1. The Emerging Metaverse

The Metaverse

1 describes the shared vision among technology entrepreneurs of “a massively scaled and interoperable network of real-time rendered 3D virtual worlds which can be experienced synchronously and persistently by an effectively unlimited number of users, and with continuity of data, such as identity, history, entitlements, objects, communications and payments” [

1]. The economic ecosystem that is being built around the Metaverse vision is substantial. The market capitalization of incumbent (Web 2.0) firms working on Metaverse technologies is

$14.8 trillion, while the estimated value of (Web 3.0) Metaverse entrepreneurs is only

$0.03 trillion.

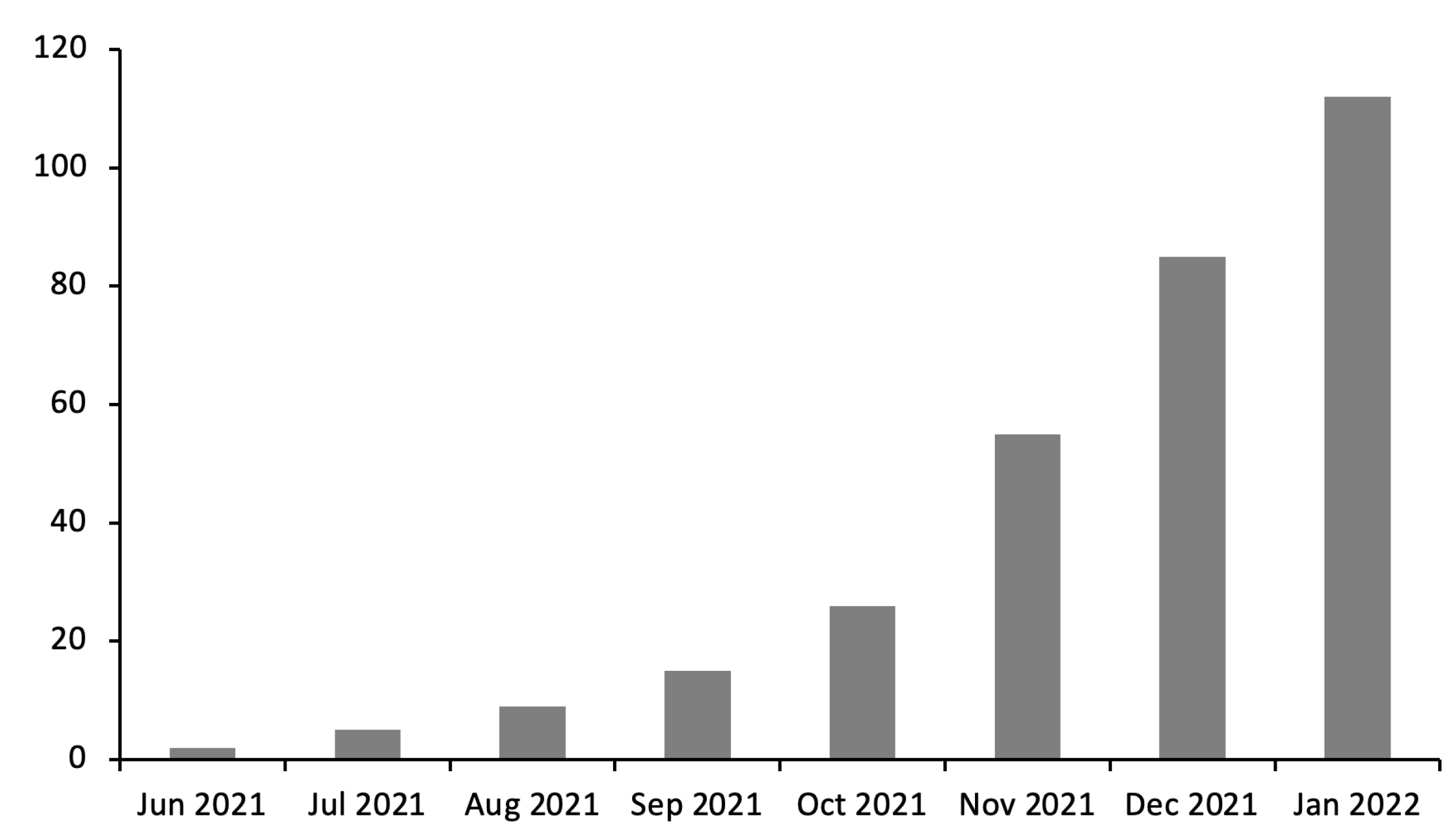

