Analyses of Scientific Collaboration Networks among Authors, Institutions, and Countries in FinTech Studies: A Bibliometric Review

Abstract

1. Introduction

2. Systematic Literature Review as an Approach in Advancing FinTech Knowledge

3. Research Design

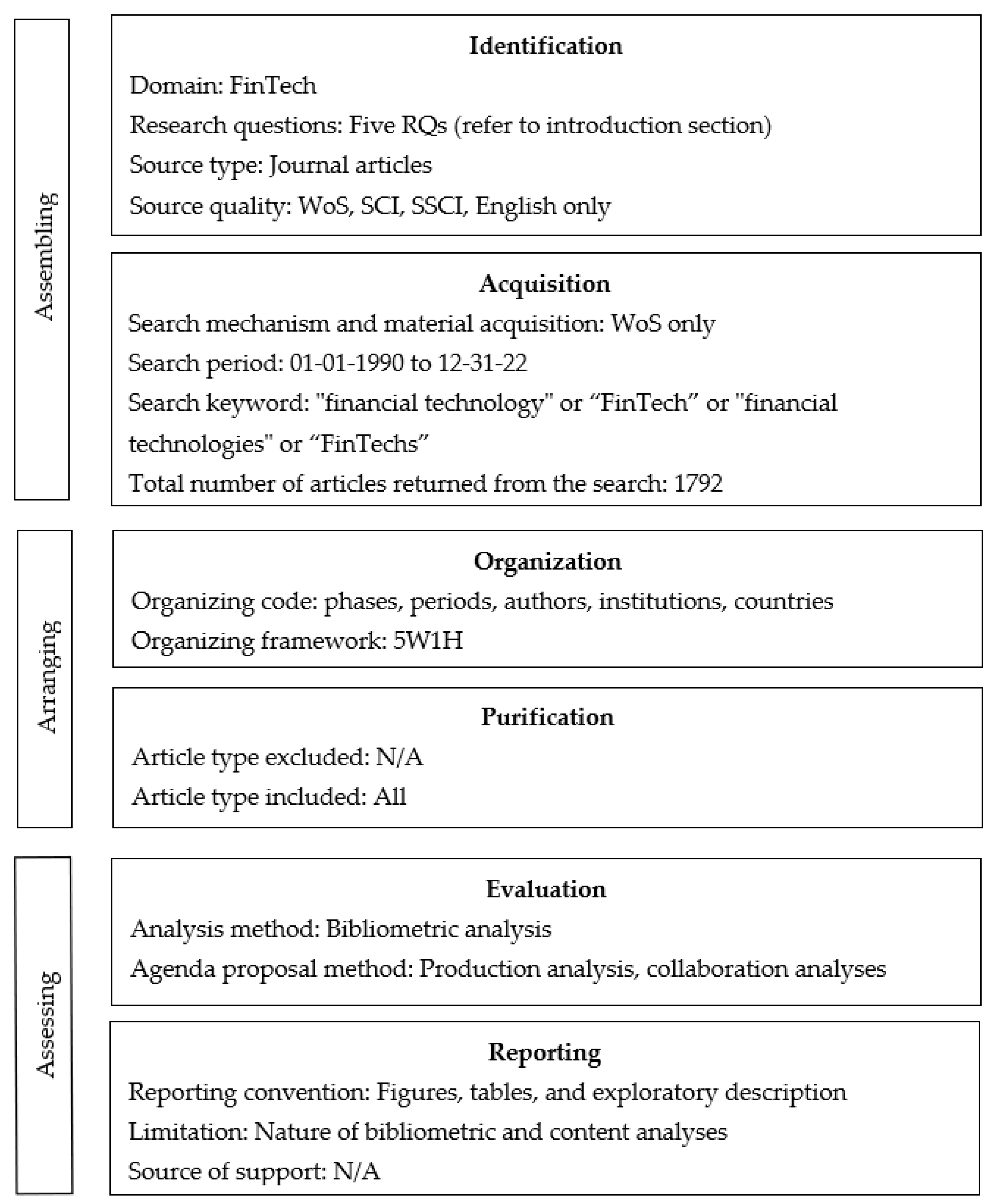

3.1. The Protocol of This Systemic Literature Review (SPAR-4-SLR)

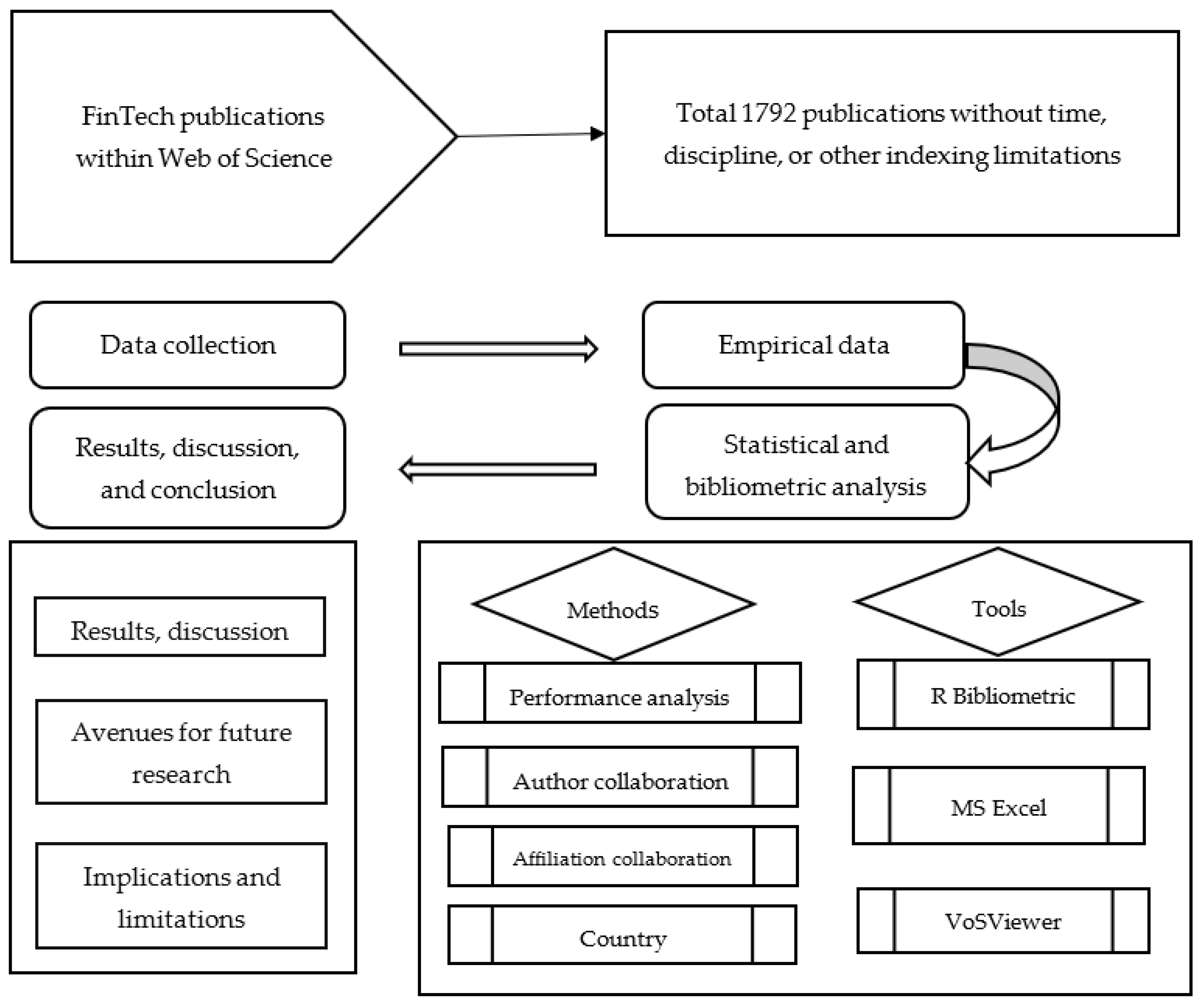

3.2. Bibliometric Analysis

3.3. Data Collection and Analysis Process

4. Results

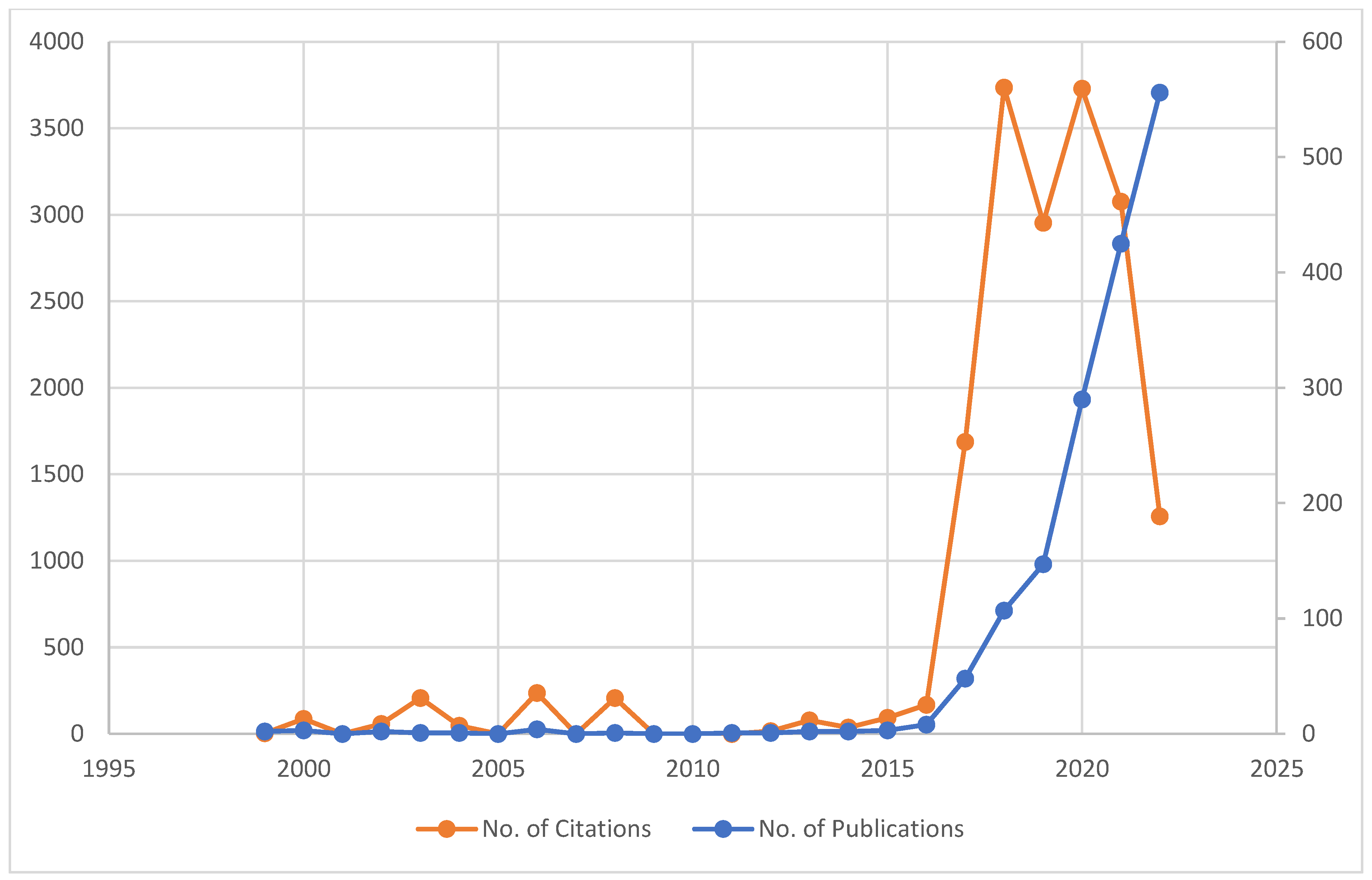

4.1. Production Analysis

4.2. Social Structure-Collaboration among Authors, Affiliations, and Countries

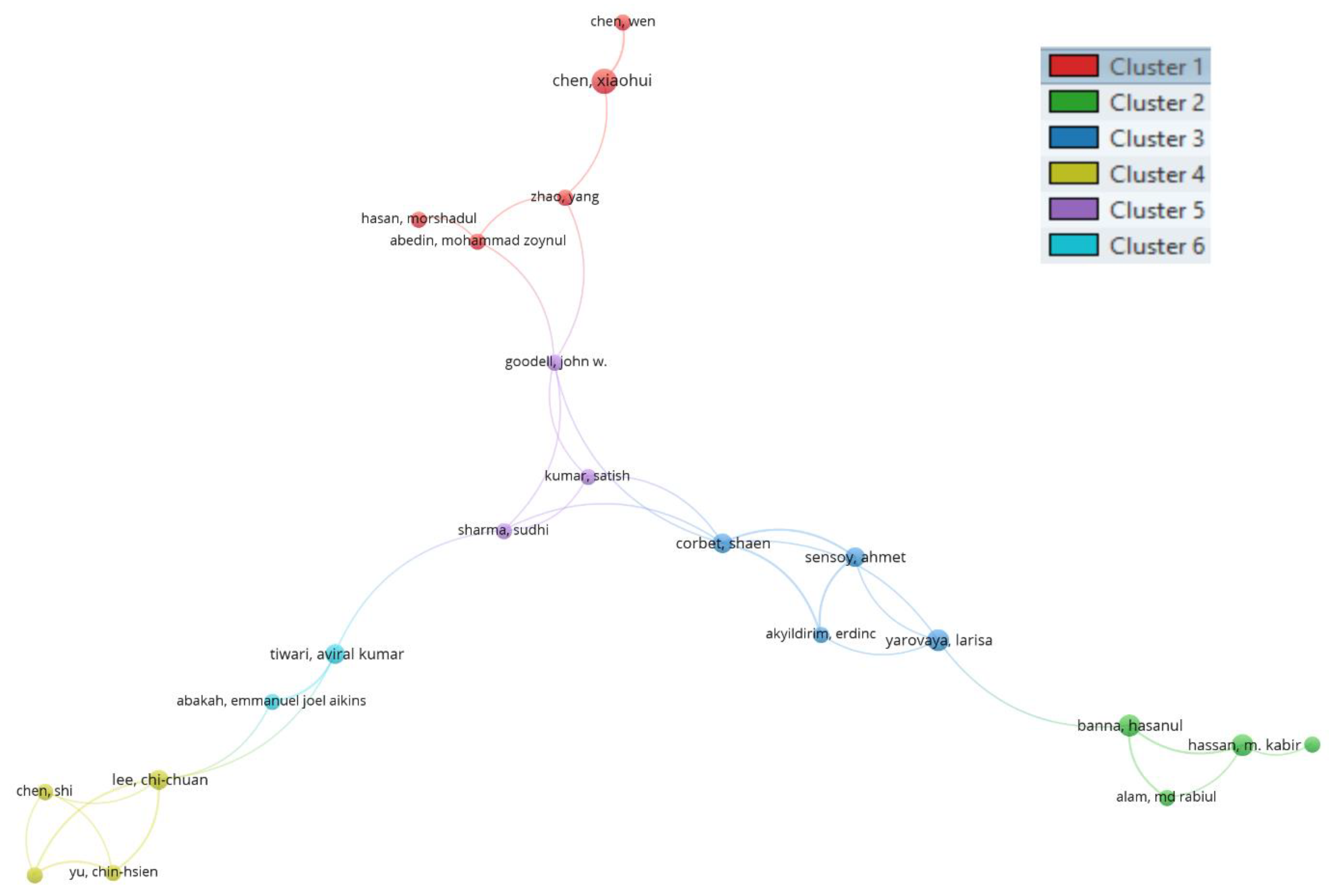

4.2.1. Authors’ Collaboration Networks

4.2.2. Institutional Collaboration Networks

4.2.3. Countries’ Collaboration Networks

5. Conclusions

Funding

Conflicts of Interest

Appendix A. Examples of Systematic Literature Reviews in FinTech

| Reference | Focuses of the Review | Findings and Contributions |

| [17] | FinTech and institutions | A framework for describing the changes in institutional models proposed by FinTech. This framework is based on a regulatory and financial institution adaptive perspective. Using this framework, we can clarify how FinTech modifies institutional behavior. |

| [18] | Blockchain and its potential applications | Identifying the business value generated by transactions, crypto-economic models, and automated and analytical processes involving organizations, individuals, and technologies. Blockchain-based applications solve various economic problems, such as storing/sharing information and generating consensus. |

| [19] | Green finance in developing countries | Green securities, green investments, climate finance, green insurance, green credit, green bonds, and green infrastructure are the primary green finance products offered by Bangladeshi banks. Additional factors include environmental performance, green economic growth, energy efficiency, green finance policies, environmental protection, and the impact of a bank’s policy formulation on risk. |

