Factors Affecting Small and Micro Enterprise Performance with the Mediating Effect of Government Support: Evidence from the Amhara Region Ethiopia

Abstract

:1. Introduction

2. Literature Review and Hypothesis Development

2.1. Entrepreneur Competence and SMEs Performance

2.2. Access to Infrastructure and SME Performance

2.3. The Effect of Entrepreneur Training and SME’s Performance

2.4. Access to Micro Finance and SMEs Performance

2.5. The Mediation Role of Government Support and SME’s Performance

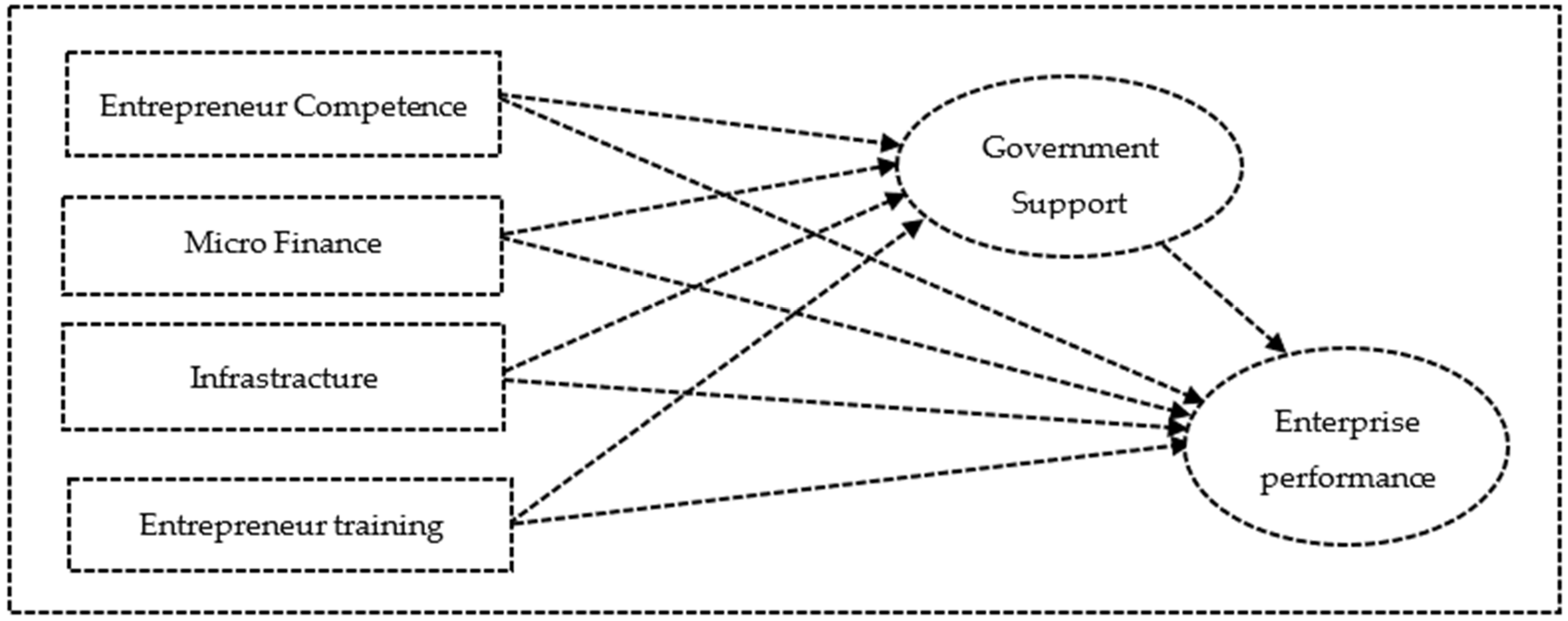

2.6. Conceptual Model of the Study

3. Research Methodology

3.1. Research Design

3.2. Sample and Data Collection

3.3. Model Specification

3.4. Measurements of Variables

4. Results and Interpretations

4.1. Demographic Data Analysis

4.2. Reliability and Validity Statistics Analysis

4.3. Analysis of Multiple Regressions

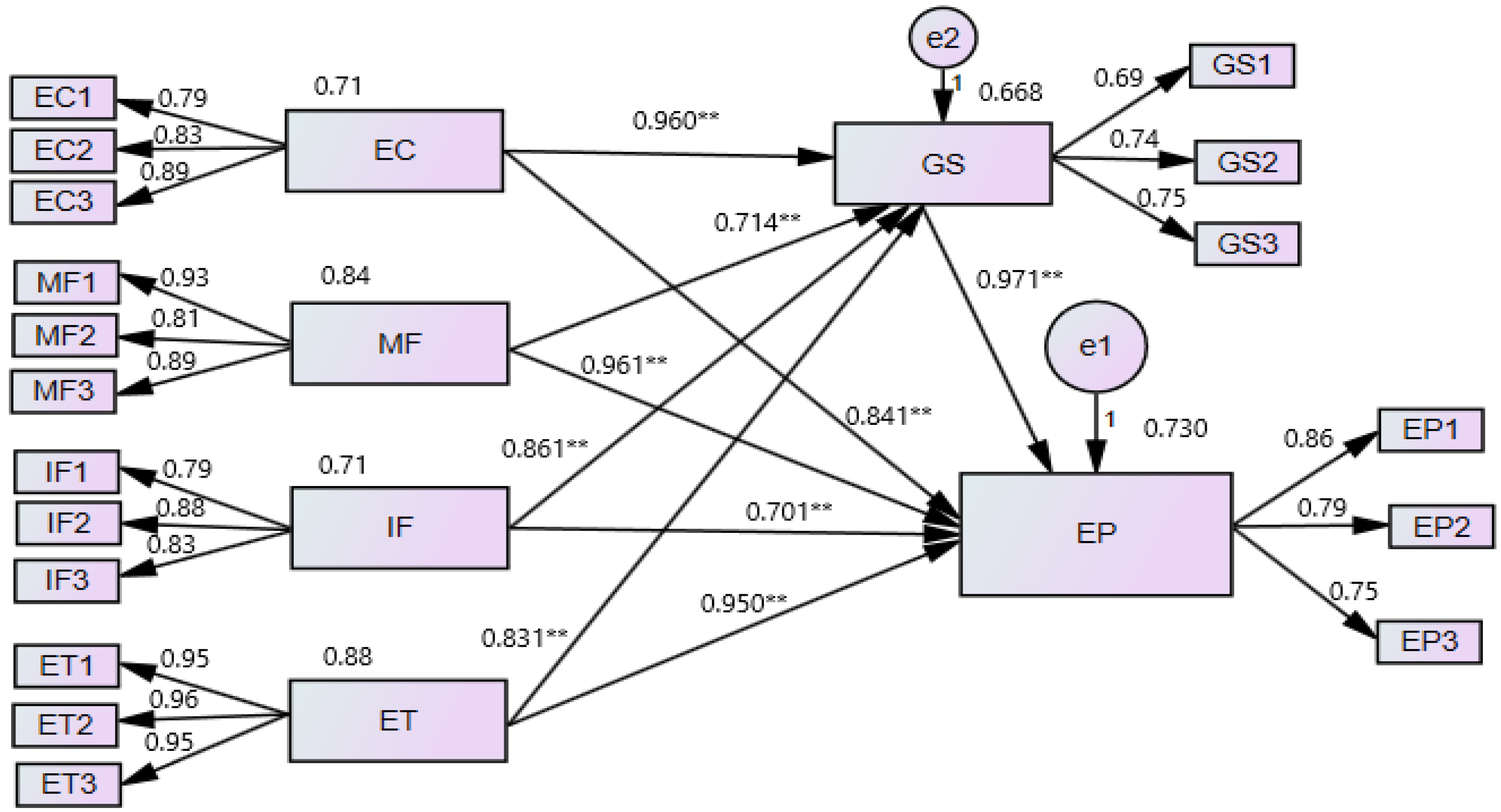

4.4. Structural Equation Model Estimate

4.5. Results of the Structural Model Goodness-of-Fit and Path Modeling Analysis

4.6. The Mediator Variable’s Direct, Indirect, and Total Effects

4.7. Mediating Effects of Government Support

4.8. Test of Hypothesis Results Analysis

5. Conclusions and Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Mamo, W.B. Growth Determinants of Micro and Small Enterprises (MSEs): Evidence from Entrepreneurs in the Eastern Region of Ethiopia. J. Knowl. Econ. 2022, 3, 2–19. [Google Scholar] [CrossRef]

- FDRE Ministry of Industry. Ethiopian Industrial Development Strategic Plan (2013–2025); Ministry of Industry: Addis Ababa, Ethiopia, 2013; pp. 1–125.

- Zambad, S.; Londhe, B.R. To Study The Scope & Importance of Amended Patent Act on Indian Pharmaceutical Company with Respect to Innovation. Procedia Econ. Financ. 2014, 11, 819–828. [Google Scholar]

