Abstract

The paper analyzes the connection between technological knowledge and organizational culture in small subsistence businesses (SSBs). It uses data from a proportional representative sample of 980 surveys in the canton of La Maná (Cotopaxí, Ecuador) to test if culture conditions the different components of technological knowledge in SSBs. This work verifies that the technological knowledge is a source of short-term and long-term performance, which confirm for SSBs previous works in intellectual capital. The study analyzes also the moderating effect of culture, verifying that culture does not condition the connection between technological knowledge with the short-term performance. It shows that culture is not a source of performance. However, when the research checks whether the effect of the technological knowledge increases the long-term performance, the results indicate that culture significantly limits this effect, suggesting that culture presents a certain opportunism, possibly because in the SSBs, entrepreneurs do not pay any attention to developing knowledge resources. The conclusions present some managerial and social implications to improve the functioning and management of SSBs.

1. Introduction

Small businesses are common in developing countries [1] because they provide a chance to avoid poverty [2]. These small businesses are called subsistence small businesses (SSBs). Usually, governments are interested in these companies growing and entering a formal sector. Therefore, they need to increase their competitiveness [3].

Innovation is critical to improving living standards and creating wealth [4], especially in developing countries. Investment in the search for technological knowledge possibly increases the innovation of small and medium-sized companies [5]. The technological knowledge of the companies contributes to market expansion [6]. Small businesses in developing countries tend to have limited technological knowledge [7]. Those that stand out for their technological capacity possibly have a better chance of being competitive and, consequently, having better performance in the short and long term and promoting the economic growth of the territory.

The organizational culture is an important factor for the growth of the company [8,9,10]. Small businesses present a community-based enterprise model [11]. This situation is more accentuated in countries that usually have poor infrastructure [12]. As a consequence, the culture of the territory influences the organizational culture and, consequently, the management of these companies [13]. Social capital includes local technological knowledge about the resources and clients of the territory [14].

Usually, technological knowledge and organizational culture [15] can affect the performance of companies. For Mannion et al. [16] and Shahzad et al. [17], culture has a positive impact on performance. For other authors, the question is complex [18,19,20], and the evidence is not conclusive. SSBs operate sometimes in informal markets and sectors [21,22], conditioning a culture and technology effect. In addition, the culture possibly is related with technology. Culture and technological knowledge are keys in SSBs [23].

The aim of this paper is to analyze the connection between culture and technology. Does culture condition the different components of technological knowledge in these countries? How do cultural factors interact with technological knowledge in SSBs? Understanding the relationship between culture and technological knowledge in small businesses can allow SSBs to improve their capacities and performance [24], and for families and countries to improve their income [25,26].

The rest of the paper is divided into four sections: the basic model for generating performance from technological knowledge and culture; introducing the working hypotheses; the methodology including a case study, which analyzes the questions addressed; and discussion and conclusions.

2. Theoretical Structure

Technology includes a systematic body of knowledge about how natural and artificial things and artefacts function and interact [27]. Small businesses in Ecuador, similarly to other Latin American countries, often work with constraints in technology and finance. Sometimes, the technology is second-hand, with creative adjustments to adapt it. SSBs usually do not use new technological knowledge because of the lack of networks to promote the dissemination of information [28]. SSBs use machinery and equipment with technology that is basically imported [29]. R&D is almost non-existent in these companies, and it is limited to the public sector with scarce resources. Innovation activities are usually the result of imitation through sporadic, non-linear, and discontinuous processes [14].

These constraints limit the possibility for any technological diversification. The SSBs use the same machines and the same technological knowledge to elaborate the same or similar products [28]. The human resources have a basic formation and are not specialized [12,30]. Consequently, the workers and the entrepreneur learn in an empirical way with the experience.

Brito and Brito [31] suggest that business performance is manifested in profitability and growth. The success of SSBs is to subsist. Consequently, the concept of success is distinct for these entrepreneurs [2]. While these companies do not reach a level of income sufficient to exceed the subsistence level, their performance interest is short term, clearly differentiating between short- and long-term success. Consequently, for the study of performance factors in SSBs, it is usually convenient to differentiate between the short-term and long-term performance. However, companies that tend to perform well in the short term also tend to achieve better long-term results, since as they consolidate their economic performance, they begin to move towards greater growth. Proper management of technological resources facilitates their performance and optimizes processes and even the performance of human resources; consequently, it increases production capacity, reduces costs, and facilitates adaptation to the needs of customers, for better long-term company performance [32].

A positive fit between technology and company strategy can bring small businesses long-term survival [33]. Technological knowledge allows the introduction of new information technologies. Witschel et al. [34] mention that technological means have changed the organization and strategy of the company by allowing the development and implementation of the strategy to stay competitive.

Hypothesis 1a (H1a).

Technological knowledge generates better long-term performance in SSBs.

Organizations need to understand and satisfy the needs of their customers in order to perform better than their competitors [35]. Technological knowledge helps to manage customers as an important means of improving economic efficiency, maintaining customer loyalty, and differentiating from the competition performance [32]. Consequently, these companies increase the sales and short-term performance. In addition, a positive fit between technology and company strategy can bring small businesses profitability [33].

