Is Bitcoin Similar to Gold? An Integrated Overview of Empirical Findings

Abstract

1. Introduction

2. Studies Revealing a High Resemblance between Bitcoin and Gold Assets

3. Studies Providing Evidence of Mixed Results, Weak or Neutral Nexus between Bitcoin and Gold

4. Studies Presenting Outcomes against Bitcoin Sharing Similar Characteristics with Gold

5. Economic Implications and Conclusions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

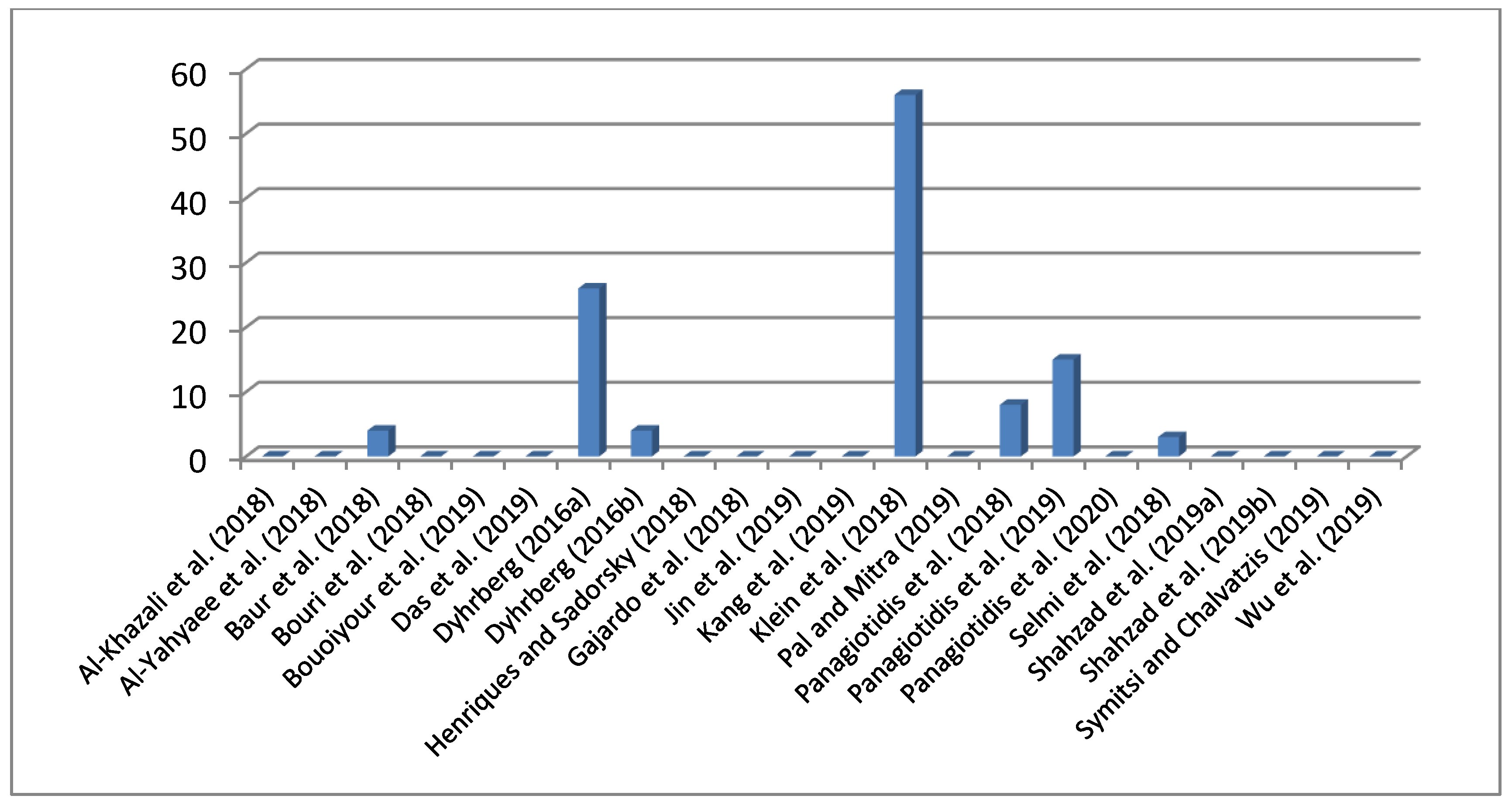

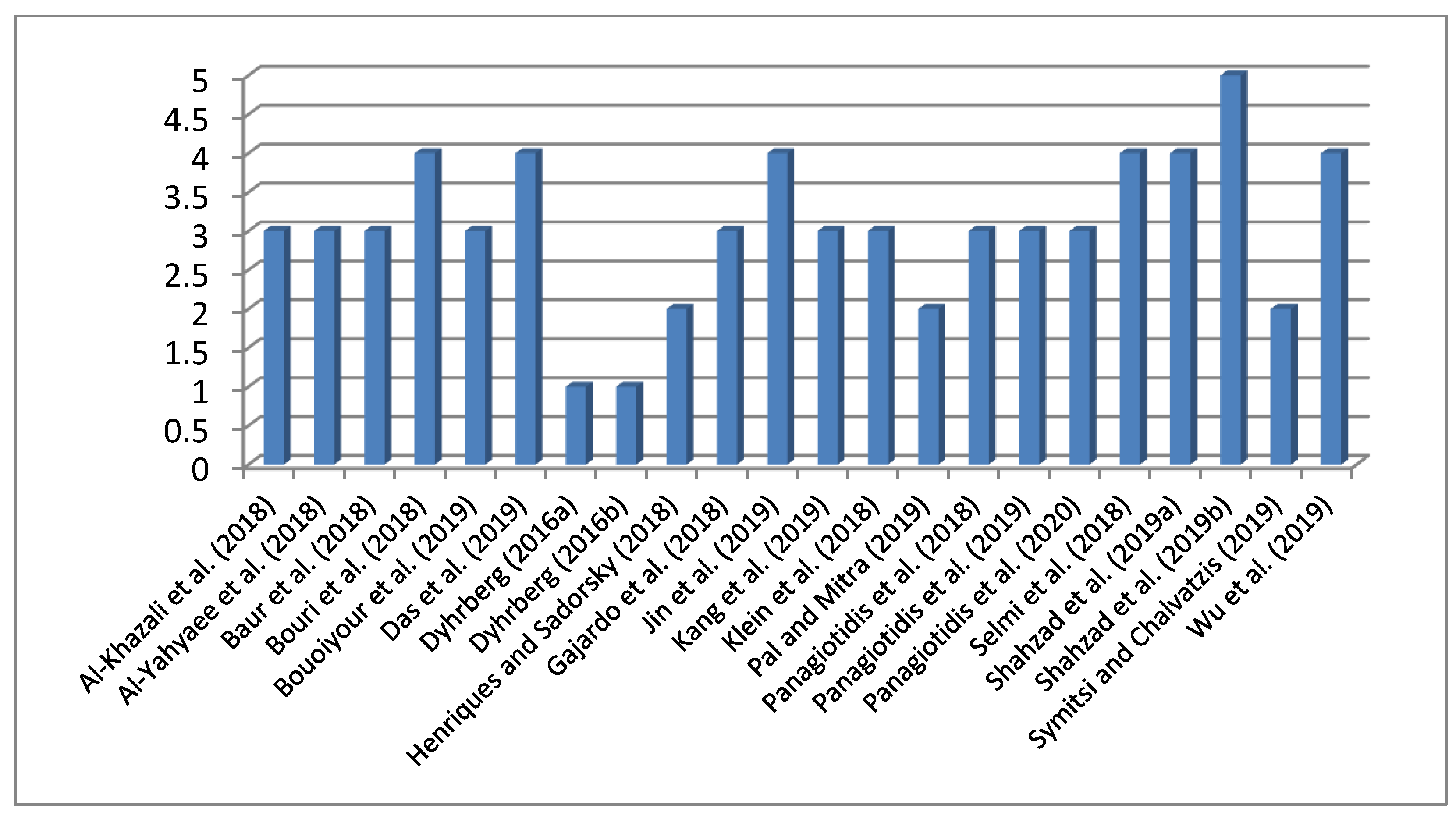

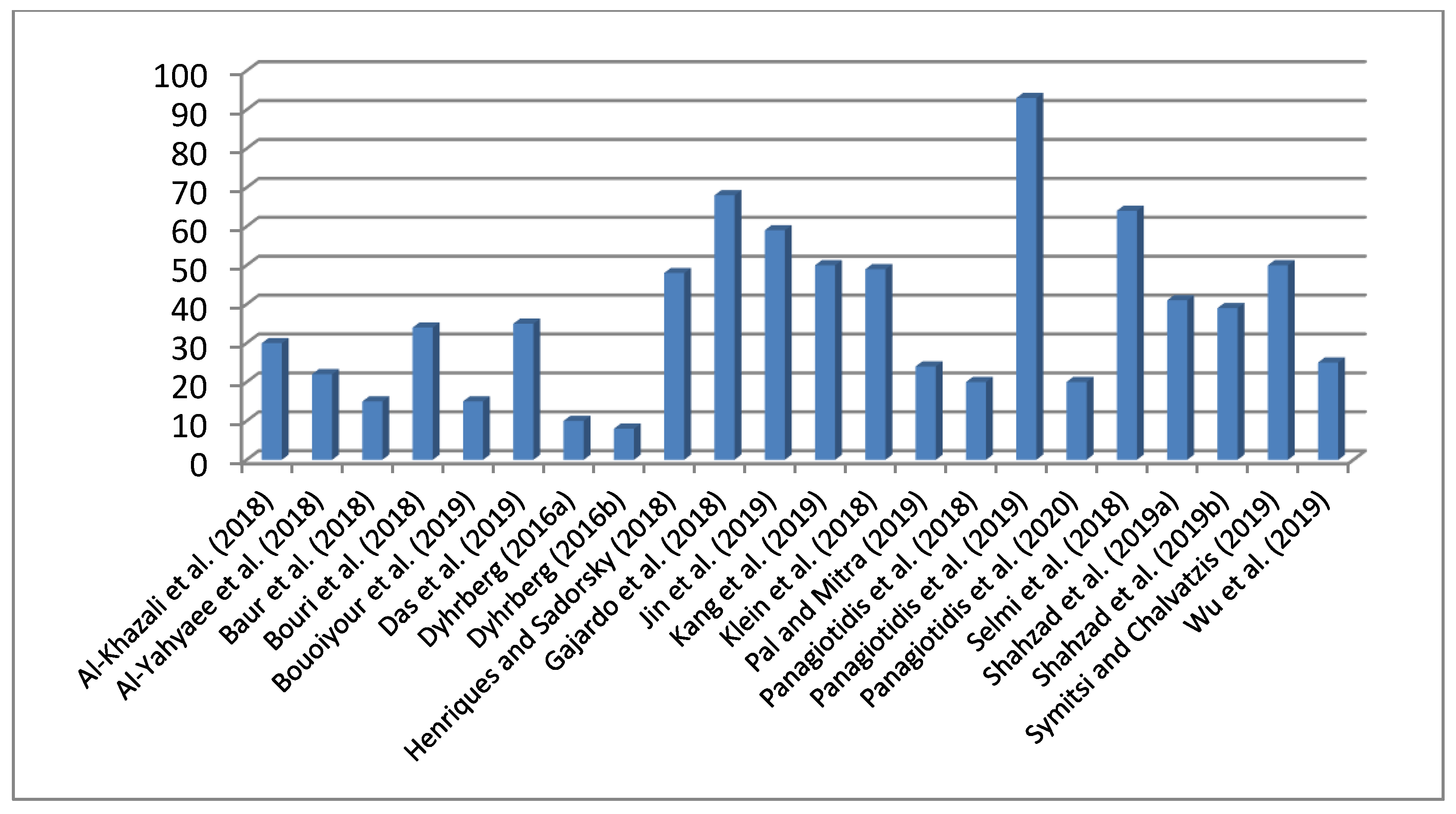

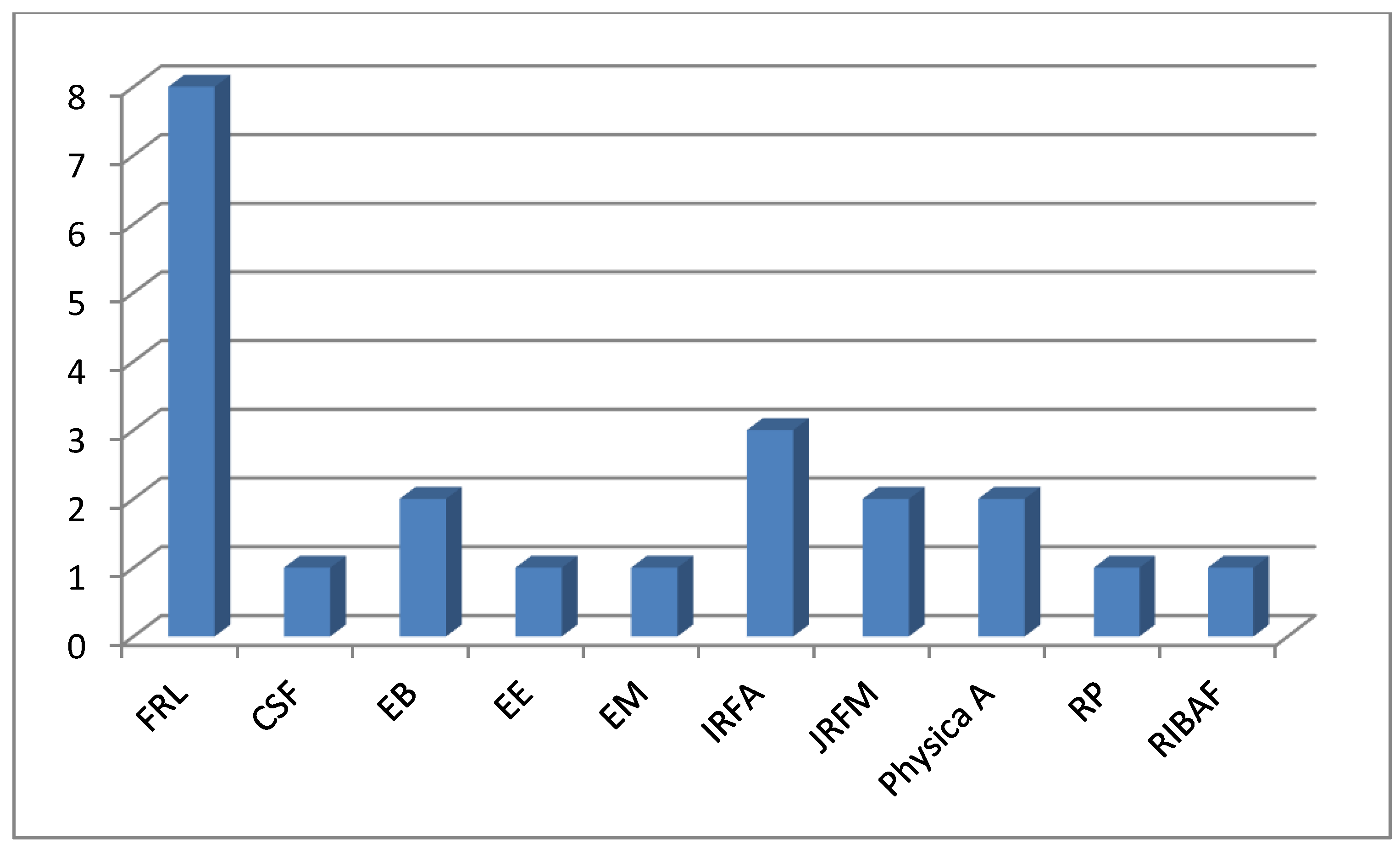

| Authors | Source | Time Period | Methodology | Findings |

|---|---|---|---|---|

| Al- Khazali et al. (2018) | https://sites.google.com/site/chiarascottifrb/research/surprise-and-uncertainty-indexes www.gold.org Coindesk.com | 19 July 2010–7 February 2017 | GARCH by Bollerslev (1986) Exponential GARCH by Nelson (1991) | Existence of asymmetric effects to positive and negative shocks. Gold returns and volatility react to surprises and abide by the safe-haven role of gold. Bitcoin is more weakly affected by surprises |

