The Role of RPA and Data Analysis in the Transformation of the Insurance and Banking Industries

Abstract

1. Introduction

2. Materials and Methods

2.1. RPA Applications in Banking

2.2. RPA Applications in Insurance

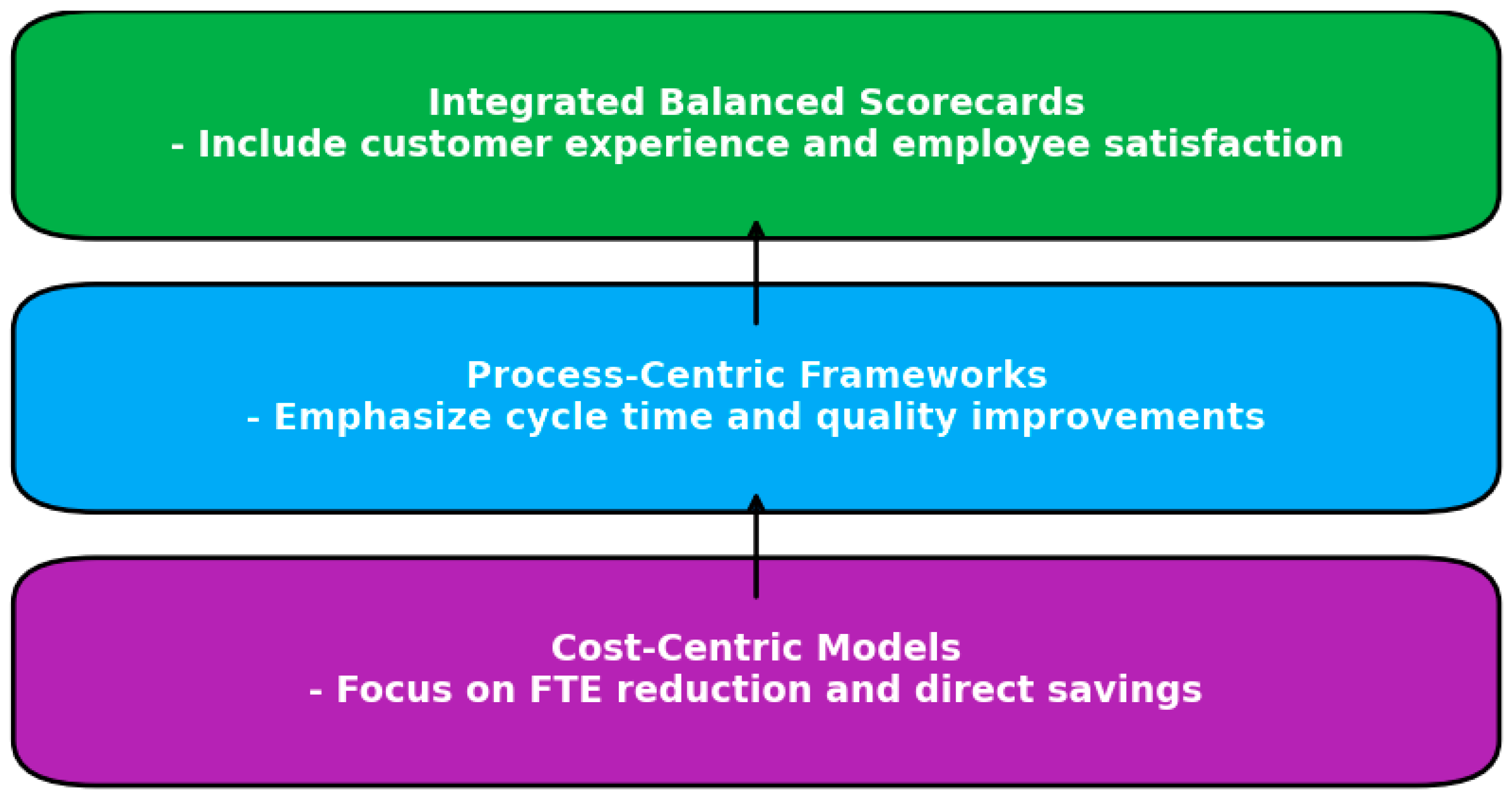

