1. Introduction

FinTech represents a set of technologies that innovate and improve current financial services. These include solutions such as blockchain technology, online platforms, mobile applications, artificial intelligence (AI), and more.

The impact of FinTech technologies on financial inclusion has been widely studied, highlighting the way they reduce costs and expand access to financial services. FinTech offers users the opportunity to manage their financial activities through automated platforms that use specific algorithms, thus facilitating the financial decision-making process. Technologies such as blockchain and digital payments contribute significantly to the modernization and efficiency of financial services, offering users more accessible and flexible solutions. Financial technology (FinTech) contributes significantly to increasing operational efficiency, improving the quality of services, and increasing managerial transparency and security while providing increased comfort for users, which justifies the rapid expansion of this field in recent years [

1].

In addition, big data analysis plays an essential role in gaining in-depth insights into consumer behaviors and needs, supporting the development of personalized solutions [

2,

3].

The impact of FinTech on higher education institutions can be noted in the context of the COVID-19 pandemic, which has generated movement and interaction restrictions. This context has accelerated the level of innovation and the digitization of universities by offering online payment services, digitizing the registration process, managing and archiving documents electronically, carrying out collection and payment operations via electronic means, as well as implementing online teaching services [

4].

Recent global events and changes in financial practices have underscored the need for a financially educated population capable of making informed decisions amid economic uncertainty. The implementation of digital technologies in higher education institutions, along with the involvement of the business environment and the banking sector, has created a favorable environment for increasing the level of digital and financial education globally. In this context, digital innovations, including financial technologies, provide new opportunities for enhancing financial literacy by enabling more inclusive and accessible education tools [

5]. However, educational challenges associated with FinTech persist, highlighting the need for an appropriate regulatory framework and the integration of these technologies to ensure the long-term success of financial education [

5,

6].

While financial education is a broad field, key themes are emerging that influence its effectiveness. This study aims to investigate the role of financial education and digitization in higher education institutions, emphasizing on their contributions to the development of the public sector, private sector, and civil society. It will also aim to identify and contextualize the main topic areas in financial literacy through the analysis of related keyword clusters.

This study examines financial literacy in higher education, with a focus on its linkages to access, behavior, and well-being. While financial technologies (FinTechs) serve as a supportive mechanism, the analysis emphasizes the foundational role of financial literacy in societal and economic resilience.

This paper brings into discussion a bibliometric analysis to approach the subject of FinTech as an element of change. Bibliometric analysis is a relatively new research method that has gained popularity in several academic fields, including finance. It is part of a broader scientometric discipline, defined as the study of the quantitative characteristics of science and scientific research [

7].

Recent bibliometric analyses have shown that the number of publications on FinTech has doubled in the last five years, with a focus on emerging topics such as data security and digital inclusion [

2,

8].

By examining 469 articles from the Web of Science database (2020–2024), this paper aims to identify trends and perspectives on financial education and information technology innovation impacting higher education.

The objectives include understanding the way financial education, information technology innovation, and the implementation of digitization can contribute to reducing economic discrepancies between various sectors, optimize organizational processes, and support digital transformation and accessibility within higher education institutions.

In the context of the diversification and increasing complexity of financial education, the perspective on the intercorrelation between the FinTech field and higher education can be expanded, leading to the adaptation, development, and progression of economic entities through FinTech mechanisms [

9,

10,

11].

FinTech has opened up new career opportunities for students in areas such as AI-based financial services, cyber security, and RegTech (regulatory technology). Universities collaborate with FinTech companies to provide students with hands-on experience in these sectors. Through FinTech internships and incubation programs, students gain direct access to the cutting-edge technologies that are transforming the financial industry.

