How to Support Expanding Sales Channels of Agri-Food Products in New Markets: Healthiness and New Experiences of Tunisian Olive Oil

Abstract

1. Introduction

1.1. Background of the Study

1.2. Research Rationale and Aim

1.3. Research Questions

2. Literature Review

2.1. Olive Oil Production

2.2. Healthy Food Experiences and Well-Being

2.2.1. Contribution to Well-Being from Healthy Dining Table

2.2.2. How to Design Effective Marketing Strategies as a New Entrant into a New Market

2.3. Investigation of the New Market and Consumers’ Perceptions: Japanese Market as a Target

2.3.1. Market Entry Modes: Sales Channels

2.3.2. Japanese Food Culture and Perceptions of Products from Emerging Markets

2.3.3. Ethical and Social Values of Producers’ Impact on Food Consumption

2.3.4. Consumer Trust in Food: Olive Oil Production and Quality

2.4. Key Take-Outs and Interview Guide for Data Collection

3. Methodology

3.1. Research Methods and Data Collection

3.2. Sampling

3.3. Data Analysis

4. Findings and Analysis

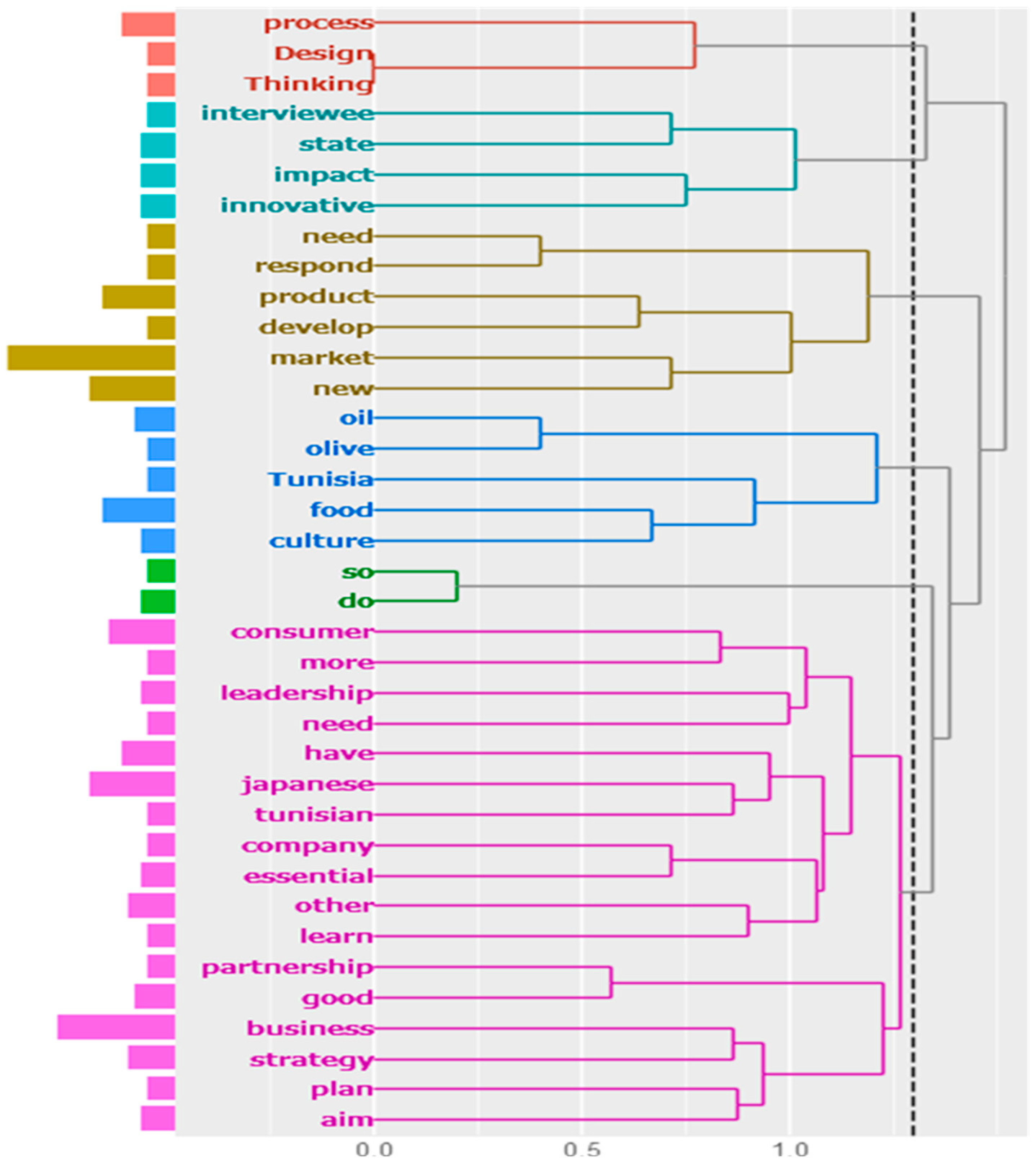

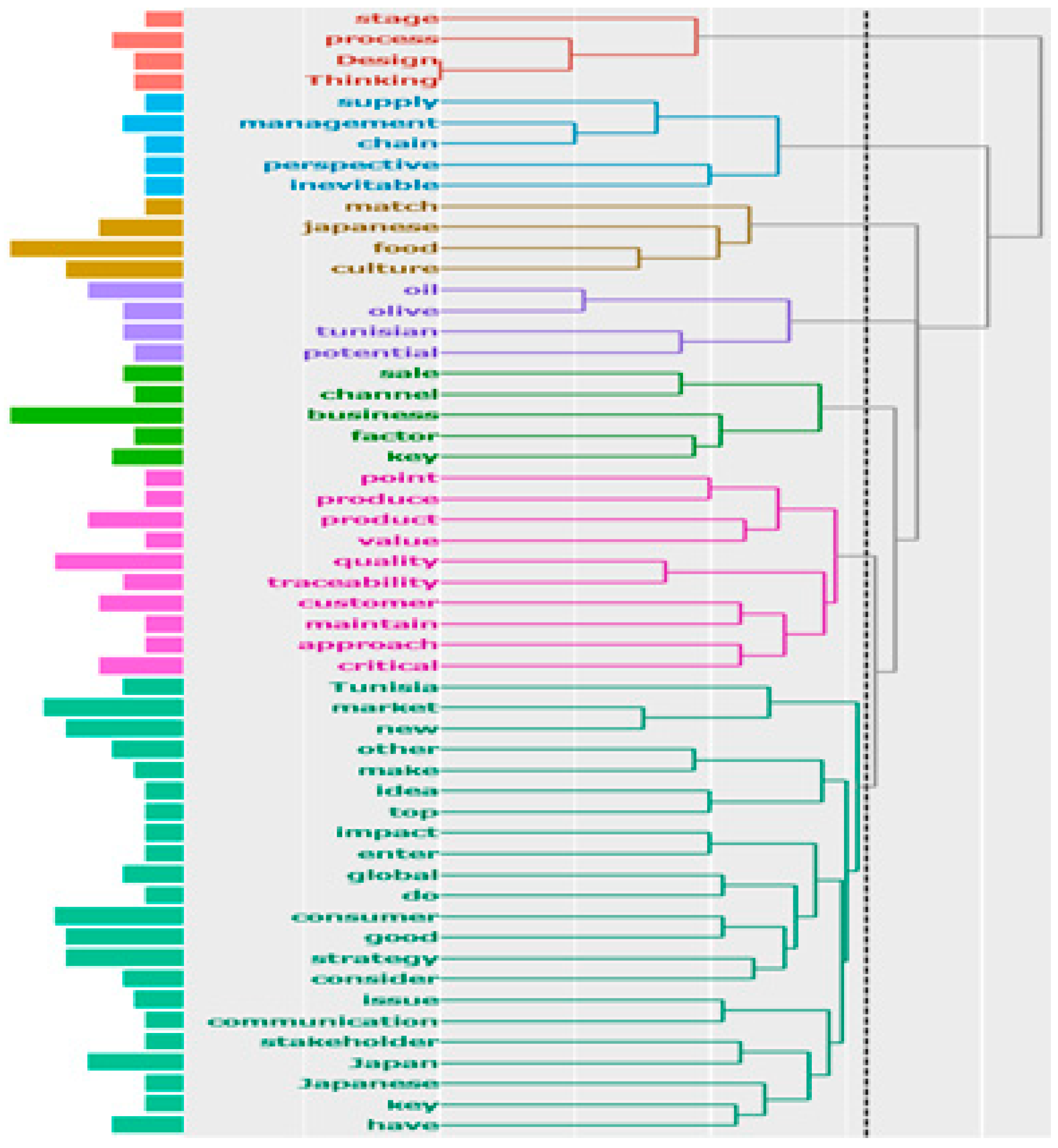

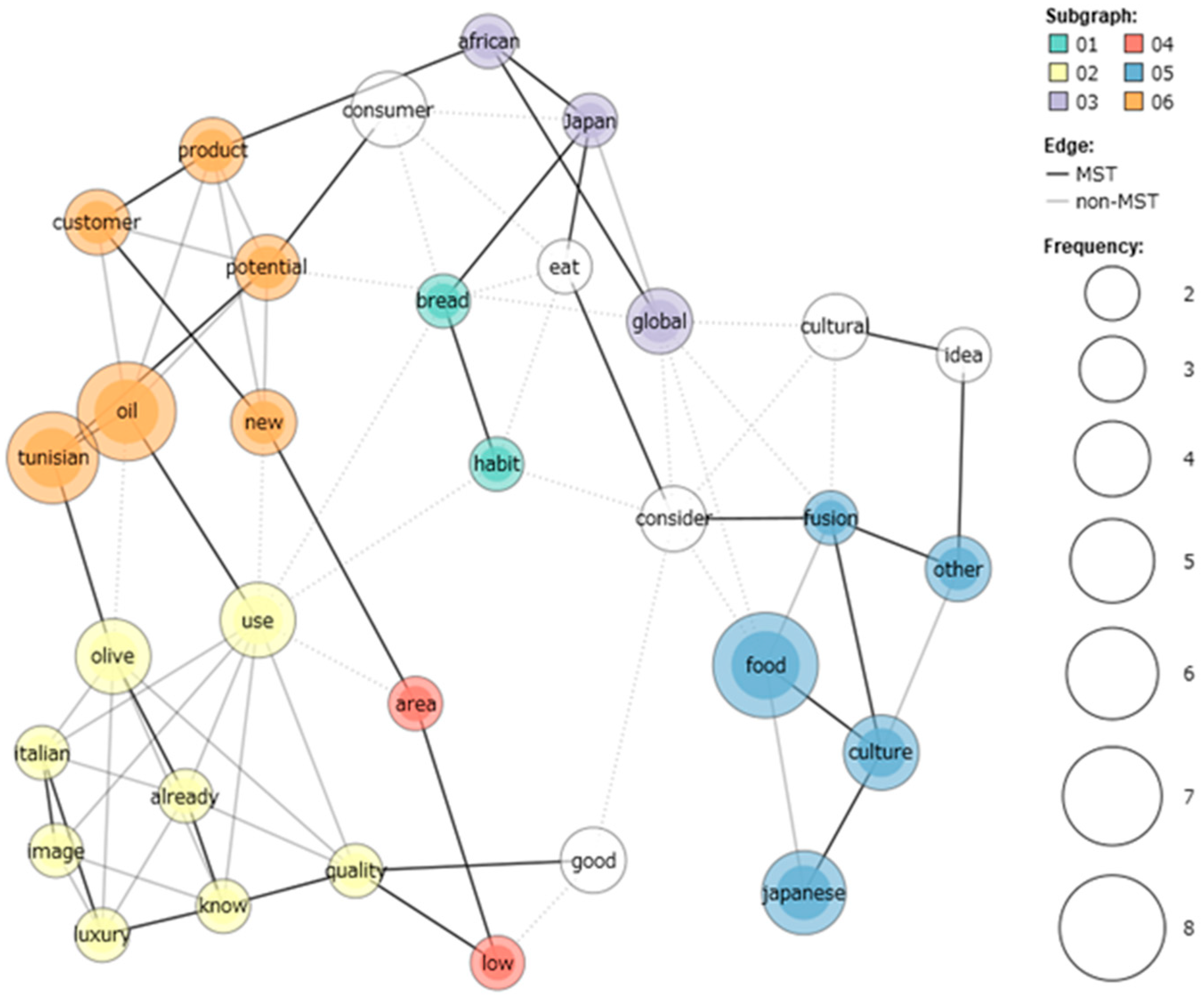

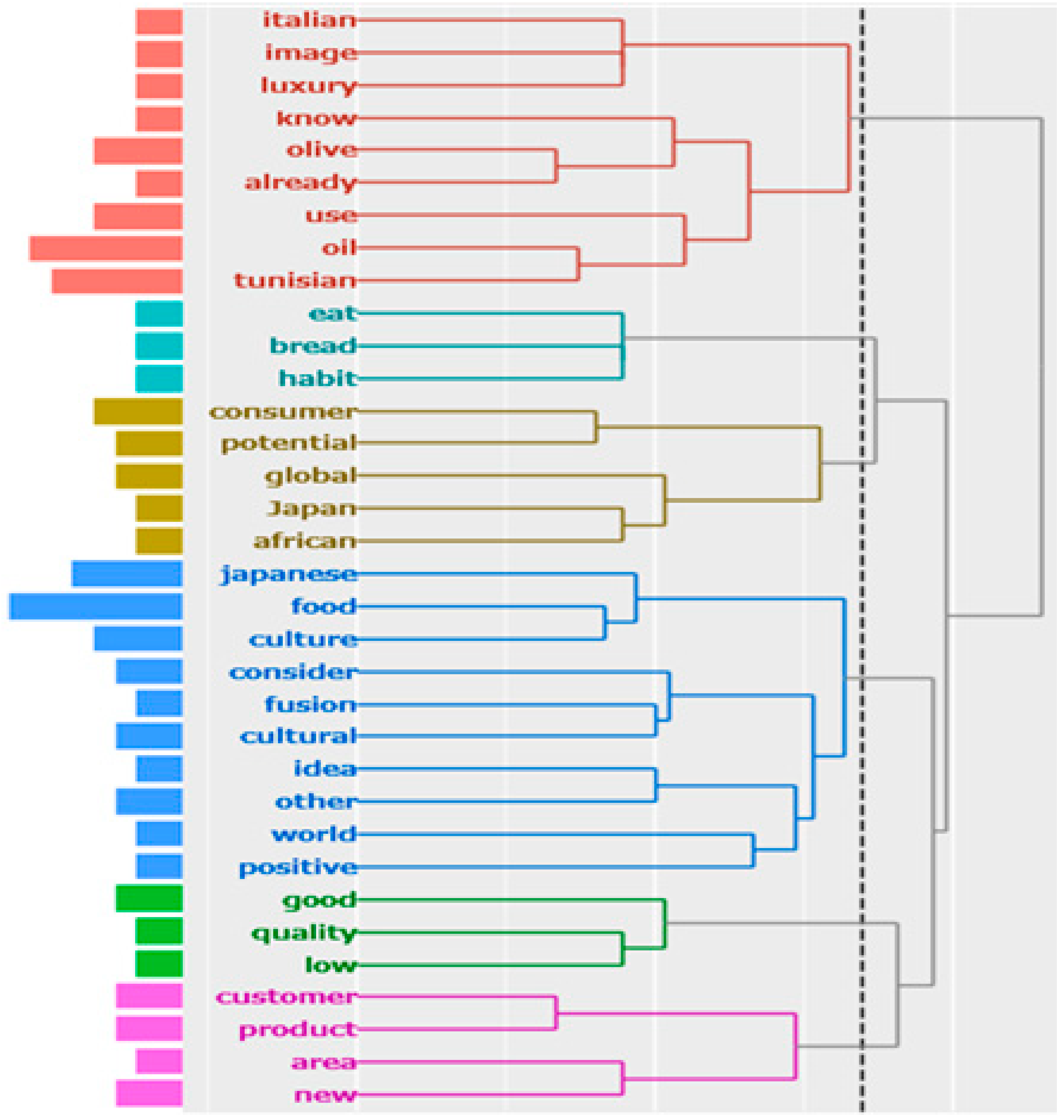

4.1. Text Mining Outcome

4.1.1. Tunisian Supplies’ Perspectives

4.1.2. Japanese Distributors’ Perspectives

4.1.3. Japanese Consumers’ Perspectives

4.1.4. Key Themes Developed from Triangulation of Three Stakeholders’ Perspectives

4.2. Details of Interview Outcome (Tunisian Side)

4.2.1. Tunisian Suppliers’ Perspectives on Entering the New Market

…when I visited Tunisia, the cooking school students tasted a ‘mélange’ with olive oil and Japanese food…It goes well with maki sushi (Sushi roll), Japanese carpaccio, and somen (thin noodles).(T5: Food planner)

Interesting ideas and plans should be examined with a clear purpose by leadership.(T6 Producer A)

…the polyphenol is higher than other Mediterranean products, which is not known in the global market yet.(T7: Producer B)

A mélange of ingredients that match olive oil….must be an attractive experiment for us!(T5: Food Planner)

