Big Data-Driven Banking Operations: Opportunities, Challenges, and Data Security Perspectives

Abstract

1. Introduction

- (i)

- How does big data promote the overall performance of bank operations?

- (ii)

- What types of challenges do banks face when utilising enormous datasets?

- (iii)

- How do banks deal with banking data security?

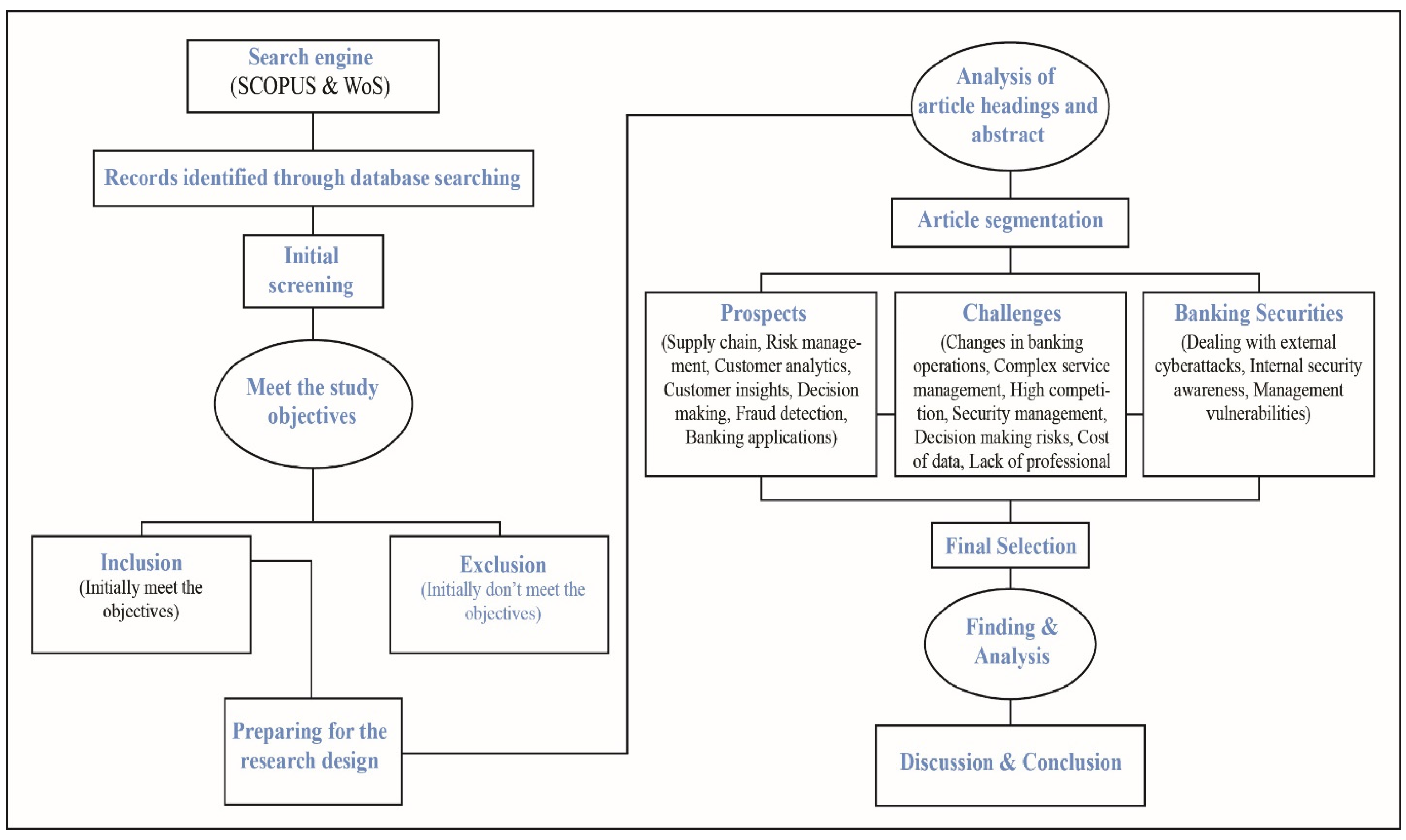

2. Methodology

2.1. Study Selection

2.2. Database Selection

2.3. Data Collection

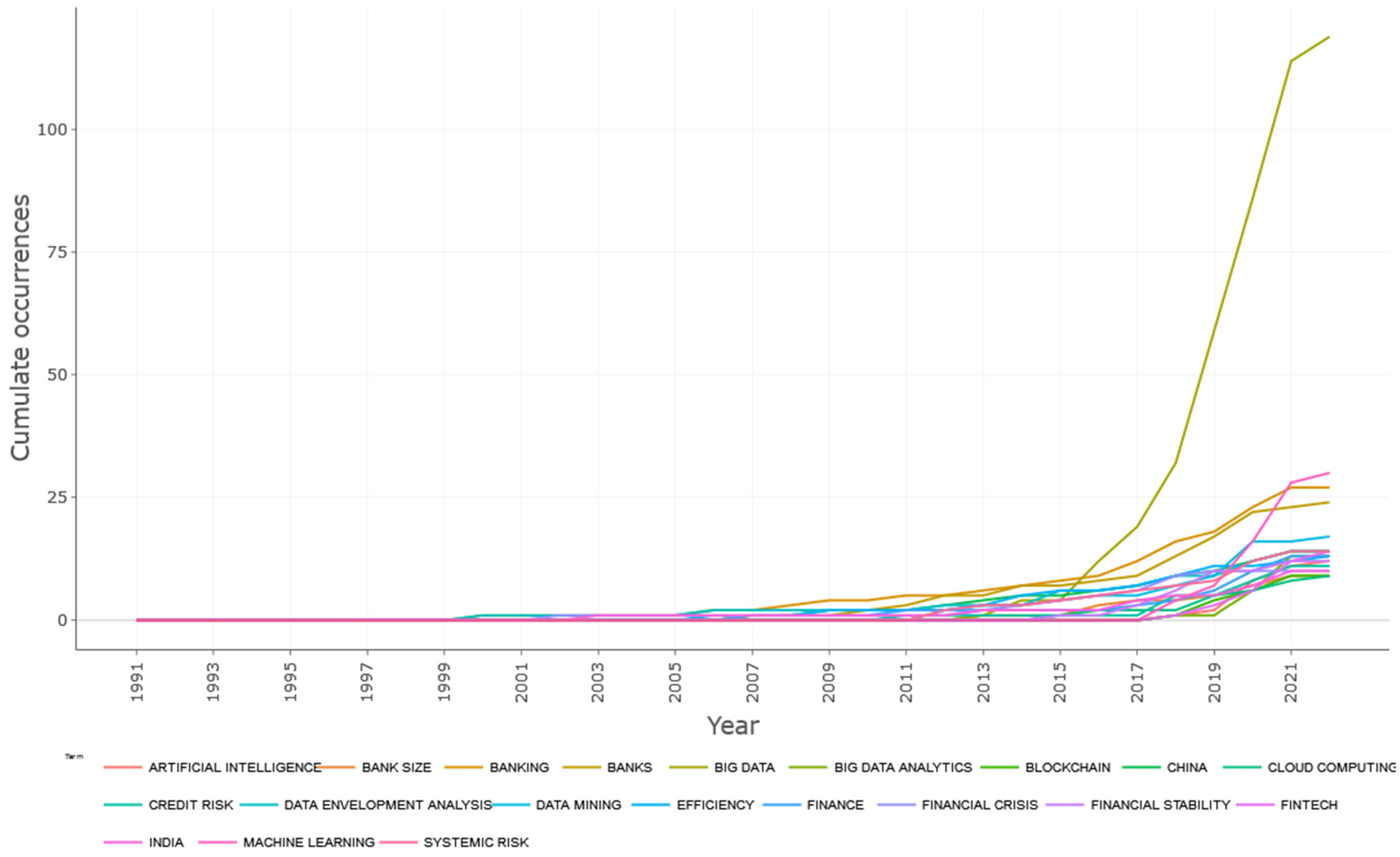

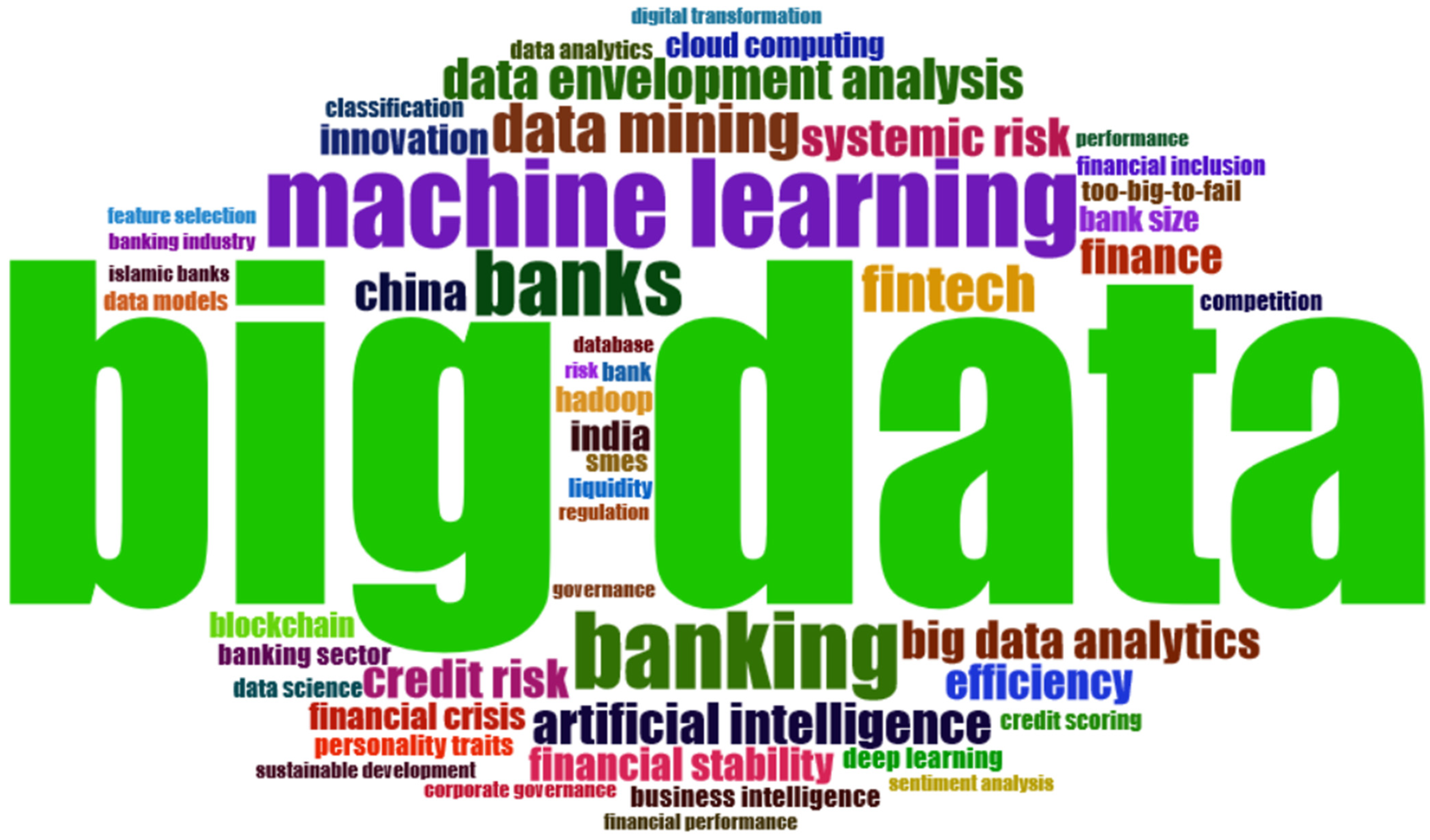

2.4. Keyword Searching

2.5. Data Inclusion and Exclusion

2.6. Research Framework

3. Theoretical Background

3.1. Terminology of Study

3.1.1. Big Data

3.1.2. Big Data Analytics

3.1.3. Machine Learning

3.1.4. Artificial Intelligence

3.1.5. Internet of Things (IoT)

3.2. Data-Driven Banking

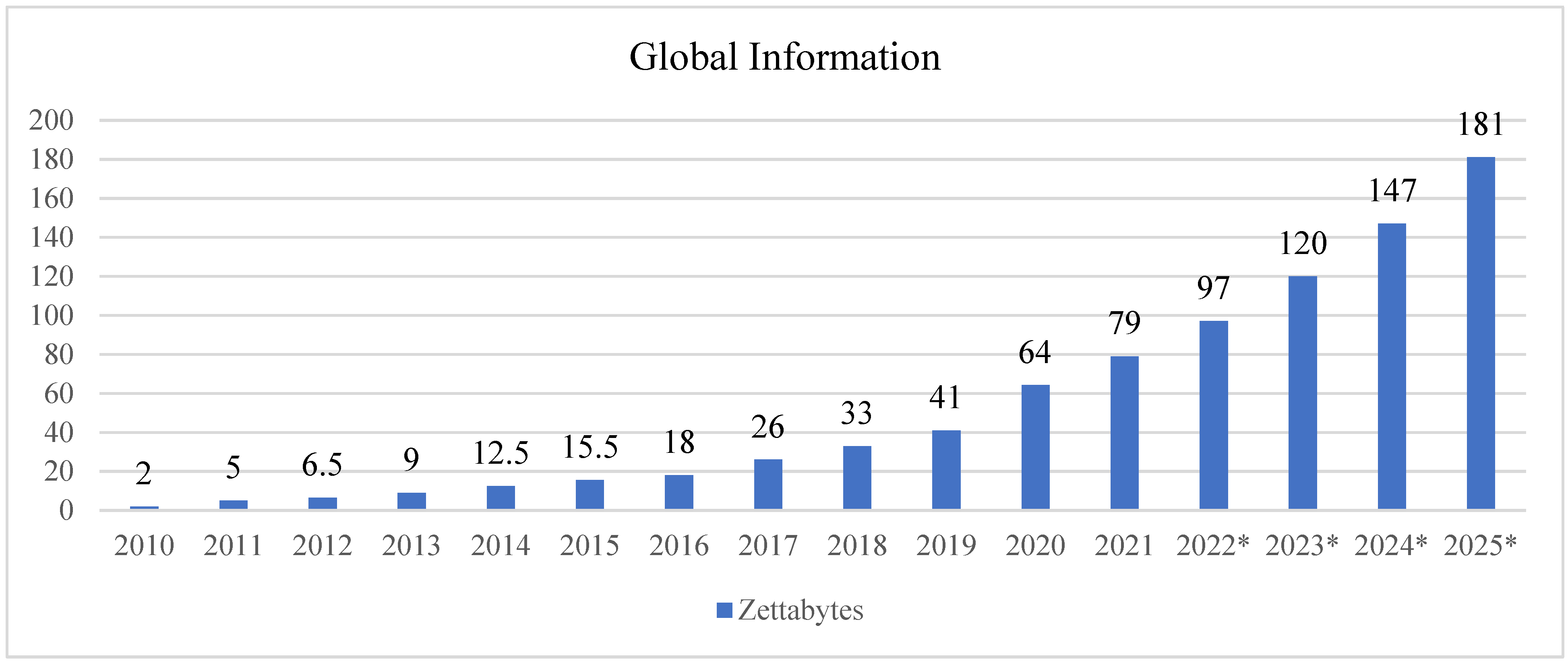

3.3. The Present Landscape of Big Data and Business

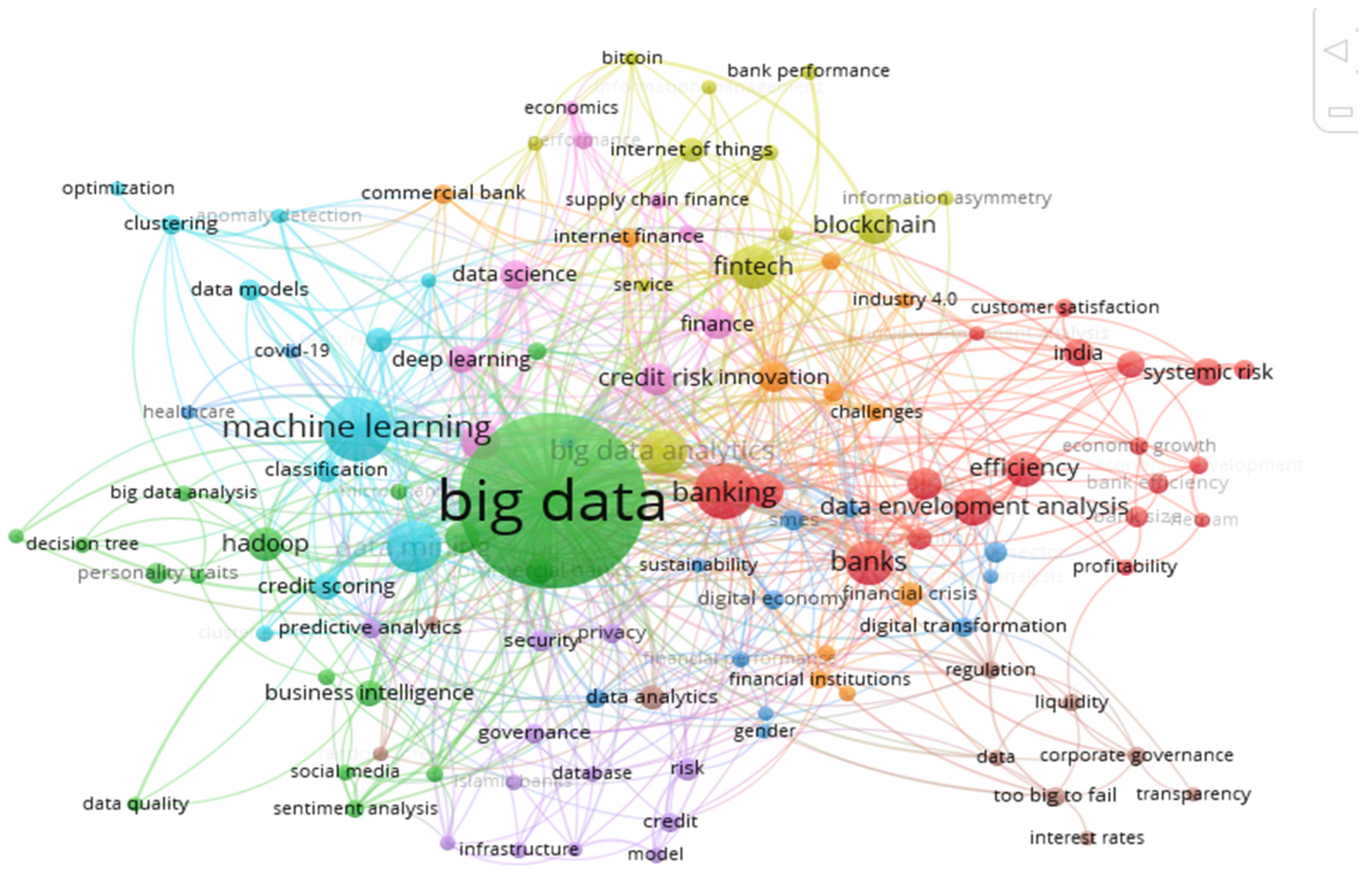

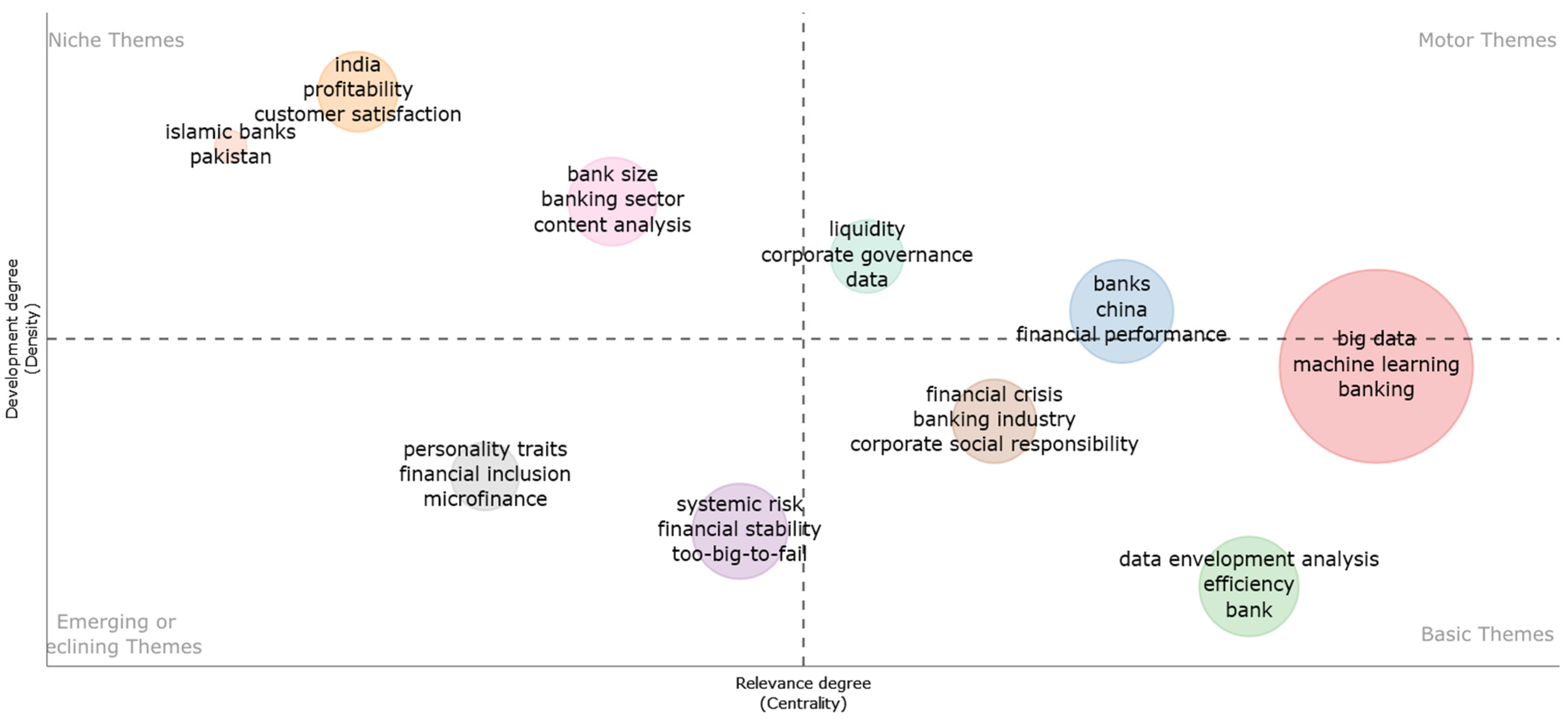

3.4. Present Literature

4. Findings

4.1. Data-Driven Opportunities in Banking Operations

4.1.1. Banking Supply Chain

4.1.2. Bank Risk Management

4.1.3. Financial Fraud Detection

4.1.4. Customer Insight and Marketing Analytics

4.1.5. Banking Decision

4.2. Challenges Faced by Banks in the Era of Big Data

4.2.1. Changes in Banking Operation

4.2.2. Complex Service Management

4.2.3. The Highly Competitive Market for Commercial Banks

4.2.4. Changes in Banking Operation

4.2.5. Lack of Professional Data Analysts, Experiences, and Knowledge

4.2.6. The Costs of Data

4.3. Banking and Data Security

4.3.1. Dealing with External Cyberattacks

4.3.2. Internal Security

4.3.3. Management Vulnerabilities

5. Discussion and Conclusions

5.1. Discussion

5.2. Conclusions

5.3. Future Research Direction

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Keyword Plus | Authors’ Keywords | Title Keywords | |||

|---|---|---|---|---|---|

| Impact | 64 | Big data | 119 | Corporate social responsibility | 4 |

| Model | 57 | Machine learning | 30 | Dynamic panel data | 4 |

| Performance | 55 | Banking | 27 | Financial risk management | 4 |

