Abstract

This paper investigates the liquidity effect of the U.S. QE on the sovereign yield spreads of commodity-exporting countries by employing the two-stage least squares approach. The key contributions of the paper are in terms of our empirical findings. First, our results show that the U.S. QE has an economically and statistically significant liquidity effect in terms of both the HPW illiquidity measure and the TIPS liquidity premium. This is of policy importance because adjusting for the liquidity premium is a key stage in modeling inflationary expectations. Second, our results show that the U.S. QE reduced the liquidity premium with improved market liquidity and hence reduce sovereign yield spreads of most commodity-exporting countries. This finding is of macroeconomic importance as reduced sovereign yield spreads have been shown to lead to higher real activity and higher credit activity.

1. Introduction

Before the 2008 Global Financial Crisis (GFC), the global economy was considered “deep” and liquid with ample and considerably cheap credit available for households and businesses [1]. Thus, the liquidity channel played a relatively negligible role in monetary policy to stimulate economic activity.

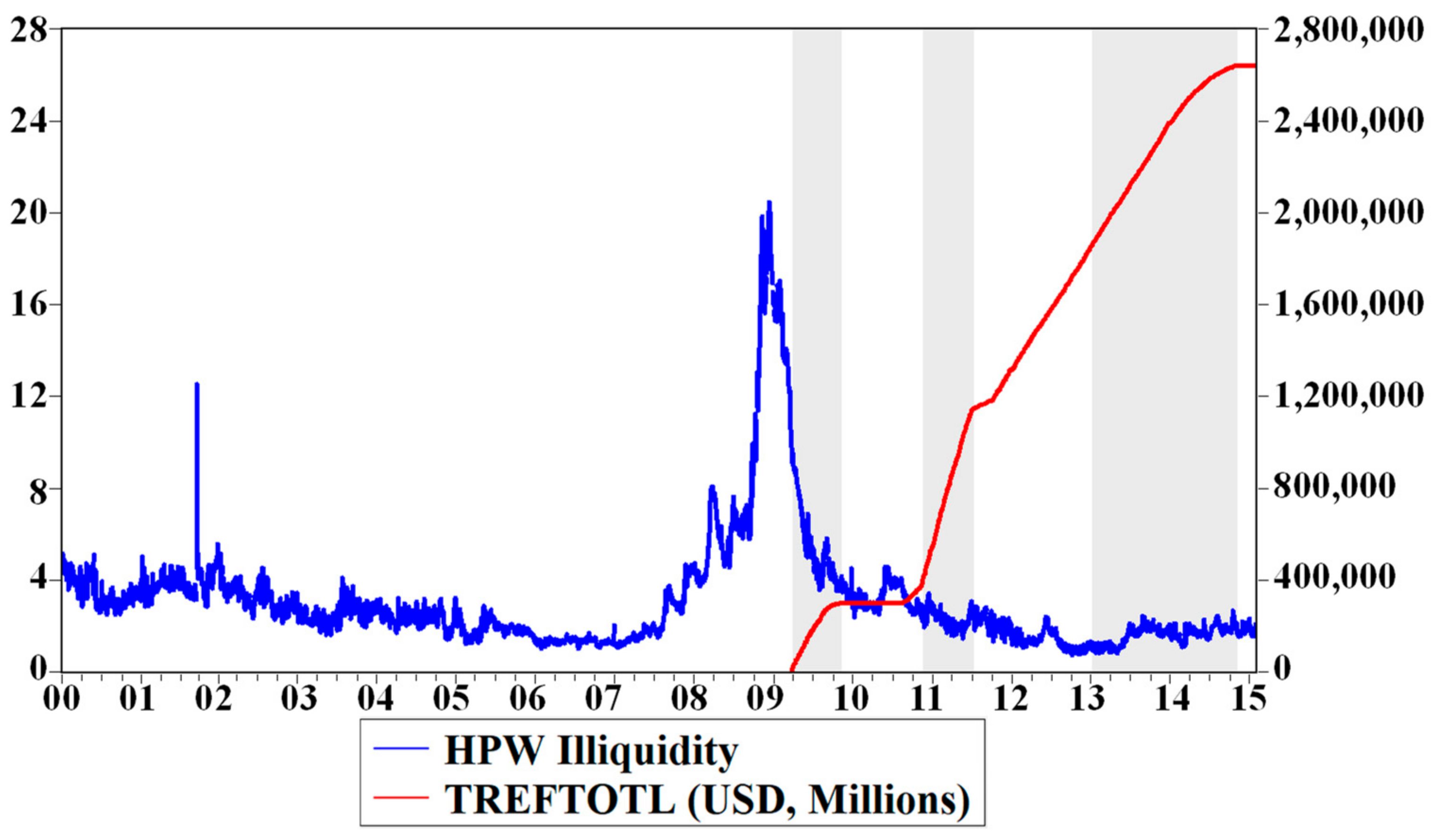

The GFC followed by the collapse of Lehman Brothers has sparked severe damage to the credit markets worldwide [2]. The global credit markets were threatened by illiquidity as indicated by a fourfold increase in HPW illiquidity from 2008 to 2009 (see Figure 1). The tight credit conditions led to the dysfunction of financial markets and a global economic recession. Therefore, global liquidity has become a key international policy issue and failure to maintain liquidity is a potential source of instability [3].

Figure 1.

The HPW illiquidity measure captures substantial market-wide liquidity risk following the approach of Hu, Pan, and Wang (HPW) (2013). The HPW illiquidity measure is downloaded from Jun Pan’s website: http://www.mit.edu/~junpan/, accessed on 10 December 2018. The TREFTOTL is collected from Bloomberg. It indicates the New York Federal Reserve total treasury purchases throughout QE1, QE2, and QE3. It is calculated as follows: TREFTOTL = treasury purchases in QE1 + treasury purchases in QE2 + treasury purchases in QE3 + the Fed operation twist maturity extension program + the Fed treasury purchase reinvestment program. Data related to TREFTOTL are extracted from Bloomberg. Shading denotes the actual purchase period of the U.S. QE1, QE2, and QE3, respectively.

