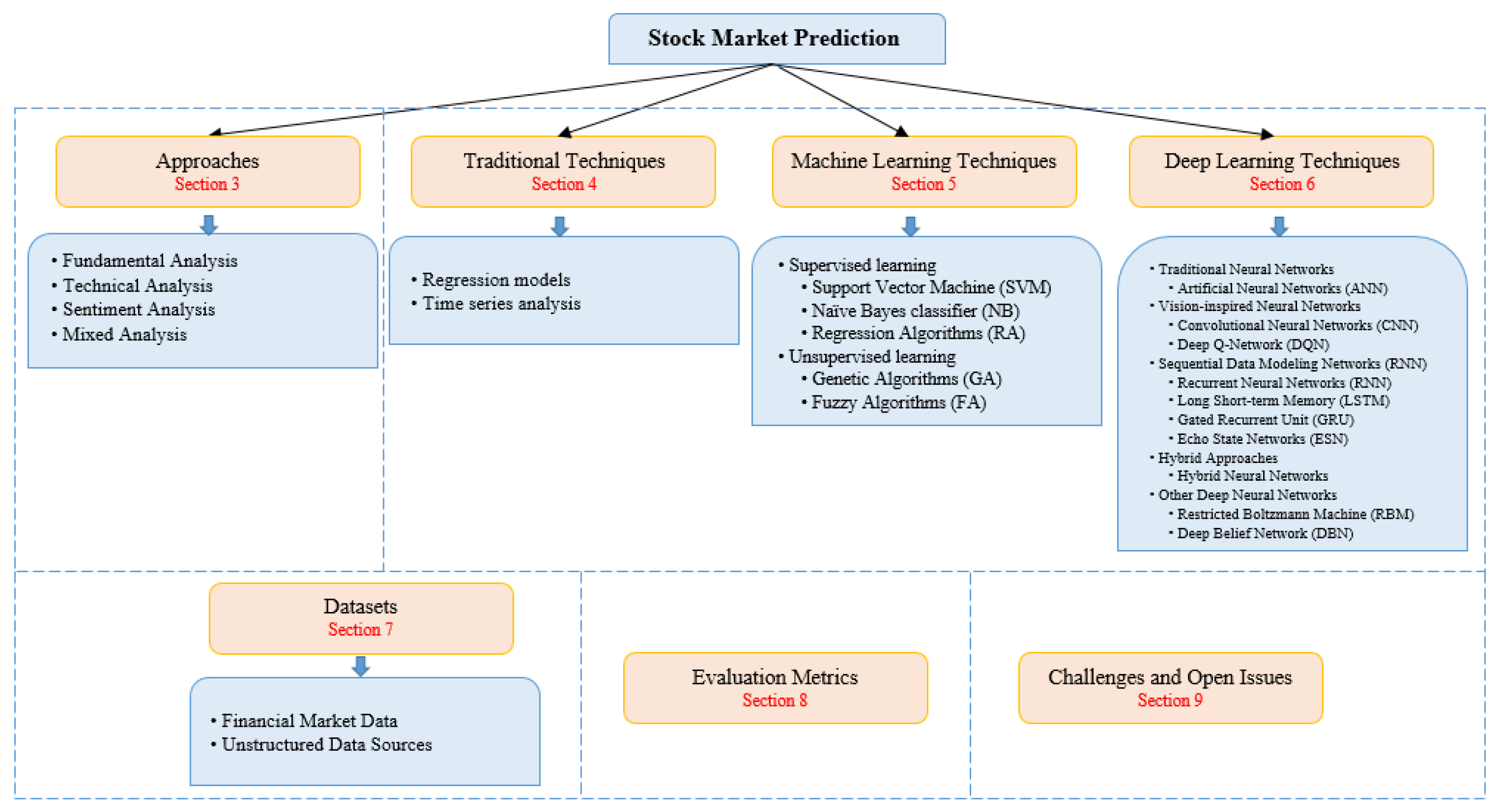

Stock Market Prediction Using Machine Learning and Deep Learning Techniques: A Review

Abstract

1. Introduction

- Human biases and emotional factors can lead to incorrect predictions and suboptimal trading decisions.

- Traditional methods often struggle to handle the complexities and non-linear patterns of financial data [3].

- Real-time analysis and response to dynamic market changes are challenging to achieve with purely manual approaches.

2. Contributions

- Comprehensive Review of ML and DL Models: We provide an in-depth review of machine learning and deep learning models used for stock market prediction, considering various algorithmic designs, including recurrent neural networks, convolutional models, and ensemble methods, along with different learning strategies (supervised, unsupervised, and hybrid).

- Analysis of Real-World Applicability: This survey offers a detailed evaluation of the models’ performance under different market conditions, timeframes, and datasets, bridging the gap between academic research and real-world financial applications. The analysis considers diverse financial datasets and evaluation metrics to provide a practical perspective on model effectiveness.

- Identification of Key Challenges and Future Directions: We summarize the main challenges and potential limitations faced by ML and DL models in stock market prediction, such as data quality, model interpretability, and real-time prediction. Additionally, we outline future research directions that could enhance the real-time adaptability, robustness, and generalization of prediction models in financial markets.

- Broad Dataset and Metric Utilization: We employ a wider range of financial datasets and performance metrics than previous reviews, offering a more extensive analysis of predictive accuracy, volatility forecasting, and trend identification, with a focus on both short-term and long-term forecasting capabilities.

