What Is the Evolution of Convergence in the EU? Decomposing EU Disparities up to NUTS 3 Level

Abstract

1. Introduction

2. Convergence Concepts and Brief Summary of Existing Empirical Evidence Concerning the EU

3. Methodology and Data

- Gini coefficient (G), which is more sensitive when changes in inequality appear around the median;

- Atkinson’s index (A), where weights to gaps between incomes in lower or upper tails of the distribution are assigned through the “aversion to inequality”;

- Theil index (T) that gives equal weights across the distribution;

- Mean logarithmic deviation (MLD), which is more sensitive to changes at the lower end of the distribution, while CV is more responsive to changes in the upper end of the distribution.

T(total disparities between countries) + T(total within countries disparities at NUTS 2 level) + T(total within NUTS 2 disparities at NUTS 3 level)

4. Empirical Findings

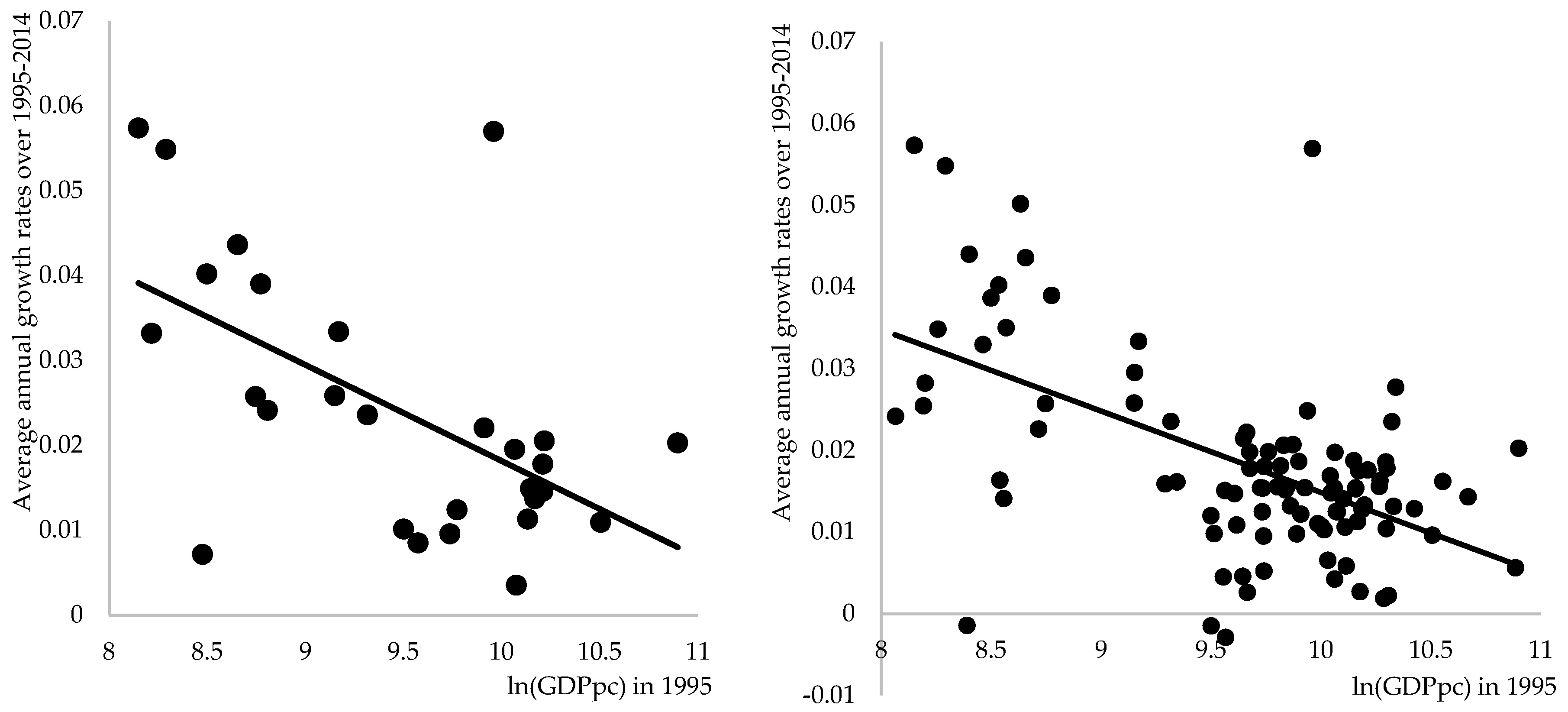

4.1. β-Convergence in the EU

- Convergence in the EU is still present at the different regional levels, but the speed of it is slowing down and during 2010–2014 it was already less than 1%, except for the convergence among countries, indicating that we are quite far away from the “legendary 2%” level.

- As we turn the analysis of convergence to smaller regional units, the speed of convergence becomes slower. These differences are not so huge at the beginning of the analyzed period but become very sharp over the last five analyzed years.

- Convergence between more similar regions is faster, which contradicts the core idea of β-convergence and suggests convergence clubs. This was detected after excluding just the top one percentile and bottom one percentile of the regions according to their average per capita GDP.

- Estimated speed of conditional convergence is slightly faster compared to one estimated using the absolute β-convergence model. Urban and capital regions were growing faster, costal and rural regions were lagging. The effect of these factors on growth is mixed over time.

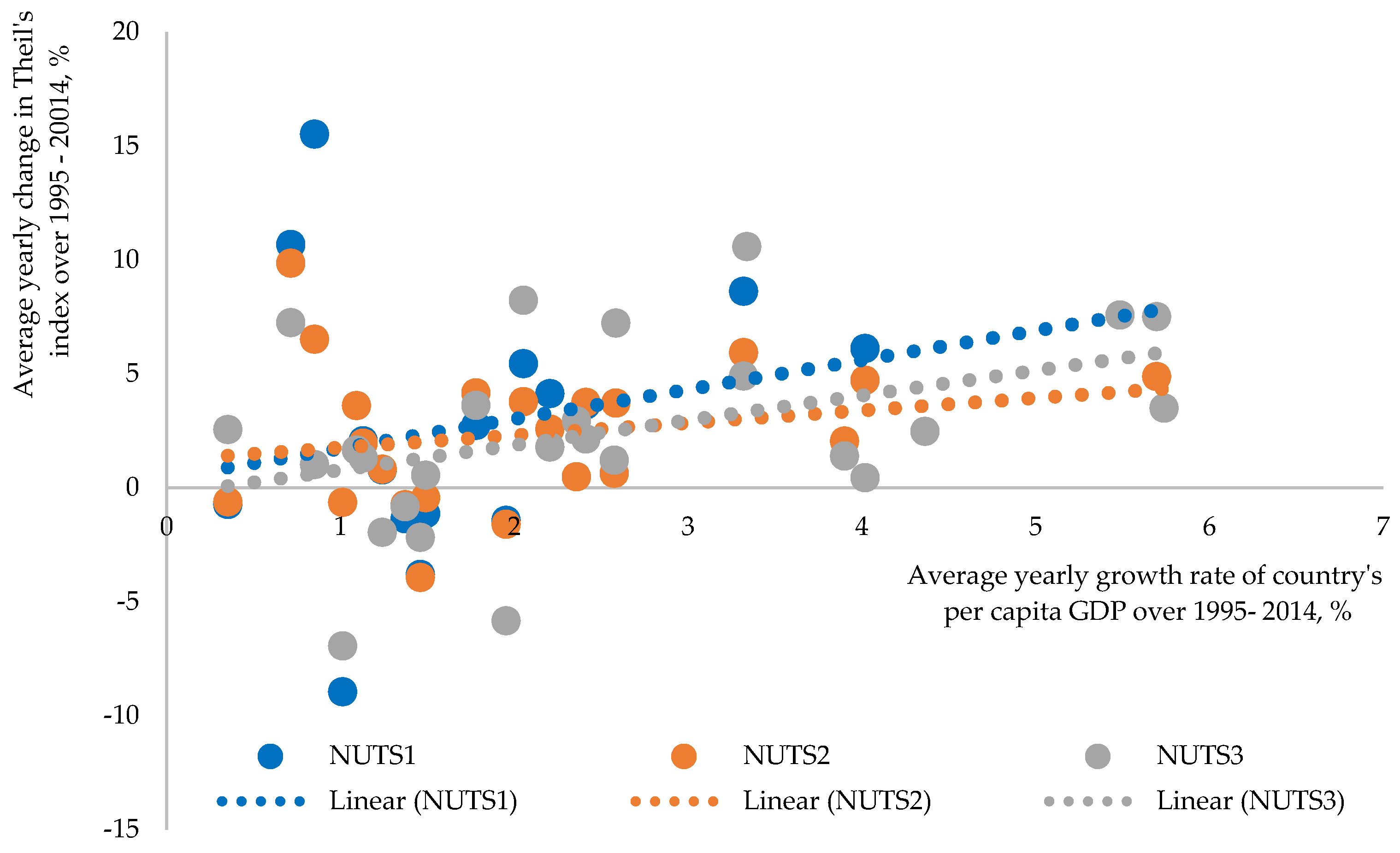

4.2. Analysis of σ-Convergence in the EU

- The clear evidence of convergence between territories at all levels was just for the period 2000–2009, with rather mixed results for the periods before and after that;

- The disparities become sharper and convergence less clear as we analyze smaller territorial units;

- For the period when convergence was detected, it was mainly present due to poor territories becoming richer, for the period when divergence was detected it was present not just due to poor regions becoming even poorer but also due to richer regions becoming even richer.

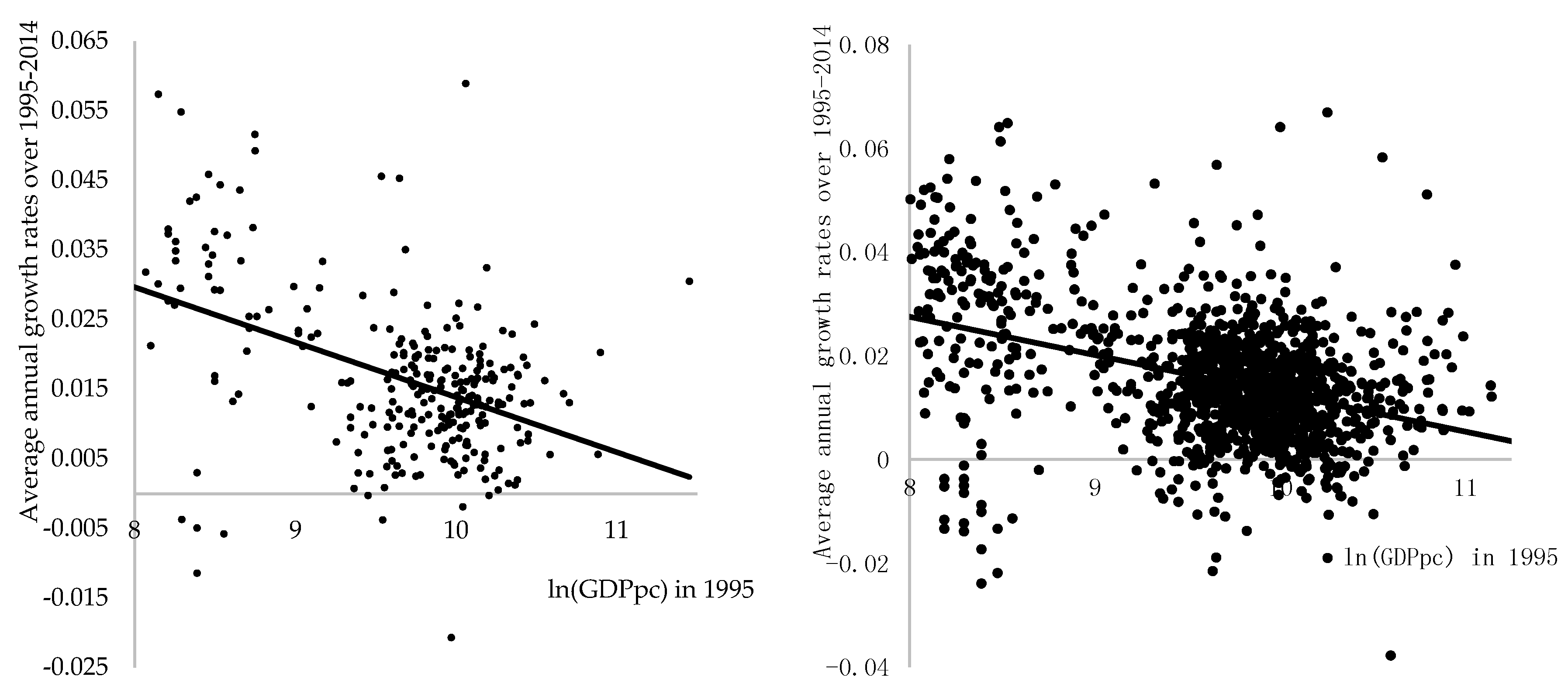

4.3. Decomposing Inequalities in the EU

- Divergence in the EU during 1995–2000 was present because of increasing within-country disparities mainly at the NUTS 2 level;

- Disparities in the EU during 2000–2009 were decreasing mainly because of reducing disparities between member states;

- Convergence in the EU is not present anymore because disparities between countries are stagnating;

- The part of EU disparities that can be attributed to within-country disparities increased and now account for almost two-fifths of them;

- In the majority of EU member states, old and new, within-country disparities were growing at all regional levels, thus bringing into the question the efficiency of EU’s Regional Policy.