The intersection of FinTech and higher education is a dynamic and constantly evolving space. The Markets in Crypto-Assets Regulation (MiCA) legislation is specific to the European Union and was adopted by the European Parliament and the Council of 31 May 2023 on markets in crypto assets in the “Regulation (EU) 2023/1114”, Revised Payment Services Directive (PSD2); this legislation is specific to the European Union and was adopted by the European Parliament through the “Directive (EU) 2015/2366 of the European Parliament and of the Council of 25 November 2015 on payment services in the internal market, amending Directives 2002/65/EC, 2009/110/EC and 2013/36/EU and Regulation (EU) No 1093/2010, and repealing Directive 2007/64/EC (Text with EEA relevance)” for updates, and it enhances the EU rules put in place by the initial PSD, which was adopted in 2007. The PSD2 entered into force on 12 January 2016, and EU Member States were given until 13 January 2018 to transpose it into national law and Digital Operational Resilience Act (DORA); this legislation is specific to the European Union and was adopted by the European Parliament and the Council of 14 December 2022 in the “Regulation (EU) 2022/2554 on digital operational resilience for the financial sector and amending Regulations (EC) No 1060/2009, (EU) No 648/2012, (EU) No 600/2014, (EU) No 909/2014 and (EU) 2016/1011”; this regulation entered into force on 16 January 2023 and will apply as of 17 January 2025. Although this legislation is mainly aimed at financial institutions, it has significant implications for universities as well. As institutions adopt new financial technologies and incorporate FinTech into their curricula, they simultaneously navigate the challenges of regulatory compliance and cybersecurity.

2. Literature Review

FinTech represents a new paradigm in finance, aiming for an equally innovative approach to regulation such as ’smart regulation’ and the use of regulatory technologies (RegTechs) to monitor and enforce compliance. Key regulatory strategies, including sandbox environments, innovation hubs, and new frameworks, are essential to ensure that FinTech innovations are well regulated while promoting financial stability, inclusion, and sustainability [

12].

Starting from the 19th century to the present, looking at the historical evolution of FinTech, we can discuss the increasing role of technology in finance, focusing in particular on the rise in artificial intelligence (AI), blockchain-distributed ledger technology (DLT), cryptocurrencies, and central bank digital currencies (CBDCs). These technological advances are transforming traditional financial services and institutions by creating efficiencies, improving financial inclusion, and providing innovative solutions in both society and higher education institutions.

The integration of artificial intelligence (AI) and chatbots into the financial technology (FinTech) industry and the education system is transforming the way companies interact with customers and teachers with their students while also leading to advances in predictive analytics. AI and machine learning (ML) enable FinTech companies and higher education institutions to automate repetitive tasks, improve security, and provide personalized experiences for customers and students. These technologies are particularly useful in areas such as fraud detection, customer service, financial advice, and financial education, providing solutions that were previously unimaginable for human brain processing.

The emergence of FinTech offers tools that enhance financial education, such as AI-based learning platforms and digital finance management applications. These tools complement broader efforts to promote financial literacy by improving accessibility and user engagement.

Higher education institutions play a key role in researching FinTech developments, including distributed ledger technologies, decentralized finance (DeFi), and central bank digital currencies (CBDCs). EU regulations such as MiCA and DORA shape the framework in which universities conduct research on these technologies, ensuring that innovations align with legal and ethical standards [

13].

As FinTech becomes a dominant force in global finance, universities are increasingly incorporating FinTech-related subjects into their curricula. Courses in blockchain, artificial intelligence in finance, and digital payments have become an integral part of business and finance curricula across Europe, reflecting a growing trend to adapt curricula to new emerging technologies in the financial sector. Renowned universities such as the University of Hong Kong and Harvard University are leaders in integrating FinTech education at the academic level. These institutions have adopted innovative strategies to support the development of student’s skills in emerging fields such as blockchain, artificial intelligence, and digital payments. Their collaborations with the FinTech industry contribute to the development of study programs that meet the needs of a constantly changing financial sector [

10,

12,

13].

