FinTech, Fractional Trading, and Order Book Dynamics: A Study of US Equities Markets †

Abstract

1. Introduction

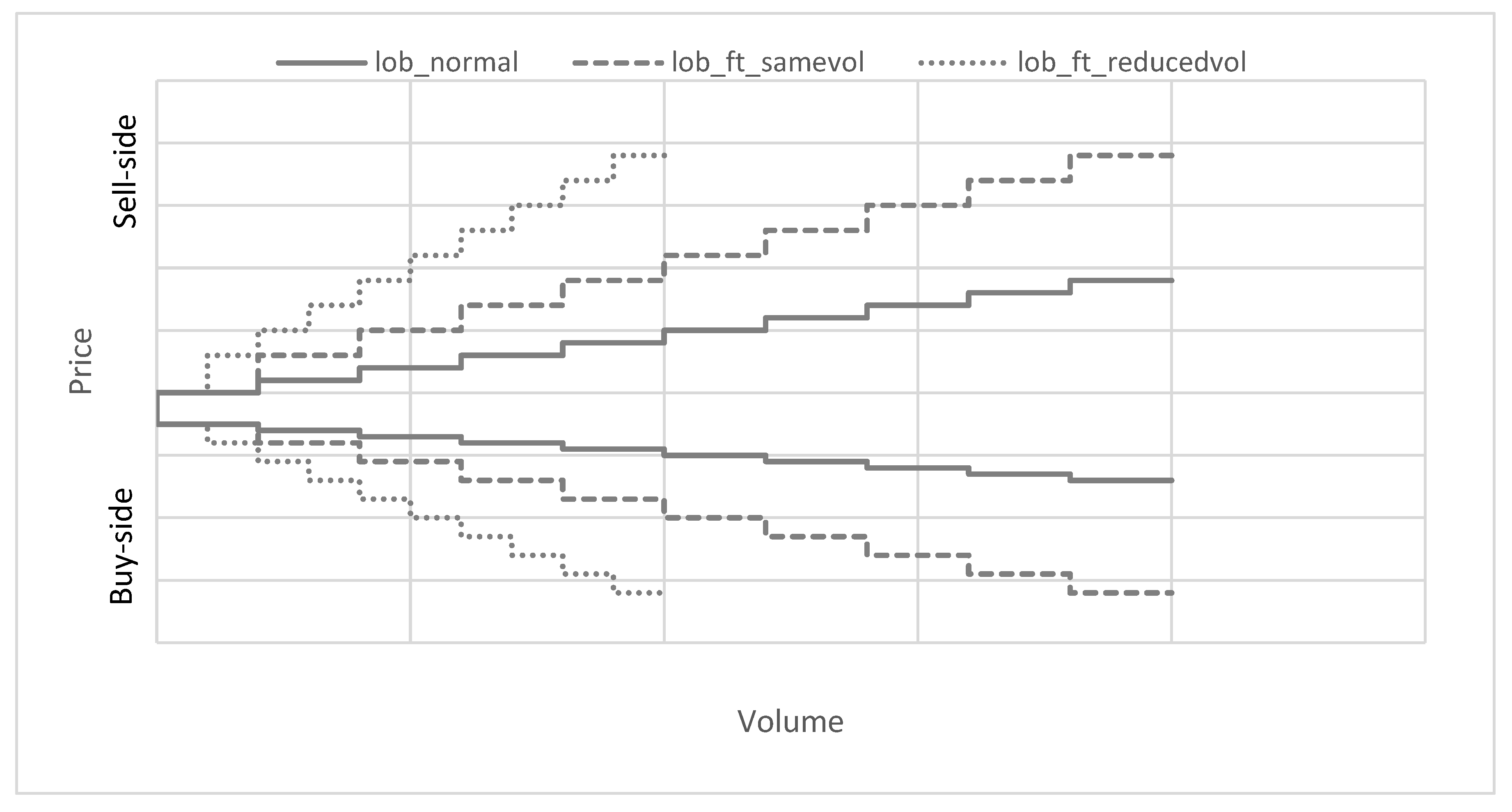

2. Limit Order Books and Their Information Content

3. Data and Methodology

4. Analysis by Top 5 and Top 10 Best Quotes

4.1. Empirical Tests and Results—Buy-Side

4.2. Empirical Tests and Results

4.3. Empirical Tests and Results—Sell-Side

- -

- The price impact factors (PIFs) increased significantly post-FinTech-FT for all four stocks (AAPL, AMZN, GOOG, and TSLA) on the other buy- and sell-sides, indicating higher execution costs.

- -

- The variance in PIFs increased sharply post-FinTech-FT, indicating reduced depth and more volatile price–volume structures.

- -

- The results consistently point to thinner liquidity and steeper order book slopes following the introduction of fractional trading.

- -

- These findings suggest that FinTech-FT significantly affects market microstructure, making trade execution more costly and uncertain.