Hypothesis 1b (H1b).

Technological knowledge generates better short-term performance in SSBs.

Culture and Technological Knowledge in SSBs of La Maná

The canton of La Maná is one of the seven cantons of the Province of Cotopaxi. It has a total area of 66,258 hectares. The population, according to the last census carried out by the INEC (2010), is 42,216 inhabitants, with a population increase of 10,101 inhabitants [36].

La Maná’s immense forests, gigantic plantations of banana, cassava, cocoa, tobacco, and coffee, strategic geographical location, and gold wealth give it special characteristics that promote its development and give it a leading role in the economy of its inhabitants. The most important products are exportable and the mainstay of the canton’s economy, serving as the main engine of its economic development. The canton is mainly characterized by having a significant number of small businesses, many of which are the main income for many families. Most businesses are made up of family members, with the father or mother being the owner and manager, who makes the business decisions.

The businesses are managed by the owner who fulfils the entire process, from product acquisition to sale to the public. The characteristic of these businesses is the close relationship of trust that the owner has with the regular customer, who trusts the quality and price of the products that the business owner is offering. The constant effort to know your customer and their needs makes the company obtain special products from suppliers with competitive prices. For this reason, knowing the needs of customers, along with a greeting and friendly smile from the owner, are intrinsic characteristics of these businesses.

In other markets, there are Non-governmental organizations (NGOs) and institutions that provide credit to SSBs with acceptable interest rates, but these types of activities do not exist in La Maná, so they are usually financed with credit cooperatives or in informal markets. Linton and Solomon [33] mention the need for interaction between the qualities of small business managers and the skills in the use of technology to generate competitive advantages in highly uncertain environments. Cultural factors are an important part of change, as openness to new ideas allows an inclination to modernize business [34].

Organizational culture is the set of values, norms, and attitudes shared by the members of the organization and accepted as a way of carrying out the work processes within the organization [8,37,38]. The organizational culture in the SSBs is closely related to the culture of the territory as the entrepreneurs and workers are usually from that territory and are imbued with that culture [39].

Culture has an effect in entrepreneurship motivations [40]; it is relevant for location-based businesses [41] and also for business performance [42]. Culture has been seen as increasingly important because it affects the organization of the enterprise, including the working climate, the capacity for innovation, and decision-making processes [16]. The culture of the territory is usually related to the performance of the companies that develop their activity in that territory [14,41,43].

Culture and technology have difficulty integrating. Culture is based on past attitudes and experiences, and technology is a break with the past and traditions, as it refers to adoption of technologies of information and communication, like new software, hardware, networks, communication channels, customer management relationships, and other tools that ease work conditions and enhance operations and services in a company [44]. Other researchers have analyzed the relationship between culture and technology [45,46,47] and have written that technology adoption depends on culture. It is clear that companies with a culture flexible to changes are more innovative than others.

Culture can influence human resources’ behavior in a technology adoption process. On the other hand, technological knowledge influences culture by pressing for innovation and motivating people to change. Organizational culture can foster technology adoption. However, depending on the cultural components, it can avoid technology adoption. It is important to identify the cultural components and characteristics that prevent technology adoption among small and medium-sized enterprises [48].

Culture is usually a source of competitive advantage [39,49,50,51]. The culture, present in the SSBs, can condition this effect. In particular, these businesses can present a certain opportunism, due to their need for economic results in the short term to survive.

In business relationships, opportunism is the search for personal interests through deception [52,53]. Opportunism has a wide variety of behaviors [54]. It can be described as the calculated cunning of owners to mislead suppliers or consumers in some way in business relationships [54]. Likewise, it is defined as a search for individual and universal interest in constant commercial relationships. It includes avoiding homework, vitiating information, breaking promises, and not fulfilling obligations [52]. Therefore, opportunistic owners can be considered “weakly moral human beings and cannot be trusted to obtain fixed rules of interaction” [54].

Crosno and Dahlstrom [55] indicate that opportunism negatively affects business results. Furthermore, [56] refer to the fact that businesses avoid accurate information because in some way it may affect the performance of the company. Subsistence businesses can act under opportunism, due to their interest in getting quick profits, as long as they do not acquire an income of subsistence [57].

Latin American subsistence markets present two complementary models. On the one hand is a bazaar-type model (the focus is not on the transaction but on personal relationships [21]), in which SSBs are related to other businesses or subsistence customers; generally, suppliers or regular customers. On the other hand, is a classic market model, based on transactions, with sporadic customers in which a certain opportunism is usually manifested. In both cases, the existing culture in the SSBs can generate better short-term results. In the first case, the common culture and the trust generated help to improve customer loyalty, increasing sales and attracting new customers [58]. In the second case, opportunism, with profitable income for the company, improves the results, although these clients can easily be lost. However, as the relationships are sporadic, they do not harm the performance of the company in the short term. This suggests a second hypothesis:

Hypothesis 2 (H2).

The culture of subsistence businesses increases economic results.

