, be because respondents felt that the other six elements were more important influencers of their adoption intention. The regression results are summarized in Figure 3.

Figure 3.

Simplified results of regression analysis.

4.10. One-Way ANOVA

We tested gender and age to see whether there were significant differences between groups. Gender was divided into two groups: female and male, and age into 18–25 years, 26–30 years, 31–40 years, and 41–50 years. Table 9 shows that there was no statistically significant mean difference between men and women (p = 0.297 > 0.05). However, it shows that there was a significant difference between age groups (p = 0.016). Age is a significant factor in intention to use WeChat Payment.

Table 9.

ANOVA of Gender and Age.

A multiple comparisons table was used to identify differences between age groups (Table 10). People aged 31–40 years were significantly different from the other three groups. There were no differences between people aged 18–25, 26–30, and 41–50 in their intention to adopt WeChat Payment. It was unexpected that people aged 31–40 were different, but it may be because people in that age group had already become accustomed to using other payment platforms. WeChat’s platform was not introduced until 2014, and many other third-party payment platforms were already being used in China by then. People in this age group may therefore be unwilling to switch to WeChat Payment. Younger people may use WeChat more often to communicate, so may find it more convenient to use the payment facility within the same application. We suggest that those aged 41–50 may have had the platform recommended by their children or other younger relatives.

Table 10.

Multiple Comparisons.

5. Discussion

With the rapid development of electronic commerce, the explosion of digital payment has not only caused financial innovation but has also changed people’s daily life. Especially, the global COVID-19 pandemic has had a novel impact and created new opportunities for the financial market. Mobile payment as one of the most important methods of digital payment provides great convenience in people’s lives. A widely used mobile payment, WeChat payment has become the mainstream payment method in the market, which has changed the payment habits of consumers, making it unnecessary to carry cash when buying things. The present study has revealed the factors affecting consumers’ intention to use WeChat. Results indicate that service quality, perceived ease of use, perceived risk, perceived security, social influence, and compatibility have a positive relationship with the intention to use WeChat payment.

The results demonstrated that service quality has the most obvious relevance to customers’ intention to use WeChat payment. This finding is the same as studies that have shown that service quality is a very important factor in intention to use [73]. Therefore, improving service quality can be the primary factor in upgrading the payment platform. Based on the individual interviews, it was suggested that the platform needs to respond quickly to the market and develop its unique features. Improvements could be in system quality or information quality to enhance user satisfaction and attract more users. Changes might include designing a more attractive interface, providing effective and artificial intelligence services, and demonstrating the ease of use of the payment platform.

These results also showed that perceived ease of use, perceived security, social influence, and compatibility have a moderate positive relationship with intention to use WeChat payment. These findings and similar research indicate the positive impact of perceived ease of use, perceived security, social influence, and compatibility on the intention to use [74,75,76]. To achieve both social influence and compatibility, digital payment platforms need to improve the reputation of their platform and also pay attention to the social influence of other on-line products. Keeping mobile payment systems safe is still a key factor in decreasing perceived risk and increasing perceived security. Many people are concerned about security of the mobile payment platform because there is a risk of payment accounts being stolen. We have two specific suggestions for mobile payment operators:

- Introduce an improved technical support system for mobile payment. The technical support system should consist of technologies for identification authentication, identity management, and secure protection of other information. These technologies collectively operate on the platform to ensure the security of trade information and user information.

- Inform users of the system about the importance of data and information. This will ensure that they update the system to prevent any security issues.

Most studies of mobile payment use age as a moderating variable and have demonstrated that age has a moderating role in the model [22,77,78]. In this study, age was used as an independent variable in the analysis with reference to the study of [61]. Surprisingly, there was no significant correlation between age and customers’ intention to use WeChat payment. This finding does not support studies that young people are more likely to use new products or technology [56,57,58]. It was believed that the younger generation has higher technology acceptance in the past. However, in the digital century and with the effect of the COVID-19 pandemic, most people regardless of their age are used to shopping in on-line stores or retailers on on-line platforms, and adopt digital payment. It is believed that age may not be the major concern when considering financial innovation and implementing digital payment in electronic businesses. We may also omit the effect of age when improving the mobile payment platform. However, to further increase the competitiveness of the mobile payment platform, the operators or other interested parties need to develop competitive strategies based on the researched factors.

