1. Introduction

In most economies today, cash is a vital component of the monetary system. Cash is a liquid financial asset that is easy to access and use daily. While the usage of cash is changing with the new forms of payment, cash is still used by most citizens to some extent. With the continued use of cash in the United States (U.S.) economy, there is a need to transfer cash from banks to retailers and from retailers to banks. To avoid robbery while transporting cash, retailers turn to armored truck couriers (ATCs) to securely move that cash. In addition, banks use ATCs to transport cash between bank branches and the Federal Reserve Bank.

Contrary to common thought, the supply of cash in the cash cycle was at an all-time high in 2022. While cashless transactions and cryptocurrencies are widespread today, cash is still extensively used. According to Mr. Robert Bujas, the Assistant Vice President of Supply Chain Engagement at the Federal Reserve Bank, there is more than USD 2.1 trillion in circulation today.

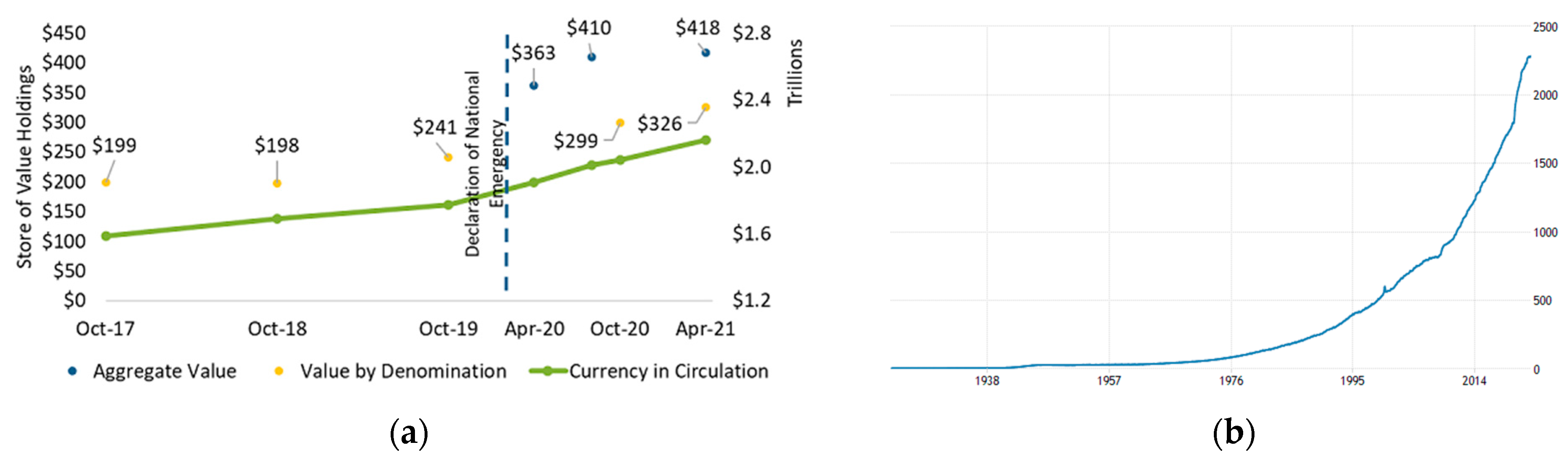

Figure 1a is a graphic of the cash in circulation as of April 2021, showing a marked increase in currency in circulation due to COVID-19.

Trading Economics [

2] provides a graphic for cash in circulation from 1918 through 2022, estimating that the money in circulation is USD 2.284 trillion (see

Figure 1b), clearly showing a consistent climb in cash circulation. Large amounts of cash in circulation require safe and effective means of movement and standards for correctly identifying cash-in-transit (CIT) containers.

Retailers rely on ATCs to efficiently move their cash assets to and from the bank as needed and in a timely manner. Retailers execute strict contracts with ATCs, ensuring specific performance metrics for the transportation of their cash. Retailers have limited options for ATCs in most areas of the U.S. because there are very few competitive couriers in each market. While ATCs are insured for the liabilities they transport, the retailer is ultimately responsible if money is lost during transport. They must launch time-consuming investigations with proof of the transaction before the ATC’s insurance pays out the claim. While the investigation and claim are in process, the retailer’s cash is tied up for months and unavailable for commerce.

All transactions within the cash management industry have a chain of custody requirement where one entity transfers the liability of the cash to the receiver. A cash shipment may require ten or more custody transfers before being delivered to the appropriate endpoint.

In addition, some armored truck companies (ATC) also act as bank storage and processing facilities. In these cases, banks keep substantial inventories of cash and coins in remote vaults at these ATCs. An ATC with these services segregates cash in their vaults by the banks they service. These are stored in lockers, containers, and small inner vaults.

Given the above information, the researchers believe that using radio frequency identification (RFID) and an application programming interface (API) between all parties in the cash management ecosystem reduces cost, improves efficiency, and increases capacity. The purpose of this research is to accurately model an existing ATC branch using common model tuning and validation techniques, then, perturb that model with RFID traceability and an API interface between the entities, observe the results, and draw conclusions about the change.

The Current State of Cash Visibility

Most cash-handling bodies (e.g., banks and ATCs) have participated in developing the GS-1 Cash Visibility Standard [

3]. This standard breaks down the elements of cash visibility and is a guide to a numbering system for packages of cash. The standard focuses entirely on barcodes as a means of traceability.

Based on interviews with ATCs and the Federal Reserve Bank, the industry has implemented barcodes as a standard on bags, with the leading characters of the barcode representing the organization that produced the bag. The GS-1 U.S. Guide for Cash Visibility Standards (USGCVS) calls this barcode a Serial Shipping Container Code, or SSCC. This barcode contains up to 18 digits, with the leading digits identifying the GS1 Company Prefix and the remainder indicating a serial reference. The intent of this in the USGCVS is to provide traceability from its source to its destination. While this code is acceptable as an identifier, it does not provide routing information.

Cash management companies are a crucial component of the United States system of commerce, yet these companies are not taking advantage of IoT technologies that have been proven in many similar industries. Walmart [

4] and Delta Airlines [

5] have adopted IoT successfully. These companies track low-value items (Walmart—cases of goods to stock and sell in stores, and Delta—customer baggage). In contrast, cash management companies transport high-value items at their best by utilizing barcodes. Walmart and Delta have successfully improved customer satisfaction, reduced losses, and increased the visibility of assets. Cash management companies offer minimal visibility, and there is a lack of interoperability between companies. The cash movement ecosystem is generally unfamiliar with IoT and operates on narrow profit margins, so they are skeptical about exploring IoT technology. The cash management industry is mired in antiquated technology and uses arcane methods while handling high-value assets.

Given the current state of cash visibility, the researchers explore using radio frequency identification (RFID) and an application programming interface (API) to significantly reduce operational costs, increase capacity, and provide increased visibility within the cash movement ecosystem.

2. Materials and Methods

Valentine [

6] describes the transfer of typical banking behaviors from banks to processing facilities such as ATCs. The author describes how the consolidation of banking services at ATCs reaches an economy of scale and allows bank customers to be serviced more safely and logically. In addition to regular banking services, ATCs enable a smart-safe option for bank customers that immediately sorts and counts cash credits and deposits into the customer’s account.

Several researchers have attempted to provide recommendations for better CIT security by optimizing the routing of armored vehicles [

7,

8,

9,

10]. This area of research seeks to save money, reduce the risk of robbery, and optimize operational behaviors. Xu et al. (2019) suggest that the risk of armored vehicle robbery correlates with the amount of cash on the truck and the distance the vehicle is required to travel. They also indicate that travel in areas of low socio-economic status dramatically increases risk.

In Automatic Teller Machine (ATM) servicing, researchers have explored several paths to predict the supply of cash availability in these machines and optimize operations [

11,

12,

13,

14,

15,

16,

17,

18,

19].

This research used a mixed-methods approach, utilizing both qualitative and quantitative methods. The investigation began with a detailed process mapping exercise at an armored courier facility for five days, with several additional trips to the courier branch to discuss findings and resolve errors in the process mapping. The process mapping was accomplished through more than 60 h of observation and interviews with employees and management.

A simulation model was developed using AnyLogic software, Version 8.8.2, a tool specifically designed for business process modeling. Much effort was made to ensure that the simulation model accurately reflected current processes through tuning and validation.

The model approach was specifically discrete-event modeling, but in cases where bags of cash were followed throughout several processes, agent-based modeling was employed. Because the nature of the model was to evaluate time, for the most part, time-delay mechanisms were used for many parts of the model. For example, in the area of bag transfer from CIT to the vault tellers, each process had a timing mechanism based on a triangular or uniform distribution derived from observations. When employees were needed to perform an action, an employee pool mechanism was utilized, and the number of employees matched the actual number of employees in the branch. Extensive use of queues and physical space seize mechanisms was used to place people and assets in the appropriate locations with the materials to be moved. In several locations, for processes that repeated, loops were used with exits upon completion of the full process.

To make quick changes to the model without changing the model code, a configuration spreadsheet was used to set the boundaries and operational behaviors of the simulation. This spreadsheet is discussed in more detail in the next section.

The system behaviors, observations, and financial information acquired from an armored courier were used to create a base business cost model. This model is based on ATC employee behaviors and transactions, as well as interviews and discussions with the armored courier to validate the existing business model.

Having completed the baseline model, the researchers applied RFID and API integration to the AnyLogic current state model simulation. The focus of this process is to evaluate the difference between the two models (current and future state) in terms of the processing time of cash bags within a branch operation, which, in turn, alters the business cost model. Following the comparison of models and business case evaluations, recommendations are provided based on the completed research and results.

