Abstract

Aluminum’s unique properties have led to its widespread use across multiple industries, including transportation, aviation, power generation, construction, and food packaging. In recent years, global aluminum consumption has risen significantly, with China experiencing particularly sharp growth in both production and demand. In Russia, the aluminum industry is dominated by UC RUSAL, which consolidates all Russian aluminum and alumina production facilities, along with several international operations and mining assets. Despite its global presence, the company remains heavily reliant on imported raw materials (approximately 50%) for alumina production, resulting in reduced operational efficiency and declining output. This dependency has necessitated the exploration of strategies to diversify raw material sources across different stages of the aluminum production value chain. This study identifies and classifies key diversification options for global aluminum companies, focusing on secondary aluminum production, primary aluminum production, and alumina extraction from mined minerals, industrial waste, and by-products. The options were evaluated based on predefined criteria (feasibility, cost per Mg of alumina, logistics, alumina output, and economic security), and two options were selected. The research substantiates the feasibility of diversifying production through nepheline utilization. For the medium term, an economic efficiency assessment was conducted for a proposed 30% capacity expansion at the Pikalevo Alumina Refinery. Additionally, long-term opportunities for increasing aluminum output were identified, including leveraging foreign assets while accounting for associated risks.

1. Introduction

1.1. Analysis of the Key Issues in the Global Aluminum Industry

In recent decades, global industries including automotive, construction, electrical engineering, and aviation have demonstrated a consistent upward trend in aluminum consumption. Between 2013 and 2022, global aluminum demand grew by 33%, rising from 51.7 million Mg to 69 million Mg [1,2], while production increased by 31% from 52.3 million Mg to 68.5 million Mg during the same period [1,2]. Remarkably, the aluminum market has maintained stable supply-demand dynamics even during economic crises. A case in point is 2020, when global demand (excluding China) declined by 8.9% to 26 million Mg during the COVID-19 pandemic, while Chinese demand simultaneously increased by 3.9% to 37.9 million Mg [3]. That same year witnessed modest global production growth of 0.2%, with China achieving a 3.9% increase and Russia maintaining stable output levels of 3.775 million Mg [3]. Russia’s aluminum production capacity currently stands at 4.07 million Mg, complemented by an alumina production capacity of 3.26 million Mg, with 71.5% of domestically produced aluminum being exported primarily to China, Turkey, and South Korea.

Future demand projections from various governmental and analytical agencies indicate continued growth. Statista forecasts global aluminum consumption reaching 78.4 million Mg by 2029 [4], while Russia’s Strategy for the Development of the Metals Industry until 2030 predicts global consumption will rise to 121 million Mg by 2030 [5]. According to Gazprombank, global consumption may reach 148 million Mg by 2040 [6].

Russia’s Strategy for the Development of the Metals Industry until 2030 outlines two potential scenarios for domestic production growth: a baseline scenario projecting expansion to 4.9 million Mg and a conservative scenario anticipating growth to 4.47 million Mg [5]. This anticipated demand increase stems primarily from several key industries: aviation (driven by the localization of component and aircraft production), automotive manufacturing, defense, as well as electrical engineering and construction sectors. However, these projections fail to account for the current shortage of domestically produced alumina, which has already necessitated temporary production reductions at UC RUSAL facilities.

Bauxite is the conventional raw material for producing alumina, which is subsequently used to produce aluminum. According to UC RUSAL’s 2021 annual report, the company extracted a total of 15 million Mg of bauxite, with only 37.78% sourced domestically while the remaining 62.28% was imported from Guinea and Jamaica [7]. This import dependence results from two primary factors: the lower alumina content in Russian bauxite deposits and challenging mining conditions. Most Russian bauxite reserves prove unsuitable for processing via the more efficient Bayer method, while the higher costs associated with underground mining operations further disadvantage Russian sources compared to imported open-pit mined bauxite.