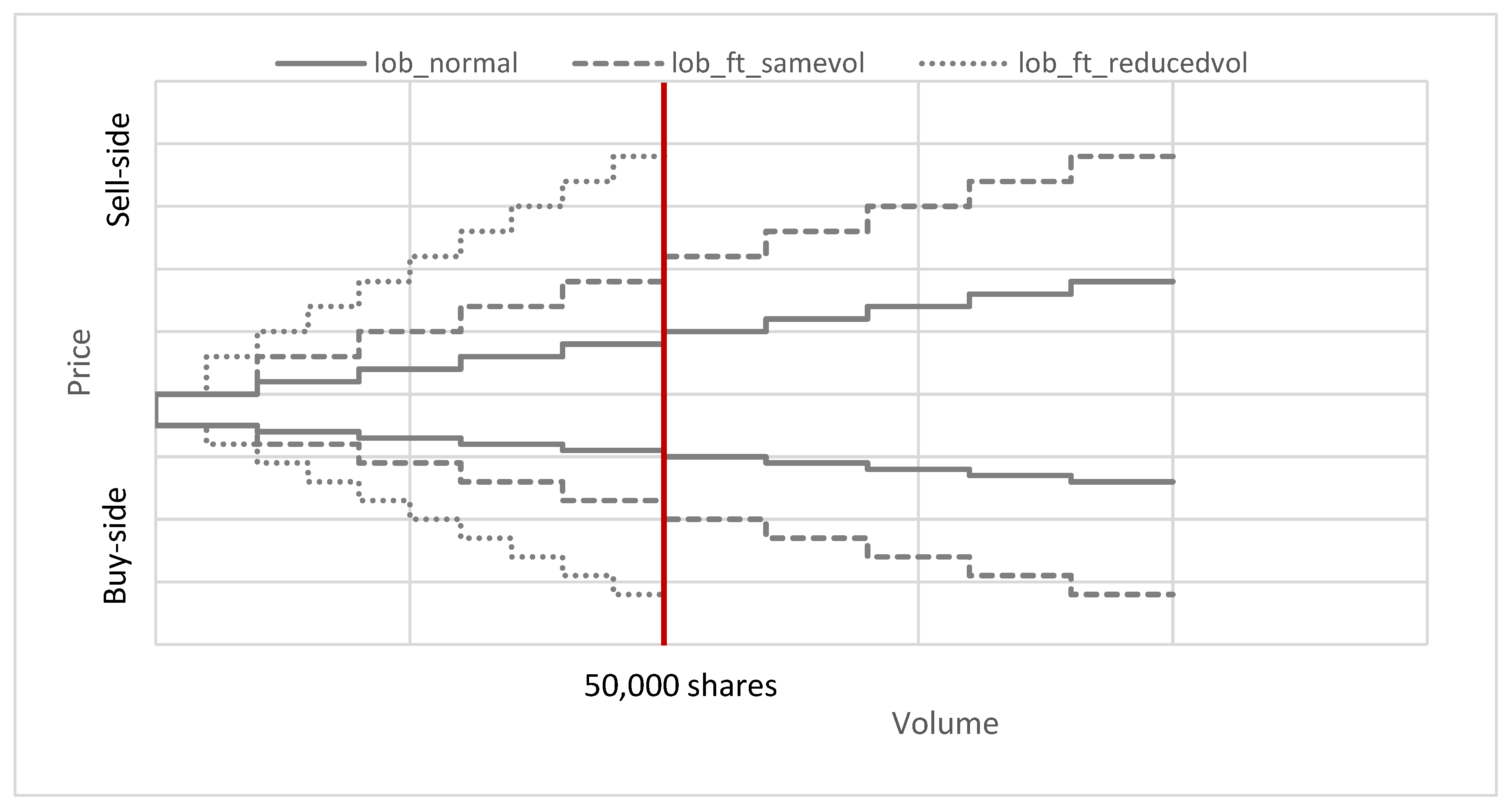

5. Analysis by Fixed Cumulative Volume

5.1. Empirical Tests and Results—Buy-Side

5.2. Empirical Test and Results—Sell-Side

6. Conclusions and Discussion

- -

- Volatility Monitoring and Market Surveillance: Given the observed rise in price volatility post-FinTech-FT, regulators should consider developing more granular, real-time monitoring tools specifically targeted at detecting unusual retail-driven volume surges or potential “pump-and-dump” patterns.

- -

- LOB Structure and Tick Size Rules: Our results show that the average tick size and price impact values increased. Regulators might revisit the tick size regime, especially for heavily traded stocks where too-wide ticks could discourage limit orders and exacerbate volatility. A tiered tick size framework, sensitive to trading volume and volatility, could help maintain LOB efficiency.

- -

- Retail Investor Protection and Execution Standards: Since FinTech-FT has increased market participation by less experienced investors (non-professional ones), the evidence of increased volatility and steeper LOBs highlights the need for better investor education around execution costs and order types. Enforcing stricter “best execution” standards for brokers handling fractional trades could reduce hidden costs for retail participants.

- -

- Liquidity Support for Institutional Trades: The observed fragmentation of liquidity suggests that institutional investors now face higher trading costs. To address this, market makers could be incentivized—through rebates or minimum quote requirements—to provide deeper liquidity during periods of increased small-order flow.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

Appendix A.1. Price Impact Factors Using the 10 Best Quotes

| PIF10 | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AAPL | AMZN | GOOG | TSLA | |||||||||||||

| Buy-Side | Sell-Side | Buy-Side | Sell-Side | Buy-Side | Sell-Side | Buy-Side | Sell-Side | |||||||||

| Dates | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 |

| Mean | −0.0009 | −0.0014 * | 0.0009 | 0.0015 * | −0.0022 | −0.0055 * | 0.003 | 0.0064 * | −0.0015 | −0.0024 * | 0.0014 | 0.0022 * | −0.0017 | −0.0045 * | 0.0021 | 0.0059 * |

| Ratio of means | 1 | 1.48 | 1 | 1.54 | 1 | 2.52 | 1 | 2.11 | 1 | 1.62 | 1 | 1.51 | 1 | 2.57 | 1 | 2.76 |

| Variance | 2E-08 | 9E-08 * | 1E-08 | 7E-08 * | 1E-07 | 3E-06 * | 3E-07 | 4E-06 * | 7E-09 | 7E-08 * | 3E-08 | 3E-07 * | 6E-08 | 4E-07 * | 1E-07 | 7E-07 * |

| Ratio of variances | 1 | 3.97 | 1 | 5.97 | 1 | 24.39 | 1 | 12.5 | 1 | 9.42 | 1 | 9.54 | 1 | 5.93 | 1 | 5.39 |

| Dates | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 |

| Mean | −0.0008 | −0.0014 * | 0.0008 | 0.0015 * | −0.0029 | −0.0055 * | 0.0024 | 0.0064 * | −0.0013 | −0.0024 * | 0.0011 | 0.0022 * | −0.0017 | −0.0045 * | 0.0018 | 0.0059 * |

| Ratio of means | 1 | 1.75 | 1 | 1.77 | 1 | 1.92 | 1 | 2.65 | 1 | 1.81 | 1 | 2.03 | 1 | 2.54 | 1 | 3.25 |

