Intercity Railfares After HSR Liberalisation in Spain: Price Patterns in the Madrid–Barcelona Corridor

Abstract

1. Introduction

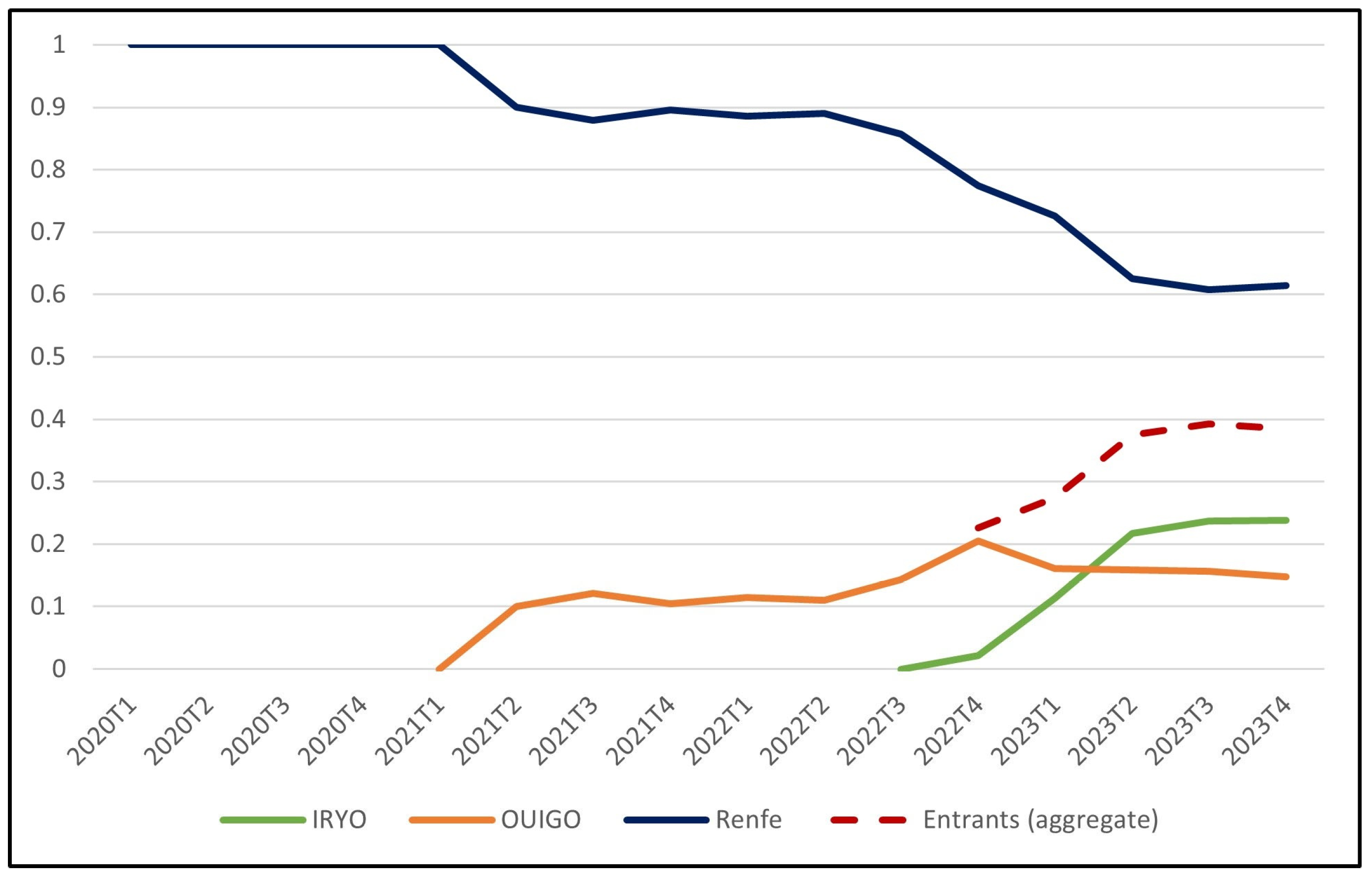

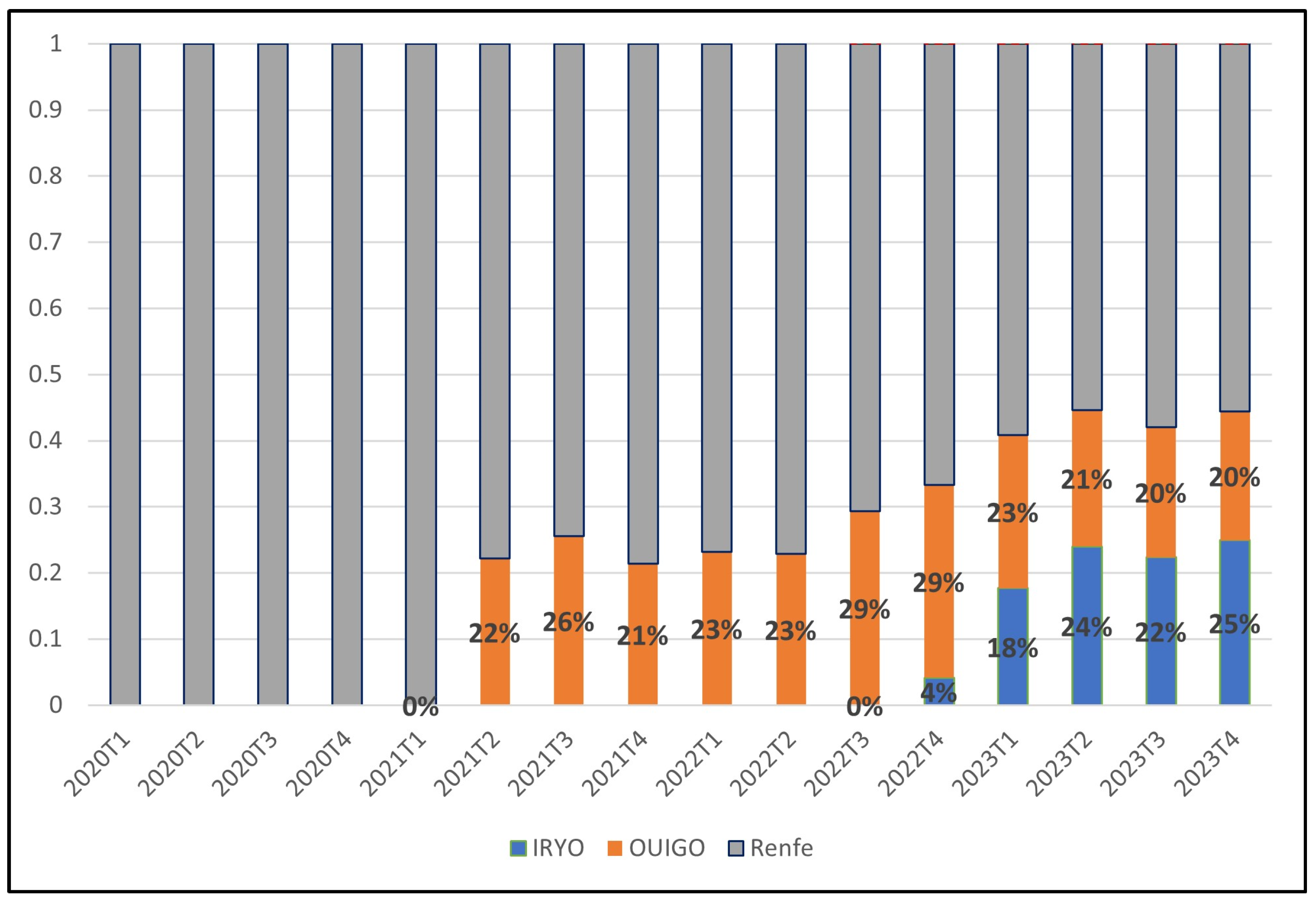

2. The Spanish HSR Liberalisation Process in Context

2.1. The Liberalisation Process in Spain

2.2. Liberalisation Results in Other Countries: Theoretical and Empirical Effects on Prices

3. Our Results: Identifiable Price Patterns

3.1. Data and Methodology

3.2. Changes in Daily Prices

3.3. Changes in the Fare Structure

4. Results: Event Study

- Price t: average price in month t,

- Price entry: average price in the month of entry of competition (20 May 2021).

4.1. Business Fares

4.2. Economy Fares

5. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- García Delgado, J.L. La Industrialización y el Desarrollo Económico en España Durante el Franquismo; Nadal, J., Carreras, A., Sudriá, Y.C., Eds.; La economía española en el siglo XX: Una perspectiva histórica; Ariel: Barcelona, Spain, 1987; pp. 164–189. [Google Scholar]

- AIREF. Estudios Sobre Infraestructuras de Transporte. Spending Review. 2020. Autoridad Independiente de Responsabilidad Fiscal. 2020. Available online: https://www.airef.es/en/document-center/studies-document-center/transport-infrastructure-study/ (accessed on 5 May 2025).