6. Conclusions and Implications

The study has introduced seven factors influencing Chinese consumers’ intention to use WeChat payment. Through questionnaire surveys and semi-structured interviews, it can be concluded that all the identified factors except age had a significant influence on consumer’s intention to use mobile payment. The results of this research provide theoretical implications for future studies on related topics and also provide a guideline for the improvement of third-party payment platforms. In conclusion, this study has identified six factors affecting consumers’ intention to use the mobile payment platform.

This study has performed research and proposed a research model to investigate the underlying factors that may influence the public to adopt mobile payment, making use of one of the most popular digital payment platforms, WeChat, as the case study. WeChat is considered as one of the most financial innovative technologies in China as it consists of multiple payments and peer-to-peer transfer functions and provides a one-stop platform for users to purchase various financial products and services. The investigation of the underlying factors of mobile payment has the following major implications for future research. First of all, due to the wider impact of the mobile payment platform, the factors and research models investigated are critically important in supporting the development of similar digital payment platforms. Service quality has a strong influence on the intention of using mobile payment platforms. Various sections of service providers including on-line payment platforms as well as the electronic business companies should focus on various considerations in improving the quality of the on-line platforms and providing a wide range of financial products in order to drive financial innovation in the future. Secondly, in the past financial risk was traditionally considered as one of the major obstacles to technological innovation. In the digital era, it was found that people are becoming more accepting of technological innovation, and the potential risk may be the major concern regarding the use of digital payment. Electronic business participants should act boldly and with confidence in innovative business development. Lastly, digital payment is considered to be closely related to business development, particularly during the COVID-19 pandemic. Electronic commerce platforms and other on-line service providers should consider wider adoption of financial innovative technologies and on-line payments to boost their market share and reputation, in order to successfully develop their electronic businesses.

Despite its investigation of the essential contributing factors for using mobile payment via WeChat, the case study still has some limitations and future research can be implemented to address these. First, the age distribution was heavily biased towards younger people. In the future, we suggest that questionnaires should be divided equally and then distributed to different age groups to increase the accuracy of the data. It seems unlikely that age has no significant influence on consumers’ intention to use WeChat Payment, and we suggest that this was probably because of the unequal distribution of questionnaires across age groups. On the other hand, this study did not identify differences in consumers’ preferences across different age groups. Future studies could therefore classify consumers into different age groups and identify whether different factors are influential. In this regard, the structural equation model can be applied to determine the correlation and factor loadings, along with the use of other groups of customers varied in age and gender, in order to determine the difference and moderating effects and to explore their acceptance of financial innovation regarding the adoption of digital payment, particularly in the successful development of the e-business system. This would enable WeChat Payment services to be more personalized. Previous studies have found that age is a crucial factor in technology acceptance [56,57]. However, we did not find it influential in this study. Future studies may instead wish to consider age as a moderating variable in the conceptual framework.

Author Contributions

Conceptualization, Y.M.T. and L.H.; methodology, Y.M.T.; software, L.H.; validation, L.H. and W.Y.; formal analysis, Y.M.T., L.H. and W.Y.; investigation, L.H.; resources, Y.M.T. and K.Y.C.; data curation, Y.M.T. and L.H.; writing—original draft preparation, Y.M.T. and L.H.; writing—review and editing, Y.M.T. and K.Y.C.; visualization, Y.K.I.; supervision, Y.M.T. and Y.K.I.; project administration, Y.M.T. and K.Y.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study was conducted according to the guidelines of the Declaration of Helsinki, and approved by the Institutional Review Board (or Ethics Committee) of the University of Warwick.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Data available on request due to restrictions eg privacy or ethical.

Acknowledgments

We would like to acknowledge the support of the University of Warwick and the Department of Industrial and Systems Engineering from the Hong Kong Polytechnic University, Hong Kong. This research study was conducted to support the Master of Science (MSc) program under the Integrated Graduate Development Scheme (IGDS) and was used as part of the thesis submission. We acknowledge support by the City University of Macau for the enhancement of this article and the open access publishing.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Lerner, J.; Tufano, P. The Consequences of Financial Innovation: A Counterfactual Research Agenda. Annu. Rev. Financ. Econ. 2011, 3, 41–85. [Google Scholar] [CrossRef]

- Oyelami, L.O.; Adebiyi, S.O.; Adekunle, B.S. Electronic payment adoption and consumers’ spending growth: Empirical evidence from Nigeria. Futur. Bus. J. 2020, 6, 1–14. [Google Scholar] [CrossRef]

