1. Introduction

There are several aspects to consider when it comes to a country’s production, such as geographical position, climate change, labour qualification, and soil quality but also the level of productivity, and thus productivity and imports play a propitious role in covering a country’s market needs [

1,

2]. Imports can also be re-exported when international market prices are favourable. In addition to imports, exports are equally important for any country, contributing to improved trade, economic development, reduced labour migration, increased value added, and higher technology levels [

3,

4].

Exports are all transactions involving the sale of or investment in goods abroad, while imports are commercial transactions, such as the purchase of goods and/or services abroad and their passage [

5,

6].

Starting from Romania’s history of grain exports in the 1930s, the country has established itself as a leading exporter in the world grain market [

7]. The competitiveness of a country’s exports is very important when it comes to its ability to face challenges in the international market. In the 1990s, Romania turned from an exporting country to an importing one, an advantage lost due to the restructuring of agriculture into a so-called centralised sector, but also due to previous policies [

8,

9].

The results of the study show that the Romanian grain market and the Ukrainian market in the period 2000–2015 experienced positive developments supported by the scale of production, consumption, and trade [

10,

11]. At the same time, there are some factors that slowed it down. Therefore, one problem that should be considered and solved in the future development of the sector is the lack of adequate infrastructure and logistics to realise the productive potential [

12,

13].

For the last two decades, Romania has been described as an importing net, with products that it imports massively, but in 2013, it recorded a surplus for some agricultural products. It is considered an importer on the EU cereals market, with wheat and maize being the main cereals exported [

14,

15].

Ukraine is one of the world’s main exporters of maize, wheat, and sunflower, and together with Russia, it exports a quarter of the world’s wheat, and Ukraine’s export limitation together with the new quota implemented by Russia related to grain exports outside the Eurasian Economic Union [

16] has led to disruption of the global wheat market [

17,

18].

This disruption is causing prices to rise; wheat, for example, has risen more than 40% since the start of the war, and trade policy interventions can make the situation worse [

19,

20].

From the start of the conflict on 23 February 2022 to 23 March 2022, 53 new trade policies were announced, mostly related to export bans and licences. Export restrictions only affect global supply, and both import liberalisation and subsidies lead to increased demand [

21,

22].

The European Union is committed to supporting Ukraine’s economy and its recovery by helping to stabilise world food markets and improve global food security [

23,

24,

25].

A challenge is seen as allowing Ukraine to export the goods it wants, helping to support local production and improve connectivity with Europe. With these considerations in mind, the European Commission has proposed to eliminate outstanding customs duties on imports from Ukraine [

26,

27].

Given that the high levels of uncertainty and instability will prevail, flexibility, agility, and resilience will be essential to maintain operational transport routes and supply chains between the EU and Ukraine as Russia’s war of aggression against Ukraine continues [

11,

28,

29,

30].

In 2021, Ukraine imported USD 1.4 billion worth of fruit and vegetables, representing the highest import value. Imports of non-food products amounted to about USD 1.3 billion, followed by the group of products consisting of coffee, tea cocoa (less than USD 1 billion), beverages (USD 0.7 billion), and miscellaneous food (USD 0.55 billion). Ukraine’s cereal imports and cereal exports in 2021 were about USD 0.4 billion, ranking 6th in terms of agricultural imports. In terms of agricultural exports, it ranked first exporting over USD 12 billion in 2021. The next largest export of agricultural products from Ukraine is animal and vegetable fats and oils with a value of USD 7 billion, followed by exports of non-food products (USD 2.2 billion) and oilseeds and oleaginous fruits (USD 2.1 billion). Ukraine’s wheat exports in 2020 were 18,055 thousand metric tonnes, reaching 20,048 thousand metric tonnes in 2020. In the case of the quantity of sunflower exported in 2021, 80 thousand metric tonnes were exported, down by more than 57% compared to the previous year (188 thousand metric tonnes) [

31,

32].

Trade is a way to increase energy efficiency, but on the one hand, the basis of trade development is research and development, but efficiency cannot be improved here. Government also plays an important role in stimulating trade, and consideration must be given to promoting energy efficiency in order to lead to economic growth [

33,

34,

35].