| Al-Yahyaee et al. (2018) | Coindesk.com Datastream | 18 July 2010–31 October 2017 | Multifractal Detrended Fluctuation Analysis (MF-DFA) by Kantelhardt et al. (2002) Hurst exponent | Bitcoin market is less efficient than the gold market and the least efficient among the markets examined |

| Baur et al. (2018) | Coindesk.com Datastream | 19 July 2010–22 May 2015 | GARCH by Bollerslev (1986)(miao) Exponential GARCH by Nelson (1991) | Bitcoin does not present many similarities with gold neither with fiat money Differences as concerns the risk-return features, the volatility process and correlation characteristics |

| Bouoiyour et al. (2019) | Coindesk.com FRED database | 18 July 2010–31 March 2018 | Dynamic Markov-switching copula model based on Patton (2006) BDS test by Broock et al. (1996) | Gold exhibits diversifying benefits for investors in digital assets but Bitcoin is more capable of efficiently transferring value |

| Bouri et al. (2018) | Coindesk.com Datastream | 17 July 2010–2 February 2017 | Non-linear Autoregressive Distributed Lag (NARDL) model by Shin et al. (2014) Quantile Autoregressive Distributed Lag (QARDL) model by Cho et al. (2015) | Bitcoin and gold present an asymmetric, non-linear nexus that is not the same across quantiles Differences between them are more obvious in extreme cases |

| Das et al. (2019) | Bloomberg | 20 July 2010–20 June 2019 | Dummy variable GARCH based on Bollerslev (1986) as in Baur and Lucey (2010) and Wu et al. (2019) Structural Vector Autoregression (SVAR) as in Ready (2018) | Bitcoin exhibits better abilities than gold as concerns hedging OVX but is an inferior safe-haven than gold in extreme conditions |

| Dyhrberg (2016a) | Coindesk.com Datastream Federal Reserve Bank of New York | 19 July 2010–22 May 2015 | GARCH by Bollerslev (1986)(miao) Exponential GARCH by Nelson (1991) | Bitcoin can serve as a hedging asset especially for risk-averse investors High persistence in volatility is detected, which is similar to what is valid about gold |

| Dyhrberg (2016b) | Coindesk.com Datastream | 19 July 2010–22 May 2015 | Threshold GARCH by Glosten et al. (1993) | Bitcoin constitutes an efficient hedger and presents significantly similar features with gold |

| Gajardo et al. (2018) | - | 13 September 2015–25 August 2017 | Multifractal Asymmetric Detrended Cross-Correlation Analysis (MF-ADCCA) | Bitcoin is confirmed to be tightly connected with gold but is not suitable to be classified among conventional assets |

| Henriques and Sadorsky (2018) | Yahoo Finance Coindesk.com | 4 January 2011–31 October 2017 | DCC-GARCH based on Engle (2002) and Bollerslev (1986) Asymmetric DCC-GARCH (ADCC-GARCH) by Cappiello et al. (2006) Generalized Orthogonal GARCH (GO-GARCH) by Van der Weide (2002) Modern portfolio theory as in Elton and Gruber (1997) | Bitcoin instead of gold in an investment portfolio could lead to higher risk-adjusted return |

| Jin et al. (2019) | Coinmarketcap.com Federal Reserve Bank of St. Louis Energy Information Administration (EIA) | 10 May 2013–7 September 2018 | Multifractal Detrended Cross-Correlation Analysis (MF-DCCA) Multivariate Generalized Autoregressive Conditional Heteroskedasticity (MV-GARCH) Information Share (IS) analysis as in Hasbrouck (1995, 2002) | The linkage between Bitcoin and gold in the form of dynamic correlations is nearly negative Gold makes a better hedger during stressed times than Bitcoin |

| Kang et al. (2019) | Coindesk.com Thomson Reuters | 26 July 2010–25 October 2017 | DCC-GARCH based on Engle (2002) and Bollerslev (1986) Wavelet coherence analysis based on Torrence and Compo (1998) | The bubble behaviour of gold prices can partly be employed in order to hedge against the bubble behaviour in Bitcoin market values |

| Klein et al. (2018) | Coindesk.com Datastream | 1 July 2011–31 December 2017 | Asymmetric Power ARCH (APARCH) by Ding et al. (1993) Fractionally Integrated APARCH (FIAPARCH) by Tse (1998) Baba-Engle-Kraft-Kroner GARCH (BEKK-GARCH) by Engle and Kroner (1995) | Bitcoin and gold present almost completely different characteristics as financial assets and exhibit different type of nexus with equity markets |