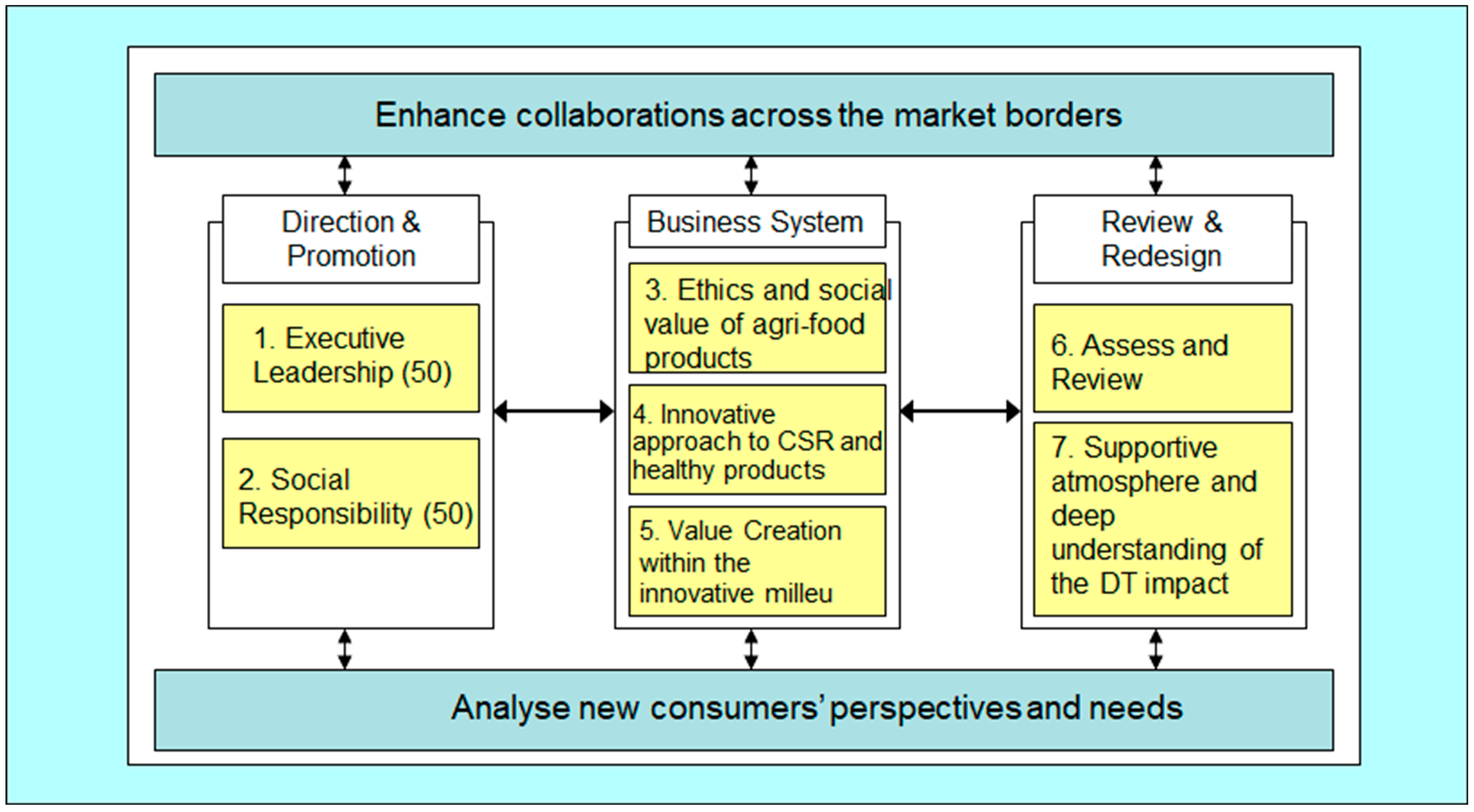

The business system should be evolving based on the review and redesign activities.(T8: Producer C)

4.2.2. Designing Effective Marketing Strategies

When products are launched in a new market, it is important to check and review the planned schedule strategically. In doing so, good partnerships or consortiums are helpful to evaluate the plan.(T8: Producer C)

When we were aiming for the British market, which went well, we planned and designed our strategy with our schedule, which supported our strategic activities. In order to differentiate ourselves from other good brands, mainly from Italy and Spain, we targeted specific consumer groups who are more interested in the ethical attributes of our production process.(T8: Producer C)

It is more important to communicate with Japanese consumers to understand the market’s conditions and requirements, and in doing so, our innovative process to develop suitable product lineups for the new market can be successful.(T3: Olive oil association)

Developing marketing strategies and implementing new products in new markets requires an incessant passion to check, review, and rearrange what we have done.(T6: Producer A)

It was quite a good opportunity for us to have an experimental sale at a department store with other North African food producers (e.g., the North African Food Fair).(T3: Olive oil industry association)

In the process of developing products aimed at the Japanese market, however, more details about consumers views and opinions are essential for our improvement.(T3: Olive oil industry association)

As the production volume and the current sales channel are limited in the global market. Therefore, we should have an experimental partnership to investigate the potential of the Japanese market in the first place.(T6: Producer A)

It should be useful to collaborate with other firms in the region. In cooperation with other members of the business cluster in the regional group, innovative ideas can be nurtured for all.(T7 Producer B)

4.2.3. Business Sustainability and Innovative Attitudes

One thing I can say is that the trigger for our success was 1) specialization and 2) marketing strategies based on a thorough market investigation. Without our motivation to be more innovative to be successful, we cannot achieve our aim.(T8: Producer C)

Perhaps it would be an idea to pay attention to the Muslim religious culture and the values within the organizations.(J1: Business consultant)

Still, not all of the business people in Tunisia know the Japanese markets, but overall, we respect Japanese culture, including their food culture, and we are happy to be considered one of the suppliers in the Japanese market. Mutual communication would be the first step for our businesses in Japan.(T2: Supply chain quality assessor)

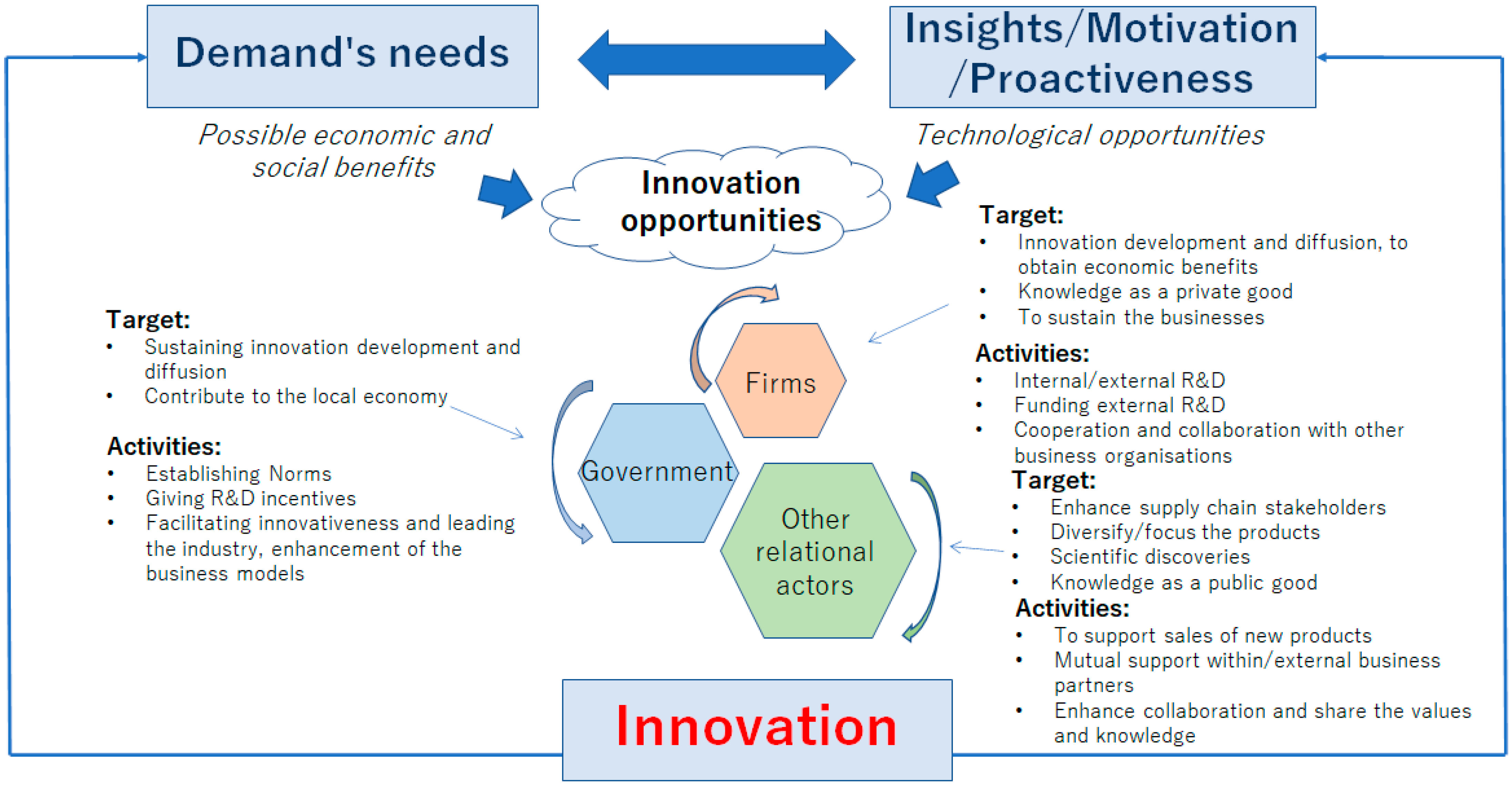

How to develop a new product responding to new markets’ needs and demand.....Establishing partnerships or consortiums should be a good kick-off action, and to do so, the whole industry should be aware of the impact of our new challenge in seeking out the new market.(T1: Business consultant)