The reliance on bauxite imports introduces multiple risk factors, including substantial transportation costs, political instability in supplier nations that could disrupt production, potential sanctions affecting maritime bauxite transportation (including freight and insurance complications), possible increases in shipping tariffs, and the considerable distance between the company’s alumina plants and seaports [8]. These combined factors could ultimately render bauxite usage economically unviable should certain risks materialize. This vulnerability manifested clearly in 2022 when production costs surged by 30.2%, with alumina expenses alone accounting for 17.1% of total costs (an increase from 9% in 2021) [2]. The absolute cost of alumina rose by 149.3% year-over-year to USD 1847 million in 2022 [2]. By 2023, alumina’s share of production costs had grown to 19.4%, and by 2024, supply shortages coupled with rising purchase prices forced temporary reductions in aluminum output.

Among various aluminum-containing minerals that could potentially address alumina scarcity, nepheline emerges as one of the most promising alternatives to bauxite [9]. While nepheline has not gained widespread adoption in the global aluminum industry due to its lower alumina content, Russian researchers have developed specialized processing technologies that enable economically viable utilization of nepheline through complex processing methods [10,11,12], particularly for apatite and nepheline ores from the Kola Peninsula [13,14,15]. To mitigate alumina supply challenges, UC RUSAL could pursue several diversification strategies [16,17,18], including developing new bauxite sources, increasing alternative raw material utilization [19], implementing secondary raw material recycling programs, direct alumina procurement, or constructing new alumina production facilities.

It should be noted, however, that not all global practices can be directly applied, as companies differ in their strategies, resources, and operational constraints. For example, UC Rusal cannot simply adopt the approach used by Alcoa. Alcoa’s strategy relies on abundant resources and a strong focus on alumina sales. The company owns numerous bauxite deposits worldwide, and its bauxite mining and alumina production far exceed the requirements for aluminum production, leading it to prioritize alumina sales. In contrast, UC Rusal focuses on aluminum production and sales, with a strategy centered on integrating production capacities across all stages of the value chain.

Similarly, UC Rusal’s strategy differs from that of Rio Tinto. UC Rusal produces only aluminum, whereas Rio Tinto is a diversified producer of various non-ferrous metals.

1.2. Literature Review

Within academic literature and corporate practice, diversification is widely recognized as a distinct business strategy, particularly prevalent in advanced economies [20,21,22]. The strategic emphasis of diversification has evolved significantly since the 1960s, transitioning from initial focuses on market and industry expansion (to mitigate risks and enhance competitiveness and profitability) to contemporary priorities centered on bolstering corporate resilience against external shocks and stabilizing cash flows (as detailed in Table 1).

Table 1.

Conceptual frameworks of diversification as a strategy [compiled by the authors].

Ansoff’s definition remains foundational to diversification theory, encapsulating its core principles: resource reallocation and expansion into novel business domains. The academic literature offers numerous complementary interpretations. Thompson and Strickland’s formulation explicitly addresses corporate expansion into unfamiliar markets or product categories, while Kotler’s broader conceptualization encompasses new product development for new markets. The definitions advanced by Makarov, Yoshinara, Sakuma, Itami, and Vikhansky collectively frame diversification as a strategic transformation of business operations. However, these scholars emphasize distinct objectives, including risk reduction, operational efficiency enhancement, profitability improvement, corporate sustainability, market expansion, competitive advantage reinforcement, or corporate value maximization.

Mining companies operate in a unique ecosystem characterized by high capital intensity, long-term planning horizons, complex technological processes, depleted and limited resource bases, the need to ensure resilience in a turbulent external environment, and negative environmental impacts, which are reflected in the characteristics, specifics, and areas of diversification.

At the same time, a mining company’s diversification must be carried out taking into account ESG (Environmental, Social, and Governance) factors. Approach to assessing ESG factors vary in the number and composition of indicators, the degree of aggregation, the method for calculating the resulting value, and the weighting factors. However, several key frameworks offer a detailed assessment of these factors.

For example, Refinitiv’s ESG rating framework is based on the relative effectiveness of environmental, social, and governance indicators, which are compared depending on the company’s industry and country of incorporation. The assessment takes into account the most significant industry indicators, minimizing distortions associated with the company’s size and transparency [26]. Moody’s (Vigeo Eiris) ESG ratings framework measures the extent to which companies consider and manage ESG factors. Different ESG criteria are analyzed and assessed [27].