2.3. Corporate Performance Measurement Approaches

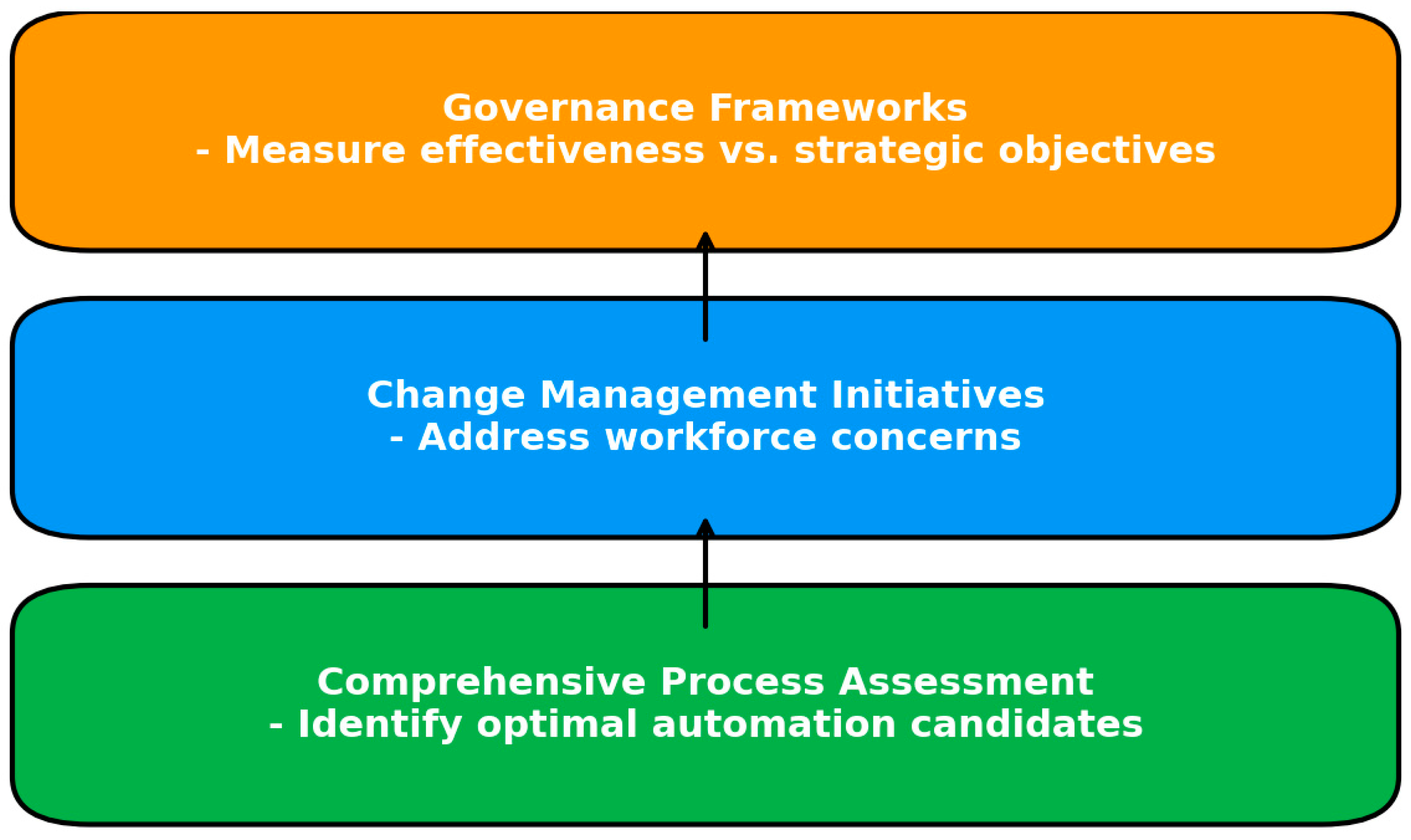

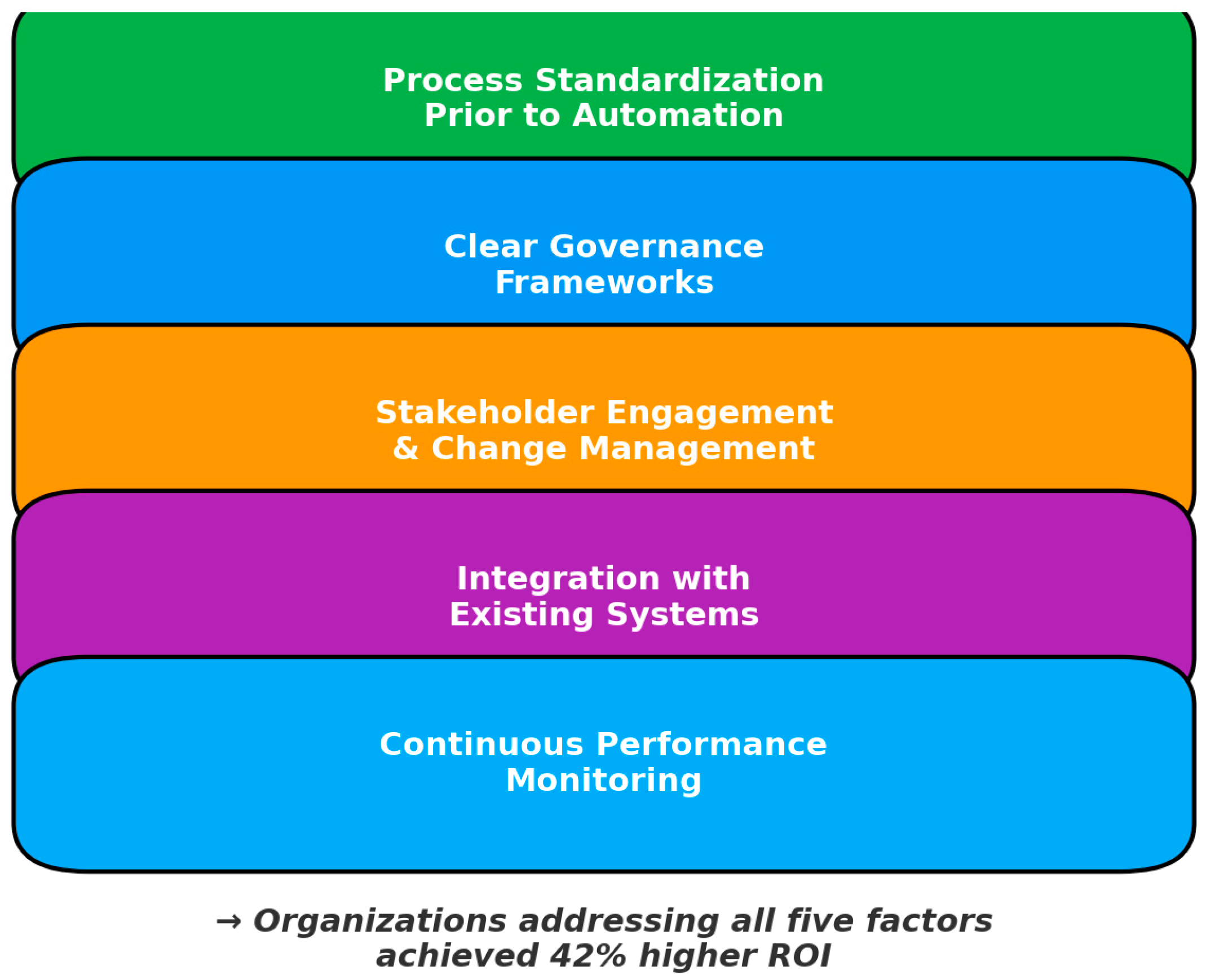

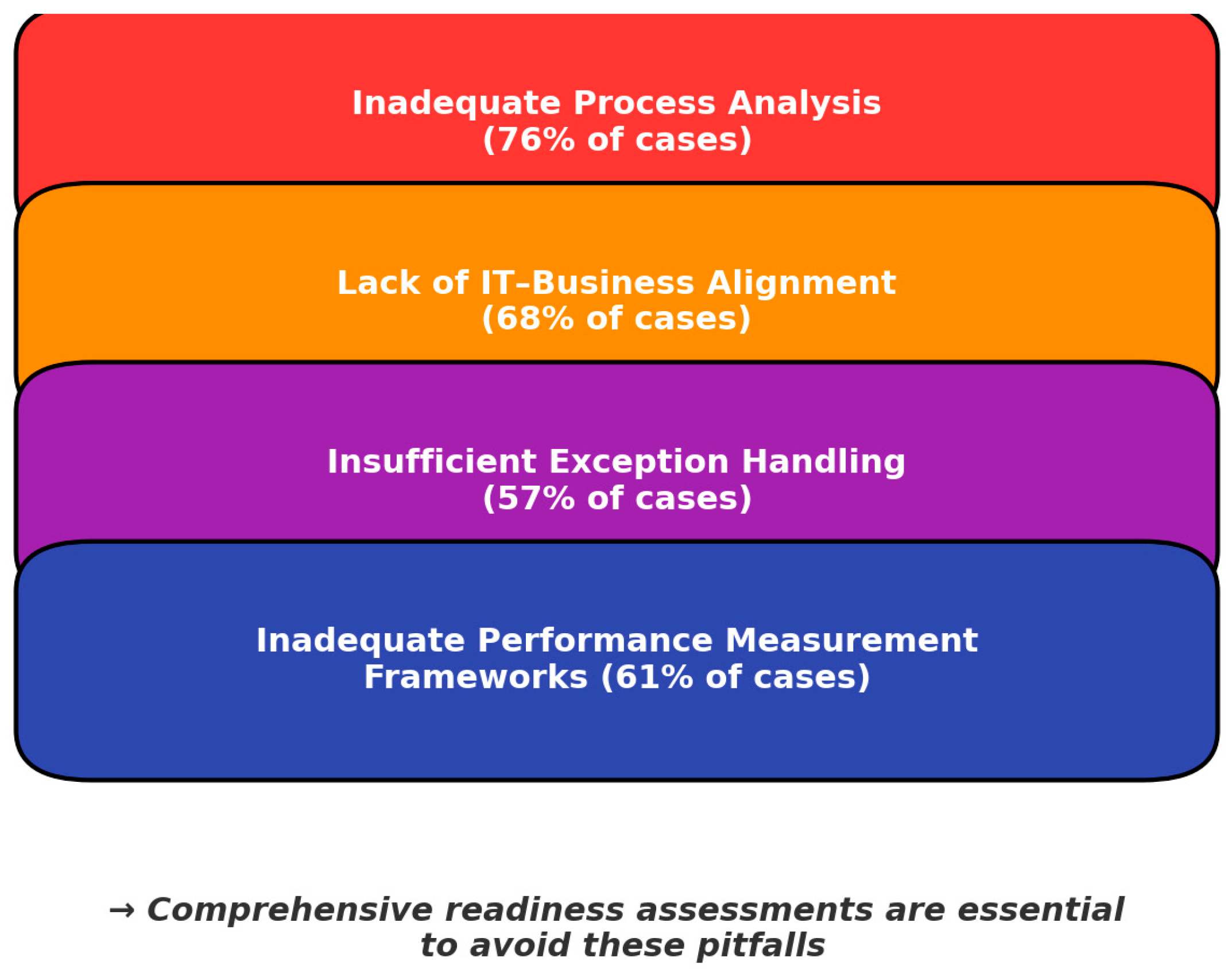

2.4. Critical Success Factors and Implementation Challenges