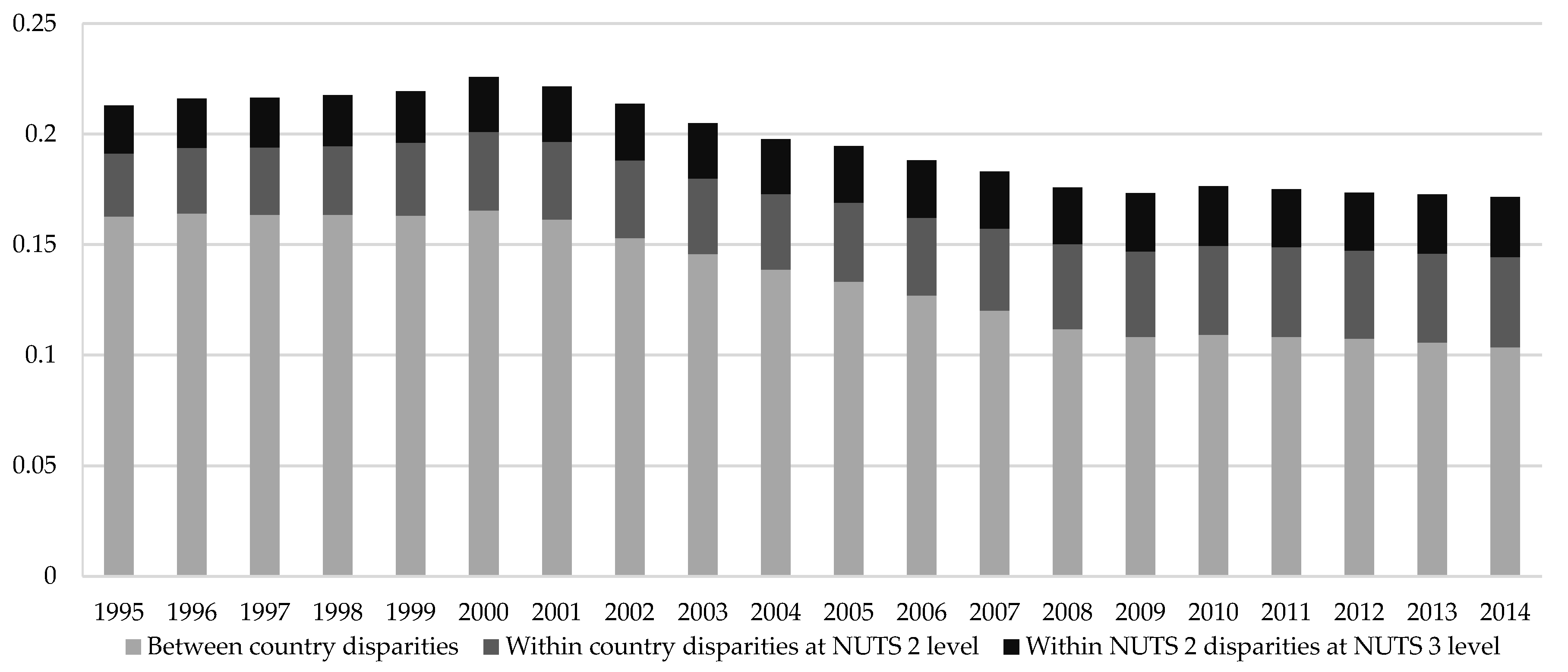

4.4. The Nexus between Growth, Sustainability, Innovation/Technology, and Regional Disparities

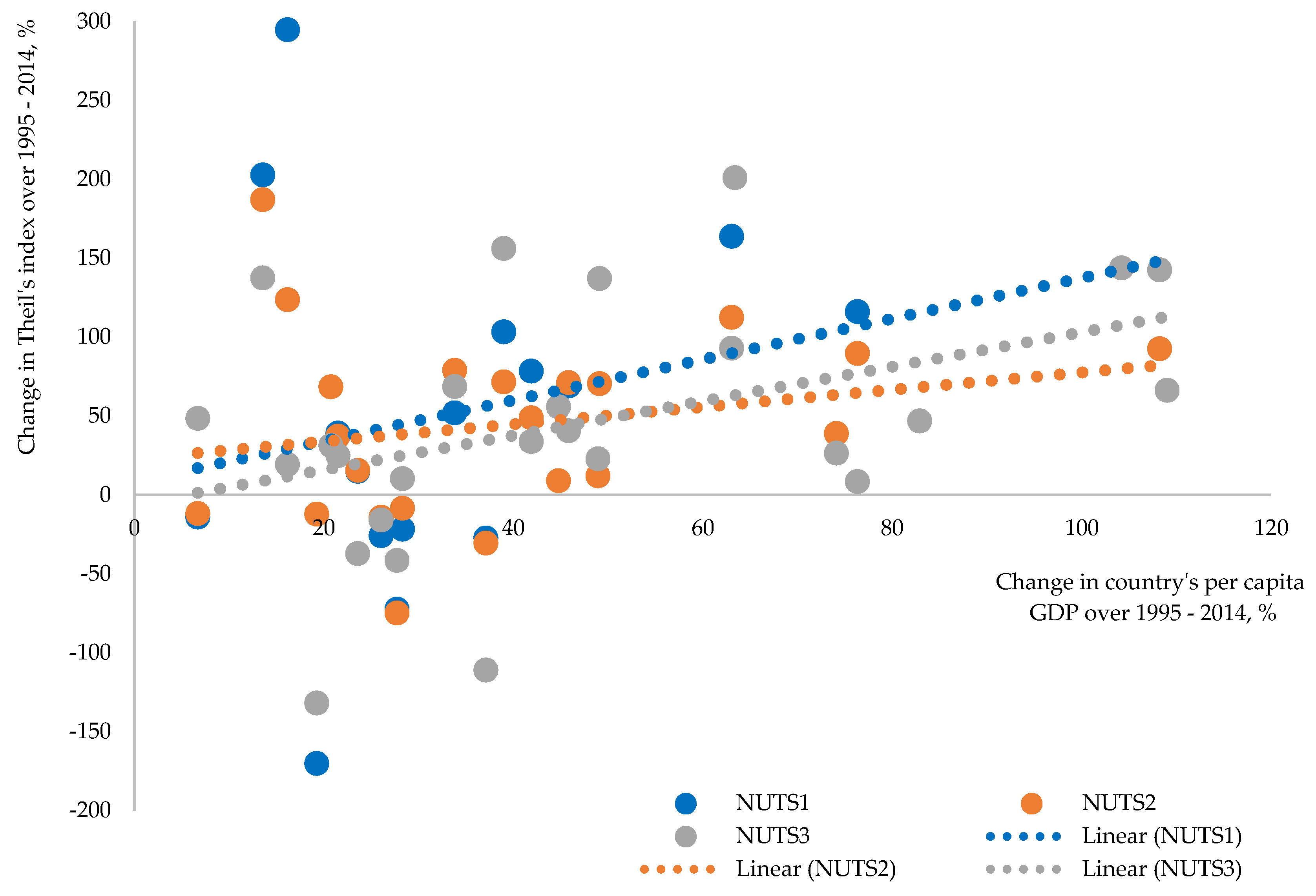

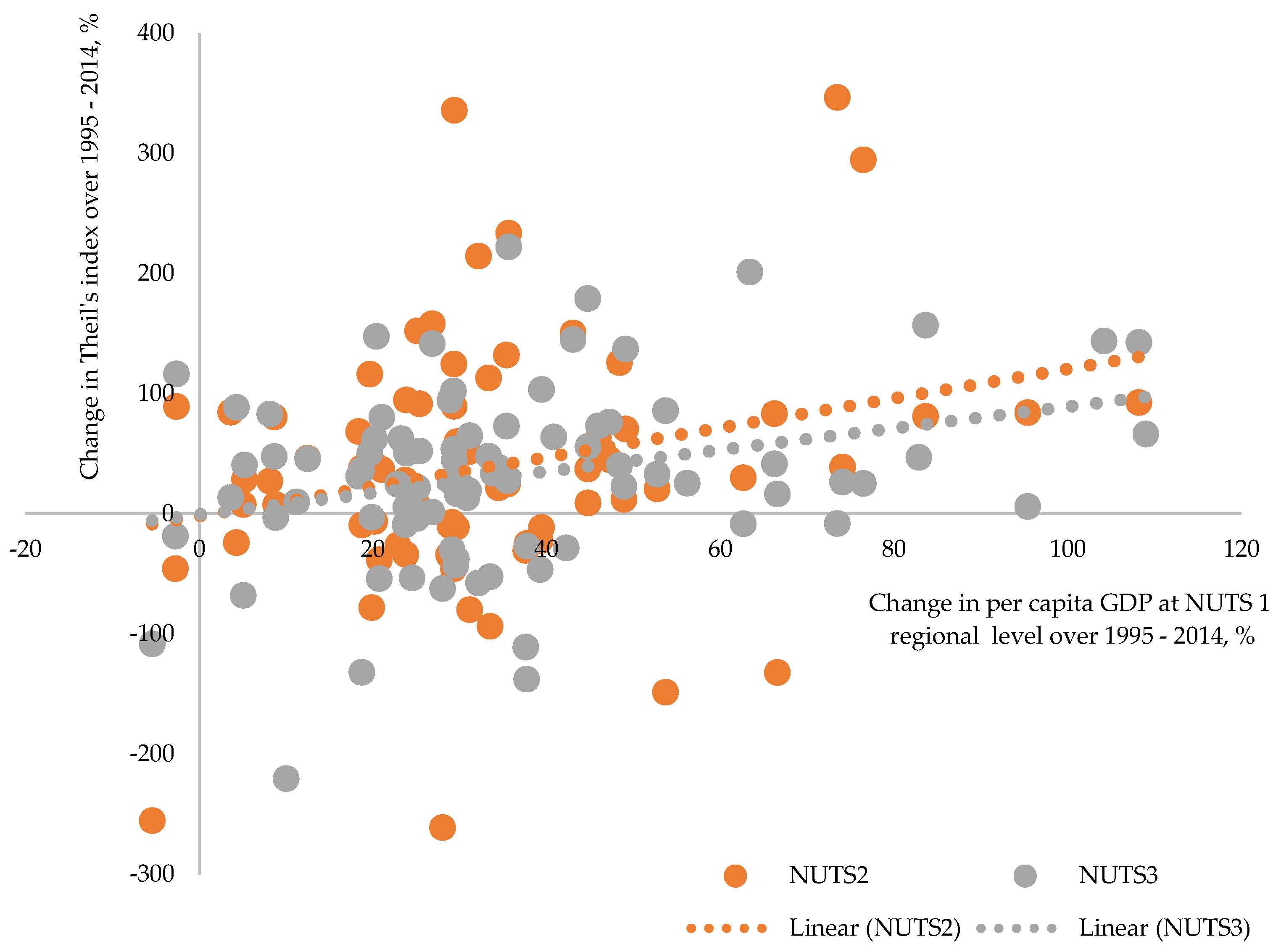

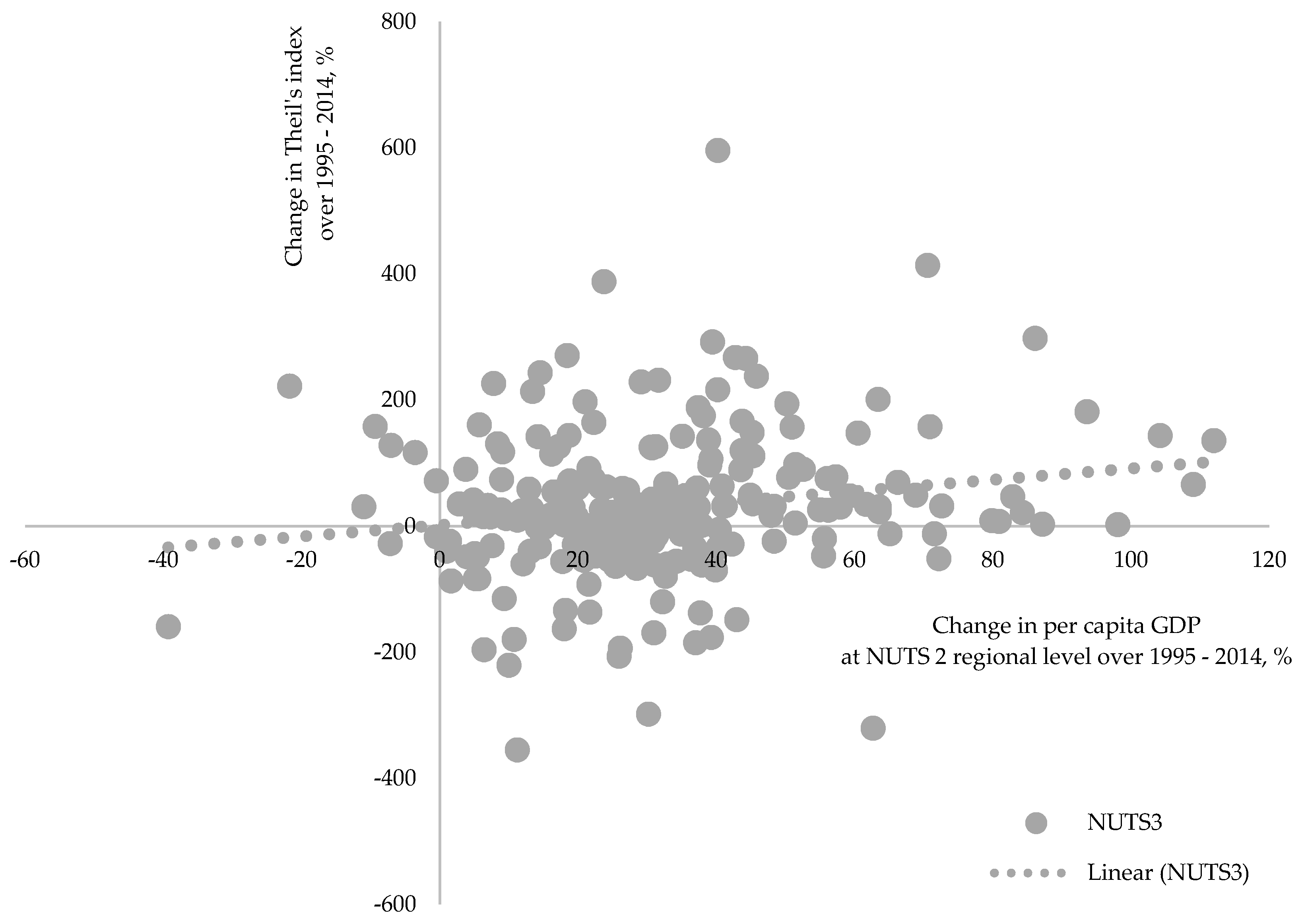

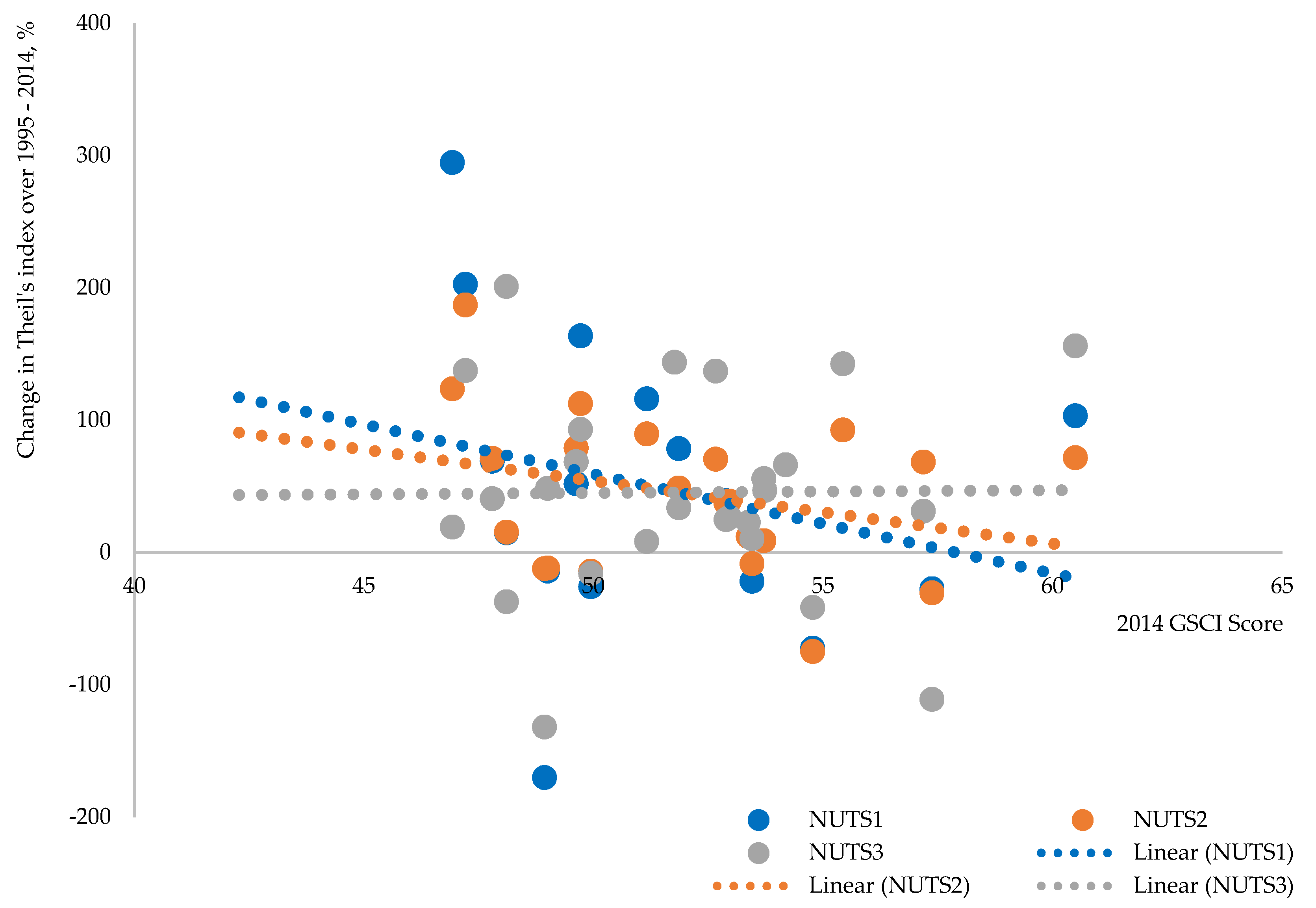

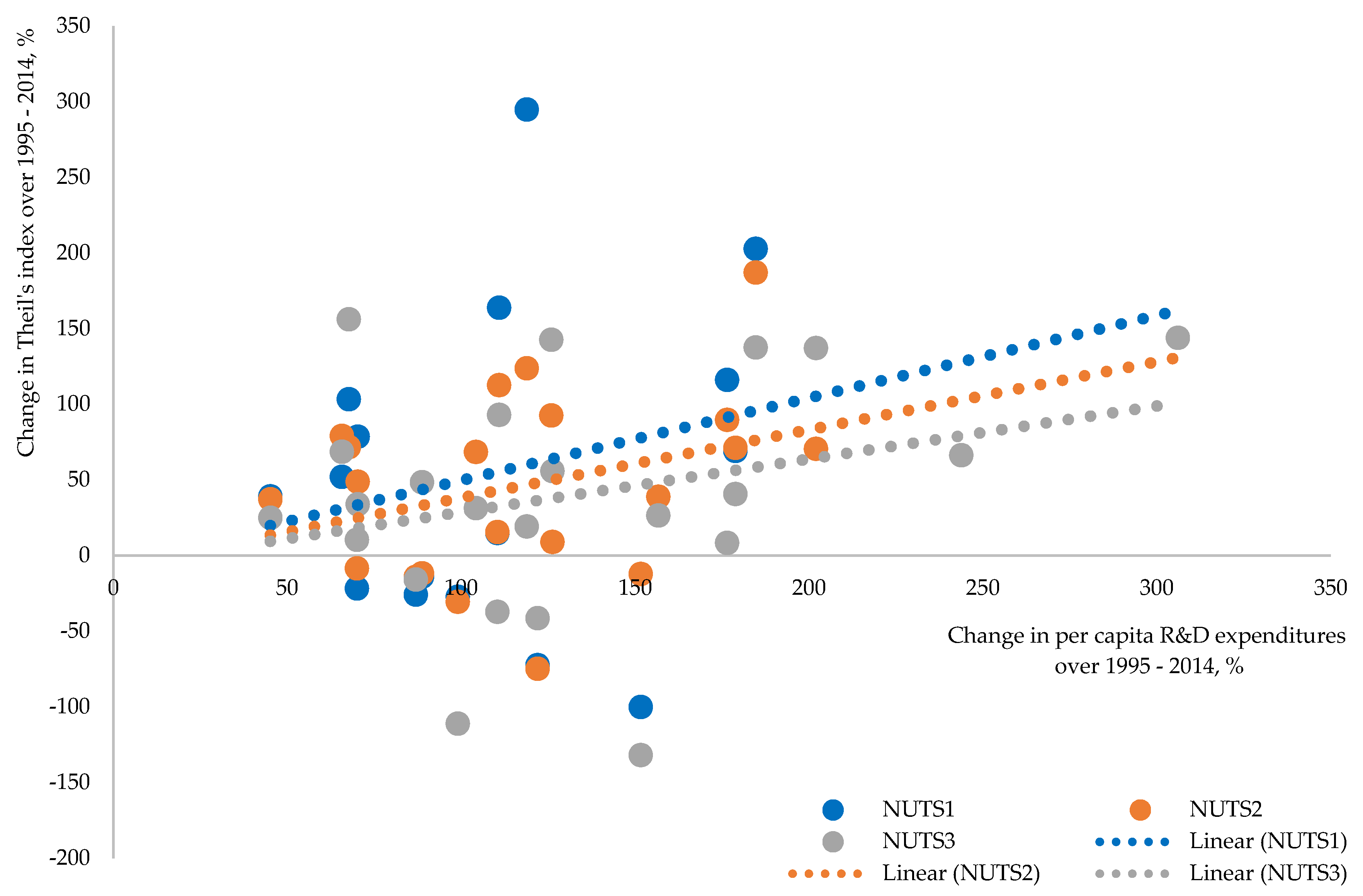

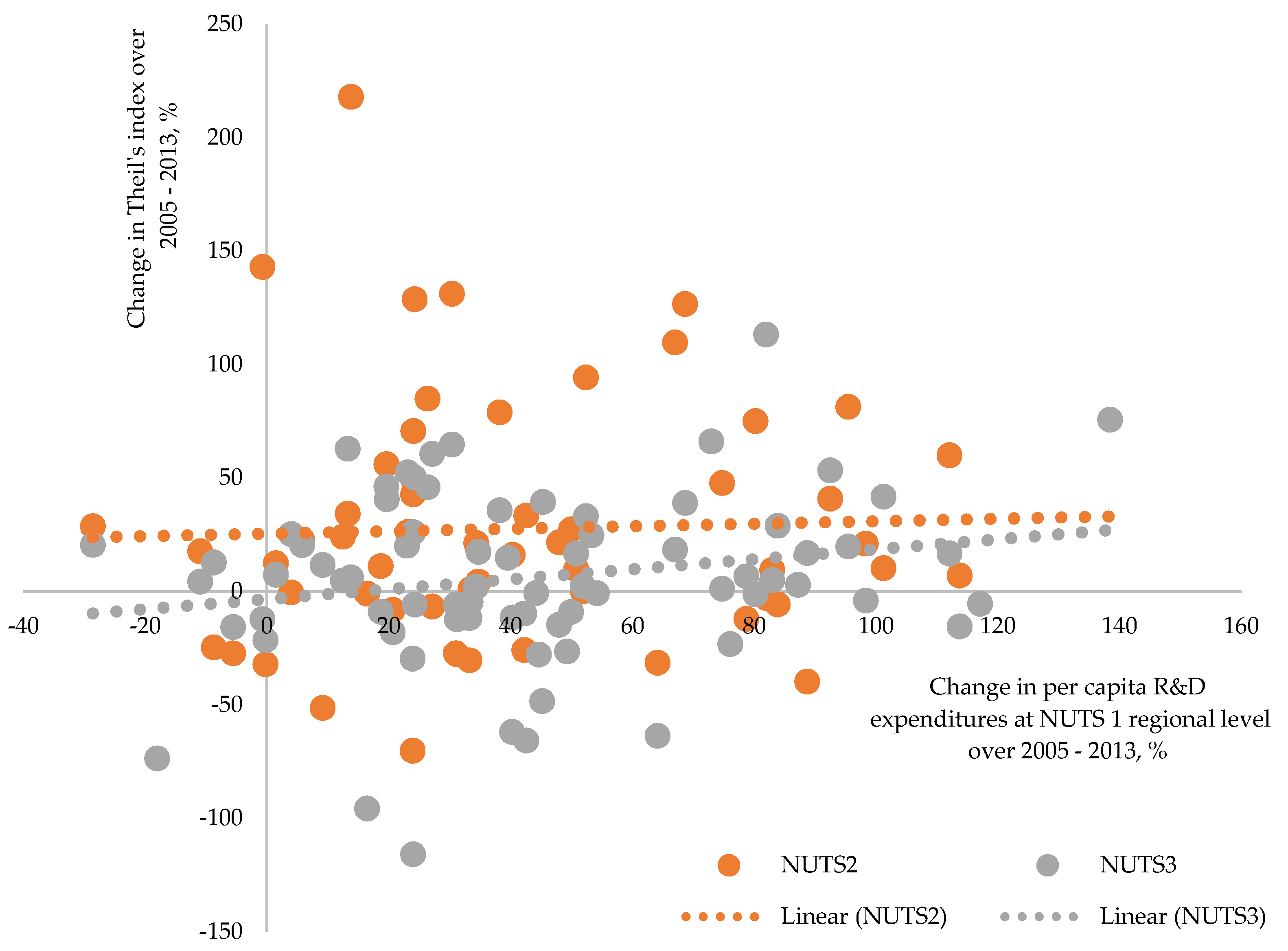

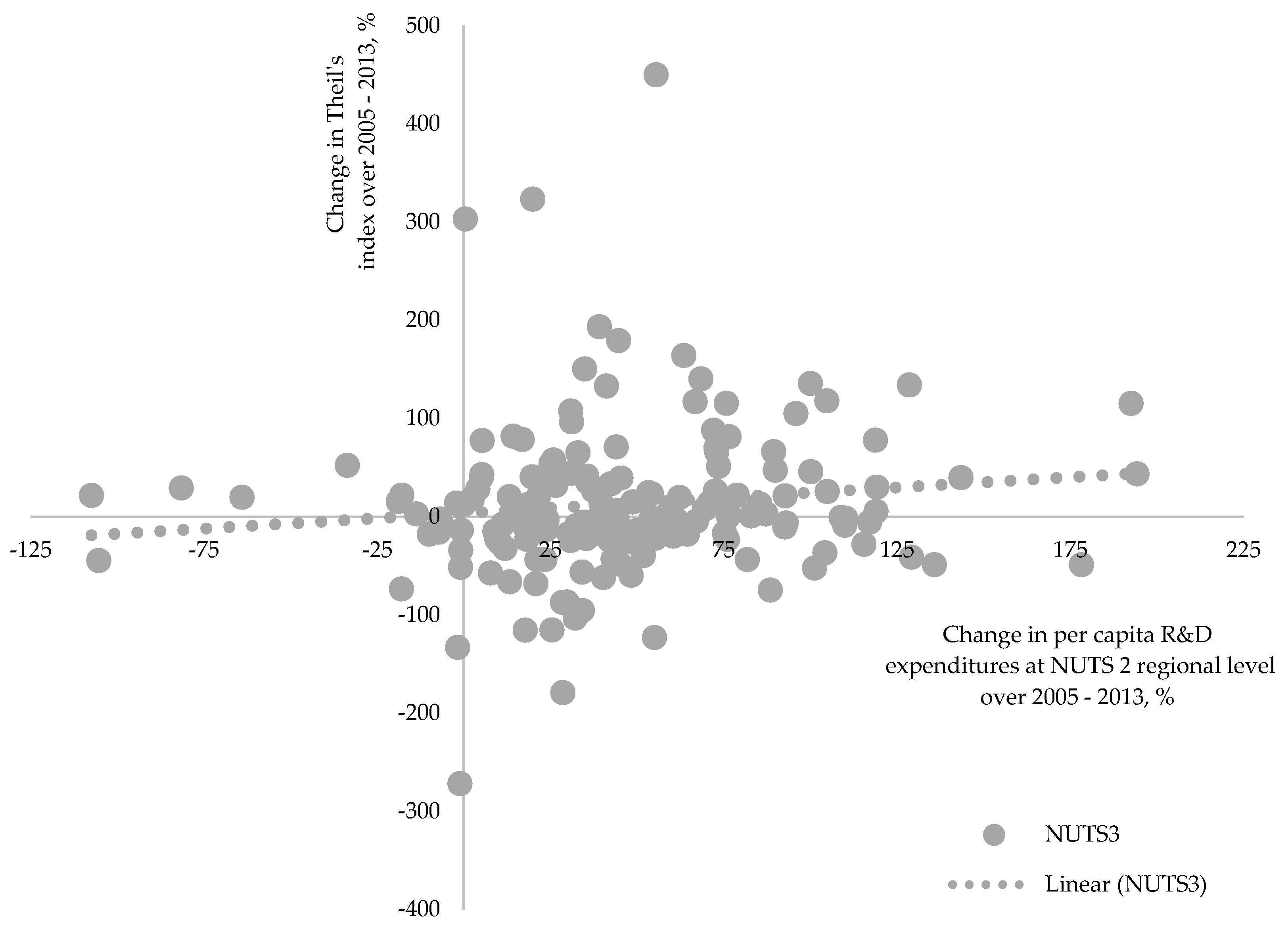