In Ecuador, institutional trust [58] is low, which facilitates the introduction of opportunism. In that case, the interaction between culture and technology can have an adverse effect on performance. Yang et al. [59] mention that opportunism negatively affects commercial relationships, conditioning the effect of technology, as opportunism limits customers’ loyalty. The sensation of opportunism in commercial transactions could slow down the effect of technology [60] with those involved in the normal evolution of the business. Companies tend to evade obligations and responsibilities acquired [54,56] in order to obtain short-term financial results. When customers participate only once in transactions with an SSB, the effect of opportunism on technology may go undetected. However, this customer may not be related to that company again, so in the long term, the effect through which the technology generates a limitation in using technology does not show itself in better performance. When customers are regular, the existence of opportunism eliminates the effect of customer loyalty that was generated because of the technology system. Therefore, the following hypothesis is presented:

Hypothesis 3 (H3).

Culture in subsistence businesses reduces the long-term effect of technology on financial results.

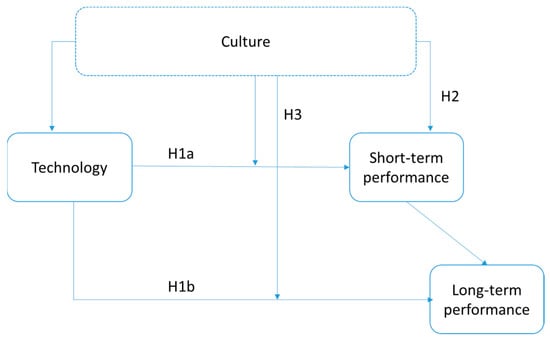

Figure 1 summarizes the model and the hypotheses.

Figure 1.

Model and hypotheses.

3. Methodology

3.1. Population and Sample

The study analyzed subsistence businesses in the canton of La Maná, a region of Ecuador whose characteristics are representative of other areas in Latin America. However, indigenous cultural aspects could present differences that could possibly condition the extension of the results. According to the database provided by the Internal Revenue Service (SRI), the canton of La Maná has 2325 active commercial microenterprises [36]. A proportional representative sample of 980 surveys was designed, with a sampling error of 2.45% and a confidence level of 95%, assuming a maximum variance where p = q = 0.5. Nine surveys that had incomplete data were eliminated from the study, leaving 971 valid observations. The survey was conducted by visiting entrepreneurs with a group of interviewers trained and led by experts in the field. They clarified to the owner any concern or doubt that appeared regarding the questionnaire. The survey was carried out during the months of November and December 2018. Basic information about data is in Supplementary Materials.

3.2. Measures of the Variables

To evaluate the variables related to technology and culture, as shown in Table 1, a Likert scale was used, valued from 1 (not agree) to 5 (strongly agree) based on the work of [61] following scales used by [62] (Supplementary Materials). To evaluate the performance of companies, the research used subjective data asking entrepreneurs about the growth of the indicated items, as shown in Table 1, in the last two years following [63]. Size was introduced as a control variable, measured by an indicator of job size, according to previous studies [64].

Table 1.

Reliability measures.

3.3. Econometric Methods

Given that it seeks to establish relationships between structural variables, an estimation of systems of structural equations by partial least squares (PLS) was used. This method performs a direct estimation of structural relationships using least squares. In this way, the variance of all the dependent variables is minimized, avoiding problems like the identification of parameters in the covariance model. Furthermore, an assumption of normality of the variables is not required [65]. On the other hand, the method that is based on the analysis of covariance [66] needs more demanding assumptions, especially the joint normal behavior of the variables used. This was not easy when the variables were measured in a Likert scale.

The PLS technique validates the estimate using the average variance extracted (AVE) to measure validity and Cronbach’s alpha (CA) as a criterion of unidimensionality. The AVE measures the variance captured by a latent construct. The CA is based on the analysis of average correlations between the items, referred to as a single aspect, from a single administration of the questionnaire. The cut-off point for these criteria was 0.5 and 0.6, respectively. Discriminant validity was studied with the cross-load matrix, showing that the maximum factor loadings are found on the main diagonal of the matrix [65].

The work analyzes the moderating effect of culture on technological knowledge. Consequently, two models were necessary, following the scheme of [67]. The first investigated the effect of technological knowledge and culture on performance. The second model introduced the interaction between both variables in the model to test its moderation effect. To validate the models, this paper used the bootstrap methodology [68]. The calculation was performed using R Ver4.0, based on the SemPLS, SEMtools, and Lavaan.

4. Results

Estimation using PLS presents two complementary models: the external model that indicates the composition of each of the constructs used, and the internal model, that indicates the relationship between constructs. The validity of the model in a global way is shown in Table 1. It is observed that the rho of Dillon–Goldstein, AVE, and CA fall within the desirability parameters. In a similar way, HTMT suggests that there is discriminant validity of the model. Table 2 shows the estimation of the external model—i.e., how each of the observable variables is related to the latent variables—using bootstrapping. It is observed that all the values are significant, suggesting that all the constructs are well defined.

Table 2.

Loadings.

The estimation of the internal model is shown in Table 3. It shows that technology has a significant impact on short-term performance and long-term performance. Culture has no significant effect on performance in either the short term or the long term. Short-term performance has a significant impact on long-term performance. Culture does not moderate the effect of technology on short-term performance, but it does reduce the effect of technology on long-term performance.

