Abstract

Ethereum is being utilized in various ways, including smart contracts and payments. Research in cryptocurrency payments has either been general, about all cryptocurrencies or focused primarily on Bitcoin. Despite some similarities with Bitcoin, Ethereum is a different technology with different governance and support. This research focuses on payments with the Ethereum token, Ether, and puts forward a model of trust in Ethereum payments. Survey data analyzed using structural equation modeling supports the model. Firstly, the model has three variables from the person’s individual characteristics: The user’s predisposition to using innovations in (a) finance and (b) technology, influence (c) their predisposition to trust in this payment process. There are then five variables from the context: (d) Adoption and reputation, (e) stable value and low transaction fees, (f) effective regulation, (g) trust in the payment intermediaries, and (h) trust in the seller. The personal and contextual factors together influence (i) trust in the Ethereum payment process, and this leads to (j) making a payment with Ethereum.

1. Introduction

This research models trust in Ethereum payments with the Ether token. Ethereum payments require digital wallets, and the process is different from paying in traditional fiat currencies such as the Euro. The use of digital wallets is expected to increase dramatically; some estimates are that it will increase by around 80% from 2023 to 2028 [1].

Cryptocurrencies have been popular for over a decade, but they still face many uncertainties. Despite the progress in regulating them, they still seem more changeable and fluid than traditional finance. There are, however, a variety of cryptocurrencies with different technologies supporting them. Bitcoin seems to lead as a store of value, while Ethereum is strong in executing smart contracts and supporting layer 2 blockchains built on top of it. While Bitcoin dominated in the past with over 80% of the value of the cryptocurrency market, this is now below 60% [2]. Bitcoin is also not the most widely used transaction for payments, as this is Ethereum [3]. Consumers and investors interested in cryptocurrencies can look at a history of over ten years to base their judgment. While investors often invest in a basket of cryptocurrencies, if a consumer wants to make a payment, they must choose the one they trust to make the payment. Trust is necessary as a payment with cryptocurrencies involves some risks. The risks a payment with Ethereum involves are different, so the factors that build trust in Ethereum are also different.

Ethereum is the second largest cryptocurrency by use and the second most valuable of the widely known cryptocurrencies. Similar to Bitcoin, it uses blockchain technology with distributed ledgers. However, unlike Bitcoin, Ethereum does not have a limit on how many tokens can be created. There are also important differences in the governance and how new tokens are created. The approach to scaling and the ecosystem around these two main cryptocurrencies are also different. These differences could be summarized as Bitcoin being closer to a traditional currency, and Ethereum being closer to a technology platform. Most of the research on Ethereum seems to focus on the smart contract functionality [4]. It is, however, also used as a payment. A payment with Ethereum not only uses the blockchain technology in a different way, but it may also involve different types of users. Research has shown that this versatile technology attracts different types of users because of the different functionality it offers [5]. It is, therefore, useful to evaluate the payment process with Ethereum and not assume it is the same with other Ethereum processes or Bitcoin payments.

When a person wants to take an action without controlling all the parameters, and some risk is unavoidable, trust is necessary [6,7]. The person must trust that the other people or systems that control the parameters they do not [8] will act in the expected way. Despite the argument that has been made that blockchain-based technologies do not require trust, from the user’s perspective, trust appears to be important when using Ethereum and other cryptocurrencies. As Ethereum has many uses in several different scenarios, there are different forms of trust needed in each of these scenarios. The payment process with Ethereum may have different trust needs than when using an Ethereum smart contract. Based on the issues discussed, the problem statement is that research on trust in cryptocurrencies for payment has focused on Bitcoin, and research on trust in Ethereum has not focused on Ethereum payments. Because of this, it is necessary to identify how trust is created to support a transaction using Ethereum. Therefore, the research question is:

How is trust built in consumer payments with Ethereum?

The main contribution of this research is a model of how trust is built in consumer payments with Ethereum. The model starts with the individual’s predisposition and then covers the factors from the specific context of Ethereum payments. From the person’s individual characteristics, their willingness to innovate in finance and technology has a role. There are then five variables from the contexts: Adoption and reputation, stable value and low transaction fees, effective regulation, payment intermediaries, and trust in the seller. The personal and contextual factors together influence trust in the Ethereum payment process and making a payment with Ether.