| Variance | 2E-08 | 9E-08 * | 2E-08 | 7E-08 * | 2E-06 | 3E-06 * | 1E-07 | 4E-06 * | 1E-08 | 7E-08 * | 4E-09 | 3E-07 * | 1E-07 | 4E-07 * | 9E-08 | 7E-07 * |

| Ratio of variances | 1 | 3.73 | 1 | 4.53 | 1 | 1.33 | 1 | 30.79 | 1 | 5.39 | 1 | 62.31 | 1 | 3.21 | 1 | 7.56 |

| Dates | Jul2019 | Jul2020 | Jul2019 | Jul2020 | Nov2019 | Nov2020 | Nov2019 | Nov2020 | Nov2019 | Nov2020 | Nov2019 | Nov2020 | Jul2019 | Jul2020 | Jul2019 | Jul2020 |

| Mean | −0.001 | −0.0016 * | 0.0007 | 0.0019 * | −0.0022 | −0.0058 * | 0.003 | 0.0139 * | −0.0015 | −0.0022 * | 0.0014 | 0.0030 * | −0.0019 | −0.0068 * | 0.0025 | 0.0047 * |

| Ratio of means | 1 | 1.63 | 1 | 2.53 | 1 | 2.64 | 1 | 4.58 | 1 | 1.45 | 1 | 2.06 | 1 | 3.56 | 1 | 1.82 |

| Variance | 6E-08 | 2E-07 * | 6E-09 | 9E-08 * | 1E-07 | 6E-07 * | 3E-07 | 3E-06 * | 7E-09 | 1E-07 * | 3E-08 | 5E-08 * | 6E-08 | 1E-06 * | 1E-06 | 3E-07 |

| Ratio of variances | 1 | 2.69 | 1 | 14.47 | 1 | 5 | 1 | 10.91 | 1 | 22.79 | 1 | 1.84 | 1 | 18.4 | 1 | 0.26 |

| Dates | Feb2019 | Feb2021 | Feb2019 | Feb2021 | Feb2019 | Feb2021 | Feb2019 | Feb2021 | ||||||||

| Mean | −0.0029 | −0.0071 * | 0.0024 | 0.0102 * | −0.0013 | −0.0026 * | 0.0011 | 0.0041 * | ||||||||

| Ratio of means | 1 | 2.48 | 1 | 4.21 | 1 | 1.95 | 1 | 3.78 | ||||||||

| Variance | 2E-06 | 2E-06 | 1E-07 | 1E-06 * | 1E-08 | 2E-07 * | 4E-09 | 1E-07 * | ||||||||

| Ratio of variances | 1 | 0.99 | 1 | 9.12 | 1 | 13.63 | 1 | 23.61 | ||||||||

| Dates | Nov2019 | Nov2021 | Nov2019 | Nov2021 | Nov2019 | Nov2021 | Nov2019 | Nov2021 | ||||||||

| Mean | −0.0022 | −0.0147 * | 0.003 | 0.0124 * | −0.0015 | −0.0053 * | 0.0014 | 0.0068 * | ||||||||

| Ratio of means | 1 | 6.63 | 1 | 4.09 | 1 | 3.54 | 1 | 4.64 | ||||||||

| Variance | 1E-07 | 2E-06 * | 3E-07 | 4E-06 * | 7E-09 | 1E-06 * | 3E-08 | 2E-06 * | ||||||||

| Ratio of variances | 1 | 13.94 | 1 | 13.86 | 1 | 143.15 | 1 | 67 | ||||||||

Appendix A.2. Data Processing Pipeline for NASDAQ ITCH Data

- Data Acquisition: The analysis utilizes the NASDAQ TotalView-ITCH 5.0 feed, which provides millisecond-level granularity on order book events, including order submissions, cancellations, modifications, and executions across the full depth of the order book.

- Binary Parsing and Storage Conversion: A custom Python 3.13.2 parser is developed to decode the raw binary data and extract relevant event-level information. The parsed data are stored in Hierarchical Data Format (HDF5), enabling efficient querying and time-based filtering, which is essential for handling large-scale intraday datasets.

- Limit Order Book (LOB) Reconstruction: Using the parsed event stream, the limit order book (LOB) is reconstructed at nanosecond granularity. Price and volume information is updated across the first ten levels (L1–L10) according to NASDAQ’s matching engine rules, following a First-In-First-Out (FIFO) logic. This process allows for a precise analysis of order book dynamics, particularly with respect to fractional trading’s impact.