- UIC. High-Speed Data and Atlas. Union Internationale des Chemins de Fer. 2023. Available online: https://uic.org/passenger/highspeed/article/high-speed-data-and-atlas?recherche=high-speed%20atlas (accessed on 5 May 2025).

- European Commission. Eight Monitoring Report on the Development of the Rail Market Under Article 15(4) of Directive 2012/34/EU of the European Parliament and of the Council. 2012. Available online: http://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52023DC0510 (accessed on 5 May 2025).

- Joskow, A.; Werden, G.; Johnson, R. Entry, exit, and performance in airline markets. Int. J. Ind. Organ. 1994, 12, 457–471. [Google Scholar] [CrossRef]

- Yamawacki, H. Price reactions to new competition: A study of U.S. luxury car market, 1986–1997. Int. J. Ind. Organ. 2002, 20, 19–39. [Google Scholar] [CrossRef]

- Campos, J. La Competencia en el Ferrocarril: Un Análisis del Nuevo Marco Institucional en Europa y en España. FEDEA Policy Papers, 2015/12. Madrid. 2015. Available online: https://documentos.fedea.net/pubs/fpp/2015/12/FPP2015-12.pdf (accessed on 5 May 2025).

- Campos, J. Efectos de la Introducción de Competencia en el Transporte Ferroviario de Viajeros en España; FUNCAS: Madrid, Spain, 2023; ISBN 978-84-17609-66-5. Available online: https://www.funcas.es/wp-content/uploads/2023/05/Reformas-de-la-competencia__Capitulo-12.pdf (accessed on 5 May 2025).

- CNMC. Balance de la Liberalización del Transporte de Viajeros por Ferrocarril. 2024. Available online: https://www.cnmc.es/sites/default/files/5307599.pdf (accessed on 5 May 2025).

- Montero, J.; Ramos Melero, R. Competitive tendering for rail track capacity: The liberalisation of railway services in Spain. Compet. Regul. Netw. Ind. 2022, 23, 43–59. [Google Scholar] [CrossRef]

- Ruiz-Rua, A.; Palacin, R. Towards a liberalised European high speed railway sector: Analysis and modelling of competition using Game Theory. Eur. Transp. Res. Rev. 2013, 5, 53–63. [Google Scholar] [CrossRef]

- Cherbonier, F.; Ivaldi, M.; Muller-Vibes, C.; Van Der Straeten, K. Competition for versus in the market of long-distance passenger rail services. Rev. Netw. Econ. 2017, 16, 203–238. [Google Scholar] [CrossRef]

- Ivaldi, M.; Vibes, C. Intermodal and Intramodal Competition in Passenger Rail Transport. 2005. Available online: https://ssrn.com/abstract=637242 (accessed on 5 May 2025).

- Coublucq, D.; Ivaldi, M.; McCullough, G. The Static-Dynamic Efficiency Trade-off in the US Rail Freight Industry: Assessment of an Open Access Policy. Rev. Netw. Econ. 2018, 17, 267–301. [Google Scholar] [CrossRef]

- Spulber, D.F.; Sidak, G. Network Access Pricing and Deregulation. Ind. Corp. Change 1997, 6, 757–782. [Google Scholar] [CrossRef]

- Lérida-Navarro, C.; Nombela, G. Liberalización de los servicios de alta velocidad ferroviaria en España: El proceso de apertura del mercado a la competencia. Stud. Appl. Econ. 2022, 40. [Google Scholar] [CrossRef]

- Lérida-Navarro, C.; Nombela, G.; Tranchez-Martin, J.M. European railways: Liberalization and productive efficiency. Transp. Policy 2019, 83, 57–67. [Google Scholar] [CrossRef]

- Esposito, G.; Doleschel, J.; Kaloud, T.; Urban-Kozlowska, J. The changing nature of railways in Europe: Empirical evidence on prices, investments and quality. In The Reform of Network Industries; Florio, M., Ed.; Edward Elgar Publishing: Cheltenham, UK, 2017. [Google Scholar]

- Beria, P.; Redondi, R.; Malighetti, P. The Effect of Open Access Competition on Average Rail Prices. The Case of Milan—Ancona. J. Rail Trans. Plan. Man. 2016, 6, 271–283. Available online: https://trid.trb.org/view/1429202 (accessed on 5 May 2025). [CrossRef]