2 However, Metaverse entrepreneurship is on the rise, with an explosive growth in centralized and decentralized applications (dApps) specifically designed for the Metaverse (see

Figure 1). For example, the market capitalization of the popular Metaverse dApp “Decentraland” is

$4.3 billion.

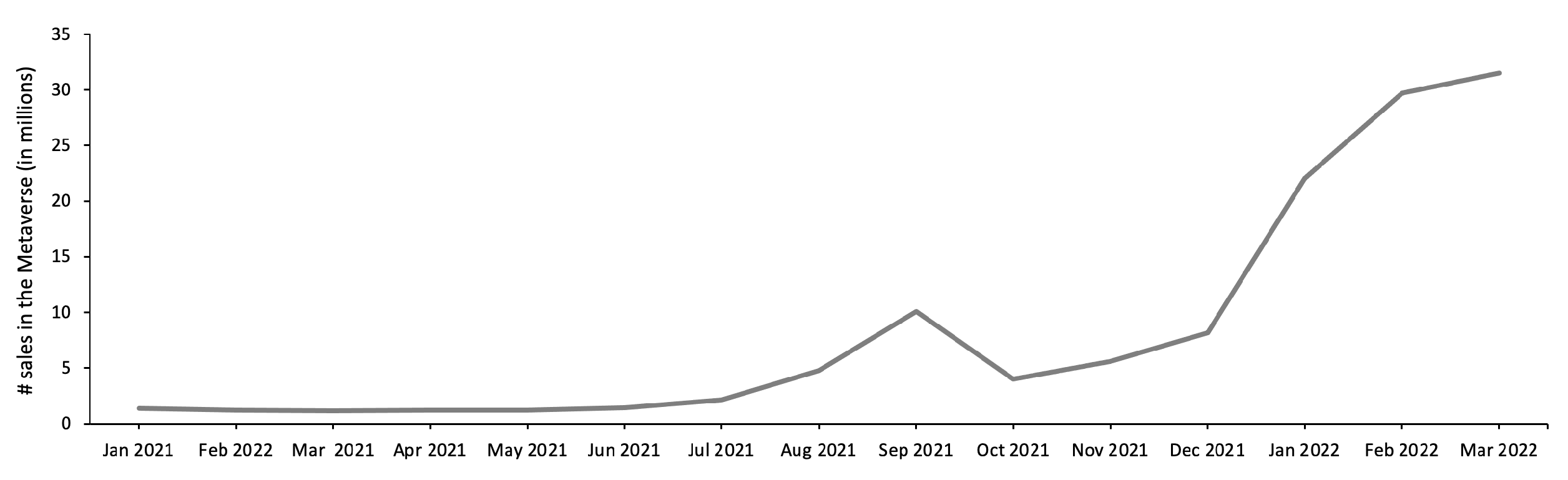

3 In fact, Metaverse dApps experience an explosive number of transactions, with more than 30 million in terms of NFT sales on the

Ethereum blockchain alone in February 2022 (see

Figure 2). Implications of the Metaverse for entrepreneurship have not yet been explicitly considered [

2,

3,

4], which is the void this brief note aims to fill. To accomplish this goal, the note largely ignores “centralized” Metaverse approaches that are pursued by incumbents.

