Innovation Pattern Heterogeneity: Data-Driven Retrieval of Firms’ Approaches to Innovation

Abstract

:1. Introduction

2. Literature

- Scale-intensive (SI), which includes both complex and consumer durables (food, chemicals, motor vehicles) and processed raw materials (e.g., metal manufacturing, glass and cement). Firms tend to be large and to rely mainly on internal resources for their innovations;

- Supplier-dominated (SD), which includes industries where firms mostly produce technologically simple goods (e.g., textiles, leather goods, pulp and paper), where the capital and intermediate components suppliers are the main sources of innovation;

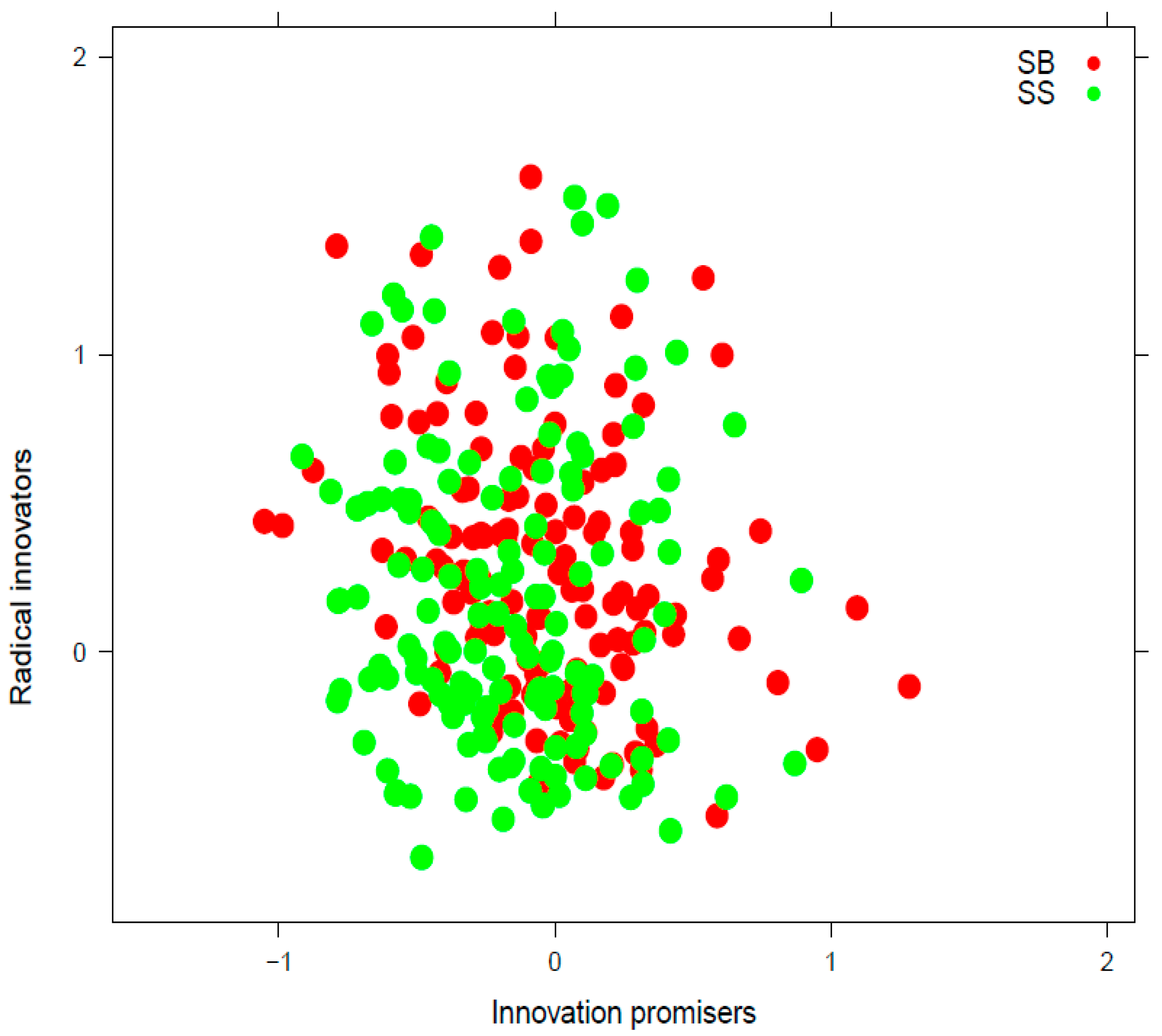

- Science-based (SB), which includes industries where innovation is linked directly to advances in academic research (e.g., pharmaceuticals, electronics, scientific instruments). Innovation rates are particularly high. Carrier industries in the ICT paradigm; and

- Specialized supplier (SS), includes equipment building, design, and mechanical engineering, where innovation typically emerges from informal activities. Firms in this group tend to be small, and innovation rates are particularly high. Supportive of the Fordist paradigm.

- Supplier-dominated services (SDS) rely on the purchase of capital goods for their innovation. They are mostly small companies providing services directly to customers (e.g., hotels, restaurants, rental services and personal services). Innovation rates are particularly low;

- Physical network services (PNS), which, which include all transport, retail, and wholesale trade-related services;

- Information network services (INS), which include all information-intensive activities (communication, financial intermediation, insurance, real estate). Firms tend to be large and to innovate in interaction with suppliers and users; and

- Knowledge intensive business services (KIBS), which include R&D services, consultancy, and computer-related activities. Firms tend to be small and medium-sized firms and to generate their own innovation. Innovation rates are particularly high.

- Cluster 1 represents the case of struggling companies competing in dynamic R&D-intensive technological trajectories;

- Cluster 2 shows a smaller group of aggressive companies competing in dynamic trajectories through a blend of R&D, industrial design, and investment policy;

- Cluster 3 contains firms that are less resolute in their innovative strategies;

- Cluster 4 is representative of technological trajectories based on industrial design and incremental technical change; and

- Clusters 5 and 6 both show embodied technical change as the main innovation channel, with Cluster 5 representing a more traditional component of the industrial landscape and Cluster 6 blending heavy capital accumulation and some in-house innovative activities.