- Giudici, P. Fintech Risk Management: A Research Challenge for Artificial Intelligence in Finance. Front. Artif. Intell. 2018, 1, 1. [Google Scholar] [CrossRef] [PubMed]

- Alt, R.; Beck, R.; Smits, M.T. FinTech and the transformation of the financial industry. Electron. Mark. 2018, 28, 235–243. [Google Scholar] [CrossRef]

- Krivosheya, E.; Belyakova, P. Financial innovations role in consumer behavior at Russian retail pay-ments market. In Proceedings of the Economics and Finance Conferences (No. 9511955), Dubrovnik, Croatia, 27–30 August 2019; International Institute of Social and Economic Sciences: London, UK, 2019. [Google Scholar]

- Ozili, P.K. Impact of digital finance on financial inclusion and stability. Borsa Istanb. Rev. 2018, 18, 329–340. [Google Scholar] [CrossRef]

- Yao, M.; Di, H.; Zheng, X.; Xu, X. Impact of payment technology innovations on the traditional financial industry: A focus on China. Technol. Forecast. Soc. Chang. 2018, 135, 199–207. [Google Scholar] [CrossRef]

- The European Payments Landscape in Perspective—Emerging Payments UK. Emergingpayments.org. 2020. Available online: https://www.emergingpayments.org/whitepaper/the-european-payments-landscape-in-perspective/ (accessed on 1 January 2020).

- Statista. Digital Payments Report 2020. Available online: https://www.statista.com/study/41122/fintech-report-digital-payments/ (accessed on 1 January 2021).

- Bezovski, Z. The future of the mobile payment as electronic payment system. Eur. J. Bus. Manag. 2016, 8, 127–132. [Google Scholar]

- Lien, C.H.; Cao, Y. Examining WeChat users’ motivations, trust, attitudes, and positive word-of-mouth: Evidence from China. Comput. Hum. Behav. 2014, 41, 104–111. [Google Scholar] [CrossRef]

- Liu, W.; He, X.; Zhang, P. Application of Red Envelopes—New Weapon of WeChat Payment. In Proceedings of the 2015 International Conference on Education, Management, Information and Medicine, Shenyang, China, 24–26 April 2015. [Google Scholar]

- Wang, Y.; Hahn, C.; Sutrave, K. Mobile payment security, threats, and challenges. In Proceedings of the 2016 Second International Conference on Mobile and Secure Services (MobiSecServ), Gainesville, FL, USA, 26–27 February 2016. [Google Scholar]

- IResearch. WeChat Payment Is Opened For M-Commerce Development. 2014. Available online: http://www.iresearchchina.com/views/5510.html (accessed on 10 October 2014).

- CAICT. 2019–2020 WeChat Employment Impact Report. 2020. Available online: http://www.caict.ac.cn/kxyj/qwfb/ztbg/202005/t20200514_281774.htm (accessed on 1 May 2020).

- Kow, Y.M.; Gui, X.; Cheng, W. Special digital monies: The design of alipay and wechat wallet for mobile payment practices in china. In Proceedings of the IFIP Conference on Human-Computer Interaction, Mumbai, India, 25–29 September 2017. [Google Scholar]

- Montag, C.; Becker, B.; Gan, C. The Multipurpose Application WeChat: A Review on Recent Research. Front. Psychol. 2018, 9, 2247. [Google Scholar] [CrossRef]

- Bollen, K.A.; Pearl, J. Eight Myths About Causality and Structural Equation Models. In Handbooks of Sociology and Social Research; Springer: Berlin/Heidelberg, Germany, 2013; pp. 301–328. [Google Scholar]

- Uyanık, G.K.; Güler, N. A Study on Multiple Linear Regression Analysis. Procedia Soc. Behav. Sci. 2013, 106, 234–240. [Google Scholar] [CrossRef]

- Slade, E.L.; Dwivedi, Y.K.; Piercy, N.C.; Williams, M. Modeling Consumers’ Adoption Intentions of Remote Mobile Payments in the United Kingdom: Extending UTAUT with Innovativeness, Risk, and Trust. Psychol. Mark. 2015, 32, 860–873. [Google Scholar] [CrossRef]

