Vertically Integrated Supply Chain of Batteries, Electric Vehicles, and Charging Infrastructure: A Review of Three Milestone Projects from Theory of Constraints Perspective

Abstract

:1. Introduction

2. Literature Review

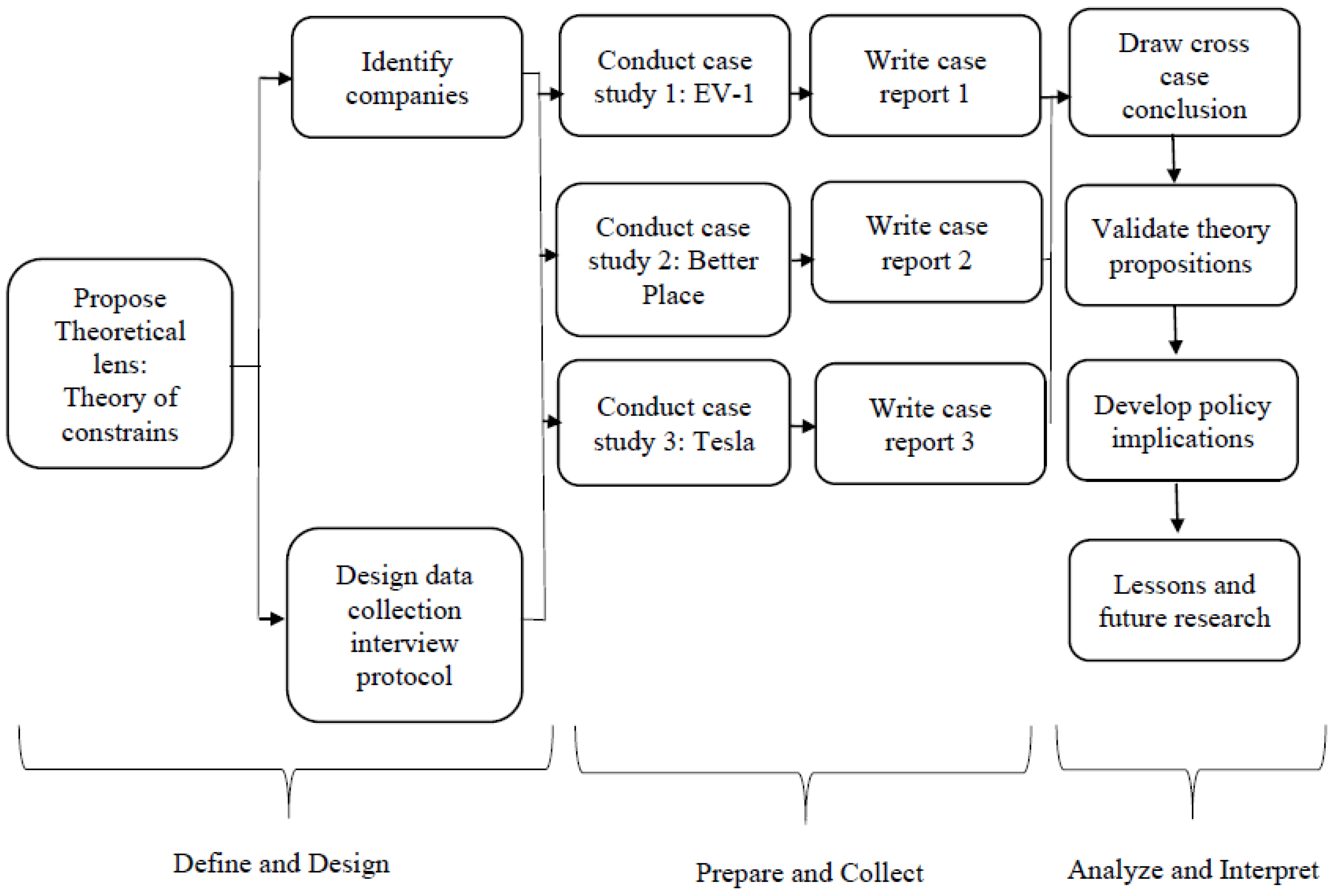

3. Methodology

3.1. Case 1: Project EV1

3.2. Case 2: Project Better Place

“To ensure that the electric cars did not overload the electrical grid, Better Place created a control center that interconnected the charging and switching stations, the entire fleet of cars and the Israel Electric Corporation’s grid. The control center also prioritized the energy consumption of all of the customers to maximize energy efficiency. For example, car owners were encouraged to charge their cars at night during off-peak hours. Similarly, they were warned about charging or switching stations that might be offline due to malfunctions. The control center also managed all of Better Place’s inventory, ensuring that all stations had adequate supplies.

