1. Introduction

In contemporary socio-economic discourse, the notion of development transcends the simplistic metrics of aggregate output. In a world increasingly governed by systemic complexity, institutional asymmetries, and ecological precarity, the demand for a more holistic evaluative paradigm becomes both epistemologically and pragmatically urgent. The principal aim of this research is to empirically examine the functional interdependencies among national logistics efficiency, ESG indicators, and per-capita economic output. Unlike existing approaches that isolate these domains, this study posits their co-deterministic influence on structural development. The core hypothesis is that logistics performance, institutional stability, equitable governance, and sustainable praxes operate not in isolation but as interdependent vectors shaping macroeconomic capabilities.

The rationale for examining logistics performance in conjunction with ESG indicators lies in their growing convergence within global development strategies. Logistics systems are not just economic facilitators—they directly influence carbon emissions, resource use, labor conditions, and regulatory compliance. ESG frameworks, on the other hand, increasingly incorporate operational dimensions such as supply chain transparency, environmental impact, and institutional governance. By analyzing their interaction, this study sheds light on how infrastructural quality and operational efficiency are embedded within broader sustainability and governance ecosystems, offering a more systemic understanding of national development dynamics.

To operationalize this inquiry, a two-tiered methodology is employed. First, this study investigates how ESG-related indicators—specifically the Environmental Performance Index (EPI), Sustainable Development Goals Index (SDG), and Worldwide Governance Indicators (WGI)—influence national logistics performance, as measured by the Logistics Performance Index (LPI). This stage uses simple linear regression models to quantify the strength and direction of these relationships. Subsequently, a multiple linear regression model is applied to assess how logistics performance, alongside ESG indicators, jointly affects economic output, with Gross Domestic Product (GDP) per capita serving as the dependent variable. This sequential approach allows for the examination of both direct and mediated pathways linking sustainability, governance, and logistics to economic development. In the second stage, a Fuzzy Cognitive Mapping (FCM) model is applied to simulate conceptual interrelations and causal feedback among the indicators. This enables a semantic representation of influence dynamics often obscured in linear modeling.

The empirical results confirm a statistically significant and conceptually consistent relationship among logistics performance, governance quality, environmental sustainability, and economic output. Logistics efficiency and institutional coherence—captured through the World Bank’s Logistics Performance Index (LPI) and Worldwide Governance Indicators (WGI)—emerge as the strongest predictors of GDP per capita, underscoring their foundational role in economic development. In parallel, sustainability indicators such as the Environmental Performance Index (EPI) from Yale University and the Sustainable Development Goals Index (SDG), compiled by Dublin University, contribute to reinforcing long-term developmental integrity. The use of these high-quality, internationally validated datasets enhances the credibility of the analysis, while the models’ strong explanatory power (R2 > 0.80) confirms the robustness of the observed relationships. Collectively, the findings highlight that economic performance is structurally embedded within broader systems of governance, infrastructure, and sustainability.

This study contributes to the field of development economics by empirically examining, for the first time, the joint impact of logistics performance and ESG-related indicators on national economic outcomes. Unlike prior research that treats these domains in isolation, it adopts a holistic analytical framework that integrates sustainability, institutional governance, and infrastructure efficiency. Methodologically, the combination of econometric modeling with Fuzzy Cognitive Mapping (FCM) enhances both the explanatory depth and the conceptual clarity of the analysis—capturing not only linear associations but also complex, dynamic interdependencies. This dual approach allows for the simulation of causal pathways and feedback loops, offering a more realistic and policy-relevant understanding of how development systems function. By identifying the most influential variables and their conditions of effectiveness, this study contributes valuable insights for policymakers, scholars, and practitioners aiming to design integrated, future-proof development strategies in a post-growth global context.

In this context, the main variables employed in the analysis—logistics performance, environmental performance, sustainable development progress, institutional quality, and economic output—are briefly introduced below, as they form the empirical backbone of this study’s integrated framework.

The Logistics Performance Index (LPI), developed by the World Bank, is a composite benchmarking tool designed to evaluate and compare the effectiveness of trade logistics across countries. The LPI serves as a stand-in for each nation’s participation in international value chains and freight flow friction [

1]. The LPI is primarily based on structured surveys administered to international freight forwarders and logistics professionals, who rate the countries they operate in along six core dimensions: (1) the efficiency of customs clearance procedures, (2) the quality of trade and transport infrastructure, (3) the ease of arranging competitively priced international shipments, (4) the competence and quality of logistics services, (5) the ability to track and trace consignments, and (6) the timeliness of shipments reaching their destination. Each dimension is scored on a scale from 1, very low performance, to 5, very high performance [

2].

The Environmental Performance Index (EPI) 2024 provides a data-driven summary of the state of sustainability in 180 countries, based on 58 indicators grouped into 11 issue categories and 3 overarching policy objectives: environmental health, ecosystem vitality, and climate change mitigation. These indicators assess national performance in areas such as air quality, biodiversity and habitat, water resources, agriculture, and waste management. Scores are normalized on a scale from 0 to 100, where 100 represents the best observed outcomes globally. Each country’s overall EPI score is calculated as a weighted average of the underlying indicators, enabling cross-country comparisons and progress tracking over time. The EPI serves as a valuable policy tool, helping decision-makers identify priority areas for environmental improvement and benchmark national outcomes against global best practices [

3].

The Sustainable Development Goals Index (SDG Index) is a composite measure designed to assess countries’ progress toward achieving the 17 United Nations Sustainable Development Goals (SDGs) outlined in the 2030 Agenda. The index draws on 125 indicators—98 global and 27 OECD-specific—covering a broad spectrum of domains such as poverty, health, education, gender equality, clean energy, institutional quality, and economic resilience. Each goal is scored on a normalized scale from 0 to 100, with 100 indicating full achievement. A country’s overall SDG Index score is calculated as the unweighted arithmetic mean of its performance across all 17 goals. The 2024 edition of the index also incorporates the International Spillover Index, which measures negative cross-border effects—such as trade, environmental degradation, and financial flows—exerted by one country on others. Together, these indicators provide a holistic tool for benchmarking sustainable development performance, enabling cross-national comparisons and the identification of policy priorities [

4].

The Worldwide Governance Indicators (WGI), developed by the World Bank, assess six key dimensions of governance—(a) Voice and Accountability, (b) Political Stability and Absence of Violence/Terrorism, (c) Government Effectiveness, (d) Regulatory Quality, (e) Rule of Law, and (f) Control of Corruption—across more than 200 countries and territories from 1996 to 2023. These indicators are constructed from over 30 primary data sources, including household and firm surveys, expert assessments, and institutional reports from think tanks, NGOs, private firms, and international organizations. The methodology follows a three-step process: (1) individual source variables are assigned to one of the six governance dimensions based on conceptual alignment; (2) each variable is rescaled to a 0–1 range for comparability; and (3) a statistical technique called the Unobserved Components Model (UCM) is used to combine the rescaled data into aggregate scores. The UCM accounts for differences in scale and reliability across sources, assigning greater weight to more consistent datasets. The resulting scores follow a standard normal distribution (mean = 0, SD = 1) and are also reported as percentile ranks (0–100), providing a robust, perception-based measure of governance quality globally [

5].

Gross Domestic Product (GDP) per capita is a widely used economic indicator that measures the average economic output per person in a given country. It is calculated by dividing the total GDP of a nation by its midyear population, thereby accounting not only for the size of an economy but also for its demographic scale. This normalization allows for meaningful cross-country comparisons of economic well-being and productivity, independent of population size. GDP itself reflects the total monetary value of all goods and services produced within a country’s borders, including product taxes and excluding subsidies not captured in market prices. Importantly, GDP per capita is reported in current U.S. dollars and does not account for inflation, asset depreciation, or the depletion of natural resources, which may affect the sustainability of growth. Despite these limitations, it remains a key proxy for living standards and macroeconomic performance, and is regularly reported by the World Bank and other international institutions [

6].

The structure of this paper is organized as follows:

Section 2 provides a critical literature review that examines the individual and combined effects of Logistics Performance (LPI), Environmental Performance (EPI), Sustainable Development (SDG Index), and Governance Quality (WGI) on economic output.

Section 3 outlines the methodological framework, detailing the econometric models and Fuzzy Cognitive Mapping (FCM).

Section 4 presents the empirical results and interprets the key statistical findings.

Section 5 offers a broader discussion, situating the results within the context of previous research and policy relevance. Finally,

Section 6 concludes the paper by summarizing the main contributions and suggesting directions for future research.

2. Literature Review

The review explores how ESG indicators (EPI, SDG, WGI) relate to logistics performance (LPI) and jointly impact GDP per capita, providing the empirical basis for the study.

2.1. Logistics Performance (LPI) and Environmental Performance

This section presents studies that examine the relationship between LPI and environmental outcomes, with a focus on CO2 emissions as the primary sustainability metric. Given the energy-intensive nature of the logistics sector, the reviewed literature explores whether improvements in LPI correlate with lower emissions or exacerbate environmental pressures. Several studies also assess how this relationship interacts with GDP growth, providing insights into whether logistics efficiency promotes sustainable development or reinforces carbon-intensive economic expansion.

The literature investigating the environmental implications of logistics performance reveals a nuanced and at times contradictory relationship, particularly when carbon dioxide (CO

2) emissions are used as the primary indicator of environmental performance. Wan et al. [

7], analyzing 22 emerging economies, found that higher LPI scores were consistently associated with increased CO

2 emissions across all quantiles, suggesting that improvements in logistics infrastructure and services may intensify environmental degradation if not accompanied by green innovation and renewable energy adoption. Similarly, Salem et al. [

8] showed that in Gulf countries, the customs and infrastructure components of the LPI had significant effects on both CO

2 emissions and energy consumption, highlighting the ecological trade-offs embedded in logistics expansion.

Conversely, other studies identify potential synergies between LPI and environmental quality. Mumin et al. [

9], using data from 43 African nations, observed that LPI was negatively associated with CO

2 emissions when combined with technological innovation, suggesting that logistics modernization aligned with green technologies can enhance environmental outcomes.

Magazzino et al. [

10], studying the top 25 logistics-performing countries, concluded that improvements in LPI significantly increase carbon emissions, reinforcing concerns that the global supply chain remains far from decarbonized. Interestingly, while LPI supported trade and economic connectivity, it had a paradoxically negative effect on GDP in the upper quantiles—implying a cost in terms of environmental degradation. On the other hand, Suki et al. [

11] confirmed the dual nature of LPI in Asian economies, where it fosters economic growth while simultaneously contributing to environmental deterioration, thus necessitating infrastructural transformation toward greener logistics. Similarly, Khan et al. [

12] demonstrated in ASEAN economies that the integration of renewable energy into logistics operations leads to reductions in emissions while improving national competitiveness and economic image.

The reviewed studies reveal a mixed and sometimes contradictory relationship between logistics performance and environmental outcomes. In several contexts, improvements in LPI appear to intensify emissions and energy use, while in others, they support environmental gains when combined with innovation and renewable energy. These inconsistencies indicate that the impact of logistics performance cannot be fully understood in isolation, pointing to the need for broader, multidimensional approaches.

2.2. Logistics Performance (LPI) and Sustainable Development

Recent research highlights the increasingly multidimensional role of logistics performance in advancing sustainable development goals (SDGs). Beyond its traditional function in trade facilitation and economic growth, logistics infrastructure and services are now examined as pivotal levers for achieving environmental, social, and institutional sustainability.

Barakat and Gerged [

13] provide compelling evidence of an indirect effect of LPI on social sustainability—particularly SDG 8.5, which targets equal pay and decent work—through the mediating role of trade openness. Their moderated mediation analysis, which includes 168 countries, shows that while LPI positively influences male wage levels via increased trade openness, the effect on female wages remains statistically insignificant. Notably, tariffs were found to moderate this indirect relationship, thus emphasizing the role of trade policy in enhancing the inclusivity of logistics-driven growth

Vilalta-Perdomo et al. [

14] explore the contribution of logistics systems to food security under SDG 2 (Zero Hunger). Analyzing LPI and SDG 2 scores globally, the study identifies logistics performance—particularly customs efficiency—as a significant predictor of a nation’s progress toward food accessibility and availability. These findings establish logistics as a backbone for sustainable food systems and equitable resource distribution.

Shamout [

15] examines the role of logistics performance in achieving the United Nations Sustainable Development Goals, particularly SDG 11 (Sustainable Cities and Communities) and SDG 13 (Climate Action). Analyzing 47 European and Central Asian countries, the study finds that key LPI components—such as customs efficiency, infrastructure, and tracking—positively influence environmental health and ecosystem vitality. However, it also notes that economic growth, trade, and industrialization increase CO

2 emissions, emphasizing that logistics can support environmental sustainability only when aligned with broader SDG-focused policies.

