1. Introduction

The impact of COVID-19 and rapid innovation in digital payment systems are pushing central banks to consider the need to issue digital currencies. At the forefront of this decision-making process is the issue of how such digital currencies could improve the efficiency of payment systems and whether such efficiency can occur through the private sector rather than through state intervention. It is important to note that there is no unanimously agreed-upon solution regarding optimal central bank digital currency (CBDC) deployment options; therefore, context becomes crucial. CBDC remains a new and fast-evolving issue, and several questions persist in the minds of central bankers regarding how to most effectively implement it.

Central banks play a critical role in ensuring the financial stability of an economy and the sustainability of payment systems. For centuries, central banks held a monopoly over the issuance of currencies. However, this monopoly has been broken in recent years due to the advent of cryptocurrencies, the most popular being Bitcoin [

1]. Several authors [

2,

3] have explored CBDCs as a means to tame the rapid growth of cryptocurrencies and found that most central banks’ understanding of CBDC design and its implications on cryptocurrencies is evolving. One issue at the centre of the CBDC debate is whether such a currency can compete with cryptocurrencies. Cryptocurrencies are designed to be transparent and without any central control, while CBDC is centralised, making competition difficult [

4].

Another important consideration is the timing for CBDC implementation, evaluating costs and benefits while considering both short- and long-term implications. Given this background, a comparison of various CBDC design options could provide valuable insights into how to improve CBDC implementation options. Ghana and Nigeria are located in the West Africa region and share somewhat similar characteristics. At the baseline, each of these countries has a documented CBDC design paper in place; however, Nigeria has fully implemented its CBDC [

5]. There is a growing body of literature on CBDC; however, there are only a few studies on CBDC design in West Africa, especially in Ghana and Nigeria. Therefore, this paper sets out to contribute a comparative analysis of CBDC design in the context of West Africa, thereby contributing to the CBDC body of knowledge in Ghana and Nigeria.

This paper compares Ghana and Nigeria’s CBDC design frameworks. To understand CBDC in Nigeria and Ghana, we pose the following questions: how does the eCedi design framework differ from eNaira? How do eCedi design and eNaira compare to the current state of play in CBDC constructs?

To elicit similarities, differences, and patterns in exploring the above questions, we investigated several elements based on the literature involved in issuing a CBDC including its objectives, context, design principles, architecture, risks, and rollout plan. The remainder of the research is organised as follows. The following section discusses the literature and methodology. The paper continues by comparing eCedi and eNaira. After a discussion of these findings, the paper concludes and offers areas for further research.

2. Literature Review

2.1. Context and Overview of the CBDC Landscape

Nobel laureate James Tobin suggested the idea of a CBDC in 1987 as a retail central bank digital currency capable of bypassing the heavy reliance on payment system deposit insurance [

6]. A CBDC can be described as a central-bank-issued digital currency with the same characteristics as cash that serves as a digital store of value, a medium of exchange, and a unit of account. A CBDC can take the form of either a token-based or an account-based currency and can be segmented into two types: a retail rCBDC and a wholesale wCBDC [

7]. Furthermore, CBDCs could take the form of an interest-bearing or non-interest-bearing instrument. CBDCs can also be classified into a 1-tier (direct) form, which represents the central bank issuing the CBDC and taking full responsibility for it, and a 2-tier (indirect or synthetic) form, in which the central bank backs private involvement. In terms of legal frameworks, a number of countries do not envisage a change in law, while others require such a change to implement a CBDC. In discussing how CBDCs are connected to the global financial network, ref. [

8] contends that the CBDC network is likely to adopt a flatter network approach that is uncoordinated, divergent, and decentralised.

Several central banks expect CBDCs to create potential benefits such as improvements in currency function, efficiency, and safety of payments while serving as a policy response to payment innovations, including privately issued e-money and digital currency [

9]. Previous studies regarding CBDC’s impact on citizens’ social welfare [

10] have found that CBDCs with positive interest can reduce inefficiency and improve welfare by rewarding tax payments and discouraging tax evasion. In terms of the impact of CBDCs on financial intermediation, ref. [

11] argued that interest-bearing CBDCs can lead to increased competition, which could result in additional deposits, lending, and lower loan rates that culminate in disintermediation in banking. Ref. [

