1. Introduction

The rapid development of information technology in recent decades has paved the way for more convenient and simple payment methods. Fintech innovations such as digital wallets (DWs), an online payment method, have recently garnered much interest and recognition (

Barroso & Laborda, 2022). A DW software system securely stores payment information and passwords and allows transactions using smartphones, smartwatches, or other connected devices without carrying physical cards (

Williams, 2024).

According to the Worldpay Global Payments Report, DWs retain global supremacy in e-commerce, reaching 50% of global transaction value in 2023. DWs are the fastest-growing e-commerce payment method, with a projected 15% compound annual growth rate through 2027 (

Worldpay, 2024).

According to the ECB SPACE 2024, the share of e-payment solutions, such as payment wallets and mobile apps, was 29% (26% in 2022). The share of e-payments in online payments ranges from 76% in the Netherlands to 46% in Germany, 13% in Estonia, and 17% in Cyprus. By payment volume, the share is 66% in the Netherlands, 33% in Germany, 9% in Lithuania, and 12% in Cyprus (

ECB, 2024).

In recent years, researchers like

Hopali et al. (

2022),

Kajol et al. (

2022),

Tounekti et al. (

2022),

Liswanty et al. (

2023),

Madan and Kour (

2023),

Panetta et al. (

2023),

Das and Shekhar (

2024),

Ha et al. (

2024),

Kamboj et al. (

2024),

Pizzan-Tomanguillo et al. (

2024), and

Ramayanti et al. (

2024) have published several systematic literature reviews (SLRs). These reviews provide in-depth insights into research trends, commonly used frameworks, methods of analysis, and factors that significantly affect the use of DWs. The analyzed SLRs conclude that researchers have insufficiently studied the specifics of the intention to use DWs in the European market. There are very few studies on the countries of Eastern Europe. Moreover, there are no studies on the Baltic states. Second, only a few studies analyze moderators and their impact on the relationship between factors and the intention to use DWs. The moderating effect of social norms on the determinants of DW use has not been studied.

This research investigates the factors influencing DW adoption and evaluates social influence (SI) as a moderator of the relationship under investigation.

After reviewing the existing models and theories, this study attempts to expand the Technology Acceptance Model (TAM) to assess perceived usefulness, perceived ease of use, facilitating conditions, perceived trust, and social influence, which influence users’ intentions toward DWs.

2. Literature Review

2.1. Main Theories and Factors Influencing Users’ Intention to Adopt DWs

Current systematic literature reviews (

Panetta et al., 2023;

Das & Shekhar, 2024;

Ramayanti et al., 2024) suggest that the most commonly used frameworks in similar studies are the TAM and Unified Theory of Acceptance and Use of Technology (UTAUT). Fred Davis developed the TAM and suggested that if users perceive a technology as practical and easy to use, they will have a positive attitude toward it, increasing their intention to use it, ultimately leading to actual usage (

Davis, 1989). The TAM is a popular framework for understanding how users adopt and utilize technology (

Malatji et al., 2020;

Kim & Kim, 2022;

Liu et al., 2022;

Senali et al., 2022;

Malik et al., 2023;

Rosli et al., 2023;

Tian et al., 2023;

Belmonte et al., 2024).

An analysis of studies utilizing the TAM reveals both its strengths and limitations. One of its primary advantages lies in its conceptual clarity, as it centers on two fundamental constructs—perceived usefulness and perceived ease of use—making it accessible and easy to implement. The model also demonstrates strong predictive validity, effectively forecasting user acceptance and behavior regarding technology use. Its extensive application across various technological contexts has further validated its utility and established it as a reliable framework for comparative research (

Davis, 1989).

Despite these strengths, the TAM has notable limitations. It tends to focus narrowly on individual perceptions, often neglecting broader contextual or environmental factors that may influence technology adoption. Additionally, the model assumes a static view of adoption, failing to account for the evolving nature of user attitudes and external influences over time. Its reliance on only two predictors may also oversimplify the complex and multifaceted nature of user behavior (

Venkatesh et al., 2003).