The central banks of the most advanced countries drastically reduced their policy rate to zero lower bounds to restore the liquidity level of global credit markets. However, this conventional monetary policy became ineffective to stimulate global activity into sustainable recovery due to the liquidity trap [4]. First, the GFC severely damaged the balance sheet of financial institutions. Thus, financial institutions restricted their credit supply to the market in conflict with the aims of expansionary monetary policy. Second, the global financial market participants had swung their risk appetite to greater risk-aversion in response to the GFC shock. Hence, a higher risk premium was required for holding riskier securities that acted to offset the consequences of the policy rate cut.

In response to these obstacles, the major central banks with very low or zero interest rates pursued quantitative easing (QE) to improve the liquidity condition of global financial systems. QE is a series of massive asset purchases by unusually expanding reserves of a central bank and led to a surge of global liquidity [5]. This is further supported by Figure 1, showing the liquidity risk fell throughout the three rounds of QE by the Fed (the HPW illiquidity slumped from 20 basis points (bps) to 2.5 bps). A possible consequence of the drop in the illiquidity premium is that investors may require a lower liquidity premium to purchase long-term sovereign bonds due to the massive injection of liquidity into the global financial system resulting in narrowing sovereign yield spreads. Thus, the key purpose of our study is to understand the empirical dimensions of this consequence. First, we aim to understand how the liquidity premium in TIPS securities was related to the changes in the illiquidity measure (HPW) and the fear index (VIX). Second, we aim to understand how this change in the TIPS liquidity premium was then associated with changes in sovereign yield spreads. Taken together this gives our study the focus to examine how the liquidity effect is related to sovereign yield spreads in the QE environment.

We focus on the liquidity effect on the sovereign yield spreads of commodity-exporting countries since there is a strong linkage between liquidity, commodities, and sovereign yields. During the Global Financial Crisis, sovereign yield spreads widened due to the severe market illiquidity and heightened default risk. Schwarz [6] also shows that the widened sovereign yield spreads over the GFC were reflected in deteriorated sovereign bond market liquidity and heightened default risk. The improved global liquidity associated with the massive purchase program of QE was an important response to this illiquidity and risk but may have created unintended inflationary pressures in commodity prices [5]. A surge in commodity prices naturally appreciates currencies of commodity-exporting countries with improved current account balances [7,8]. The central bank of these countries may reduce interest rates to weaken the local currency [9]. This process could eventually lead to narrower sovereign yield spreads, thus motivating our study of the liquidity effect on sovereign yield spreads in commodity-exporting countries under QE scenarios. The remainder of the paper is structured as follows. In the following section, we provide an overview of the relationship of QE with market liquidity. Section 3 reviews the literature on the liquidity channel of QE. We describe the data employed and the econometric framework in Section 4. Findings and discussions are highlighted in Section 5, and the conclusions are drawn in Section 6.

2. The Relationship of QE with Market Liquidity

The illiquidity triggered by the GFC and its associated consequences for market functioning prompted the Fed to implement QE to address dysfunctional financial markets. The Fed purchased a large scale of assets by pumping new money into the economy, which can increase the amount of funds available to banks. The relaxed funding constraints allow banks to finance their inventories and hence support market liquidity [10].

However, existing empirical studies seem to provide conflicting views with regard to the relationship of QE with market liquidity. The opposing views can be interpreted in an adverse selection model [11]. If the information varied across market participants (i.e., central banks and rational speculators), it may lead to inconsistency in the implied target price by the policy signal and the fundamentals and could result in increased market uncertainty, and therefore, also market illiquidity [12].

Brunetti, di Filippo, and Harris [13] suggest that the ECB intervention failed to improve market liquidity due to the challenge of reducing asymmetric information that occurred consistently during the GFC. Kandrac [14,15] also shows that MBS purchases by the Fed had an adverse consequence on both market functioning and market liquidity. These adverse effects became more pronounced at the beginning of QE3. Nonetheless, the magnitude of the effects seems to be isolated to the total share of MBS outstanding held by the Fed.

Conversely, the purchasing policy might improve market liquidity as central banks can mitigate the adverse selection problem by improving the market’s informational environment, see [11]. Their findings document that the massive asset purchase program by the BOJ substantially improved the market liquidity mainly due to the central banks’ communication and transparency. Herbst, Wu, and Ho [16] document theoretical evidence that the QE ease in channeling credit to the real sector boosts economic activity. They also argue that QE might be an inefficient monetary policy if the liquidity trap (or reserve trap) exists.

Wong, Mariscal, Yao, and Howells [17] examine the interrelationship between credit risk and the liquidity premium in the London Interbank Offered Rate-Overnight Indexed Swap (LIBOR-OIS) spreads pre-QE and during QE, Decomposition into credit risk and liquidity premium was conducted using three-month Repo-OIS, and the LIBOR-Repo spreads, respectively. Their findings support that QE by the BOE had changed the interrelationship. In the pre-QE period, credit risk drove the liquidity spread significantly, but the correlation is reversed during QE. The BOE significantly narrowed the liquidity spreads and this resulted in a fall in the credit spreads.

Caldentey [18] proposes that QE has a significant association with global liquidity as the majority of the primary dealers involved in large-scale asset purchasing programs are global banks. These banks also played a vital role in boosting liquidity expansion before the GFC. They also suggest that QE has a direct relationship with global bank liquidity after the GFC based on two forces. First, global banks significantly reduced their leverage after the GFC. Second, following QE as practiced by the Fed, other major central banks such as the BOE and the ECB also unusually expanded their reserves. Despite most empirical studies supporting that large asset purchases contribute significantly to market liquidity, Kandrac and Schlusche [19] find no evidence of flow effects in the liquidity of Treasury securities during the large-scale asset purchase program by the Fed. Thus, the Treasury purchases during the U.S. QE had an insignificant association with the Treasury bond market functioning.

3. Liquidity Channel

Literature has identified the potential transmission channels that explain the financial effects of QE. Gagnon et al. [20], Bauer and Rudebusch [21], Bauer and Neely [22] suggest that the consequences of QE for bond yields were principally explained by the signaling channel; Bernanke [23], Fratzscher, Lo Duca and Straub [24], Joyce, Liu and Tonks [25], Goldstein, Witmer and Yang [26] attribute the price effect of QE to the portfolio balance channel; Kozicki, Santor and Suchanek [27] show that QE increases commodity prices through the exchange rate channel.

In this study, we focus on the role of the liquidity channel of QE on sovereign yield spreads in commodity-exporting countries. In normal market conditions, the liquidity channel could be an insignificant transmission channel of monetary policy as the markets are liquid and deep. However, the liquidity channel plays an important role in monetary policy to influence the banks’ capability to loosen credit and spur aggregate demand in the aftermath of the GFC. Joyce and Tong [28] support that market functioning has been improved with the presence of the central bank as a significant buyer of the securities in the market and hence increases the market liquidity.