The ESG assessment methodology developed by ACRA combines qualitative and quantitative analysis of ESG factors, using weighted averages to calculate final ESG scores based on the importance of each factor for the specific organization being assessed [28]. The MSCI ESG framework evaluates how a company manages these risks relative to its peers in its industry, and also determines the extent to which each industry is exposed to various ESG issues [29].

Within the mining and metals sector, scholars have identified a specialized form of diversification: resource diversification [30,31,32], which specifically examines the utilization of diverse mineral resource types and sources to ensure corporate sustainability [33,34,35]. Ponomarenko et al. analyze seven diversification models consolidated into three primary categories: multipurpose utilization of raw materials, new product development, and enhanced processing, all ultimately aimed at establishing competitive advantages [36,37,38].

Gavrishev, Zalyadnov, and Bikteev propose an alternative classification system comprising three principal directions: expanded product portfolios, utilization of anthropogenic resources, and development of ancillary products or services for external markets [39,40]. Our study advocates for a bifurcated classification distinguishing between product diversification and raw material diversification.

Contemporary global practice demonstrates growing interest in utilizing mineral resources from anthropogenic deposits [41,42,43], mining waste [44,45,46], and processing tailings [47,48,49]. This paradigm aligns with sustainable development principles and circular economy models, thereby providing justification for anthropogenic resource utilization [50,51,52]. Researchers have proposed specific approaches for sourcing valuable and scarce raw materials, including waste recycling [53,54,55], recovering materials from waste that used to be unrecoverable [56,57,58] or cost-prohibitive to extract [59,60,61]. Nevertheless, the academic literature remains deficient in studies examining raw material diversification strategies specific to the aluminum industry, highlighting a gap that requires further scholarly investigation.

One of the most promising directions is the use of alternative raw materials. In the complex processing of nepheline, by-products such as potash, sodium carbonate, and cement are also obtained, the sale of which further enhances economic efficiency [62]. In Russia, nepheline ores are already utilized as raw materials at the Achinsk and Pikalevo alumina refineries. Several studies have focused on improving technologies for the complex processing of nepheline [63], confirming its technological feasibility. Parallel research is being conducted on the potential use of kaolin clays as an alternative raw material in alumina production [64,65].

A particularly promising direction in this field is the exploitation of anthropogenic deposits, owing to the high nepheline content found in the waste heaps of Apatit JSC.

Bruno examines regional industrial pollution by focusing on nepheline, a by-product of apatite beneficiation [66]. This analysis underscores the necessity of processing nepheline not only for alumina production but also to mitigate environmental burdens. The mechanism for utilizing anthropogenic deposits for alumina production is further explored in [67].

Diversification needs and increased resource independence have only recently gained attention in academic literature. Nonetheless, several significant findings have already emerged. For instance, the correlation between imported raw material volumes and prices has been documented, showing that higher prices lead to reduced import volumes [64]. The specific risks associated with reliance on imported raw materials for UC RUSAL have also been analyzed [68].

The beneficiation of apatite and nepheline ores has been extensively studied [69]. Advances in processing technologies, particularly for ores with low concentrations of primary minerals, hold promise for increasing the exploitation of reserves that are currently uneconomical to develop. Contemporary scientific efforts have achieved substantial progress in increasing flotation efficiency for complex apatite and nepheline ores [70,71,72]. A newly developed method for crushing multicomponent materials—demonstrated through apatite and nepheline ores—offers further improvements in processing performance. In scientific publications by V. M. Sizyakov, the prospects of using nepheline at the Pikalevo Alumina Refinery are examined in depth. These studies describe technologies that enable not only economically viable processing of raw materials but also the production of high-quality alumina from nepheline through sintering with limestone [73,74].

1.3. Purpose and Scope of the Work

Consequently, this study aims to identify and economically validate the most promising diversification strategy for UC RUSAL through a structured methodological approach.