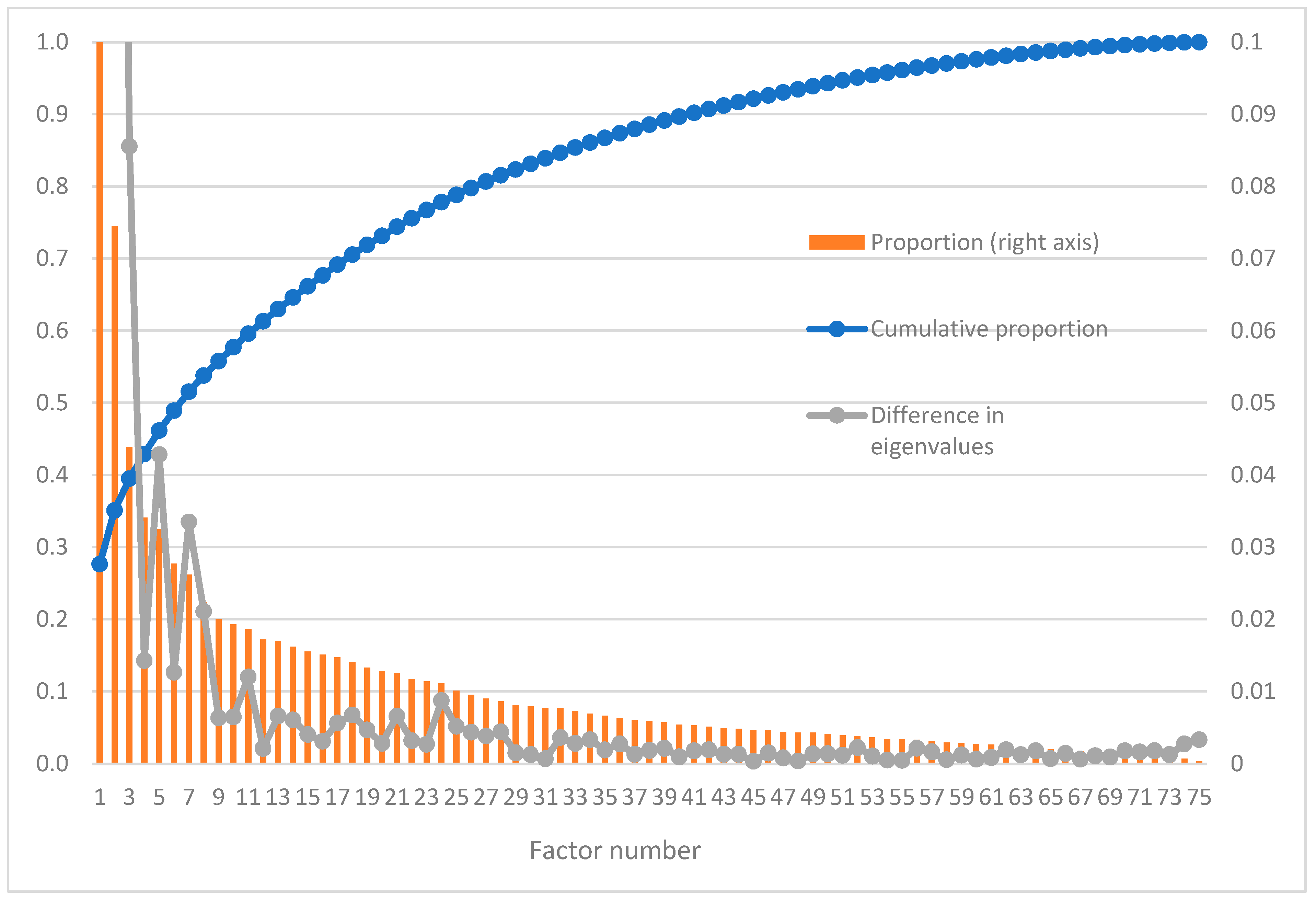

3. Materials and Methods

4. Results

4.1. Approaches to Innovation

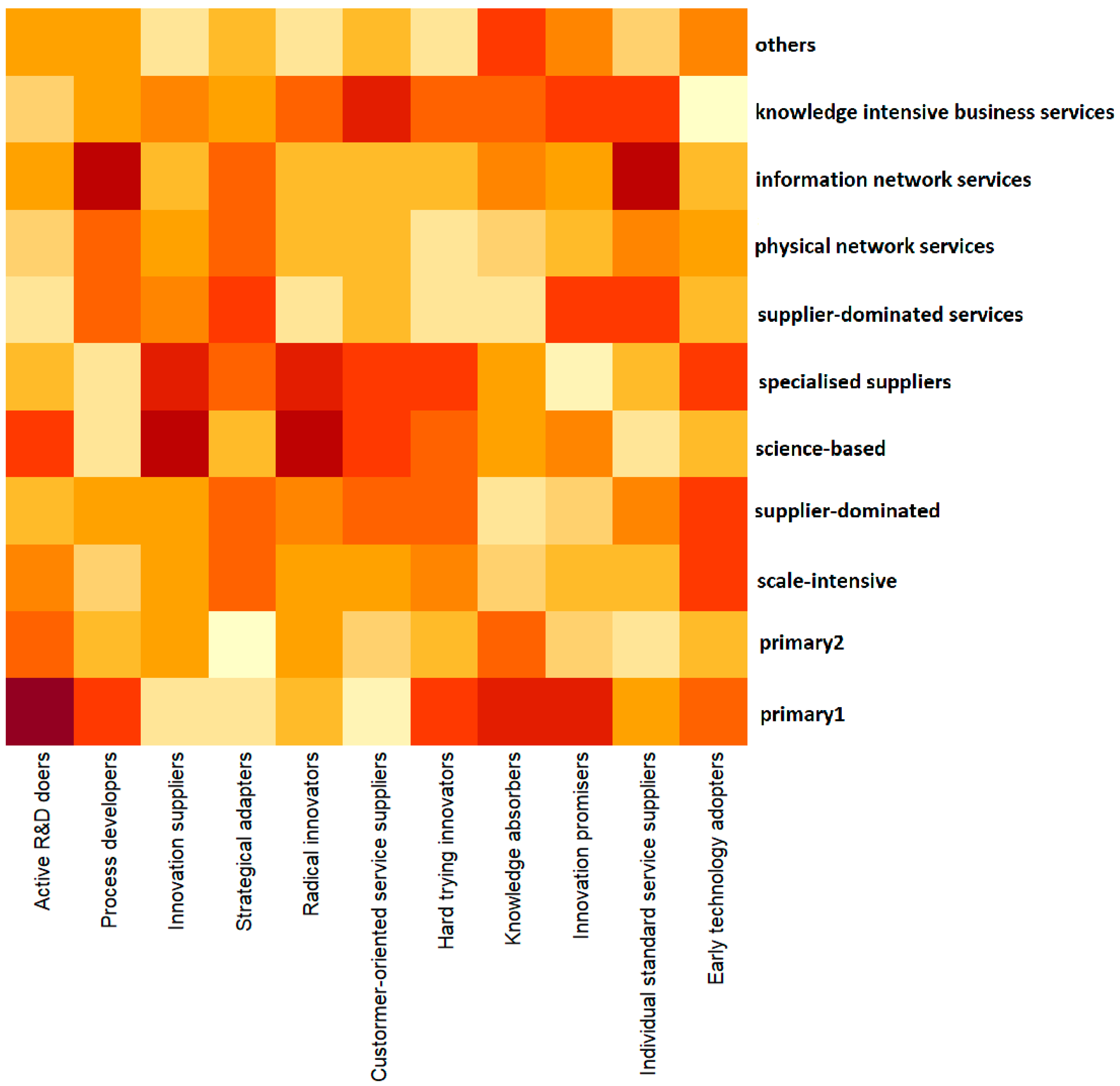

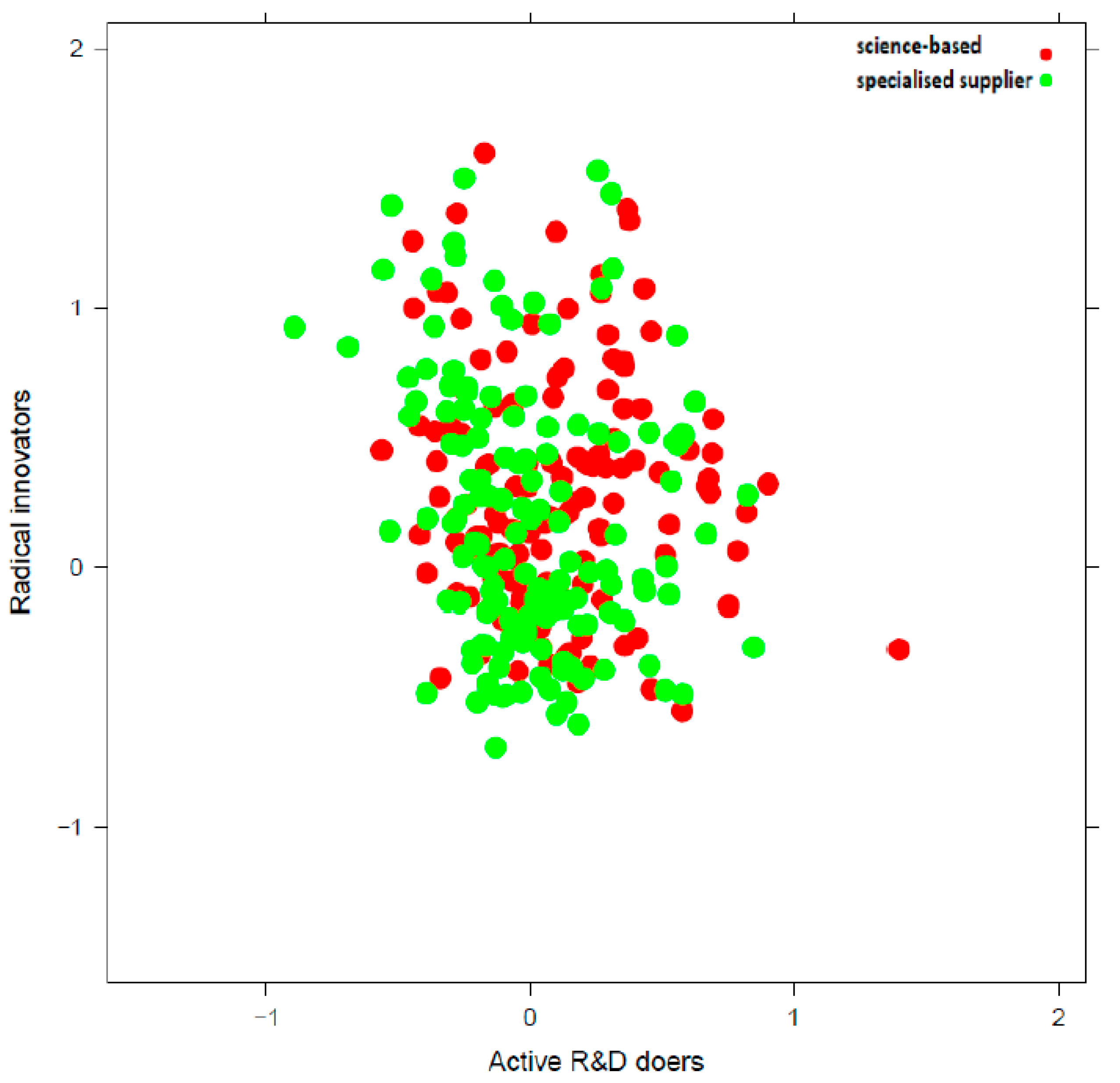

4.2. Relationships with the Pavitt–Miozzo–Soete Taxonomy

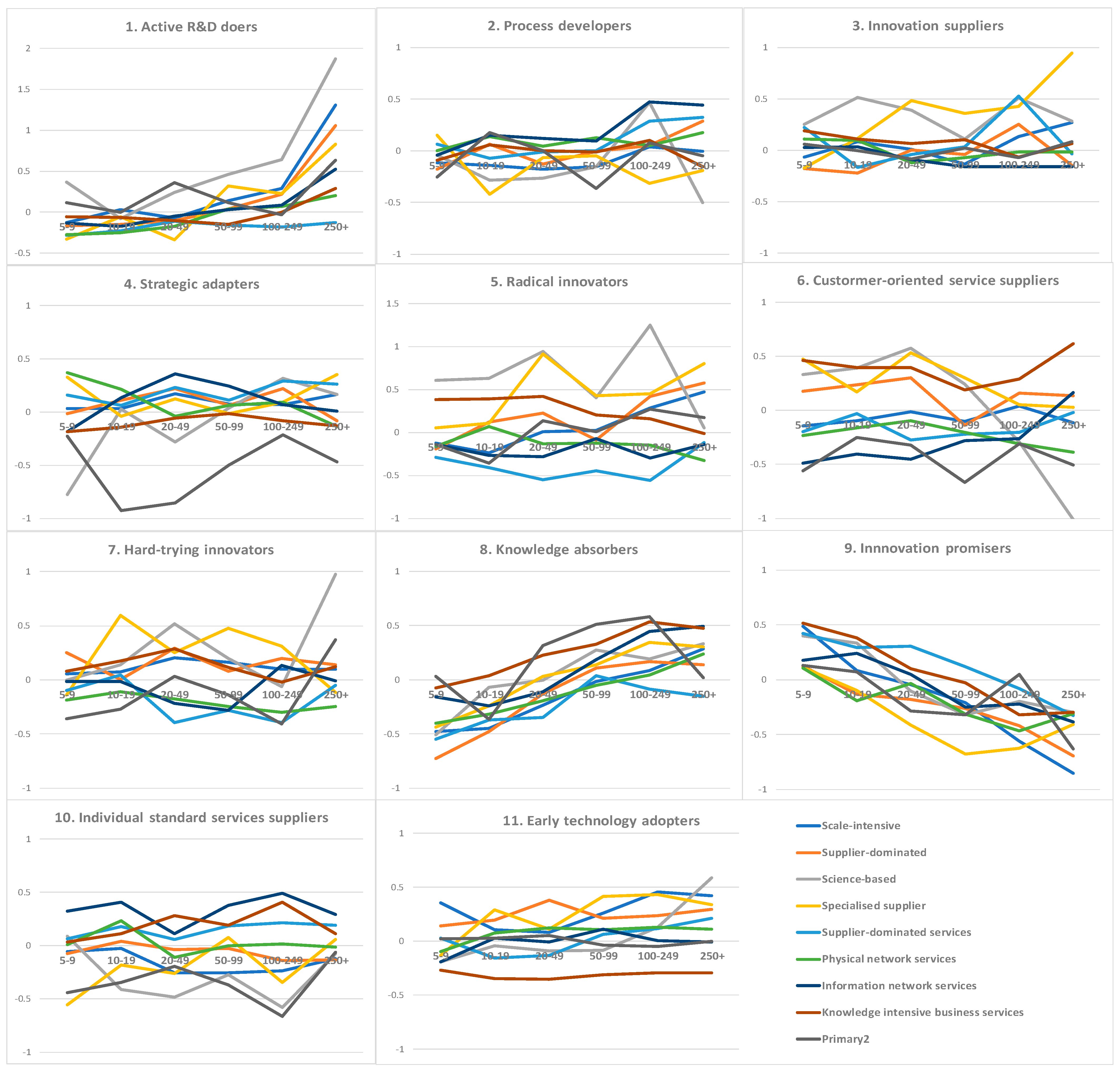

4.3. Relationship with Firm Size

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Definition of Indicators Based on Community Innovation Survey 2018 for Norway. The Question Number from the Norwegian Version of CIS2018 Used to Construct the Corresponding Set of Indicators Is in Parentheses

- Market location (Question 1.1): A set of dummy variables indicating whether a firm sells its products (goods or services) mainly in local/regional, national, European, or other international markets. This question indicates the location of a firm’s main competitors. The corresponding dummy variables are d_sigmarloc, d_sigmarnat, d_sigmareur and d_sigmaroth.

- Firm’s strategies (Question 2): A set of dummy variables indicating whether the following strategies were important (the corresponding indicator is set equal to 1 in the case of high or medium importance, and 0 in the case of low or no importance) to the economic performance of a firm in 2016–2018:

- o

- Focus on improving your existing goods or services, d_straimp

- o

- Focus on introducing new goods or services, d_straint

- o

- Focus on low-price (price leadership), d_stralow

- o

- Focus on high-quality (quality leadership), d_straqua

- o

- Focus on a broad range of goods or services, d_straran

- o

- Focus on one or a small number of key goods or services, d_strafoc

- o

- Focus on satisfying established customer groups, d_straest

