This study adopts a two-tier empirical model analysis to evaluate the rationale of fuel hedging (model 1) and system dynamic forecasting (model 2).

The hedging analysis was derived from two sources: the airline share prices were from the Thomson Reuters Datastream, and the WTI oil prices were from the Federal Reserve Bank of St. Louis, and the growth rate of the world economy was depicted from the World Bank.

3.1. Empirical Model 1—Fuel Hedging

As the first step, the hedging strategy of the examined airlines and their reported profits and losses from these activities are presented. Firstly, several regression analyses were carried out, covering a sample of airlines over a period from 2008–2017 as panel data. This is to answer the hypothesis that fuel hedging affects the value of the airline (tested on TobinsQ and the share price of the airline). By applying several dummy variables, the extended hypothesis was tested as to whether and how the corporate structure and geographical location of the airline contribute to a different corporate valuation caused by fuel hedging activities.

To determine how airlines are exposed to changes in oil prices and global economic trends, several regression analyses were conducted for several airlines to measure the impact of annual oil price changes (WTI) and adjusted to U.S. consumer prices and annual global economic growth on the development of airlines’ annual share prices (

Table 2).

The airline’s stock price is the dependent variable (Y), while the annual world economic growth rate (X

1) and the annual oil price changes (WTI) adjusted to U.S. consumer prices (X

2) are the two independent variables. The reason for the integration of the economic growth rate into this simple regression analysis is to determine whether there is some multicollinearity that limits the effects of the energy (oil) price development on the shares of the airlines and, in turn, on the performance of the company. In addition, a simple linear regression analysis was performed for each airline if for only one independent variable a significant effect on the airline’s share performance (Y) was detected (

Table 2).

Y = Airline’s stock;

X1 = Annual world economic growth rate;

X2 = Annual oil price development.

The regression analysis results for all companies are as follows in

Table 2:

Based on the analysis, the airlines could be categorised into three groups regarding the response to oil price changes and global economic growth (

Table 3).

Understanding these distinct groups, presented in

Table 3, helps to highlight the varied sensitivities of airlines to external economic factors and provides valuable insights for investors and stakeholders in the aviation industry. It is crucial to recognise that each airline’s unique characteristics and strategies contribute to its individual response to market dynamics, including oil price fluctuations and global economic trends.

Lufthansa: (Observation period: 1991–2017; N = 27)

As the largest European airline, the Lufthansa Group carried 130 million passengers in 2017 and comprises a fleet of 728 aircraft. With 130,000 employees, the mother company achieved a turnover of more than EUR 35 billion. The company also divides its business units into network airlines (Lufthansa, Swiss, and Austrian Airlines), point-to-point Airlines (Eurowings, Brussels, and Sunexpress) and aviation service (logistics, catering, maintenance, repair, and overhaul). The hubs used for network airlines are Frankfurt and Munich (for Lufthansa) as well as Zurich (for Swiss Airlines) and Vienna (Austrian Airlines) [

35].

In total, 9.2% of Lufthansa’s share price performance Y can be attributed to the development of oil prices and global economic growth (R

2). The F-test for the overall model is not significant at 0.120 (

Table 4). This means that the hypothesis that the two independent variables have no influence on the dependent variable cannot be rejected. The

p-value for the single independent variable X

2 is not significant (0.654), but the

p-value for the economic growth rate X

1 is significant, which is at a confidence level of 95% (0.046) (

Table 4). No collinearity can be measured between the two independent variables X

1 and X

2.

Considering the result of the previous analysis that shows that the annual world GDP growth does have a significant influence on Lufthansa’s stock, a single linear regression was performed with the annual world GDP growth variable (X

1) as the only independent variable (

Table 5).

Overall, 12.1% (R

2) of Lufthansa’s share performance Y can be attributed to the annual world economic growth (X

1). This influence is statistically significant (

p-value = 0.042) (

Table 5).

Southwest: (Observation period: 1980–2017; N = 38)

Southwest Airlines is headquartered in Dallas, Texas, and, after initially concentrating only on the state of Texas, it has now focused on the entire United States as a whole. Southwest is the largest airline in the U.S. in terms of domestic air traffic, and it offers point-to-point connections. The company has 58,000 employees and carries more than 120 million passengers annually, with an annual turnover of over USD 21 million (2017) and a fleet size of 750 aircraft (Boeing 737 type) [

36].

Overall, −5.2% of the share price development of Southwest’s Y can be attributed to oil price development and the world economic growth (R

2) (

Table 6). The F-test for the overall model is clearly not significant at 0.916 (

Table 6); i.e., the hypothesis that the two independent variables have no influence on the dependent variable cannot be rejected. The

p-value for the two individual independent variables X

1 and X

2 is not significant at a confidence level of 95% (0.679 and 0.907, respectively). No collinearity can be measured between the two independent variables X

1 and X

2.

Air France: (Observation period: 1985–2017; N = 33)

Air France is the former state-owned company of the legacy carrier of France (founded in 1933) and uses Paris-Charles de Gaulle and Paris-Orly as its hubs. Together with the Dutch legacy carrier KLM, it has merged into what is now the Air France-KLM group. With more than 25,000 employees, Air France transports over 100 million passengers a year (airfrance.com, 2019, accessed on 20 May 2020).

A total of 10.8% of Air France’s share performance Y can be attributed to the development of oil prices and global economic growth (R

2). The F-test for the overall model is not significant at 0.068 (narrow); i.e., the hypothesis that the two independent variables have no influence on the dependent variable cannot be rejected (

Table 7). The

p-value for the single independent variable X

2 is significant (0.022) at a 95% confidence level, while for the economic growth rate X

1, the

p-value at a 95% confidence level (0.841) is not significant. No collinearity can be measured between the two independent variables X

1 and X

2.

After having the result of the previous analysis that shows that the annual oil price development has a significant influence on Air France’s share, a single linear regression analysis—wherein the annual oil price development X

2 is the only independent variable—was carried out.

Overall, 13.6% (R

2) of Air France’s share price development Y can be attributed to the annual oil price development X

2. This influence is statistically significant (

p-value = 0.020) (

Table 8).

Ryanair: (Observation period: 1997–2017; N = 21)

Ryanair is an Irish-based airline that operates pioneer-to-point flights within Europe. With its 13,000 employees, it carries over 130 million passengers, making Ryanair the largest airline in Europe in terms of intra-European traffic. They achieved a turnover of over EUR 7 billion last year [

37] and operate with a fleet size of 430 aircraft (type Boeing 737) [

37].

In total, −11% of the Ryanair share performance Y can be attributed to the development of oil prices and global economic growth (R

2). The F-test for the overall model is clearly not significant at 0.993; i.e., the hypothesis that the two independent variables have no influence on the dependent variable cannot be rejected (

Table 9). The

p-value for the two individual independent variables X

1 and X

2 is clearly not significant at a confidence level of 95% (0.915 and 0.995, respectively). No collinearity can be measured between the two independent variables X

1 and X

2.

