Navigating the Challenges of Commodity Traps and Platform Economies: An Assessment in the Context of the Northern Black Forest Region and Future Directions

Abstract

1. Introduction

1.1. The Impact of BEV Transition on Northern Black Forest Automotive Suppliers

1.2. Research Problem

2. Research Method

3. State of the Art

3.1. Platform Economy

3.2. Commodity Trap in the Context of the Automotive Industry

3.2.1. Functional Principle

3.2.2. Escape Strategies

4. Mobility in Harmony Consortium

4.1. MIH Organization

4.2. MIH Working Groups

4.3. Projects

4.4. Technological Innovations and the Role of Commodity Hardware in the MIH Consortium

- Battery packs: Standardized lithium-ion battery packs, sourced from open market suppliers, serve as the primary energy storage solution in BEVs [38].

- Electric motors: Off-the-shelf electric motors, such as those utilized in MIH EV Open Networks, provide the propulsion system for BEVs, offering efficiency and reliability at competitive costs.

- Power electronics: Standardized power electronics components, encompassing inverters and motor controllers, manage the flow of electricity between the battery pack and electric motor, optimizing performance and efficiency [37].

- Charging infrastructure: Standard charging infrastructure, including stations and connectors compliant with MIH EV standards, facilitates convenient and efficient BEV charging [39].

- Benefits:

- Lower cost: Commodity hardware reduces manufacturing expenses, thereby enhancing BEV affordability and accessibility for consumers.

- Interchangeability: Standardized components enable easy interchangeability and compatibility among various BEV models and manufacturers.

- Availability: Components sourced from open networks like MIH EV are widely accessible through multiple suppliers, mitigating supply chain constraints.

- Disadvantages:

- Performance limitations: While standardized components offer cost advantages, they may not always deliver peak performance compared to proprietary solutions.

- Troubleshooting complexity: Utilizing components from diverse suppliers can lead to compatibility issues and pose challenges in troubleshooting.

- Limited support: Unlike fully integrated proprietary systems, commodity hardware may receive limited support from the original equipment manufacturer.