Therefore, the objective of this research s to analyse what influence this new grain trade between Ukraine and Romania may have on grain prices at Romanian customs, i.e., on import and especially export prices.

The hypothesis of the research that will be tested in this paper is that this quantitative increase in imports will lead to a decrease in export prices, given the economic theory and the indirect relationships between quantities and prices.

3. Discussion

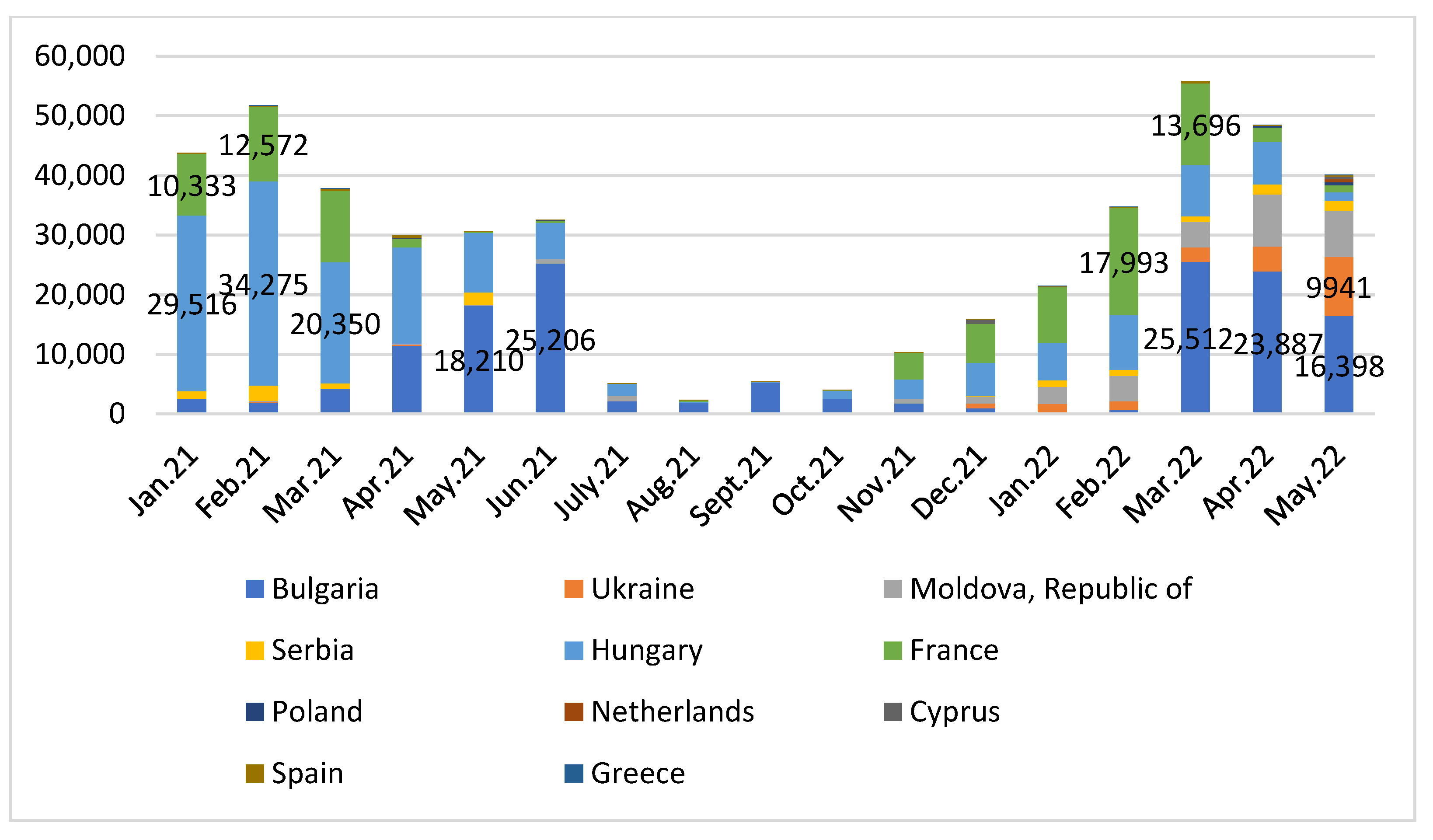

To determine the influence of Ukraine’s export through Romania on the import and especially export prices of cereals at Romania’s borders, as specified above, we analysed data on Romania’s trade in wheat and maize monthly from the beginning of last year to the present to identify the main differences between the pre- and postmilitary conflict periods (

Figure 1).

As regards the dynamics of the value of wheat imports shown in

Figure 1, there are quite large oscillations between the calendar months analysed, i.e., January 2021 and May 2022, and the highest imported value was recorded in the month corresponding to the harvest period, i.e., July, when trade is more frequent, given a lower market price. The total imported value of wheat was EUR 3.9 million in July 2021, and then the following month saw a high level of imports in value terms, that is, EUR 2.95 million. This import decreased, until the current period, i.e., the last month for which data were recorded, i.e., May 2022, when the value of wheat imports amounted to EUR 535,000, compared to an average at the beginning of the year of up to EUR 100,000 (

Figure 1).

On average, in each month analysed from the beginning of 2021 to the present, wheat worth EUR 641,600 was imported, with a very large deviation from this average of EUR 1.12 million, resulting in a coefficient of variation of 175%, which can also be seen from the graph. This is due to the fact that wheat imports fluctuate greatly from one month to the next, depending on internal consumption needs and the trade that has to be met or to the fact that wheat has started to be transited through Romania, given the military conflict in the east. This statement is also supported by the share of countries directing wheat into Romania. If until now, in2021, the main share in the value of wheat imports was held by Hungary or Bulgaria, ranging between 47% and even 100% in certain months, but in the last month analysed of the total value imported, Hungary held only 9%, Bulgaria 10%, and Ukraine held 73%, and so far, Romania has not recorded wheat imports from this country (

Figure 1).

When analysing the dynamics of the quantity of wheat imported by Romania, according to