- Lu, J.; Wei, J.; Yu, C.-S.; Liu, C. How do post-usage factors and espoused cultural values impact mobile payment continuation? Behav. Inf. Technol. 2017, 36, 140–164. [Google Scholar] [CrossRef]

- Musa, A.; Khan, H.U.; AlShare, K.A. Factors influence consumers’ adoption of mobile payment devices in Qatar. Int. J. Mob. Commun. 2015, 13, 670. [Google Scholar] [CrossRef]

- Lin, R.; Xie, J. Understanding the Adoption of Third-Party on-Line Payment: An Empirical Study of User Acceptance of Alipay in China. 2014. Available online: http://urn.kb.se/resolve?urn=urn:nbn:se:hj:diva-24231 (accessed on 12 April 2021).

- Rust, R.T.; Oliver, R.L. Service Quality: New Directions in Theory and Practice; Sage Publications: Thousand Oaks, CA, USA, 1994. [Google Scholar]

- Cronin, J.J.; Taylor, S.A. Measuring Service Quality: A Reexamination and Extension. J. Mark. 1992, 56, 55. [Google Scholar] [CrossRef]

- Zeithaml, V.A. Consumer perceptions of price, quality, and value: A means-end model and synthesis of evidence. J. Mark. 1988, 52, 2–22. [Google Scholar] [CrossRef]

- Zeithmal, V.A.; Parasuraman, A.; Berry, L.L. Delivering Quality Service: Balancing Customer Perceptions and Expectations; Free Press: New York, NY, USA, 1990. [Google Scholar]

- Zeithmal, V.A.; Bitner, M.J. Services Marketing: Integrating Customer Focus across the Firm; McGraw-Hill: New York, NY, USA, 2000. [Google Scholar]

- Grubor, A.; Salai, S.; Leković, B. Service quality as a factor of marketing competitiveness. Rom. Assoc. Econ. Univ. 2010, 273–281. [Google Scholar]

- Nitin, S.; Deshmukh, S.G.; Prem, V. Service Quality Models: A Review. Int. J. Qual. Reliab. Manag. 2005, 22, 913–949. [Google Scholar]

- Davis, F.D. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Q. 1989, 13, 319–339. [Google Scholar] [CrossRef]

- Moore, G.C.; Benbasat, I. Development of an Instrument to Measure the Perceptions of Adopting an Information Technology Innovation. Inf. Syst. Res. 1991, 2, 192–222. [Google Scholar] [CrossRef]

- Vijayasarathy, L.R. Predicting consumer intentions to use on-line shopping: The case for an augmented technology acceptance model. Inf. Manag. 2004, 41, 747–762. [Google Scholar] [CrossRef]

- Ramayah, T.; Aafaqi, B.; Jantan, M. Internet usage among students of institution of higher learning: The role of mo-tivational variables. In Proceedings of the 1st International Conference on Asian Academy of Applied Business Conference, Sabah, Malaysia, 10–12 July 2003. [Google Scholar]

- Trautman, L.J. E-Commerce, cyber, and electronic payment system risks: Lessons from PayPal. UC Davis Bus. LJ 2015, 16, 261. [Google Scholar]

- Luarn, P.; Lin, H.-H. Toward an understanding of the behavioral intention to use mobile banking. Comput. Hum. Behav. 2005, 21, 873–891. [Google Scholar] [CrossRef]

- IResearch. IResearh Wisdom: Date of Chinese Netizens Use Cell Phone Banking in 2009. [R/OL] (2009-09-16). 2009. Available online: http://www.iresearch.com.cn/html/consulting/online_payment/DetailNews_id_101315.html (accessed on 26 September 2009).

- Bauer, R.A. Consumer behavior as risk taking. In Dynamic Marketing for a Changing World; Hancock, R., Ed.; American Marketing Association: Chicago, IL, USA, 1960; pp. 389–398. [Google Scholar]

- Shin, D.-H. Towards an understanding of the consumer acceptance of mobile wallet. Comput. Hum. Behav. 2009, 25, 1343–1354. [Google Scholar] [CrossRef]

- Yang, S.; Lu, Y.; Gupta, S.; Cao, Y.; Zhang, R. Mobile payment services adoption across time: An empirical study of the effects of behavioral beliefs, social influences, and personal traits. Comput. Hum. Behav. 2012, 28, 129–142. [Google Scholar] [CrossRef]