One of the most significant applications of AI in FinTech is its ability to handle large amounts of data, performing complex analyses to identify patterns and risks. As noted in the literature, AI can streamline processes such as payment processing, credit scoring, and fraud detection, allowing financial institutions to mitigate risk more effectively. AI can also support researchers and teachers by analyzing large data sets of information to obtain results in the shortest possible time and in the most efficient way with the aim of sharing them with students and the civil society to increase the well-being and the education level of the population [

14].

AI is also used in predictive analytics to forecast customer behavior and financial trends. By analyzing historical data, AI can help FinTech companies predict future outcomes, such as changes in stock prices, interest rates, or market trends. This information enables companies to make more informed decisions by optimizing their cross-selling strategies, risk management, and portfolio management [

14].

Developments in AI are proceeding at a rapid pace. While AI has already played a role in our daily lives for several years, AI and robotics are driving innovation, leading to new business models and playing a key role in transforming our societies and digitizing the economy in many sectors, including industry, education, health, construction, and transport [

15].

Despite the many benefits of AI and chatbots in FinTech, there are challenges associated with their implementation. A major problem is the shortage of skilled AI professionals, which has slowed the adoption of AI technologies in some financial institutions as well as in some sectors such as higher education institutions. Furthermore, although AI can provide accurate predictions and improve security, it is not immune to errors, and the consequences of such mistakes can be significant in the financial industry, in various sectors of the economy, and in the research area [

14].

FinTech, in addition to the undeniable benefits that it has brought and continues to bring to society, also presents potential risks that can be associated in particular with those related to cyber security, data privacy, and market dominance by large technology companies (BigTechs). The literature also addresses the critical role of regulation in mitigating systemic risks, ensuring that the benefits of digital finance are realized in both developed and developing economies.

AI and chatbots have revolutionized and are revolutionizing the FinTech industry by improving customer experience, improving operational efficiency, and providing valuable predictive insights. As FinTech companies continue to adopt these technologies, they are reshaping the way financial services are delivered, making them more personalized, secure, and accessible. However, overcoming the challenges of talent shortages and customer trust will be crucial to the successful integration of AI into financial, research, and education ecosystems. As AI and chatbots continue to evolve, their roles in FinTech will expand, providing new opportunities for innovation both in customer and student services, as well as in the financial management of companies and higher education institutions.

3. Research Methodology

By means of bibliometric analysis, frequently used keywords and evolving ideas can be identified, offering perspectives on future trends [

15,

16]. This analysis is based on quantitative measurements and investigative techniques applied to written documents [

17].

In order to accomplish the bibliometric analysis, the Web of Science database was used, whereas for their processing, the VOSviewer application was used. Taking into consideration the fact that the FinTech field and the academic environment of higher education have visible connections only in the economic sphere, we intended to make a correlation between the two categories and find an area of intercorrelation in the valuable scientific literature contained in the Web of Science. By applying tagging techniques and using specific filters from the Web of Science database, 469 relevant scientific articles were identified. By processing their specific data (article title, keywords, abstract country of origin of authors, and connections between articles) new points of view can be generated in terms of FinTech higher education intercorrelation. The research was based on a systematic analysis of the scientific literature by applying several comparative bibliometric analyzes on 469 scientific research articles that offer some perspectives on the manifestation of the FinTech higher education correlation.

Bibliometrics, although a useful method for analyzing the scientific literature, can encounter significant difficulties in capturing all relevant aspects of a research field, due to the large and ever-expanding volume of information. Thus, carrying out a comprehensive and high-quality bibliometric analysis requires a considerable effort in the organization and interpretation of data, and their diversity requires substantial resources [

18,

19,

20].

The Web of Science database query began with the primary tag “higher education FinTech”, resulting in 345 articles. To maximize the breadth of identified connections be-tween FinTech and the educational environment, additional labels such as “personal fi-nance management”, “modern financial technologies”, and “financial education” were included. The following Boolean operators facilitated this process:

TS = (“FinTech in Higher Education”) AND TS = (“personal finance management”) AND TS = (“financial education”) AND TS = (“modern financial management”), ensures results that address FinTech while simultaneously incorporating key subtopics. In this query, the TS (topic) field searches for specified terms within article titles, abstracts, or keywords.