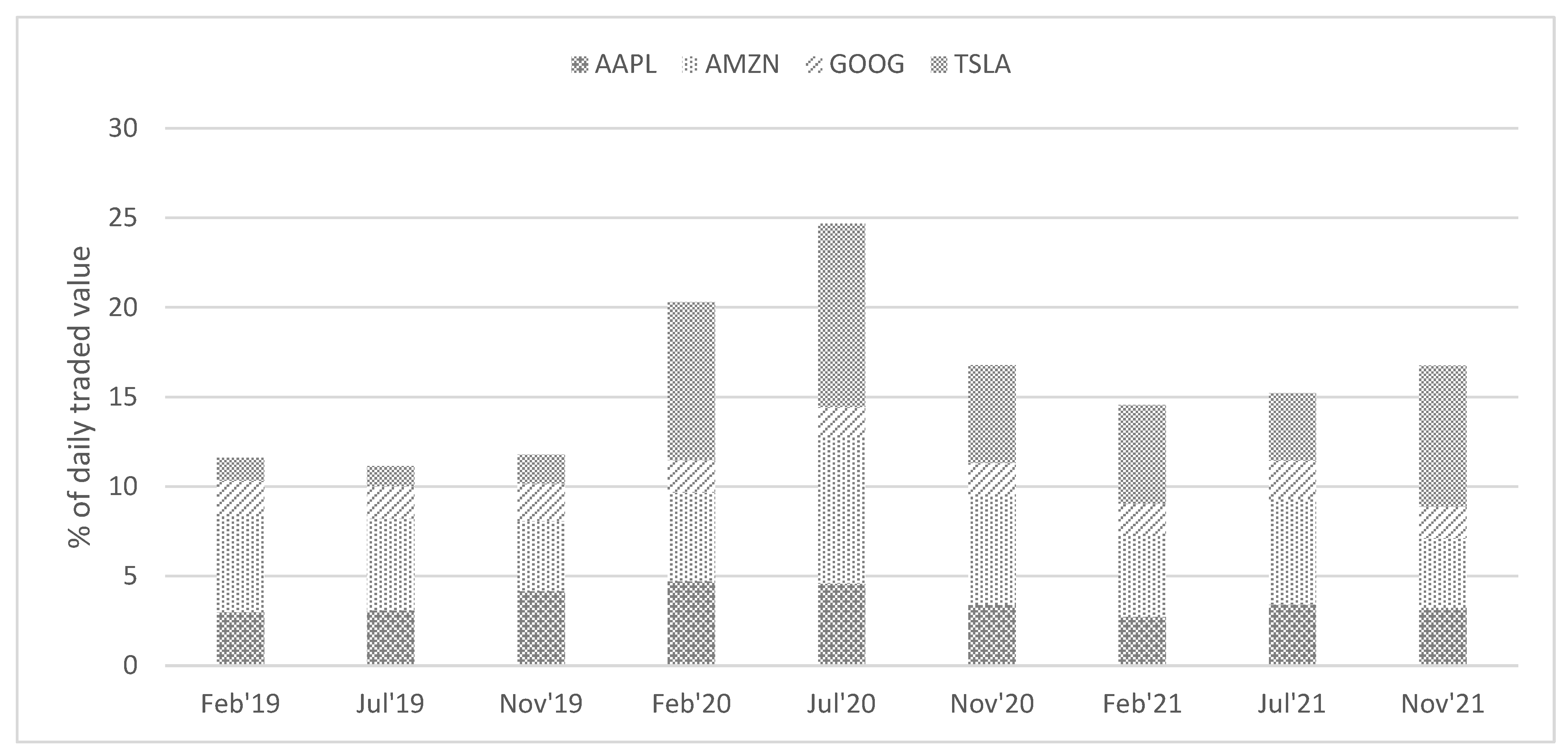

- Data Filtering and Selection: This study focuses on high-liquidity technology stocks—AAPL, AMZN, GOOG, and TSLA—due to their early adoption of fractional trading and their significant role in the NASDAQ ecosystem. These four stocks account for 15–20% of the daily traded value post the introduction of fractional trading in the study period (see Figure 2). Trading activity for each stock is extracted for both pre- and post-FinTech-FT periods to enable a comparative analysis of market conditions before and after the adoption of fractional trading.

- Feature Engineering and Metric Construction: Key market microstructure metrics are computed, including tick size, price volatility, price impact factor (PIF), order flow imbalance, and the depth and slope of the LOB. These indicators are calculated at high frequency and aggregated over intraday intervals to facilitate the comparison of market dynamics between the two regimes (pre- and post-FinTech-FT).

- Statistical Analysis: Statistical hypothesis testing is employed to identify significant changes in the LOB dynamics and investor behavior between the pre- and post-FinTech-FT periods. Robustness checks and visual summaries are incorporated to ensure the consistency and reliability of the results.

- Interpretation and Policy Relevance: The empirical findings are interpreted within the broader context of market structure, investor behavior, and regulatory implications. Emphasis is placed on understanding how FinTech and fractional trading influence price formation, liquidity, and market efficiency in a post-commission trading environment.

References

- Chordia, T.; Roll, R.; Subrahmanyam, A. Recent trends in trading activity and market quality. J. Financ. Econ. 2011, 101, 243–263. [Google Scholar] [CrossRef]

- Kirilenko, A.; Kyle, A.S.; Samadi, M.; Tuzun, T. The flash crash: High-frequency trading in an electronic market. J. Financ. 2017, 72, 967–998. [Google Scholar] [CrossRef]

- Zhang, Z.; Zohren, S.; Roberts, S. Deep reinforcement learning for trading. arXiv 2019, arXiv:1911.10107. [Google Scholar] [CrossRef]

- Lo, A.W. The Gordon Gekko Effect: The Role of Culture in the Financial Industry; No. w21267; National Bureau of Economic Research: Cambridge, MA, USA, 2015. [Google Scholar]

- Cong, L.W.; He, Z. Blockchain disruption and smart contracts. Rev. Financ. Stud. 2019, 32, 1754–1797. [Google Scholar] [CrossRef]

- Harz, D.; Knottenbelt, W. Towards safer smart contracts: A survey of languages and verification methods. arXiv 2018, arXiv:1809.09805. [Google Scholar]

- Barber, B.M.; Morse, A.; Yasuda, A. Impact investing. J. Financ. Econ. 2021, 139, 162–185. [Google Scholar] [CrossRef]

- D’Acunto, F.; Prabhala, N.; Rossi, A.G. The promises and pitfalls of robo-advising. Rev. Financ. Stud. 2019, 32, 1983–2020. [Google Scholar] [CrossRef]

- Tripathi, J.S.; Rengifo, E.W. The Impact of Fractional Trading on Risk Aversion for Non-professional Investors. Financ. Res. Lett. 2023, 52, 103547. [Google Scholar] [CrossRef]

- Berk, J.B.; Van Binsbergen, J.H. The impact of impact investing. J. Financ. Econ. 2025, 164, 103972. [Google Scholar] [CrossRef]

- Rengifo, E.W.; Trifan, E. How Investors Face Financial Risk: Loss Aversion and Wealth Allocation. J. Cent. Cathedra 2010, 3, 41–59. [Google Scholar] [CrossRef]

- Glosten, L.R.; Milgrom, P.R. Bid, ask and transaction prices in a specialist market with heterogeneously informed traders. J. Financ. Econ. 1985, 14, 71–100. [Google Scholar] [CrossRef]

- Kahneman, D.; Tversky, A. Prospect Theory: An Analysis of Decision under Risk. Econometrica 1979, 47, 263–291. [Google Scholar] [CrossRef]