It is essential for Tunisian companies to understand the Japanese market and consumers. The first stage of putting the companies into learning mode is essential, and in doing so, collaboration with other "neighbor" firms in the regional area should be helpful.(T4: Adviser)

When designing business strategy, an internal spiral aiming for a better plan is essential. Human resource management, focusing on individual skill development and increasing individual eligibility to respond to the market’s needs, is the primary factor in sustaining business continuity in a competitive situation.(T4: Adviser)

To be able to empathize with customers, training to enhance employees’ abilities and sense of catching markets’ needs and trends should be at the top of the organizational agenda.(T4: Adviser)

Internal communication is essential. A clear vision of the company’s strategy should prevail and be communicated with the employees at an organizational level.(T7: Producer B)

Sharing information about our business strategies in the geographical cluster has contributed to our learning to go forward with innovative actions.(T7: Producer B)

Still, not all of the business people in Tunisia know the Japanese markets, but overall, we respect Japanese culture, including their food culture, and we are happy to be considered one of the suppliers in the Japanese market. Mutual communication would be the first step for our businesses in Japan.(T2: Supply Chain Quality Assessor)

When building business strategy, organizational learning attitudes under the top manager’s leadership are key to success. Especially when seeking out new markets, it is critical to act proactively and communicate with the potential customers in the new market.(J2: SME adviser/management quality assessor)

Organizational behavior in building an entry-mode strategy is critical. Internal strategic actions should be reviewed, tested, and adjusted to respond to the market situation and consumers’ needs. The information should be analyzed and reflected in the business plan. Moreover, an organization itself should learn and process critical market data to build a business strategy.(T1: Business consultant)

How to judge and select relevant issues following the five stages should be an endless business cycle to realize a tailored business strategy responding to the market’s needs based on the learning organization.(J4: Advisor/University Professor)

4.3. Interview with Japanese Stakeholders: Distributors and Consumers

4.3.1. Recommendations Regarding the Sales Channels

The process of entering a new market is critical for all businesses. Aiming to expand sales channels through the human network is a basic strategy for new entrants and an established tactic.(J5: Chairman, Japan Association of Performance Excellence)

The quality of the product as a luxury product and the scarcity of small-lot sales successfully penetrated the UK market. ‘Differentiate strategy’ should be a good plan when entering the Japanese market.(J2: SME adviser/management quality assessor)

For example, there are several examples of holding ‘small-scale matching events’ with restaurants and cooking schools in Tokyo. They are good opportunities for checking each other’s needs and opening new sales channels.(J9: Imported food wholesale and retail B)

North Africa is a potential market that Japan’s JETRO (Japan External Trade Organization, a Japanese government agency) is also paying attention to. It is a priority area where Japan should establish sustainable partnerships in the food industry sector.(J5: Chairman, Japan Association of Performance Excellence)

Since the Italian cuisine boom in Japan in the 1980s, many celebrities have advertised olive oil on TV cooking shows and other programs. It is remarkable in our sales trend, but in order to promote products from emerging markets such as Tunisia, it is indispensable to select age-specific appeal media.(J10: Sales adviser of Food wholesaler)

Women in their 60s and above respond more to shopping sites on the internet such as Rakuten, TV shopping channels, and newspaper inserts than to SNS.(J13: Consumer A)

It is a good idea to focus on top fine restaurants and luxury food stores such as Kinokuniya and Seijo Ishii (Japanese superstores specializing in good-quality food and imported materials).(J8: Imported food wholesale and retail A)

4.3.2. Food Culture and Impact on Purchase Intention of Global Products

Since luxury stores are already occupied by Italian and Spanish olive oil, and Japanese customers prefer the products from southern Europe. It is necessary to consider the age group and eating habits of the targeted customer.(J10: Sales adviser of Food wholesaler)

The flavor is unique and herby, and the slight spiciness that tingles at the back of the tongue stimulates the appetite! This could be a big selling point. How to cover the low awareness of the producing area would be the first challenge.(J2: SME adviser/management quality assessor)

Familiarity is overwhelmingly low. If the quality is good, it could be an idea to raise the profile on TV and other mass media, but recently there have also been SNS and other individual tools to make potential consumers aware of Tunisian olive oil.(J17: Consumer E)

I do not know where Tunisia is, and I do not have the image of luxury goods from there; perhaps I am more of an average majority as a consumer in Japan. It might be nice to eat it directly on bread. However, we don’t have the habit of using olive oil for bread, so what about Japanese dining tables?(J15: Consumer C)

I have been using Italian oil mostly, but the image of Carthage is exotic, and I am interested in using something new from a new area of the world.(J14: Consumer B)

As a pianist, I have been on world tours when I could enjoy global foods that I seldom found in Japan. I like North African food, such as lemon pickles. I cook it at home. I am very positive about using Tunisian olive oil, of which I already know the quality.(J13: Consumer A)

Considering an appeal for ‘good chemistry’ with Japanese food and sake as UNESCO’s intangible cultural heritage could be an idea.(J9: Imported food wholesale and retail B)

How to embed Tunisian ingredients in Japanese food culture needs a communication strategy.(J16: Consumer D)

4.3.3. Japanese Consumers’ Perceptions towards the Ethical and Good Quality of Food Products

The fragrance and deep green color when opened the bottle cannot be experienced with commodity-level olive oil, but the location of Tunisia itself, I don’t know...(J15: Consumer C)

Food safety is my top concern as a mother of young children. I would like to ask how to ensure the quality control of food traveling from North Africa. It is important to make consumers aware of the ethical production behavior and social values of the products.(J3: Cabinet office, advisor)

Recent consumers are clever. Supply chain quality management can be a good point from which consumers’ sympathy and supportive intentions toward good products arise. Consumers are also interested in environmental issues.(J12: Food coordinator: French and Food coordinator: French and Pacific Lim)

Supply chain management perspectives are inevitable (blockchain). How to maintain quality is critical for gaining customers’ trust.(J1: Business consultant)

The challenge is quality control for olive oil. In terms of nutritional value, we should publicize the benefits of eating together.(J6: Nutritionist/University Professor)

Supply chain management is a critical point; further research and guidance on how to implement effective IT support are required.