The research focuses on two key objectives:

- Identifying potential resource diversification pathways for aluminum companies through the development of viable resource alternatives.

- Selecting optimal resource alternatives for global aluminum producers using UC RUSAL as a case study, employing specialized methodologies and investment analysis techniques.

2. Materials and Methods

The research methodology employed in this study incorporates several approaches, including content analysis of scientific literature, information analysis, synthesis, systematization, grouping, and generalization, as well as mathematical modeling.

The study is based on scientific articles published in high-impact journals, financial and sustainability reports from leading industry participants such as RUSAL (Moscow, Russia) and PhosAgro (Moscow, Russia), news sources covering industry developments, official strategic documents including Russia’s Strategy for the Development of the Metals Industry until 2030, and reports from analytical agencies including Statista (Hamburg, Germany) and Gazprombank (Moscow, Russia).

The research comprises three stages:

- Analysis and classification of potential raw material diversification strategies within the aluminum industry by means of content analysis of corporate annual reports, government policy documents, analytical agency publications, and scholarly articles. The findings were compiled in a table.

- Comparative assessment of raw material diversification strategies applicable to UC RUSAL by means of content analysis, data collection, and three key indicators such as production capacity expansion, viability, and projected economic efficiency. For the most promising areas of diversification, SWOT and PESTLE analyses of the projects were conducted.

- Economic assessment of two diversification strategies relevant for UC RUSAL, including expansion at the Pikalevo Alumina Refinery (PGLZ), construction of a new alumina production facility (LGZ), and enhancement of the company’s own mining operations to secure raw material supply. Cost calculations for each option were derived from established material and energy consumption benchmarks [75] and market prices. The economic evaluation framework compared the projected production costs of each strategy with market prices for alumina, with the difference interpreted as the potential economic benefit. Investment requirements and annual production metrics for each option were sourced from press releases and news reports issued by UC RUSAL. The analysis included calculating key performance metrics such as Net Present Value (NPV), Profitability Index (PI), Internal Rate of Return (IRR), and discounted payback periods. It also incorporated a sensitivity analysis.

3. Results

3.1. Diversification Strategies in the Aluminum Industry

To identify potential opportunities for diversifying corporate activities within the aluminum sector, four key stages of aluminum production (Figure 1) in the value-added chain (VAC) need to be examined: bauxite mining (or alternative raw material extraction), alumina refining, primary aluminum production via electrolysis, and the manufacturing of various value-added products [76]. Leading global players in the aluminum industry—such as CHINALCO, Hongqiao Group, Xinfa Group, and Rio Tinto—are vertically integrated corporations that encompass all stages of the production chain. This integration is essential to ensure operational stability, improve efficiency, and maximize added value. For example, UC RUSAL operates bauxite mining capacities both within Russia and internationally (in Guinea, Jamaica, and Guyana), with bauxite transported to its alumina refineries located in Russia, Ireland, Guinea, and Jamaica. From these alumina plants, the refined alumina is supplied to UC RUSAL’s aluminum refineries in Russia. The company also owns facilities dedicated to producing value-added products such as wheel rims and foil. Since aluminum production is highly energy-intensive, aluminum refineries are typically situated near hydroelectric power plants to utilize environmentally friendly and cost-effective energy sources [77,78]. UC RUSAL’s ownership of hydroelectric facilities exemplifies vertical integration.

Figure 1.

Aluminum production stages [compiled by the authors].

The key stage in the production chain is electrolysis, where alumina is used to extract aluminum—an impure form of primary aluminum containing high levels of impurities such as iron, silicon, titanium, sodium, hydrogen, alumina particles, carbon, and cryolite—before refining [79]. The predominant technologies employed involve electrolytic cells with prebaked anodes or self-baking anodes. The diagram illustrates the raw materials required for electrolysis (left), useful products (right), and waste or by-products (bottom). It is important to note that this stage consumes a significant amount of energy; consequently, electricity costs constitute a substantial portion of aluminum production expenses. Alumina can be produced via two main methods: from bauxite or alternative raw materials.

