From Likes to Wallets: Exploring the Relationship Between Social Media and FinTech Usage

Abstract

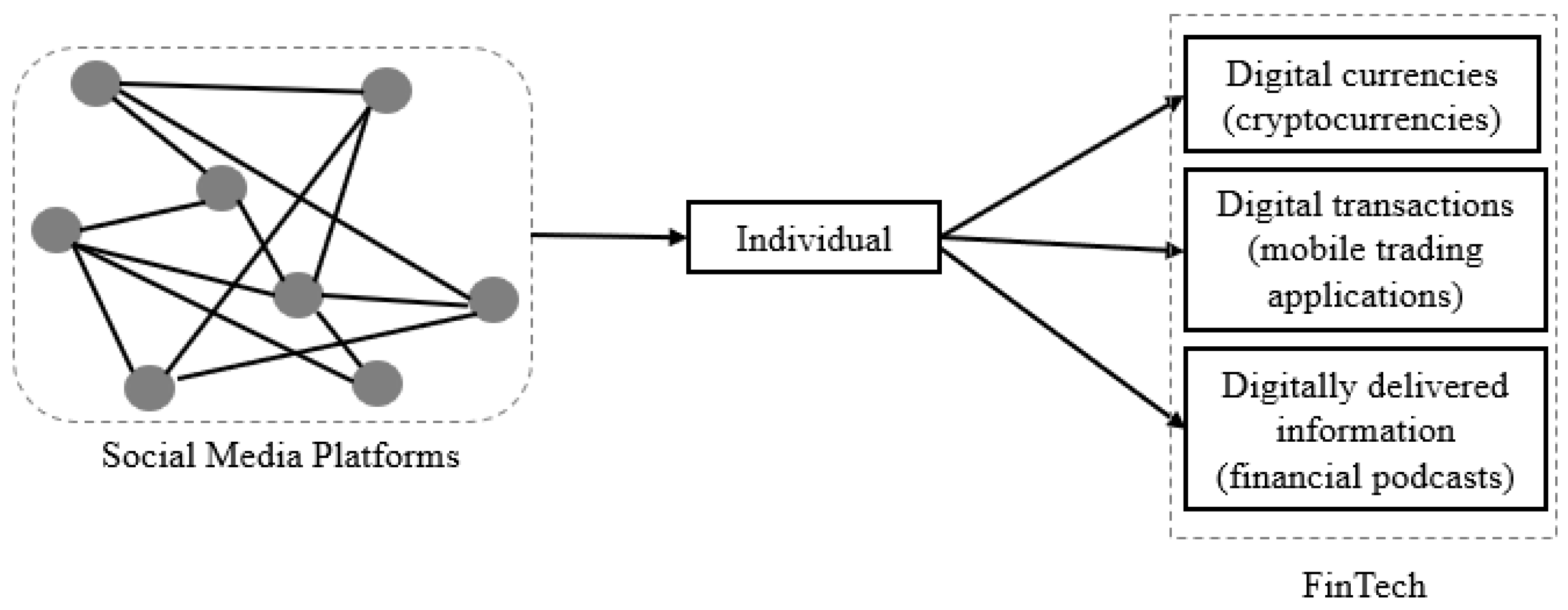

1. Introduction

2. Literature Review

2.1. FinTech and Social Media Integration

2.2. Social Media Usage and Cryptocurrency Investing

2.3. Social Media, Digital Dissemination of Financial Information (Podcasts), and Mobile Trading Applications

2.4. Gaps in the Current Literature

2.5. Theoretical Framework and Hypotheses

3. Materials and Methods

3.1. Data

3.1.1. Dependent Variables

3.1.2. Independent Variables

3.2. Methods

4. Results

4.1. Investing in Digital Currencies

4.2. Transacting Through Digital Platforms

4.2.1. Mobile Trading Applications and Social Media for Information

4.2.2. Mobile Trading Applications and Social Media for Investment Decisions

4.3. Digital Dissemination of Financial Information

4.3.1. Reliance on Financial Podcasts and Social Media for Information

4.3.2. Reliance on Financial Podcasts and Various Social Media Platforms for Investment Decisions

5. Discussion

5.1. Theoretical Contributions

5.2. Practical and Managerial Implications

5.3. Limitations and Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Cryptocurrency Investing | |||

|---|---|---|---|

| β (SE) | OR | 95% CI | |

| Social media | 0.88 (0.14) *** | 2.45 | [1.85, 3.24] |

| Investment Exp (ref 10 yr+) | |||

| Less than 1 yr | 0.46 (0.36) | 1.59 | [0.78, 3.22] |

| 1 yr to less than 2 yr | 1.02 (0.28) *** | 2.79 | [1.61, 4.82] |

| 2 yr to less than 5 yr | 0.42 (0.27) | 1.52 | [0.90, 2.56] |

| 5 yr to less than 10 yr | 0.18 (0.24) | 1.20 | [0.74, 1.93] |

| Age (ref aged 65+) | |||

| 18 to 24 | 1.48 (0.51) ** | 4.41 | [1.61, 12.06] |

| 25 to 34 | 1.27 (0.40) ** | 3.57 | [1.63, 7.81] |

| 35 to 44 | 1.21 (0.36) ** | 3.36 | [1.67, 6.76] |

| 45 to 54 | 1.33 (0.33) *** | 3.78 | [2.00, 7.17] |

| 55 to 64 | 0.84 (0.29) ** | 2.31 | [1.30, 4.10] |

| Investment Assets (ref less than USD 50 K) | |||

| USD 50 K up to USD 100 K | −0.73 (0.25) ** | 0.48 | [0.29, 0.79] |

| USD 100 K up to USD 500 K | −0.07 (0.21) | 0.93 | [0.61, 1.41] |

| USD 500 K up to USD 1 M | −0.78 (0.30) ** | 0.46 | [0.26, 0.83] |

| USD 1 M or more | −0.62 (0.35) | 0.54 | [0.27, 1.08] |

| Investment Risk Preference (ref Average Risk) | |||

| Take substantial risk | 1.04 (0.26) *** | 2.83 | [1.70, 4.72] |

| Take above average risk | 0.57 (0.18) ** | 1.78 | [1.24, 2.53] |

| Not willing to take risk | −0.64 (0.35) | 0.52 | [0.27, 1.03] |

| Obj financial knowledge | −0.00 (0.06) | 1.00 | [0.89, 1.12] |

| Gender (ref Male) | |||

| Female | −0.98 (0.20) *** | 0.38 | [0.25, 0.56] |

| Ethnicity (ref White non-Hispanic) | |||

| Non-White | −0.11 (0.19) | 0.90 | [0.61, 1.32] |

| Employment (ref Retired) | |||

| Self-employed | 0.68 (0.34) * | 1.98 | [1.03, 3.82] |

| Full-time | 0.28 (0.28) | 1.32 | [0.76, 2.29] |

| Part-time | −0.46 (0.41) | 0.63 | [0.28, 1.42] |

| Other + | 0.63 (0.38) | 1.88 | [0.89, 3.98] |

| Marital Status (ref Married) | |||

| Single | 0.19 (0.21) | 1.21 | [0.80, 1.83] |

| Separated/Divorced | 0.35 (0.25) | 1.42 | [0.88, 2.29] |

| N | 2044 | ||

| Log likelihood | −686.610 | ||

| Chi-square | 340.76 *** | ||

| Pseudo R2 | 0.298 | ||

| Cryptocurrency Investing | |||

|---|---|---|---|

| β (SE) | OR | 95% CI | |

| Social Media Platforms | |||

| YouTube | −0.54 (0.28) | 0.58 | [0.33, 1.02] |

| −0.26 (0.32) | 0.77 | [0.42, 1.43] | |

| −0.54 (0.27) * | 0.58 | [0.34, 0.99] | |

| TikTok | −0.19 (0.37) | 0.83 | [0.40, 1.70] |

| 0.08 (0.38) | 1.08 | [0.52, 2.27] | |

| −0.52 (0.31) | 0.60 | [0.32, 1.10] | |

| −0.25 (0.32) | 0.78 | [0.42, 1.45] | |

| Stocktwits | −0.21 (0.34) | 0.81 | [0.42, 1.58] |

| Investment Exp (ref 10 yr+) | |||

| Less than 1 yr | 1.26 (0.52) * | 3.52 | [1.27, 9.80] |

| 1 yr to less than 2 yr | 1.18 (0.45) ** | 3.26 | [1.35, 7.86] |

| 2 yr to less than 5 yr | 0.31 (0.40) | 1.37 | [0.63, 2.97] |

| 5 yr to less than 10 yr | 0.29 (0.41) | 1.34 | [0.60, 3.00] |

| Age (ref aged 65+) | |||

| 18 to 24 | 0.29 (0.97) | 1.33 | [0.20, 8.86] |

| 25 to 34 | 0.05 (0.89) | 1.05 | [0.18, 6.06] |

| 35 to 44 | 0.38 (0.87) | 1.46 | [0.27, 8.01] |

| 45 to 54 | 0.45 (0.86) | 1.57 | [0.29, 8.51] |

| 55 to 64 | 0.28 (0.83) | 1.32 | [0.26, 6.78] |

| Investment Assets (ref less than USD 50 K) | |||

| USD 50 K up to USD 100 K | −0.16 (0.40) | 0.86 | [0.39, 1.86] |

| USD 00 K up to USD 500 K | 0.10 (0.33) | 1.10 | [0.58, 2.10] |

| USD 500 K up to USD 1 M | −0.25 (0.56) | 0.78 | [0.26, 2.32] |

| USD 1 M or more | −1.60 (1.02) | 0.20 | [0.03, 1.50] |

| Investment Risk Preference (ref Average Risk) | |||

| Take substantial risk | 1.17 (0.37) ** | 3.24 | [1.56, 6.71] |