The model supported by this research is based on models of trust in payments in other contexts and trust in cryptocurrency payments [9], but it has some important differences. The distinctive nature of Ethereum as a technology and a currency requires some additional variables to capture the complete role of trust.

The theoretic foundation that follows identifies the most relevant literature. The third section presents the research model that is put forward. The fourth section covers the methodology and explains how the sample from France was collected and analyzed. This is followed by the analysis and the discussion of the practical and theoretical implications. Lastly, the limitations and opportunities for future research are outlined.

2. Theoretic Foundation

The literature review covers the characteristics of the payment process with Ethereum and the role of trust in other contexts related to online digital payments.

2.1. Ethereum Payment Process

Making a payment with Ethereum has some important differences from making a payment with Bitcoin, as illustrated in Table 1. The open blockchain technology Ethereum uses to complete a transaction offers certain advantages, but it also has some disadvantages. The advantages of Ethereum for payments include the reliable network, the many people and vendors that use it, and a degree of transparency. The network used is mostly secure but similar to most cryptocurrencies and payment methods, there are some security risks [10,11]. After the move to proof-of-stake, it is one of the most sustainable and environmentally friendly payment methods [12]. There are several disadvantages, starting from that the payments are not free and not instantaneous. Another important disadvantage is that if the consumer decides to return the product they purchased, the vendor may return the cost of the product, but the cost of the Ethereum transaction, known as ‘gas money,’ is not refunded by the Ethereum network. Lastly, as with most cryptocurrencies apart from stablecoins, the value of Ethereum can change regularly [13].

Table 1.

Differences between Ethereum and Bitcoin.

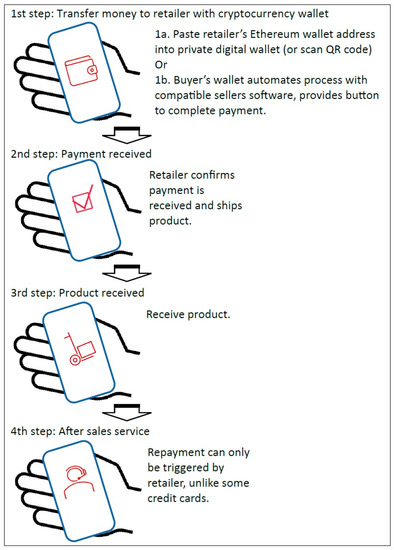

2.2. Payment Process

For an Ethereum payment to be made by someone who has not done it before, they must first obtain an electronic wallet that can store and use the Ethereum token Ether (either control the Ether directly or indirectly) or a bank card that supports Ether. Once this is done, the purchase can be made, and Ether can be transferred to the vendor. If the consumer is using an electronic wallet without additional integration with the vendor, then they must (1a) paste the seller’s Ethereum wallet address into a private digital wallet (or scan a QR code). If the consumer’s electronic wallet has software from an intermediary that coordinates and automates the process with compatible software on the seller’s side, (1b) a button can be provided to complete payment [14]. The button for the payment replaces the manual process of copying the seller’s address. (2) The second stage is that the retailer confirms they received the payment. (3) After the consumer receives the product, the final stage is (4) after-sales service. If they need a refund, they will receive Ether in their electronic wallet or bank card. The payment process with four stages is illustrated in Figure 1.

Figure 1.

Consumer journey to make a payment using Ethereum.

If the payment follows the process of 1a or 1b, this may influence trust and how it is built. The process 1a builds trust through self-ownership and decentralization, while 1b builds trust through integration and institutional trust. There may be consumers who prioritize either independence or ease of use more, but there may also be those who hope to strike a balance between them.

In addition to the typical payment scenario, there are some variations such as (i) having a payment provider integrated into the electronic wallet, for example, MetaMask and PayPal [15], (ii) using a crypto debit card to convert crypto to cash, (iii) using a card that uses Ether but makes the payment in fiat currency (e.g., BitPay Card), and (iv) buying gift cards with Ether and making the purchase with the gift card.

The electronic wallet not only speeds up the process for the consumer but also masks what is happening to some degree. In order to make a payment with a cryptocurrency utilizing blockchain, the consumer needs their public key, their private key, and the address they are making a payment. The electronic wallet stores the private key and utilizes it to make payments. The cryptocurrency the consumer owns is technically stored on the blockchain and not in the wallet, but the wallet makes it easy to use [16].

