Exploring the Moral Hazard Evolutionary Mechanism for BIM Implementation in an Integrated Project Team

Abstract

:1. Introduction

- Conduct design activities in a big room (Obeya in Japanese). Toyota has used it successfully, especially in product development, to enhance effective and timely communication. The Obeya is similar in concept to traditional war rooms, and will contain charts, pictures and graphs on display boards that visually represent program timing, milestones and progress to date. The boards also display actions or recommendations to resolve delays or technical problems. The Obeya houses project leaders and key staff in close but comfortable proximity to shorten the communication cycle and promote an effective plan, do, check and act (PDCA) cycle. Spontaneity comes easily as specialists can collaborate readily in key design or construction decisions.

- Work closely with the client to establish the target value. Designers should guide clients to establish what represents value and how that value is produced. They should ensure that clients are active participants in the process, not passive customers.

- Once the target value is established, use it to work with a detailed estimate. Have the design team develop a method for estimating the cost of design alternatives as they are developed. Deviations should not continue unchecked; if a particular design feature exceeds the budget allocated for it, then that design should be adjusted promptly in order not to abort further design work that cannot be accepted.

- Apply concurrent design principles to design both the product and the process that will produce it. This work should be done as a collaboration between architects/engineers, specialty designers, contractors/subcontractors and the client. Be flexible to include innovation in this process. Practice reviewing and approving design work as it progresses.

- Working in small, diverse groups are best. Groups of eight or fewer people establish better group dynamics; it is easier to create a spirit of collegiality and trust that lead in turn to more innovation and learning. Design with the customer in mind. Focus on designing in the sequence of the discipline that will use it. Use the “pull” approach with each design assignment to serve the next discipline. Lean is obtained by meeting downstream needs as opposed to producing what is convenient. Overproduction increases the possibility that the work so produced may not be what is needed for the next discipline to maintain its schedule, and it may lack the collaboration necessary for constructability.

- Collaboratively plan and replan the project. Planning should involve all stakeholders to continually maintain an actionable schedule. Joint planning will refine practices of coordinating action. This will avoid delay, rework and out-of-sequence design.

- Lead the design effort for learning and innovation. Expect the team to learn and produce something surprising. Expect also surprise events to upset the current plan and require more re-planning.

- Learn by carrying out conversations on the results of each design cycle. Include all project participants in order to capture knowledge on success factors. Use this information as a part of the PDCA cycle, and use formal measurement systems, if possible.