| Big data | 53 | Banks | 24 | Machine learning methods | 4 |

| Management | 39 | Data mining | 17 | Credit risk evaluation | 3 |

| Risk | 39 | China | 14 | Data envelopment analysis | 3 |

| Information | 31 | Data envelopment analysis | 14 | Umbilical cord blood | 3 |

| Determinants | 28 | Fintech | 14 | Business_automated data economy | 2 |

| Competition | 22 | Systemic risk | 14 | Chinese commercial banks | 2 |

| Growth | 21 | Big data analytics | 13 | Clinical trial data | 2 |

| Banking | 20 | Efficiency | 13 | Credit banking risk | 2 |

| Cost | 20 | Finance | 13 | Credit risk evidence | 2 |

| Efficiency | 20 | Artificial intelligence | 12 | Data bank itrdb | 2 |

| Models | 20 | Financial stability | 12 | Data economy model | 2 |

| Prediction | 20 | Credit risk | 11 | Data management system | 2 |

| Ownership | 19 | Financial crisis | 10 | Decision support system | 2 |

| Behavior | 17 | India | 10 | Direct investment inflow | 2 |

| Innovation | 17 | Bank size | 9 | Efficient feature selection | 2 |

| Panel-data | 17 | Blockchain | 9 | Foreign direct investment | 2 |

| Challenges | 16 | Cloud computing | 9 | Home equity loans | 2 |

| Information-technology | 16 | Hadoop | 9 | Indian banking system | 2 |

| Market | 15 | Banking sector | 8 | International tree_ring data | 2 |

| Scale | 15 | Business intelligence | 8 | Internet banking services | 2 |

| System | 15 | Deep learning | 8 | Listed commercial banks | 2 |

| Classification | 14 | Innovation | 8 | Mobile banking adoption | 2 |

| Systems | 14 | Smes | 8 | Oil price shocks | 2 |

| Banks | 13 | Bank | 7 | Panel data analysis | 2 |

| Internet | 13 | Classification | 7 | Panel data approach | 2 |

| Policy | 13 | Credit scoring | 7 | Perceived information pollution | 2 |

| Profitability | 13 | Data models | 7 | Social media sentiment | 2 |

| Analytics | 12 | Financial inclusion | 7 | Systemic risk analysis | 2 |

| Data envelopment analysis | 12 | Liquidity | 7 | Systemic risk contributions | 2 |

| Diversification | 12 | Personality traits | 7 | Systemic risk measurement | 2 |

| Governance | 12 | Too-big-to-fail | 7 | Tree_ring data bank | 2 |