12] suggested that CBDCs crowd out bank deposits; nevertheless, this crowding-out effect can be addressed if the central bank opts to disincentivise large-scale CBDC accumulation by using low CBDC interest rates as a tool. One argument advanced for implementing a CBDC is the opportunity to leverage it as a tool for monetary control. A study by [

13] revealed that interest-bearing CBDCs could be helpful in improving monetary policy by enabling non-linear transfers and maintaining the effectiveness of monetary policy. Furthermore, in assessing the cost and benefits of CBDC, ref. [

14] argued that, in the context of the United States of America and Canada, if the cost of using a CBDC relative to cash is approximately 0.25% when measured against transaction value, CBDC deployment can result in an increase of 0.12–0.21% consumption for the United States and 0.04–0.07% for Canada.

For many centuries, commercial banks served as middlemen by playing an intermediation role; however, the process of disintermediation occurs when these middlemen are removed from the equation. One risk of CBDC deployment could be the structural disintermediation of the deposit-collecting functions of financial institutions, which entails users moving their funds from bank accounts held with commercial banks into CBDC holdings [

15]. Faced with the challenge of dwindling bank deposits, these commercial banks could be forced to increase interest rates. Such action potentially implies reducing the funds available for borrowing and could cause an attendant negative impact on the economy [

2,

16]. In expressing a contrary view, ref. [

17] noted that a CBDC deployment that follows a conservative approach will ensure banking intermediation and mitigate the risk of a system-wide run from bank deposits to CBDCs. Ref. [

18] revealed a risk of CBDCs enabling systemic runs on banks in times of crisis. To manage disintermediation hazards, the central bank could consider three options: imposing a ceiling on CBDC holdings, implementing an adjustable and countercyclical two-tier interest rate, and paying an attractive interest rate to CBDC holdings at a specific limit [

19]. Another author [

20] confirmed that the risk of disintermediation could be managed by implementing a positive interest spread on CBDCs and applying a stricter collateral constraint. Though this may reduce central banks’ welfare goals, such actions have considerable potential to contain disintermediation on the condition of a smaller elasticity of substitution between bank deposits and CBDCs.

The deployment of CBDCs remains a highly debatable issue [

21]; therefore, an understanding of arguments for and against them becomes important. Ref. [

10] suggested that countries that master CBDC technology will have a competitive advantage because it is a primary tool in the digital economy. Key factors such as maintaining the central bank’s relevance in the monetary system, financial inclusion, the digitisation of the economy, a decline in the use of cash, and the advancement of virtual payments are significant reasons for adopting CBDCs [

22,

23].

Table 1 summarises the reasons for and against issuing CBDCs.

2.2. CBDC Technical Aspects

There are three types of CBDC. In the first, a unilateral CBDC, the central bank is responsible for all functions. The second type assigns a role to the private sector. In the third model, private firms issue digital currency backed by the central bank. This third option is more of a stablecoin than a CBDC and is known as a synthetic CBDC (sCBDC). CBDCs can either be implemented within the existing real-time gross settlement payment systems or designed as an independent system [

24]. The cost of running a CBDC could be a transaction-based fee structure in which private participants are compensated and the central bank is responsible for establishing a free or low-cost platform to ensure that the CBDC functions [

25]. A CBDC can be built on a public blockchain or be a hybrid that is a private instance of a public blockchain. As a CBDC demands more controllable decentralisation and supervision, emphasis is placed on a modular blockchain architecture as opposed to a decentralised design that includes the distributed ledger technology (DLT) utilised by cryptocurrencies [

26,

27,

28,

29]. According to [

30], South Africa can be considered one of the countries in Africa with the most optimal environment for implementing a CBDC owing to the advanced nature of its payment infrastructure. The CBDC design experimented by its central bank, the South African Reserve Bank, is a wholesale CBDC designed to facilitate interbank transfers among financial institutions under Project Khokha, based on distributed ledger technology (DLT), specifically Ethereum. Project Khokha was designed as a collaborative project with the South African Reserve Bank, providing leadership by working with a consortium of South African settlement banks and technical and support partners. The South African Reserve Bank CBDC is framed as a distributed network, with each participating bank responsible for configuring its node in the system by using a combination of on-premise virtual machines, cloud-based virtual and physical machines [

31,

32].