2. Literature Review

3. Methodology

4. Evolutionary Game Model

4.1. Model Parameters

4.2. Hypothesis

4.3. Evolutionary Game Model

5. Simulation of the Evolutionary Game Model

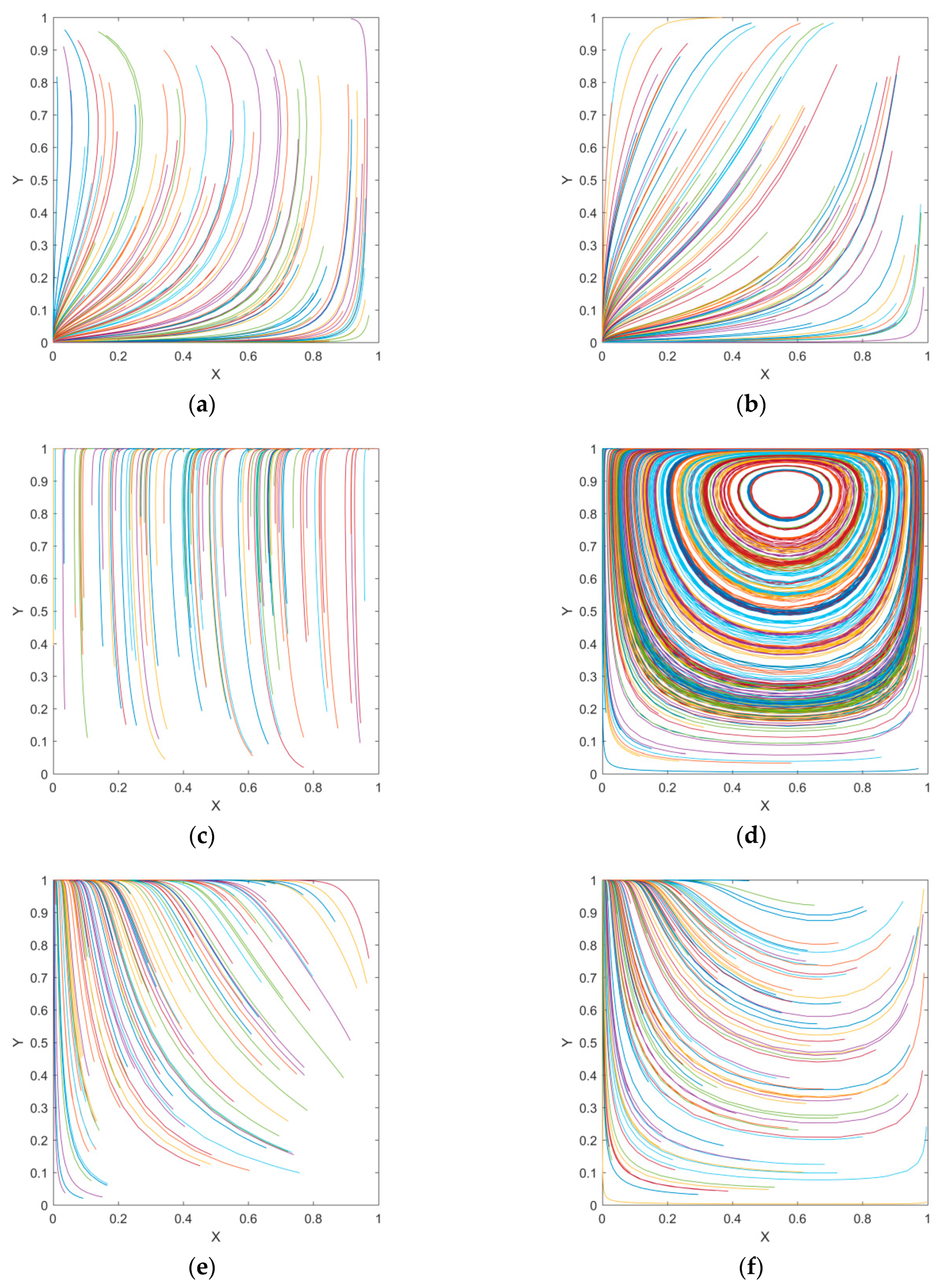

5.1. Simulation of BIM-Based Interactive Behavior

5.2. Impact of Model Variables on the Evolution Trend

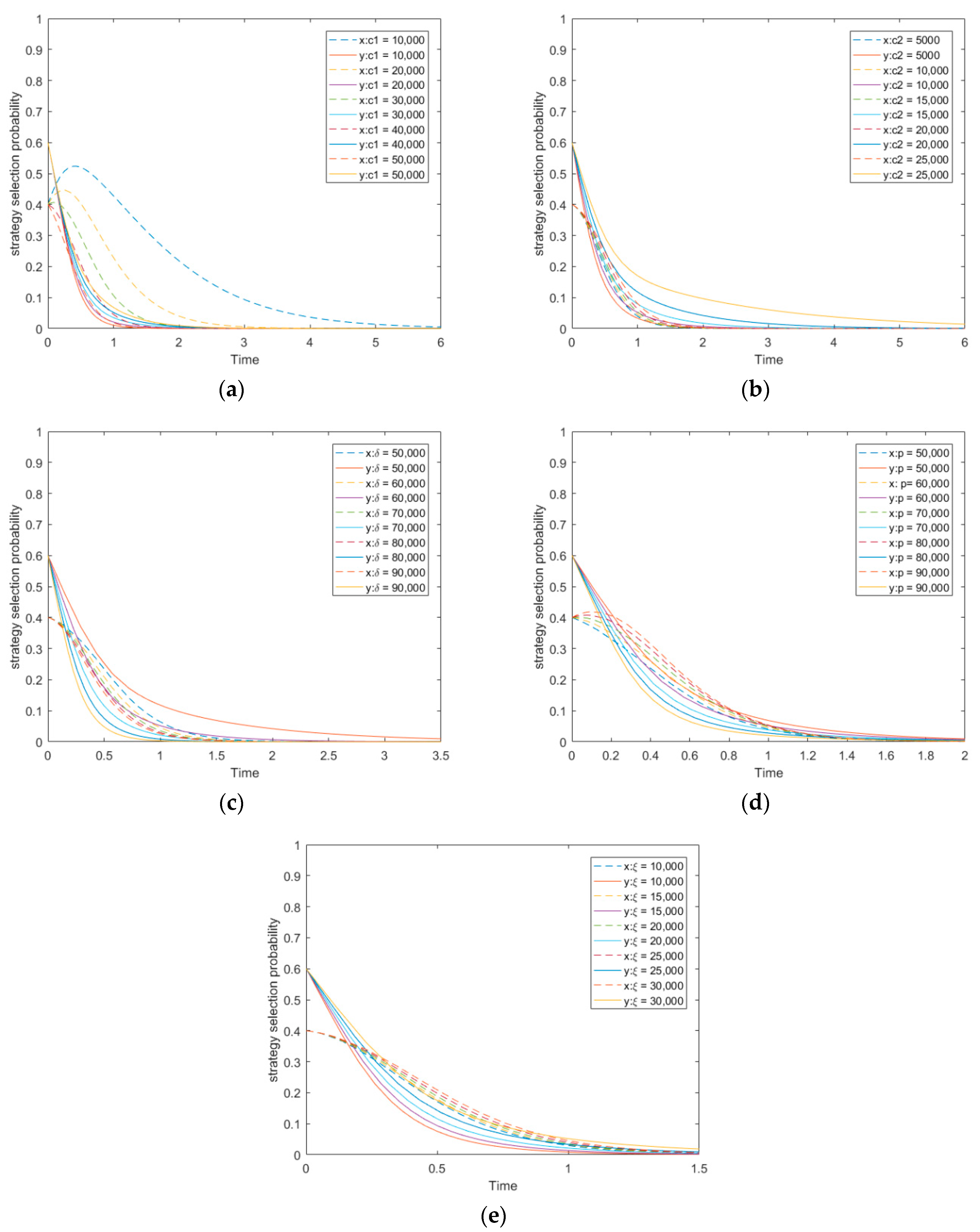

5.2.1. Impact of Model Variables on the Evolution Trend in Scenarios 1 and 2

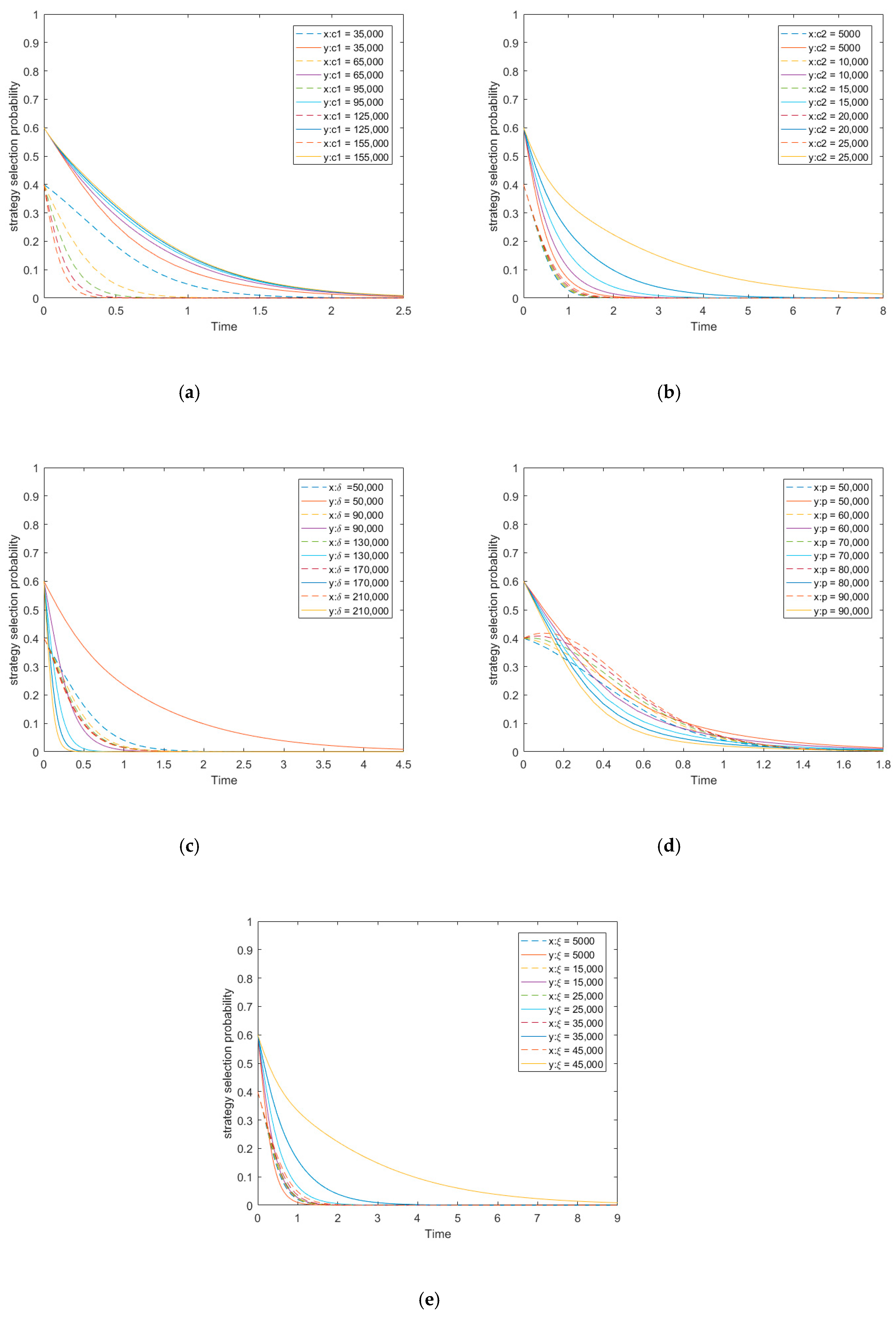

5.2.2. Impact of Model Parameters on the Evolution Trend in Scenario 3

5.2.3. Impact of Model Parameters on the Evolution Trend in Scenario 4

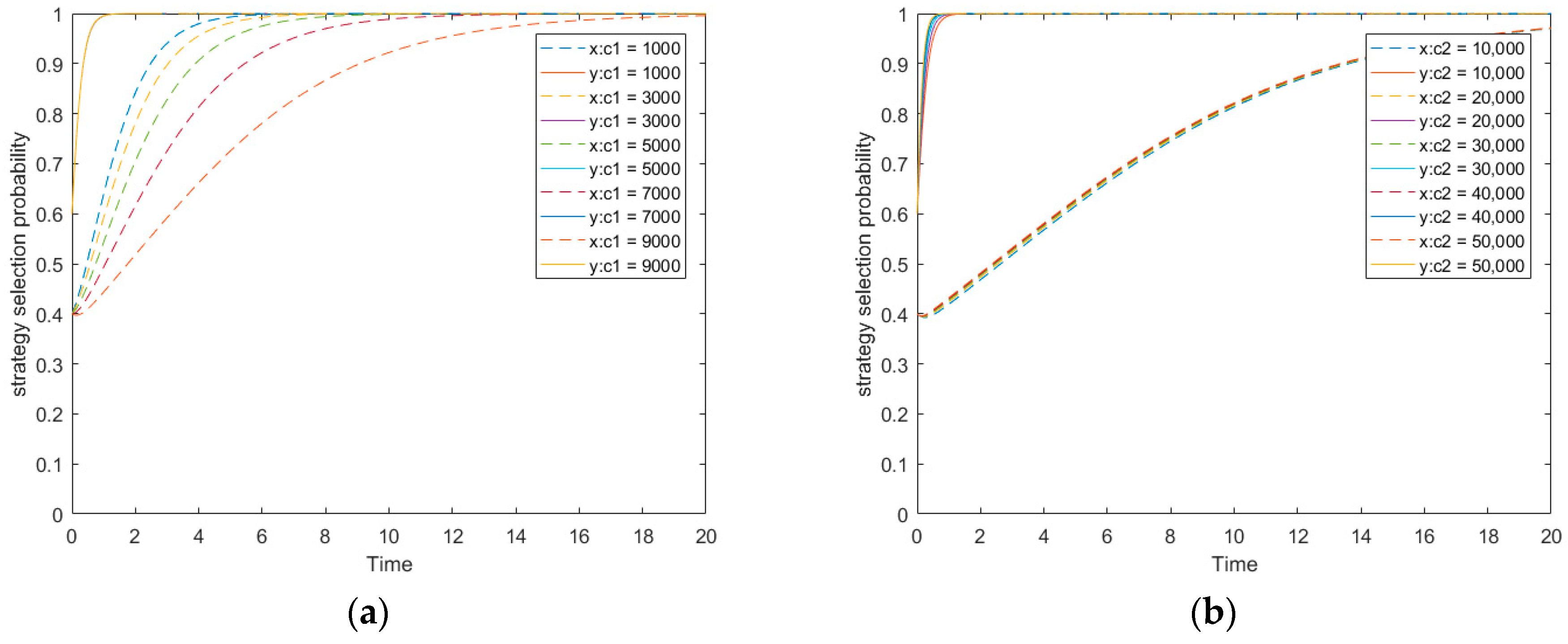

5.2.4. Impact of Model Parameters on the Evolution Trend in Scenarios 5 and 6

6. Results and Discussion

- (1)

- Based on the evolutionary paths, as presented in Figure 2a,b, we discovered that when the incentive payment provided by the owner (i.e., player 1) can cover the speculative benefit and proprietary cost incurred by the non-owner participant (i.e., player 2), namely , both game players would choose the combined strategy (). Thus, player 2 would be more likely to apply BIM at high level effort, and work hardly to deliver a BIM outcome with high quality. Moreover, the non-owner participant would try their best to explore meritorious application of BIM, which may bright in a more significant added value for the overall project. Against this background, the owner relaxes supervision and is in favor of BIM exploration. Choosing a moral hazard behavior or not is identified as a function of cost and benefit. Nevertheless, proprietary cost derived from high level effort in using BIM and speculative benefit