Figure 2, we see, as is natural, that it shows the same trend with the value of imports; thus, in the months corresponding to the harvest period, the highest imports were recorded in terms of quantity, the maximum of the period reaching in July 2021, when Romania imported 16.6 thousand tonnes of wheat, almost the entire quantity coming from Bulgaria. The following month saw the second highest amount of wheat imported, namely 11.35 thousand tonnes of wheat, 67% of which came from Bulgaria and 33% from Hungary. Romania did not import a significant quantity of wheat until May 2022, when about 1.74 thousand tonnes of wheat were imported, of which 1.27 thousand tonnes or 72.9% came from Ukraine, a country that has never directed wheat into Romania before (

Figure 2).

On average, in each month analysed from the beginning of 2021 until now, 2.9 thousand tonnes of wheat were imported, with a very large deviation from this average of 4.9 thousand tonnes, thus determining a coefficient of variation of 169%, which can also be seen from the graph and the fact that the volume of imported wheat fluctuates greatly from one month to the next, depending on needs and trade agreements (

Figure 2).

When analysing the export dynamics, i.e., the value and volume exported, a similar trend to that of imports is observed; i.e., there was a low level of exports in the first period of the year, and then in the harvest season, they increased to the maximum level, and then towards the end of the year, wheat exports decreased. The peak of the period under review was recorded in September for wheat exports, with a volume of almost 10 thousand tonnes, the value of which amounted to EUR 3.13 million. As can be seen in June, with the harvest and replenishment of stock, the surplus was exported, with a steady increase until September, when the peak of the period was reached. This year, a similar trend to last year was observed in the first months, and then, as in 2021, the imported value decreased until May when it started to increase, and in the current period, a change from this trend was observed, given that in February the military conflict began, and there has been a fluctuating trend in the export of wheat, with some partner countries possibly wishing to build up additional stock, with a substantial increase in wheat exports in the last month to Germany, a country somewhat affected by the conflict, given its dependence on Russian gas. Up until now, wheat exports to Germany accounted for up to 30% of the total monthly wheat exports, and in May 2022, out of the total export of 3.11 thousand tonnes, about 1.95 thousand tonnes, or 62.4%, were directed to this country (

Figure 3).