Delta Airlines: (Observation period: 2007–2017; N = 11)

Delta Airlines is an American airline founded in 1928 and has its headquarters in Atlanta, Georgia, where the company also has its largest hub, the Atlanta Hartsfield-Jackson Airport. With 800,000 employees and a fleet of over 800 aircraft, this airline carries 180 million passengers annually (

Delta.com, 2019, accessed on 20 May 2020).

Overall, 46.3% of the Delta Airlines share performance Y can be attributed to the development of oil prices and global economic growth (R

2). The F-test for the overall model is significant at 0.034; i.e., the hypothesis that there is no influence of the two independent variables on the dependent variable can be rejected (

Table 10). The

p-value for the single independent variable X

2 is significant (0.015) at a 95% confidence level. And as for the economic growth rate X

1, the

p-value is not significant at a 95% confidence level (0.467). No collinearity can be measured between the two independent variables X

1 and X

2.

After the result of the previous analysis that shows that the annual oil price development has a significant influence on the Delta Airlines share (

Table 10), a single linear regression analysis—wherein the annual oil price development X

2 is the only independent variable—was carried out (

Table 11).

In total, 48.8% (R

2) of the Delta Airlines share performance Y can be attributed to the annual oil price developments X

2. This influence is statistically significant (

p-value = 0.010) (

Table 11).

United Airlines: (Observation period: 2006–2017; N = 12)

United Airlines is an American carrier operating from its Chicago, Denver, Houston, Los Angeles, Newark, San Francisco, and Washington D.C. hubs. Together with their regional carrier, United Express, they transported 158 million passengers in 2018 [

38].

In total, 56.0% of the United Airlines share performance Y can be attributed to the development of oil prices and global economic growth (R

2). The F-test for the overall model is significant at 0.010; i.e., the hypothesis that there is no influence of the two independent variables on the dependent variable can be rejected at a 95% confidence level (

Table 12). The

p-value for the single independent variable X

2 is also very significant (0.008), and as for the economic growth rate X

1, the

p-value is not significant at a 95% confidence level (0.090).

No collinearity can be measured between the two independent variables X1 and X2.

After the result of the previous analysis that shows that the annual oil price development has a significant influence on United Airlines’ share (

Table 12), a single linear regression analysis—wherein the annual oil price development X

1 is the only independent variable—was carried out (

Table 13).

Overall, 44.6% (R

2) of the United Airlines share performance Y can be attributed to the annual oil price developments X

2. This influence is statistically significant (

p-value = 0.011) (

Table 13).

Air Canada: (Observation period: 2006–2017; N = 12)

Air Canada is the flag carrier of Canada, and with their 30,000 employees, they transported 51 million in 2018. In addition to its main hub for international flights in Toronto, Air Canada operates from Montreal, Vancouver, Calgary, and other smaller hubs (Aircanada.com, 2019, accessed on 25 April 2020).

Overall, 28.2% of Air Canada’s share price development Y can be attributed to the development of oil prices and global economic growth (R

2). The F-test for the overall model is not significant at 0.091 (narrow) (

Table 14); i.e., the hypothesis that there is no influence of the two independent variables on the dependent variable cannot be rejected at a 95% confidence level. The

p-values for the two independent variables, X

1 and X

2, are not significant at a 95% confidence level (0.134 and 0.105, respectively).

No collinearity can be measured between the two independent variables X1 and X2.

Cathay Pacific: (Observation period: 1986–2017; N = 32)

Cathay Pacific is Hong Kong’s international airline, founded in 1946. It is registered and based in Hong Kong since 1948. With a fleet of 201 aircraft and approximately 20,000 employees, Cathay Pacific operates global flights to and from this special administrative region of China, making the airliner its flag carrier. It has also helped the Hong Kong International Airport become one of the most important hubs in the world (

Cathaypacific.com, 2019, accessed on 25 April 2020).

A total of 37.9% of Cathay Pacific’s share performance Y can be attributed to oil price developments and global economic growth (R

2). The F-test for the overall model is very significant at 0.000 (

Table 15); i.e., the hypothesis that there is no influence of the two independent variables on the dependent variable can be rejected at a 95% confidence level. The

p-value for the single independent variable X

2 is also very significant (0.000). And as for the economic growth rate X

1, the

p-value is not significant at a 95% confidence level (almost significant at 0.072).

No collinearity can be measured between the two independent variables X1 and X2.

After the result of the previous analysis that shows that the annual oil price development has a significant influence on the Cathay Pacific share (

Table 15), a single linear regression analysis was carried out, where the annual oil price development X

2 variable is the only independent variable (

Table 16).

In total, 32.7% (R

2) of the Cathay Pacific share performance Y can be attributed to the annual oil price developments X

2. This influence is statistically very significant (

p-value = 0.000) (

Table 16).

Finnair: (Observation period: 1989–2017; N = 29)

Finnair was founded in 1923 and is majority-owned by Finland. It also operates as a network airline from its hub in Helsinki. Finnair employs 5900 people and operates a fleet of over 60 aircraft (

Finnair.com, 2019, accessed on 25 April 2020).

Overall, 15.0% of Finnair’s stock price performance Y can be attributed to the development of oil prices and global economic growth (R

2). The F-test for the overall model is significant at 0.046, which means that the hypothesis that there is no influence of the two independent variables on the dependent variable can be rejected (

Table 17). The

p-value for the single independent variable X

2 is not significant (0.610), and as for the economic growth rate X

1, the

p-value is significant at a 95% confidence level (0.015). No collinearity can be measured between the two independent variables X

1 and X

2.

After having the result of the previous analysis that shows that the annual growth in world GDP has a significant impact on Finnair’s share price (

Table 17), a single linear regression analysis—wherein the annual oil price development variable X

1 being the only independent variable—was carried out (

Table 18).

In total, 17.4% (R

2) of Finnair’s share performance Y can be attributed to the annual world GDP growth X

1. This influence is statistically significant (

p-value = 0.014) (

Table 18).

Qantas: (Observation period: 1995–2017; N = 23)

Founded in 1920, Qantas is Australia’s largest airline with over 30,000 employees (Qantas.com. 2019, accessed on 25 April 2020).

A total of −1.3% of the Qantas stock performance Y is attributed to oil price developments and global economic growth (R

2). The F-test for the overall model is not significant at 0.437 (

Table 19); i.e., the hypothesis that the two independent variables have no influence on the dependent variable cannot be rejected. The

p-value for the single independent variable X

2 is not significant, and the

p-value for X

1 is also not significant even at a confidence level of 95% (0.318 and 0.484, respectively). No collinearity can be measured between the two independent variables X

1 and X

2.

SAS: (Observation period: 2001–2017; N = 17)

SAS is the largest Scandinavian network carrier, flying 135 aircraft under its banner. It was formed in 1946 from a merger of the Swedish, Norwegian, and Danish state airlines. SAS focuses its business model primarily on Scandinavian businesses and frequent flyers (SAS website, 2019).