| Trust | 12 | Banking industry | 6 | Two_stage hybrid default | 2 |

| Adoption | 11 | Competition | 6 | Abandoned mining tunnel | 1 |

| Framework | 11 | Corporate governance | 6 | Abdurrahman agas shipbuilding | 1 |

| Identification | 11 | Data analytics | 6 | Access mine requiring | 1 |

| Internet banking | 11 | Data science | 6 | Account fees competition | 1 |

| Knowledge | 11 | Database | 6 | Achieving strong customer | 1 |

| Corporate governance | 10 | Feature selection | 6 | Acquisition matching method | 1 |

| Countries | 10 | Financial performance | 6 | Actionable idea connecting | 1 |

| Firm | 10 | Islamic banks | 6 | Actual consumer usage | 1 |

| Quality | 10 | Regulation | 6 | Adaptive anomaly detection | 1 |

| Satisfaction | 10 | Risk | 6 | Administration employment predictor | 1 |

| Services | 10 | Sentiment analysis | 6 | Adopt Islamic financing | 1 |

| Strategy | 10 | Sustainable development | 6 | Adopt mobile banking | 1 |

| Technology | 10 | Challenges | 5 | Adoption key challenges | 1 |

| Access | 9 | Corporate social responsibility | 5 | Adrenocortical carcinoma improving | 1 |

| Economic growth | 9 | Data | 5 | Advanced machine learning | 1 |

| Paper | DOI | TC | TC/Year |

|---|---|---|---|

| Queiroz Mm, 2019, Int J Inform Manage | 10.1016/j.ijinfomgt.2018.11.021 | 220 | 55 |

| Hudson J, 2006, Kyklos | 10.1111/j.1467-6435.2006.00319.x | 211 | 12.4118 |

| Lincoln Jr, 1996, Am Sociol Rev | 10.2307/2096407 | 207 | 7.6667 |

| Basheer A, 2018, Chirality | 10.1002/chir.22808 | 205 | 41 |

| Pichonpesme V, 1995, J Phys Chem-Us | 10.1021/j100016a071 | 173 | 6.1786 |

| Wu Ds, 2006, Expert Syst Appl | 10.1016/j.eswa.2005.09.034 | 171 | 10.0588 |

| Roe Mj, 1993, Yale Law J | 10.2307/796856 | 158 | 5.2667 |

| Fu Xq, 2009, J Bank Financ | 10.1016/j.jbankfin.2006.11.023 | 157 | 11.2143 |

| Williamson B, 2016, J Educ Policy | 10.1080/02680939.2015.1035758 | 150 | 21.4286 |

| Hasan S, 2013, J Stat Phys | 10.1007/s10955-012-0645-0 | 150 | 15 |

| Benoit S, 2017, Rev Financ | 10.1093/rof/rfw026 | 140 | 23.3333 |

| Miltgen Cl, 2013, Decis Support Syst | 10.1016/j.dss.2013.05.010 | 139 | 13.9 |