| [35] | Crowdfunding and P2P lending research | This study provides an overview of the current state of crowdfunding and peer-to-peer lending literature. Furthermore, it provides details on the co-citation analysis of authors, the co-occurrence analysis of author keywords, and the citation analysis of documents. Finally, the paper discusses the future directions for research in this burgeoning field. |

| [36] | Blockchain in FinTech | Fintech ecosystems are always evolving into new regimes. Blockchain is here to stay and is slowly permeating all aspects of society. Based on the categories of distributed ledger technologies and the most widely used blockchain platforms, a taxonomy of blockchain platforms was developed. After describing each Fintech ecosystem extensively, the paper presents use cases. Furthermore, it concludes that blockchain, at least in enterprise contexts, still faces a number of challenges due to its infancy. |

| [37,38] | Financial innovations | Based on the analysis, disciplines differ in their research methodologies, units of analysis, data sources, and innovations. There was a positive trend in the number of articles published during this period. The majority of studies, however, have been conducted in the USA and Europe, and less so in other parts of the world. In light of the three market disruptions, the literature synthesis identifies research gaps in the available research that highlight future research opportunities. Due to disruptions within and outside the industry as well as the entrance of new generations of consumers, the financial services industry is on the brink of a new era. In addition, the financial industry has become a fertile ground for innovative services, processes, and business models. In this way, financial innovations can bridge the gap between product and service innovation research. |

| [39] | Crowdfunding and token issues in FinTech | Contrary to traditional methods of raising funds, these innovations: (1) use modern technology (online transactions, blockchain, etc.) much more actively; (2) are usually faster in reaching potential investors/funders; and (3) utilize more active network benefits, such as large interactions between investors/funders and between funders and firms. |

| [40,41] | Impact of COVID-19 on FinTech | The outbreak of COVID-19 has caused significant economic issues including risky stock market and trade price movements, decreased bank performance, fluid crisis, and credit rating failures. |