2.3. Trust in Payments

Most payment methods involve some risk. The payment process, with four stages, already discussed and illustrated in Figure 1, also involves several risks for the consumer. The traditional payment scenario, using cash and receiving the product immediately, involves far less risk compared to payment methods that require several technologies to work and have some delay in receiving the product. Each consumer will evaluate the payment situation in their own way using their own individual psychology. Along with the individual’s psychology, the characteristics of the payment scenario have an influence. This distinction between psychological factors and the sociological factors of the context is prevalent in many models of trust [17]. The typical variables that capture personal psychology in similar situations are the person’s predisposition to innovative products and trust [18]. The characteristics of the situation can include some institutions that influence the transaction [17]. In addition to institutions that influence the payment process in some way, the technology itself requires trust [8].

The dimensions of trust related to payments are predisposition to trust, institutional trust, trust in the seller, and trust in the payment provider or currency. Several aspects of a person’s predisposition have an influence on trust [19]. Predisposition to trust can play a role along with institutional trust [18]. Institutional trust reduces uncertainty, builds on the legal and regulatory framework, and can be complementary to trust in the seller [20]. For trust in the seller, seller characteristics such as reputation and brand characteristics are influential [21]. Research into trust in the payment provider and currency being used has found that trust and the usefulness and ease of use of a technology are important [22] and that consumer trust leads to repeated purchases [23].

The first peer-reviewed research published adapting these theories on trust to cryptocurrencies made some adjustments to capture the role of the different contexts of cryptocurrencies better [9]. This model asked participants about Bitcoin and may not fully capture the idiosyncrasies of Ethereum payments. The literature review supports that Ethereum payments may have some similarities, but they also have some differences from other cryptocurrency payments and should be researched separately.

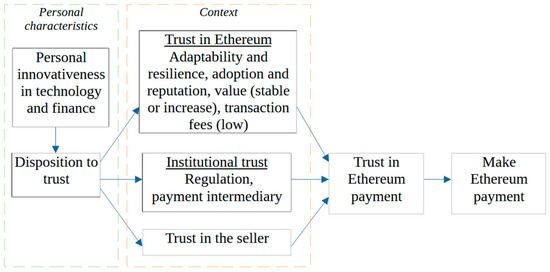

3. Research Model

This research puts forward a model of trust in Ethereum payments with twelve variables as summarized in Figure 2. Firstly, there are three variables from the person’s individual characteristics: The user’s predisposition to using innovations in (a) finance and (b) technology influence (c) their predisposition to trust in this payment process. There are then seven variables from the contexts: (d) Adaptability and resilience, (e) adoption and reputation, (f) stable value, (g) low transaction fees, (h) regulation, (i) payment intermediaries, and (j) trust in the seller. The personal and contextual factors together influence (k) trust in the Ethereum payment process, and this leads to (l) making a payment with Ethereum.

Figure 2.

Initial research model of trust in Ethereum payments.

The hypotheses for the person’s individual predisposition to adopt innovations are discussed first. It was identified many years ago that users have a predisposition to adopt new innovations in technology [24]. With the emergence of Fintech and the increasing rate of financial innovation, it is useful to distinguish between personal willingness to adopt innovations in technology and willingness to adopt innovations in finance, as a consumer may have a stronger predisposition to one of them. The user’s predisposition to using innovations in (a) finance and (b) technology [24,25] influence (c) the person’s predisposition in this context. Therefore, the first two hypotheses are:

Hypothesis 1a.

A consumer’s predisposition to utilizing innovations in finance reinforces their predisposition to trust.

Hypothesis 1b.

A consumer’s predisposition to utilizing innovations in technology reinforces their predisposition to trust.

Hypotheses for the person’s individual predisposition to trust: Individual disposition to trust, sometimes referred to as a trusting stance [21], or more generally as the individual’s characteristics in relation to trust, is widely used to capture a consumer’s trust when purchasing online. The individual’s predisposition to trust influences all the contextual factors related to trust. Both the individual characteristics and the contextual characteristics shape trust. Therefore, the second, third, and fourth hypotheses are:

Hypothesis 2.

A consumer’s predisposition to trust reinforces their trust in (a) adaptability and resilience, (b) adoption and reputation, (c) stable value, and (d) low transaction fees.

Hypothesis 3.

A consumer’s predisposition to trust reinforces their trust in the (a) Ethereum regulation and (b) an Ethereum payment intermediary.

