Abstract

The paper contributes to the debate on the holistic sustainability assessment of real estate projects, integrating economic, financial, environmental, and social aspects. A methodological study is presented to support decision-making processes involving the preferability ranking of alternative investment scenarios: new building production vs. retrofitting the existing stock, in the context of urban transformation interventions. The study integrates life cycle approaches by introducing the social components besides the economic and environmental ones. Firstly, a composite unidimensional (monetary) indicator calculation is illustrated. The sustainability components are internalized in the NPV calculation through a Discounted Cash-Flow Analysis (DCFA). Life Cycle Costing (LCC) and Life Cycle Assessment (LCA) are suggested to assess the economic and environmental impacts, and the Social Return on Investment (SROI) to assess the intervention’s extra-financial value. Secondly, a methodology based on multicriteria techniques is proposed. The Hierarchical Analytical Process (AHP) model is suggested to harmonize various performance indicators. Focus is placed on the criticalities emerging in both the methodological approaches, while highlighting the relevance of multidimensional approaches in decision-making processes and for supporting urban policies and urban resilience.

1. Introduction

It is the authors’ intent to clarify the research assumptions -in terms of the general research topic and specific purposes and goals- on the sustainability evaluation of RE projects and deal with the integration among economic, environmental, and social aspects. The evaluation, in particular, is fundamental to informing the decision-making process for urban transformation interventions.

The paper is part of the debate on the sustainability assessment of real estate projects, focusing on the role of environmental and social components alongside economic/financial and social ones, to support decision-making processes. It ranks among the multidisciplinary studies for the joint application of approaches and models of analysis, to harmonize the dimensions and languages that emerge in the identification/quantification of the effects/impacts of a project, expressed through specific performance indicators of environmental, economic, social, and quality nature.

The research framework adopted starts from premises, highlighted in two paragraphs: Section 1.1 describes the covered general topic, contextualizes the framework, and highlights the open research questions; Section 1.2 details the specific objectives of the research, explicitly stating the direction and purpose of the investigation.

The two paragraphs mentioned introduce the other sections of the paper, which are articulated as follows. Section 2 details the literature and regulatory background on the topic. Section 3 illustrates the methodological study, with references to the joint indicator calculation and the multicriteria approach, with insights into their criticalities. Section 4 presents future research perspectives, and Section 5 concludes.

1.1. The Research Topic: General Framework

The paper argues why the role of evaluation is fundamental in the prefiguration of optional project scenarios and in the decision-making processes aimed at evaluating and selecting them, with a view to the eligibility and preferability of solutions. It focuses on structuring the knowledge framework underlying the application of evaluation tools in contexts characterised by complexity and uncertainty, from a life cycle perspective. The thesis argued—the enabling role of evaluation in a context of multidisciplinary contributions, aimed at synergistically managing project complexities and supporting decisions—is also argued through the proposal of multidimensional and multi-objective project sustainability evaluation methodologies, which attempt to overcome the criticalities of unidimensional approaches. Indeed, it is assumed that holistic project sustainability assessment cannot disregard synergic and integrated (not just ‘assembled’) analytical inputs, harmonized through specific indicators, to support decision-making in all phases of the architectural project life cycle, and policy-making processes for urban transformations.

The methodological study aims to develop the evaluation equipment for managing and enhancing urban resilience. In fact, the increasing complexity of urban regeneration, mainly through building construction and existing building upcycling processes, requires adopting evaluation tools capable of integrating heterogeneous dimensions, such as environmental sustainability, economic/financial efficiency, and social value generated. Linear Economy decision support models, focused mainly on technical or economic indicators such as the conventional Discounted Cash-Flow Analysis, are increasingly inadequate to respond to the plurality of objectives and stakeholders involved in contemporary real estate development projects.

In fact, there remain some questions that have not yet been sufficiently investigated. The direction and purpose of the investigation start from these general premises, identifying specific research objectives, which are explained in Section 1.2.

1.2. The Specific Aims and Goals

It is the intent of the authors to outline two specific research addresses. The methodological study is tracked in Section 1.1.

Operatively, the work takes inspiration from a dual methodological address.

The first address can be traced back to the concept of “integrated methodologies” [1,2], which provides for the simultaneous assessment of the different dimensions of sustainability. Centrality is based on the calculation of joint unidimensional (monetary) indicators, which encompass the monetized components due to the different impacts [3,4]. In this case, the same objectives are assumed. The second address can be traced back to the concept of “complementary methodology” [5,6], which provides, as proposed by the United Nations Environmental Program—UNEP, the parallel development of approaches for the assessment of the different dimensions of sustainability, indeed on the same objectives, system boundaries, and functional units. The different contributions can then be harmonized with the use of multi-criteria approaches and related multidimensional indicators, identified from a life cycle perspective.

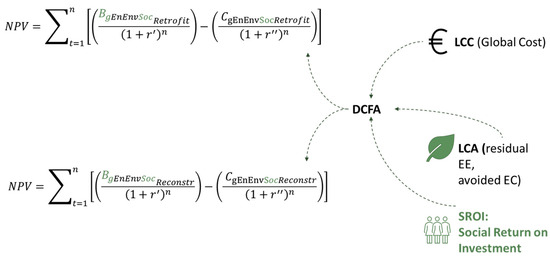

According to the first address, a methodological approach is illustrated, implying the use of the life cycle approaches for economic and environmental evaluation, through Life Cycle Costing (LCC) as formalized in ISO 15686-5:2017 [7], and Life Cycle Assessment (LCA) as formalized in ISO 14040:2021 [8], respectively. Besides, the Social Return on Investment (SROI) is aimed at monetizing the social impacts generated by interventions, as formalized in the guidelines and manuals edited by the Roberts Enterprise Development Fund and Human Foundation. Operatively, aiming at introducing a holistic perspective in the investment analysis, the conventional Discounted Cash-flow Analysis (DCFA)—and the related Net Present Value (NPV) indicator—well established for evaluating project financial feasibility, is enriched by internalizing environmental and social components. The global cost and the «global benefit» as reformulated in previous studies from a life cycle perspective [3,9], are furtherly revised in this work by internalizing the social value components in the NPV synthetic indicator (comparative) calculation.

According to the second address, a multicriteria methodological scenario is proposed. The AHP, developed by Saaty in 1980 [10], forms the conceptual core of this second part of the research, as it is widely recognized as a reference tool for supporting decision-making processes, based on the hierarchical structuring of complex decisional problems and comparative weighting of alternatives [11]. The model’s flexibility has favoured the integration with the aforementioned approaches, such as the LCC for analyzing costs over the entire project lifespan, the LCA for the environmental impact measurement, and the SROI for quantifying the project’s social impacts. LCC and LCA support relevant measurable indicators identified for each criterion to assess economic and environmental impacts, respectively. DCFA and SROI approaches seek to assess the ratio between total revenues and the inputs needed to obtain them, and to measure the extra-financial value of an intervention net of invested resources and budgeting tools, respectively. The combination of these tools allows the construction of a multidimensional assessment framework, capable of returning in a harmonized form the environmental, economic, and social impacts associated with urban interventions involving building production and building upcycling strategies.

The methodological study integrates the framework of synergistic applications between life cycle approaches, widely shared in the literature, by introducing the component of social evaluations. Thus, it provides the foundation for defining a methodological framework applicable to building and urban transformation contexts, capable of supporting informed, transparent, and sustainability-driven decision-making processes.

Considering these premises, this paper firstly seeks to systematize the most recent scholarly literature on sustainability-oriented decision-making models, with a specific focus on methodologies that integrate different nature criteria from a life-cycle perspective. The review focuses in particular on the theorization and application of compound indicators, and, furtherly, on the evolution and combined application of the key methodological approaches—AHP, LCC, and SROI—with a focus on the AHP applications. Besides, the regulatory framework is synthesized, assuming that the analysis fits within the broader international regulatory and policy framework, in line with standards such as Directive (EU) 2024/1275 [12], and the goals of the 2030 Agenda for Sustainable Development.