- Morduch, J.; Wagner, R.F.; Haley, B. Analysis of the Effects of Microfinance on Poverty Reduction: The NYU Wagner Working Paper Series. Can. Int. Dev. Agency 2002, 1014, 7. [Google Scholar]

- Wang, Y. What are the biggest obstacles to growth of SMEs in developing countries? An empirical evidence from an enterprise survey. Borsa Istanb. Rev. 2016, 16, 167–176. [Google Scholar] [CrossRef] [Green Version]

- Selvakumar, M.; Sathyalakshmi, V. Economic and social thought. J. Econ. Soc. Thought 2015, 2, 106–120. [Google Scholar]

- Meyer, D.F.; Meyer, N. Management of small and medium enterprise (SME) development: An analysis of Stumbling blocks in a developing region. Polish J. Manag. Stud. 2017, 16, 127–141. [Google Scholar] [CrossRef]

- Asian Development Bank. Asia SME Finance Monitor. Asia Development Bank; Asian Development Bank: Mandaluyong, Philippines, 2014; pp. 1–90. [Google Scholar]

- Nichter, S.; Goldmark, L. Small Firm Growth in Developing Countries. World Dev. 2009, 37, 1453–1464. [Google Scholar] [CrossRef]

- Marolt, M.; Zimmermann, H.D.; Pucihar, A. Enhancing marketing performance through enterprise-initiated customer engagement. Sustainability 2020, 12, 3931. [Google Scholar] [CrossRef]

- Chandrayanti, T.; Nidar, S.R.; Mulyana, A.; Anwar, M. Credit accessibility model of small enterprises based on firm characteristics and business performance. Case study at small enterprises in West Sumatera Indonesia. Int. J. Entrep. 2019, 23, 2–20. [Google Scholar]

- Tefera, H.; Gebremichael, A.; Abera, N. Growth Determinants of Micro and Small Enterprises: Swiss Program for Research for Global Development WP. 2016, 1–27. Available online: http://www.iiste.org (accessed on 31 May 2022).