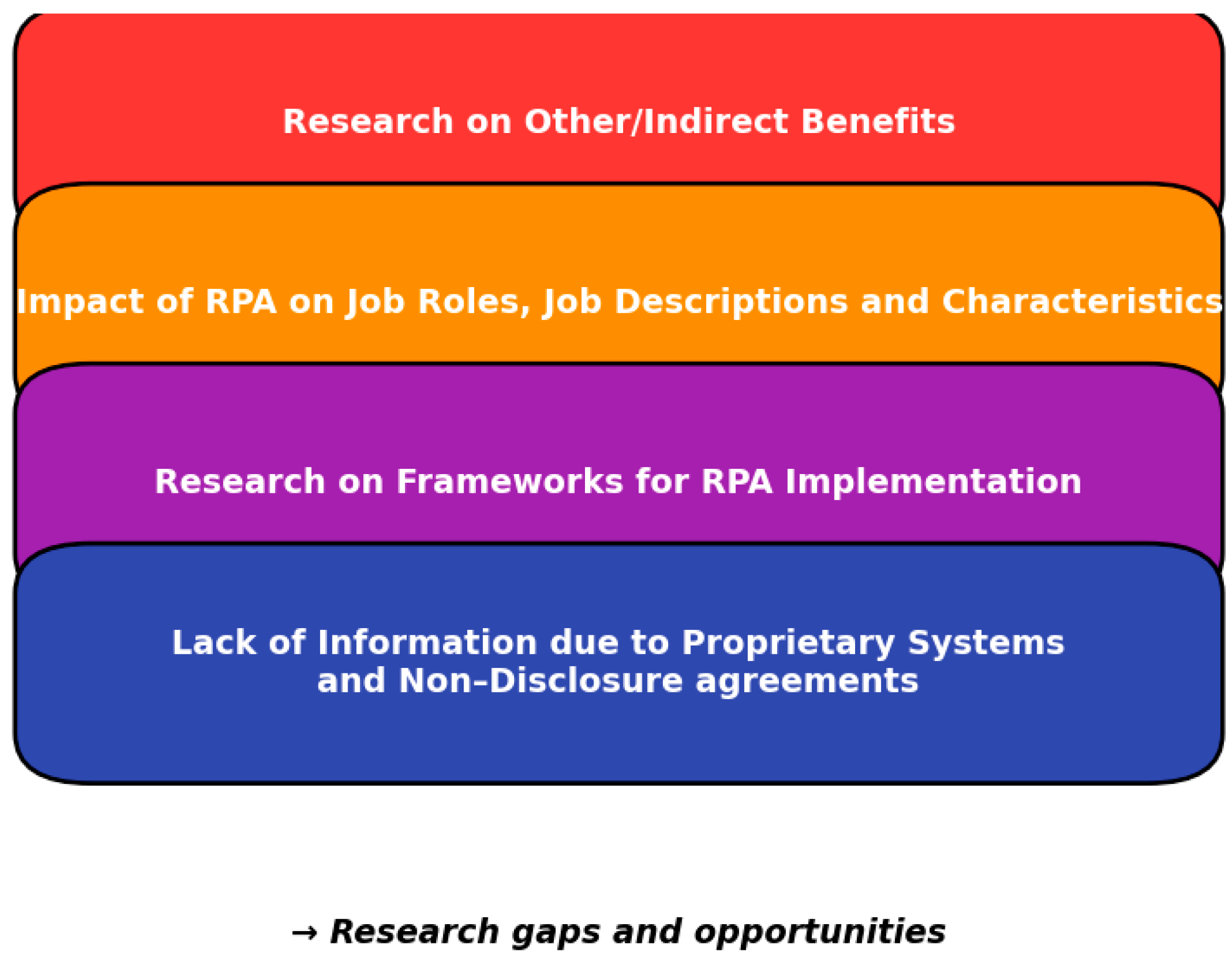

2.5. Research Gaps and Opportunities

2.6. Methods

3. Results and Discussion

3.1. Prevalent RPA Applications in Banking and Insurance

3.2. Banking Sector Applications

3.3. Insurance Sector Applications

3.4. Regarding Performance Measurement

3.5. Discussion

4. Conclusions and Prospects

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| RPA | Robotic Process Automation |

| ROI | Return on Investment |

| NPS | Net Promoter Score |

| BPA | Business Process Automation |

| FTE | Full-Time Equivalent |

| KYC | Know your Customer |

References

- What Is Robotic Process Automation (RPA)? Available online: https://www.ibm.com/think/topics/rpa (accessed on 18 August 2025).