In a broader cross-country analysis, Larson [

16] finds that logistics performance is strongly correlated with indicators of social well-being, including education, health, and equality. While LPI is associated with economic dynamism, it also correlates with increased emissions due to transportation-related energy consumption. This duality reinforces the necessity of green logistics strategies that promote growth without compromising environmental goals

On the other hand, Rashidi and Cullinane [

17] found that although countries with high LPI scores often demonstrate strong trade and transport infrastructure, these rankings do not necessarily translate into superior performance in sustainability terms. In particular, the study uncovers that some nations rank highly on the LPI yet underperform in environmental and social dimensions, such as emissions control and labor intensity. Conversely, a few lower-ranking LPI countries exhibit comparatively better sustainability metrics. This misalignment suggests that while LPI reflects trade efficiency and logistics competence, it does not sufficiently capture the environmental and social responsibilities embedded in sustainable development strategies.

The reviewed evidence shows that while logistics performance contributes to various SDG targets—from food security to sustainable cities—it does not consistently translate into broader sustainability outcomes. In some cases, higher LPI scores coincide with environmental pressures or limited social inclusiveness, indicating that LPI alone cannot capture the complexity of sustainable development. These discrepancies suggest that logistics needs to be studied in conjunction with other ESG-related dimensions to provide a more comprehensive picture.

2.3. Logistics Performance (LPI) and Governance Quality (WGI)

The interdependence between logistics performance and governance quality has garnered increased attention in recent years, particularly through the lens of the World Governance Indicators (WGI).

Uyar et al. [

18] demonstrate that public governance has a significant direct impact on logistics performance, and that corporate governance acts as a mediating factor. Their global dataset reveals that countries with stronger public institutions and corporate accountability mechanisms exhibit higher logistics sector efficiency. In a similar vein, Koh et al. [

19] find that in Asian economies, corruption negatively affects all six dimensions of the LPI. However, government effectiveness moderates this relationship—where governance is strong, the negative impact of corruption is reduced, thereby preserving logistics capacity. Visbal-Cadavid et al. [

20], using multiple factor analysis and hierarchical clustering, show that countries with strong governance and infrastructure quality consistently fall into the most advanced logistics clusters globally, while those with institutional deficits underperform in both LPI and human development.

From a firm-level perspective, Karaman et al. [

21] highlight that in weak governance environments, the link between logistics performance and sustainability reporting becomes more pronounced—suggesting that firms compensate for institutional gaps via voluntary transparency mechanisms. Finally, Shepherd and Sriklay [

22] apply machine learning to LPI data and confirm that institutional quality is among the top predictors of national logistics performance, alongside economic structure and infrastructure.

Collectively, these findings reinforce the conclusion that effective public governance not only enhances logistics performance but also acts as a foundational enabler of broader economic, social, and environmental progress. Integrating WGI indicators into logistics evaluation frameworks is thus essential for a comprehensive understanding of national development dynamics.

2.4. Logistics Performance (LPI) and Economic Development (GDP)

A plethora of studies confirm a strong link between logistics performance (LPI) and economic output (GDP), with LPI positively influencing growth directly or through factors like trade and infrastructure quality.

Coto-Millan et al. [

23] argue that logistics is no longer a passive background factor in global production but a core production determinant. Their panel study across 85 countries from 2007 to 2022 reveals that enhancements in logistics infrastructure—particularly customs efficiency and shipment tracking—significantly elevate GDP. Conversely, inefficiencies in delivery timeliness and shipping costs suppress output growth, indicating asymmetries among LPI components.

Celebi [

24] introduces a mediation model and finds that the relationship between LPI and GDP is not purely direct. Instead, Foreign Direct Investment (FDI) and patent activity serve as strong mediators. Countries with superior logistics performance attract more FDI and foster innovation, which in turn boost GDP. Notably, both FDI and patents fully mediate the LPI–GDP relationship, highlighting the role of logistics in facilitating not just trade but technological advancement.

In a complementary study, Karabulut and Civelek [

25] examined the potential mediating role of business creation. Using data from 76 countries, they found that even without new business formation, improvements in logistics infrastructure directly support economic growth. This suggests that logistics capacity enhances the efficiency and competitiveness of existing firms, contributing to GDP growth without necessarily depending on entrepreneurship as a transmission mechanism.

Sabir et al. [

26] reinforce this link through a time-series panel study of 107 countries. Their results confirm a statistically significant long-term relationship between logistics and GDP. Crucially, the study stresses that policymakers should focus on comprehensive logistics development—not just physical infrastructure—to sustain economic expansion.

Kumari and Bharti [

27] found that an enhanced logistics efficiency significantly increases bilateral trade, with population size acting as a key moderating factor. Larger countries benefit more in absolute GDP due to economies of scale, but when focusing on GDP per capita, smaller and medium-sized countries often achieve greater relative gains. This distinction underscores the importance of evaluating logistics performance not just at the aggregate level, but through a per-capita lens to capture its true developmental impact.

Jayathilaka et al. [

28] analyzed data from 142 countries (2007–2018) and found that LPI positively affects net exports across regions, especially in Asia, Europe, and Oceania. In contrast, GDP has mixed or even negative effects in some regions, highlighting that logistics efficiency—not just economic scale—drives trade. Building upon this multi-layered influence, Saini and Hrusecka [

29] examine the relationship between the Logistics Performance Index (LPI), Ease of Doing Business (EODB), and Logistics Cost (LC) with GDP per capita in ten countries, combining large and medium-sized economies, finding that LPI is the most stable and significant determinant of economic growth, in contrast to EODB and LC, which show mixed results. The study highlights that logistics efficiency is a key driver of economic growth, particularly when analyzed in terms of GDP per capita, which is in line with the methodological approach of this paper.

The decision to employ GDP per capita as the dependent variable is also grounded in the theoretical insights of endogenous growth models. Romer [

30] emphasizes that long-term development is driven by technological change and knowledge spillovers, while Lucas [

31] highlights the central role of human capital accumulation in sustaining productivity. Both perspectives underscore that economic progress is better captured by per- capita measures, since they reflect the distribution of growth across individuals and the capacity of societies to transform innovation and skills into lasting welfare improvements. In this sense, GDP per capita offers a more appropriate outcome variable than aggregate GDP for analyzing how logistics performance and institutional quality contribute to sustainable development.

Widayat et al. [

32] show that key LPI components—customs, infrastructure, and timeliness—strongly influence a country’s global competitiveness, often more than macroeconomic factors. Improved logistics boost competitiveness, which in turn drives sustainable economic growth, reinforcing their strategic role in national development policies.

Taken together, the literature confirms the consistent and multifactorial impact of logistics performance on economic development, both directly and through mediating mechanisms such as investment, innovation, and trade facilitation.

The reviewed studies consistently indicate that governance quality enhances logistics performance and vice versa, yet the relationship is often presented as one-directional. Few contributions explore the feedback effects whereby logistics capacity might in turn shape institutional effectiveness, transparency, or governance outcomes. Moreover, most analyses emphasize aggregate WGI scores, with limited discussion of how specific governance dimensions interact with logistics. This points to the need for a more integrated framework that captures the mutual reinforcement between governance and logistics performance.

2.5. Environmental Performance, Sustainable Development, Governance Quality, and Economic Development

Environmental performance, governance quality, and sustainable development each influence economic growth, but their effects are deeply interrelated. Recent studies emphasize their combined role in promoting resilient, inclusive, and sustainable development, rather than viewing them in isolation.

Recent research suggests that governance does not merely act as an independent driver of development, but often functions as a moderating or mediating factor between environmental outcomes and economic expansion. Wendling et al. [

33] confirm that governance quality (WGI) is one of the strongest predictors of environmental performance index (EPI), even beyond the effects of income levels. Similarly, Mavragani et al. [

34] demonstrate that economies with high institutional quality and openness achieve better environmental results (EPI), pointing to governance as a foundational enabler of sustainability. This interdependence is further emphasized by Teixeira et al. [

35], who show that the relationship between economic growth and environmental sustainability differs significantly across countries, with stronger institutions and sustainable policy frameworks mitigating the environmental costs of growth. Their findings highlight that balanced governance and long-term sustainability strategies can transform the growth–environment trade-off into a mutually reinforcing relationship.

Focusing on South Asia, Ullah et al. [

36] show that governance quality significantly moderates the environmental consequences of rising GDP per capita, with stronger institutions able to curb CO

2 emissions even amid economic expansion. Reinforcing this, Naz et al. [

37] argue that environmental performance acts as a mediating variable in the relationship between governance and sustainable development, suggesting that institutional reform alone is insufficient without ecological accountability.

Recent findings deepen this perspective. San Ong et al. [

38] highlight that governance (WGI) exerts a stronger influence on environmental performance (EPI) in developing countries, where regulatory enforcement and public accountability are more variable. De Miranda et al. [

39] add that innovation and governance (WGI) jointly shape environmental (EPI) outcomes, implying that policies for sustainable development must account for both institutional and technological capacities. Meanwhile, Handoyo [

40], using cross-national correlation analysis, provides strong empirical support for the positive association between all six WGI components—public accountability, regulatory quality, government effectiveness, political stability, rule of law, and control of corruption—and environmental sustainability (EPI). The analysis affirms that well-governed countries not only manage their economies more effectively but also outperform in environmental resilience and ecosystem protection.

As Baciu [

41] demonstrates, all core governance dimensions (WGI)—ranging from control of corruption to regulatory quality—positively influence sustainable development across a global panel of countries. Saba et al. [

42] reinforce this by showing that institutional quality plays a decisive role in mitigating environmental degradation, especially in vulnerable regions. At the same time, Ellis and Edmonds [

43] raise important concerns about the rise of indicator-based governance, cautioning that while sustainability indices are critical tools, they must complement—rather than replace—normative, legal, and participatory structures. These insights point toward the growing importance of comprehensive and balanced metrics for development assessment.

Although the reviewed studies underline strong interdependencies between governance, environmental performance, and sustainable development, they tend to examine these links in fragmented ways. Most analyses highlight either the moderating role of governance or the mediating role of environmental performance, but few capture their simultaneous and systemic effects on economic development. This indicates a need for more integrative approaches that move beyond bilateral relationships to assess how these dimensions interact collectively in shaping sustainable growth.

2.6. Research Gap

Across the reviewed literature, several common patterns and limitations emerge. Studies linking LPI to environmental outcomes highlight contradictory effects, with some pointing to higher emissions and others to green synergies, depending on context. Research on LPI and the SDGs underscores positive contributions in certain domains, yet reveals that logistics capacity does not consistently translate into broader sustainability outcomes. Analyses of LPI and governance emphasize the enabling role of strong institutions, but rarely address feedback effects or the role of specific governance dimensions. Likewise, studies of LPI and GDP confirm a robust connection, though often mediated by trade, FDI, or innovation, leaving the systemic interdependencies underexplored. Finally, integrated works that consider governance, environment, and development together remain largely descriptive and fragmented, without capturing their multidirectional interactions. These gaps collectively point to the absence of a unified empirical framework that can assess how logistics performance, ESG metrics, and governance quality reinforce or counterbalance each other in shaping sustainable economic development. The present study addresses this void by combining econometric analysis with fuzzy cognitive mapping to provide a systemic and multidimensional perspective.

2.7. Research Questions

Building on the insights drawn from the literature, it becomes evident that logistics performance, environmental sustainability, governance quality, and sustainable development are not merely parallel dimensions but part of an interdependent system influencing national prosperity. The recurring empirical evidence of their mutual reinforcement points to a structural nexus that warrants deeper investigation. The study formulates two key research questions to empirically explore the nature and extent of these interrelations:

RQ1: What is the relationship between ESG-related metrics (Environmental Performance Index, Sustainable Development Goals Index, and Worldwide Governance Indicators) and a country’s Logistics Performance Index (LPI)?

RQ2: To what extent do logistics performance and ESG-related indicators jointly explain cross-country variation in GDP per capita?

3. Materials and Methods

3.1. Data and Variables

To address the research questions, this study utilized a set of internationally recognized indicators reflecting economic performance, governance quality, environmental sustainability, and logistics efficiency. The most recently available data were collected from authoritative sources for each indicator. Although the reference years differ slightly across variables—owing to the publication cycles of each index—the selection prioritized the most up-to-date datasets accessible as of 2024. This minor temporal variation does not compromise the analysis, as these indicators typically exhibit limited short-term volatility and remain robust proxies of structural national performance.

Table 1 presents the full list of variables, including their definitions, sources, and reference years.

To ensure comparability across variables measured on different scales, all indicators were normalized to a common 0–100 range. The Environmental Performance Index (EPI) and Sustainable Development Goals Index (SDG) required no transformation, as they are already expressed on a 0–100 scale by their original sources. In contrast, the Logistics Performance Index (LPI) and its subcomponents—originally scored from 1 to 5—were normalized using the formula:

Similarly, the Worldwide Governance Indicators (WGI), originally ranging from −2.5 to +2.5, were rescaled as follows:

The WGI variable employed in this study is an original composite measure constructed by the authors, calculated as the arithmetic mean of the six governance dimensions provided by the World Bank (Voice and Accountability, Political Stability, Government Effectiveness, Regulatory Quality, Rule of Law, and Control of Corruption). The Worldwide Governance Indicators (WGI) were included as a composite index that averages the six governance dimensions. This approach was selected to provide a parsimonious specification and to reduce the risks of multicollinearity that could arise if each component were entered separately. While this choice enhances model stability, we acknowledge that future studies could explore alternative methods such as principal component analysis (PCA) or the use of separate governance dimensions to capture more nuanced effects.