3. Results

Robert Sargent [

20] defines model validation as “substantiation that a model within its domain of applicability possesses a satisfactory range of accuracy consistent with the intended application of the model”. Because of the nature of this model, validation is based on a set of experimental conditions, which are the measure of validity based on the acceptable range of accuracy. In looking at the key output variables in this model, typically time, an acceptable range must be chosen that represents the system variables (observed system operational times) or outputs of the existing system. The system variables and the simulation variables should produce similar outcomes. For instance, a straightforward comparison of the system to the simulation may be indicative of operational behavior. The mean and standard deviation of the simulation output should reasonably match the system. Because the system and the simulation are dynamic, some broad choices for the accuracy range must be made. The overall dynamics of the branch can change significantly from day to day and month to month. For validation processes, a 15% difference from the observed data is considered acceptable for observed data vs. simulation data. The observed processes and additional information provided by the armored courier were used to tune the model to reasonably match an armored courier branch process.

Where possible, a 95% confidence interval (CI) is calculated for observed or provided operational data. The CI is achieved by utilizing Equation (1),

where

is the probability of committing a Type I error (probability of rejecting the null hypothesis when the null hypothesis is true), and

is the power test based on the probability of committing a Type II error (probability of not rejecting the null hypothesis when the null hypothesis is false). Simulation data standard deviations are compared/validated using this technique.

The simulation model was developed in AnyLogic software, Version 8.8.2, and focused on processes and interactions between individuals (bag sorting, customer–messenger, vault teller–messenger, CMS teller). The model breaks down each process into actions and delays that mimic the actual processes discussed earlier. An example of a process is shown in

Figure 2.

Because time and the use of resources are the critical variables in the model, one can see a series of tasks and associated delay blocks. Each task has an associated resource pool used to accomplish it. For instance, when a messenger (a resource) enters a mantrap (the location where bags are passed), a delay block indicates the timing of that particular process. A teller must also be allocated from the resource pool to accept the bags; thus, the process is timed to complete the transaction. The model focuses on time and resource allocation to inform the business model. The processes in

Table 1 are the critical areas of interest.

In addition, a series of parameters are established with purposeful variation to indicate normal human behavior. These parameters are stored in an Excel spreadsheet that is consumed during the compilation of the simulation.

Table 2 is an example of the branch processing time variables.

4. Discussion

4.1. Data Collection and Validation

The researchers collected many quantitative and qualitative operational behavior data points (process mapping) on-site and during subsequent interactions. An objective of the research was a time-motion study of teller-messenger interactions in the mantrap, but the ATC did not allow much time for a time-motion study of quantitative data collection. Some activities were observed and timed, and other activities were explained by ATC personnel but not observed. Three days of time-motion study data collection for a single teller were observed and timed. Additionally, quantitative data were provided by the ATC indicating bag processing for the top 30 branches within the company and hourly employee work hours for 22 weeks. The remainder of the data were collected anecdotally through observations and interviews. In addition, some assumptions made by the researchers were validated through meetings with the ATC operational management team.

The time-motion study provided 46 observations of vault tellers receiving bags and accessories from messengers. Two of the observations were excluded from the analysis because of the operational behavior in the process (e.g., passing one emergency ATM refill bag and a truncated route with 12 bags). The values of total time in the mantrap, time passing bags, time passing accessories, and time for checkout were collected. The observed data were collected by observing one vault teller for three shifts on Wednesday, Thursday, and Friday. For this investigation, the researchers consider this information equivalent to one day for one teller. Therefore, the observed data are regularly compared with a single day/single teller of simulation data.

The simulation model was developed based on the holistic operation of an ATC branch with 45 armored vehicles that conduct outsourced bank operations. The primary purpose of the simulation is to look at operational times when bags are handled through the CIT and vault operational procedures. The model does not evaluate or simulate CMS processing but includes CMS’s bag sorting behaviors. The model is evaluated based on general operational timing that is observed (e.g., total time frame for transfer of bags from the vault to CIT and reverse) and from data provided by the ATC. In addition, where possible, the model was validated by comparing the mean, first and third quartiles, and median of observed quantitative data with model simulation data.

Discussing sample sizes, the observational data, and the provided data established the value of n for all cases. For the simulation data, the model has a limit of 100 days. This constraint is a software memory utilization limit. A single day of the simulation produces 3000+ bags, 45 truck routes, and 12,000+ bag touches. Running the model for a maximum of 100 days produces a multiple of the single-day values.

In some cases, large data files were manipulated through RStudio, Version 2022.12.0, Build 353, first and then Microsoft Excel, Version 2305. For instance, bag touches by tellers for 100 days produce 1.2 M transactions. Those transactions were sorted by the teller type in R, and new files were created to evaluate further in Excel (e.g., pivot tables, box plots, histograms). In all cases, the simulation data from the model were used as a complete dataset (no sampling). In addition, when daily values were required, the simulation data were manipulated into a pivot table by date, and totals or value means were taken for each date. These values appear as 100 samples in some tables, but each is a total or summary of many additional samples.

4.2. Current State Analysis

4.2.1. Evaluation of Transfer of Custody

One key area of focus for the research is the time it takes for a messenger from CIT to transfer bags picked up from the route to a vault teller. The observed branch collects bags for 45 trucks between 2 p.m. and 9 p.m. Trucks entering the facility peak between 4 p.m. and 6 p.m. In addition, it was observed that tellers work more quickly during peak times and more slowly during slack times. In the model, the time to process a bag is established in a triangular distribution between 2 and 16 s with a mean of 8 s, but the values for time per bag are shifted during slack times by adding a multiplier to accurately simulate the observed behavior. An example is that bags collected during the 2 p.m. hour have a multiple of 1.2, which shifts the uniform distribution from 2.4 to 19.2 with a mean of 9.6 s per bag.

Table 3 compares the observed and simulation runs of 1, 7, 30, and 100 days and the resulting results. The 100-day simulation data were compared with the observed data, indicating the model’s accuracy. Note that the mean, first and third quartiles, and median are well within the ascribed 15% threshold.

However, the standard deviation of the data is approximately 25% narrower in the simulation, as indicated in

Table 4. The range of the model prevented a wider spread of the standard deviation while maintaining the mean and the first and third quartiles. The researchers felt that the amount of observed data were too small to establish an accurate value for the standard deviation and placed more value in the mean and the first and third quartiles of the limited dataset.

Looking at a 95% confidence interval (CI) for the observed data, the CI is:

The low number of samples for this observation significantly impacts the wider confidence interval. Referring to

Table 3, the simulation mean is well within the 95% CI.

Linear regression was also attempted but yielded uncertain results because of the limited number of observations and did not yield a conclusive correlation.

Figure 3 illustrates the regression for the observed data and a single-day simulation run.

The R2 value of the observed data is low, at 0.2568, because of the limited number of observations. The R2 value of the simulation model is 0.9296. Overall, the time involved in passing bags and the total time spent in the mantrap between the observed and simulated data are well within validation limits.

4.2.2. Bags per Truck

In addition to the time spent passing bags, the model can be validated through a report provided by the ATC indicating the number of bags the branch handles during a typical month. The report indicates that the observed branch handles approximately 85,500 bags of cash each month with 45 trucks. These bags break down further to 25% delivered (e.g., change orders, ATM refills) and 75% pickups (e.g., deposits, ATM residuals, bank-created change orders). The mean of this would indicate approximately 63 bags per truck per day. From observation and interviews, there are more bags on Monday and Friday and fewer on Saturday and Sunday.

Table 5 shows data from the observed and simulated periods of 1, 7, 30, and 100 days. The variance from 63 (the average daily value provided by the ATC) is denoted in blue in the rightmost column. In addition, note that the observed data included data from only weekday operations. The standard deviation for the number of bags per truck is 14.9814.

Utilizing the 95% CI for the number of bags per truck, the CI is

The simulation mean for bags per truck is well within the CI limits of observed and ATC-provided data.

4.2.3. Teller Utilization

The remaining variables are discussed below based on observed behaviors and facility constraints. There are three teller windows/mantraps used for vault teller-messenger interactions. Three vault tellers work eight-hour shifts. The tellers work shifts that support the behavior of the branch. During the reception of bags in the afternoon, the vault window tellers perform bag inspections (six-sided inspections), locate the deposit slip in the bag, annotate the bag with the receiving bank name, and pre-sort bags. The pre-sort is conducted by identifying bags as internally processed, externally processed, and bags that need to be delivered to other entities in the following days.

A single teller accepts the bags that are internally processed and sorted by the receiving bank. The observed branch processed bags for more than 50 different banks. This teller accepts the bank name written on the bag as accurate as long as the bags are sorted. The bags are sorted again the following morning by five CMS tellers, who verify the deposit slip inside the bag. Each day, approximately 3000 bags are processed internally.

The overnight tellers sort the bags that are not processed internally. This process is referred to as “repackaging”. These bags have a destination bank or customer, typically for the next day, and are sorted and prepared as outbound bags. Two overnight tellers perform this action. The overnight tellers also prepare all other outbound materials for CIT, including accessories (e.g., keys, manuals, and radios).

During the day, a teller takes bags from the bag preparation room and assigns them to routes. A teller and a security guard place the bags in lockable carts and maintain a running inventory of each cart.

Finally, two vault tellers interface with CIT messengers in the mornings, moving carts and issuing accessories. They also supply route sheets and a truck manifest to each messenger.