from moral hazard behavior is often ignored when analyzing the impact of cost on moral hazard behavior in IPD-based projects in extant literatures, which easily leads to an unreliable conclusion that may cloud the judgment of the project manager. Compared with previous researches, we demonstrated that proprietary cost and speculative benefit affected significantly the selection of behaviors.

- (2)

- When the incentive payment provided by the owner cannot cover the speculative benefit and proprietary cost incurred by the non-owner participant, and the punishment is greater than the monitoring cost and less than the sum of speculative benefit and proprietary cost minus the incentive payment, namely , the evolution path as shown in Figure 1c, both game players eventually selected the combined strategy (). Player 2 chose to use BIM at low level effort, and only provided conceptual BIM-based products to player 1. The owner would strengthen supervision and strictly stipulated the scope of BIM application to regulate the behavior of player 2. When we continued to decrease the punishment and made it less than the monitoring cost, two kinds of situation existed, namely, (1) and and (2) . Based on evolution paths as shown in Figure 1e,f, we could find the combined strategy changes from () to (). Therefore, player 1 would relax supervision on BIM application and detailed content of work. Compared to traditional studies that only highlight the influence of incentive mechanism on the agent within the principal-agent framework, the simulation results in this study demonstrated that the owner was also influenced by punishment that was rarely paid attention to in extant literatures.

- (3)