5. Automotive Suppliers in the Northern Black Forest Region

6. Impact Analysis for Automotive Suppliers in the Northern Black Forest Region

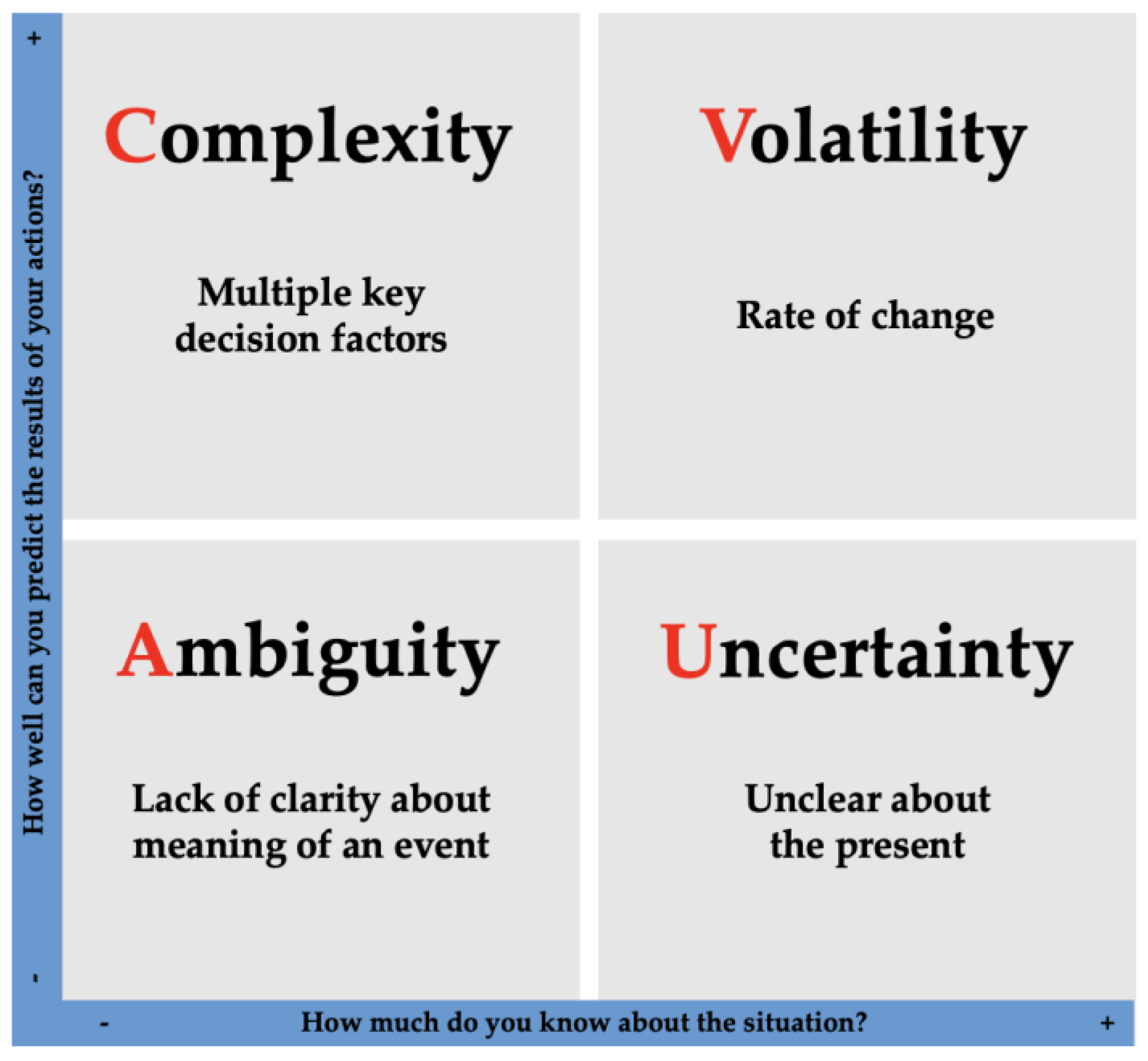

6.1. VUCA Method

6.2. VUCA Analysis for the Northern Black Forest Region

6.2.1. Volatility

6.2.2. Uncertainty

6.2.3. Complexity

6.2.4. Ambiguity

7. Recommended Action for Positioning

7.1. Integration into Platform Economies

7.2. Innovation for Differentiation

7.3. Adoption of Advanced Technologies

7.4. Strategic Customer Relationship Management

7.5. Invest in Talent Development

8. Conclusions, Limitations and Outlook

8.1. Conclusions

8.2. Implications for Practice and Policy

8.3. Limitations

- Rapidly evolving landscape: One of the primary limitations of this research is the rapidly evolving nature of the platform economy and electric mobility landscapes. These sectors are characterized by constant innovation, emerging technologies, and evolving market dynamics. While this analysis provides a snapshot in time, the dynamics of the industry may change swiftly due to new technological advancements, market entrants, regulatory changes, and shifts in consumer preferences. Therefore, the findings and recommendations presented here may need to be continually reassessed and updated to remain relevant in a dynamic environment. Foxconn, based on MIH EV Open, in partnership with Saudi Arabia’s Public Investment Fund (PIF), has launched Ceer, the first Saudi electric vehicle brand. This joint venture will involve Foxconn in designing, manufacturing, and selling electric vehicles within Saudi Arabia [62,63].

- Regional focus: This study focuses specifically on the Northern Black Forest Region, which possesses a distinctive industrial composition and ecosystem. The characteristics and challenges identified in this research may not be fully generalizable to other automotive supplier clusters globally. Variations in industry structure, regulatory environments, economic conditions, and technological adoption across different regions could influence the applicability of the findings beyond the Northern Black Forest. Future studies could explore other automotive clusters to provide a more comprehensive understanding of the broader implications.