The researchers focused on each teller’s observed behaviors and the teller shift’s limits to validate the teller transactions. For instance, it is known that afternoon vault tellers are receiving bags from messengers from 2 p.m. to 9 p.m. The model must support this. In addition, tellers and messengers have known shifts, and the researchers were provided overtime data for several employee types.

For the most part, the researchers know the overall flow of the branch through observation, process mapping, and discussions with employees. The company’s management validated or corrected many of the assumptions during the observation period.

As accurately as possible, the simulation model attempts to simulate the branch’s operational behaviors as the bags flow in and out. For instance, the manager of the vault operation indicated that 60% of the bags entering the branch from CIT each afternoon go to CMS for processing. Therefore, in the model, this proportion was maintained. See

Figure 4a for inbound bags from CIT and

Figure 4b for outbound bag preparation.

The ATC supplied teller hours for 22 weeks.

Table 6 shows the average weekly work hours for 43 workers over 22 weeks. This document also includes partial weeks for employees who left and for new hires. The document also does not include paid time off for employees. This information skews the staffing hours lower. These data are also based on workweeks.

Given the work hour standard deviation of 9.9122, the 95% CI:

Given the overtime standard deviation of 4.1687, the 95% CI:

From the previous work hour data for tellers, by removing weeks for which the person worked less than 30 h a week, the regular weekly work hour mean is 38.483, and the standard deviation is 3.636. For overtime hours, the new mean is 2.3629, and the standard deviation is 4.476. Both have

n = 452. Applying these values to the 95% CI yields these values:

The model simulation also evaluates teller hours but focuses only on the sorting behaviors of each teller type.

Table 7 illustrates the sorting activities in hours. Comparing the values above with the “only sorting” responsibilities becomes a loose comparison. Some tellers only sort bags (e.g., outbound sorting, sorting 1), while others have additional duties beyond sorting.

4.2.4. Driver–Messenger Utilization

The time utilization of the CIT crew (driver and messenger) is in

Table 8. These values were taken from an ATC-provided document that covers 22 weeks of Driver–Messenger hours for 167 crew members. Of note, while the mean hours are below 40, 47.8% of these employees earn some overtime each week, with some obtaining more than 20 h of overtime pay. This document also includes partial weeks for employees who left and for new hires. The document also does not include paid time off for employees. This information skews the staffing hours lower. These data are also based on workweeks.

The Driver–Messenger regular work hours standard deviation from the provided information is 11.7348. Evaluating the 95% CI:

Overtime work hours for the Driver–Messengers are based on the standard deviation of 7.5445 derived from the supplied data. Evaluating the 95% CI:

From the previous work hour data for Driver–Messengers, by removing weeks for which the person worked less than 30 h a week, the regular weekly work hour mean is 39.016, and the standard deviation is 2.997. For overtime hours, the new mean is 7.8605, and the standard deviation is 7.8013. Both have

n = 2175. Applying these values to the 95% CI yields these values:

The simulation model created a single truck route to simulate a crew earning one to four hours of overtime daily. The model assumes a truck route is operated seven days per week, with the weekend routes servicing fewer customers and developing less overtime. The data in

Table 9 assumes the same crew for five weekdays (excluding weekends). The model data for this route purposefully simulates a very busy route with high overtime for comparison purposes in the future state. The twelve hours of overtime are expressly intended.

Another view of Driver–Messenger utilization comes from the simulation model route simulation, which evaluates the routes’ daily start and finish times. The model was run for 100 days, and the results of the start and finish times for the model are shown in

Table 10.

Extending the daily value to a five-day workweek would approximate overtime at 7.1–8.8 h per week. Given the 95% CI overtime of 7.8605 ± 0.8593 h, the simulation model aligns with the provided data from the ATC.

4.2.5. Truck Route Timing

The truck stops at retailers, banks, ATMs, and competitors as part of a regular daily route. The duration of a stop includes finding the appropriate delivery bag(s) (if applicable), loading the bag(s) in a black canvas over-bag, leaving the truck and entering the facility, interacting with the manager (or ATM), exchanging bags, completing transfer of custody processes, placing cash bags (if applicable) in a black canvas over-bag, and entering the truck. These processes were not observable at the ATC facility. The typical transaction timing was gathered through interviews with ATC managers and drivers/messengers. The time was also deduced from work-hour reports and observed transactions.

Table 11 illustrates the average simulation model timing for each type of encounter on a route. The model ran for 100 days. The simulation model’s stop weighting is retailer—74%, ATM—15%, bank—8%, and competitor—3%.

In summary, the metrics produced by the simulation model were validated by several methods to ensure baseline model behavior. This baseline is used for building the business model and comparing it with the future state discussion. See

Table 12 for a summary of the data, the source, and the means used to validate the simulation model.

4.3. Current State Business Model

The business baseline is focused on time-able behaviors involving the movement of cash bags throughout the entire CIT and vault sorting processes. This business model is not intended to evaluate every function in the branch. Since the critical value of time correlates to employee wages, a financial model for these processes can be developed through observed, provided, and simulation model data.

The ATC provided fully loaded average wages for each type of employee. These wages were provided in 2021, so the cost-of-living adjustments are made and the wages are rounded to develop

Table 13.

Applying these wages to the activities listed above yields a baseline operational cost for a branch. Using the data above,

Table 14 illustrates a branch’s daily and annual staffing operating expenses with 45 trucks, showing each task and the model output of minutes worked per task.

4.4. Current Model Summary

The researchers have spent countless hours understanding the business flow of an ATC, observing behaviors, and collecting historical data. A simulation model was built and validated by all available means. After validation, the model produced a series of baseline data that was then applied to a business model, which became the baseline for the future case. Having established the baseline, the following discussion is about evaluating various IoT technologies that may have an application to cash movements by armored vehicles.

4.5. Future State Analysis

The research’s fundamental hypothesis is that adding IoT technology to the cash movement ecosystem reduces costs, improves capacity, and provides visibility to all parties involved in the cash movement. The addition of IoT also brings with it the assumption of software interoperability between the entities (retailer, ATC, and bank), who all have a vested interest in the timely and accurate movement of financial assets. Within the ecosystem, the customer can be the retailer or the bank, depending on the type of movement. For change orders and deposits, the customer is the retailer. For ATM servicing and smart safes, the customer is the bank. The bank is also a customer for Federal Reserve Bank transactions.

4.5.1. Vision

The vision of the future of cash visibility is to have an interoperable and integrated system that (1) reduces operational costs for all parties involved, (2) increases the capacity of ATCs, which improves profitability without adding personnel, (3) integrates the business systems of cash management organizations, (4) provides visibility to clients/customers that use ATC services of the status of transported goods, and (5) raises the level of awareness of operational status in real-time, allowing all parties to make better decisions.

4.5.2. Reducing Operational Costs

Reducing operational costs is mostly about speeding up processes and behaviors. For instance, adding technology to the system should speed up the processes of picking up deposits, transferring bags from CIT to the vault, and sorting bags. These reductions in operational times reduce staffing costs by reducing the number of work hours and overtime for employees. RFID also allows for robotic sorting systems that shift sorting work from tellers by hand to automated systems.

4.5.3. Increasing Capacity

The observed ATC was at its operational capacity limit, and the branch was very sensitive to adding additional customers. Reducing staff work hours, in turn, increases capacity for the ATC. Transforming routes that chronically require overtime into manageable routes with available capacity allows the ATC to take on more business.

4.5.4. Integration and Interoperability

One of the keys to this solution is the addition of business system connectivity between entities in the cash supply chain. For example, a retailer creates a deposit bag, which, in turn, prints an RFID label and notifies both the retailer’s bank and ATC that a bag is ready for pickup. This process populates the databases of both the bank and the ATC systems. The databases then contain the deposit information and the bag I.D. RFID readers can then scan the bag’s RFID tag at any point in the movement, and updates are provided to the retailer. Picking up the bag at the retailer is as easy as a quick RFID scan and visual inspection.

4.5.5. Visibility

Throughout this research, retailers consistently complain of a lack of understanding of where a deposit or change order is within the ATC. In a day where Amazon can tell us how many stops away our deliveries are, ATCs are quite the antithesis of Amazon. Without explanation, a deposit may appear in the retailer’s bank account in one or five days. RFID can provide very granular visibility of the location of every bag as it moves through the process. Additional visibility also provides a detailed history of every bag and each employee that has come into proximity with the bag. If a bag has signs of tampering, the investigation quickly pulls a complete bag record from the historical record.

4.5.6. Raising Operational Awareness

Operational awareness allows managers to visualize system behaviors in a new and exciting way. Operational scoreboards can inform processing teams about the status and quantity of bags in CIT, including route progress and compliance with operational limits. (e.g., an armored vehicle carrying more cash than allowed). The researchers address many of these topics in greater detail in the following paragraphs.

4.5.7. API Integration

The future state of the entire industry is already moving toward API integration between cash-handling industry elements. The Federal Reserve Bank has a Cash Advisory Council comprising businesses from a cross-section of the industry whose role is to develop the API standard. The API is an integral part of the future state of this research.

As previously mentioned, armored couriers and banks have no knowledge of customer deposits prepared for pick-up by the ATC. This issue is overcome by contractual agreements between retailers and ATCs, which spell out the exact days of the week and the time of day when couriers check for deposits. ATCs lack foreknowledge of the preparation of change orders by banks and, again, show up according to a preset schedule. This process is inefficient and can be addressed through an API application.