The global aluminum industry predominantly employs the Bayer process—considered highly efficient—yet in Russia, due to high silicon content in domestic bauxites, a modified approach known as Bayer sintering is used. This method involves sintering high-silicon bauxites (with a silica ratio below 7) with limestone. Producing one Mg of alumina through Bayer sintering requires approximately 2.54 to 2.74 Mg of bauxite [75].

Given Russia’s limited bauxite reserves and their low grade, alternative raw materials such as nepheline from the Kiya-Shaltyrskoe deposit and nepheline concentrate from Apatit JSC are also utilized for alumina production. Additionally, nepheline deposits on man-made sites on the Kola Peninsula can serve as raw material sources. Compared to the Bayer process and Bayer sintering, processing nepheline involves higher raw material consumption: approximately 6–8 Mg of limestone per Mg of alumina, 4–5 Mg of nepheline, 5.6 times higher fuel consumption, and 2.8 times higher electricity usage. Despite these challenges, nepheline processing is nearly waste-free: slurry can be repurposed for cement production; mother liquor serves as a sodium carbonate feedstock; and thermal energy consumption is reduced by a factor of 2.6.

Limited access to high-quality mineral reserves—particularly in Guinea where most profitable deposits are controlled by major international corporations—alongside high logistical costs, declining production efficiency, and volatile raw material and aluminum prices underscore the necessity for diversification strategies within aluminum companies to sustain competitiveness on a global scale.

Potential avenues for resource diversification in the aluminum sector include:

- Developing own alumina production capacities (expanding existing facilities or constructing new ones using diverse raw materials);

- Purchasing alumina from third-party suppliers at prevailing market prices;

- Acquiring equity stakes in alumina manufacturing enterprises;

- Incorporating aluminum scrap into production processes.

To illustrate resource diversification options within global aluminum companies—using UC RUSAL as a case study—we gathered data on existing mechanisms for activity diversification based on scientific literature, annual reports, corporate press releases, and news outlets.

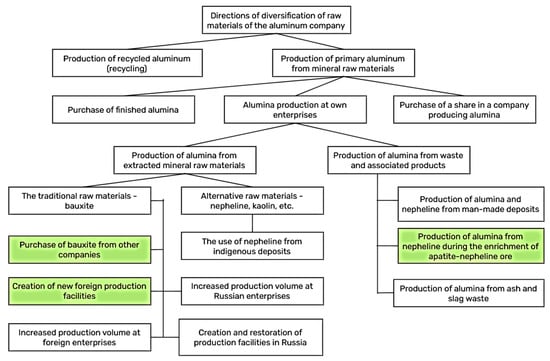

These resource diversification strategies are grouped into categories: secondary aluminum production via recycling, primary aluminum production, and alumina production using raw materials, waste, or by-products (see Figure 2 (The most prospective strategies are highlighted in green)).

Figure 2.

Diversification strategies in the aluminum sector [compiled by the authors].

The primary avenues for diversification in aluminum production are secondary aluminum production through recycling and primary aluminum production from raw materials.

Secondary aluminum production, which relies on recycling aluminum waste (scrap), is not addressed in this study, as the share of secondary raw materials currently accounts for less than 2% of annual aluminum output in Russia. In contrast, countries like Brazil—ranked fourth globally in alumina and aluminum production—recycle approximately 97% of their aluminum scrap [80,81]. There is a growing trend toward recycling among global industry leaders and a significant portion of aluminum will likely be produced from recycled materials over the long term [82,83]. In the Russian context, however, the scrap collection process remains poorly organized, and the issue of ensuring a stable supply of scrap has yet to be resolved. Consequently, scrap recycling alone cannot address the alumina deficit or sufficiently load primary aluminum production capacities. The main advantages of recycling include its near-complete elimination of CO2 emissions, a 95% reduction in energy consumption, and the avoidance of using raw materials [84,85,86]. These benefits align with sustainable development principles and circular economy models, making recycling a promising direction for future industry growth.