- o

- Focus on reaching out to new customer groups, d_stranew

- o

- Focus on standardized goods or services, d_strasta

- o

- Focus on customer-specific solutions, d_stracus

- Customization and co-creation (Questions 3 and 3.1). The difference between customization and co-creation is that in ‘customization’ the enterprise designed and developed the product alone, whereas in ‘co-creation’ the enterprise designed and developed the product together with the user. A set of dummy variables indicating whether a firm offered any of the following types of goods or services to meet user requirements in 2016–2018 and the group of users involved:

- o

- Goods or services co-created with users (i.e., the user had an active role in the creation of the idea, design, and development of the product (co-creation)), d_specoc

- o

- Goods or services designed and developed specifically to meet the needs of particular users (customization), d_specom

- o

- Standardized goods or services offered to different users in the same way (mass customization), d_specus

- o

- Users involved in customization and co-creation included private business enterprises, d_spedpr

- o

- Users involved in customization and co-creation included public sector and non-profit organizations, d_spedpu

- o

- Users involved in customization and co-creation included individuals or households, d_spedhi

- Use of intellectual property rights, IPR (Question 4): A set of dummy variables indicating whether a firm applied for a patent, registered an industrial design right or trademark, claimed a copyright, or used trade secrets in 2016–2018. The corresponding dummy variables are d_propat, d_prodes, d_protm, d_prosec, and d_procp.