- Abebe, G.T.; Caria, S.; Fafchamps, M.; Falco, P.; Franklin, S.; Quinn, S. Curse of Anonymity or Tyranny of Distance? The Impacts of Job-Search Support in Urban Ethiopia. NBER Work 2016, 72. [Google Scholar] [CrossRef]

- Abara, G.; Banti, T. Role of Financial Institutions in the Growth of Micro and Small Enterprises in Assosa Zone. Int. J. Sci. Res. 2015, 6, 852–856. [Google Scholar]

- Tether, B.S.; Storey, D.J. Public policy measures to support new technology-based firms in the European Union. Res. Policy 1998, 26, 1037–1057. [Google Scholar]

- Alkahtani, A.; Nordin, N.; Khan, R.U. Does government support enhance the relation between networking structure and sustainable competitive performance among SMEs? J. Innov. Entrep. 2020, 9, 2–19. [Google Scholar] [CrossRef]

- Ntiamoah, E.B.; Li, D.; Kwamega, M. Impact of Government and Other Institutions’ Support on Performance of Small and Medium Enterprises in the Agribusiness Sector in Ghana. Am. J. Ind. Bus. Manag. 2016, 6, 558–567. [Google Scholar]

- Gu, J.; Wang, J.; Yang, Y.; Xu, Z. Credit line models for supply chain enterprises with channel background and soft information. Sustainability 2019, 11, 2985. [Google Scholar] [CrossRef] [Green Version]

- Yang, L.; Zhang, Y. Digital financial inclusion and sustainable growth of small and micro enterprises-evidence based on China’s new third board market listed companies. Sustainability 2020, 12, 3733. [Google Scholar] [CrossRef]

- Piot-lepetit, I.; Nzongang, J. Business Analytics for Managing Performance of Microfinance Institutions: A Flexible Management of the Implementation Process. Sustainability 2021, 13, 4882. [Google Scholar] [CrossRef]

- Xu, W.; Fu, H.; Liu, H. Evaluating the sustainability of microfinance institutions considering macro-environmental factors: A cross-country study. Sustainability 2019, 11, 5947. [Google Scholar] [CrossRef] [Green Version]

- OECD. Enhancing the Contributions of SMEs in a Global and Digitalized Economy. OECD Couns. Minist. 2017, 1, 7–8. [Google Scholar]

- Yoshino, N.; Taghizadeh-hesary, F. The Roles of SMEs in Asia and their Difficulty in Assessing Finance. Asia Bus. Dev. 2018, 911, 1–22. [Google Scholar]

- Bouri, A.; Breij, M.; Diop, M.; Kempner, R.; Klinger, B.; Stevenson, K. Report on Support to SMEs in Developing Countries Through Financial Intermediaries; Dalberg: Washington, DC, USA, 2011. [Google Scholar]

- Ocholah, R.M.A.; Okelo, S.; Ojwang, C.; Aila, F.; Ojera, P.B. Literature Review on the Relationship between Microfinance Provision and Women Enterprise Performance. Greener J. Soc. Sci. 2013, 3, 278–285. [Google Scholar] [CrossRef] [Green Version]

- Ahmad, P.S.; Choudhary, U. Microfinance and Socio-Economic Development of Poor Families in Rural India: An Empirical Investigation. Int. J. Manag. 2021, 12, 610–619. [Google Scholar]

- Peter, F.O.; Oladele, P.; Adegbuyi, O.; Olokundun, A.M.; Peter, A.O.; Amaihian, A.B. Data set on training assistance and the performance of small and medium enterprises in Lagos, Nigeria. Data Br. 2018, 19, 2477–2480. [Google Scholar] [CrossRef] [PubMed]

- Diabate, A.; Allate, B.M.; Wei, D.; Yu, L. Do firm and entrepreneur characteristics play a role in SMEs’ Sustainable growth in a middle-income economy like Côte d’Ivoire? Sustainability 2019, 11, 1557. [Google Scholar] [CrossRef] [Green Version]

- Sarfraz, M.; Qun, W.; Abdullah, M.I.; Alvi, A.T. Employees’ perception of Corporate Social Responsibility impact on employee outcomes: Mediating role of organizational justice for Small and Medium Enterprises. Sustainability 2018, 10, 2429. [Google Scholar] [CrossRef] [Green Version]

- Zhao, X.; Lynch, J.G.; Chen, Q. Reconsidering Baron and Kenny: Myths and truths about mediation analysis. J. Consum. Res. 2010, 37, 197–206. [Google Scholar] [CrossRef]