2.3. CBDC Design Principles

According to [

33], CBDC designers are faced with the difficulties of how to manage privacy, performance, and security when deciding on the various options to select. Other design decisions relate to how CBDC supports policy goals or mitigates risks, financial stability, anonymity, offline capabilities, cross-border payment features, and ensuring a CBDC does not compete directly with bank deposits. Most central banks rely on third-party technology vendors to deploy CBDCs [

34], while others rely on their internal capabilities, occasionally backed by third-party suppliers in limited roles. In evaluating CBDC designs, ref. [

25] suggested allocative efficiency and attractiveness to users as variables. Allocative efficiency involves whether a CBDC is solving a market failure that private providers cannot ordinarily resolve. In terms of attractiveness for users, a CBDC is assessed based on its competitive and efficacy value in comparison to existing payment systems. Broadly speaking, a CBDC can be designed as a cash or deposit type. Though cash-like CBDC is a laudable design goal in tandem with the declining use of physical cash, ref. [

35] argues that replicating cash properties, including its convenience in a cash-like electronic format, is extremely difficult; hence a “minimally invasive” design is recommended. The “minimally invasive” design meets the policy design goal of cash-like digital instruments without distorting the existing monetary and financial system. Ref. [

36] argued that the general equilibrium of a CBDC can be viewed through the three lenses of payment efficiency, price effects, and banking costs, with a cash-like CBDC outperforming a deposit-like CBDC regarding the promotion of consumption and the welfare of citizens. Ref. [

37] suggests optimal CBDC design demands a balancing act of ensuring bank intermediation and social value of having multiple payments in an economy with interest-bearing CBDC playing a pivotal role in this trade-off.

2.4. Risks

Ref. [

24] listed several CBDC risks as single points of failure: cash no longer being available as a backup, cybersecurity vulnerabilities, adverse impacts on monetary sovereignty, crowding out banks, facilitating bank runs, and reputational risk to the central bank if the CBDC does not receive widespread acceptance. Additionally, the more anonymity a CBDC offers, the higher the potential risk of its illicit use. An offline CBDC solution based on a token-based bearer approach can present security risks such as counterfeiting. Moreover, the adoption of a bearer instrument approach to facilitate anonymous transactions presents a greater risk of a user losing their CBDC if their digital wallet becomes unavailable [

22]. A CBDC ledger could also become a target for attacks from hostile non-state and state entities. Another element of risk emerges when a central bank is perceived as an agent of a government that is able to undertake state surveillance of an individual’s spending patterns [

38]. Although a CBDC can help foster financial inclusion, ref. [

39] stressed that eNaira, for example, carries the risk of financing terrorism and enabling money laundering.

2.5. Theoretical Underpinning

Most central banks’ core mission is related to the promotion of the welfare of their citizens through the maintenance of monetary and financial stability [

40,

41]. Unpacking the theory of central banking at an ontological level [

42] postulates two streams. The first involves the conceptual separation of the monetary economy from the real economy or the economic from the non-economic within a closed-system ontology, which led itself to formal modelling. The second stream is conceptual interconnectedness—a non-mainstream ontology of complex interconnectedness based on a political-economy approach that operates within an evolving social system. The non-mainstream approach hinges on a central-banking theory framed around a political-economy tradition in which greater emphasis is placed on central banking’s functions beyond the pursuit of traditional monetary stability. As an ‘unconventional’ tool, a CBDC makes an ideal candidate for the non-mainstream approach.

2.6. CBDC Context in Ghana and Nigeria

The Sub-Saharan Africa financial inclusion index, covering Ghana and Nigeria, currently stands at an average of 43% [

43,

44,

45], meaning many citizens are outside the scope of financial services. Several authors [

46] have emphasised the view that central banks have a key role to play in financial inclusion and ref. [

47] stressed that CBDCs can promote financial inclusion. Ref. [

48] suggested that a CBDC designed to achieve financial inclusion may conflict with other motivations. Therefore, for financial inclusion to be successful as a CBDC design policy goal, central banks must ensure technology designs and policy choices are in tune with this goal.

There is a relatively small body of literature on CBDCs in Nigeria and Ghana. However, studies such as [

49] have reviewed eNaira, highlighting opportunities such as more effective management of monetary policy, convenience, more efficient payments, improving financial inclusion, and the identification of cyberattacks and data theft risks. One author [

50] suggested that 80% of bankers in Ghana expressed scepticism concerning the capacity of Ghana’s technology infrastructure to support the rollout of Ghana’s CBDC. Therefore, this paper is important because it is one of the first to offer a detailed comparison of Ghana and Nigeria’s CBDC design frameworks.