3. Approaches to Stock Price Prediction

3.1. Fundamental Analysis

3.2. Technical Analysis

3.3. Sentiment Analysis

3.4. Mixed Approach

| Methodology | Key Features | Notable Studies | Challenges |

|---|---|---|---|

| Fundamental Analysis |

|

| |

| Technical Analysis |

|

| |

| Sentiment Analysis |

|

| |

| Mixed Approach |

|

|

4. Statistical and Traditional Techniques

4.1. Regression Models

4.2. Time Series Analysis

| Technique | Key Features | Notable Studies | Challenges |

|---|---|---|---|

| Regression Models |

|

| |

| Time Series Analysis |

|

|

5. Machine Learning Techniques

5.1. Supervised Learning

5.1.1. Support Vector Machine (SVM)

5.1.2. Naïve Bayes (NB)

5.1.3. Regression Algorithms (RA)

5.2. Unsupervised Learning

5.2.1. Genetic Algorithms (GA)

5.2.2. Fuzzy Algorithms (FA)

| Level | Technique | Key Features | Notable Studies | Challenges |

|---|---|---|---|---|

| Supervised | Support Vector Machine (SVM) |

|

| |

| Naïve Bayes (NB) |

|

|

| |

| Regression Algorithms (RA) |

|

| ||

| Unsupervised | Genetic Algorithms (GA) |

|

| |

| Fuzzy Algorithms (FA) |

|

|

6. Deep Learning Techniques

6.1. Artificial Neural Networks (ANN)

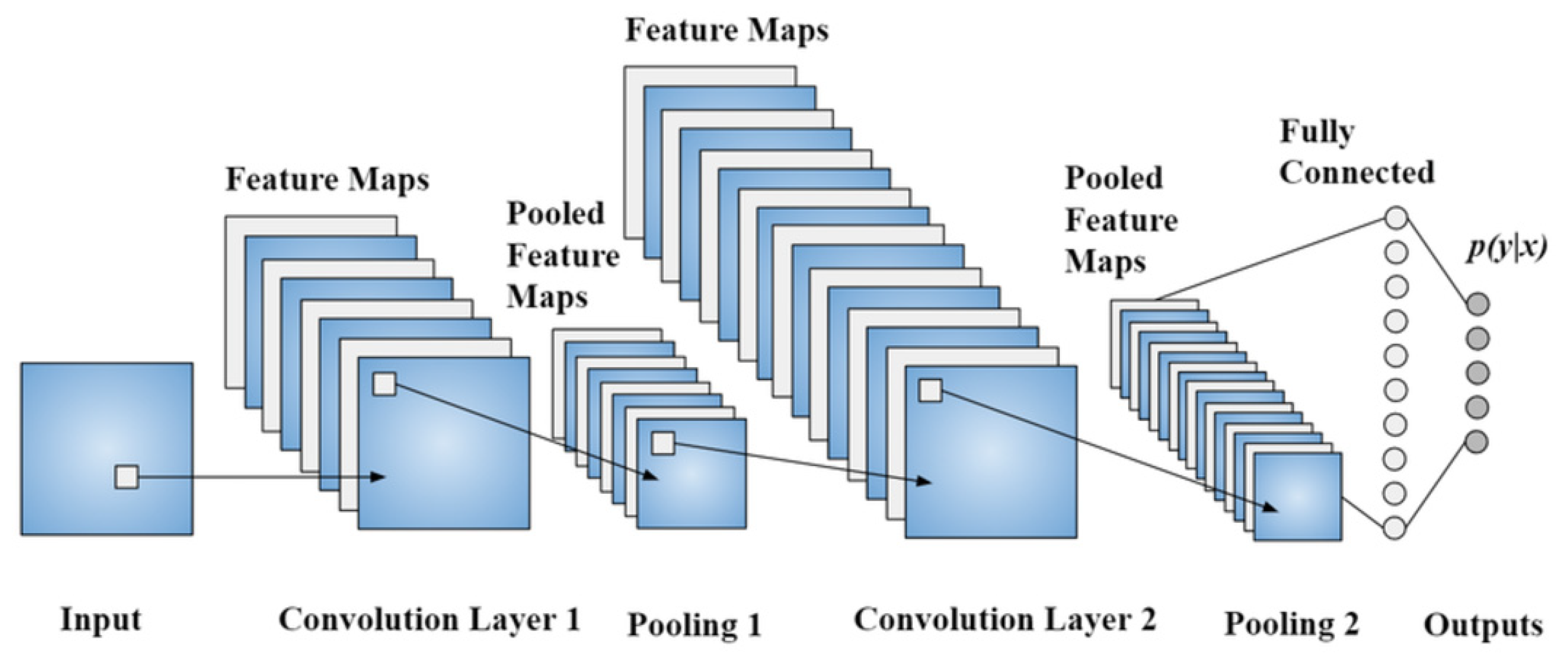

6.2. Vision-Inspired Neural Networks

6.2.1. Convolutional Neural Networks (CNN)

6.2.2. Deep Q-Network (DQN)

6.3. Sequential Data Modeling Networks

6.3.1. Recurrent Neural Networks (RNN)

6.3.2. Long Short-Term Memory (LSTM)

6.3.3. Gated Recurrent Unit (GRU)

6.3.4. Echo State Networks (ESN)

6.4. Hybrid Approaches

Hybrid Neural Networks

6.5. Other Deep Neural Networks

6.5.1. Restricted Boltzmann Machine (RBM)

6.5.2. Deep Belief Network (DBN)

| Technique | Key Features | Notable Studies | Challenges |

|---|---|---|---|

| Artificial Neural Networks (ANN) |

|

| |

| Convolutional Neural Networks (CNN) |

|

| |

| Recurrent Neural Networks (RNN) |

|

| |

| Long Short-Term Memory (LSTM) |

|

| |

| Gated Recurrent Unit (GRU) |

|

| |

| Echo State Networks (ESN) |

|

| |

| Hybrid Neural Networks |

|

| |

| Deep Neural Networks (DNN) |

|

|

7. Datasets

7.1. Financial Market Data

7.2. Unstructured Data Sources

| Citation | Data Source | Type of Input | Prediction Timeline |

|---|---|---|---|

| [135] | Enron Corpus | Sentiment analysis, financial metrics | Daily or Weekly |

| [39] | Yahoo Finance | Social media activity, market updates | Monthly and Daily |

| [146] | NASDAQ, DJIA, Apple | Market data, news reports, technical inputs | Forecast: Next Day |

| [140] | Yahoo Finance | Stock-related news | Within the Same Day |

| [133] | Columbia Market | Trends and technical data | Forecast for Next Day |

| [142] | Microsoft Corporation | Insights from Twitter | Day-by-Day |

| [86] | Google Shares | Stock movement statistics | Five-Day Horizon |

| [5] | BSE, Tech Mahindra | Twitter trends, trading data | Weekly and Daily |

| [147] | Apple and Yahoo Finance | Technical signals, stock performance | 60-Day to 90-Day Range |

| [129] | DJIA | Market signals via social platforms | Daily Updates |

| [15] | Global Stock Markets | News, finance platforms, Wikipedia | Weekly Predictions |

| [33] | Apple Stock | Fundamental stock data | Daily Forecast |

| [148] | Google Stock | Trading insights | Day-by-Day |

| [130] | DAX 30 Index | Newsletters, RSS feeds, trading data | Short-Term (Intraday) |

| [131] | S&P 500 | Real-time market analysis | Intraday Forecasting |

| [144] | Yahoo Finance (18 Stocks) | Message boards, market data | Per-Day Analytics |

| [57] | S&P, NYSE, DJIA | Insights from social media, indicators | Weekly or Daily |

| [128] | NASDAQ Stocks | Stock trend analysis | Prediction: Few Days |

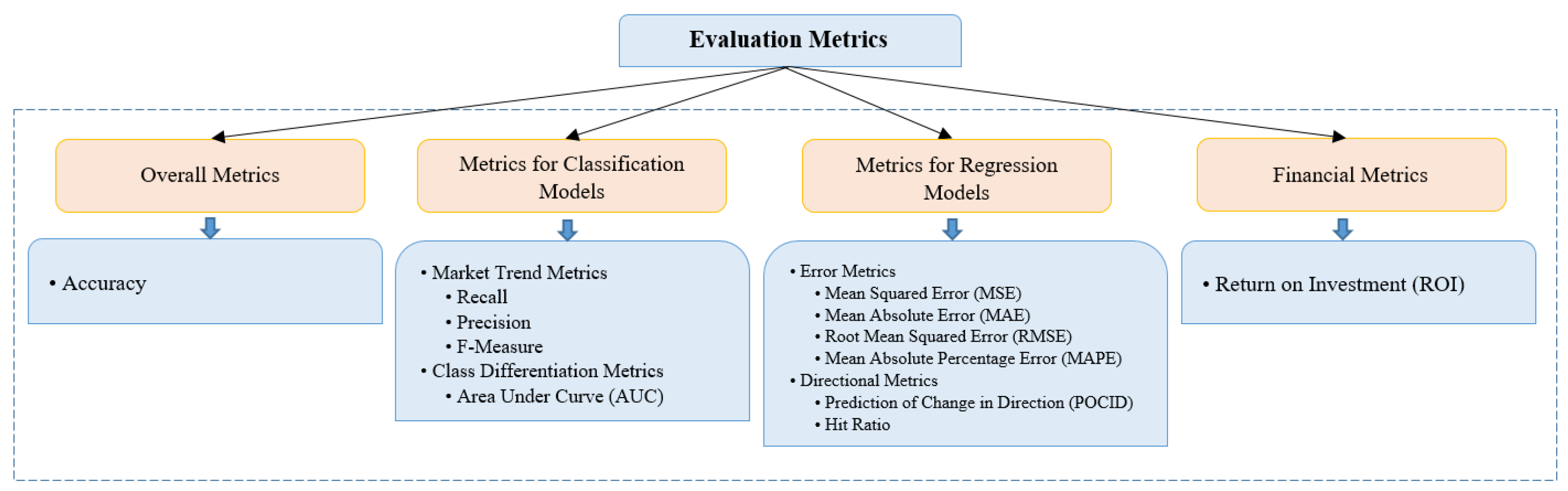

8. Evaluation Metrics

| Category | References | Metric | Common Use |

|---|---|---|---|

| Overall Metrics | [149,150] | Accuracy | Suitable for balanced datasets. |

| [151] | Area Under the Curve (AUC) | Classification tasks with imbalanced datasets. | |