TS = (“FinTech in Higher Education”) AND (TS = (“personal finance manage-ment”) OR TS = (“digital finance management”)) AND (TS = (“financial education”) OR TS = (“financial literacy”)) expanded the scope of the search by considering alternative terminologies, such as “financial literacy” alongside “financial education”.

The authors wanted the conclusions drawn from this bibliometric analysis to be based on accessible and up-to-date scientific research. This was achieved by using the following filters that exist in the Web of Science database:

Articles, because the published papers are filtered through the reviews specific to each journal;

Open Access, because articles published in this form can be studied for free;

Publication years 2020–2024, because we wanted to study the content of articles published in the last 5 years.

By applying these three filters, our selection provided 469 articles, which was then subjected to bibliometric analysis.

The first approach within the bibliometric analysis was the analysis according to the years of publication and according to the country of origin of the authors of the scientific articles.

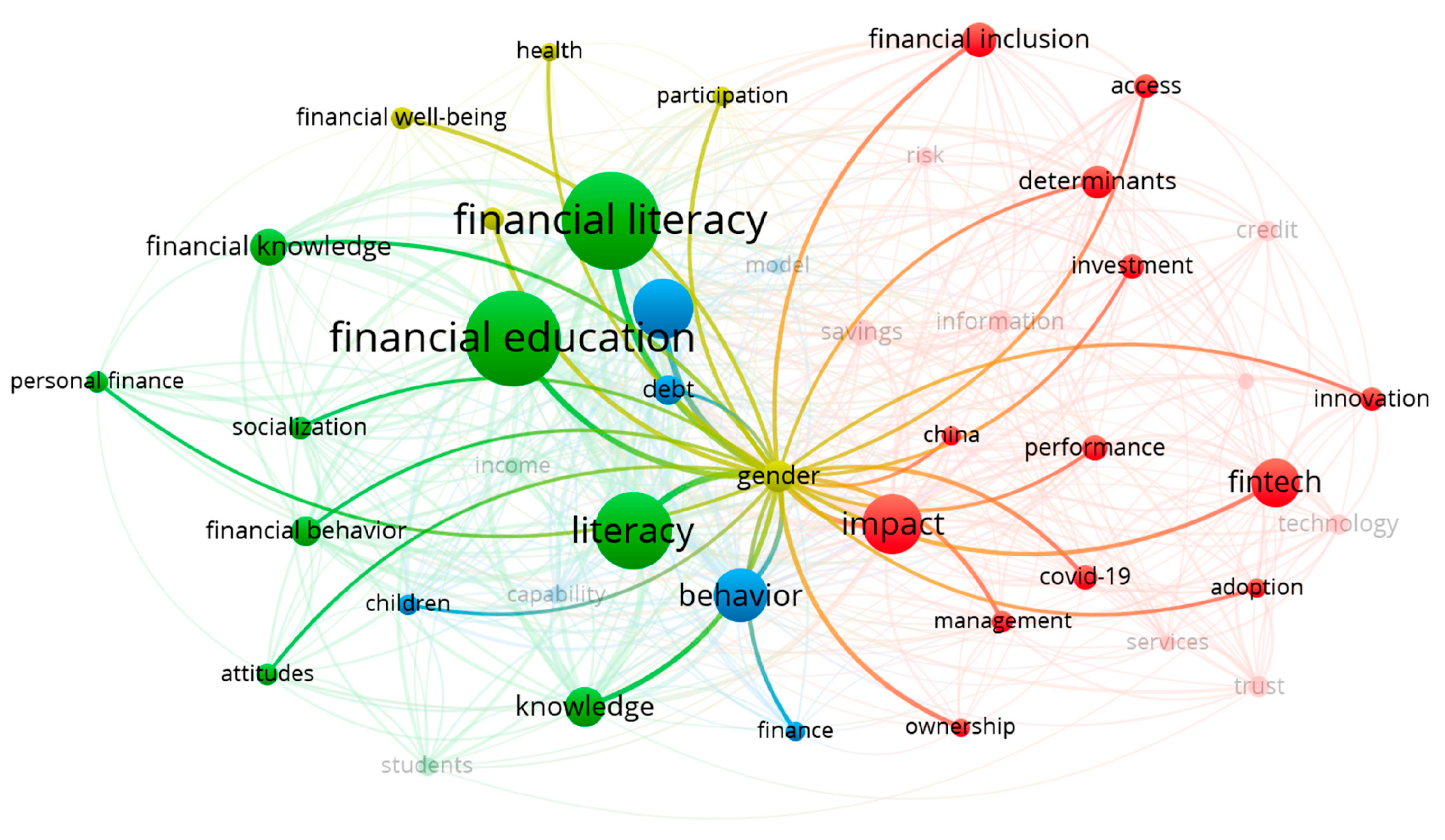

To capture new aspects and correlations between FinTech and the educational environment resulting from clustering analysis, we used the VOSviewer software by applying the following filters: co-occurrence filters, author keywords, and minimum 9 co-occurrences. Clusters within the VOSviewer program are generated as item pairs.

Through this process, keywords were grouped, where each keyword’s occurrence and link strength were calculated to determine its association with others. The strength of the link between the terms, based on co-occurrence, enabled the identification of clusters within the broader field of financial literacy. The data set generated four primary clusters whose composition is presented in the following Table in Results and Discussion. Each cluster comprises terms related to specific thematic areas in financial literacy, highlighting aspects such as access, attitudes, behavior, and well-being.

The objective of this bibliometric analysis is to examine key themes in financial literacy research, including access, behavior, and well-being, while considering the role of digital innovations such as FinTech in facilitating these outcomes.

4. Results and Discussion

The evolution of the number of articles in the sample is presented in

Table 1, with information on the number of articles included when applying Keywords and Keywords added.

