Abstract

This paper explores the intervening role in SEP performance of corporate environmental, cultural, and ethnic activities (ECEAs) and diversity, equity, inclusion, and social initiatives (DEISIs) on blockchain adoption (BCA) strategy, particularly useful in the Western Balkans (WB), which demands transparency due to extended fraud and ethnic complexities. In this domain, a question has been raised: In BCA strategies, is there any correlation between SEP performance and ECEAs and DEISIs in a mediating role? A serial mediation model was tested on a dataset of 630 WB and EU companies, and the research conceptual model was validated by CFA (Confirmation Factor Analysis), and the SEM (Structural Equation Model) fit was assessed. We found a statistically sound (significant, positive) correlation between BCA and ESG success performance, especially in the innovation and integrity ESG performance success indicators, when DEISIs mediate. The findings confirmed the influence of technology, and environmental, cultural, ethnic, and social factors on BCA strategy. The findings revealed some important issues of BCA that are of worth to WB companies’ managers to address BCA for better performance. This study adds to the literature on corporate blockchain transformation, especially for organizations seeking investment opportunities in new international markets to diversify their assets and skill pool. Furthermore, it contributes to a deeper understanding of how DEI initiatives impact the correlation between business transformation and socioeconomic performance, which is referred to as the “social impact”.

Keywords:

FinTech; entrepreneurship performance; blockchain adoption; diverse workspace; national cultural values; ethnical particularities; structural equation modeling JEL Classification:

B26; D86; G10; G20; L15

1. Introduction

There is always an explicit requirement for entrepreneurship to be responsive to change in technological agility for ESG performance success. Furthermore, blockchain disruptive functionalities are particularly useful in geographical areas, like the Western Balkans region (WB), which demand straightforwardness in organizational operations due to extended fraud and sociocultural complexities. Additionally, in the WB, corporate environmental, cultural, and ethnic activities (ECEAs) and diversity, equity, inclusion, and social initiatives (DEISIs) are common and successful corporate practices.

Traditionally, entrepreneurship foundation has been laid on the fundamental issue of proof in transactions, while commercial activities depend on fidelity, trust, and transparency between all involved parties [1,2,3,4,5,6,7,8]. Blockchain technology (BCT), a disruptive distributed ledger technology, offers this proof, since it minimizes fraudulence and cyber hacking, supports same-data and knowledge sharing among stakeholders, introduces smart contracts, and terminates brokers, agents, and intermediaries [9,10,11,12].

BCT builds trust and transparent management because by leveraging cryptographic techniques, blockchain can enable secure digital signatures and timestamping, making it difficult for malicious actors to manipulate or forge digital assets or transactions [13,14,15,16,17]. This enhances fidelity, trust, and confidence among participants in the metaverse ecosystem [18,19,20,21,22]. Therefore, corporate blockchain transformation is a new challenge in entrepreneurship management [23,24,25,26,27,28].

Since there is a lack of standard metrics, it is difficult to evaluate performance progress. Consequently, firms often do not have the means to access data and track information efficiently and reliably, and therefore trust issues are raised in their earnings reports. According to [1,8,27], the recently introduced ESG (Environmental, Social, Governance) entrepreneurship approach can create value, measure performance, and report sustainability. Hence, ESG theory’s performance success dimensions, implemented as sustainable entrepreneurship performance (SEP) metric indicators [8,29], are an alternative to KPIs (Key Performance Indicators) [15,30,31], while all KPIs are business metrics but not all business metrics are KPIs [15]. Hence, business model metrics track and monitor performance in quality, quantity, productivity, and efficiency [28,32,33,34,35,36,37].

According to [8,30,38,39,40,41], modern businesses therefore need both BCT and ESG business model metric assessment. Hence, for trusty and transparent management (entrepreneurship blockchain ESG compliance transformation), blockchain adoption (BCA) should be measured by ESG performance success indicators [8,28,36]. BCT can provide immutable certification and automated reporting on commitments, and data that relate to an organization’s ESG performance monitoring (e.g., commitment to significantly reducing or eliminating carbon footprint; data relating to an organization’s carbon emissions and credits can be tracked on a blockchain and benchmarked against set goals). Similarly, firms can track products, evaluate services, and monitor quality along their supply chains [27,42,43,44,45,46,47].

Following, the findings from the ESG metric indicators can be archived on a blockchain and all the information would remain permanently on-chain. Following, these immutable key ESG performance findings can be shared with stakeholders in a trusty, transparent, and efficient way through smart contracts [48,49,50]. The need for trust, sincerity, and straightforwardness in ESG business model metrics and reporting presents a challenge for entrepreneurship management and therefore discloses the role of BCT [47,51,52,53,54].

Additionally, BCT is correlated to corporate ECEAs, and to DEISIs due to reliability (decentralization, transparency, visibility, immutability), traceability, and autonomous agreement enforcement [55,56,57,58,59,60]. Corporate sustainability issues, equity and ethics challenges, and ethnic affairs require trust, transparency, innovation, and integrity. Therefore, in this domain, blockchain is an essential tool [56,61,62]. Additionally, with ESG performance success metrics for corporate social responsibility (CSR), green activities, innovation, and integrity, firms can be liable for their environmental, cultural, and ethnic activities, and DEI social initiatives [1,8,15,63,64,65]. In addition, the utilization of BCT visibility and traceability applications assists retailers in addressing cultural and ethical variations, resolving issues, dealing with inquiries, and verifying the proofs of their merchandise [47,50,66,67,68,69,70].

In the context of the WB, for example, if a local farmer issues a recall for its milk product due to a fault (e.g., dirtiness), a vendor has the option to employ BCT to identify and eliminate the affected foods and products [15,71,72,73]. BCT can effectively monitor and safeguard the origination and nomination of distinct items, such as local food-related products [74,75,76,77].

This is particularly critical for protecting the origin’s designation, which serves as a significant form of geographical indication, especially in the culturally and ethnically diverse WB region [8,15,78,79,80]. Hence, ECEAs alongside DEISIs could have a crucial mediating role between BCA and SEP measured by ESG success indicators (business model metrics) [15,28,81,82,83].

ESG (ECEAs in our WB case study with emphasis on “ethnic” corporate activities because of the particularities in the WB) is an acronym for an investment philosophy that gives corporate governance, social concerns, and environmental concerns top priority. ESG is a complete framework that considers organizational implications on the environment, how a firm treats its employees, stakeholders, and community members, and the quality of its governance systems. It is also a metric used to assess a company’s performance in three key categories. Investment in ESG factors is sometimes called impact investment or, in more proactive situations, responsible investing [6,8,51].

Businesses may operate responsibly and sustainably with the support of the ESG pillars. These pillars—economic sustainability, social responsibility, governance, and environmental sustainability—all center on how businesses impact people, the environment, and their bottom line. Impact on the natural environment, including carbon footprint, resource utilization, waste management, stakeholder theory, agency theory, institutional theory, and resource-based theory, are the most often used pertinent theoretical frameworks for comprehending ESG performance. In the context of sustainability, corporate behavior refers to how a business’s actions and policies affect social and environmental systems [8,15,51].

Fundamentally, the theoretical underpinnings of ECEAs seek to develop a quantifiable and comparable framework for assessing many facets of business conduct [6,8,71]. Organizations employ DEI (DEISIs in our WB case study with emphasis on “social” corporate initiatives because of the particularities in the WB) as a concept and practice to value individual diversity, provide equitable opportunities for all, and create a work atmosphere where everyone is valued and feels welcome [8,76]. DEI’s theoretical underpinnings are derived from several social science fields, most notably organizational studies, psychology, and sociology. The term DEI refers to the values that organizations and groups should adhere to promote varied surroundings, guarantee fair treatment, and establish an inclusive culture [15,51,76].

We are striving for a more inclusive, equitable, and diversified future where no human difference—race, gender, or otherwise—will prevent people from achieving better educational outcomes, enjoying excellent health, or escaping and remaining out of poverty [8,15,71,76].

DEISI key concepts include the following:

- Embedded Intergroup Relations Theory: This theory examines how relationships between groups are influenced by structural factors and historical inequalities.

- Structural Integration Theory: This theory focuses on how individuals’ integration into different social structures (e.g., workplace, community) can impact their experiences with diversity, equity, and inclusion.

- Social Identity Theory: This theory explores how individuals perceive themselves and others based on group membership, which can influence attitudes and behaviors towards out-groups.

- Critical Race Theory: This framework analyzes how race and racism have shaped social structures and institutions, offering a lens through which to examine systemic inequalities.

- Human Capital Theory: This theory emphasizes the importance of individual characteristics and skills in determining employment outcomes, but DEI challenges the notion that all individuals have equal opportunities to acquire these skills.

- Intersectionality: This concept recognizes that individuals’ identities (race, gender, class, sexual orientation, etc.) intersect and shape their experiences of discrimination and privilege.

- Social Justice: This concept focuses on creating a fair and equitable society, where all individuals have equal access to opportunities and resources.

- Organizational Behavior: This field examines how individuals and groups behave within organizations, including issues of diversity, equity, and inclusion.

- Human Resources Management: This field focuses on attracting, retaining, and developing diverse talent within organizations, and DEI plays a crucial role in shaping human resources practices.