| Take above average risk | 1.07 (0.29) *** | 2.90 | [1.63, 5.17] |

| Not willing to take risk | 0.96 (0.60) | 2.62 | [0.80, 8.58] |

| Obj financial knowledge | 0.17 (0.09) | 1.18 | [0.98, 1.42] |

| Gender (ref Male) | |||

| Female | −1.08 (0.30) *** | 0.34 | [0.19, 0.62] |

| Ethnicity (ref White non-Hispanic) | |||

| Non-White | −0.29 (0.30) | 0.75 | [0.42, 1.33] |

| Employment (ref Retired) | |||

| Self-employed | 0.42 (0.83) | 1.52 | [0.30, 7.78] |

| Full-time | 0.46 (0.78) | 1.59 | [0.34, 7.34] |

| Part-time | 0.13 (0.89) | 1.14 | [0.20, 6.54] |

| Other + | 1.18 (0.88) | 3.24 | [0.58, 18.14] |

| Marital Status (ref Married) | |||

| Single | 0.18 (0.34) | 1.20 | [0.61, 2.36] |

| Separated/Divorced | 0.51 (0.50) | 1.67 | [0.63, 4.47] |

| N | 391 | ||

| Log pseudo-likelihood | −212.49 | ||

| Chi-square | 115.71 *** | ||

| Pseudo R2 | 0.214 | ||

Appendix B

| Mobile Trading Apps | |||

|---|---|---|---|

| β (SE) | RRR | 95% CI | |

| Never (ref category) | |||

| Sometimes | |||

| Social media | 0.96 (0.19) *** | 2.62 | [1.79, 3.82] |

| Investment Exp (ref 10 yr+) | |||

| Less than 1 yr | 1.05 (0.40) ** | 2.85 | [1.30, 6.27] |

| 1 yr to less than 2 yr | 1.03 (0.34) ** | 2.79 | [1.43, 5.46] |

| 2 yr to less than 5 yr | 0.39 (0.27) | 1.48 | [0.88, 2.49] |

| 5 yr to less than 10 yr | −0.10 (0.25) | 0.90 | [0.55, 1.49] |

| Age (ref aged 65+) | |||

| 18 to 24 | 1.33 (0.57) * | 3.79 | [1.23, 11.67] |

| 25 to 34 | 1.73 (0.40) *** | 5.63 | [2.56, 12.37] |

| 35 to 44 | 1.54 (0.33) *** | 4.67 | [2.43, 8.99] |

| 45 to 54 | 1.31 (0.30) *** | 3.71 | [2.08, 6.64] |

| 55 to 64 | 0.60 (0.26) * | 1.83 | [1.10, 3.05] |

| Investment Assets (ref less than USD 50 K) | |||

| USD 50 K up to USD 100 K | −0.63 (0.28) * | 0.53 | [0.31, 0.92] |

| USD 100 K up to USD 500 K | −0.23 (0.20) | 0.80 | [0.54, 1.17] |

| USD 500 K up to USD 1 M | −0.61 (0.32) | 0.55 | [0.29, 1.01] |

| USD 1 M or more | −0.36 (0.31) | 0.70 | [0.38, 1.27] |

| Investment Risk Preference (ref Average Risk) | |||

| Take substantial risk | 0.47 (0.32) | 1.61 | [0.86, 3.01] |

| Take above average risk | 0.40 (0.18) * | 1.48 | [1.04, 2.11] |

| Not willing to take risk | −1.27 (0.44) ** | 0.28 | [0.12, 0.66] |

| Obj financial knowledge | −0.00 (0.06) | 0.99 | [0.88, 1.13] |

| Gender (ref Male) | |||

| Female | −0.12 (0.17) | 0.89 | [0.63, 1.24] |

| Ethnicity (ref White non-Hispanic) | |||

| Non-White | 0.39 (0.19) * | 1.48 | [1.01, 2.17] |

| Employment (ref Retired) | |||

| Self-employed | 0.38 (0.35) | 1.46 | [0.74, 2.88] |

| Full-time | 0.40 (0.26) | 1.48 | [0.89, 2.48] |

| Part-time | −0.38 (0.37) | 0.68 | [0.33, 1.40] |

| Other+ | 0.14 (0.36) | 1.15 | [0.56, 2.32] |

| Marital Status (ref Married) | |||

| Single | −0.35 (0.21) | 0.70 | [0.46, 1.07] |

| Separated/Divorced | 0.06 (0.25) | 1.06 | [0.65, 1.72] |

| Frequently | |||

| Social media | 1.15 (0.20) *** | 3.19 | [2.17, 4.68] |

| Investment Exp (ref 10 yr+) | |||

| Less than 1 yr | 1.81 (0.45) *** | 6.08 | [2.52, 14.66] |

| 1 yr to less than 2 yr | 1.83 (0.38) *** | 6.22 | [2.95, 13.12] |

| 2 yr to less than 5 yr | 1.06 (0.29) *** | 2.90 | [1.63, 5.15] |

| 5 yr to less than 10 yr | 0.57 (0.28) * | 1.76 | [1.01, 3.07] |

| Age (ref aged 65+) | |||

| 18 to 24 | 1.94 (0.63) ** | 7.03 | [2.04, 24.16] |

| 25 to 34 | 1.52 (0.50) ** | 4.55 | [1.69, 12.23] |

| 35 to 44 | 1.92 (0.44) *** | 6.79 | [2.89, 15.94] |

| 45 to 54 | 1.14 (0.42) ** | 3.12 | [1.38, 7.09] |

| 55 to 64 | 0.65 (0.36) | 1.92 | [0.94, 3.91] |

| Investment Assets (ref less than USD 50 K) | |||

| USD 50 K up to USD 100 K | −0.52 (0.28) | 0.59 | [0.34, 1.03] |

| USD 100 K up to USD 500 K | −0.66 (0.24) ** | 0.52 | [0.32, 0.84] |

| USD 500 K up to USD 1 M | −1.24 (0.34) *** | 0.29 | [0.15, 0.57] |

| USD 1 M or more | −1.14 (0.44) * | 0.32 | [0.14, 0.76] |

| Investment Risk Preference (ref Average Risk) | |||

| Take substantial risk | 1.35 (0.29) *** | 3.85 | [2.17, 6.83] |

| Take above average risk | 0.70 (0.22) ** | 2.01 | [1.31, 3.08] |

| Not willing to take risk | −1.37 (0.43) ** | 0.25 | [0.10, 0.59] |

| Obj financial knowledge | −0.07 (0.07) | 0.93 | [0.81, 1.06] |

| Gender (ref Male) | |||

| Female | −0.32 (0.22) | 0.73 | [0.48, 1.11] |

| Ethnicity (ref White non-Hispanic) | |||

| Non-White | 0.54 (0.22) * | 1.72 | [1.12, 2.67] |

| Employment (ref Retired) | |||

| Self-employed | 0.46 (0.43) | 1.58 | [0.67, 3.69] |

| Full-time | 0.09 (0.36) | 1.09 | [0.54, 2.22] |

| Part-time | 0.09 (0.52) | 1.09 | [0.39, 3.03] |

| Other + | −0.38 (0.48) | 0.68 | [0.27, 1.75] |

| Marital Status (ref Married) | |||

| Single | −0.53 (0.26) * | 0.59 | [0.36, 0.98] |

| Separated/Divorced | −0.18 (0.28) | 0.83 | [0.48, 1.46] |

| N | 2044 | ||