Venkatesh et al. (

2003) developed the UTAUT, extended it as the UTAUT2, and saw it gain wide application (

Koenig-Lewis et al., 2015;

Oliveira et al., 2016;

Jung et al., 2020;

Liébana-Cabanillas et al., 2020;

Yang et al., 2021;

Bommer et al., 2022;

Esawe, 2022;

Migliore et al., 2022;

Mulyati et al., 2023;

Elasaria, 2024;

Othman et al., 2024).

The UTAUT2 presents several notable advantages that contribute to its widespread application in technology adoption research. One of its key strengths is its comprehensive framework, which extends the original UTAUT model by incorporating additional constructs, such as social influence, facilitating conditions, hedonic motivation, price value, and habit. This expansion allows for a more holistic understanding of the factors influencing user behavior (

Oliveira et al., 2016;

Migliore et al., 2022;

Venkatesh et al., 2023;

Elasaria, 2024). Moreover, the UTAUT2 demonstrates considerable contextual flexibility, enabling researchers to adapt the model to various technological environments and user demographics. Its enhanced predictive power, resulting from including multiple variables, further strengthens its capacity to accurately forecast user intentions and behaviors.

Despite these advantages, the UTAUT2 also presents certain limitations. The model’s complexity, stemming from its broad scope and numerous constructs, can pose challenges in application and interpretation. This complexity often necessitates extensive data collection and sophisticated analytical techniques. Additionally, some constructs within the model may overlap or interact in ways that are challenging to disentangle, potentially complicating empirical analysis. The resource-intensive nature of implementing the UTAUT2—particularly in terms of time, effort, and data requirements—may also limit its feasibility for certain studies or research contexts.

Both the TAM and the UTAUT2 model have strengths and weaknesses. The choice between them depends on a study’s specific context and objectives and the data available for model calibration. The TAM is helpful because it is simple and easy to use, while the UTAUT2 provides a more comprehensive and nuanced understanding of technology adoption. Given this study’s objective, conceptual clarity, and the desire to focus on the most important determinants of DW use, the TAM was chosen as the basis for this study.

Previous studies conducting bibliometric analyses of DW research based on databases like Scopus, Web of Science, and others highlighted key factors influencing the adoption of digital wallets.

Table 1 summarizes the most often mentioned SLR factors determining the intention to use prospective technologies. The following subsections will analyze these factors in more detail.

2.2. Perceived Usefulness

Perceived usefulness (PU) refers to the degree to which a person believes using a particular technology will enhance their performance or significantly benefit their daily activities (

Davis, 1989). PU plays a crucial role in DW adoption and continued usage.

Recent research highlights several key factors contributing to the perceived usefulness of digital payment systems. One of the primary benefits identified is enhanced efficiency, as users often view these systems as valuable tools that facilitate faster and more convenient transactions compared to traditional payment methods (

Khan & Abideen, 2023;

Belmonte et al., 2024). This efficiency contributes to a more positive user experience, increasing the likelihood of continued use. Systems perceived as helpful and user-friendly tend to foster user satisfaction and loyalty (

Mew & Millan, 2021;

Malik et al., 2023).

Moreover, perceived usefulness is critical in reducing resistance to new technologies. When users recognize clear advantages, they are more inclined to overcome initial hesitations and adopt the system (

Malik et al., 2023). This perception also significantly influences behavioral intention, as individuals who find the technology beneficial are more likely to intend to use it, a tendency that often translates into actual usage behavior (

Khan & Abideen, 2023;

Malik et al., 2023).

Overall, perceived usefulness strongly predicts DW initial adoption and ongoing use. It highlights the importance of demonstrating clear, tangible benefits to potential users. Hence, we can formulate the first hypothesis as follows:

H1. Perceived usefulness positively affects the intention to use DWs.

2.3. Perceived Ease of Use

Perceived ease of use (PE) is critical to adopting and sustaining DWs. Prior research underscores that users will likely continue engaging when they find a DW intuitive and enjoyable. This enjoyment may stem from various factors, including the interface’s simplicity, the design’s aesthetic appeal, or the efficiency with which consumers can complete transactions (

Khan & Abideen, 2023;

Belmonte et al., 2024). Such positive experiences contribute significantly to user satisfaction, as individuals who enjoy using the system are more inclined to report higher satisfaction levels, supporting user retention (

Mulyati et al., 2023).