4 1.1. Motivating Examples

To illustrate the nature of entrepreneurship in the Metaverse, consider the business models of two popular ventures:

Decentraland: Decentraland is a virtual, blockchain-based world that features 90,601 “parcels“ (i.e., virtual land plots). Each parcel is represented by a Non-Fungible Token (NFT; for details, see [

12]). Locations are unique and have (x,y) coordinates. For example,

JPMorgan recently purchased a parcel and opened a banking lounge,

5 while a real estate developer recently paid

$912,228 for 259 parcels to build a virtual shopping mall called “Metajuku” modeled on Tokyo’s famous “Harajuku” district to rent shops out to retailers.

6 Indeed, first analyses find that the real estate economy on Decentraland features behavior known from real estate in the physical world [

13], is not merely driven by cryptocurrency markets [

14], although the pricing of digital land does not yet seem to be efficient [

15].

KONG Land: KONG Land is a cryptostate that is governed by its “citizens” through an overarching Decentralized Autonomous Organization (DAO; for details, see [

3]) structure. Its innovation are so-called “Silicon Locked Contracts” (“SiLos”). A SiLo is essentially a physical microchip linked to a virtual smart contract. The microchip links the virtual and physical worlds by enabling the export of crypto-assets from the Metaverse into the physical world, or for example verifying an identity in the physical world for the Metaverse. Citizens of KONG Land can deposit their funds in the government’s treasury (much like a tax), which funds KONG Land’s expansion, and provides citizens with governance rights in a decentralized crypto-state.

1.2. Advantages, Challenges, and Limitations of the Metaverse

Benefits of the Metaverse include that it expands the living and working space, extends human intelligence to knowledge robots, and enables human “superproductivity” via multiple avatars [

16]. It could also eliminate vertical agency costs through flat Decentralized Autonomous Organizations (DAOs) [

3], create new job profiles, such as digital fashion designer, and determine the future of work, realize gains from trade thanks to global market integration because avatars can move across the Metaverse without time delay at no costs, and reduce transaction costs. It could also transform our society into a more sustainable and equitable one, for example because the infinity of digital resources might lower the rate of natural resource depletion in the physical world, or because mask effects eliminate social bias in human-to-human interactions in the offline world (e.g., [

17]) (because avatars can be chosen free of race, gender, etc.), or because new AR/VR technologies may render physiological constraints in people with disabilities irrelevant and re-include them into economic and social life and let them enjoy activities that are not possible in the offline world (e.g., think of VR lenses that let people with eyesight problems drive cars in the Metaverse, [

18]). Additionally, the data in the Metaverse will ultimately lead to deep intelligence about human society and economics, which could improve human and model-based decision-making and facilitate targeted policy-interventions through simulations in the Metaverse [

16].

On the flip side, there are several challenges that technology entrepreneurs need to overcome to make the shared vision of the Metaverse a reality. For example, there are concerns about data privacy, moral and ethics in a world in which digital resources are infinite and all products and services can be offered (hidden from regulators), as well as health-related concerns that range from a neglect of self-care to addiction [

18,

19]. There is also the concern that the Metaverse could be environmentally detrimental because of high gas fees required to operate it, although several Web 3.0 startups are working on solutions to reduce gas fees, increase Transactions Per Second (TPS), and therefore avoid network congestion (e.g.,

Ethereum 2.0,

Cardano, and

Solana, among others, are all determined to resolve these issues). Finally, Ref. [

20] highlights the challenge of “the adoption of decentralization logics” to “overcome the paradox of centrally legitimate, decentralized solutions” in a blockchain-enabled Web 3.0-version of the Metaverse. This would require users to trust blockchains, which needs “a combination of algorithmic, and organizational” trust [

21].