Table 3.

Effects among constructs.

5. Discussion

The intellectual capital literature considers technological knowledge as a part of structural capital [69] and, therefore, a source of competitive advantage [61]. Companies take advantage of that knowledge to obtain better performance. In SSBs, technological knowledge is rather scarce and usually it is based on local knowledge. For this reason, it could be thought that it is not a source of performance, especially in the short term.

The model analyzes whether technological knowledge generates better short-term and long-term performance. The results confirm the relevance of technological knowledge as a source of performance also in SBSs, in accordance with Navimipour et al. [70] and Jabbouri et al. [71].

In small companies, especially in developing countries, culture is a fundamental element for the development and growth of these companies [8]. However, when these companies are subsistence companies, it is possible that this culture is mixed with a certain opportunism, due to the need to obtain income to cover the basic needs of the entrepreneur and their family. This paper studies whether culture moderates the effect of technological knowledge on business results. The findings indicate that if culture is introduced in this model as a moderating factor, the relations of the process of generating performance change a little.

First, it is verified that the culture is not a source of competitive advantage, unlike Hardcopf and Shah [19]. In this sense, the results agree with Dana [21] and Mason et al. [22], suggesting that there are no clear conclusions about the effect of culture on performance.

Second, culture does not moderate the effect of technological knowledge to create short-term performance. This suggests that culture does not influence to take advantage of technological knowledge to get short-term performance. These results coincide in part with previous results [45,46,47] that suggest that the interaction between culture and technology depends on culture, in this case conditioned by the existence of opportunism [55,56].

Third, the paper analyzes the moderating effect of culture on the effect of technological knowledge on long-term performance. The finding detects that there is a negative impact. Consequently, the culture limits the possibility to taking advantage of technological knowledge, possibly because it is highly based on traditional values [72] that hardly accept the changes associated with the novelties of the technology [73].

The results point out that short-term performance also increases long-term performance, suggesting that these companies can take advantage of their success in the short term to grow and establish long-term survival strategies.

The findings indicate that culture does not moderate the effect of technological knowledge in the short term; that is, it does not affect at all the behavior of companies in the search for economic results. However, culture negatively moderates the effect in the long term, unlike previous authors [39,49,50,51]. The impact of technological knowledge decreases when the culture of entrepreneurs is taken into account. This suggests that these companies present a certain opportunism limiting their long-term growth [55,56].

Managerial and Social Implications

The findings of this paper can help to improve the functioning and management of SSBs, usually in developing countries, with high levels of poverty [74].

First, it verifies that technological knowledge is important to get performance in SSBs. Therefore, it is possible to develop political actions for fostering technological knowledge. Bruhn et al. [75] suggest that this knowledge, associated with managerial capital, should be taught to subsistence entrepreneurs to become transforming entrepreneurs.

Second, culture does not affect performance in SSBs, so the managers of these companies should be oriented towards an organizational culture that helps them to improve their competitiveness based on technological knowledge. In that sense, this can include training policies in technological knowledge with assistance of consultants [75,76] and coaching to combine culture and technology [77]. The role of business schools and training institutions is important to professionalize the managers of small business [78].

Finally, it is observed that culture does not moderate the impact of technological knowledge on short-term performance and limits the use of technological knowledge on long-term performance, possibly because of the opportunism. As a consequence, managers and consultants should insist on promoting a culture for collaboration; for example, promoting cooperative activities [79,80] with other companies, trying to avoid, in a certain way, the opportunistic culture. Therefore, it is important to promote a culture based on attitudes and values [81] that allow limiting this opportunistic behavior.

Similarly, political actions must be oriented towards equitable economic growth, striving to establish a stable institutional framework, which would reduce the risk associated with entrepreneurs, limiting their opportunistic behavior [54]. At the same time, it seems necessary that the authorities make an effort to increase the training of the managers and workers of these companies and, in general, of the population [82]. The training should be oriented, especially, to increase the formal education and qualification of the managers themselves, to limit opportunism and promote cooperation activities and other activities that allow the generation of long-term commercial relationships.

There is a positive interaction between the job and the economic and social conditions, so in situations of poverty and low standards of living it is more difficult to achieve a professional position. On the contrary, a higher level of the job allows an increase in better living conditions [83]. Therefore, the actions aimed at improving the job position will have an impact on the conditions of the entire territory.

6. Conclusions

The paper has analyzed the ties between technological knowledge and organizational culture, relevant for small business management. It verifies that technological knowledge is a source of short-term and long-term performance, which confirms for SSBs previous works in intellectual capital.

Secondly, this work analyzes the moderating effect of culture, verifying that culture does not condition the connection between technological knowledge with the short-term performance. It shows, too, that culture is not a source of performance, unlike Hardcopf and Shah [19].

However, when the research checks whether the effect of the technological knowledge increases the long-term performance, the results indicate that culture significantly limits this effect, suggesting that culture presents a certain opportunism, possibly because in the SSBs, entrepreneurs do not pay any attention to developing knowledge resources.

Limitations and Future Research

This work used data from only one country and sector, which could limit the validity of the conclusions. The use of cross-sectional data in this paper opens up the interest to use panel data, to check the evolution of the results.