- Zhang, H.; Li, H. Factors affecting payment choices in on-line auctions: A study of eBay traders. Decis. Support Syst. 2006, 42, 1076–1088. [Google Scholar] [CrossRef]

- Hernandez, J.M.C.; Mazzon, J.A. Adoption of internet banking: Proposition and implementation of an integrated methodology approach. Int. J. Bank Mark. 2007, 25, 72–88. [Google Scholar] [CrossRef]

- Chen, Y.H.; Barnes, S. Initial trust and on-line buyer behaviour. Ind. Manag. Data Syst. 2007, 107, 21–36. [Google Scholar] [CrossRef]

- Siau, K.; Sheng, H.; Nah, F.; Davis, S. A qualitative investigation on consumer trust in mobile commerce. Int. J. Electron. Bus. 2004, 2, 283. [Google Scholar] [CrossRef]

- Lwin, M.; Wirtz, J.; Williams, J.D. Consumer on-line privacy concerns and responses: A power-responsibility equilibrium perspective. J. Acad. Mark. Sci. 2007, 35, 572–585. [Google Scholar] [CrossRef]

- Venkatesh, V.; Morris, M.G. Davis User Acceptance of Information Technology: Toward a Unified View. MIS Q. 2003, 27, 425. [Google Scholar] [CrossRef]

- Zhou, T.; Lu, Y.; Wang, B. Integrating TTF and UTAUT to explain mobile banking user adoption. Comput. Hum. Behav. 2010, 26, 760–767. [Google Scholar] [CrossRef]

- Hong, S.-J.; Tam, K.Y. Understanding the Adoption of Multipurpose Information Appliances: The Case of Mobile Data Services. Inf. Syst. Res. 2006, 17, 162–179. [Google Scholar] [CrossRef]

- Lu, J.; Yao, J.; Yu, C. Personal innovativeness, social influences and adoption of wireless Internet services via mo-bile technology. J. Strateg. Inf. Syst. 2005, 14, 245–268. [Google Scholar] [CrossRef]

- Rogers, E.M. Diffusion of Innovations, 4th ed.; Free Press: New York, NY, USA, 1995. [Google Scholar]

- Bao, Y.; Zhou, K.Z.; Su, C. Face consciousness and risk aversion: Do they affect consumer decision-making? Psychol. Mark. 2003, 20, 733–755. [Google Scholar] [CrossRef]

- Tornatzky, L.G.; Klein, K.J. Innovation characteristics and innovation adoption- implementation: A me-ta-analysis of findings. IEEE Trans. Eng. Manag. 1982, 29, 28–45. [Google Scholar] [CrossRef]

- Lee, M.S.Y.; McGoldrick, P.J.; Keeling, K.A.; Doherty, J. Using ZMET to explore barriers to the adoption of 3G mo-bile banking services. Int. J. Retail Distrib. Manag. 2003, 31, 340–348. [Google Scholar] [CrossRef]

- Wu, J.-H.; Wang, S.-C. What drives mobile commerce? An empirical evaluation of the revised technology acceptance model. Inf. Manag. 2005, 42, 719–729. [Google Scholar] [CrossRef]

- Chen, L. A model of consumer acceptance of mobile payment. Int. J. Mob. Commun. 2008, 1, 32–52. [Google Scholar] [CrossRef]

- Arning, K.; Ziefle, M. Understanding age differences in PDA acceptance and performance. Comput. Hum. Behav. 2007, 23, 2904–2927. [Google Scholar] [CrossRef]

- Phang, C.; Sutanto, J.; Kankanhalli, A.; Li, Y.; Tan, B.; Teo, H.-H. Senior Citizens’ Acceptance of Information Systems: A Study in the Context of e-Government Services. IEEE Trans. Eng. Manag. 2006, 53, 555–569. [Google Scholar] [CrossRef]

- Dean, D.H. Shopper age and the use of self-service technologies. Manag. Serv. Qual. Int. J. 2008, 18, 225–238. [Google Scholar] [CrossRef]

- Mensah, I.K. Predictors of the Continued Adoption of WECHAT Mobile Payment. Int. J. E-Business Res. 2019, 15, 1–23. [Google Scholar] [CrossRef]

- Abrahão, R.D.S.; Moriguchi, S.N.; Andrade, D.F. Intention of adoption of mobile payment: An analysis in the light of the Unified Theory of Acceptance and Use of Technology (UTAUT). Rev. Adm. Innov. RAI 2016, 13, 221–230. [Google Scholar] [CrossRef]