| Markose S, 2012, J Econ Behav Organ | 10.1016/j.jebo.2012.05.016 | 132 | 12 |

| Ballen Kk, 2001, Bone Marrow Transpl | 10.1038/sj.bmt.1702729 | 121 | 5.5 |

| Grijalva E, 2015, Appl Psychol-Int Rev | 10.1111/apps.12025 | 119 | 14.875 |

| Kou G, 2019, Technol Econ Dev Eco | 10.3846/tede.2019.8740 | 118 | 29.5 |

| Singh R, 2017, Rsc Adv | 10.1039/c7ra07191d | 114 | 19 |

| Lambie-Mumford H, 2013, J Soc Policy | 10.1017/S004727941200075X | 111 | 11.1 |

| Hughes Jp, 2013, J Financ Intermed | 10.1016/j.jfi.2013.06.004 | 106 | 10.6 |

| Huang X, 2012, J Financ Serv Res | 10.1007/s10693-011-0117-8 | 106 | 9.6364 |

| Liu Cs, 1998, Terr Atmos Ocean Sci | 10.3319/TAO.1998.9.4.705(TAICRUST) | 105 | 4.2 |

| Zhang Wp, 2019, Nat Commun | 10.1038/s41467-019-08463-z | 104 | 26 |

| O’neill K, 2003, Comp Polit Stud | 10.1177/0010414003257098 | 101 | 5.05 |

| Pierce L, 2009, Strategic Manage J | 10.1002/smj.736 | 98 | 7 |

| Tang Dl, 2002, Remote Sens Environ | 10.1016/S0034-4257(02)00062-7 | 96 | 4.5714 |

| Rey M, 2016, J Mol Spectrosc | 10.1016/j.jms.2016.04.006 | 94 | 13.4286 |

| Dean Dj, 2011, Geomorphology | 10.1016/j.geomorph.2010.03.009 | 88 | 7.3333 |

| Golany B, 1999, Interfaces | 10.1287/inte.29.3.14 | 87 | 3.625 |

| Lehrer C, 2018, J Manage Inform Syst | 10.1080/07421222.2018.1451953 | 86 | 17.2 |

| Zhang Z, 2017, Nucleic Acids Res | 10.1093/nar/gkw1060 | 85 | 14.1667 |

| De Fortuny Ej, 2013, Big Data-Us | 10.1089/big.2013.0037 | 82 | 8.2 |

| Balcerzak Ap, 2017, Acta Polytech Hung | NA | 81 | 13.5 |

| Kittel B, 1999, Eur J Polit Res | 10.1111/1475-6765.00448 | 80 | 3.3333 |

| Kesgin U, 2006, Energy | 10.1016/j.energy.2005.01.012 | 78 | 4.5882 |

| Aujla Gs, 2018, Ieee T Ind Inform | 10.1109/TII.2017.2738841 | 78 | 15.6 |

| Xu Xj, 2018, Nucleic Acids Res | 10.1093/nar/gkx897 | 75 | 15 |

| Lusher Sj, 2014, Drug Discov Today | 10.1016/j.drudis.2013.12.004 | 72 | 8 |

| Claessens S, 2012, J Bank Financ | 10.1016/j.jbankfin.2011.11.020 | 69 | 6.2727 |

| Sohangir S, 2018, J Big Data-Ger | 10.1186/s40537-017-0111-6 | 69 | 13.8 |

| Silva W, 2017, J Financ Stabil | 10.1016/j.jfs.2016.12.004 | 69 | 11.5 |

| Lo Sf, 2006, Asia Pac J Oper Res | 10.1142/S0217595906000930 | 66 | 3.8824 |

| Holloway J, 2018, Remote Sens-Basel | 10.3390/rs10091365 | 65 | 13 |

| Koschker Ac, 2006, Exp Clin Endocr Diab | 10.1055/s-2006-923808 | 63 | 3.7059 |

| Downey Po, 2016, Aob Plants | 10.1093/aobpla/plw047 | 63 | 9 |

| Wigand C, 2014, Ecol Appl | 10.1890/13-0594.1 | 62 | 6.8889 |

| Joh Ee, 2014, Wash Law Rev | NA | 62 | 6.8889 |

| Koyuncugil As, 2012, Expert Syst Appl | 10.1016/j.eswa.2011.12.021 | 61 | 5.5455 |

| Borensztein E, 2002, J Monetary Econ | 10.1016/S0304-3932(02)00116-2 | 60 | 2.8571 |

| Brewer E, 2013, J Financ Serv Res | 10.1007/s10693-011-0119-6 | 59 | 5.9 |

| Kshetri N, 2016, Int J Inform Manage | 10.1016/j.ijinfomgt.2015.11.014 | 59 | 8.4286 |

| Most Published | Most Published and Cited | |||

|---|---|---|---|---|

| Region | Freq | Country | Total Citations | Average Article Citations |

| USA | 354 | USA | 3084 | 25.916 |

| China | 310 | China | 1331 | 10.318 |

| UK | 118 | United Kingdom | 1213 | 29.585 |

| India | 103 | France | 725 | 40.278 |

| Germany | 97 | Canada | 414 | 23 |

| Spain | 72 | India | 404 | 6.733 |

| France | 66 | Germany | 396 | 10.703 |

| Russia | 63 | Australia | 374 | 13.357 |

| Italy | 58 | Italy | 331 | 12.731 |

| Australia | 56 | Netherlands | 302 | 17.765 |

| Malaysia | 49 | Turkey | 254 | 12.095 |

| Pakistan | 45 | Belgium | 237 | 21.545 |

| Brazil | 39 | Korea | 217 | 11.421 |

| Canada | 39 | Spain | 216 | 7.714 |

| Turkey | 37 | Switzerland | 175 | 29.167 |

| Netherlands | 36 | Poland | 158 | 7.524 |

| South Korea | 35 | Japan | 152 | 13.818 |

| Vietnam | 35 | Czech Republic | 126 | 8.4 |

| Poland | 34 | Israel | 124 | 41.333 |

| Iran | 31 | Iran | 120 | 10.909 |

- Step-by-Step Bibliometrix Package:

- Step 1—install “bibliometrix” package. Use the command “install.packages (“bibliometrix”)”.

- Step 2—run “bibliometrix” package (command “library (bibliometrix)”).

- Step 3—“bibliometrix” library is ready for use.

- Step 4—open Biblioshiny’ web-based software (command “Biblioshiny ()”)

- Step 5—convert the collected raw data from Scopus and WoS to Excel.

- Step 6—merge both datasets into one single dataset.

- Step 7—analyse the data to fulfill the research purpose.

References

- Cohen, M.C. Big Data and Service Operations. Prod. Oper. Manag. 2018, 27, 1709–1723. [Google Scholar] [CrossRef]

- Arjun, R.; Kuanr, A.; Kr, S. Developing banking intelligence in emerging markets: Systematic review and agenda. Int. J. Inf. Manag. Data Insights 2021, 1, 100026. [Google Scholar] [CrossRef]

- Akter, S.; Michael, K.; Uddin, M.R.; McCarthy, G.; Rahman, M. Transforming business using digital innovations: The application of AI, blockchain, cloud and data analytics. Ann. Oper. Res. 2020, 308, 7–39. [Google Scholar] [CrossRef]

- Kou, G.; Akdeniz, O.; Dinçer, H.; Yüksel, S. Fintech investments in European banks: A hybrid IT2 fuzzy multidimensional decision-making approach. Financial Innov. 2021, 7, 39. [Google Scholar] [CrossRef] [PubMed]

- Zha, Q.; Kou, G.; Zhang, H.; Liang, H.; Chen, X.; Li, C.-C.; Dong, Y. Opinion dynamics in finance and business: A literature review and research opportunities. Financial Innov. 2020, 6, 44. [Google Scholar] [CrossRef]

- Xu, M.; Chen, X.; Kou, G. A systematic review of blockchain. Financ. Innov. 2019, 5, 27. [Google Scholar] [CrossRef]

- González-Carrasco, I.; Jiménez-Márquez, J.L.; López-Cuadrado, J.L.; Ruiz-Mezcua, B. Automatic detection of relationships between banking operations using machine learning. Inf. Sci. 2019, 485, 319–346. [Google Scholar] [CrossRef]

- Ngo, J.; Hwang, B.-G.; Zhang, C. Factor-based big data and predictive analytics capability assessment tool for the construction industry. Autom. Constr. 2019, 110, 103042. [Google Scholar] [CrossRef]

- Raman, S.; Patwa, N.; Niranjan, I.; Ranjan, U.; Moorthy, K.; Mehta, A. Impact of big data on supply chain management. Int. J. Logist. Res. Appl. 2018, 21, 579–596. [Google Scholar] [CrossRef]

- Hajiheydari, N.; Delgosha, M.S.; Wang, Y.; Olya, H. Exploring the paths to big data analytics implementation success in banking and financial service: An integrated approach. Ind. Manag. Data Syst. 2021, 121, 2498–2529. [Google Scholar] [CrossRef]

- de Paz, J.C.L. Some implications of the new global digital economy for financial regulation and supervision. J. Bank. Regul. 2022, 24, 146–155. [Google Scholar] [CrossRef]

- Hock, K. Big Data Analytics in the German Banking Sector Using the Example of Retail Banking. Acc. Financial Manag. J. 2022, 7, 2601–2616. [Google Scholar] [CrossRef]

- Nobanee, H.; Dilshad, M.N.; Al Dhanhani, M.; Al Neyadi, M.; Al Qubaisi, S.; Al Shamsi, S. Big Data Applications the Banking Sector: A Bibliometric Analysis Approach. SAGE Open 2021, 11, 21582440211067234. [Google Scholar] [CrossRef]