The Table below shows the monthly prices, the import prices, and the export prices for wheat for the period January 2021–May 2022 on the basis of which the main statistical indicators were calculated: standard deviation, coefficient of variation, and annual growth rate.

By establishing the ratio between the value of trade (of imports and exports) and their volume, it was possible to determine the average import and export prices for each month for the product wheat. As far as the import price for wheat was concerned, it fluctuated greatly during the period under analysis between the minimum of EUR 0.21 per kilogramme and EUR 6.52 per kilogramme; it should be noted that this value is a very high one, possibly due to an error in data collection, so this gap also led to a rather high average of EUR 0.84 per kilogramme and a very high variation of over 100% (

Table 1).

Concerning the export price for wheat, the minimum was also maintained for this category at EUR 0.21/kilogramme, and the maximum was also maintained at EUR 0.78/kilogramme in March 2021. These high prices might have come from a weak agricultural year, as was the case in 2020, so in the first half of 2021, the prices might have been very high, but these are to be viewed against the backdrop of high inflation in recent times across the globe. On average, a price of EUR 0.34/kilogramme was recorded from this average, and there was a variation of EUR 0.12/kilogramme, representing a variation of 36%. Looking at the dynamics, the prices increased over the period under review, which is also confirmed by the average monthly rate of 5.88% (

Table 1).

An analysis of the value of imports for maize in the same period mentioned above showed a slightly different situation. Therefore, from

Figure 4, the highest import value was recorded in the period when supply was low on the market, that is, not in the harvest season as was the case for the wheat product. Thus, at the beginning of the year, when stock is rather limited and prices are higher, the highest values of maize imports were recorded. In the first half of 2021, the highest value was recorded in February, which was EUR 64.67 million, of which 53% (EUR 34.3 million) represented the value of maize from Hungary and 19.4% (EUR 12.5 million) represented the value of maize from France (

Figure 4).

However, the peak of the period analysed was recorded in March 2022, when maize worth EUR 67.3 million was imported, of which 37.9% (EUR 25.5 million) represented the value of maize from Bulgaria, 20.3% (EUR 13.7 million) the value of maize from France, and with a smaller but hitherto non-existent share, the value of maize from Ukraine at 3.6%. This share of the value of maize from Ukraine rose by May, i.e., in just two months, to 24.8%, i.e., from EUR 16.4 million of the total imports of EUR 40.15 million (

Figure 4).

A very low value was observed in the maize harvest period, so in that period, the consumption needs were ensured, but possibly not enough stock was accumulated in the cold period. This oscillation can also be seen from the determination of the coefficient of variation; therefore, starting from the average of the period, there was an average monthly value of maize imports of EUR 30.8 million and a deviation of EUR 20.3 million; thus, the variation exceeded the threshold of 65%, i.e., ±67% (

Figure 4).

As in the case of wheat, the value of the imports and the volume of the imports were directly proportional, as is natural, and when analysing the dynamics of the quantity of imported maize in

Figure 5, we saw that it oscillated in a similar way, i.e., there were high imports in the first months of the year, and the lowest quantities were imported during the harvest period. Although the highest value of maize imports was recorded in the first half of 2022, in terms of the quantity imported, the highest value was recorded in the first half of 2021, which may mean that prices have risen in the last period, both due to the military conflict and inflation. Thus, the highest quantity of maize was imported in February 2021, which amounted to 185.75 thousand tonnes, of which 76% (141.5 thousand tonnes) came from Hungary and 5% from Bulgaria (

Figure 5).

In the current year, the largest quantity of maize was imported in April, amounting to 143.7 thousand tonnes, of which 48% (68.4 thousand tonnes) came from Bulgaria, 21% from Moldova, 16% from Hungary, and 11% from Ukraine. The share of Ukraine has increased in the post-conflict period, while before, Romania did not import maize from this country, and in the last month, the share of maize brought from this country in total was 30% (

Figure 5).