In total, −3.9% of the SAS share price development Y can be attributed to the development of oil prices and global economic growth (R

2). The F-test for the overall model is not significant at 0.514 (

Table 20); i.e., the hypothesis that the two independent variables have no influence on the dependent variable cannot be rejected. The

p-value for the two individual independent variables X

1 and X

2 is not significant at a confidence level of 95% (0.289 and 0.685, respectively). No collinearity can be measured between the two independent variables X

1 and X

2.

Singapore Airlines: (Observation period: 1985–2017; N = 33)

Singapore Airlines is the flag carrier of Singapore and serves as a network carrier to all relevant global hubs from its base in Changi International Airport. With a fleet of 107 aircraft and nearly 15,000 employees, Singapore Airlines has flown over 19 million passengers and has generated sales of USD 11.5 million in 2018 [

39].

A total of 20.9% of the Singapore Airlines share price performance can be attributed to the development of oil prices and global economic growth (R

2). The F-test for the overall model is significant at 0.011 (

Table 21); i.e., the hypothesis that there is no influence of the two independent variables on the dependent variable can be rejected at a 95% confidence level. The

p-value for the single independent variable X

2 is also significant (0.003). As for the economic growth rate X

1, the

p-value is not significant at a confidence level of 95% (0.581).

No collinearity can be measured between the two independent variables X1 and X2.

After the result of the previous analysis that shows that the annual oil price development has a significant influence on Singapore Airline’s share (

Table 21), a single linear regression analysis—wherein the annual oil price development variable X

2 is the only independent variable—was carried out (

Table 22).

Overall, 22.7% (R

2) of the Singapore Airlines share performance Y can be attributed to annual oil price development X

2. This influence is statistically very significant (

p-value = 0.003) (

Table 22).

WestJet: (Observation period: 1999–2017; N = 19)

WestJet is a Canada-based, low-cost carrier established in 1996 with a fleet of three aircraft. Today, WestJet has grown to a fleet of more than 150 aircraft serving more than 100 destinations in North and Central America and the Caribbean, and with more than 13,000 employees, it transports 22 million passengers annually (

Westjet.com, 2019, accessed on 25 April 2020).

In total, −5.8% of WestJet’s share price performance can be attributed to oil price developments and global economic growth (R

2). The F-test for the overall model is not significant at 0.613 (

Table 23); i.e., the hypothesis that the two independent variables have no influence on the dependent variable cannot be rejected. The

p-value for the two individual independent variables X

1 and X

2 is not significant at a confidence level of 95% (0.972 and 0.331, respectively). No collinearity can be measured between the two independent variables X

1 and X

2.

3.1.1. Interpretation of Findings

The results for the regression analysis of how airline stocks are influenced by oil price movement and overall economic growth are very uneven. The potentially expected outcome that airline stocks are, at least, as a rule, negatively affected by rising oil prices is not reflected in the results at all. The explanatory power of the regression models is often not very convincing, and more importantly for many airlines, the regression model and the influence of the two single independent variables on airline stock is often not significant at all. However, it is worthwhile to have a closer look at the results and to try to analyse certain patterns in the uneven results.

The regression analysis of how the airline’s stocks are influenced by the two independent variables (annual oil price (WTI) changes adjusted to U.S. consumer prices and annual world economic growth rate) is only statistically significant for Delta Airlines, United Airlines, Cathay Pacific, Finnair, and Singapore Airlines (0.034, 0.010, 0.000, 0.046, and 0.011, respectively, on a 95% confidence level). Relatively close to being statistically significant are the results for Lufthansa, Air France, and Air Canada (0.120, 0.068, and 0.091, respectively, on a 95% confidence level). Analysing the single influence of oil price development on airlines stock (simple linear regression), the results are only statistically significant for Delta Airlines, United Airlines, Cathay Pacific, Singapore Airlines, and Air France. Surprisingly, the directions in which airline stocks are influenced by oil price movements are completely different in all these results. The two major U.S. airlines stocks of Delta and United are strongly negatively affected by higher crude oil prices.

Delta Airlines stock reacts by −8.979 if the oil price goes up by one digit (significant with 0.010 on a 95% confidence level). United Airlines stock goes down by −10.724 if oil goes up by one digit (significant with 0.011 on a 95% confidence level). However, this result becomes completely different when analysing the two East Asian carriers Cathay Pacific and Singapore Airlines. Cathay Pacific stock is, in this regression, positively correlated to oil price development by 1.401 if the oil price goes up by one (statistically very significant with 0.000 on a 95% confidence level). The same applies to Singapore Airlines. Their stock goes up by 1.291 if the oil price goes up by one (statistically very significant with 0.003 on a 95% confidence level). As a European carrier, Air France stock is also statistically and significantly affected by the oil price movement. Its stock goes down by −6.696 for every single digit of oil price that moves up (statistically significant with 0.020 on a 95% confidence level). These results raise the question regarding to what extent the performance of an airline is influenced by changes in the oil price. It seems difficult to establish a link between airline performance and oil price developments. One possible answer would be that there are many more influencing factors than oil prices, which have an impact on airline stocks. For this reason, regression analysis was always carried out with overall economic development (annual world economic growth) as a second variable. The results of how these variable influences airline stocks were not clearer than those of oil price developments, and no regression analysis found collinearity between these two independent variables. It is noteworthy that the regression analysis for the low-cost carriers (Ryanair, Southwest, and to a lesser extent WestJet) was too insignificant for both independent variables. A possible explanation (or hypothesis) for this finding could be that the business model of low-cost carriers is relatively independent of external factors and that the drivers for business performance could usually lie within the business model. In the case of Ryanair, one possible explanation could be that they were the first and most aggressive low-cost carrier on the European market and were able to expand rapidly without being significantly influenced by endogenous factors. Moreover, due to their cost and price structure, low-cost carriers may also be able to gain market share. All these factors could explain the different results, often related to the airline’s business model or territory (airline based in East Asia, legacy carrier based in the U.S., low-cost carrier, etc.).

3.1.2. Testing the Hypotheses

In the following section, an OLS regression is presented for the entire airline sample, which determines how TobinsQ is influenced by the hedging ratio of the two previous years and by the application of several control variables that WERE tested for multicollinearity and contribute to a higher validity of the model (i.e., higher R

2) (

Table 24).

Table 25 presents the regression models included in the panel data regression analysis (

Table 24). It attempts to explain their relevance and potential impact on the market valuation of different airlines.

Tested for no multicollinearity for the control variables, the regression explains nearly 65% of the variance of TobinsQ (R

2 = 0.644) (

Table 24). Observing the effect of the two hedging variables on TobinsQ, which only affects the hedging for the second year (hedge2), there is a significant (95% confidence level) positive effect on TobinsQ, and the coefficient for hedge2 is 0.216 (

Table 24).