- Zhu, X.; Yang, Y. Big Data Analytics for Improving Financial Performance and Sustainability. J. Syst. Sci. Inf. 2021, 9, 175–191. [Google Scholar] [CrossRef]

- Shakya, S.; Smys, S. Big Data Analytics for Improved Risk Management and Customer Segregation in Banking Applications. J. ISMAC 2021, 3, 235–249. [Google Scholar] [CrossRef]

- More, R.; Moily, Y. Big Data Analysis in Banking Sector. Int. J. New Technol. Res. 2021, 11, 1–5. [Google Scholar]

- Al-Khatib, A.W. Intellectual capital and innovation performance: The moderating role of big data analytics: Evidence from the banking sector in Jordan. EuroMed J. Bus. 2022, 17, 391–423. [Google Scholar] [CrossRef]

- Angelica, B.-C.; Mariluzia, P. The Impact of Data Science, Big Data, Forecasting, and Predictive Analytics on the Efficiency of Business System. In Digitalization and Big Data for Resilience and Economic Intelligence; Springer International Publishing: Cham, Switzerland, 2022; pp. 10–13. [Google Scholar] [CrossRef]

- Peng, H.; Lin, Y.; Wu, M. Bank Financial Risk Prediction Model Based on Big Data. Sci. Program. 2022, 2022, 3398545. [Google Scholar] [CrossRef]

- Khan, M.A.; Khojah, M.; Vivek, U. Artificial Intelligence and Big Data: The Advent of New Pedagogy in the Adaptive E-Learning System in the Higher Educational Institutions of Saudi Arabia. Educ. Res. Int. 2022, 2022, 1263555. [Google Scholar] [CrossRef]

- Hassani, H.; Huang, X.; Silva, E. Banking with blockchain-ed big data. J. Manag. Anal. 2018, 5, 256–275. [Google Scholar] [CrossRef]

- Hung, J.-L.; He, W.; Shen, J. Big data analytics for supply chain relationship in banking. Ind. Mark. Manag. 2019, 86, 144–153. [Google Scholar] [CrossRef]

- Corbett, C.J. How Sustainable Is Big Data? Prod. Oper. Manag. 2018, 27, 1685–1695. [Google Scholar] [CrossRef]

- Fosso Wamba, S.; Akter, S.; Trinchera, L.; De Bourmont, M. Turning information quality into firm performance in the big data economy. Manag. Decis. 2019, 57, 1756–1783. [Google Scholar] [CrossRef]

- Fosso Wamba, S.; Akter, S.; de Bourmont, M. Quality dominant logic in big data analytics and firm performance. Bus. Process Manag. J. 2019, 25, 512–532. [Google Scholar] [CrossRef]

- Amakobe, M. The Impact of Big Data Analytics on the Banking Industry. Colo. Tech. Univ. 2015, 4, 1–12. [Google Scholar] [CrossRef]

- Hassani, H.; Norouzi, K.; Ghodsi, A.; Huang, X. Revolutionary Dentistry through Blockchain Technology. Big Data Cogn. Comput. 2023, 7, 9. [Google Scholar] [CrossRef]

- Mohamed, T.S. How Big Data Does Impact Finance (Issue October); Aksaray University: Aksaray, Türkiye, 2019. [Google Scholar]

- Tranfield, D.; Denyer, D.; Smart, P. Towards a Methodology for Developing Evidence-Informed Management Knowledge by Means of Systematic Review*. Br. J. Manag. 2003, 14, 207–222. [Google Scholar] [CrossRef]

- Lamba, K.; Singh, S.P. Big data in operations and supply chain management: Current trends and future perspectives. Prod. Plan. Control. 2017, 28, 877–890. [Google Scholar] [CrossRef]

- Lê, J.K.; Schmid, T. The Practice of Innovating Research Methods. Organ. Res. Methods 2020, 25, 308–336. [Google Scholar] [CrossRef]

- Hasan, M.; Yajuan, L.; Khan, S. Promoting China’s Inclusive Finance Through Digital Financial Services. Glob. Bus. Rev. 2020, 23, 984–1006. [Google Scholar] [CrossRef]

- Hasan, M.; Yajuan, L.; Mahmud, A. Regional Development of China’s Inclusive Finance Through Financial Technology. SAGE Open 2020, 10, 2158244019901252. [Google Scholar] [CrossRef]

- Hasan, M.; Nekmahmud; Yajuan, L.; Patwary, M.A. Green business value chain: A systematic review. Sustain. Prod. Consum. 2019, 20, 326–339. [Google Scholar] [CrossRef]

- Aria, M.; Cuccurullo, C. bibliometrix: An R-tool for comprehensive science mapping analysis. J. Informetr. 2017, 11, 959–975. [Google Scholar] [CrossRef]

- Hutzschenreuter, T.; Matt, T.; Kleindienst, I. Going subnational: A literature review and research agenda. J. World Bus. 2020, 55, 101076. [Google Scholar] [CrossRef]

- Molasso, W.R. Theoretical Frameworks in Qualitative Research. J. Coll. Character 2006, 7, 1–2. [Google Scholar] [CrossRef]

- Abdulla, H.; Ketzenberg, M.; Abbey, J.D. Taking stock of consumer returns: A review and classification of the literature. J. Oper. Manag. 2019, 65, 560–605. [Google Scholar] [CrossRef]

- Collins, C.S.; Stockton, C.M. The Central Role of Theory in Qualitative Research. Int. J. Qual. Methods 2018, 17, 1609406918797475. [Google Scholar] [CrossRef]

- Hasan, M.; Popp, J.; Oláh, J. Current landscape and influence of big data on finance. J. Big Data 2020, 7, 21. [Google Scholar] [CrossRef]

- Laney, D. 3D Data Management: Controlling Data Volume, Velocity and Variety. 2001. Available online: http://blogs.gartner.com/doug-laney/files/2012/01/ad949-3D-Data-Management-Controlling-Data-Volume-Velocity-and-Variety.pdf (accessed on 16 July 2021).

- Mcafee, A.; Brynjolfsson, E. Big Data: The Management Revolution. Harv. Bus. Rev. 2012, 90, 60–68. Available online: http://tarjomefa.com/wp-content/uploads/2017/04/6539-English-TarjomeFa-1.pdf (accessed on 16 July 2021).

- Sicular, S. Gartner’s Big Data Definition Consists of Three Parts, Not to Be Confused with Three ‘V’s. Forbes. 2013. Available online: https://www.forbes.com/sites/gartnergroup/2013/03/27/gartners-big-data-definition-consists-of-three-parts-not-to-be-confused-with-three-vs/?sh=358bf63b42f6 (accessed on 1 August 2021).

- Giacalone, M.; Scippacercola, S. Big data: Issues and an Overview in Some Strategic Sectors. J. Appl. Quant. Methods 2016, 11, 1–17. [Google Scholar]

- Zakir, J.; Seymour, T.; Berg, K. Big data analytics. Issues Inf. 2015, 126, 81–90. [Google Scholar] [CrossRef]

- Tsai, C.-W.; Lai, C.-F.; Chao, H.-C.; Vasilakos, A.V. Big data analytics: A survey. J. Big Data 2015, 2, 21. [Google Scholar] [CrossRef]

- Singh, D.; Reddy, C.K. A survey on platforms for big data analytics. J. Big Data 2014, 2, 1–20. [Google Scholar] [CrossRef]

- Lavalle, S.; Lesser, E.; Shockley, R.; Hopkins, M.S.; Kruschwitz, N. Big Data, Analytics and the Path from Insights to Value; MIT Sloan Management Review: Cambridge, MA, USA, 2011; Volume 52. [Google Scholar]

- El Naqa, I.; Murphy, M.J. What Is Machine Learning? In Machine Learning in Radiation Oncology; Springer: Cham, Switzerland, 2015; pp. 3–11. [Google Scholar] [CrossRef]

- Jordan, M.I.; Mitchell, T.M. Machine learning: Trends, perspectives, and prospects. Science 2015, 349, 255–260. [Google Scholar] [CrossRef]

- Bi, Q.; Goodman, E.K.; Kaminsky, J.; Lessler, J. What is machine learning? A primer for the epidemiologist. Am. J. Epidemiol. 2019, 188, 2222–2239. [Google Scholar] [CrossRef]

- Enterprise, P.K.D. Machine Learning and Artificial Intelligence in Banking. Eng. Int. 2017, 5, 83–86. [Google Scholar] [CrossRef]

- Beutel, J.; List, S.; von Schweinitz, G. Does machine learning help us predict banking crises? J. Financ. Stab. 2019, 45, 100693. [Google Scholar] [CrossRef]

- Hamet, P.; Tremblay, J. Artificial intelligence in medicine. Metab. Clin. Exp. 2017, 69, S36–S40. [Google Scholar] [CrossRef] [PubMed]

- Dick, S. Artifi cial Intelligence. Harv. Data Sci. Rev. 2019, 11, 102–129. [Google Scholar] [CrossRef]

- McCarthy, J. What is AI? / Basic Questions. 2007. Available online: http://jmc.stanford.edu/artificial-intelligence/what-is-ai/index.html (accessed on 16 July 2021).

- Khan, M.A.; Salah, K. IoT security: Review, blockchain solutions, and open challenges. Futur. Gener. Comput. Syst. 2018, 82, 395–411. [Google Scholar] [CrossRef]

- Shafique, K.; Khawaja, B.A.; Sabir, F.; Qazi, S.; Mustaqim, M. Internet of Things (IoT) for Next-Generation Smart Systems: A Review of Current Challenges, Future Trends and Prospects for Emerging 5G-IoT Scenarios. IEEE Access 2020, 8, 23022–23040. [Google Scholar] [CrossRef]

- Gubbi, J.; Buyya, R.; Marusic, S.; Palaniswami, M. Internet of Things (IoT): A vision, architectural elements, and future directions. Future Gener. Comput. Syst. 2013, 29, 1645–1660. [Google Scholar] [CrossRef]

- Lee, I.; Lee, K. The Internet of Things (IoT): Applications, investments, and challenges for enterprises. Bus. Horiz. 2015, 58, 431–440. [Google Scholar] [CrossRef]

- OECD. Digital Disruption in Banking and its Impact on Competition. 2020. Available online: http://www.oecd.org/daf/competition/digital-disruption-in-financial-markets.htm%0AThis (accessed on 1 August 2021).