Finally, there are limitations to what the Metaverse can achieve. One limitation is that some sensations are just better in the physical world (e.g., sunlight). Another is that real-time data-rendering impose limits on current implementations of Metaverse technologies (e.g., VR lenses need to show 360-degree views of users’ environments if the users turn their heads, which involves a large amount of data that is currently often somewhat delayed, which causes digital motion sickness) [

18]. Finally, the Metaverse could be subject to censorship (e.g., China’s vision of the Metaverse is fundamentally different from that of the rest of the world

7). Therefore, many of the current technological limitations of the Metaverse create entrepreneurial opportunities.

1.3. The Rise of Entrepreneurship in the Metaverse

Entrepreneurship in the Metaverse is soaring.

Figure 1 shows the cumulative number of mobile apps that update their name to include the term “Metaverse” on a monthly basis. Additionally,

Figure 2 plots the cumulative number of sales through Metaverse apps, as proxied by NFT sales on the

Ethereum blockchain. By March 2022, there have been more than 30 million sales of Metaverse goods and services. These figures illustrate that the market for Metaverse products is already substantial, and the market growth rates have dramatically increased recently.

The remainder is organized as follows:

Section 2 explains the Metaverse vision, and

Section 3 discusses the role of Non-Fungible Tokens (NFTs) as enablers for the Metaverse.

Section 4 describes the emerging Metaverse economy.

Section 5 discusses some simple economics of building and operating the Metaverse.

2. What Is the Metaverse?

The Metaverse refers to a shared vision among technology entrepreneurs of a three-dimensional virtual world, an embodied internet with humans and the physical world in it. In the Metaverse, avatars, i.e., humans’ alter egos, engage in social and economic interactions. The technology that bridges virtual and physical realities is Extended Reality (XR), which combines Augmented, Virtual, and Mixed Reality (AR, VR, and MR) technologies. As such, the Metaverse is thought to expand the domain of human activity by overcoming spatial, temporal, and resource-related constraints imposed by nature.

The shared vision of the Metaverse features several defining attributes that fall into three broad categories (e.g., [

1,

2,

16,

18]):

Infrastructure: The Metaverse is a persistent virtual system with real-time information processing capabilities that makes available the current state of knowledge to all users at the same time at all times.

Architecture: The Metaverse is a decentralized platform that features a high degree of interoperability to enable the mobility of digital identities, experiences, and possessions across the Metaverse from one place, event, or activity to another.

Human couth: The Metaverse overcomes limitations of Web 2.0-based virtual realities by enhancing users’ self-perception and presence, increasing human interactivity, and improving realistic expressions of human qualities, such as emotions.

8

The terms “Metaverse” and “avatar” have their etymological origins in the 1992 science fiction novel “Snow Crash” by Neal Stephenson. However, the Metaverse’s historic antecedents trace longer back to

Sensorama, an immersive multi-sensory theater that was conceptualized in 1955 [

23];

Maze War, a shooter video game that pioneered the representation of players as avatars in 1974; and

Multi-User Dungeon 1 (

MUD1), the first multi-user real-time virtual world created in 1976. The closest existing analogue to the Metaverse is

Second Life, which is a three-dimensional virtual world with user-generated content in which users can communicate, participate in multi-user activities, and trade. A crucial difference is, however, that users cannot export their digital identities, experiences, and possessions from

Second Life to another virtual world.

3. Non-Fungible Tokens (NFTs): Enablers of the Metaverse

NFTs are “blockchain-enabled cryptographic assets that represent proof-of-ownership for digital objects” [

12], p. 1. NFTs are the enablers of the Metaverse because they are based on technical standards for interoperability (e.g.,

ERC721 for Ethereum-based NFTs) and can be exchanged in secondary markets for tokens, so that NFTs have between-application rather than only within-application utility. The between-application utility marks a stark contrast to antecedent forms of the Metaverse, such as

World of Warcraft or

Minecraft, where game items and cosmetics only have in-game utility, and outside-exchanges in grey markets is illegal. Much like the impact of the invention of money on the barter system and subsequent economic growth [

24], cryptocurrencies, and NFTs in particular, can be expected to spur economic activity and the development of the Metaverse.