- IPR marked (Question 5): A set of dummy variables indicating whether a firm sold its own IPR or purchased IPR from others in 2016–2018:

- o

- Sold its own IPRs (or assign IP rights) to others, d_intoth

- o

- Licensed out its own IPRs to others, d_intlic

- o

- Exchanged IPRs (pooling, cross-licensing, etc.) with others, d_intsha

- o

- Purchased or licensed-in patents or other IPRs from private business enterprises or individuals, d_intbpr

- o

- Purchased or licensed-in patents or other IPRs from public research organizations, universities, or other higher education institutions, d_intbpu

- Acquisition of knowledge (Question 6): A set of dummy variables indicating whether a firm used any of the following channels to acquire knowledge in 2016–2018:

- o

- Conferences, trade fairs or exhibitions, scientific/technical journals or trade publications, d_kno_research

- o

- Information from professional or industry associations, d_kno_proforg

- o

- Information from open databases, published patents, standardization documents or committees, d_kno_data

- o

- Social web-based networks, crowd-sourcing, open business-to-business platforms, or open-source software, d_kno_network

- o

- Extracting knowledge or design information from goods or services (reverse engineering), d_kno_other

- Skills management (Question 7): A set of dummy variables indicating the importance to the management of a firm of the following methods of organizing work in 2016–2018:

- o

- Planned job rotation of staff across different functional areas, d_worrot

- o

- Regular brainstorming sessions for staff to consider how improvements could be made within the business, d_worbra

- o

- Cross-functional work groups or teams (combined across different working areas or functions), d_worwor

- o

- In-house training and/or possibility of professional development and skills upgrading through continuing education and external courses, d_worcom

- Product innovation (Questions 8, 8.2, 8.3): A set of dummy variables indicating whether a firm introduced any product innovation in 2016–2018 and whether this product was new to the market (the broadest market is shown here, e.g., the European market in the case of both the Norwegian and the European markets; various answers are possible only in the case of multiple innovation) or only to the firm:

- o

- New or improved goods, d_inpd_good

- o

- New or improved services, d_inpd_serv

- o

- These new or improved products were not previously available on the local/regional market, d_newmktloc

- o

- On the national market, d_newmktnat

- o

- On the European market, d_newmkteur

- o

- On other international markets, d_newmktoth

- o

- These new or improved products were new only to the firm (identical or very similar products were already offered by a firm’s competitors on the market), d_newfrm

- Process innovation (Question 9): A set of dummy variables indicating whether a firm introduced any of the following process innovations in 2016–2018:

- o

- Methods for producing goods or providing services (including methods for developing goods or services), d_inpcs_prod

- o

- Logistics, delivery, or distribution methods, d_inpcs_log

- o

- Methods for information processing or communication, d_inpcs_ict

- o

- Methods for accounting or other administrative operations, d_inpcs_adm

- o

- Business practices for organizing procedures or external relations, d_inpcs_nw

- o

- Methods for organizing work responsibility, decision-making, or human resource management, d_inpcs_hr

- o

- Marketing methods for promotion, packaging, pricing, product placement, or after-sales services, d_inpcs_mkt

- Formal R&D activities (Questions 10, 10.1): A set of dummy variables indicating whether a firm had in-house and/or contracted-out R&D activities in 2016–2018 and whether the firm performed in-house R&D continuously (had permanent R&D staff) or occasionally. The corresponding dummy variables are d_rrd_int, d_rrd_ext, and d_rrd_cont.

- Other innovation activities (Question 11): A set of dummy variables indicating whether a firm’s expenditures on other innovation activities (excluding formal R&D) was higher than the average share in the population of innovative firms for the corresponding type of expenditures (expenditures on innovation activities such as marketing of innovation, product design, preparation of production/distribution of innovation activities other than R&D have an average share of less than 0.08, and hence are not represented by a separate indicator):

- o

- Share of expenditures on own personnel working on innovation is higher than or equal to 0.52, d_invinno_pers

- o

- Share of expenditures on services, materials, supplies purchased from others for innovation is higher than or equal to 0.2, d_invinno_ext

- o

- Share of expenditures on capital goods for innovation (acquisition of machinery, equipment, software, IPRs, buildings etc.) is higher than or equal to 0.2, d_invinno_tech

- o

- Firm did not have any other innovation activities, d_invinno_zero

- Expectations regarding innovation expenditures (Question 13): A set of dummy variables indicating whether a firm expected an increase or decrease in their total innovation expenditures (including formal R&D) in 2019 compared to 2018. This question indicates the innovation ambitions of the firm.

- o

- Increase by more than 5%, d_exp_up

- o

- Stay about the same (+/−5%), d_exp_fixed

- o

- Decrease by more than 5%, d_exp_down

- o

- No innovation expenditures expected, d_exp_zero

- o

- Do not know, d_exp_not

- Collaboration (Question 14.1): A set of dummy variables indicating whether a firm co-operated with other firms or organizations in their innovation activities (including formal R&D) in 2016–2018 by type and location of cooperation partner:

- o

- Enterprises within the same enterprise group (other types are outside enterprise group), d_coop_group

- o

- Consultants, commercial labs, or private research institutes, d_coop_ consult

- o

- Suppliers of equipment, materials, components, or software, d_coop_suppl

- o

- Enterprises that are your clients or customers, d_coop_custom

- o

- Enterprises that are your competitors, d_coop_compet

- o

- Other enterprises, d_coop_otherf

- o

- Universities or other higher education institutions, government or public research institutes, d_coop_high

- o

- Public sector customers, non-profit organizations, d_coop_publ

- o

- Non-innovative collaboration, d_coop_noinno

- o

- Cooperation with partner(s) from the same region, d_coop_loc

- o

- From other regions of Norway, d_coop_norw

- o

- From other Nordic countries, d_coop_nordic

- o

- From other European countries (EU or EFTA), d_coop_eur

- o

- From all other countries, d_coop_world

- Hampering factors (Question 15): A set of dummy variables (the corresponding indicator was set equal to 1 in the case of high or medium importance, i.e., if the answer is 2 or 3 of at least one of the sub-indicators, and 0 otherwise) indicating how important the following factors were in hampering the firm’s decision to start innovation activities, or its execution of innovation activities in 2016–2018:

- o

- Financial issues (i.e., lack of internal finance for innovation, lack of credit or private equity, difficulties in obtaining public grants or subsidies), d_hemp_fin

- o

- Costs are too high, d_hemp_cost

- o

- Skills needs (i.e., lack of skilled employees within the firm and/or lack of collaboration partners, lack of access to external knowledge), d_hemp_skills

- o

- Market and competition issues (i.e., uncertain market demand for the ideas, too much competition in the relevant market, different priorities within the firm), d_hemp_mkt

- Funding for innovation activities (Questions 16.2 and 17.1): A set of dummy variables indicating whether a firm obtained the following types of funding for its innovation activities in 2016–2018:

- o

- Equity finance (finance provided in exchange for a share in the ownership of the enterprise), d_fin_owni