To avoid overloading the grid, Better Place introduced a system called managed charging, which allowed the control center to determine when and how to charge the car based on factors such as the driving profile of its owner, the depletion level of the battery and the load on the grid. As a result of this determination, the cars were not necessarily charged immediately or fully.”

3.3. Case 3: Project Tesla

4. Analysis

4.1. Analysis of EV1′s Project Termination

4.2. Analysis of Better Place’s Project Termination

4.3. An Assessment of Tesla’s Operations Strategy

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Acknowledgments

Conflicts of Interest

Appendix A. Interview Protocol with EV1 Marketing Director

- What was your previous work experience prior to joining project EV1?

- What were your role and job tasks in EV1 marketing team?

- What was motivation for establishing EV1 project?

- From which financial sources was EV1 funded?

- Who was the founder of EV1 inside GM?

- How were the specs of EV1 developed and what were their engineering parameters?

- What innovations were discovered by EV1 development?

- What was the sale’s volume of EV1?

- Why was the contract purchase of EV1 by leasing?

- Who was the niche market (median age group) for EV1?

- How was the EV1 advertised in media?

- What was the significance of EV1 inside the GM automobile division group?

- Why EV1 project wasn’t continued?

- Why did GM leadership lose interest in EV1?

- Do you believe there was conspiracy to shut down the project as shown in the movie? why were the cars recalled from customers?

- Why did the California Air Resource Board (CARB) cave from the zero-emission mandate (ZEV)?

- Can you compare between EV1, Better Place and Tesla projects? What are the similarities and differences? Do you see a learning curve?

- What is the impact of economy on customer willingness to purchase EV?

- What is the impact of oil price on EV demand?

- Should EV be a prime car or second household car?

- Does Tesla being a focused electric car company provide an advantage over other manufacturers such as GM in which electric car was small part of the company portfolio.

- Did Tesla and other EV manufacturers gain valuable lessons from EV1? What are they?

- How can the government promote and assist Electric car companies to cover investment? Should the tax credit program be extended?

- What was the bottleneck for EV1 project? What do you see as future constraint for electric car after battery, demand and capacity bottlenecks are relieved?

- What was the significance of EV1 in the overall electric transportation movement?

- Do electric cars have the potential to become in the future a mainstream product in the automobile industry?

Appendix B. Interview Protocol with Tesla Representatives

- Where are the company headquarters based?

- Who is the top leadership of Tesla?

- What is Tesla’s workforce size?

- 4.

- What types of cars is Tesla selling (coupe, sedan, sport, etc.)?

- 5.

- Is Tesla planning to enter the electric truck market?

- 6.

- What are the technical specifications of Tesla’s various models (velocity, acceleration, noise, comfortable steering, safety, overall driving experience, design appearance, etc.)?

- 7.

- Are the cars produced based on customer preferences (mass customization) or is there limited offer of models similar to Ford T last century?

- 8.

- Is the Tesla care affordable? What is approximately the price of Tesla’s various car models?

- 9.

- Do Tesla owners pay based on electric consumption or miles driven?

- 10.

- How many cars per month of each model is Tesla producing (3, X and S)?

- 11.

- When is Tesla Model Y going to be released to the market? Where is it going to be produced?

- 12.

- What is unique about Tesla’s Roadster model?

- 13.

- Which car model is most popular among consumers?

- 14.

- What is the travel range of Tesla’s Models 3, X and S on a fully charged battery?

- 15.

- What is the sales rate of Tesla’s various car models?

- 16.

- Do the monthly sales match the forecasts? Why, unlike its competitors, is Tesla relying on social media advertising instead of traditional marketing?

- 17.

- What are the leasing options for the purchase of cars?

- 18.