- van der Aalst, W.M.P.; Bichler, M.; Heinzl, A. Robotic Process Automation. Bus. Inf. Syst. Eng. 2018, 60, 269–272. [Google Scholar] [CrossRef]

- Willcocks, L.; Lacity, M.; Craig, A. Robotic Process Automation: Strategic Transformation Lever for Global Business Services? J. Inf. Technol. Teach. Cases 2017, 7, 17–28. [Google Scholar] [CrossRef]

- Moffitt, K.C.; Rozario, A.M.; Vasarhelyi, M.A. Robotic Process Automation for Auditing. J. Emerg. Technol. Account. 2018, 15, 1–10. [Google Scholar] [CrossRef]

- Aguirre, S.; Rodriguez, A. Automation of a Business Process Using Robotic Process Automation (RPA): A Case Study. In Proceedings of the 4th Workshop on Engineering Applications, WEA 2017, Cartagena, Colombia, 27–29 September 2017. [Google Scholar] [CrossRef]

- Thekkethil, M.S.; Shukla, V.K.; Beena, F.; Chopra, A. Robotic Process Automation in Banking and Finance Sector for Loan Processing and Fraud Detection. In Proceedings of the 2021 9th International Conference on Reliability, Infocom Technologies and Optimization (Trends and Future Directions) (ICRITO), Noida, India, 3–4 September 2021. [Google Scholar] [CrossRef]

- Rane, N.L.; Choudhary, S.P.; Rane, J. Artificial Intelligence-driven corporate finance: Enhancing efficiency and decision-making through machine learning, natural language processing, and robotic process automation in corporate governance and sustainability. Stud. Econ. Bus. Relat. 2024, 5, 1–22. [Google Scholar] [CrossRef]

- Patrício, L.; Varela, L.; Silveira, Z. Integration of Artificial Intelligence and Robotic Process Automation: Literature Review and Proposal for a Sustainable Model. Appl. Sci. 2024, 14, 9648. [Google Scholar] [CrossRef]

- Ayinla, B.S.; Atadoga, A.; Ike, C.U.; Ndubuisi, N.L.; Asuzu, O.F.; Adeleye, R.A. The role of Robotic Process Automation (RPA) in modern Accounting: A Review—Investigating how automation tools are transforming traditional accounting practices. Eng. Sci. Technol. J. 2024, 5, 427–447. [Google Scholar] [CrossRef]

- Lamberton, C.; Brigo, D.; Hoy, D. Impact of Robotics, RPA and AI on the Insurance Industry: Challenges and Opportunities. J. Financ. Perspect. 2017, 4, 8–20. [Google Scholar]

- Anagnoste, S. Robotic Automation Process—The operating system for the digital enterprise. Proc. Int. Conf. Bus. Excel. 2018, 12, 54–69. [Google Scholar] [CrossRef]

- Hofmann, P.; Samp, C.; Urbach, N. Robotic process automation. Electron. Mark. 2019, 30, 99–106. [Google Scholar] [CrossRef]

- Kumar, M. Robotic Process Automation (RPA) in Healthcare Insurance: Streamlining Administrative Tasks. Prog. Med. Sci. 2022, 6, 1–6. [Google Scholar] [CrossRef]

- Mahadevkar, S.V.; Patil, S.; Kotecha, K.; Soong, L.W.; Choudhury, T. Exploring AI-driven Approaches for Unstructured Document Analysis and Future Horizons. J. Big Data 2024, 11, 92. [Google Scholar] [CrossRef]