| Classification Metrics | [146] | Precision | Evaluates relevance of positive predictions. |

| [15] | Recall | Measures sensitivity. | |

| [41,144] | F-Measure | Balances false positives and false negatives. | |

| Regression Metrics | [152] | Mean Squared Error (MSE) | Indicates model precision. |

| [125,151] | Mean Absolute Error (MAE) | Regression tasks requiring simpler measures. | |

| [125,151] | Mean Absolute Percentage Error (MAPE) | Measures proportional errors. | |

| [152] | R-squared (R2) | Evaluates explained variance. | |

| [154] | Prediction of Change in Direction (POCID) | Regression and market trend evaluations. | |

| [154] | Hit Ratio | Practical directional accuracy assessments. | |

| Profitability Metrics | [56,138] | Return on Investment (ROI) | Measures financial impact. |

9. Challenges and Open Issues

- Contextual integration of external events such as political changes and global occurrences into prediction models can enhance their robustness.

- Developing models that adapt to real-time market conditions while addressing noise and unanticipated events remains a critical goal.

- Increasing the interpretability of prediction models could provide deeper insights into market behavior and build trust among investors.

- Leveraging metaheuristic algorithms to optimize NN weights and architectures is another potential research area.

- Expanding the scope of analysis to derivatives-based markets and hybrid approaches could yield significant advancements.

10. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Terminology

References

- Ingle, V.; Deshmukh, S. Ensemble deep learning framework for stock market data prediction (EDLF-DP). Glob. Transit. Proc. 2021, 2, 47–66. [Google Scholar] [CrossRef]

- Upadhyay, A.; Bandyopadhyay, G.; Dutta, A. Forecasting Stock Performance in Indian Market using Multinomial Logistic Regression. J. Bus. Stud. Q. 2012, 3, 16–39. [Google Scholar]

- Ferreira, F.G.D.C.; Gandomi, A.H.; Cardoso, R.T.N. Artificial Intelligence Applied to Stock Market Trading: A Review. IEEE Access 2021, 9, 30898–30917. [Google Scholar] [CrossRef]

- Hu, Z.; Zhao, Y.; Khushi, M. A Survey of Forex and Stock Price Prediction Using Deep Learning. Appl. Syst. Innov. 2021, 4, 9. [Google Scholar] [CrossRef]

- Shah, D.; Isah, H.; Zulkernine, F. Stock Market Analysis: A Review and Taxonomy of Prediction Techniques. Int. J. Financ. Stud. 2019, 7, 26. [Google Scholar] [CrossRef]

- Al-Alawi, A.I.; Alshakhoori, N. Stock Price Prediction Using Artificial Intelligence: A Literature Review. In Proceedings of the 2024 ASU International Conference in Emerging Technologies for Sustainability and Intelligent Systems (ICETSIS), Manama, Bahrain, 28–29 January 2024; pp. 1–6. [Google Scholar] [CrossRef]

- Hu, Y.; Liu, K.; Zhang, X.; Su, L.; Ngai, E.; Liu, M. Application of evolutionary computation for rule discovery in stock algorithmic trading: A literature review. Appl. Soft Comput. 2015, 36, 534–551. [Google Scholar] [CrossRef]

- Imam, S.; Barker, R.; Clubb, C. The Use of Valuation Models by UK Investment Analysts. Eur. Account. Rev. 2008, 17, 503–535. [Google Scholar] [CrossRef]

- Gordon, M.J. Dividends, Earnings, and Stock Prices. Rev. Econ. Stat. 1959, 41, 99–105. [Google Scholar] [CrossRef]

- Md, A.Q.; Kapoor, S.; Chris Junni, A.V.; Sivaraman, A.K.; Tee, K.F.; Sabireen, H.; Janakiraman, N. Novel optimization approach for stock price forecasting using multi-layered sequential LSTM. Appl. Soft Comput. 2023, 134, 109830. [Google Scholar] [CrossRef]

- Lee, T.-W.; Teisseyre, P.; Lee, J. Effective Exploitation of Macroeconomic Indicators for Stock Direction Classification Using the Multimodal Fusion Transformer. IEEE Access 2023, 11, 10275–10287. [Google Scholar] [CrossRef]

- Dutta, A.; Bandopadhyay, G.A.; Sengupta, S. Prediction of Stock Performance in the Indian Stock Market Using Logistic Regression. Int. J. Bus. Inf. 2012, 7, 105. [Google Scholar]

- Chen, S.; Zhou, C. Stock Prediction Based on Genetic Algorithm Feature Selection and Long Short-Term Memory Neural Network. IEEE Access 2020, 9, 9066–9072. [Google Scholar] [CrossRef]

- Chen, W.; Zhang, H.; Mehlawat, M.K.; Jia, L. Mean–variance portfolio optimization using machine learning-based stock price prediction. Appl. Soft Comput. 2021, 100, 106943. [Google Scholar] [CrossRef]

- Khan, W.; Malik, U.; Ghazanfar, M.A.; Azam, M.A.; Alyoubi, K.H.; Alfakeeh, A.S. Predicting stock market trends using machine learning algorithms via public sentiment and political situation analysis. Soft Comput. 2019, 24, 11019–11043. [Google Scholar] [CrossRef]

- Trading on the Edge: Neural, Genetic, and Fuzzy Systems for Chaotic Financial Markets|Wiley. Wiley.com. Available online: https://www.wiley.com/en-us/Trading+on+the+Edge%3A+Neural%2C+Genetic%2C+and+Fuzzy+Systems+for+Chaotic+Financial+Markets-p-9780471311003 (accessed on 8 December 2024).

- Moghar, A.; Hamiche, M. Stock Market Prediction Using LSTM Recurrent Neural Network. Procedia Comput. Sci. 2020, 170, 1168–1173. [Google Scholar] [CrossRef]

- Wang, Y.; Guo, Y. Forecasting method of stock market volatility in time series data based on mixed model of ARIMA and XGBoost. China Commun. 2020, 17, 205–221. [Google Scholar] [CrossRef]

- Sunny, A.I.; Maswood, M.M.S.; Alharbi, A.G. Deep Learning-Based Stock Price Prediction Using LSTM and Bi-Directional LSTM Model. In Proceedings of the 2020 2nd Novel Intelligent and Leading Emerging Sciences Conference (NILES), Giza, Egypt, 24–26 October 2020; pp. 87–92. [Google Scholar] [CrossRef]

- Khang, P.Q.; Hernes, M.; Kuziak, K.; Rot, A.; Gryncewicz, W. Liquidity prediction on Vietnamese stock market using deep learning. Procedia Comput. Sci. 2020, 176, 2050–2058. [Google Scholar] [CrossRef]

- Kamara, A.F.; Chen, E.; Pan, Z. An ensemble of a boosted hybrid of deep learning models and technical analysis for forecasting stock prices. Inf. Sci. 2022, 594, 1–19. [Google Scholar] [CrossRef]

- Hulbert, M. VIEWPOINT; More Proof for the Dow Theory. The New York Times, 6 September 1998. Available online: https://www.nytimes.com/1998/09/06/business/viewpoint-more-proof-for-the-dow-theory.html (accessed on 8 December 2024).