The key focus to date in the relevant literature is on understanding how yield spreads might be related to changes in liquidity. Early in the QE period, [20] focus on how this channel is related to the yield spreads between certain types of assets. First, QE aids in narrowing the spread between yields on riskier securities and yields on risk-free securities (i.e., treasury securities). Second, QE may help to narrow the spread between yields on off-the-run securities and on-the-run issued securities. During the GFC, the yield spreads between these securities was well above historical norms due to the high liquidity risk premium of riskier securities and other securities. QE may narrow the yield spreads by recovering liquidity in these markets and reducing the liquidity risk premium of these securities.

An interesting extension of the work of [20] is to consider whether the same results are found for broader asset types. Krishnamurthy and Vissing-Jorgensen [29] extend the literature by considering Agency bonds and Treasury bonds and also support that QE narrowed yield spreads through the liquidity channel. Their findings also suggest that QE lowered Agency yields (which are less liquid) more than Treasury yields.

Christensen and Gillan [30] further extend the asset classes considered in quantifying the importance of liquidity channels as a separate transmission channel of the U.S. QE. During the U.S. QE2, their findings suggest that the TIPS purchases in QE2 significantly depressed the liquidity premium in both inflation swaps and TIPS markets. They also argue that the liquidity effects appear to be sustained if massive asset purchases by the Fed are continually executed, and only on the targeted securities.

Our study follows [30] by focusing on the TIPS liquidity premium as the proxy of the liquidity channel. We then extend the work of [30] by empirically analyzing the liquidity effect of the U.S. QE on yield spreads in commodity-exporting countries. They find evidence of QE2 significantly reducing the liquidity premium in both inflation swaps and TIPS markets. We employ a two-stage least squares approach to examine the association of the U.S. QE on the liquidity premium (first stage), and then the effect of liquidity premium on yield spreads in commodity-exporting countries (second stage). Therefore, this approach provides a further study of the mechanism of the liquidity channel in affecting yield spreads in commodity-exporting countries by changing liquidity premiums.

Our key research questions are: (i) Was the reduction in liquidity risk during QE associated with changes in the TIPS liquidity premium? (ii) Was the change in the liquidity premium associated with changes in sovereign yield spreads across commodity-exporting countries?

4. Data and Econometric Framework

Regression in the form of the two-stage least squares approach is employed to assess the association of the U.S. QE on sovereign yield spreads in commodity-exporting countries through the liquidity channel. The first stage of the regression quantifies the liquidity effect of the U.S. QE with the liquidity premium, while the second stage of the regression examines the relationship of the liquidity effect of the U.S. QE on sovereign yield spreads in commodity-exporting countries.

Only thirteen commodity-exporting are drawn from the sample countries of [31] due to data unavailability of a consistent sample period on their sovereign bond yields. There are fifty-eight commodity countries in the study of [31]. Their sample countries are extracted based on UNCOMTRADE and IMF. However, only thirteen sample countries were included, which are Australia, Brazil, Canada, Chile, India, Indonesia, Malaysia, Mexico, New Zealand, Norway, South Africa, Thailand, and Turkey. Data are at a daily frequency, over the period from 25 November 2008 to 29 October 2014; covering the U.S. QE1, QE2, and QE3.

Two-stage least squares regression analysis is employed in the analysis of structural equations. It is a model extended from ordinary least squares (OLS) where there is an endogeneity problem. An endogeneity problem exists when the error terms of the dependent variable correlate with the independent variables. As a result, it will lead to a sizable bias in OLS estimations. Hence, the instrumental variable is included in the model to address the endogeneity problem.

The application of instrumental variables in a model relies on two main assumptions. First, the instrumental variable is distributed independently of the error process. This implies that the instrumental variable affects the dependent variable through its association with the endogenous variable. Second, the correlation between the instrumental variable and the endogenous variable is sufficiently strong to allow identification.

An instrument variable is identified in the model, which is the market-wide liquidity risk. This assumes that the market-wide liquidity risk tends to affect TIPS liquidity premium while being weakly correlated with the sovereign yield spreads of commodity-exporting countries as follows:

and

where denotes the TIPS liquidity premium, is the market-wide liquidity risk, and is the error term of sovereign yield spreads of commodity-exporting countries.

4.1. The Relationship of the U.S. QE with the TIPS Liquidity Premium

In the first regression of the two-stage approach, the liquidity premium is the dependent variable in a regression analysis to investigate the liquidity effect of the U.S. QE. The TIPS liquidity premium will be employed in this study. The TIPS liquidity premium is considered rather than the Treasury liquidity premium based on three reasons. First, TIPS purchases are observed to involve smaller trading sizes, a more extended turnover period, and broader bid-ask spreads as compared with the nominal Treasury bond market [32]. Second, the TIPS liquidity premium measures the yield difference instead of quantities by quantifying the frictions to trading in the inflation swap and TIPS markets. Third, [19] find no evidence of the effect of Treasury purchases on the Treasury bond market functioning.

Following [30], the TIPS liquidity premium, is constructed as follows,

where denotes the inflation swap rate, which is explained by a theoretical relationship . and represented by a set of observed nominal and real Treasury zero-coupon bond yields, respectively. denotes the breakeven inflation, which is constructed by the difference in regular Treasury bond yields and TIPS of the same maturity.

Unlike regular Treasury bond yields, TIPS provide real yields because their par values and coupon payments are paid by adjusting for inflation, measured by the CPI. Meanwhile, an inflation swap allows the party with an extended position to pay a fixed premium in exchange for a floating payment equal to the change in the CPI used in the inflation indexation of TIPS. Hence, the cash flows of both TIPS and inflation swaps are adjusted with the same price index, which is the CPI.

In a frictionless world, the inflation swap is equal to BEI in the absence of arbitrage opportunities. This is because the cash flows generated from buying a nominal discount bond today with a given maturity is equal to the cash flows generated from buying a real discount bond of the same maturity and selling an inflation swap contract of the same maturity. Hence, the is explained as follows,

However, the trading of both TIPS and inflation swaps is impeded by frictions, thus, inflation swap rates will not be equal to BEI. Three assumptions are made to measure how far TIPS and inflation swaps are from the frictionless outcome:

- The nominal Treasury bond yields are very close to the unobservable frictionless nominal yields, hence, for all t and all relevant .