Primary aluminum production from raw materials is based on two processing options: (1) producing alumina from raw materials and (2) producing alumina from waste and by-products. An analysis to evaluate their respective merits is presented below.

3.1.1. Alumina Production from Raw Materials

The expansion of bauxite production at the company’s operational Russian deposits faces significant challenges due to complex geological conditions, a high proportion of underground mining operations, and the high production rates demonstrated by open-pit mines—specifically, Timan Bauxites operate at 112% capacity [87,88]. Long-term production growth is feasible only through substantial investments.

Development prospects for new bauxite deposits within Russia are constrained by several factors: the low quality of domestic bauxites—characterized by high silicon content—limited reserves, and their remote locations relative to existing alumina refineries.

An increase in bauxite output at the company’s existing overseas assets is theoretically possible, as these facilities are underutilized. However, geopolitical tensions in Guyana, along with technological and logistical challenges in Guinea and Jamaica, hinder the ability to operate these assets at full capacity [89].

The utilization of nepheline from primary deposits is restricted by the finite reserves available. Currently, the company mines nepheline at the Kiya-Shaltyrskoe nepheline deposit, with the ore supplied to the Achinsk alumina refinery. The remaining reserves are estimated to last approximately ten years under challenging mining conditions. Although large reserves of nepheline (urtite) are present in the Republic of Tyva, their extraction remains unfeasible at present due to inadequate logistical infrastructure in the region.

3.1.2. Alumina Production from Secondary Materials

The utilization of nepheline derived from man-made deposits presents a promising avenue for future alumina production, given the substantial reserves—estimated at approximately 500 million Mg. Realizing this potential necessitates investments in equipment and infrastructure at the PGLZ to establish a processing line capable of producing nepheline concentrate from these artificial deposits. Currently, the supply of man-made raw materials is monopolized by a single company, which poses risks to the sustainability and stability of this approach. Additionally, the variable quality of the materials supplied introduces further challenges [90,91].

One alternative man-made material for alumina production is ash and slag waste generated from coal combustion. This technology has gained widespread adoption in China [92,93]. One of the key obstacles for its adoption in Russia is the geographical remoteness of alumina refineries from waste-producing stations.

The options mentioned hold future promise, especially recycling. However, they currently require substantial capital investments, extended implementation timelines, and prolonged periods for return on investment.

3.2. Selection and Economic Evaluation of Promising Diversification Strategies

For primary aluminum production, raw material diversification can be achieved through diversifying alumina procurement sources, establishing or expanding in-house production capacities, and acquiring stakes in alumina-producing enterprises.

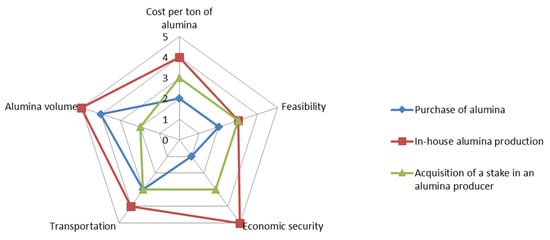

Table 2 and Figure 3 present an expert evaluation of these diversification strategies for primary aluminum production. The options were assessed based on key criteria, including price, feasibility, economic security, alumina volume, and transportation (Table 3). Each criterion was rated on a scale of 0 to 5.

Table 2.

Evaluation of raw material diversification strategies for primary aluminum production [compiled by authors].

Figure 3.

Raw material diversification in primary aluminum production.

Table 3.

Criteria for comparing alternative strategies: Interpretation and rating scale [compiled by authors].

Currently, further increases in alumina procurement appear unlikely due to several challenges: significant price volatility in the alumina market, limited market supply, high transportation costs, and threats to economic security.

Alumina can be supplied from China, but there are several limiting factors:

- Sourcing alumina from China involves complex organizational processes. Chinese alumina often requires additional processing to meet specific quality standards.

- Alumina imported from China is typically sold at a premium, with prices approximately 30% higher than the global average.

- Deliveries are frequently conducted through extended logistics chains due to Chinese traders’ concerns over secondary sanctions and are further complicated by overloads on the Eastern division of Russian Railways, which increases both delivery time and costs.