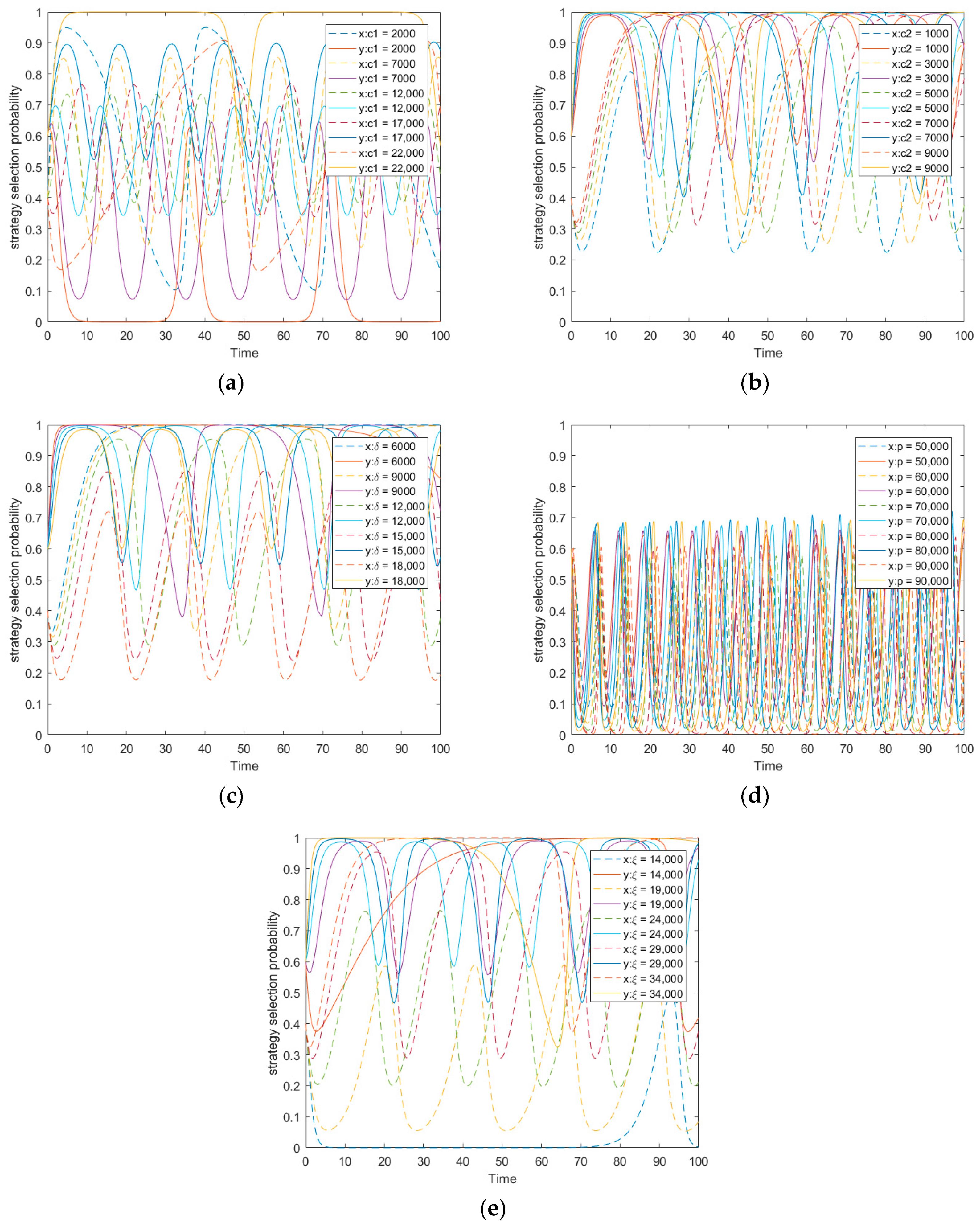

- To the best of our knowledge, very few studies have successfully explained the confused phenomenon of why BIM application is in a chaos state from the theory aspect. The evolution path, as shown in Figure 2d, indicates that the proposed model in this study had no equilibrium stable strategy when the incentive payment provided by the owner could not cover the speculative benefit and proprietary cost incurred by the non-owner participant, and the punishment was greater than the monitoring cost, meanwhile the punishment was larger than the sum of speculative benefit and proprietary cost minus the incentive payment, namely and . In this context, the simulation results as presented in Figure 5a–e, indicate that with the players’ strategies selection changing frequently, the uncertainty of integrated project team increased greatly. Moreover, it would consume a lot of organizational resources, including budget, time and energy to deal with communication and technology problems, thereby leading to organizational productivity declines and project failure.

- (4)