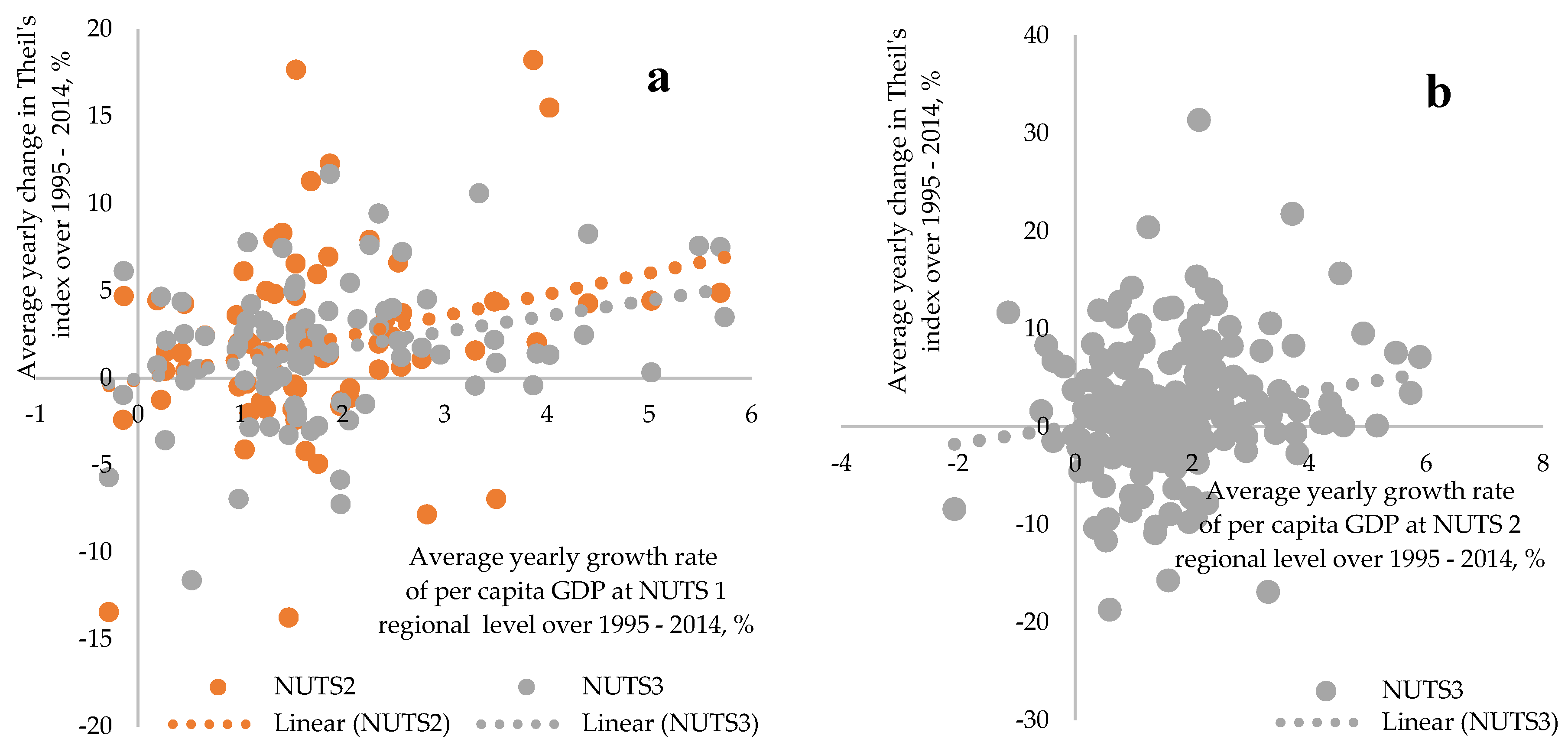

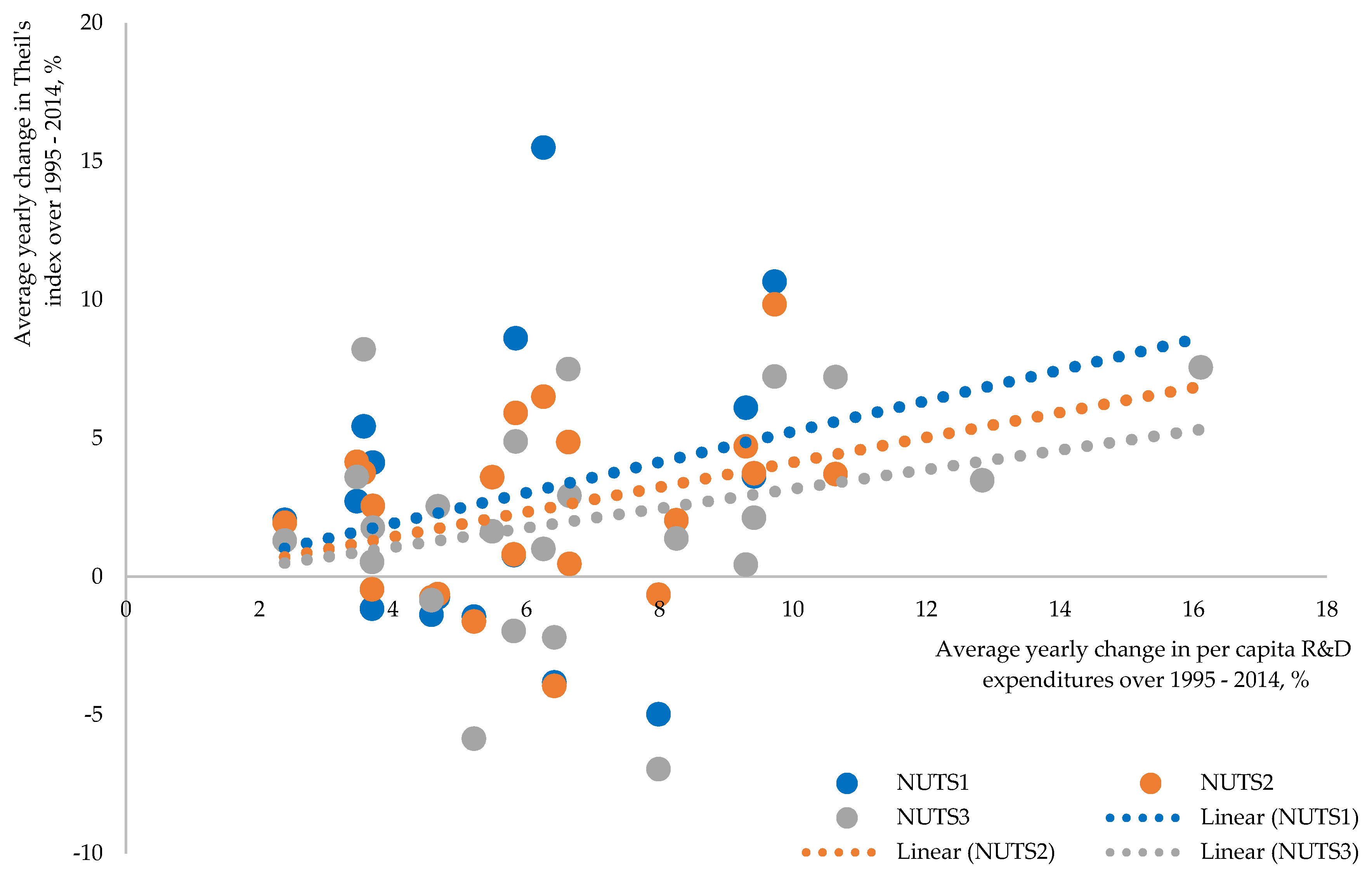

- Economic growth in the EU is geographically unbalanced, i.e., growth rates in countries and regions positively correlate with the increasing within-country and within-region inequalities, implying that faster growth probably leads to bigger spatial differences.

- The development of innovations and technologies being one of the main growth factors and characterized as