An NFT alone is a unit of data without inherent value [

12,

25,

26]. Therefore, we need to discuss the value proposition of NFTs, which can be decomposed into three pillars. First, NFTs certify the ownership of digital assets, which are an infinite resource. To create resource scarcity in order to justify a positive value of NFTs, creators artificially limit the supply of NFTs on the blockchain. The elasticity of the supply consensus is therefore an important determinant of NFTs’ value. Second, the degree of NFTs’ compatibility with third-party applications, in particular NFTs’ between-application utility, creates value because it enables users to realize gains from trade across the Metaverse. Third, similarly to the second pillar, between-application utility enables continuous social identities that transcend across Metaverse applications, which improves the socializing experience in the Metaverse and aligns offline and online identities. Metaverse developers can extract some of this value, for instance, by selling minted NFTs, charging commission fees for facilitating NFT trade, or entrance fees for new developers to join existing Metaverse projects.

The virtual NFT-based world is fundamentally capitalistic, just like the physical world. Avatars can make social and economic decisions, form coalitions or organizations and compete against others to secure their piece of the pie. Those who perform best—according to the virtual communities’ self-imposed rules—will be able to extract most economic rents. However, in contrast to the government’s monopoly of setting the rules of the game in the physical world, the Metaverse allocates governance rights in a decentralized way to applications’ communities, often organized in the form of Decentralized Autonomous Organizations (DAOs) [

3].

Panels A and B of

Figure 3 show the cointegration of NFTs and Metaverse activity. Panel A shows the cumulative trading volume (in US

$ million) for NFTs since March 2021, while Panel B shows the corresponding value for dedicated Metaverse tokens. The resemblance of the two patters illustrates the role of NFTs as enablers for the Metaverse.

4. The Emerging Metaverse Economy

Demand-driven Metaverse. The Metaverse is demand-driven in the sense of [

27] because digital objects can be created largely without any constraints thanks to the infinity of digital resources. Therefore, Metaverse infrastructure and content will likely be created “on-demand.” The virtual gaming community serves as a good vantage point to understand the demand forces behind the Metaverse evolution. A survey by [

28] reports that more than one-third often or occasionally join game worlds for social rather than gaming purposes, with the portion being twice as high in under-18 s than in over-35 s. Indeed, when asked about activities that respondents would be interested or very interested to shift to the Metaverse, more than two-thirds reported routine social activities, such as meeting family and friends, watching files, hosting birthday parties or other events, and attending concerts. When asked about what features they are most interested in in the Metaverse, respondents mentioned the ability to freely choose and customize their avatar’s physical appearance, even before access to free or user-generated content and between-application transcendentalism.

Shifting preferences. Not only the demand for Metaverse’s products and services but also demand for its way-of-living and -working will determine its evolution. For example, the gradual shift in Gen Z’s preferences to work jobs that they find fulfilling rather than financially rewarding and hybrid modes of work, by some referred to as the “Great Reshuffle”, will shape the future of work in the Metaverse. Remote work options in the virtual world will lead to an integration of global labor markets and lower barriers to jobs in high-wage countries. The Metaverse will also produce new business models and job profiles, such as smart contract lawyers and digital fashion designers. A famous example is RTFKT, a bespoke digital shoemaker that reports several million USD in revenue from selling customized digital footware to avatars. Burberry and Louis Vuitton have followed with digital fashion products, among many others, to equip avatars for the Metaverse. As per preferences for organizing, many Gen Z individuals view corporate hierarchy with contempt and tend to get involved in new organizational forms with flatter hierarchies in the Metaverse, such as DAOs.

Social sustainability. The Metaverse could also have a positive impact on social inclusion. For example, virtual identities are not bound to their physical identities’ disabilities. AR/VR hardware, e.g., could compensate for poor eyesight so that these individuals can enjoy activities in the virtual world that they cannot in the physical world. Moreover, avatars in the Metaverse offer an effective way to deal with social bias (e.g., [

17]) because they can be chosen free of gender, race, sexual orientation, and so forth, as compared to the physical world.