| [34] | Artificial intelligence in FinTech | At the beginning of this century, AI research was focused on credit risk in the financial sector. Expert systems were increasingly replaced by data-driven, “algorithmic” AI during the 2010s. There was a lot of hype around big data in that decade, which faded later due to unsuccessful implementation. There is a great deal of published research on big data that relates to machine learning and deep learning, but not to big data in itself. |

References

- Duan, C. Knowledge mapping of entrepreneurship research during COVID-19 and forecasting research directions for the post-pandemic era. Aslib J. Inf. Manag. 2023. ahead-of-print. [Google Scholar] [CrossRef]

- Green, B.N.; Johnson, C.D. Interprofessional collaboration in research, education, and clinical practice: Working together for a better future. J. Chiropr. Educ. 2015, 29, 1–10. [Google Scholar] [CrossRef]

- Wu, W.; Xie, Y.; Liu, X.; Gu, Y.; Zhang, Y.; Tu, X.; Tan, X. Analysis of Scientific Collaboration Networks among Authors, Institutions, and Countries Studying Adolescent Myopia Prevention and Control: A Review Article. Iran J. Public Health 2019, 48, 621–631. [Google Scholar] [CrossRef] [PubMed]

- Duan, C. A state-of-the-art review of the sharing economy business models and forecast of future research directions: Bibliometric analysis approach. Sustainability 2023, 15, 4568. [Google Scholar] [CrossRef]

- Kumar, S.; Lim, W.M.; Pandey, N.; Christopher Westland, J. 20 years of Electronic Commerce Research. Electron. Commer. Res. 2021, 21, 1–40. [Google Scholar] [CrossRef]

- Donthu, N.; Kumar, S.; Mukherjee, D.; Pandey, N.; Lim, W.M. How to conduct a bibliometric analysis: An overview and guidelines. J. Bus. Res. 2021, 133, 285–296. [Google Scholar] [CrossRef]

- Snyder, H. Literature review as a research methodology: An overview and guidelines. J. Bus. Res. 2019, 104, 333–339. [Google Scholar] [CrossRef]

- Kumar, S.; Lim, W.M.; Sivarajah, U.; Kaur, J. Artificial Intelligence and Blockchain Integration in Business: Trends from a Bibliometric-Content Analysis. Inf. Syst. Front. 2022, 25, 871–896. [Google Scholar] [CrossRef] [PubMed]