- Chaturvedi, R.; Sharma, S. Robotic Process Automation (RPA) in Healthcare: Transforming Revenue Cycle Operations. Int. J. Recent Innov. Trends Comput. Commun. 2023, 11, 652–658. [Google Scholar]

- Cooper, L.A.; Holderness, D.K.; Sorensen, T.L.; Wood, D.A. Robotic Process Automation in Public Accounting. Account. Horiz. 2019, 33, 15–35. [Google Scholar] [CrossRef]

- Syed, R.; Suriadi, S.; Adams, M.; Bandara, W.; Leemans, S.J.J.; Ouyang, C.; ter Hofstede, A.H.M.; van de Weerd, I.; Wynn, M.T.; Reijers, H.A. Robotic Process Automation: Contemporary themes and challenges. Comput. Ind. 2020, 115, 103162. [Google Scholar] [CrossRef]

- Fernandez, D.; Aman, A. Impacts of Robotic Process Automation on Global Accounting Services. Asian J. Account. Gov. 2018, 9, 123–132. [Google Scholar] [CrossRef]

- Santos, F.; Pereira, R.; Vasconcelos, J.B. Toward robotic process automation implementation: An end-to-end perspective. Bus. Process. Manag. J. 2019, 26, 405–420. [Google Scholar] [CrossRef]

- Leopold, H.; Van Der Aa, H.; Reijers, H. Identifying Candidate Tasks for Robotic Process Automation in Textual Process Descriptions. In Proceedings of the 19th International Conference, BPMDS 2018, 23rd International Conference, EMMSAD 2018, Held at CAiSE 2018, Tallinn, Estonia, 11–12 June 2018. [Google Scholar] [CrossRef]

- Horvat, D.; Pjanić, M.; Ivanišević, R.; Gluščević, L. The impact of robotic process automation in financial institutions. Bizinfo Blace 2025. [Google Scholar] [CrossRef]

- Pingili, R. The integration of generative AI in RPA for enhanced insurance claims processing. J. Adv. Res. Eng. Technol. 2024, 3, 38–52. [Google Scholar] [CrossRef]

- Mamede, H.S.; Martins, C.M.G.; da Silva, M.M. A lean approach to robotic process automation in banking. Heliyon 2023, 9, e18041. [Google Scholar] [CrossRef]

- Bheemarpu, N.S.U.K. Microbots in robotic process automation. World J. Adv. Eng. Technol. Sci. 2025, 15, 2492–2502. [Google Scholar] [CrossRef]

- Vilaplana, F.; Stein, G. Digitalización y personas. Rev. Empresa Y Humanismo 2020, 23, 113–137. [Google Scholar] [CrossRef]

- Shet, S.V.; Pereira, V. Proposed managerial competencies for Industry 4.0—Implications for social sustainability. Technol. Forecast. Soc. Chang. 2021, 173, 121080. [Google Scholar] [CrossRef]

- Gandía, J.A.G.; Gavrila, S.G.; Ancillo, A.d.L.; Núñez, M.T.d.V. RPA as a Challenge Beyond Technology: Self-Learning and Attitude Needed for Successful RPA Implementation in the Workplace. J. Knowl. Econ. 2024, 15, 19628–19655. [Google Scholar] [CrossRef]

- Rizvi, A.; Srivastava, N. Exploring the Potentials of Robotic Process Automation: A Review. J. Informat. Electr. Electron. Eng. (JIEEE) 2023, 4, 1–12. [Google Scholar] [CrossRef]

- Tzavaras, P.; Stelios, S. “Digital virtues”? Aristotelian Leadership in the Fourth Industrial Revolution. J. Adv. Res. Leadersh. 2022, 1, 1–8. [Google Scholar] [CrossRef]