Due to the highly skewed distribution of GDP per capita across countries, a natural logarithmic transformation was applied to stabilize variance and improve linearity, following standard econometric practice [

44].

Subsequently, LnGDP per capita was normalized using the min–max scaling method, after applying the logarithmic transformation:

This normalization process preserves the relative distances between countries while enabling coherent integration across all analytical stages—regression models and fuzzy cognitive mapping.

To assess the statistical properties of the dataset, normality tests were conducted on both the original and normalized values of all variables. The Shapiro–Wilk and Kolmogorov–Smirnov tests were applied to evaluate distributional normality, complemented by visual inspections using histograms and Q–Q plots. Although some variables—particularly GDP per capita and governance scores—exhibited non-normality in their raw forms, the normalization process improved symmetry and reduced skewness in most cases.

Additionally, descriptive statistics were computed for each variable, including measures of central tendency (mean, median), dispersion (standard deviation, range), and shape (skewness, kurtosis). These descriptive profiles served both as diagnostic tools and as foundational inputs for regression modeling, enabling a more precise interpretation of relative variable behavior across countries.

For the purposes of this analysis, a sample of 123 countries was selected based on the availability of complete and consistent data across all key variables (LPI, EPI, SDG, WGI, and GDP per capita). This ensures comparability and statistical validity throughout the study.

All statistical analyses were conducted using IBM SPSS Statistics version 23, which provided the computational environment for regression modeling, correlation testing, and diagnostic validation.

3.2. Regression

To explore the structural relationships among logistics performance, sustainability indicators, governance quality, and economic output, four linear regression models were estimated. These analyses serve both an explanatory and preparatory function: they provide insights into the statistical associations among key variables and generate the empirical basis for the Fuzzy Cognitive Map (FCM) simulation framework introduced later.

The regressions were divided into two groups, corresponding to the study’s two central research questions:

Regarding RQ1 (“How do ESG-related metrics relate to logistics performance?”), three simple regression models were estimated with LPI as the dependent variable and, alternatively, EPI, SDG, or WGI as single predictors. This setup makes it possible to isolate the individual contribution of environmental sustainability, sustainable development progress, and governance quality to national logistics performance.

To examine RQ2 (“How do all selected indicators jointly relate to GDP per capita?”), we employed a multivariate regression framework in which GDP per capita (log-transformed and normalized) served as the dependent variable. LPI, EPI, SDG, and WGI were entered simultaneously as explanatory factors, allowing us to assess their combined influence on economic performance.

This multivariate model captures the combined effect of logistics, environmental sustainability, governance, and development progress on economic performance.

For each model, a comprehensive suite of diagnostics was conducted and is reported in the

Section 4:

Model Summary tables provide R, R2, and Adjusted R2 values, quantifying the explanatory power of each model.

ANOVA tables confirm model significance via F-tests, all statistically significant at p < 0.05.

The regression output includes coefficient tables reporting both standardized and unstandardized beta values, allowing for the interpretation of the strength and direction of each predictor’s effect.

Collinearity diagnostics—specifically the Variance Inflation Factor (VIF) and Tolerance—were employed to assess potential multicollinearity among independent variables.

Residual analyses were conducted to verify key model assumptions, including linearity, normality, and homoscedasticity.

Scatterplots were used to visually inspect the linear fit, detect potential outliers, and identify any deviations from model assumptions.

This study applied several diagnostic tests to ensure the validity of the econometric analysis. Variance Inflation Factors (VIFs) and collinearity statistics confirmed the absence of multicollinearity, while the Durbin–Watson statistic and residual plots supported the appropriateness of the OLS specification. Although these tests increase confidence in the robustness of the results, we also recognize that potential endogeneity issues—such as reverse causality between governance and GDP per capita—cannot be fully ruled out in a cross-country setting and should be examined in future work.

Ordinary Least Squares (OLS) regression was employed as the main estimation method. The use of OLS is justified by the diagnostic results, which showed no evidence of multicollinearity or serial correlation and confirmed the appropriateness of the specification. Nevertheless, we recognize that future research could employ robust estimators, such as heteroskedasticity-robust regressions, instrumental variables, or panel-data techniques, to further strengthen the analysis.

3.3. Correlation

To further examine the interdependencies between key institutional and logistical indicators—specifically the component dimensions of the Logistics Performance Index (LPI) and the Worldwide Governance Indicators (WGI)—a series of bivariate correlation analyses were conducted.

Given the non-parametric nature of some variables and the results of the normality tests, the Kendall’s tau-b coefficient was selected over Pearson’s r. The Shapiro–Wilk and Kolmogorov–Smirnov tests revealed that many of the governance and logistics sub-indicators exhibited significant skewness and deviated from a normal distribution. Since Pearson’s r assumes bivariate normality and continuous linear relationships, it was deemed inappropriate for these data.

Kendall’s tau-b was thus employed as a more robust and distribution-free alternative. It is particularly suitable for ordinal or rank-based data and handles tied ranks more effectively than Spearman’s rho. Moreover, Kendall’s tau-b provides a more conservative and interpretable measure of monotonic association between non-normally distributed variables [

45].

3.4. Fuzzy Cognitive Map Construction Rationale

To complement the statistical findings and explore complex interrelations between ESG metrics, logistics performance, and economic development, a Fuzzy Cognitive Mapping (FCM) approach was applied. FCM provides a simulation-based methodology capable of capturing nonlinear, dynamic, and feedback-driven causal structures—particularly useful in multidimensional policy analysis.

Fuzzy Cognitive Maps (FCMs) offer a robust modeling framework for capturing complex causal relationships among multidimensional variables in dynamic systems. Originally introduced by Kosko [

46], FCMs integrate elements of fuzzy logic and neural networks, enabling the representation of uncertainty, feedback loops, and nonlinear interdependencies. Glykas [

47] highlights the advantages of FCMs in strategic decision-making contexts, emphasizing their capacity to simulate alternative scenarios and incorporate the temporal evolution of systems—overcoming limitations of traditional strategy maps which often assume static, linear causality. Moreover, recent advancements by Aral et al. [

48] have further reinforced the applicability of FCMs in social and policy modeling, showcasing their ability to encode stakeholder knowledge into weighted causal graphs and simulate systemic impacts under various interventions. In this study, FCM is employed as a complementary tool to regression and correlation analysis, allowing for the exploration of structural interactions between ESG indicators, logistics performance, and economic outcomes under defined policy scenarios.

The choice of Fuzzy Cognitive Mapping (FCM) over System Dynamics (SD) is methodologically grounded in the nature of the research problem and the data structure. While SD models require precise quantitative parameters and detailed temporal dynamics, FCM is better suited for capturing conceptual interdependencies, semi-quantitative causal relationships, and expert-informed structures—especially in policy contexts involving institutional quality, sustainability, and logistics performance. FCM allows for the integration of both statistical findings and heuristic reasoning, accommodating uncertainty and feedback without the need for fully parameterized models [

49,

50]. Given the aggregated, cross-national nature of the data and the emphasis on scenario-based exploration, FCM offers a more flexible and interpretable modeling approach for analyzing systemic development dynamics.

Building on the results of the regression and correlation analyses, a Fuzzy Cognitive Map was constructed to model the systemic interdependencies between the key variables under study. The causal structure of the FCM was derived directly from the statistical outputs—specifically the direction and strength of the associations observed in the regression coefficients and the Kendall’s tau-b correlation matrix (see Table 26).

To translate the statistical findings into a functional cognitive model, edge weights in the Fuzzy Cognitive Map were assigned proportionally based on the strength and direction of empirical relationships derived from the statistical analyses. Specifically, the relationships between the six components of the Logistics Performance Index (LPI) and the six components of the Worldwide Governance Indicators (WGI) were determined using Kendall’s tau-b correlation coefficients, as part of the correlation analysis framework. These bivariate correlations capture non-parametric, monotonic associations between institutional and logistical dimensions.

Furthermore, the causal relationships between LPI, EPI, SDG, and WGI were extracted from the standardized regression coefficients of Models 1, 2, and 3, where LPI served as the dependent variable. These models enabled the quantification of how sustainability and governance indicators affect logistics performance.

The structural links connecting GDP per capita with the four main explanatory indicators (LPI, WGI, SDG, and EPI) were drawn from the multivariate regression coefficients of Model 4, in which GDP was the dependent variable. This final model captured the joint economic impact of institutional, environmental, and logistical variables.

Each link (edge) in the FCM represents a directed, weighted influence from one variable (node) to another. The weights range from −1 to +1 and reflect the empirical magnitude and polarity of the relationships. Positive weights indicate reinforcing relationships, while negative weights represent inhibitory effects. Variables with consistently strong statistical effects in the prior analyses were assigned proportionally higher weights.

In constructing the FCM, standardized regression coefficients and correlation values were normalized and rescaled to the [−1, +1] interval to generate causal weights between nodes, following established practices in socio-economic and environmental modeling [

51,

52]. A threshold of ±0.30 for causal weights was adopted in order to balance interpretability and parsimony. Lower thresholds risk introducing weak or spurious relationships, while higher thresholds may exclude relevant but moderate influences. Connections with absolute values below 0.30 were omitted to ensure that the map remains clear and analytically focused.

This approach is consistent with recommendations to avoid over-complexity and enhance the transparency of causal pathways in simulation outputs [

53]. Model validation was conducted through sensitivity and consistency checks, including the examination of alternative weight specifications and their effect on system dynamics, a practice that has been shown to improve robustness and reproducibility in FCM applications [

54]. These procedures strengthen the interpretability of the results and ensure that the observed interactions between logistics performance, governance quality, and environmental indicators are not artifacts of model specification.

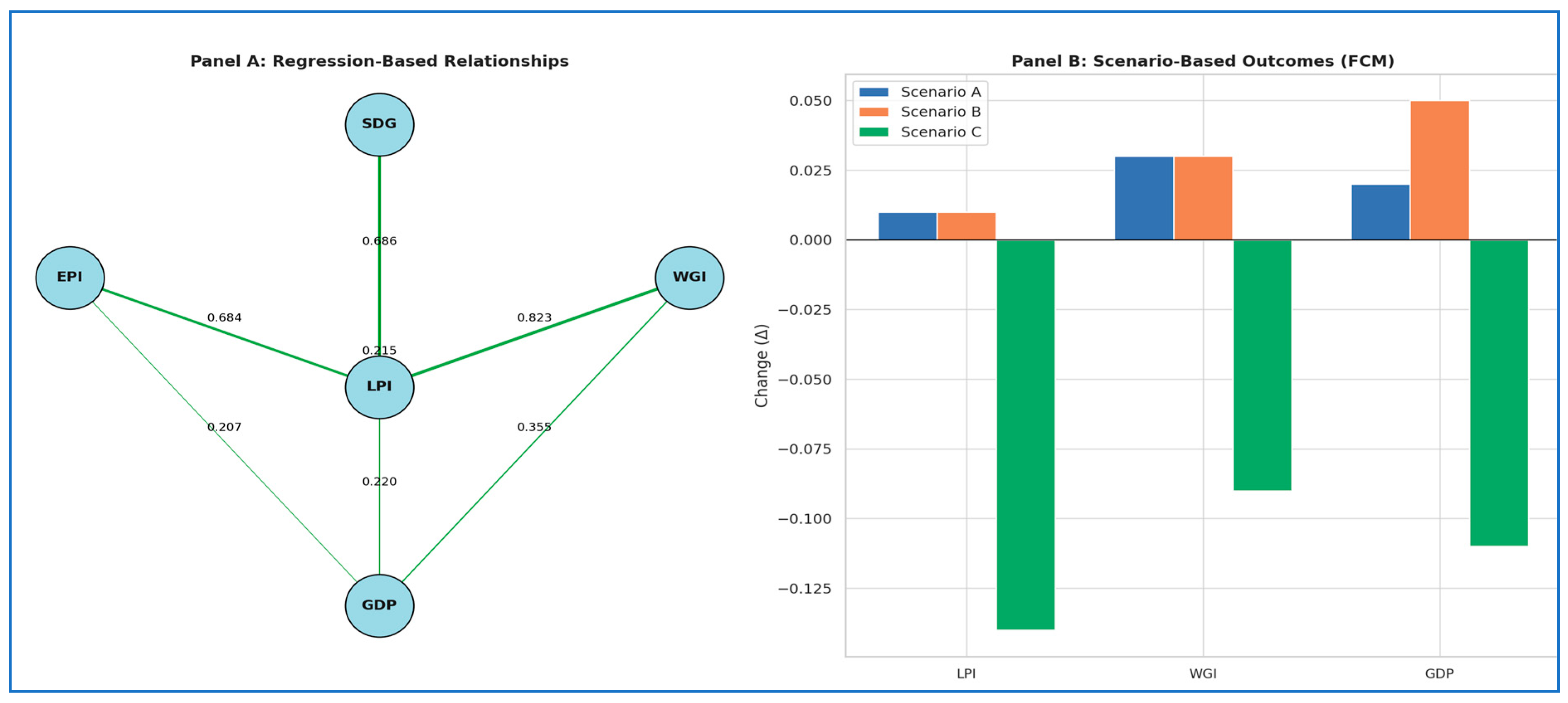

3.5. Fuzzy Cognitive Map Scenarios’ Rationale

Based on the finalized cognitive model, three simulation scenarios (A, B, and C) were designed and executed. Each scenario modifies a distinct subset of input variables—selected for their theoretical significance and empirical support—and observes the system-wide ripple effects on core outcomes such as GDP and LPI. Scenario A represents the median (baseline) case, reflecting moderate and stable development dynamics. Scenario B constitutes the best-case trajectory, where targeted improvements in sustainability, governance, and logistics lead to an enhanced economic performance. Scenario C models the worst-case scenario, simulating regression across key dimensions and its detrimental impact on national development. Collectively, these scenarios are not abstract constructions; they are structured to reflect plausible trajectories observed in the real world, enabling policy-oriented experimentation under varying post-growth conditions.