3. Methodology

This paper conducts a comparative case study of Ghana and Nigeria’s CBDC designs by addressing key questions: How does the eCedi design framework differ from eNaira? How do eCedi design and eNaira compare to the current state of play in CBDC constructs?

Methodologically, this research objective is reflected in thematic issues framed as the basis of a systematic comparison between eNaira and eCedi [

51,

52] The paper used a structured, focused comparison method that defines Ghana and Nigeria’s CBDC designs in relation to four key interconnected themes: context, technical aspects, use cases, and deployment plans. This paper is therefore grounded in an exhaustive thematic analysis of the secondary sources issued by the Central Bank of Ghana under the title “Design paper of the digital Cedi (eCedi)” [

53] and by the Central Bank of Nigeria under the title “Design paper for the (eNaira)” [

54].

The analysis of this paper relies on the Edeholt and Löwgren’s design framework, which provides the basis to compare eNaira and eCedi designs. Edeholt and Löwgren analytic framework posit three design elements: process, material, and deliverables. The process covers several areas in the design process, referred to as explorative and analytical, meaning the design process is in a constant flux of problem reframing and dynamic solutions. The analytic framework’s material element refers to the design output’s intangibility and tangibility. The design framework’s material component comprises service design evidence and a clear-cut service interface, for example, software or virtual material and hardware. The deliverable part of the analytic framework denotes the scope of deliverables, such as the type of product, its use, performance, and the artefacts that facilitate the service’s user experience. [

55,

56]. The process elements included the digital payment landscape and CBDC objectives. The material component captures technical issues such as design principles, architecture and risks related to the deployment of CBDC. The deliverables elements focus on use cases and plans for CBDC deployment.

The research process was organised into four main phases. The first phase covered the research design, and the main parameters of the study were elucidated, mainly the research purpose and questions. Phase two involved reviewing and exploring Ghana’s and Nigeria’s CBDC design documents through a detailed search process and selecting relevant themes based on the research goal using a qualitative data analysis software tool. The third phase of this process focused on analysis and a specific evaluation of relevant research themes. Finally, the report was structured and anchored to ensure the quality of results by cohesively presenting themes.

Regarding African countries, Morocco, Tunisia, Egypt, Kenya, Madagascar, Zambia, Zimbabwe, Namibia, and Eswatini are all currently undertaking CBDC research. However, while Ghana and South Africa are conducting pilot programmes, Nigeria remains the only country to have fully implemented a CBDC [

34]. This study selected Nigeria and Ghana based on two conditions: both have issued a CBDC design and both are located in West Africa.

4. Results

4.1. Context—Overview of the CBDC and Payment Landscape in Nigeria and Ghana

With a GDP of

$450 billion, Nigeria is one of the largest economies in Africa. The country has a growing population of 211 million people and a relatively resilient banking system due to years of reforms. The Central Bank of Nigeria, at its January 2022 monetary policy meeting, pegged the monetary policy rate to the major foreign exchange rate at 11.5%, the cash reserve ratio at 27.5%, and the liquidity ratio at 30% as a strategy to address rising inflation and the rapid depreciation of the Naira. The number of licensed banks was reduced from 89 to 24 due to significant banking reforms in 2005. The banks in Nigeria are recording impressive performances that exhibit an annualised average growth rate of 15.6% in total assets and a 6.8% growth in profit. Nigeria’s payment system is recording remarkable achievements, and digital payment services remain a key growth area [

57].

Banking in Ghana is one of the most vibrant sectors of the economy. Indeed, according to the Bank of Ghana’s 2021 statistics on the banking sector’s performance, the sector is broadly liquid, profitable, resilient, and well capitalised. Through its Monetary Policy Committee, the Central Bank of Ghana set its monetary policy rate at 19% as of May 2022. The size of Ghana’s economy stands at

$77.59 billion (2021), with Ghana’s population pegged at 31 million inhabitants (2021). There are 23 banks, the entire banking sector’s annual growth is 18.5%, and growth in profit after tax is estimated at 5.9%. As with Nigeria, Ghana’s payment system is robust, with digital payment services as a significant growth driver [

58].