When using Europe (Lufthansa, Ryanair, and Easyjet) as a dummy variable, both hedging variables become significant, and the model registers a high R2, but the result should somehow be interpreted suspiciously, as hedge1 has relatively high multicollinearity (32.02). Therefore, the results should be considered invalid. Only testing for North American airlines (Southwest, Westjet, Air Canada, United Airlines, and Delta Air Lines), no significant influence of the hedging ratio on TobinsQ could be proven.

If only low-cost carriers (Ryanair, Easyjet, Westjet, and Southwest) are considered, the result for hedge2 is highly significant (99% confidence level) and positive for TobinsQ with a coefficient of 0.44. The explanatory power of the regression is also relatively high with an R

2 of 0.77 (

Table 24).

In the study of legacy carriers only (Lufthansa, Air Canada, United Airlines, and Delta Airlines), no significant correlation of the two hedging ratios on TobinsQ could be found.

Another dummy variable was introduced for airlines that are relatively constantly hedged (Lufthansa, Southwest, Ryanair, and Easyjet). In this analysis, hedge2 has a significant (95% confidence level) positive impact on TobinsQ with a coefficient of 0.348.

Airlines with a more selective hedging strategy (Westjet, Air Canada, United Airlines, and Delta Airlines) have no significant influence on TobinsQ.

Taxation on fixed effects and the regression for the entire airline sample hedge2 is slightly significant (p value = 0.069) and positively correlated with TobinsQ (coefficient = 0.278). The variable hedge1 is clearly not significant.

In the regression for European airlines with fixed effects, the variable hedge2 has a highly significant (99% confidence level) positive effect on TobinsQ with a coefficient of 1.054. The significance of the model is relatively weak with an R2 of 0.115.

With fixed effects, hedge2 also has significant positive effects on TobinsQ for American airlines with a coefficient of 0.131. The significance of regression analysis is very weak with an R

2 of 0.0184. Checking for low-cost as the dummy variable, the outcome for hedge2 is again highly significant with a positive coefficient of 0.366. R

2 of 0.748 suggests the high validity of the explanation. No significant influence of hedge1 or hedge2 on TobinsQ is found for legacy carriers, including fixed effects. Applying constantly hedged as a dummy variable for fixed-effects regression analysis, the variable hedge2 again yields a significant and positive effect on TobinsQ (coefficient = 0.363). R

2 has a high explanatory power at 0.8156 (

Table 24).

The hedging ratios have no significant effect on TobinsQ when checking for selectively hedged airlines with fixed effects.

In summary, it can be said that hedging over a longer period (two years in advance, as the variable hedge2 shows) increases the market value of an airline in relation to its book value (measured according to TobinsQ), or at least, potential investors believe it to be so.

These results were even more significant and clear when the analysis was carried out for low-cost carriers and airlines with a constant hedging strategy. The interpretation of this result could be that airlines that pursue a longer-term and constant hedging strategy are rewarded by higher market expectations (higher TobinsQ). This means that the instrument of fuel hedging is used as a permanent risk management strategy and not as a means of counteracting flowing market trends or future oil price expectations.

3.2. Model 2: Dynamic Capacity Forecasting

The literature review addresses the dynamics of capacity forecasting that have an influence, involving demand, airfares, and flight schedules. The capacity-forecasting procedure is deconstructed into a dynamic causal feedback loop system, which prioritises the interconnections among the distinct internal and external influencing factors by deriving the hypotheses. Nevertheless, owing to the extent of this study, not all factors that have an influence are encompassed within the framework. Therefore, there exists a possibility for additional exploration with regard to the expansion of the model by incorporating more relevant variables.

Explaining the methodology along the individual steps, it can be stated that the first step considers the identification of the real problem along with critical variables and concepts. Furthermore, it is important to characterise the problem dynamically, as it is essential for the actual model development. The dynamic hypothesis is derived from the second step by investigating the origin of the problem and building linkages between variables in a causal loop diagram, which will be later transformed into a flow diagram. The third step elucidates the definition of the system dynamics model by translating the flow diagram into the stock, rate, and auxiliary equations. Additionally, parameters and behavioural relationships are estimated. The development of the causal loop diagram as well as the flow diagram along with parameter estimations takes place in a computer-simulated model through specific software. Regarding the fourth step of the process, the comparison of the simulated behaviour of the model and the actual behaviour of the system takes place as to validate the model. The fifth and last step considers the interpretation of results as well as evaluating and developing suitable strategies for improvement.