- o

- Debt finance (finance that the enterprise must repay), d_fin_loan

- o

- Public financial support (i.e., from local or regional authorities, central government agencies or ministries and/or from the EU), d_fin_publ

- Technology adoption (Question 18): A set of dummy variables indicating whether a firm purchased machinery, equipment, or software in 2016–2018 that was based on:

- o

- An improved version of technology previously used in the firm, d_tech_pro

- o

- New technology not previously used in the firm, d_tech_new

Appendix B. Factor Loadings of Indicators in 11 Approaches to Innovation

| Active R&D Doers | Process Developers | Innovation Suppliers | Strategical Adapters | Radical Innovators | Custormer-Oriented Service Suppliers | Hard Trying Innovators | Knowledge Absorbers | Innnovation Promissers | Individual Standard Services Suppliers | Early Technology Adopters | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Variable | Factor1 | Factor2 | Factor3 | Factor4 | Factor5 | Factor6 | Factor7 | Factor8 | Factor9 | Factor10 | Factor11 |

| d_sigmarloc | −0.2066 | 0.0486 | −0.2724 | −0.0200 | −0.4982 | −0.0164 | −0.1144 | −0.0112 | 0.0320 | 0.0059 | −0.0453 |

| d_sigmarnat | 0.0657 | −0.0737 | 0.1155 | 0.0604 | 0.0648 | 0.1080 | 0.0783 | 0.0752 | −0.1760 | 0.4345 | 0.0777 |

| d_sigmareur | 0.1476 | 0.0362 | 0.1361 | −0.0853 | 0.2916 | −0.0927 | 0.0406 | −0.0279 | 0.0278 | −0.1494 | 0.0319 |

| d_sigmaroth | 0.2161 | −0.0161 | 0.1595 | 0.0280 | 0.3040 | 0.0241 | 0.0701 | −0.0180 | 0.2364 | −0.2970 | −0.0569 |

| d_straimp | 0.0823 | 0.2067 | 0.0778 | 0.7176 | 0.1045 | 0.1570 | 0.1233 | 0.1271 | −0.0319 | 0.1876 | −0.0293 |

| d_straint | 0.1895 | 0.1385 | 0.3148 | 0.5513 | 0.2022 | 0.2134 | 0.0662 | −0.0080 | 0.1615 | 0.2403 | −0.0555 |

| d_stralow | −0.1110 | 0.0387 | −0.0451 | 0.4775 | −0.0267 | −0.0262 | 0.1023 | −0.0476 | −0.1315 | −0.2647 | 0.0922 |

| d_straqua | 0.0713 | 0.0846 | 0.0190 | 0.8358 | 0.0955 | 0.1981 | 0.1043 | 0.1751 | −0.0081 | 0.0564 | 0.0838 |

| d_straran | −0.1171 | 0.1055 | −0.0024 | 0.5465 | −0.0662 | 0.1517 | −0.0706 | 0.0412 | −0.3508 | −0.0125 | 0.1324 |

| d_strafoc | 0.1234 | 0.0318 | 0.0503 | 0.4680 | 0.0386 | −0.0548 | 0.0935 | −0.0893 | 0.4137 | −0.0383 | −0.1418 |

| d_straest | 0.0100 | 0.0636 | −0.0781 | 0.7439 | −0.0454 | 0.1550 | 0.1095 | 0.1057 | −0.1506 | −0.0634 | 0.0537 |

| d_stranew | −0.0355 | 0.0631 | 0.1559 | 0.6817 | 0.0484 | 0.1548 | −0.0240 | 0.0545 | 0.1349 | 0.0037 | 0.0291 |

| d_strasta | 0.0523 | 0.1062 | −0.0641 | 0.6297 | −0.0408 | −0.1575 | 0.0659 | 0.0128 | 0.0791 | 0.0977 | −0.0209 |

| d_stracus | 0.0188 | 0.0919 | −0.0047 | 0.5568 | 0.0517 | 0.4285 | 0.0792 | 0.0497 | −0.0789 | −0.2423 | 0.0228 |

| d_specoc | 0.2585 | 0.0986 | 0.0209 | 0.0932 | 0.1488 | 0.8015 | 0.1421 | 0.0898 | 0.0093 | −0.0275 | −0.0122 |

| d_specom | 0.2578 | 0.1354 | 0.2855 | 0.1855 | 0.1332 | 0.7416 | 0.1001 | 0.0054 | 0.1140 | 0.1728 | 0.0983 |

| d_specus | 0.1376 | 0.1509 | −0.0019 | 0.2400 | 0.1492 | 0.6648 | 0.1534 | 0.0893 | −0.0745 | −0.0153 | 0.0921 |

| d_spedpr | 0.1942 | 0.1255 | 0.1515 | 0.1583 | 0.2462 | 0.8076 | 0.1664 | 0.0370 | 0.0179 | 0.0126 | 0.0960 |

| d_spedpu | 0.1433 | 0.1041 | 0.0880 | 0.0915 | −0.1455 | 0.6947 | −0.0727 | 0.2282 | 0.0586 | 0.1161 | −0.1561 |

| d_spedhi | −0.0070 | 0.1199 | 0.2516 | 0.1623 | −0.4998 | 0.3568 | −0.0946 | −0.0287 | 0.0191 | 0.2381 | 0.1765 |

| d_propat | 0.3503 | −0.0466 | 0.6092 | 0.0112 | 0.4276 | 0.0655 | 0.1043 | 0.0916 | 0.1901 | −0.1736 | 0.1336 |

| d_prodes | 0.1406 | 0.0529 | 0.7123 | 0.0878 | 0.1842 | 0.0311 | 0.0006 | 0.1167 | 0.0233 | 0.0799 | 0.2910 |

| d_protm | 0.2250 | 0.0732 | 0.6547 | 0.0328 | 0.1801 | 0.0526 | −0.0202 | 0.1193 | 0.1661 | 0.1865 | 0.1593 |

| d_prosec | 0.4059 | 0.1242 | 0.4585 | 0.0460 | 0.3097 | 0.2021 | 0.1101 | 0.1339 | 0.1328 | −0.0446 | 0.0128 |

| d_procp | 0.1581 | 0.0417 | 0.6893 | 0.0568 | 0.0739 | 0.1389 | 0.0931 | 0.0903 | −0.0024 | 0.1053 | 0.0253 |

| d_intoth | 0.0780 | 0.1261 | 0.7834 | 0.0574 | 0.0254 | 0.1433 | 0.1297 | 0.0460 | −0.0086 | −0.0003 | −0.0906 |

| d_intlic | 0.2591 | 0.0429 | 0.6318 | −0.0152 | 0.1960 | 0.0567 | 0.1332 | 0.0176 | 0.0130 | 0.0398 | −0.1981 |

| d_intsha | 0.3934 | 0.1185 | 0.5938 | −0.0155 | 0.0137 | 0.1919 | 0.0859 | 0.0020 | 0.0402 | 0.0055 | −0.1972 |

| d_intbpr | 0.3162 | 0.1199 | 0.6271 | −0.0220 | 0.0442 | 0.0083 | 0.0813 | 0.0561 | 0.0272 | 0.0130 | −0.0393 |

| d_intbpu | 0.3578 | 0.0379 | 0.6072 | −0.0003 | 0.0066 | 0.0848 | 0.0929 | −0.0839 | 0.2515 | −0.2325 | −0.1334 |

| d_kno_viten | 0.4455 | 0.1526 | 0.1023 | 0.2138 | 0.0799 | 0.1506 | 0.1007 | 0.6604 | 0.0636 | 0.0668 | 0.1247 |

| d_kno_bransje | 0.2457 | 0.0806 | 0.0449 | 0.1494 | −0.1089 | 0.0101 | 0.0012 | 0.6848 | −0.1338 | 0.0223 | 0.0775 |