- Leadership Theories: Different leadership styles (e.g., transformational, servant) can impact on how organizations approach DEI initiatives and create inclusive cultures.

Considering the previous discussion regarding the connection between BCA and SEP, green corporate activities, and corporate culture, it becomes necessary to evaluate the dependability of these correlations. Therefore, the primary objective of this article is to assess the statistical significance of the correlation by addressing the following four research questions in view of structural (inner) model fit assessment.

The theoretical mechanisms through which BCA affects firm performance are not well understood, and there is a dearth of empirical studies that examine the BCA–firm performance relationship for a large cross-section of firms [15,74,75].

This motivated our first research question: “Does BCT adoption improve a firm’s ESG performance?” BCA can result in immediate performance gains, for example, by improving supply chain efficiency and lowering operational costs [84,85,86]. We believe that adopting BCT can also increase the number of growth opportunities a company has, which boosts hopes for the company’s future performance [87,88,89,90]. According to [91,92,93,94,95] the benefits of BCT adoption may depend on how well a company can implement BCT into its operations and the racial and cultural makeup of the business environment it operates [27,69,70,96,97,98,99,100].

Therefore, we produced the second research question: “How do environmental, cultural, and ethnic corporate activities affect (mediate) the link between BCA and a firm’s ESG performance?” We specifically look, in the case of a BCA, at the correlation between a company’s intangible environmental, cultural, and ethnic activity (ECEA) dynamism and its long-term ESG performance metrics.

Additionally, as the third research question, we considered corporate DEI and social initiatives (DEISIs) in a mediating role between BCA and SEP (“How does corporate DEI and social activities affect (mediate) the link between BCA and a firm’s ESG performance?”). Finally, we considered a chain mediation, with DEISIs as a mediator between BCA and SEP and ECEAs as an intervenor between DEISIs and SEP to process the fourth research question “How do environmental, cultural, and ethnic activities, and corporate DEI and social initiatives influence BCA impact on ESG performance?”.

To answer these four research questions, we used the classic Structural Equation Model (SEM) method and performed a structural model fit assessment to value the standardized path coefficients (BCA to SEP through ECEAs and DEISIs). Therefore, the primary objective of this article is to address the following set of four research inquiries:

RQ1:

Is blockchain adoption an effective channel to support sustainable entrepreneurship performance?

RQ2:

Do environmental, cultural, and ethnic activities positively mediate the relationship between blockchain adoption and sustainable entrepreneurship performance?

RQ3:

In a firm that has adopted BCT, does a corporate strategy with diversity, equity, inclusion, and social initiatives affect sustainable entrepreneurship performance?

RQ4:

Are environmental, cultural, and ethnic activities productive intervenors between corporate’s DEISIs and the firm’s ESG performance?

Furthermore, the advantages of using BCT may depend on the firm’s age (i.e., date of incorporation), size, type of business, and location [101,102,103,104]. Hence, we want to know how the age, size, type of industry, and country of business as independent control variables (corporate features) of a firm that has adopted BCT affect its ESG performance metrics indirectly through the DEISI mediator factor [8,105,106,107]. This is an application domain assessment of the fourth research question (i.e., the best-performing hypothesis).

According to [93,101,108,109,110], although there has been a growing emphasis in the recent literature on the benefits and advantages of BCT in corporate management and entrepreneurship performance, the practical applications of BCT are still in their initial stages. The existing literature does not specifically highlight the integration of BCT to entrepreneurship as a promoter of entrepreneurship performance [27,56,69,111].

This integration can potentially contribute to various aspects such as reducing fraudulence and cyber hacking, facilitating same-data and knowledge sharing, utilizing smart contracts, and mitigating cultural and ethnic differences [47,74,112,113,114,115]. Therefore, the objective of this study is to address the existing gap in the literature by examining the potential contribution of BCT to sustainable entrepreneurial performance through the mediating role of green corporate activities and DEI initiatives, while exploring cultural influences as well as ethnic variations and issues within the Western Balkans region [8,15,116,117,118,119,120].

Entrepreneurship in Western Balkans developing countries, as recent democracies in a poor region of Europe with many corruption problems, face many challenges with financing, restrictions on international markets and loans, lack of trust, corruption, and bureaucracy [121,122,123]. According to [28,50,124,125,126], these entrepreneurship performance limitations are more obvious when sustainability is adopted in corporate strategy.

The BCA among small and medium enterprises (SMEs) poses a significant challenge in this field [127,128,129,130]. The impact of BCA on business performance was examined in a study conducted by [8] in the Western Balkans, a developing region in southwest Europe. The findings revealed that new companies experience a more significant influence on their performance because of adopting BCT, as opposed to established organizations. It is evident that developing nations naturally seek solutions for the internal challenges of their economies through the utilization of innovative technologies [131,132,133,134,135].

The significance of cultural and ethical values in the context of corporate strategic planning has been extensively examined by scholars such as [136,137,138,139]. Ref. [140] conducted a recent study that suggests that implementing BCT may impact the operational aspects of corporate management within a firm. According to [141,142] as well as [143], a positive relationship exists between a heterogeneous corporate work environment and financial performance.

While previous research has investigated the impact of business coaching and training on various aspects of corporate functioning, there is currently no published literature that explores the dynamics of BCT adoption on sustainable entrepreneurship performance, specifically considering the influence of national cultural values, ethnic characteristics, and diverse work environments [8,15,28,144,145,146,147]. The addressing of this research gap is considered this paper’s novelty. Therefore, the originality of this work lies on the description, evaluation (statistically significant correlation between BCA and SEP in the WB and Eurozone), and documentation of a conceptual framework for studying the influence of national cultural values, ethnic characteristics, and diverse work environments on entrepreneurship growth in BCA initiatives.

In the Western Balkans region, the greater the absence of transparency or susceptibility to corruption, the more imperative it becomes to adopt innovative strategies. This is the context in which BCT emerges as a potential solution to address the challenge of integrating entrepreneurship performance within corporate management. The study at hand examines the potential impact of blockchain’s decentralized nature on the supervisory mechanism of organizations, specifically in relation to the relationship between BCA and companies’ performance. This assumption is based on the understanding that the elimination of intermediaries and the immutability of information facilitated by blockchain can have implications for the supervisory processes within organizations. Contrarily, it is hypothesized that the incorporation of BCT as a framework for digital currency infrastructure could potentially impact the operational efficiency of a company by enabling straightforwardness and fostering trust.

Therefore, the primary objective of this work is to propose a theoretical model that examines the influence of BCT on ESG corporate governance, with a specific focus on the mediating roles of ECEAs and DEISIs. Therefore, the following sentence perfectly describes the purpose of this work: “Examine the impact of BCA on SEP in compliance with the ESG business success model, through the mediating roles of ECEAs and DEISIs.” Furthermore, the findings of this study might be applicable to WB corporate managers adopting the ESG theory.

The subsequent sections of this work are structured in the following manner: Section 2 (Materials and Methods) gives an overview of the theoretical justification of BCT and its impact on sustainable (ESG metrics) entrepreneurship. In addition, the mediating role of both environmental, cultural, and social corporate activities, and corporate culture (diversity, equity, inclusion) initiatives is analyzed. Following, this paper goes through data topics, research methodology, hypotheses, and the conceptual framework pertaining to the dynamics of adopting BCT. Section 3 (Results) introduces the research instrument (questionnaire) and presents an in-depth CFA (Confirmation Factor Analysis) and SEM analysis of the obtained results, while Section 4 (Discussion) delves into a comprehensive discussion of the research findings. Finally, Section 5 (Conclusions) serves as the final segment of this empirical investigation.

2. Materials and Methods

In this section, we theoretically present the methodology and the basic statistical tools that allow for us to draw statistically significant conclusions about the impact of BCA on ESG performance success indicators. Subsequently, in the next section (Results), we discuss real measurements from a questionnaire for companies located in the EU and the Western Balkans.

2.1. Theoretical Foundation

2.1.1. BCA and SEP

Considering the entrepreneurship blockchain transformation concept, the BCA can significantly alter organizational processes and capabilities, leading to increased value creation and improved firm performance [128,129,130,131,132,133,134,135,136,137,138,139,140,141,142,143,144,145,146,147,148,149]. BCA can grant a competitive edge to firms that enhance their prospective earnings and offer a long-lasting competitive advantage by enhancing the adaptability and agility of sustainable entrepreneurship performance [56,74,78,150,151,152]. Hence, BCA dynamics and ESG/SEP metric indicators are the two main factors of the proposed measurement model.

BCA dynamics. Our conceptual framework integrates seven indicators (BCT functionality dimensions) into the BCT adoption component, strengthening BCA dynamics (transparency/TRA, same-data sharing/SDS, knowledge sharing/KNS, smart contracts utilization/SCU, cyber-hacking protection/CHP, fraudulence suspension/FRS, and fidelity–integrity–trust/FIT). We defined these indicators as independent observed variables (TRA, SDS, KNS, SCU, CHP, FRS, and FIT).