The future state relies on an API integration that provides foreknowledge for preparing bank change orders and deposits for customers. This foreknowledge creates manifests that are distributed to the actors in the cash movement. Since the manifest of any exchange is known, there is less reliance on human data entry. See

Figure 5.

In addition to populating the shipment manifest, the foreknowledge of prepared cash bags enables more efficient route management for the armored vehicle. It removes stops where no retailer deposit bag or bank change order is ready for retrieval. In addition, the electronic manifest allows the messenger to retrieve the deposit and change order bags. In the current state, messengers must enter the final destination for each bag on a small handheld computer, opening the door to human error and customer dissatisfaction. In this future state, this requirement is removed, which in turn eliminates the opportunity for human error.

4.5.8. RFID IoT Application

RFID enables real-time tracking of cash bags throughout the movement process, human identification of bags, and robotic sorting. RFID readers can be deployed in several locations to enhance traceability and speed up transactions. At the pickup point, the messenger has a handheld RFID reader connected to the messenger’s cellular-capable tablet to scan and accept bags from customers and banks quickly. Each armored vehicle has an RFID reader with a cellular data connection to identify each vehicle’s contents accurately. The transition area (mantrap) at the branch where the bags are transferred to the vault teller has an RFID reader with a network connection for information transfer. Inside the branch, RTLS systems would maintain the position of every bag within the facility. Security carts, totes, and bins would also have RFID readers to enable instantaneous inventory of each receptacle.

Each cash bag has an RFID tag label placed on the surface to serve two purposes during transportation. First, the RFID tag has the EPC memory area encoded with the same bag I.D. represented on the bag’s barcode. In addition, the final endpoint of the bag is encoded in the EPC memory. Each time the bag is inventoried at any location, these two pieces of primary routing information are read. Second, the RFID label is printed with human-readable text, becoming the bag’s transaction slip (e.g., deposit, change order). Account numbers, the bag’s value, routing information, and customer information are readable for human sorting. In addition to the human-readable information, a 2D barcode could be printed on the bag for optical machine routing. Each bag has its own manifest readable by humans, RFID tags, and optical machine readers.

The bag label also becomes a source of interoperability between non-connected entities in the cash movement ecosystem. For instance, when competitors must exchange bags, the RFID tags can be scanned by the receiving ATC messenger, confirming the entire shipment.

4.5.9. Robotic Sorting

AmbiSort Robotics, Berkeley, CA, USA, has a barcode-based package sorting system that shipping companies use to sort packages. With only the addition of RFID readers, the system can sort cash bags. The bin system has up to 66 bins for sorting. The robotics system can be used to sort incoming and outgoing cash bags. This sorting system can accurately sort bags without error. Bags that are not readable are sent to a reject bin for the teller’s attention. The robotic system can sort bags at a rate of ten per minute and can run 24 h a day.

The robotic sorting system’s operations start in the morning with outbound bags, which are sorted into route bins. When that operation is complete, the route bins can be stored and bank bins placed in the machine. As incoming bags are gathered, the tellers put them in large bins and, when full, move the large bin to the robotic sorting machine. After inbound bags are sorted by endpoint banks and repackaged, the route bins are returned to the robotic sorting machine for final route sorting.

4.6. Future State Process

In the future state, the customer has an API integration with their bank and a contracted ATC. The customer enters the change order, and both the bank and the ATC are notified. The change order is automatically queued in the ATC packing room. The packing room teller creates the bag, and an RFID label is automatically printed and encoded with the client’s endpoint and bag I.D. The bag is automatically assigned to a route for the next delivery day for that client. The finished change order is placed in a large bin. As the number of change orders increases, the large bin is placed in a robotic sorting machine. The robotic sorting machine can handle 45 routes and foreign courier change requests. ATM cash has the same path. The robotic sorting system uses RFID tags to look up the assigned route and put the bags in the appropriate route bin. While sorting, the system keeps track of the manifest for each route bin. Any unrouteable or unreadable bags are placed in the reject bin for teller review. See

Figure 6 for a graphical representation of the process.

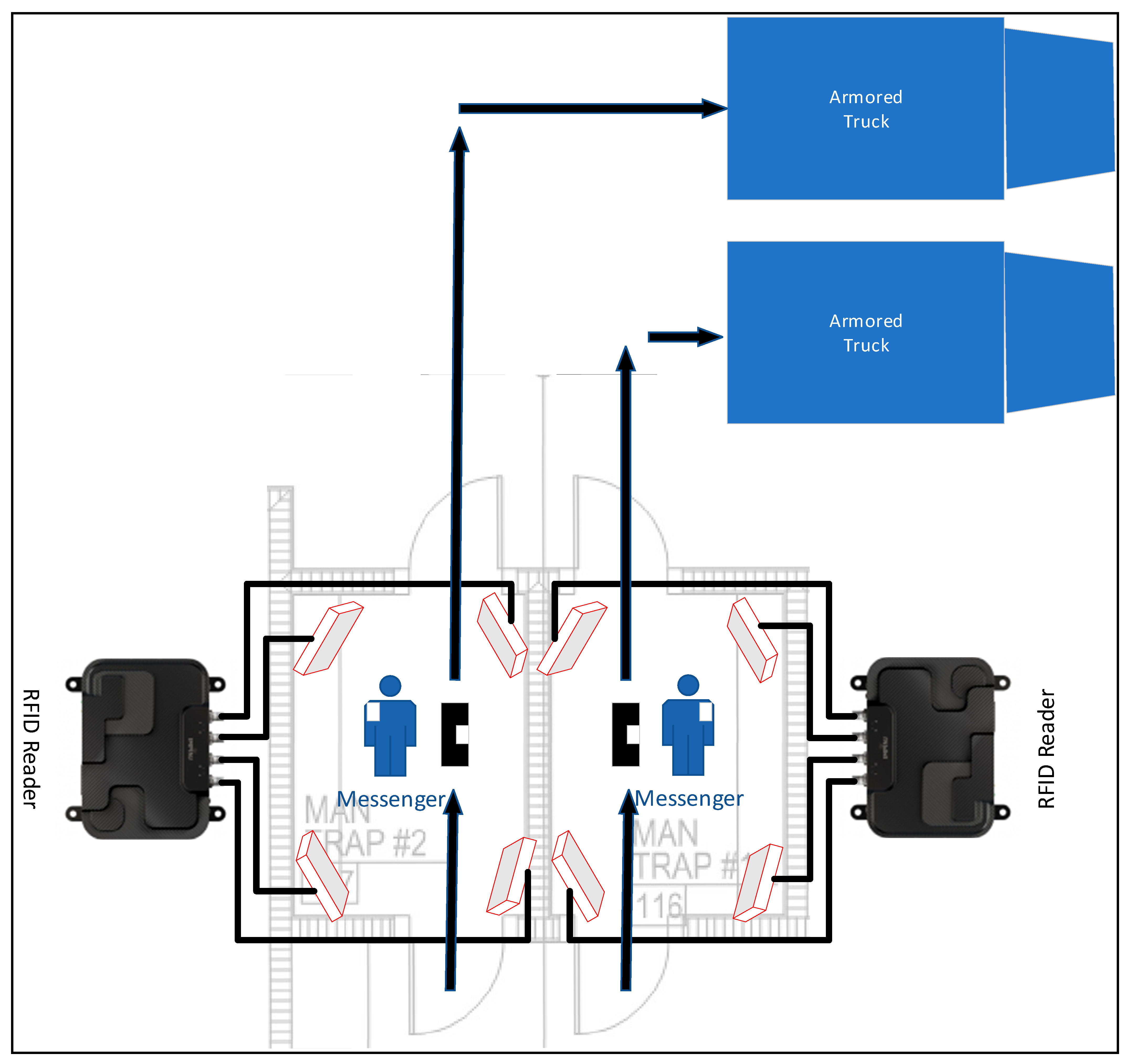

When the messengers arrive at the branch in the morning, the appropriate route bin is pulled for the messenger. The RFID system detects the bin in the mantrap along with the accessories. The messenger also has an RFID badge. The bin, its contents, the accessories, and the messenger are all associated with the mantrap. See

Figure 7.

When the messenger reaches the truck, the truck’s RFID system validates the accessories, messenger, and bags as they are placed on the truck. Any inconsistency is identified as materials are placed in the vehicle. See

Figure 8.

The exchanges are much faster during visits to banks, competitors, and retailers because the cash deposit bags are already in the handheld database. The messenger must only scan the bags and accept them with one touch. Bag drop-off is quicker because of RFID. In the future, the armored truck crew will not stop at locations without a deposit.

When the truck returns to the branch after completing the route, the cash bags, accessories, and the messenger’s RFID tag are detected leaving the vehicle and entering the mantrap. All items are registered automatically by the branch RFID system, and custody exchange is accomplished in just a few moments. The teller checks the manifest for the vehicle and the RFID-read bags in the mantrap and assumes custody transfer. The contents of the container are transferred to a large container and placed in the robotic sorting system.