- How do the costs of Tesla cars compare with those for comparable internal combustion engine cars? After how many years does the consumer reach the break-even point on the investment?

- 19.

- When is Tesla expected to reach sales of one million cars?

- 20.

- How much has Tesla invested in developing fast charging and the newly designed V3 supercharger infrastructure?

- 21.

- Are all Tesla car models compatible with the V3 supercharger architecture? Are the usage fees similar for all car models? Is the speed of charging similar for all car models?

- 22.

- Is parking in a supercharger station time-limited?

- 23.

- How much time does it take to charge a car overnight?

- 24.

- How long does it take to charge a car using a supercharger station compared to home charging?

- 25.

- Does Tesla maintain a national control center that monitors the occupancy of supercharger stations and directs drivers to a nearby station that is vacant or has a short queue?

- 26.

- Can the supercharger station partially charge a battery quickly rather than charging it fully? What is the commensurate driving distance ratio per charge time length?

- 27.

- Does each usage of a supercharger station incur a cost that is in addition to the payment of the electric bill in order to deter customers from excessive use of the supercharger stations? If so, how much is the additional cost?

- 28.

- Where are the superchargers located? Are they equally spread all over the 50 states of the USA?

- 29.

- Are the supercharger stations user-friendly? Is the process fully automatic?

- 30.

- Can the supercharger station share electric power between multiple cars simultaneously?

- 31.

- Based on what criteria does the company decide the location of new supercharging stations?

- 32.

- What is the cost for Tesla to install a new supercharger station?

- 33.

- Is the Tesla supercharger station infrastructure compatible with other electric car manufacturers? How much is Tesla going to charge users of other car brands?

- 34.

- Are the supercharger stations open 24 h? Is the charging process safe for bystanders?

- 35.

- What is the on route battery warmup feature? Does the battery temperature impact charging efficiency? How much does it cut the length of time required to charge the battery in a supercharger station?

- 36.

- How long will it take to reach 80% battery charge capacity using the new technology in the V3 supercharger architecture?

- 37.

- Does excessive use of the supercharger station degrade the battery’s performance?

- 38.

- How does the driver know when recharging is needed and where the nearest supercharger station is?

- 39.

- What is Tesla’s vision about connecting its infrastructure in the future with a nationwide smart grid? Can the car batteries be used as storage devices during off-peak hours?

- 40.

- Is the self-driving capability operational in the current cars being sold?

- 41.

- Can Tesla cars parallel park by using the self-driving capability?

- 42.

- Can Tesla cars drive on highways using cruise control when in the self-driving mode?

- 43.

- If the government approves self-driving vehicles in cities, are Tesla cars equipped with technology for safe self-driving on city roads when pedestrians are present?

- 44.

- How is the company protecting the privacy of customers using the self-driving feature?

- 45.

- Can Tesla owners of Models 3, X, Y and S use other electric car companies’ charging infrastructure similar to having a roaming contract agreement in the cell phone industry?

- 46.

- How does the self-driving capability operate? Where are the sensors, radar and sonar located?

- 47.

- Is Tesla’s self-driving feature safe? Is it protected against cyber-attack?

- 48.

- Where are Tesla’s Gigafactories located? What is the square-feet size of a Gigafactory? Does it hold a large inventory of batteries? How many employees are employed inside Gigafactory? How many Gigafactories Tesla is already in process of building or has blueprint in the pipeline? What is the average number of cars produced in a Gigafactory per week? How much time does it consume to produce a car from beginning to end? Does the concept of Gigafactory emulate Ford T high-productivity factory line last century?

- 49.

- Can Tesla be considered a made in the USA car? Are all of the parts produced or assembled in the USA?

- 50.

- Are the batteries of various Tesla models the same size and weight? What is their life span?

- 51.

- Are Tesla batteries compatible with those of other car manufacturers? Is Tesla going to sell batteries to other electric car companies?

- 52.

- What is the planned second-life use of Tesla batteries after their performance degrades?

- 53.

- Is the Tesla supply chain green? Can the batteries be charged by Tesla home solar panels?

- 54.

- Is the Tesla supply chain vertically integrated? Does Tesla produce its batteries, cars and supercharger stations independently? Does Tesla supply chain resemble Ford T assembly line meant for mass production?