- Sgantzos, K.; Stelios, S.; Tzavaras, P.; Theologou, K. Minds and machines: Evaluating the feasibility of constructing an advanced artificial intelligence. Discov. Artif. Intell. 2024, 4, 104. [Google Scholar] [CrossRef]

| Process Categories | Examples |

|---|---|

| Account opening | Ticket-based procedures, system data-entry, etc. |

| Loan processing | Loan approval, loan monitoring, loan pricing |

| Payment reconciliation | - |

| Compliance reporting | Reporting procedures, due diligence tasks, information collection from various sources, form-based automation, etc. |

| Customer onboarding (customer information collection) | Data collection, data processing and entry |

| Know-your-customer (KYC) | Reporting, searching various data sources, etc. |

| Middle- and back-office functions | Data extraction, document extraction, OCR, data entry, other ticket-based processes |

| Accounting/Finance | Data reconciliation, corporate finance, data entry, data collection |

| AI and ML | Decision-making, sentiment analysis, NLP |

| HR task automation | Employee onboarding/offboarding processes, sending notifications, email automations (mandatory training notifications, etc.) |

| Other office-related tasks (sending reminders/notifications, office booking automations, etc.) | Reporting, processing forms, reserving office spaces, data entry, data extraction, etc. |

| Process Categories | Examples |

|---|---|

| Automated claims processing | Ticket-based procedures, system data entry, etc. |

| Underwriting operations | Property and casualty insurance sectors |

| Automated data collection and validation | - |

| Regulatory reporting automation/automated compliance processes | Generating reports, due diligence procedures, information collection from various sources, form-based automation, etc. |

| Customer onboarding (customer information collection) | Data collection, data processing and entry, document processing |

| Back-office functions | Automation of processes in terminal emulators, reporting, searching various data sources, etc. |

| Commercial operations | Data extraction, document extraction, pricing monitoring/comparison |

| Accounting/finance | Data reconciliations, corporate finance, data entry, data collection |

| Marketing operations | Sending promotional emails, management of campaigns, automated management of potential customers, automation of various forms |

| HR task automation | Employee onboarding/offboarding processes, sending notifications, email automations (mandatory training notifications, etc.) |

| Other office-related tasks (sending reminders/notifications, office booking automation, etc.) | Reporting, processing forms, reserving office spaces, data entry, data extraction, etc. |

| Categories | Keywords used |

|---|---|

| RPA | ‘RPA’, ‘Robotic Process Automation’, ‘RPA technology’, ‘Software Automation’, ‘Low Code/No code’, ‘Low Code’, ‘No Code’, ‘RPA tools’ |

| Insurance sector | ‘Insurance’, ‘Insurance sector’, ‘Healthcare’, ‘Underwriting’ |

| Banking sector | ‘Banking’, ‘Banking sector’, ’Finance’, ‘Financial Services’, ‘Accounting’, ‘Corporate finance’ |

| Performance metrics | ‘Corporate Performance’, ‘KPIs’, ‘performance’, ‘performance metrics’, ‘evaluation’, ‘efficiency’, ‘savings’, ‘costs’, ‘benefits’, ‘issues’, ‘estimation’, ‘measurement’, ‘impact’ |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Delagrammatikas, M.; Stelios, S.; Tzavaras, P. The Role of RPA and Data Analysis in the Transformation of the Insurance and Banking Industries. Encyclopedia 2025, 5, 155. https://doi.org/10.3390/encyclopedia5040155

Delagrammatikas M, Stelios S, Tzavaras P. The Role of RPA and Data Analysis in the Transformation of the Insurance and Banking Industries. Encyclopedia. 2025; 5(4):155. https://doi.org/10.3390/encyclopedia5040155

Chicago/Turabian StyleDelagrammatikas, Michalis, Spyridon Stelios, and Panagiotis Tzavaras. 2025. "The Role of RPA and Data Analysis in the Transformation of the Insurance and Banking Industries" Encyclopedia 5, no. 4: 155. https://doi.org/10.3390/encyclopedia5040155

APA StyleDelagrammatikas, M., Stelios, S., & Tzavaras, P. (2025). The Role of RPA and Data Analysis in the Transformation of the Insurance and Banking Industries. Encyclopedia, 5(4), 155. https://doi.org/10.3390/encyclopedia5040155