| Log pseudo-likelihood | −1217.438 | ||

| Wald Chi-square | 484.01 *** | ||

| Pseudo R2 | 0.283 | ||

| Mobile Trading Apps | |||

|---|---|---|---|

| β (SE) | RRR | 95% CI | |

| Never (ref category) | |||

| Sometimes | |||

| Social Media Platforms Used for Financial Information | |||

| YouTube | −0.39 (0.39) | 0.68 | [0.32, 1.44] |

| −0.06 (0.47) | 0.94 | [0.38, 2.37] | |

| 0.44 (0.40) | 1.55 | [0.71, 3.37] | |

| TikTok | −0.00 (0.62) | 1.00 | [0.30, 3.33] |

| −1.20 (0.51) | 0.30 | [0.09, 1.00] | |

| −0.57 (0.48) | 0.57 | [0.22, 1.45] | |

| −0.11 (0.48) | 0.89 | [0.35, 2.31] | |

| Stocktwits | −1.09 (0.55) * | 0.34 | [0.11, 0.98] |

| Investment Exp (ref 10 yr+) | |||

| Less than 1 yr | 1.71 (0.78) * | 5.50 | [1.19, 25.44] |

| 1 yr to less than 2 yr | 1.59 (0.36) * | 4.90 | [1.42, 16.88] |

| 2 yr to less than 5 yr | 0.32 (0.28) | 1.38 | [0.51, 3.75] |

| 5 yr to less than 10 yr | 0.23 (0.25) | 1.25 | [0.44, 3.61] |

| Age (ref aged 65+) | |||

| 18 to 24 | −0.04 (1.15) | 0.96 | [0.10, 9.07] |

| 25 to 34 | 0.55 (0.97) | 1.73 | [0.26, 11.49] |

| 35 to 44 | 1.00 (0.88) | 2.72 | [0.48, 15.29] |

| 45 to 54 | 0.47 (0.86) | 1.60 | [0.29, 8.73] |

| 55 to 64 | −0.21 (0.80) | 0.81 | [0.17, 3.91] |

| Investment Assets (ref less than USD 50 K) | |||

| USD 50 K up to USD 100 K | 0.29 (0.55) | 1.33 | [0.45, 3.92] |

| USD 100 K up to USD 500 K | 0.48 (0.43) | 1.61 | [0.69, 3.75] |

| USD 500 K up to USD 1 M | −1.63 (0.76) * | 0.20 | [0.04, 0.88] |

| USD 1 M or more | 0.00 (1.10) | 1.00 | [0.12, 8.73] |

| Investment Risk Preference (ref Average Risk) | |||

| Take substantial risk | 0.88 (0.61) | 2.42 | [0.73, 8.04] |

| Take above average risk | 0.84 (0.38) * | 2.32 | [1.10, 4.87] |

| Not willing to take risk | −2.73 (0.97) ** | 0.07 | [0.01, 0.43] |

| Obj financial knowledge | −0.02 (0.13) | 0.98 | [0.77, 1.26] |

| Gender (ref Male) | |||

| Female | −0.19 (0.41) | 0.82 | [0.37, 1.84] |

| Ethnicity (ref White non-Hispanic) | |||

| Non-White | −0.22 (0.42) | 0.80 | [0.35, 1.83] |

| Employment (ref Retired) | |||

| Self-employed | 1.20 (0.90) | 3.33 | [0.57, 19.46] |

| Full-time | 0.65 (0.81) | 1.92 | [0.40, 9.30] |

| Part-time | 1.51 (0.94) | 4.50 | [0.71, 28.59] |

| Other + | 1.12 (1.00) | 3.06 | [0.43, 21.59] |

| Marital Status (ref Married) | |||

| Single | 0.55 (0.47) | 1.74 | [0.69, 4.41] |

| Separated/Divorced | 0.25 (0.61) | 1.28 | [0.39, 4.27] |

| Frequently | |||

| Social Media Platforms Used for Financial Information | |||

| YouTube | −0.66 (0.37) | 0.52 | [0.25, 1.07] |

| −0.33 (0.45) | 0.72 | [0.30, 1.72] | |

| 0.09 (0.38) | 1.10 | [0.52, 2.30] | |

| TikTok | −0.10 (0.59) | 0.91 | [0.29, 2.87] |

| −0.29 (0.60) | 0.75 | [0.23, 2.42] | |

| −0.91 (0.46) * | 0.40 | [0.16, 0.99] | |

| −0.27 (0.48) | 0.76 | [0.30, 1.94] | |

| Stocktwits | −0.62 (0.55) | 0.54 | [0.18, 1.58] |

| Investment Exp (ref 10 yr+) | |||

| Less than 1 yr | 1.89 (0.75) * | 6.62 | [1.52, 28.80] |

| 1 yr to less than 2 yr | 1.61 (0.62) ** | 5.00 | [1.49, 16.78] |

| 2 yr to less than 5 yr | 0.59 (0.50) | 1.81 | [0.68, 4.83] |

| 5 yr to less than 10 yr | 0.48 (0.53) | 1.61 | [0.57, 4.54] |

| Age (ref aged 65+) | |||

| 18 to 24 | 0.62 (1.07) | 1.85 | [0.23, 15.10] |

| 25 to 34 | 0.27 (0.91) | 1.30 | [0.22, 7.81] |

| 35 to 44 | 0.41 (0.84) | 1.51 | [0.29, 7.82] |

| 45 to 54 | −0.12 (0.82) | 0.89 | [0.18, 4.45] |

| 55 to 64 | −0.57 (0.76) | 0.56 | [0.13, 2.52] |

| Investment Assets (ref less than USD 50 K) | |||

| USD 50 K up to USD 100 K | −0.09 (0.53) | 0.91 | [0.32, 2.57] |

| USD 100 K up to USD 500 K | −0.27 (0.43) | 0.76 | [0.33, 1.76] |

| USD 500 K up to USD 1 M | −1.56 (0.70) * | 0.21 | [0.05, 0.83] |

| USD 1 M or more | −0.51 (1.04) | 0.60 | [0.08, 4.60] |

| Investment Risk Preference (ref Average Risk) | |||

| Take substantial risk | 1.64 (0.58) ** | 5.15 | [1.65, 16.13] |

| Take above average risk | 0.87 (0.38) * | 2.38 | [1.13, 5.00] |

| Not willing to take risk | −1.79 (0.77) * | 0.17 | [0.04, 0.77] |

| Obj financial knowledge | −0.09 (0.12) | 0.91 | [0.72, 1.16] |

| Gender (ref Male) | |||

| Female | −0.24 (0.40) | 0.78 | [0.36, 1.71] |

| Ethnicity (ref White non-Hispanic) | |||

| Non-White | 0.43 (0.40) | 1.54 | [0.70, 3.40] |

| Employment (ref Retired) | |||

| Self-employed | 1.19 (0.86) | 3.29 | [0.61, 17.60] |

| Full-time | 0.33 (0.77) | 1.39 | [0.31, 6.29] |

| Part-time | 1.12 (0.92) | 3.07 | [0.51, 18.57] |

| Other + | 0.75 (0.96) | 2.11 | [0.32, 13.77] |

| Marital Status (ref Married) | |||

| Single | −0.37 (0.49) | 0.71 | [0.27, 1.87] |

| Separated/Divorced | −0.18 (0.61) | 0.84 | [0.25, 2.79] |

| N | 391 | ||

| Log pseudo-likelihood | −329.328 | ||

| Wald Chi-square | 171.82 *** | ||