The analyses of this document, contribute to a better understanding of how technological knowledge exists in subsistence small businesses, and too, what the relationship between knowledge and culture in SSBs is like, in order to improve their performance. It seems that, with political decisions and training for the SSB entrepreneurs, these companies can apply technology and can modernize themselves, to upgrade the status of subsistence.

Supplementary Materials

The following are available online at https://www.mdpi.com/2071-1050/12/22/9694/s1.

Author Contributions

Conceptualization, C.F.-J., X.M.-C. and F.M.-O.; methodology, C.F.-J., X.M.-C. and F.M.-O.; investigation, C.F.-J., X.M.-C. and F.M.-O.; writing—original draft preparation, C.F.-J., X.M.-C. and F.M.-O. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Peltoniemi, M. Mechanisms of capability evolution in the Finnish forest industry cluster. J. For. Econ. 2013, 19, 190–205. [Google Scholar] [CrossRef]

- Toledo-López, A.; Díaz-Pichardo, R.; Jiménez-Castañeda, J.C.; Sánchez-Medina, P.S. Defining success in subsistence businesses. J. Bus. Res. 2012, 65, 1658–1664. [Google Scholar] [CrossRef]

- Wilton, N.A. Growth, what growth? It is not on the menu: Subsistence entrepreneurship among Zimbabwean entrepreneurs—A country perspective. Int. J. Entrep. Small Bus. 2012, 17, 44. [Google Scholar] [CrossRef]

- Gronum, S.; Verreynne, M.-L.; Kastelle, T. Medium-Sized Enterprise Innovation and and Firm Performance. J. Small Bus. Manag. 2012, 50, 257–282. [Google Scholar] [CrossRef]

- Yang, D. What should SMEs consider to introduce environmentally innovative products to market? Sustainblity 2019, 11, 1117. [Google Scholar] [CrossRef]

- Cho, I.; Park, J.; Heo, E. Measuring knowledge diffusion in water resources research and development: The case of Korea. Sustainblity 2018, 10, 2944. [Google Scholar] [CrossRef]

- Mukhtarova, K.S.; Kozhakhmetova, A.K.; Belgozhakyzy, M.; Dosmbek, A.; Barzhaksyyeva, A. High-tech entrepreneurship in developing countries: Way to success. Acad. Entrep. J. 2019, 25, 1–10. [Google Scholar]

- Adebayo, O.P.; Worlu, R.E.; Moses, C.L.; Ogunnaike, O.O. An Integrated Organisational Culture for Sustainable Environmental Performance in the Nigerian Context. Sustainability 2020, 12, 8323. [Google Scholar] [CrossRef]

- Bakhsh Magsi, H.; Ong, T.; Ho, J.; Sheikh Hassan, A. Organizational Culture and Environmental Performance. Sustainability 2018, 10, 2690. [Google Scholar] [CrossRef]

- Ali, H.S.H.; Said, R.M.; Abdullah, A.; Daud, Z.M. The impact of organizational culture on corporate financial performance: A review. Int. J. Econ. Commer. Manag. 2017, 6, 123. [Google Scholar] [CrossRef][Green Version]

- Peredo, A.M.; Chrisman, J.J. Toward a theory of community-based enterprise. Acad. Manag. Rev. 2006, 31, 309–328. [Google Scholar] [CrossRef]

- Adam, Y.O.; Pettenella, D. The Contribution of Small-Scale Forestry-Based Enterprises to the Rural Economy in the Developing World: The Case of the Informal Carpentry Sector, Sudan. Small Scale For. 2013, 12, 461–474. [Google Scholar] [CrossRef]

- Smith, R. Developing and animating enterprising individuals and communities. J. Enterprising Communities People Places Glob. Econ. 2012, 6, 57–83. [Google Scholar] [CrossRef]

- Jardón, C.M.; Tañski, N.C. Place-based competitiveness in subsistence small businesses. J. Entrep. Emerg. Econ. 2018, 10, 23–41. [Google Scholar] [CrossRef]

- Jardon, C.M.; Martínez-Cobas, X. Leadership and Organizational Culture in the Sustainability of Subsistence Small Businesses: An Intellectual Capital Based View. Sustainability 2019, 11, 3491. [Google Scholar] [CrossRef]

- Shahzad, F.; Xiu, G.; Shahbaz, M. Organizational culture and innovation performance in Pakistan’s software industry. Technol. Soc. 2017, 51, 66–73. [Google Scholar] [CrossRef]

- Mannion, R.; Marshall, M.N.; Davies, H.T.O. Cultures for Performance in Health Care: Evidence on the Relationships Between Organisational Culture and Organisational Performance in the NHS; University of York, Centre for Health Economics: Heslington, UK, 2003. [Google Scholar]

- Anning-Dorson, T. Moderation-mediation effect of market demand and organization culture on innovation and performance relationship. Mark. Intell. Plan. 2017, 35, 222–242. [Google Scholar] [CrossRef]

- Hardcopf, R.; Shah, R. Lean and Performance: The Impact of Organizational Culture. Acad. Manag. Proc. 2014, 2014, 10747. [Google Scholar] [CrossRef]