Furthermore, perceived enjoyment has been shown to influence behavioral intention. When users find the experience of using a digital wallet pleasurable, they are more likely to form a firm intention to use it regularly. This intention often serves as a precursor to actual usage behavior, reinforcing the importance of designing functional and enjoyable systems (

Mulyati et al., 2023).

Overall, PE is a crucial factor that can enhance user satisfaction, increase behavioral intention, and drive DW adoption and continued use. Based on the depiction above, we can formulate the second hypothesis as follows:

H2. Perceived ease of use positively affects the intention to use DWs.

2.4. Facilitating Conditions

Facilitating conditions (FCs) play a pivotal role in adopting and continuing DWs, encompassing the resources and support systems that enable users to engage with the technology effectively. Access to essential technological infrastructure—such as smartphones, stable internet connectivity, and compatible payment terminals—ensures users can utilize digital wallets efficiently (

Yang et al., 2021). In addition, the availability of technical support, including customer service and troubleshooting assistance, enhances user confidence and helps resolve potential issues that may arise during usage (

Yang et al., 2021).

Educational initiatives and user training also contribute significantly to reducing barriers to adoption. When users have clear guidance and instructions on navigating DW systems, they are more likely to adopt and use them effectively (

Yang et al., 2021). Furthermore, a robust technological and commercial infrastructure—characterized by widespread merchant acceptance and seamless integration with banking systems—facilitates smoother adoption processes (

Othman et al., 2024).

The regulatory environment further influences adoption by establishing a secure and trustworthy framework for digital payments. Supportive policies that ensure data privacy, consumer protection, and transaction security can foster a more favorable climate for digital wallet usage (

Othman et al., 2024). Lastly, compatibility with users’ lifestyles is a critical factor; digital wallets that align with daily routines and integrate well with commonly used applications and services are more likely to be embraced by users (

Yang et al., 2021).

Overall, facilitating conditions play a significant role in reducing barriers and enhancing the ease of use, which can drive the adoption and continued usage of DWs. Consequently, we formulate the third hypothesis as follows:

H3. Facilitating conditions positively affect the intention to use DWs.

2.5. Perceived Trust

In the context of DWs, perceived trust (PT) refers to the level of trust users have in the DW provider, which can mitigate perceived risks and encourage adoption. Several studies explore the impact of PT on the usage of DWs. Khan and Abideen examined how PT, perceived risk, and service quality influence DW usage behavior. They found that PT significantly moderates the relationship between perceived risk and DW usage, highlighting the importance of PT in reducing perceived risks and encouraging usage (

Khan & Abideen, 2023). Yang et al. investigated the factors that affect the intention to use and adopt DWs, including PT. Their study concluded that PT positively affects the intention to use and adopt DWs (

Yang et al., 2021). These studies underscore the critical role of PT in the adoption and continued use of DWs. Trust reduces perceived risks and enhances users’ confidence, making them more likely to use these digital payment systems.

PT is a critical factor influencing DW adoption and sustained use, as it shapes users’ confidence in the technology and their willingness to engage with it (

Belmonte et al., 2024). Trust in the security features of digital wallets—such as encryption protocols and fraud prevention mechanisms—plays a central role in reducing perceived risk. When users believe their financial information is protected, they are more inclined to adopt and continue using the service (

Khan & Abideen, 2023;

Belmonte et al., 2024).

Reliability is another essential dimension of trust. Users are more likely to engage with DWs that consistently perform well and are free from technical disruptions. Over time, dependable performance fosters a sense of trust and reinforces user confidence (

Belmonte et al., 2024). Additionally, trust in the platform’s ability to safeguard personal data and uphold privacy standards significantly influences adoption decisions. Users who feel assured that their data will not be misused are more likely to embrace the technology (

Chin et al., 2022).

Trust also contributes to overall user satisfaction. When users perceive a digital wallet as trustworthy, they tend to have more positive experiences, which enhances satisfaction and encourages continued use (

Khan & Abideen, 2023). Furthermore, high levels of trust can foster user loyalty. Satisfied users who trust the platform are less likely to switch to alternative services, supporting long-term retention (

Khan & Abideen, 2023).