- Brenna, C. Price impact of high-speed rail competition between multiple full-service and low-cost operators on less congested corridors in Spain. Transp. Policy 2024, 156, 77–88. [Google Scholar] [CrossRef]

- Froidh, O.; Bystrom, C. Competition on the tracks—Passenger’s response to deregulation of interregional rail services. Transp. Res. Part A 2013, 56, 1–10. [Google Scholar]

- Beria, P.; Tolentino, S.; Shtele, E.; Lunkar, V. A difference-in-difference approach to estimate the price effect of market entry on high-speed rail. Compet. Regul. Netw. Ind. 2022, 23, 183–213. [Google Scholar] [CrossRef]

- Laroche, F. Goodbye monopoly: The effect of open access passenger rail competition on price and frequency in France on the high-speed Paris-Lyon line. Transp. Policy 2024, 147, 12–21. [Google Scholar] [CrossRef]

- Trifunović, D.; Stojadinović, N.; Ristić, B.; Jovanović, P. Investigating the market share convergence and welfare potentials of asymmetric train access charges for the commercial passenger rail services. Res. Transp. Econ. 2024, 107, 101465. [Google Scholar] [CrossRef]

- MacKinlay, C. Event Studies in Economics and Finance. J. Econ. Lit. 1997, 35, 13–39. [Google Scholar]

| Fare Type | Time Series | |

|---|---|---|

| Before July 2021 | Turista Preferente | Low WTP High WTP |

| After July 2021 | Básico Elige + Elige Confort | Low WTP High WTP |

| Service | Observations | Mean | Std. Dev. | Min. | Max. |

|---|---|---|---|---|---|

| AVE MAD–BCN | 1103 | 79.09 | 16.34 | 45.06 | 127.87 |

| AVLO MAD–BCN | 734 | 41.52 | 9.24 | 21.52 | 85.29 |

| AVE BCN–MAD | 1103 | 78.82 | 10.18 | 43.63 | 130.15 |

| AVLO BCN–MAD | 734 | 41.20 | 11.24 | 19.87 | 83.54 |

| Service | Observations (Months) | Mean | Std. Dev. | Min. | Max. |

|---|---|---|---|---|---|

| Low WTP | |||||

| AVE MAD–BCN | 39 | 96.22 | 21.38 | 56.21 | 160.37 |

| AVE BCN–MAD | 39 | 95.71 | 19.94 | 58.12 | 133.72 |

| High WTP | |||||

| AVE MAD–BCN | 39 | 78.09 | 14.53 | 51.65 | 106.81 |

| AVE BCN–MAD | 39 | 78.14 | 14.24 | 53.64 | 107.50 |

| Time Period. | 2019 Average | 2022 Average | Total Change | % Change | 2019 Average | 2022 Average | Total Change | % Change |

|---|---|---|---|---|---|---|---|---|

| Low WTP Fares | High WTP Fares | |||||||

| 1–30 April | 90.15 | 72.81 | −17.3 | −19.2% | 129.28 | 122.13 | −7.15 | −5.5% |

| 1–30 May | 84.59 | 68.93 | −15.6 | −18.5% | 110.68 | 109.89 | −0.80 | −0.7% |

| 1–30 June | 88.51 | 70.45 | −18.06€ | −20.4% | 107.52 | 117.64 | 10.12 | 9.4% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

García-Samaniego, S.; Campos, J. Intercity Railfares After HSR Liberalisation in Spain: Price Patterns in the Madrid–Barcelona Corridor. Future Transp. 2025, 5, 66. https://doi.org/10.3390/futuretransp5020066

García-Samaniego S, Campos J. Intercity Railfares After HSR Liberalisation in Spain: Price Patterns in the Madrid–Barcelona Corridor. Future Transportation. 2025; 5(2):66. https://doi.org/10.3390/futuretransp5020066

Chicago/Turabian StyleGarcía-Samaniego, Santiago, and Javier Campos. 2025. "Intercity Railfares After HSR Liberalisation in Spain: Price Patterns in the Madrid–Barcelona Corridor" Future Transportation 5, no. 2: 66. https://doi.org/10.3390/futuretransp5020066

APA StyleGarcía-Samaniego, S., & Campos, J. (2025). Intercity Railfares After HSR Liberalisation in Spain: Price Patterns in the Madrid–Barcelona Corridor. Future Transportation, 5(2), 66. https://doi.org/10.3390/futuretransp5020066