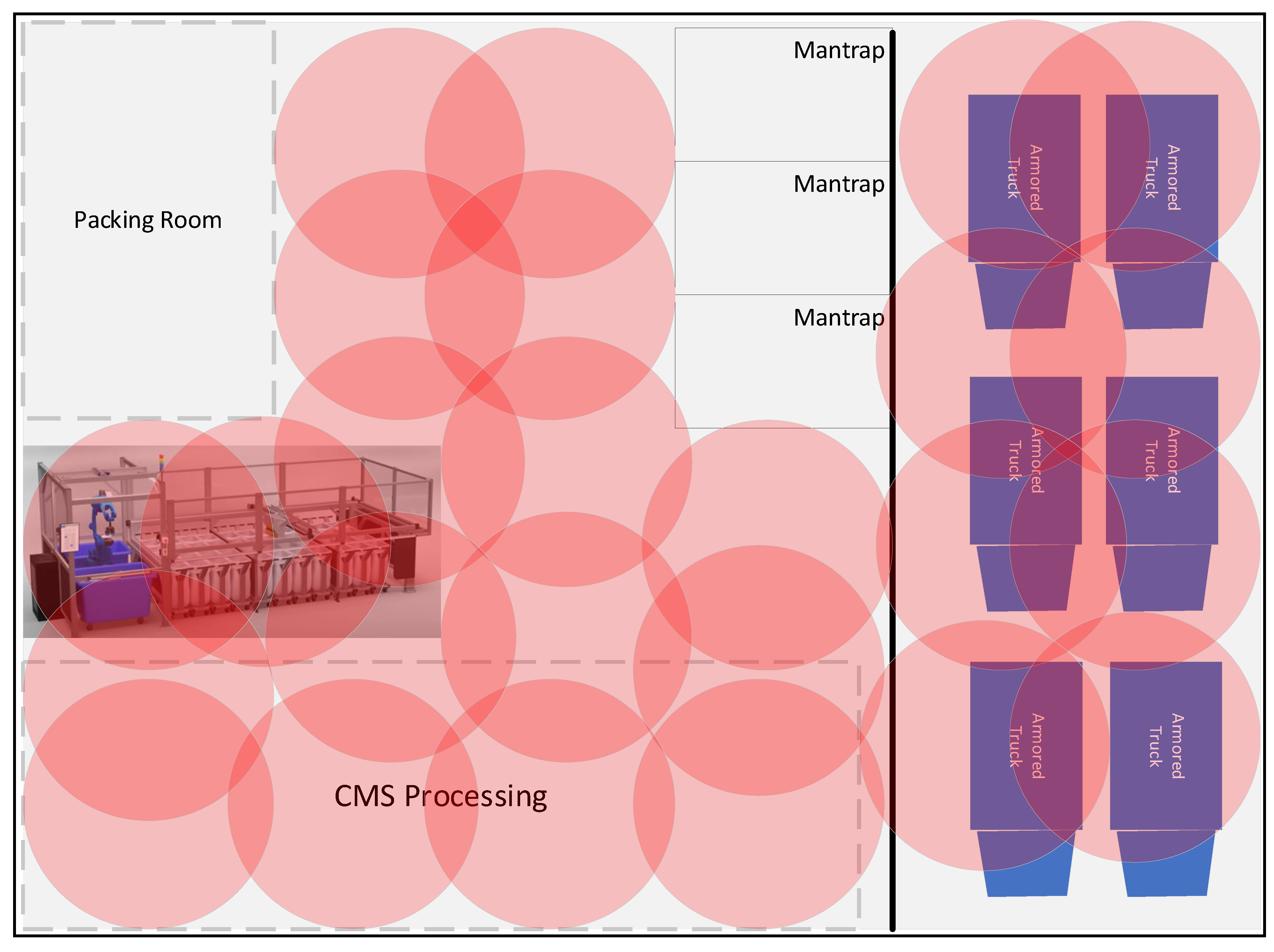

In addition to the RFID in the mantrap and armored vehicle, a Real-Time Location System (RTLS) maintains the general location of all employees, accessories, carts, and cash bags within the branch area, including the armored truck CIT lanes. See

Figure 9. RTLS zones are indicated in pink-shaded circles.

Throughout the entire process, there is 100% visibility of every bag of cash from beginning to end. Customers (typically retailers) see the progress of their deposits and have Amazon-like estimates of when the armored courier team is arriving at their location.

4.7. Future State Simulation Model

The future state modifies some parameters in the simulation model. To avoid disturbing the current state parameters, a mode switch was placed in the model to operate in the current or future state. See

Table 15 for parameter changes between the current and future state modes of simulation model changes. The changes in the model focus on changes that occur by adding API integration, RFID tags on bags, and RFID infrastructure at various locations within the cash movement process.

4.7.1. Future State Model Data

The first area of the simulation model that was evaluated in its current state was the evaluation of the transfer of custody in the mantrap. Using the same methods, the model’s output in future state mode compares the total time spent in the mantrap in both modes. See

Table 16 for a comparison of the mantrap time for both the current and future states.

The change in modes is significant, nearly eliminating waiting time for entering the mantrap (congestion) and reducing the time spent transferring inbound bags by 77%. Since the bags are detected automatically by the RFID system, a complete inventory of the bags within the mantrap can be verified against the electronic manifest of the vehicle. The custody transfer is entirely automatic, and any exception is immediately identified. The rolling bin used to bring the cash bags to the mantrap can be rolled directly to the sorting machine without human sorting.

The second area of investigation in the current state was the number of bags per truck. These values stay the same in the future state without further customer additions.

Next, teller utilization was explored. The most significant operational change in teller utilization is the addition of robotic sorting of cash bags. The cash bags are loaded into a large sorting robotic cell and sorted into smaller mobile bins. In the future state, tellers have multiple roles and are called “general tellers”. The teller utilization comparison between the current and future states is in

Table 17.

The teller team size can be substantially reduced while at the same time servicing the same number of customers. The new model reduces the tellers’ sorting activities from 68+ person-hours per day to only 14.1, a 79% reduction. These tellers can be cross-utilized for other tasks while still covering the 24 h operational needs of the branch. Regarding bag sorting, the general tellers are now only utilized at 30% on average. The tellers can spend additional time dealing with exceptions or handling keys, manuals, PDAs, and phones. Even though the total person-hours for sorting are only 14.1 h, tellers must be available in all shifts. The distribution would be two dayshift tellers, two evening tellers, and one overnight teller. There is also a supervisor on each shift (not addressed in the simulation).

Following the teller utilization is the Driver–Messenger utilization evaluation, conducted by comparing the total route time of truck crews. The model simulation for the future use case reduces the time in the mantrap and the time at each customer, bank, and perhaps competitor (if the competitor adopts the solution). ATM transaction timing remains the same.

Table 18 compares the current and future states.

Of most significance in

Table 18 is the overwhelming reduction in time to conduct the same route. The 43% reduction in route time eliminates overtime and yields additional capacity within the route. The potential savings are significant compared with the maximum values in the table. The mean value here also includes weekend operations, which are significantly lower. One must also remember that these times are doubled because these values affect both the driver and the messenger.

Considering that the current model’s Driver–Messenger armored crew had been operating at 140% capacity (total work hours with overtime), the armored truck crew is now operating at 80% capacity, avoiding overtime while servicing the same customer base. The additional 20% excess capacity is now available for the business development and sales teams to acquire additional customers.

Finally, the truck route timing was reviewed in the current state discussion. Much of the time savings within the future state route duration can be attributed to the reduced time required to interact with customers, especially retailers. Since retailers compose 74% of the stops in the model, any significant change in this category is observed in the truck route duration. The simulation model comparison of the current and future states is located in

Table 19.

The time on customer site reduction also improves customer engagement with the armored courier. Transactions are completed more quickly and accurately, which in turn should improve the overall customer experience. The transaction with the retailer first has to be announced before the messenger arrives, allowing the retail manager to be ready. Since the bag information was transmitted to the ATC (and bank) via API, the messenger can do a brief RFID scan and quickly accept the bags.

At a competitor, in the current state, there is a paper manifest and a bag-by-bag check of the transfer. The paper document is completed. In the future state, the messenger can scan the bags, much like the retail experience, and accept the bags more quickly. In the current state, the competitor transaction is notoriously time-consuming since it lacks integration. In the future state, it is quicker and significantly reduce errors. In addition, even if the competitor does not fully integrate with the API, the bagID and the standard endpoint are stored in the memory of the RFID tag, allowing a separate system to consume the data (e.g., manifest on the tag).

In summary, the application of RFID and API integration to the cash transportation system has yielded significant improvements in the cost of operational behaviors. These reductions include a 43% reduction in route time, the elimination of overtime, a 79% reduction in teller utilization, and a 77% reduction in the time spent passing bags in the mantrap. Next, these values are compared with the previous business case.

4.7.2. Future Business Case Model

The future business case model must include the cost of the robotics system, the RFID systems, and the RFID tags. It must also include the installation and maintenance of the equipment. For the most part, the model consists of retail pricing for equipment, although significant hardware price reductions are likely. It is impossible to predict the buying power of an entity, so retail prices are used.

From the workforce’s perspective, the savings are significant. The model shows savings in all categories.

Table 20 shows the future business model breakdown based on the future state simulation model.

The difference between the two models is USD 2,864,082.51 annually and USD 7846.80 daily. It is important to note that trimming almost all overtime, reducing the time required for virtually every task for 95 employees, and eliminating two employees are responsible for this significant reduction.

The observed ATC provided some estimates of the reduction in risk because of the cash visibility system. These include reductions in ATM loading errors, loss of currency, accidental loss through inadvertently dropping bags in the garbage, errors in documentation, and errors where customer accounts are not credited with deposits. The risk-cost savings estimates are approximately USD 59,000 annually.

While the staffing and risk cost savings are significant, the model must include the cost of equipment, installation, maintenance, and recurring purchases (e.g., RFID tags). The cost of a single installation at each location for RFID (truck, mantrap, packing room, and RTLS) is listed in

Table 21. These prices, as mentioned earlier, are full retail prices.