Economic growth and environmental sustainability. The Metaverse may also reconcile economic growth with environmental sustainability. The pursuit of economic growth may lead to natural resource depletion in the physical world, but not in the Metaverse where healthy digital oceans, green digital woods, and clean digital air are infinite resources. Therefore, several activities that are environmentally unsustainable in the physical world may be environmentally sustainable in the virtual world. This requires that such activity can be transferred to the Metaverse, and that energy consumption to power the Metaverse has no detrimental net effect on the environment. Indeed, Ref. [

29] finds that blockchain-based platforms that are environmentally friendly are more valuable to crowd-investors.

Bootstrap policymaking. The Metaverse could also serve as a bootstrap mechanism to improve human and model-based decision-making. As per [

16], “small economic data in the real economic system can be converted into large virtual economic data in the MetaEconomic system (i.e., the Metaverse), and then artificial intelligence algorithms such as machine learning, deep learning, and reinforcement learning can be used to transform virtual economy big data into deep intelligence”. As such, the Metaverse might help economic simulations in a virtual world or game to improve policymaking and targeted policy interventions in the physical world.

5. Some Very Simple Metaverse Economics

5.1. Building the Metaverse: Startups vs. Incumbents

The question of who will be building the Metaverse, startups or incumbents, reflects a deeper issue: whether the Metaverse will be a truly decentralized, open and public, virtual world or a network of private virtual worlds. Ref. [

8] describes the two competing versions, the private versus public Metaverse, as follows: “The private metaverse is a centralized future [with] big corporates such as Facebook’s

Meta, whereby value is extracted from users as consumers. This metaverse is both virtual reality accessed via headsets, such as

Oculus that projects a digital world, as well as augmented reality, accessed via face wear, such as glasses that project digital things over the physical world. In contrast, the public metaverse is a vision of numerous, decentralized digital worlds that people can move between that are built and owned by participants. The public metaverse is predicated on open, interoperable decentralized technological architecture. It integrates a suite of crypto community innovations in decentralized finance (DeFi) for payments and NFTs for digital in-world items that hold real value. Furthermore, the public metaverse is governed and owned by networks of

decentralized autonomous organizations (or DAOs) where distributed, objective-aligned communities collectively own, govern and work in digital worlds”.

That incumbents are resistant to building the public version of the Metaverse is evident, given that this would imply the sharing of their data and opening interfaces to enable cross-dApp interoperability. The public Metaverse thus would reduce incumbents’ rents from lock-in and network effects, while startups would benefit from access to incumbents’ data and existing infrastructure.