The authors wanted this selection of scientific works to capture current theoretically grounded aspects to which we have access. That is why we used consecutive filters to select articles, specifically with open access and published in the last 5 years. The evolution of the number of articles in the selection following the successful application of the filters is presented in

Table 2.

The number of 469 articles is the number in which the bibliometric analysis was performed using the specific filters of Web of Science and the VOSviewer application [

21].

From the analysis of the annual distribution over the 5 years, an increase in the number of articles can be observed every year, excluding the year 2024 which has not been completed, which leads us to a conclusion that in the course of the development of the FinTech field, more and more bridges to higher education academia are found. The evolution of the number of scientific articles is presented in

Table 3 [

21].

In

Figure 1, the first 12 countries according to the number of existing articles in the database subject to our research are analyzed with the help of the analysis of the bibliometric results from the Web of Science database and the density analysis of the countries of origin of the authors [

21]. From the analysis of the distribution of the articles by country, we see that there are countries from all continents, which leads us to the conclusion that the analysis undertaken by us is of worldwide interest.

Another analysis carried out was on the research area presented in

Figure 2 [

21]. We see that the predominant fields are related to the economic field and the information technology field.

A new analysis regarding the density of phrases or words used in the 469 selected articles was carried out with the help of the VOSviewer program by applying the co-occurrence filter for all keywords with an appearance of at least 9 times. Only 44 words/phrases out of the 2148 analyzed met this criterion, and

Figure 3 shows the distribution and links between words/phrases resulting from the application of the filters.

After processing the data with the help of the VOSviewer program, the words and phrases that have the highest density included financial literacy, financial education, literacy, impact, education, behavior, knowledge, financial behavior, and financial knowledge. Also, through the VOSviewer program, we obtained the classification of words according to total link strength, which is presented in

Table 4.