On average, 83 thousand tonnes of maize were imported every month during the review period, and there was a deviation of 63.3 thousand tonnes from this average, which represented a variation of ±76%, which was very high, given the fluctuation between the harvest and the cold season (

Figure 5).

As regards Romania’s maize exports, when analysing the value and volume of maize exports, naturally from a technical and economic point of view, we observed that they showed a trend similar to that of wheat, i.e., a lower export in the first part of the year when more was imported, a significant increase in the harvest period when consumption needs and stock were ensured, and the surplus was exported, and this is when the largest quantity was recorded, as can be seen in

Figure 6. However, in the last part of the period, a different trend was observed; there was an increase in exports, especially in their value, and the most pertinent explanation is that of the direction of maize by Ukraine through our country, increasing imports in recent months, but also exports (

Figure 6).

As previously mentioned, the highest quantity of maize exported by Romania was in October 2021, when 1.39 million tonnes were exported, the highest share being to Egypt, about 15% and 11% to Spain, and in March, when in the same period last year exports were low (below 400 thousand tonnes), the second highest export in the period under review was recorded at 1.1 million tonnes, and in addition to the two countries mentioned above, which imported the most maize from Romania, the Netherlands also joined in this post-conflict period, a country that had trade with Romania, but at a much lower level. Consequently, we believe that a good part of the maize imports from Ukraine was directed through Romania to the Netherlands. In addition, in March of this year, the highest export value for maize was recorded at EUR 353.3 million, which led to an increase in prices given the military conflict and inflation in the last period (

Figure 6).

By establishing the ratio between the value of trade (of imports and exports) and their volume, it was possible to determine the average import and export prices for each month for the product maize. The import price for maize ranged from a minimum of EUR 0.22 per kilogramme to EUR 1.13 per kilogramme during the period analysed. On average, the monthly import price was EUR 0.49 per kilogramme, with a deviation of EUR 0.34/kilogramme, resulting in a variation of ±69%. In terms of dynamics, the average monthly rate of change was negative, i.e., a decrease of 0.64% (

Table 2).

As regards the export price for maize, the minimum was maintained for this category as well at EUR 0.22/kilogramme and the maximum at EUR 0.35/kilogramme in January 2022. These high prices might have come from a weak agricultural year, but also against the backdrop of high inflation across the globe recently. The average price was EUR 0.27 per kilogramme, with a variation of EUR 0.04 per kilogramme from this average, representing a variation of 16%, so it can be established that maize exports were somewhat constant and extensive, with a direct proportional relationship between quantity and value. Looking at the dynamics, prices increased during the period under review, which was also confirmed by the average monthly rate of 1.66% (

Table 2).

In

Table 3, a descriptive statistical analysis was carried out, and kurtosis and skewness coefficients were determined for the import and export of wheat and maize.

When analysing the variables considered in this study from a statistical point of view, according to

Table 3, we saw that on average, the imported quantity of wheat was 3.126 thousand tonnes, with a deviation of 5.05 thousand tonnes, and this deviation led to a variation of more than 100%, so as evident from the analysis of the dynamics, these oscillations could be seen, as well as a trend similar to the Gaussian bell; thus, the asymmetry coefficient and the bolting coefficient were determined, respectively, with skewness having a value of 2, which led to a positive asymmetry (left), which meant that the imported volume of wheat was higher in the first part of the period analysed, and kurtosis registered a value of 3.36, which led to a leptokurtic bolting (

Table 3).

Regarding the volume of exported wheat, it averaged 3.23 thousand tonnes, only 3.42% more than the import, and there was a deviation of 2.98 thousand tonnes from this average, representing a variation of more than 90%. When analysing the bolting coefficient (kurtosis), a value of 1.31 was recorded, which determined a flattening distribution, and the asymmetry coefficient (skewness) was 1.38, which determined a left asymmetry, with exports being higher in the first part of the period (

Table 3).