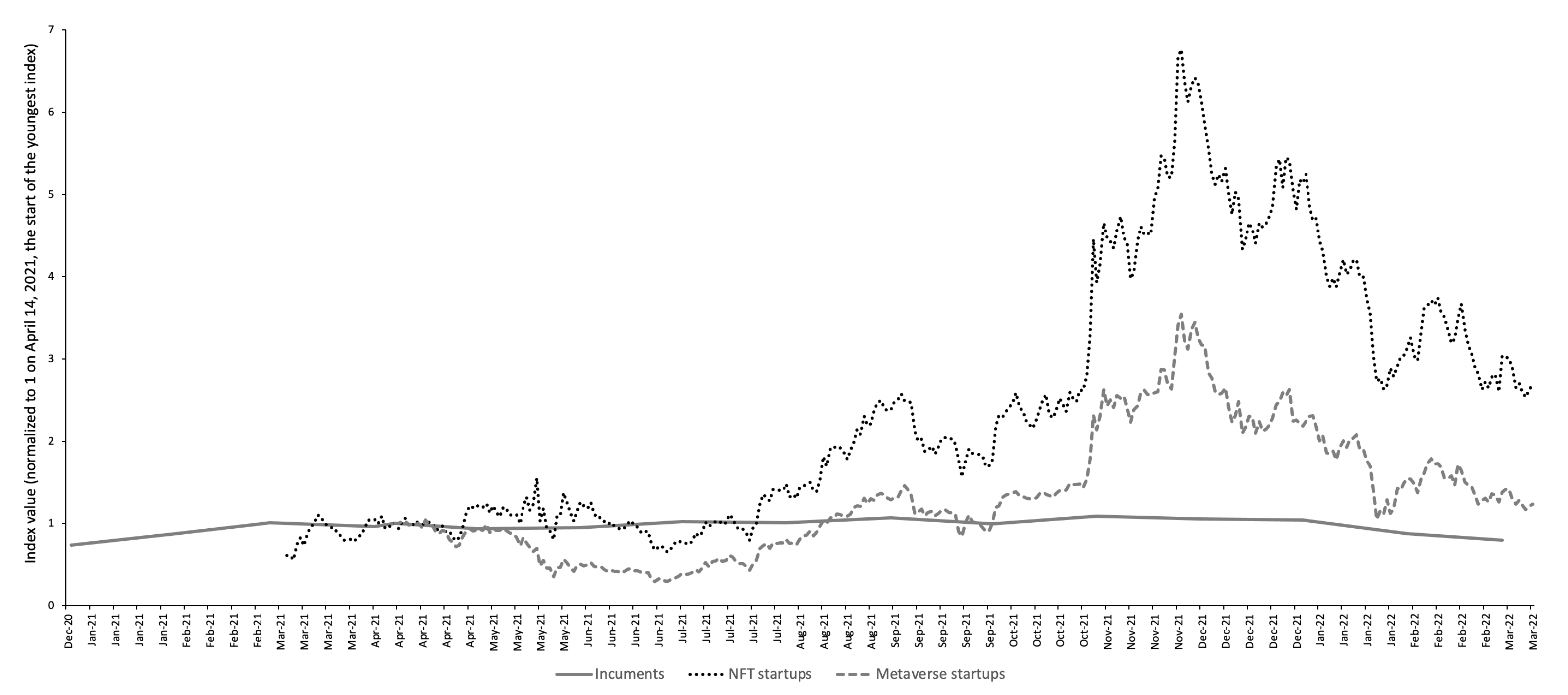

Figure 4 shows the value appropriation of incumbents (proxied by the

Solactive Metaverse index) and startups (proxied by

Coinmarketcap’s Metaverse Value Index, MVI, and

Coinmarketcap’s NFT Index, NFTI). The curves show that both startup categories have larger growth rates than incumbents, suggesting that startups capture relatively more value from the emerging Metaverse economy than incumbents.

5.2. Operating the Metaverse: Welfare Implications

Whether society will benefit from the Metaverse depends on many contingencies, but essentially comes down to a trade-off between transaction and participation or search costs in a hyperspecialized, decentralized virtual world, with implications for resource (mis)allocations and price competition. Indeed, Ref. [

30] finds that semi-decentralized platforms create more value than centralized or decentralized blockchain-based platforms and [

31,

32] show that token-based crowdfunding is more efficient when partially centralized through intermediaries. These studies plausibly reflect the inherent trade-off between transaction and participation/search costs on decentralized, blockchain-based platforms.

Transaction cost efficiency. The Metaverse may improve the efficiency of social and economic interactions. Avatars will be able to move between locations instantaneously, increasing the amount of productive time. Users are able to have more than one avatar so that multiple avatars can work multiple tasks at the same time. Importantly, the Metaverse’s underlying technology (i.e., blockchain, smart contracts, and decentralized finance) significantly reduces transactions costs for the exchange and proof-of-ownership of digital assets [

12,

33]. Because technology facilitates decentralized markets, Metaverse users may potentially save on intermediation costs (e.g., [

34,

35]).