Secondly, methodological reasoning is illustrated, with insights on formal aspects and assumptions, focusing on issues and criticalities, and hints to future research perspectives.

2. Literature Background

The theoretical framework underpinning this contribution is developed through a thorough analysis of recent scientific literature, aimed at exploring the integration of methodological approaches for evaluating sustainability in urban regeneration and building construction/upcycling projects.

The literature research follows these steps:

- (1)

- Definition of the objective: focused on identifying multi-criteria approaches for the integrated (environmental, economic, and social) assessment of urban regeneration and building upcycling projects;

- (2)

- Definition of the time frame: limited to the period during which joint methodological applications of AHP, LCA, LCC, and SROI experienced a marked increase;

- (3)

- Selection of documentary sources: identification and systematic querying of online databases and collection of scientific publications;

- (4)

- Evaluation of selected contributions, conducted through an examination of methodological aspects, objectives, application contexts, and analytical tools adopted in each study.

The selection of contributions covered the period between 2009 and 2025 (current year, analyzed for the first five months).

The online sources consulted were the international database Scopus, Web of Science, and Google Scholar. These were queried using logical combinations of both primary keywords (AHP, LCC, SROI) and secondary ones (urban transformation, sustainability, cost analysis, social value) to isolate a body of studies aligned with the research objective. Additionally, keyword combinations were employed to ensure thematic specificity and interdisciplinarity, avoiding the inclusion of generic or unrelated contributions.

To ensure greater search specificity, keywords were linked using the “AND” operator.

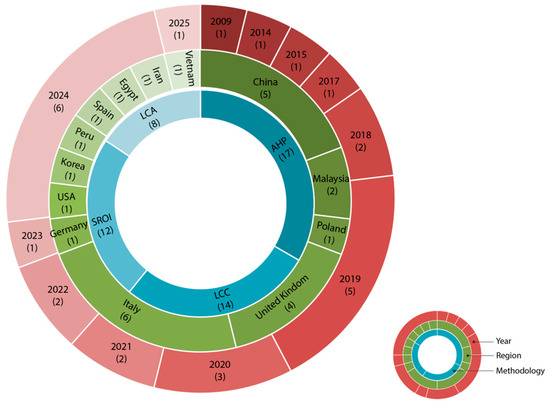

The investigation led to the identification of 41 scientific contributions that, despite the variety of application contexts, reveal converging trends in the use of joint evaluation tools. As shown in Figure 1, the selected studies originate from various geographical areas, including Italy (6 articles), China (5), the United Kingdom (4), Malaysia (2), Poland (1), Germany (1), and other countries, highlighting a global interest in the topics addressed. Some studies focus on the economic (LCC—14 articles) and sustainability (LCA—8 articles) assessment of infrastructures and industrial processes, while others analyze social value in cultural and environmental sectors (SROI—12 articles; AHP—17 articles). The integration of various analytical methodologies allows for addressing the complexity of decision-making in fields related to urban transformation, planning, and regeneration.

Figure 1.

Results of the literature review: a graphical representation (the number in parentheses represents the number of articles found for those years and countries.). Source: Authors’ elaboration.

The identified articles were classified based on the methodological combinations employed to assess the degree of integration among the main analytical approaches adopted. As shown in Table 1, the most frequently adopted combination is AHP–LCC (13 articles), followed by AHP–SROI (3 articles) and SROI–LCC (1 article). Specifically, AHP is used in studies ranging from the evaluation of urban infrastructure to waste management and rural development, suggesting its flexibility in supporting decision-making processes. LCA and LCC are often used together, particularly in the building and industrial sectors, reflecting growing attention to the environmental and economic dimensions of sustainability. The SROI approach stands out for its contribution to assessing social impact, especially in contexts such as social enterprises, cultural organizations, and urban area development.

Table 1.

Bibliographic references emerging from the review, selected as most relevant to the analysis conducted, and the approaches adopted in them. Source: Authors’ elaboration.

The literature reveals a clear consensus on the effectiveness of AHP in breaking down complex problems into hierarchical structures, organizing decision-making criteria, and assigning relative weights to alternative options. Its flexibility makes it particularly suitable for integration with life cycle–oriented approaches. Studies such as those by [18,21] demonstrate how the integration of AHP and LCC enables the evaluation of hybrid (green and grey) infrastructure effectiveness in urban water management, highlighting the need for solutions that balance economic efficiency with environmental resilience.

Similarly, applications in waste management [23,30] and industrial production [35] confirm the utility of these tools for integrated evaluation of alternative scenarios—not only in terms of costs and benefits, but also regarding environmental and social impacts. Cerchione et al. [34] introduce the use of predictive technologies and computational models to enhance the analytical capabilities of traditional methods, paving the way for hybridization between qualitative and quantitative approaches. In the construction sector, the analysis of contributions by [15,29,33] demonstrates that the combined use of AHP and LCC is particularly effective in supporting decisions within highly complex contexts, often characterized by regulatory, economic, and environmental constraints. El Hadidi et al. [29] structured a life cycle cost assessment for industrial buildings in Egypt, concluding that operational costs account for more than half of total expenditures and that the design phase should explicitly consider these recurring burdens. Plebankiewicz et al. [15], working within the Central European context, highlight methodological fragmentation across countries and the need for common standards, while [33], in the Chinese context, developed a system of multidimensional indicators weighted through AHP to support energy retrofit policies.

Despite the lower frequency of SROI applications in the reviewed literature, the studies that do apply it [16], Courtney et al. [24] underscore its potential to quantify the social value generated by interventions not only in the built environment but also in cultural, health, and community sectors. SROI’s ability to provide an economic measure of intangible impacts—such as social cohesion, inclusion, and well-being—makes it a valuable tool for incorporating the social dimension into decision-making processes. However, its systematic application remains limited due to several challenges, including high data requirements, variability in monetization proxies, and subjectivity in defining outcomes.

The literature background established for this study has helped to highlight key methodological advances made between 2009 and 2025 (current year) in the field of urban and building sustainability assessment. The adoption of joint approaches, particularly the combination of AHP and LCC, emerges as an effective response to the increasing complexity of decision-making related to land transformation and the management of the built environment. A significant finding of the analysis is that none of the reviewed studies used all analytical approaches simultaneously, nor were there any cases in which at least three methods were applied in combination. Each contribution tends to adopt a binary combination of tools. This represents a significant methodological limitation, as it indicates a fragmented approach to sustainability assessment, with poor integration between the social, environmental, and economic dimensions.

AHP remains a versatile tool for hierarchical structuring of decision criteria, but it remains subject to significant subjectivity. The LCC approach allows for an accurate assessment of cost dynamics across the entire life cycle, although it is heavily influenced by forecasting assumptions. LCA provides methodologically sound measures of environmental impacts, but its effectiveness is often limited by the availability of reliable data. Finally, SROI represents a significant attempt to monetize social impacts, although it presents challenges related to standardization and replicability. From this perspective, the methodological fragmentation emerging from the literature reduces the transferability of results and hinders their application in complex decision-making processes. This underscores the need to direct research toward the construction of truly integrated frameworks, capable of combining scientific rigor and operational feasibility, to support more systemic, transparent, and comparable decisions.

Indeed, the integration of heterogeneous approaches, such as SROI for the social dimension, LCA for the environmental dimension, and LCC for the economic dimension, enhances decision-making by enabling policymakers, planners, and investors to prioritize interventions that generate the greatest overall value for communities, thereby supporting more resilient and sustainable urban strategies.