| d_kno_data | 0.3295 | 0.0481 | 0.2868 | 0.0384 | 0.1974 | 0.1222 | 0.0791 | 0.5586 | 0.0519 | −0.2152 | 0.0732 |

| d_kno_nettverk | 0.1874 | 0.2534 | 0.0337 | 0.1263 | 0.0459 | 0.2038 | 0.1039 | 0.5470 | 0.2144 | 0.1570 | −0.0945 |

| d_kno_other | 0.1254 | 0.1659 | 0.1421 | 0.0710 | 0.1638 | 0.1891 | 0.1421 | 0.5290 | 0.1178 | −0.0009 | −0.0444 |

| d_worrot | 0.0065 | 0.2811 | 0.0077 | 0.3168 | 0.0066 | 0.0569 | 0.1286 | 0.2686 | 0.0057 | −0.0503 | −0.1385 |

| d_worbra | 0.2019 | 0.3248 | 0.1599 | 0.3495 | 0.0756 | 0.2019 | 0.1088 | 0.3393 | 0.1727 | 0.1445 | −0.1245 |

| d_worwor | 0.2906 | 0.2943 | 0.2219 | 0.3035 | 0.1424 | 0.1754 | 0.1175 | 0.4302 | 0.0763 | 0.0751 | −0.1492 |

| d_worcom | 0.0970 | 0.2672 | −0.0089 | 0.3493 | −0.0522 | 0.0589 | 0.0613 | 0.5043 | −0.0108 | 0.0155 | −0.1436 |

| d_inpd_good | 0.3641 | 0.2173 | 0.2178 | 0.2018 | 0.4918 | 0.2581 | 0.1564 | −0.0545 | 0.0613 | 0.2809 | 0.2156 |

| d_inpd_serv | 0.2860 | 0.3578 | −0.0075 | 0.1908 | 0.2693 | 0.2902 | 0.1266 | 0.0718 | 0.0985 | 0.5067 | 0.0101 |

| d_newmktloc | 0.3038 | 0.2422 | −0.0186 | 0.1515 | 0.4080 | 0.3031 | 0.0066 | 0.0077 | 0.0846 | 0.3441 | 0.0288 |

| d_newmktnat | 0.3766 | 0.1408 | 0.0914 | 0.1208 | 0.5870 | 0.2991 | 0.0399 | 0.0507 | 0.0287 | 0.3636 | −0.0007 |

| d_newmkteur | 0.3805 | 0.1324 | 0.1735 | 0.0629 | 0.7548 | 0.1885 | 0.0215 | 0.0246 | 0.0985 | 0.1041 | −0.0227 |

| d_newmktoth | 0.3383 | 0.0848 | 0.2226 | 0.0568 | 0.7831 | 0.1717 | 0.0301 | 0.0124 | 0.1500 | −0.0578 | 0.0103 |

| d_newfrm | 0.2142 | 0.2305 | 0.0818 | 0.1968 | 0.0438 | 0.1938 | 0.2249 | 0.0315 | 0.0584 | 0.3829 | 0.2199 |

| d_inpcs_produksjon | 0.3173 | 0.5743 | 0.0603 | 0.1256 | 0.2100 | 0.2473 | 0.1477 | 0.0863 | 0.1605 | 0.1781 | 0.0871 |

| d_inpcs_logistikk | 0.1569 | 0.6838 | 0.0685 | 0.1618 | 0.0024 | 0.0099 | 0.0591 | −0.0319 | 0.0598 | 0.1007 | 0.1828 |

| d_inpcs_ikt | 0.1959 | 0.7782 | 0.0796 | 0.0784 | 0.0762 | 0.1275 | 0.0675 | 0.1309 | 0.0023 | 0.1726 | 0.0221 |

| d_inpcs_regn_adm | 0.0470 | 0.7615 | 0.0771 | 0.0220 | −0.0224 | 0.0824 | 0.0750 | 0.0451 | −0.0207 | −0.0672 | 0.0684 |

| d_inpcs_relasjoner | 0.2008 | 0.8198 | 0.0404 | 0.0452 | 0.0900 | 0.0915 | 0.0714 | 0.1128 | 0.0081 | −0.0834 | −0.0313 |

| d_inpcs_hrm | 0.1481 | 0.8258 | −0.0156 | 0.0925 | 0.0242 | 0.0742 | 0.0902 | 0.1089 | −0.0210 | −0.0663 | −0.0028 |

| d_inpcs_marketing | 0.1418 | 0.7056 | 0.2142 | 0.1959 | 0.0845 | 0.1162 | 0.0520 | 0.0284 | 0.0507 | 0.1543 | 0.1401 |

| d_rrd_int | 0.6803 | 0.0554 | 0.1655 | 0.0806 | 0.4128 | 0.1624 | 0.2402 | 0.1041 | 0.2267 | 0.1252 | 0.0532 |

| d_rrd_ext | 0.6989 | 0.0866 | 0.2241 | −0.0057 | 0.2817 | 0.0252 | 0.1493 | 0.0867 | 0.1713 | 0.0321 | 0.0336 |

| d_rrd_cont | 0.5753 | 0.0251 | 0.2344 | 0.0576 | 0.4738 | 0.1102 | 0.1420 | 0.1218 | 0.2808 | 0.0923 | −0.0104 |

| d_invinno_perc | 0.2237 | 0.1444 | 0.0869 | 0.0334 | 0.1659 | 0.1789 | 0.3301 | 0.1013 | 0.0254 | 0.3294 | −0.2258 |

| d_invinno_extj | 0.1868 | 0.1799 | 0.1071 | 0.0775 | 0.1064 | 0.1439 | 0.1571 | −0.0204 | 0.1243 | 0.1392 | 0.4499 |

| d_invinno_tech | 0.1640 | 0.3162 | −0.0935 | 0.0965 | −0.0567 | 0.0975 | 0.1069 | 0.0360 | 0.0768 | −0.0104 | 0.6495 |

| d_invinno_null | −0.3828 | −0.3524 | −0.1060 | −0.0735 | −0.1472 | −0.2117 | −0.3078 | −0.0338 | −0.1314 | −0.2723 | −0.3953 |

| d_exp_vekst | 0.2251 | 0.0714 | 0.0429 | 0.0317 | 0.1082 | 0.0546 | 0.1255 | 0.0648 | 0.4042 | 0.1051 | −0.0235 |

| d_exp_fast | 0.2145 | 0.1487 | 0.1524 | 0.0975 | 0.1754 | 0.0960 | 0.0927 | 0.0505 | −0.2515 | 0.2268 | −0.0014 |

| d_exp_ned | 0.2107 | −0.0074 | 0.0498 | 0.0408 | 0.0408 | 0.0608 | 0.1478 | −0.0256 | 0.0303 | −0.0801 | 0.3081 |

| d_exp_null | −0.2197 | 0.0456 | −0.2193 | −0.0198 | 0.0281 | −0.0684 | −0.0853 | 0.1175 | −0.2165 | 0.1729 | 0.0279 |

| d_exp_usikker | −0.1169 | 0.2152 | −0.0012 | 0.0231 | −0.1836 | 0.1004 | −0.0035 | −0.0212 | 0.1195 | −0.2024 | −0.0956 |

| d_coop_konsern | 0.7304 | 0.2021 | 0.1231 | 0.1023 | 0.1141 | 0.0208 | 0.1038 | 0.0611 | −0.2335 | −0.0048 | 0.0405 |

| d_coop_konsult | 0.7961 | 0.1263 | 0.1195 | 0.0394 | 0.1249 | 0.0501 | 0.1006 | 0.0774 | 0.1153 | 0.0407 | 0.0772 |

| d_coop_leveran | 0.7937 | 0.1788 | 0.0619 | 0.0609 | 0.1014 | 0.0727 | 0.1053 | 0.0994 | 0.0017 | 0.0205 | 0.1889 |