- 55.

- How does Tesla plan to recycle its batteries?

- 56.

- What kind of support is Tesla receiving from the government to fund its sustainability efforts? Is the company receiving funds from the Department of Energy or the Department of Transportation?

- 57.

- To which countries is Tesla planning to expand internationally?

- 58.

- Is the supercharger V3′s newly developed infrastructure going be deployed internationally too?

- 59.

- What are the risk vulnerabilities of Tesla’s charging infrastructure? For example, how will the company cope with a long-term nationwide outage?

- 60.

- What new technologies does Tesla have in the pipeline to extend travel range?

- 61.

- In sum, do you think Tesla has the potential to transform electric car into a mainstream customer choice for households in similar way Ford T became popular vehicle last century?

Appendix C. Timetable of Interviews with Informants from EV1, Better Place (BP), and Tesla

| Date | Interviewee Position 1 | Duration | Location |

|---|---|---|---|

| December 2009 | Senior System Architect 1 (BP 2) | 50 min | Israel |

| January 2010 | Senior System Architect 1 (BP) | 70 min | Headquarters, Israel |

| July 2010 | Senior System Architect (BP) | 70 min | Headquarters |

| June 2011 | Associate Engineer 1 (BP) | 90 min | Visitor Center |

| July 2011 | Marketing/Sales Manager (BP) | 100 min | Visitor Center |

| July 2011 | Global Environmental Manager | 80 min | Headquarters |

| December 2011 | Associate Engineer 2 (BP) | 90 min | Visitor Center |

| January 2012 | Marketing/Sales Manager (BP) | 90 min | Visitor Center |

| December 2012 | Global Environmental Manager | 90 min | Headquarters |

| January 2013 | Electricity Commissioner, Israel | 30 min | Phone |

| January 2013 | Director of the Department of Air Pollution, Israel | 45 min | Phone |

| January 2013 | Advisor to Israel’s Ministry for International Energy Policies | 45 min | Phone |

| October 2013 | Post-bankruptcy interview Better Place | 90 min | Technion University campus |

| December 2013 | Interview with Marketing Director Project EV1 | 90 min | Phone |

| August 2014 | Post-bankruptcy interview Better Place | 45 min | Phone |

| November 2017 | Tesla Marketing/Sales Manager | 90 min | Visitor Center McLean, VA, USA |

| January 2018 | Tesla System Design Manager | 90 min | Phone |

| June 2018 | Tesla Procurement Manager | 120 min | Visitor Center McLean, VA, USA |

| February 2019 | Tesla Marketing Manager | 120 min | Visitor Center Washington, DC, USA |

| March 2019 | Test driving Tesla Model 3 with professional explanations | 120 min | Visitor Center Washington, DC, USA |

| July 2019 | Tesla sales personnel | 120 min | Washington, DC, USA |

| July 2019 | Interview with Marketing Director Project EV1 | 90 min | Phone |

| August 2019 | Interview with Marketing Director Project EV1 | 90 min | Phone |

| October 2020 | Tesla Sales Department | 60 min | Washington, DC, USA |

References

- Calef, D.; Goble, R. The allure of technology: How France and California promoted electric and hybrid vehicles to reduce urban air pollution. Policy Sci. 2007, 40, 1–34. [Google Scholar] [CrossRef] [Green Version]

- Naor, M.; Druehl, C.; Bernardes, E.S. Servitized business model innovation for sustainable transportation: Case study of failure to bridge the design-implementation gap. J. Clean. Prod. 2018, 170, 1219–1230. [Google Scholar] [CrossRef]

- Stringham, E.P.; Miller, J.K.; Clark, J.R. Overcoming barriers to entry in an established industry: Tesla Motors. Calif. Manag. Rev. 2015, 57, 85–103. [Google Scholar] [CrossRef] [Green Version]

- Klebnikov, S. Tesla Is Now the World Most Valuable Car Manufacturer with $208 Billion Valuation. Forbes: 2020. Available online: https://www.forbes.com/sites/sergeiklebnikov/2020/07/01/tesla-is-now-the-worlds-most-valuable-car-company-with-a-valuation-of-208-billion/?sh=35da1a005334 (accessed on 15 March 2020).