spatially concentrated activities could be a potential cause of observed positive correlation between growth and increasing territorial disparities.

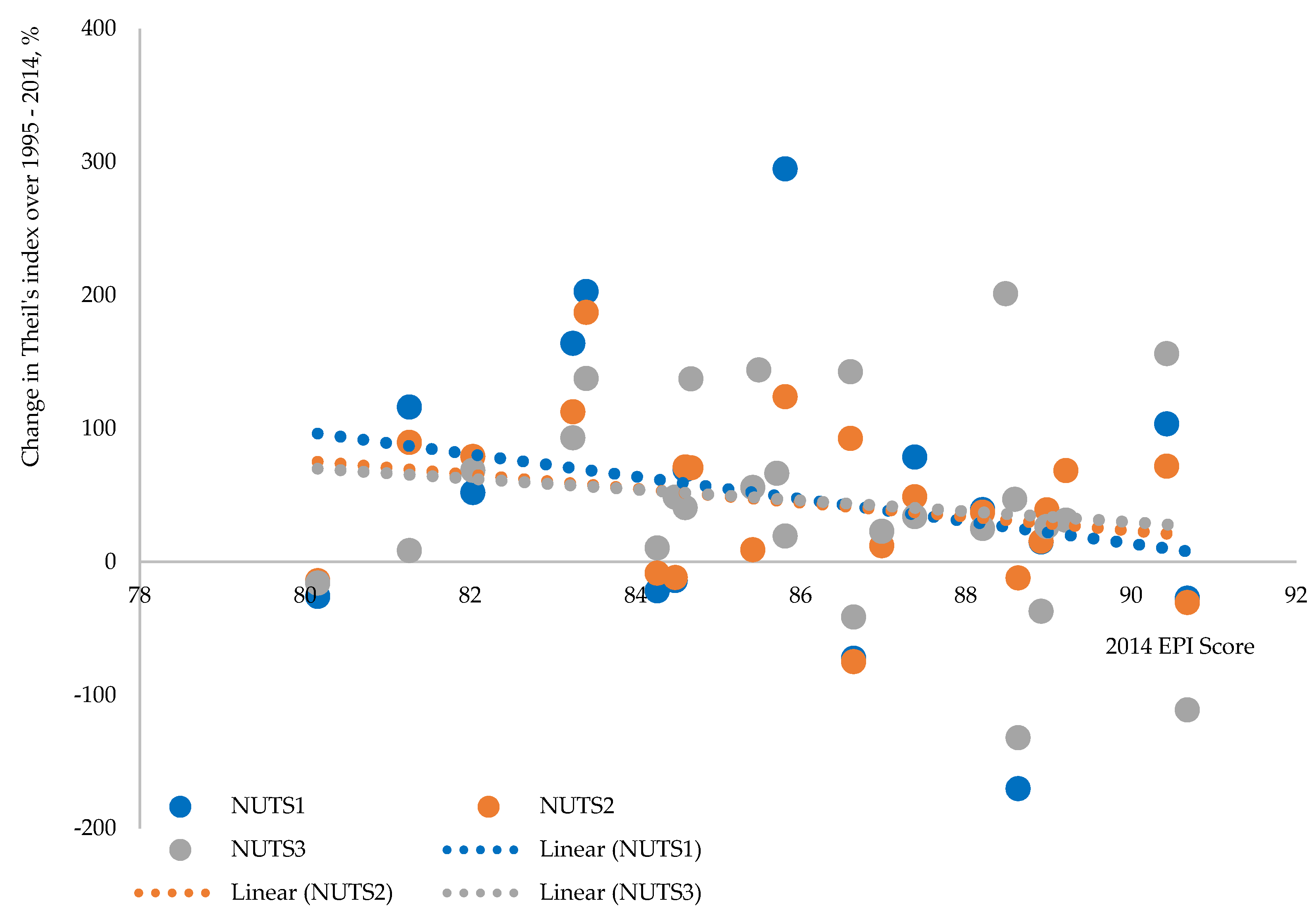

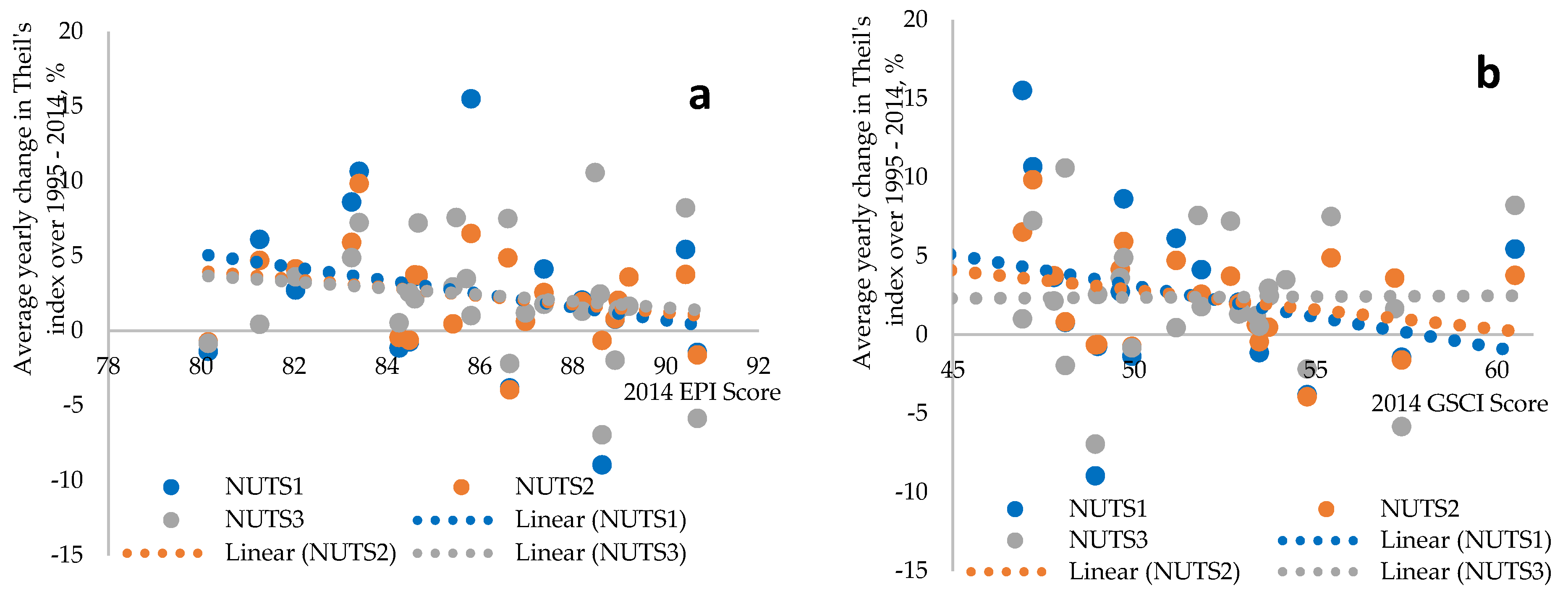

- Countries’ sustainability is negatively correlated with within-country disparities, implying that actions taken to promote sustainable growth were also in line with promoting more spatially balanced growth.