| Pal and Mitra (2019) | Yahoo Finance Datastream | 3 January 2011–19 February 2018 | DCC-GARCH based on Engle (2002) and Bollerslev (1986) Asymmetric DCC-GARCH (ADCC-GARCH) by Cappiello et al. (2006) Generalized Orthogonal GARCH (GO-GARCH) by Van der Weide (2002) Optimal hedge ratios as in Kroner and Sultan (1993) | 1 US dollar long of Bitcoin could be hedged with 70 cents short of gold. Gold provides a better hedge against Bitcoin |

| Panagiotidis et al. (2018) | Coindesk.com Quandl us.spindices.com policyuncertainty.com R package ’gtrendsR’ R package ’wikipediatrend’ tools.wmflabs.org | 17 June 2010–23 June 2017 | Glmnet and lars Least Absolute Shrinkage and Selection Operator (LASSO) based on Tibshirani (1996) | Bitcoin is positively and strongly affected by gold |

| Panagiotidis et al. (2019) | Coindesk.com Quandl ECB statistics FRED database us.spindices.com policyuncertainty.com R package ‘gtrendsR’ R package ‘wikipediatrend’ tools.wmflabs.org/pageviews | 18 July 2010 to 31 August 2018 | Alternative VAR and Factor- Augmented VAR (FAVAR) | Shocks to gold positively influence Bitcoin returns but findings are not stable over different horizons |

| Panagiotidis et al. (2020) | Coindesk.com Thomson Reuters Eikon R package ‘wikipediatrend’ tools.wmflabs.org/page views | 21 July 2010–31 May 2018 | Least Absolute Shrinkage and Selection Operator (LASSO) based on Tibshirani (1996) and Principal component-guided sparse regression (PC-LASSO) LASSO (PC-LASSO) by Tay et al. (2018) Flexible Least Squares FLS models by Kalaba and Tesfatsion (1989) Rolling window generalized supremum Augmented Dickey–Fuller test for bubbles (GSADF) by Phillips et al. (2015) | Commodities such as gold are not influential on Bitcoin returns |

| Selmi et al. (2018) | Coindesk.com Bank of England US Energy Information Administration www.policyuncertainty.com www.federalreserve.gov www.sydneyludvigson.com www.philadelphiafed.org | 13 September 2011–29 August 2017 | Quantile-on-quantile regression (QQR) as in Sim and Zhou (2015) Value at Risk (VaR) Conditional Value at Risk (CoVaR) Risk reduction effectiveness (RR) Expected Shortfall (ES) Semi-variance (SV) Regret (RE) | Both Bitcoin and gold exhibit relevant hedging abilities against fluctuations in oil market values |

| Shahzad et al. (2019a) | Coindesk.com Thomson Reuters Datastream | 20 July 2010–31 December 2018 | Conditional Diversification Benefit (CDB) measure of Christoffersen et al. (2018) Optimal coefficient as in Baillie and Myers (1991)(miao) Asymmetric Generalized Dynamic Conditional Correlation GARCH (AGDCC-GARCH) estimation of hedge ratios as in Kroner and Sultan (1993) Hedging effectiveness (HE) index as in Basher and (Sadorsky 2016) and Toyoshima et al. (2013) | Gold is an effective hedger against a much larger spectrum of countries (France, Germany, Italy, Japan, the United Kingdom, the United States as well as the MSCI G7 index) compared to Bitcoin. |

| Shahzad et al. (2019b) | Coindesk.com Datastream | 19 July 2010–22 February 2018 | Bivariate cross-quantilogram by Han et al. (2016) | Bitcoin and gold constitute weak safe-havens regarding the world stock market index while gold is the only safe-haven as concerns developed stock markets |

| Symitsi and Chalvatzis (2019) | Coindesk.com | 20 September 2011–14 July 2017 | Identification of multiple bubbles by Phillips et al. (2015) Equal-weighted (EW) portfolio Global minimum-variance (GMV) portfolio Constrained global minimum-variance (CGMV) portfolio Constrained global minimum-variance portfolio with dynamic conditional correlation forecasts (CGMV-DCC) based on Engle (2002) | Portfolios that are made of gold, currencies and stocks benefit from adding Bitcoin as it is found to exhibit low correlation with gold and other assets |

| Wu et al. (2019) | www.investing.com www.policyuncertainty.com | 2 February 2012–31 December 2018 | GARCH with dummy variables in quantiles based on Bollerslev (1986) | Bitcoin is more influenced by uncertainty at both lower and higher quantiles whereas gold remains stable with smaller hedge and safe-haven coefficients |

References

- Al-Khazali, O., B. Elie, and D. Roubaud. 2018. The impact of positive and negative macroeconomic news surprises: Gold versus Bitcoin. Economics Bulletin 38: 373–82. [Google Scholar]

- Al-Yahyaee, K. H., W. Mensi, and S. M. Yoon. 2018. Efficiency, multifractality, and the long-memory property of the Bitcoin market: A comparative analysis with stock, currency, and gold markets. Finance Research Letters 27: 228–34. [Google Scholar] [CrossRef]

- Ammous, S. 2018. Can cryptocurrencies fulfil the functions of money? The Quarterly Review of Economics and Finance 70: 38–51. [Google Scholar] [CrossRef]

- Avdjiev, S., L. Gambacorta, L. S. Goldberg, and S. Schiaffi. 2020. The shifting drivers of global liquidity. Journal of International Economics, 103324. [Google Scholar] [CrossRef]