From the analysis of the VOSviewer program on the 44 keywords/phrases that appear at least 9 times within the 469 articles, four clusters emerged; their composition is presented in

Table 5. The cluster represents a set of elements included in a bibliometric map; articles belong to only one cluster, and we can have articles that do not belong to any cluster. Based on the information contained in each cluster, we will deepen the analysis for each cluster separately, taking into account the strength of the links of the keywords with the highest density and the links in these and other clusters. Thus, these bibliometric maps give us a new picture of the subject matter and existing orientations within the scientific articles.

Next, we will comment on the content of the four clusters and try to present some aspects of the FinTech higher education relationship.

Within cluster 1, we can see that articles included in it have channeled the fundamental aspects of financial literacy, such as “access”, “adoption-of strategies”, “impact”, and “credit”. High-frequency terms such as “financial literacy” (135 occurrences) and “education” (63 occurrences) emphasize the importance of making financial knowledge accessible. Additionally, terms such as “COVID-19” suggest that recent global events have impacted financial access, shaping the educational needs and challenges people face in the financial realm [

22].

Within cluster 2, the behavioral components of financial literacy are addressed, including “attitudes”, “financial behaviour”, and “financial knowledge”. With ’financial behaviour’ and ’capability’ as central themes, this cluster captures the intersection between knowledge and actionable behavior. The emphasis on behavioral terms reflects the growing need for financial education programs that not only impart knowledge but also promote positive financial habits.

Cluster 3 is focused on ability and demographics; this group includes keywords such as “children”, “debt”, and “education”. Here, the focus on young people (“kids”) suggests an awareness of the critical role that early financial education plays in building long-term financial literacy. Terms like “ability” and “debt” indicate that financial literacy is critical to managing financial challenges from an early age, ultimately contributing to better financial decision-making in adulthood.

Culture 4, the smallest but a significant group, focuses on financial health and well-being, with keywords such as “gender”, “health”, and “participation”. This cluster reflects the growing awareness of the impact of financial education on quality of life and overall well-being. The inclusion of “gender” highlights the need for inclusive financial education efforts that address the specific financial challenges faced by various demographic groups, including women.

The results of these groups reveal how financial literacy encompasses more than just acquiring knowledge. Instead, it is a multi-faceted field that addresses accessibility, behavioral development, capacity building, and well-being. Cluster 1’s focus on access and education reflects fundamental needs such as creating opportunities for financial learning, while cluster 2 demonstrates that financial literacy must go beyond knowledge to drive behavior change. Cluster 3, focused on youth and capability, and this indicates a proactive approach to financial education, focusing on early education. Finally, cluster 4 aligns with recent trends that view financial well-being as part of overall health, suggesting that financial literacy contributes to a holistic sense of quality of life.

The group also emphasizes the need for targeted approaches in financial education. For example, financial education programs could tailor content to specific demographic needs, such as youth or underrepresented groups, to maximize their impact.

To analyze the links between and within the clusters, we chose one word from each, with the strongest links within each, according to the data in

Table 5:

For cluster 1: ”keyword

impact with link strength 200”, (

Figure 4);

For cluster 2: ”keyword

financial literacy with link strength 340”, (

Figure 5);

For cluster 3: ”keyword

behavior with link strength 182”, (

Figure 6);

For cluster 4: ”keyword

gender with link strength 74”, (

Figure 7);

Starting from the dominant keyword within this cluster, impact, we can group together several economic notions to formulate a perspective on the correlations within the cluster:

access, adoption, financial inclusion, FinTech, and technology: articles containing these keywords suggest that “impact” could be related to how technology influences access to and the use of financial services;

investment, credit, and savings: articles containing these keywords suggest that “impact” could be related to financial results or effects on these areas;

risk and trust: articles dealing with this research area can address the impact of financial technology on risk perception and trust in financial systems;

innovation, management, and performance: articles specific to this area can refer to the operational and strategic impact in the FinTech landscape.

COVID-19 and China: we may have articles that present external or geographic impacts on FinTech development or access, given the effects of the pandemic globally.