Furthermore, the supply side should consider how to develop sales strategies in the new markets. Japan is extremely far away from Tunisia. Learning to understand different cultures and consumers should be a key to mutual win-win relations.(J4: Advisor/University Professor)

When we had seminar sessions on quality management of the products, the topic of how to maintain traceability to attain consumers’ trust was raised as the number one issue on the agenda, both from B2B and B2C perspectives.(J11: Tokyo Chamber of Commerce, Japan)

It is inevitable for agribusinesses to consider how to enhance their production and how to attract global consumers. In doing so, the ‘Agtech’ approach is critical to sustain the businesses; IoT, AI, and other technological tools would be essential to making the products’ quality and traceability seamless in the markets.(J7: ICT standardization expert/consultant to smart agribusiness)

In the global age, food culture can be more global with respect for different cultures. Not only are we importing food from overseas to sell it in Japan, but we have also launched collaborative research activities and consortia to support the agribusinesses in the supplier countries. One of the key themes for us currently is how to attract consumers with good quality and trustworthy production processes, including traceability.(J9: Imported food wholesale and retail B)

4.4. Discussion

4.4.1. Overall Findings and Discussion

Lack of information is an issue. I believe there must be good potential customers for Tunisian oil. I am open-minded to new products.(J14: Consumer B)

4.4.2. Conceptual Model

5. Conclusions

5.1. Contribution to Theories and Practices

5.2. Limitations and Further Research Opportunities

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- JICA. Annual Reports 2020. Available online: https://www.jica.go.jp/english/publications/reports/annual/2020/index.html (accessed on 25 August 2022).

- Rejeb, A.; Keogh, J.G. Applying HACCP in the Tunisian Olive Oil Industry: A Theoretical Background. J. Bus. Manag. Econ. Res. 2019, 3, 1–18. [Google Scholar] [CrossRef]

- Yamaoka, Y.; Oe, H. Marketing strategies for agricultural goods in the global market: Emerging market perspectives. In Proceedings of the Annual Conference of Japan Association for Performance Excellence, Tsukuba, Japan, 16 November 2019. [Google Scholar]

- Mills, J.O. An Environment of Olive Oil. 2020. Available online: https://fresh-olive2.com/import/ (accessed on 2 February 2022).

- Olive Oil Sommelier Association Japan. 2022. Available online: https://www.oliveoil.or.jp/ (accessed on 6 September 2022).

- Issaoui, M.; Delgado, A.M. Olive Oil Properties from Technological Aspects to Dietary and Health Claims. In Fruit Oils: Chemistry and Functionality; Springer: Cham, Switzerland, 2019; pp. 85–129. [Google Scholar]

- Kitagawa, T.; Kashiwagi, K.; Isoda, H. Effect of Religious and Cultural Information of Olive Oil on Consumer Behavior. Evidence from Japan. Sustainability 2020, 12, 810. [Google Scholar] [CrossRef]

- Tokudome, S.; Nagaya, T.; Okuyama, H.; Tokudome, Y.; Imaeda, N.; Kitagawa, I.; Kuriki, K. Japanese versus Mediterranean diets and cancer. Asian Pac. J. Cancer Prev. 2000, 1, 61. [Google Scholar] [PubMed]

- Mtimet, N.; Kashiwagi, K.; Zaibet, L.; Masakazu, N. Exploring Japanese olive oil consumer behavior. In Proceedings of the European Association of Agricultural Economists (EAAE) 2008, International Congress, Ghent, Belgium, 26–29 August 2008. [Google Scholar]

- Olsen, N.V. Design Thinking and food innovation. Trends Food Sci. Technol. 2015, 41, 182–187. [Google Scholar] [CrossRef]

- Borsellino, V.; Schimmenti, E.; El Bilali, H. Agri-food markets towards sustainable patterns. Sustainability 2020, 12, 2193. [Google Scholar] [CrossRef]

- Beber, C.L.; Langer, G.; Meyer, J. Strategic actions for a sustainable inter-nationalization of agri-food supply chains: The case of the dairy industries from Brazil and Germany. Sustainability 2021, 13, 10873. [Google Scholar] [CrossRef]

- Rossi, A.; Bui, S.; Marsden, T. Redefining power relations in agrifood systems. J. Rural Stud. 2019, 68, 147–158. [Google Scholar] [CrossRef]

- El Bilali, H. The multi-level perspective in research on sustainability transitions in agriculture and food systems: A systematic review. Agriculture 2019, 9, 74. [Google Scholar] [CrossRef]

- Dridi, J.; Fendri, M.; Ayadi, M.; Jendoubi, F.; Msallem, M.; Larbi, A. Fruit and oil characteristics of Tunisian olive progenies obtained by controlled crosses. J. New Sci. 2019, 62, 3914–3923. [Google Scholar]

- Kitagawa, T. The Experience of Place in the Annual Festival Held in an Amazigh Village in Southern Tunisia. Sustainability 2021, 13, 5479. [Google Scholar] [CrossRef]

- Kotabe, M.M.; Helsen, K. Global Marketing Management; John Wiley & Sons: Hoboken, NJ, USA, 2022. [Google Scholar]

- Addis, M.; Holbrook, M. From food Services to Food Experiences: Eating, Wellbeing, and Marketing. In Food and Experiential Marketing; Interpretative Marketing Research Series; Routledge: New York, NY, USA, 2019; pp. 16–37. [Google Scholar]

- Batat, W. Food and Experiential Marketing; Interpretative Marketing Research Series; Routledge: New York, NY, USA, 2019. [Google Scholar]

- Batat, W.; Peter, P.C.; Moscato, E.M.; Castro, I.A.; Chan, S.; Chugani, S.; Muldrow, A. The experiential pleasure of food: A savoring journey to food well-being. J. Bus. Res. 2019, 100, 392–399. [Google Scholar] [CrossRef]

- Scott, M.L.; Vallen, B. Expanding the Lens of Food Well-Being: An Examination of Contemporary Marketing, Policy, and Practice with an Eye on the Future. J. Public Policy Mark. 2019, 38, 127–135. [Google Scholar] [CrossRef]

- Batat, W.P.; Vicdan, P.; Manna, H. Alternative Food Consumption (AFC): Idiocentric and Allocentric Factors of Influence among Low Socio-Economic Status (SES) Consumers. J. Mark. Manag. 2017, 33, 580–601. [Google Scholar] [CrossRef]

- Batat, W. New paths in researching “alternative” consumption and well-being in marketing: Alternative food consumption. Mark. Theory 2016, 16, 561. [Google Scholar] [CrossRef]

- Nosratabadi, S.; Mosavi, A.; Shamshirband, S.; Kazimieras Zavadskas, E.; Rakotonirainy, A.; Chau, K.W. Sustainable business models: A review. Sustainability 2019, 11, 1663. [Google Scholar] [CrossRef]

- Pegan, G.; Vianelli, D.; de Luca, P. Strategic Entry Modes and Country of Origin Effect. In International Marketing Strategy; Springer: Cham, Switzerland, 2020; pp. 23–38. [Google Scholar]

- Katsikea, E.; Theodosiou, M.; Makri, K. The interplay between market intelligence activities and sales strategy as drivers of performance in foreign markets. Eur. J. Mark. 2019, 53, 2080–2108. [Google Scholar] [CrossRef]

- Bredahl, M.E. Agriculture, Trade, and the Environment: Discovering and Measuring the Critical Linkages; Routledge: London, UK, 2019. [Google Scholar]

- UNESCO Washoku, Traditional Dietary Cultures of the Japanese, Notably for the Celebration of New Year. 2020. Available online: https://ich.unesco.org/en/RL/washoku-traditional-dietary-cultures-of-the-japanese-notably-for-the-celebration-of-new-year-00869 (accessed on 15 August 2022).