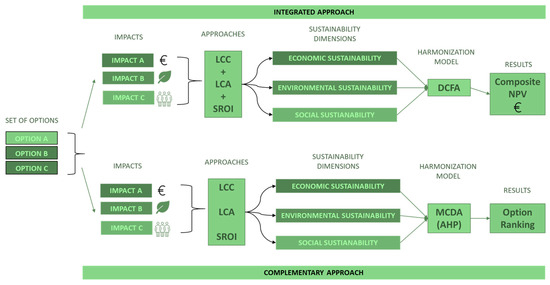

Based on the evidence emerging from the relevant literature, two main methodological directions for sustainability assessment are outlined: on the one hand, the integrated approach, which involves the combination of multiple tools within a unified analytical framework for the simultaneous assessment of economic, environmental and social dimensions; and on the other hand, the complementary approach, in which the different methodologies are applied separately but synergistically, often at separate moments in the decision-making process. The integrated approach is characterized by greater methodological consistency and allows for the development of more robust multidimensional analyses, for example, through the use of composite indicators and shared weighting schemes. However, the literature review shows that most studies adopt a complementary perspective, placing different tools side by side without full structural integration.

This trend reflects a certain fragmentation in the evaluation approach, which may compromise the effectiveness of analyses in representing the complexity of sustainability-related phenomena. At the same time, this evidence opens up a relevant space for future research, which could move toward the definition of integrated methodological frameworks capable of combining tools such as AHP, LCC, LCA, and SROI, thus fostering more holistic, transparent, and systemic sustainability-oriented decision-making processes, as will be discussed in the next sections of this work.

3. Methodological Addresses

As anticipated in the Introduction and based on the scientific background outlined in Section 2, this section illustrates the methodological approaches, discussing the criticalities of the integrated and complementary approaches.

3.1. The Integrated Approach

Based on the aforementioned concept of an integrated approach, this subsection develops the reasoning formalized in previous works [3,9], based on the following assumptions.

Firstly, the Global Cost concept (EN 15459:2007 Standard and Guidelines accompanying Commission Delegated Regulation (EU) No 244/2012 [39]), formalized in Equation (1):

where: represents the Global Cost, referred to as the initial year 0, the initial investment costs in year 0, the annual cost at the year i for the j component (including running costs and periodic or replacement costs), the discount factor at year i, the final value of the j component at the end of the calculation period (referred to as the initial year 0). Notice that represents the residual value and that it should be discounted by multiplying it by the discount factor (Rf).

Secondly, the synthetic economic-environmental indicator obtained through the joint application of the LCA and the LCC, encompassing recycled materials, dismantling, and waste produced, as formalized in Equation (2):

where: is the Life Cycle Cost encompassing environmental and economic indicators; CI is the investment cost; CEE is the cost related to EE; CEC is the cost associated with the EC; Cm is the maintenance cost, Cr is the replacement cost; Cdm and Cdp the dismantling and disposal cost respectively; Vr is the residual value; t is the year in which the cost occurred and N the number of years of the analysis; Rd is the discount factor.

Thirdly, the centrality of the end-of-life stage and the building’s final value, which can be positive or negative.

Then, the concept of Global Benefit as proposed in [40], representing the sum of the incomes from investment in a building reconstruction/retrofitting, incorporates the energy-environmental value components of the existing building. Energy-environmental value components are monetized through the embodied residual energy, potentially reused in a building’s upcycling process, and through the quantity of CO2 embodied in material/component/system production and operation, potentially saved/avoided by building recycling in place of building dismantling and reconstruction, as formalized in Equation (3):

where: BgEnEnv represents the economic-energy-environmental Global Benefit, Vtr is the market value of the asset under transformation, Ven is the residual energy value, and Venv is the environmental value (avoided EC). RRevenue is the income from the market, t the year in which the income occurred, and N is the number of years considered for the analysis; Vr is the residual value, and Rd is the discount factor. Notice that the choice to calculate Global Benefit by summing the impacts using linear equations is due to two main reasons. First, to be consistent with the functional form of the Global Cost calculation. Second, to be consistent with the DCFA model. Any other relationships or different weights to be assigned to the components will be the subject of subsequent refinements to the model.

Lastly, the DCFA-NPV calculation according to the Global Cost and Global Benefit concepts, formalized by including externalities throughout the life cycle, as in Equation (4):

This last can be further developed by considering two different scenarios: the retrofit (upcycling) of the existing building and the demolition-reconstruction scenario, as in Equations (5) and (6):

Notice that in the Equations (5) and (6) r′ represents the financial or market rate (conventional ‘time preference’ rate) and r″ represents the ‘environmental hurdle rate.’ The use of the hurdle rate is due to its capacity to model the expectations of future knowledge (for example, the technology development), as illustrated in previous studies [40,41,42,43].

Assuming these premises, a further step is proposed in this paper aiming at completing the calculation internalizing the social component, in terms of social value from a life cycle perspective. Thus, the complete model results as in Equation (7):

Consequently, the final indicator results as in the following Equation (8):

and, analogously to the previous scenarios, the NPV can be formalized in the Equations (9) and (10):

For clearness, the operative modality is schematized in Figure 2.

Figure 2.

Internalization of economic, environmental, and social components into the DCFA model and NPV formalization.

Considering the measurement vulnerabilities of the variables, a risk and uncertainty analysis is lastly suggested, through, for example, a Sensitivity Analysis for detecting the perturbation of model input over the model output (the NPV indicator). This last calculation phase, commonly adopted in financial and economic model applications [44], is particularly crucial when, as in this case, environmental and social variables are involved.

Despite the potentialities of the approach, several criticalities emerge, as discussed in Section 3.3.

3.2. The Complementary Approach

In this subsection, a reasoning is presented by assuming the previously mentioned concept of the complementary approach.

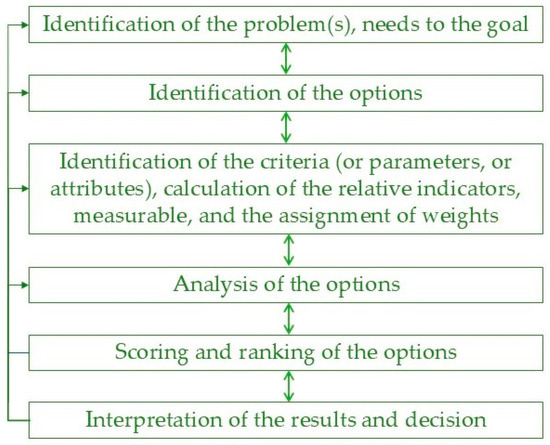

In premises, the concept of evaluation is conceived as a process applied simultaneously to a finite number of alternatives, of a cyclical and retroactive nature, strictly dependent on the problems addressed, on time, on the organizational context of reference, and on knowledge. The logical steps of the decision process are summarized in the following Figure 3, in which: step 1 consists of identifying the objective of the analysis, which is to obtain the preferability ranking among design alternatives; step 2 is intended for the identification/selection of alternatives with the support of a set of criteria identified in step 3, which provides for the attribution of weights to the criteria; step 4 provides for the application of the analysis, the production of results, and the final decision.

Figure 3.

Evaluation process: iterative workflow.

Specifically, among the wide number of MCDA approaches, the focus is placed on the AHP by R. W. Saaty [9], one of the most widespread multi-criteria techniques, due to its effectiveness in the treatment of complex, non-linear problems, capable of structuring the variables of the problem in the form of a hierarchy from which preference orders are obtained. Furthermore, it allows for producing both qualitative and quantitative evaluations. In addition to these characteristics, the AHP approach is selected from the multiplicity of available multi-criteria techniques for continuity with previous studies [22]. Decisions involving environmental and social, as well as economic and financial, spheres are characterized by a high level of complexity. Therefore, it is necessary to employ a particularly flexible, structured multi-criteria evaluation method capable of simultaneously addressing qualitative and quantitative variables. Furthermore, the approach adopted must be capable of addressing subjective components in the decision-making process and supporting the comparison of different perspectives. For these reasons, as well as for its simplicity of application, the AHP approach is selected from among those available, drawing on numerous previous studies in a variety of contexts and, above all, for its potential for joint applications with life cycle approaches.