- Tversky, A.; Kahneman, D. Advances in prospect theory: Cumulative representation of uncertainty. J. Risk Uncertain. 1992, 5, 297–323. [Google Scholar] [CrossRef]

- Kyle, A.S. Continuous auctions and insider trading. Econom. J. Econom. Soc. 1985, 53, 1315–1335. [Google Scholar] [CrossRef]

- Glosten, L.R. Is the electronic open limit order book inevitable? J. Financ. 1994, 49, 1127–1161. [Google Scholar] [CrossRef]

- Bolton, P.; Freixas, X.; Gambacorta, L.; Mistrulli, P.E. Relationship and transaction lending in a crisis. Rev. Financ. Stud. 2016, 29, 2643–2676. [Google Scholar] [CrossRef]

- Madhavan, A. Market microstructure: A survey. J. Financ. Mark. 2000, 3, 205–258. [Google Scholar] [CrossRef]

- Da, Z.; Fang, V.W.; Lin, W. Fractional Trading. 2021. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3949697 (accessed on 1 April 2024).

- Gempesaw, D.; Henry, J.J.; Velthuis, R. Piecing together the extent of retail fractional trading. Glob. Financ. J. 2022, 54, 100757. [Google Scholar] [CrossRef]

- Bartlett, R.P.; McCrary, J.; O’Hara, M. A Fractional Solution to a Stock Market Mystery. 2022. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4167890 (accessed on 1 April 2024).

- Bartlett, R.P.; McCrary, J.; O’Hara, M. Tiny Trades, Big Questions: Fractional Shares. 2022. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4248449 (accessed on 1 April 2024).

- Jansen, S. Machine Learning for Algorithmic Trading: Predictive Models to Extract Signals from Market and Alternative Data for Systematic Trading Strategies with Python; Packt Publishing Ltd.: Birmingham, UK, 2020. [Google Scholar]

| PIF5 | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AAPL | AMZN | GOOG | TSLA | |||||||||||||

| Buy-Side | Sell-Side | Buy-Side | Sell-Side | Buy-Side | Sell-Side | Buy-Side | Sell-Side | |||||||||

| Dates | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 |

| Mean | −0.0009 | −0.0014 * | 0.001 | 0.0013 * | −0.0025 | −0.0056 * | 0.0028 | 0.0048 * | −0.0015 | −0.0030 * | 0.0014 | 0.0026* | −0.0017 | −0.0046 * | 0.0024 | 0.0062* |

| Ratio of means | 1 | 1.47 | 1 | 1.36 | 1 | 2.26 | 1 | 1.74 | 1 | 1.96 | 1 | 1.82 | 1 | 2.69 | 1 | 2.59 |

| Variance | 3E-08 | 9E-08 * | 1E-08 | 5E-08 * | 2E-07 | 3E-06 * | 4E-07 | 2E-06 * | 1E-08 | 2E-07 * | 3E-08 | 5E-07 * | 7E-08 | 7E-07 * | 2E-07 | 1E-06 * |

| Ratio of variances | 1 | 3.36 | 1 | 3.63 | 1 | 18.14 | 1 | 4.88 | 1 | 19.81 | 1 | 16.11 | 1 | 9.89 | 1 | 4.84 |

| Dates | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 |

| Mean | −0.0008 | −0.0014 * | 0.0008 | 0.0013 * | −0.0029 | −0.0056 * | 0.0021 | 0.0048 * | −0.0013 | −0.0030 * | 0.0011 | 0.0026 * | −0.0018 | −0.0046 * | 0.0017 | 0.0062 * |

| Ratio of means | 1 | 1.74 | 1 | 1.63 | 1 | 1.89 | 1 | 2.28 | 1 | 2.27 | 1 | 2.43 | 1 | 2.56 | 1 | 3.64 |

| Variance | 2E-08 | 9E-08 * | 2E-08 | 5E-08 * | 7E-06 | 3E-06 | 8E-08 | 2E-06 * | 1E-08 | 2E-07 * | 4E-09 | 5E-07 * | 1E-07 | 7E-07 * | 1E-07 | 1E-06 * |

| Ratio of variances | 1 | 3.83 | 1 | 2.41 | 1 | 0.42 | 1 | 26.79 | 1 | 20.22 | 1 | 110.46 | 1 | 5.27 | 1 | 10.1 |

| Dates | Jul2019 | Jul2020 | Jul2019 | Jul2020 | Nov2019 | Nov2020 | Nov2019 | Nov2020 | Nov2019 | Nov2020 | Nov2019 | Nov2020 | Jul2019 | Jul2020 | Jul2019 | Jul2020 |

| Mean | −0.001 | −0.0015 * | 0.0007 | 0.0019 * | −0.0025 | −0.0056 * | 0.0028 | 0.0103 * | −0.0015 | −0.0021 * | 0.0014 | 0.0029* | −0.0019 | −0.0082 * | 0.0022 | 0.0043 * |

| Ratio of means | 1 | 1.46 | 1 | 2.43 | 1 | 2.26 | 1 | 3.69 | 1 | 1.4 | 1 | 2.03 | 1 | 4.25 | 1 | 1.91 |

| Variance | 7E-08 | 3E-09 * | 7E-09 | 9E-08 * | 2E-07 | 7E-07 * | 4E-07 | 4E-06 * | 1E-08 | 5E-07 * | 3E-08 | 6E-08 * | 7E-08 | 2E-06 * | 5E-07 | 2E-07 |

| Ratio of variances | 1 | 1.56 | 1 | 12.62 | 1 | 4.09 | 1 | 10 | 1 | 45.08 | 1 | 1.97 | 1 | 35.93 | 1 | 0.51 |

| Dates | Feb2019 | Feb2021 | Feb2019 | Feb2021 | Feb2019 | Feb2021 | Feb2019 | Feb2021 | ||||||||

| Mean | −0.0029 | −0.0071 * | 0.0021 | 0.0111 * | −0.0013 | −0.0025 * | 0.001 | 0.0042 * | ||||||||