- Stancu, A.; Filip, A.; Rosca, M.I.; Ionita, D.; Caplescu, R.; Cânda, A. Value creation attributes-clustering strategic options for Romanian SMEs. Sustainability 2020, 12, 7007. [Google Scholar] [CrossRef]

- Kim, J.; Hwang, E.; Phillips, M.; Jang, S.; Kim, J.E. Mediation Analysis Revisited: Practical suggestions for addressing common deficiencies. Australas. Mark. J. 2018, 26, 59–64. [Google Scholar] [CrossRef] [Green Version]

- Alavi, A.H.; Buttlar, W.G. An overview of smartphone technology for citizen-centered, real-time, and scalable civil infrastructure monitoring. Future Gener. Comput. Syst. 2019, 93, 651–672. [Google Scholar] [CrossRef]

- Obokoh, L.O.; Goldman, G. Infrastructure deficiency and the performance of small- and medium-sized enterprises in Nigeria’s Liberalized Economy. Acta Commer. 2016, 16, 1–19. [Google Scholar] [CrossRef]

- Chatterjee, S.; Datta, D. Entrepreneurial Ability and Development of Micro Enterprise. J. Econ. Theory Pract. 2020, 8, 1–19. [Google Scholar] [CrossRef]

- Mambula, C. Perceptions of SME growth constraints in Nigeria. J. Small Bus. Manag. 2002, 40, 58–65. [Google Scholar] [CrossRef]

- Agburu, J.I.; Anza, N.C.; Iyortsuun, A.S. Effect of outsourcing strategies on the performance of small and medium scale enterprises. J. Glob. Entrep. Res. 2017, 7, 26. [Google Scholar] [CrossRef] [Green Version]

- Beynon, M.J.; Jones, P.; Pickernell, D.; Packham, G. Investigating the impact of training influence on employee retention in small and medium enterprises: A regression-type classification and ranking believe simplex analysis on sparse data. Expert Syst. 2015, 32, 141–154. [Google Scholar] [CrossRef] [Green Version]

- Cámara, N.; Tuesta, D. Measuring Financial Inclusion: A Multidimensional Index; B BVA: Madrid, Spain, 2014. [Google Scholar]

- McKinney, W. Data Structures for Statistical Computing in Python. Proc. 9th Python Sci. Conf. 2010, 1, 56–61. [Google Scholar]

- MUDHC. National Report on Housing & Sustainable Urban Development; MUDHC: Adis Ababa, Ethiopia, 2014; pp. 1–75. [Google Scholar]

- Marri, H.B.; Nebhwani, M.; Sohag, R.A. Study of government support system in SMEs: An empirical investigation. Mehran Univ. Res. J. Eng. Technol. 2011, 30, 435–446. [Google Scholar]

- Mitchelmore, S.; Rowley, J. Entrepreneurial competencies: A literature review and development agenda. Int. J. Entrep. Behav. Res. 2010, 16, 92–111. [Google Scholar] [CrossRef]

- Sefiani, Y. SMEs: A Perspective from Tangier; Emerald: Bingley, UK, 2013; pp. 1–443. [Google Scholar]

- Ndiaye, N.; Razak, L.A.; Nagayev, R.; Ng, A. Demystifying small and medium enterprises’ (SMEs) performance in emerging and developing economies. Borsa Istanbul Rev. 2018, 18, 269–281. [Google Scholar] [CrossRef]

- Murphy, G.; Trailer, J.; Hill, R. Measuring Research Performance in Entrepreneurship. J. Bus. Res. 1996, 36, 15–23. [Google Scholar] [CrossRef]

- Bird, B. Towards a Theory of Entrepreneurial Competency; JAI Press Inc.: Stamford, CT, USA, 1995; pp. 51–72. [Google Scholar]

- Boyatzis, R.E. Competencies in the 21st century. J. Manag. Dev. 2008, 27, 5–12. [Google Scholar] [CrossRef]

- Ahmad, N.H.; Ramayah, T.; Wilson, C.; Kummerow, L. Is entrepreneurial competency and business success relationship contingent upon business environment? A study of Malaysian SMEs. Int. J. Entrep. Behav. Res. 2010, 16, 182–203. [Google Scholar] [CrossRef]

- Man, T.W.Y.; Lau, T.; Chan, K.F. The competitiveness of small and medium enterprises: A conceptualization with focus on entrepreneurial competencies. J. Bus. Ventur. 2002, 17, 123–142. [Google Scholar] [CrossRef]

- Segal, G.; Borgia, D.; Schoenfeld, J. The motivation to become an entrepreneur. Int. J. Entrep. Behav. Res. 2005, 11, 42–57. [Google Scholar] [CrossRef] [Green Version]

- Kiyabo, K.; Isaga, N. Strategic entrepreneurship, competitive advantage, and SMEs’ performance in the welding industry in Tanzania. J. Glob. Entrep. Res. 2019, 9, 2–17. [Google Scholar] [CrossRef]

- Kamyabi, Y.; Devi, S. The impact of advisory services on Iranian SME performance: An empirical investigation of the role of professional accountants. S. Afr. J. Bus. Manag. 2012, 43, 61–72. [Google Scholar] [CrossRef]