ESG/SEP metric indicators. We considered the three factors of ESG theory as an ESG strategy for sustainable corporate practices. Hence, our corporate performance evaluation approach apart from the typical financial and operational practices and procedures (the G in ESG, governance criteria) considered the role of the environment like green corporate activity (the E in ESG; i.e., environmental criteria as an observed variable affected by corporate environmental disclosure activities as a responsibility to the society), and the role of the social initiatives like CSR (the S in ESG; i.e., social criteria as an observed variable affected by corporate culture (diversity, equity, inclusion), and cultural and ethnic activities). Every company, let alone companies in the Western Balkans, operates within a broader, diverse society, and a strong ESG proposition can create value [8,140].

Following, we describe seven ESG indicators (dependent observed variables: the variables that we measure directly to see how they change in response to manipulations or variation of the seven BCA dynamics independent variables TRA, SDS, KNS, SCU, CHP, FRS, and FIT) as accounting and qualitative performance metrics to rate a company’s sustainable entrepreneurship performance.

The seven dependent observed variables (corresponding ESG indicators) are defined as follows: financial performance (FIP), operational performance (OPP), quality and supply chain performance (QSP), CSR performance (CSR), green corporate performance (GCP), innovation performance (IVP), and integrity performance (IGP).

BCA may exhibit a positive correlation with SEP as it is expressed by the seven ESG performance metrics and therefore an initial hypothesis could be formulated as follows: “BCA has a favorable influence on the performance of sustainable entrepreneurship” (a positive statistical correlation into the RQ1 domain).

2.1.2. ECEAs as a Mediator Between BCA and SEP

The identification, valuation, and exploitation of opportunities within the external environment of a firm are crucial factors [140,151]. The external environment’s intangible capital encloses the human capital, routines, processes, and practices of firms [27,70,151].

The acquisition and integration of new knowledge into a firm’s existing knowledge base is widely recognized as being dependent on intangible capital and it is posited that companies possessing a greater quantity of intangible assets are more likely to effectively incorporate BCT into their business operations and reap the multitude of advantages it offers for commercial purposes in agility, efficiency, and performance [151]. In this domain, we defined intangible assets environmental, cultural, and social corporate activities [8,140].

We considered environmental, cultural, and ethnic activities as the ECEA mediator described by four indicators (staff and laborer habits/SLH, clients and customs values/CCV, ethnic communities’ customs/ECC, and power consumption reduction/PCR) and defined as independent observed variables (SLH, CCV, ECC, and PCR). In addition, the creation of synthetic (artificial) data that replicates the characteristics of real-world data, specifically for simulating social media events, can enhance the facilitation of ECEA mediation [144]. Therefore, it is anticipated that BCA companies, possessing ECEA intangible capital as a mediator, will enjoy improved ESG performance success metrics.

Consequently, the second hypothesis could be formulated as follows: “The adoption of blockchain technology (BCA) has a beneficial influence on the performance of sustainable entrepreneurship (SEP), with the mediating role of ECEA.” (a positive statistical correlation into the RQ2 domain).

2.1.3. DEISIs as a Mediator Between BCA and SEP

Corporate culture is about behavior culture, social codes, and biases. Diversity, equity, and inclusion (DEI) are three closely linked values held by many organizations that are working to be supportive of different groups of individuals, including people of different races, ethnicities, cultures, religions, abilities, education, genders, and sexual orientations.

Companies that are diverse, equitable, and inclusive are better able to respond to challenges, win top talent, and meet the needs of different customer bases [1]. Diversity is about recognizing and understanding individual differences. The literature review shows a correlative relationship between business performance (e.g., return on equity/ROE, return on assets/ROA, and Tobin’s Q) and diversity. Equality is about creating a fairer corporate environment by providing all employees with opportunities to make the most of their abilities and skills. Inclusion underpins both equality and diversity. Being inclusive means creating an environment where people feel comfortable [120,128,129].

It is worth noting that greater access to talent and increased employee engagement contribute to this performance effect. The business case for DEI is robust, and the relationship between DEI factors on executive teams and the likelihood of financial outperformance has become stronger over time [27].

There are clear correlations between DEI factors and business performance. Analysis of 2019 data shows that companies in the top quartile for gender diversity within executive teams were 25 percent more likely than companies in the fourth quartile to have above-average ROE, ROA, and Tobin’s Q profitability.

The business case for ethnic and cultural diversity is also strong: in 2024, companies in the top quartile bested those in the fourth quartile by 39% in profitability. Notably, the likelihood of outperformance continues to be higher for diversity in ethnicity than in gender [26,151].

In addition, inclusion and diversity can significantly affect an organization’s overall performance (winning talent, improving the quality of decision-making, increasing customer insight) and innovation, as diverse teams are typically more innovative and better at anticipating shifts, driving employee motivation and satisfaction, and improving a company’s global image and license to operate, as companies that can maintain or increase their focus on inclusion and diversity during crises are poised to avoid consequences such as struggling to attract talent or losing customers and government support [26,81,93].

Valuing DEI has a positive financial and reputational impact on business, innovation, corporate integrity, and CSR [112,113,114]. Having a more diverse workforce has been shown to build trust. According to PwC (PricewaterhouseCoopers), 80% of young professionals look for diversity and inclusion markers before applying to a role [13,140].

Valuing diversity enhances employee engagement and corporate integrity. It shows that your company understands and respects different cultures. This can cut costs by reducing turnover and absenteeism, which in turn increases overall productivity. The examination of how BCT provides a competitive advantage to enterprises operating in a DEI environment is of the greatest significance since conventional models fail to consider DEI’s impact as a competitive advantage. Notably, these conventional models also fail to consider the impact of environmental dynamism [27,32,33].

In accordance with previous scholarly works on dynamic business and market dynamics [6,17,19], we employ the three DEI indicators as corporate culture and dynamics. DEI is regarded as a dynamic capability due to its ability to enhance visibility, performance, innovation functionality, and trust within a company, and can assist organizations in reorganizing their resources to capitalize on opportunities presented by uncertain environments, such as the Western Balkans region [8,140]. Hence, in our conceptual framework, diversity, equity, and inclusion are described as indicators in corporate social initiatives (DEISIs) and defined as independent observed variables (D, E, I).

Therefore, the third hypothesis could be formulated as follows: “Corporate DEISIs act significantly and positively as a mediator in the association between BCA and firm performance, specifically in terms of return on equity (ROE), return on assets (ROA), Tobin’s Q, CSR, quality performance, green performance, innovation, and integrity” (a positive statistical correlation into the RQ3 domain).

2.1.4. Research Aim

The three hypotheses, as initially approached above, describe a positive correlation between the adoption of BCT and the performance of firms as defined by ESG theory. Hence, this study investigates, as the main research aim, the statistically significant correlation between BCA (corporate blockchain transformation) and sustainable entrepreneurship performance in the Western Balkans region and the Eurozone as the experimental domain.

Additionally, the intangible influence of both environmental, cultural, and social corporate activities, and corporate culture dynamics (diversity, equity, inclusion) is examined as a mediating factor between BCT dynamics and ESG performance success indicators.

Consequently, the main research aim is defined as “Examine the impact of blockchain adoption (BCA) on sustainable entrepreneurship performance (SEP), in compliance with the ESG business success model, through the mediating roles of environmental, cultural, and ethnic corporate activities (ECEAs), and corporate DEI and social initiatives (DEISIs).”

2.2. Questionnaire Sampling Design

We collected targeted corporate data from a questionnaire (refer to Appendix A for further details), sampling design and construction of which followed the methodology outlined in previous studies [25,33,35]. Additionally, it adhered to the guidelines provided by the University of Macedonia’s Department of Balkan, Slavic, and Oriental Studies (Thessaloniki, Greece), which focuses on economic and social sciences. The Department of Balkan, Slavic, and Oriental Studies is an active and interdisciplinary academic department that seeks to advance understanding of the languages, history, and culture of Balkan, Slavic, and Oriental nations. Its primary objective is to examine and enhance the economic, social, and political connections between these countries and Greece.

2.3. Research Methodology

SEM is a statistical method, based on the SEM fit assessment model, that integrates two validation analysis techniques, namely, path analysis (PA) and CFA.

2.3.1. PA, CMB, and CFA

PA originated in biometrics and was developed to identify causal relationships between variables through the construction of path diagrams. SEM enhances the capabilities of PA by enabling the establishment of connections between latent variables, also known as factors or hypothetical constructs in other methodologies. These latent variables are not directly observable but are inferred through their influence on observed and recorded observable variables, such as BCT dynamics, corporate dimensions, and features, measured, usually, with questionnaire/survey scale items as a set of answer options for dedicated closed-ended questions on performance.

Frequently used in conjunction with a marker variable approach, Common Method Bias (CMB) tests evaluate systematic errors in data collected using the same method for multiple variables. Examples of common methods include Confirmatory Factor Analysis (CFA) and Variance Inflation Factor (VIF) tests used in the proposed methodology. In particular, CFA is a statistical technique developed in the field of psychometrics and is utilized to estimate latent psychological constructs, such as attitude and satisfaction. In our research methodology, the CFA validity and reliability technique for the SEM fit assessment model was adopted.

2.3.2. PLS-SEM Method

Partial least squares structural equation modeling (PLS-SEM) is a method for structural equation modeling that allows—in path models with latent constructs—for the estimation of complex cause–effect relationships.