- The volume of alumina purchased from China remains insufficient, primarily because China prioritizes its own processing of alumina into aluminum.

- Increasing alumina imports from China would significantly heighten dependence on foreign supplies, thereby posing a threat to Russia’s economic security.

Other potential sources include India and Kazakhstan; however, their mining capacities are limited.

Investing in equity stakes in alumina producers presents additional challenges: there are no guarantees of stable supply, as evidenced by experiences with Chinese investments; the pool of companies is limited; transportation costs and organizational complexities pose major barriers; substantial financial investments are required.

UC RUSAL has already acquired a 30% stake in Hebei Wenfeng New Materials (HWNM), a Chinese company operating an alumina plant with a capacity of 4.8 million Mg per year. Additionally, an agreement exists for a phased acquisition of up to 50% of shares in the Indian Pioneer Aluminium Industries Limited (located in Andhra Pradesh), which has an initial capacity of 1.5 million Mg per year, potentially increasing to 2 million Mg.

The ongoing acquisition of shares in alumina producers, combined with prior experience in asset acquisition, highlights the following key factors:

- The limited number of global alumina refineries constrains share acquisitions; moreover, purchase agreements are complex organizational endeavors. Variations in quality standards across countries further complicate these transactions.

- While acquiring alumina at preferential prices is possible, factors such as necessary investments in plant modernization often diminish the cost advantage.

- Logistics challenges persist when transporting alumina obtained through shareholdings—particularly when involving Chinese companies—due to long supply chains.

- The volume of alumina produced through participation in these enterprises generally remains insufficient to fully address raw material deficits.

- Ownership stakes can positively influence dependence reduction on imported supplies.

Although producing alumina internally involves certain difficulties, it offers advantages over other diversification strategies.

Implementing this approach invariably requires expanding existing capacities or constructing new production facilities.

In this context, alumina can be produced from waste materials and associated components (see Table 4), as well as from mined ores—including traditional sources such as bauxite ores and alternative raw materials like nepheline and kaolin.

Table 4.

Alumina production from waste and associated components. A case study of UC Rusal [compiled by authors].

When evaluating alternative methods for producing alumina from waste, the criteria outlined in Table 3 were employed. While all the presented alternatives have limitations regarding their potential to substitute alumina demand volumes, the production of alumina from apatite and nepheline concentrate is considered to be a practical short-term solution for covering small deficits. This option has a number of advantages: no need for significant capital investments in new production facilities; no logistical challenges; traditional production process.

Among the diversification strategies listed in Table 5, the most promising ones are purchasing bauxite from various suppliers and establishing new production capacities in countries with stable geopolitical environments and moderate transportation costs.

Table 5.

Alumina production from traditional resources (bauxite ores). A case study of UC Rusal [compiled by authors].

The potential for increasing bauxite production at the company’s Russian assets is constrained by complex mining and geological conditions, reliance on underground mining methods, and high current utilization rates of existing capacities—such as Timan Bauxites, which was operating at 112% capacity utilization [87,88].

Expanding bauxite output at overseas assets is feasible, given that these facilities are underutilized, but there are a number of objective reasons that make this difficult [89].

Nepheline, kaolin, and other raw materials are also considered viable alternatives. The company currently mines nepheline at the Kiya-Shaltyrskoe nepheline deposit, with raw material transported to the Achinsk alumina refinery. Nonetheless, significant increases in production are limited by reserves—estimated to last less than ten years—and challenging mining and geological conditions. Large reserves of nepheline (urtite) are located in the Republic of Tyva; however, extraction is currently unfeasible due to inadequate logistical infrastructure in the region [95,96].

Among the various options considered for diversifying alumina sources, three strategies have been identified for further detailed analysis and economic evaluation. These options aim to provide quick solutions to alumina shortages stemming, addressing both short-term and long-term need.

During the study, SWOT and PESTLE analyses were carried out and are summarized in Table 6 and Table 7.

Table 6.

PESTLE analysis.