| Pseudo R2 | 0.207 | ||

Appendix C

| Financial Podcasts | |||

|---|---|---|---|

| β (SE) | RRR | 95% CI | |

| Not at all (ref category) | |||

| Somewhat | |||

| Social media | 1.48 (0.18) *** | 4.37 | [3.08, 6.22] |

| Investment Exp (ref 10 yr+) | |||

| Less than 1 yr | 0.35 (0.40) | 1.43 | [0.65, 3.12] |

| 1 yr to less than 2 yr | 0.07 (0.28) | 1.07 | [0.62, 1.85] |

| 2 yr to less than 5 yr | 0.39 (0.30) | 1.48 | [0.82, 2.67] |

| 5 yr to less than 10 yr | 0.03 (0.25) | 1.03 | [0.63, 1.68] |

| Age (ref aged 65+) | |||

| 18 to 24 | 0.82 (0.52) | 2.26 | [0.81, 6.30] |

| 25 to 34 | 1.05 (0.40) ** | 2.87 | [1.32, 6.24] |

| 35 to 44 | 0.48 (0.34) | 1.62 | [0.84, 3.13] |

| 45 to 54 | 0.48 (0.29) | 1.61 | [0.92, 2.83] |

| 55 to 64 | 0.19 (0.24) | 1.21 | [0.75, 1.96] |

| Investment Assets (ref less than USD 50 K) | |||

| USD 50 K up to USD 100 K | 0.28 (0.24) | 1.32 | [0.82, 2.11] |

| USD 100 K up to USD 500 K | 0.09 (0.21) | 1.09 | [0.72, 1.65] |

| USD 500 K up to USD 1 M | 0.16 (0.27) | 1.17 | [0.69, 2.01] |

| USD 1 M or more | 0.13 (0.29) | 1.14 | [0.65, 2.01] |

| Investment Risk Preference (ref Average Risk) | |||

| Take substantial risk | 0.23 (0.25) | 1.26 | [0.78, 2.05] |

| Take above average risk | 0.07 (0.17) | 1.08 | [0.77, 1.51] |

| Not willing to take risk | −1.19 (0.37) ** | 0.30 | [0.15, 0.63] |

| Obj financial knowledge | −0.00 (0.06) | 1.00 | [0.89, 1.12] |

| Gender (ref Male) | |||

| Female | −0.12 (0.17) | 0.89 | [0.64, 1.23] |

| Ethnicity (ref White non-Hispanic) | |||

| Non-White | 0.42 (0.18) * | 1.53 | [1.07, 2.17] |

| Employment (ref Retired) | |||

| Self-employed | 0.44 (0.29) | 1.55 | [0.87, 2.74] |

| Full-time | 0.51 (0.24) * | 1.67 | [1.04, 2.69] |

| Part-time | 0.04 (0.35) | 1.04 | [0.53, 2.05] |

| Other + | −0.10 (0.38) | 0.90 | [0.43, 1.91] |

| Marital Status (ref Married) | |||

| Single | −0.12 (0.22) | 0.89 | [0.58, 1.36] |

| Separated/Divorced | 0.32 (0.22) | 1.39 | [0.89, 2.13] |

| A great deal | |||

| Social media | 2.22 (0.23) *** | 9.24 | [5.91, 14.45] |

| Investment Exp (ref 10 yr+) | |||

| Less than 1 yr | −0.60 (0.63) | 0.55 | [0.16, 1.89] |

| 1 yr to less than 2 yr | −0.43 (0.48) | 0.65 | [0.26, 1.66] |

| 2 yr to less than 5 yr | 0.13 (0.48) | 1.14 | [0.44, 2.93] |

| 5 yr to less than 10 yr | −0.07 (0.40) | 0.93 | [0.42, 2.05] |

| Age (ref aged 65+) | |||

| 18 to 24 | 2.10 (0.82) * | 8.14 | [1.64, 40.57] |

| 25 to 34 | 1.28 (0.76) | 3.61 | [0.81, 16.04] |

| 35 to 44 | 1.11 (0.70) | 3.03 | [0.76, 12.09] |

| 45 to 54 | 0.36 (0.72) | 1.43 | [0.35, 5.88] |

| 55 to 64 | −0.20 (0.65) | 0.82 | [0.23, 2.94] |

| Investment Assets (ref less than USD 50 K) | |||

| USD 50 K up to USD 100 K | −0.21 (0.44) | 0.81 | [0.34, 1.93] |

| USD 100 K up to USD 500 K | 0.39 (0.36) | 1.47 | [0.72, 3.00] |

| USD 500 K up to USD 1 M | 0.73 (0.51) | 2.07 | [0.76, 5.65] |

| USD 1 M or more | 0.65 (0.58) | 1.91 | [0.61, 5.97] |

| Investment Risk Preference (ref Average Risk) | |||

| Take substantial risk | 1.41 (0.37) *** | 4.11 | [1.99, 8.48] |

| Take above average risk | 0.75 (0.31) * | 2.11 | [1.15, 3.85] |

| Not willing to take risk | −0.73 (0.74) | 0.48 | [0.11, 2.04] |

| Obj financial knowledge | −0.21 (0.10) * | 0.81 | [0.67, 0.98] |

| Gender (ref Male) | |||

| Female | −0.23 (0.29) | 0.80 | [0.45, 1.42] |

| Ethnicity (ref White non-Hispanic) | |||

| Non-White | 0.25 (0.29) | 1.28 | [0.73, 2.25] |

| Employment (ref Retired) | |||

| Self-employed | 1.07 (0.73) | 2.92 | [0.71, 12.10] |

| Full-time | 1.19 (0.66) | 3.28 | [0.90, 11.95] |

| Part-time | 0.92 (0.73) | 2.51 | [0.60, 10.55] |

| Other + | −0.06 (0.84) | 0.94 | [0.18, 4.91] |

| Marital Status (ref Married) | |||

| Single | −0.06 (0.34) | 0.94 | [0.49, 1.83] |

| Separated/Divorced | −0.15 (0.49) | 0.85 | [0.33, 2.25] |

| N | 2044 | ||

| Log pseudo-likelihood | −1071.698 | ||

| Wald Chi-square | 370.30 *** | ||

| Pseudo R2 | 0.256 | ||

| Financial Podcasts | |||

|---|---|---|---|

| β (SE) | RRR | 95% CI | |

| Not at all (ref category) | |||

| Somewhat | |||

| Social Media Platforms Used for Financial Information | |||

| YouTube | −0.78 (0.32) ** | 0.46 | [0.24, 0.86] |

| 0.01 (0.38) | 1.01 | [0.48, 2.12] | |

| 0.23 (0.33) | 1.25 | [0.66, 2.38] | |

| TikTok | 0.28 (0.50) | 1.32 | [0.49, 3.54] |

| −1.01 (0.52) | 0.36 | [0.13, 1.01] | |

| −0.27 (0.37) | 0.76 | [0.37, 1.58] | |

| 0.39 (0.39) | 1.48 | [0.69, 3.15] | |

| Stocktwits | −0.45 (0.43) | 0.64 | [0.28, 1.48] |

| Investment Exp (ref 10 yr+) | |||

| Less than 1 yr | −0.15 (0.56) | 0.86 | [0.29, 2.58] |

| 1 yr to less than 2 yr | 0.08 (0.50) | 1.08 | [0.40, 2.88] |

| 2 yr to less than 5 yr | −0.07 (0.46) | 0.93 | [0.38, 2.28] |