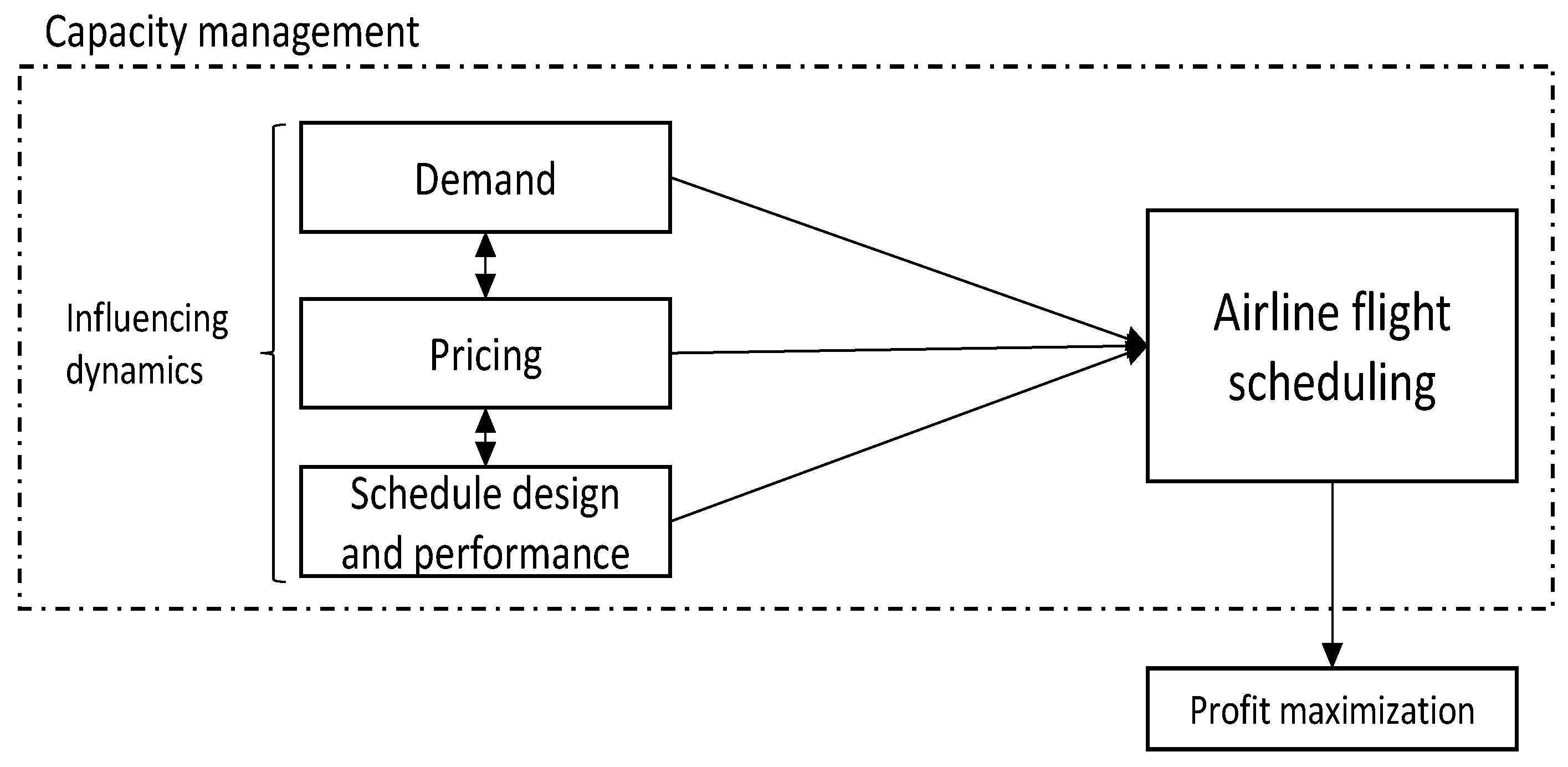

The diagram illustrated in

Figure 1 presents a simplified causal feedback loop system associated with the forecasting of airline capacity. The interplay among individual influencing dynamics is depicted using directional arrows (

Figure 2). The arrowhead refers to the variable that is being stimulated, while the direction of the relationship signifies the degree to which the parameter is being stimulated. The nature of this association can be described as a causal relationship. A positive polarity denotes that a rise in the output variable results in a corresponding increase in the stimulated variable. With respect to the negative polarity of a relationship, a reduction in the output variable will result in a decrease in the stimulated variable. Furthermore, the interconnectedness of the influencing factors ultimately results in a closed feedback loop.

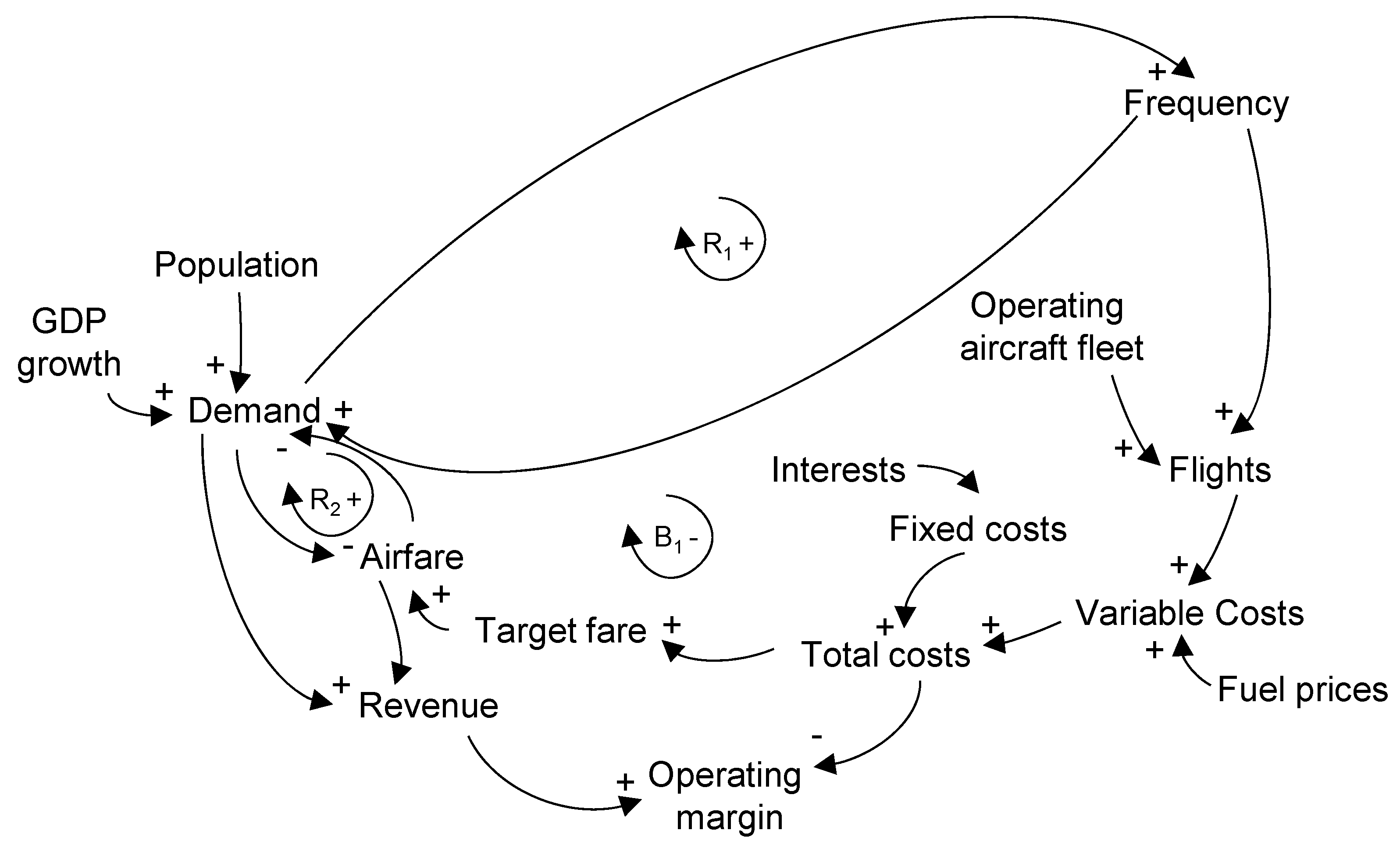

In

Figure 2, three closed feedback loops can be identified. Considering the first closed feedback loop, which is marked as R

1+ within the loop, it describes the inter-causal relationship of demand and frequency of approached routes. As both cause–effect relationships show a positive polarity, the closed feedback loop is characterised as reinforcing, which indicates growth. The second closed feedback loop in

Figure 2 is labelled as R

2+ and incorporates the cause–effect relationships of demand and airfare. Both relationships are assessed with a negative polarity. Nevertheless, the polarity of the whole loop is determined by adding the individual relationships. Therefore, in the case of R

2+, the closed feedback loop is considered positive, as the addition of two negative relationships results in a positive loop, and thus, R

2+ is considered a reinforcing loop. The third closed feedback loop, which is marked as B

1-, considers the cause–effect relationship of the main input factors regarding capacity forecasting in

Figure 2.