Hypothesis 4.

A consumer’s predisposition to trust reinforces their trust in the seller to whom they will make the payment.

Hypotheses for the influence of the context on trust in the payment: The four dimensions of trust in Ethereum influence trust in the payment. The history of cryptocurrencies so far has been characterized by instability, with regularly emerging and failing cryptocurrencies. The currencies that show adaptability to technological, regulatory and other changes, and resilience to economic and other challenges, are trusted more by the consumer as the value of Ethereum and Bitcoin illustrate. Based on the theory of diffusion of innovation and network effects [26], technology that has increasing adoption and reputation creates momentum and a positive feedback loop. Cryptocurrencies have been shown to be trusted more when they are widely adopted, and they have a positive reputation [5]. Cryptocurrencies, in a similar way to traditional currencies, must have a stable or increasing value and low transaction fees to create a reliable and transparent payment process that increases trust. Therefore, the following four hypotheses are:

Hypothesis 5a.

High adaptability and resilience of Ethereum strengthen trust in the Ethereum payment.

Hypothesis 5b.

High adoption and reputation of Ethereum strengthen trust in the Ethereum payment.

Hypothesis 5c.

The value of Ether increasing, strengthens trust in the Ethereum payment.

Hypothesis 5d.

Low transaction fees for the Ether payment strengthen trust in the Ethereum payment.

The institutions tasked with regulating payments create a secure, transparent environment that strengthens trust [27]. Payment intermediaries are often used when making Ethereum payments as they offer various benefits, such as making the process simpler and more secure. Trust in the institutions that regulate or serve as intermediaries, therefore, supports trust in the whole payment process:

Hypothesis 6a.

Trust in the regulation of Ethereum strengthens trust in the Ethereum payment.

Hypothesis 6b.

Trust in the Ethereum payment intermediary strengthens trust in the Ethereum payment.

The buyer is at risk from the seller in several ways, including the quality of the product or service, how personal information will be handled, and whether payment information will be kept secure [28]. If there is trust in the seller, this will also strengthen trust in the payment process:

Hypothesis 7.

Trust in the seller strengthens trust in the Ethereum payment.

The final hypothesis attempts to verify that trust does indeed influence the decision to make the payment. There is extensive support in the literature that a consumer’s trust in a process strengthens the possibility of the consumer following that process [29]. This should also apply to making a purchase with Ethereum:

Hypothesis 8.

Trust in Ethereum payment positively influences making the Ethereum payment.

4. Materials and Methods

4.1. Procedure

As the literature has a strong theoretical foundation, a quantitative method is applied to test the model developed. The model is analyzed with Structural Equation Modeling and Partial Least Squares (SEM-PLS) using the SmartPLS 4 software [30]. This method is particularly well suited for modeling consumer behavior when using technology due to the use of latent variables that can capture more nuanced beliefs that are hard to measure directly. The first stage of the analysis was evaluating the relationship between the latent variables and their three observed variables. The second stage was to measure the relationships between the latent variables.

4.2. Study Context and Sample

The context the method evaluates is a consumer making a purchase with Ethereum. Data was collected by survey. Participants with experience making payments with Ethereum were allowed to complete the survey. The participants were all French residents, so the influences from differences in regulations and culture were limited. No financial reward was given.

Before the survey started, there was a question asking the participants if they were over eighteen and if they had experience using Ethereum. A negative answer to any of these would result in them not being allowed to participate. The first part of the survey asked some basic questions about Ethereum that someone who had used it would be expected to know. The purpose of these questions was to check that the participant had indeed used Ethereum. The subsequent questions covered the eight hypotheses that form the model. Each question includes a Likert scale from 1, representing a strong disagreement, to 7, representing a strong agreement. The final section of the survey includes questions on the participant’s demographic characteristics. The demographic characteristics of the participants are presented in Table 2.

Table 2.

Participants demographic profile.

The minimum sample size was calculated based on the guidance in the seminal handbook on applying SEM-PLS [30] and by using the G*Power 3.1.9.7 software [31]. Based on the guidance from the seminal handbook, as the maximum number of observed variables for one latent variable is three, for a minimum R2 of 0.10 and a significance level of 1%, the minimum sample size is 191. The parameters given to the G*Power software were that the model tested would have a statistical power of 95%, and there were twelve latent and thirty-six observed variables. The minimum sample size recommended is 185.