| 5 yr to less than 10 yr | −0.32 (0.48) | 0.73 | [0.28, 1.87] |

| Age (ref aged 65+) | |||

| 18 to 24 | −0.94 (0.92) | 0.39 | [0.06, 2.37] |

| 25 to 34 | −0.05 (0.80) | 0.95 | [0.20, 4.54] |

| 35 to 44 | −0.24 (0.74) | 0.78 | [0.18, 3.34] |

| 45 to 54 | −0.19 (0.72) | 0.83 | [0.20, 3.39] |

| 55 to 64 | −0.62 (0.67) | 0.54 | [0.15, 1.98] |

| Investment Assets (ref less than USD 50 K) | |||

| USD 50 K up to USD 100 K | 0.56 (0.46) | 1.75 | [0.71, 4.28] |

| USD 100 K up to USD 500 K | 0.78 (0.38) * | 2.18 | [1.04, 4.58] |

| USD 500 K up to USD 1 M | 0.72 (0.67) | 2.06 | [0.56, 7.64] |

| USD 1 M or more | 1.17 (0.98) | 3.21 | [0.47, 22.06] |

| Investment Risk Preference (ref Average Risk) | |||

| Take substantial risk | 0.52 (0.50) | 1.69 | [0.63, 4.50] |

| Take above average risk | −0.61 (0.31) | 0.54 | [0.29, 1.00] |

| Not willing to take risk | −1.57 (0.66) ** | 0.21 | [0.06, 0.75] |

| Obj financial knowledge | −0.18 (0.06) | 0.83 | [0.67, 1.04] |

| Gender (ref Male) | |||

| Female | 0.32 (0.34) | 1.38 | [0.71, 2.70] |

| Ethnicity (ref White non-Hispanic) | |||

| Non-White | 0.49 (0.35) * | 2.20 | [1.10, 4.39] |

| Employment (ref Retired) | |||

| Self-employed | 1.74 (0.76) * | 5.72 | [1.29, 25.44] |

| Full-time | 0.97 (0.67) | 2.63 | [0.71, 9.75] |

| Part-time | 0.87 (0.76) | 2.40 | [0.54, 10.62] |

| Other + | −0.09 (0.79) | 0.92 | [0.20, 4.27] |

| Marital Status (ref Married) | |||

| Single | −0.18 (0.39) | 0.83 | [0.39, 1.80] |

| Separated/Divorced | −0.08 (0.50) | 0.93 | [0.35, 2.48] |

| A great deal | |||

| Social Media Platforms Used for Financial Information | |||

| YouTube | −0.33 (0.42) | 0.72 | [0.32, 1.65] |

| −0.48 (0.46) | 0.62 | [0.25, 1.53] | |

| 0.20 (0.40) | 1.22 | [0.55, 2.70] | |

| TikTok | −0.51 (0.54) | 0.60 | [0.21, 1.74] |

| −2.04 (0.59) ** | 0.13 | [0.04, 0.41] | |

| 0.36 (0.47) | 1.44 | [0.57, 3.63] | |

| 0.81 (0.47) | 2.25 | [0.90, 5.62] | |

| Stocktwits | −0.42 (0.51) | 0.66 | [0.24, 1.78] |

| Investment Exp (ref 10 yr+) | |||

| Less than 1 yr | −0.92 (0.76) | 0.40 | [0.09, 1.78] |

| 1 yr to less than 2 yr | −0.44 (0.65) | 0.64 | [0.18, 2.28] |

| 2 yr to less than 5 yr | −0.06 (0.58) | 0.94 | [0.30, 2.93] |

| 5 yr to less than 10 yr | −0.40 (0.61) | 0.67 | [0.21, 2.20] |

| Age (ref aged 65+) | |||

| 18 to 24 | 1.73 (1.45) | 5.65 | [0.33, 97.06] |

| 25 to 34 | 1.89 (1.37) | 6.64 | [0.46, 96.72] |

| 35 to 44 | 2.39 (1.33) | 10.89 | [0.86, 146.40] |

| 45 to 54 | 1.66 (1.32) | 5.27 | [0.39, 70.43] |

| 55 to 64 | 0.51 (1.30) | 1.67 | [0.13, 21.46] |

| Investment Assets (ref less than USD 50 K) | |||

| USD 50 K up to USD 100 K | 0.69 (0.57) | 1.98 | [0.65, 6.05] |

| USD 100 K up to USD 500 K | 1.03 (0.48) * | 2.79 | [1.09, 7.18] |

| USD 500 K up to USD 1 M | 1.24 (0.79) | 3.45 | [0.74, 16.15] |

| USD 1 M or more | 1.73 (1.25) | 5.63 | [0.48, 65.45] |

| Investment Risk Preference (ref Average Risk) | |||

| Take substantial risk | 1.22 (0.57) * | 3.38 | [1.10, 10.40] |

| Take above average risk | −0.20 (0.43) | 0.82 | [0.36, 1.89] |

| Not willing to take risk | −2.64 (1.02) * | 0.07 | [0.01, 0.53] |

| Obj financial knowledge | −0.34 (0.14) * | 0.71 | [0.54, 0.93] |

| Gender (ref Male) | |||

| Female | 0.09 (0.44) | 1.09 | [0.46, 2.60] |

| Ethnicity (ref White non-Hispanic) | |||

| Non-White | 0.69 (0.44) | 2.00 | [0.85, 4.71] |

| Employment (ref Retired) | |||

| Self-employed | 1.40 (1.16) | 4.06 | [0.42, 39.31] |

| Full-time | 0.62 (1.06) | 1.86 | [0.23, 14.93] |

| Part-time | 1.32 (1.18) | 3.73 | [0.37, 37.49] |

| Other + | −0.88 (1.24) | 0.41 | [0.04, 4.74] |

| Marital Status (ref Married) | |||

| Single | 0.32 (0.49) | 1.37 | [0.52, 3.62] |

| Separated/Divorced | −0.39 (0.83) | 0.68 | [0.13, 3.45] |

| N | 391 | ||

| Log pseudo-likelihood | −326.619 | ||

| Wald Chi-square | 177.70 *** | ||

| Pseudo R2 | 0.214 | ||

References

- NerdWallet. Social Media Money Advice: Avoiding the Bad, Finding the Good. 2024. Available online: https://www.nerdwallet.com/article/finance/social-media-money-advice-avoiding-the-bad-finding-the-good (accessed on 2 February 2025).

- Kim, K.T.; Fan, L. Beyond the hashtags: Social media usage and cryptocurrency investment. Int. J. Bank Mark. 2025, 43, 569–590. [Google Scholar] [CrossRef]

- Zhao, H.; Zhang, L. Financial literacy or investment experience: Which is more influential in cryptocurrency investment? Int. J. Bank Mark. 2021, 39, 1208–1226. [Google Scholar] [CrossRef]

- Forbes Advisor. Nearly 80% of Young Adults Get Financial Advice from This Surprising Place. 2023. Available online: https://www.nasdaq.com/articles/nearly-80-of-young-adults-get-financial-advice-from-this-surprising-place (accessed on 2 February 2025).