- TIPS are less liquid than nominal Treasury bonds with the presence of frictions. Thus, the observed TIPS yields, consists of both a time-varying liquidity premium, and a frictionless counterpart, , with for all t and all relevant .

- Inflation swaps are less liquid than nominal Treasury bonds with frictions. Hence, the observed inflation swap rates, , with for all t and all relevant .

From Equation (3), it is noticed that is a nonnegative value and is equal to the sum of liquidity premiums in inflation swap rates and TIPS yields.

In this model, the TIPS liquidity premium is the dependent variable. It is expected that the large-scale asset purchases by the U.S. QE will improve market functioning and liquidity and hence reduce the TIPS liquidity premium. The market-wide liquidity risk and VIX are considered risk factors. Hu et al. [33] construct the HPW illiquidity measure to quantify substantial market-wide liquidity risk by examining the interrelationship between the volume of arbitrage capital available in the market and observed “noise” in the U.S. Treasury bonds. A higher value of HPW indicates higher liquidity risk and lower market liquidity. The U.S. QE improves market liquidity by injecting broad money into the economy and thus reduces HPW illiquidity as a lower liquidity risk.

Meanwhile, the VIX reflects a market estimate of future volatility. A higher value of the VIX indicates that investors anticipate that the market will be more volatile in the future and creates higher uncertainty. It is expected to have a positive relationship between the VIX and TIPS liquidity premium during the U.S. QE. The U.S. QE is expected to spur economic growth by improving market liquidity. Consequently, the investors perceive that the market will be less volatile and this will lead to lower excess returns required to hold less liquid securities. The U.S. 10-year sovereign zero coupon bond yields are the yield-factor. Prior studies show that the U.S. QE lowers long-term yields and hence lowers the liquidity premium. The description of the data is shown in Table 1.

Table 1.

Description of data.

Following the discussion above, the regression equation is set as follows,

where , , and are the parameters to be estimated, is a constant and is an error term.

4.2. The Relationship of the TIPS Liquidity Premium with Sovereign Yield Spreads

The second regression measures the relationship of the liquidity premium with the sovereign yield spreads in commodity-exporting countries during the U.S. QE. The dependent variable is the yields spread between 10-year sovereign zero coupon bond yields and 1-year sovereign zero coupon bond yields for each of the commodity-exporting countries, . According to [20], QE narrows the yield spread between agency debt and Treasury securities through the liquidity channel by lowering the liquidity premium embedded in agency bonds (i.e., riskier bonds) and hence lowering its yields.

In this second stage regression, the TIPS liquidity premium, is the only endogenous variable. The U.S. QE is anticipated to reduce the TIPS liquidity premium and lead to narrowed sovereign yield spreads in commodity-exporting countries due to the effect of liquidity flow. Meanwhile, the U.S. 10-year sovereign zero coupon bond yields, VIX, term premium, and central bank policy rate for each commodity-exporting country are the exogenous variables. The HPW illiquidity measure is used for the instrumental variable.

The U.S. QE reduces the U.S. 10-year sovereign zero coupon yields and prompts investors to seek higher yielding securities in commodity-exporting countries, including in 10-year sovereign zero coupon bonds. Hence, increasing demand for 10-year sovereign bonds leads to an increase in respective prices and a decrease in yields, and therefore, also sovereign yield spreads. With regard to the VIX, the U.S. QE is expected to spur aggregate demand by improving market liquidity. Consequently, the investors perceive that the market will be less volatile and lead to lower excess returns required to hold less liquid securities and sovereign yield spreads.

The term premium indicates the excess returns required by the investors to hold longer-term securities instead of reinvesting in short-term securities with the same maturity. It is expected that the term premium is positively correlated with sovereign yield spreads during the U.S. QE. The U.S. QE reduced the term premium with improved global liquidity and resulted in narrowing yield spreads in commodity-exporting countries.

The central bank policy rate is commonly used to signal the direction of its monetary policy, either tightening or easing. It is essential to highlight that a country’s monetary policy would also influence the yields of the sovereign bonds. It is expected that a lower central bank policy rate narrows yield spreads. For example, an increasing policy rate indicates the central bank intends to tighten its monetary policy, in which reduces the money supply thus tightening the credit condition of a country. Therefore, the liquidity premium demanded by investors for less liquid securities increases and results in widening yield spreads between liquid securities and less liquid securities. The description of the data is shown in Table 2.

Table 2.

Description of data.

In accordance with the discussion above, the regression equation is as follows,

where is the parameter associated with the endogenous variable, while , , , and are the parameters associated with the exogenous variables. is a constant and is an error term.

For Equation (5), thirteen regression models are generated for assessing the liquidity effect of the U.S. QE on sovereign yield spreads in thirteen commodity-exporting countries, respectively.

4.3. Diagnostic Tests

Two diagnostic tests are carried out to check the validity of the instrument variable employed in the model, which are the weak instrument test and the Wu–Hausman test. Stock and Yogo [34] propose the weak instrument test used to examine the strength of the correlation between the instrumental variable and the endogenous variable with a null hypothesis of the instrument is weak as follows:

where denotes the instrumental variable and is the relative bias definition of a weak instrument.

where denotes the minimum eigenvalue of the matrix version of the F-statistic from the first stage regression of the two-stage least squares. is the 100 critical value percentile) of the noncentral chi-squared distribution with degrees of freedom and nonconcentrality parameter . Rejection of the null hypothesis implies that the instrumental variable is not weak.

The Wu–Hausman test (also known as the Durbin–Wu–Hausman test) is primarily used to test the presence of endogeneity in the two-stage least squares regression compared with the standard OLS regression [35,36,37]. The null hypothesis is both the standard OLS and two-stage least squares estimates are consistent:

where denotes the difference between the standard OLS and two-stage least squares estimators.

Under the null hypothesis, assume that the difference between the two root- consistent estimators is also root- consistent, with a mean of 0 and a limit normal distribution, then:

where is the variance matrix in the limiting distribution. So, the Hausman test statistic is:

The statistic, has the chi-squared distribution, asymptotically. The null hypothesis is rejected at a certain confidence level if , implying that the standard OLS estimates are inconsistent with the two-stage least squares estimates.