Multiplying the cost of a single installation by the number of locations at a branch yields the values found in

Table 22. Employee RFID badges are also included in the branch cost. Note that five mantraps are included in the cost estimate to cover additional points where employees travel.

The software development and deployment costs are based on an unofficial quotation from a software vendor. The installation costs are based on a percentage of the hardware cost: 5% for branch installation and 7% for vehicle installation. These values bring the total cost of hardware and software to USD 2,788,202.20. See

Table 23.

The recurring costs include the lease of the AmbiSort robotic sorting system, the purchase of RFID tags, and annual hardware and software maintenance agreements. The annual hardware and software agreements start in year two of the project. The software maintenance agreement is estimated at 18% of the purchase price. The hardware maintenance agreement is based on 20% of the original purchase price. The estimated tag use is equivalent to the actual monthly bag counts multiplied by twelve. The actual monthly count for the branch observed is 85,362 bags. When multiplied by annual usage, the total comes to 1,024,344 RFID tags for a single branch for one year. The tag cost is estimated at 0.10 USD/tag. See

Table 24.

Given the preceding information, the overall first-year cost of the system is USD 3,010,633.00, with an annualized savings of USD 2,922,895.92. The payback period is 1.03 years. In years two and beyond, the annual savings are approximately USD 2,196,223.12. See

Table 25.

4.7.3. Additional Non-Financial Benefits

There are several non-financial benefits to adding such a system to an ATC. These include customer satisfaction, visibility benefits, compliance requirements, reduced loss, and handling errors.

Services, customer satisfaction, and customer retention are inextricably tied together [

21]. An ATC that adopts a new technology that provides greater visibility of cash movement to its customers creates a new service to retain and add new customers. As mentioned earlier, the researchers spoke to several large retail chains and found frustration regarding knowing where their deposits are in the cash movement process. When citing the research, several volunteered to participate in future research.

People inherently understand that knowledge allows for informed decisions. Each morning, people look at the weather forecast to determine clothing choices and whether or not to carry an umbrella. Stock values and company reports determine whether a person might buy or sell a stock. Customers of UPS and Amazon find satisfaction in regular updates on deliveries. Within factories, informational scoreboards inform the workers of their collective progress for a shift.

On the other hand, people find incredible frustration over a lack of information they consider pertinent to decision-making. With a “black box” process, one only knows the input and output but rarely the internal behaviors of the black box. Often, as with the ATC industry, companies are unwilling to share what they consider sensitive information [

22].

From a visibility standpoint, a system can have internal and external benefits. The external benefits are customer-facing and addressed above. The internal benefits yield highly actionable information for ATCs. The CIT manager understands the daily progress of the fleet of armored vehicles, crews, and cash liabilities. If a problem or deviation from the law or corporate policy is detected, the issue can be resolved more quickly. For instance, if a vehicle breaks down, the cash transfer from one vehicle to another would instantly be realized, and truck manifests would change automatically. The vault and CMS managers can know the bag count and make staffing decisions with better information. Employees can watch scoreboards as progress is made in processing deposits.

Customer satisfaction is impacted by the speed and accuracy of exchanging bags by the truck crews, a reduction in handling errors, faster resolution of investigations of missing deposits, and cash visibility. The visibility of cash deposits as they move through the armored truck service can keep customers informed and eventually allow ATCs to verify contractual performance measures with their customers. Finally, providing Amazon-like notifications to customers of the arrival of armored trucks can allow customers to be prepared before the messenger’s arrival and further reduce the time to make bag exchanges.

Beyond the immediate benefits, researching cash bags when an error exists can be accomplished in record time with live bag tracking. With each employee wearing an RFID badge, employees can be associated with bag movement. As mentioned in the financials, the risk department at the observed ATC felt the company’s risk would decrease by reducing lost/misplaced bags, theft, tampering, customer account credit errors, and documentation errors.

4.7.4. Items Not Included in Business Cost Model

The approach of this model has been focused on a single branch of an ATC and not on the complete industry adoption of this technology. The researchers believe that, with such significant savings, the industry seeks to deploy such systems broadly. The following paragraphs explore additional costs not included in the model.

RFID label printers at retailers and banks are not included in the model. A low-volume RFID label printer costs around USD 2500 (Zebra ZD-500). Each customer of the adopting ATC must purchase an RIFD label printer for every location that produces cash bags. Retailers such as T-Mobile, Bonn, Germany, and Walgreens, Deerfield, IL, USA, have told the researchers that this purchase is possible with better traceability and visibility of cash movement. It is impracticable for the ATC to purchase the printer for every customer. An alternative is adding a small portable label printer to the messenger, which adds time to every transaction. A second alternative is adding a printer to the armored vehicle, but again, visibility is lost. The researchers believe that the ATC should be responsible for purchasing the RFID tags for the customers since its buying power is much greater than that of most retailers and banks.

The integration work of an API from the retailer to the bank and ATC is not included in this model. Each retailer has business systems that must comply with the transactions. The API already exists and is being promoted in the industry, but adoption is minimal.

The integration work for the API between competing ATCs is very challenging. Competition for clients in the market drives down profit margins between ATCs in specific markets. There is a genuine dislike between ATCs.

4.8. Additional Challenges

The cash management industry is fragmented, with several competing interests. Some ATCs feel that technology is great, and others are technology-phobic. Some ATCs focus on volume with small profit margins, and others focus on providing additional services, growing the profit margin.

There is a concern among ATCs that providing armored vehicle locations to customers is a security risk, and they strongly object to sharing location information and Amazon-like behaviors. There are some workarounds available that have not been explored in this research.

Coin management is not addressed in this research. There is a growing trend in the industry to outsource coin processing to third-party contractors. Throughout the investigation, coins have been considered but not included in the model. The solution for coins could be to place a generic denomination RFID tag in each box of coins (e.g., a tag that responds with an EPC of “Box of Quarters”).

4.9. Summary

Cash movements by ATCs today employ small deployments of technology but lack a cooperative, holistic view of the entire ecosystem of cash traceability and visibility. Adding API integrations between retailers, ATCs, banks, competitors, and the Federal Reserve Bank allows a free flow of information about cash movements. By adding passive RFID systems and leveraging information sharing, ATCs and others in the cash ecosystem can significantly reduce operational costs, increase operational capacity, and improve customer satisfaction.

During this research, a detailed process mapping study was accomplished and validated through several exchanges with ATC employees and leadership. The process map was turned into a simulation model using AnyLogic software and tuned to match the process map documentation, observed behaviors, and documents provided by the ATC (e.g., staff pay scales, historical working hours, historical bag processing, and risk analysis information). This output became the baseline for a financial business estimation of operational costs for the branch in specific areas (e.g., bag sorting and bag transfer of custody).

Once a model was established and produced results similar to those of the branch, an investigation was made into three IoT technologies, comparing them to the requirements and needs of the various use cases of the branch. The time savings produced by transactions and API integration between entities that transfer cash bags were evaluated, and the model was adjusted to operate with those values. A new business financial model was established and then compared, illustrating significant optimizations with the addition of RFID and API integration.

Adopting these proven innovations in the cash industry has now been shown to have a significant financial impact. In the example shown here, the investment in equipment has a payback period of roughly one year. A 45-vehicle branch that processes change orders and deposits can save as much as USD 2.1 million annually. The system also has non-monetary advantages, including improved customer satisfaction and reduced errors.

5. Conclusions

The operational cost savings illustrated in this research are substantial and worthy of further action. While expecting an entire industry to adopt a new technology application overnight is unrealistic, this research strongly indicates that adding RFID technology within the cash transportation industry can reduce costs, improve capacity, and provide visibility to all parties involved in the cash movement. As with any new application, the researchers recommend that a few ATCs, banks, and retailers use proof-of-concepts to validate these findings within their organizations and the industry.

This research relies on adopting an API that the Federal Reserve Bank and the cash management industry are already exploring. As more ATCs, banks, and retailers adopt the API, the next logical step is integrating RFID. The researcher, however, firmly believes that an ATC that adopts even part of this solution (RFID tags on bags, robotic sorting, mantrap, and truck readers) can reduce costs and expand branch capacity. ATCs that engage at this level find lower costs, increased capacity, and improved cash visibility, which, in turn, yields increased customer satisfaction if they share information with their customers.

The researchers clearly show that the expectation of reduced costs and increased capacity is proven throughout this paper. The assumption of improved visibility relies on the ATC’s willingness to share information with customers, but the model does prove that improved visibility is possible.

In the case examined, the savings of USD 2.1 million annually are not trivial. The next step in the research is taking this concept from theory to proof of concept. The researchers hope this topic does not stop within this document but has a lasting impact on cash visibility in ATCs, banks, and retailers.

Author Contributions

Conceptualization, L.D. and B.Z.; methodology, L.D.; software, L.D.; validation, L.D.; formal analysis, L.D.; investigation, L.D.; resources, L.D.; data curation, L.D.; writing—original draft preparation, L.D.; writing—review and editing, L.D. and B.Z.; visualization, L.D.; supervision, B.Z.; project administration, L.D. and B.Z.; funding acquisition, B.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Much of the data used within this research is proprietary to the ATC, allowing the research within their facility and cannot be disclosed. The authors are under non-disclosure agreements. The simulation model and configuration can be obtained through a formal request to Texas A&M University, Ben Zoghi,

zoghi@tamu.edu.

Acknowledgments

The authors thank the undergraduate research team that worked on testing, software development, and data analysis. Jamil Badawi, Coleman Beggs, Subha Cherukupalli, Travis Cook, Harrison Cope, Jacob Ladigo, Ian Schryver, Eliot Stein, and Avinash Subramanian were invaluable to this research effort. Additionally, graduate student Mohammad Affan Khokhar has been instrumental in data analytics. Finally, Soheila Antar’s contribution to the Anylogic model’s development is greatly appreciated.