- Bai, Z.; Wang, P.; Zhang, H. When uncertainties matter: The causal effect of cryptocurrency investment on retirement hardship withdrawals. Financ. Res. Lett. 2024, 67, 105952. [Google Scholar] [CrossRef]

- Qi, J.; Zhang, Y.; Ouyang, C. Cryptocurrency investments: The role of advisory sources, investor confidence, and risk perception in shaping behaviors and intentions. J. Risk Financ. Manag. 2025, 18, 57. [Google Scholar] [CrossRef]

- Olajide, O.; Pandey, S.; Pandey, I. Social media for investment advice and financial satisfaction: Does generation matter? J. Risk Financ. Manag. 2024, 17, 410. [Google Scholar] [CrossRef]

- Ammann, M.; Schaub, N. Do individual investors trade on investment-related social media? Manag. Sci. 2021, 67, 5679–5702. [Google Scholar] [CrossRef]

- Reiter, M.; Qing, D.; Nations, M. Who uses social media for investment advice? J. Financ. Plan. 2023, 36, 78–99. Available online: https://www.financialplanningassociation.org/learning/publications/journal/SEP23-who-uses-social-media-investment-advice-OPEN (accessed on 26 March 2025).

- Su, B.-C.; Wu, L.-W.; Chang, Y.-Y.-C.; Hong, R.-H. Influencers on social media as references: Understanding the importance of parasocial relationships. Sustainability 2021, 13, 10919. [Google Scholar] [CrossRef]

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B.W. On the Fintech Revolution: Interpreting the Forces of Innovation, Disruption, and Transformation in Financial Services. J. Manag. Inf. Syst. 2018, 35, 220–265. [Google Scholar] [CrossRef]

- Granovetter, M.S. The strength of weak ties. Am. J. Sociol. 1973, 78, 1360–1380. [Google Scholar] [CrossRef]

- Lee, K.; Lee, B.; Oh, W. Thumbs up, Sales up? The Contingent Effect of Facebook Likes on Sales Performance in Social Commerce. J. Manag. Inf. Syst. 2015, 32, 109–143. [Google Scholar] [CrossRef]

- Hudson, Y.; Yan, M.; Zhang, D. Herd behaviour & investor sentiment: Evidence from UK mutual funds. Int. Rev. Financ. Anal. 2020, 71, 101494. [Google Scholar] [CrossRef]

- Anderson, J.; Sanchez, D.; Gallardo, J.; Lawson, D.; Ouyang, C. Exploring the effect of federal student loan payment resumption on borrowers through sentiment and textual analysis using X. Financ. Serv. Rev. 2025, 33, 36–54. [Google Scholar] [CrossRef]

- Lusardi, A.; Mitchell, A. The Economic Importance of Financial Literacy: Theory and Evidence. J. Econ. Lit. 2014, 52, 5–44. [Google Scholar] [CrossRef]

- Pew Research Center. Social Media and News Fact Sheet. 2024. Available online: https://www.pewresearch.org/journalism/fact-sheet/social-media-and-news-fact-sheet/ (accessed on 24 March 2025).

- Daniela, N.; Elena, T.; Rina, Ț. Finfluencers in digital economy transforming financial behavior. Agric. Manag. Lucr. Stiintifice Ser. I Manag. Agric. 2024, 26, 656. [Google Scholar]

- Ouvrein, G.; Pabian, S.; Giles, D.; Hudders, L.; De Backer, C. The web of influencers. A marketing-audience classification of (potential) social media influencers. J. Mark. Manag. 2021, 37, 1313–1342. [Google Scholar] [CrossRef]

- Vrontis, D.; Makrides, A.; Christofi, M.; Thrassou, A. Social media influencer marketing: A systematic review, integrative framework and future research agenda. Int. J. Consum. Stud. 2021, 45, 617–644. [Google Scholar] [CrossRef]

- Rohden, S.F.; Tassinari, G.; Netto, C.F. Listen as much as you want: The antecedents of the engagement of podcast consumers. Int. J. Internet Mark. Advert. 2022, 17, 82–97. [Google Scholar] [CrossRef]

- Chan-Olmsted, S.; Wang, R. Understanding podcast users: Consumption motives and behaviors. New Media Soc. 2020, 24, 684–704. [Google Scholar] [CrossRef]

- Fan, L. Mobile investment technology adoption among investors. Int. J. Bank Mark. 2022, 40, 50–67. [Google Scholar] [CrossRef]

- Provoke.fm. Breaking Banks. Available online: https://provoke.fm/show/breaking-banks (accessed on 25 April 2025).

- Wharton Fintech. Available online: https://www.whartonfintech.org (accessed on 25 April 2025).

- Fan, L.; Chatterjee, S. The utilization of robo-advisors by individual investors: An analysis using diffusion of innovation and information search frameworks. J. Financ. Couns. Plan. 2020, 31, 130–145. [Google Scholar] [CrossRef]

- Hong, C.Y.; Lu, X.; Pan, J. FinTech adoption and household risk-taking: From digital payments to platform investments (No. w28063). National Bureau of Economic Research: Cambridge, MA, USA, 2020; pp. 1–7. Available online: https://www.nber.org/papers/w28063 (accessed on 24 March 2025).

- Liu, W.; Sidhu, A.; Beacom, A.M.; Valente, T.W. Social network theory. Int. Encycl. Media Eff. 2017, 1, 1–12. [Google Scholar] [CrossRef]

- Moreno, J.L. Who Shall Survive? A New Approach to the Problem of Human Interrelations; Nervous and Mental Disease: Washington, DC, USA, 1934. [Google Scholar]

- Freeman, L. Centrality in social networks: Conceptual clarification. Soc. Netw. 1979, 1, 215–239. [Google Scholar] [CrossRef]

- Granovetter, M. The strength of weak ties: A network theory revisited. Sociol. Theory 1983, 1, 201–233. [Google Scholar] [CrossRef]

- del Fresno García, M.; Daly, A.J.; Segado Sanchez-Cabezudo, S. Identifying the new Influences in the Internet Era: Social Media and Social Network Analysis. Rev. Española Investig. Sociológicas 2016, 153, 23–40. [Google Scholar] [CrossRef]

- Finra Investor Education Foundation (FINRA). 2021 Study Overview. Available online: https://cdn.finra.org/nfcs/2021/geography.html (accessed on 20 March 2025).

- Lin, J.T.; Bumcrot, C.; Mottola, G.; Valdes, O.; Walsh, G. The Changing Landscape of Investors in the United States: A Report of the National Financial Capability Study. FINRA Investor Education Foundation. 2022. Available online: https://www.finrafoundation.org/sites/finrafoundation/files/NFCS-Investor-Report-Changing-Landscape.pdf (accessed on 24 March 2025).

- Noman, A.; Chu, L.; Rahman, M. Subjective and objective financial knowledge and their associations with financial risk tolerance. J. Financ. Couns. Plan. 2023, 34, 219–237. [Google Scholar] [CrossRef]

- Kay, R.H. Exploring the use of video podcasts in education: A comprehensive review of the literature. Comput. Hum. Behav. 2012, 28, 820–831. [Google Scholar] [CrossRef]

- Lonn, S.; Teasley, S.D. Podcasting in higher education: What are the implications for teaching and learning? Internet High. Educ. 2009, 12, 88–92. [Google Scholar] [CrossRef]

- Bishara, A.J.; Hittner, J.B. Testing the significance of a correlation with nonnormal data: Comparison of Pearson, Spearman, transformation, and resampling approaches. Psychol. Methods 2012, 17, 399–417. [Google Scholar] [CrossRef]

- De Winter, J.C.; Gosling, S.D.; Potter, J. Comparing the Pearson and Spearman correlation coefficients across distributions and sample sizes: A tutorial using simulations and empirical data. Psychol. Methods 2016, 21, 273. [Google Scholar] [CrossRef]

- Asuero, A.G.; Sayago, A.; González, A.G. The correlation coefficient: An overview. Crit. Rev. Anal. Chem. 2006, 36, 41–59. [Google Scholar] [CrossRef]

- Campino, J.; Yang, S. Decoding the cryptocurrency user: An analysis of demographics and sentiments. Heliyon 2024, 10, e26671. [Google Scholar] [CrossRef] [PubMed]

- Senkardes, C.G.; Akadur, O. A research on the factors affecting cryptocurrency investments within the gender context. J. Bus. Econ. Financ. 2021, 10, 178–189. [Google Scholar] [CrossRef]

- Arli, D.; van Esch, P.; Bakpayev, M.; Laurence, A. Do consumers really trust cryptocurrencies? Mark. Intell. Plan. 2021, 39, 74–90. [Google Scholar] [CrossRef]

- Bonaparte, Y. On the Portfolio Choice of Crypto Asset Class: Why the Millennials Own Crypto? 2021; SSRN 3829275; Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3829275 (accessed on 24 March 2025).