As is known, the AHP method is based on three fundamental axioms, which correspond to as many operational phases [10,45,46,47]: (1) Principle of decomposition, based on which the data of the problem being evaluated is broken down into its fundamental components. Operationally, this principle involves the identification of a set of criteria, eventual sub-criteria, and alternatives, structured according to a hierarchical method; (2) Principle of comparative judgments, based on which the pairwise comparison is developed, aimed at obtaining a scale of priorities between the alternatives for each level of the hierarchy. This principle allows the identification of the priorities of the elements of each level of the hierarchy, through the comparison in pairs of the elements of each level with each element of the higher level considered as a comparison criterion. Each binary relation is assigned a positive real number that corresponds to a value judgment, based on Saaty’s “fundamental scale”; (3) Principle of synthesis of priorities, based on which we proceed with the calculation of the priority orderings. By calculating the principal eigenvector of each previously produced pairwise comparison matrix, priority scales or weights are produced until the final ranking of preferability of the options is obtained.

In the case under examination, the hypothesis is assumed to compare alternatives that differ in terms of the technological scenarios for new building production or upcycling of the existing stock, compatible with the energy performance levels required by the norms, but with different cost amounts and relative environmental and social impacts. The operating method uses life cycle approaches to support the phases of identification/selection of project options, based on preliminary economic, environmental, and social assessments, considering the entire life cycle “from cradle to grave”. Precisely, the methodology uses a set of criteria and related measurable indicators for quantifying the economic-environmental-social sustainability parameters, based on life cycle approaches.

Notice that in this paper, attention is paid to the final phase of ordering the alternatives (building construction vs. building upcycling projects). Usually, this is explained more in terms of reaching the technical compromise, while, on the contrary, it would be desirable to reach the “social compromise”. For this reason, a crucial importance is given to the social sustainability component in the decision-making process. Indeed, AHP can be effectively adopted for ordering the criteria weights or importance, as well as for ranking a set of specific indicators previously identified, even as a preliminary step for further analysis applications. Summing up, the objective, the set of criteria, related measurable indicators, and operative modalities for their calculation are synthesized in the following Table 2.

Table 2.

AHP objective, criteria, measurable indicators, and related calculation approaches.

In the following sub-sections, a synthesis of each criterion and related measurable indicator is presented.

3.2.1. “Financial Feasibility” Criterion

The Financial Feasibility criterion is configured as a quantitative parameter, aimed at allowing the comparison between project alternatives on the basis of measurable indicators of economic sustainability. These indicators, expressed in monetary terms and updated over time, can be quantified through the Discounted Cash Flow Analysis (DCFA) and include [48,49].

- The Net Present Value (NPV): it measures the net increase in value generated by the project, calculating the difference between the discounted benefits and the discounted costs. In addition, it consists of the discounted sum of cash flows at the initial time and makes it possible to estimate the possible increase in wealth that the promoter could achieve by implementing the investment. The investment is feasible when the NPV is positive, when revenues exceed costs;

- The Internal Rate of Return (IRR) represents the discount rate at which the NPV cancels out and indicates the intrinsic profitability of the project. IRR corresponds to the value of the rate for which the condition NPV = 0 is verified, i.e., the maximum acceptable rate, beyond which the investor would begin to incur losses. The feasibility of the investment is confirmed when the IRR has a value higher than the discount rate used for the calculation of the NPV, and at the same time is higher than a threshold value equal to the minimum profitability acceptable to the investor;

- The Payback Period (PBP) identifies the time interval within which the project fully repays the initial investment. The investment will be feasible if the smaller PBP is in relation to the size and type of the project.

The operational articulation of the DCFA analysis consists of two main phases:

- The modeling and quantification of cash flows, through an analytical structuring of costs and revenues over time;

- The synthetic assessment of economic performance, through standardized indicators of profitability and financial sustainability.

The first phase involves the detailed definition of the economic variables that make up the incoming and outgoing flows. Especially:

- Project costs are identified, distinguishing between direct costs (purchase of materials, labor, equipment) and indirect costs (overheads, financial charges, administrative costs);

- The expected revenues are estimated, which may be derived from the sale of the final products or the operational management of the assets generated by the project;

- The time profile of the cash flows is determined, establishing the time horizon in which the outcomes (investment phase) and the income (economic return phase) occur, in line with the schedule of the activities and with sales or management forecasts.

Subsequently, the DCFA goes on to define an appropriate discount rate, which summarizes both the specific risk of the project and the concept of the opportunity cost of capital, i.e., the expected return of investment alternatives with a similar risk profile. This parameter is a key element for the transformation of future flows into comparable present values. Finally, a sensitivity assessment and scenario analysis are carried out to test the robustness of the investment with respect to changes in critical variables, such as the level of revenues or operating costs. The outcome of this analysis makes it possible to identify the most efficient design configuration from an economic-financial point of view, supporting strategic decisions based on quantitative evidence.

3.2.2. “Economic Sustainability” Criterion

The Economic Sustainability criterion is quantified through LCC, which is a methodology codified in the international standard ISO 15686-5:2008 and which constitutes the methodological reference for evaluating costs throughout the life cycle of a work or a construction system.

The LCC approach takes the form of a tool for technical-economic evaluation based on objective and standardized quantification of the costs associated with each phase of the life cycle of a product, process, or service. LCC involves comparing a base scenario, representing the conventional technological solution, with one or more alternative scenarios, characterized by optimized configurations in terms of technical-functional efficiency. The main objective of the LCC is to identify the most efficient techno-economic configuration in the long run, considering all phases of the life cycle: initial investment costs, operational and maintenance costs, up to decommissioning or end-of-life costs [50].

The LCC takes the form of a tool for technical-economic evaluation based on objective and standardized quantification of the costs associated with each phase of the life cycle of a product, process, or service. LCC involves comparing a base scenario, representing the conventional technological solution, with one or more alternative scenarios, characterized by optimized configurations in terms of technical-functional efficiency. The main objective of the LCC is to identify the most efficient techno-economic configuration in the long run, considering all phases of the life cycle: initial investment costs, operational and maintenance costs, up to decommissioning or end-of-life costs [50].

The LCC makes use of the calculation of quantitative economic indicators, expressed in monetary, temporal, or relative units, which allow for an objective and comparative evaluation of the technical solutions analyzed. These indicators make it possible to estimate the overall economic efficiency of design alternatives throughout the life cycle of a product, service, or system, supporting informed choices oriented toward cost optimization and sustainable resource management.

The main indicators applied in the LCC context are:

- Net Present Value (NPV): represents the discounted value of costs over the entire time horizon, also taking into account indirect or “non-cost” components (e.g., operational savings, intangible benefits, residual value, positive cash flows);

- Net Present Cost (NPC): a variant of NPV that only considers discounted costs, useful for evaluations focused on direct economic comparison;

- Pay-Back Period (PBP): expresses the number of years required for the savings obtained to compensate for the initial investment, assuming constant and undiscounted cash flows;

- Discounted Pay-Back Period (DPB): an extension of the PBP that considers the discounting of cash flows, making it possible to determine the pay-back period of the investment under more realistic economic conditions;

- Net Saving (NS) and Net Benefit (NB): measure the net economic margin of an alternative scenario compared to the reference scenario, evaluating the difference between the discounted costs of the two solutions. A positive value indicates greater economic benefit of the alternative scenario;

- Saving to Investment Ratio (SIR): evaluates the ratio between the economic savings obtained in the operational phase and the additional investment required;

- Adjusted Internal Rate of Return (AIRR): measures the adjusted rate of return, including the effect of intermediate reinvestments, useful for comparative evaluations between projects with different durations and expenditure profiles.

The calculation of these indicators allows for a sound and articulated analysis, which makes it possible to:

- Minimize overall costs (NPV, NPC);

- Define the temporal profitability of the investment (PBP, DPB);

- Estimate the net economic effectiveness between project scenarios (NS, NB);

- Assess the economic sustainability of technological solutions (SIR);

- Maximize the overall return on investment (AIRR).

Methodologically, the application of the LCC is divided into fifteen operational steps, which guide the analysis along a structured and comprehensive path [51]. This articulated process ensures a comprehensive, transparent, and replicable LCC analysis that can provide valuable decision support in the technical project and economic-strategic spheres.