Cluster analysis highlights the significance of access and education as foundational aspects of financial literacy. Digital innovations, including FinTech, contribute to these outcomes by facilitating easier access to financial information and tools, though their role is secondary to broader educational initiatives. By facilitating more inclusive, efficient, and transparent financial systems, FinTech continues to play a vital role in modern economic development [

23].

To analyze the relationship between “financial literacy” and other words in this cluster, we will evaluate potential connections based on context, thematic similarities, or typical associations found in financial research. Thus, we analyze the terms present in the cluster in relation to “financial literacy”.

The term “financial literacy” is associated with the following words in cluster 2:

attitudes: often reflect how beliefs and perceptions influence financial decisions, closely related to financial literacy;

financial behavior: refers to actions such as budgeting and saving, which are influenced by the level of financial literacy;

financial education: a direct source for improving financial literacy;

financial literacy: fundamental to financial literacy as it involves the understanding needed to make informed financial decisions;

income: although not directly literacy itself, it is often related to how well people manage their finances;

knowledge: general cognitive skills essential for literacy in any field, including finance;

literacy: generally, it refers to financial skills and understanding;

personal finance: practical application of financial literacy to money management;

socialization: influences how individuals learn financial habits and attitudes, shaping financial literacy;

students: a key group often studied in relation to the development of financial literacy.

These connections indicate that “financial literacy” serves as a central node interconnected with education, behavior, knowledge, and attitudes, all of which contribute to or are influenced by an individual’s financial competence.

Measuring the impact of financial literacy involves evaluating how financial education or literacy programs influence individuals’ financial knowledge, behavior, and outcomes.

By using a combination of these measurement methods, researchers and policymakers can assess not only the short-term knowledge gains but also the long-term behavioral and economic benefits of financial education initiatives.

Leveraging technological advances in the financial literacy process leads to the acquisition of knowledge and the development of tools necessary to make the better financial decisions needed to build long-term financial security. By incorporating these factors, financial literacy programs can go beyond simply imparting knowledge and foster lasting behavior changes that lead to improved long-term financial well-being.

The results obtained within this cluster confirm that financial education remains a major challenge, thereby having a significant impact on citizens’ financial decisions. These findings are also supported by previous research, such as that carried out by Șimandan, Leuștean, and Dobrescu (2022), who emphasize that, despite economic progress and expanded access to financial services, financial education directly influences the financial behaviors of individuals and contributes to the perpetuation of existing economic inequalities [

24].

Articles within this cluster may highlight thematic relationships that may involve behavioral aspects in various contexts, such as financial capability, education, interactions with children, financial modeling, and debt management [

25].

Financial capability refers to the ability of individuals to effectively manage their financial resources. Behavioral patterns such as spending habits, saving tendencies, and risk aversion play a crucial role in determining financial capability. Responsible financial behavior can enhance capacity, while poor financial habits can impair it.

In the broader context of finance, behavior is a critical factor that drives market trends and investment decisions. Behavioral finance is an entire field that examines how psychological factors and biases affect the behavior of investors and financial analysts. Understanding behavior can reveal why markets might react irrationally to news or why individuals make poor financial choices despite having access to information.

In financial modeling, assumptions about human behavior are often integrated to predict financial trends and outcomes. Models can take into account behavioral patterns such as herd mentality in trading, consumer spending behavior, or the psychological impact of market volatility on investment strategies [

26]. These behavioral insights can make financial models more realistic and applicable in predicting real-world scenarios.

In conclusion, behavior intertwines with financial terms to shape both individual and financial health. By leveraging these technological resources, parents, teachers, and educators can make financial literacy more accessible, interactive, and engaging for children, preparing them for a future of informed and responsible money management.

Insights into behavioral trends enable better financial planning, policy making, and the development of tools that support healthier financial practices [

27].