- Motamarri, S.; Akter, S.; Yanamandram, V.; Wamba, S.F. Why is Empowerment Important in Big Data Analytics? Procedia Comput. Sci. 2017, 121, 1062–1071. [Google Scholar] [CrossRef]

- Fosso Wamba, S.; Queiroz, M.M.; Wu, L.; Sivarajah, U. Big data analytics-enabled sensing capability and organisational outcomes: Assessing the mediating effects of business analytics culture. Ann. Oper. Res. 2020. [Google Scholar] [CrossRef]

- Babu, M.M.; Rahman, M.; Alam, A.; Dey, B.L. Exploring big data-driven innovation in the manufacturing sector: Evidence from UK firms. Ann. Oper. Res. 2021, 1–28. [Google Scholar] [CrossRef] [PubMed]

- Glass, R.; Callahan, S. Big Data, Big Benefits. In The Big Data-Driven Business: How to Use Big Data to Win Customers, Beat Competitors, and Boost Profits; John Wiley & Sons: Hoboken, NJ, USA, 2014; pp. 1–14. [Google Scholar]

- Hale, G.; Lopez, J.A. Monitoring banking system connectedness with big data. J. Econ. 2019, 212, 203–220. [Google Scholar] [CrossRef]

- Jagtiani, J.; Lemieux, C. Do fintech lenders penetrate areas that are underserved by traditional banks? J. Econ. Bus. 2018, 100, 43–54. [Google Scholar] [CrossRef]

- Rabhi, L.; Falih, N.; Afraites, A.; Bouikhalene, B. Big Data Approach and its applications in Various Fields: Review. Procedia Comput. Sci. 2019, 155, 599–605. [Google Scholar] [CrossRef]

- Zhu, Q.; Li, X.; Li, F.; Amirteimoori, A. Data-driven approach to find the best partner for merger and acquisitions in banking industry. Ind. Manag. Data Syst. 2020, 121, 879–893. [Google Scholar] [CrossRef]

- Moro, S.; Cortez, P.; Rita, P. A Data-Driven Approach to Predict the Success of Bank Telemarketing. Decis Support Syst 2014, 62, 22–31. [Google Scholar] [CrossRef]

- Gasser, U.; Gassmann, O.; Hens, T.; Leifer, L.; Puschmann, T.; Zhao, L. Digital Banking. April 2017. Available online: http://www.dv.co.th/blog-th/digital-banking-trend/ (accessed on 10 August 2021).

- Brynjolfsson, E.; Hitt, L.; Kim, H. Strength in numbers: How does data-driven decision-making affect firm performance? Int. Conf. Inf. Syst. 2011, 1, 541–558. [Google Scholar] [CrossRef]

- Liu, S. Big data and Analytics Software Revenue Worldwide from 2011 to 2019 (in Billion U.S. Dollars). 2020. Available online: https://www.statista.com/statistics/472934/business-analytics-software-revenue-worldwide/ (accessed on 10 August 2021).

- Holst, A. Volume of Data/Information Created, Captured, Copied, and Consumed Worldwide from 2010 to 2024. 2021. Available online: https://www.statista.com/statistics/871513/worldwide-data-created/ (accessed on 16 July 2021).

- Dialani, P. Top 10 Big data Trends 2020. Analyrics Insight. 2020. Available online: https://www.analyticsinsight.net/top-10-big-data-trends-2020/ (accessed on 10 August 2021).

- Adam, K.; Adam, M.; Fakharaldien, I.; Zain, J.M.; Majid, M.A. Big Data Management and Analysis. In Proceedings of the International Conference on Computer Engineering & Mathematical Sciences (ICCEMS 2014), Langkawi, Malaysia, 4 December 2014. [Google Scholar]

- Hussain, K.; Prieto, E. Big Data in the Finance and Insurance Sectors. In New Horizons for a Data-Driven Economy: A Roadmap for Usage and Exploitation of Big Data in Europe; Cavanillas, J.M., Curry, E., Wahlster, W., Eds.; SpringerOpen: London, UK, 2016; pp. 2019–2223. [Google Scholar] [CrossRef]

- Leskovec, J.; Rajaraman, A.; Ullman, J. Mining of Massive Data Sets, 2nd ed.; Cambridge University Press: Cambridge, UK, 2014. [Google Scholar]

- Parashar, S. Big Data Analytics: An Approach for Banking Industry. Emerg. Trends Big Data IoT Cyber Secur. 2020, 45–48. [Google Scholar]

- Sun, Y.; Shi, Y.; Zhang, Z. Finance Big Data: Management, Analysis, and Applications. Int. J. Electron. Commer. 2019, 23, 9–11. [Google Scholar] [CrossRef]

- Yadegaridehkordi, E.; Nilashi, M.; Shuib, L.; Nasir, M.H.N.B.M.; Asadi, S.; Samad, S.; Awang, N.F. The impact of big data on firm performance in hotel industry. Electron. Commer. Res. Appl. 2019, 40, 100921. [Google Scholar] [CrossRef]

- Shen, D.; Chen, S.-H. Big Data Finance and Financial Markets; Computational Social Sciences; Springer: Berlin/Heidelberg, Germany, 2018; pp. 235–248. [Google Scholar] [CrossRef]

- Zhang, S.; Xiong, W.; Ni, W.; Li, X. Value of big data to finance: Observations on an internet credit Service Company in China. Financial Innov. 2015, 1, 17. [Google Scholar] [CrossRef]

- Yang, D.; Chen, P.; Shi, F.; Wen, C. Internet Finance: Its Uncertain Legal Foundations and the Role of Big Data in Its Development. Emerg. Mark. Finance Trade 2017, 54, 721–732. [Google Scholar] [CrossRef]

- Choi, T.; Lambert, J.H. Advances in Risk Analysis with Big Data. Risk Anal. 2017, 37, 1435–1442. [Google Scholar] [CrossRef]

- Pérez-Martín, A.; Pérez-Torregrosa, A.; Vaca, M. Big Data techniques to measure credit banking risk in home equity loans. J. Bus. Res. 2018, 89, 448–454. [Google Scholar] [CrossRef]

- Lyu, X.; Zhao, J. Compressed Sensing and its Applications in Risk Assessment for Internet Supply Chain Finance Under Big Data. IEEE Access 2019, 7, 53182–53187. [Google Scholar] [CrossRef]

- Chen, R.-Y. Iot-Enabled Supply Chain Finance Risk Management Performance Big Data Analysis Using Fuzzy Qfd. In Proceedings of the 2nd International Conference on Big Data Technologies, Jinan, China, 28–30 August 2019; pp. 82–86. [Google Scholar] [CrossRef]

- Wang, F.; Ding, L.; Yu, H.; Zhao, Y. Big data analytics on enterprise credit risk evaluation of e-Business platform. In Information Systems and e-Business Management; Springer: Berlin/Heidelberg, Germany, 2021; Volume 18. [Google Scholar] [CrossRef]

- Zhao, X.; Yeung, K.; Huang, Q.; Song, X. Improving the predictability of business failure of supply chain finance clients by using external big dataset. Ind. Manag. Data Syst. 2015, 115, 1683–1703. [Google Scholar] [CrossRef]

- Tiwari, S.; Wee, H.; Daryanto, Y. Big data analytics in supply chain management between 2010 and 2016: Insights to industries. Comput. Ind. Eng. 2018, 115, 319–330. [Google Scholar] [CrossRef]

- Lai, Y.; Li, S. Research on Enterprise Credit System under the Background of Big Data; Atlantis Press: Amsterdam, The Netherlands, 2017. [Google Scholar] [CrossRef]

- Rodrigues, A.R.D.; Ferreira, F.A.; Teixeira, F.J.; Zopounidis, C. Artificial intelligence, digital transformation and cybersecurity in the banking sector: A multi-stakeholder cognition-driven framework. Res. Int. Bus. Financ. 2022, 60, 101616. [Google Scholar] [CrossRef]

- Panja, B.; Fattaleh, D.; Mercado, M.; Robinson, A.; Meharia, P. Cybersecurity in banking and financial sector: Security analysis of a mobile banking application. In Proceedings of the 2013 International Conference on Collaboration Technologies and Systems 2013, CTS, San Diego, CA, USA, 20–24 May 2013; pp. 397–403. [Google Scholar] [CrossRef]

- Mohamed, N.; Al-Jaroodi, J. Real-time big data analytics: Applications and challenges. In Proceedings of the 2014 International Conference on High Performance Computing and Simulation 2014, HPCS, Bologna, Italy, 21–25 July 2014; pp. 305–310. [Google Scholar] [CrossRef]

- Yin, S.; Kaynak, O. Big Data for Modern Industry: Challenges and Trends [Point of View]. Proc. IEEE 2015, 103, 143–146. [Google Scholar] [CrossRef]

- Leo, M.; Sharma, S.; Maddulety, K. Machine Learning in Banking Risk Management: A Literature Review. Risks 2019, 7, 29. [Google Scholar] [CrossRef]

- Delgosha, M.S.; Hajiheydari, N.; Fahimi, S.M. Elucidation of bi data Analytics in banking: A Four-stage Delphi Study. J. Enterp. Inf. 2019, 34, 1577–1596. [Google Scholar] [CrossRef]

- Lyko, K.; Nitzschke, M.; Ngomo, A.-C.N. New Horizons for a Data-Driven Economy: A Roadmap for Usage and Exploitation of Big Data in Europe; Springer Nature: Berlin, Germany, 2016; pp. 1–303. [Google Scholar] [CrossRef]

- Chintagunta, P.; Hanssens, D.M.; Hauser, J.R. Editorial—Marketing Science and Big Data. Manag. Sci. 1970, 17, B–124–B–126. [Google Scholar] [CrossRef][Green Version]

- Amado, A.; Cortez, P.; Rita, P.; Moro, S. Research trends on Big Data in Marketing: A text mining and topic modeling based literature analysis. Eur. Res. Manag. Bus. Econ. 2017, 24, 1–7. [Google Scholar] [CrossRef]

- Erevelles, S.; Fukawa, N.; Swayne, L. Big Data consumer analytics and the transformation of marketing. J. Bus. Res. 2016, 69, 897–904. [Google Scholar] [CrossRef]

- Khade, A.A. Performing Customer Behavior Analysis using Big Data Analytics. Procedia Comput. Sci. 2016, 79, 986–992. [Google Scholar] [CrossRef]

- Satish, L.; Yusof, N. A Review: Big Data Analytics for enhanced Customer Experiences with Crowd Sourcing. Procedia Comput. Sci. 2017, 116, 274–283. [Google Scholar] [CrossRef]

- Mauricio. The Role of Big Data in the Banking Industry. Big Data Made Simple. 2016. Available online: https://bigdata-madesimple.com/role-big-data-banking-industry/ (accessed on 16 July 2021).