- Atiase, V.Y.; Mahmood, S.; Wang, Y.; Botchie, D. Entrepreneurship development in Africa: Investigating critical resource challenges. J. Small Bus. Enterp. Dev. 2017, 25, 644–666. [Google Scholar] [CrossRef] [Green Version]

- Piot-Lepetit, I.; Nzongang, J. Financial sustainability and poverty outreach within a network of village banks in Cameroon: A multi-DEA approach. Eur. J. Oper. Res. 2014, 234, 2–19. [Google Scholar] [CrossRef]

- Asenge, B.; Lubem, E.; Richard, T. Entrepreneurial Competencies and Entrepreneurial Mindset as Determinants of Small and Medium Scale Enterprises Performance in Nigeria. Int. Res. J. Publ. Glob. J. 2018, 18, 2–21. [Google Scholar]

- Ibidunni, A.S.; Atolagbe, T.M.; Obi, J.; Olokundun, M.A.; Oke, O.A.; Amaihian, A.B. Moderating effect of entrepreneurial orientation on entrepreneurial competencies and performance of agro-based SMEs. Int. J. Entrep. 2018, 22, 1–9. [Google Scholar]

- Ombi, N.; Ambad, S.N.A.; Bujang, I. The Effect of Business Development Services on Small Medium Enterprises (SMEs) Performance. Int. J. Acad. Res. Bus. Soc. Sci. 2018, 8, 114–127. [Google Scholar] [CrossRef] [Green Version]

- Enang, U.; Bassey, E. Human Capital and Industrialization in Nigeria. Nile J. Bus. Econ. 2017, 5, 58–78. [Google Scholar]

- Calderon, C.; Cantu, C.; Chuhan-Pole, P. Infrastructure Development in Sub-Saharan Africa: A Scorecard; World Bank Policy Research Working Paper No. 8425; World Bank: Washington, DC, USA, 2018. [Google Scholar]

- Sefiani, Y.; Bown, R. What Influences the Success of Manufacturing SMEs ? A Perspective from Tangier Yassine Sefiani the University of Gloucestershire Senior Lecturer in Market Interpretation the University of Gloucestershire. Int. J. Bus. Soc. Sci. 2013, 4, 297–309. [Google Scholar]

- Ahmed, K.; Chowdhury, T.A. Performance Evaluation of SMEs of Bangladesh. Int. J. Bus. Manag. 2009, 4, 2–21. [Google Scholar] [CrossRef] [Green Version]

- Islam, S.; Hossain, F. Constraints to small and medium-sized enterprises development in Bangladesh: Results from a cross-sectional study. J. Account. Econ. 2018, 6, 2–18. [Google Scholar] [CrossRef]

- Kithae, P.P. Effect of Legal and Technological Arrangements on Performance of Micro and Small Enterprises in Kenya. Eur. J. Bus. Manag. 2013, 5, 160–168. [Google Scholar]

- Mayuran, L. The Impacts of Entrepreneurship Training on Performance of Small Enterprises in Jaffna District Problem Statement and Research Questions Entrepreneurship training financial management Performance of Small enterprises. Glob. J. Commer. Manag. Perspect. 2016, 5, 1–6. [Google Scholar]

- Ezzahra, K.F.; Mohamed, R.; Omar, T.; Mohamed, T. Training for Effective Skills in SMEs in Morocco. Procedia-Soc. Behav. Sci. 2014, 116, 2926–2930. [Google Scholar] [CrossRef] [Green Version]

- Atiase, V.; Mahmood, S.; Yong, W. BAM2019 Conference Proceedings FNGOs and Microfinance Delivery: The Institutional Logic Perspective Victor Yawo Atiase International Centre for Transformational Entrepreneurship; University of Wolverhampton: Wolverhampton, UK, 2019. [Google Scholar]

- Ibor, B.I.; Offiong, A.I.; Mendie, E.S. Financial Inclusion and Performance of Micro, Small and Medium Scale Enterprises in Nigeria. Int. J. Res. 2017, 5, 104–1228. [Google Scholar] [CrossRef]

- Bank, W. Industrial Clusters and Micro and Small Enterprises in Africa: From Survival to Growth; World Bank: Washington DC, USA, 2011. [Google Scholar]

- Parvin, S.S.; Hossain, B.; Mohiuddin, M.; Cao, Q. Capital structure, financial performance, and sustainability of micro-finance institutions (MFIs) in Bangladesh. Sustainability 2020, 12, 6222. [Google Scholar] [CrossRef]

- Kijkasiwat, P.; Phuensane, P. Innovation and Firm Performance: The Moderating and Mediating Roles of Firm Size and Small and Medium Enterprise Finance. J. Risk Financ. Manag. 2020, 13, 97. [Google Scholar] [CrossRef]

- Khan, S.J.M.; Anuar, A.R. Access to finance: Exploring barriers to entrepreneurship development in SMEs. Glob. Entrep. New Ventur. Creat. Shar. Econ. 2017, 92–111. [Google Scholar] [CrossRef]

- Fowowe, B. Access to finance and firm performance: Evidence from African countries. Rev. Dev. Financ. 2017, 7, 6–17. [Google Scholar] [CrossRef]