When analysing the trade in maize, we saw that the average quantity imported was 83 thousand tonnes, and the quantity exported was 632% higher, i.e., 607.6 thousand tonnes. An analysis of the standard deviations from these averages showed variations of ±76% and ±53%, respectively. Regarding the distribution of variables, maize imports showed a negative bolting coefficient, which led to a convex distribution, as determined above, with a decrease in the harvest period, and the skewness coefficient was close to zero, which led to a symmetry of the distribution. Regarding the distribution of the exported maize volume, it showed a skewness coefficient of 1.21, that is, a skewed distribution and a symmetry coefficient of 0.74, representing a slight positive skewness (

Table 3).

In

Table 4, an analysis using the t-test method was developed to identify whether the mean of the import volume of wheat and maize and the import volume of wheat and maize differed from the null value, that is, whether these means differed significantly with a probability of more than 95%. From the analysis carried out, the value of the parameter t Stat was greater than the critical value of the parameter (t Critical one-tail), and the value of the significance test (P) was less than the maximum accepted threshold of 0.05 (5%); thus, it can be judged that both the average imports of wheat and maize in the pre-military conflict period differed significantly from the average post-military conflict imports. However, it should be noted that the absolute value of the parameter was taken into account, but its sign analysis showed that for the wheat import, the value was positive, which meant that the average imports in the pre-February 2022 period were higher than the average of the last 3 months, and for the maize import, the value of the parameter was negative, which determined that the average pre-conflict imports were lower than the average post-conflict imports (

Table 4).

Next, linear regression models between the imported quantity and the grain price, both import and import, were concretised, and the following two models were validated to one extent or another; i.e., the development of a function between the imported wheat quantity and the export price and the second model led to a function between the imported maize quantity and the import price (

Table 4).

Table 5 presents an analysis of the possible influence that the quantity of the imported wheat may have on the wheat export price and shows the linear regression model between these two variables, the first being the independent variable and the second the dependent variable 5. Thus, the correlation coefficient registered a value of 0.347, which led to a relationship with a medium to weak intensity, but this relationship existed. We also saw that the F parameter registered a value of 1.51, and for the degrees of freedom taken into account and a statistical probability of 5%, the critical value of the F parameter (critical) would be 4.84; thus, it can be seen that the registered value of the parameter did not exceed the critical one, which can also be seen from the level of significance that exceeded the maximum level of 0.05, being 0.24. Thus, we can state that the results can be validated in proportion of 75.6%. With all these limitations of the research, the hypothesis from which we started is partially confirmed for the wheat product; i.e., an increase in the import value can lead to a decrease in the export price. This can be seen from the value of the coefficients; i.e., if the quantity of imported wheat increased by one unit, the price decreased by 9.67 × 10

−9 units, and if the import of wheat increased by 10 thousand tonnes, the export price decreased by EUR 0.096/kilogramme (

Table 5).

As far as the maize product is concerned, the hypothesis was not confirmed, and it was not possible to establish a direct influence of the imported quantity of maize on the export price, but this influence on the import price was established, which would be somewhat natural in the bargaining theory, that a higher quantity usually pays a lower price per unit of product (

Table 6).

Analysing the influence of the quantity of the imported maize on the import price of maize in

Table 6, the value of the correlation coefficient was 0.48, which represented a medium link in terms of intensity, and the value of the statistical F parameter of 4.569 exceeded the value of the critical F parameter, which was 4.54 in the case of the degrees of freedom shown in the Table. This can also be seen from the significance level, which was below the 5% threshold, i.e., 0.049, and the confidence intervals did not contain the null value, so the null hypothesis was rejected. As for the influence of quantity on price, from studying the table of coefficients, we noticed that when the volume of imported maize increased by one unit, the import price decreased by −2.65 × 10

−9 units, respectively, and when the import of maize increased by 10 thousand tonnes, the import price decreased by EUR 0.026/kilogramme (

Table 6).