In Scenario A, the Environmental Performance Index (EPI) is increased by one unit, reflecting a policy framework that strongly emphasizes environmental sustainability. This is grounded in empirical findings showing that environmental performance enhances long-term infrastructure planning, fosters clean technology adoption, and improves logistics reliability. For instance, the Environmental Kuznets Curve hypothesis suggests that economic growth initially harms the environment, but improves it at higher income levels [

35]. The SDG Index increases by 0.5 points to reflect moderate but targeted progress on specific Sustainable Development Goals—such as Goals 9 (industry, innovation, and infrastructure) and 16 (peace, justice, and strong institutions)—which are shown to have positive associations with logistics performance [

4]. To assess how ESG improvements translate into functional performance, the LPI subcomponent “Logistics Quality and Competence” (QUAL) is increased by 1, given its role in representing technical capability and skill intensity in national logistics systems. Simultaneously, the WGI subindicator “Rule of Law” (RL) is increased by 1.Scenario A is designed to evaluate a sustainability-led pathway and test its impacts on logistics performance (RQ1) and economic development (RQ2). This scenario simulates a moderate, status quo trajectory in which institutional quality, sustainability performance, and logistics efficiency remain relatively stable. The input values in this scenario reflect conditions typical of middle-income countries with no major structural disruption or breakthrough.

Scenario B focuses on strengthening governance and commercial readiness as levers to stimulate economic performance. The WGI subindicator “Regulatory Quality” (RQ) is increased by 1, representing improvements in policy consistency and pro-business regulatory frameworks. Such regulatory reforms are empirically associated with better trade facilitation, customs performance, and investment attraction [

55,

56]. In parallel, the LPI subcomponent “Competence and Quality of Logistics Services” (COM) is increased by 1, in alignment with studies indicating that logistics expertise and service quality drive trade efficiency and competitiveness [

57]. Furthermore, the SDG Index is fully increased by 1 point in this scenario to simulate a multidimensional and integrated development effort that supports institutional strengthening and operational capacity.

By modifying these specific variables, Scenario B simulates a bottom-up development strategy that begins with institutional consolidation and sectoral capacity-building, aiming to observe their combined effects on LPI and GDP per capita (RQ1 and RQ2). Scenario B models a developmental trajectory characterized by targeted improvements in key variables. These inputs correspond to real-world policy advances such as major investments in renewable energy, cross-sectoral SDG alignment, and institutional reforms that enhance transparency and effectiveness. For instance, a +1 increase in EPI could reflect measurable reductions in fine particulate pollution or increased protected natural areas, while a +1 increase in SDG index may align with improved access to education or healthcare. Such positive shifts have been observed in high-performing countries (e.g., Sweden, Germany) and are used here to test the upper limits of systemic synergies.

The design of A and B Scenarios reflects an intention to explore two contrasting but complementary development trajectories: one driven by sustainability and environmental goals (top-down), and the other by governance quality and competitiveness (bottom-up). The selection of specific variables for adjustment is grounded in robust empirical evidence. The EPI, SDG, WGI (RL/RQ), and LPI components (QUAL/COM) have all been identified in prior studies as critical enablers of economic and trade performance [

57,

58]. The magnitudes of change were chosen to represent realistic yet policy-significant improvements that are achievable over medium-term planning horizons. By testing how these shifts affect both logistics performance (RQ1) and economic output (RQ2), the scenarios provide valuable insight into the causal logic of different reform strategies and allow for simulation within the FCM framework.

Scenario C simulates a regressive development pathway, in which the degradation of Environmental Performance Index (EPI), Sustainable Development Goals Index (SDG), Transparency (TR), and Government Effectiveness (WGI-GE) by 0.5 leads to a measurable decline in GDP per capita. Empirical studies support these interdependencies. A decrease in LPI weakens trade capacity and economic output, as shown by Widayat et al. [

30], who demonstrate that poor logistics directly erode global competitiveness. Similarly, Inoue and Todo [

59] highlight how disruptions in supply chains can reduce GDP by over 5% in major urban economies. Deterioration in governance, especially in indicators such as regulatory quality, control of corruption, and government effectiveness, has been linked to economic stagnation and investor withdrawal [

55]. Environmental degradation also imposes long-term economic costs; Kurth et al. [

60] emphasize that declining EPI scores—particularly related to emissions and resource use—can destabilize infrastructure and affect productivity. The Sustainable Development Goals (SDG Index) reflect holistic progress; a decline in SDG performance signals structural imbalances across sectors, hindering equitable and sustainable growth. Lastly, transparency and institutional trust are strongly correlated with economic efficiency, particularly in contexts of public investment and reform delivery [

61]. Altogether, the literature validates the inclusion of these variables in the negative scenario and underscores their combined impact on national economic decline.

Scenario C is designed to represent a realistic yet adverse policy environment in which institutional fragility, underinvestment in logistics, and erosion of sustainability commitments converge to undermine economic performance. This scenario reflects observed patterns in countries facing political instability, weak governance, environmental degradation, or systemic neglect of infrastructure. It serves not only as a stress test for development resilience but also as a cautionary projection of how multidimensional decline can compound and reverse developmental gains. Modeling such a scenario allows policymakers to anticipate critical thresholds and identify leverage points for avoiding long-term stagnation.

4. Results

4.1. Descriptive Statistics and Normality Tests

Table 2 reports the descriptive statistics and normality diagnostics for the initial dataset. Measures of central tendency and dispersion are provided, along with skewness and kurtosis values used to assess distributional properties before transformation.

Most variables, including LPI initial, EFF initial, QUAL initial, and COM initial, deviate significantly from normality (p < 0.05), as indicated by the Shapiro–Wilk test. Only EASE initial approximates a normal distribution with a p-value of 0.086. Skewness and kurtosis values support this observation, suggesting slightly asymmetric and platykurtic distributions. Given these findings, non-parametric methods such as Kendall’s tau-b or data transformations are appropriate for subsequent analyses.

Key variables such as LPI, EFF, QUAL, COM, and most WGI indicators showed p-values below the significance threshold, indicating significant deviations from normality. However, variables like EASE (p = 0.086) and WGI GE (p = 0.411) passed the test, suggesting near-normal distributions. GDPLOG, though transformed, still displayed marginal deviation (p = 0.015), though greatly improved compared to its raw form. These findings justify the use of both parametric and non-parametric methods in subsequent analyses, depending on the variable and analytical context.

A comparison between the initial (

Table 2) and normalized (

Table 3) datasets revealed that normalization improved the distributional characteristics of several variables, particularly in reducing skewness and kurtosis. Nonetheless, the Shapiro–Wilk test results indicated that the majority of variables continued to deviate from perfect normality. This non-normality, however, does not significantly affect the validity of the analysis, as non-parametric correlation methods (e.g., Kendall’s tau-b) will be employed where appropriate. Additionally, in all linear regression models, residual diagnostics and outlier controls will be systematically applied to ensure the robustness of the results.

4.2. Regression Analyses

4.2.1. Model 1 Regression Analysis

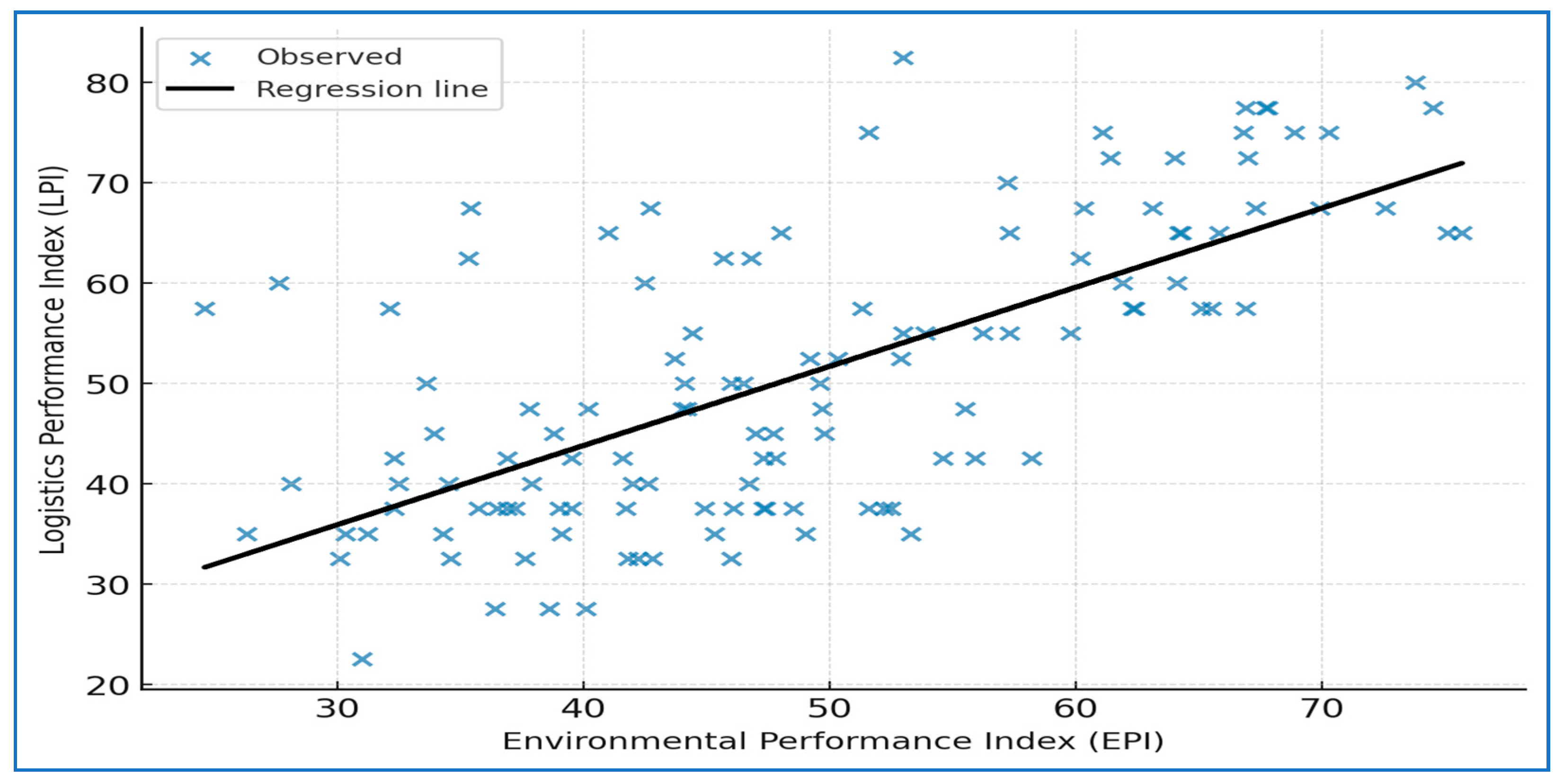

A simple linear regression (Dependent variable: LPI, Independent variable: EPI) was conducted to examine the effect of environmental performance (EPI) on logistics performance (LPI).

According to

Table 4, the model was statistically significant and explained a substantial proportion of the variance in LPI (R

2 = 0.468, Adjusted R

2 = 0.463). The standardized regression coefficient (R = 0.684) indicates a strong positive association between the two variables. Additionally, the Durbin–Watson statistic (2.089) suggests no serious autocorrelation in the residuals. These findings support the hypothesis that a better environmental performance is associated with an improved logistics performance at the country level.

The ANOVA results (

Table 5) confirmed the statistical significance of the model (F(1,121) = 106.269,

p < 0.05), indicating that the regression equation reliably predicts logistics performance based on environmental performance scores. The large F-value and highly significant

p-value strengthen the conclusion that EPI has a substantial predictive effect on LPI.

The regression coefficients (

Table 6) further confirmed the statistical significance of the model. The unstandardized coefficient (B = 0.789) indicates that for every one-unit increase in a country’s Environmental Performance Index (EPI), its Logistics Performance Index (LPI) increases by approximately 0.789 units. This effect is statistically significant at the

p < 0.001 level (t = 10.309), providing strong evidence of a positive and meaningful relationship.