5. Conclusions

Supplementary Materials

Author Contributions

Funding

Conflicts of Interest

Appendix A. Commonly Used σ-Convergence Indices and Their Properties

- Mean or income scale independence—measure should not be affected by the proportional increase or decrease of per capita GDP in all regions.

- Population size independence—measure should not be affected by the proportional change in population, ceteris paribus.

- Symmetry—measure should not be affected by the swap in incomes between the two persons.

- Pigou-Dalton Transfer sensitivity—the income transfer from rich to poor should reduce inequality measured by the index.

- Decomposability—it is possible to break down inequality index by dimensions like population groups or income sources or other.

| Full Name | Short Name | Formula | Satisfaction of the Criteria | ||||

|---|---|---|---|---|---|---|---|

| Mean Independence | Population Size Independence | Symmetry | Pigou-Dalton Transfer Sensitivity | Decomposability | |||

| Coefficient of variation | CV (1) | , where and is the weight of the region acording to population size | + | + | + | + | |

| Gini coefficient | G (1) | Formally, let xi be a point on the X-axis, and yi a point on the Y-axis. | + | + | + | + | |

| Theil T index or simply Theil index | T (2) | + | + | + | + | + | |

| Theil L index or simply mean logarithmic deviation | MLD (2) | + | + | + | + | + | |

Appendix B. Decomposition of the Theil Index

T(total disparities between NUTS 1 regions) + T(total within NUTS 1 disparities at NUTS 2 level) + T(total within NUTS 2 disparities at NUTS 3 level)

Appendix C. Computation and Estimation Results

| Period | OLS Estimates | WLS Estimates | ||||

|---|---|---|---|---|---|---|

| NUTS0 n = 28 | NUTS0 (1) n = 28 | NUTS0 (2) n = 28 | ||||

| β1·100 (t-Stat) | Half-Life | β1·100 (t-Stat) | Half-Life | β1·100 (t-Stat) | Half-Life | |

| 1995–2014 | −1.1310 *** (−3.579) | 60.9 | −1.1926 *** (−3.026) | 57.8 | −1.2515 *** (−5.072) | 55.0 |

| 1995–2004 | −0.7411 (−1.280) | −1.2699 * (−1.856) | −0.8422 * (−1.960) | |||

| 2005–2014 | −1.3615 *** (−4.222) | 50.6 | −1.0962 ** (−2.106) | 62.9 | −1.6690 *** (−4.711) | 41.2 |

| 1995–1999 | 0.5652 (0.5428) | −0.5598 (−0.6001) | 0.2804 (0.3427) | |||

| 2000–2004 | −2.2152 *** (−4.937) | 30.9 | −1.9133 *** (−3.197) | 35.9 | −2.3205 *** (−6.456) | 29.5 |

| 2005–2009 | −1.8856 *** (−6.031) | 36.4 | −2.2222 *** (−4.545) | 30.8 | −2.6250 *** (−7.764) | 26.1 |

| 2010–2014 | −1.2476 ** (−2.063) | 55.2 | −0.0598 (−0.079) | −1.1276 ** (−2.090) | 61.1 | |

| 2000–2006 | −2.2753 *** (−5.294) | 30.1 | −1.8528 *** (−3.530) | 37.1 | −2.2685 *** (−7.351) | 30.2 |

| 2007–2013 | −1.1469 *** (−2.837) | 60.1 | −0.8392 (−1.266) | −1.4296 ** (−3.025) | 48.1 | |

| Period | OLS Estimates | WLS Estimates | ||||||

|---|---|---|---|---|---|---|---|---|

| NUTS1 n = 98 | NUTS1 n = 96 (1) | NUTS1 (2) n = 98 | NUTS1 (3) n = 98 | |||||

| β1·100 (t-Stat) | Half-Life | β1·100 (t-Stat) | Half-Life | β1·100 (t-Stat) | Half-Life | β1·100 (t-Stat) | Half-Life | |

| 1995–2014 | −0.9957 *** (−6.615) | 69.3 | −1.1354 *** (−7.744) | 60.7 | −0.8992 *** (−4.317) | 76.7 | −1.0647 *** (−7.255) | 64.8 |

| 1995–2004 | −0.6580 ** (−2.622) | 105.0 | −0.9103 *** (−3.859) | 75.8 | −1.0130 *** (−2.976) | 68.1 | −0.6933 *** (−2.986) | 99.6 |

| 2005–2014 | −1.2757 *** (−6.398) | 54.0 | −1.3661 *** (−6.430) | 50.4 | −0.6915 *** (−2.637) | 99.9 | −1.3807 *** (−6.895) | 49.9 |

| 1995–1999 | 0.4141 (0.9090) | −0.0741 (−0.1831) | −0.3768 (−0.8123) | 0.3392 (0.8121) | ||||

| 2000–2004 | −2.0894 *** (−9.629) | 32.8 | −2.2117 *** (−9.651) | 31.0 | −1.7274 *** (−5.812) | 39.8 | −2.1336 *** (−10.64) | 32.1 |

| 2005–2009 | −1.9637 *** (−8.527) | 35.0 | −2.1537 *** (−8.928) | 31.8 | −1.5998 *** (−5.432) | 43.0 | −2.2098 *** (−9.381) | 31.0 |

| 2010–2014 | −0.9494 *** (−3.166) | 72.7 | −0.9434 *** (−2.906) | 73.1 | 0.0523 0.1505 | −0.9333 *** (−3.370) | 73.9 | |

| 2000–2006 | −2.0790 *** (−10.45) | 33.0 | −2.2070 *** (−10.55) | 31.1 | −1.7034 *** (−6.477) | 40.3 | −2.1040 *** (−11.58) | 32.6 |

| 2007–2013 | −0.9806 *** (−3.763) | 70.3 | −0.9918 *** (−3.511) | 69.5 | −0.4105 (−1.270) | −1.1446 *** (−4.579) | 60.2 | |

| Period | β1·100 (t-Stat) | Half-Life | R-Squared | Dummies | |

|---|---|---|---|---|---|

| Capital (1) | Country | ||||

| 1995–2014 | −0.9957 *** (−6.615) | 69.3 | 0.313 | ||

| 1995–2014 | −0.955 *** (−6.958) | 72.3 | 0.438 | 0.9455 *** (4.584) | |

| 1995–2014 | −0.4370 (−1.627) | 0.900 | 0.6541 *** (4.259) | 27 country dummies (2) | |

| 1995–2004 | −0.6580 ** (−2.622) | 105.0 | 0.067 | ||

| 1995–2004 | −0.5962 ** (−2.554) | 115.9 | 0.205 | 1.4241 *** (4.059) | |

| 1995–2004 | −0.1155 (−0.2729) | 0.878 | 0.7671 *** (3.171) | 27 country dummies (2) | |

| 2005–2014 | −1.2757 *** (−6.298) | 54.0 | 0.299 | ||

| 2005–2014 | −1.2908 *** (−6.546) | 53.4 | 0.323 | 0.5137 * (1.823) | |

| 2005–2014 | −0.5570 ** (−2.117) | 124.1 | 0.933 | 0.4554 *** (2.746) | 27 country dummies (2) |

| 1995–1999 | 0.4141 (0.9090) | 0.009 | |||

| 1995–1999 | 0.4638 (1.026) | 0.037 | 1.1456 * (1.685) | ||

| 1995–1999 | 0.2346 (0.3596) | 0.907 | 0.4460 (1.196) | 27 country dummies (2) | |

| 2000–2004 | −2.0894 *** (−9.629) | 32.8 | 0.491 | ||

| 2000–2004 | −2.0827 *** (−10.23) | 32.9 | 0.556 | 1.2013 *** (3.736) | |

| 2000–2004 | −0.9063 * (−1.992) | 0.894 | 0.1093 (0.3763) | 27 country dummies (2) | |

| 2005–2009 | −1.9637 *** (−8.527) | 35.0 | 0.431 | ||

| 2005–2009 | −1.9894 *** (−8.918) | 34.5 | 0.473 | 0.8731 *** (2.739) | |

| 2005–2009 | −1.2438 *** (−2.715) | 55.4 | 0.876 | 1.2708 *** (4.402) | 27 country dummies (2) |

| 2010–2014 | −0.9494 *** (−3.166) | 72.7 | 0.095 | ||

| 2010–2014 | −0.9681 *** (−3.219) | 71.3 | 0.103 | 0.3760 (0.9396) | |

| 2010–2014 | −0.2248 (−0.5962) | 0.914 | −0.1433 (−0.5964) | 27 country dummies (2) | |

| 2000–2006 | −2.0790 *** (−10.45) | 33.0 | 0.532 | ||

| 2000–2006 | −2.0712 *** (−11.64) | 33.1 | 0.630 | 1.4045 *** (5.000) | |

| 2000–2006 | −0.9933 ** (−2.368) | 69.4 | 0.902 | 0.3705 (1.384) | 27 country dummies (2) |

| 2007–2013 | −0.9806 *** (−3.763) | 70.3 | 0.129 | ||

| 2007–2013 | −0.9800 *** (−3.732) | 70.4 | 0.129 | −0.0121 (−0.03384) | |

| 2007–2013 | −0.5108 (−1.515) | 0.915 | 0.3080 (1.448) | 27 country dummies (2) | |

| Period | OLS Estimates | WLS Estimates | ||||||

|---|---|---|---|---|---|---|---|---|

| NUTS2 n = 276 | NUTS2 n = 270 (1) | NUTS2 (2) n = 276 | NUTS2 (3) n = 276 | |||||

| β1·100 (t-Stat) | Half-Life | β1·100 (t-Stat) | Half-Life | β1·100 (t-Stat) | Half-Life | β1·100 (t-Stat) | Half-Life | |

| 1995–2014 | −0.7910 *** (−8.2072) | 87.3 | −0.9832 *** (−10.48) | 70.1 | −0.6963 *** (−5.653) | 99.2 | −0.9993 *** (−11.11) | 69.0 |

| 1995–2004 | −0.4319 *** (−2.6909) | 160.1 | −0.7389 *** (−4.854) | 93.5 | −0.8957 *** (−4.537) | 77.0 | −0.6582 *** (−4.544) | 105.0 |

| 2005–2014 | −1.0978 *** (−8.3578) | 62.8 | −1.2489 *** (−8.860) | 55.2 | −0.4328 *** (−2.798) | 159.8 | −1.3110 *** (−10.88) | 52.5 |

| 1995–1999 | 0.8794 *** (2.9251) | 0.1550 (0.6151) | −0.1470 (−0.5463) | 0.4268 1.617 | ||||

| 2000–2004 | −1.8170 *** (−13.6779) | 37.8 | −1.8980 *** (−13.23) | 36.2 | −1.5115 *** (−8.516) | 45.5 | −2.0335 *** (−16.22) | 33.7 |

| 2005–2009 | −1.7763 *** (−11.5163) | 38.7 | −2.0465 *** (−12.55) | 33.5 | −1.1304 *** (−6.058) | 61.0 | −2.0938 *** (−14.17) | 32.8 |

| 2010–2014 | −0.7705 *** (−4.2016) | 89.6 | −0.8309 *** (−4.133) | 83.1 | 0.1335 (0.6748) | −0.9569 *** (−5.810) | 72.1 | |

| 2000–2006 | −1.7255 *** (−14.5624) | 39.8 | −1.8320 *** (−14.41) | 37.5 | −1.4220 *** (−8.977) | 48.4 | −1.9319 *** (−17.10) | 35.5 |

| 2007–2013 | −0.8345 *** (−4.9769) | 82.7 | −0.9122 *** (−4.964) | 75.6 | −0.1706 (−0.9200) | −1.0483 *** (−7.034) | 65.8 | |

| Period | β1·100 (t-Stat) | Half-Life | R-Squared | Dummies | |

|---|---|---|---|---|---|

| Capital (1) | Country | ||||

| 1995–2014 | −0.7910 *** (−8.207) | 87.3 | 0.197 | ||

| 1995–2014 | −0.8247 *** (−9.226) | 83.7 | 0.314 | 1.2244 *** (6.822) | |

| 1995–2014 | −0.4727 *** (−3.201) | 146.3 | 0.812 | 0.8089 *** (6.309) | 27 country dummies (2) |

| 1995–2004 | −0.4319 *** (−2.691) | 160.1 | 0.026 | ||

| 1995–2004 | −0.4809 *** (−3.167) | 143.8 | 0.134 | 1.7808 *** (5.841) | |

| 1995–2004 | −0.7601 *** (−3.168) | 90.8 | 0.783 | 1.2475 *** (5.988) | 27 country dummies (2) |

| 2005–2014 | −1.0978 *** (−8.358) | 62.8 | 0.203 | ||

| 2005–2014 | −1.1511 *** (−8.767) | 59.9 | 0.224 | 0.7021 *** (2.722) | |

| 2005–2014 | −0.2330 (−1.272) | 0.839 | 0.2800 * (1.661) | 27 country dummies (2) | |

| 1995–1999 | 0.8794 *** (2.925) | 0.030 | |||

| 1995–1999 | 0.8352 *** (2.805) | 0.055 | 1.6074 *** (2.689) | ||

| 1995–1999 | −0.0585 (−0.1582) | 0.854 | 1.2376 *** (3.857) | 27 country dummies (2) | |