- Jing, N.; Wu, Z.; Wang, H. A hybrid model integrating deep learning with investor sentiment analysis for stock price prediction. Expert Syst. Appl. 2021, 178, 115019. [Google Scholar] [CrossRef]

- Mehta, P.; Pandya, S.; Kotecha, K. Harvesting social media sentiment analysis to enhance stock market prediction using deep learning. PeerJ Comput. Sci. 2021, 7, e476. [Google Scholar] [CrossRef]

- COVID-19 Sentiment and the Chinese Stock Market: Evidence from the Official News Media and Sina Weibo—ScienceDirect. Available online: https://www.sciencedirect.com/science/article/pii/S0275531921000532 (accessed on 8 December 2024).

- Wu, J.-L.; Huang, M.-T.; Yang, C.-S.; Liu, K.-H. Sentiment analysis of stock markets using a novel dimensional valence–arousal approach. Soft Comput. 2021, 25, 4433–4450. [Google Scholar] [CrossRef]

- Tuarob, S.; Wettayakorn, P.; Phetchai, P.; Traivijitkhun, S.; Lim, S.; Noraset, T.; Thaipisutikul, T. DAViS: A unified solution for data collection, analyzation, and visualization in real-time stock market prediction. Financ. Innov. 2021, 7, 56. [Google Scholar] [CrossRef]

- Zhao, Y.; Yang, G. Deep Learning-based Integrated Framework for stock price movement prediction. Appl. Soft Comput. 2023, 133, 109921. [Google Scholar] [CrossRef]

- Multi-Model Generative Adversarial Network Hybrid Prediction Algorithm (MMGAN-HPA) for Stock Market Prices Prediction—ScienceDirect. Available online: https://www.sciencedirect.com/science/article/pii/S1319157821001683 (accessed on 8 December 2024).

- Yun, K.K.; Yoon, S.W.; Won, D. Prediction of stock price direction using a hybrid GA-XGBoost algorithm with a three-stage feature engineering process. Expert Syst. Appl. 2021, 186, 115716. [Google Scholar] [CrossRef]

- Ayala, J.; García-Torres, M.; Noguera, J.L.V.; Gómez-Vela, F.; Divina, F. Technical analysis strategy optimization using a machine learning approach in stock market indices. Knowl.-Based Syst. 2021, 225, 107119. [Google Scholar] [CrossRef]

- Bhuriya, D.; Kaushal, G.; Sharma, A.; Singh, U. Stock market predication using a linear regression. In Proceedings of the 2017 International Conference of Electronics, Communication and Aerospace Technology (ICECA), Coimbatore, India, 20–22 April 2017; pp. 510–513. [Google Scholar] [CrossRef]

- Chandar, S.K. Fusion model of wavelet transform and adaptive neuro fuzzy inference system for stock market prediction. J. Ambient. Intell. Humaniz. Comput. 2019. [Google Scholar] [CrossRef]

- Ariyo, A.A.; Adewumi, A.O.; Ayo, C.K. Stock Price Prediction Using the ARIMA Model. In Proceedings of the 2014 UKSim-AMSS 16th International Conference on Computer Modelling and Simulation, Cambridge, UK, 26–28 March 2014; pp. 106–112. [Google Scholar] [CrossRef]

- Devi, B.U.; Sundar, D.; Alli, P. An Effective Time Series Analysis for Stock Trend Prediction Using ARIMA Model for Nifty Midcap-50. Int. J. Data Min. Knowl. Manag. Process. 2013, 3, 65–78. [Google Scholar] [CrossRef]

- Fu, T.-C.; Chung, F.-L.; Luk, R.; Ng, C.-M. Preventing Meaningless Stock Time Series Pattern Discovery by Changing Perceptually Important Point Detection. In Fuzzy Systems and Knowledge Discovery; Wang, L., Jin, Y., Eds.; Springer: Berlin/Heidelberg, Germany, 2005; pp. 1171–1174. [Google Scholar] [CrossRef]

- Yuan, X.; Yuan, J.; Jiang, T.; Ain, Q.U. Integrated Long-Term Stock Selection Models Based on Feature Selection and Machine Learning Algorithms for China Stock Market. IEEE Access 2020, 8, 22672–22685. [Google Scholar] [CrossRef]

- Ayyappa, Y.; Kumar, A.S. A Compact Literature Review on Stock Market Prediction. In Proceedings of the 2022 4th International Conference on Inventive Research in Computing Applications (ICIRCA), Coimbatore, India, 21–23 September 2022; pp. 1336–1347. [Google Scholar] [CrossRef]

- Nayak, A.; Pai, M.M.M.; Pai, R.M. Prediction Models for Indian Stock Market. Procedia Comput. Sci. 2016, 89, 441–449. [Google Scholar] [CrossRef]

- Mokhtari, S.; Yen, K.K.; Liu, J. Effectiveness of Artificial Intelligence in Stock Market Prediction based on Machine Learning. Int. J. Comput. Appl. 2021, 183, 1–8. [Google Scholar] [CrossRef]

- Alotaibi, S.S. Ensemble Technique with Optimal Feature Selection for Saudi Stock Market Prediction: A Novel Hybrid Red Deer-Grey Algorithm. IEEE Access 2021, 9, 64929–64944. [Google Scholar] [CrossRef]

- Xianya, J.; Mo, H.; Haifeng, L. Stock Classification Prediction Based on Spark. Procedia Comput. Sci. 2019, 162, 243–250. [Google Scholar] [CrossRef]

- Milosevic, N. Equity forecast: Predicting long term stock price movement using machine learning. arXiv 2016, arXiv:1603.00751. [Google Scholar] [CrossRef]

- Ihlayyel, H.A.; Sharef, N.M.; Nazri, M.Z.A.; Abu Bakar, A. An enhanced feature representation based on linear regression model for stock market prediction. Intell. Data Anal. 2018, 22, 45–76. [Google Scholar] [CrossRef]

- Yu, Y.; Duan, W.; Cao, Q. The impact of social and conventional media on firm equity value: A sentiment analysis approach. Decis. Support Syst. 2013, 55, 919–926. [Google Scholar] [CrossRef]

- Zhang, L.; Zhang, L.; Teng, W.; Chen, Y. Based on Information Fusion Technique with Data Mining in the Application of Finance Early-Warning. Procedia Comput. Sci. 2013, 17, 695–703. [Google Scholar] [CrossRef]

- Gururaj, V. Stock Market Prediction using Linear Regression and Support Vector Machines. Int. J. Appl. Eng. Res. 2019, 14, 1931–1934. [Google Scholar]

- Kamley, S.; Jaloree, S.; Thakur, R.S. Multiple regression: A data mining approach for predicting the stock market trends based on open, close and high price of the month. Future 2013, 2, 6. [Google Scholar]

- Yuan, J.; Luo, Y. Test on the Validity of Futures Market’s High Frequency Volume and Price on Forecast. In Proceedings of the 2014 International Conference on Management of e-Commerce and e-Government (ICMeCG), Shanghai, China, 31 October–2 November 2014; pp. 28–32. [Google Scholar] [CrossRef]

- Meesad, P.; Rasel, R.I. Predicting stock market price using support vector regression. In Proceedings of the 2013 2nd International Conference on Informatics, Electronics and Vision (ICIEV), Dhaka, Bangladesh, 17–18 May 2013; pp. 1–6. [Google Scholar] [CrossRef]

- Polamuri, S.R.; Srinivas, K.; Mohan, A.K. Multi model-Based Hybrid Prediction Algorithm (MM-HPA) for Stock Market Prices Prediction Framework (SMPPF). Arab. J. Sci. Eng. 2020, 45, 10493–10509. [Google Scholar] [CrossRef]

- Kim, Y.; Ahn, W.; Oh, K.J.; Enke, D. An intelligent hybrid trading system for discovering trading rules for the futures market using rough sets and genetic algorithms. Appl. Soft Comput. 2017, 55, 127–140. [Google Scholar] [CrossRef]