To analyze the relationship between “gender” and the other words in this group, we will look at potential associations, themes, or contexts where the keywords might interconnect:

gender and financial well-being: These examine how gender influences financial stability or access to economic resources. These could include studies on gender pay gaps, disparities in financial literacy, or access to financial services;

gender and health: These explore how gender influences health outcomes and access to healthcare. This relationship often covers differences in life expectancy, health risks, and how medical research and healthcare policies might respond differently to different genders;

gender and participation: These investigate gender differences in participation in different sectors such as the workforce, education, or political representation. This analysis may reveal gender-specific barriers or opportunities;

gender and women-directly related: The examination of gender often involves a focus on the rights, roles, and challenges of women in society. This includes issues such as gender equality, empowerment, and specific policies aimed at improving conditions for women.

Cluster 4 reflects the critical connection between financial literacy and well-being. Gender and participation themes underscore the need for inclusive educational efforts, addressing disparities and promoting equitable access to financial resources.

5. Conclusions

The analyses carried out in this article emphasize the importance of grouping in understanding the various components of financial education. The content of the four clusters—access and literacy, behavior, capability, and well-being—captures key areas of focus in the field, reflecting a spectrum of educational needs. Financial literacy extends beyond knowledge to include behavior, health, and inclusion. Policymakers and educators can leverage these insights to design programs that address the full spectrum of financial literacy, contributing to a financially secure and capable society. Thus, some suggestions are required for future financial education strategies:

Educational programs should focus on fundamental topics such as budgeting, savings, and credit management, ensuring that these resources reach people who do not have and understand the concepts specific to this area or are less financially literate. Post-crisis resilience training could also be valuable [

28];

FinTech and educational actors should develop educational initiatives that emphasize behavioral change, including strategies for positive financial habits, impulse control, and long-term financial planning. Programs could also integrate insights from behavioral psychology to address the emotional aspects of financial decision-making;

Educational programs should target a younger audience, perhaps by integrating basic financial education into school curricula. These programs could cover topics such as budgeting, savings, and understanding debt to better prepare young adults for financial independence;

Supporting the development of inclusive, tailored financial education programs that address the specific needs of different demographics (e.g., women and marginalized communities). These programs can focus on financial independence, reducing financial stress and promoting financial security as part of overall wellness.

This study underscores the multifaceted nature of financial literacy, linking it to access, behavior, and well-being. While FinTech provides innovative tools that support these outcomes, the core emphasis remains on financial education as a driver of behavioral change and societal resilience. Policymakers and educators should prioritize inclusive financial literacy programs that address demographic-specific needs, leveraging digital innovations to enhance accessibility and impact.

By analyzing 469 scientific articles using bibliometric methods and the VOSviewer software, this study identified key thematic clusters that highlight the various aspects of financial education and its integration into digital innovation. Universities are increasingly including FinTech subjects in their curricula, giving students the opportunity to develop skills in areas such as AI-based financial services, cyber security and regulatory technologies.

Collaborative initiatives between academia and the FinTech industry, such as internships and incubators, provide hands-on exposure and align education with market demands.

In conclusion, financial education is often overlooked due to a combination of systemic, cultural, and policy factors. Addressing these barriers requires coordinated efforts by educational institutions, governments, and communities to prioritize financial literacy and recognize its critical role in fostering economic stability and personal well-being.

Overcoming these challenges requires coordinated efforts among educators, policymakers, and industry leaders to ensure equitable access and the adoption of financial technologies.

The intersection of FinTech and higher education is a dynamic and evolving field with the potential to drive both technological innovation and societal progress. By using FinTech to address gaps in financial literacy, institutions and governments can foster a financially capable population, enhance economic stability, and build resilience in the face of global uncertainties. Future research should explore deeper interconnections and develop innovative and inclusive strategies for promoting financial literacy in the digital age.

Limitations of the Study

To properly understand the results, discussions, and conclusions resulting from a bibliometric analysis, the limitations must be contextualized by the authors. In this article, data were collected exclusively from the Web of Science platform, and querying other databases may reveal additional aspects. The authors chose this database because they believed it to be representative and relevant to the research being conducted.