Both eNaira and eCedi are designed as retail token-based CBDCs and as digital replicas of each country’s traditional currency—Ghana’s Cedi and Nigeria’s Naira—that serves as legal tender convertible to fiat in the form of cash or deposits at a 1:1 value. Therefore, these CBDCs have the same characteristics as cash and do not earn interest. The eCedi design document traced the history of Ghana’s payment landscape. The document listed several of eCedi’s strategic goals, such as fostering the FinTech ecosystem, promoting digital payments, and enabling an environment conducive to digital financial products. eCedi is designed to ensure accessibility, support low-value payments, utilise existing payment infrastructures, and mitigate potential risks to disintermediation. The eCedi design paper suggested that eCedi will be simple to use and not require sophisticated digital literacy. Consumer experiences with using mobile money, a dominant form of digital payment, could be transferable in order to drive the usage of eCedi.

On the other hand, the Central Bank of Nigeria (CBN) began its CBDC journey in 2017 by undergoing a series of sequential steps that consisted of research, consultations, identification of use cases, and the final testing of eNaira in a sandbox environment. After completing these steps, the CBN launched eNaira on 25 October 2021. The eNaira design paper provided insights into significant developments that included the growth of digital payments, such as a record 2.7 billion transactions valued at NGN162.9 trillion as of 2020, which is 1.06 times larger than the country’s 2020 GDP of NGN154.3 trillion. The design document provided salient information on the eNaira framework and the key national policies guiding the evolution of the payment ecosystem in Nigeria. The eNaira vision is stated to be a digital currency that enables fast, efficient, and reliable payments while benefiting from a resilient, innovative, inclusive, and competitive payment system summarised in a slogan: “same Naira, more possibilities.” The eNaira design document stressed the issue of uncertainties around the rollout of eNaira. Hence, it includes plans to implement an adaptive regulatory approach.

Table 2 lists the objectives of deploying CBDCs in Nigeria and Ghana. Given that each country’s context is different, there are different motivations for rolling out CBDCs. A common objective for both countries is the use of CBDCs to foster financial inclusion. Both countries’ objectives for deploying CBDCs are in tandem with other central banks’ motivations [

3,

4,

8,

21,

24].

4.2. CBDC Technical Aspects

The eNaira design principles are anchored in three fundamental principles championed by the Bank for International Settlements: do no harm, coexistence, and innovation and efficiency in payment infrastructure. Based on these principles, eNaira was further based on the following design tenets: inclusivity, continuous innovation and collaboration, efficiency, and resilience (the ability of the financial system to withstand, avoid, and recover from shocks emitting from the impact of introducing the CBDC). The eNaira must also be proudly Nigerian and should therefore embody Nigerian identity while solving problems specific to the Nigerian payment system. In contrast, eCedi is anchored on four design principles: governance, inclusivity, interoperability, and infrastructure.

4.2.1. Architecture

The Bank of Ghana is the issuer of the eCedi and has full authority to create and destroy eCedi. Based on the eCedi architecture, the commercial banks are assigned the responsibility for its distribution, while FinTech will provide wallet and support services. The architecture takes into consideration compliance requirements regarding countering money laundering and the financing of both terrorism and the proliferation of weapons of mass destruction. Moreover, risk-based monitoring and reporting requirements will be instituted to promote financial stability without undermining financial inclusion and consumer privacy. Similarly, eNaira is designed on a two-tiered CBDC architecture. The CBN is responsible for issuing the eNaira based on the existing payment infrastructure, whereas the financial sector actors serve as a retail interface. Under this architecture, the CBN maintains control over the eNaira payment system, administering the eNaira’s issuance, managing the wallets, and overseeing the central archive of all transactions. eNaira’s core infrastructure is the Hyperledger Fabric variant of the DLT linked to its adopted two-tiered model architecture. The Hyperledger Fabric can be described as an open-source enterprise-grade permissioned DLT platform. This modular framework provides a robust security architecture that is versatile, optimisable, scalable, and open to innovation by enabling other regulated market players to serve as nodes. Both eNaira and eCedi designs factored in anonymity, privacy, data protection, and compliance with the Nigerian National Data Protection Regulations and Ghana’s Data Protection Act.