The survey was implemented online over a period of one month. It was completed 427 times, of which 386 are considered valid. Checks excluded 41 submissions for several reasons, such as because they were completed unreasonably quickly or they chose the same response for all questions. The extensive demographic information indicates that the sample is sufficiently representative of consumers. Several tests were implemented to explore possible variations in the responses based on the demographic information, but no significant difference was found.

4.3. Operationalization of Model Variables

The scales used are adapted from literature sources, as illustrated in Table 3. Three observed variables are used to capture the value of each latent variable. As some latent variables cannot be measured accurately directly, three observed variables are considered sufficient to capture different aspects of them that together give an accurate representation [30].

Table 3.

The variables and the research the survey questions were adapted from.

5. Results

The measurement model is presented first, followed by the structural model.

5.1. Measurement Model

The measurement model applies several statistical tests to achieve some clarity on whether the observed variables do indeed measure their latent variable [30]. The initial exploration of the measurement model found that stable value ‘V’ and low transaction fees ‘L’ were very close statistically. Given that they are also close theoretically, as they refer to the financial cost of the transaction, they were merged. The measurement model was then re-evaluated with them merged. Refining a model during an iterative exploration is a valid approach and one of the main reasons to use SEM-PLS [30]. The first two tests of the refined model measure the convergent validity by evaluating the factor loadings and Average Variance Extracted (AVE). As the lowest factor loading is 0.972, they are all over the minimum of 0.7. The lowest Average Variance Extracted (AVE) is 0.960, so they are all higher than the lowest acceptable level of 0.5. The following test, Composite Reliability (CR), measures the reliability of the latent variables and must be above 0.7. As illustrated in Table 4, all the values are higher, with the lowest being 0.979. The next step is to evaluate if there is enough discriminant validity between the latent variables. The Fornell–Larcker criterion presented in Table 5 illustrates that the latent variables are sufficiently distinct. All the tests implemented show strong support for the validity of the measurement model.

Table 4.

Analysis for convergent validity, consistency, and reliability.

Table 5.

Analysis for discriminant validity.

5.2. Procedure

The structural model focuses on finding support for the relationships between the latent variables [30]. The results are presented in Table 6 and Table 7. R-square, the coefficient of determination is strong, above 0.75 for ‘P’, ‘I’ and ‘E,’ and moderate, from 0.50 to 0.75, for the rest, ‘A’, ‘D’, ‘V’, ‘R’ and ‘S’ [36]. The effect size (ƒ2) is strong, over 0.35, or moderate, over 0.15, for most variables, as illustrated in Table 6. Two variables are considered insignificant by this test as they are below 0.02. The first one, ‘V,’ is close to the threshold to be significant with 0.013, and the second, ‘A,’ has a very small effect size of 0.001 [30]. To assess the p-values of the path coefficients, bootstrapping with 5000 samples was implemented, as illustrated in Table 6. The model fit is not the focus of SEM-PLS, but once the rejected variable ‘A’ was taken out, the Normed Fit Index (NFI) model fit measure suggested a sufficient fit as the value of 0.912 is above the threshold of 0.9.

Table 6.

Results of the structural model.

Table 7.

Summary of hypotheses and results.

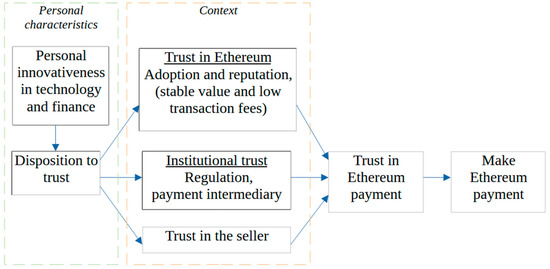

6. Discussion and Conclusions

This research developed and tested a model of trust in Ethereum payments, TRUSTEP presented in Figure 3. The model is developed based on research on trust in e-commerce and trust in cryptocurrencies. It is tested with a sample of 386 adult participants from France. The structural equation modeling finds support for the model proposed. Several similarities to other forms of payment are found, but also some important differences that need special consideration. This model makes a theoretical and practical contribution outlined below.

Figure 3.

Model of trust in Ethereum payments, TRUSTEP.