- Kim, H.K.; Lee, M. Factors associated with health services utilization between the years 2010 and 2012 in Korea: Using Andersen’s behavioral model. Osong Public Health Res. Perspect. 2016, 7, 18–25. [Google Scholar] [CrossRef]

- Buhrmester, M.; Kwang, T.; Gosling, S.D. Amazon’s Mechanical Turk: A new source of inexpensive, yet high-quality data? Perspect. Psychol. Sci. 2016, 6, 3–5. [Google Scholar] [CrossRef]

- DiCicco-Bloom, B.; Crabtree, B.F. The qualitative research interview. Med. Educ. 2006, 40, 314–321. [Google Scholar] [CrossRef]

- Nykvist, R.; Stalfors, P. Consumer Acceptance of Mobile Payment Services. Bachelor’s Thesis, Handelshögskolan Vidgöteborgs Universitet, Göteborg, Sweden, 2011. [Google Scholar]

- Zheng, H.M.; Chen, G.S. How Has the Third Party Reduced the Perceived Risk of Young Consumers in China? School of Sustainability Development of Society and Technology, Mälardalen University: Västerås, Sweden, 2012; pp. 18–25. [Google Scholar]

- Kurnia, S.; Smith, S.P.; Lee, H. Consumers’ perception of mobile internet in Australia. E-Bus. Rev. 2006, 5, 19–32. [Google Scholar]

- Draper, N.R.; Smith, H. Applied Regression Analysis; John Wiley & Sons: Hoboken, NJ, USA, 1996; Volume 326. [Google Scholar]

- Zhou, W. Correlation Analysis: From Computational Hardness to Practical Success. Ph.D. Thesis, Graduate School, Rutgers University, Newark, NJ, USA, 2011. [Google Scholar]

- Venkatesh, V. Determinants of Perceived Ease of Use: Integrating Control, Intrinsic Motivation, and Emotion into the Technology Acceptance Model. Inf. Syst. Res. 2000, 11, 342–365. [Google Scholar] [CrossRef]

- Pagani, M.; Schipani, D. Motivations and barriers to the adoption of 3G mobile multimedia services. In E-Commerce and M-Commerce Technologies; Deans, P.C., Ed.; Idea Group: Hershey, PA, USA, 2005; pp. 80–95. [Google Scholar]

- Oliveira, T.; Manoj, T.; Goncalo, B.; Filipe, C. Mobile payment: Understanding the determinants of customer adoption and intention to recommend the technology. Comput. Hum. Behav. 2016, 61, 404–414. [Google Scholar] [CrossRef]

- Wu, R.; Lee, J. The Comparative Study on Third Party Mobile Payment Between UTAUT2 and TTF. J. Distrib. Sci. 2017, 15, 5–19. [Google Scholar] [CrossRef]

- Chen, Y.-F.; Lan, Y.-C. An empirical study of the factors affecting mobile shopping in Taiwan. In Mobile Commerce: Concepts, Methodologies, Tools, and Applications; IGI Global: Hershey, PA, USA, 2018; pp. 1329–1340. [Google Scholar]

- Bhimasta, R.A.; Suprapto, B. What Drives Young Indonesian’S Intention to Use Mobile Payment? A Case of T-Cash. Adv. Sci. Lett. 2018, 24, 4802–4805. [Google Scholar] [CrossRef]

- Kim, C.; Mirusmonov, M.; Lee, I. An empirical examination of factors influencing the intention to use mobile payment. Comput. Hum. Behav. 2010, 26, 310–322. [Google Scholar] [CrossRef]

- Shankar, A.; Datta, B. Factors Affecting Mobile Payment Adoption Intention: An Indian Perspective. Glob. Bus. Rev. 2018, 19, S72–S89. [Google Scholar] [CrossRef]

- Acheampong, P.; Li, Z.W.; Kamal, K.H.; Obobisa, E.S.; Frank, B.; Isaac, A.B. Examining the intervening role of age and gender on mobile payment acceptance in Ghana: UTAUT model. Can. J. Appl. Sci. Technol. 2018, 5, 2. [Google Scholar]

- Sobti, N. Impact of demonetization on diffusion of mobile payment service in India: Antecedents of behavioral in-tention and adoption using extended UTAUT model. J. Adv. Manag. Res. 2019, 16. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).