5. Findings and Discussions

The findings of the two-stage least squares regression analysis will be discussed in this section. This section will be divided into two parts to assess the role of the liquidity channel in affecting sovereign yield spreads of commodity-exporting countries. First, the study will assess the liquidity effect of the U.S. QE by quantifying the liquidity premium. Second, the association of the liquidity premium with the sovereign yield spreads of commodity-exporting countries is explored.

5.1. The Liquidity Effect of the U.S. QE

Table 3 shows the liquidity effect of the U.S. QE by considering the TIPS liquidity premium (first stage of the regression). Of the observable proxies for liquidity risk, both the HPW illiquidity measure and the VIX are significant at the 1 percent level with an expected positive sign. A key macroeconomic dimension of modeling the TIPS liquidity premium is in terms of modeling inflationary expectations. Gurkaynak, Sack and Wright [38] show the importance of correcting for the liquidity premium in calculating inflationary expectations from TIPS data. Thus, an understanding of how liquidity is associated with QE is likely to be of importance in modeling inflationary expectations and the setting of monetary policy. The findings are consistent with [30], and [39]. The coefficient of HPW is 0.0516, indicating that an increase of 1 basis point in the HPW illiquidity measure leads on average to a 0.0516 percentage point increase in the U.S. liquidity premium. In terms of the magnitude of the economic significance (for detailed results see Table 4), the effect of an increase of 1 basis point in the HPW illiquidity premium measure is a change of 0.06 percent of the mean and 0.01 percent of standard deviation in the U.S. liquidity premium. Fratzscher et al. [24] suggest that the U.S. QE successfully recovered the dysfunctional financial market by providing liquidity to the market. The massive purchase program by the Fed has increased arbitrage capital available in the economy. Hence, this would improve the liquidity condition of the economy and hence decline the illiquidity measure. Consequently, the liquidity premium reduces as the excess yields required by investors for holding comparatively less liquid securities decrease with improved liquidity conditions.

Table 3.

The liquidity effect of the U.S. QE.

Table 4.

Economic Significance of the liquidity effect of the U.S. QE.

For the VIX, the model estimates that a one percentage point decrease in VIX leads to a 0.0031 percentage point decrease in the TIPS liquidity premium on average. The economic significance of this estimate is a one percentage point decrease in VIX leads to a change of 0.36 percent of the mean and 0.0007 percent of standard deviation in the TIPS liquidity premium. The Fed aimed to recover economic activity from the GFC through the implementation of QE. Therefore, the U.S. QE is expected to decline the investors’ fear level or uncertainty arising from the GFC. A lower fear level among investors tends to reduce the risk attached to the future purchased financial securities. As a consequence, investors demanded a lower premium for holding relatively illiquid financial securities with a lower VIX.

For 10-year sovereign zero coupon bond yields, the findings show that YIELD has a positive relationship with the U.S. liquidity premium, with a one percentage point decrease in YIELD, LP will decrease by 0.0201 percentage points. The economic significance of this estimate is a one percentage point decrease in YIELD leads to a 0.02 percent change in the mean and a 0.005 percent change in standard deviation in the U.S. liquidity premium. The empirical literature suggests that the U.S. QE significantly reduces the local long-term bond yields through a massive asset purchase program (see, among others, [21,29,40]. Lower long-term bond yields, reduce additional compensation demanded by investors for holding less liquid securities, including longer-term maturity securities, and therefore, also lower the liquidity premium.

5.2. The Relationship of the Liquidity Effect of the U.S. QE with Sovereign Yield Spreads

Table 5 reports the relationship of the TIPS liquidity premium with sovereign yield spreads for each of the commodity-exporting countries. Notably, the estimated effect of the TIPS liquidity premium on sovereign yield spreads is sizeable but also varies across commodity-exporting countries. More than half of the commodity countries show that the TIPS liquidity premium is statistically significant and positively related to yield spreads, although this is not the result for Australia, India, Indonesia, Malaysia, New Zealand and South Africa. Intriguingly, the majority of the countries with the positive coefficient on the TIPS liquidity premium are neighboring countries of the U.S., implying that sovereign yield spreads of neighboring countries tend to be positively related to the liquidity premium during the U.S. QE.

Table 5.

The association of the TIPS liquidity premium on sovereign yield spreads of commodity-exporting countries.

The U.S. QE reduced the liquidity premium by improving the liquidity condition of the economy. The reduction in the liquidity premium indicates that the investors require lower additional compensation for holding relatively illiquid securities (including long-term foreign bonds) and hence reduce sovereign yield spreads of foreign bonds. The macroeconomic consequences of the reduced sovereign yield spreads are likely to be economically important. Altavilla, Giannone and Lanza [41] develop a macroeconomic simulation model for four European countries (France, Germany, Italy and Spain) and find reduced sovereign bond yields for Italy and Spain led to higher real activity and higher credit activity. For our different sample consider the case of Brazil, where we find that a one percentage point decrease in the U.S. liquidity premium reduces the yield spreads of Brazil by 0.2590 percent. This is statistically significant at the 1% level and is also economically significant as the effect of a one percentage point decrease in the U.S. liquidity premium is 0.823 percent of the mean and 0.289 percent of the standard deviation in the yield spread of Brazil (for details see Table 6). Thus, comparing the economic significance across the two stages of the analysis we find larger impacts in terms of economic significance in the analysis of the sovereign yield.

Table 6.

Economic Significance of the association of the TIPS liquidity premium on sovereign yield spreads of commodity-exporting countries.

Among the exogenous variables, both the VIX and the TP have a significant association with sovereign yield spreads of all the commodity-exporting countries. For all countries (except for Thailand) the VIX is positively related to sovereign yield spreads. The U.S. QE reduced investors’ fear by improving the liquidity functioning of the economy through large scale asset purchases. This would increase the investor confidence level to hold longer-term bonds (i.e., less liquid and riskier) and flatten the yield curve, and hence reduce sovereign yield spreads. Rey [42,43] also suggests that the U.S. monetary easing was likely to lower volatility as well as the degree of risk aversion of market participants.

With regards to the TP, more than half of the countries (7 out of 13 countries) show that the term premium has a positive correlation with the sovereign yield spreads, including Australia, Canada, Indonesia, New Zealand, Norway, South Africa, and Turkey. Thus, all advanced countries show positive coefficients. The advanced countries are classified according to Standard and Poor’s, including Australia, Canada, New Zealand, and Norway. The positive coefficient might be ascribed to the preference of investors toward sovereign bonds in advanced countries. The findings are supported by [22], suggesting that the U.S. unconventional monetary policy substantially lowered the bond yields of the advanced countries (which are Canada, Australia, and Germany).