6.1. Theoretical Contribution

This research extends the literature on trust and cryptocurrencies to payments using the Ethereum blockchain and Ether token [19,22,23]. This advances research because previous literature on cryptocurrency payments focused on Bitcoin, while the literature on Ethereum focused on other uses, such as its ability to support smart contracts, its role in DeFi, and staking [37,38].

The analysis finds support for the model of trust in Ethereum payments with ten variables. One variable, adaptability and resilience, is removed from the initial model because it does not have a strong enough effect on trust. Both the person’s individual characteristics and the context particular to making a payment with Ethereum play a role. There are three variables from the person’s individual characteristics: The user’s predisposition to using innovations in (a) finance and (b) technology influence (c) their predisposition to trust in this payment process. There are then five variables from the contexts: (d) adoption and reputation, (e) stable value and low transaction fees, (f) effective regulation, (g) trust in the payment intermediaries, and (h) trust in the seller. The personal and contextual factors together influence (i) trust in the Ethereum payment process, and this leads to (j) making a payment with Ethereum.

While the model has similarities to previous models of trust, such as the role of each individual’s psychological predisposition [35,36] and the role of reputation [37,38], the role of institutions such as regulators and the importance of trust in the retailer, the distinct characteristics of Ethereum also play a role. In fact, the factors related to the distinct characteristics of Ethereum have the strongest support based on the average of the responses. This research can be added to a growing body of research on trust that illustrates how users’ beliefs in each cryptocurrency need to be explored separately.

Furthermore, the role of the organizations involved in the payment process is shown. While trust in the retailer is usually a factor in retail payments, the regulators and payment intermediaries are not always a significant factor, so it is a theoretic contribution to show that this is the case here [39].

6.2. Practical Contribution

The TRUSTEP model demystifies the use of Ethereum in payments for all stakeholders. It is no longer a black box or a different world where completely different rules apply. Demystifying the consumer beliefs behind Ethereum payments can be seen as being in line with the maturing of this technology and moving gradually from a narrow niche to a more mainstream phenomenon. There are similarities with regular online payments and Bitcoin payments, but there are also some differences. The model informs both how payment technology can be implemented and how its implementation can be communicated to consumers.

The retailer accepting an Ethereum payment can see their role in building trust in the payment, but also the role of the regulation and Ethereum itself. Therefore, the retailer knows that they can influence trust, and they also know that the regulations in their country and the current state of Ethereum play a role. If the regulation and the current situation of Ethereum are favorable, then less weight will fall on them to build trust in this process. Similarly, if the regulation and the current situation of Ethereum are less favorable, then more weight falls on the retailer. Appreciating the role of the different stakeholders allows the retailer to use their finite resources more wisely.

In a similar way, the regulators gain a more nuanced understanding of trust in Ethereum payment and will be able to predict the effect of their regulations on this process better. From the perspective of public policy, demystifying how trust in Ethereum works can make financial policy more effective. Governments around the world are exploring how to develop the most effective policy on Fintech and payment processes, including Central Bank Digital Currencies (CBDC).

Lastly, organizations in finance and Fintech that often provide several currencies and transaction methods gain a more granular understanding of when to treat Ethereum the same and when to treat it differently.

6.3. Limitations and Future Research

The first limitation and avenue for future research is that the sample is from one European country, France; thus, the model can be tested in other countries. The second limitation is that the model was developed specifically for Ethereum; future research can test it with other cryptocurrencies. While some variables should be influential across several cryptocurrencies, the role of institutions such as the regulators and the intermediaries may be different.

Funding

This research received no external funding.

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Data is unavailable due to privacy restrictions.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Juniper Research. Digital Wallets Transaction Value to Surpass $16 Trillion Globally by 2028; Driven by Advanced Services. 2023. Available online: https://www.juniperresearch.com/press/digital-wallets-transaction-value-16-trillion-2028?ch=digitalwallet (accessed on 20 September 2023).

- CoinMarketCap. Global Cryptocurrency Charts. CoinMarketCap. 2023. Available online: https://coinmarketcap.com/charts/ (accessed on 20 September 2023).

- Statista. Number of Daily Cryptocurrency Transactions by Type. 2023. Available online: https://www.statista.com/statistics/730838/number-of-daily-cryptocurrency-transactions-by-type/ (accessed on 29 May 2023).