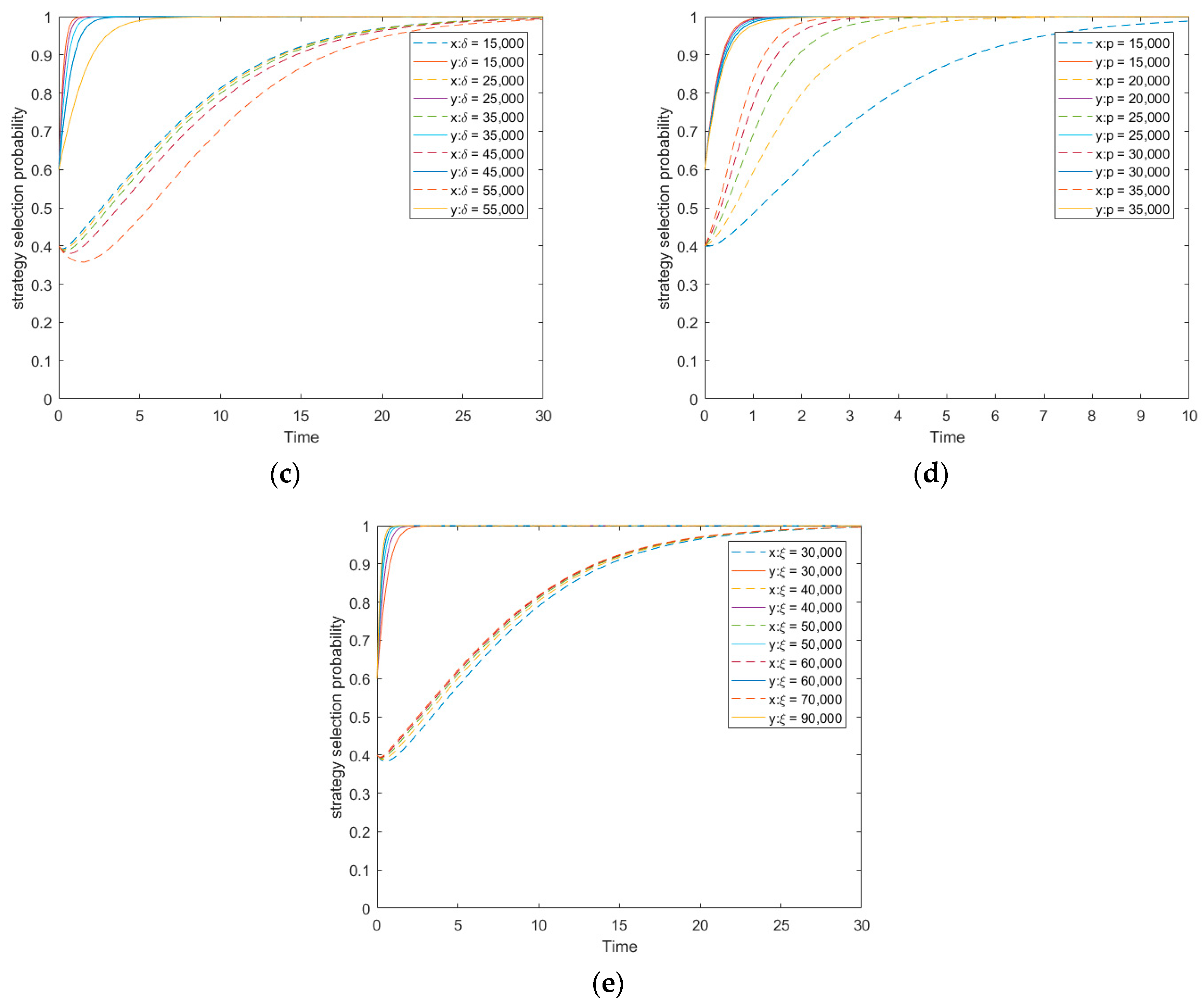

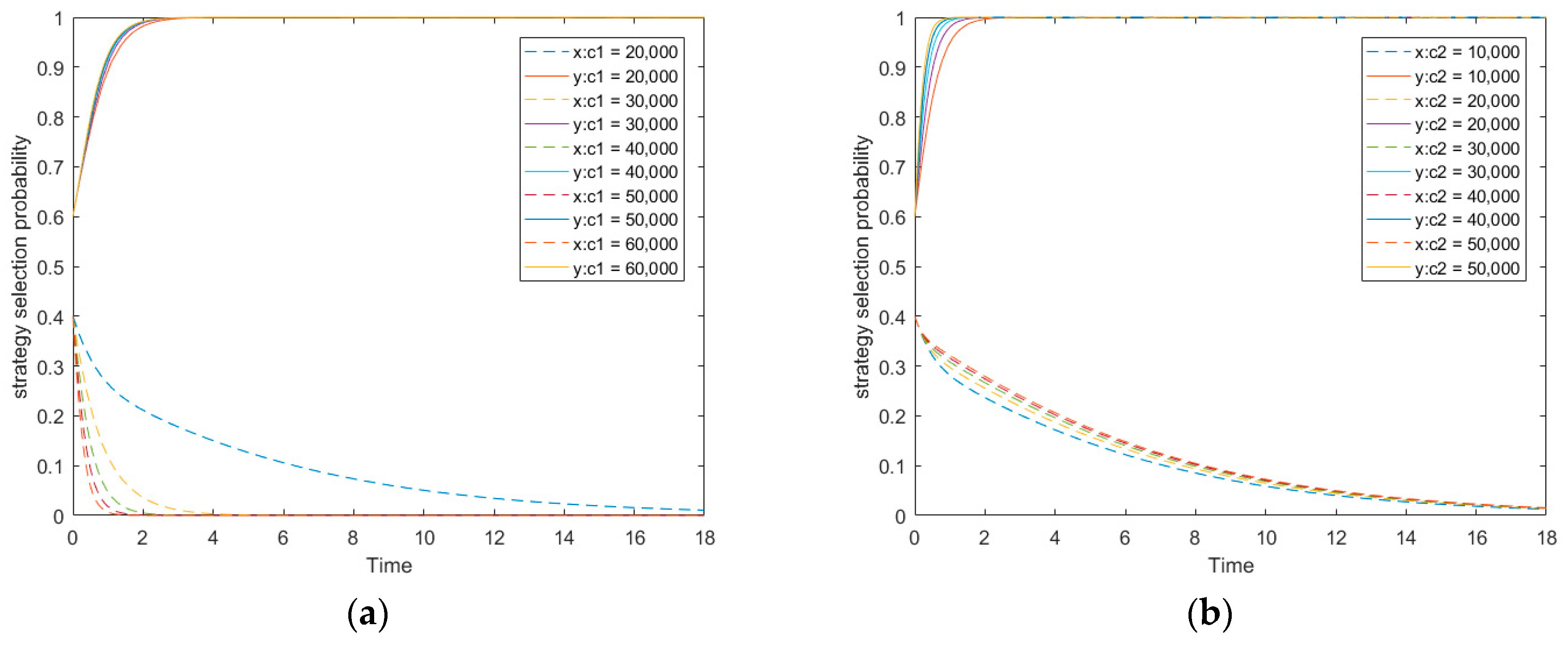

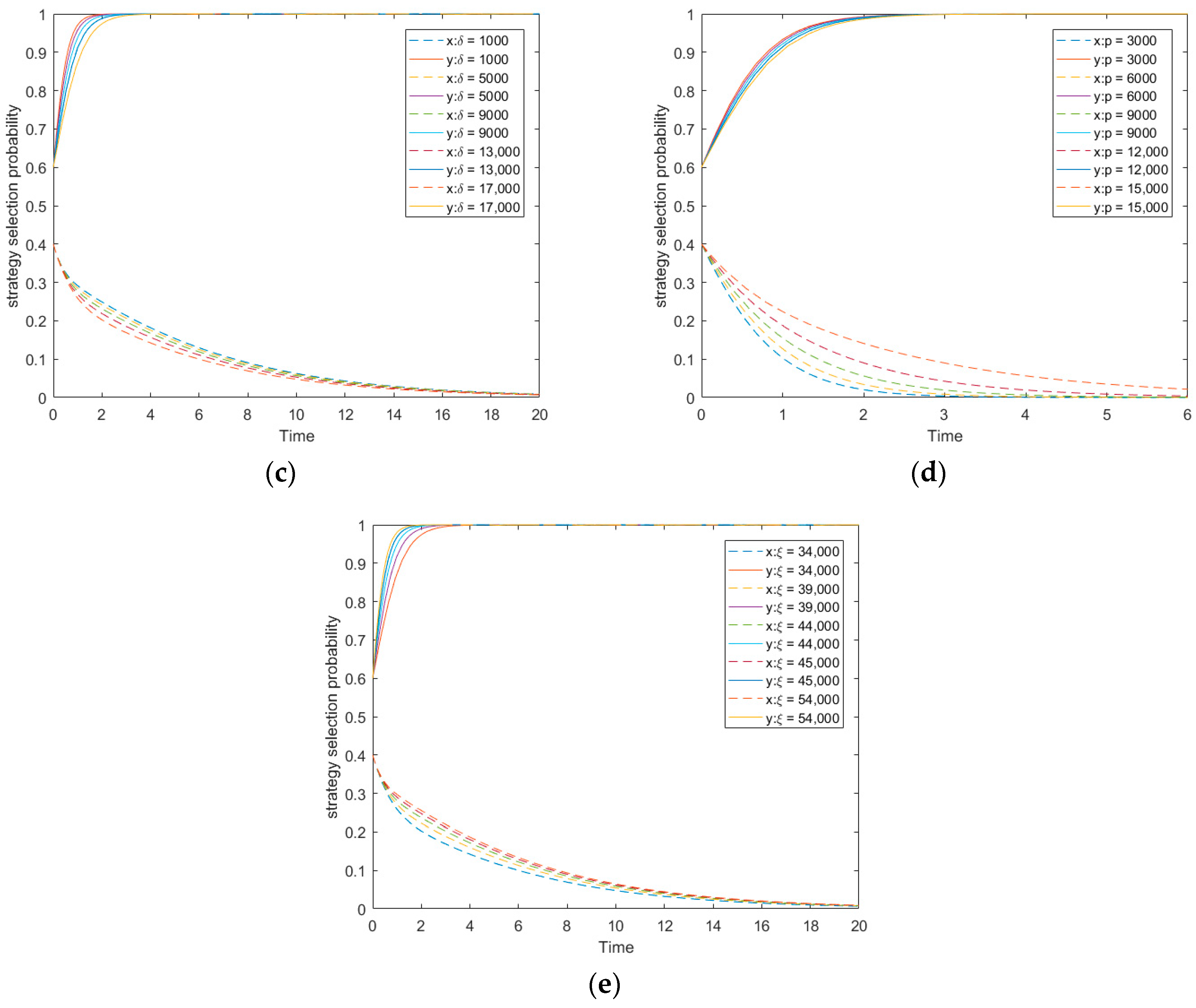

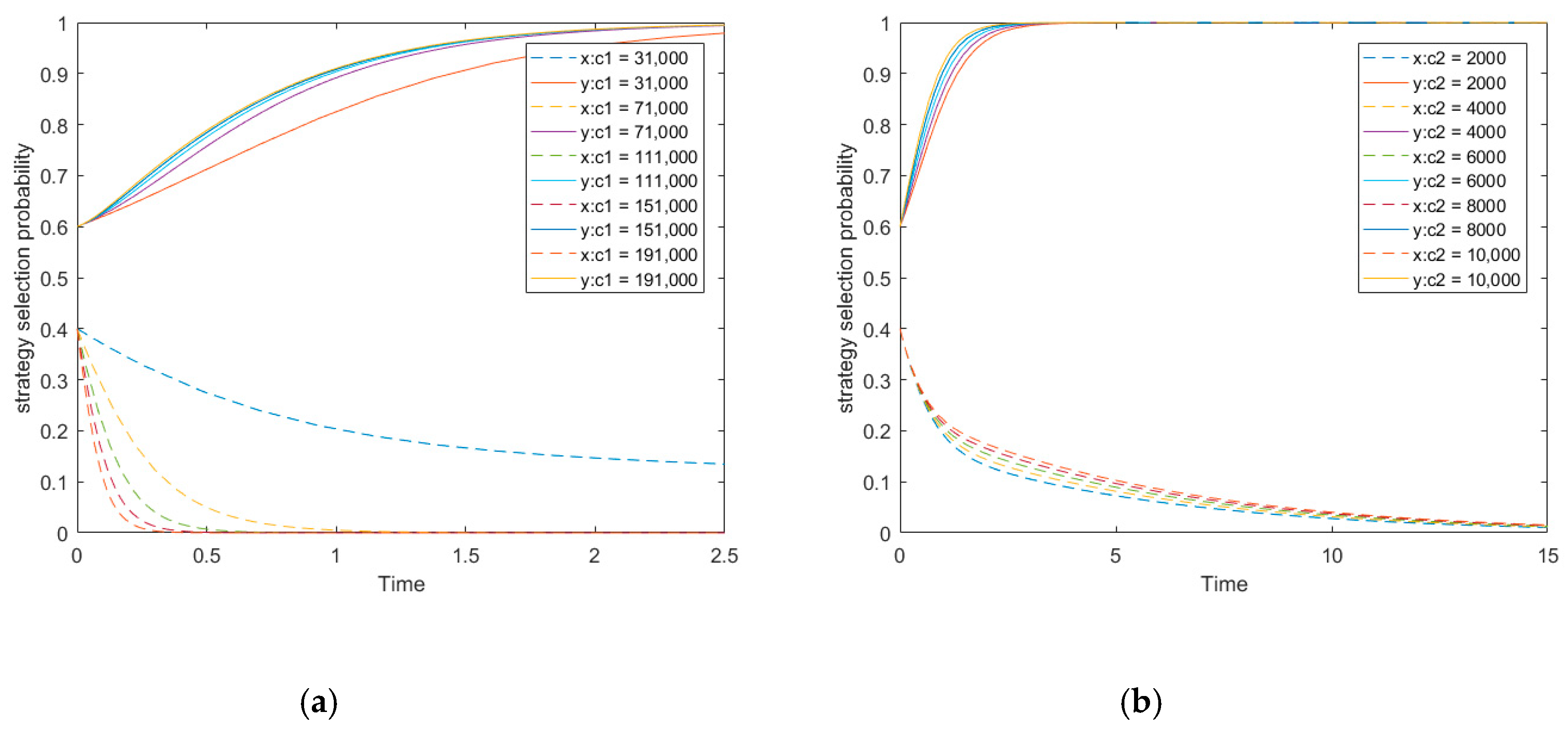

- By exploring the influences of special parameters on the evolutionary trend, some significant findings could be acquired. First of all, according to the simulation results as shown in the subgraph (a) of Figure 3, Figure 4, Figure 5, Figure 7 and Figure 8, we found that when the monitoring cost increased, the evolutionary rate of adopting strategy by the owner was slowed. On this background, the owner would likely lose supervision on BIM application and exploration with the increase of the monitoring cost. Secondly, according to the simulation results as presented in the subgraph (b) of Figure 3, Figure 4, Figure 5, Figure 7 and Figure 8, we could see that the moral hazard behavior from the non-owner participant was influenced positively, which means that the larger the proprietary cost, the more motivation the non-owner participant would adopt to use BIM at the low level effort. Thirdly, based on the simulation results as shown in the subgraph (c) of Figure 3, Figure 4, Figure 5, Figure 7 and Figure 8, the incentive payment provided by the owner had negative correlations with the occurring probability of the non-owner participants’ moral hazard behavior. When the incentive payment increased and reached a certain level, the willingness of applying BIM at low level effort by the non-owner participant decreased and ultimately gave up moral hazard behavior. Fourthly, from numerical simulation results, as shown in the subgraph (d) of Figure 3, Figure 4, Figure 5, Figure 7 and Figure 8, we could see that the larger the parameter of punishment, the slower the evolutionary rate of adopting BIM by the non-owner participant at low level effort, which means that the punishment mechanism played an important role in controlling moral hazard behavior from the non-owner participant. Lastly, speculative benefit, according to simulation results as shown in the subgraph (e) of Figure 3, Figure 4, Figure 5, Figure 7 and Figure 8, significantly affected the strategies selection. If it was large enough, the non-owner participant would adopt moral hazard behavior without hesitation, even though they were fined by the owner.

7. Conclusions and Implications

- (1)

- For integrated project team leaders, the priority is to make sure that the incentive payment is higher than the sum of speculative benefit and proprietary cost incurred by the non-owner participant when developing an incentive mechanism. Under this situation, the incentive mechanism can effectively restrain the non-owner participants’ moral hazard behavior, reduce the owner’s supervision cost and improve the overall project benefit, which is the best choice for all stakeholders. Whether the owner strengthens supervision or not on BIM