Overall, PT is essential for overcoming initial adoption barriers and fostering long-term usage of digital wallets. It influences users’ perceptions of security, reliability, and privacy, which is crucial for building a loyal user base. Therefore, we formulate the fourth hypothesis as follows:

H4. Perceived trust positively affects the intention to use DWs.

2.6. Social Influence

Social influence (SI) refers to how others’ opinions affect an individual’s technology usage (

Venkatesh et al., 2003). Research by

Bommer et al. (

2022) indicates that social influence (SI) has a positive impact on individuals’ behavioral intention to adopt DWs. We expect SI to emerge as the most significant and impactful factor in predicting the adoption of new financial technology (

Oliveira et al., 2016;

Belmonte et al., 2024). Social acceptance and the opinions of others can influence users’ decisions to adopt mobile payments (

Bland et al., 2024).

SI is pivotal in shaping individuals’ decisions to adopt and continue using digital wallets (DWs). One of the primary mechanisms through which SI operates is peer influence. When individuals observe friends, family members, or colleagues using digital wallets and sharing positive experiences, they are more likely to perceive the technology as trustworthy and beneficial, increasing their likelihood of adoption (

Belmonte et al., 2024). This peer-driven dynamic is closely linked to the formation of social norms. As digital wallet usage becomes more widespread and socially accepted, individuals may feel more inclined to conform to these norms, reinforcing adoption behaviors (

Adiani et al., 2024).

In addition to peer influence, the role of opinion leaders—such as technology influencers, financial advisors, and bloggers—is also significant. These figures can shape public perceptions by endorsing digital wallets, demonstrating their functionality, and highlighting their advantages. Such endorsements help reduce perceived risks and build trust among potential users (

Yang et al., 2021;

Khan & Abideen, 2023). Cultural context further moderates the impact of social influence. In collectivist societies or cultures that are more receptive to technological innovation, the collective attitudes and behaviors toward financial technologies can significantly affect adoption rates (

Zhao & Pan, 2023;

Yang et al., 2021).

SI can enhance a DW’s perceived value and trustworthiness, making individuals more likely to adopt and use them regularly. Thus, we formulate the fifth hypothesis as follows:

H5. Social influence positively affects the intention to use DWs.

2.7. Moderating Effect of Social Influence

In this study, we define a moderator as a variable that influences the strength or direction of the relationship between independent and dependent variables. It is an interactive element that alters how these variables are associated under varying conditions. Prior research suggests that consumers are more likely to adopt mobile payment systems when they are socially accepted and actively endorsed by others (

Oliveira et al., 2016;

Liébana-Cabanillas et al., 2020). Singh et al. examined the moderating effect of innovativeness, stress to use, and SI on users’ perceived satisfaction and recommendation to use DW services. They determined the significant moderating effect of stress to use and SI on users’ perceived satisfaction and recommendation of mobile wallet services (

Singh et al., 2020). Bommer et al. researched whether theoretically based moderators affect the relationships between antecedents and DW use intention and concluded that no relationships were significantly moderated (

Bommer et al., 2022). Senali et al. tested the moderating effect of personal innovativeness and propensity to trust (

Senali et al., 2022). Shetu et al. investigated the moderating role of perceived technological innovativeness but did not find enough evidence to support the initial hypothesis (

Shetu et al., 2022). Khan and Abideen studied the moderating roles of perceived service quality and perceived trust. Their study emphasized the complex interplay between these factors and suggested that enhancing trust and service quality can encourage digital wallet adoption despite perceived risks (

Khan & Abideen, 2023).