- Martinez-Climent, C.; Zorio-Grima, A.; Ribeiro-Soriano, D. Financial return crowdfunding: Literature review and bibliometric analysis. Int. Entrep. Manag. J. 2018, 14, 527–553. [Google Scholar] [CrossRef]

- Chen, T.H.; Peng, J.L. Statistical and bibliometric analyses of the effects of financial innovation. Libr. Hi Tech 2020, 38, 308–319. [Google Scholar] [CrossRef]

- Galvez-Sanchez, F.J.; Lara-Rubio, J.; Verdu-Jover, A.J.; Meseguer-Sanchez, V. Research Advances on Financial Inclusion: A Bibliometric Analysis. Sustainability 2021, 13, 3156. [Google Scholar] [CrossRef]

- Nasir, A.; Shaukat, K.; Khan, K.I.; Hameed, I.A.; Alam, T.M.; Luo, S.H. Trends and Directions of Financial Technology (Fintech) in Society and Environment: A Bibliometric Study. Appl. Sci. 2021, 11, 353. [Google Scholar] [CrossRef]

- Nobanee, H.; Dilshad, M.N.; Al Dhanhani, M.; Al Neyadi, M.; Al Qubaisi, S.; Al Shamsi, S. Big Data Applications the Banking Sector: A Bibliometric Analysis Approach. SAGE Open 2021, 11, 21582440211067234. [Google Scholar] [CrossRef]

- Ahmed, S.; Alshater, M.M.; El Ammari, A.; Hammami, H. Artificial intelligence and machine learning in finance: A bibliometric review. Res. Int. Bus. Financ. 2022, 61, 101646. [Google Scholar] [CrossRef]

- Ali, A.; Ramakrishnan, S.; Faisal, F.; Ullah, Z. Bibliometric analysis of global research trends on microfinance institutions and microfinance: Suggesting new research agendas. Int. J. Financ. Econ. 2022, 28, 3552–3573. [Google Scholar] [CrossRef]

- Bhatt, A.; Joshipura, M.; Joshipura, N. Decoding the trinity of Fintech, digitalization and financial services: An integrated bibliometric analysis and thematic literature review approach. Cogent Econ. Financ. 2022, 10, 2114160. [Google Scholar] [CrossRef]

- Tello-Gamarra, J.; Campos-Teixeira, D.; Longaray, A.A.; Reis, J.; Hernani-Merino, M. Fintechs and Institutions: A Systematic Literature Review and Future Research Agenda. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 722–750. [Google Scholar] [CrossRef]

- Sun, Y.; Jiang, S.Q.; Jia, W.J.; Wang, Y. Blockchain as a cutting-edge technology impacting business: A systematic literature review perspective. Telecommun. Policy 2022, 46, 102443. [Google Scholar] [CrossRef]

- Rahman, S.; Moral, I.H.; Hassan, M.; Hossain, G.S.; Perveen, R. Review A systematic review of green finance in the banking industry: Perspectives from a developing country. Green Financ. 2022, 4, 347–363. [Google Scholar] [CrossRef]

- Paul, J.; Lim, W.M.; O‘Cass, A.; Hao, A.W.; Bresciani, S. Scientific procedures and rationales for systematic literature reviews (SPAR-4-SLR). Int. J. Consum. Stud. 2021, 45, O1–O16. [Google Scholar] [CrossRef]

- Kumar, S.; Sahoo, S.; Lim, W.M.; Dana, L.-P. Religion as a social shaping force in entrepreneurship and business: Insights from a technology-empowered systematic literature review. Technol. Forecast. Soc. Chang. 2022, 175, 121393. [Google Scholar] [CrossRef]

- Kraus, N.M.; Kraus, K.M.; Andrusiak, N.O. Digital cubic space as a new economic augmented reality. Sci. Innov. 2020, 16, 92–105. [Google Scholar] [CrossRef]

- Duan, C. Thematic evolution, emerging trends for sharing economy business model research, and future research directions in the post-COVID-19 era. R D Manag. 2023. ahead-of-print. [Google Scholar] [CrossRef]

- Klarin, A.; Suseno, Y. A state-of-the-art review of the sharing economy: Scientometric mapping of the scholarship. J. Bus. Res. 2021, 126, 250–262. [Google Scholar] [CrossRef]

- Block, J.H.; Fisch, C. Eight tips and questions for your bibliographic study in business and management research. Manag. Rev. Q. 2020, 70, 307–312. [Google Scholar] [CrossRef]

- Duan, C. Towards a comprehensive analytical framework and future research agenda for research on sharing economy business models: Thematic analyses approach. Inf. Syst. e-Business Manag. 2023, 21, 977–1016. [Google Scholar] [CrossRef]

- Bajwa, I.A.; Rehman, S.U.; Iqbal, A.; Anwar, Z.; Ashiq, M.; Khan, M.A. Past, Present and Future of FinTech Research: A Bibliometric Analysis. SAGE Open 2022, 12, 21582440221131242. [Google Scholar] [CrossRef]

- Vergura, D.T.; Zerbini, C.; Luceri, B.; Palladino, R. Investigating sustainable consumption behaviors: A bibliometric analysis. Br. Food J. 2023, 125, 253–276. [Google Scholar] [CrossRef]

- Focardi, S. Business as usual and rare events. J. Portf. Manag. 1999, 25, 47–54. [Google Scholar] [CrossRef]

- Tepe, G.; Geyikci, U.B.; Sancak, F.M. FinTech Companies: A Bibliometric Analysis. Int. J. Financ. Stud. 2022, 10, 2. [Google Scholar] [CrossRef]

- Donthu, N.; Gremler, D.D.; Kumar, S.; Pattnaik, D. Mapping of Journal of Service Research Themes: A 22-Year Review. J. Serv. Res. 2022, 25, 187–193. [Google Scholar] [CrossRef]

- Kumari, A.; Devi, N.C. The Impact of FinTech and Blockchain Technologies on Banking and Financial Services. Technol. Innov. Manag. Rev. 2022, 12, 1–11. [Google Scholar] [CrossRef]

- Elsbach, K.D.; Knippenberg, D. Creating High-Impact Literature Reviews: An Argument for ‘Integrative Reviews’. J. Manage. Stud. 2020, 57, 1277–1289. [Google Scholar] [CrossRef]

- Herrmann, H.; Masawi, B. Three and a half decades of artificial intelligence in banking, financial services, and insurance: A systematic evolutionary review. Strateg. Chang. 2022, 31, 549–569. [Google Scholar] [CrossRef]

- Rabbani, M.R.; Bashar, A.; Hawaldar, I.T.; Shaik, M.; Selim, M. What Do We Know about Crowdfunding and P2P Lending Research? A Bibliometric Review and Meta-Analysis. J. Risk Financ. Manag. 2022, 15, 451. [Google Scholar] [CrossRef]

- Nelaturu, K.; Du, H.; Le, D.P. A Review of Blockchain in Fintech: Taxonomy, Challenges, and Future Directions. Cryptography 2022, 6, 18. [Google Scholar] [CrossRef]