application, the non-owner participant would always use BIM at high level effort. Therefore, it is not hard to see that the incentive plays a dominant role in making the non-owner participant apply BIM at high level effort. However, the project manager should not just depend on the incentive mechanism. The punishment mechanism that has a strong deterrent effect on moral hazard behavior should also be considered, when certain constraint conditions are satisfied. In fact, compared to a single incentive mechanism, a more significant implementation effect on controlling moral hazard behavior can be achieved under both the incentive and punishment mechanism.

- (2)

- Speculative benefit is the main motivation for the non-owner participant to use BIM at low level effort. Therefore, reducing speculative benefit is a very important way to control moral hazard behavior. We have to bring in the third party, namely the competent department of construction administration, for the purpose of solving this problem from the perspective of the overall market environment. To prompt widespread application and healthy development of the integrated project delivery system, the competent departments of construction administration should establish the information sharing platform and credit evaluation system, improve the information dissemination mechanism. For example, if the non-owner participants adopt moral hazard behavior, their credit rating would be downgraded or even forbidden to enter the construction market. In this context, the violation cost would be increased greatly, and thus speculative benefit expected by the non-owner participant can be offset. Consequently, the moral hazard behavior can be controlled effectively from the external environment.

- (3)

- Proprietary cost should be paid more attention to. According to the simulation results, there is a positive correlation between the proprietary cost and probability of occurrence of moral hazard behavior. In order to reduce proprietary cost incurred by the non-owner participant, the integrated project team manager should first conduct reengineering of the business process that significantly affects integration between the IPD system and BIM. The traditional work process that is established based on computer-aided design has not adapted to deep application of BIM, which increases implementation cost [13]. Moreover, the project manager should check and ensure the BIM software adopted by each stakeholder compatible, and provide the uniformed data standard manual to make information flow unimpeded, for the purpose of reducing technology cost [45]. Last but not least, the integrated project team leader should select integrated project team members with rich experiences in BIM-and IPD-based projects, so as to reduce trail-and-error cost that is also believed as an important kind of proprietary cost [46].