3.2.3. “Environmental Sustainability” Criterion

The environmental sustainability criterion is based on the application of the LCA (Life Cycle Assessment) methodology, which is internationally recognized and standardized by ISO 14040 and ISO 14044 [52]. This approach allows for a systematic, objective, and comparable assessment of the environmental impacts associated with the entire life cycle of a product, process, or service from a “cradle-to-grave” perspective.

The analysis considers input flows (raw materials, energy) and output flows (emissions, waste), returning a holistic view of the environmental performance of the system studied. Quantification of environmental impacts is done through indicators that describe the state of the environment and its effects on humans, ecosystems, and materials, as well as representing environmental pressures, driving forces, and systemic responses [53].

Among the numerous indicators available, this study considers the following:

- Global warming;

- Embodied Energy;

- Embodied Carbon.

The four main phases of LCA, as defined by ISO, include:

- The definition of the objective and scope, which specifies functional unit, system boundaries, assumptions, and limits;

- Inventory Analysis (LCI), which involves quantifying the material and energy fluxes of the system;

- The Environmental Impact Assessment (LCIA), in which these data are converted into environmental indicators according to consolidated methodologies [52,54];

- The interpretation of the results, which integrates the data obtained to identify the prevailing environmental contributions (“hotspots”) and makes recommendations for the reduction of impacts [55].

In the application field, the method makes use of advanced digital tools and databases such as Ecoinvent, Gabi, SimaPro, and Open LCA, and is used in specific sectoral areas such as construction, supported by the UNI EN 15804:2019 [56] and UNI EN 15978:2011 [57]. The European Commission, through the Joint Research Centre (JRC), has developed technical manuals known as ILCD (International Reference Life Cycle Data System), in order to ensure quality, methodological consistency, and interoperability of data [58].

From a modelling point of view, two approaches are distinguished: attributive, of a descriptive and accounting nature, which statically attributes a portion of the environmental load to each process within the system boundaries [52]; and the more recently formulated consequential (formalized in 2011), which aims to assess the changes in global environmental impacts resulting from specific decision-making changes. The conceptual difference between the two models lies in the ability of the consequential model to estimate the marginal effects of decisions over the life cycle, making it particularly useful for prospective and public policy support studies.

The LCA approach is configured as an indispensable analytical tool in sustainable design, in the definition of corporate environmental strategies, and in the support of regulatory decisions, responding to the three fundamental pillars of sustainability: environmental, economic, and social [6].

3.2.4. “Social Sustainability” Criterion

The “Social Sustainability” criterion explicitly refers to the SROI index, which is quantitative, calculated according to a numerical index that represents a sort of “efficiency” index. It measures an entity or organization’s ability to transform the resources invested into actions capable of generating a social impact. The reference to the “efficiency index” refers to the theoretical background of the Cost-Benefit Analysis [59,60], with a view to integration concerning the sole “Effectiveness criterion”. This conceptual meaning is made explicit through the ratio of two numerical indicators of the NPV and the NPVI, calculated through the CBA and the proxy analysis. The reference is the CBA combined with methods and approaches that take into account the multidimensional qualitative-quantitative aspects of the processes of stakeholder involvement and detection of needs, preferences, behaviors, and responsibilities, as well as numerical indicators (financial proxies) that recall the sectors that can benefit from the social impacts. This index is the ratio between the Generated Value (valorization of results) and Invested Value (invested inputs). To calculate the ratio on a percentage basis, it is first necessary to calculate the NPV and to relate it to the Invested Value (input), as indicated below:

which can be summarized as:

SROI Index % = [(Total Value of Benefits − Investment)/Investment] × 100

NPV (Net Present Value)/NPVI (Net Present Value Investment)

The SROI ratio is closely linked to the definition of the SROI approach: “a framework for measuring and accounting for a much broader concept of value; it seeks to reduce inequality and environmental degradation and improve wellbeing by incorporating social, environmental and economic costs and benefits” [61].

The mathematical formula stated is the result of some translation steps from a qualitative to a quantitative nature, thanks to the use of proxies. Indeed, to calculate the SROI ratio, recent contributions [62] agree in indicating that each impact should be evaluated through the use of 4 types of proxy criteria, which must be planned into a time interval defined by the analyst: (i) deadweight defined as the measure of the quantity of outcome that would have occurred even if the activity had not taken place; (ii) attribution, i.e., the evaluation of how much of the outcome comes from the contribution of other organizations or people; (iii) displacement, i.e., how much what is a benefit for a given group of stakeholders may have the opposite effect on another group of stakeholders; (iv) drop-off, i.e., the quantity of the outcome will likely decrease over time.

There is currently no codification or standard for LCC and LCA. However, references remain to guidelines from third-sector and Government bodies, such as the Roberts Enterprise Development Fund in the USA [63], which provide examples for evaluating the monetization of employment services programs [64].

After the identification of the case study on which to apply it, the calculation of the SROI ratio is placed in a specific phase of a complex process (point 5), illustrated in the guidelines according to the following structure:

- Mapping and identification of stakeholders: application of mapping models and launching surveys through different tools and methods, ranging from the administration of online questionnaires [16,19], face-to-face interviews [24,27], focus groups [32];

- Mapping of outcomes: identification of the changes that are to be achieved thanks to the involvement of stakeholders;

- Monetization of outcomes with value attribution: financial proxies assign monetary value to the outcomes;

- Establish the impact: the impact is calculated for each of the outcomes, taking into account the external overestimation factors mentioned in point 3;

- Calculation of the SROI ratio;

- Share the results with other stakeholders.

Despite the limitations that have emerged (see Section 3.3, the few experiments suggest that the SROI methodology can represent a significant value for organizations interested in evaluating and optimizing the effects of their projects in the long term, thus providing solid support for more informed and responsible decisions.

In the context of the SROI calculation, recent experiments have focused on the calculation of proxies, making use of both co-participatory activities within the accounting system to mitigate standardized deficiencies, and methods of analysis and consultation of demand (of the qualitative, quantitative, or qualitative-quantitative nature), broken down into different targets and end users of impacts. Interesting operational approaches are those that refer to face-to-face interviews [17,19,24,27,28,38] and the use of focus groups [20,38], up to the administration of questionnaires [16,25,26,32] and the application of methods such as the Delphi Method [25] or more strictly linked to management such as the Business Model Canvas [38].

The continued evolution of the method, together with its integration with other analytical techniques, as suggested in this contribution, could help to overcome the current critical issues, further improving the effectiveness of SROI in promoting positive change in communities and organizations globally. In this sense, the application of integrated techniques can provide innovative contributions to address contemporary challenges, including social ones, focusing the evaluation steps on the following points of attention: (1) the identification, in terms of forecasting and responsibility, of the changes generated by the interventions; (2) the circular monitoring of the values generated by the investment; (3) the signing of a “responsibility pact” between the interested parties from the initial stages of the processes [60].

3.3. Criticalities

Besides the potentialities, the models’ integrated/complementary adoption according to the aforementioned methodological paths also implies issues and criticalities. In general, the integration of LCC, LCA, and SROI implies criticalities mostly related to the following three main aspects:

- The presence of differences in the model’s output, sometimes even conflictual, for example, the preferable scenario under the economic viewpoint can be less preferable in comparison to the environmental or social ones. In this regard, in recent years, a line of research has developed studies dedicated to exploring methodologies—in particular those of a multi-criteria nature—for the harmonization of outputs produced by different analyses. Furtherly, different results derive from different objects and targets assumed for the analysis;

- The difficulty in monetizing the impacts not directly expressed in monetary terms (precisely, environmental and social impacts). Even in this context, a line of research is exploring possible solutions for identifying a shared unit of measure, such as the contribution of Thiebat [6].

- The model joint application processes are resource-intensive in terms of time, human resources, and financial costs, especially due to the data collection phases. Cruciality is due to data sources, frequently deriving from different datasets. Contextually, there is a certain degree of complexity due to the presence of different units of measurement, assumed in modeling the economic, environmental, and social inputs.