- Nejad, M.G. Research on financial innovations: An interdisciplinary review. Int. J. Bank Mark. 2022, 40, 578–612. [Google Scholar] [CrossRef]

- Wang, J.; Zhao, C.; Huang, L.; Yang, S.; Wang, M. Uncovering research trends and opportunities on FinTech: A scientometric analysis. Electron. Commer. Res. 2022, 24, 105–129. [Google Scholar] [CrossRef]

- Miglo, A. Theories of Crowdfunding and Token Issues: A Review. J. Risk Financ. Manag. 2022, 15, 218. [Google Scholar] [CrossRef]

- Jing, W.L.; Rashid, S.B.A.; Islam, M.U. The Impact of COVID-19 on Financial Markets & Institutions: A Literature Review. Int. J. Early Child. Spec. Educ. 2022, 14, 6488–6502. [Google Scholar]

- Duan, C. and K. Sandhu, Advancement of sharing economy for digital innovation in emerging countries. Econ. Lett. 2023, 233, 111364. [Google Scholar] [CrossRef]

| Description | Results | Description | Results |

|---|---|---|---|

| MAIN INFORMATION ABOUT DATA | AUTHORS | ||

| Timespan | 1999:2023 | Authors | 4272 |

| Sources (journals, books, etc.) | 738 | Authors of single-authored documents | 308 |

| Documents | 1792 | AUTHORS’ COLLABORATION | |

| Annual growth rate % | 2.93 | Single-authored documents | 350 |

| Document’s average age | 1.56 | Co-authors per document | 2.87 |

| Average citations per document | 9.99 | International co-authorships % | 32.7 |

| References | 80,507 | DOCUMENT TYPES | |

| DOCUMENT CONTENTS | Article | 1512 | |

| Keywords plus (ID) | 1946 | Article; book chapter | 6 |

| Author’s keywords (DE) | 4427 | Article; data paper | 2 |

| Article; early access | 173 | ||

| Article; proceedings paper | 9 | ||

| Review | 79 | ||

| Review; early access | 11 |

| Cluster | Author(s) | Avg. Pub. Year | Links | Total Link Strength | No. of Articles | Citations | Norm. Citations | Avg. Citations | Avg. Norm. Citation |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Abedin, Mohammad Zoynul | 2022 | 3 | 3 | 2 | 3 | 0.00 | 1.50 | 0.00 |

| Chen, Xiaohui | 2022 | 2 | 3 | 5 | 19 | 7.96 | 3.80 | 1.59 | |

| Zhao, Yang | 2022 | 3 | 3 | 2 | 0 | 0.00 | 0.00 | 0.00 | |

| Chen, Wen | 2022 | 1 | 2 | 2 | 18 | 7.96 | 9.00 | 3.98 | |

| Hasan, Morshadul | 2021 | 1 | 1 | 2 | 22 | 2.62 | 11.00 | 1.31 | |

| 2 | Banna, Hasanul | 2022 | 3 | 5 | 4 | 32 | 8.98 | 8.00 | 2.24 |

| Hassan, M. Kabir | 2022 | 3 | 4 | 4 | 16 | 4.94 | 4.00 | 1.24 | |

| Alam, Md Rabiul | 2022 | 2 | 3 | 2 | 17 | 4.47 | 8.50 | 2.24 | |

| Selim, Mohammad | 2022 | 1 | 1 | 2 | 5 | 1.30 | 2.50 | 0.65 | |

| 3 | Corbet, Shaen | 2021 | 6 | 8 | 3 | 29 | 2.25 | 9.67 | 0.75 |

| Akyildirim, Erdinc | 2021 | 3 | 5 | 2 | 29 | 2.25 | 14.50 | 1.12 | |

| Sensoy, Ahmet | 2019 | 3 | 5 | 3 | 117 | 4.75 | 39.00 | 1.58 | |

| Yarovaya, Larisa | 2021 | 4 | 4 | 4 | 59 | 8.82 | 14.75 | 2.21 | |

| 4 | Lee, Chi-Chuan | 2022 | 5 | 7 | 3 | 58 | 14.39 | 19.33 | 4.80 |

| Yu, Chin-Hsien | 2022 | 3 | 5 | 2 | 58 | 14.39 | 29.00 | 7.20 | |

| Zhao, Jinsong | 2022 | 3 | 5 | 2 | 58 | 14.39 | 29.00 | 7.20 | |

| Chen, Shi | 2022 | 3 | 3 | 2 | 22 | 9.28 | 11.00 | 4.64 | |

| 5 | Goodell, John W. | 2022 | 5 | 5 | 2 | 0 | 0.00 | 0.00 | 0.00 |

| Sharma, Sudhi | 2022 | 4 | 4 | 2 | 0 | 0.00 | 0.00 | 0.00 | |

| Kumar, Satish | 2022 | 3 | 3 | 2 | 13 | 5.75 | 6.50 | 2.87 | |

| 6 | Tiwari, Aviral Kumar | 2021 | 3 | 4 | 3 | 76 | 10.49 | 25.33 | 3.50 |

| Abakah, Emmanuel Joel Aikins | 2021 | 2 | 3 | 2 | 76 | 10.49 | 38.00 | 5.25 | |

| Average | 3 | 4 | 3 | 33 | 6.16 | 12.93 | 2.47 |

| Affiliation | Cluster | Links | Total Link Strength | Documents | Citations | Avg. Pub. Year |

|---|---|---|---|---|---|---|

| Univ. Hong Kong | 10 | 18 | 35 | 22 | 340 | 2020 |

| Univ. Sydney | 6 | 19 | 30 | 19 | 389 | 2020 |

| Univ. Luxembourg | 10 | 6 | 23 | 12 | 205 | 2020 |

| UNSW Sydney | 10 | 7 | 22 | 10 | 204 | 2020 |

| Shanghai Univ. Finance and Econ | 2 | 15 | 19 | 15 | 112 | 2022 |

| Heinrich Heine Univ. | 10 | 4 | 19 | 6 | 147 | 2020 |

| Peking Univ. | 2 | 12 | 18 | 18 | 234 | 2021 |

| Univ. New South Wales | 11 | 11 | 18 | 13 | 244 | 2020 |

| Univ. Aberdeen | 5 | 10 | 16 | 7 | 67 | 2021 |

| Univ. Zurich | 10 | 9 | 15 | 8 | 91 | 2020 |

| Cluster | Top Three Affiliations | Links | Total Link Strength | Total No. of Articles | TC | Norm. TC | Avg. Pub. Year | Avg. Cites | Avg. Norm. Cites |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Univ. Edinburgh | 9 | 12 | 12 | 127 | 5.13 | 2021 | 10.58 | 0.43 |

| Univ. Nottingham | 9 | 12 | 11 | 301 | 22.90 | 2020 | 27.36 | 2.08 | |

| Singapore Management Univ. | 9 | 10 | 9 | 392 | 15.46 | 2020 | 43.56 | 1.72 | |

| Cluster average | 6 | 6 | 7 | 147 | 9.39 | 2020 | 21.99 | 1.33 | |

| 2 | Shanghai Univ. Finance and Econ. | 15 | 19 | 15 | 112 | 39.23 | 2022 | 7.47 | 2.62 |