Author Contributions

Acknowledgments

Conflicts of Interest

References

- Xia, B.; Chan, A.P. Measuring complexity for building projects: A Delphi study. Eng. Constr. Arch. Manag. 2012, 19, 7–24. [Google Scholar] [CrossRef]

- Kent, D.C.; Becerik-Gerber, B. Understanding Construction Industry Experience and Attitudes toward Integrated Project Delivery. J. Constr. Eng. Manag. 2010, 136, 815–825. [Google Scholar] [CrossRef]

- Hanna, A.S. Benchmark Performance Metrics for Integrated Project Delivery. J. Constr. Eng. Manag. 2016, 142, 4016040. [Google Scholar] [CrossRef]

- Mesa, H.A.; Molenaar, K.R.; Alarcón, L.F. Exploring performance of the integrated project delivery process on complex building projects. Int. J. Proj. Manag. 2016, 34, 1089–1101. [Google Scholar] [CrossRef]

- Habibi, S. The promise of BIM for improving building performance. Energy Build. 2017, 153, 525–548. [Google Scholar] [CrossRef]

- Eadie, R.; Browne, M.; Odeyinka, H.; McKeown, C.; McNiff, S. BIM implementation throughout the UK construction project lifecycle: An analysis. Autom. Constr. 2013, 36, 145–151. [Google Scholar] [CrossRef]

- Eastman, C.; Teicholz, P.; Sacks, R.; Liston, K.B. BIM Handbook: A Guide to Building Information Modeling for Owners, Managers, Designers, Engineers, and Contractors, 2nd ed.; Wiley Publishing: Hoboken, NJ, USA, 2011; pp. 65–100. [Google Scholar]

- Ma, J.; Ma, Z.; Li, J. An IPD-based Incentive Mechanism to Eliminate Change Orders in Construction Projects in China. KSCE J. Civ. Eng. 2016, 21, 2538–2550. [Google Scholar] [CrossRef]

- Matthews, O.; Howell, G. Integrated project delivery: An example of relational contracting. Lean Constr. J. 2005, 2, 46–61. [Google Scholar]

- Ballard, G.; Howell, G. The St Olaf fieldhouse project: A case study in designing to target cost. In Proceedings of the 12th Annual Conference of the International Group for Lean Construction, Elsinore, Denmark, 3 August 2004. [Google Scholar]

- Lichtig, W.A. Sutter health: Developing a contracting model to support lean project delivery. Lean Constr. J. 2005, 2, 105–112. [Google Scholar]

- Chang, C.-Y.; Pan, W.; Howard, R. Impact of Building Information Modeling Implementation on the Acceptance of Integrated Delivery Systems: Structural Equation Modeling Analysis. J. Constr. Eng. Manag. 2017, 143, 04017044. [Google Scholar] [CrossRef]

- Hosseini, M.R.; Maghrebi, M.; Akbarnezhad, A.; Martek, I.; Arashpour, M. Analysis of Citation Networks in Building Information Modeling Research. J. Constr. Eng. Manag. 2018, 144, 04018064. [Google Scholar] [CrossRef]

- Liu, Y.; Van Nederveen, S.; Hertogh, M. Understanding effects of BIM on collaborative design and construction: An empirical study in China. Int. J. Proj. Manag. 2017, 35, 686–698. [Google Scholar] [CrossRef]

- Sackey, E.; Tuuli, M.; Dainty, A. Sociotechnical Systems Approach to BIM Implementation in a Multidisciplinary Construction Context. J. Manag. Eng. 2015, 31, A4014005. [Google Scholar] [CrossRef]

- Lu, Q.; Won, J.; Cheng, J.C. A financial decision making framework for construction projects based on 5D Building Information Modeling (BIM). Int. J. Proj. Manag. 2016, 34, 3–21. [Google Scholar] [CrossRef]

- Gu, N.; London, K. Understanding and facilitating BIM adoption in the AEC industry. Autom. Constr. 2010, 19, 988–999. [Google Scholar] [CrossRef]

- Bryde, D.; Broquetas, M.; Volm, J.M. The project benefits of Building Information Modelling (BIM). Int. J. Proj. Manag. 2013, 31, 971–980. [Google Scholar] [CrossRef]

- Li, D.; Ma, J.; Tian, Z.; Zhu, H. An evolutionary game for the diffusion of rumor in complex networks. Phys. A: Stat. Mech. Its Appl. 2015, 433, 51–58. [Google Scholar] [CrossRef]

- Duffy, J.; Ochs, J. Cooperative behavior and the frequency of social interaction. Games Econ. Behav. 2009, 66, 785–812. [Google Scholar] [CrossRef] [Green Version]

- Zheng, L.; Lu, W.; Chen, K.; Chau, K.W.; Niu, Y. Benefit sharing for BIM implementation: Tackling the moral hazard dilemma in inter-firm cooperation. Int. J. Proj. Manag. 2017, 35, 393–405. [Google Scholar] [CrossRef] [Green Version]

- Obloj, T.; Zemsky, P. Value creation and value capture under moral hazard: Exploring the micro-foundations of buyer–supplier relationships. Strateg. Manag. J. 2015, 36, 1146–1163. [Google Scholar] [CrossRef]

- Arrow, K.J. Uncertainty and welfare economics of medical care. Am. Econ. Rev. 1963, 53, 941–973. [Google Scholar]

- Zhang, Y.; Gu, Y.; Pan, M.; Tran, N.H.; Dawy, Z.; Han, Z. Multi-Dimensional Incentive Mechanism in Mobile Crowdsourcing with Moral Hazard. IEEE Trans. Mob. Comput. 2018, 17, 604–616. [Google Scholar] [CrossRef]

- Ma, L.; Zhang, P. Game analysis on moral hazard of construction project managers in China. Int. J. Civ. Eng. 2014, 12, 429–438. [Google Scholar]

- Rubinstein, A. Equilibrium in supergames with the overtaking criterion. J. Econ. Theory 1979, 21, 1–9. [Google Scholar] [CrossRef]

- Monitoring cooperative agreement in a repeated principal-agent relationship. Econometrica 1981, 49, 1127–1148. [CrossRef]

- Chen, Y.; Ding, S.; Zheng, H.; Zhang, Y.; Yang, S. Exploring diffusion strategies for mHealth promotion using evolutionary game model. Appl. Math. Comput. 2018, 336, 148–161. [Google Scholar] [CrossRef]

- Cohen, M.A. Optimal Enforcement Strategy to Prevent Oil Spills: An Application of a Principal-Agent Model with Moral Hazard. J. Law Econ. 1987, 30, 23–51. [Google Scholar] [CrossRef]

- Bardhan, P. The new institutional economics and development theory: A brief critical assessment. World Dev. 1989, 17, 1389–1395. [Google Scholar] [CrossRef]

- Basu, K.; Jones, E.; Schlicht, E. The growth and decay of custom: The role of the new institutional economics in economic history. Explor. Econ. Hist. 1987, 24, 1–21. [Google Scholar] [CrossRef] [Green Version]