| d_coop_kunder | 0.6790 | 0.0870 | 0.1896 | 0.0758 | 0.2019 | 0.3004 | 0.1158 | 0.0278 | 0.0135 | −0.0556 | 0.0257 |

| d_coop_bransje | 0.6311 | 0.1490 | 0.1157 | −0.1459 | −0.2163 | 0.0549 | 0.1674 | 0.1946 | −0.0073 | 0.1548 | −0.0248 |

| d_coop_andref | 0.5576 | 0.1227 | 0.0481 | 0.1096 | −0.0095 | 0.0972 | 0.1116 | −0.0302 | 0.0155 | 0.2276 | −0.0292 |

| d_coop_fuh | 0.7826 | 0.0318 | 0.1421 | −0.0685 | 0.1786 | 0.0964 | 0.0758 | 0.1708 | 0.1971 | −0.0654 | −0.0474 |

| d_coop_off | 0.6634 | 0.1193 | 0.0094 | 0.0487 | −0.0635 | 0.2398 | 0.0010 | 0.1554 | 0.0652 | 0.1732 | −0.2756 |

| d_coop_ikke_inno | 0.6531 | 0.1690 | 0.0561 | 0.0307 | −0.0175 | 0.0887 | 0.1351 | 0.1100 | −0.0053 | 0.0643 | −0.0344 |

| d_coop_lokalt | 0.7980 | 0.1884 | −0.0044 | 0.0031 | −0.0042 | 0.1468 | 0.1464 | 0.0200 | 0.1045 | 0.0658 | 0.0262 |

| d_coop_norge | 0.8201 | 0.0886 | 0.1883 | 0.0470 | 0.0786 | 0.0877 | 0.1206 | 0.0962 | 0.0032 | 0.0941 | 0.0806 |

| d_coop_norden | 0.7064 | 0.0874 | 0.0963 | 0.0598 | 0.1778 | 0.1321 | 0.0245 | 0.0624 | −0.0483 | 0.0512 | 0.0740 |

| d_coop_eur | 0.7263 | 0.0828 | 0.3228 | 0.0234 | 0.2748 | 0.0857 | 0.0422 | 0.0759 | −0.0338 | −0.1046 | 0.0715 |

| d_coop_verden | 0.6719 | 0.0810 | 0.1976 | 0.0375 | 0.3712 | 0.1204 | 0.0567 | 0.0291 | 0.1019 | −0.1589 | −0.0410 |

| d_hemp_fin | 0.2906 | 0.1023 | 0.0656 | 0.1057 | 0.1515 | 0.1526 | 0.7327 | −0.0265 | 0.2408 | −0.0093 | 0.0087 |

| d_hemp_kost | 0.2410 | 0.0966 | 0.0717 | 0.0974 | 0.0898 | 0.1213 | 0.7966 | 0.0113 | 0.1019 | −0.0082 | 0.0605 |

| d_hemp_kunn | 0.1880 | 0.1383 | 0.1509 | 0.0807 | −0.0003 | 0.0935 | 0.7401 | 0.0913 | 0.0260 | 0.0338 | 0.0574 |

| d_hemp_mkt | 0.2141 | 0.1150 | 0.1186 | 0.1148 | −0.0052 | 0.0875 | 0.7823 | 0.1567 | −0.1928 | 0.0625 | 0.0392 |

| d_fin_owni | 0.2844 | 0.0642 | 0.2689 | −0.1138 | 0.2989 | 0.0626 | 0.0244 | 0.0753 | 0.7480 | 0.0145 | 0.0651 |

| d_fin_loan | 0.3157 | 0.1320 | 0.0916 | 0.0300 | 0.1806 | 0.1109 | 0.1474 | 0.0478 | 0.5067 | 0.0008 | 0.3048 |

| d_fin_publ | 0.5973 | 0.0286 | 0.1679 | 0.0166 | 0.2716 | 0.1557 | 0.1666 | 0.0511 | 0.3813 | 0.0628 | 0.0659 |

| d_tech_pro | 0.2396 | 0.2071 | 0.0699 | 0.1018 | −0.0775 | 0.0443 | 0.1495 | 0.3328 | −0.1616 | −0.0487 | 0.3505 |

| d_tech_new | 0.3832 | 0.3240 | 0.0759 | 0.0389 | 0.0461 | 0.0934 | 0.1391 | 0.2783 | 0.0629 | 0.0711 | 0.3093 |

Appendix C. Scores for Each of the Approaches to Innovation by Firm Size and by Pavitt–Miozzo–Soete Sector

References

- Dosi, G.; Marsili, O.; Orsenigo, L.; Salvatore, R. Learning, market selection and the evolution of industrial structures. Small Bus. Econ. 1995, 7, 411–436. [Google Scholar] [CrossRef]

- Nelson, R.; Winter, S. An Evolutionary Theory of Economic Change; Belknap Press of Harvard University: Cambridge, MA, USA, 1982. [Google Scholar]

- Tether, B.S. Growth diversity amongst innovative and technology–based new and small firms: An interpretation. New Technol. Work Employ. 1997, 12, 91–107. [Google Scholar] [CrossRef]

- Aghion, P.; Howitt, P. A Model of Growth Through Creative Destruction. Econom. J. Econom. Soc. 1992, 60, 323–351. [Google Scholar] [CrossRef]

- Klette, T.J.; Griliches, Z. Empirical patterns of firm growth and R&D investment: A quality ladder model interpretation. Econ. J. 2000, 110, 363–387. [Google Scholar]

- Pakes, A.; Ericson, R. Empirical implications of alternative models of firm dynamics. J. Econ. Theory 1998, 79, 1–45. [Google Scholar] [CrossRef] [Green Version]

- Nelson, R.; Winter, S. In search of useful theory of innovation. Res. Policy 1977, 6, 36–76. [Google Scholar] [CrossRef]

- Coad, A.; Mathew, N.; Pugliese, E. What’s good for the goose ain’t good for the gander: Heterogeneous innovation capabilities and the performance effects of R&D. Ind. Corp. Chang. 2020, 29, 621–644. [Google Scholar]

- Freel, M.S. Do small innovating firms outperform non-innovators? Small Bus. Econ. 2000, 14, 195–210. [Google Scholar] [CrossRef]

- Pavitt, K. Sectoral patterns of technical change: Towards a taxonomy and a theory. Res. Policy 1984, 13, 343–373. [Google Scholar] [CrossRef]

- Miozzo, M.; Soete, L. Internationalization of services: A technological perspective. Technol. Forecast. Soc. Chang. 2001, 67, 159–185. [Google Scholar] [CrossRef] [Green Version]

- Castellacci, F. Technological paradigms, regimes and trajectories: Manufacturing and service industries in a new taxonomy of sectoral patterns of innovation. Res. Policy 2008, 37, 978–994. [Google Scholar] [CrossRef] [Green Version]

- Archibugi, D. Pavitt’s taxonomy sixteen years on: A review article. Econ. Innov. New Technol. 2001, 10, 415–425. [Google Scholar] [CrossRef]

- De Jong, J.P.; Marsili, O. The fruit flies of innovations: A taxonomy of innovative small firms. Res. Policy 2006, 35, 213–229. [Google Scholar] [CrossRef]

- Leiponen, A.; Drejer, I. What exactly are technological regimes?: Intra-industry heterogeneity in the organization of innovation activities. Res. Policy 2007, 36, 1221–1238. [Google Scholar] [CrossRef]

- Baregheh, A.; Rowley, J.; Sambrook, S. Towards a multidisciplinary definition of innovation. Manag. Decis. 2009, 47, 1323–1339. [Google Scholar] [CrossRef]

- Paananen, M. I’ll find it where I can: Exploring the role of resource and financial constraints in search behaviour among innovators. Ind. Innov. 2012, 19, 63–84. [Google Scholar] [CrossRef]