These general issues are accompanied by a series of more specific difficulties of an operational nature. For example, the time horizons assumed for the analysis application can be sensibly different, or, concerning the LCA approach, the financial discounting is not expected, whilst it represents a fundamental step in LCC application. The LCC and LCA approaches are based on quantitative input data, whilst the SROI approach must integrate quantitative, semi-quantitative, and qualitative data to translate them quantitatively. The SROI results may depend on input data strictly related to the economic value of the processes, generated by their outcomes.

As said before, these problems have been the subject of attention by researchers for some time. A separate discussion concerns the conjunction of life cycle models joint application with the SROI, for which specific “additional” problems emerge, as mentioned below.

SROI Critical Issue and Criticalities

Concerning the SROI calculation, critical issues emerge which can be traced back to what Olsen and Lingane [65] (p. 13) state: “SROI” cannot and should not be used as the sole indicator of social performance, in the same way that ROI is not used as a sole indicator of financial performance”, since SROI ratios need to be interpreted against depending on the approach adopted and complemented with additional information. In fact, the process that leads to the SROI index calculation involves various methodological choices, such as the definition of stakeholders, the selection of benefits to be considered, and the calculation method, which can influence the final result. These complexities are underlined by [66] and, in recent debates, are also linked to attempts at experimentation not only in the third sector. In synthesis, the conceptual-operational issues that remain unresolved can be classified into four macro-questions:

- The subjectivity in the definition and quantification of inputs (financial, human, material resources) necessary to produce social benefits

- The difficulty of measuring social benefits and impacts with a view to their monetization: the complexity is highlighted in obtaining values capable of accurately capturing social impacts (many are considered intangible) or comparing different entities according to a common metric. SROI can lead, on the one hand, to a simplification of reality, focusing only on social benefits measurable in economic terms and neglecting other important aspects; on the other hand, it can lead to overestimating the benefits;

- The absence of a shared standardization in the process of identifying proxy variables, strictly necessary in the construction of the SROI index;

- The technical step of calculating the SROI index is strictly linked to the temporality of effects, in particular, the linearity of social returns and the issue of discount rates [67]. Common approaches involve discounting monetary or even non-monetary returns with an interest rate in the range of base rates. The time variable is a critical factor in at least two respects: (a) the deterioration of results over time (the proxy criteria drop-off) can influence the calculation of the SROI, especially for projects with a limited duration; (b) the discount rate used to calculate the SROI can influence the final result, especially for projects with long-term benefits.

4. Research Perspectives

The criticalities highlighted in Section 3.3 demonstrate how using one method or the other cannot comprehensively resolve the evaluation problem. It is therefore hypothesized that an effective solution could be the use of both approaches in synergy. For example, by applying the complementary approach supported by AHP, it is possible to analyze the weights of criteria, or sets of measurable (or qualitative) indicators, arriving at importance rankings that can support the interpretation of the results obtained through the calculation of joint indicators. Alternatively, the joint indicator can be included in the set of criteria in the AHP application, or it can be adopted as the objective of the AHP application itself.

In other words, the logical path summarized in Figure 4, where a distinction is made between an integrated approach and a complementary approach, is nothing other than the basis for further “application schemes” based on appropriate alternations of analysis, the logical sequence of which is defined according to the object of the evaluation, the available data, and the actors involved.

Figure 4.

Evaluation process according to integrated/complementary approach.

According to a multimethodological perspective, to exemplify the possible synergies between the approaches and aiming at reducing their critical issues highlighted in the previous section, we refer to future applications on concrete cases or simulations, currently under development.

On one side, considering that “AHP proved an effective method for aggregating the multiple sustainability criteria” [18], the use of AHP is currently under testing in conjunction with LCC, LCA, and SROI, after an initial phase devoted to the selection of the criteria and related indicators set. The criteria weight is defined by considering the stakeholders involved in the decision-making problem.

On the other side, the composite indicator will be quantified by introducing different weights to each sustainability impact, according to the results of the previous phase of the analysis. Operationally, assigning weights to the criteria can be obtained by adopting a system of diverse discount rates. Attention is posed on the Environmental Hurdle Rate approach, illustrated in [41]. As is known, this last is based on the “hurdle rate principle” which adopts different rate values given the degree of the negative contribution to the environment produced by each input variable. It represents—in the case of the environmental sustainability component—an alternative to the financial (conventional) discount rate, founded on the time preference principle. Analogously, different rates can be identified for the other sustainability dimensions.

According to this proposal—which effectiveness is going to be verified—the AHP represents a rational approach for defining the weight of different discount rate values in relation to each sustainability dimension, otherwise arbitrarily defined or, in any case, assigned with a certain degree of subjectivity. On the contrary, the Hurdle Rate application can represent an operative modality to operationalize the AHP results, expressed through the priority vector.

5. Conclusions

The proposal, already in its phase of reconnaissance of the literature background, has highlighted its contribution to the updating of the debate on the evaluation of the holistic sustainability of real estate projects. Consolidated aspects have emerged, but also areas that are not yet fully explored, for the joint applications of the techniques recalled here. In particular, there is a gap regarding the integrated use of AHP–LCC–SROI approaches, due to the complexity of harmonizing the three environmental, economic, and social indicators within a life cycle–oriented evaluation framework. The literature review, carried out on the state of the art and on the theoretical background, in support of the methodological proposal, clearly highlights both the growing—and not fully explored—importance of the social dimension, and the increasingly urgent need for multidimensional approaches in decision-making processes in the presence of social components. It is clear how holistic and integrated analyses are crucial for sustainable construction and heritage upcycling projects, in support of urban policies and urban resilience.

The reasoning that has been conducted here is linked to the simulation of a process of choice assistance, in support of the identification of the preferred project option (effective and sustainable). This has led to leaning towards the methodological assumption of the integrated approach, based on a set of multi-dimensional criteria, related measurable indicators, and operational modalities to calculate the indicators themselves (“Financial Feasibility” criterion, “Economic Sustainability” criterion, “Environmental Sustainability” criterion, and Social Sustainability” criterion). There are still opportunities for further investigation regarding the theoretical operational criticalities within the calculation and measurement processes of each criterion and regarding new application contexts. Some criticalities still need to be overcome in the calculation phase, through synthetic indicators of the economic, financial, environmental, and social components: their internalization in the NPV calculation through a Discounted Cash-Flow Analysis (DCFA), implying a certain complexity in impact monetizing phases, besides other criticalities.

In each case, the methodological proposal of a double research direction (the integrated methodological proposal and the complementary methodological proposal) seems to be an interesting trajectory, albeit double, about: (1) degrees of advancement in the scientific debate, (2) potential new lines of research in a holistic dimension and supported by synergistic applications and (3) focus on the need for technical insights—necessary in the development of the decision-making process—on the social dimension for heritage upcycling and building construction.

Author Contributions

Conceptualization, E.F.; methodology, C.C., E.F., F.P. and C.S.; writing—original draft preparation, C.C., E.F., F.P. and C.S.; writing—review and editing, C.C., E.F., F.P. and C.S.; visualization, C.S. and F.P.; supervision E.F., C.C. and C.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data supporting the findings of this study are available within the article.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Halog, A.; Manik, Y. Advancing Integrated Systems Modelling Framework for Life Cycle Sustainability Assessment. Sustainability 2011, 3, 469–499. [Google Scholar] [CrossRef]

- Guinée, J.B. Life cycle sustainability Assessment: What is it and what are its challenges? In Taking Stock of Industrial Ecology; Springer: Cham, Switzerland, 2016; pp. 45–68. [Google Scholar]

- Fregonara, E.; Giordano, R.; Ferrando, D.G.; Pattono, S. Economic-Environmental Indicators to support investment Decisions: A focus on the buildings. End-of-Life stage. Buildings 2017, 7, 65. [Google Scholar] [CrossRef]

- Guarini, M.R.; Sica, F.; Morano, P.; Vadalà, J.A. An Integrated Economic-Energy-Environmental Framework for the Assessment of Alternative Eco-Sustainable Building Designs. Urban Sci. 2021, 5, 82. [Google Scholar] [CrossRef]

- Valdivia, S.; Ugaya, C.M.L.; Hildenbrand, J.; Traverso, M.; Mazijn, B.; Sonnemann, G. A UNEP/SETAC approach towards a life cycle sustainability assessment—Our contribution to Rio+20. Int. J. Life Cycle Assess 2013, 18, 1673–1685. [Google Scholar] [CrossRef]

- Thiebat, F. Life Cycle Design: An Experimental Tool for Designers; Springer: Cham, Switzerland, 2019. [Google Scholar]

- ISO 15686-5:2017; Buildings and Constructed Assets Service Life Planning—Part 5: Life-Cycle Costing. ISO: Geneva, Switzerland, 2017. Available online: https://www.iso.org/standard/61148.html (accessed on 10 March 2025).