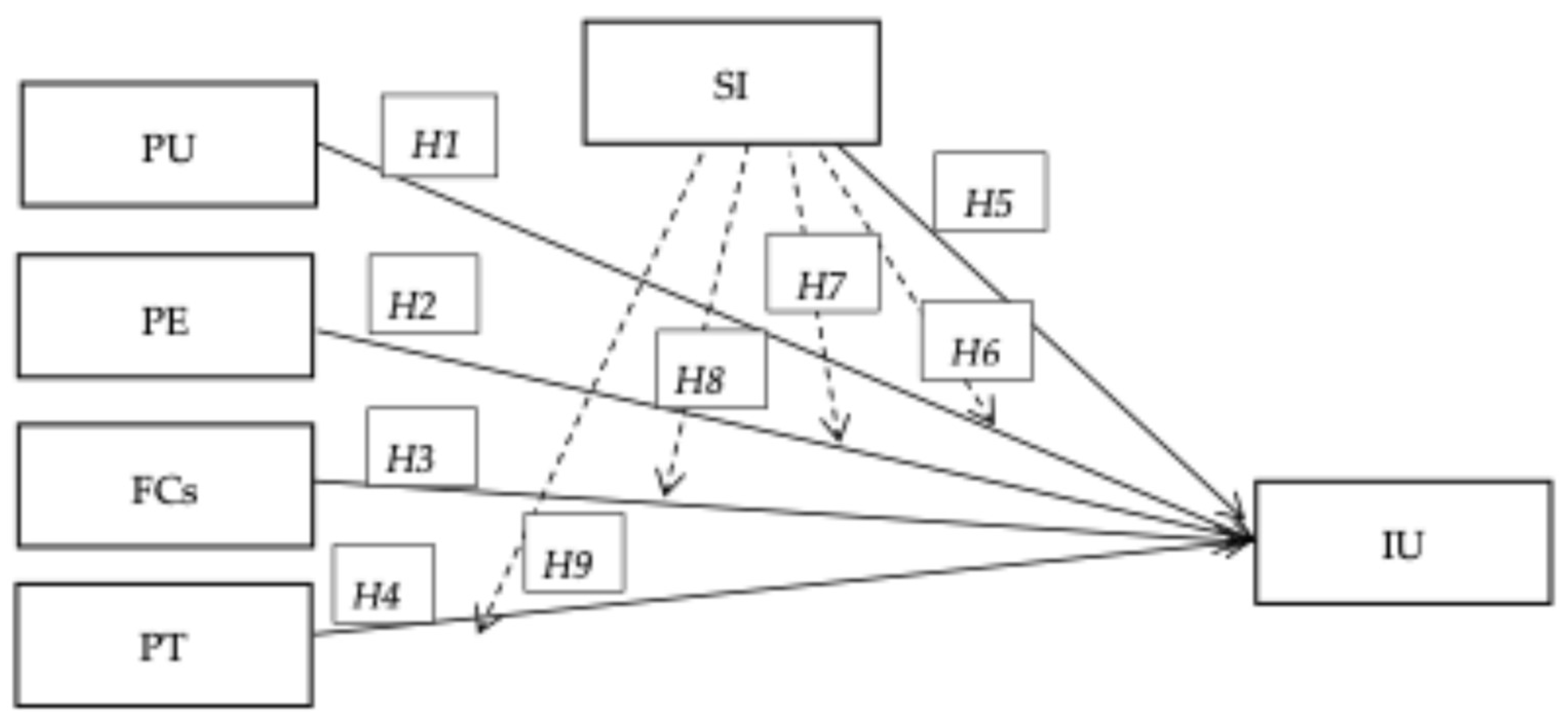

The preceding arguments suggest that SI may moderate the relationship between PU, PE, FCs, PT, and intention to use DWs. Accordingly, the sixth to the ninth hypotheses are formulated as follows:

H6. Social influence moderates the relationship between perceived usefulness and intention to use DWs.

H7. Social influence moderates the relationship between perceived ease of use and intention to use DWs.

H8. Social influence moderates the relationship between facilitating conditions and intention to use DWs.

H9. Social influence moderates the relationship between perceived trust and intention to use DWs.

The conceptual model in

Figure 1 highlights the relationships under investigation.

6. Conclusions, Limitations, and Future Research Directions

This study evaluated the factors influencing users’ intention to adopt DWs in financial services. A conceptual model grounded in technology adoption theory was developed based on an extensive literature review to identify the key factors influencing and moderating users’ intentions to adopt DWs. Using PLS-SEM, we empirically tested various dimensions of technology adoption alongside users’ behavioral intentions. This analysis provided insights into the interrelationships among the different variables under investigation. In addition, we examined the moderating effect of social influence on relationships between independent variables and intention to use DWs.