Specifically, we utilized the classical partial least squares structural equation model (PLS-SEM) method to evaluate the proposed conceptual path model. PLS-SEM is a robust multivariate technique increasingly used in scientific research to examine and assess causal relationships among multiple variables and distinguishes itself from other modeling approaches (e.g., covariance-based SEM/CB-SEM) by its ability to assess both direct and indirect effects within pre-established causal relationships [1,15,152,153].

According to [140], the PLS-SEM is indicated in cases where the phenomenon to be considered (i.e., BCA in our case) is relatively new and an outer (measurement) model needs to be introduced with many latent constructs and items (observed variables).

The PLS-SEM method encompasses two primary components as models: (a) the outer (measurement) model, which outlines the factors’ quantity, the associations between the different indicators and factors, and the interconnections among indicator errors, i.e., a CFA model; and (b) the inner (structural) model, which outlines the relationships between the multiple factors. The outer model is employed to assess latent constructs and investigate the association between these constructs and their observable indicators (variables) as entities that are measurable with a battery of items. On the other hand, the inner model encompasses the relationships between the latent constructs and evaluates all hypothetical dependencies using path analysis for fit assessment.

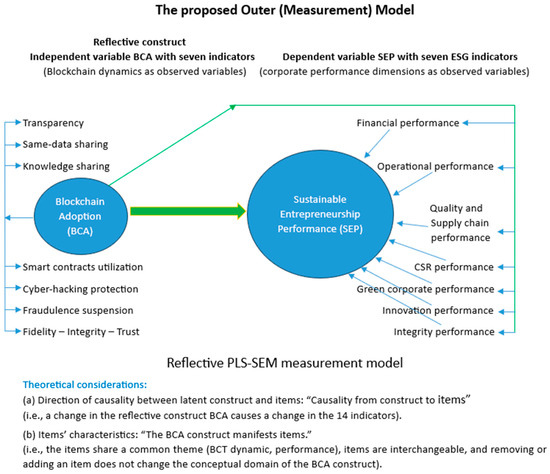

Figure 1 presents the proposed measurement model. In our theoretical concept design considerations, BCA functions as a reflective construct due to (a) its inherent nature, which allows for it to exist independently of the measures employed; (b) the direction of construct–item causality (BCA variation causes variation in the item measures but variation in an item’s measures does not cause variation in BCA); and (c) the items characteristics; this is because the items (i.e., the seven BCA dynamics and the seven SEP dimensions as ESG metric indicators) share a common theme (BCT dynamic and performance, respectively), are interchangeable, and removing/adding an item does not change the conceptual BCA domain.

Additionally, in the proposed measurement model, the BCA-reflective latent construct operates as an independent variable, while the SEP latent construct is a dependent one.

Figure 1.

The proposed PLS-SEM outer (measurement) model.

2.4. Proposed Conceptual Model

For the proposed validation model “BCA impact on ESG performance with environmental, cultural, and ethnic activities, and DEI, and social initiatives in a mediation role”, we initiated an SEM methodology with control, latent, and observable variables (definition and reliability/validity tests). In particular, the proposed model verifies the questionnaire’s consistency and coherence (reliability test), the latent–observed variables’ meaningful relationships (constructs reliability test), and the constructs’ distinctiveness (validity test).

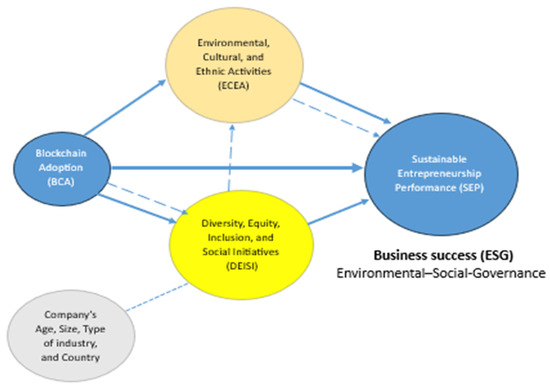

Figure 2 displays the path analysis of the proposed conceptual model with a double mediation (ECEAs, DEISIs) applied for the EU and WB countries. There are both direct and indirect effects in the path analysis relationships, where ECEAs and DEISIs are the mediators that intervene between BCA and SEP, and the company’s features age, size, type of industry, and country operate as independent control variables. We decided to describe the path analysis of the proposed conceptual model emphasizing the “Ethnic” activities and “Social” initiatives because of the strong WB ethnic and social particularities.

Figure 2.

The proposed conceptual framework with path analysis (business success—ESG model).

2.5. Latent Constructs and Observed Indicators (Variables)

The term “construct” pertains to the depiction of a particular concept within a specified statistical model. The establishment of a concept is typically accomplished through a conceptual or theoretical definition. On the other hand, the development of a construct for a concept is undertaken by the researcher, who operates the concept within a statistical model.

In the context of SEM, constructs are regarded as latent variables due to their unobservable nature and inability to be directly measured. SEM involves the formulation of a system of linear equations that encompasses both these latent variables and observed variables. Latent variables play a critical role in SEM as they function as fundamental constructs that assist in clarifying the correlations among observed variables. The entities in question possess qualities that cannot be quantified, yet their existence can be deduced by examining fluctuations in observable indicators. Prominent instances of latent variables encompass intelligence, personality traits, and attitudes.

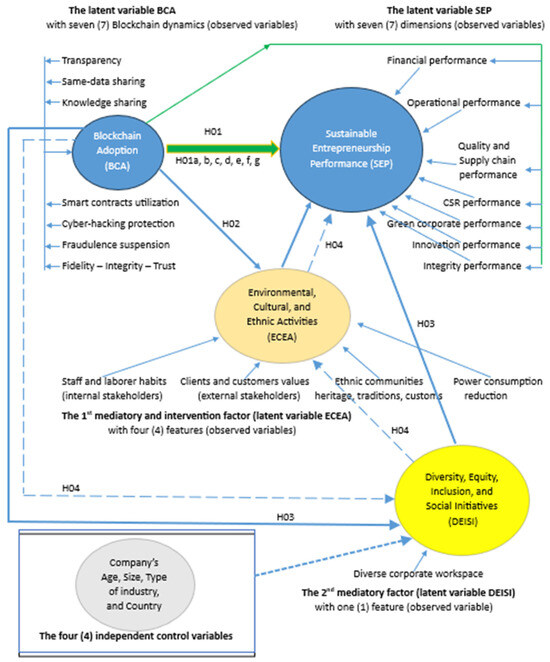

Figure 3 illustrates the latent SEM constructs (abstract concepts in the ovals) and the observed variables (dynamics, dimensions, and firm features with measurement functionality).

Figure 3.

The latent constructs and the observed variables. The proposed conceptual model (path diagram in both “reflective” and “formative” measurement models).

2.6. Conceptual Model Evaluation

As the conceptual model’s evaluation, we adopted a measurement model validation and a structural model fit assessment. In particular, the proposed conceptual model’s fit evaluation was achieved by performing (a) descriptive statistics (normality distribution and multi-collinearity tests), and (b) outer model validation (i.e., validity test for accuracy and reliability test for consistency) and inner model fit assessment.

Additionally, we assessed the questionnaire’s consistency and coherence (i.e., how distinct from one another the latent constructs and the observed variables are). Thus, the reflective outer (measurement) model was tested for internal consistency reliability using Cronbach’s a coefficient criterion as our preference vs. the composite reliability criterion because the topic under consideration is new and undocumented [22,28]. Additionally, we considered composite and internal consistency reliability through the utilization of CFA, which serves the purpose of verifying the unidimensionality of the proposed reflective model.

In the literature, the unidimensional construct refers to a single theoretical concept characterized by a particular type of 1D measurement scale. In alternative terms, a construct is multidimensional when it refers to several distinct but related dimensions treated as a single theoretical concept.

Subsequently, we considered the constructs’ validity (i.e., how meaningful the relationships between the latent constructs and the observed variables being measured are). We accomplished constructs’ validity by performing both convergent and discriminant validity tests.

Specifically, to establish that the constructs within the conceptual model are distinct from one another in an empirical sense, we conducted discriminant validity analysis (DVA) using the Fornell and Larcker criterion because the topic under consideration is new and undocumented.

In the context of the inner (structural) model, a statistical technique known as “path analysis” was employed to examine and evaluate the theoretical relationships posited by the conceptual model under consideration.

2.6.1. Descriptive Analysis

Normality Distribution Statistics

Skewness and kurtosis serve as measures to characterize the dispersion and peakedness of a normal distribution. Skewness is a statistical measure used to quantify the degree of asymmetry or asymmetry (departure from symmetry) in a dataset’s distribution along the X-axis.

On the other hand, kurtosis is a measure used to assess the vertical pull or the height of the peak in a distribution, indicating whether the data exhibit heavy-tailed or light-tailed behavior relative to a normal distribution. Specifically, a skewness value greater than +1.0 indicates a right-skewed distribution and a smaller than −1.0 indicates that the distribution is skewed towards the left.