- Verma, S.; Sahu, S.P.; Sahu, T.P. Discrete Wavelet Transform-based feature engineering for stock market prediction. Int. J. Inf. Technol. 2023, 15, 1179–1188. [Google Scholar] [CrossRef]

- Hao, P.-Y.; Kung, C.-F.; Chang, C.-Y.; Ou, J.-B. Predicting stock price trends based on financial news articles and using a novel twin support vector machine with fuzzy hyperplane. Appl. Soft Comput. 2021, 98, 106806. [Google Scholar] [CrossRef]

- Howells, K.; Ertugan, A. Applying fuzzy logic for sentiment analysis of social media network data in marketing. Procedia Comput. Sci. 2017, 120, 664–670. [Google Scholar] [CrossRef]

- Sedighi, M.; Jahangirnia, H.; Gharakhani, M.; Fard, S.F. A Novel Hybrid Model for Stock Price Forecasting Based on Metaheuristics and Support Vector Machine. Data 2019, 4, 75. [Google Scholar] [CrossRef]

- Ghanavati, M.; Wong, R.K.; Chen, F.; Wang, Y.; Fong, S. A Generic Service Framework for Stock Market Prediction. In Proceedings of the 2016 IEEE International Conference on Services Computing (SCC), San Francisco, CA, USA, 27 June–2 July 2016; pp. 283–290. [Google Scholar] [CrossRef]

- Vijh, M.; Chandola, D.; Tikkiwal, V.A.; Kumar, A. Stock Closing Price Prediction using Machine Learning Techniques. Procedia Comput. Sci. 2020, 167, 599–606. [Google Scholar] [CrossRef]

- Zhong, X.; Enke, D. Forecasting daily stock market return using dimensionality reduction. Expert Syst. Appl. 2017, 67, 126–139. [Google Scholar] [CrossRef]

- Bing, Y.; Hao, J.K.; Zhang, S.C. Stock Market Prediction Using Artificial Neural Networks. Adv. Eng. Forum 2012, 6–7, 1055–1060. [Google Scholar] [CrossRef]

- Classification of Tennis Shots with a Neural Network Approach. Available online: https://www.mdpi.com/1424-8220/21/17/5703 (accessed on 8 December 2024).

- Singh, R.; Srivastava, S. Stock prediction using deep learning. Multimed. Tools Appl. 2017, 76, 18569–18584. [Google Scholar] [CrossRef]

- Mukherjee, S.; Sadhukhan, B.; Sarkar, N.; Roy, D.; De, S. Stock market prediction using deep learning algorithms. CAAI Trans. Intell. Technol. 2023, 8, 82–94. [Google Scholar] [CrossRef]

- Kraus, M.; Feuerriegel, S. Decision support from financial disclosures with deep neural networks and transfer learning. Decis. Support Syst. 2017, 104, 38–48. [Google Scholar] [CrossRef]

- Eapen, J.; Bein, D.; Verma, A. Novel Deep Learning Model with CNN and Bi-Directional LSTM for Improved Stock Market Index Prediction. In Proceedings of the 2019 IEEE 9th Annual Computing and Communication Workshop and Conference (CCWC), Las Vegas, NV, USA, 7–9 January 2019; pp. 264–270. [Google Scholar] [CrossRef]

- Liu, W.; Wang, Z.; Liu, X.; Zeng, N.; Liu, Y.; Alsaadi, F.E. A survey of deep neural network architectures and their applications. Neurocomputing 2017, 234, 11–26. [Google Scholar] [CrossRef]

- Hoseinzade, E.; Haratizadeh, S. CNNpred: CNN-based stock market prediction using a diverse set of variables. Expert Syst. Appl. 2019, 129, 273–285. [Google Scholar] [CrossRef]

- Nti, I.K.; Adekoya, A.F.; Weyori, B.A. A novel multi-source information-fusion predictive framework based on deep neural networks for accuracy enhancement in stock market prediction. J. Big Data 2021, 8, 17. [Google Scholar] [CrossRef]

- Maqsood, H.; Mehmood, I.; Maqsood, M.; Yasir, M.; Afzal, S.; Aadil, F.; Selim, M.M.; Muhammad, K. A local and global event sentiment based efficient stock exchange forecasting using deep learning. Int. J. Knowl. Manag. 2020, 50, 432–451. [Google Scholar] [CrossRef]

- Tsantekidis, A.; Passalis, N.; Tefas, A.; Kanniainen, J.; Gabbouj, M.; Iosifidis, A. Forecasting Stock Prices from the Limit Order Book Using Convolutional Neural Networks. In Proceedings of the 2017 IEEE 19th Conference on Business Informatics (CBI), Thessaloniki, Greece, 24–27 July 2017; Volume 1, pp. 7–12. [Google Scholar] [CrossRef]

- Patil, P.; Wu, C.-S.M.; Potika, K.; Orang, M. Stock Market Prediction Using Ensemble of Graph Theory, Machine Learning and Deep Learning Models. In Proceedings of the ICSIM ’20: The 3rd International Conference on Software Engineering and Information Management, ICSIM ’20, Sydney, NSW, Australia, 12–15 January 2020; Association for Computing Machinery: New York, NY, USA, 2020; pp. 85–92. [Google Scholar] [CrossRef]

- Zhang, X.; Zhang, Y.; Wang, S.; Yao, Y.; Fang, B.; Yu, P.S. Improving stock market prediction via heterogeneous information fusion. Knowl.-Based Syst. 2018, 143, 236–247. [Google Scholar] [CrossRef]

- Zhao, Y.; Khushi, M. Wavelet Denoised-ResNet CNN and LightGBM Method to Predict Forex Rate of Change. In Proceedings of the 2020 International Conference on Data Mining Workshops (ICDMW), Sorrento, Italy, 17–20 November 2020; pp. 385–391. [Google Scholar] [CrossRef]

- Lee, J.; Kim, R.; Koh, Y.; Kang, J. Global Stock Market Prediction Based on Stock Chart Images Using Deep Q-Network. IEEE Access 2019, 7, 167260–167277. [Google Scholar] [CrossRef]

- Carta, S.; Ferreira, A.; Podda, A.S.; Recupero, D.R.; Sanna, A. Multi-DQN: An ensemble of Deep Q-learning agents for stock market forecasting. Expert Syst. Appl. 2021, 164, 113820. [Google Scholar] [CrossRef]

- Koratamaddi, P.; Wadhwani, K.; Gupta, M.; Sanjeevi, S.G. Market sentiment-aware deep reinforcement learning approach for stock portfolio allocation. Eng. Sci. Technol. Int. J. 2021, 24, 848–859. [Google Scholar] [CrossRef]

- Qin, Y.; Song, D.; Chen, H.; Cheng, W.; Jiang, G.; Cottrell, G.W. A Dual-Stage Attention-Based Recurrent Neural Network for Time Series Prediction. arXiv 2017, arXiv:1704.02971. [Google Scholar] [CrossRef]

- Zeng, Z.; Khushi, M. Wavelet Denoising and Attention-based RNN-ARIMA Model to Predict Forex Price. In Proceedings of the 2020 International Joint Conference on Neural Networks (IJCNN), Glasgow, UK, 19–24 July 2020; pp. 1–7. [Google Scholar] [CrossRef]

- Zhang, L.; Aggarwal, C.; Qi, G.-J. Stock Price Prediction via Discovering Multi-Frequency Trading Patterns. In Proceedings of the KDD ’17: The 23rd ACM SIGKDD International Conference on Knowledge Discovery and Data Mining, KDD ’17, Halifax, NS, Canada, 13–17 August 2017; Association for Computing Machinery: New York, NY, USA, 2017; pp. 2141–2149. [Google Scholar] [CrossRef]