- Todorovic, Z.W.; Ma, J. Entrepreneurial and market orientation relationship to performance. J. Enterprising Communities People Places Glob. Econ. 2008, 2, 21–36. [Google Scholar] [CrossRef]

- Dana, L.-P. Change and circumstance in Kyrgyz markets. Qual. Mark. Res. Int. J. 2000, 3, 62–73. [Google Scholar] [CrossRef]

- Mason, A.M.; Dana, L.P.; Anderson, R.B. A study of enterprise in Rankin Inlet, Nunavut: Where subsistence self-employment meets formal entrepreneurship. Int. J. Entrep. Small Bus. 2009, 7, 1–23. [Google Scholar] [CrossRef]

- Kubo, H. Incorporating Agency Perspective into Community Forestry Analysis. Small Scale For. 2009, 8, 305–321. [Google Scholar] [CrossRef]

- Rantšo, T.A. Factors affecting performance/success of small-scale rural non-farm enterprises in Lesotho. J. Enterprising Communities People Places Glob. Econ. 2016, 10, 226–248. [Google Scholar] [CrossRef]

- Christensen, L.J.; Parsons, H.; Fairbourne, J. Building Entrepreneurship in Subsistence Markets: Microfranchising as an Employment Incubator. J. Bus. Res. 2010, 63, 595–601. [Google Scholar] [CrossRef]

- Drolet, S.; LeBel, L. Forest harvesting entrepreneurs, perception of their business status and its influence on performance evaluation. For. Policy Econ. 2010, 12, 287–298. [Google Scholar] [CrossRef]

- Itami, H.; Numagami, T. Dynamic interaction between strategy and technology. Strateg. Manag. J. 1992, 13, 119–135. [Google Scholar] [CrossRef]

- Tañski, N.C.; Fernandez Jardon, C.M. Learning processes as drivers of change in SMEs of forest industry of Misiones. Visión Future 2015, 19, 206–227. [Google Scholar]

- Maslatón, C.; Ladrón Gonzalez, A. Cifras para pensar: Estructura productiva de la industria maderera. Argentina For. 2008, 4, 14–16. [Google Scholar]

- Jardon, C.M.; Gutawski, S.; Martos, S.; Aguilar, C.; Barajas, A. Visión Estratégica de la Cadena Empresarial de la Madera de Oberá, Misiones; EDUNAM—Editorial Universitaria de la Universidad Nacional de Misiones: Posadas, Argentina, 2007. [Google Scholar]

- De Brito, R.P.; Brito, L.A.L. Vantagem competitiva, criação de valor e seus efeitos sobre o desempenho. Rev. Adm. Empres. 2012, 52, 70–84. [Google Scholar] [CrossRef]

- Bhat, J.S.A.; Kumar, V. A structured approach to knowledge management in SMEs: Towards a successful manufacturing strategy. Int. J. Bus. Perform. Manag. 2004, 6, 233–244. [Google Scholar] [CrossRef]

- Linton, J.D.; Solomon, G.T. Technology, Innovation, Entrepreneurship and The Small Business—Technology and Innovation in Small Business. J. Small Bus. Manag. 2017, 55, 196–199. [Google Scholar] [CrossRef]

- Witschel, D.; Döhla, A.; Kaiser, M.; Voigt, K.-I.; Pfletschinger, T. Riding on the wave of digitization: Insights how and under what settings dynamic capabilities facilitate digital-driven business model change. J. Bus. Econ. 2019, 89, 1023–1095. [Google Scholar] [CrossRef]

- Pelham, A. Mediating Influences on the Relationship Between Market Orientation and Profitability in Small Industrial Firms. J. Mark. Theory Pract. 1997, 5, 55–76. [Google Scholar] [CrossRef]

- INEC Ecuador en Cifras. Available online: http://www.ecuadorencifras.gob.ec/ (accessed on 1 June 2016).

- Moses, C.; Olokundun, A.M.; Akinbode, M.; Agboola, M.G. Organizational culture and creativity in entrepreneurship education: A study of secondary education in Nigeria. Res. Jourml Appl. Sci. 2016, 11, 586–591. [Google Scholar]

- Tahir, R.; Athar, M.R.; Faisal, F.; Shahani, N.N.; Solangi, B. Green Organizational Culture: A Review of Literature and Future Research Agenda. Ann. Contemp. Dev. Manag. HR 2019, 1, 23–38. [Google Scholar] [CrossRef]

- Jardon, C.M.; Martinez–Cobas, X. Culture and competitiveness in small-scale Latin-American forestry-based enterprising communities. J. Enterprising Communities 2020, 14, 161–181. [Google Scholar] [CrossRef]

- Valliere, D. Culture, values and entrepreneurial motivation in Bhutan. J. Enterprising Communities People Places Glob. Econ. 2014, 8, 126–146. [Google Scholar] [CrossRef]

- Di Gregorio, D. Place-based business models for resilient local economies. J. Enterprising Communities People Places Glob. Econ. 2017, 11, 113–128. [Google Scholar] [CrossRef]