- Srivastava, U.; Gopalkrishnan, S. Impact of Big Data Analytics on Banking Sector: Learning for Indian Banks. Procedia Comput. Sci. 2015, 50, 643–652. [Google Scholar] [CrossRef]

- Jonker, D.; Langevin, S.; Schretlen, P.; Canfield, C. Agile visual analytics for banking cyber “big data”. In Proceedings of the 2012 IEEE Conference on Visual Analytics Science and Technology (VAST), Seattle, WA, USA, 14–19 October 2012; pp. 299–300. [Google Scholar] [CrossRef]

- Wang, H.; Xu, Z.; Fujita, H.; Liu, S. Towards felicitous decision making: An overview on challenges and trends of Big Data. Inf. Sci. 2016, 367–368, 747–765. [Google Scholar] [CrossRef]

- Janssen, M.; van der Voort, H.; Wahyudi, A. Factors influencing big data decision-making quality. J. Bus. Res. 2017, 70, 338–345. [Google Scholar] [CrossRef]

- Elgendy, N.; Elragal, A. Big Data Analytics in Support of the Decision Making Process. Procedia Comput. Sci. 2016, 100, 1071–1084. [Google Scholar] [CrossRef]

- Akter, S.; Gunasekaran, A.; Wamba, S.F.; Babu, M.M.; Hani, U. Reshaping competitive advantages with analytics capabilities in service systems. Technol. Forecast. Soc. Chang. 2020, 159, 120180. [Google Scholar] [CrossRef]

- Hajirahimova, M.; Ismayilova, M. Big Data Visualization: Existing Approaches and Problems. Problems of Information. Probl. Inf. Technol. 2018, 9, 65–74. [Google Scholar] [CrossRef]

- Márquez, F.P.G.; Lev, B. Data Science and Digital Business; Springer International Publishing: New York, NY, USA, 2019. [Google Scholar] [CrossRef]

- Perkhofer, L.M.; Hofer, P.; Walchshofer, C.; Plank, T.; Jetter, H.-C. Interactive visualization of big data in the field of accounting: A survey of current practice and potential barriers for adoption. J. Appl. Account. Res. 2019, 20, 497–525. [Google Scholar] [CrossRef]

- Ram, J.; Yang, H. Examining Impacts of Big Data Analytics on Consumer Finance: A Case of China. Int. J. Manag. Inf. Technol. 2017, 9, 13–22. [Google Scholar] [CrossRef]

- Bedeley, R.; Iyer, L.S. Big Data Opportunities and Challenges: The Case of Banking Industry; SAIS 2014 Proceedings; University of North Carolina, Greensboro: Greensboro, NC, USA, 2014; Available online: http://aisel.aisnet.org/sais2014/2/ (accessed on 16 February 2021).

- Calvard, T.S.; Jeske, D. Developing human resource data risk management in the age of big data. Int. J. Inf. Manag. 2018, 43, 159–164. [Google Scholar] [CrossRef]

- Fosso Wamba, S.; Gunasekaran, A.; Dubey, R.; Ngai, E.W.T. Big data analytics in operations and supply chain management. Ann. Oper. Res. 2018, 270, 1–4. [Google Scholar] [CrossRef]

- Lioutas, E.D.; Charatsari, C. Big data in agriculture: Does the new oil lead to sustainability? Geoforum 2019, 109, 1–3. [Google Scholar] [CrossRef]

- Balachandran, B.M.; Prasad, S. Challenges and Benefits of Deploying Big Data Analytics in the Cloud for Business Intelligence. Procedia Comput. Sci. 2017, 112, 1112–1122. [Google Scholar] [CrossRef]

- Bauder, R.A.; Khoshgoftaar, T.M. The effects of varying class distribution on learner behavior for medicare fraud detection with imbalanced big data. Health Inf. Sci. Syst. 2018, 6, 9. [Google Scholar] [CrossRef] [PubMed]

- Begenau, J.; Farboodi, M.; Veldkamp, L. Big data in finance and the growth of large firms. J. Monet. Econ. 2018, 97, 71–87. [Google Scholar] [CrossRef]

- Shamim, S.; Zeng, J.; Shariq, S.M.; Khan, Z. Role of big data management in enhancing big data decision-making capability and quality among Chinese firms: A dynamic capabilities view. Inf. Manag. 2018, 56, 103135. [Google Scholar] [CrossRef]

- Li, M.; Xu, G.; Lin, P.; Huang, G.Q. Cloud-based mobile gateway operation system for industrial wearables. Robot. Comput. Manuf. 2019, 58, 43–54. [Google Scholar] [CrossRef]

- Hao, M.C.; Keim, D.A.; Dayal, U. VisBiz: A Simplified Visualization of Business Operation; IEEE: Austin, TX, USA, 2005. [Google Scholar] [CrossRef]

- Hariri, R.H.; Fredericks, E.M.; Bowers, K.M. Uncertainty in big data analytics: Survey, opportunities, and challenges. J. Big Data 2019, 6, 44. [Google Scholar] [CrossRef]

- Khalfan, A.M.; AlShawaf, A. Adoption and Implementation Problems of E-Banking: A Study of the Managerial Perspective of the Banking Industry in Oman. J. Glob. Inf. Technol. Manag. 2004, 7, 47–64. [Google Scholar] [CrossRef]

- Chang, W.-L.; Chan, P. The Ethics of Big Data: Balancing economic benefits and ethical questions of Big Data in the EU policy context. Rev. Bus. Res. 2015, 15, 55–60. [Google Scholar] [CrossRef]

- Court, D.; Perrey, J.; McGuire, T.; Gordon, J.; Spilecke, D. Big Data, Analytics, and the Future of Marketing & Sales; McKinsey&Company: New York, NY, USA, 2015. [Google Scholar]

- Skyrius, R.; Giriūnienė, G.; Katin, I.; Kazimianec, M.; Žilinskas, R. The Potential of Big Data in Banking. Guide Big Data Appl. 2017, 26, 451–486. [Google Scholar] [CrossRef]

- Mbelli, T.M.; Dwolatzky, B. Cyber Security, a Threat to Cyber Banking in South Africa: An Approach to Network and Application Security. In Proceedings of the 3rd IEEE International Conference on Cyber Security and Cloud Computing, CSCloud 2016 and 2nd IEEE International Conference of Scalable and Smart Cloud, SSC, New York, NY, USA, 18–20 November 2016; pp. 1–6. [Google Scholar] [CrossRef]

- Grover, V.; Chiang, R.H.; Liang, T.P.; Zhang, D. Creating Strategic Business Value from Big Data Analytics: A Research Framework. J. Manag. Inf. Syst. 2018, 35, 388–423. [Google Scholar] [CrossRef]

- Oussous, A.; Benjelloun, F.-Z.; Lahcen, A.A.; Belfkih, S. Big Data technologies: A survey. J. King Saud Univ. Comput. Inf. Sci. 2018, 30, 431–448. [Google Scholar] [CrossRef]

- Dey, L.; Saxena, S.; Joshi, C. Leveraging Unstructured Text Data for Banks. 2013. Available online: http://www.tcs.com/SiteCollectionDocuments/WhitePapers/BFS-Whitepaper-Unstructured-Text-Data-Banks-0613-2.pdf (accessed on 1 August 2021).

- Oguntimilehin, A.; Ademola, E.O. A Review of Big Data Management, Benefits and Challenges. J. Emerg. Trends Comput. Inf. Sci. 2014, 5, 433–438. Available online: http://www.cisjournal.org (accessed on 1 August 2021).

- Bandara, R.; Fernando, M.; Akter, S. Managing consumer privacy concerns and defensive behaviours in the digital marketplace. Eur. J. Mark. 2020, 55, 219–246. [Google Scholar] [CrossRef]

- Cockcroft, S.; Russell, M. Big Data Opportunities for Accounting and Finance Practice and Research. Aust. Account. Rev. 2018, 28, 323–333. [Google Scholar] [CrossRef]

- Jain, P.; Gyanchandani, M.; Khare, N. Big data privacy: A technological perspective and review. J. Big Data 2016, 3, 25. [Google Scholar] [CrossRef]

- Asadi, S.; Nilashi, M.; Husin, A.R.C.; Yadegaridehkordi, E. Customers perspectives on adoption of cloud computing in banking sector. Inf. Technol. Manag. 2016, 18, 305–330. [Google Scholar] [CrossRef]

- Bose, R.; Luo, X.; Liu, Y. The Roles of Security and Trust: Comparing Cloud Computing and Banking. Procedia Soc. Behav. Sci. 2013, 73, 30–34. [Google Scholar] [CrossRef]

- Orçun Kaya, A.; Jan Schildbach, E. Artificial intelligence in banking: A lever for profitability with limited implementation to date. Dtsch. Bank Res. 2019, 5–9. Available online: www.dbresearch.com (accessed on 1 August 2021).