- Li, C.; Song, D.; Tao, D. Multi-task Recurrent Neural Networks and Higher-order Markov Random Fields for Stock Price Movement Prediction: Multi-task RNN and Higer-order MRFs for Stock Price Classification. In Proceedings of the 25th ACM SIGKDD International Conference on Knowledge Discovery & Data Mining, in KDD ’19, Anchorage, AK, USA, 4–8 August 2019; Association for Computing Machinery: New York, NY, USA, 2019; pp. 1141–1151. [Google Scholar] [CrossRef]

- Elman, J. Finding structure in time. Cogn. Sci. 1990, 14, 179–211. [Google Scholar] [CrossRef]

- Jordan, M.I. Chapter 25—Serial Order: A Parallel Distributed Processing Approach. Adv. Psychol. 1997, 121, 471–495. [Google Scholar] [CrossRef]

- Jaeger, H.; Haas, H. Harnessing Nonlinearity: Predicting Chaotic Systems and Saving Energy in Wireless Communication. Science 2004, 304, 78–80. [Google Scholar] [CrossRef] [PubMed]

- Bernal, A.; Fok, S.; Pidaparthi, R. Financial Market Time Series Prediction with Recurrent Neural Networks; Citeseer: State College, PA, USA, 2012. [Google Scholar]

- Chen, W.; Yeo, C.K.; Lau, C.T.; Lee, B.S. Leveraging social media news to predict stock index movement using RNN-boost. Data Knowl. Eng. 2018, 118, 14–24. [Google Scholar] [CrossRef]

- Di Persio, L.; Honchar, O. Recurrent Neural Networks Approach to the Financial Forecast of Google Assets. 2017. Available online: https://iris.univr.it/handle/11562/959057 (accessed on 8 December 2024).

- Ni, L.; Li, Y.; Wang, X.; Zhang, J.; Yu, J.; Qi, C. Forecasting of Forex Time Series Data Based on Deep Learning. Procedia Comput. Sci. 2019, 147, 647–652. [Google Scholar] [CrossRef]

- Deepika, N.; Bhat, M.N. An Efficient Stock Market Prediction Method Based on Kalman Filter. J. Inst. Eng. India Ser. B 2021, 102, 629–644. [Google Scholar] [CrossRef]

- Li, Z.; Tam, V. A comparative study of a recurrent neural network and support vector machine for predicting price movements of stocks of different volatilites. In Proceedings of the 2017 IEEE Symposium Series on Computational Intelligence (SSCI), Honolulu, HI, USA, 27 November–1 December 2017; pp. 1–8. [Google Scholar] [CrossRef]

- Li, H.; Shen, Y.; Zhu, Y. Stock Price Prediction Using Attention-based Multi-Input LSTM. In Proceedings of the 10th Asian Conference on Machine Learning, PMLR, Beijing, China, 14–16 November 2018; pp. 454–469. Available online: https://proceedings.mlr.press/v95/li18c.html (accessed on 8 December 2024).

- Pang, X.; Zhou, Y.; Wang, P.; Lin, W.; Chang, V. Stock Market Prediction Based on Deep Long Short Term Memory Neural Network. In Proceedings of the 3rd International Conference on Complexity, Future Information Systems and Risk—COMPLEXIS; SciTePress: Setúbal, Portugal, 2024; pp. 102–108. Available online: https://www.scitepress.org/Link.aspx?doi=10.5220/0006749901020108 (accessed on 8 December 2024).

- Li, Z.; Yu, H.; Xu, J.; Liu, J.; Mo, Y. Stock Market Analysis and Prediction Using LSTM: A Case Study on Technology Stocks. Innov. Appl. Eng. Technol. 2023, 2, 1–6. [Google Scholar] [CrossRef]

- Xu, Y.; Keselj, V. Stock prediction using deep learning and sentiment analysis. In Proceedings of the IEEE International Conference on Big Data, Los Angeles, CA, USA, 9–12 December 2019; pp. 5573–5580. [Google Scholar] [CrossRef]

- Nabipour, M.; Nayyeri, P.; Jabani, H.; Mosavi, A.; Salwana, E. Deep Learning for Stock Market Prediction. Entropy 2020, 22, 840. [Google Scholar] [CrossRef]

- Thakkar, A.; Chaudhari, K. CREST: Cross-Reference to Exchange-based Stock Trend Prediction using Long Short-Term Memory. Procedia Comput. Sci. 2020, 167, 616–625. [Google Scholar] [CrossRef]

- Thakkar, A.; Chaudhari, K. Fusion in stock market prediction: A decade survey on the necessity, recent developments, and potential future directions. Inf. Fusion 2021, 65, 95–107. [Google Scholar] [CrossRef]

- Pinheiro, L.D.S.; Dras, M. Stock Market Prediction with Deep Learning: A Character-based Neural Language Model for Event-based Trading. In Proceedings of the Australasian Language Technology Association Workshop 2017, Brisbane, Australia, 6–8 December 2017; Wong, J.S.-M., Haffari, G., Eds.; pp. 6–15. Available online: https://aclanthology.org/U17-1001 (accessed on 8 December 2024).

- Wang, C.; Gao, Q. High and Low Prices Prediction of Soybean Futures with LSTM Neural Network. In Proceedings of the 2018 IEEE 9th International Conference on Software Engineering and Service Science (ICSESS), Beijing, China, 23–25 November 2018; pp. 140–143. [Google Scholar] [CrossRef]

- Lakshminarayanan, S.K.; McCrae, J. A Comparative Study of SVM and LSTM Deep Learning Algorithms for Stock Market Prediction. Available online: https://ceur-ws.org/Vol-2563/aics_41.pdf (accessed on 8 December 2024).

- Sun, T.; Wang, J.; Ni, J.; Cao, Y.; Liu, B. Predicting Futures Market Movement using Deep Neural Networks. In Proceedings of the 2019 18th IEEE International Conference on Machine Learning and Applications (ICMLA), Boca Raton, FL, USA, 16–19 December 2019; pp. 118–125. [Google Scholar] [CrossRef]

- Nikou, M.; Mansourfar, G.; Bagherzadeh, J. Stock price prediction using DEEP learning algorithm and its comparison with machine learning algorithms. Intell. Syst. Account. Financ. Manag. 2019, 26, 164–174. [Google Scholar] [CrossRef]

- Rana, M.; Uddin, M.; Hoque, M. Effects of Activation Functions and Optimizers on Stock Price Prediction using LSTM Recurrent Networks. In Proceedings of the CSAI2019: 2019 3rd International Conference on Computer Science and Artificial Intelligence, CSAI ’19, Normal, IL, USA, 6–8 December 2019; Association for Computing Machinery: New York, NY, USA, 2020; pp. 354–358. [Google Scholar] [CrossRef]

- Huynh, H.D.; Dang, L.M.; Duong, D. A New Model for Stock Price Movements Prediction Using Deep Neural Network. In Proceedings of the SoICT 2017: The Eighth International Symposium on Information and Communication Technology, SoICT ’17, Nha Trang City, Vietnam, 7–8 December 2017; Association for Computing Machinery: New York, NY, USA, 2017; pp. 57–62. [Google Scholar] [CrossRef]

- Chen, W.; Zhang, Y.; Yeo, C.K.; Lau, C.T.; Lee, B.S. Stock market prediction using neural network through news on online social networks. In Proceedings of the 2017 International Smart Cities Conference (ISC2), Wuxi, China, 14–17 September 2017; pp. 1–6. [Google Scholar] [CrossRef]

- Lin, X.; Yang, Z.; Song, Y. Intelligent stock trading system based on improved technical analysis and Echo State Network. Expert Syst. Appl. 2011, 38, 11347–11354. [Google Scholar] [CrossRef]

- Zhang, H.; Liang, J.; Chai, Z. Stock Prediction Based on Phase Space Reconstruction and Echo State Networks. J. Algorithms Comput. Technol. 2013, 7, 87–100. [Google Scholar] [CrossRef]