- Data availability: A significant challenge encountered during this research was the limited availability of comprehensive data, particularly concerning newer initiatives such as the MIH Consortium. Access to detailed and up-to-date information on the operations, strategies, and impacts of these initiatives is crucial for conducting a thorough analysis. The reliance on publicly available data and the timing of data collection may have restricted the depth and breadth of the analysis, potentially influencing the comprehensiveness of the conclusions drawn.

- Methodological constraints: While the VUCA (volatility, uncertainty, complexity, ambiguity) framework proved valuable in structuring the analysis, it inherently has limitations in capturing the full complexity of the automotive industry transformation. The framework provides a structured approach to assessing challenges but may not fully encompass all nuances and interdependencies within the industry. Incorporating additional analytical approaches, such as scenario planning, stakeholder interviews, or longitudinal studies, could provide complementary perspectives and enrich the understanding of the implications identified in this research.

- Addressing these limitations requires ongoing vigilance and adaptation to changes in the automotive industry landscape. Future research endeavors should aim to overcome these challenges by incorporating more robust data sources, expanding the geographical scope of analysis, employing diverse analytical methods, and maintaining flexibility to accommodate evolving industry dynamics.

8.4. Outlook

- Longitudinal studies: Tracking the ongoing evolution of platform economics and its impact on automotive suppliers over extended periods can provide deeper insights into long-term trends and implications.

- Cross-regional comparisons: Comparing the experiences and strategies of automotive supplier clusters in diverse regions can offer a broader perspective and identify transferable best practices.

- Empirical investigations: Conducting empirical research through surveys, interviews, or case studies with automotive suppliers can offer nuanced insights into their specific challenges, adaptive strategies, and decision-making processes.

- Modeling and simulation: Developing computational models or simulations can help predict potential outcomes of different platform economy scenarios, aiding strategic decision-making among stakeholders.

- Policy implications: Exploring the role of policymakers and regulatory frameworks in shaping the impact of platform economics on the automotive industry can inform potential interventions or supportive policy measures.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Vom Brocke, J.; Simons, A.; Niehaves, B.; Niehaves, B.; Reimer, K.; Plattfaut, R.; Cleven, A. Reconstructing the Giant: On the Importance of Rigour in Documenting the Literature Search Process. In Proceedings of the 17th European Conference on Information Systems (ECIS), Verona, Italy, 13–19 June 2009; Volume 161. [Google Scholar]

- Cooper, H.M. Organizing Knowledge Syntheses: A Taxonomy of Literature Reviews. Knowl. Soc. 1988, 1, 104. [Google Scholar] [CrossRef]

- Webster, J.; Watson, R.T. Analyzing the Past to Prepare for the Future: Writing a Literature Review. MIS Q. 2002, 26, xiii–xxiii. [Google Scholar]

- Haucap, J. Plattformökonomie: Neue Wettbewerbsregeln—Renaissance der Missbrauchsaufsicht. Wirtschaftsdienst 2020, 100, 20–29. [Google Scholar] [CrossRef]

- Xue, C.; Tian, W.; Zhao, X. The Literature Review of Platform Economy. Sci. Program. 2020, 2020, 8877128. [Google Scholar] [CrossRef]

- Evans, P.C.; Gawer, A. The Rise of the Platform Enterprise: A Global Survey; The Emerging Platform Economy Series No. 1; The Center for Global Enterprise: New York, NY, USA, 2016. [Google Scholar]

- Hildebrandt, A.; Landhäußer, W. CSR und Digitalisierung: Der Digitale Wandel als Chance und Herausforderung für Wirtschaft und Gesellschaft; Management-Reihe Corporate Social Responsibility; Springer: Berlin/Heidelberg, Germany, 2021; ISBN 978-3-662-61835-6. [Google Scholar]

- Jaekel, M. Die Macht der Digitalen Plattformen; Springer: Wiesbaden, Germany, 2017; ISBN 978-3-658-19177-1. [Google Scholar]

- Rochet, J.-C.; Tirole, J. Platform Competition in Two-Sided Markets. J. Eur. Econ. Assoc. 2003, 1, 990–1029. [Google Scholar] [CrossRef]

- Amerland, A. Vertrauen ist Unabdingbar für die Digitalisierung. Available online: https://www.springerprofessional.de/transformation/corporate-social-responsibility/vertrauen-ist-unabdingbar-fuer-die-digitalisierung/16095820 (accessed on 1 March 2023).