- Baillie, R. T., and R. J. Myers. 1991. Bivariate GARCH estimation of the optimal commodity futures hedge. Journal of Applied Econometrics 6: 109–24. [Google Scholar] [CrossRef]

- Basher, S. A., and P. Sadorsky. 2016. Hedging emerging market stock prices with oil, gold, VIX, and bonds: A comparison between DCC, ADCC and GO-GARCH. Energy Economics 54: 235–47. [Google Scholar] [CrossRef]

- Baur, D. G., and B. M. Lucey. 2010. Is gold a hedge or a safe haven? An analysis of stocks, bonds and gold. Financial Review 45: 217–29. [Google Scholar] [CrossRef]

- Baur, D. G., T. Dimpfl, and K. Kuck. 2018. Bitcoin, gold and the US dollar–A replication and extension. Finance Research Letters 25: 103–10. [Google Scholar] [CrossRef]

- Beneki, C., A. Koulis, N. A. Kyriazis, and S. Papadamou. 2019. Investigating volatility transmission and hedging properties between Bitcoin and Ethereum. Research in International Business and Finance 48: 219–27. [Google Scholar] [CrossRef]

- Böhme, R., N. Christin, B. Edelman, and T Moore. 2015. Bitcoin: Economics, technology, and governance. Journal of Economic Perspectives 29: 213–38. [Google Scholar] [CrossRef]

- Bollerslev, T. 1986. Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics 31: 307–27. [Google Scholar] [CrossRef]

- Bouoiyour, J., R. Selmi, and M. E. Wohar. 2019. Bitcoin: competitor or complement to gold? Economics Bulletin 39: 186–91. [Google Scholar]

- Bouri, E., R. Gupta, A. Lahiani, and M. Shahbaz. 2018. Testing for asymmetric nonlinear short-and long-run relationships between bitcoin, aggregate commodity and gold prices. Resources Policy 57: 224–35. [Google Scholar] [CrossRef]

- Broock, W. A., J. A. Scheinkman, W. D. Dechert, and B. LeBaron. 1996. A test for independence based on the correlation dimension. Econometric Reviews 15: 197–235. [Google Scholar] [CrossRef]

- Cappiello, L., R. F. Engle, and K. Sheppard. 2006. Asymmetric dynamics in the correlations of global equity and bond returns. Journal of Financial Econometrics 4: 537–72. [Google Scholar] [CrossRef]

- Cho, J. S., T. H. Kim, and Y. Shin. 2015. Quantile cointegration in the autoregressive distributed-lag modeling framework. Journal of Econometrics 188: 281–300. [Google Scholar] [CrossRef]

- Christoffersen, P., K. Jacobs, X. Jin, and H. Langlois. 2018. Dynamic dependence and diversification in corporate credit. Review of Finance 22: 521–60. [Google Scholar] [CrossRef]

- Corbet, S., B. Lucey, A. Urquhart, and L. Yarovaya. 2019. Cryptocurrencies as a financial asset: A systematic analysis. International Review of Financial Analysis 62: 182–99. [Google Scholar] [CrossRef]

- Das, D., C. L. Le Roux, R. K. Jana, and A. Dutta. 2019. Does Bitcoin hedge crude oil implied volatility and structural shocks? A comparison with gold, commodity and the US Dollar. Finance Research Letters, 101335. [Google Scholar] [CrossRef]

- Ding, Z., C. W. Granger, and R. F. Engle. 1993. A long memory property of stock market returns and a new model. Journal of Empirical Finance 1: 83–106. [Google Scholar] [CrossRef]

- Dyhrberg, Anne H. 2016a. Bitcoin, gold and the dollar–A GARCH volatility analysis. Finance Research Letters 16: 85–92. [Google Scholar] [CrossRef]

- Dyhrberg, Anne H. 2016b. Hedging capabilities of bitcoin. Is it the virtual gold? Finance Research Letters 16: 139–44. [Google Scholar] [CrossRef]

- Engle, Robert. 2002. Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business & Economic Statistics 20: 339–50. [Google Scholar]

- Engle, Robert F., and Kroner F. Kroner. 1995. Multivariate simultaneous generalized ARCH. Econometric Theory 11: 122–50. [Google Scholar] [CrossRef]

- Elton, Edwin J., and Martin J. Gruber. 1997. Modern portfolio theory, 1950 to date. Journal of Banking & Finance 21: 1743–59. [Google Scholar]

- Etula, Etula, Kalle Rinne, Matti Suominen, and Lauri Vaittinen. 2020. Dash for cash: Monthly market impact of institutional liquidity needs. The Review of Financial Studies 33: 75–111. [Google Scholar] [CrossRef]

- Fang, Fan, Camine Ventre, Michail Basios, Hoiliong Kong, Leslie Kanthan, Lingbo Li, David Martinez-Regoband, and Fan Wu. 2020. Cryptocurrency Trading: A Comprehensive Survey. arXiv arXiv:2003.11352. [Google Scholar]

- Fassas, Athanasios. P, Stephano Papadamou, and Alexandros Koulis. 2020. Price discovery in bitcoin futures. Research in International Business and Finance 52: 101116. [Google Scholar] [CrossRef]

- Fischer, Thomas Gunter, Christopher Krauss, and Alexander Deinert. 2019. Statistical arbitrage in cryptocurrency markets. Journal of Risk and Financial Management 12: 31. [Google Scholar] [CrossRef]