- Jones, B. Integrated Project Delivery (IPD) for Maximizing Design and Construction Considerations Regarding Sustainability. Procedia Eng. 2014, 95, 528–538. [Google Scholar] [CrossRef] [Green Version]

- Allameh, S.M.; Pool, J.K.; Jaberi, A.; Soveini, F.M. Developing a model for examining the effect of tacit and explicit knowledge sharing on organizational performance based on EFQM approach. J. Sci. Technol. Policy Manag. 2014, 5, 265–280. [Google Scholar] [CrossRef]

- Wang, Y.; Su, Z.; She, X. Project Team Incentive Mechanism Design and Analysis in IPD Mode. J. Eng. Manag. 2012, 27, 72–76. [Google Scholar]

- Berger, P.G.; Hann, R.N. Segment Profitability and the Proprietary and Agency Costs of Disclosure. Account. Rev. 2007, 82, 869–906. [Google Scholar] [CrossRef] [Green Version]

- Johnson, J.E.V.; Jones, O.; Tang, L. Exploring Decision Makers’ Use of Price Information in a Speculative Market. Manag. Sci. 2006, 52, 897–908. [Google Scholar] [CrossRef]

- Su, G.; Deng, X.; Feng, K.; Xue, Y. Incentive mechanism for construction projects based on the IPD philosophy. J. Tsinghua Univ. 2018, 58, 317–323. [Google Scholar]

- Mei, T.; Wang, Q.; Xiao, Y.; Yang, M. Rent-seeking behavior of BIM- and IPD-based construction project in China. Eng. Constr. Arch. Manag. 2017, 24, 514–536. [Google Scholar] [CrossRef]

- Friedman, D.; Fung, K. International trade and the internal organization of firms: An evolutionary approach. J. Int. Econ. 1996, 41, 113–137. [Google Scholar] [CrossRef]

- Friedman, D. Evolutionary games in economics. Econometrica 1991, 59, 637–666. [Google Scholar] [CrossRef]

- Wong, W.K.; Cheung, S.O.; Yiu, T.W.; Pang, H.Y. A framework for trust in construction contracting. Int. J. Proj. Manag. 2008, 26, 821–829. [Google Scholar] [CrossRef]

- Huang, C.H.; Huang, I.C. The moderating effect of co-workers’ reactions on social ties and knowledge sharing in work teams. Int. J. Learn. Intellect. Cap. 2008, 6, 156–169. [Google Scholar] [CrossRef]

- Humphreys, J.H.; Ma, Z.; Qi, L.; Wang, K. Knowledge sharing in Chinese construction project teams and its affecting factors: an empirical study. Chin. Manag. Stud. 2008, 2, 97–108. [Google Scholar]

- Ding, Z.; Ng, F. Knowledge sharing among architects in a project design team: an empirical test of theory of reasoned action in China. Chin. Manag. Stud. 2009, 2, 130–142. [Google Scholar]

- Migilinskas, D.; Popov, V.; Juocevicius, V.; Ustinovichius, L. The Benefits, Obstacles and Problems of Practical Bim Implementation. Procedia Eng. 2013, 57, 767–774. [Google Scholar] [CrossRef] [Green Version]

- Chen, Y.; Dib, H.; Cox, R.F.; Shaurette, M.; Vorvoreanu, M. Structural Equation Model of Building Information Modeling Maturity. J. Constr. Eng. Manag. 2016, 142, 04016032. [Google Scholar] [CrossRef]

| No. | Variables | Content |

|---|---|---|

| 1 | Refers to the speculative benefit that is interpreted as reduced cost in comparison with the cost at high level effort, when the non-owner participant adopt BIM-based selection strategy at low level effort | |

| 2 | Refers to the penalty imposed by the owner when the non-owner participant adopt BIM-based selection strategy at low level effort | |

| 3 | Refers to the incentive provided by the owner when the non-owner participant adopt BIM-based selection strategy at high level effort | |

| 4 | Refers to the monitoring cost incurred by the owner | |

| 5 | Refers to the proprietary costs if the non-owner participants adopt a BIM-based selection strategy at high level effort in comparison with cost at low level effort |

| Player 1 | Player 2 | |

|---|---|---|

| (x) | , | , |

| (1-x) | , | , |

| LEP | The Determinant and Trace of J |

|---|---|

| A(0,0) | det(J) = tr(J) = |

| B(0,1) | det(J) = tr(J) = |

| C(1,0) | det(J) = tr(J) = |

| D(1,1) | det(J) = tr(J) = |

| E(x*,y*) | det(J) = tr(J) = 0 |

| Scenarios | Range of Values | LEP | det(J) | tr(J) | Equilibrium results |

|---|---|---|---|---|---|

| Scenario 1 | (0,0) | + | − | ESS | |

| (0,1) | + | + | Unstable | ||

| (1,0) | − | − | Saddle | ||

| (1,1) | − | + | Saddle | ||

| (x*,y*) | − | 0 | Saddle | ||

| Scenario 2 | (0,0) | + | − | ESS | |

| (0,1) | − | Uncertain | Saddle | ||

| (1,0) | − | Uncertain | Saddle | ||

| (1,1) | + | + | Saddle | ||

| (x*,y*) | + | 0 | Neutral | ||

| Scenario 3 | (0,0) | − | Uncertain | Saddle | |

| (0,1) | − | Uncertain | Saddle | ||

| (1,0) | + | + | Unstable | ||

| (1,1) | + | − | ESS | ||

| (x*,y*) | − | 0 | Saddle | ||

| Scenario 4 | and | (0,0) | − | Uncertain | Saddle |

| (0,1) | − | Uncertain | Saddle | ||

| (1,0) | − | Uncertain | Saddle | ||

| (1,1) | − | Uncertain | Saddle | ||

| (x*,y*) | + | 0 | Neutral | ||

| Scenario 5 | and | (0,0) | − | Uncertain | Saddle |

| (0,1) | + | − | ESS | ||

| (1,0) | + | + | Unstable | ||

| (1,1) | − | Uncertain | Saddle | ||

| (x*,y*) | + | 0 | Neutral | ||

| Scenario 6 | (0,0) | − | Uncertain | Saddle | |

| (0,1) | + | − | ESS | ||

| (1,0) | − | + | Saddle | ||

| (1,1) | + | + | Unstable | ||

| (x*,y*) | − | 0 | Saddle |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Du, Y.; Zhou, H.; Yuan, Y.; Xue, H. Exploring the Moral Hazard Evolutionary Mechanism for BIM Implementation in an Integrated Project Team. Sustainability 2019, 11, 5719. https://doi.org/10.3390/su11205719

Du Y, Zhou H, Yuan Y, Xue H. Exploring the Moral Hazard Evolutionary Mechanism for BIM Implementation in an Integrated Project Team. Sustainability. 2019; 11(20):5719. https://doi.org/10.3390/su11205719

Chicago/Turabian StyleDu, Yanchao, Hengyu Zhou, Yongbo Yuan, and Hong Xue. 2019. "Exploring the Moral Hazard Evolutionary Mechanism for BIM Implementation in an Integrated Project Team" Sustainability 11, no. 20: 5719. https://doi.org/10.3390/su11205719