4.1. Descriptive Statistics

The descriptive statistics in

Table 2 highlight key patterns and data quality issues in the fiscal and macroeconomic indicators used to model fiscal stress. The general government balance (govbal) has a mean of –98,217 and a median of –5825, indicating a strong right skew driven by a few extreme deficit observations. While most countries maintain balances closer to zero, some exhibit exceptionally large fiscal imbalances. These large negative values are historically justified, reflecting sustained deficit spending in response to major shocks such as the global financial crisis, the Eurozone sovereign debt crisis, the COVID-19 pandemic, and recent inflation-driven policy interventions. To avoid undue influence from these extreme values, this variable was retained in its original scale but included in a logistic regression model that is robust to non-normality. Additional robustness checks included alternative specifications using winsorized values and dummy indicators for crisis years to ensure that results were not driven by outliers.

Lagged government debt (govdebt_lag) also shows substantial dispersion, with a mean of approximately 1.65 million and a standard deviation exceeding 5.7 million. The median value (279,531) is far below the mean, suggesting large outliers likely tied to crisis episodes or high-debt member states. Real GDP growth (gdp_growth) appears problematic; although the median is reasonable (2.42%), the mean (26.67%) and standard deviation (458.27) are implausibly high, likely due to data entry errors or inconsistent units. This variable was cleaned and winsorized prior to estimation. The long-term interest rate (ltrate) is more stable (mean and median ~4%), but with 69 missing values—over 10% of the sample. Its missingness was addressed through multiple imputations by country. Inflation is modest on average (1.19%) but shows high variability (SD = 11.33), indicating inconsistent scaling or structural differences across countries. Like gdp_growth, it was also subjected to winsorization.

Together, these steps ensured that the fiscal indicators were retained with appropriate treatment for outliers, while macroeconomic variables were cleaned, imputed and transformed as needed to support robust and interpretable model estimation.

4.2. Logistic Regression

Table 3 presents the coefficients, standard errors, z-values, and significance levels from a logistic regression model estimating the likelihood of fiscal stress based on macro-fiscal indicators. The regression results indicate that two fiscal indicators—government balance and lagged government debt—are statistically significant predictors of fiscal stress in Eurozone countries. The coefficient for government balance is negative and highly significant (

p < 0.001), suggesting that larger deficits (or smaller surpluses) increase the likelihood of fiscal stress. This aligns with theoretical expectations that persistent deficits undermine fiscal sustainability. Similarly, the coefficient on lagged government debt is positive and statistically significant (

p = 0.002), implying that countries with higher existing debt levels are more prone to fiscal stress episodes.

The logistic regression results in

Table 3 underscore the central role of fiscal variables, particularly the general government balancing fiscal stress in Eurozone economies. The coefficient for govbal is negative and highly significant (

p < 0.001), suggesting that larger deficits substantially increase the likelihood of fiscal stress, consistent with theoretical expectations. In contrast, govdebt_lag is not statistically significant (

p = 0.191), implying that debt levels alone, without accompanying fiscal imbalance, may not be a strong predictor of short-term fiscal distress. Among macroeconomic variables, only gdp_growth is statistically significant (

p < 0.001), with a negative coefficient. This indicates that higher economic growth reduces fiscal stress probability, likely through its positive impact on revenues and debt sustainability. However, ltrate and inflation remain statistically insignificant, with small and imprecisely estimated effects (

p = 0.561 and

p = 0.727, respectively). Their weak performance may reflect indirect or nonlinear influences not captured in the current model. These findings lend empirical support to fiscal balance as a dominant and robust indicator of fiscal vulnerability, while suggesting that macroeconomic variables may play a secondary or conditional role. Extensions of the model incorporating interactions and nonlinear terms (e.g., govdebt_lag × ltrate, quadratic gdp_growth) offered improved model fit (lower AIC, higher McFadden R

2) and predictive performance on out-of-sample data. In particular, the interaction model demonstrated better precision and F1-score, supporting its use as the preferred specification.