It should be discussed from the outset that until February 2022, which was the of the military conflict between Ukraine and Russia, Romania had no trade in cereals with Ukraine, and since then, trade, especially from Ukraine to Romania, has been growing, which indicates a transfer of these products through Romania to established partners.

This increase in imported volume was confirmed for maize in the analysis of significant differences between the two periods. Significant differences in the volumes of wheat and maize imported in the post-conflict period compared to the previous stable period could be determined using the test, but for maize, the highest quantity was recorded in the post-conflict period.

This increase in the volume traded can have implications on the volume of supply in Romania or on the volume of trade at the borders, which can influence the price level, as was also found after the development of the two regression models, so both the import price and export prices were negatively influenced by the increase in the volume of grain imported from Ukraine.

4. Conclusions

The main purpose of the paper was to determine a possible influence of Ukraine’s grain trade through Romania on the import and export prices at Romanian customs.

The analysis showed that the volume and value of wheat imports showed a similar trend, which is natural, with very large fluctuations on a monthly basis, i.e., with high values in the cold period, at the beginning and end of the year, but with high values in the harvest period. This pattern was repeated on a different scale for the value and quantity of the wheat exported. When analysing the level of countries exporting the wheat that Romania imports, we observed an increase in the share of Ukraine’s exports in total imports, which did not exist before the military conflict.

When analysing the import and export prices for wheat at the Romanian customs, we observed an increase in their dynamics, given the conflict situation and the state of instability, as well as the inflation of the last period.

When analysing the dynamics of the value and volume of maize imports, we observed large fluctuations, but the opposite of those recorded for wheat. In the case of maize imports, there were high imports during the cold period when the stock was almost depleted and demand was constant with a high price level as opposed to during the harvest period, when imports were very low and consumption needs were met and the necessary stock was created. Like wheat, there were increasing shares in recent months for maize from Ukraine, which was almost non-existent in trade in the past.

In terms of the value and volume of maize exports, the situation was somewhat similar to that of imports. There were low exports in the first part of the year, and then they were very high during the harvest period, but in a different way: in the last part of the period under review, following the military conflict, exports increased sharply compared to the same period last year, both in quantity and especially in value. Thus, it is possible that imports from Ukraine were continuing to export through Romania, and it is also possible, given this conflict situation characterised by uncertainty, that certain countries may have wanted to supplement their stock.

Regarding maize import and export prices, there were large variations for the import price, which was characterised by large fluctuations but much smaller variations for the export price, which meant that maize exports were characterised by consistency, being of the extensive type.

When analysing the share of Ukrainian cereal imports in the volume of total exports, we found that the volume of wheat imported from Ukraine represented 41% of the total volume exported by Romania, while the quantity of maize imported from Ukraine represented 6% of the total quantity exported.

The analysis of the significant differences between wheat and maize imports in the pre-military conflict and postmilitary conflict period revealed the existence of these significant differences for both products, but only for maize was there a significant increase in imports, which indicated the passage of maize from Ukraine through Romania. At the same time, the result for wheat imports could also be interpreted because of the conflict situation, given a reduction in imports, with Romania preferring internal consumption or stock creation.

When analysing the direct influence of changes in the quantity of wheat and maize imports on prices, we established in the two linear regression model analyses that an increase in wheat imports led to a decrease in the export price and an increase in maize imports led to a decrease in the import price.

It should be noted that the hypothesis was partially validated, and there were limitations in our research based on the existence of available data and just a few records after the onset of the conflict state. The links between the variables were of medium intensity, and the level of significance for the model to the wheat product was above the maximum value; thus, in the case of wheat, the results were validated in a proportion of 76%. In addition, among the limitations of the research, it should be mentioned that the number of observations on which the first regression equation was based was quite small (13 in number), so the results may be less reliable. With all these limitations, it can be concluded that there are disturbances in the grain market, and the economic theory is confirmed once again that increasing grain supply can lead to lower and lower prices.

For future research, a multiple regression using import, area, and cereal production as the variables should be considered to identify in what proportion the chosen variables are impacted. Considering the current situation in Ukraine, forecasts will be made for the country’s grain trade.