| Ratio of means | 1 | 2.38 | 1 | 5.17 | 1 | 1.93 | 1 | 3.89 | ||||||||

| Variance | 7E-06 | 3E-06 | 8E-08 | 2E-06 * | 1E-08 | 2E-07 * | 4E-09 | 1E-07 * | ||||||||

| Ratio of variances | 1 | 0.36 | 1 | 26.72 | 1 | 19.4 | 1 | 32.29 | ||||||||

| Dates | Nov2019 | Nov2021 | Nov2019 | Nov2021 | Nov2019 | Nov2021 | Nov2019 | Nov2021 | ||||||||

| Mean | −0.0025 | −0.0143 * | 0.0028 | 0.0127 * | −0.0015 | −0.0056 * | 0.0014 | 0.0073 * | ||||||||

| Ratio of means | 1 | 5.74 | 1 | 4.54 | 1 | 3.62 | 1 | 5.00 | ||||||||

| Variance | 3E-07 | 4E-06 * | 4E-07 | 8E-06 * | 1E-08 | 2E-06 * | 3E-08 | 3E-06 * | ||||||||

| Ratio of variances | 1 | 22.96 | 1 | 18.18 | 1 | 148.09 | 1 | 104.78 | ||||||||

| PIF50k | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AAPL | AMZN | GOOG | TSLA | |||||||||||||

| Buy-Side | Sell-Side | Buy-Side | Sell-Side | Buy-Side | Sell-Side | Buy-Side | Sell-Side | |||||||||

| Dates | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 |

| Mean | −0.0009 | −0.0013 * | 0.0017 | 0.0036 * | −0.0023 | −0.0064 * | 0.0096 | 0.0190 * | −0.0018 | −0.0022 * | 0.0033 | 0.0051 * | −0.002 | −0.0062 * | 0.0042 | 0.0181 * |

| Ratio of means | 1 | 1.47 | 1 | 2.14 | 1 | 2.77 | 1 | 1.97 | 1 | 1.2 | 1 | 1.55 | 1 | 3.04 | 1 | 4.29 |

| Variance | 1E-08 | 6E-08 * | 5E-09 | 9E-08 * | 1E-07 | 2E-06 * | 1E-06 | 5E-06 * | 2E-08 | 4E-08 * | 9E-08 | 1E-07 * | 1E-07 | 5E-07 * | 2E-07 | 1E-06 * |

| Ratio of variances | 1 | 4.87 | 1 | 16.79 | 1 | 12.68 | 1 | 4.38 | 1 | 2.01 | 1 | 1.58 | 1 | 5.05 | 1 | 5.16 |

| Dates | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 |

| Mean | −0.0007 | −0.0013 * | 0.0013 | 0.0036 * | −0.0042 | −0.0064 * | 0.0124 | 0.0190 * | −0.0016 | −0.0022 * | 0.003 | 0.0051 * | −0.0019 | −0.0062 * | 0.0055 | 0.0181 * |

| Ratio of means | 1 | 1.69 | 1 | 2.65 | 1 | 1.53 | 1 | 1.53 | 1 | 1.34 | 1 | 1.67 | 1 | 3.23 | 1 | 3.28 |

| Variance | 2E-08 | 6E-08 * | 3E-08 | 9E-08 * | 7E-07 | 2E-06 * | 2E-06 | 5E-06 * | 2E-08 | 4E-08 * | 2E-08 | 1E-07 * | 7E-08 | 5E-07 * | 2E-07 | 1E-06 * |

| Ratio of variances | 1 | 3.37 | 1 | 3.12 | 1 | 2.56 | 1 | 2.85 | 1 | 2.15 | 1 | 5.77 | 1 | 7.82 | 1 | 4.41 |

| Dates | Jul2019 | Jul2020 | Jul2019 | Jul2020 | Nov2019 | Nov2020 | Nov2019 | Nov2020 | Nov2019 | Nov2020 | Nov2019 | Nov2020 | Jul2019 | Jul2020 | Jul2019 | Jul2020 |

| Mean | −0.0009 | −0.0015 * | 0.0012 | 0.0029 * | −0.0023 | −0.0070 * | 0.0096 | 0.0202 * | −0.0018 | −0.0026 * | 0.0033 | 0.0051 * | −0.0016 | −0.0066 * | 0.0038 | 0.0225 * |

| Ratio of means | 1 | 1.64 | 1 | 2.82 | 1 | 3.01 | 1 | 2.09 | 1 | 1.41 | 1 | 1.56 | 1 | 3.94 | 1 | 5.89 |

| Variance | 2E-08 | 8E-08 * | 3E-08 | 7E-08 * | 1E-07 | 4E-06 * | 1E-06 | 2E-06 * | 2E-08 | 8E-08 * | 9E-08 | 4E-07 * | 5E-08 | 5E-07 * | 4E-07 | 6E-06 * |

| Ratio of variances | 1 | 3.66 | 1 | 2.01 | 1 | 27.4 | 1 | 1.52 | 1 | 4.59 | 1 | 5.04 | 1 | 9.56 | 1 | 14.9 |

| Dates | Feb2019 | Feb2021 | Feb2019 | Feb2021 | Feb2019 | Feb2021 | Feb2019 | Feb2021 | ||||||||

| Mean | −0.0042 | −0.0103 * | 0.0124 | 0.0183 * | −0.0016 | −0.0032 * | 0.003 | 0.0081 * | ||||||||

| Ratio of means | 1 | 2.44 | 1 | 1.48 | 1 | 1.95 | 1 | 2.66 | ||||||||

| Variance | 7E-07 | 3E-06 * | 2E-06 | 2E-06 | 2E-08 | 7E-08 * | 2E-08 | 3E-07 * | ||||||||

| Ratio of variances | 1 | 3.87 | 1 | 0.98 | 1 | 4.12 | 1 | 12.1 | ||||||||

| Dates | Nov2019 | Nov2021 | Nov2019 | Nov2021 | Nov2019 | Nov2021 | Nov2019 | Nov2021 | ||||||||