The standardized coefficient (Beta = 0.684) supports this finding, showing that the EPI has a strong effect on the LPI even when measured in standardized units. The low standard error (SE = 0.077) and high t-value indicate a precise and robust estimate of the regression slope.

The collinearity statistics (

Table 6) confirmed the absence of multicollinearity in the model. Specifically, the Tolerance value of 1.000 and Variance Inflation Factor (VIF) of 1.000 indicate that the predictor variable (EPI) is not linearly correlated with any other variable in the model. As expected in a simple linear regression with a single independent variable, these values reflect perfect independence. This ensures the stability and interpretability of the regression coefficient and eliminates concerns about inflated standard errors due to multicollinearity.

The collinearity diagnostics (

Table 7) revealed no indication of multicollinearity. The Condition Index values were all below the critical threshold of 30, with the highest observed index at 7.948, which is well within acceptable limits. Furthermore, the variance proportions for both the constant and EPI are evenly distributed across dimensions, and no high proportions (>0.90) were found in the same dimension.

These results further confirm the absence of multicollinearity concerns in the model, supporting the stability of the regression estimates and reinforcing the validity of the inference drawn from the coefficients.

The residual statistics (

Table 8) suggest that the assumptions of linear regression are reasonably satisfied. The residuals exhibit a mean of approximately zero (0.000) and a standard deviation of 10.574, consistent with the model’s error term. The standardized residuals fall within the range of −1.818 to +2.678, which is well within the commonly accepted threshold of ±3 for outlier detection, indicating no serious violations or extreme deviations.

The distribution of standardized predicted values is symmetrical (mean = 0.000, SD = 1.000), supporting the assumption of homoscedasticity. These findings confirm that the residuals are appropriately distributed, enhancing the credibility of the model estimates and validating the use of linear regression in this context.

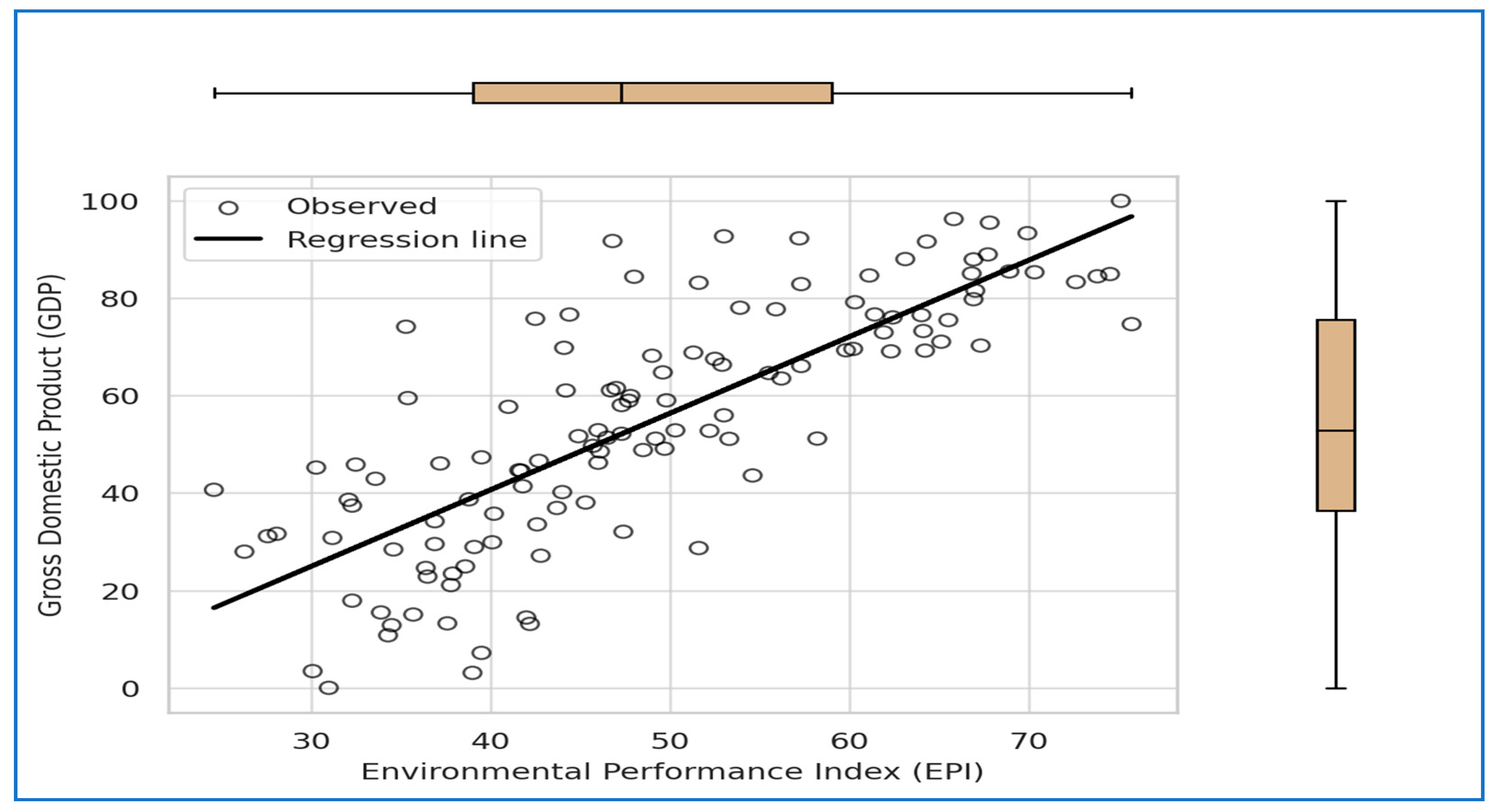

The scatterplot (

Figure 1) shows a clear positive linear relationship between the Environmental Performance Index (EPI) and the Logistics Performance Index (LPI). The data points show a clear upward trend, supporting the presence of a positive linear association between the two variables. While some dispersion is present—especially at mid-range EPI scores—the majority of observations cluster around the regression line, indicating a reasonably good fit. The linear trend line reinforces the regression findings and suggests that increases in environmental performance are generally associated with a higher logistics efficiency.

4.2.2. Model 2 Regression Analysis

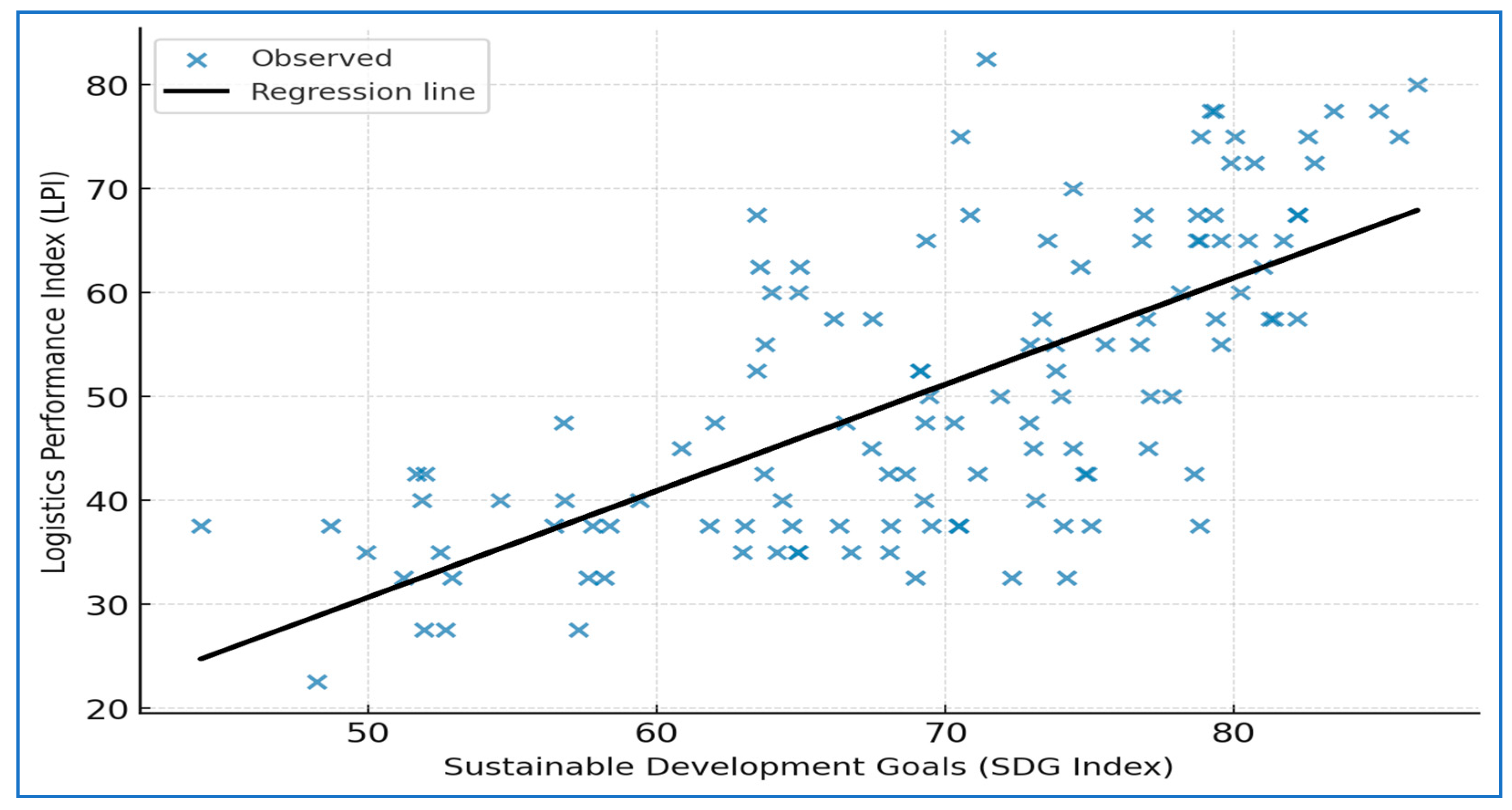

To evaluate the effect of sustainable development (SDG) on logistics efficiency (LPI), a simple regression analysis was performed.

The linear regression model (

Table 9) explains 47.0% of the variance in LPI (R

2 = 0.470, Adjusted R

2 = 0.466), indicating a strong and meaningful relationship. The correlation coefficient (R = 0.686) suggests a high degree of association, and the Durbin–Watson statistic (2.127) confirms the independence of residuals, further validating the model’s reliability.

The ANOVA results (

Table 10) indicate that the model is statistically significant (F= 107.430,

p < 0.05), confirming that SDG scores meaningfully contribute to the prediction of LPI. The high F-value and the very low

p-value validate the robustness of the linear relationship.

The regression coefficient (

Table 11) is statistically significant (b = 1.026,

p < 0.001), indicating that for every one-point increase in a country’s Sustainable Development Goal (SDG) score, its Logistics Performance Index (LPI) is expected to increase by approximately 1.03 units. The standardized coefficient (β = 0.686) suggests a strong positive effect. The model demonstrates high explanatory power and precision (t = 10.365), and no multicollinearity issues were detected (VIF = 1.000, Tolerance = 1.000).

The collinearity diagnostics (

Table 12) support the absence of multicollinearity in the model. The highest Condition Index (14.514) falls well below the critical threshold of 30, and the variance proportions for both the constant and SDG predictor, while high in the same dimension, are not indicative of collinearity since there is only one predictor in the model. These results confirm that the regression estimates are stable and not affected by collinearity.

The residual statistics (

Table 13) demonstrate that the assumptions of linear regression are satisfied. The residuals are symmetrically distributed around a mean of zero (0.000) with a standard deviation of 10.547. All standardized residuals fall within the acceptable range of ±3, indicating that there are no influential outliers. Furthermore, the standardized predicted values are well-balanced (range: −2.629 to 1.721), supporting the assumptions of linearity and homoscedasticity. These results confirm the robustness and reliability of the regression model.

The scatterplot (

Figure 2) illustrates a clear positive linear relationship between SDG scores and LPI, suggesting that countries with stronger progress on sustainable development goals also tend to achieve a higher logistics performance. The upward-sloping regression line reflects a consistent trend: as countries perform better on Sustainable Development Goals, their logistics performance tends to improve. While there is some dispersion of data points around the line, especially at mid-range SDG values, the majority of observations align well with the model’s predicted trajectory. No curvature or clustering pattern indicates a violation of linearity, supporting the assumption of a linear relationship.