- Rameder, H.; di Angelo, M.; Salzer, G. Review of Automated Vulnerability Analysis of Smart Contracts on Ethereum. Front. Blockchain 2022, 5, 1–20. [Google Scholar] [CrossRef]

- Wu, J.; Huang, B.; Liu, J.; Li, Q.; Zheng, Z. Understanding the dynamic and microscopic traits of typical Ethereum accounts. Inf. Process. Manag. 2023, 60, 103384. [Google Scholar] [CrossRef]

- McKnight, H.; Choudhury, V.; Kacmar, C. The impact of initial consumer trust on intentions to transact with a web site: A trust building model. J. Strateg. Inf. Syst. 2002, 11, 297–323. [Google Scholar] [CrossRef]

- McKnight, H.; Chervany, N.L. What Trust Means in E-Commerce Customer Relationships: An Interdisciplinary Conceptual Typology. Int. J. Electron. Commer. 2002, 6, 35–59. [Google Scholar] [CrossRef]

- Lankton, N.; McKnight, H.; Tripp, J. Technology, Humanness, and Trust: Rethinking Trust in Technology. J. Assoc. Inf. Technol. 2015, 16, 880–918. [Google Scholar] [CrossRef]

- Zarifis, A.; Efthymiou, L.; Cheng, X.; Demetriou, S. Consumer Trust in Digital Currency Enabled Transactions. Lect. Notes Bus. Inf. Process. 2014, 183, 307–317. [Google Scholar] [CrossRef]

- Tan, R.; Tan, Q.; Zhang, Q.; Zhang, P.; Xie, Y.; Li, Z. Ethereum fraud behavior detection based on graph neural networks. Computing 2023, 105, 2143–2170. [Google Scholar] [CrossRef]

- Xu, G.; Guo, B.; Su, C.; Zheng, X.; Liang, K.; Wong, D.S.; Wang, H. Am I eclipsed? A smart detector of eclipse attacks for Ethereum. Comput. Secur. 2020, 88, 101604. [Google Scholar] [CrossRef]

- De Vries, A. Cryptocurrencies on the road to sustainability: Ethereum paving the way for Bitcoin. Patterns 2023, 4, 100633. [Google Scholar] [CrossRef]

- Wang, J.; Ma, F.; Bouri, E.; Guo, Y. Which factors drive Bitcoin volatility: Macroeconomic, technical, or both? J. Forecast. 2022, 42, 970–988. [Google Scholar] [CrossRef]

- PayPal. Using PayPal as a Payment Method within Your External Crypto Wallet. 2023. Available online: https://www.paypal.com/us/cshelp/article/using-paypal-as-a-payment-method-within-your-external-crypto-wallet-help946 (accessed on 20 September 2023).

- MetaMask. Buy: Fund Your Wallet Easily. MetaMask News. 2023. Available online: https://metamask.io/news/latest/buy-fund-your-wallet-easily/ (accessed on 20 September 2023).

- Watters, C. When Criminals Abuse the Blockchain: Establishing Personal Jurisdiction in a Decentralised Environment. Laws 2023, 12, 33. [Google Scholar] [CrossRef]

- Gefen, D. TAM or Just Plain Habit: A Look at Experienced Online Shoppers. Int. J. End User Comput. 2003, 15, 1–3. [Google Scholar] [CrossRef]

- McKnight, D.H.; Kacmar, C.; Choudhury, V. Dispositional Trust and Distrust Distinctions in Predicting High- and Low-Risk Internet Expert Advice Site Perceptions. e-Serv. J. 2004, 3, 35. [Google Scholar] [CrossRef]

- Bansal, G.; Zahedi, F.M.; Gefen, D. The impact of personal dispositions on information sensitivity, privacy concern and trust in disclosing health information online. Decis. Support Syst. 2010, 49, 138–150. [Google Scholar] [CrossRef]

- Patnasingham, P.; Gefen, D.; Pavlou, P.A. The role of facilitating conditions and institutional trust in electronic markets. J. Electron. Commer. Organ. 2005, 14, 69–82. [Google Scholar] [CrossRef][Green Version]

- Oliveira, T.; Alhinho, M.; Rita, P.; Dhillon, G. Modelling and testing consumer trust dimensions in e-commerce. Comput. Hum. Behav. 2017, 71, 153–164. [Google Scholar] [CrossRef]

- Pavlou, P.A.; Fygenson, M. Understanding and Predicting Electronic Commerce Adoption: An Extension of the Theory of Planned Behavior. MIS Q 2006, 30, 115. [Google Scholar] [CrossRef]