Conflicts of Interest

The authors declare no conflict of interest.

References

- O’Brien, S. Consumer Payments and the COVID-19 Pandemic: Findings from the April 2021 Supplemental Survey. 2021. Available online: https://www.frbsf.org/cash/publications/fed-notes/2021/september/consumer-payments-covid-19-pandemic-diary-consumer-payment-choice-supplement-3/ (accessed on 10 November 2022).

- United States—Currency in Circulation. 2022. Available online: https://tradingeconomics.com/united-states/currency-in-circulation-bil-of-$-m-nsa-fed-data.html (accessed on 10 November 2022).

- GS-1; U.S. Guide for Cash Visibility Standards. GS-1: Ewing Township, NJ, USA, 2020.

- Tao, F.; Wang, L.; Fan, T.; Yu, H. RFID adoption strategy in a retailer-dominant supply chain with competing suppliers. Eur. J. Oper. Res. 2022, 302, 117–129. [Google Scholar] [CrossRef]

- Wyld, D.C.; Jones, M.A.; Totten, J.W. Where is my suitcase? RFID and airline customer service. Mark. Intell. Plan. 2005, 23, 382–394. [Google Scholar] [CrossRef]

- Valentine, L. Putting some new moves on “old” money. ABA Bank. J. 2011, 103, 24–27. Available online: http://0-search.ebscohost.com.wam.city.ac.uk/login.aspx?direct=true&db=bth&AN=65025923&site=ehost-live (accessed on 18 January 2023).

- Allahyari, S.; Yaghoubi, S.; Van Woensel, T. A novel risk perspective on location-routing planning: An application in cash transportation. Transp. Res. Part E Logist. Transp. Rev. 2021, 150, 102356. [Google Scholar] [CrossRef]

- Tikani, H.; Setak, M.; Demir, E. A risk-constrained time-dependent cash-in-transit routing problem in multigraph under uncertainty. Eur. J. Oper. Res. 2021, 293, 703–730. [Google Scholar] [CrossRef]

- Wu, L. Path Planning of Armor Cash Carrier Based on Intelligent Algorithm. In Proceedings of the 2021 IEEE International Conference on Emergency Science and Information Technology (ICESIT), Chongqing, China, 22–24 November 2021; pp. 329–332. [Google Scholar] [CrossRef]

- Xu, G.; Li, Y.; Szeto, W.Y.; Li, J. A cash transportation vehicle routing problem with combinations of different cash denominations. Int. Trans. Oper. Res. 2019, 26, 2179–2198. [Google Scholar] [CrossRef]

- Ágoston, K.C.; Benedek, G.; Gilányi, Z. Pareto improvement and joint cash management optimisation for banks and cash-in-transit firms. Eur. J. Oper. Res. 2016, 254, 1074–1082. [Google Scholar] [CrossRef]

- Almansoor, M.; Harrath, Y. Big Data Analytics, Greedy Approach, and Clustering Algorithms for Real-Time Cash Management of Automated Teller Machines. In Proceedings of the 2021 International Conference on Innovation and Intelligence for Informatics, Computing, and Technologies (3ICT), Zallaq, Bahrain, 29–30 September 2021; pp. 631–637. [Google Scholar] [CrossRef]

- Chiussi, A.; Orlis, C.; Roberti, R.; Dullaert, W. ATM cash replenishment under varying population coverage requirements. J. Oper. Res. Soc. 2022, 73, 869–887. [Google Scholar] [CrossRef]

- Ekinci, Y.; Serban, N.; Duman, E. Optimal ATM Replenishment Policies under Demand Uncertainty; Springer: Berlin/Heidelberg, Germany, 2021; Volume 21, ISBN 0123456789. [Google Scholar] [CrossRef]

- Fedets, A. Improving the efficiency of cash collection operations with the help of modern information technologies. EUREKA Soc. Humanit. 2021, 49–57. [Google Scholar] [CrossRef]

- Hasheminejad, S.M.H.; Reisjafari, Z. ATM management prediction using Artificial Intelligence techniques: A survey. Intell. Decis. Technol. 2017, 11, 375–398. [Google Scholar] [CrossRef]

- Ilagan, C.; Trinidad, A.; Wee, J.L.; Sy, C. A scheduling model for full maintenance of automated teller machines. In Proceedings of the International Conference on Industrial Engineering and Operations Management, Bangkok, Thailand, 5–7 March 2019; Volume 2019, pp. 1449–1455. [Google Scholar]

- Nemeshaev, S.; Tsyganov, A. Model of the Forecasting Cash Withdrawals in the ATM Network. Procedia Comput. Sci. 2016, 88, 463–468. [Google Scholar] [CrossRef]

- Orlis, C.; Laganá, D.; Dullaert, W.; Vigo, D. Distribution with Quality of Service Considerations: The Capacitated Routing Problem with Profits and Service Level Requirements. Omega 2020, 93, 102034. [Google Scholar] [CrossRef]

- Sargent, R.G. A New Statistical Procedure for Validation of Simulation and Stochastic Models. In SURFACE; SYR-EECS-2010-06; Syracuse University: Syracuse, NY, USA, 2010. [Google Scholar]

- Krishnan, M.S.; Ramaswamy, V.; Meyer, M.C.; Damien, P. Customer satisfaction for financial services: The role of products, services, and information technology. Manag. Sci. 1999, 45, 1194–1209. [Google Scholar] [CrossRef]

- Fawcett, S.E.; Fawcett, A.M.; Watson, B.J.; Magnan, G.M. Peeking inside the black box: Toward an understanding of supply chain collaboration dynamics. J. Supply Chain Manag. 2012, 48, 44–72. [Google Scholar] [CrossRef]

Figure 1.

These charts indicate the continued growth in currency in circulation in the United States (USD). (

a) Illustrates the short term rise in cash in circulation and focuses on the change associated with the COVID-19 pandemic [

1]. (

b) Illustrates the cash in circulation in the U.S. since 1918 [

2].

Figure 1.

These charts indicate the continued growth in currency in circulation in the United States (USD). (

a) Illustrates the short term rise in cash in circulation and focuses on the change associated with the COVID-19 pandemic [

1]. (

b) Illustrates the cash in circulation in the U.S. since 1918 [

2].

Figure 2.

Example of Simulation.

Figure 2.

Example of Simulation.

Figure 3.

Linear regression observed vs. model. (a) illustrates linear regression for the observed data while (b) illustrates the linear regression for model data.

Figure 3.

Linear regression observed vs. model. (a) illustrates linear regression for the observed data while (b) illustrates the linear regression for model data.

Figure 4.

Inbound and outbound bag sorting. (a) illustrates the movement of inbound cash bag from the messenger through several stages of sorting. (b) illustrates how outbound cash bags are created and prepared for delivery.

Figure 4.

Inbound and outbound bag sorting. (a) illustrates the movement of inbound cash bag from the messenger through several stages of sorting. (b) illustrates how outbound cash bags are created and prepared for delivery.

Figure 5.

Future state flow diagram.

Figure 5.

Future state flow diagram.

Figure 6.

Bag creation and storage.

Figure 6.

Bag creation and storage.

Figure 7.

RFID in the mantraps.

Figure 7.

RFID in the mantraps.

Figure 8.

RFID in the armored truck.

Figure 8.

RFID in the armored truck.

Figure 9.

RTLS zones in the branch.

Figure 9.

RTLS zones in the branch.

Table 1.

Areas of interest.

Table 1.

Areas of interest.

| Process | Measure | Resource |

|---|

| Retailer Interaction | Time | Messenger |

| Bank Interaction | Time | Messenger |

| ATM Service | Time | Messenger |

| Transfer from CIT to Vault | Time | Messenger and Vault Teller |

| Inbound Bag Sorting | Time | Vault and CMS Tellers |

| Outbound Bag Sorting | Time | Vault and CMS Tellers |

| Route Completion | Time | Driver and Messenger |

| Branch Processing Multiple Truck Crews | Time | Messengers and Tellers |

| Congestion at Vault Teller | Time | Messengers |

Table 2.

Parameters in simulation.

Table 2.

Parameters in simulation.

| Parameter | Value | Units |

|---|

| inspect truck at entrance | uniform (3,5) | minutes |

| truck moves from entrance to parking and park | triangular (20,30,60) | seconds |

| unload one bag from truck to trolley/load bag from trolley to truck | 2 | seconds |

| messenger moves from branch entrance to the mantrap along the lane or backwards and closes/opens the entry door | triangular (20,30,60) | seconds |

| open vault door | 5 | seconds |

| submit, scan, and bag messenger’s belongings | uniform (1,2) | minutes |

| one bag inspect and scan by vault teller | uniform (4,10) | seconds |

| one bag preliminary sort by vault teller | uniform (15,30) | seconds |

| one bag sort by sorting teller | uniform (15,30) | seconds |

| paperwork and release | uniform (2,3) | minutes |

| one bag overnight re-sort | uniform (15,30) | seconds |

| issue keys, manuals, phone/PDA(s), radios, a manifest, and a detailed route sheet for that day to the messenger | uniform (1,2) | minutes |

| load bag from branch to trolley | 5 | seconds |

| move trolley from branch to truck | triangular (20,30,60) | seconds |

| verify and accept bag on the electronic manifest on the phone/PDA | 5 | seconds |

| one bag sort by early morning crew member | uniform (15,30) | seconds |

| assign outbound change order bag to route or competitor | uniform (15,30) | seconds |

| take bag to relevant rolling cabinet | triangular (4,5,6) | seconds |

| register bag on inventory records | 5 | seconds |

Table 3.