Generally, the U.S. QE is likely to reduce global liquidity risk by unusually expanding the reserves of the Fed. This has encouraged an aggressive search for yield and led to large capital inflows to other countries, creating cross-border liquidity flows. Hence, the investors might lower their required excess yields for holding long-term bonds instead of reinvesting shorter-term bonds for the same amount of maturity, and therefore, also reduce the term premium. A lower term premium might enhance investors’ demand for long-term bonds in these commodity-exporting countries, particularly in advanced countries. Higher demand pushes up the prices of the respective bonds and thus reduces their yields. Consequently, the sovereign yield spreads of these countries might be narrowed due to lower bond yields.

Consistent with expectations, most of the countries of interest show that YIELD has a positive and marginally significant relationship with the sovereign yield spreads during the U.S. QE, with the exception of South Africa (negative coefficient) and Australia (statistically insignificant relationship). The findings suggest that the U.S. QE induced a fall in the U.S. sovereign bond yields, which in turn, narrowed yield spreads of these commodity-exporting countries by lowering the bond yields of these countries. Several empirical studies suggest that the U.S. QE contributed substantially to the compression of foreign yield spreads by reducing lower long-term bond yields (see for example, [44]). Consistent with [45], Brazil experienced the most significant decline in yield spreads in response to a decline in U.S. yields, with a coefficient of 1.3251. The economic significance of this is a one percentage point change in YIELD leads to a change of 4.213 percent in the mean and a 1.478 percent change in the standard deviation of the yield spread of Brazil.

The central bank policy rate of each commodity-exporting countries is considered in the study on the assumption that the yield spreads of these countries might be affected by their monetary policy direction. Surprisingly, almost all the countries show an adverse relationship between the central bank policy rate and yield spreads during the U.S. QE, except for South Africa (with a positive coefficient of 0.2504). The perverse effect might be possibly explained by the lower risk appetite of investors in the countries of interest after the GFC. Angelini, Nobili, and Picillo [46] suggest that risk aversion among market participants was the critical driver of widening the interbank spreads.

Most central banks attempted to stimulate economic activity by reducing a country’s central bank policy rate in the aftermath of the GFC (i.e., expansionary monetary policy). The rationale behind this approach is to restore investors’ confidence in the potential investment opportunities of a country in the future. However, investors might worry that their holding investment return might be affected adversely by further declining interest rates. Thus, they prefer to hold a short-term sovereign bond with higher liquidity and lower interest rate risk. Raised demand for short-term sovereign bonds forces corresponding yields to decline, and therefore, expands sovereign yield spreads.

Table 5 shows that the null hypothesis of weak instrument tests for all the sample commodity-exporting countries is rejected at a 1 percent significance level. It suggests that the implication of HPW as an instrumental variable is sufficiently strong in the model. Additionally, findings from the correlation tests between HPW and the error term of the second-stage regression show that there is no correlation between these two variables, supporting the suitability of using HPW as an instrumental variable. With regards to the Wu–Hausman test, most of the sample countries reject the null hypothesis at the 1 percent significance level, except for Mexico, Thailand, and Turkey. The findings conclude that the standard OLS estimates are not consistent with the two-stage least squares estimates, implying that the two-stage least squares are preferable in most countries.

6. Conclusions and Implications of the Study

The study quantifies the role of the liquidity channel in affecting sovereign yield spreads of commodity-exporting countries during the U.S. QE. A two-stage least squares regression is employed for each of the commodity-exporting countries. The first stage of the regression quantifies the liquidity effect of the U.S. QE by examining the relationship of the U.S. QE with the liquidity premium. The TIPS liquidity premium is constructed following [30]. The second stage of the regression focuses on the effect of the TIPS liquidity premium on the sovereign yield spreads of thirteen commodity-exporting countries. The statistical regressions highlight several interesting findings.

In terms of our first research question (i), we find that the first stage regressions show that the U.S. QE has a significant liquidity effect as indicated by the significant relationship between the HPW illiquidity measure and the TIPS liquidity premium. Consistent with [30], and [39], the results suggest that the U.S. QE improved market liquidity through a series of massive asset purchases and lead to a decline in excess yields required by investors for holding comparatively less liquid securities.

In terms of our second research question (ii) we find that the estimated effect of the TIPS liquidity premium on sovereign yield spreads is sizeable, and also varies across commodity-exporting countries. More than half of the commodity countries show that the TIPS liquidity premium is positively related to yield spreads. This implies that the U.S. QE reduced the liquidity premium with improved market liquidity and hence reduced sovereign yield spreads of commodity-exporting countries, especially the countries that are neighboring countries with the U.S. Thus, the liquidity effect of the U.S. QE tends to flow to the U.S. neighboring commodity-exporting countries. This provides an avenue for future research work taking the neighborhood effect into account. This could also be linked to the financial gravity dimensions explored by [47].

Third, both the VIX and the TP have a significant association with sovereign yield spreads of all the commodity-exporting countries during the U.S. QE. With regards to the VIX, the U.S. QE reduced investor fears by improving liquidity through large scale asset purchases hence enhancing market functioning This would increase investor confidence to hold longer-term bonds (i.e., less liquid and riskier) and flatten the yield curve, and hence reduce sovereign yield spreads. Moreover, all the advanced countries show a positive relationship between the term premium and sovereign yield spreads. It might be partly explained by the preference of investors for sovereign bonds in advanced countries.

Fourth, almost all the countries show that the central bank policy rate has an adverse relationship with yield spreads during the U.S. QE. The perverse effect might be ascribed to the lower risk appetite of investors in the country of interest after the GFC. Most central banks attempted to stimulate economic activity by reducing a country’s central bank policy rate in the aftermath of the GFC. However, investors might worry their holding investment return might be affected adversely by further monetary policy easing.