- Long, Z.; Axsen, J.; Miller, I.; Kormos, C. What does Tesla mean to car buyers? Exploring the role of automotive brand in perceptions of battery electric vehicles. Transp. Res. Part A Policy Pract. 2019, 129, 185–204. [Google Scholar] [CrossRef]

- Shiftan, Y.; Kaplan, S.; Hakkert, S. Scenario building as a tool for planning a sustainable transportation system. Transp. Res. Part D Transp. Environ. 2003, 8, 323–342. [Google Scholar] [CrossRef]

- Hardman, S.; Shiu, E.; Steinberger-Wilckens, R. Changing the fate of Fuel Cell Vehicles: Can lessons be learnt from Tesla Motors? Int. J. Hydrog. Energy 2015, 40, 1625–1638. [Google Scholar] [CrossRef] [Green Version]

- Goldratt, E.M.; Cox, J. The Goal, Revised Edition; The Northern River Press Publishing Corporation: Great Barrington, MA, USA, 1986. [Google Scholar]

- Rothenberg, S. Sustainability through servicizing. MIT Sloan Manag. Rev. 2007, 48, 83. [Google Scholar]

- Chen, Y.; Perez, Y. Business model design: Lessons learned from Tesla Motors. In Towards a Sustainable Economy; Springer: Cham, Switzerland, 2018; pp. 53–69. [Google Scholar]

- Kirsch, D.A. The Electric Vehicle and the Burden of History; Rutgers University Press: New Brunswick, NJ, USA, 2000. [Google Scholar]

- Crabtree, G. The coming electric vehicle transformation. Science 2019, 366, 422–424. [Google Scholar] [CrossRef] [Green Version]

- Mangram, M.E. The globalization of Tesla Motors: A strategic marketing plan analysis. J. Strateg. Mark. 2012, 20, 289–312. [Google Scholar] [CrossRef]

- Mann, M.K.; Mayyas, A.T.; Steward, D.M. Supply-Chain Analysis of Li-Ion Battery Material and Impact of Recycling (No. NREL/PO-6A20-71724); National Renewable Energy Lab (NREL): Golden, CO, USA, 2019.

- Harper, G.; Sommerville, R.; Kendrick, E.; Driscoll, L.; Slater, P.; Stolkin, R.; Walton, A.; Christensen, P.; Heidrich, O.; Lambert, S.; et al. Recycling lithium-ion batteries from electric vehicles. Nature 2019, 575, 75–86. [Google Scholar] [CrossRef] [Green Version]

- Siqi, Z.; Guangming, L.; Wenzhi, H.; Juwen, H.; Haochen, Z. Recovery methods and regulation status of waste lithium-ion batteries in China: A mini review. Waste Manag. Res. 2019, 37, 1142–1152. [Google Scholar] [CrossRef]

- Hua, Y.; Liu, X.; Zhou, S.; Huang, Y.; Ling, H.; Yang, S. Toward sustainable reuse of retired lithium-ion batteries from electric vehicles. Resour. Conserv. Recycl. 2020, 168, 105249. [Google Scholar] [CrossRef]

- Yang, J.; Gu, F.; Guo, J. Environmental feasibility of secondary use of electric vehicle lithium-ion batteries in communication base stations. Resour. Conserv. Recycl. 2020, 156, 104713. [Google Scholar]

- Skinner, W. The focused factory. Harv. Bus. Rev. 1974, 52, 113–121. [Google Scholar]

- Qin, K.; Huang, J.; Holguin, K.; Luo, C. Recent advances in developing organic electrode materials for multivalent rechargeable batteries. Energy Environ. Sci. 2020, 13, 3950–3992. [Google Scholar] [CrossRef]

- Shenhar, A.; Holzmann, V. The three secrets of megaproject success: Clear strategic vision, total alignment, and adapting to complexity. Proj. Manag. J. 2017, 48, 29–46. [Google Scholar] [CrossRef] [Green Version]

- Shenhar, A.J.; Holzmann, V.; Melamed, B.; Zhao, Y. The challenge of innovation in highly complex projects: What can we learn from Boeing’s Dreamliner experience? Proj. Manag. J. 2016, 47, 62–78. [Google Scholar] [CrossRef]