| 2000–2004 | −1.8170 *** (−13.68) | 37.8 | 0.406 | ||

| 2000–2004 | −1.8865 *** (−14.75) | 36.4 | 0.457 | 1.3911 *** (5.094) | |

| 2000–2004 | −1.1656 *** (−4.530) | 59.1 | 0.793 | 0.3065 (1.276) | 27 country dummies (2) |

| 2005–2009 | −1.7763 *** (−11.52) | 38.7 | 0.326 | ||

| 2005–2009 | −1.8583 *** (−12.17) | 37.0 | 0.357 | 1.0793 *** (3.598) | |

| 2005–2009 | −0.7200 ** (−2.448) | 95.9 | 0.745 | 0.9690 *** (3.579) | 27 country dummies (2) |

| 2010–2014 | −0.7705 *** (−4.202) | 89.6 | 0.061 | ||

| 2010–2014 | −0.8219 *** (−4.430) | 84.0 | 0.070 | 0.5627 (1.636) | |

| 2010–2014 | −0.0163 (−0.06718) | 0.808 | −0.2634 (−1.161) | 27 country dummies (2) | |

| 2000–2006 | −1.7255 *** (−14.56) | 39.8 | 0.436 | ||

| 2000–2006 | −1.8052 *** (−16.33) | 38.0 | 0.517 | 1.5936 *** (6.754) | |

| 2000–2006 | −1.0763 *** (−4.581) | 64.1 | 0.794 | 0.5728 *** (2.611) | 27 country dummies (2) |

| 2007–2013 | −0.8345 *** (−4.977) | 82.7 | 0.083 | ||

| 2007–2013 | −0.8580 *** (−5.041) | 80.4 | 0.085 | 0.2653 (0.8207) | |

| 2007–2013 | −0.1461 (−0.6570) | 0.821 | 0.1787 (0.8693) | 27 country dummies (2) | |

| Period | OLS | WLS | ||||||

|---|---|---|---|---|---|---|---|---|

| NUTS3 n = 1342 | NUTS3 n = 1313 (1) | NUTS3 (2) n = 1342 | NUTS3 (3) n = 1342 | |||||

| β1·100 (t-Stat) | Half-Life | β1·100 (t-Stat) | Half-Life | β1·100 (t-Stat) | Half-Life | β1·100 (t-Stat) | Half-Life | |

| 1995–2014 | −0.7388 *** (−16.1096) | 93.5 | −0.9547 *** (−21.69) | 72.2 | −0.4734 *** (−8.401) | 146.1 | −0.9227 *** (−21.14) | 74.8 |

| 1995–2004 | −0.6240 *** (−7.8956) | 110.7 | −0.9710 *** (−12.74) | 71.0 | −0.6090 *** (−6.810) | 113.5 | −0.6161 *** (−8.827) | 112.2 |

| 2005–2014 | −0.8983 *** (−13.9355) | 76.8 | −1.0673 *** (−15.38) | 64.6 | −0.2652 *** (−3.935) | 261.0 | −1.2020 *** (−20.74) | 57.3 |

| 1995–1999 | 0.5871 *** (4.2287) | −0.0765 (−0.6088) | −0.0129 (−0.09915) | 0.3316 *** (2.639) | ||||

| 2000–2004 | −2.0118 *** (−26.7588) | 34.1 | −2.1140 *** (−26.18) | 32.4 | −1.2175 *** (−14.31) | 56.6 | −1.9431 *** (−28.74) | 35.3 |

| 2005–2009 | −1.5947 *** (−18.9970) | 43.1 | −1.8466 *** (−20.48) | 37.2 | −0.8071 *** (−8.817) | 85.5 | −1.8865 *** (23.97) | 36.4 |

| 2010–2014 | −0.5614 *** (−6.4016) | 123.1 | −0.6658 *** (−6.948) | 103.8 | 0.0895 (1.051) | −0.9075 *** (−11.31) | 76.0 | |

| 2000–2006 | −1.7042 *** (−28.3455) | 40.3 | −1.8387 *** (−28.72) | 37.3 | −1.1112 *** (−15.02) | 62.0 | −1.7704 *** (−30.80) | 38.8 |

| 2007–2013 | −0.7085 *** (−8.4738) | 97.5 | −0.8196 *** (−8.985) | 84.2 | −0.8130 (−0.9887) | −1.0079 *** (−13.80) | 68.4 | |

| Period | β1·100 (t-Stat) | Half-Live | R-Squared | Dummies | ||||

|---|---|---|---|---|---|---|---|---|

| Capital (2) | Coastal (2) | Rural–Urban Typology (1) | ||||||

| Urban (2) | Rural (2) | Country | ||||||

| 1995–2014 | −0.7388 *** (−16.1096) | 93.5 | 0.162 | |||||

| 1995–2014 | −0.83252 *** (−18.0820) | 82.9 | 0.233 | 0.9929 *** (6.6366) | −0.2617 *** (−4.1637) | 0.3189 *** (4.0480) | −0.1640 ** (−2.3458) | |

| 1995–2014 | −0.4660 *** (−6.3317) | 148.4 | 0.666 | 0.9846 *** (9.1502) | −0.0194 (−0.3728) | 0.0987 * (1.7345) | −0.0461 (−0.9306) | 27 country dummies (3) |

| 1995–2004 | −0.6240 *** (−7.896) | 110.7 | 0.044 | |||||

| 1995–2004 | −0.8097 *** (−10.46) | 85.3 | 0.166 | 1.7922 *** (7.128) | 0.8244 *** (7.805) | 0.8148 *** (6.154) | 0.2497 ** (2.126) | |

| 1995–2004 | −0.6834 *** (−5.476) | 101.1 | 0.631 | 1.2522 *** (6.862) | 0.0766 (0.8654) | 0.3866 *** (4.008) | −0.0783 (−0.9318) | 27 country dummies (3) |

| 2005–2014 | −0.8983 *** (−13.94) | 76.8 | 0.127 | |||||

| 2005–2014 | −0.8551 *** (−13.65) | 80.7 | 0.280 | 0.2706 (1.391) | −1.3167 *** (−16.09) | −0.0967 (−0.9421) | −0.4982 *** (−5.517) | |

| 2005–2014 | −0.3244 *** (−3.679 | 213.3 | 0.716 | 0.7574 *** (5.620) | −0.1402 ** (−2.179) | −0.1752 ** (−2.482) | 0.0361 (0.5899) | 27 country dummies (3) |

| 1995–1999 | 0.5871 *** (4.229) | 0.013 | ||||||

| 1995–1999 | 0.4708 *** (3.277) | 0.040 | 1.2508 *** (2.679) | 0.7578 *** (3.864) | 0.6788 *** (2.761) | 0.3943 * (1.808) | ||

| 1995–1999 | −0.2849 (−1.458) | 243.0 | 0.697 | 1.2068 *** (4.223) | −0.0712 (−0.5137) | 0.1571 (1.040) | −0.0337 (−0.2556) | 27 country dummies (3) |

| 2000–2004 | −2.0118 *** (−26.76) | 34.1 | 0.348 | |||||

| 2000–2004 | −2.1498 *** (−27.86) | 31.9 | 0.392 | 1.3516 *** (5.155) | 0.6563 *** (5.951) | 0.5275 *** (3.812) | 0.3412 *** (2.795) | |

| 2000–2004 | −0.9112 *** (−6.046) | 75.7 | 0.611 | 0.0933 (0.4031) | 0.1384 (1.252) | 0.2349 * (1.940) | 0.0175 (0.1660) | 27 country dummies (3) |

| 2005–2009 | −1.5947 *** (−19.00) | 43.1 | 0.212 | |||||

| 2005–2009 | −1.6371 *** (−18.95) | 42.0 | 0.272 | 0.9641 *** (3.595) | −0.9952 *** (−8.819) | −0.0646 (−0.4563) | −0.5350 *** (−4.296) | |

| 2005–2009 | −0.7911 *** (−5.251) | 87.3 | 0.559 | 1.2484 *** (5.421) | 0.1198 (1.090) | −0.0155 (−0.1286) | −0.1778 * (−1.700) | 27 country dummies (3) |

| 2010–2014 | −0.5614 *** (−6.402) | 123.1 | 0.030 | |||||

| 2010–2014 | −0.5547 *** (−6.265) | 124.6 | 0.134 | −7.41 *10−5 (−0.028) | −1.3676 *** (−12.39) | 0.0490 (0.3528) | −0.3830 *** (−3.120) | |

| 2010–2014 | −0.2912 ** (−2.237) | 237.7 | 0.589 | 0.4422 ** (2.192) | −0.2974 *** (−3.114) | −0.2695 ** (−2.577) | 0.1486 (1.634) | 27 country dummies (3) |

| 2000–2006 | −1.7042 *** (−28.35) | 40.3 | 0.375 | |||||

| 2000–2006 | −1.8246 *** (−29.37) | 37.6 | 0.409 | 1.3487 *** (6.391) | 0.3090 *** (3.481) | 0.2684 ** (2.410) | 0.0431 (0.4387) | |

| 2000–2006 | −0.6343 *** (−5.330) | 108.9 | 0.636 | 0.3081 * (1.685) | 0.1074 (1.230) | 0.1100 (1.151) | −0.1374 * (−1.655) | 27 country dummies (3) |

| 2007–2013 | −0.7085 *** (−8.474) | 97.5 | 0.051 | |||||

| 2007–2013 | −0.6316 *** (−7.717) | 109.4 | 0.207 | −0.1609 (−0.6505) | −1.6141 *** (−15.54) | −0.1611 (−1.235) | −0.5818 *** (−5.063) | |

| 2007–2013 | −0.5392 *** (−4.748) | 128.2 | 0.675 | 0.8833 *** (5.047) | −0.1021 (−1.225) | −0.2491 *** (−2.727) | 0.1439 * (1.813) | 27 country dummies (3) |

| Index/Regional Level/Year | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Coefficient of variation | NUTS 3 | 0.612 | 0.616 | 0.619 | 0.620 | 0.635 | 0.634 | 0.633 | 0.626 | 0.620 | 0.617 | 0.624 | 0.617 | 0.624 | 0.619 | 0.627 | 0.637 | 0.640 | 0.644 | 0.651 | 0.663 |

| NUTS 2 | 0.530 | 0.531 | 0.531 | 0.531 | 0.537 | 0.537 | 0.534 | 0.528 | 0.522 | 0.518 | 0.520 | 0.514 | 0.517 | 0.512 | 0.512 | 0.518 | 0.521 | 0.525 | 0.529 | 0.536 | |

| NUTS 1 | 0.492 | 0.491 | 0.488 | 0.487 | 0.489 | 0.495 | 0.491 | 0.486 | 0.478 | 0.473 | 0.471 | 0.465 | 0.463 | 0.457 | 0.451 | 0.455 | 0.457 | 0.459 | 0.461 | 0.463 | |

| EU 28 | 0.434 | 0.433 | 0.430 | 0.428 | 0.428 | 0.430 | 0.427 | 0.421 | 0.416 | 0.412 | 0.410 | 0.407 | 0.402 | 0.391 | 0.384 | 0.385 | 0.388 | 0.391 | 0.391 | 0.391 | |

| Gini coefficient, % | NUTS 3 | 21.8 | 21.9 | 22.0 | 22.1 | 22.2 | 22.9 | 22.8 | 22.4 | 21.9 | 21.5 | 21.4 | 20.9 | 20.6 | 20.3 | 20.3 | 20.3 | 20.0 | 19.8 | 19.8 | 19.8 |

| NUTS 2 | 21.5 | 21.4 | 21.3 | 21.2 | 21.2 | 21.6 | 21.5 | 21.0 | 20.3 | 19.9 | 19.6 | 19.1 | 18.9 | 18.5 | 18.4 | 18.6 | 18.6 | 18.4 | 18.4 | 18.4 | |

| NUTS 1 | 21.6 | 21.4 | 21.3 | 21.2 | 21.2 | 21.5 | 21.1 | 20.6 | 20.0 | 19.4 | 19.1 | 18.5 | 18.4 | 18.1 | 17.8 | 18.0 | 18.1 | 18.1 | 18.0 | 18.1 | |

| EU 28 | 18.4 | 17.8 | 17.3 | 17.0 | 16.5 | 16.0 | 15.7 | 15.0 | 14.2 | 13.7 | 13.2 | 12.9 | 12.5 | 12.5 | 12.1 | 12.9 | 12.6 | 12.8 | 12.9 | 12.6 | |

| Theil index | NUTS 3 | 0.213 | 0.216 | 0.217 | 0.218 | 0.221 | 0.226 | 0.222 | 0.214 | 0.205 | 0.198 | 0.195 | 0.188 | 0.183 | 0.176 | 0.173 | 0.176 | 0.175 | 0.174 | 0.173 | 0.171 |

| NUTS 2 | 0.191 | 0.193 | 0.194 | 0.194 | 0.197 | 0.201 | 0.197 | 0.188 | 0.180 | 0.173 | 0.169 | 0.162 | 0.157 | 0.150 | 0.147 | 0.149 | 0.149 | 0.147 | 0.146 | 0.144 | |

| NUTS 1 | 0.180 | 0.183 | 0.182 | 0.184 | 0.183 | 0.189 | 0.184 | 0.176 | 0.168 | 0.161 | 0.156 | 0.149 | 0.144 | 0.136 | 0.133 | 0.135 | 0.134 | 0.133 | 0.131 | 0.130 | |

| EU 28 | 0.162 | 0.165 | 0.164 | 0.164 | 0.163 | 0.166 | 0.162 | 0.153 | 0.146 | 0.139 | 0.133 | 0.128 | 0.121 | 0.113 | 0.109 | 0.110 | 0.109 | 0.108 | 0.106 | 0.104 | |

| Mean logarithmic deviation | NUTS 3 | 0.174 | 0.176 | 0.176 | 0.176 | 0.181 | 0.183 | 0.181 | 0.177 | 0.171 | 0.168 | 0.167 | 0.163 | 0.162 | 0.158 | 0.157 | 0.161 | 0.161 | 0.162 | 0.163 | 0.164 |

| NUTS 2 | 0.149 | 0.149 | 0.149 | 0.149 | 0.150 | 0.152 | 0.150 | 0.146 | 0.141 | 0.137 | 0.136 | 0.132 | 0.131 | 0.127 | 0.125 | 0.128 | 0.128 | 0.128 | 0.129 | 0.129 | |