Our findings deliver some important implications to policymakers and investors. First, the findings are particularly informative to policymakers in the policy decision-making process by assessing the role of the liquidity channel of the U.S. QE. The policy dimensions of the research are still relevant in the contemporary setting. Kirik and Ulusoy [47] with a sample including the start of the COVID pandemic discuss the importance of US monetary policy in the context of the world economy. Thus, in terms of policy frameworks, we now have four major changes to settings of monetary policy since the onset of the GFC as follows: (i) the QE period for recovery from the GFC; (ii) the tapering of the QE measures; (iii) the expansionary monetary policy in response to the pandemic and (iv) the understanding of the inflation surge as we move from the pandemic period. A direction for future research would be to analyze the monetary policy settings over a longer timeline that would require extending the current modeling to consider multiple regimes and the factors that play a role in regime switching. Second, our findings also deliver an important message to investors in their investment decision-making process by considering the significant flow of liquidity effect of the U.S. QE to sovereign bond markets. The empirical analyses show that the U.S. QE tends to reduce the liquidity risk of the global market as indicated by narrowed yield spreads of commodity-exporting countries due to the low liquidity premium. Hence, investors might consider reducing liquidity risk and optimizing returns by investing in sovereign bond markets of the U.S. neighboring commodity-exporting countries such as Canada and Chile.

The findings also provide some implications on the possible reverse effect of liquidity flows during the QE tapering process. The “hot money” created by the U.S. QE that flows to commodity-exporting countries could raise inflation and financial asset prices primarily through commodity prices and the lending capacity of the banking system. In the anticipation of the economic recovery, the Fed would wind down asset purchases (i.e., QE tapering), and this has led to capital flows back to the U.S. economy. It may create a great concern about inflationary pressures and excessive risk-taking in financial markets in commodity-exporting countries due to the U.S. QE. Hence, the policymakers of commodity-exporting countries should take the reverse liquidity effect resulting from QE tapering into consideration when implementing either fiscal or monetary policy.

Author Contributions

Conceptualization, P.-S.Y. and W.-Y.L.; methodology, P.-S.Y., W.-Y.L. and R.B.; software, P.-S.Y.; validation, P.-S.Y., W.-Y.L. and R.B.; formal analysis, P.-S.Y.; investigation, P.-S.Y.; resources, P.-S.Y., W.-Y.L. and R.B.; data curation, P.-S.Y.; writing—original draft preparation, P.-S.Y.; writing—review and editing, P.-S.Y., W.-Y.L. and R.B.; visualization, P.-S.Y.; supervision, W.-Y.L. and R.B.; project administration, P.-S.Y., W.-Y.L. and R.B.; All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

The authors wish to thank two reviewers for their helpful and constructive comments on an earlier version of the paper. The revised paper has been significantly improved as a result of their comments.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Adrian, T.; Shin, H.S. Money, Liquidity, and Monetary Policy. Am. Econ. Rev. 2009, 99, 600–605. [Google Scholar] [CrossRef]

- Edey, M. The Global Financial Crisis and Its Effects. Econ. Pap. J. Appl. Econ. Policy 2009, 28, 186–195. [Google Scholar] [CrossRef]

- Committee on the Global Financial System. Global Liquidity—Concept, Measurement and Policy Implications; CGFS Papers No. 45; Committee on the Global Financial System: Basel, Switzerland, 2011. [Google Scholar]

- Loisel, O.; Mésonnier, J.S. Unconventional Monetary Policy Measures in Response to the Crisis; Banque de France Current Issues 1; Banque de France: Paris, France, April 2009. [Google Scholar]

- Belke, A.; Bordon, I.G.; Volz, U. Effects of global liquidity on commodity and food prices. World Dev. 2013, 44, 31–43. [Google Scholar] [CrossRef]

- Schwarz, K. Mind the gap: Disentangling credit and liquidity in risk spreads. Rev. Financ. 2019, 23, 557–597. [Google Scholar] [CrossRef]

- Krugman, P. Oil shocks and exchange rate dynamics. In Exchange Rates and International Macroeconomics; University of Chicago Press: Chicago, IL, USA, 1983; pp. 259–284. [Google Scholar]

- Malik, F.; Umar, Z. Dynamic connectedness of oil price shocks and exchange rates. Energy Econ. 2019, 84, 104501. [Google Scholar] [CrossRef]

- Umar, Z.; Aharon, D.Y.; Esparcia, C.; AlWahedi, W. Spillovers between sovereign yield curve components and oil price shocks. Energy Econ. 2022, 109, 105963. [Google Scholar] [CrossRef]

- Brunnermeier, M.K.; Pedersen, L.H. Market liquidity and funding liquidity. Rev. Financ. Stud. 2009, 22, 2201–2238. [Google Scholar] [CrossRef]

- Iwatsubo, K.; Taishi, T. Quantitative Easing and Liquidity in the Japanese Government Bond Market. Int. Rev. Financ. 2018, 18, 463–475. [Google Scholar] [CrossRef]

- Chari, A. Heterogeneous Market-Making in Foreign Exchange Markets: Evidence from Individual Bank Responses to Central Bank Interventions. J. Money Credit. Bank. 2007, 39, 1131–1162. [Google Scholar] [CrossRef]

- Brunetti, C.; di Filippo, M.; Harris, J.H. Effects of Central Bank Intervention on the Interbank Market during the Subprime Crisis. Rev. Financ. Stud. 2010, 24, 2053–2083. [Google Scholar] [CrossRef]

- Kandrac, J. Have Federal Reserve MBS Purchases Affected Market Functioning? Econ. Lett. 2013, 121, 188–191. [Google Scholar] [CrossRef]

- Kandrac, J. The Costs of Quantitative Easing: Liquidity and Market Functioning Effects of Federal Reserve MBS Purchases. Int. J. Cent. Bank. 2018, 14, 259–304. [Google Scholar] [CrossRef]

- Herbst, A.F.; Wu, J.S.; Ho, C.P. Quantitative Easing in an Open Economy—Not a Liquidity but a Reserve Trap. Glob. Financ. J. 2014, 25, 1–16. [Google Scholar] [CrossRef]

- Wong, W.; Mariscal, I.B.-F.; Yao, W.; Howells, P. Liquidity and Credit Risks in the UK’s Financial Crisis: How QE Changed the Relationship; UWE Economics Working Paper Series 1301; University of the West England: Bristol, UK, 2013. [Google Scholar]

- Caldentey, E.P. Quantitative Easing (QE), Changes in Global Liquidity, and Financial Instability. Int. J. Political Econ. 2017, 46, 91–112. [Google Scholar] [CrossRef]