- Farina, F. Book Review: Katarzyna J. Cwiertka and Yasuhara Miho (2020) Branding Japanese food: From meibutsu to washoku University of Hawai’i Press (Honululu). J. Contemp. East. Asia 2020, 20, 77–81. [Google Scholar]

- Farrer, J.; Hess, C.; de Carvalho, M.R.; Wang, C.; Wank, D. Japanese culinary mobilities: The multiple globali-zations of Japanese cuisine. In Routledge Handbook of Food in Asia; Routledge: London, UK, 2019; pp. 39–57. [Google Scholar]

- Falk, J.H. Born to Choose: Evolution, Self, and Well-Being; Routledge: London, UK, 2017. [Google Scholar]

- Jang, S.S.; Kim, D. Enhancing ethnic food acceptance and reducing perceived risk: The effects of personality traits, cultural familiarity, and menu framing. Int. J. Hosp. Manag. 2015, 47, 85–95. [Google Scholar] [CrossRef]

- Demangeot, C.; Kipnis, E.; Pullig, C.; Cross, S.N.; Emontspool, J.; Galalae, C.; Best, S.F. Constructing a bridge to multicultural marketplace well-being: A consumer-centered framework for marketer action. J. Bus. Res. 2019, 100, 339–353. [Google Scholar] [CrossRef]

- Paquet, C. Environmental Influences on Food Behaviour. Int. J. Environ. Res. Public Health 2019, 16, 2763. [Google Scholar] [CrossRef]

- Shaw, H.J.; Shaw, J.J. Corporate Social Responsibility, Social Justice and the Global Food Supply Chain: Towards an Ethical Food Policy for Sustainable Supermarkets; Routledge: London, UK, 2019. [Google Scholar]

- Ota, M.; Sakata, Y.; Iijima, T. Fair trade information eliminates the positive brand effect: Product choice behavior in Japan. Asian J. Sustain. Soc. Responsib. 2019, 4, 6. [Google Scholar] [CrossRef]

- Martinuzzi, A.; Schönherr, N. Introduction: The Sustainable Development Goals and the Future of Corporate Sustainability. In Business and the Sustainable Development Goals; Palgrave Pivot: Cham, Switzerland, 2019; pp. 1–17. [Google Scholar]

- Zhu, Z.; Chu, F.; Dolgui, A.; Chu, C.; Zhou, W.; Piramuthu, S. Recent advances and opportunities in sustainable food supply chain: A model-oriented review. Int. J. Prod. Res. 2018, 56, 5700–5722. [Google Scholar] [CrossRef]

- McKitterick, L.; Quinn, B.; Tregear, A. Trust formation in agri-food institutional support networks. J. Rural Stud. 2019, 65, 53–64. [Google Scholar] [CrossRef]

- Tonkin, E.; Wilson, A.M.; Coveney, J.; Meyer, S.B.; Henderson, J.; McCullum, D.; Ward, P.R. Consumers respond to a model for (re) building consumer trust in the food system. Food Control 2019, 101, 112–120. [Google Scholar] [CrossRef]

- Kamble, S.S.; Gunasekaran, A.; Parekh, H.; Joshi, S. Modeling the internet of things adoption barriers in food retail supply chains. J. Retail. Consum. Serv. 2019, 48, 154–168. [Google Scholar] [CrossRef]

- Montecchi, M.; Plangger, K.; Etter, M. It’s real, trust me! Establishing supply chain provenance using blockchain. Bus. Horiz. 2019, 62, 283–293. [Google Scholar] [CrossRef]

- Caro, M.P.; Ali, M.S.; Vecchio, M.; Giaffreda, R. Blockchain-Based Traceability in Agri-Food Supply Chain Management: A Practical Implementation; IoT Vertical and Topical Summit on Agriculture-Tuscany; IEEE: Piscataway, NJ, USA, 2018; pp. 1–4. [Google Scholar]

- Kamilaris, A.; Fonts, A.; Prenafeta-Boldύ, F.X. The rise of blockchain technology in agriculture and food supply chains. Trends Food Sci. Technol. 2019, 91, 640–652. [Google Scholar] [CrossRef]

- Nilsson, F.; Göransson, M.; Båth, K. Models and technologies for the enhancement of transparency and visibility in food supply chains. In Sustainable Food Supply Chains; Academic Press: Cambridge, MA, USA, 2019; pp. 219–236. [Google Scholar]

- Behnke, K.; Janssen, M.F.W.H.A. Boundary conditions for traceability in food supply chains using blockchain technology. Int. J. Inf. Manag. 2019, 52, 101969. [Google Scholar] [CrossRef]

- Bryman, A. Integrating quantitative and qualitative research: How is it done? Qual. Res. 2006, 6, 97–113. [Google Scholar] [CrossRef]

- Saunders, M.; Lewis, P.; Thornhill, A. Research Methods For Business Students, 5th ed.; Financial Times Prentice Hall: Harlow, UK, 2009. [Google Scholar]

- Bryman, A.; Bell, E. Business Research Methods; Oxford University Press: Oxford, UK, 2015. [Google Scholar]

- Saunders, M.; Lewis, P.; Thornhill, A.; Bristow, A. Research Methods for Business Students, Chapter 4: Understanding Research Philosophy and Approaches to Theory Development; Research Methods for Business Students Edition: 8 Chapter: 4; Pearson Education: New York, NY, USA, 2019. [Google Scholar]

- Lancaster, G. Research Methods in Management; Routledge: London, UK, 2007. [Google Scholar]

- Saunders, M.; Lewis, P.; Thornhill, A. Research Methods for Business Students; Pearson education: New York, NY, USA, 2009. [Google Scholar]

- Matthews, B.; Ross, L. Research Methods; Pearson Longman: London, UK, 2010. [Google Scholar]

- Fusch, P.; Ness, L. Are We There Yet? Data Saturation in Qualitative Research. Qual. Rep. 2015, 20, 1408–1416. [Google Scholar] [CrossRef]