Through the addition of the individual polarities, an overall negative polarity is achieved, which results in a balancing feedback loop. A balancing feedback loop aims to maintain the system stability. There are further cause–effect relationships that stimulate the influencing dynamics. However, these are not considered in the model individually due to the scope and the focus of this study. Nevertheless, these are still involved in the analysis, as they are included in the given dataset.

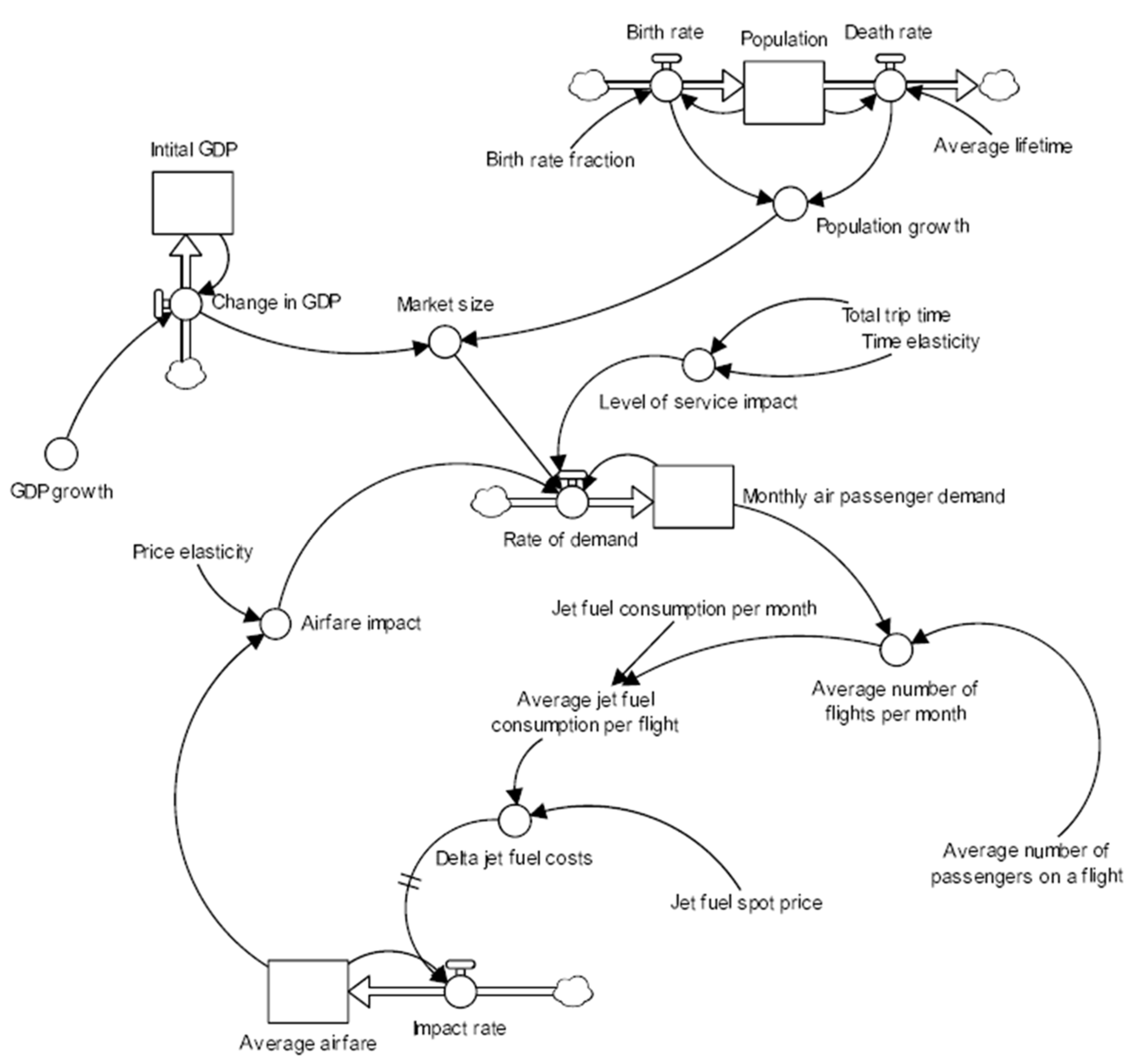

Given the causal feedback loop diagram in

Figure 3, it can already be stated that there is a positive cause–effect relationship of fuel prices, variable costs, total costs, and hence airfare. As fuel price volatility (commodity risk) accounts as the to-be-tested risk factor, the following hypotheses result:

H1a. Commodity risks moderately have a positive effect on costs, hence influencing airfares.

H1b. Commodity risks moderately have a negative effect on costs, hence influencing airfares.

H1c. A strong correlation between risks and airfares has an impact on capacity forecasting.

The aforementioned hypotheses were subjected to testing through the employment of the stock and flow diagram, which was derived from the causal feedback loop diagram seen below (

Figure 4).

The variables related to market size and service level impact are represented by the growth rate variable, which affects the demand rate in combination with the airfare impact. The rate of demand is used as the input for the stock of monthly air passenger demand (D) over the duration of the model’s operation. The evaluation is conducted via the subsequent mathematical formula.

Equation (1) integrates a specified set of values associated with the monthly mean growth rate of air passenger demand into the growth rate, whereas the airfare impact derives its input parameters from the average airfare of the stock. Moreover, it entails an adjustment of the airfare at a specific point in time, denoted as t.

Equation (2) represents the average airfare as a variable in the model, which is influenced by the input value for time t1 obtained from the dataset. The calculation of average airfare values is determined by the flow impact rate. The impact rate refers to the proportion of the fluctuation in jet fuel expenditures that is transferred to airfare and, subsequently, to the consumer. The assumption is that other cost factors do not experience comparable volatility; therefore, just the fluctuation in jet fuel expenses is considered to be transferred to the passenger.

The impact rate, which involves cost variations, is influenced by several factors, including the per-gallon spot price of jet fuel (P), the average consumption of jet fuel per flight, and the average seating capacity of an aircraft.

Figure 4 displays a connecting arrow that links the airline jet fuel costs and the passing-through rate. This arrow suggests the presence of two horizontal lines, which signify a delay in the impact. Incorporating a time lag into the model is imperative, as the prompt transmission of increased costs is not feasible due to the possibility of cost escalation at a later stage than the actual determination of airfare. The equation that describes the mathematical assessment of the change in jet fuel costs (Δ Jet fuel costs) is as follows:

The fluctuation in the average airfare depends on the flow impact rate during a given time period t, which is determined by the ratio of the average airfare at that time and the variation in jet fuel prices at a prior time point, t-x, as well as the percentage of pass-through rate. The assessment of the change in jet fuel costs occurs at time t-x due to the consequential effects of delay.

The calculation procedure of the impact rate can be derived from the following mathematical Equation (5):

The calculation of the variable representing the mean monthly frequency of flights involves the correlation between the yearly demand for air travel and the average number of passengers per flight. This value is obtained from the dataset and is expressed mathematically as Equation (6).