4.2.3. Model 3 Regression Analysis

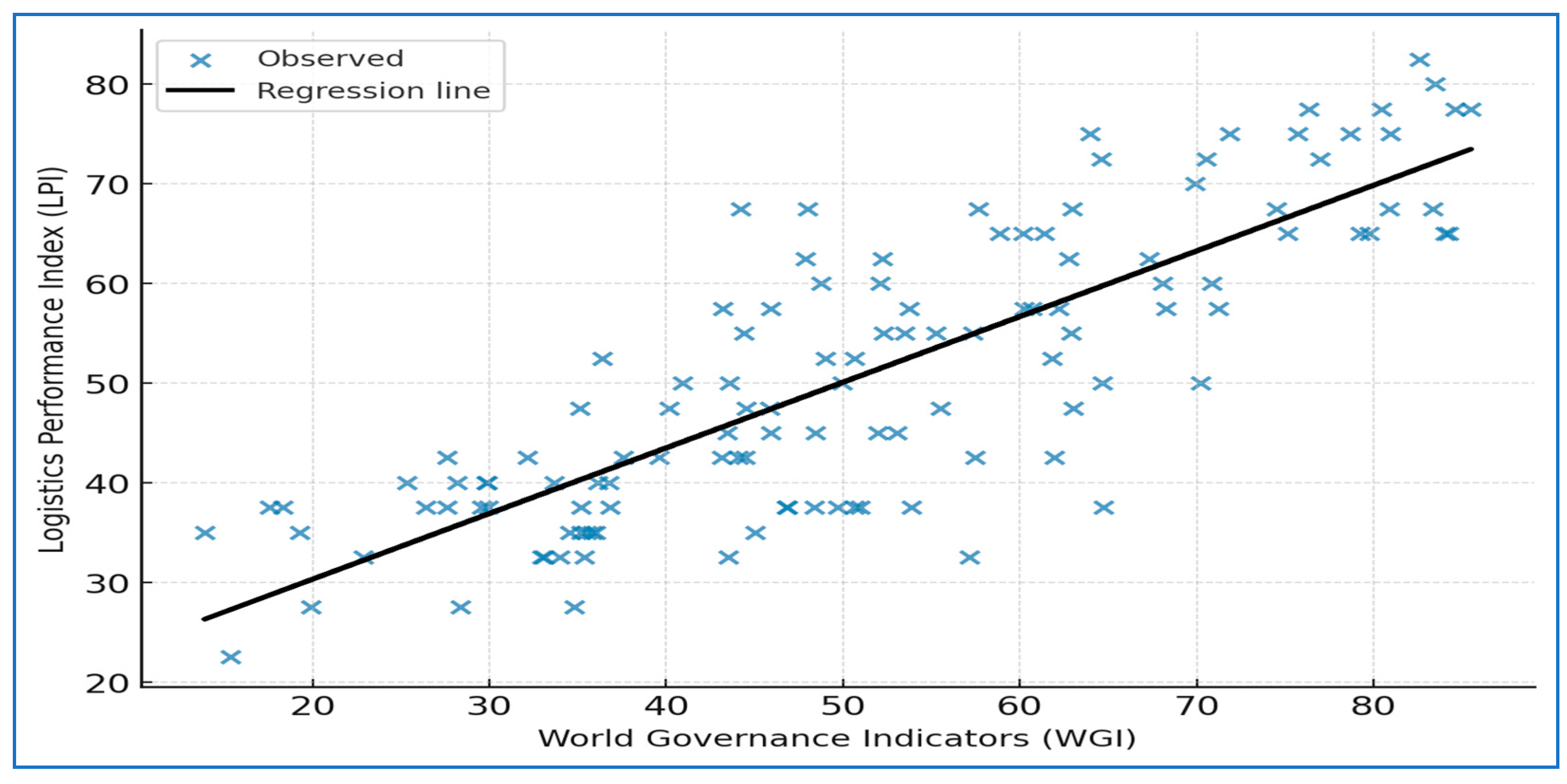

A linear regression analysis was conducted to evaluate how governance quality (WGI) influences logistics performance (LPI).

The regression model (

Table 14) using WGI as the predictor of LPI demonstrated a very strong linear relationship. The model explains 67.7% of the variance in logistics performance (R

2 = 0.677, Adjusted R

2 = 0.674), with a high correlation coefficient (R = 0.823). The standard error of the estimate (8.269) is the lowest among the models tested so far, indicating a superior predictive accuracy. Additionally, the Durbin–Watson statistic (2.130) suggests no autocorrelation in the residuals, confirming model independence.

The ANOVA test (

Table 15) confirmed the model’s statistical significance (F= 253.69,

p < 0.05), showing that the governance index (WGI) is a highly effective predictor of logistics performance (LPI). The exceptionally high F-statistic further supports the robustness of the model.

The regression coefficient (

Table 16) for WGI was statistically significant (b = 0.659,

p < 0.001), indicating that a one-unit increase in governance quality is associated with a 0.659-point increase in LPI. The standardized coefficient (β = 0.823) is the highest among all tested models, confirming a very strong positive effect. The precision of the estimate is reflected in the high t-value (15.928), and multicollinearity is absent (VIF = 1.000, Tolerance = 1.000). Overall, governance emerges as the most powerful predictor of logistics performance in this analysis.

The collinearity diagnostics (

Table 17) show no indication of multicollinearity. The highest Condition Index (5.847) is well below the accepted threshold of 30, and although the variance proportions are high for both the constant and WGI, this is not a concern given the univariate nature of the model. The results confirm that the regression estimates are statistically stable and reliable.

The residual analysis (

Table 18) confirms that the assumptions of linear regression are satisfied. The residuals are symmetrically distributed around zero, with no extreme outliers (standardized residuals fall within the acceptable ±3 range). The relatively low standard deviation of residuals (8.235) further supports the model’s high predictive accuracy. These results indicate that the model is both statistically and diagnostically robust.

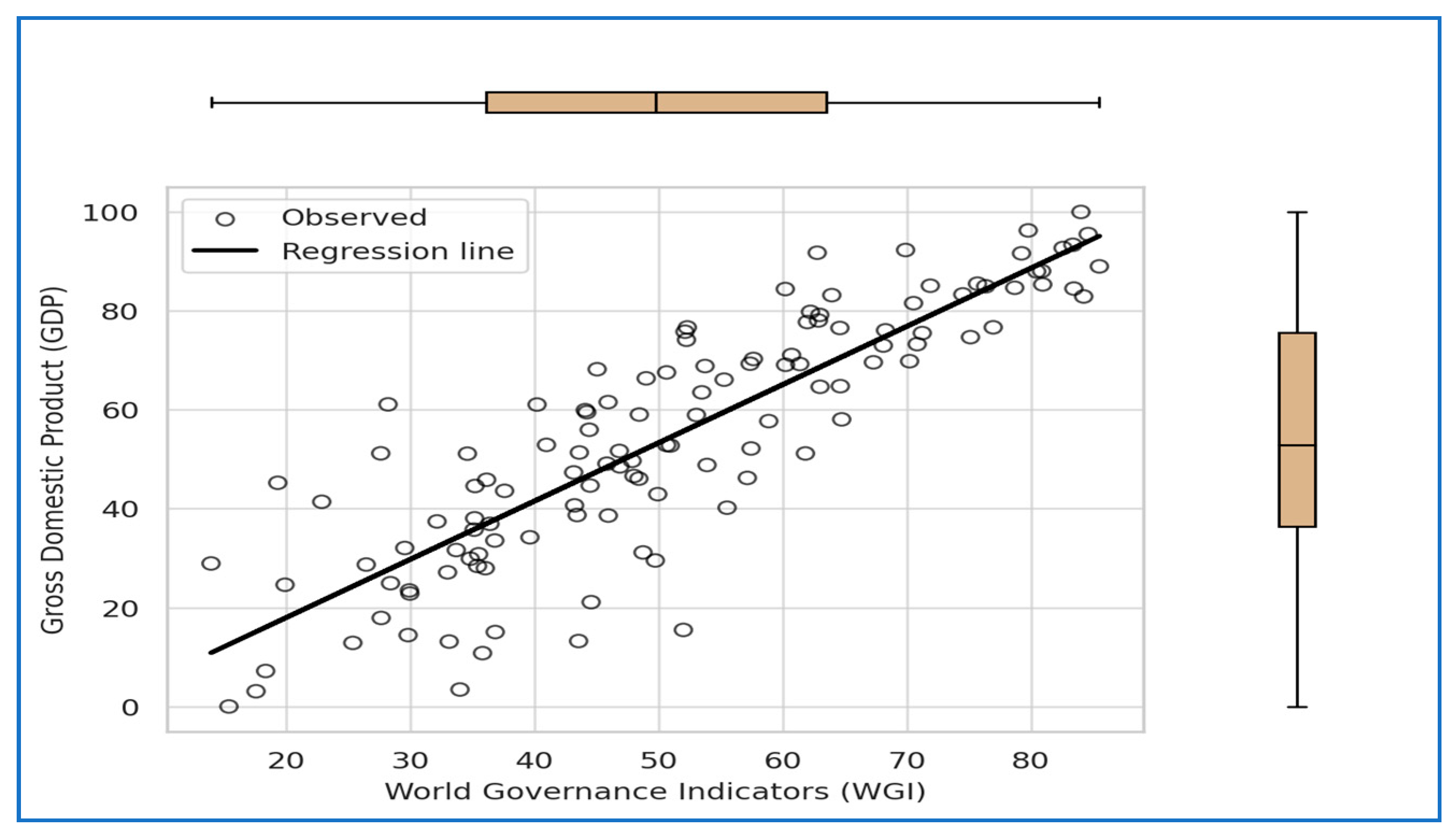

Figure 3 shows a strong positive link between governance quality (WGI) and logistics performance (LPI). The data points are closely aligned with the regression line, indicating a well-fitting model. The slope is steep, consistent with the high standardized regression coefficient (β = 0.823). There is minimal dispersion, and no visible curvature or clustering that would suggest nonlinearity. These visual patterns reinforce the statistical results and confirm that WGI is a powerful predictor of LPI.

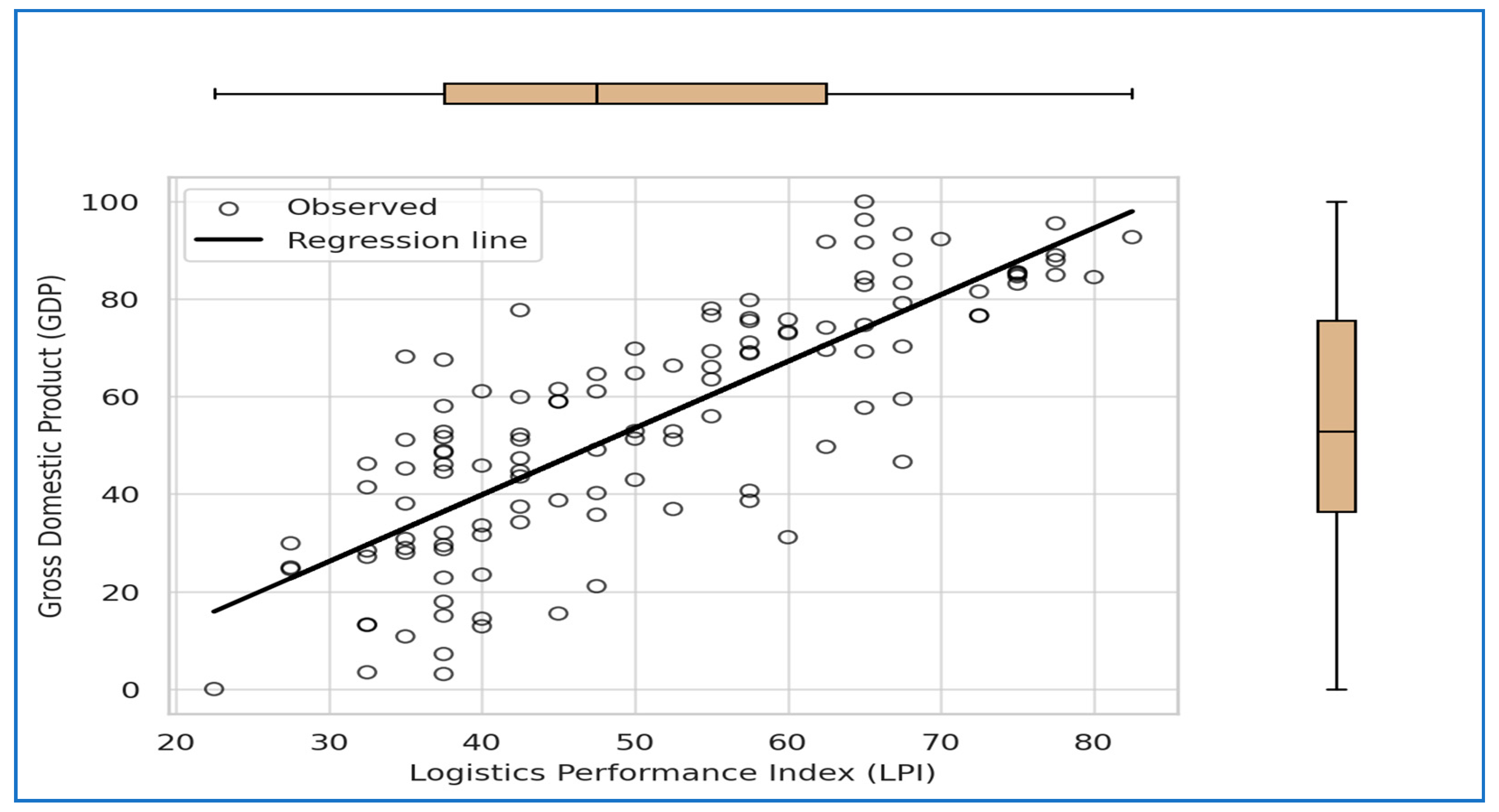

4.2.4. Model 4 Regression Analysis

A multiple linear regression (Dependent variable: GDP, Independent variables: LPI, EPI, SDG, WGI) was conducted to assess the combined effect of logistics performance (LPI), environmental sustainability (EPI), sustainable development (SDG), and institutional quality (WGI) on economic output, as measured by GDP per capita. The model aimed to evaluate whether these systemic factors jointly contribute to explaining cross-country variation in GDP levels. This analysis builds upon prior single-variable regressions and tests the cumulative predictive power of the LESG dimensions within a unified framework.