4.2.2. Risks

Given that CBDCs are a relatively new technological innovation, they present several hazards. The eNaira design document noted that the eNaira risks disrupting the banking ecosystem and can therefore have far-reaching implications for the economy. Four risks were specifically identified: strategic and policy risks, operational risks, cyber security risks, and reputational risks. First, eNaira holds the potential for disintermediation and therefore threatens to have a negative impact on the availability of banking credit. Second, eNaira could expose the payment system to uncertainties. As CBDCs are relatively novel, with few countries having implemented them, there is no available data to gauge their impact. Further, eNaira may lead to complexities and exacerbate the risk of further financial exclusion. Though eNaira is designed to work through simple channels, a segment of the population—particularly the uneducated and those without access to reliable internet—may be unable to access eNaira effectively. eNaira might also expand the potential for attacks on its users and even on the central bank itself. In recognising these risks, eNaira provided several mitigation measures for each of the threats identified. The eCedi design document suggested eCedi could be the target of cyberattacks in a manner similar to counterfeiting banknotes by criminals—though this time by digital means. eCedi is also expected to be designed to mitigate potential risks concerning the banking system’s disintermediation.

4.3. Use Cases and Deployment Plans

A CBDC can be considered an innovative online and offline payment instrument with a unique infrastructure that can be used for diverse types of payments. Both design documents stated a variety of functionalities. Users can access a CBDC from existing payment options that include mobile phone wallets, mobile banking apps, wearables, debit cards, point of sale terminals, Unstructured Supplementary Service Data (USSD), quick response codes, and internet banking. A typical use case could be utilising a CBDC to make payments, shop online, or send remittances by loading a wallet with eCedi or eNaira. In terms of the fees model, it recognises eCedi as cash with an interest rate of zero that is convertible on 1:1 ratio to physical cash. Moreover, similar to cash, its usage will be free of charge. However, given intermediaries such as banks, specialised deposit-taking institutions, and payment service providers play a role in facilitating access and usage, it is envisaged that the free-market model will be applicable in the determination of any applicable fees. Ghana’s design document did not provide information on daily limits. However, eNaira provided information on wallet tiers and transaction limits based on the bank verification number or the national identity number of the user. The eNaira implementation roadmap is organised into four phases. Phase one represents the launch and includes onboarding banking customers and creating a wallet. Phase two involves onboarding unbanked customers, merchandise, and international money transfer operators. Phase three concerns the inclusion of trade exchanges and government ministries, departments, and agencies. Finally, phase four enables an offline eNaira, cross-border payments, multiple signatory wallets, and interoperability with other CBDCs. In contrast, eCedi design document did not provide detailed information on its deployment plan.