| Peking Univ. | 12 | 18 | 18 | 234 | 19.44 | 2021 | 13.00 | 1.08 | |

| Fudan Univ. | 8 | 14 | 11 | 126 | 29.27 | 2021 | 11.45 | 2.66 | |

| Cluster average | 7 | 9 | 9 | 77 | 11.62 | 2021 | 8.36 | 1.22 | |

| 3 | CEPR 1 | 9 | 11 | 9 | 206 | 16.99 | 2021 | 22.89 | 1.89 |

| NBER 2 | 9 | 11 | 10 | 269 | 18.20 | 2021 | 26.90 | 1.82 | |

| Univ. Michigan | 7 | 7 | 7 | 112 | 8.73 | 2020 | 16.00 | 1.25 | |

| Cluster average | 5 | 5 | 7 | 97 | 8.08 | 2020 | 13.55 | 1.15 | |

| 4 | Univ. Portsmouth | 7 | 9 | 6 | 18 | 3.34 | 2021 | 3.00 | 0.56 |

| Jiangsu Univ. | 5 | 7 | 6 | 110 | 14.35 | 2021 | 18.33 | 2.39 | |

| Univ. Warwick | 6 | 6 | 6 | 170 | 14.97 | 2020 | 28.33 | 2.50 | |

| Cluster average | 3 | 4 | 7 | 73 | 8.27 | 2021 | 10.57 | 1.16 | |

| 5 | Univ. Aberdeen | 10 | 16 | 7 | 67 | 5.06 | 2021 | 9.57 | 0.72 |

| Univ. Birmingham | 6 | 13 | 12 | 88 | 11.35 | 2021 | 7.33 | 0.95 | |

| Florida Atlantic Univ. | 3 | 8 | 6 | 86 | 7.73 | 2021 | 14.33 | 1.29 | |

| Cluster average | 3 | 6 | 7 | 58 | 7.24 | 2021 | 9.60 | 1.20 | |

| 6 | Univ. Sydney | 19 | 30 | 19 | 389 | 31.76 | 2020 | 20.47 | 1.67 |

| Shanghai Univ. | 9 | 10 | 9 | 133 | 22.54 | 2021 | 14.78 | 2.50 | |

| Univ. Southampton | 6 | 10 | 9 | 106 | 12.33 | 2021 | 11.78 | 1.37 | |

| Cluster average | 5 | 8 | 8 | 148 | 14.20 | 2020 | 18.69 | 1.80 | |

| 7 | Univ. Sheffield | 8 | 8 | 8 | 58 | 4.52 | 2021 | 7.25 | 0.57 |

| Neoma Business Sch. | 6 | 6 | 5 | 23 | 5.97 | 2021 | 4.60 | 1.19 | |

| Univ. Kent | 6 | 6 | 5 | 45 | 3.77 | 2020 | 9.00 | 0.75 | |

| Cluster average | 4 | 4 | 7 | 56 | 5.67 | 2020 | 8.30 | 0.86 | |

| 8 | City Univ. Hong Kong | 13 | 14 | 9 | 161 | 7.85 | 2020 | 17.89 | 0.87 |

| Univ. Cambridge | 11 | 12 | 8 | 33 | 2.72 | 2021 | 4.13 | 0.34 | |

| Macquarie Univ. | 8 | 11 | 7 | 68 | 5.69 | 2020 | 9.71 | 0.81 | |

| Cluster average | 6 | 7 | 8 | 102 | 8.12 | 2020 | 12.15 | 0.99 | |

| 9 | Xi’an Jiao Tong Univ. | 5 | 7 | 9 | 79 | 8.92 | 2021 | 8.78 | 0.99 |

| Chinese Culture Univ. | 3 | 6 | 8 | 20 | 2.20 | 2021 | 2.50 | 0.28 | |

| Southern Univ. Sci. and Technol. | 5 | 6 | 7 | 85 | 8.68 | 2021 | 12.14 | 1.24 | |

| Cluster average | 4 | 5 | 8 | 43 | 5.15 | 2021 | 5.30 | 0.65 | |

| 10 | Univ. Hong Kong | 18 | 35 | 22 | 340 | 21.88 | 2020 | 15.45 | 0.99 |

| Univ. Luxembourg | 6 | 23 | 12 | 205 | 14.61 | 2020 | 17.08 | 1.22 | |

| UNSW Sydney | 7 | 22 | 10 | 204 | 14.19 | 2020 | 20.40 | 1.42 | |

| Cluster average | 7 | 17 | 10 | 152 | 10.80 | 2020 | 14.30 | 1.05 | |

| 11 | Univ. New South Wales | 11 | 18 | 13 | 244 | 12.05 | 2020 | 18.77 | 0.93 |

| Chinese Univ. Hong Kong | 7 | 10 | 14 | 122 | 8.58 | 2020 | 8.71 | 0.61 | |

| Jiangxi Univ. Finance and Econ. | 4 | 5 | 5 | 111 | 6.52 | 2020 | 22.20 | 1.30 | |

| Cluster average | 5 | 7 | 8 | 128 | 8.10 | 2020 | 17.15 | 1.09 | |

| 12 | Zhejiang Gongshang Univ. | 7 | 10 | 6 | 121 | 5.27 | 2020 | 20.17 | 0.88 |

| Copenhagen Business Sch. | 5 | 6 | 8 | 226 | 12.31 | 2020 | 28.25 | 1.54 | |

| Southwestern Univ. Finance and Econ. | 5 | 6 | 13 | 324 | 43.23 | 2021 | 24.92 | 3.33 | |

| Cluster average | 4 | 5 | 8 | 149 | 15.49 | 2021 | 16.75 | 1.68 | |

| 13 | RMIT Univ. | 4 | 10 | 6 | 40 | 5.92 | 2021 | 6.67 | 0.99 |

| Singapore Univ. Social Sci | 2 | 8 | 5 | 41 | 5.97 | 2021 | 8.20 | 1.19 | |

| Tampere Univ. | 2 | 8 | 7 | 48 | 6.57 | 2021 | 6.86 | 0.94 | |

| Cluster average | 3 | 9 | 6 | 43 | 6.15 | 2021 | 7.24 | 1.04 | |

| Total average | 8 | 12 | 9 | 145 | 12.98 | 14.89 | 1.33 |

| Cluster | Affiliations |

|---|---|

| 1 (23) | Univ. Edinburgh, Univ. Nottingham, Singapore Management Univ., Univ. Durham, Monash Univ., Nyu, Xiamen Univ., Penn State Univ., Univ. Auckland, Xian Jiaotong Liverpool Univ., Zhejiang Univ., Nanyang Technol Univ., Shandong Univ., Shanghai Jiao Tong Univ., Univ. Minnesota, Natl. Univ. Singapore, Hong Kong Univ. Sci. and Technol., Arizona State Univ., Teesside Univ., Univ. Kentucky, Nanjing Audit Univ., Dalian Univ. Technol., Univ. Bologna |