- Andrew, G. The Top 20 Cyberattacks on Industrial Control Systems. Waterfall Secur. Solut. 2018, 1–28. Available online: www.waterfall-security.com (accessed on 12 June 2021).

- Kumire, J. How are Banks Dealing with a Rise in Cyber Attacks? 11:FS. Available online: https://11fs.com/article/how-are-banks-dealing-with-a-rise-in-cyber-attacks (accessed on 28 January 2020).

- Zetter, K. That Insane, $81M Bangladesh Bank Heist? Here’s What We Know. WIRED. Available online: https://www.wired.com/2016/05/insane-81m-bangladesh-bank-heist-heres-know/ (accessed on 17 May 2016).

- Bouveret, A. Cyber Risk for the Financial Sector: A Framework for Quantitative Assessment; International Monetary Fund: Washington, DC, USA, 2018; Volume 18. [Google Scholar] [CrossRef]

- Gana, N.N.; Abdulhamid, S.M.; Ojeniyi, J.A. Security Risk Analysis and Management in Banking Sector: A Case Study of a Selected Commercial Bank in Nigeria. Int. J. Inf. Eng. Electron. Bus. 2019, 11, 35–43. [Google Scholar] [CrossRef]

- Vatis, M.A.; Cohn, R.K.; Koochesfabani, M.M. Cyber Attacks During the War on Terrorism: A Predictive Analysis. Inst. Secur. Technol. Stud. Dartm. Coll. 2001, 22, 1–27. [Google Scholar] [CrossRef]

- Hasan, M. Banks Further Alerted about Cyberattack Threat. Dhaka Tribune. Available online: https://www.dhakatribune.com/bangladesh/2020/11/22/banks-further-alerted-about-cyber-attack-threat (accessed on 22 November 2020).

- West, J. A Prediction Model Framework for Cyber-Attacks to Precision Agriculture Technologies. J. Agric. Food Inf. 2018, 19, 307–330. [Google Scholar] [CrossRef]

- Patterson, D. How Banks Fight Back against Cyberattacks. Tech Republic. Available online: https://www.techrepublic.com/article/how-banks-fight-back-against-cyberattacks/ (accessed on 18 October 2016).

- Pasqualetti, F.; Carli, R.; Bicchi, A.; Bullo, F. Identifying cyber attacks via local model information. In Proceedings of the IEEE Conference on Decision and Control, Jeju Island, Republic of Korea, 14–18 December 2010; pp. 5961–5966. [Google Scholar] [CrossRef]

- Bauer, S.; Bernroider, E.W.; Chudzikowski, K. Prevention is better than cure! Designing information security awareness programs to overcome users' non-compliance with information security policies in banks. Comput. Secur. 2017, 68, 145–159. [Google Scholar] [CrossRef]

- Koesyairy, A.A.; Kurniawan, A.; Hidayanto, A.N.; Budi, N.F.A.; Samik-Ibrahim, R.M. Mapping Internal Control of Data Security Issues of BYOD Program in Indonesian Banking Sector. In Proceedings of the 2019 5th International Conference on Computing Engineering and Design (ICCED), Singapore, 11–13 April 2019. [Google Scholar] [CrossRef]

- Költzsch, G. Innovative methods to enhance transaction security of banking applications. J. Bus. Econ. Manag. 2006, 7, 243–249. [Google Scholar] [CrossRef][Green Version]

- Borodzicz, E.P.; van Haperen, K. Learning and Training: A Reflective Account of Crisis Management in a Major UK Bank. Risk Manag. 2003, 5, 33–50. [Google Scholar] [CrossRef]

- Pattinson, M.; Butavicius, M.; Parsons, K.; McCormac, A.; Calic, D. Managing information security awareness at an Australian bank: A comparative study. Inf. Comput. Secur. 2017, 25, 181–189. [Google Scholar] [CrossRef]

- Singha, R. Banking Industry Faces Surge in Cyber Security Challenges. Security Bloggers Network. Available online: https://securityboulevard.com/2020/12/banking-industry-faces-surge-in-cyber-security-challenges/ (accessed on 19 December 2020).

- William, C.A. Impact of Alleged Russian Cyber Attacks. Balt. Secur. Def. Rev. 2009, 11, 4–40. [Google Scholar]

- Watkins, B. The Impact of Cyber Attacks on the Private Sector. Association for International Affairs. 1–11 August 2014. Available online: http://pdc.ceu.hu/archive/00007108/01/AMO_cyber-attacks_2014.pdf (accessed on 10 September 2021).

- Corporation, O. Big Data in Financial Services and Banking (Oracle Enterprise Architecture White Paper, Issue February). 2015. Available online: http://www.oracle.com/us/technologies/big-data/big-data-in-financial-services-wp-2415760.pdf (accessed on 1 August 2021).

- Siddiqui, A.A.; Qureshi, R. (Big Data in Banking, 2017) Big Data in Banking: Opportunities and Challenges Post Demonetisation in India. IOSR J. Comput. Eng. 2017, 33–39. Available online: www.iosrjournals.org (accessed on 1 August 2021).

- Yu, S.; Guo, S. Big data concepts, theories, and applications. In Big Data Concepts, Theories, and Applications; Springer: Berlin/Heidelberg, Germany, 2016; pp. 1–437. [Google Scholar] [CrossRef]

- Khan, M.N.R.; Ara, J.; Yesmin, S.; Abedin, M.Z. Machine learning approaches in cybersecurity. In Data Intelligence and Cognitive Informatics: Proceedings of ICDICI 2021; Springer Nature Singapore: Singapore, 2022; pp. 345–357. [Google Scholar]

- Sunny, F.A.; Hajek, P.; Munk, M.; Abedin, M.Z.; Satu, M.S.; Efat, M.I.A.; Islam, M.J. A systematic review of blockchain applications. IEEE Acc. 2022, 10, 59155–59177. [Google Scholar] [CrossRef]

- Efat, M.I.A.; Hajek, P.; Abedin, M.Z.; Azad, R.U.; Jaber, M.A.; Aditya, S.; Hassan, M.K. Deep-learning model using hybrid adaptive trend estimated series for modelling and forecasting sales. Ann. Oper. Res. 2022, 1–32. [Google Scholar] [CrossRef]

| Paper | DOI | TC | TC/Year |

|---|---|---|---|

| Queiroz Mm, 2019, Int J Inform Manage | 10.1016/j.ijinfomgt.2018.11.021 | 220 | 55 |

| Hudson J, 2006, Kyklos | 10.1111/j.1467-6435.2006.00319.x | 211 | 12.4118 |

| Lincoln Jr, 1996, Am Sociol Rev | 10.2307/2096407 | 207 | 7.6667 |

| Basheer A, 2018, Chirality | 10.1002/chir.22808 | 205 | 41 |

| Pichonpesme V, 1995, J Phys Chem-Us | 10.1021/j100016a071 | 173 | 6.1786 |

| Wu Ds, 2006, Expert Syst Appl | 10.1016/j.eswa.2005.09.034 | 171 | 10.0588 |

| Roe Mj, 1993, Yale Law J | 10.2307/796856 | 158 | 5.2667 |

| Fu Xq, 2009, J Bank Financ | 10.1016/j.jbankfin.2006.11.023 | 157 | 11.2143 |

| Williamson B, 2016, J Educ Policy | 10.1080/02680939.2015.1035758 | 150 | 21.4286 |

| Hasan S, 2013, J Stat Phys | 10.1007/s10955-012-0645-0 | 150 | 15 |

| Benoit S, 2017, Rev Financ | 10.1093/rof/rfw026 | 140 | 23.3333 |

| Miltgen Cl, 2013, Decis Support Syst | 10.1016/j.dss.2013.05.010 | 139 | 13.9 |

| Markose S, 2012, J Econ Behav Organ | 10.1016/j.jebo.2012.05.016 | 132 | 12 |

| Ballen Kk, 2001, Bone Marrow Transpl | 10.1038/sj.bmt.1702729 | 121 | 5.5 |

| Grijalva E, 2015, Appl Psychol-Int Rev | 10.1111/apps.12025 | 119 | 14.875 |

| Kou G, 2019, Technol Econ Dev Eco | 10.3846/tede.2019.8740 | 118 | 29.5 |

| Singh R, 2017, Rsc Adv | 10.1039/c7ra07191d | 114 | 19 |

| Lambie-Mumford H, 2013, J Soc Policy | 10.1017/S004727941200075X | 111 | 11.1 |

| Hughes Jp, 2013, J Financ Intermed | 10.1016/j.jfi.2013.06.004 | 106 | 10.6 |

| Huang X, 2012, J Financ Serv Res | 10.1007/s10693-011-0117-8 | 106 | 9.6364 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hasan, M.; Hoque, A.; Le, T. Big Data-Driven Banking Operations: Opportunities, Challenges, and Data Security Perspectives. FinTech 2023, 2, 484-509. https://doi.org/10.3390/fintech2030028

Hasan M, Hoque A, Le T. Big Data-Driven Banking Operations: Opportunities, Challenges, and Data Security Perspectives. FinTech. 2023; 2(3):484-509. https://doi.org/10.3390/fintech2030028

Chicago/Turabian StyleHasan, Morshadul, Ariful Hoque, and Thi Le. 2023. "Big Data-Driven Banking Operations: Opportunities, Challenges, and Data Security Perspectives" FinTech 2, no. 3: 484-509. https://doi.org/10.3390/fintech2030028

APA StyleHasan, M., Hoque, A., & Le, T. (2023). Big Data-Driven Banking Operations: Opportunities, Challenges, and Data Security Perspectives. FinTech, 2(3), 484-509. https://doi.org/10.3390/fintech2030028