- Ahmmed, K.F. Increasing SMEs’ Financial Accessibility in Developing Countries: A study in Bangladesh. Int. J. Econ. Manag. Eng. 2016, 10, 893. [Google Scholar]

- Nguyen, T.; Tripe, D.; Ngo, T. Operational Efficiency of Bank Loans and Deposits: A Case Study of Vietnamese Banking System. Int. J. Financ. Stud. 2018, 6, 14. [Google Scholar] [CrossRef] [Green Version]

- Ayuba, B.; Zubairu, M. Impact of Banking Sector Credit on the Growth of Small and Medium Enterprises (SME’s) in Nigeria. J. Resour. Dev. Manag. 2015, 15, 1–9. [Google Scholar]

- Lee, R. The Effect of Supply Chain Management Strategy on Operational and Financial Performance. Sustainability 2021, 13, 5138. [Google Scholar] [CrossRef]

- De Torre, A.; Schmukler, S.L. Bank Involvement with SMEs: World Bank Policy Research Work; WPS4649; World Bank: Washington, DC, USA, 2008; pp. 1–90. [Google Scholar]

- Kozolchyk, B. The Paperless Letter of Credit and Related Documents of Title. Law Contemp. Probl. 1992, 55, 2–39. [Google Scholar] [CrossRef] [Green Version]

- Lang, F. The Importance of Leasing for SME Finance; European Investment Fund: Luxembourg, 2012. [Google Scholar]

- Deloof, M.; Lagaert, I.; Verschueren, I. Leases and Debt: Complements or Substitutes? Evidence from Belgian SMEs. J. Small Bus. Manag. 2007, 45, 491–500. [Google Scholar] [CrossRef]

- Adedeji, A.; Stapleton, R.C. Leases, Debt and Taxable Capacity; Aston University: Birmingham, UK, 2015; Volume 6, pp. 37–41. [Google Scholar]

- Lassala, C.; Apetrei, A.; Sapena, J. Sustainability matter and financial performance of companies. Sustainability 2017, 9, 1498. [Google Scholar] [CrossRef] [Green Version]

- Doh, S.; Kim, B. Government support for SME innovations in the regional industries: The case of government financial support program in South Korea. Res. Policy 2014, 43, 1557–1569. [Google Scholar] [CrossRef]

- Smallbone, D.; Welter, F. The Role of Government in SME Development in Transition Economies. Int. J. Small Bus. 2001, 19, 63–77. [Google Scholar] [CrossRef]

- Nugroho, M.A. Impact of Government Support and Competitor Pressure on the Readiness of SMEs in Indonesia in Adopting the Information Technology. Procedia Comput. Sci. 2015, 72, 102–111. [Google Scholar] [CrossRef] [Green Version]

- Seo, J.H.; Cho, D. Analysis of the effect of R&D planning support for smes using latent growth modeling. Sustainability 2020, 12, 1018. [Google Scholar]

- Lyver, M.J.; Lu, T.J. Sustaining innovation performance in SMEs: Exploring the roles of strategic entrepreneurship and IT capabilities. Sustainability 2018, 10, 442. [Google Scholar] [CrossRef] [Green Version]

- Yi, H.T.; Amenuvor, F.E.; Boateng, H. The impact of entrepreneurial orientation on new product creativity, competitive advantage and new product performance in smes: The moderating role of corporate life cycle. Sustainability 2021, 13, 3586. [Google Scholar] [CrossRef]

- Esubalew, A.A.; Raghurama, A. The moderating effect of size on the relationship between commercial banks financing and the performance of micro, small, and medium enterprises (MSMEs). J. Glob. Entrep. Res. 2021, 5, 2–19. [Google Scholar] [CrossRef]

- Choi, J.H.; Kim, S.; Yang, D.H. Small and medium enterprises and the relation between social performance and financial performance: Empirical evidence from Korea. Sustainability 2018, 10, 1816. [Google Scholar] [CrossRef] [Green Version]

- Ardyan, E. SMEs’ marketing performance: The mediating role of market entry capability. J. Res. Mark. Entrep. 2018, 20, 122–146. [Google Scholar]

- Cardoza, G.; Fornes, G.; Farber, V.; Duarte, R.G.; Gutierrez, J.R. Barriers and public policies affecting the international expansion of Latin American SMEs: Evidence from Brazil, Colombia, and Peru. J. Bus. Res. 2016, 69, 2–21. [Google Scholar] [CrossRef]

- Delmar, F.; Davidsson, P.; Gartner, W.B. Arriving at the high-growth firm. J. Bus. Ventur. 2003, 18, 189–216. [Google Scholar] [CrossRef] [Green Version]

- Adams, D.; Bucior, H.; Day, G.; Rimmer, J.A. Houdini. Make that urinary catheter disappear-nurse-led protocol. J. Infect. Prev. 2012, 13, 44–46. [Google Scholar] [CrossRef]

- Wubet, G.G.; Mmopelwa, G. Performance of Micro and Small Enterprisers in Tigray, Northern Ethiopia. Momona Ethiop. J. Sci. 2020, 12, 103–122. [Google Scholar] [CrossRef]