| 2 (16) | Shanghai Univ. Finance and Econ., Peking Univ., Fudan Univ., Shanghai Lixin Univ. Accounting and Finance, Beijing Normal Univ., Wuhan Univ., Zhongnan Univ. Econ. and Law, Tsinghua Univ., Chinese Acad. Sci., Univ. Chinese Acad. Sci., Univ. Sci. and Technol. China, Renmin Univ. China, Cent Univ. Finance and Econ., Univ. Int. Business and Econ., Hong Kong Polytech Univ., East China Normal Univ. |

| 3 (14) | Nber, Cepr, Univ. Michigan, MIT, Georgia Inst. Technol., Univ. N. Carolina, Univ. Penn., Univ. Calif. Berkeley, Washington Univ., Duke Univ., George Washington Univ., Harvard Sch. Business, Santa Clara Univ., Harvard Univ., Univ. Georgia |

| 4 (12) | Univ. Georgia, Univ. Portsmouth, Jiangsu Univ., Univ. Warwick, Univ. Elect. Sci. and Technol. China, Univ. Groningen, Guangzhou Univ., Boston Univ., Univ. Kebangsaan Malaysia, Univ. Pavia, Makerere Univ., Univ. Ghana, Univ. Brunei Darussalam |

| 5 (9) | Univ. Aberdeen, Univ. Birmingham, Florida Atlantic Univ., Emirates Coll. Technol., Sunway Univ., Univ. Utara Malaysia, Tianjin Univ., Taylors Univ., Univ. Econ. Ho Chi Minh City, York Univ. |

| 6 (9) | Univ. Sydney, Shanghai Univ., Univ. Southampton, Univ. Reading, Univ. Queensland, Univ. Malaya, Columbia Univ., Fed. Reserve Bank Philadelphia, Rutgers State Univ., Univ. Management and Technol. |

| 7 (9) | Univ. Sheffield, Neoma Business Sch., Univ. Kent, UCL, Newcastle Univ., Univ. Amsterdam, Univ. Genoa, Coventry Univ., Qatar Univ., Univ. Manchester |

| 8 (8) | City Univ. Hong Kong, Univ. Cambridge, Univ. Oxford, Macquarie Univ., Univ. Melbourne, La Trobe Univ., Univ. London, Univ. Sussex, Islamic Azad Univ. |

| 9 (8) | Xi An Jiao Tong Univ., Chinese Culture Univ., Southern Univ. Sci. and Technol., Chongqing Univ., Natl. Taiwan Univ. Sci. and Technol., Ming Chuan Univ., Natl. Taipei Univ. Business, Soochow Univ. |

| 10 (7) | Univ. Hong Kong, Univ. Luxembourg, UNSW Sydney, Heinrich Heine Univ., Univ. Zurich, Univ. Indonesia, Bina Nusantara Univ. |

| 11 (6) | Univ. New South Wales, Chinese Univ. Hong Kong, Univ. Vaasa, Jiangxi Univ. Finance and Econ., Natl. Taiwan Univ., Univ. Jyvaskyla, Univ. St. Gallen |

| 12 (5) | Zhejiang Gongshang Univ., Southwestern Univ. Finance and Econ., Copenhagen Business Sch., Yibin Univ., Sichuan Univ. |

| 13 (3) | RMIT Univ., Tampere Univ., Singapore Univ. Social Sci. |

| Cluster (No. of Countries) | Countries (All 81) | Links | Total Link Strength | Documents | TC | Norm. TC | Avg. Pub. Year | Avg. Citations | Avg. Norm. Citations |

|---|---|---|---|---|---|---|---|---|---|

| 1 (15) | Peoples R. China | 51 | 296 | 416 | 4283 | 512.16 | 2021 | 10.30 | 1.23 |