- ISO 14040:2021; Gestione Ambientale—Valutazione del Ciclo di vita—Principi e Quadro di Riferimento. ISO: Geneva, Switzerland, 2021. Available online: https://store.uni.com/uni-en-iso-14044-2021 (accessed on 10 March 2025).

- Fregonara, E.; Ferrando, D.G. Building Upcycling vs. Building Reconstruction: A Life Cycle Valuation for investment decisions. Procedia Struct. Integr. 2024, 64, 1727–1732. [Google Scholar] [CrossRef]

- Saaty, T.L. The Analytic Hierarchy Process: Planning, Priority Setting, Resource Allocation; McGraw-Hill: Columbus, OH, USA, 1980. [Google Scholar]

- Lombardi, P.; Todella, E. Multi-Criteria Decision Analysis to Evaluate Sustainability and Circularity in Agricultural Waste Management. Sustainability 2023, 15, 14878. [Google Scholar] [CrossRef]

- Direttiva (Ue) 2024/1275 del Parlamento Europeo e del Consiglio del 24 Aprile 2024 Sulla Prestazione Energetica Degli Edifici. Il Parlamento Europeo e il Consiglio dell’Unione Europea. Available online: https://eur-lex.europa.eu/legal-content/IT/TXT/PDF/?uri=OJ:L_202401275 (accessed on 10 March 2025).

- Yi, H.; Wen, H.-J. Analysis of the Life Cycle Cost of the Power Plants Based on Analytic Hierarchy Process Method. In Proceedings of the International Conference on Information Management, Innovation Management and Industrial Engineering, Xi’an, China, 26–27 December 2009; pp. 639–642. [Google Scholar]

- Mulubrhan, F.; Mokhtar, A.B.B.; Muhamed, M. Decision Support System Using Fuzzy AHP and Activity-Based Life Cycle Costing. Aust. J. Basic Appl. Sci. 2014, 8, 48–54. [Google Scholar]

- Plebankiewicz, E.; Zima, K.; Wieczorek, D. Review of methods of determining the life cycle cost of buildings. In Proceedings of the Creative Construction Conference, Krakow, Poland, 21–24 June 2015. [Google Scholar]

- Watson, K.J.; Whitley, T. Applying Social Return on Investment (SROI) to the built environment. Build. Res. Inf. 2017, 45, 875–891. [Google Scholar] [CrossRef]

- Viganò, F.; Lombardo, G. Misurare l’impatto sociale generato dai musei. L’applicazione della metodologia del Ritorno Sociale sull’investimento (SROI). In Ambienti Digitali per L’educazione All’arte e al Patrimonio, 1st ed.; Luigini, A., Panciroli, C., Eds.; FrancoAngeli: Milano, Italy, 2018; pp. 332–350. [Google Scholar]

- Opher, T.; Friedler, E.; Shapira, A. Comparative life cycle sustainability assessment of urban water reuse at various centralization scales. Int. J. Life Cycle Assess 2019, 24, 1319–1332. [Google Scholar] [CrossRef]

- Lombardo, G.; Mazzocchetti, A.; Rapallo, I.; Tayser, N.; Cincotti, S. Assessment of the Economic and Social Impact Using SROI: An Application to Sport Companies. Sustainability 2019, 11, 3612. [Google Scholar] [CrossRef]

- Bottero, M.; Comino, E.; Dell’Anna, F.; Dominici, L.; Rosso, M. Strategic Assessment and Economic Evaluation: The Case Study of Yanzhou Island (China). Sustainability 2019, 11, 1076. [Google Scholar] [CrossRef]

- Xu, C.; Tang, T.; Jia, H.; Xu, M.; Xu, T.; Liu, Z.; Long, Y.; Zhang, R. Benefits of coupled green and grey infrastructure systems: Evidence based on analytic hierarchy process and life cycle costing. Resour. Conserv. Recycl. 2019, 151, 104478. [Google Scholar] [CrossRef]

- Fregonara, E.; Coscia, C. Multi Criteria Analyses, Life Cycle Approaches and Delphi Method: A Methodological Proposal to Assess Design Scenarios|Analisi Multi Criteria, approcci Life Cycle e Delphi Method: Una proposta metodologica per valutare scenari di Progetto. Valori Valutazioni 2019, 23, 107–117. [Google Scholar]

- Zhou, Z.; Chi, Y.; Dong, J.; Tang, Y.; Ni, M. Model development of sustainability assessment from a life cycle perspective: A case study on waste management systems in China. J. Clean. Prod. 2019, 210, 1005–1014. [Google Scholar] [CrossRef]

- Courtney, P.; Powell, J. Evaluating Innovation in European Rural Development Programmes: Application of the Social Return on Investment (SROI) Method. Sustainability 2020, 12, 2657. [Google Scholar] [CrossRef]

- Kim, D.-J.; Ji, Y.-S. The Evaluation Model on an Application of SROI for Sustainable Social Enterprises. J. Open Innov. Technol. Mark. Complex. 2020, 6, 7. [Google Scholar] [CrossRef]

- Hunter, R.F.; Dallat, M.A.T.; Tully, M.A.; Heron, L.; O’Neill, C.; Kee, F. Social return on investment analysis of an urban greenway. Cities Health 2020, 6, 693–710. [Google Scholar] [CrossRef]

- Saenz, C.S. A new mapping outcome method to measure social return on investment: A case study in Peru. Soc. Responsib. J. 2021, 17, 562–577. [Google Scholar] [CrossRef]

- Ariza-Montes, A.; Sianes, A.; Fernández-Rodríguez, V.; López-Martín, C.; Ruíz-Lozano, M.; Tirado-Valencia, P. Social Return on Investment (SROI) to Assess the Impacts of Tourism: A Case Study. SAGE Open 2021, 11, 2158244020988733. [Google Scholar] [CrossRef]

- El Hadidi, O.; Meshref, A.; El-Dash, K.; Basiouny, M. Evaluation of Building Life Cycle Cost (LCC) Criteria in Egypt Using the Analytic Hierarchy Process (AHP). Int. J. Anal. Hierarchy Process 2022, 14. [Google Scholar] [CrossRef]

- Abu, R.; Ab Aziz, M.A.; Noor, Z. Integrated Life Cycle Assessment, Life Cycle Costing and Multi Criteria Decision Making for Food Waste Composting Management. J. Adv. Res. Bus. Manag. Stud. 2021, 21, 1–9. [Google Scholar] [CrossRef]

- Tate, C.; O’Neill, C.; Tran, N.; Heron, L.; Kee, F.; Tully, M.A.; Dallat, M.; Hunter, R.F. The social return on investment of an urban regeneration project using real-world data: The Connswater Community Greenway, Belfast, UK. Cities Health 2023, 7, 699–718. [Google Scholar] [CrossRef]

- Vasiliu, E.-E.; Torabi Moghadam, S.; Bisello, A.; Lombardi, P. Visionary Nature-Based Solutions Evaluated through Social Return on Investment: The Case Study of an Italian Urban Green Space. Smart Cities 2024, 7, 946–972. [Google Scholar] [CrossRef]