- Proelss, J.; Schweizer, D.; Buchwalter, B. Do risk preferences drive momentum in cryptocurrencies? Financ. Res. Lett. 2025, 73, 106531. [Google Scholar] [CrossRef]

- Lusardi, A.; Mitchell, O.S. Financial literacy: Evidence and implications for financial education. Trends Issues 2009, 155, 1–10. [Google Scholar] [CrossRef]

- Lusardi, A.; Mitchell, O.S. How ordinary consumers make complex economic decisions: Financial literacy and retirement readiness. Q. J. Financ. 2017, 7, 1750008. [Google Scholar] [CrossRef]

- Van Rooij, M.; Lusardi, A.; Alessie, R. Financial literacy and stock market participation. J. Financ. Econ. 2011, 101, 449–472. [Google Scholar] [CrossRef]

- Goyal, K.; Kumar, S. Financial literacy: A systematic review and bibliometric analysis. Int. J. Consum. Stud. 2021, 45, 80–105. [Google Scholar] [CrossRef]

- Khan, M.S.; Ahmad, Z. The effects of financial literacy and social media on financial behaviour. In Mixed Methods Perspectives on Communication and Social Media Research; Routledge: London, UK, 2022; pp. 144–164. [Google Scholar]

- Hayashi, F.; Routh, A. Financial Literacy, Risk Tolerance, and Cryptocurrency Ownership in the United States. Available online: https://www.kansascityfed.org/research/research-working-papers/financial-literacy-risk-tolerance-and-cryptocurrency-ownership-in-the-united-states/ (accessed on 24 March 2025).

- FGS Global. 2021 National Financial Capability Study. FINRA Investor Education Foundation. Available online: https://finrafoundation.org/sites/finrafoundation/files/NFCS-2021-State-by-State-Methodology.pdf (accessed on 1 March 2025).

- Nick, T.G.; Campbell, K.M. Logistic regression. In Topics in Biostatistics; 2007; pp. 273–301. Available online: https://pubmed.ncbi.nlm.nih.gov/18450055/ (accessed on 24 March 2025).

- Allison, P.D. Logistic Regression Using SAS: Theory and Application; SAS Institute: Cary, NC, USA, 2012. [Google Scholar]

- Long, J.S. Regression Models for Categorical and Limited Dependent Variables; Sage Publications: New York, NY, USA, 1997. [Google Scholar]

| Weighted n * | % | n | % | |

|---|---|---|---|---|

| Investment Experience | ||||

| Less than 1 year | 93.52 | 4.58 | 86 | 4.21 |

| 1 year to less than 2 years | 173.66 | 8.50 | 155 | 7.58 |

| 2 years to less than 5 years | 177.64 | 8.69 | 179 | 8.76 |

| 5 years to less than 10 years | 229.27 | 11.22 | 219 | 10.71 |

| 10 years or more | 1369.91 | 67.02 | 1405 | 68.74 |

| Investment Assets | ||||

| Less than USD 50 K | 610.57 | 29.87 | 592 | 28.96 |

| USD 50 K up to USD 100 K | 248.20 | 12.14 | 255 | 12.48 |

| USD 100 K up to USD 500 K | 691.45 | 33.83 | 674 | 32.97 |

| USD 500 K up to USD 1 M | 235.82 | 11.54 | 251 | 12.28 |

| USD 1 M or more | 257.95 | 12.62 | 272 | 13.31 |

| Investment Risk Preference | ||||

| Take substantial financial risk | 177.54 | 8.69 | 171 | 8.37 |

| Take above average financial risk | 554.09 | 27.11 | 584 | 28.57 |

| Take average financial risk | 1130.41 | 55.30 | 1117 | 54.65 |

| Not willing to take any financial risk | 181.96 | 8.90 | 172 | 8.41 |

| Age | ||||

| 18 to 24 | 68.25 | 3.34 | 56 | 2.74 |

| 25 to 34 | 142.98 | 7.00 | 143 | 7.00 |

| 35 to 44 | 272.97 | 13.35 | 264 | 12.92 |

| 45 to 54 | 244.12 | 11.94 | 264 | 12.92 |

| 55 to 64 | 470.74 | 23.03 | 463 | 22.65 |

| 65 and older | 844.94 | 41.34 | 854 | 41.78 |

| Gender | ||||

| Male | 1304.92 | 63.84 | 1299 | 63.55 |

| Female | 739.08 | 36.16 | 745 | 36.45 |

| Ethnicity | ||||

| White, non-Hispanic | 1527.04 | 74.71 | 1683 | 82.34 |

| Non-White | 516.96 | 25.29 | 361 | 17.66 |

| Employment Status | ||||

| Self-employed | 166.14 | 8.13 | 170 | 8.32 |

| Full-time | 759.33 | 37.15 | 779 | 38.11 |

| Part-time | 128.12 | 6.27 | 132 | 6.46 |

| Retired | 842.43 | 41.21 | 835 | 40.85 |

| Other | 147.98 | 7.24 | 128 | 6.26 |

| Marital Status | ||||

| Married | 1367.23 | 66.89 | 1364 | 66.73 |

| Single | 372.42 | 18.22 | 365 | 17.86 |

| Separated/Divorced/Widowed | 304.36 | 14.89 | 315 | 15.41 |

| n | Mean | Std Dev | Min/Max | |

| Objective financial knowledge | 2044 | 4.38 | 1.41 | 0/6 |

| Weighted n * | % | n | % | |

|---|---|---|---|---|

| Digital Currency Investing (Cryptocurrency) | ||||

| No | 1625.56 | 79.53 | 1646 | 80.53 |

| Yes | 418.44 | 20.47 | 398 | 19.47 |

| Mobile Trading Apps | ||||

| Never | 1344.94 | 65.80 | 1378 | 67.42 |

| Sometimes | 359.04 | 17.57 | 347 | 16.98 |

| Frequently | 340.02 | 16.64 | 319 | 15.61 |

| Podcasts for Financial Information | ||||

| Not at all | 1477.38 | 72.28 | 1495 | 73.14 |

| Somewhat | 425.25 | 20.80 | 411 | 20.11 |

| A great deal | 141.37 | 6.92 | 138 | 6.75 |

| Weighted n * | % | n | % | |

|---|---|---|---|---|

| Social Media Groups Used for Investment Decisions | ||||

| Not at all | 1628.17 | 79.66 | 1653 | 80.87 |

| Somewhat | 305.40 | 14.94 | 285 | 13.94 |

| A great deal | 110.44 | 5.40 | 106 | 5.19 |

| Social Media Platforms Used for Investing Information | ||||

| YouTube | 407.50 | 19.94 | 374 | 18.30 |

| 215.28 | 10.53 | 203 | 9.93 | |

| 214.44 | 10.49 | 197 | 9.64 | |

| 201.88 | 9.88 | 189 | 9.25 | |

| 185.34 | 9.07 | 170 | 8.32 | |

| 171.76 | 8.40 | 152 | 7.44 | |

| Stocktwits | 115.14 | 5.63 | 104 | 5.09 |

| TikTok | 103.57 | 5.07 | 99 | 4.84 |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | |

|---|---|---|---|---|---|---|---|---|

| 1. YouTube | 1.00 | |||||||

| 2. Facebook | 0.51 *** | 1.00 | ||||||

| 3. Reddit | 0.42 *** | 0.35 *** | 1.00 | |||||

| 4. TikTok | 0.38 *** | 0.44 *** | 0.34 *** | 1.00 | ||||

| 5. Instagram | 0.48 *** | 0.62 *** | 0.34 *** | 0.59 *** | 1.00 | |||

| 6. Twitter | 0.47 *** | 0.53 *** | 0.43 *** | 0.49 *** | 0.64 *** | 1.00 | ||

| 7. LinkedIn | 0.41 *** | 0.42 *** | 0.31 *** | 0.39 *** | 0.45 *** | 0.42 *** | 1.00 | |

| 8. Stocktwits | 0.25 *** | 0.30 *** | 0.33 *** | 0.26 *** | 0.29 *** | 0.32 *** | 0.33 *** | 1.00 |

| Variable | Measurement |

|---|---|

| Age | 18–24, 25–34, 35–44, 45–54, 55–64, 65 and older |

| Gender | Male, female |

| Race | White non-Hispanic, non-White |

| Marital status | Married, single, separated/divorced/widowed |

| Education | HS or less, some college, associate’s, bachelor’s, post-graduate |

| Employment status | Self-employed, full-time, part-time, retired, other * |

| Objective financial knowledge | |

| Interest |

|

| Inflation |

|

| Bond pricing |

|

| Compounding |

|

| Mortgage |

|

| Portfolio risk |

|

| Investment experience | Less than a year ago, 1 year to less than 2 years ago, 2 years to less than 5 years ago, 5 years to less than 10 years ago, 10 years ago or more |

| Investment assets | Less than USD 50 K, USD 50 K up to USD 100 K, USD 100 K up to USD 500 K, USD 500 K up to USD 1 M, USD 1 M or more |

| Investment risk preference | Substantial financial risks, above average financial risks, average financial risks, not willing to take any financial risks |

| Cryptocurrency Investing | ||||

|---|---|---|---|---|

| n | β (SE) | OR | 95% CI | |

| Social media—Investment Decisions | 2044 | 0.88 (0.14) *** | 2.45 | [1.85, 3.24] |

| Social Media Users Only | ||||

| Social media—Financial Information | ||||

| YouTube | 391 | −0.54 (0.28) | 0.58 | [0.33, 1.02] |

| 391 | −0.26 (0.32) | 0.77 | [0.42, 1.43] | |

| 391 | −0.54 (0.27) * | 0.58 | [0.34, 0.99] | |

| TikTok | 391 | −0.19 (0.37) | 0.83 | [0.40, 1.70] |

| 391 | 0.08 (0.38) | 1.08 | [0.52, 2.27] | |

| 391 | −0.52 (0.31) | 0.60 | [0.32, 1.10] | |

| 391 | −0.25 (0.32) | 0.78 | [0.42, 1.45] | |

| Stocktwits | 391 | −0.21 (0.34) | 0.81 | [0.42, 1.58] |

| Mobile Trading Apps | Financial Podcasts | ||||||

|---|---|---|---|---|---|---|---|

| β (SE) | RRR | 95% CI | β (SE) | RRR | 95% CI | ||

| Never (ref category) | Not at all (ref category) | ||||||

| Sometimes | Somewhat | ||||||

| Social media | 0.96 (0.19) *** | 2.62 | [1.79, 3.82] | Social media | 1.48 (0.18) *** | 4.37 | [3.08, 6.22] |

| Frequently | A great deal | ||||||

| Social media | 1.15 (0.20) *** | 3.19 | [2.17, 4.68] | Social media | 1.48 (0.18) *** | 4.37 | [3.08, 6.22] |

| Mobile Trading Apps | Financial Podcasts | ||||||

|---|---|---|---|---|---|---|---|

| β (SE) | RRR | 95% CI | β (SE) | RRR | 95% CI | ||

| Never (ref category) | Not at all (ref category) | ||||||

| Sometimes | Somewhat | ||||||

| Social Media Platforms Used for Financial Information | Social Media Platforms Used for Financial Information | ||||||

| YouTube | −0.39 (0.39) | 0.68 | [0.32, 1.44] | YouTube | −0.78 (0.32) ** | 0.46 | [0.24, 0.86] |

| −0.06 (0.47) | 0.94 | [0.38, 2.37] | 0.01 (0.38) | 1.01 | [0.48, 2.12] | ||

| 0.44 (0.40) | 1.55 | [0.71, 3.37] | 0.23 (0.33) | 1.25 | [0.66, 2.38] | ||

| TikTok | −0.00 (0.62) | 1.00 | [0.30, 3.33] | TikTok | 0.28 (0.50) | 1.32 | [0.49, 3.54] |

| −1.20 (0.51) | 0.30 | [0.09, 1.00] | −1.01 (0.52) | 0.36 | [0.13, 1.01] | ||

| −0.57 (0.48) | 0.57 | [0.22, 1.45] | −0.27 (0.37) | 0.76 | [0.37, 1.58] | ||

| −0.11 (0.48) | 0.89 | [0.35, 2.31] | 0.39 (0.39) | 1.48 | [0.69, 3.15] | ||

| Stocktwits | −1.09 (0.55) * | 0.34 | [0.11, 0.98] | Stocktwits | −0.45 (0.43) | 0.64 | [0.28, 1.48] |

| Frequently | A great deal | ||||||

| Social Media Platforms Used for Financial Information | Social Media Platforms Used for Financial Information | ||||||

| YouTube | −0.66 (0.37) | 0.52 | [0.25, 1.07] | YouTube | −0.33 (0.42) | 0.72 | [0.32, 1.65] |

| −0.33 (0.45) | 0.72 | [0.30, 1.72] | −0.48 (0.46) | 0.62 | [0.25, 1.53] | ||

| 0.09 (0.38) | 1.10 | [0.52, 2.30] | 0.20 (0.40) | 1.22 | [0.55, 2.70] | ||

| TikTok | −0.10 (0.59) | 0.91 | [0.29, 2.87] | TikTok | −0.51 (0.54) | 0.60 | [0.21, 1.74] |

| −0.29 (0.60) | 0.75 | [0.23, 2.42] | −2.04 (0.59) ** | 0.13 | [0.04, 0.41] | ||

| −0.91 (0.46) * | 0.40 | [0.16, 0.99] | 0.36 (0.47) | 1.44 | [0.57, 3.63] | ||

| −0.27 (0.48) | 0.76 | [0.30, 1.94] | 0.81 (0.47) | 2.25 | [0.90, 5.62] | ||

| Stocktwits | −0.62 (0.55) | 0.54 | [0.18, 1.58] | Stocktwits | −0.42 (0.51) | 0.66 | [0.24, 1.78] |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Joseph, M.; Ouyang, C.; White, K.J. From Likes to Wallets: Exploring the Relationship Between Social Media and FinTech Usage. FinTech 2025, 4, 28. https://doi.org/10.3390/fintech4030028

Joseph M, Ouyang C, White KJ. From Likes to Wallets: Exploring the Relationship Between Social Media and FinTech Usage. FinTech. 2025; 4(3):28. https://doi.org/10.3390/fintech4030028

Chicago/Turabian StyleJoseph, Mindy, Congrong Ouyang, and Kenneth J. White. 2025. "From Likes to Wallets: Exploring the Relationship Between Social Media and FinTech Usage" FinTech 4, no. 3: 28. https://doi.org/10.3390/fintech4030028

APA StyleJoseph, M., Ouyang, C., & White, K. J. (2025). From Likes to Wallets: Exploring the Relationship Between Social Media and FinTech Usage. FinTech, 4(3), 28. https://doi.org/10.3390/fintech4030028