- Naor, M.; Bernardes, S.E.; Coman, A. Theory of Constraints: Is it a Theory and a Good One? Int. J. Prod. Res. 2012, 51, 542–554. [Google Scholar] [CrossRef]

- Ito, N.; Takeuchi, K.; Managi, S. Willingness-to-pay for infrastructure investments for alternative fuel vehicles. Transp. Res. Part D Transp. Environ. 2013, 18, 1–8. [Google Scholar] [CrossRef] [Green Version]

- Axsen, J.; Kurani, K.S.; Burke, A. Are batteries ready for plug-in hybrid buyers? Transp. Policy 2010, 17, 173–182. [Google Scholar] [CrossRef] [Green Version]

- Skippon, S.; Garwood, M. Responses to battery electric vehicles: UK consumer attitudes and attributions of symbolic meaning following direct experience to reduce psychological distance. Transp. Res. Part D Transp. Environ. 2011, 16, 525–531. [Google Scholar] [CrossRef]

- Anderson, J.C.; Rungtusanatham, M.; Schroeder, R.G. A theory of quality management underlying the Deming management method. Acad. Manag. Rev. 1994, 19, 472–509. [Google Scholar] [CrossRef]

- Collantes, G.; Sperling, D. The origin of California’s zero emission vehicle mandate. Transp. Res. Part A Policy Pract. 2008, 42, 1302–1313. [Google Scholar] [CrossRef] [Green Version]

- Naor, M.; Bernardes, E.S.; Druehl, C.; Shiftan, Y. Overcoming barriers to adoption of environmentally-friendly innovations through design and strategy: Learning from failure of an electric vehicle infrastructure. Int. J. Oper. Prod. Manag. 2015, 35, 26–59. [Google Scholar] [CrossRef]

- Deutsche Bank. “Electric Cars: Plugged In”, June 9; Deutsche Bank Securities: 2008. Available online: http://www.libralato.co.uk/docs/Electric_Cars_Plugged_In_Deutsche_Bank.pdf (accessed on 23 March 2021).

- Ghadimi, P.; Wang, C.; Lim, M.K. Sustainable supply chain modeling and analysis: Past debate, present problems and future challenges. Resour. Conserv. Recycl. 2019, 140, 72–84. [Google Scholar] [CrossRef]

- Wolfson, A.; Tavor, D.; Mark, S.; Schermann, M.; Krcmar, H. Better Place: A case study of the reciprocal relations between sustainability and service. Serv. Sci. 2011, 3, 172–181. [Google Scholar] [CrossRef]

- Senor, D.; Singer, S. Start-up Nation: The Story of Israel’s Economic Miracle; Hachette: New York, NY, USA, 2009. [Google Scholar]

- Christensen, T.B.; Wells, P.; Cipcigan, L. Can innovative business models overcome resistance to electric vehicles? Better Place and battery electric cars in Denmark. Energy Policy 2012, 48, 498–505. [Google Scholar] [CrossRef]

- Noel, L.; Sovacool, B.K. Why did better place fail? range anxiety, interpretive flexibility, and electric vehicle promotion in Denmark and Israel. Energy Policy 2016, 94, 377–386. [Google Scholar] [CrossRef]

- Perkins, G.; Murmann, J.P. What does the success of Tesla mean for the future dynamics in the global automobile sector? Manag. Organ. Rev. 2018, 14, 471–480. [Google Scholar] [CrossRef] [Green Version]

- Tesla Motors. 2017 Annual Report of Tesla Motors Inc.; Tesla Motors: Palo Alto, CA, USA, 2018. Available online: https://www.sec.gov/Archives/edgar/data/1318605/000156459018002956/tsla-10k_20171231.htm (accessed on 23 March 2021).