- Tamar, M.; Wirawan, H.; Bellani, E. The Buginese entrepreneurs; the influence of local values, motivation and entrepreneurial traits on business performance. J. Enterprising Communities People Places Glob. Econ. 2019, 13, 438–454. [Google Scholar] [CrossRef]

- Shrivastava, P.; Kennelly, J.J. Sustainability and Place-Based Enterprise. Organ. Environ. 2013, 26, 83–101. [Google Scholar] [CrossRef]

- Sadok, M.; Chatta, R.; Bednar, P. ICT for development in Tunisia: “Going the last mile”. Technol. Soc. 2016, 46, 63–69. [Google Scholar] [CrossRef]

- Carmeli, A.; Sternberg, A.; Elizur, D. Organizational culture, creative behavior, and information and communication technology (ICT) usage: A facet analysis. Cyberpsychol. Behav. 2008, 11, 175–180. [Google Scholar] [CrossRef] [PubMed]

- Udagedara RMU, S.; Allman, K. Organisational dynamics and adoption of innovations: A study within the context of software firms in Sri Lanka. J. Small Bus. Manag. 2017, 57, 450–475. [Google Scholar] [CrossRef]

- Nguyen, T.H.; Newby, M.; Macaulay, M.J. Information Technology Adoption in Small Business: Confirmation of a Proposed Framework. J. Small Bus. Manag. 2015, 53, 207–227. [Google Scholar] [CrossRef]

- Chouki, M.; Khadrouf, O.; Talea, M.; Okar, C. Organizational culture as a barrier of information technology adoption: The case of Moroccan Small and Medium Enterprises. In Proceedings of the 2018 IEEE International Conference on Technology Management, Operations and Decisions, ICTMOD 2018, Marrakech, Morocco, 21–23 November 2018; pp. 80–85. [Google Scholar]

- Barney, J.B. Organizational Culture: Can It Be a Source of Sustained Competitive Advantage? Acad. Manag. Rev. 1986, 11, 656–665. [Google Scholar] [CrossRef]

- Flatt, S.J.; Kowalczyk, S.J. Creating competitive advantage through intangible assets: The direct and indirect effects of corporate culture and reputation. J. Compet. Stud. 2008, 16, 13–30. [Google Scholar]

- Sadri, G.; Lees, B. Developing corporate culture as a competitive advantage. J. Manag. Dev. 2001, 20, 853–859. [Google Scholar] [CrossRef]

- Liu, L.; Yu, B.; Wu, W. The Formation and Effects of Exploitative Dynamic Capabilities and Explorative Dynamic Capabilities: An Empirical Study. Sustainability 2019, 11, 2581. [Google Scholar] [CrossRef]

- Wang, C.-C.; Chuang, H.-C.; Liu, N.-T.; Shih, H.-S. The Organizational Evolutions and Strategies of Family Businesses in Taiwan. Open J. Bus. Manag. 2014, 02, 329–338. [Google Scholar] [CrossRef]

- Wathne, K.H.; Heide, J.B. Opportunism in Interfirm Relationships: Forms, Outcomes, and Solutions. J. Mark. 2000, 64, 36–51. [Google Scholar] [CrossRef]

- Crosno, J.L.; Dahlstrom, R. A meta-analytic review of opportunism in exchange relationships. J. Acad. Mark. Sci. 2008, 36, 191–201. [Google Scholar] [CrossRef]

- Cho, M.; Bonn, M.A.; Terrell, B.B. Interaction effects between contract specificity, competence trust and goodwill trust upon supplier opportunism and relational stability. Int. J. Contemp. Hosp. Manag. 2019, 31, 1505–1524. [Google Scholar] [CrossRef]

- Chung, J.-E. When and How Does Supplier Opportunism Matter for Small Retailers’ Channel Relationships with the Suppliers? J. Small Bus. Manag. 2012, 50, 389–407. [Google Scholar] [CrossRef]

- Bachmann, R.; Inkpen, A.C. Understanding Institutional-based Trust Building Processes in Inter-organizational Relationships. Organ. Stud. 2011, 32, 281–301. [Google Scholar] [CrossRef]

- Yang, P.; Qian, L.; Zheng, S. Improving performance and curtailing opportunism: The role of contractual issue inclusiveness and obligatoriness in channel relationships. J. Bus. Ind. Mark. 2017, 32, 371–384. [Google Scholar] [CrossRef]

- Jimenez, N.; San-Martin, S.; Azuela, J.I. Trust and satisfaction: The keys to client loyalty in mobile commerce. Acad. Rev. Latinoam. Adm. 2016, 29, 486–510. [Google Scholar] [CrossRef]

- Jardon, C.M.; Martos, M.S. Intellectual capital as competitive advantage in emerging clusters in Latin America. J. Intellect. Cap. 2012, 13, 457–484. [Google Scholar] [CrossRef]

- Singh, B.; Rao, M.K. Effect of intellectual capital on dynamic capabilities. J. Organ. Chang. Manag. 2016, 29, 129–149. [Google Scholar] [CrossRef]

- Lahiri, S.; Kedia, B.L.; Mukherjee, D. The impact of management capability on the resource–performance linkage: Examining Indian outsourcing providers. J. World Bus. 2012, 47, 145–155. [Google Scholar] [CrossRef]