- Liu, Z.; Liu, Z.; Song, Y.; Gong, Z.; Chen, H. Predicting stock trend using multi-objective diversified Echo State Network. In Proceedings of the 2017 Seventh International Conference on Information Science and Technology (ICIST), Da Nang, Vietnam, 16–19 April 2017; pp. 181–186. [Google Scholar] [CrossRef]

- Samarawickrama, A.; Fernando, T. A recurrent neural network approach in predicting daily stock prices an application to the Sri Lankan stock market. In Proceedings of the 2017 IEEE International Conference on Industrial and Information Systems (ICIIS), Peradeniya, Sri Lanka, 15–16 December 2017; pp. 1–6. [Google Scholar] [CrossRef]

- Hsieh, T.-J.; Hsiao, H.-F.; Yeh, W.-C. Forecasting stock markets using wavelet transforms and recurrent neural networks: An integrated system based on artificial bee colony algorithm. Appl. Soft Comput. 2011, 11, 2510–2525. [Google Scholar] [CrossRef]

- Karaboga, D.; Basturk, B. A powerful and efficient algorithm for numerical function optimization: Artificial bee colony (ABC) algorithm. J. Glob. Optim. 2007, 39, 459–471. [Google Scholar] [CrossRef]

- Chaudhari, K.; Thakkar, A. Travelling Salesman Problem: An Empirical Comparison Between ACO, PSO, ABC, FA and GA. In Emerging Research in Computing, Information, Communication and Applications—ERCICA 2018; Shetty, N.R., Patnaik, L.M., Nagaraj, H.C., Hamsavath, P.N., Nalini, N., Eds.; Springer: Singapore, 2019; pp. 397–405. [Google Scholar] [CrossRef]

- Corizzo, R.; Rosen, J. Stock market prediction with time series data and news headlines: A stacking ensemble approach. J. Intell. Inf. Syst. 2024, 62, 27–56. [Google Scholar] [CrossRef]

- Chong, E.; Han, C.; Park, F.C. Deep learning networks for stock market analysis and prediction: Methodology, data representations, and case studies. Expert Syst. Appl. 2017, 83, 187–205. [Google Scholar] [CrossRef]

- Ma, Y.; Han, R. Research on Stock Trading Strategy Based on Deep Neural Network. In Proceedings of the 2018 18th International Conference on Control, Automation and Systems (ICCAS), PyeongChang, Republic of Korea, 17–20 October 2018; pp. 92–96. Available online: https://ieeexplore.ieee.org/abstract/document/8571531 (accessed on 8 December 2024).

- Nakagawa, K.; Uchida, T.; Aoshima, T. Deep Factor Model. In Proceedings of the ECML PKDD 2018 Workshops, Dublin, Ireland, 10–14 September 2018; Alzate, C., Monreale, A., Bioglio, L., Bitetta, V., Bordino, I., Caldarelli, G., Ferretti, A., Guidotti, R., Gullo, F., Pascolutti, S., et al., Eds.; Springer International Publishing: Cham, Switzerland, 2019; pp. 37–50. [Google Scholar] [CrossRef]

- Wu, Y.; Fu, Z.; Liu, X.; Bing, Y. A hybrid stock market prediction model based on GNG and reinforcement learning. Expert Syst. Appl. 2023, 228, 120474. [Google Scholar] [CrossRef]

- Naik, N.; Mohan, B.R. Stock Price Movements Classification Using Machine and Deep Learning Techniques—The Case Study of Indian Stock Market. In Engineering Applications of Neural Networks; Macintyre, J., Iliadis, L., Maglogiannis, I., Jayne, C., Eds.; Springer International Publishing: Cham, Switzerland, 2019; pp. 445–452. [Google Scholar] [CrossRef]

- Li, Q.; Chen, Y.; Jiang, L.L.; Li, P.; Chen, H. A Tensor-Based Information Framework for Predicting the Stock Market. ACM Trans. Inf. Syst. 2016, 34, 11:1–11:30. [Google Scholar] [CrossRef]

- Song, Y.; Lee, J.W.; Lee, J. A study on novel filtering and relationship between input-features and target-vectors in a deep learning model for stock price prediction. Appl. Intell. 2019, 49, 897–911. [Google Scholar] [CrossRef]

- Abe, M.; Nakayama, H. Deep Learning for Forecasting Stock Returns in the Cross-section. In Advances in Knowledge Discovery and Data Mining; Phung, D., Tseng, V.S., Webb, G.I., Ho, B., Ganji, M., Rashidi, L., Eds.; Springer International Publishing: Cham, Switzerland, 2018; pp. 273–284. [Google Scholar] [CrossRef]

- Liang, Q.; Rong, W.; Zhang, J.; Liu, J.; Xiong, Z. Restricted Boltzmann machine based stock market trend prediction. In Proceedings of the 2017 International Joint Conference on Neural Networks (IJCNN), Anchorage, AK, USA, 14–19 May 2017; pp. 1380–1387. [Google Scholar] [CrossRef]

- Vullam, N.; Yakubreddy, K.; Vellela, S.S.; Sk, K.B.; B., V.R.; Priya, S.S. Prediction and Analysis Using a Hybrid Model for Stock Market. In Proceedings of the 2023 3rd International Conference on Intelligent Technologies (CONIT), Hubli, India, 23–25 June 2023; pp. 1–5. [Google Scholar] [CrossRef]

- Cai, X.; Hu, S.; Lin, X. Feature extraction using Restricted Boltzmann Machine for stock price prediction. In Proceedings of the 2012 IEEE International Conference on Computer Science and Automation Engineering (CSAE), Zhangjiajie, China, 25–27 May 2012; pp. 80–83. [Google Scholar] [CrossRef]

- Zhang, R.; Shen, F.; Zhao, J. A model with Fuzzy Granulation and Deep Belief Networks for exchange rate forecasting. In Proceedings of the 2014 International Joint Conference on Neural Networks (IJCNN), Beijing, China, 6–11 July 2014; pp. 366–373. [Google Scholar] [CrossRef]

- Shen, F.; Chao, J.; Zhao, J. Forecasting exchange rate using deep belief networks and conjugate gradient method. Neurocomputing 2015, 167, 243–253. [Google Scholar] [CrossRef]

- Shilpa, B.L.; Shambhavi, B.R. Combined deep learning classifiers for stock market prediction: Integrating stock price and news sentiments. Kybernetes 2021, 52, 748–773. [Google Scholar] [CrossRef]

- Bhardwaj, A.; Narayan, Y.; Vanraj; Pawan; Dutta, M. Sentiment Analysis for Indian Stock Market Prediction Using Sensex and Nifty. Procedia Comput. Sci. 2015, 70, 85–91. [Google Scholar] [CrossRef]

- Guresen, E.; Kayakutlu, G.; Daim, T.U. Using artificial neural network models in stock market index prediction. Expert Syst. Appl. 2011, 38, 10389–10397. [Google Scholar] [CrossRef]

- Ranco, G.; Aleksovski, D.; Caldarelli, G.; Grčar, M.; Mozetič, I. The Effects of Twitter Sentiment on Stock Price Returns. PLoS ONE 2015, 10, e0138441. [Google Scholar] [CrossRef]

- Lugmayr, A.; Gossen, G. Evaluation of methods and techniques for language based sentiment analysis for dax 30 stock exchange—A first concept of a ‘LUGO’ sentiment indicator. In Proceedings of the 5th International Workshop on Semantic Ambient Media Experience, SAME 2012, in Conjunction with Pervasive 2012, Newcastle, UK, 18 June 2012; pp. 69–76. [Google Scholar]