4.4. Comparison of Ghana and Nigeria’s CBDCs

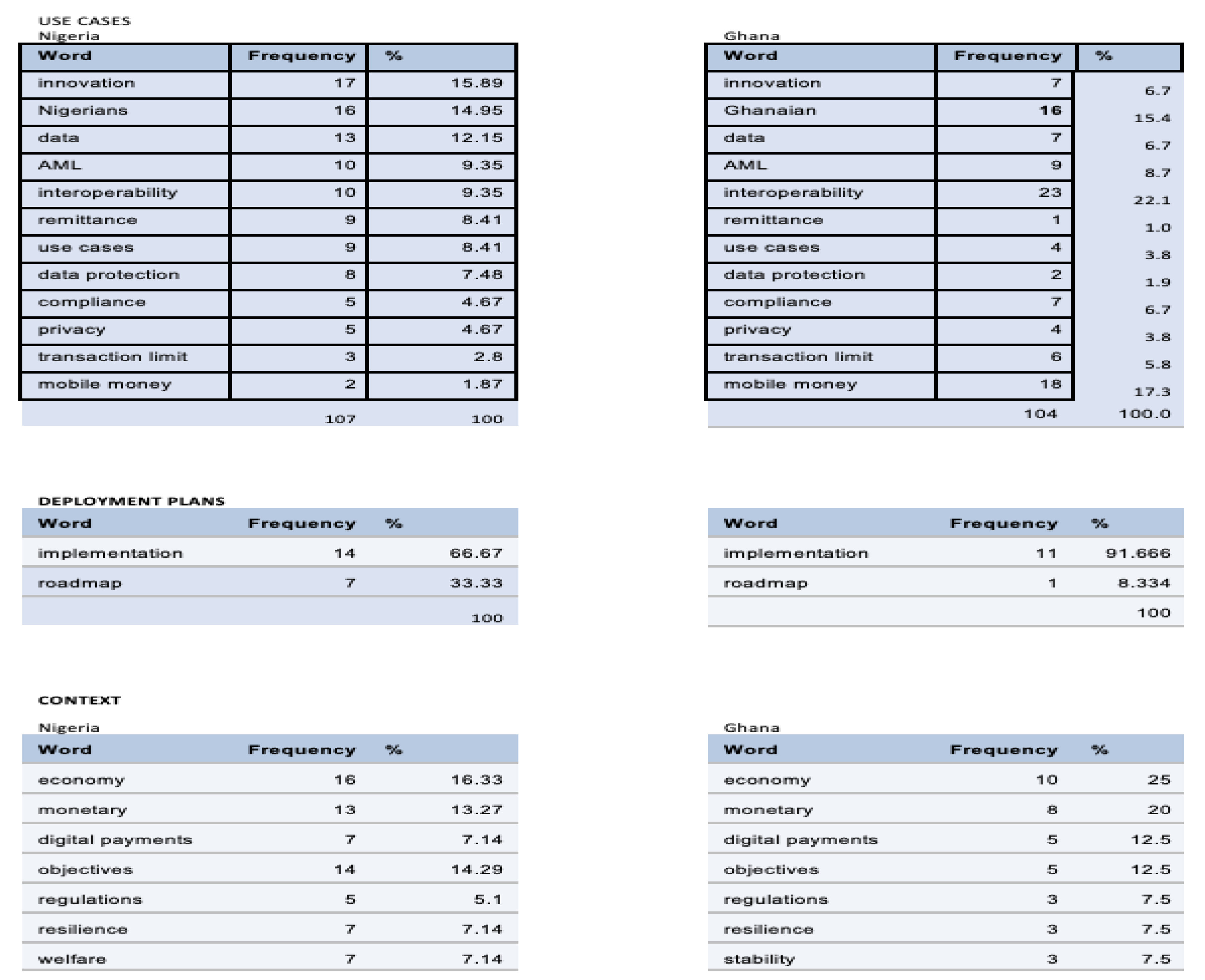

The eNaira and eCedi design documents are comparable in many ways, and a detailed analysis of their similarities in terms of word count and key words is provided in

Appendix A.

Table 3 below provides highlights of a comparative analysis of Ghana and Nigeria’s CBDC design documents.

5. Discussion

The eNaira and eCedi designs are highly similar in several ways. However, the eNaira’s design document contained detailed information on a roadmap for deployment and adequate information on risk and mitigation factors. It also provided information on wallet tiers and transaction limits. Both designs indicated a CBDC as a means to solve issues related to cryptocurrency regulations. However, evidence suggests this policy objective is virtually impossible to achieve. The idea of a CBDC representing a response to cryptocurrency is too late. Given the advances that have been made in this space, central banks simply cannot catch up [

1,

2,

4]. Moreover, while cash provides the optimal means of anonymity, a CBDC raises many privacy concerns, as each user transaction is recorded in a central ledger held by the central bank. The suggested solution is to ensure at least smaller transactions are relatively anonymous, though this is not straightforward to accomplish.

In comparing eNaira and eCedi to the optimal design of CBDC, an appraisal revealed that eNaira and eCedi have cash-like designs with no interest-bearing attributes. The design of eNaira and eCedi means they do not compete with bank deposits with no ability to depress bank credit and economic output. Also, the cash-like CBDC attributes of eNaira and eCedi risk stimulating the disappearance of cash. The results of this paper point to the fact that eNaira and eCedi design fails to meet optimal CBDC design, which describes the status quo of somewhat maintenance of bank intermediation role and diverse payment instruments in the economy [

37]. The results from analysing the eNaira and eCedi design frameworks provide evidence that these two CBDCs do not meet the “minimally invasive” design requirement, which is not surprising because CBDCs are still in the infancy stages globally with more questions than answers. The expectation is that CBDC design best practices will evolve as countries start actual implementation, and are therefore able to adjust design frameworks based on the exigencies of the deployment context [

32].