- Enke, M.; Geigenmüller, A.; Leischnig, A. Commodity Marketing: Strategies, Concepts, and Cases; Management for Professionals; Springer International Publishing: Cham, Switzerland, 2022; ISBN 978-3-030-90656-6. [Google Scholar]

- Schallmo, D.R.A.; Brecht, L. Mind the Trap—11 Typische Unternehmensfallen: Frühzeitig Erkennen, Bewerten und Erfolgreich Vermeiden; Springer: Wiesbaden, Germany, 2016; ISBN 978-3-658-09564-2. [Google Scholar]

- D’Aveni, R.A. Beating the Commodity Trap: How to Maximize Your Competitive Position and Increase Your Pricing Power; Harvard Business Review Press: Boston, MA, USA, 2010; ISBN 978-1-4221-5616-2. [Google Scholar]

- Ghodsi, M.; Stehrer, R. Avoiding and Escaping the “Commodity Trap” in Development. WIIW Work. Pap. 2018, 153, 187–211. [Google Scholar] [CrossRef]

- Yun, J.J. Business Model Design Compass; Management for Professionals; Springer: Singapore, 2017; ISBN 978-981-10-4126-6. [Google Scholar]

- Karakaya, F. Market Exit and Barriers to Exit: Theory and Practice. Psychol. Mark. 2000, 17, 651–668. [Google Scholar] [CrossRef]

- Kölmel, B. Automobilindustrie—Es Droht Eine Vollkommene Veränderung der Wertschöpfungsstrukur: Der iPhone Fertiger Foxconn Mischt den Markt Auf! Available online: https://www.linkedin.com/pulse/automobilindustrie-es-droht-eine-vollkommene-der-iphone-koelmel/ (accessed on 25 February 2023).

- Automotive World Ltd. Foxconn: MIH Unveils Project X: An A-Segment Electric Vehicle Platform with Modular Design Approach. Available online: https://www.automotiveworld.com/news-releases/foxconn-mih-unveils-project-x-an-a-segment-electric-vehicle-platform-with-modular-design-approach/ (accessed on 4 December 2022).

- Foxtron Inc. Foxtron Vehicle Technologies and North-Star International\Kaohsiung Bus Company of San- Ti Group Collaborating on Green Transportation MIH Platform Product Debute! Independently Developed Electric Bus: “E BUS” Drives into Southern Taiwan! Available online: https://www.foxtronev.com/en/news/detail?id=46%20 (accessed on 4 December 2022).

- Hon Hai Precision Industry Co., Ltd. Overview of Hon Hai Technology Group (Foxconn®). Available online: https://www.foxconn.com/en-us/about/group-profile (accessed on 2 December 2022).

- Hon Hai Precision Industry Co., Ltd. MIH Consortium Announces Next Level Operating Model to Foster Innovation and Collaboration to Lower Entry Barriers for Alliance Partners. Available online: https://www.honhai.com/en-us/press-center/events/ev-events/640 (accessed on 2 December 2022).

- MIH Consortium. Available online: https://www.mih-ev.org/en/consortium/ (accessed on 3 December 2022).

- MIH Consortium. Mobility In Harmony: Creating an Open EV Ecosystem That Promotes Collaboration in the Mobility Industry. Available online: https://www.mih-ev.org/en/index/ (accessed on 3 December 2022).

- MIH. Demo Day: Whole Day Livestream. Available online: https://www.youtube.com/watch?v=cdw2oUMaBFI (accessed on 3 December 2022).

- MIH Consortium. Member Services Introduction. Available online: https://www.mih-ev.org/en/member-services/ (accessed on 25 February 2023).

- MIH Consortium. MIH Alliance Member Gathering. Available online: https://www.mih-ev.org/wp-content/uploads/2021/08/MIH-Alliance-Member-Gathering-20210325-Slide-Deck.pdf (accessed on 3 December 2022).