| Mean | −0.0023 | −0.0154 * | 0.0096 | 0.0279 * | −0.0018 | −0.0095 * | 0.0033 | 0.0147 * | ||||||||

| Ratio of means | 1 | 6.6 | 1 | 2.89 | 1 | 5.08 | 1 | 4.47 | ||||||||

| Variance | 1E-07 | 2E-06 * | 1E-06 | 1E-05 * | 2E-08 | 3E-06 * | 9E-08 | 2E-06 * | ||||||||

| Ratio of variances | 1 | 11.37 | 1 | 7.95 | 1 | 184.88 | 1 | 27.34 | ||||||||

| Steps50k | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AAPL | AMZN | GOOG | TSLA | |||||||||||||

| Buy-Side | Sell-Side | Buy-Side | Sell-Side | Buy-Side | Sell-Side | Buy-Side | Sell-Side | |||||||||

| Dates | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 |

| Mean | 38.95 | 39.90 * | 40.94 | 40.94 | 50.93 | 54.70 * | 53.23 | 54.85 * | 51.18 | 52.18 * | 54.9 | 53.84 * | 51.76 | 51.82 | 52.46 | 49.46 * |

| Ratio of means | 1 | 1.02 | 1 | 1 | 1 | 1.07 | 1 | 1.03 | 1 | 1.02 | 1 | 0.98 | 1 | 1 | 1 | 0.94 |

| Variance | 2E+00 | 1E+00 | 9E-01 | 1.81 * | 2E+01 | 1E+01 | 2E+01 | 1E+01 | 4E+00 | 3E+00 | 4E+00 | 3E+00 | 4E+00 | 16.43 * | 5E+00 | 14.13 * |

| Ratio of variances | 1 | 0.64 | 1 | 2.13 | 1 | 0.66 | 1 | 0.55 | 1 | 0.81 | 1 | 0.67 | 1 | 4.1 | 1 | 2.65 |

| Dates | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 |

| Mean | 35.17 | 39.90 * | 37.05 | 35.94 * | 48.37 | 54.70 * | 49.57 | 54.85 * | 47.58 | 52.18 * | 47.84 | 53.84 * | 49.02 | 51.82 * | 50.09 | 49.46 * |

| Ratio of means | 1 | 1.13 | 1 | 0.97 | 1 | 1.13 | 1 | 1.11 | 1 | 1.09 | 1 | 1.13 | 1 | 1.06 | 1 | 0.99 |

| Variance | 3E+00 | 1E+00 | 6E-01 | 1.81 * | 4E+01 | 1E+01 | 3E+01 | 1E+01 | 2E+00 | 3.08 * | 2E+00 | 2.90 * | 8E+00 | 16.43 * | 1E+01 | 1E+01 |

| Ratio of variances | 1 | 0.45 | 1 | 2.92 | 1 | 0.29 | 1 | 0.38 | 1 | 2.03 | 1 | 1.74 | 1 | 2.09 | 1 | 1.01 |

| Dates | Jul2019 | Jul2020 | Jul2019 | Jul2020 | Nov2019 | Nov2020 | Nov2019 | Nov2020 | Nov2019 | Nov2020 | Nov2019 | Nov2020 | Jul2019 | Jul2020 | Jul2019 | Jul2020 |

| Mean | 37.52 | 43.14 * | 36.9 | 42.37 * | 50.93 | 59.83 * | 53.23 | 56.94 * | 51.18 | 59.38 * | 54.9 | 57.78 * | 50.76 | 50.79 | 50.33 | 49.64 * |

| Ratio of means | 1 | 1.15 | 1 | 1.15 | 1 | 1.17 | 1 | 1.07 | 1 | 1.16 | 1 | 1.05 | 1 | 1 | 1 | 0.99 |

| Variance | 1E+00 | 1E+00 | 7E-01 | 1E+00 | 2E+01 | 30.19 * | 2E+01 | 30.94 * | 4E+00 | 4E+00 | 4E+00 | 4E+00 | 2E+00 | 17.08 * | 4E+00 | 21.00 * |

| Ratio of variances | 1 | 0.92 | 1 | 1.66 | 1 | 1.77 | 1 | 1.49 | 1 | 1.17 | 1 | 0.96 | 1 | 11.16 | 1 | 4.82 |

| Dates | Feb2019 | Feb2021 | Feb2019 | Feb2021 | Feb2019 | Feb2021 | Feb2019 | Feb2021 | ||||||||

| Mean | 48.37 | 62.14 * | 49.56 | 57.82 * | 47.58 | 57.46 * | 47.84 | 58.23 * | ||||||||

| Ratio of means | 1 | 1.28 | 1 | 1.17 | 1 | 1.21 | 1 | 1.22 | ||||||||

| Variance | 4E+01 | 43.59 * | 3E+01 | 48.91 * | 2E+00 | 4.68 * | 2E+00 | 3.49 * | ||||||||

| Ratio of variances | 1 | 1.14 | 1 | 1.60 | 1 | 3.09 | 1 | 2.09 | ||||||||

| Dates | Nov2019 | Nov2021 | Nov2019 | Nov2021 | Nov2019 | Nov2021 | Nov2019 | Nov2021 | ||||||||

| Mean | 50.93 | 62.82 * | 53.23 | 61.56 * | 51.18 | 65.97 * | 54.89 | 63.86 * | ||||||||

| Ratio of means | 1 | 1.23 | 1 | 1.16 | 1 | 1.29 | 1 | 1.16 | ||||||||

| Variance | 2E+01 | 61.19 * | 2E+01 | 1E+01 | 4E+00 | 14.76 * | 4E+00 | 12.66 * | ||||||||

| Ratio of variances | 1 | 3.59 | 1 | 0.66 | 1 | 3.9 | 1 | 2.94 | ||||||||

| Average Tick Size | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AAPL | AMZN | GOOG | TSLA | |||||||||||||

| Buy-Side | Sell-Side | Buy-Side | Sell-Side | Buy-Side | Sell-Side | Buy-Side | Sell-Side | |||||||||

| Dates | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 | Nov2019 | Feb2020 |