In the context of kurtosis, a distribution can be classified as leptokurtic, indicating heavy-tailed data, when its kurtosis value exceeds +3.0 and if the value is below −3.0, the distribution is classified as platykurtic, indicating the presence of light-tailed data.

We examined the statistical measures of normality distribution, including the mean, standard deviation, median, skewness, and kurtosis. Skewness and kurtosis statistics were utilized as measures to assess the adherence of a distribution to the normality assumption.

Skewness statistics were employed to assess the symmetry of a distribution. In contrast, the Kurtosis statistic was employed to evaluate the extent of heaviness in the distribution tails. We detected that the research variables (latent and observed) distribution is normal as indicated by their skewness values falling within the range of −2 to 2.

Multi-Collinearity Statistics

The statistical measures of multi-collinearity, namely, tolerance and Variance Inflation Factor (VIF), are also of interest in the conceptual model’s assessment. The presence of multi-collinearity in the independent variables’ dimensions was assessed by employing the VIF and the tolerance variant statistics (Tolerance).

In our research the tolerance coefficient, lower than the threshold of 1, indicating an important level of multi-collinearity. Additionally, the tolerance coefficient was higher than the significance level of 0.05, suggesting that the independent variables are not highly correlated. Furthermore, all three values of the VIF were observed to be less than the threshold of 10, indicating that multi-collinearity is not a significant concern in the model.

According to previous studies [27,34,35], the findings indicate the absence of multi-collinearity among the various dimensions. This implies that multiple regression analysis is a suitable method for examining the research hypotheses.

2.6.2. Reflective Measurement Model’s Validity and Reliability

The SEM method offers valuable tools for conducting preliminary assessments of differential validity and reliability of measurement instruments across diverse demographic cohorts. The consideration of reliability and validity is of utmost importance in research design, procedures organization, and findings presentation, particularly in the context of quantitative research.

The assessment of research quality involves the application of validity and reliability as principles about how well a method measures something. Validity refers to the accuracy of a measure (i.e., whether the results really do represent what they are supposed to measure), and reliability refers to the consistency of a measure (i.e., whether the results can be reproduced under the same conditions) [27].

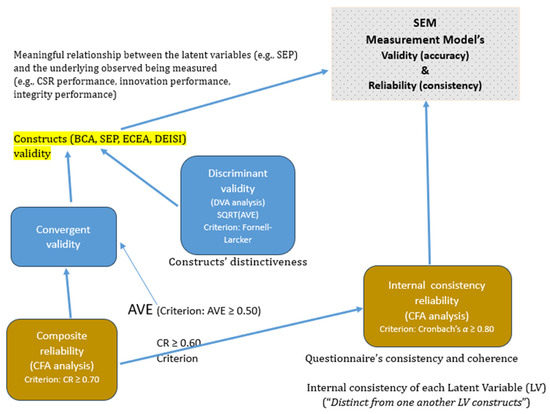

Figure 4 presents the validity and reliability terms relationship under the proposed reflective PLS-SEM outer model.

Figure 4.

Reliability and validity in our reflective PLS-SEM analysis.

Validity Test

The assessment of the research instrument (questionnaire), as a dataset’s validity, is related to the extent to which the collected or analyzed dataset accurately represents the relevant information. Therefore, it is imperative to establish validity and, in our case, a reflective measurement’s model validity. The concept of validity refers to the degree of accuracy in the results obtained from a test, as stated by Rex B. Kline [153], and in the context of the adopted PLS-SEM analysis, this statistical technique offers valuable evidence to support the accurate interpretation of the findings.

(A) Measurement model’s validity. Measurement validity refers to the degree to which the data or outcomes obtained from a research methodology (e.g., questionnaire) accurately reflect the intended construct (e.g., SEP in our case). Establishing validity in methods and results is crucial to ensure the utility and applicability of the research findings across diverse contexts. Hence, we tested whether the methods employed for data collection exhibit both reliability and reproducibility (i.e., composite reliability).

We performed the reflective measurement model’s validation by assessing the construct validity for all constructs using CFA. Particularly, we investigated and evaluated the correlation between the latent construct (BCA, SEP, ECEAs, and DEISIs) and their corresponding measurement determinants (BCA dynamics, SEP dimensions, and ECEAs and DEISIs).

CFA is a statistical technique used to assess latent variables by extracting a latent construct from a set of variables and identifying the items that have the highest shared variance with said construct. Additionally, CFA can help reduce the dimensions of the dataset, standardize the scale of multiple indicators, and account for the inherent correlations present in the data.

Construct validity is about how well a test measures the concept it was designed to evaluate and pertains to the degree to which a given assessment accurately measures the underlying construct (e.g., SEP) it is designed to assess. Hence, construct validity tested how well the set of the 21 indicators represents or reflects the proposed concept (BCA impact on ESG performance metrics) that is not directly measurable (questionnaire soundness). Therefore, we considered the soundness of the evaluation using construct validity, which is classified into two primary forms (convergent validity and discriminant validity), and recorded evidence of these two forms also demonstrated evidence for construct validity.

(a) Convergent validity (CV), as measured by the average variance extracted (AVE), is an important aspect of assessing the validity of a measurement instrument in academic research. Convergent validity refers to the degree to which two measures that theoretically should be related, are in fact related. Criteria for convergent validity: Convergent validity pertains to the degree of correlation observed between the responses of distinct variables when evaluating a shared construct. Convergent validity is a statistical assessment that ensures the presence of a meaningful relationship between variables (e.g., CSR, innovation, integrity) and the underlying construct (e.g., SEP) being measured. Consequently, it is imperative for factors to exhibit a robust correlation with the underlying construct.

To assess convergent validity, we evaluated the AVE value, as the AVE technique is deemed suitable due to its ability to elucidate the extent to which items are jointly accounted for by constructs. To achieve validity, it is necessary for the AVE to have a value that is equal to or greater than 0.5.

(b) Discriminant validity (DV), also referred to as divergent validity, was established as a measure of validity to ascertain the distinctiveness of the constructs (e.g., BCA, SEP, ECEAs, DEISIs), and in SEM using PLS, it is usually evaluated by three informative approaches (criterions): the Fornell–Larcker, cross-loading, and HTMT criterions. We chose the Fornell–Larcker criterion because the other two criterions are too sensitive to causal effects interpretation that does not fit in our traditional PLS-SEM case for evaluating a relatively new complex concept (BCA impact on ESG performance metrics) with many latent constructs and observed variables.

In DV, it is imperative to ascertain that all constructs exhibit empirical distinctiveness from one another, and DV investigates the extent to which a latent construct demonstrates distinctiveness from other latent variables in its ability to predict the dependent variable.

According to [154], in the assessment of the Fornell–Larcker criterion, if all constructs’ correlation coefficient values are lower than the square root of their AVE value, it indicates the presence of discriminant validity. Therefore, in our method, the constructs’ AVE values and the initiation of the correlations between the constructs served as evidence for the presence of discriminant validity [15,154].

(c) Structural model’s validity (fit assessment). The development of path analysis (a statistical technique) aimed to quantitatively assess the relationships between multiple variables. Path analysis was utilized to illuminate the causal relationships that exist among variables.

Moreover, mediation (ECEAs, DEISIs) is a commonly utilized component of path analysis in which it is hypothesized that a variable can have both direct and indirect impacts on an outcome through the involvement of another variable.

Reliability Test

The concept of reliability pertains to the degree of consistency in measuring outcomes, as stated by [15,154,155]. The assessment of reliability holds considerable importance as it pertains to the consistency of measuring the various components of the instrument. When the items on a scale exhibit coherence and assess the same underlying construct, the scale is considered to have favorable internal consistency reliability. The measurement of reliability for any given dataset or construct can be categorized into three distinct forms, reliability of internal consistency, composite reliability, and reliability of external consistency:

(a) Reliability of internal consistency refers to the extent to which the items within a measurement instrument are consistent in measuring the same construct. This reliability can be assessed using various methods, such as Cronbach’s alpha coefficient and CFA. In statistics and research, the concept of internal consistency is commonly assessed by examining the intercorrelations among distinct items within a given test. This assessment determines the degree of similarity in scores among multiple items designed to measure a common construct.

Therefore, internal reliability refers to the extent to which a measurement instrument demonstrates consistency and coherence within its own set of items or components. Put differently, if the same question were asked in an alternative manner, it would yield identical outcomes. The split-half method is frequently employed for measurement.

External reliability pertains to the extent to which findings can be compared among different individuals and over different time periods. The assessment of internal consistency is a measure of reliability in SEM analysis. Internal consistency reliability refers to the degree of consistency in the data obtained from multiple tests. The reliability method is employed to assess the degree of association between the factors present in each test and other factors, as described by [15,28,154].

The Cronbach alpha coefficient was used as a measure of internal consistency and the Likert scale, widely recognized as the most employed method for assessing consistency, was adopted in our questionnaire. It is advisable that the level of reliability for an exploratory or pilot study should be at least 0.70 or higher. According to [53,54], reliability can be categorized into distinct levels based on the values obtained. An index of 0.90 and above is indicative of excellent reliability, while a range of 0.70–0.90 signifies high reliability. On the other hand, the range of 0.50–0.70 suggests moderate reliability, and values of 0.50 and below indicate low reliability.