- Agyapong, A.; Osei, H.V.; Akomea, S.Y. Marketing capability, competitive strategies and performance of micro and small family businesses in Ghana. J. Dev. Entrep. 2015, 20, 1550026. [Google Scholar] [CrossRef]

- Chin, W.W. The partial least squares approach for structural equation modeling. In Modern Methods for Business Research Methodology for Business and Management; Marcoulides, G.A., Ed.; Lawrence Erlbaum Associates Publishers: Mahwah, NJ, USA, 1998; pp. 295–336. [Google Scholar]

- Hair, J.; Black, W.; Babin, B.; Anderson, R.; Tatham, R. Multivariate Data Analysis, 6th ed.; Pearson Prentice Hall: Upper Saddle River, NJ, USA, 2006. [Google Scholar]

- Henseler, J.; Fassott, G. Testing Moderating Effects in PLS Path Models: An Illustration of Available Procedures. In Handbook of Partial Least Squares; Vinzi, V., Wynne, W., Chin, W., Henseler, J., Eds.; Springer: Berlin, Germany, 2010; pp. 713–735. ISBN 978-3-540-32825-4. [Google Scholar]

- Efron, B. Bootstrap Methods: Another Look at the Jackknife. Ann. Stat. 1979, 7, 1–26. [Google Scholar] [CrossRef]

- Roos, G.G.; Roos, J. Measuring your company’s intellectual performance. Long Range Plann. 1997, 30, 413–426. [Google Scholar] [CrossRef]

- Navimipour, N.J.N.J.; Milani, F.S.F.S.; Hossenzadeh, M. A model for examining the role of effective factors on the performance of organizations. Technol. Soc. 2018, 55, 166–174. [Google Scholar] [CrossRef]

- Jabbouri, N.I.; Siron, R.; Zahari, I.; Khalid, M. Impact of Information Technology Infrastructure on Innovation Performance: An Empirical Study on Private Universities In Iraq. Procedia Econ. Financ. 2016, 39, 861–869. [Google Scholar] [CrossRef]

- Dana, L.P. Entrepreneurship in Bolivia: An Ethnographic Enquiry. In Informal Ethnic Entrepreneurship; Springer International Publishing: Cham, Switherland, 2019; pp. 133–147. ISBN 9783319990644. [Google Scholar]

- Leidner, D.E.; Kayworth, T. Review: A review of culture in information systems research: Toward a theory of information technology culture. MIS Q. Manag. Inf. Syst. 2006, 30, 357–399. [Google Scholar] [CrossRef]

- Qureshil, S.; Kamal, M.; Wolcott, P. Information technology interventions for growth and competitiveness in micro-enterprises. Int. J. Enterp. Inf. Syst. 2009, 5, 72–95. [Google Scholar] [CrossRef]

- Bruhn, B.M.; Karlan, D.; Schoar, A. What Capital is Missing in Developing Countries? Am. Econ. Rev. Pap. Proc. 2010, 100, 629–633. [Google Scholar] [CrossRef]

- Anand, J.; Brenes, E.; Karnani, A.; Rodriquez, A. Strategic responses to economic liberalization in emerging economies: Lessons from experience. J. Bus. Res. 2006, 59, 365–371. [Google Scholar] [CrossRef]

- Vidal-Salazar, M.D.; Ferrón-Vílchez, V.; Cordón-Pozo, E. Coaching: An effective practice for business competitiveness. Compet. Rev. 2012, 22, 423–433. [Google Scholar] [CrossRef]

- Kantis, H.; Ishida, M.; Komori, M. Entrepreneurship in Emerging Economies: The Creation and Development of New Firms in Latin America and East Asia. Available online: https://publications.iadb.org/en/entrepreneurship-emerging-economies-creation-and-development-new-firms-latin-america-and-east-asia (accessed on 10 September 2013).

- Cieslik, K.; D’Aoust, O. Risky Business? Rural Entrepreneurship in Subsistence Markets: Evidence from Burundi. Eur. J. Dev. Res. 2018, 30, 693–717. [Google Scholar] [CrossRef]

- Ojong, N.; Simba, A. Fostering micro-entrepreneurs’ structural and relational social capital through microfinance. J. Small Bus. Entrep. 2019, 31, 1–20. [Google Scholar] [CrossRef]

- Vargas-Hernández, J.G.; Casas Cárdenaz, R.; Calderón Campos, P. Internal Control and Organizational Culture in Small Businesses, A Conjunct…: EBSCOhost. J. Organ. Stud. Innov. 2016, 3, 16–30. [Google Scholar]

- Fernández-Jardón, C.M.; Martos, M.S. Capital intelectual y ventajas competitivas en pymes basadas en recursos naturales de Latinoamérica. Rev. Innovar J. Rev. Ciencias Adm. Soc. 2016, 26, 117–132. [Google Scholar] [CrossRef]

- Borowski, P.F. Environmental pollution as a threats to the ecology and development in Guinea Conakry. Ochr. Sr. Zasobow Nat. 2017, 28, 27–32. [Google Scholar] [CrossRef][Green Version]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).