This study’s results confirmed how influential a user’s recommendation to use a DW for financial services is. According to the structural equation modeling results using the partial least squares method, the conceptual model explained 75.9% of the total variance of the dependent variable—the intention to use DWs. The path estimates were statistically significant at a 95% confidence level.

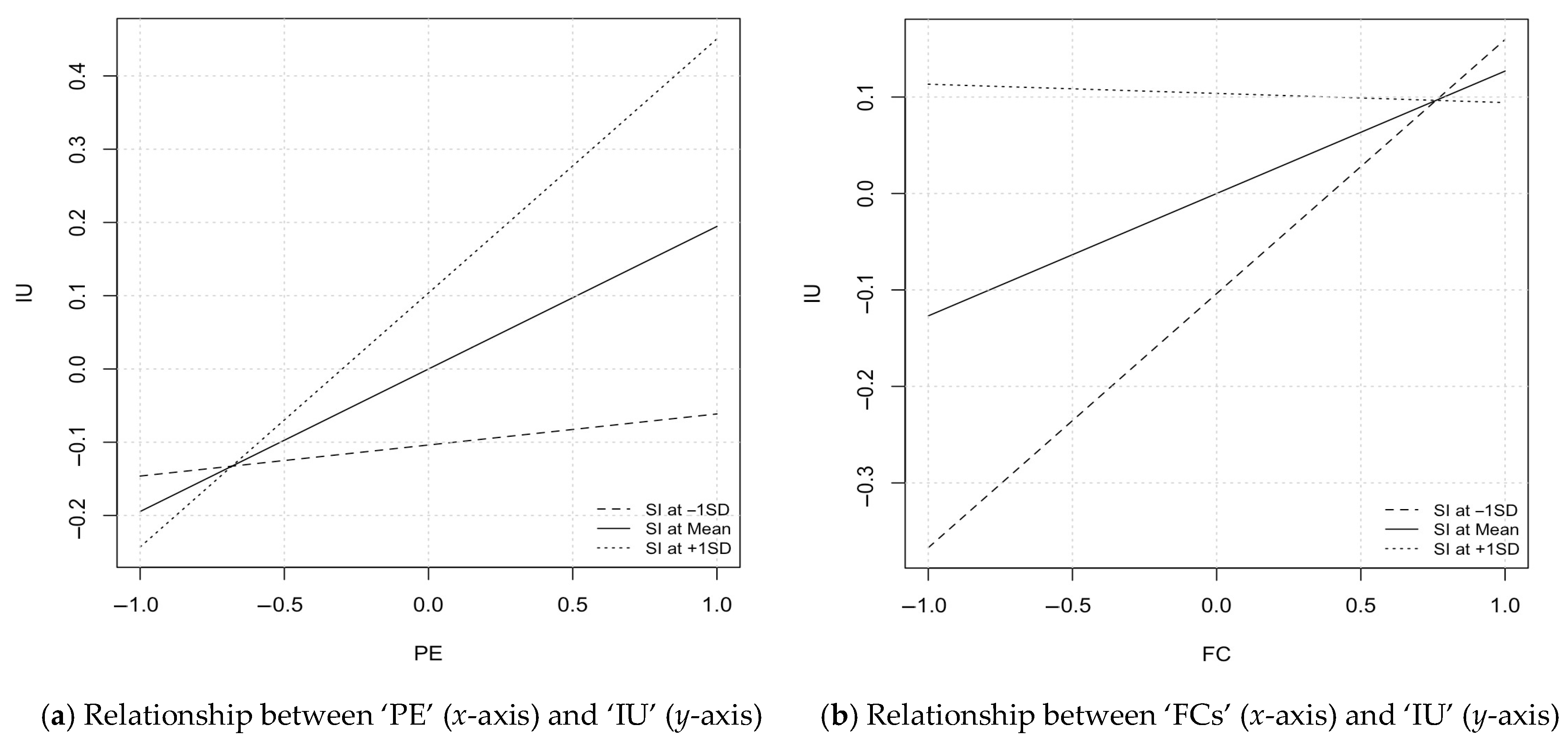

The key findings of this study align with the existing literature on mobile payment technology acceptance. Furthermore, analyzing the moderating effect of SI on users’ intention to adopt DWs, we found that strong SI can have a dual impact—reinforcing and weakening the relationship between factors and dependent variables. High SI strengthens the relationship between PE and intentions to use DWs for financial services, which has a logical explanation. If friends, family, and the social environment have a significant impact and give a clear signal that “learning to use a DW is easy”, “it is easy to remember how to make payments with a DW”, “payments with a DW require minimal effort”, “interaction with the DW is clear and understandable”, and “DW is convenient and easy to use”, then it can manifest itself in a growing intention to use DWs.

In turn, the moderating effect of SI on FCs is the opposite—SI weakens the impact of facilitating conditions on users’ intention to adopt DWs. When SI is high, FCs have a lower impact on the intention to adopt DWs, and when SI is low, FCs have a higher impact on users’ intention to adopt DWs for financial services.

This study extends prior research on DW adoption by examining the impact of various behavioral and technological determinants, e.g., PU, PE, FCs, and PT, on users’ behavioral intention. This study contributes to the theoretical development of the TAM by integrating SI as a moderating variable rather than treating it solely as a direct predictor. This nuanced role enhances our understanding of how SI interacts with other constructs like PU, PE, FCs, and PT. By focusing on DWs, this research contextualizes general adoption theories within a financial technology setting, offering insights specific to mobile payment behavior in the digital economy. This study adds to the limited research on DW adoption in Baltic contexts, highlighting how social norms and peer influence may vary across regions and affect adoption differently. The findings support the idea that behavioral intention is not only shaped by individual perceptions but also by external social pressures, reinforcing the importance of social context in digital behavior research.