Comparison of observed data and model data.

Table 3.

Comparison of observed data and model data.

| Variable | # | Mean | Min | Lower Whisker | Q1 | Median | Q3 | Upper Whisker | Max |

|---|

| Obs1day | 43 | 9.6225 | 3.3833 | 3.3833 | 6.4917 | 9.1000 | 12.0750 | 18.3833 | 18.3833 |

| CM1day | 44 | 9.7978 | 3.6079 | 3.6079 | 8.0836 | 9.7570 | 11.6683 | 16.3681 | 16.3681 |

| CM7day | 308 | 9.2408 | 3.6079 | 3.6079 | 6.7428 | 8.8423 | 11.2855 | 17.8486 | 18.4616 |

| CM30day | 1320 | 9.3614 | 2.7867 | 2.7867 | 7.0880 | 8.9967 | 11.4276 | 17.8646 | 19.1386 |

| CM100day | 4400 | 9.4597 | 2.7867 | 2.7867 | 7.1487 | 9.1478 | 11.6022 | 18.0965 | 19.3050 |

| Δ Obs1day | | 98% | 82% | 82% | 110% | 101% | 96% | 98% | 105% |

Table 4.

Standard deviation comparison.

Table 4.

Standard deviation comparison.

| Observed 1 Day | Model 1 Day | Model 7 Day | Model 30 Day | Model 100 Day |

|---|

| 4.002 | 3.059 | 3.060 | 3.105 | 3.086 |

Table 5.

Comparison of bags per truck (data, model, observed).

Table 5.

Comparison of bags per truck (data, model, observed).

| Variable | # | Mean | Min | Lower Whisker | Q1 | Median | Q3 | Upper Whisker | Max | Average 63 |

|---|

| Obs1day | 43 | 69.4419 | 38.0000 | 38.0000 | 61.0000 | 71.0000 | 77.5000 | 97.0000 | 104.0000 | 110% |

| CM1day | 44 | 63.3864 | 26.0000 | 26.0000 | 50.5000 | 62.5000 | 79.0000 | 98.0000 | 98.0000 | 101% |

| CM7day | 308 | 59.5487 | 22.0000 | 22.0000 | 43.0000 | 58.0000 | 74.2500 | 109.0000 | 109.0000 | 95% |

| CM30day | 1320 | 60.2379 | 22.0000 | 22.0000 | 46.0000 | 58.0000 | 74.0000 | 110.0000 | 110.0000 | 96% |

| CM100day | 4401 | 60.9275 | 21.0000 | 21.0000 | 46.0000 | 59.0000 | 75.0000 | 112.0000 | 112.0000 | 97% |

Table 6.

Vault teller work hours.

Table 6.

Vault teller work hours.

| Vault Teller | # | Mean | Min | Lower Whisker | Q1 | Median | Q3 | Upper Whisker | Max |

|---|

| Reg_Hours | 624 | 33.3206 | 0.0000 | 14.1000 | 29.5575 | 38.7600 | 40.0000 | 50.5400 | 50.5400 |

| OT_Hours | 624 | 2.0377 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 2.0075 | 5.0000 | 35.5100 |

Table 7.

Teller sorting time in hours.

Table 7.

Teller sorting time in hours.

| Variable | Count | Mean | Minimum | Lower Whisker | Q1 | Median | Q3 | Upper Whisker | Maximum |

|---|

| VAULT 1 Hours | 31 | 4.4170 | 0.0000 | 3.9283 | 4.3138 | 4.5142 | 4.7167 | 5.1994 | 5.4344 |

| VAULT 2 Hours | 31 | 4.5269 | 0.0000 | 4.1450 | 4.3933 | 4.7044 | 4.8213 | 5.1906 | 5.1906 |

| VAULT 3 Hours | 31 | 4.4421 | 0.0000 | 3.9983 | 4.3531 | 4.5306 | 4.8179 | 5.2208 | 5.2208 |

| SORTING 1 Hours | 31 | 9.9479 | 1.7739 | 9.0719 | 9.6963 | 10.1914 | 10.6832 | 11.7303 | 11.7303 |

| OUTBOUNDSORTING 1 Hours | 31 | 7.1775 | 0.0000 | 6.4700 | 7.1947 | 7.4144 | 7.6897 | 8.1039 | 8.1039 |

| CABINET 1 Hours | 31 | 4.2083 | 0.0000 | 3.7389 | 4.1042 | 4.3550 | 4.6155 | 4.8683 | 4.8683 |

| SECURITY 1 Hours | 31 | 4.2086 | 0.0000 | 3.7464 | 4.1106 | 4.3600 | 4.6104 | 4.8606 | 4.8606 |

| OVERNIGHT 1 Hours | 31 | 8.4185 | 3.0000 | 7.7822 | 8.4141 | 8.6131 | 8.9563 | 9.6854 | 9.6854 |

| OVERNIGHT 2 Hours | 31 | 8.4185 | 3.0028 | 7.7821 | 8.4174 | 8.6189 | 8.9518 | 9.6879 | 9.6879 |

| EARLYMORNING 1 Hours | 31 | 1.9769 | 0.0000 | 1.8769 | 1.9575 | 2.0447 | 2.0954 | 2.2158 | 2.3586 |

| EARLYMORNING 2 Hours | 31 | 1.9767 | 0.0000 | 1.8822 | 1.9581 | 2.0431 | 2.0953 | 2.2178 | 2.3519 |

| EARLYMORNING 3 Hours | 31 | 1.9768 | 0.0000 | 1.8789 | 1.9554 | 2.0389 | 2.0963 | 2.2192 | 2.3564 |

| EARLYMORNING 4 Hours | 31 | 1.9761 | 0.0000 | 1.8792 | 1.9569 | 2.0383 | 2.0968 | 2.2139 | 2.3556 |

| EARLYMORNING 5 Hours | 31 | 1.9769 | 0.0000 | 1.8786 | 1.9544 | 2.0408 | 2.0986 | 2.2203 | 2.3558 |

Table 8.

Driver–Messenger actual work hours.

Table 8.

Driver–Messenger actual work hours.

Driver/

Messenger | # | Mean | Min | Lower Whisker | Q1 | Median | Q3 | Upper Whisker | Max |

|---|

| Reg_Hours | 3049 | 32.4797 | 0.0000 | 9.0500 | 27.6100 | 39.9900 | 40.0000 | 52.8600 | 52.8600 |

| OT_Hours | 3049 | 6.5066 | 0.0000 | 0.0000 | 0.0000 | 4.1200 | 10.5600 | 26.3800 | 39.7600 |

Table 9.

Simulation model route duration (hours/week).

Table 9.

Simulation model route duration (hours/week).

| Variable | # | Mean | Min | Lower Whisker | Q1 | Median | Q3 | Upper Whisker | Max |

|---|

| Average | 14 | 52.0991 | 47.8247 | 51.0111 | 51.4709 | 52.6319 | 52.9278 | 53.7428 | 53.7428 |

| Overtime | 14 | 12.0991 | 7.8247 | 11.0111 | 11.4709 | 12.6319 | 12.9278 | 13.7428 | 13.7428 |

Table 10.

Simulation model route duration (hours/day).

Table 10.

Simulation model route duration (hours/day).

| Variable | # | Mean | Min | Lower Whisker | Q1 | Median | Q3 | Upper Whisker | Max |

|---|

| Average | 100 | 9.4488 | 6.2869 | 6.2869 | 7.3114 | 10.0590 | 10.6299 | 12.1214 | 12.1214 |

| Overtime | 100 | 1.7548 | 0.0000 | 0.0000 | 0.0000 | 2.0590 | 2.6299 | 4.1214 | 4.1214 |

Table 11.

Simulation route stop timing by type (minutes).

Table 11.

Simulation route stop timing by type (minutes).

| Current State | # | Mean | Min | Lower Whisker | Q1 | Median | Q3 | Upper Whisker | Max |

|---|

| Retailer | 2680 | 8.9484 | 1.6333 | 1.6333 | 6.5000 | 8.9333 | 11.4208 | 15.6333 | 15.6333 |

| ATM | 531 | 8.2562 | 0.3667 | 7.0000 | 7.6417 | 8.4333 | 9.1917 | 11.5000 | 11.9833 |

| Bank | 288 | 13.7612 | 4.7833 | 10.9333 | 13.1292 | 14.0833 | 14.8833 | 17.1000 | 17.1000 |

| Competitor | 117 | 10.1101 | 6.4833 | 7.1167 | 9.3667 | 10.1333 | 10.9167 | 12.9833 | 14.3333 |

Table 12.

Data sources and validation.

Table 12.

Data sources and validation.

| Item | Source | Model Validation |

|---|

| Messenger Route Transaction Timing | Interview/Observation | Comparison to Operational Behaviors/Validation with

Managers/Work hour data |

| Transfer of Custody from CIT to Vault | Time-Motion Study/Observation | Comparison Time-Motion Study/Work Hour Evaluation |

| Teller Utilization—Inbound | ATC Data/Observation | Work Hour Evaluation/Comparison to Operational Behaviors |

| Teller Utilization—Outbound | ATC Data/Observation | Work Hour Evaluation/Comparison to Operational Behaviors |

| Total Route Duration | ATC Data/Observation | Work Hour Evaluation/Comparison to Operational Behaviors |