- Cheng, J. MIH Demo Day Keynote with MIH CEO Jack Cheng. Available online: https://www.youtube.com/watch?v=ZyDhn9-Co90 (accessed on 3 December 2022).

- Kürten, C. Body Structure Keynote with FEV Vehicle Architecture Manager Kürten Christian|MIH Demo Day. Available online: https://www.youtube.com/watch?v=DOTJj8WDg_c (accessed on 3 December 2022).

- Huang, C. Powertrain Keynote with AAM Senior Consultant Colin Huang. Available online: https://www.youtube.com/watch?v=9w9N2Ibu_7U&list=PLbM03FlLZCraRAJDbLqiOc2RXccTfCO00&index=2 (accessed on 3 December 2022).

- Liao, E. EEA Keynote with MIH Technical Development Consultant Eric Liao. Available online: https://www.youtube.com/watch?v=sA-60xcxW74&list=PLbM03FlLZCraRAJDbLqiOc2RXccTfCO00&index=3 (accessed on 3 December 2022).

- John, C. Autonomy Keynote with Tier IV President Christian John. Available online: https://www.youtube.com/watch?v=PZUh0CMiAuk&list=PLbM03FlLZCraRAJDbLqiOc2RXccTfCO00&index=5 (accessed on 3 December 2022).

- Lien, T. Smart Cabin Keynote with MIH Technical Development Consultant Ted Lien. Available online: https://www.youtube.com/watch?v=xuYpeqzIZ-o&list=PLbM03FlLZCraRAJDbLqiOc2RXccTfCO00&index=6 (accessed on 3 December 2022).

- Lu, B. Security & OTA Keynote with MIH Technical Development Consultant Brook Lu. Available online: https://www.youtube.com/watch?v=8BspqvOfPC0&list=PLbM03FlLZCraRAJDbLqiOc2RXccTfCO00&index=7 (accessed on 3 December 2022).

- Foxtron Inc. The More Open It Is, the Stronger It Will Be. Available online: https://www.foxtronev.com/en/design (accessed on 7 December 2022).

- Foxconn. 3 November 2022. HRH Crown Prince Launches CEER, the First Saudi Electric Vehicle Brand. Available online: https://www.foxconn.com/en-us/press-center/press-releases/latest-news/912 (accessed on 19 June 2024).

- Spooner, J.G. “Commodity” Not a Dirty Word at Dell. Available online: https://www.cnet.com/tech/computing/commodity-not-a-dirty-word-at-dell/ (accessed on 14 May 2024).

- Elphinstone, K.; Shen, Y. Increasing the Trustworthiness of Commodity Hardware through Software. In Proceedings of the 2013 43rd Annual IEEE/IFIP International Conference on Dependable Systems and Networks (DSN), Budapest, Hungary, 24–27 June 2013; pp. 1–6. [Google Scholar]

- Ding, Y.; Cano, Z.P.; Yu, A.; Lu, J.; Chen, Z. Automotive Li-Ion Batteries: Current Status and Future Perspectives. Electrochem. Energ. Rev. 2019, 2, 1–28. [Google Scholar] [CrossRef]

- Franzese, P.; Patel, D.D.; Mohamed, A.; Iannuzzi, D.; Fahimi, B.; Risso, M.; Miller, J.M. Fast DC Charging Infrastructures for Electric Vehicles: Overview of Technologies, Standards, and Challenges. IEEE Trans. Transp. Electrific. 2023, 9, 3780–3800. [Google Scholar] [CrossRef]

- Zhang, W.Z.; Wang, G.X.; Cheok, B.T.; Nee, A.Y.C. A Functional Approach for Standard Component Reuse. Int. J. Adv. Manuf. Technol. 2003, 22, 141–149. [Google Scholar] [CrossRef]

- Wirtschaftsförderung Nordschwarzwald GmbH. Wirtschaft. Available online: https://www.nordschwarzwald.de/lightbox/wirtschaft.html (accessed on 3 March 2023).