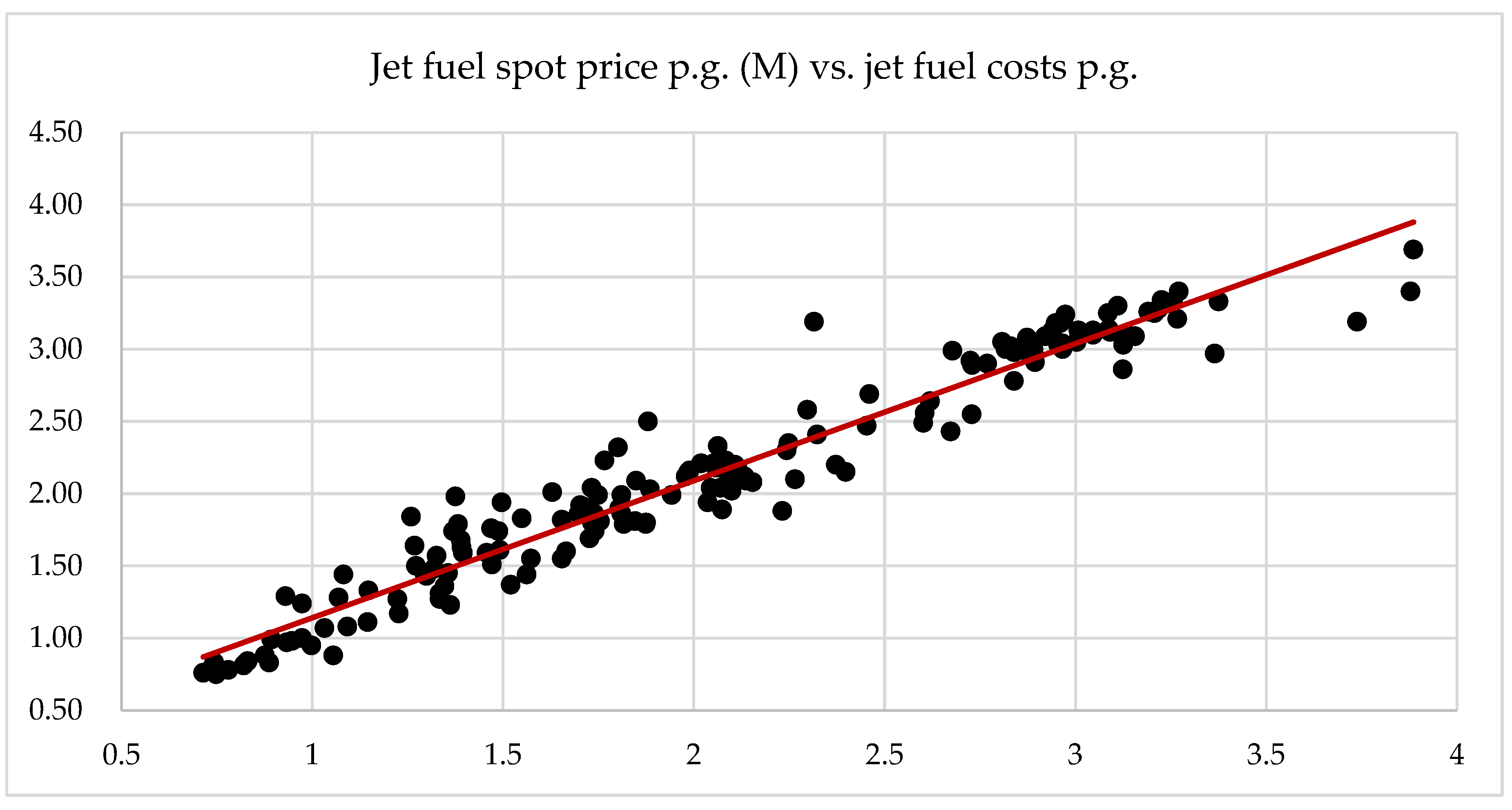

A correlation analysis was conducted to determine the statistical significance of the main input variables associated with the relationship between the monthly average jet fuel spot price per gallon (jet fuel spot price p.g. (M)) and the costs of jet fuel per gallon (jet fuel costs p.g.) as well as the quarterly average jet fuel spot price per gallon (jet fuel spot price p.g. (Q)) and the average airfare.

The evaluation involves the utilisation of the covariance, coefficient of correlation, and coefficient of determination to determine the magnitude of the association between two variables. Equation (7) presents the formula for evaluating the covariance of a given sample of data.

The covariance for a data sample describes mathematically the differences between each independent variable x and each dependent variable y and their mean within the dataset.

The coefficient of correlation is a measure of the strength of the relationship between two variables. It is calculated by dividing the covariance by the standard deviation of the variables. The mathematical representation of the phenomenon is presented in Equation (8), followed by the mathematical derivation of the standard deviation as expressed in Equation (9).

The aforementioned method is commonly referred to as Pearson’s correlation coefficient, which assesses the association between variables by establishing upper and lower boundaries. Equation (10) establishes the determination of limits for the variable

r, which represents the coefficient of correlation:

The magnitude of the relationship is constrained between −1 and 1 due to the possibility of it being either positive or negative in character. The strength of a relationship is evaluated based on its proximity to the value of 1, indicating a strong relationship, or to the value of 0, indicating a weak relationship. Due to the significant disparity between the upper and lower bounds, the coefficient of correlation is considered imprecise. The coefficient of determination is computed to determine the proportions of the relationship that are explained and unexplained. This provides insight into the degree to which changes in the independent variable account for adjustments in the dependent variable. The quantification of this phenomenon involves the calculation of the square of the correlation coefficient, indicated as

r. Moreover, the mathematical expressions for the determination coefficient of a given dataset can be derived using Equation (11).

The key input parameters represent the jet fuel spot price p.g. (M) and the jet fuel costs as well as the jet fuel spot price p.g. (Q) and the quarterly mean values of the average airfare. The aforementioned delay impact will be incorporated into the correlation analysis. The variable “d” denotes a period of duration measured in months and accounts for a shift in the spot price of jet fuel over time. Thus, the shift can be determined by the correlation coefficient between the mean airfare value at time t and the spot price of jet fuel p.g. (Q) at time t-3. In addition, it is noteworthy that a delay is pertinent not only to the mean airfare but also to the expenses incurred in jet fuel. The results are depicted in

Table 26.

The correlation between the jet fuel spot price p.g. (M) and the jet fuel costs p.g. at d = 0 is highly significant, with 94% of the variance in jet fuel costs p.g. being attributable to the variance in the jet fuel spot price p.g. (M).

Figure 5 offers a visual representation in support of the outcome. Thus, it can be assumed that there exists a partial correlation between the jet fuel costs per gallon and the fluctuations in the jet fuel spot price per gallon (M), as both exhibit a similar degree of volatility. Thus, it can be seen that the initial assertion of hypothesis1a is true, while hypothesis1b is rejected.