(b) Composite reliability (CR) is a statistical measure used to assess the extent to which the variables that underlie constructs are effective in SEM, and CFA is employed to assess the constructs’ CR. The estimation of CR is derived from the analysis of factor loadings, as demonstrated by [15,153]. The build reliability coefficient may exhibit a value exceeding 0.70. To attain construct reliability, it is necessary to have a value of CR ≥ 0.7.

(c) The reliability of external consistency evaluates the degree of consistency in the measurement of a variable across multiple applications or instances. For instance, in the context of a study, if a participant underwent an IQ assessment at one point in time, and subsequently underwent the same assessment a year later, yielding a notably comparable score, this would indicate the presence of external reliability. An illustration of external consistency can be observed in the context of a cognitive ability test, wherein the test has been demonstrated to yield consistent scores across diverse populations or cultures.

2.6.3. Conceptual Model’s Validation and Fit Assessment Process

With respect to the above discussion, we performed the following validation and fit assessment process for the proposed “BCA impact on ESG performance metrics” conceptual model (see next section, “Results”):

(A) Descriptive statistics (normality distribution, multi-collinearity) (Figure 5).

(B) Measurement’s model validity (accuracy) and reliability (consistency) test.

Step I. Questionnaire/research instrument’s internal consistency reliability (Cronbach’s alpha coefficient and Dillon-Goldstein’s rho). Cronbach’s alpha coefficient and Dillon Goldstein’s rho were used to evaluate the research instrument’s consistency and coherence (Figure 6). As a rule of thumb, Dillon-Goldstein’s rho values higher than 0.70 suggest one-dimensionality, and given that both indexes are larger than 0.7, it can be claimed that the research instrument (i.e., the questionnaire) has acceptable reliability [154,155].

Step II. Construct reliability as indicated by the convergent validity (composite reliability and AVE). The reliability of each construct and its scale items is acceptable when the composite reliability (CR) is ≥0.7 and the average variance extracted (AVE) is ≥0.5. The values of these indices are shown in Figure 6.

Step III. Constructs’ distinctiveness as measured by discriminant validity (SQRT(AVE)). The distinctiveness of the constructs (BCA, SEP, ECEAs, DEISIs) is discovered by discriminant validity analysis (Figure 7).

(C) SEM structural model’s fit assessment. Structural model assessment in PLS-SEM focuses on evaluating the significance and relevance of path coefficients, followed by the model’s explanatory and predictive power:

Step IV. Research hypotheses assessment/construct paths (t-statistics, p-value). Results are reported in Figure 8.

Step V. Research hypotheses assessment from measurement invariants through a control variable. Results are reported in Figure 9.

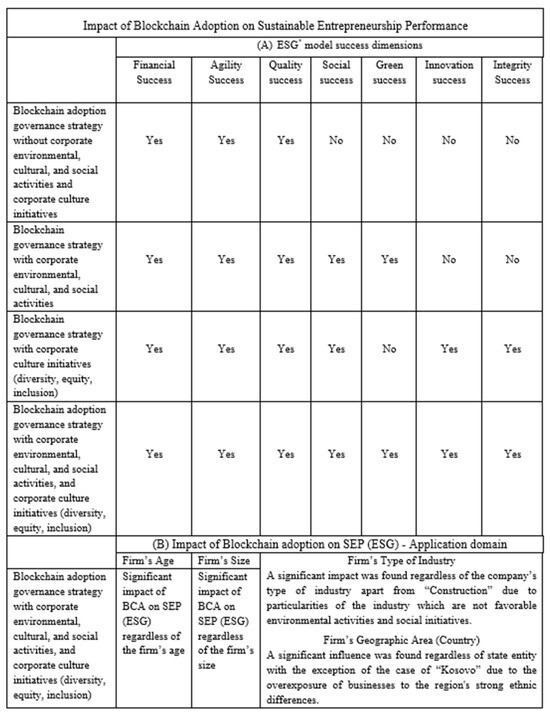

Step VI. Comparative analysis (a) for all the hypotheses (H01, H02, H03, and H04) testing results as they projected on the seven ESG model’s success dimensions (financial success, agility success, quality success, social success, green success, innovation success, and integrity success), and (b) for the hypothesis H04 (most successful setup) as it projected on company’s age, size, type of industry, and country as the four independent control variables (Figure 10).

2.7. Research Hypotheses

The primary hypothesis of this study was formulated as follows: There is a statistically significant effect at the level (α ≤ 0.05) of BCA on ESG performance. To evaluate the primary hypothesis, a multiple linear regression analysis was conducted. The null hypothesis (H0) is either accepted or rejected based on the predetermined significance level (α).

A significance level (α) of 0.05 was chosen as the upper limit. Hence, when the level of significance is equal to or below 0.05, a statistically significant effect will be observed. Conversely, if the level exceeds 0.05, no statistically significant effect will be observed.

The primary hypothesis and the four research questions defined the scope for the development of the main four hypotheses (H01, H02, H03, and H04) as follows:

First Hypothesis (H01):

Blockchain adoption governance strategy without corporate environmental, cultural, and ethnic activities, and corporate DEI and social initiatives. The 1st hypothesis construct’s path is defined as BCA→SEP and is formulated as follows (Figure 3):

H01:

BCA has a positive impact on SEP.

Additionally, the following seven thematic sub-hypotheses are proposed to examine the BCT–entrepreneurship performance relationship in detail (see Box 1 below).

Box 1. The seven thematic sub-hypotheses for the first hypothesis (H01).

H01a: In the H01 hypothesis construct path, BCA has a positive impact on financial performance (FIP).

H01b: In the H01 hypothesis construct path, BCA has a positive impact on operational performance (OPP).

H01c: In the H01 hypothesis construct path, BCA has a positive impact on quality and supply chain performance (QSP).

H01d. In the H01 hypothesis construct path, BCA has a positive impact on CSR performance (CSR).

H01e. In the H01 hypothesis construct path, BCA has a positive impact on green corporate performance (GCP).

H01f. In the H01 hypothesis construct path, BCA has a positive impact on innovation performance (IVP).

H01g. In the H01 hypothesis construct path, BCA has a positive impact on integrity performance (IGP).

Additionally, considering the mediating role of ECEAs and DEISIs, the following three hypotheses and many relative sub-hypotheses are proposed:

Second Hypothesis (H02):

Blockchain adoption governance strategy with ECEAs. The 2nd hypothesis construct path is defined as BCA→ECEA (mediator)→SEP and is formulated as follows (Figure 3):

H02:

ECEAs mediate positively in the relationship between BCA and SEP.

Additionally, the following seven thematic sub-hypotheses are proposed to examine BCT–ECEA–entrepreneurship performance interaction in detail (see Box 2 below).

Box 2. The seven thematic sub-hypotheses for the second hypothesis (H02).

H02a: In the H02 hypothesis construct path, BCA has a positive impact on financial performance (FIP).

H02b: In the H02 hypothesis construct path, BCA has a positive impact on operational performance (OPP).

H02c: In the H02 hypothesis construct path, BCA has a positive impact on quality and supply chain performance (QSP).

H02d. In the H02 hypothesis construct path, BCA has a positive impact on CSR performance (CSR).

H02e. In the H02 hypothesis construct path, BCA has a positive impact on green corporate performance (GCP).

H02f. In the H02 hypothesis construct path, BCA has a positive impact on innovation performance (IVP).

H02g. In the H02 hypothesis construct path, BCA has a positive impact on integrity performance (IGP).

Third Hypothesis (H03):

Blockchain adoption governance strategy with DEISIs. The 3rd hypothesis construct path is defined as BCA→DEISI (mediator)→SEP and is formulated as follows (Figure 3):

H03:

Corporate DEISIs mediate positively in the relationship between BCA and SEP.

Additionally, the following seven thematic sub-hypotheses are proposed to examine the BCT–DEISI–entrepreneurship performance relationship in detail (see Box 3 below).

Box 3. The seven thematic sub-hypotheses for the third hypothesis (H03).

H03a: In the H03 hypothesis construct path, BCA has a positive impact on financial performance (FIP).

H03b: In the H03 hypothesis construct path, BCA has a positive impact on operational performance (OPP).

H03c: In the H03 hypothesis construct path, BCA has a positive impact on quality and supply chain performance (QSP).

H03d. In the H03 hypothesis construct path, BCA has a positive impact on CSR performance (CSR).

H03e. In the H03 hypothesis construct path, BCA has a positive impact on green corporate performance (GCP).

H03f. In the H03 hypothesis construct path, BCA has a positive impact on innovation performance (IVP).

H03g. In the H03 hypothesis construct path, BCA has a positive impact on integrity performance (IGP).

Fourth Hypothesis (H04):

Blockchain adoption governance strategy with ECEAs and DEISIs. The 4th hypothesis construct path is defined as BCA→DEISI (mediator)→ECEA (intervenor)→SEP and formulated as follows:

H04:

Corporate ECEAs intervene positively in the DEISI mediating role between BCA and SEP.

Additionally, the following seven thematic sub-hypotheses are proposed to examine the BCT–DEISI–ECEA–entrepreneurship performance correlation in detail (see Box 4 below).

Box 4. The seven thematic sub-hypotheses for the fourth hypothesis (H04).