| NUTS 1 | 0.137 | 0.137 | 0.136 | 0.136 | 0.136 | 0.139 | 0.137 | 0.133 | 0.128 | 0.124 | 0.122 | 0.118 | 0.115 | 0.111 | 0.109 | 0.110 | 0.111 | 0.111 | 0.111 | 0.111 | |

| EU 28 | 0.116 | 0.116 | 0.115 | 0.114 | 0.114 | 0.115 | 0.113 | 0.109 | 0.105 | 0.102 | 0.099 | 0.096 | 0.093 | 0.088 | 0.085 | 0.085 | 0.086 | 0.086 | 0.086 | 0.085 | |

| Theil Index/Year | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Total Theil index | 0.213 | 0.216 | 0.216 | 0.218 | 0.219 | 0.226 | 0.221 | 0.214 | 0.205 | 0.198 | 0.195 | 0.188 | 0.183 | 0.176 | 0.173 | 0.176 | 0.175 | 0.174 | 0.173 | 0.171 | |

| Between-country disparities | Theil index | 0.163 | 0.164 | 0.164 | 0.164 | 0.163 | 0.166 | 0.161 | 0.153 | 0.146 | 0.139 | 0.133 | 0.127 | 0.12 | 0.112 | 0.108 | 0.109 | 0.108 | 0.108 | 0.106 | 0.104 |

| % of total | 76.4 | 76.0 | 75.6 | 75.1 | 74.3 | 73.3 | 72.9 | 71.6 | 71.1 | 70.1 | 68.4 | 67.5 | 65.6 | 63.5 | 62.5 | 61.9 | 61.9 | 61.9 | 61.2 | 60.4 | |

| Within-country disparities at NUTS 2 level | Theil index | 0.029 | 0.03 | 0.03 | 0.031 | 0.033 | 0.035 | 0.035 | 0.035 | 0.034 | 0.034 | 0.036 | 0.035 | 0.037 | 0.039 | 0.039 | 0.04 | 0.041 | 0.04 | 0.04 | 0.041 |

| % of total | 13.4 | 13.7 | 14.0 | 14.3 | 15.1 | 15.7 | 15.8 | 16.5 | 16.7 | 17.3 | 18.4 | 18.8 | 20.2 | 21.9 | 22.3 | 22.8 | 23.2 | 22.9 | 23.4 | 23.8 | |

| Within-NUTS 2 disparities at NUTS 3 level | Theil index | 0.022 | 0.022 | 0.023 | 0.023 | 0.023 | 0.025 | 0.025 | 0.025 | 0.025 | 0.025 | 0.026 | 0.026 | 0.026 | 0.026 | 0.026 | 0.027 | 0.026 | 0.026 | 0.027 | 0.027 |

| % of total | 10.2 | 10.3 | 10.4 | 10.6 | 10.6 | 11.0 | 11.3 | 11.9 | 12.2 | 12.6 | 13.2 | 13.8 | 14.2 | 14.5 | 15.2 | 15.2 | 15.0 | 15.1 | 15.4 | 15.8 | |

| Theil Index/Year | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Total Theil index | 0.213 | 0.216 | 0.216 | 0.218 | 0.219 | 0.226 | 0.221 | 0.214 | 0.205 | 0.198 | 0.195 | 0.188 | 0.183 | 0.176 | 0.173 | 0.176 | 0.175 | 0.174 | 0.173 | 0.171 | |

| Between-NUTS 1 disparities | Theil index | 0.181 | 0.183 | 0.183 | 0.183 | 0.184 | 0.189 | 0.184 | 0.176 | 0.168 | 0.161 | 0.156 | 0.149 | 0.144 | 0.136 | 0.133 | 0.135 | 0.134 | 0.133 | 0.131 | 0.130 |

| % of total | 85.1 | 84.8 | 84.5 | 84.2 | 83.9 | 83.6 | 83.3 | 82.4 | 81.9 | 81.3 | 80.1 | 79.4 | 78.4 | 77.6 | 76.6 | 76.5 | 76.6 | 76.5 | 76.0 | 75.6 | |

| Within-NUTS 1 disparities at NUTS 2 level | Theil index | 0.010 | 0.011 | 0.011 | 0.011 | 0.012 | 0.012 | 0.012 | 0.012 | 0.012 | 0.012 | 0.013 | 0.013 | 0.014 | 0.014 | 0.014 | 0.015 | 0.015 | 0.015 | 0.015 | 0.015 |

| % of total | 4.8 | 4.9 | 5.1 | 5.2 | 5.5 | 5.4 | 5.5 | 5.7 | 5.9 | 6.2 | 6.7 | 6.9 | 7.4 | 7.9 | 8.2 | 8.3 | 8.4 | 8.4 | 8.6 | 8.6 | |

| Within-NUTS 2 disparities at NUTS 3 level | Theil index | 0.022 | 0.022 | 0.023 | 0.023 | 0.023 | 0.025 | 0.025 | 0.025 | 0.025 | 0.025 | 0.026 | 0.026 | 0.026 | 0.026 | 0.026 | 0.027 | 0.026 | 0.026 | 0.027 | 0.027 |

| % of total | 10.2 | 10.3 | 10.4 | 10.6 | 10.6 | 11.0 | 11.3 | 11.9 | 12.2 | 12.6 | 13.2 | 13.8 | 14.2 | 14.5 | 15.2 | 15.2 | 15.0 | 15.1 | 15.4 | 15.8 | |

Appendix D

References

- Arbia, G.; Basile, R.; Salvatore, M. Measuring spatial effects in parametric and non-parametric modelling of regional growth and convergence. In UNU/WIDER Project Meeting on Spatial Inequality in Development; UNU/WIDER: Helsinki, Finland, 2003. [Google Scholar]

- Braga, V. Regional growth and local convergence: Evidence for Portugal. In Proceedings of the 43rd Congress of the European Regional Science Association: “Peripheries, Centres, and Spatial Development in the New Europe”, Jyväskylä, Finland, 27–30 August 2003; pp. 1–19. [Google Scholar]

- Soukiazis, E.; Antunes, M. The evolution of real disparities in Portugal among the NUTS III regions. An empirical analysis based on the convergence approach. Estudos Reg. 2004, 6, 163–181. [Google Scholar]

- Artelaris, P.; Kallioras, D.; Petrakos, G. Regional Inequalities and Convergence Clubs in the European Union New Member-States. Dis. Paper Ser. Univ. Thessaly 2010, 16, 43–62. [Google Scholar]

- Cardoso, C.; Pentecost, E.J. Regional Growth and Convergence: The Role of Human Capital in Portuguese Regions. Work. Pap. Loughborough Univ. 2011, 3, 1–28. [Google Scholar]

- Supińska, J. Does human factor matter for economic growth? Determinants of economic growth process in CEE countries in light of spatial theory. Bank i Kredyt 2013, 44, 505–532. [Google Scholar]

- Viegas, M.; Antunes, M. Convergence in the Spanish and Portuguese NUTS 3 regions: An exploratory spatial approach. Intereconomics 2013, 48, 59–66. [Google Scholar] [CrossRef]

- Tsionas, M.; Sakkas, S.; Baltas, N.C. Regional Convergence in Greece (1995–2005): A Dynamic Panel Perspective. Econ. Res. Int. 2014. [Google Scholar] [CrossRef]

- Panzera, D.; Postiglione, P. Economic growth in Italian NUTS 3 provinces. Ann. Reg. Sci. 2014, 53, 273–293. [Google Scholar] [CrossRef]

- Lopes, J.C.; Araújo, T. Geographic and Demographic Determinants of Regional Growth and Convergence: A Network Approach. Revista Portuguesa de Estudos Reg. 2016, 43, 1–15. [Google Scholar]

- Folfas, P. Income Absolute Beta-Convergence of NUTS 3 Level Regions in New EU Member States before and During a Crisis. Folia Oecon. Stetin. 2016, 16, 151–162. [Google Scholar] [CrossRef]

- Hegerty, S.W. Regional Convergence and Growth Clusters in Central and Eastern Europe: An Examination of Sectoral-Level Data. Eastern Eur. Bus. Econ. J. 2016, 2, 95–110. [Google Scholar]

- Regional Growth and Convergence of the NUTS 3 Regions of Eastern European Countries. Available online: http://www.fiwi.uni-bayreuth.de/de/download/WPs/WP_13-03.pdf 2017 (accessed on 7 May 2018).

- Geppert, K.; Stephan, A. Regional disparities in the European Union: Convergence and agglomeration. Pap. Regional Sci. 2008, 87, 193–217. [Google Scholar] [CrossRef]

- Paas, T.; Kuusk, A.; Schlitte, F.; Võrk, A. Econometric Analysis of Income Convergence in Selected EU Countries and Their Nuts 3 Level Regions 2007; University of Tartu: Tartu, Estonia, 2004. [Google Scholar]

- Paas, T.; Schlitte, F. Regional Income Disparities and Spatial Interaction of Regional Convergence Processes. In Recent Development in INFORUM-Type Modelling; Wyd; Plich, M., Przybyliński, M., Eds.; Łόdź University Press: Łόdź, Poland, 2008. [Google Scholar]

- Mikulić, D.; Lovrinčević, Ž.; Nagyszombaty, A.G. Regional convergence in the European Union, new Member States and Croatia. South East European J. Econ. Bus. 2013, 8, 7–19. [Google Scholar] [CrossRef]

- Kramar, H. Regional convergence and economic development in the EU: The relation between national growth and regional disparities within the old and the new member states. Int. J. Latest Trends Finance Econ. Sci. 2016, 6, 1052–1062. [Google Scholar]

- Goecke, H.; Hüther, M. Regional convergence in Europe. Intereconomics 2016, 51, 165–171. [Google Scholar] [CrossRef]

- Solow, R.M. A Contribution to the Theory of Economic Growth. Q. J. Econ. 1956, 70, 65–94. [Google Scholar] [CrossRef]

- Koopmans, T. On the Concept of Optimal Economic Growth. In The Econometric Approach to Development Planning; Koopmans, T., Ed.; Rand McNally: Chicago, IL, USA, 1965; pp. 225–300. [Google Scholar]

- Barro, R.J.; Sala-i-Martin, X. Convergence across States and Regions. Brookings Pap. Econ. Activity 1991, 1, 107–182. [Google Scholar] [CrossRef]

- Barro, R.J.; Sala-i-Martin, X. Convergence. J. Political Econ. 1992, 100, 223–251. [Google Scholar] [CrossRef]

- Fagerberg, J.; Verspagen, B. Heading for Divergence? Regional Growth in Europe Reconsidered. J. Common Mark. Stud. 1996, 34, 431–448. [Google Scholar] [CrossRef]

- Fingleton, B. Economic Geography with Spatial Econometrics. A ‘Third Way’ to Analyse Economic Development and ‘Equilibrium’ with Application to the EU Regions; Economics Working Papers eco99/21; European University Institute: San Domenico di Fiesole, Florence, Italy, 1999. [Google Scholar]

- Cuadrado-Roura, J.R. Regional Convergence in the European Union. From Hypothesis to the Actual Trends. Ann. Reg. Sci. 2001, 35, 333–356. [Google Scholar] [CrossRef]

- Cappelen, A.; Castellacci, F.; Fagerberg, J.; Verspagen, B. The Impact of EU Regional Support on Growth and Convergence in the European Union. J. Common Mark. Stud. 2003, 41, 621–644. [Google Scholar] [CrossRef]

- Cappelen, A.; Castellacci, F.; Fagerberg, J.; Verspagen, B. Regional Disparities in Income and Unemployment in Europe. In European Regional Growth. Advances in Spatial Science 2003; Fingleton, B., Ed.; Springer: Berlin/Heidelberg, Germany, 2003. [Google Scholar] [CrossRef]

- Baumont, B.; Ertur, C.; Le Gallo, J. Spatial Convergence Clubs and the European Regional Growth Process, 1980–1995. In European Reg. Growth; Fingleton, B., Ed.; Springer Verlag: Berlin, Germany, 2003; pp. 131–158. [Google Scholar]

- Carrington, A. A Divided Europe? Regional Convergence and Neighbourhood Spillover Effects. Kyklos 2003, 56, 381–394. [Google Scholar] [CrossRef]

- Bräuninger, M.; Niebuh, A. Agglomeration, Spatial Interaction and Convergence in the EU; HWWA Discussion Paper 322; Hamburg Institute of International Economics: Hamburg, Germany, 2005. [Google Scholar] [CrossRef][Green Version]

- Próchniak, M.; Witkowski, B. Time stability of the beta convergence among EU countries: Bayesian model averaging perspective. Econ. Modell. 2013, 30, 322–333. [Google Scholar] [CrossRef]

- Campos, N.F.; Coricelli, F.; Moretti, L. Economic Growth and Political Integration: Estimating the Benefits from Membership in the European Union Using the Synthetic Counterfactuals Method. IZA Discussion Paper 8162. 2014. Available online: https://ssrn.com/abstract=2432446 (accessed on 03 May 2018).

- Goedemé, T.; Collado, D. The EU Convergence Machine at Work. To the Benefit of the EU’s Poorest Citizens? J. Common Mark. Stud. 2016, 54, 1142–1158. [Google Scholar] [CrossRef]

- Magrini, S. The Evolution of Income Disparities among the Regions of the European Union. Reg. Sci. Urban Econ. 1999, 29, 257–281. [Google Scholar] [CrossRef]

- Fingleton, B. Estimates of Time to Economic Convergence. An Analysis of Regions of the European Union. Int. Reg. Sci. Rev. 1999, 22, 5–34. [Google Scholar] [CrossRef]

- Rodríguez-Pose, A.; Crescenzi, R. Research and development, spillovers, innovation systems, and the genesis of regional growth in Europe. Reg. Stud. 2008, 42, 51–67. [Google Scholar] [CrossRef]

- Kim, B.W. Growth regression revisited: R&D promotes convergence? Appl. Econ. 2012, 44, 1347–1362. [Google Scholar] [CrossRef]

- Rego, C.; Caleiro, A. On the Spatial Diffusion of Knowledge by Universities Located in Small and Medium Sized Towns. iBusiness 2010, 2, 99–105. [Google Scholar] [CrossRef]

- Rego, C.; da Saudade Baltazar, M.; Caleiro, A. Higher education and social cohesion. Higher Educ. Soc. Sci. 2012, 2, 17–24. [Google Scholar]

- Guerreiro, G.; Guerreiro, A. Regional Convergence and R&D Investment: Applied investigation in Portugal. In Proceedings of the 55th Congress of the European Regional Science Association: “World Renaissance: Changing roles for people and places”, Lisbon, Portugal, 25–28 August 2015; Available online: http://hdl.handle.net/10419/124652 (accessed on 10 March 2018).