- Kudachimath, B.S.; Ragashetti, N.S. Disruptive Innovation: How Tesla Motors, SpaceX and Solar City are disrupting industries. Int. J. Manag. IT Eng. 2015, 5, 109–117. [Google Scholar]

- Thomas, V.J.; Maine, E. Market entry strategies for electric vehicle start-ups in the automotive industry–Lessons from Tesla Motors. J. Clean. Prod. 2019, 235, 653–663. [Google Scholar] [CrossRef]

- Christensen, C.M. The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail; Harvard Business Review Press: Boston, MA, USA, 2013. [Google Scholar]

- Alizon, F.; Shooter, S.B.; Simpson, T.W. Henry Ford and the Model T: Lessons for product platforming and mass customization. Des. Stud. 2009, 30, 588–605. [Google Scholar] [CrossRef]

- Brooke, L. Ford Model T: The Car that Put the World on Wheels; Motorbooks International: St. Paul, MN, USA, 2008. [Google Scholar]

- Shiftan, Y.; Albert, G.; Keinan, T. The impact of company-car taxation policy on travel behavior. Transp. Policy 2012, 19, 139–146. [Google Scholar] [CrossRef]

- Meadowcroft, J. Engaging with the politics of sustainability transitions. Environ. Innov. Soc. Transit. 2011, 1, 70–75. [Google Scholar] [CrossRef]

- Klier, T.; Rubenstein, J.M. Restructuring of the US Auto Industry in the 2008–2009 Recession. Econ. Dev. Q. 2013, 27, 144–159. [Google Scholar] [CrossRef]

- Kane, M. Compare Electric Cars: EV Range, Specs, Pricing & More; INSIDEEVs: Miami, FL, USA, 2021. Available online: https://insideevs.com/reviews/344001/compare-evs/ (accessed on 20 March 2021).

- Wu, Y.; Yang, L.; Tian, X.; Li, Y.; Zuo, T. Temporal and spatial analysis for end-of-life power batteries from electric vehicles in China. Resour. Conserv. Recycl. 2020, 155, 104651. [Google Scholar] [CrossRef]

- Harlow, J.E.; Ma, X.; Li, J.; Logan, E.; Liu, Y.; Zhang, N.; Ma, L.; Glazier, S.L.; Cormier, M.M.; Genovese, M.; et al. A wide range of testing results on an excellent lithium-ion cell chemistry to be used as benchmarks for new battery technologies. J. Electrochem. Soc. 2019, 166, A3031–A3044. [Google Scholar] [CrossRef]

- Big Ideas Report. 2021. Available online: https://ark-invest.com/big-ideas-2021/?utm_campaign=Big%20Ideas%202021&utm_medium=email&_hsmi=108239947&_hsenc=p2ANqtz-_DosaDBniWZ3ZtBhhpnLmcjIPKY5kt20hxNGb710eUTGnPbk3MwSwEs3Ys9-VpCRSq7nSSPQJQSjbQ6Tp2MEPvF8de-g&utm_content=108239947&utm_source=hs_email (accessed on 23 March 2021).

- Sovacool, B.K.; Hirsh, R.F. Beyond batteries: An examination of the benefits and barriers to plug-in hybrid electric vehicles (PHEVs) and a vehicle-to-grid (V2G) transition. Energy Policy 2009, 37, 1095–1103. [Google Scholar] [CrossRef]

- Nøland, J.K. Prospects and challenges of the hyperloop transportation system: A systematic technology review. IEEE Access 2021, 9, 28439–28458. [Google Scholar] [CrossRef]

| EV1 | Better Place | Tesla | |

|---|---|---|---|

| Years | 1996–1999 | 2007–2013 | 2003–present |

| Entrepreneur | Roger Smith | Shai Agassi | Elon Musk |

| Motivation for project | CARB mandate to diminish air pollution by zero emission vehicles | Make the world a better place by cutting its dependency on oil | Sustainability movement to the usage of green energy sources |

| Manufacturer | General Motors | Renault | Tesla |

| Types of vehicle | EV1 (2 seat car) | Renault Fluence (Sedan) | Models 3, X, S, Y, Cybertruck (Sedan and SUV) |

| Charging infrastructure technology | Magne Charge Inductive (3 h) | Network of battery switching stations (5 min) | Supercharger V3 stations (45 min) |

| Full battery Charging time | 8 h | 6–8 h | 1–12 h |

| Bottleneck of process | Battery material performance | Amount of sales (market demand) | production quota to meet demand and deliver preorders |

| Number of cars sold to customers | 1117 | 1200 | 500,000 by 2019, 1,000,000 by 2021 |