The extended logistic regression model (

Table 4) includes quadratic terms to capture possible nonlinear effects of growth, interest rates, and inflation on fiscal stress. The core result remains robust: govbal continues to be a strong and significant predictor (

p < 0.001), indicating that worsening fiscal balances significantly increase the likelihood of stress. The linear term for gdp_growth is negative and significant (

p = 0.0496), suggesting that higher growth lowers fiscal risk. Although the quadratic term I(gdp_growth^2) is not statistically significant (

p = 0.1406), its positive sign hints at diminishing returns—very high or low growth may be less stabilizing than moderate growth. This supports the possibility of a U-shaped relationship, albeit weakly. The variable ltrate is marginally significant (

p = 0.0739), with a negative coefficient. The positive but non-significant quadratic term again points to a potential U-shaped relationship. This suggests that both very low and very high interest rates could coincide with elevated fiscal stress, though the evidence is inconclusive at conventional significance levels. Inflation and its square remain insignificant (

p = 0.827 and 0.741), indicating no clear pattern linking price dynamics to fiscal stress in this specification.

Model comparison statistics (

Table 5) reinforce the value of introducing nonlinear terms. The nonlinear model achieved a lower AIC (181.6 vs. 182.9), indicating a better overall fit despite the increase in complexity. Furthermore, pseudo-R

2 metrics, particularly McFadden’s R

2, increased slightly from 0.740 to 0.751, supporting the modest improvement in explanatory power. These gains, while incremental, suggest that the nonlinear effects of macroeconomic variables may help capture residual variation not explained by the linear model. Although not all nonlinear terms are statistically significant, the improved fit justifies their inclusion as a robustness check. In combination with the better out-of-sample performance observed earlier, this provides a more nuanced and flexible specification for modeling fiscal stress in Eurozone economies.

4.4. SVM Model

A Support Vector Machine (SVM) with a radial basis function (RBF) kernel was used to classify fiscal stress based on macro-fiscal indicators (results in

Table 7). The model employed a C-classification approach, where the cost parameter was set to one, indicating a moderate penalty for misclassification. Class weights were set to 0.8 for non-stress (class 0) and 0.2 for stress (class 1), to address the imbalance in the dataset where stress events were the majority class. The SVM model identified 359 support vectors—288 from the non-stress class and 71 from the stress class—indicating that a substantial proportion of the training data was necessary to define the classification boundary. This is common in macroeconomic applications where class separation is not clean and nonlinear relationships are likely. Enabling probability estimation allows for further performance evaluation using ROC curves and AUC.

The Support Vector Machine (SVM) model was included primarily as a robustness check to test the consistency of the results across classifiers. However, its performance was significantly weaker than that of the other models. This likely reflects the characteristics of macro-fiscal data, which involve complex, overlapping class structures and non-linear relationships that SVM’s kernel functions may struggle to capture. Additionally, the high dimensionality and sparsity of the dataset may have further limited the model’s generalizability. Based on these findings, we recommend that future research consider alternative approaches, such as LightGBM, which efficiently handles non-linearity and feature interactions, or Generalized Additive Models (GAMs), which balance interpretability with flexibility in capturing smooth effects.