- Agler, R.; de Boeck, P. On the interpretation and use of mediation: Multiple perspectives on mediation analysis. Front. Psychol. 2017, 8, 1984. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Morgan. Activities of human RRP6 and structure of the human RRP6 catalytic domain. Rna 2011, 17, 1566–1577. [Google Scholar] [CrossRef] [Green Version]

- Youtang, Z.; Yesuf, A.E. Driving Model of Determinant Factors Affecting the Performance of Small and Micro Enterprises: Empirical Evidence from Amhara Region, Ethiopia. Preprints 2021. [CrossRef]

- Postelnicu, L.; Hermes, N. Microfinance Performance and Social Capital: A Cross-Country Analysis. J. Bus. Ethics 2018, 153, 427–445. [Google Scholar] [CrossRef] [Green Version]

- Li, Y.H.; Huang, J.W.; Tsai, M.T. Entrepreneurial orientation and firm performance: The role of knowledge creation process. Ind. Mark. Manag. 2009, 38, 440–449. [Google Scholar] [CrossRef]

- Sidik, I.G. Conceptual Framework of Factors Affecting SME Development: Mediating Factors on the Relationship of Entrepreneur Traits and SME Performance. Procedia Econ. Financ. 2012, 4, 373–383. [Google Scholar] [CrossRef] [Green Version]

- Leitner, K.H.; Güldenberg, S. Generic strategies and firm performance in SMEs: A longitudinal study of Austrian SMEs. Small Bus. Econ. 2010, 35, 169–189. [Google Scholar] [CrossRef]

- Abor, J.; Quartey, P. Issues in SME development in Ghana and South Africa. Int. Res. J. Financ. Econ. 2010, 39, 218–228. [Google Scholar]

- Taber, K.S. The Use of Cronbach’s Alpha When Developing and Reporting Research Instruments in Science Education. Res. Sci. Educ. 2018, 48, 1273–1296. [Google Scholar] [CrossRef]

- Brusset, X. Production Economics Does supply chain visibility enhance agility ? Intern. J. Prod. Econ. 2016, 171, 46–59. [Google Scholar] [CrossRef]

- Bagozzi, R.P.; Yi, Y.; Phillips, L.W. Assessing Construct Validity in Organizational Research. JSTOR 1991, 36, 421–458. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D. Equation Algebra Unobservable Error: Variables. J. Mark. Res. 2012, 18, 382–388. [Google Scholar] [CrossRef]

- Heeren, A.; van Broeck, N.; Philippot, P. The effects of mindfulness on executive processes and autobiographical memory specificity. Behav. Res. 2009, 47, 403–409. [Google Scholar] [CrossRef]

- Tofighi, D.; MacKinnon, D.P.R. Mediation: An R package for mediation analysis confidence intervals. Behav. Res. Methods 2011, 43, 692–700. [Google Scholar] [CrossRef] [Green Version]

- Zaremba, L.S.; Smoleński, W.H. Optimal portfolio choice under a liability constraint. Anal. Oper. Res. 2000, 97, 131–141. [Google Scholar]

| List of Variables | Indicator Items | References |

|---|---|---|

| Enterprise Performance (EP) | Employment growth SMEs sales growth SMEs capital growth Profit growth Managerial performance growth Competitive capability | [54,94,101,102,103,104,105,106] |

| Entrepreneur Competence (EC) | Personal relationship competency Business and management skill competency Entrepreneurial and human relations competency Market competitive competency Financial skill competency Innovative and entrepreneur competency | [35,51,52] |

| Access Infrastructure (IF) | Access to market facility technology Access and fulfill related to infrastructure facilities Access training workshop facility Access land for working and selling place Access road Access water | [34,39,63] |

| Entrepreneur Training (ET) | Entrepreneur training consistency Entrepreneur training effectiveness Entrepreneur training quality Entrepreneur Training redundancy Entrepreneur Training competency | [54,64,107] |

| Access Finance (MF) | Time duration of the loan (long term loan Loan Adequacy for entrepreneur Microfinance loan cost and Influence of interest rate Lease machine accessibility | [54,94] |

| Government Support (GS) | Facilitating to access electricity Facilitating working and selling place Facilitating ICT infrastructure Issued supportive policy Facilitating financial support Facilitating training | [35,86,87] |

| EP | EC | MF | IF | ET | GS | ||

|---|---|---|---|---|---|---|---|

| EP | Pearson Correlation | 0.954 | |||||

| Sig. (2-tailed) | |||||||

| N | 384 | ||||||

| EC | Pearson Correlation | 0.656 ** | 0.889 | ||||

| Sig. (2-tailed) | 0.000 | ||||||

| N | 384 | 384 | |||||

| MF | Pearson Correlation | 0.844 ** | 0.837 ** | 0.880 | |||

| Sig. (2-tailed) | 0.000 | 0.000 | |||||

| N | 384 | 384 | 384 | ||||

| IF | Pearson Correlation | 0.635 ** | 0.845 ** | 0.785 ** | 0.964 | ||

| Sig. (2-tailed) | 0.000 | 0.000 | 0.000 | ||||

| N | 384 | 384 | 384 | 384 | |||

| ET | Pearson Correlation | 0.859 ** | 0.689 ** | 0.801 ** | 0.687 ** | 0.884 | |