- Saunders, M.N.K.; Lewis, P.; Thornhill, A. Research Methods for Business Students, 7th ed.; Pearson Education Limited: Essex, UK, 2015. [Google Scholar]

- Schultze, A.; Avital, M. Designing interviews to generate rich data for information systems research. Inf. Organ. 2011, 21, 1–16. [Google Scholar] [CrossRef]

- Kallio, H.; Pietilä, A.M.; Johnson, M.; Kangasniemi, M. Systematic methodological review: Developing a framework for a qualitative semi-structured interview guide. J. Adv. Nurs. 2016, 72, 2954–2965. [Google Scholar] [CrossRef] [PubMed]

- Van Houte, E. Sampling techniques. In Research Methods in the Social Sciences; An AZ of Key Concepts; Oxford University Press: Oxford, UK, 2021; p. 247. [Google Scholar]

- Creswell, J.W. Research Design: Qualitative, Quantitative, and Mixed Methods Approaches, 3rd ed.; Sage Publications: Thousand Oaks, CA, USA, 2009. [Google Scholar]

- Lehnert, K.; Craft, J.; Singh, N.; Park, Y.H. The human experience of ethics: A review of a decade of qualitative ethical decisionmaking research. Bus. Ethics Eur. Rev. 2016, 25, 498–537. [Google Scholar] [CrossRef]

- Bernard, H.R. Research Methods in Anthropology, 5th ed.; AltaMira Press: Maryland, MD, USA, 2011. [Google Scholar]

- Kumar, V. Transformative Marketing: The Next 20 Years. J. Mark. 2018, 82, 1–12. [Google Scholar] [CrossRef]

- Olson, S.H.; Voigt, L.F.; Begg, C.B.; Weiss, N.S. Reporting participation in case-control studies. Epidemiology 2002, 13, 123–126. [Google Scholar] [CrossRef] [PubMed]

- Higuchi, K. KH Coder Index Page. 2020. Available online: https://khcoder.net/en/ (accessed on 9 December 2020).

- Sgroi, F. The circular economy for resilience of the agricultural landscape and promotion of the sustainable agriculture and food systems. J. Agric. Food Res. 2022, 8, 100307. [Google Scholar] [CrossRef]

- Oe, H.; Yamaoka, Y.; Ochiai, H. Coffee narrative with a focus on certification schemes: Ethiopian agri-food value chain in a global market context. Int. J. Bus. Manag. Econ. Rev. 2022, 5, 103–122. [Google Scholar] [CrossRef]

- Hsu, F.C.; Agyeiwaah, E.; Scott, N. Understanding tourists’ perceived food consumption values: Do different cultures share similar food values? Int. J. Gastron. Food Sci. 2022, 28, 100533. [Google Scholar] [CrossRef]

- Reigada, A. A Link in Global Agrifood Chains: Recruitment Policies, Work, and Sexuality in the Strawberry Fields of Andalusia (Spain). Curr. Anthropol. 2022, 63, 519–540. [Google Scholar] [CrossRef]

- Auerbach, C.; Silverstein, L.B. Qualitative Data: An Introduction to Coding and Analysis; NYU Press: New York, NY, USA, 2003; Volume 21. [Google Scholar]

- Akagawa, N. National Identity, Culinary Heritage and UNESCO: Japanese Washoku. In Safeguarding Intangible Heritage; Routledge: London, UK, 2018; pp. 200–217. [Google Scholar]

- Cang, V. Japan’s Washoku as Intangible Heritage: The Role of National Food Traditions in UNESCO’s Cultural Heritage Scheme. Int. J. Cult. Prop. 2018, 25, 491–513. [Google Scholar] [CrossRef]

- Pilcher, J.M. Food in World History; Routledge: London, UK, 2017. [Google Scholar]

- Grew, R. Food in Global History; Routledge: London, UK, 2018. [Google Scholar]

| Key Themes | Relevant Stakeholders (Interviewees) |

|---|---|

| 1. Overall perspectives and evaluation for Tunisian olive oil |

|

| 2. Healthy food provision |

|

| 3. Consumer experiences and expectations |

|

| 4. Effective marketing strategies in the new market (e.g., sales channels, impact of different cultural values). |

|

| 5. Ethical business behavior and consumer trust |

|

| 6. Consumers’ awareness of Tunisian products and new values of healthy agri-food |

|

| Subject Area | Control | Occupation | |

|---|---|---|---|

| Tunisian Interviewees (Suppliers) | T1 | Business consultant | |

| T2 | Supply chain quality assessor | ||

| T3 | Olive oil industry association | ||

| T4 | Adviser | ||

| T5 | Food planner | ||

| T6 | Producer A | ||

| T7 | Producer B | ||

| T8 | Producer C | ||

| Japanese Interviewees | (Suppliers/distributors) | J1 | Business consultant |

| J2 | SME adviser/management quality assessor | ||

| J3 | Cabinet office, advisor | ||

| J4 | Advisor/University Professor | ||

| J5 | Chairman, Japan Association of Performance Excellence | ||

| J6 | Nutritionist/University Professor | ||

| J7 | ICT standardization expert/consultant to smart agribusiness | ||

| J8 | Imported food wholesale and retail A | ||

| J9 | Imported food wholesale and retail B | ||

| J10 | Sales adviser of Food wholesaler | ||

| J11 | Tokyo Chamber of Commerce, Japan | ||

| J12 | Food coordinator: French and Food coordinator: French and Pacific Lim | ||

| (Consumers) | J13 | Consumer A | |

| J14 | Consumer B | ||

| J15 | Consumer C | ||

| J16 | Consumer D | ||

| J17 | Consumer E | ||

| J18 | Consumer F | ||

| J19 | Consumer G | ||

| J20 | Consumer H | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Oe, H.; Yamaoka, Y. How to Support Expanding Sales Channels of Agri-Food Products in New Markets: Healthiness and New Experiences of Tunisian Olive Oil. Businesses 2023, 3, 382-401. https://doi.org/10.3390/businesses3030024

Oe H, Yamaoka Y. How to Support Expanding Sales Channels of Agri-Food Products in New Markets: Healthiness and New Experiences of Tunisian Olive Oil. Businesses. 2023; 3(3):382-401. https://doi.org/10.3390/businesses3030024

Chicago/Turabian StyleOe, Hiroko, and Yasuyuki Yamaoka. 2023. "How to Support Expanding Sales Channels of Agri-Food Products in New Markets: Healthiness and New Experiences of Tunisian Olive Oil" Businesses 3, no. 3: 382-401. https://doi.org/10.3390/businesses3030024

APA StyleOe, H., & Yamaoka, Y. (2023). How to Support Expanding Sales Channels of Agri-Food Products in New Markets: Healthiness and New Experiences of Tunisian Olive Oil. Businesses, 3(3), 382-401. https://doi.org/10.3390/businesses3030024