4.5. Model Performance Comparison

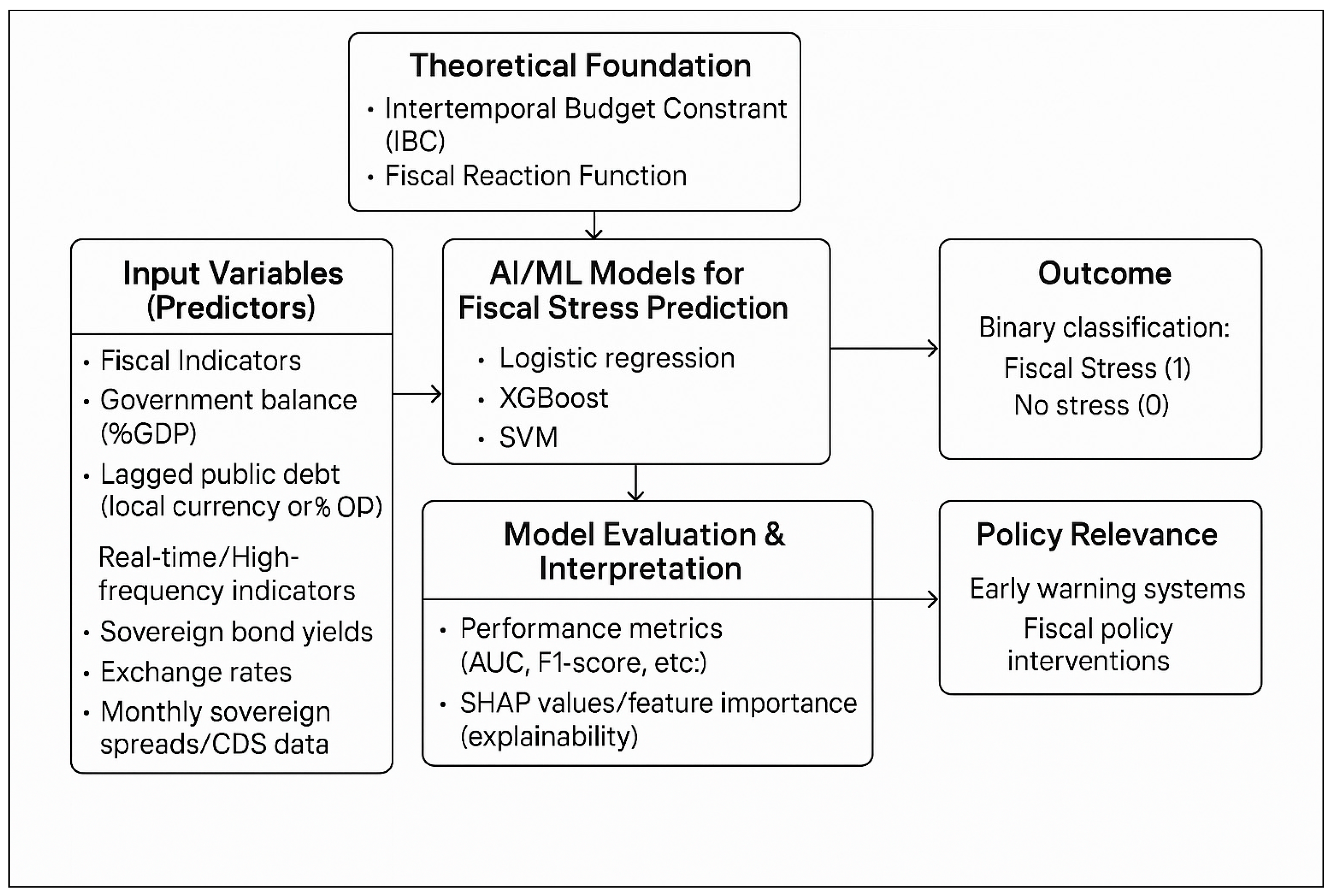

The comparison of model performance across logistic regression, XGBoost, and support vector machine (SVM) highlights important differences in predictive accuracy, precision, recall, and robustness in classifying fiscal stress (results in

Table 8). Among the three, the XGBoost model performed the best across most evaluation metrics. It achieved an out-of-sample accuracy of 0.961, precision of 0.998, recall of 0.951, F1 score of 0.974, and an AUC of 0.961. These results suggest that XGBoost remains highly effective at detecting fiscal stress events while reducing false positives, although its slight performance drop compared to the training set indicates mild overfitting. These findings are consistent with prior work demonstrating the superiority of tree-based ensemble methods in sovereign risk prediction [

22,

23].

Logistic regression also performed strongly, with an accuracy of 0.934, precision of 0.976, recall of 0.920, F1 score of 0.959, and AUC of 0.991. This model reliably identifies fiscal stress without false alarms and offers interpretability that is particularly valuable for institutional use. These results confirm that simpler models can still provide credible benchmarks when fiscal indicators are informative, as noted by [

23] in IMF research and broader policy applications.

In contrast, the SVM model underperformed across all metrics. It achieved only 0.642 accuracy, 0.821 precision, 0.727 recall, F1 score of 0.771, and AUC of 0.678. Despite using a radial basis kernel and addressing class imbalance, the model failed to generalize well. Re-specification of the kernel using polynomial and linear forms yielded only marginal improvements, reinforcing the conclusion that SVM may not be well-suited to macro-fiscal data—an observation consistent with findings by Refs. [

5,

22] who noted SVM’s instability in high-dimensional economic datasets.

To further assess robustness and address overfitting, we implemented a rolling-origin, time-aware cross-validation procedure. This design respects temporal ordering and avoids leakage from future observations. The XGBoost model’s performance remained strong but slightly declined out-of-sample, supporting the presence of mild overfitting and reaffirming the need for future validation using real-time data and prospective fiscal events [

23].