- Spithoven, A. Open innovation practices and innovative performances: An international comparative perspective. Int. J. Technol. Manag. 2013, 62, 1–34. [Google Scholar] [CrossRef]

- Di Berardino, C.; Onesti, G. Explaining deindustrialisation from a vertical perspective: Industrial linkages, producer services, and international trade. Econ. Innov. New Technol. 2021, 30, 685–706. [Google Scholar] [CrossRef]

- Ascani, A.; Balland, P.-A.; Morrison, A. Heterogeneous foreign direct investment and local innovation in Italian Provinces. Struct. Chang. Econ. Dyn. 2020, 53, 388–401. [Google Scholar] [CrossRef]

- Dosi, G.; Piva, M.; Virgillito, M.E.; Vivarelli, M. Embodied and disembodied technological change: The sectoral patterns of job-creation and job-destruction. Res. Policy 2021, 50, 104199. [Google Scholar] [CrossRef]

- Felice, G.; Lamperti, F.; Piscitello, L. The employment implications of additive manufacturing. Ind. Innov. 2021, 1–34. [Google Scholar] [CrossRef]

- Bogliacino, F.; Pianta, M. The Pavitt Taxonomy, revisited: Patterns of innovation in manufacturing and services. Econ. Politica 2016, 33, 153–180. [Google Scholar] [CrossRef]

- Schneider, L.; Günther, J.; Brandenburg, B. Innovation and skills from a sectoral perspective: A linked employer–employee analysis. Econ. Innov. New Technol. 2010, 19, 185–202. [Google Scholar] [CrossRef]

- Bonaccorsi, A.; Colombo, M.G.; Guerini, M.; Rossi-Lamastra, C. University specialization and new firm creation across industries. Small Bus. Econ. 2013, 41, 837–863. [Google Scholar] [CrossRef]

- Castaldi, C. The relative weight of manufacturing and services in Europe: An innovation perspective. Technol. Forecast. Soc. Chang. 2009, 76, 709–722. [Google Scholar] [CrossRef]

- Baroncelli, A.; Landoni, M. Exploring differences in university support practices and the effects on spin-off companies in Boston. Int. J. Entrep. Innov. Manag. 2017, 21, 366–394. [Google Scholar] [CrossRef]

- Consoli, D.; Rentocchini, F. A taxonomy of multi-industry labour force skills. Res. Policy 2015, 44, 1116–1132. [Google Scholar] [CrossRef] [Green Version]

- Colombo, M.G.; Foss, N.J.; Lyngsie, J.; Lamastra, C.R. What drives the delegation of innovation decisions? The roles of firm innovation strategy and the nature of external knowledge. Res. Policy 2021, 50, 104134. [Google Scholar] [CrossRef]

- Flores, M.; Medellín, S.; Villarreal, A. Global Markets and the Role of Geographical Proximity in Mexico’s Employment Growth. Growth Chang. 2018, 49, 548–568. [Google Scholar] [CrossRef]

- Padilla-Perez, R.; Villarreal, F.G. Structural change and productivity growth in Mexico, 1990–2014. Struct. Chang. Econ. Dyn. 2017, 41, 53–63. [Google Scholar] [CrossRef]

- Flikkema, M.; De Man, A.-P.; Castaldi, C. Are trademark counts a valid indicator of innovation? Results of an in-depth study of new benelux trademarks filed by SMEs. Ind. Innov. 2014, 21, 310–331. [Google Scholar] [CrossRef]

- Cesaratto, S.; Mangano, S. Technological profiles and economic performance in the Italian manufacturing sector. Econ. Innov. New Technol. 1993, 2, 237–256. [Google Scholar] [CrossRef]

- Miller, R.; Blais, R.A. Configurations of innovation: Predictable and maverick modes. Technol. Anal. Strateg. Manag. 1992, 4, 363–386. [Google Scholar] [CrossRef]

- Caves, R.E.; Porter, M.E. From entry barriers to mobility barriers: Conjectural decisions and contrived deterrence to new competition. Q. J. Econ. 1977, 91, 241–261. [Google Scholar] [CrossRef]

- Kaiser, H.F. The application of electronic computers to factor analysis. Educ. Psychol. Meas. 1960, 20, 141–151. [Google Scholar] [CrossRef]

- Capasso, M.; Cefis, E.; Frenken, K. On the existence of persistently outperforming firms. Ind. Corp. Chang. 2014, 23, 997–1036. [Google Scholar] [CrossRef] [Green Version]

| Name | Main Characteristics |

|---|---|

| 1. Active R&D doers | Practice formal R&D activities on a regular basis (both intramural and extramural) Cooperate often with others Receive mainly public support for R&D and innovation Main market: outside Norway |

| 2. Process developers | High score on all types of process innovation Main strategy: improving existing goods or services Cooperate within own group on the local/regional level Innovation expenditures go mainly to machinery, equipment, and software based on new technology |

| 3. Innovation suppliers | Use actively different types of IPR Sell, license out, and exchange their own IPRs to/with others Innovation expenditures go mainly to purchasing services from others Main market: not local/regional |

| 4. Strategic adaptors | Main strategies: focus on high-quality products, on improving existing products and on satisfying established customer groups Practice customization of their products Implement machinery, equipment, and software based on new technology |

| 5. Radical innovators | Conduct formal R&D activities on a regular basis Introduce product innovation with a high degree of novelty (new product on the national or international market) Engage in active patenting and license out their IPRs Cooperate with customers outside Norway Main market: outside Norway |

| 6. Customer-oriented service suppliers | Main strategy: focus on customer-specific solutions Practice “co-creation” and “customization” of their products Introduce service innovation with local/regional/national novelty Cooperate with private customers and public sector |

| 7. Hard-trying innovators | Irregular R&D activity, innovation expenditures go mainly on own personnel High score on all types of factors that hamper innovation Try to cooperate with competitors locally Introduce product innovation that is new for firm or for the local market |

| 8. Knowledge absorbers | Actively use all channels for knowledge acquisition Offer goods and services co-created with users, often public sector organizations Practice skills upgrading, regular brainstorming sessions, cross-functional work groups or teams No formal R&D activities or significant innovation expenditures and no innovation introduced Implement machinery, equipment, and software based mainly on existing technology |

| 9. Innovation promisers | Have not introduced any innovation, but have plans to increase their innovation spending Have recently obtained funding (both private and public) for innovation Have some formal R&D activities Main strategy: focus on one or a small number of key goods or services Main marked: outside the EU |

| 10. Individual standard services suppliers | Main strategy: introducing new goods or services Oriented towards households and individuals as main customers Innovation spending mainly on own personnel Introduce service innovation with novelty at local/regional/national level Main market: Norway |

| 11. Early technology adopters | Invest in machinery, equipment, and software based on new technology Expect reduction in innovation expenditures in the next period Have recently obtained funding for innovation through a loan Introduce new products that are new to the firm Cooperate with suppliers |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Capasso, M.; Rybalka, M. Innovation Pattern Heterogeneity: Data-Driven Retrieval of Firms’ Approaches to Innovation. Businesses 2022, 2, 54-81. https://doi.org/10.3390/businesses2010004

Capasso M, Rybalka M. Innovation Pattern Heterogeneity: Data-Driven Retrieval of Firms’ Approaches to Innovation. Businesses. 2022; 2(1):54-81. https://doi.org/10.3390/businesses2010004

Chicago/Turabian StyleCapasso, Marco, and Marina Rybalka. 2022. "Innovation Pattern Heterogeneity: Data-Driven Retrieval of Firms’ Approaches to Innovation" Businesses 2, no. 1: 54-81. https://doi.org/10.3390/businesses2010004

APA StyleCapasso, M., & Rybalka, M. (2022). Innovation Pattern Heterogeneity: Data-Driven Retrieval of Firms’ Approaches to Innovation. Businesses, 2(1), 54-81. https://doi.org/10.3390/businesses2010004