| Sig. (2-tailed) | 0.000 | 0.000 | 0.000 | 0.000 | |||

| N | 384 | 384 | 384 | 384 | 384 | ||

| GS | Pearson Correlation | 0.835 ** | 0.766 ** | 0.826 ** | 0.855 ** | 0.883 ** | 0.961 |

| Sig. (2-tailed) | 0.033 | 0.000 | 0.000 | 0.000 | 0.000 | ||

| Pearson Correlation | 384 | 384 | 384 | 384 | 384 | 384 |

| Measuring Items | Path | Estimation (β) | Standard Error | Composite Reliability | Sig | |

|---|---|---|---|---|---|---|

| EP | ← | EC | 0.950 | 0.065 | 4.564 | 0.000 |

| EP | ← | MF | 0.961 | 0.056 | 2.526 | 0.000 |

| EP | ← | IF | 0.701 | 0.057 | 2.944 | 0.000 |

| EP | ← | ET | 0.711 | 0.051 | 2.588 | 0.000 |

| EP | ← | GS | 0.971 | 0.063 | 3.508 | 0.033 |

| GS | ← | EC | 0.960 | 0.057 | 2.734 | 0.000 |

| GS | ← | MF | 0.841 | 0.048 | 3.054 | 0.000 |

| Model Fit Indices | Criteria | Standard Measured Model |

|---|---|---|

| Chi-square (χ2) | Low | 319.83 |

| Degree of freedom | >0.0 | 183 |

| χ2/df | <3.0 | 1.780 |

| Goodness-of-fit index (GFI) | ≥0.90 | 0.952 |

| Adjusted Goodness of Fit (AGFI) | ≥0.90 | 0.937 |

| Normed fit index (NFI) | >0.90 | 0.926 |

| Incremental fit index (IFI) | >0.90 | 0.972 |

| Tuker-Lewis Index (TLI) | ≥0.90 | 0.928 |

| Comparative Fit Index (CFI) | ≥0.90 | 0.982 |

| Root Mean Square Error of Approximation (RMSEA) | <0.08 | 0.043 |

| Path | Micro Finance (MF) | Enterprise Performance (EP) | Effects of Mediation | |||

|---|---|---|---|---|---|---|

| Direct Effects | Indirect Effects | Total Effects | Direct Effects | Indirect Effects | ||

| EC | 0.858 | 0.000 | 0.858 | 0.144 | 0.688 | 0.832 |

| MF | 0.950 | 0.000 | 0.950 | 0.042 | 0.880 | 0.921 |

| IF | 0.859 | 0.000 | 0.859 | 0.145 | 0.684 | 0.834 |

| ET | 0.834 | 0.000 | 0.834 | 0.168 | 0.909 | 0.977 |

| GS | 0.000 | 0.000 | 0.000 | 0.970 | 0.000 | 0.970 |

| Mediator (Path) | Coefficient | Standard Error | Sobel Test z-Value | LL95%CI | UL95%CI |

|---|---|---|---|---|---|

| EC → GS → EP | 0.960 0.971 | 0.055 0.083 | 9.71791357 | 0.348 | 0.544 |

| MF → GS → EP | 0.841 0.971 | 0.068 0.083 | 8.49891857 | 0.272 | 0.392 |

| IF → GS → EP | 0.861 0.971 | 0.059 0.083 | 9.12783006 | 0.195 | 0.225 |

| ET → GS → EP | 0.831 0.971 | 0.079 0.083 | 7.82200163 | 0.214 | 0.357 |

| Hypothesis | Direction and Structural Path | Path Coefficient | p-Value | Inference |

|---|---|---|---|---|

| H1 | EC → EP | 0.950 ** | 0.000 | Supported |

| H2 | IF → EP | 0.701 ** | 0.000 | Supported |

| H3 | ET → EP | 0.711 ** | 0.000 | Supported |

| H4 | MF → EP | 0.961 ** | 0.000 | Supported |

| H5 | GS → EP | 0.971 ** | 0.033 | Supported |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, Y.; Ayele, E.Y. Factors Affecting Small and Micro Enterprise Performance with the Mediating Effect of Government Support: Evidence from the Amhara Region Ethiopia. Sustainability 2022, 14, 6846. https://doi.org/10.3390/su14116846

Zhang Y, Ayele EY. Factors Affecting Small and Micro Enterprise Performance with the Mediating Effect of Government Support: Evidence from the Amhara Region Ethiopia. Sustainability. 2022; 14(11):6846. https://doi.org/10.3390/su14116846

Chicago/Turabian StyleZhang, Youtang, and Eshetu Yesuf Ayele. 2022. "Factors Affecting Small and Micro Enterprise Performance with the Mediating Effect of Government Support: Evidence from the Amhara Region Ethiopia" Sustainability 14, no. 11: 6846. https://doi.org/10.3390/su14116846

APA StyleZhang, Y., & Ayele, E. Y. (2022). Factors Affecting Small and Micro Enterprise Performance with the Mediating Effect of Government Support: Evidence from the Amhara Region Ethiopia. Sustainability, 14(11), 6846. https://doi.org/10.3390/su14116846