H04a: In the H04 hypothesis construct path, BCA has a positive impact on financial performance (FIP).

H04b: In the H04 hypothesis construct path, BCA has a positive impact on operational performance (OPP).

H04c: In the H04 hypothesis construct path, BCA has a positive impact on quality and supply chain performance (QSP).

H04d. In the H04 hypothesis construct path, BCA has a positive impact on CSR performance (CSR).

H04e. In the H04 hypothesis construct path, BCA has a positive impact on green corporate performance (GCP).

H04f. In the H04 hypothesis construct path, BCA has a positive impact on innovation performance (IVP).

H04g. In the H04 hypothesis construct path, BCA has a positive impact on integrity performance (IGP).

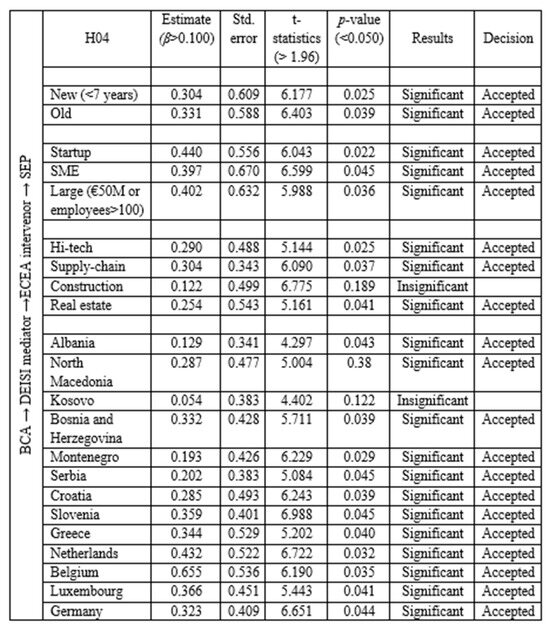

We also performed a hypothesis H04 assessment with the company’s age, size, type of industry, and country as independent control variables (construct path: BCA→DEISI mediator→ECEA intervenor→SEP).

2.8. The Final Conceptual Model

After the latent, observed, and control variables’ introduction (see Section 3.4) and the research hypotheses definition (see Section 3.5), the final conceptual framework for evaluating the BCT adoption dynamics on sustainable entrepreneurship ESG performance was formulated.

Figure 3 shows the proposed conceptual model in detail (latent, observed, and control variables, mediations, constructs path’s direct and indirect relationships, and formulated hypotheses).

3. Results

3.1. Questionnaire Structured Formation

According to the findings of a survey, the central Europe and Western Balkans region had a recorded number of over 30,000 registered companies at the time [8,140]. This study’s purpose involved selecting 3270 companies whose products had successfully reached the production stage. These companies were chosen based on their products, which not only incorporated a design informed by research and development but also demonstrated a significant level of technological advancement. The website provided contact details for the company.

The survey took place in all eight Western Balkan countries (Albania, North Macedonia, Kosovo, Bosnia and Herzegovina, Montenegro, Serbia, Croatia, and Slovenia) and five core Eurozone countries (Greece, the Netherlands, Belgium, Luxembourg, and Germany) with a significant presence of businesses that have adopted BCT. The variable CGA (company’s geographic area), used in our conceptual model as a control variable, refers to these 13 countries.

A convenience sampling technique was employed to distribute 3000 electronic questionnaires to CEOs and managers of small and medium-sized enterprises (SMEs). Of those distributed, 654 questionnaires were completed and returned. After removing any outliers, 630 responses were deemed valid and included in the analysis. The research hypotheses were tested using path analysis and the Smart PLS 4.1.1.4 for Windows software package, which was chosen for its capability to analyze causal relationships among multiple variables.

The demographic information of the participants reveals that most of them possessed a higher education degree in the field of information and communication technology (ICT), accounting for 58% of the total (Table 1). Additionally, 51.7% of the participants had accumulated over ten years of experience in management, indicating a satisfactory level of expertise among the participants. Furthermore, it is worth noting that out of the total number of participants, 62 individuals (equivalent to 9.8%) possessed experience in the field of DevOps, while 38 participants (accounting for 6%) had experience specifically in DevSecOps (Table 1).

Table 1.

Demographic data.

DevOps is a set of tools, practices, and cultural philosophies that integrate and automate the processes between software development (Dev) and deployment, and IT operations (Ops) teams. It emphasizes team empowerment, cross-team collaboration, technology, and software delivery and deployment automation.

DevSecOps represents development (Dev), security (Sec), and operations (Ops). It is a software development approach that integrates security practices throughout the global software development lifecycle. This mindset, automation, and platform design approach make security a shared responsibility across the IT lifecycle. DevSecOps is often considered the safer alternative.

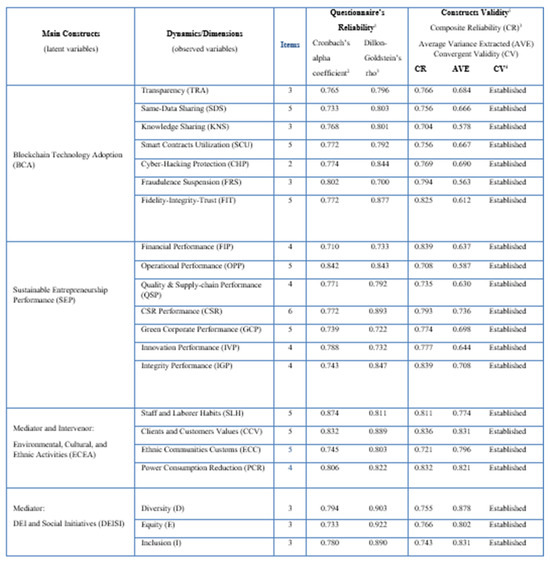

To establish the measurement model’s validity (accuracy) and reliability (consistency), we conducted tests to assess the reliability of the questionnaire (Figure 6) and the constructs (Figure 6 and Figure 7). There are two types of construct reliability, namely, convergent validity (Figure 6) and discriminant validity (Figure 7). The concept of convergent validity refers to the measurement of constructs that are theoretically expected to be correlated, and empirical evidence supports this expectation.

Conversely, the concept of discriminant validity concerns constructs’ measurements that are theoretically expected to be unrelated, and empirical evidence confirms this lack of association.

The full sample used for this analysis comprises 630 firm-year observations for corporates that adopt BCT. The analysis encompasses a sample period ranging from 1 June 2024 to 31 October 2024. In total, the dataset used for the blockchain analysis consists of 630 observations spanning multiple years.

These observations pertain to firms operating in 13 different countries, including 8 countries from the Western Balkans region and 5 countries from the European Union. The firms in the dataset are classified into four industry sectors based on the 2-digit Global Industry Classification Standard (GICS). These sectors are hi-tech, supply chain, construction, and real estate. The data in this applied research study were collected through a questionnaire administered to polling companies operating in the Western Balkans region and the Eurozone.

A total of three thousand (3000) questionnaires were distributed electronically to managers, CEOs, and presidents of various companies. Out of these, 654 questionnaires were returned and considered for analysis. After removing outliers, the final sample size was reduced to 630 complete questionnaires.

The questionnaire addressed only corporate management and consisted of two parts. In part A, we are asking for information about the company’s features, economic performance, investments in BCA, and various management data. The questionnaire’s second part is composed of four sections, each addressing a specific topic.

The first section comprised 26 questions about BCT adoption, with a latent variable called BCA for the statistical evaluation. The second section included 32 questions focusing on the performance of sustainable entrepreneurship (ESG approach), represented in the statistical analysis by a latent variable denoted as SEP. The third section consisted of 19 questions exploring environmental, cultural, and social corporate activities, with a latent variable for the statistical analysis named ECEA.

Lastly, the fourth section encompassed 6 questions examining the corporate culture’s dynamics (diversity, equity, inclusion), represented by a latent variable labeled DEISI. Please refer to Appendix A for further details.

Table 1 presents detailed demographic information of the questionnaire respondents.

3.2. Conceptual Model Constructs

In our experimental evaluation study, the control, latent, and observable variables were defined as follows:

- Control variables: The company’s features: CA, CS, CTI, and CGA (Table 2).

Table 2. Independent control variables.

Table 2. Independent control variables. - Latent constructs/variables: BCA, SEP, ECEA, and DEISI were defined as latent constructs (common factors) (Figure 5).

- Observable variables: Respectively, as observable variables, seven BCA dynamics (TRA, SDS, KNS, SCU, CHP, FRS, and FIT), seven SEP dimensions as ESG indicators (FIP, OPP, QSP, CSR, GCP, IVP, and IGP), four ECEA indicators (SLH, CCV, ECC, and PCR), and three DEISIs (D, E, and I) (Table 2, and Figure 1 and Figure 3).

Subsequently, the questionnaire’s validity and reliability were tested.

A “latent construct” is a theoretical concept or idea that is not directly observable. Specifically, latent constructs provide a framework for understanding and explaining complex economic or social phenomena like “Blockchain Adoption”, “Sustainable Entrepreneurship Performance”, etc. Latent constructs are represented by latent variables, which are then measured through observable indicators (Figure 5).