Search cost inefficiency. The Metaverse represents a hyperspecialized, decentralized virtual world with low entry barriers thanks to blockchain technologies. As a result, the Metaverse will feature granular markets because of high market participation and completion. High market participation results from low entry barriers, e.g., because labor supply in low-wage countries can meet labor demand in high-wage countries with negligible transaction costs. Market completion results from high market participation paired with infinite digital resources and opportunities in a virtual world. Because, in principle, every object can be made available in a virtual world, there will be hyperspecialization in the product and service supply. As a consequence of explosive market granularity, search frictions will be more salient [

31]. As an intuitive example, it is easier to find the transaction counterparty with the perfectly matching unique product in a game with 10 players with unique product offerings than in a game with 100 players with unique product offerings (everything else equal, the probability of search-and-match is

versus

in the two markets). Moreover, there can be multiple Metaverses and unique users can send multiple avatars to different Metaverses at the same time, so search frictions is expected to play a dramatic role, plausibly reducing the efficiency of the Metaverse economy. Problems with search frictions are exacerbated by asymmetric information in decentralized markets [

36,

37,

38], and these problems have no easy remedy in a borderless, cross-jurisdictional Metaverse, in which legal rules are difficult to enforce [

39] and have complicated spillover effects [

40].

Resource (mis)allocations and pricing competition. The welfare implications of the Metaverse come down to the allocation and prices of resources in the virtual economy. The path to equilibrium in the Metaverse economy may feature resource misallocations, e.g., in the form of bespoke footware for avatars long before, they can be “worn” (see the

RTFTK example above). An interesting study finds that virtual land plots in the Metaverse auctioned by

Decantraland have various premia attached to them, depending on their virtual proximity to important virtual landmarks or memorable addresses [

13]. Related work finds that the pricing of NFTs, as enablers of the Metaverse, are relatively inefficient [

14,

15]. The inefficiency of the market for Metaverse assets may reflect a deeper issue, at least during the early-adoption phase of the Metaverse: The pricing of digital goods in the Metaverse is difficult. In principle, infinite digital resources would push prices to zero. This is the reason why Metaverse developers artificially cap the supply of digital goods on the blockchain. However, it is not clear what mechanisms would prevent competitors to imitate the virtual products or services and cap the supply at a marginally lower level to beat the incumbent’s pricing. In the logic of game-theoretical forward induction, this would also push the price toward zero. Therefore, the Metaverse will likely develop strong network and lock-in effects, just like existing technology incumbents in the physical world. This, however, might lead to difficult-to-resolve anti-competitive effects (e.g., for the physical world, [

41]), which are more difficult to resolve in a borderless, cross-jurisdictional virtual world. All these open questions and contingencies will ultimately determine Metaverse’s net value-add for society.

6. Conclusions

The Metaverse refers to a shared vision among technology entrepreneurs and digital innovators of a three-dimensional virtual world, an embodied internet with humans and the physical world in it. As such, the Metaverse is thought to expand the domain of human activity by overcoming spatial, temporal, and resource-related constraints imposed by nature. This paper has sought to provide a first characterization of the Metaverse vision and describe its advantages, challenges, and limitations. We have reviewed the central role of Non-Fungible Tokens (NFTs) in being enablers of the Metaverse, sketched the emerging Metaverse economy, and discussed some simple economics revolving around building and operating the Metaverse. In particular, we have highlighted the role of relative market power between incumbents and startups, which will ultimately determine whether there will be an “open” Metaverse (i.e., a Metaverse that reflects Web3 and is owned and operated in a decentralized, public way) or a “closed” Metaverse (i.e., a Metaverse that is privately owned and operated by a few technology giants). We have concluded with some simple welfare implications of operating the Metaverse, which essentially reflects a trade-off between transactional efficiency and search-related inefficiency. Of course, the Metaverse is a nascent, shared vision, and the thoughts expressed in this note may be more or less valid as the Metaverse evolves over time. Therefore, validating the claims made in this note is up to future studies on the Metaverse.