| Traveling range | 60–80 miles | 100–120 miles | Models 3, X, S, Y: 300–400 miles, Roadster: 650 miles |

| Business Model | Leasing of car | Leasing of battery (servicizing) | Ownership Variety of prices |

| Customer Contract | Electric Utility bill | Pay-per-mile subscription | Electric Utility bill |

| Sustainability implications | Car made by sustainable materials (Fiberglass) | Uses natural gas in Israel and wind energy in Denmark to energize the fleet | Batteries have a second life purpose as the storage of solar energy to power homes appliances |

| Supply chain architecture | Limited availability of spare parts and lack of maintenance | Batteries are swapped and recharged in stations to electrify cars | Giga-factories of batteries and cars were built to create a vertical supply chain |

| Countries/States of deployment | California, Arizona | Israel, Denmark, Australia, Hawaii | North America, Europe, China |

| Connectivity with alternative infrastructure | Feasible to charge using competitor’s infrastructure | Not feasible, restricted by the feasibility of car’s battery to be swapped | Feasible to charge using competitor’s infrastructure |

| Financial struggles | Large investment in innovation to pioneer an electric car design | Large investment required to deploy infrastructure of switching stations | Project overcame liquidity problems, currently expanding internationally |

| Aantecedents for EV1 failure |

|

| Causes of Better Place bankruptcy |

|

| Factorscontributing for Tesla success |

|

| Model | Drive | Battery (kWh) | EPA Range | 0–60 mph (s) | Top Speed |

|---|---|---|---|---|---|

| 2021 Audi e-tron | AWD | 95 | 222 mi (357 km) | 5.5 | 124 mph (200 km/h) |

| 2021 BMW i3s | RWD | 42.2 | 153 mi (246 km) | 6.8 | 100 mph (161 km/h) |

| 2021 Chevrolet Bolt EV | FWD | 66 | 259 mi (417 km) | 6.5 | 90 mph (145 km/h) |

| 2021 Ford Mustang Mach-E Select SR RWD | RWD | 75.7 | 230 mi (370 km) | 5.8 | |

| 2021 Hyundai Kona Electric | FWD | 64 | 258 mi (415 km) | 7.9 | 104 mph (167 km/h) |

| 2020 Jaguar I-PACE | AWD | 90 | 234 mi (377 km) | 4.5 | 124 mph (200 km/h) |

| 2020 Kia Niro EV (e-Niro) | FWD | 64 | 239 mi (385 km) | 7.5 | 104 mph (167 km/h) |

| 2021 MINI Cooper SE | FWD | 32.6 | 110 mi (177 km) | 6.9 | 93 mph (150 km/h) |

| 2021 Nissan LEAF S (40 kWh) | FWD | 40 | 149 mi (240 km) | 7.4 * | 90 mph (145 km/h) |

| 2021 Porsche Taycan 4S (93 kWh) | AWD | 93.4 | 227 mi (365 km) | 3.8 | 155 mph (249 km/h) |

| 2021 Volvo XC40 Recharge | AWD | 78 | 208 mi (335 km) | 4.7 | |

| 2021 Volkswagen ID.4 Pro S | RWD | 82 | 250 mi (402 km) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Naor, M.; Coman, A.; Wiznizer, A. Vertically Integrated Supply Chain of Batteries, Electric Vehicles, and Charging Infrastructure: A Review of Three Milestone Projects from Theory of Constraints Perspective. Sustainability 2021, 13, 3632. https://doi.org/10.3390/su13073632

Naor M, Coman A, Wiznizer A. Vertically Integrated Supply Chain of Batteries, Electric Vehicles, and Charging Infrastructure: A Review of Three Milestone Projects from Theory of Constraints Perspective. Sustainability. 2021; 13(7):3632. https://doi.org/10.3390/su13073632

Chicago/Turabian StyleNaor, Michael, Alex Coman, and Anat Wiznizer. 2021. "Vertically Integrated Supply Chain of Batteries, Electric Vehicles, and Charging Infrastructure: A Review of Three Milestone Projects from Theory of Constraints Perspective" Sustainability 13, no. 7: 3632. https://doi.org/10.3390/su13073632