- Gajardo, Gabriel, Werner D. Kristjanpoller, and Marcel Minutolo. 2018. Does Bitcoin exhibit the same asymmetric multifractal cross-correlations with crude oil, gold and DJIA as the Euro, Great British Pound and Yen? Chaos Solitons & Fractals 109: 195–205. [Google Scholar]

- Gans, Joshua S., and Hanna Halaburda. 2015. Some economics of private digital currency. In Economic Analysis of the Digital Economy. Chicago: University of Chicago Press, pp. 257–76. [Google Scholar]

- Glosten, Lawrence. R., Ravi Jagannathan, and Davide E. Runkle. 1993. On the relation between the expected value and the volatility of the nominal excess return on stocks. The Journal of Finance 48: 1779–801. [Google Scholar] [CrossRef]

- Han, Han, Oliver Linton, Tatsushi Oka, and Yoon Jae Whang. 2016. The cross-quantilogram: Measuring quantile dependence and testing directional predictability between time series. Journal of Econometrics 193: 251–70. [Google Scholar] [CrossRef]

- Hasbrouck, J. 1995. One security, many markets: Determining the contributions to price discovery. The Journal of Finance 50: 1175–99. [Google Scholar] [CrossRef]

- Hasbrouck, J. 2002. Stalking the “efficient price” in market microstructure specifications: an overview. Journal of Financial Markets 5: 329–39. [Google Scholar] [CrossRef]

- Henriques, I., and P. Sadorsky. 2018. Can bitcoin replace gold in an investment portfolio? Journal of Risk and Financial Management 11: 48. [Google Scholar] [CrossRef]

- Jin, J., J. Yu, Y. Hu, and Y. Shang. 2019. Which one is more informative in determining price movements of hedging assets? Evidence from Bitcoin, gold and crude oil markets. Physica A Statistical Mechanics and Its Applications 527: 121121. [Google Scholar] [CrossRef]

- Kalaba, R., and L. Tesfatsion. 1989. Time-varying linear regression via flexible least squares. Computers & Mathematics with Applications 17: 1215–45. [Google Scholar]

- Kang, S. H., R. P McIver, and J. A. Hernandez. 2019. Co-movements between Bitcoin and Gold: A wavelet coherence analysis. Physica A Statistical Mechanics and Its Applications 536: 120888. [Google Scholar] [CrossRef]

- Kantelhardt, J. W., S. A. Zschiegner, E. Koscielny-Bunde, S. Havlin, A Bunde, and H. E. Stanley. 2002. Multifractal detrended fluctuation analysis of nonstationary time series. Physica A Statistical Mechanics and Its Applications 316: 87–114. [Google Scholar] [CrossRef]

- Klein, Thomas, Hien Pham Thu, and Thomas Walther. 2018. Bitcoin is not the New Gold–A comparison of volatility, correlation, and portfolio performance. International Review of Financial Analysis 59: 105–16. [Google Scholar] [CrossRef]

- Kroner, K. F., and J. Sultan. 1993. Time-varying distributions and dynamic hedging with foreign currency futures. Journal of Financial and Quantitative Analysis 28: 535–51. [Google Scholar] [CrossRef]

- Kyriazis, N. A. 2019a. A survey on efficiency and profitable trading opportunities in cryptocurrency markets. Journal of Risk and Financial Management 12: 67. [Google Scholar] [CrossRef]

- Kyriazis, N. A. 2019b. A Survey on Empirical Findings about Spillovers in Cryptocurrency Markets. Journal of Risk and Financial Management 12: 170. [Google Scholar] [CrossRef]

- Kyriazis, Ν. A., and P. Prassa. 2019. Which Cryptocurrencies Are Mostly Traded in Distressed Times? Journal of Risk and Financial Management 12: 135. [Google Scholar] [CrossRef]

- Kyriazis, Ν, A. K. Daskalou, M. Arampatzis, P. Prassa, and E. Papaioannou. 2019. Estimating the volatility of cryptocurrencies during bearish markets by employing GARCH models. Heliyon 5: e02239. [Google Scholar] [CrossRef]

- Maese, V. A., A. W. Avery, B. A. Naftalis, S. P. Wink, and Y. D. Valdez. 2016. Cryptocurrency: A Primer. Banking LJ 133: 468. [Google Scholar]

- Nelson, D. B. 1991. Conditional heteroskedasticity in asset returns: A new approach. Econometrica: Journal of the Econometric Society 59: 347–70. [Google Scholar] [CrossRef]

- O’Connor, F. A., B. M. Lucey, J. A. Batten, and D. G. Baur. 2015. The financial economics of gold—A survey. International Review of Financial Analysis 41: 186–205. [Google Scholar] [CrossRef]

- Pal, Debdatta, and Subrata K. Mitra. 2019. Hedging bitcoin with other financial assets. Finance Research Letters 30: 30–36. [Google Scholar] [CrossRef]

- Panagiotidis, Theodore, Thanasis Stengos, and Orestis Vravosinos. 2018. On the determinants of bitcoin returns: A LASSO approach. Finance Research Letters 27: 235–40. [Google Scholar] [CrossRef]

- Panagiotidis, Theodore, Thanasis Stengos, and Orestis Vravosinos. 2019. The effects of markets, uncertainty and search intensity on bitcoin returns. International Review of Financial Analysis 63: 220–42. [Google Scholar] [CrossRef]