The regression model (

Table 19) predicting GDP based on LPI, EPI, SDG, and WGI achieved a high R

2 of 0.817, indicating that 81.7% of the variance in GDP can be explained by these predictors. The Durbin–Watson statistic (2.067) suggests no autocorrelation in residuals, confirming that the model satisfies the independence assumption. These results highlight the strong explanatory power of institutional and ESG-related indicators in determining economic performance.

The ANOVA results (

Table 20) confirm that the regression model is statistically significant overall (F = 131.97,

p < 0.05). This indicates that the combination of LPI, EPI, SDG, and WGI provides a meaningful and robust prediction of GDP levels across countries. The model’s predictive strength is unlikely to be due to random variation.

According to

Table 21, all four predictors—WGI, EPI, SDG, and LPI—show statistically significant positive effects on GDP (

p < 0.01 for all). Among them, governance quality (WGI) exhibited the strongest influence (β = 0.355), followed closely by LPI (β = 0.220), SDG (β = 0.215), and EPI (β = 0.207). Variance Inflation Factor (VIF) values were all below 5, indicating no problematic multicollinearity. This suggests that both institutional quality and ESG-related factors jointly contribute to economic performance.

Although the fifth dimension (

Table 22) shows a condition index above 30 (33.385), only the SDG variable loads heavily on this dimension (variance proportion = 0.98), while the remaining predictors are well below the critical threshold. Combined with VIF values under 5, there is no evidence of severe multicollinearity, and the model remains statistically reliable.

The residuals (

Table 23) are symmetrically distributed around zero, with standardized residuals within the acceptable range of ±3. The standard deviation of residuals closely matches the model’s standard error of the estimate, suggesting homoscedasticity. These indicators support the assumption of normally distributed and independent residuals, validating the reliability of the regression model.

The joint scatterplot (

Figure 4) with marginal boxplots demonstrates a strong positive association between LPI and GDP. The upward trend reflects that countries with a higher logistics performance also tend to have a higher economic output. The distributions of both variables are approximately symmetric, with no significant outliers detected. This visual representation supports the regression findings and further validates the inclusion of LPI as a meaningful predictor of GDP.

The scatterplot (

Figure 5) between EPI and GDP reveals a positive and approximately linear relationship, suggesting that countries with better environmental performance tend to have higher GDP levels. The marginal boxplots confirm the absence of significant outliers in both variables. Although the strength of the correlation appears slightly lower than that of LPI, the EPI still demonstrates a meaningful association with economic output, supporting its inclusion in the multiple regression model.

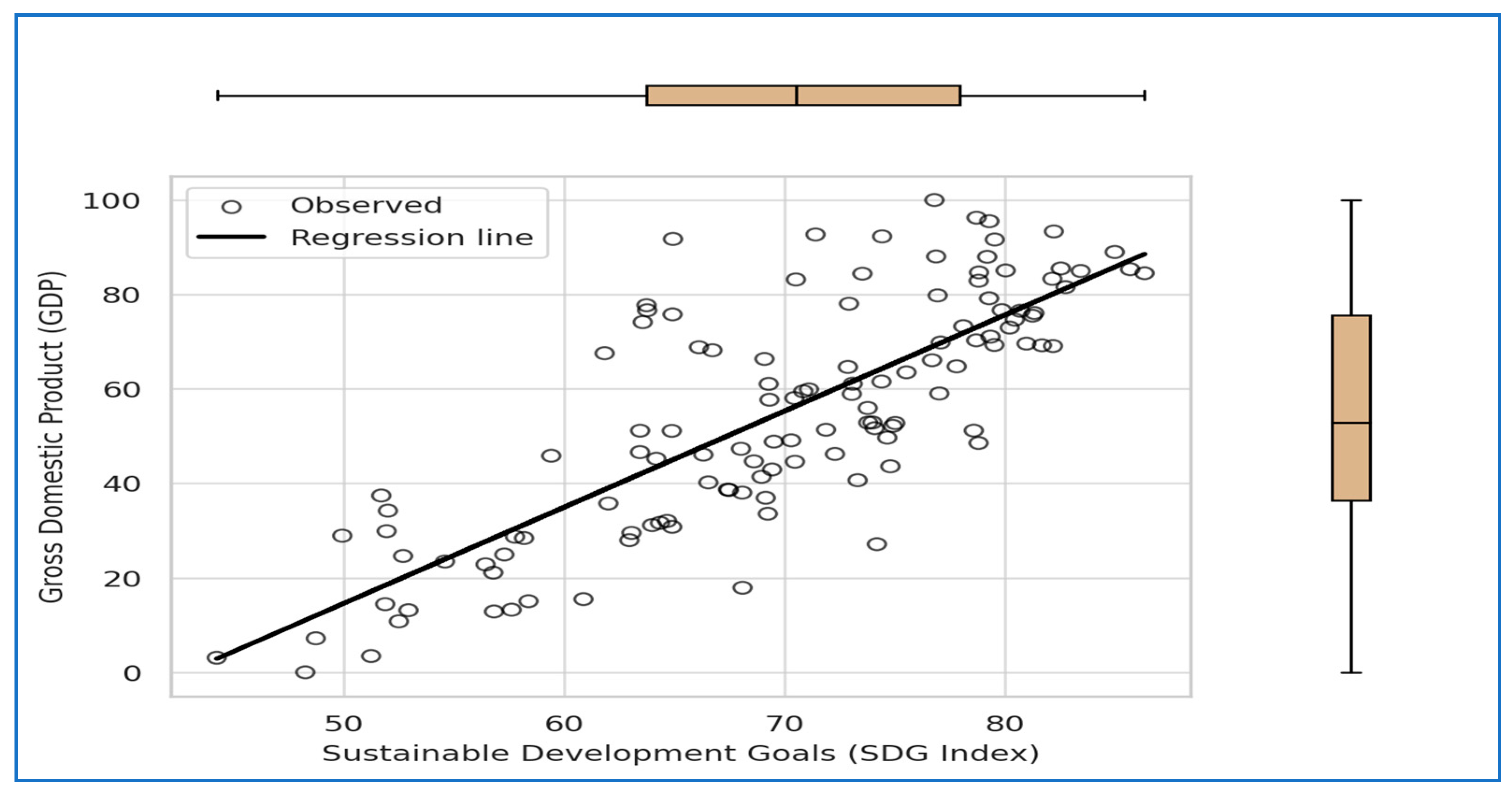

The scatterplot (

Figure 6) confirms a strong positive association between countries’ SDG scores and GDP levels. The trend is visibly linear, indicating that improvements in sustainable development are aligned with higher economic output. The distribution of SDG scores is relatively concentrated among mid-to-high values, while GDP remains more dispersed. Nonetheless, the alignment of points reinforces the relevance of SDG performance in explaining economic variation across countries.

Among all the predictors, the scatterplot (

Figure 7) for WGI and GDP exhibits the strongest linear relationship. Countries with better governance consistently show higher GDP levels, with very little dispersion around the trend. This visual evidence supports the regression results, where WGI demonstrated the highest standardized effect (β = 0.355). The result reinforces the importance of institutional quality in shaping national economic performance.

4.3. Correlation Analyses

To investigate the relationships between the component variables of LPI and WGI, Kendall’s tau-b correlation coefficient was employed.

4.3.1. Correlation Analysis Among LPI and the Six Components of LPI

Table 24 presents Kendall’s tau-b correlations among the six subcomponents of the Logistics Performance Index (LPI) and the LPI as well: Efficiency (EFF), Quality (QUAL), Ease (EASE), Competence (COM), Frequency (FREQ), and Timeliness (TR). All pairwise correlations are positive and statistically significant at the 0.01 level, indicating strong internal consistency within the LPI structure.

The highest correlation was observed between LPI and Competence (COM) (τ = 0.873, p < 0.05), followed closely by Efficiency (EFF) (τ = 0.863) and Timeliness (TR) (τ = 0.858). The lowest, albeit still strong, correlation was with Ease (EASE) (τ = 0.767), suggesting it might reflect slightly different logistical dimensions.

These results confirm that the LPI components are strongly interrelated and collectively measure a cohesive latent construct, justifying the use of their aggregate score in regression and FCM modeling.

4.3.2. Correlation Analysis Among WGI and the Six Components of WGI

Table 25 displays Kendall’s tau-b correlation coefficients among the six subcomponents of the Worldwide Governance Indicators (WGI) and the WGI as well: Control of Corruption (CC), Government Effectiveness (GE), Political Stability and Absence of Violence (PV), Rule of Law (RL), Regulatory Quality (RQ), and Voice and Accountability (VA), as well as their relationship with the composite WGI index.

All correlations are positive and highly significant (p < 0.05), indicating strong internal consistency. The strongest associations with the overall WGI score were observed for Rule of Law (τ = 0.862), Regulatory Quality (τ = 0.846), and Government Effectiveness (τ = 0.824). The weakest, yet still substantial, was for Political Stability (τ = 0.669).

These findings suggest that while all six dimensions contribute meaningfully to the overall governance indicator, particular emphasis is placed on institutional effectiveness and rule-based governance. The internal coherence of WGI further justifies its use as a single composite measure in both regression analysis and conceptual modeling frameworks such as FCM.

4.4. Fuzzy Cognitive Map (FCM) Construction

A Fuzzy Cognitive Map was developed to visualize the directional relationships among the variables examined in this study. The structure of the map is based on the strength of associations derived from regression models and Kendall’s tau-b correlations, as summarized in

Table 26.

Table 26.

Coefficients’ FCM.

Table 26.

Coefficients’ FCM.