- MODULDREI GmbH; Regionalverband Nordschwarzwald; Wirtschaftsförderung Nordschwarzwald GmbH. Wirtschaftsstrukturanalysen für die Region Nordschwarzwald: Zusammenfassung. Available online: https://www.nordschwarzwald.de/news/details/aktuelles/view/transformationsstrategie-fuer-die-region-nordschwarzwald.html (accessed on 17 April 2023).

- Lache, G.; Neff, L. Die Zeit Ist Reif für Den Einstieg in die Automobile Transformation. Available online: https://wirtschaftskraft.de/artikel/die-zeit-ist-reif-fuer-den-einstieg-in-die-automobile-transformation-jobangebote (accessed on 22 February 2023).

- Regionalverband. Nordschwarzwald Regionalverband. Available online: http://www.nordschwarzwald-region.de/regionalverband (accessed on 1 December 2022).

- Hanno, K.; Johannes, E.; Oliver, K.; Benita, Z. Wirtschaftliche Bedeutung Regionaler Automobilnetzwerke in Deutschland: Studie für das Bundesministerium für Wirtschaft und Energie (BMWi). Available online: https://www.iwkoeln.de/studien/hanno-kempermann-johannes-ewald-manuel-fritsch-oliver-koppel-benita-zink-wirtschaftliche-bedeutung-regionaler-automobilnetzwerke-in-deutschland.html (accessed on 5 December 2022).

- INFO—Das Magazin Pforzheim GmbH. Sieben Millionen Euro für Automotive-Projekt “TraFoNetz Nordschwarzwald”. Available online: https://wirtschaftskraft.de/artikel/sieben-millionen-euro-fuer-automotive-projekt-trafonetz-nordschwarzwald (accessed on 8 December 2022).

- Wang-Mlynek, L.; Foerstl, K. Barriers to Multi-Tier Supply Chain Risk Management. Int. J. Logist. Manag. 2020, 31, 465–487. [Google Scholar] [CrossRef]

- Wirtschaftsförderung Nordschwarzwald GmbH. TRAFONETZ Nordschwarzwald Bewilligt. Available online: https://www.nordschwarzwald.de/news/details/aktuelles/view/trafonetz-nordschwarzwald-bewilligt.html (accessed on 5 December 2022).

- Effenberger, J. Auf dem Weg in Eine Erfolgreiche Zukunft. Available online: https://www.nordschwarzwald.de/fileadmin/user_upload/Publikationen/2022_Sindelfinger_Zeitung_WFG_Version_aktuell.pdf (accessed on 8 December 2022).

- Dhir, S.; Sushil. Flexible Strategies in VUCA Markets; Flexible Systems Management; Springer: Singapore, 2018; ISBN 978-981-10-8925-1. [Google Scholar]

- Lawrence, K. The Key to Measuring the Impact of Learning and Development: Align It with Business Strategy. Available online: https://www.emergingrnleader.com/wp-content/uploads/2013/02/developing-leaders-in-a-vuca-environment.pdf (accessed on 3 March 2023).

- Bennett, N.; Lemoine, J. What VUCA Really Means for You; Harvard Business Review: Cambridge, MA, USA, 2014; Volume 92. [Google Scholar]

- Kail, E. Leading in a VUCA Environment: U Is for Uncertainty. Available online: https://hbr.org/2010/11/leading-in-a-vuca-environment-1 (accessed on 3 March 2023).

- Kail, E. Leading in a VUCA Environment: V Is for Volatility. Available online: https://hbr.org/2010/11/leading-in-a-vuca-environment (accessed on 3 March 2023).

- Kail, E. Leading Effectively in a VUCA Environment: C Is for Complexity. Available online: https://hbr.org/2010/12/leading-effectively-in-a-vuca (accessed on 3 March 2023).

- Kail, E. Leading Effectively in a VUCA Environment: A Is for Ambiguity. Available online: https://hbr.org/2011/01/leading-effectively-in-a-vuca-1 (accessed on 3 March 2023).