- Panagiotidis, Theodore, Thanasis Stengos, and Orestis Vravosinos. 2020. A Principal Component-Guided Sparse Regression Approach for the Determination of Bitcoin Returns. Journal of Risk and Financial Management 13: 33. [Google Scholar] [CrossRef]

- Papadamou, Stephannos, Nikolaos A. Kyriazis, and Panayiotis G. Tzeremes. 2019. Unconventional monetary policy effects on output and inflation: A meta-analysis. International Review of Financial Analysis 61: 295–305. [Google Scholar] [CrossRef]

- Papadamou, Stephannos, Costas Siriopoulos, and Nikolaos A. Kyriazis. 2020. A survey of empirical findings on funconventional central bank policies. Journal of Economic Studies. [Google Scholar] [CrossRef]

- Patton, A. J. 2006. Modelling asymmetric exchange rate dependence. International Economic Review 47: 527–56. [Google Scholar] [CrossRef]

- Phillips, P. C., S. Shi, and J. Yu. 2015. Testing for multiple bubbles: Historical episodes of exuberance and collapse in the S&P 500. International Economic Review 56: 1043–78. [Google Scholar]

- Ready, R. C. 2018. Oil prices and the stock market. Review of Finance 22: 155–76. [Google Scholar] [CrossRef]

- Selgin, G. 2015. Synthetic commodity money. Journal of Financial Stability 17: 92–99. [Google Scholar] [CrossRef]

- Selmi, R., W. Mensi, S. Hammoudeh, and J. Bouoiyour. 2018. Is Bitcoin a hedge, a safe haven or a diversifier for oil price movements? A comparison with gold. Energy Economics 74: 787–801. [Google Scholar] [CrossRef]

- Shahzad, S. J. H., E. Bouri, D. Roubaud, and L. Kristoufek. 2019a. Safe haven, hedge and diversification for G7 stock markets: Gold versus bitcoin. Economic Modelling. [Google Scholar] [CrossRef]

- Shahzad, S. J. H., E. Bouri, D. Roubaud, L. Kristoufek, and B Lucey. 2019b. Is Bitcoin a better safe-haven investment than gold and commodities? International Review of Financial Analysis 63: 322–30. [Google Scholar] [CrossRef]

- Shin, Y., B. Yu, and M. Greenwood-Nimmo. 2014. Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In Festschrift in honor of Peter Schmidt. New York: Springer, pp. 281–314. [Google Scholar]

- Sim, N., and H. Zhou. 2015. Oil prices, US stock return, and the dependence between their quantiles. Journal of Banking & Finance 55: 1–8. [Google Scholar]

- Symitsi, E., and K. J. Chalvatzis. 2019. The economic value of Bitcoin: A portfolio analysis of currencies, gold, oil and stocks. Research in International Business and Finance 48: 97–110. [Google Scholar] [CrossRef]

- Tay, J. Kenneth, Joerome Friedman, and Robert Tibshirani. 2018. Principal component-guided sparse regression. arXiv arXiv:1810.04651. [Google Scholar]

- Tibshirani, R. 1996. Regression shrinkage and selection via the lasso. Journal of the Royal Statistical Society Series B (Methodological) 58: 267–88. [Google Scholar] [CrossRef]

- Torrence, C., and G. P. Compo. 1998. A practical guide to wavelet analysis. Bulletin of the American Meteorological Society 79: 61–78. [Google Scholar] [CrossRef]

- Toyoshima, Y., T. Nakajima, and S. Hamori. 2013. Crude oil hedging strategy: new evidence from the data of the financial crisis. Applied Financial Economics 23: 1033–41. [Google Scholar] [CrossRef]

- Tse, Y. K. 1998. The conditional heteroscedasticity of the yen–dollar exchange rate. Journal of Applied Econometrics 13: 49–55. [Google Scholar] [CrossRef]

- Van der Weide, R. 2002. GO-GARCH: a multivariate generalized orthogonal GARCH model. Journal of Applied Econometrics 17: 549–64. [Google Scholar] [CrossRef]

- Wei, W. C. 2018. Liquidity and market efficiency in cryptocurrencies. Economics Letters 168: 21–24. [Google Scholar] [CrossRef]

- Wu, S., M. Tong, Z. Yang, and A. Derbali. 2019. Does gold or Bitcoin hedge economic policy uncertainty? Finance Research Letters 31: 171–78. [Google Scholar] [CrossRef]

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kyriazis, N.A. Is Bitcoin Similar to Gold? An Integrated Overview of Empirical Findings. J. Risk Financial Manag. 2020, 13, 88. https://doi.org/10.3390/jrfm13050088

Kyriazis NA. Is Bitcoin Similar to Gold? An Integrated Overview of Empirical Findings. Journal of Risk and Financial Management. 2020; 13(5):88. https://doi.org/10.3390/jrfm13050088

Chicago/Turabian StyleKyriazis, Nikolaos A. 2020. "Is Bitcoin Similar to Gold? An Integrated Overview of Empirical Findings" Journal of Risk and Financial Management 13, no. 5: 88. https://doi.org/10.3390/jrfm13050088

APA StyleKyriazis, N. A. (2020). Is Bitcoin Similar to Gold? An Integrated Overview of Empirical Findings. Journal of Risk and Financial Management, 13(5), 88. https://doi.org/10.3390/jrfm13050088