The practical implications of this study are related in several directions. First, regarding marketing and communication strategies, businesses and fintech providers can leverage SI by promoting peer recommendations, testimonials, and influencer endorsements to boost adoption rates. Campaigns that highlight community usage or social approval may be more effective. Second, related to policy and regulatory design, policymakers aiming to increase digital financial inclusion can design awareness programs emphasizing social proof and community-level benefits, especially in regions where trust in digital finance is still developing. Third, understanding that SI moderates adoption behavior regarding user segmentation and personalization allows service providers to tailor strategies for different user segments, e.g., targeting younger users with peer-driven campaigns and older users with trust-based messaging. Fourth, regarding the design of DW platforms, developers can integrate social features (e.g., sharing transactions, referral systems, social rewards) into DW apps to capitalize on SI and encourage network effects. Fifth, regarding cross-cultural strategy development, for multinational fintech firms, recognizing the varying strength of SI across cultures can inform localized strategies that align with regional social norms and behaviors.

This study has several limitations. First, this study used convenience sampling to collect data on DW adoption, which presents certain limitations. While this approach enabled efficient access to participants and facilitated timely data collection, it may have introduced selection bias, as the participants were selected based on their availability and willingness to participate. As a result, the sample may not fully represent the broader population of DW users, particularly regarding demographic diversity, technological literacy, or financial behavior. Consequently, the generalizability of the findings is limited, and caution should be exercised when applying these results to other contexts or populations.

A comparison between countries is outside the scope of this study. Future research should explore how cultural and demographic differences influence the adoption and recommendation of DW services in the context of the European Union. Employing a larger and more diverse sample could yield broader insights and potentially different outcomes. Second, regarding the data collection method, this research was conducted through a cross-section, which does not allow for analyzing the evolution of users’ behavior over time. A longitudinal study would allow us to verify the robustness of the established relationships. Future research could also explore and compare users’ behaviors before and after adoption, examining how these behavioral shifts influence the continued use of DWs. Finally, given the complexity of user behavior, we propose the inclusion of new variables that allow us to better define intention to use financial technologies. Future research could incorporate additional variables, such as hedonic motivation, price value, and perceived risk, and examine the moderating effects of demographic factors, which have not yet been thoroughly investigated and can provide significant insights.