To understand how do eCedi and eNaira designs compare to the current state of play in CBDC constructs, we rely on South Africa’s CBDC as a case in point. The analysis of this paper shows South Africa’s CBDC design differs from Ghana’s and Nigeria’s approaches. First, South Africa selected the wholesale CBDC design, which is easier to implement than the retail CBDC design because of the number of parties involved. In contrast, retail CBDC is linked to millions of citizens, and wholesale CBDC involves few licensed financial institutions providing a more controllable environment for experimentation of CBDC at the pilot stage. Second, the South African approach is highly dependent on collaboration among key stakeholders, rather than a full-fledged central bank approach, as is the case in Ghana and Nigeria. The South African collaborative design approach brings increased knowledge and ideas to the table to ensure a functional end-product. Finally, the South African design approach infused cross-border inputs, thereby expanding the CBDC design scope [

31,

32].

Mobile money wallets are one of the most dominant forms of payment in both Ghana and Nigeria, and both design documents suggested that a CBDC offers mobile money operators the ability to offer additional payment features. However, none of the design documents provided information on how a CBDC will interact with mobile money or addressed whether a CBDC will compete with or replace mobile money. This is because a CBDC is similar to mobile money in many ways.

The issue of financial inclusion becomes an important context in the deployment of CBDCs because financial inclusion holds the promise of providing a mechanism that can ensure persons outside the banking sector are able to consume formal financial services. The results indicated that financial inclusion is a major justification for a CBDC. This is important because many citizens in both Ghana and Nigeria are outside the banking system [

44]. This result can be explained by [

42], who noted that the non-mainstream approach of central banks hinged on central-banking theory within the political-economy tradition. This focus emphasises the function of central banks in enabling citizens’ welfare, which extends central banks’ roles beyond the pursuit of traditional monetary stability. Further, this result aligns with [

27,

46] on the use of CBDCs as a new tool to promote financial inclusion. In the context of the CBDC rollout’s financial inclusion objective, it is important to highlight that, though CBDC can help with financial inclusion, there are other solutions on the table. Such solutions include increasing digital routes to banking and financial services, particularly the use of mobile money wallets. There is a need to ensure that the introduction of a CBDC does not negatively impact existing channels facilitating financial inclusion. Rather, a CBDC should complement them.

6. Conclusions

Based on a case study of Ghana’s eCedi and Nigeria’s eNaira, this research set out to compare CBDC design frameworks in order to highlight elements of convergence, divergence, and the implications of CBDC within the West African context. The results indicated more similarities between eCedi and eNaira designs than differences. The eCedi and eNaira design documents shared similar CBDC objectives, design principles, architectures, and use cases. As the central point of departure, the eNaira document provided detailed information regarding risks and its deployment plan. Neither the eCedi nor the eNaira design provided adequate information on the legal and regulatory environment of a CBDC, particularly regarding whether new laws will be passed to facilitate a CBDC’s operation or whether it will operate within existing legal frameworks.

The rollout of CBDCs has wide-ranging implications for regulators and banks in Ghana, Nigeria, and Africa as a whole. Banking regulators across the continent struggle with a shortage of the foreign currency necessary to facilitate foreign transactions. CBDC designs could consider how to address this perpetual scarcity and use CBDCs as a lever to finance growing cross-border transactions among African countries and thereby help ameliorate foreign currency shortages in the long term. Moreover, commercial banks must critically consider how they can effectively participate in CBDC deployments because a CBDC remains a significant financial disintermediation risk that could negatively impact their business. Such a risk denotes a critical implication for commercial banks, as a CBDC can destroy their middleman role. It is also crucial to note that CBDCs are faced with substantial uncertainty. Therefore, it is recommended that given that CBDCs are a relatively new area, central banks use adaptive legal and policy approaches that can react to uncertainties.

The inability of this paper to incorporate the assessments of experts and users concerning the eCedi and eNaira design frameworks is a key limitation. Moreover, because Ghana and Nigeria’s CBDC design documents did not provide detailed technical information, this paper could not evaluate any core hardware and software design features. This study could not compare the CBDC designs of Nigeria and Ghana with the CBDC design standards because there is currently no universal CBDC design standard for such comparisons. CBDC is an evolving area, and over time, this standard may emerge as more countries implement CBDC and CBDC performance empirical data become more available. Future studies could consider such a universal CBDC design as a basis for analysis by evaluating the following questions: How does the CBDC design shape the promotion of financial inclusion? What provisions can a CBDC design incorporate to ensure no payment market distortion, particularly regarding the most dominant digital payment system, mobile money wallets? What is the optimum CBDC design to achieve cost-effectiveness? How does a CBDC design address the cost of a CBDC, and how will the central bank pay CBDC’s setup costs?