- Kandrac, J.; Schlusche, B. Flow Effects of Large-Scale Asset Purchases. Econ. Lett. 2013, 121, 330–335. [Google Scholar] [CrossRef]

- Gagnon, J.; Raskin, M.; Remache, J.; Sack, B. The Financial Market Effects of the Federal Reserve’s Large-Scale Asset Purchases. Int. J. Cent. Bank. 2011, 7, 3–43. [Google Scholar]

- Bauer, M.D.; Rudebusch, G.D. The Signaling Channel for Federal Reserve Bond Purchases. Int. J. Cent. Bank. 2014, 10, 233–289. [Google Scholar] [CrossRef]

- Bauer, M.D.; Neely, C.J. International Channels of the Fed’s Unconventional Monetary Policy. J. Int. Money Financ. 2014, 44, 24–46. [Google Scholar] [CrossRef]

- Bernanke, B.S. Opening remarks: The economic outlook and monetary policy. In Proceedings of the Economic Policy Symposium, Jackson Hole, WY, USA, 26–28 August 2010; Federal Reserve Bank of Kansas City: Kansas City, MO, USA, 2010; pp. 1–16. [Google Scholar]

- Fratzscher, M.; Lo Duca, M.; Straub, R. On the International Spillovers of US Quantitative Easing. Econ. J. 2017, 128, 330–377. [Google Scholar] [CrossRef]

- Joyce, M.A.; Liu, Z.; Tonks, I. Institutional investors and the QE portfolio balance channel. J. Money Credit. Bank. 2017, 49, 1225–1246. [Google Scholar] [CrossRef]

- Goldstein, I.; Witmer, J.; Yang, J. Following the Money: Evidence for the Portfolio Balance Channel of Quantitative Easing (No. 2018-33). Retrieved from Bank of Canada Website. 2018. Available online: https://www.bankofcanada.ca/wp-content/uploads/2018/07/swp2018-33.pdf (accessed on 5 February 2018).

- Kozicki, S.; Santor, E.; Suchanek, L. Large-Scale Asset Purchases: Impact on Commodity Prices and International Spillover Effects (No. 2015-21). Retrieved from Bank of Canada Website. 2015. Available online: https://www.bankofcanada.ca/2015/06/working-paper-2015-21/ (accessed on 5 February 2018).

- Joyce, M.A.S.; Tong, M. QE and the gilt market: A disaggregated analysis. Econ. J. 2012, 122, 348–384. [Google Scholar] [CrossRef]

- Krishnamurthy, A.; Vissing-Jorgensen, A. The Effect of Quantitative Easing on Interest Rates: Channels and Implications for Policy. Brook. Pap. Econ. Act. 2011, 43, 215–287. [Google Scholar] [CrossRef]

- Christensen, J.H.; Gillan, J.M. Does quantitative easing affect market liquidity? J. Bank. Financ. 2022, 134, 106349. [Google Scholar] [CrossRef]

- Cashin, P.; Céspedes, L.F.; Sahay, R. Commodity Currencies and the Real Exchange Rate. J. Dev. Econ. 2004, 75, 239–268. [Google Scholar] [CrossRef]

- Fleming, M.; Krishnan, N. The Microstructure of the TIPS Market. FRBNY Econ. Policy Rev. 2012, 18, 27–45. [Google Scholar]

- Hu, G.X.; Pan, J.; Wang, J. Noise as Information for Illiquidity. J. Financ. 2013, 68, 2341–2382. [Google Scholar] [CrossRef]

- Stock, J.H.; Yogo, M. Testing for Weak Instruments in Linear IV Regression; NBER Technical Working Paper No. 284; National Bureau of Economic Research: Cambridge, MA, USA, October 2002. [Google Scholar]

- Durbin, J. Errors in Variables. Rev. L’inst. Int. Stat. 1954, 22, 23–32. [Google Scholar] [CrossRef]

- Wu, D.M. Alternative Tests of Independence between Stochastic Regressors and Disturbances. Econom. J. Econom. Soc. 1973, 41, 733–750. [Google Scholar] [CrossRef]

- Hausman, J.A. Specification Tests in Econometrics. Econom. J. Econom. Soc. 1978, 46, 1251–1271. [Google Scholar] [CrossRef]

- Gurkaynak, R.; Sack, B.; Wright, J. The TIPS Yield Curve and Inflation Compensation. Am. Econ. J. Macroecon. 2010, 2, 70–92. [Google Scholar] [CrossRef]

- Andreasen, M.M.; Christensen, J.H.; Riddell, S. The TIPS Liquidity Premium; FRBSF Working Paper No. 2017-11; Federal Reserve Bank of San Francisco: San Francisco, CA, USA, March 2018. [Google Scholar]

- Wright, J.H. What Does Monetary Policy Do to Long-Term Interest Rates at the Zero Lower Bound? Econ. J. 2012, 122, F447–F466. [Google Scholar] [CrossRef]

- Altavilla, C.; Giannone, D.; Lenza, M. The Financial and Macroeconomic Effects of OMT Announcements; ECB Working Paper No. 1707; European Central Bank: Frankfurt, Germany, August 2014. [Google Scholar]

- Rey, H. Dilemma Not Trilemma: The Global Cycle and Monetary Policy Independence; NBER Working Paper No. 21162; National Bureau of Economic Research: Cambridge, MA, USA, May 2015. [Google Scholar]

- Rey, H. International Channels of Transmission of Monetary Policy and the Mundellian Trilemma. IMF Econ. Rev. 2016, 64, 6–35. [Google Scholar] [CrossRef]

- Baumeister, C.; Benati, L. Unconventional Monetary Policy and the Great Recession: Estimating the Macroeconomic Effects of a Spread Compression at the Zero Lower Bound. Int. J. Cent. Bank. 2013, 9, 165–212. [Google Scholar]

- Bowman, D.; Londono, J.M.; Sapriza, H. US Unconventional Monetary Policy and Transmission to Emerging Market Economies. J. Int. Money Financ. 2015, 55, 27–59. [Google Scholar] [CrossRef]

- Angelini, P.; Nobili, A.; Picillo, C. The Interbank Market after August 2007: What has Changed, and Why? J. Money Credit. Bank. 2011, 43, 923–958. [Google Scholar] [CrossRef]

- Kirik, A.; Ulusoy, V. Winds of Tapering, Financial Gravity and COVID-19. N. Am. J. Econ. Financ. 2022, 62, 101719. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).