- Muhammad, M.S.; Kerbache, L.; Elomri, A. Potential of Additive Manufacturing for Upstream Automotive Supply Chains. Supply Chain Forum Int. J. 2022, 23, 1–19. [Google Scholar] [CrossRef]

- Santacreu, A.M.; LaBelle, J. Global Supply Chain Disruptions and Inflation During the COVID-19 Pandemic. SSRN 2022, 104, 4029211. [Google Scholar] [CrossRef]

- Badakhshan, E.; Ball, P. Applying Digital Twins for Inventory and Cash Management in Supply Chains under Physical and Financial Disruptions. Int. J. Prod. Res. 2022, 61, 5094–5116. [Google Scholar] [CrossRef]

- Tata Technologies. Tata Technologies Joins the MIH Consortium to Promote the Engineering of Sustainable Mobility Solutions. Available online: https://www.tatatechnologies.com/in/newsroom/tata-technologies-joins-the-mih-consortium-to-promote-the-engineering-of-sustainable-mobility-solutions/ (accessed on 19 March 2023).

- Stellantis NV. Electrification: Accelerating the Drive to Electrification. Available online: https://www.stellantis.com/en/technology/electrification (accessed on 19 March 2023).

- Volkswagen AG. Strategie: Mit der Konzernstrategie NEW AUTO—Mobility for Generations to Come Bereiten Wir Uns auf die Globalen Veränderungen der Mobilität vor und Treiben Damit die Transformation von Volkswagen in Ein Softwareorientiertes Unternehmen Maß-Geblich Voran. Available online: https://www.volkswagenag.com/de/strategy.html?5FDBFDDA-D7F9-4145-B1B3-FAAB83402DB0_kis_cup_C6FA3ED5_6D17_47D1_B6E2_F4B02CC905E0_# (accessed on 19 March 2023).

- Teema. The Rise of Electric Vehicles Worldwide. Available online: https://times.teema.org.tw/e/195.pdf (accessed on 19 June 2024).

| Trap-Type | Deterioration | Proliferation | Escalation |

|---|---|---|---|

| Beforehand: Spot and identify |

|

|

|

| Escape |

|

|

|

| Destroy |

|

|

|

| Turn the trap to your advantage |

|

|

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Koelmel, B.; Fischer, L.; Juraschek, E.; Peuker, L.; Stemmler, N.; Vielsack, A.; Bulander, R.; Hinderer, H.; Kilian-Yasin, K.; Brugger, T.; et al. Navigating the Challenges of Commodity Traps and Platform Economies: An Assessment in the Context of the Northern Black Forest Region and Future Directions. Commodities 2024, 3, 314-333. https://doi.org/10.3390/commodities3030018

Koelmel B, Fischer L, Juraschek E, Peuker L, Stemmler N, Vielsack A, Bulander R, Hinderer H, Kilian-Yasin K, Brugger T, et al. Navigating the Challenges of Commodity Traps and Platform Economies: An Assessment in the Context of the Northern Black Forest Region and Future Directions. Commodities. 2024; 3(3):314-333. https://doi.org/10.3390/commodities3030018

Chicago/Turabian StyleKoelmel, Bernhard, Leon Fischer, Emilia Juraschek, Levi Peuker, Noah Stemmler, Anton Vielsack, Rebecca Bulander, Henning Hinderer, Katharina Kilian-Yasin, Tanja Brugger, and et al. 2024. "Navigating the Challenges of Commodity Traps and Platform Economies: An Assessment in the Context of the Northern Black Forest Region and Future Directions" Commodities 3, no. 3: 314-333. https://doi.org/10.3390/commodities3030018

APA StyleKoelmel, B., Fischer, L., Juraschek, E., Peuker, L., Stemmler, N., Vielsack, A., Bulander, R., Hinderer, H., Kilian-Yasin, K., Brugger, T., Kühn, A., & Brysch, T. (2024). Navigating the Challenges of Commodity Traps and Platform Economies: An Assessment in the Context of the Northern Black Forest Region and Future Directions. Commodities, 3(3), 314-333. https://doi.org/10.3390/commodities3030018