- Song, P.; Wu, L.; Zhao, W.; Ma, W.; Hao, J. Life Cycle Sustainability Assessment: An Index System for Building Energy Retrofit Projects. Buildings 2024, 14, 2817. [Google Scholar] [CrossRef]

- Cerchione, R.; Morelli, M.; Passaro, R.; Quinto, I. A critical analysis of the integration of life cycle methods and quantitative methods for sustainability assessment. Corp. Soc. Responsib. Environ. Manag. 2025, 32, 1508–1544. [Google Scholar] [CrossRef]

- Ghorbannezhad, P.; Azizi, M.; Ray, C.; Amiri, M.; Ghofrani, M. Evaluation of Life Cycle Assessment in Furniture Manufacturing Using the Analytical Hierarchy Process. Int. J. Anal. Hierarchy Process 2024, 16. [Google Scholar] [CrossRef]

- Dinh, T.H.; Nguyen, T.T.D. An integrated multi-criteria decision-making approach for life cycle approach in road construction projects. J. Infrastruct. Policy Dev. 2024, 8, 6926. [Google Scholar] [CrossRef]

- Liu, S.; Pan, R.; Chen, X.; Xue, Z.; Zhang, Y.; Cao, Z. A Comprehensive Evaluation Method of Cost-Effectiveness of LID Facilities in Sponge City Based on the Life Cycle. Water Conserv. Sci. Eng. 2024, 9, 84. [Google Scholar] [CrossRef]

- Basset, F.; Giarè, F.; Senni, S.; Soriano, B. A New Integrated Framework to Assess the Impact of Social Farming on Sustainability and Rural Development: A Case Study in Lazio. Sustainability 2025, 17, 1715. [Google Scholar] [CrossRef]

- Guidelines Accompanying Commission Delegated Regulation (EU) No 244/2012 of 16 January 2012 Supplementing Directive 2010/31/EU of the European Parliament and of the Council on the Energy Performance of Buildings by Establishing a Comparative Methodology Framework for Calculating Cost-Optimal Levels of Minimum Energy Performance Requirements for Buildings and Building Elements. Eur-Lex: Geneva, Switzerland, 2012. Available online: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=oj:JOC_2012_115_R_0001_01 (accessed on 10 June 2025).

- Fregonara, E. Building upcycling or building reconstruction? The ‘Global Benefit’ perspective to support investment decisions for sustainable cities. Front. Sustain. Cities 2023, 5, 1282748. [Google Scholar] [CrossRef]

- Gray, R.H.; Bebbington, J.; Walters, D. Accounting for the Environment; Paul Chapman: London, UK, 1993. [Google Scholar]

- Pearce, D.W.; Turner, R.K. Economics of Natural Resources and the Environment; The Johns Hopkins University Press: Baltimore, MD, USA, 1990. [Google Scholar]

- Fregonara, E.; Ferrando, D.G. The discount rate in evaluating project economic-environmental sustainability. Sustainability 2023, 15, 2467. [Google Scholar] [CrossRef]

- Curto, R.; Fregonara, E. Decision tools for investments in the real estate sector with risk and uncertainty elements. Jahrb. Fuer Reg. 1999, 19, 55–85. [Google Scholar]

- Saaty, R.W. The analytic hierarchy processes what it is and how it is used. Math. Model. 1987, 9, 161–176. [Google Scholar] [CrossRef]

- Figueira, J.R.; Greco, S.; Ehrgott, M. Multiple Criteria Decision Analysis, State of the Art Surveys; Spinger: Berlin/Heidelberg, Germany, 2005. [Google Scholar]

- Saaty, T.L.; Vargas, L. The Analytic Network Process; Spinger: Berlin/Heidelberg, Germany, 2006. [Google Scholar]

- Brown, G.R.; Matysiak, G.A. Real Estate Investment. A Capital Market Approach; Financial Times Prentice Hall: Harlow, UK, 2000. [Google Scholar]

- Jaffe, A.J.; Sirmans, C.F. Fundamentals of Real Estate Investment, 3rd ed.; Prentice Hall: Upper Saddle River, NJ, USA, 1995. [Google Scholar]

- Department of Energy—DOE. Life Cycle Cost Handbook Guidance for Life Cycle Cost Estimate and Life Cycle Cost Analysis; Department of Energy (DOE): Washington, DC, USA, 2014.

- Langdon, D. Life Cycle Costing (LCC) as a Contribution to Sustainable Construction: A Common Methodology—Final Methodology. 2007. Available online: https://www.tmb.org.tr/uploads/publications/6065d0814e2c483e72ff9009/1617285248294-lcc-draft-methodology.pdf (accessed on 10 March 2025).

- ISO 14040/44; Environmental Management—Life Cycle Assessment—Principles and Framework. International Organization for Standardization: Geneva, Switzerland, 2006.

- EEAGlossary. European Union. 2024. Available online: https://www.eea.europa.eu/help/glossary/eea-glossary (accessed on 10 March 2025).

- Wu, R.; Su, H. Environmental Impact Assessment Using LCA: Methods and Case Studies; Springer: Berlin/Heidelberg, Germany, 2020; pp. 39–55. [Google Scholar]

- Moazzem, S.; Rahman, A.; Daver, F. Life Cycle Assessment and Circular Economy Strategies for Sustainable Textile and Fashion Value Chains; Springer: Berlin/Heidelberg, Germany, 2021. [Google Scholar]

- UNI EN 15804:2019; Sostenibilità Delle Costruzioni—Dichiarazioni Ambientali di Prodotto—Regole Quadro di Sviluppo per Categoria di Prodotto. Ente Nazionale Italiano di Unificazione: Milan, Italy, 2020.

- UNI EN 15978:2011; Sostenibilità Delle Costruzioni—Valutazione Della Prestazione Ambientale Degli Edifici—Metodo di Calcolo. Ente Nazionale Italiano di Unificazione: Milan, Italy, 2011.

- Wolf, M.A.; Pant, R.; Chomkhamsri, K.; Sala, S.; Pennington, D. ILCD Handbook: Towards More Sustainable Production and Consumption for A Resource-Efficient Europe; Publications Office of the European Union: Luxembourg, 2012. [Google Scholar]

- Coscia, C. The Ethical and Responsibility Components in Environmental Challenges: Elements of Connection between Corporate Social Responsibility and Social Impact Assessment. In Corporate Social Responsibility; Orlando, B., Ed.; Oxford University Press: Oxford, UK, 2020. [Google Scholar]

- Coscia, C.; Rubino, I. Fostering new value chains and social impact-oriented strategies in urban regeneration processes: What challenges for the evaluation discipline? In Proceedings of the International Symposium: New Metropolitan Perspectives, Reggio Calabria, Italy, 26–28 May 2020; Springer International Publishing: New York, NY, USA, 2020; pp. 983–992. [Google Scholar]

- Nicholls, J.; Lawlor, E.; Neitzert, E.; Goodspeed, T. A Guide to Social Return on Investment (SROI) (Revised). Available online: https://www.socioeco.org/bdf_fiche-publication-929_en.html (accessed on 20 January 2025).

- Maldonado, M.; Corbey, M. Social Return on Investment (SROI): A review of the technique. Manag. Account. 2016, 90, 79–86. [Google Scholar] [CrossRef]

- REDF. Available online: https://redf.org (accessed on 11 February 2025).

- REDF. Available online: https://redf.org/2023-impact-report/ (accessed on 11 February 2025).

- Olsen, S.; Lingane, A. Social Return on Investment: Standard Guidelines; Center for Responsible Business; UC Berkeley: Berkeley, CA, USA, 2003. [Google Scholar]

- Maier, F.; Schober, C.; Simsa, R.; Millner, R. SROI as a method for evaluation research: Understanding merits and limitations. Int. J. Volunt. Nonprofit Organ. 2014, 26, 1805–1830. [Google Scholar] [CrossRef]

- Polonsky, M.; Grau, S.L. Assessing the social impact of charitable organizations—Four alternative approaches. Int. J. Nonprofit Volunt. Sect. Mark. 2011, 16, 195–211. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).