| Relationship | Method | Coefficient (Standardized β or Kendall’s tau-b) |

|---|

| EPI → LPI | Model 1

Linear Regression | 0.684 |

| SDG → LPI | Model 2

Linear Regression | 0.686 |

| WGI → LPI | Model 3

Linear Regression | 0.823 |

| LPI → GDP | Model 4

Linear Regression | 0.220 |

| EPI → GDP | Model 4

Linear Regression | 0.207 |

| SDG → GDP | Model 4

Linear Regression | 0.215 |

| WGI → GDP | Model 4

Linear Regression | 0.355 |

| EFF → LPI | Correlation Kendall’s tau-b | 0.863 |

| QUAL → LPI | Correlation Kendall’s tau-b | 0.836 |

| EASE → LPI | Correlation Kendall’s tau-b | 0.767 |

| COM → LPI | Correlation Kendall’s tau-b | 0.873 |

| FREQ → LPI | Correlation Kendall’s tau-b | 0.813 |

| TR → LPI | Correlation Kendall’s tau-b | 0.858 |

| WGI CC → WGI | Correlation Kendall’s tau-b | 0.836 |

| WGI GE → WGI | Correlation Kendall’s tau-b | 0.824 |

| WGI PV → WGI | Correlation Kendall’s tau-b | 0.669 |

| WGI RL → WGI | Correlation Kendall’s tau-b | 0.862 |

| WGI RQ → WGI | Correlation Kendall’s tau-b | 0.846 |

| WGI VA → WGI | Correlation Kendall’s tau-b | 0.715 |

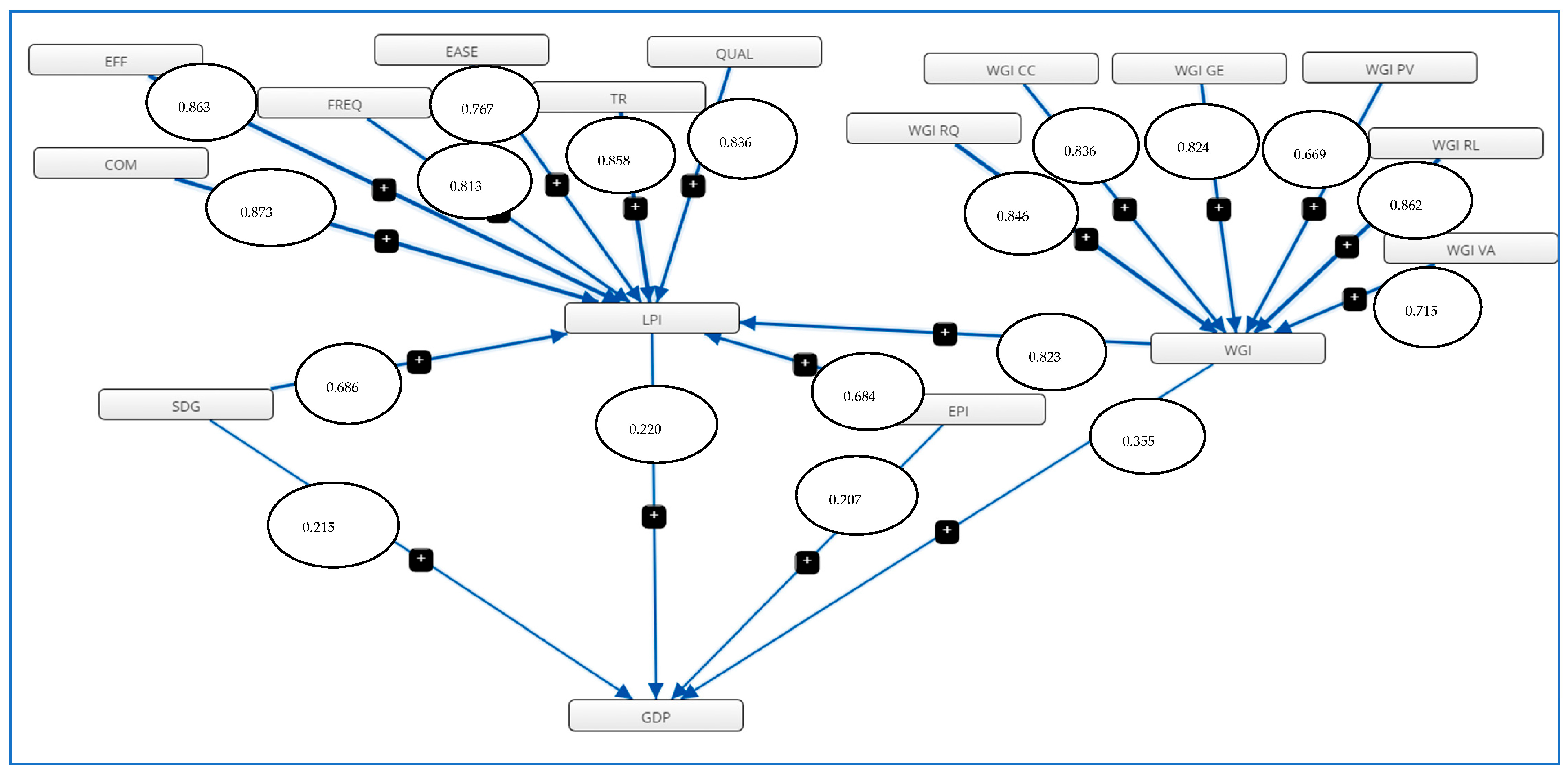

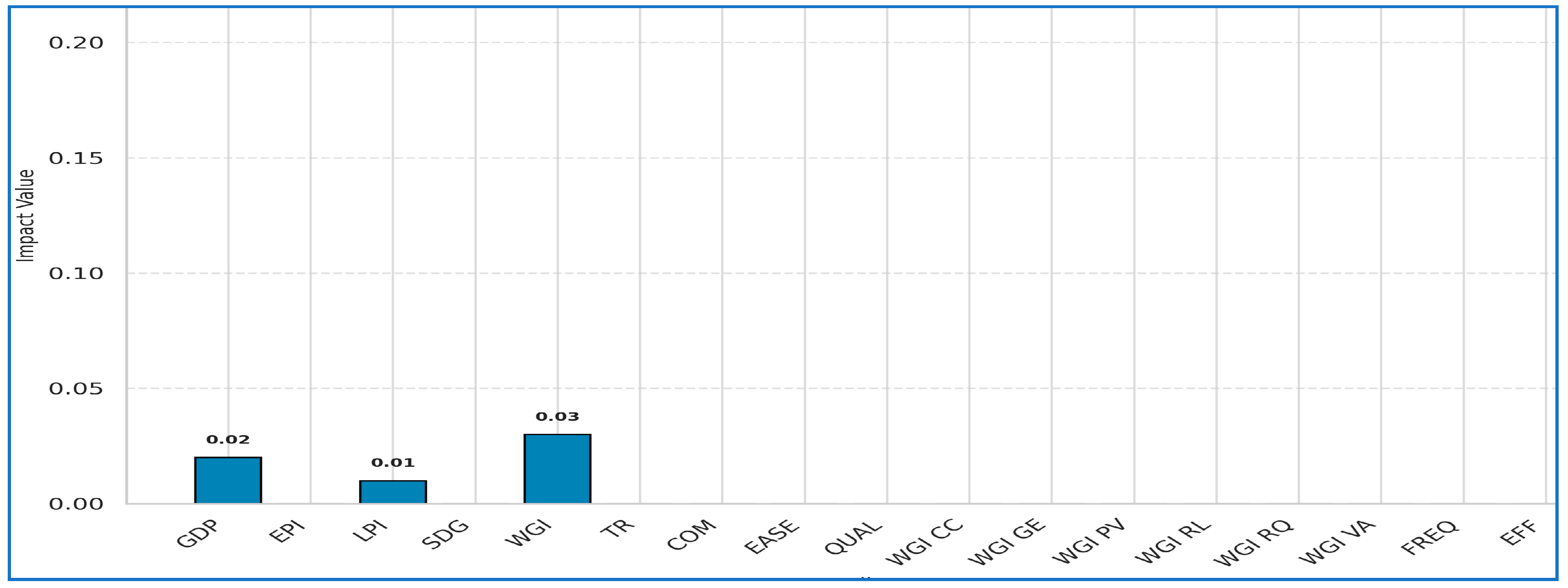

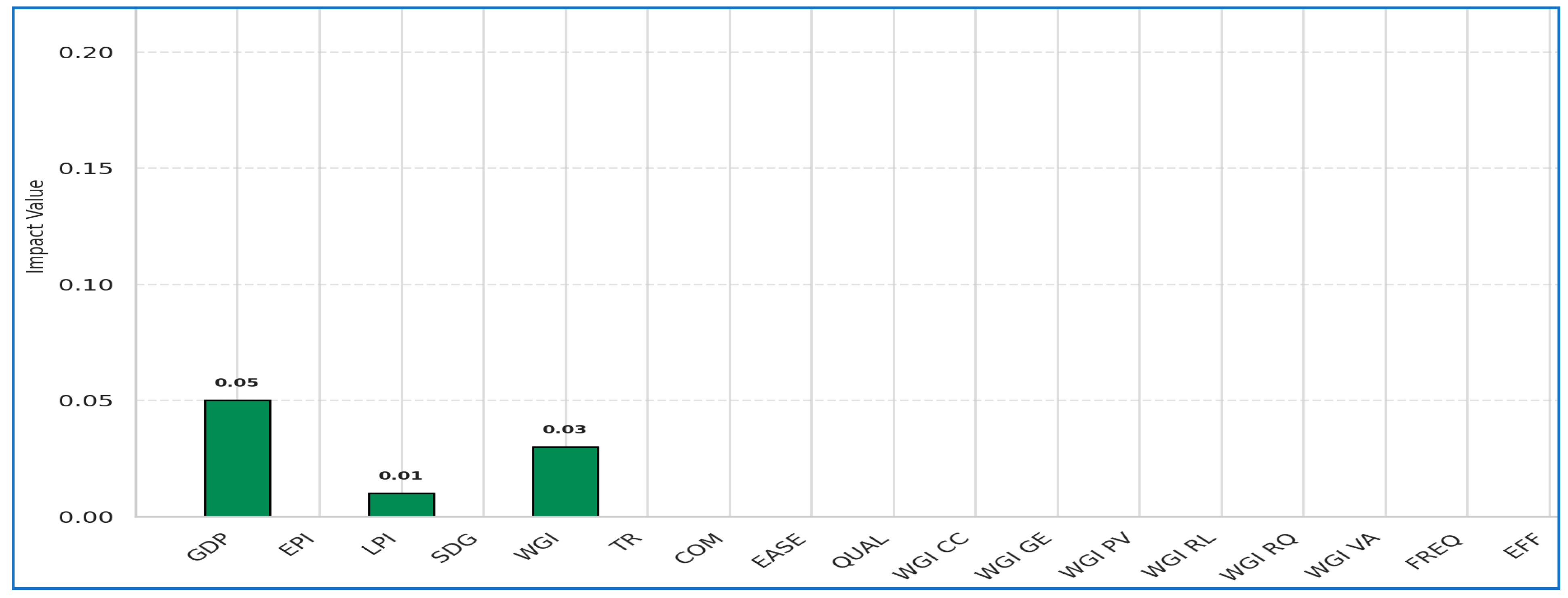

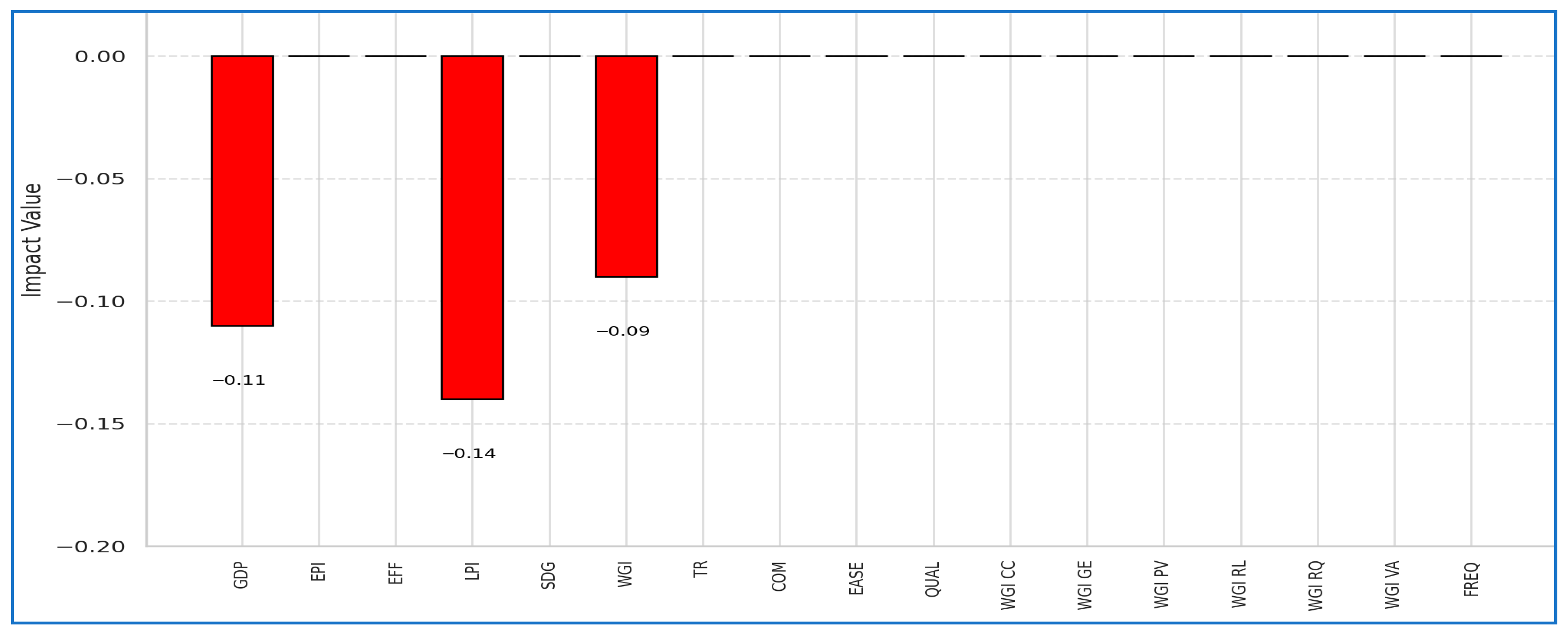

The Fuzzy Cognitive Map (FCM) above (

Figure 8) represents the systemic relationships among the key variables analyzed in this study, with GDP per capita serving as the model’s main output. The LPI (Logistics Performance Index) acts as a moderator, receiving influence from both its six internal components (EFF, QUAL, EASE, COM, FREQ, TR) and from three higher-level inputs: EPI (Environmental Performance Index), SDG Index, and WGI (Worldwide Governance Indicators). These three indicators also exert a direct influence on GDP, independently of LPI. Meanwhile, WGI itself is a composite construct, shaped by six sub-dimensions of governance (CC, GE, PV, RL, RQ, VA).

Figure 8 illustrating the causal relationships among the study variables. Blue arrows indicate directional causal links between variables, where the arrow points from the influencing variable to the affected variable. Each arrow represents a positive causal relationship, meaning that an increase in the originating variable leads to an increase in the target variable. The “+” symbols denote these reinforcing (positive) effects within the system. The thickness of the arrows reflects the relative strength of influence, as derived from the standardized regression and correlation coefficients. All causal relationships in the model are positive, and the weights applied to each connection are drawn directly from

Table 26, based on standardized beta coefficients and Kendall’s tau-b correlations. Arrows in the diagram indicate the direction of influence, and the numerical weights quantify the strength of each effect. This model can function as a scenario analysis tool, enabling users to adjust input parameters (e.g., governance scores, environmental metrics) and simulate how these changes might influence GDP, both directly and indirectly, through logistics performance.