- Carter, M.; Wright, R.; Thatcher, J.B.; Klein, R. Understanding online customers’ ties to merchants: The moderating influence of trust on the relationship between switching costs and e-loyalty. Eur. J. Inf. Syst. 2014, 23, 185–204. [Google Scholar] [CrossRef]

- Agarwal, R.; Prasad, J. A Conceptual and Operational Definition of Personal Innovativeness in the Domain of Information Technology. Inf. Syst. Res. 1998, 9, 204–215. Available online: https://about.jstor.org/terms (accessed on 20 September 2023). [CrossRef]

- Dang, V.T.; Nguyen, N.; Nguyen, H.V.; Nguyen, H.; Van Huy, L.; Tran, V.T.; Nguyen, T.H. Consumer attitudes toward facial recognition payment: An examination of antecedents and outcomes. Int. J. Bank Mark. 2022, 40, 511–535. [Google Scholar] [CrossRef]

- Rogers, E.M. Diffusion of Innovations; Free Press: New York, NY, USA, 1995. [Google Scholar]

- Söilen, K.; Benhayoun, L. Household acceptance of central bank digital currency: The role of institutional trust. Int. J. Bank Mark. 2022, 40, 172–196. [Google Scholar] [CrossRef]

- Daragmeh, A.; Lentner, C.; Sági, J. FinTech payments in the era of COVID-19: Factors influencing behavioral intentions of ‘Generation X’ in Hungary to use mobile payment. J. Behav. Exp. Financ. 2021, 32, 100574. [Google Scholar] [CrossRef] [PubMed]

- Pavlou, P.A. Consumer Acceptance of Electronic Commerce: Integrating Trust and Risk with the Technology Acceptance Model. Int. J. Electron. Commer. 2003, 7, 101–134. [Google Scholar] [CrossRef]

- Hair, J.; Hult, T.; Ringle, C.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM), 3rd ed.; Sage Publishing: Thousand Oaks, CA, USA, 2021. [Google Scholar]

- Erdfelder, E.; Faul, F.; Buchner, A.; Lang, A.G. Statistical power analyses using G*Power 3.1: Tests for correlation and regression analyses. Behav. Res. Methods 2009, 41, 1149–1160. [Google Scholar] [CrossRef]

- Alaklabi, S.; Kang, K. The extended TRA model for the assessment of factors driving individuals’ behavioral intention to use cryptocurrency. Interdiscip. J. Inf. Knowl. Manag. 2022, 17, 125–149. [Google Scholar] [CrossRef] [PubMed]

- Kim, C.; Mirusmonov, M.; Lee, I. An empirical examination of factors influencing the intention to use mobile payment. Comput. Hum. Behav. 2010, 26, 310–322. [Google Scholar] [CrossRef]

- Faria, I. Trust, reputation and ambiguous freedoms: Financial institutions and subversive libertarians navigating blockchain, markets, and regulation. J. Cult. Econ. 2019, 12, 119–132. [Google Scholar] [CrossRef]

- Mendoza-Tello, J.C.; Mora, H.; Pujol-López, F.A.; Lytras, M.D. Social Commerce as a Driver to Enhance Trust and Intention to Use Cryptocurrencies for Electronic Payments. IEEE Access 2018, 6, 50737–50751. [Google Scholar] [CrossRef]

- Chin, W.W. The partial least squares approach to structural equation modelling. In Modern Methods for Business Research; Marcoulides, G.A., Ed.; Lawrence Erlbaum Associates: Mahwah, NJ, USA, 1998; pp. 295–336. [Google Scholar]

- Grassi, L.; Lanfranchi, D.; Faes, A.; Renga, F.M. Do we still need financial intermediation? The case of decentralized finance—DeFi. Qual. Res. Account. Manag. 2022, 19, 323–347. [Google Scholar] [CrossRef]

- Wendl, M.; Doan, M.H.; Sassen, R. The environmental impact of cryptocurrencies using proof of work and proof of stake consensus algorithms: A systematic review. J. Environ. Manag. 2023, 326, 116530. [Google Scholar] [CrossRef]

- Gefen, D.; Pavlou, P.A.; Benbasat, I.; McKnight, H.; Stewart, K.; Straub, D.W. ICIS panel summary: Should institutional trust matter in information systems research. Commun. AIS 2006, 17, 205–222. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).