A “latent variable” in statistics is a random variable that is not directly observed but is instead inferred from other observed variables. So, latent variables are unmeasured but not necessarily unmeasurable. They are introduced into our model to represent features of interest that are not directly measurable (i.e., BCA, SEP, ECEAs, and DEISIs).

Latent variables help us understand complex phenomena by grouping related observable variables into meaningful, underlying main latent constructs. In Figure 5, the latent variables BCA, SEP, ECEA, and DEISI represent our four main latent constructs.

Figure 5.

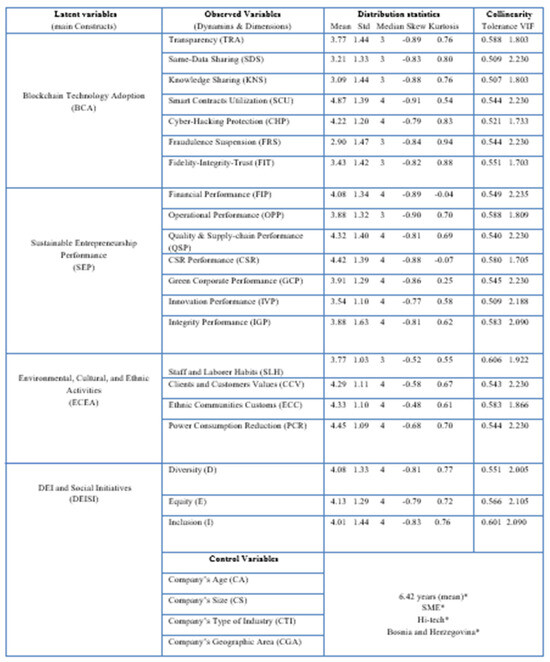

Latent constructs—latent variables—observed variables and descriptive statistics for the full sample (n = 630). Source: Questionnaire data under a 5-point Likert scale ranging from “strongly disagree” (1) to “strongly agree” (5). * Most of the companies polled were new, SME, and hi-tech from Bosnia and Herzegovina.

3.3. Descriptive Statistics

Descriptive statistics (mean, standard deviation, median, skewness, and kurtosis) pertain to the proposed PLS-SEM model’s assessment. Figure 5 displays the descriptive statistics for the entire sample. Subsequently, the means of the characteristics are compared using the t-test as a means of testing for equality, with the corresponding β-value and p-value provided for each comparison.

3.4. CFA Analysis

3.4.1. Questionnaire’s Reliability

The internal consistency reliability of the research instrument (questionnaire) was assessed using CFA. The measurement model’s testing, as indicated by the Cronbach’s alpha value, yielded results of ≥0.800. This finding aligns with [154], i.e., a minimum requirement of 0.8, as shown in Figure 6.

3.4.2. Constructs Validity

Construct validity is strongly associated with construct convergent validity (CV), which is associated with composite reliability (CR) and average variance extracted (AVE).

Hence, initially, the CR and the AVE values were computed and utilized to assess the convergent validity of all latent variables (constructs), including their subscales BCA dynamics, SEP dimensions, and corporate features.

According to [155], the criteria for establishing convergent validity are met when the CR is equal to or greater than 0.7 and the AVE is equal to or greater than 0.5. Subsequently, after the CV assessment, the construct reliability was estimated for all constructs separately.

Figure 6 indicates that construct validity was established for all constructs and their dynamics, dimensions, and features. Hence, we detect a meaningful relationship between the latent variables (e.g., SEP) and the underlying observed ones being measured (e.g., CSR performance, innovation performance, integrity performance).

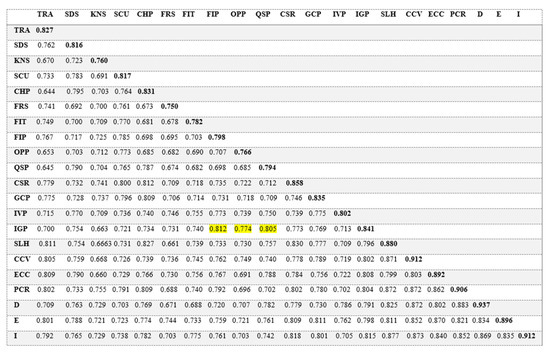

3.4.3. Constructs Distinctiveness Validity

A discriminant validity assessment (Fornell–Larcker criterion) is conducted by analyzing the correlation matrix between the constructs while the measurement of the degree of correlation was conducted using a correlation coefficient, specifically Pearson’s r.

Fornell–Larcker criterion compared the square root of AVE with the latent variable correlations (off-diagonal correlation coefficients). In particular, the square root of each construct’s AVE was found greater than its highest correlation with any other construct. The findings, reported in Figure 7, demonstrate the extent to which the research discriminant validity is deemed acceptable [154,155]. For the IGP-FIP, IGP-OPP, and IGP-GSP constructs, a small dispute was found. Nevertheless, the negative differences are too small (−0.14, −0.08, and −0.11, respectively) and thus disregarded.

The diagonal line in Figure 7 consists of bold values that correspond to the square roots of the AVE values. The square roots of the AVE values exhibit a stronger correlation between the paired indicators, which serves as an indicator of discriminant validity. Additionally, it is important to note that the correlation between the pair of variables (off-diagonal) used as predictors should not exceed a value of 0.90.

The findings presented in Figure 7 plainly demonstrate that all the measurements pertaining to discriminant validity have been satisfied and therefore the discriminant validity was achieved [153]. Hence, all the conceptual model’s constructs were found discriminant.

3.5. SEM Analysis

3.5.1. Structural Model Evaluation Results

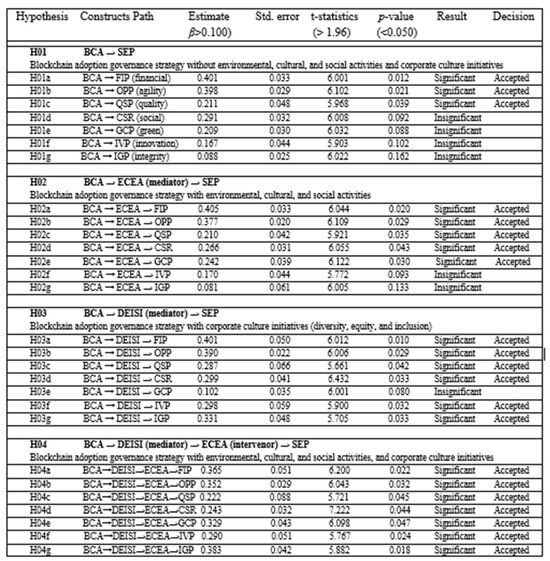

Structural model evaluation results achieved on the pooled data are presented in Figure 8. Based on these results, 21 out of the 28 research hypotheses were confirmed with statistical significance at a level below 0.05. Particularly, the findings support the H01 hypothesis for a direct, significant, and positive impact of BCA governance strategy on SEP for three of the seven ESG success dimensions (financial, agility, and quality success) as follows: H01a (β = 0.401, p-value < 0.05), H01b (β = 0.398, p-value < 0.05), and H01c (β = 0.211, p-value < 0.05). Hypotheses H01d (social success), H01e (green success), H01f (innovation success), and H01g (integrity success) were not verified.

For hypothesis H02 (indirect, significant, and positive impact of BCA governance strategy on SEP through the mediating role of environmental, cultural, and ethnic corporate activities, ECEAs), the results verified hypotheses H02a (β = 0.405, p-value < 0.05), H02b (β = 0.377, p-value < 0.05), H02c (β = 0.210, p-value < 0.05), H02d (β = 0.266, p-value < 0.05), and H02e (β = 0.242, p-value < 0.05). Hypotheses H02f (innovation success), and H02g (integrity success) were not verified.

For hypothesis H03 (indirect, significant, and positive impact of BCA governance strategy on SEP through the mediating role of corporate DEI and social initiatives, DEISIs), the results verified hypotheses H03a (β = 0.401, p-value < 0.05), H03b (β = 0.390, p-value < 0.05), H03c (β = 0.287, p-value < 0.05), H03d (β = 0.299, p-value < 0.05), H03f (β = 0.298, p-value < 0.05), and H03g (β = 0.331, p-value < 0.05). Hypothesis H03e (green success) was not verified.

Finally, for hypothesis H04 (indirect, significant, and positive impact of BCA governance strategy on SEP through the intervening role of ECEAs on the mediating role of DEISIs), the results verified all hypotheses as follows: H04a (β = 0.365, p-value < 0.05), H04b (β = 0.352, p-value < 0.05), H04c (β = 0.222, p-value < 0.05), H04d (β = 0.243, p-value < 0.05), H04e (β = 0.329, p-value < 0.05), H04f (β = 0.290, p-value < 0.05), and H04g (β = 0.383, p-value < 0.05).

Based on the p-value (<0.05) and the t-statistic values presented in Figure 8, 21 out of 28 research hypotheses were found to be statistically significant at a 95% confidence level. The findings from the hypotheses testing indicate that a corporate governance strategy for BCT transformation has a favorable impact on ESG model success dimensions especially when the corporate culture favors diversity, equity, inclusion, and environmental, cultural, and social activities.