| Mean | 0.0117 | 0.0169 * | 0.0209 | 0.045 * | 0.0231 | 0.0632 * | 0.0899 | 0.1843 * | 0.0183 | 0.0212 * | 0.0301 | 0.0503 * | 0.02 | 0.0638 * | 0.0414 | 0.1927 * |

| Ratio of means | 1 | 1.44 | 1 | 2.15 | 1 | 2.73 | 1 | 2.05 | 1 | 1.16 | 1 | 1.67 | 1 | 3.18 | 1 | 4.65 |

| Variance | 1E-06 | 1E-05 * | 1E-06 | 1E-05 * | 5E-06 | 3E-04 * | 1E-04 | 4E-04 * | 1E-06 | 3E-06 * | 8E-06 | 1E-05 * | 1E-05 | 9E-05 * | 3E-05 | 2E-04 * |

| Ratio of variances | 1 | 10.61 | 1 | 14.69 | 1 | 52.43 | 1 | 3.45 | 1 | 2.42 | 1 | 1.66 | 1 | 6.89 | 1 | 7.54 |

| Dates | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 | Feb2019 | Feb2020 |

| Mean | 0.0113 | 0.0169* | 0.0184 | 0.0450* | 0.0454 | 0.0632* | 0.1321 | 0.1843* | 0.0175 | 0.0212* | 0.0333 | 0.0503* | 0.0199 | 0.0638* | 0.0566 | 0.1927* |

| Ratio of means | 1 | 1.49 | 1 | 2.44 | 1 | 1.39 | 1 | 1.39 | 1 | 1.21 | 1 | 1.51 | 1 | 3.19 | 1 | 3.4 |

| Variance | 2E-06 | 1E-05* | 5E-06 | 1E-05* | 8E-05 | 3E-04* | 3E-04 | 4E-04* | 1E-06 | 3E-06* | 2E-06 | 1E-05* | 1E-05 | 9E-05* | 5E-05 | 2E-04* |

| Ratio of variances | 1 | 6.79 | 1 | 2.88 | 1 | 3.03 | 1 | 1.4 | 1 | 1.8 | 1 | 5.76 | 1 | 9.17 | 1 | 3.98 |

| Dates | Jul2019 | Jul2020 | Jul2019 | Jul2020 | Nov2019 | Nov2020 | Nov2019 | Nov2020 | Nov2019 | Nov2020 | Nov2019 | Nov2020 | Jul2019 | Jul2020 | Jul2019 | Jul2020 |

| Mean | 0.0129 | 0.0184* | 0.0173 | 0.0345 * | 0.0231 | 0.0585 * | 0.0899 | 0.1882 * | 0.0183 | 0.0223 * | 0.0301 | 0.0454 * | 0.0168 | 0.0712 * | 0.0383 | 0.2314 * |

| Ratio of means | 1 | 1.43 | 1 | 1.99 | 1 | 2.53 | 1 | 2.09 | 1 | 1.22 | 1 | 1.51 | 1 | 4.22 | 1 | 6.04 |

| Variance | 3E-06 | 1E-05 * | 6E-06 | 7E-06 * | 5E-06 | 1E-04 * | 1E-04 | 2E-04 * | 1E-06 | 6E-06 * | 8E-06 | 4E-05 * | 5E-06 | 8E-05 * | 4E-05 | 8E-04 * |

| Ratio of variances | 1 | 3.88 | 1 | 1.23 | 1 | 19.71 | 1 | 2.04 | 1 | 5.74 | 1 | 4.85 | 1 | 16.82 | 1 | 18.95 |

| Dates | Feb2019 | Feb2021 | Feb2019 | Feb2021 | Feb2019 | Feb2021 | Feb2019 | Feb2021 | ||||||||

| Mean | 0.0454 | 0.0808 * | 0.1321 | 0.1709 * | 0.0175 | 0.0286 * | 0.0333 | 0.0712 * | ||||||||

| Ratio of means | 1 | 1.78 | 1 | 1.29 | 1 | 1.63 | 1 | 2.13 | ||||||||

| Variance | 8E-05 | 5E-05 | 3E-04 | 2E-04 | 1E-06 | 4E-06 * | 2E-06 | 3E-05 * | ||||||||

| Ratio of variances | 1 | 0.64 | 1 | 0.74 | 1 | 2.78 | 1 | 10.89 | ||||||||

| Dates | Nov2019 | Nov2021 | Nov2019 | Nov2021 | Nov2019 | Nov2021 | Nov2019 | Nov2021 | ||||||||

| Mean | 0.0231 | 0.1317 * | 0.0898 | 0.2545 * | 0.0183 | 0.0682 * | 0.0301 | 0.1117 * | ||||||||

| Ratio of means | 1 | 5.69 | 1 | 2.83 | 1 | 3.73 | 1 | 3.71 | ||||||||

| Variance | 5E-06 | 1E-04 * | 1E-04 | 7E-04 * | 1E-06 | 1E-04 * | 8E-06 | 1E-04 * | ||||||||

| Ratio of variances | 1 | 20.86 | 1 | 6.24 | 1 | 135.03 | 1 | 15.26 | ||||||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tripathi, J.S.; Rengifo, E.W. FinTech, Fractional Trading, and Order Book Dynamics: A Study of US Equities Markets. FinTech 2025, 4, 16. https://doi.org/10.3390/fintech4020016

Tripathi JS, Rengifo EW. FinTech, Fractional Trading, and Order Book Dynamics: A Study of US Equities Markets. FinTech. 2025; 4(2):16. https://doi.org/10.3390/fintech4020016

Chicago/Turabian StyleTripathi, Janhavi Shankar, and Erick W. Rengifo. 2025. "FinTech, Fractional Trading, and Order Book Dynamics: A Study of US Equities Markets" FinTech 4, no. 2: 16. https://doi.org/10.3390/fintech4020016

APA StyleTripathi, J. S., & Rengifo, E. W. (2025). FinTech, Fractional Trading, and Order Book Dynamics: A Study of US Equities Markets. FinTech, 4(2), 16. https://doi.org/10.3390/fintech4020016