| England | 57 | 265 | 217 | 3458 | 301.39 | 2020 | 15.94 | 1.39 | |

| Australia | 37 | 148 | 106 | 1712 | 140.24 | 2020 | 16.15 | 1.32 | |

| France | 30 | 77 | 51 | 1141 | 72.83 | 2020 | 22.37 | 1.43 | |

| Ghana | 17 | 30 | 20 | 82 | 6.52 | 2021 | 4.10 | 0.33 | |

| Thailand | 17 | 24 | 14 | 82 | 7.33 | 2020 | 5.86 | 0.52 | |

| South Africa | 13 | 22 | 26 | 106 | 11.13 | 2021 | 4.08 | 0.43 | |

| Nigeria | 10 | 15 | 17 | 83 | 13.48 | 2021 | 4.88 | 0.79 | |

| Cyprus | 9 | 14 | 6 | 28 | 2.53 | 2021 | 4.67 | 0.42 | |

| Morocco | 9 | 10 | 5 | 31 | 4.28 | 2021 | 6.20 | 0.86 | |

| Philippines | 7 | 9 | 3 | 0 | 0.00 | 2022 | 0.00 | 0.00 | |

| Romania | 8 | 8 | 11 | 71 | 7.57 | 2019 | 6.45 | 0.69 | |

| Iran | 6 | 7 | 16 | 66 | 8.37 | 2020 | 4.13 | 0.52 | |

| Cameroon | 3 | 6 | 4 | 119 | 9.57 | 2021 | 29.75 | 2.39 | |

| Uganda | 3 | 3 | 5 | 35 | 3.44 | 2020 | 7.00 | 0.69 | |

| 2 (15) | Germany | 23 | 95 | 79 | 1513 | 97.24 | 2020 | 19.15 | 1.23 |

| Switzerland | 29 | 77 | 42 | 509 | 33.01 | 2020 | 12.12 | 0.79 | |

| Russia | 19 | 40 | 40 | 96 | 15.77 | 2021 | 2.40 | 0.39 | |

| Luxembourg | 11 | 32 | 15 | 215 | 15.75 | 2020 | 14.33 | 1.05 | |

| Poland | 19 | 26 | 33 | 123 | 16.25 | 2021 | 3.73 | 0.49 | |

| Czech Republic | 11 | 14 | 14 | 49 | 12.02 | 2021 | 3.50 | 0.86 | |

| Latvia | 8 | 12 | 12 | 45 | 6.93 | 2021 | 3.75 | 0.58 | |

| Ukraine | 6 | 11 | 40 | 70 | 6.10 | 2021 | 1.75 | 0.15 | |

| Greece | 7 | 7 | 6 | 79 | 10.25 | 2021 | 13.17 | 1.71 | |

| Malta | 4 | 6 | 3 | 23 | 2.51 | 2021 | 7.67 | 0.84 | |

| Serbia | 6 | 6 | 3 | 5 | 0.82 | 2021 | 1.67 | 0.27 | |

| Slovakia | 6 | 6 | 5 | 20 | 3.37 | 2022 | 4.00 | 0.67 | |

| Estonia | 4 | 5 | 6 | 38 | 4.34 | 2021 | 6.33 | 0.72 | |

| Lithuania | 5 | 5 | 10 | 50 | 5.38 | 2021 | 5.00 | 0.54 | |

| Bulgaria | 4 | 4 | 3 | 17 | 2.65 | 2022 | 5.67 | 0.88 | |

| 3 (14) | India | 32 | 70 | 74 | 413 | 55.54 | 2021 | 5.58 | 0.75 |

| Pakistan | 24 | 57 | 43 | 371 | 65.26 | 2021 | 8.63 | 1.52 | |

| South Korea | 21 | 43 | 68 | 1184 | 62.75 | 2020 | 17.41 | 0.92 | |

| U. Arab Emirates | 24 | 42 | 25 | 134 | 20.14 | 2021 | 5.36 | 0.81 | |

| Turkey | 25 | 37 | 19 | 274 | 25.94 | 2021 | 14.42 | 1.37 | |

| Saudi Arabia | 15 | 27 | 28 | 64 | 21.46 | 2022 | 2.29 | 0.77 | |

| Tunisia | 14 | 18 | 8 | 98 | 5.13 | 2021 | 12.25 | 0.64 | |

| Bahrain | 12 | 15 | 13 | 44 | 5.89 | 2021 | 3.38 | 0.45 | |

| Qatar | 12 | 13 | 11 | 162 | 13.40 | 2021 | 14.73 | 1.22 | |

| Wales | 11 | 11 | 9 | 178 | 35.06 | 2021 | 19.78 | 3.90 | |

| Jordan | 9 | 10 | 11 | 26 | 4.20 | 2021 | 2.36 | 0.38 | |

| Oman | 8 | 8 | 3 | 91 | 3.83 | 2020 | 30.33 | 1.28 | |

| Egypt | 4 | 4 | 4 | 9 | 1.44 | 2022 | 2.25 | 0.36 | |

| Yemen | 3 | 3 | 3 | 8 | 3.54 | 2022 | 2.67 | 1.18 | |

| 4 (9) | Malaysia | 29 | 95 | 74 | 338 | 62.35 | 2021 | 4.57 | 0.84 |

| Vietnam | 18 | 30 | 35 | 235 | 37.52 | 2021 | 6.71 | 1.07 | |

| Indonesia | 10 | 24 | 59 | 311 | 40.89 | 2021 | 5.27 | 0.69 | |

| Austria | 14 | 23 | 15 | 138 | 15.51 | 2020 | 9.20 | 1.03 | |

| Japan | 7 | 15 | 22 | 139 | 15.32 | 2020 | 6.32 | 0.70 | |

| Brunei | 8 | 13 | 11 | 34 | 7.49 | 2021 | 3.09 | 0.68 | |

| Kenya | 9 | 9 | 3 | 26 | 2.38 | 2021 | 8.67 | 0.79 | |

| Hungary | 4 | 4 | 6 | 31 | 9.63 | 2021 | 5.17 | 1.60 | |

| Slovenia | 1 | 1 | 4 | 59 | 3.36 | 2021 | 14.75 | 0.84 | |

| 5 (8) | Canada | 24 | 55 | 47 | 501 | 36.52 | 2020 | 10.66 | 0.78 |

| Portugal | 16 | 33 | 21 | 138 | 19.66 | 2021 | 6.57 | 0.94 | |

| Sweden | 17 | 26 | 16 | 358 | 45.32 | 2020 | 22.38 | 2.83 | |

| Brazil | 7 | 12 | 22 | 164 | 14.08 | 2021 | 7.45 | 0.64 | |

| Lebanon | 6 | 7 | 4 | 22 | 4.42 | 2022 | 5.50 | 1.10 | |

| Croatia | 4 | 4 | 3 | 49 | 2.86 | 2020 | 16.33 | 0.95 | |

| Peru | 4 | 4 | 3 | 7 | 0.97 | 2022 | 2.33 | 0.32 | |

| Colombia | 2 | 2 | 5 | 22 | 2.08 | 2020 | 4.40 | 0.42 | |

| 6 (7) | USA | 47 | 247 | 324 | 5319 | 343.38 | 2020 | 16.42 | 1.06 |

| Italy | 27 | 61 | 89 | 655 | 69.63 | 2020 | 7.36 | 0.78 | |

| Spain | 24 | 46 | 53 | 714 | 61.47 | 2020 | 13.47 | 1.16 | |

| Chile | 3 | 4 | 5 | 38 | 4.70 | 2021 | 7.60 | 0.94 | |

| Israel | 3 | 4 | 5 | 12 | 0.31 | 2020 | 2.40 | 0.06 | |

| Argentina | 1 | 1 | 4 | 2 | 0.16 | 2021 | 0.50 | 0.04 | |

| Mexico | 1 | 1 | 5 | 85 | 3.27 | 2021 | 17.00 | 0.65 | |

| 7 (4) | Singapore | 26 | 67 | 32 | 558 | 35.14 | 2020 | 17.44 | 1.10 |

| Scotland | 15 | 39 | 28 | 237 | 15.02 | 2021 | 8.46 | 0.54 | |

| Denmark | 9 | 18 | 12 | 286 | 13.96 | 2019 | 23.83 | 1.16 | |

| North Ireland | 6 | 7 | 5 | 40 | 3.11 | 2021 | 8.00 | 0.62 | |

| 8 (3) | Belgium | 13 | 28 | 19 | 285 | 23.86 | 2021 | 15.00 | 1.26 |

| Ireland | 14 | 24 | 12 | 78 | 7.02 | 2021 | 6.50 | 0.59 | |

| New Zealand | 11 | 23 | 15 | 77 | 8.27 | 2020 | 5.13 | 0.55 | |

| 9 (3) | Finland | 20 | 41 | 27 | 272 | 26.50 | 2020 | 10.07 | 0.98 |

| Norway | 20 | 40 | 17 | 173 | 21.00 | 2020 | 10.18 | 1.24 | |

| Ethiopia | 3 | 3 | 3 | 6 | 0.32 | 2018 | 2.00 | 0.11 | |

| 10 (2) | Netherlands | 13 | 37 | 32 | 322 | 23.28 | 2020 | 10.06 | 0.73 |

| Taiwan | 14 | 37 | 69 | 552 | 63.49 | 2021 | 8.00 | 0.92 | |

| 11 (1) | Bangladesh | 3 | 7 | 9 | 18 | 3.51 | 2022 | 2.00 | 0.39 |

| Average | 14 | 34 | 33 | 364 | 33.39 | 8.87 | 0.87 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Duan, C. Analyses of Scientific Collaboration Networks among Authors, Institutions, and Countries in FinTech Studies: A Bibliometric Review. FinTech 2024, 3, 249-273. https://doi.org/10.3390/fintech3020015

Duan C. Analyses of Scientific Collaboration Networks among Authors, Institutions, and Countries in FinTech Studies: A Bibliometric Review. FinTech. 2024; 3(2):249-273. https://doi.org/10.3390/fintech3020015

Chicago/Turabian StyleDuan, Carson. 2024. "Analyses of Scientific Collaboration Networks among Authors, Institutions, and Countries in FinTech Studies: A Bibliometric Review" FinTech 3, no. 2: 249-273. https://doi.org/10.3390/fintech3020015

APA StyleDuan, C. (2024). Analyses of Scientific Collaboration Networks among Authors, Institutions, and Countries in FinTech Studies: A Bibliometric Review. FinTech, 3(2), 249-273. https://doi.org/10.3390/fintech3020015