- Zhang, Y.; Wu, L. Stock market prediction of S&P 500 via combination of improved BCO approach and BP neural network. Expert Syst. Appl. 2009, 36, 8849–8854. [Google Scholar] [CrossRef]

- Makrehchi, M.; Shah, S.; Liao, W. Stock Prediction Using Event-Based Sentiment Analysis. In Proceedings of the 2013 IEEE/WIC/ACM International Joint Conferences on Web Intelligence (WI) and Intelligent Agent Technologies (IAT), Atlanta, GA, USA, 17–20 November 2013; pp. 337–342. [Google Scholar] [CrossRef]

- Bustos, O.; Pomares, A.; Gonzalez, E. A comparison between SVM and multilayer perceptron in predicting an emerging financial market: Colombian stock market. In Proceedings of the 2017 Congreso Internacional de Innovacion y Tendencias en Ingenieria (CONIITI), Bogota, Colombia, 4–6 October 2017; pp. 1–6. [Google Scholar] [CrossRef]

- Huang, C.-F.; Li, H.-C. An Evolutionary Method for Financial Forecasting in Microscopic High-Speed Trading Environment. Comput. Intell. Neurosci. 2017, 2017, 9580815. [Google Scholar] [CrossRef]

- Zhou, P.-Y.; Chan, K.C.C.; Ou, C.X. Corporate Communication Network and Stock Price Movements: Insights from Data Mining. IEEE Trans. Comput. Soc. Syst. 2018, 5, 391–402. [Google Scholar] [CrossRef]

- Hagenau, M.; Liebmann, M.; Hedwig, M.; Neumann, D. Automated News Reading: Stock Price Prediction Based on Financial News Using Context-Specific Features. In Proceedings of the 2012 45th Hawaii International Conference on System Sciences, Maui, HI, USA, 4–7 January 2012; pp. 1040–1049. [Google Scholar] [CrossRef]

- Stock Market Prediction Using Machine Learning Techniques: A Decade Survey on Methodologies, Recent Developments, and Future Directions. Available online: https://www.mdpi.com/2079-9292/10/21/2717 (accessed on 8 December 2024).

- Rahman, A.S.A.; Abdul-Rahman, S.; Mutalib, S. Mining Textual Terms for Stock Market Prediction Analysis Using Financial News. In Soft Computing in Data Science; Mohamed, A., Berry, M.W., Yap, B.W., Eds.; Springer: Singapore, 2017; pp. 293–305. [Google Scholar] [CrossRef]

- Ding, X.; Zhang, Y.; Liu, T.; Duan, J. Knowledge-Driven Event Embedding for Stock Prediction. In Proceedings of the COLING 2016, the 26th International Conference on Computational Linguistics: Technical Papers; Matsumoto, Y., Prasad, R., Eds.; The COLING 2016 Organizing Committee: Osaka, Japan, 2016; pp. 2133–2142. Available online: https://aclanthology.org/C16-1201 (accessed on 8 December 2024).

- Evaluating Sentiment in Financial News Articles—ScienceDirect. Available online: https://www.sciencedirect.com/science/article/abs/pii/S0167923612000875?via%3Dihub (accessed on 8 December 2024).

- Huang, C.-J.; Liao, J.-J.; Yang, D.-X.; Chang, T.-Y.; Luo, Y.-C. Realization of a news dissemination agent based on weighted association rules and text mining techniques. Expert Syst. Appl. 2010, 37, 6409–6413. [Google Scholar] [CrossRef]

- Sentiment Analysis of Twitter Data for Predicting Stock Market Movements|IEEE Conference Publication|IEEE Xplore. Available online: https://ieeexplore.ieee.org/abstract/document/7955659 (accessed on 8 December 2024).

- Pandarachalil, R.; Sendhilkumar, S.; Mahalakshmi, G.S. Twitter Sentiment Analysis for Large-Scale Data: An Unsupervised Approach. Cogn. Comput. 2015, 7, 254–262. [Google Scholar] [CrossRef]

- Nguyen, T.H.; Shirai, K.; Velcin, J. Sentiment analysis on social media for stock movement prediction. Expert Syst. Appl. 2015, 42, 9603–9611. [Google Scholar] [CrossRef]

- Bollacker, K.; Evans, C.; Paritosh, P.; Sturge, T.; Taylor, J. Freebase: A collaboratively created graph database for structuring human knowledge. In Proceedings of the 2008 ACM SIGMOD international conference on Management of data, in SIGMOD ’08, Vancouver, BC, Canada, 9–12 June 2008; Association for Computing Machinery: New York, NY, USA, 2008; pp. 1247–1250. [Google Scholar] [CrossRef]

- Weng, B.; Ahmed, M.A.; Megahed, F.M. Stock market one-day ahead movement prediction using disparate data sources. Expert Syst. Appl. 2017, 79, 153–163. [Google Scholar] [CrossRef]

- Forecasting to Classification: Predicting the Direction of Stock Market Price Using Xtreme Gradient Boosting. ResearchGate. Available online: https://www.researchgate.net/publication/309492895_Forecasting_to_Classification_Predicting_the_direction_of_stock_market_price_using_Xtreme_Gradient_Boosting (accessed on 12 December 2024).

- Google Stock Prices Prediction Using Deep Learning|IEEE Conference Publication|IEEE Xplore. Available online: https://ieeexplore.ieee.org/abstract/document/9265146 (accessed on 12 December 2024).

- IASC|Enhancing the Classification Accuracy in Sentiment Analysis with Computational Intelligence Using Joint Sentiment Topic Detection with MEDLDA. Available online: https://www.techscience.com/iasc/v26n1/39857 (accessed on 8 December 2024).

- Hossin, M.; Sulaiman, M.N. A Review on Evaluation Metrics for Data Classification Evaluations. Int. J. Data Min. Knowl. Manag. Process. 2015, 5, 1–11. [Google Scholar] [CrossRef]

- Huang, J.; Ling, C. Using AUC and accuracy in evaluating learning algorithms. IEEE Trans. Knowl. Data Eng. 2005, 17, 299–310. [Google Scholar] [CrossRef]

- Nti, I.K.; Adekoya, A.F.; Weyori, B.A. A comprehensive evaluation of ensemble learning for stock-market prediction. J. Big Data 2020, 7, 20. [Google Scholar] [CrossRef]

- Stock Price Prediction Using News Sentiment Analysis|IEEE Conference Publication|IEEE Xplore. Available online: https://ieeexplore.ieee.org/abstract/document/8848203 (accessed on 8 December 2024).

- de Oliveira, F.A.; Nobre, C.N.; Zárate, L.E. Applying Artificial Neural Networks to prediction of stock price and improvement of the directional prediction index—Case study of PETR4, Petrobras, Brazil. Expert Syst. Appl. 2013, 40, 7596–7606. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Saberironaghi, M.; Ren, J.; Saberironaghi, A. Stock Market Prediction Using Machine Learning and Deep Learning Techniques: A Review. AppliedMath 2025, 5, 76. https://doi.org/10.3390/appliedmath5030076

Saberironaghi M, Ren J, Saberironaghi A. Stock Market Prediction Using Machine Learning and Deep Learning Techniques: A Review. AppliedMath. 2025; 5(3):76. https://doi.org/10.3390/appliedmath5030076

Chicago/Turabian StyleSaberironaghi, Mohammadreza, Jing Ren, and Alireza Saberironaghi. 2025. "Stock Market Prediction Using Machine Learning and Deep Learning Techniques: A Review" AppliedMath 5, no. 3: 76. https://doi.org/10.3390/appliedmath5030076

APA StyleSaberironaghi, M., Ren, J., & Saberironaghi, A. (2025). Stock Market Prediction Using Machine Learning and Deep Learning Techniques: A Review. AppliedMath, 5(3), 76. https://doi.org/10.3390/appliedmath5030076