- Furková, A.; Chocholatá, M. Interregional R&D spillovers and regional convergence: A spatial econometric evidence from the EU regions. Equilibrium. Quarterly J. Econ. Econ. Policy 2017, 12, 9–24. [Google Scholar] [CrossRef]

- Barro, R.J.; Sala-i-Martin, X. Economic Growth, 2nd ed.; The MIT Press: Cambridge, MA, USA, 2004. [Google Scholar]

- Boldrin, L.; Canova, F. Inequality and Convergence in Europe’s Regions. Reconsid. Eur. Reg. Policies Econ. Policy 2001, 16, 207–253. [Google Scholar] [CrossRef]

- Yin, L.; Zestos, G.K.; Michelis, L. Economic Convergence in the European Union. J. Econ. Integr. 2003, 18, 188–213. [Google Scholar] [CrossRef]

- Neven, D.J. Regional Convergence in the European Union. J. Common Mark. Stud. 1995, 33, 47–65. [Google Scholar] [CrossRef]

- López-Bazo, E.; Vayá, E.; Mora, A.J.; Suriñach, J. Regional economic dynamics and convergence in the European Union. Ann. Reg. Sci. 1999, 33, 343–370. [Google Scholar] [CrossRef]

- Tondl, G. Convergence after Divergence: Regional Growth in Europe; Springer: Wien, Austria; New York, NY, USA, 2001; ISBNs 9783211836729, 3211836721. [Google Scholar]

- Basile, R.; de Nardis, S.; Girardi, A. Regional Inequalities and Cohesion Policies in the European Union; ISAE Working Paper, 23; Italian National Institute of Statistics: Rome, Italy, 2005. [CrossRef]

- Baumol, W. Productivity Growth, Convergence and Welfare: What the Long-Run Data Show? Am. Econ. Rev. 1986, 76, 1072–1085. Available online: http://www.jstor.org/stable/1816469 (accessed on 10 March 2018).

- Durlauf, S.N.; Johnson, P.A. Multiple regimes and cross-country growth behaviour. J. Appl. Econ. 1995, 10, 365–384. [Google Scholar] [CrossRef]

- Galor, O. Convergence? Inferences from theoretical models. Econ. J. 1996, 1056–1069. [Google Scholar] [CrossRef]

- Borsi, M.T.; Metiu, N. The evolution of economic convergence in the European Union. Empir. Econ. 2015, 48, 657–681. [Google Scholar] [CrossRef]

- von Lyncker, K.; Thoennessen, R. Regional club convergence in the EU: Evidence from a panel data analysis. Empir. Econ. 2017, 52, 525–553. [Google Scholar] [CrossRef]

- Bourdin, S. National and regional trajectories of convergence and economic integration in Central and Eastern Europe. Can. J. Reg. Sci. 2015, 38, 55–63. [Google Scholar]

- Ferrer, E.M. Regional Convergence and Productive Structure in Iberian Regions: A Spatial Approach. Revista Portuguesa de Estudos Regionais 2018, 47, 5–20. [Google Scholar]

- Gagliardi, L.; Percoco, M. The impact of European Cohesion Policy in urban and rural regions. Reg. Stud. 2017, 51, 857–868. [Google Scholar] [CrossRef]

- Paas, T.; Kuusk, A.; Schlitte, F. Modelling Regional Income Convergence in EU-25; Regional and Urban Modeling 283600067; University of Tartu: Tartu, Estonia, 2004. [Google Scholar]

- Percoco, M. Impact of European Cohesion Policy on regional growth: Does local economic structure matter? Reg. Stud. 2017, 51, 833–843. [Google Scholar] [CrossRef]

- Smetkowski, M.; Wójcik, P. Regional Convergence in Central and Eastern European Countries: A Multidimensional Approach. Eur. Plan. Stud. 2012, 20, 923–939. [Google Scholar] [CrossRef]

| Research | Analysis Period | Method | Research Sample | Result |

|---|---|---|---|---|

| Arbia et al. [1] | 1951–2000 | σ-convergence (coefficient of variation); β-convergence estimated using common cross-sectional ordinary least squares (OLS) approach; Moran’s I for spatial autocorrelation | 92 Italian regions | Spillover and convergence clubs are spatially concentrated |

| Artelaris et al. [4] | 1990–2005 | σ-convergence (coefficient of variation) | Regions of EU New Member States | Regional convergence clubs were identified in many of the new EU member states |

| Bourdin [55] | 1995–2007 | Gini index | Regions of Central and Eastern Europe (CEE) | Convergence was identified at a national level but regional inequalities within each country were increasing |

| Braga [2] | 1970–2001 | β-convergence estimated using nonlinear least squares and Levenberg–Marquardt method | Portuguese regions | The growth and convergence within regions and between regions is influenced by clustering phenomenon |

| Cardoso, Pentecost [5] | 1991–2008 | β-convergence via shift-share analysis was applied, which allows the decomposition of the deviation of a region’s output growth rate | Portuguese regions | Significant and positive impact of human capital on regional growth and convergence was identified |

| Ferrer [56] | 2000–2005 | Moran’s I for spatial autocorrelation; spatial Durbin model (SDM); spatial autoregressive model (SAR), spatial error model (SEM) | 82 Iberian regions | Iberian regions grew at a cumulative growth rate of 0.303%, while in the Spanish and Portuguese regions it increased at 0.313% and 0.03%, respectively. |

| Folfas [11] | 2000–2011 | β-convergence (spatial lagged model (SLM) and spatial error model (SEM)) | 211 regions of CEE | Absolute β-convergence was not confirmed during the crisis of 2008–2011 |

| Gagliardi, Percoco [57] | 2000–2006 | Regression discontinuity design RDD and a local average treatment effect (LATE) estimator | 1233 EU-25 regions | European Cohesion funds positively affected the growth of lagging rural regions |

| Goecke, Hüther [19] | 2000–2011 | σ-convergence (coefficient of variation) | 1289 European regions | High starting level of GDP per capita does indeed correlate with a growth rate in this variable below the EU average |

| Hegerty [12] | 2000–2013 | Moran’s I for spatial autocorrelation | 238 regions of CEE | Convergence is more likely to occur at the national level than the regional level |

| Kotosz, Lengyel [13] | 2000–2014 | σ-convergence; β-convergence estimated using cross-sectional approach | 99 regions in Eastern Europe | β-convergence cannot be proved |

| Kramar [18] | 2000–2011 | σ-convergence (coefficient of variation) | EU-28 1090 regions | Disparities between growing economic centers and lagging rural areas are increasing, but there is no clear evidence that the degree of divergence is higher in the fastest growing countries |

| Lopes, Araújo [10] | 1995–2012 | Stochastic geometry | 81 Portuguese and Spanish regions | Very low velocities of convergence |

| Mikulić et al. [17] | 2001–2008 | β-convergence estimated using common cross-sectional OLS approach | EU-27 and Croatia | Absolute β-convergence occurs at the national level for EU countries and for NMS regions |

| Paas et al. [15] | 1995–2002 | β-convergence estimated using cross-sectional approach; σ-convergence (coefficient of variation) | 1214 EU 25 regions | Old and new member states are experiencing significant regional disparities |

| Paas et al. [58] | 1995–2002 | β-convergence (OLS; spatial lagged model (SLM); spatial error model (SEM)) | EU-25 countries | The EU-15 and the new member states (NMS) experienced absolute regional income convergence during the EU pre-enlargement period |

| Panzera, Postiglione [9] | 1981–2008 | Spatial Durbin Model; Bayesian Interpolation Method | 103 Italian regions | Different growth paths appear to confirm the presence of disparities among the Italian provinces |

| Percoco [59] | 1997–2008. | Heterogeneous local average treatment effects (HLATE) estimation procedure based on an RDD and a local average treatment effect (LATE) estimator | EU-25 countries | Economic disparities are decreasing while promoting the service sector at its early stages |

| Schlitte, Paas [16] | 1995–2003 | σ-convergence (coefficient of variation); β-convergence estimated using common cross-sectional OLS approach; Moran’s I for spatial autocorrelation | 861 regions of the EU | Regional catching-up process was relatively slow |

| Smetkowski, Wójcik [60] | 1998–2005 | σ-convergence (coefficient of variation); Kernel density estimator (KDE); Moran’s I for spatial autocorrelation | 179 CEE regions | Weak regional convergence was identified |

| Soukiazis, Antunes [3] | 1991–2000 | β-convergence estimated using OLS estimation by pooling the data, least squares dummy variable (LSDV) estimation assuming that regional specific effects are fixed and the generalized least squares (GLS) estimation assuming that regional differences are random | 30 Portuguese regions | Convergence is more conditional than absolute |

| Stephan et al. [14] | 1980–2000 | Analysis of distribution (Kernel estimation, Markov chain analysis); β-convergence estimated using cross-sectional approach | 167 regions in the EU-15 except the eastern part of Germany | Disparities between the countries are decreasing |

| Supińska [6] | 1999–2008 | β-convergence (spatial lagged model (SLM) and spatial error model (SEM)) | 211 CEE regions | Spatial coefficients occurred to be significant and positive |

| Tsionas et al. [8] | 1995–2005 | Generalized method of moments (GMM) estimation of Barro regressions in dynamic panel data framework | 13 Greek regions and 51 prefectures | Convergence is identified at the NUTS 3 level, while between NUTS 2 regions it was not detected |

| Viegas, Antunes, [7] | 1995–2008 | σ-convergence (coefficient of variation); Moran’s I for spatial autocorrelation | 75 Portuguese and Spanish regions | Results point to a σ-divergence process between 1995 and 2008, while at the national level, both countries have followed a sigma convergence process during the same period |

| Country Code | NUTS 1 Level (1) | NUTS 2 Level (2) | NUTS 3 Level (3) | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Number of Regions | Disparities among Regions Increased (I) or Decreased (D) | Number of Regions | Disparities among Regions Increased (I) or Decreased (D) | Number of Regions | Disparities among Regions Increased (I) or Decreased (D) | ||||||||||

| 1995–2014 | 1995–2000 | 2000–2009 | 2009–2014 | 1995–2014 | 1995–2000 | 2000–2009 | 2009–2014 | 1995–2014 | 1995–2000 | 2000–2009 | 2009–2014 | ||||

| BE | 3 | D | I | D | D | 11 | D | I | D | D | 44 | D | D | D | I |

| BG | 2 | I | I | I | D | 6 | I | I | I | D | 28 | I | I | I | I |

| CZ | 1 | 8 | I | I | I | D | 14 | I | I | I | I | ||||

| DK | 1 | 5 | I | I | I | I | 11 | I | D | I | I | ||||

| DE | 16 | D | I | D | D | 38 | D | I | D | D | 402 | I | I | D | D |

| EE | 1 | 1 | 5 | I | I | I | D | ||||||||

| IE | 1 | 2 | I | I | D | I | 8 | I | I | I | I | ||||

| EL | 4 | I | I | I | I | 13 | I | I | I | I | 52 | I | D | I | I |

| ES | 7 | I | I | D | I | 19 | I | I | D | I | 59 | D | I | D | I |

| FR | 9 | I | I | I | I | 27 | I | I | I | I | 101 | I | I | D | I |

| HR | 1 | 2 | I | I | I | I | 21 | I | D | I | I | ||||

| IT | 5 | D | D | D | I | 21 | D | D | D | I | 110 | I | I | I | D |

| CY | 1 | 1 | 1 | ||||||||||||

| LV | 1 | 1 | 6 | I | I | D | I | ||||||||

| LT | 1 | 1 | 10 | I | I | I | D | ||||||||

| LU | 1 | 1 | 1 | ||||||||||||

| HU | 3 | I | I | I | D | 7 | I | I | I | D | 20 | I | I | I | D |

| MT | 1 | 1 | 2 | I | D | I | I | ||||||||

| NL | 4 | I | I | D | D | 12 | I | I | I | I | 40 | I | I | I | I |

| AT | 3 | D | D | D | D | 9 | D | D | D | D | 35 | D | I | D | D |

| PL | 6 | I | I | I | I | 16 | I | I | I | I | 72 | I | D | I | D |

| PT | 3 | D | D | D | I | 7 | D | I | D | D | 25 | D | D | D | D |

| RO | 4 | I | I | I | D | 8 | I | I | I | I | 42 | I | I | I | I |

| SI | 1 | 2 | I | D | I | D | 12 | I | I | I | D | ||||

| SK | 1 | 4 | I | I | I | D | 8 | I | I | D | I | ||||

| FI | 2 | D | D | I | D | 5 | D | D | I | D | 19 | D | D | D | D |

| SE | 3 | I | I | I | D | 8 | I | I | I | D | 21 | I | I | D | I |

| UK | 12 | I | I | D | I | 40 | I | I | I | I | 173 | I | I | I | D |

| Tot. | 98 | D | I | D | D | 276 | D | I | D | D | 1342 | D | I | D | D |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Butkus, M.; Cibulskiene, D.; Maciulyte-Sniukiene, A.; Matuzeviciute, K. What Is the Evolution of Convergence in the EU? Decomposing EU Disparities up to NUTS 3 Level. Sustainability 2018, 10, 1552. https://doi.org/10.3390/su10051552

Butkus M, Cibulskiene D, Maciulyte-Sniukiene A, Matuzeviciute K. What Is the Evolution of Convergence in the EU? Decomposing EU Disparities up to NUTS 3 Level. Sustainability. 2018; 10(5):1552. https://doi.org/10.3390/su10051552

Chicago/Turabian StyleButkus, Mindaugas, Diana Cibulskiene, Alma Maciulyte-Sniukiene, and Kristina Matuzeviciute. 2018. "What Is the Evolution of Convergence in the EU? Decomposing EU Disparities up to NUTS 3 Level" Sustainability 10, no. 5: 1552. https://doi.org/10.3390/su10051552

APA StyleButkus, M., Cibulskiene, D., Maciulyte-Sniukiene, A., & Matuzeviciute, K. (2018). What Is the Evolution of Convergence in the EU? Decomposing EU Disparities up to NUTS 3 Level. Sustainability, 10(5), 1552. https://doi.org/10.3390/su10051552