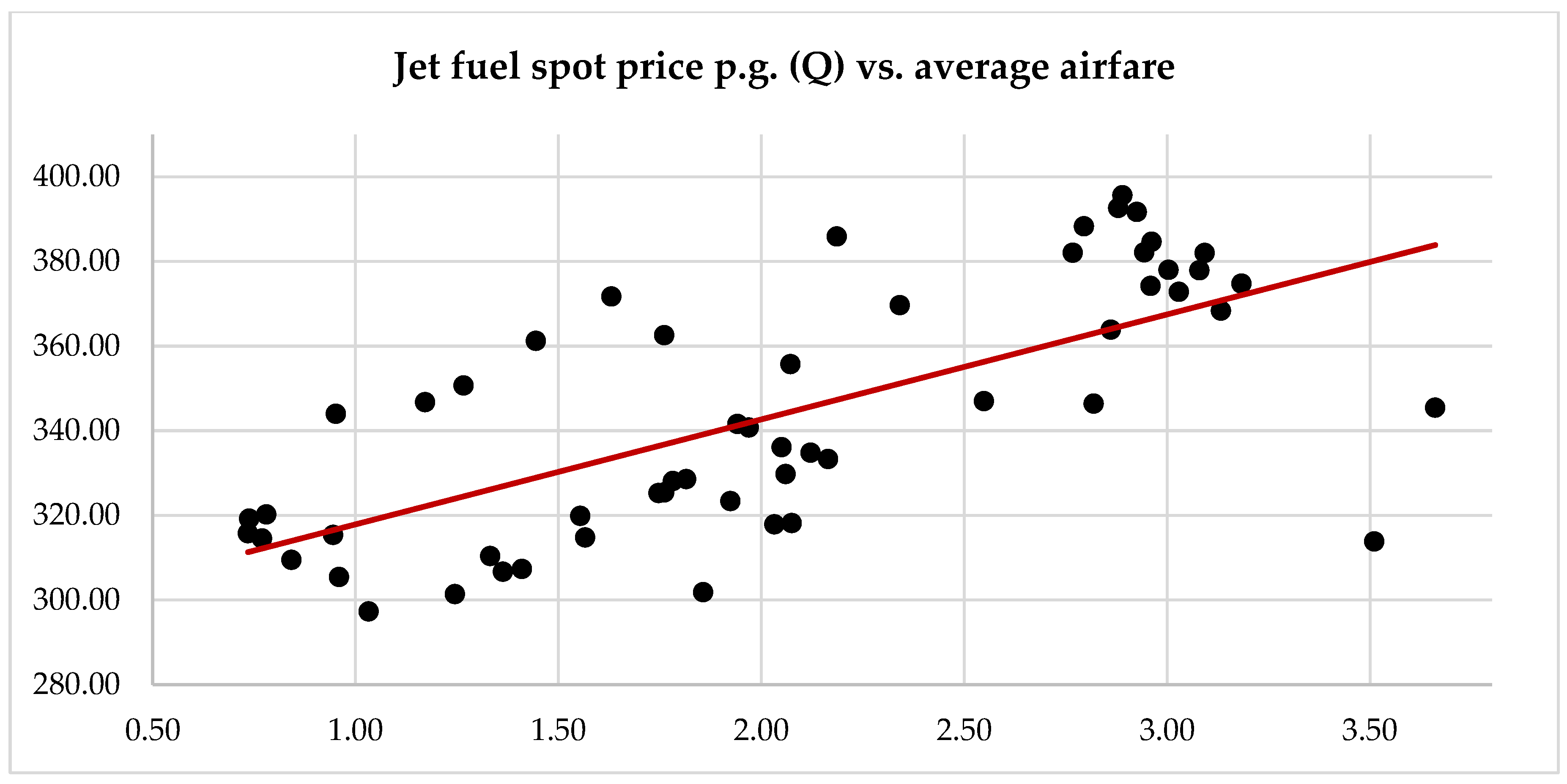

The current study conducted a correlation analysis between the spot price per gallon of jet fuel (Q) and the average airfare (

Figure 6). The analysis determined that the most reliable relationship was observed at d = 6, indicating that the impact of the jet fuel spot price at time t on the average airfare was delayed by six months. However, the strength of this relationship is considered to be weak owing to the significant number of outliers and their considerable deviation from the regression line, as depicted in

Figure 6. Nevertheless, the hypotheses H

1a and H

2 are thus rejected.

Table 27 presents the effects of the fluctuation in jet fuel spot price on the mean airfare, along with the essential initial parameters for the model’s execution. The model simulation incorporates a delayed impact of 9 months based on the findings of the correlation analysis. Due to the dataset, which provides monthly data starting from 2003 to 2016, the model runs in total through 168 months.

The examination of the relationship between the jet fuel spot price p.g. (Q) and the average quarterly airfare suggests that there is no significant correlation (

Table 28). This observation is substantiated by the coefficient of determination, which elucidates that merely 47% of the fluctuations in the average airfare can be attributed to changes in the jet fuel spot price p.g. (Q). This finding underscores the notion that the average quarterly airfare is influenced by a multitude of factors beyond the jet fuel spot price p.g. (Q), indicating a more complex interrelation of variables impacting airfare trends.

Regarding the quantitative evaluation procedure utilising the error rate approach, the subsequent outcomes were computed for the mean monthly airfare, the monthly air passenger demand, and the monthly flight count. These are provided in

Table 29.

Interpretation of Findings

The rejection of hypothesis H1b has already been considered above, as the result of the correlation analysis of the jet fuel costs p.g. and the jet fuel spot price p.g. (M) shows a strong positive correlation, along with 94% of the jet fuel costs p.g. being explained by the jet fuel spot price p.g. (M). The initial segment of hypothesis H1a has been accepted by correlation analysis. Additionally, based on the outcomes of the stock-flow diagram’s model simulation, it can be entirely accepted. With regards to hypothesis H1c, it was observed that there is no significant correlation between the jet fuel spot price p.g. (Q) and the average quarterly airfare. This is evident from the coefficient of determination, which indicates that only 47% of the average airfare’s fluctuations can be attributed to the jet fuel spot price p.g. (Q). However, the influence of fluctuations in jet fuel expenses on the mean airfare, as determined by the jet fuel spot price, was validated using the stock-flow diagram. Therefore, the reliability of considering the impact of risk on capacity forecasting is acknowledged. The absence of a notable association between the mean airfare and the spot price of jet fuel could be attributed to the limitations of the dataset employed, which exclusively encompasses quarterly average airfares within the domestic United States market. Consequently, varying outcomes concerning correlation could arise from conducting an analysis utilising an alternative dataset. However, with respect to the investigative methodology and the employed dataset, it is not possible to entirely accept hypothesis H1c.