Table 7.

SWOT analysis.

Conducting a PESTLE analysis enabled the identification of external factors influencing the projects, while the subsequent SWOT analysis highlighted their internal strengths and weaknesses. The primary distinction between the two projects lies in their raw material dependence: the PGLZ expansion project is fully independent of imports, whereas the LGZ construction project relies on raw materials sourced from the company’s international operations. Consequently, the PGLZ project demonstrates greater resilience to external fluctuations and is subject to fewer risk factors. Both projects, however, face a shared challenge in the procurement of imported equipment. Overall, the analyses confirm that both project options are suitable for economic evaluation and strategic planning.

The options associated with these two projects include (Table 8):

- Expansion of existing capacities at PGLZ to achieve alumina production growth by 30%;

- Construction of a new alumina refinery (LGZ) in Russia with associated mining facilities in Sierra Leone to meet rising bauxite demand;

- Construction of a new alumina refinery (LGZ) with procurement of bauxite from third-party suppliers at market prices.

Table 8.

Three resource diversification strategies: A comparative assessment [compiled by authors].

Table 8.

Three resource diversification strategies: A comparative assessment [compiled by authors].

| Option | Investment, USD mln. | Period | Production Capacity, Thousand Mg of Alumina per Year | Capacity Growth Rate, % | Feasibility | Economic Efficiency | |

|---|---|---|---|---|---|---|---|

| A | Increasing PGLZ capacity by 30% (90 thousand Mg) | 23.5 | 2 | 90 | 3.5 | 0.001 | 0.60 |

| B | Establishing a bauxite mining facility in Sierra Leone and constructing the LGZ refinery | 4105 | 8 | 4800 | 187 | 0.191 | 0.21 |

| C | Constructing the LGZ refinery utilizing existing bauxite sources and purchasing the shortfall from third-party suppliers | 4000 | 8 | 4800 | 187 | 0.186 | 0.14 |

The first option—expansion of PGLZ capacity—involves increasing alumina output by 30%. An alternative raw material—nepheline concentrate—can be sourced from PhosAgro’s operations. This strategy enables a production increase within two years and reduces the alumina deficit by approximately 3.5%. Its primary advantages include utilizing domestically available raw materials obtained through an alternative production process and requiring relatively modest investments.

The second and the third options envisage establishing a new alumina refinery in Ust-Luga (the Gulf of Finland, Russia). The second option involves creating overseas ore mining capacities (3 million Mg of ore) to supply bauxite directly to the refinery, aiming to lower costs and enhance supply stability. The third option entails purchasing bauxite from international mining companies at market prices to meet raw material needs. The proposed large-scale refinery would have an annual capacity of approximately 4.8 million Mg of alumina, capable not only of covering current raw material deficits but also supporting future increases in aluminum production. The project’s implementation spans eight years across two stages, with an estimated capacity surplus covering about 187% of the current deficit. The total investment required is substantial—approximately USD 4 billion—though precise figures are yet to be finalized. A key drawback is ongoing dependence on imported bauxite, which introduces risks related to potential supply disruptions.

To compare these three options, three key indicators are proposed (Formulas (1)–(4)):

This metric assesses how significantly each diversification option can address the alumina deficit relative to shortfalls in 2023.

where 2 is the consumption rate for producing one Mg of alumina

This ratio reflects the financial viability by comparing project investments against total company assets.

This ratio measures the return on investment by comparing economic gains—derived from global market prices minus production costs—to capital expenditure. The costs of producing alumina from nepheline, the company’s bauxite ores, and purchased bauxite were calculated for options a, b, and c, respectively. The cost calculations incorporate raw material consumption rates based on BAT standards [75], with market-based pricing applied.

When comparing these options across three key indicators, several insights emerge:

- The capacity expansion is minimal for Option A, whereas Options B and C not only fully address the current deficit but also generate a substantial surplus, supporting future growth in aluminum production.

- From an implementation perspective, Option A is the simplest for the company to execute; Options B and C demand significant capital investments.

- Economically, Option A demonstrates the highest efficiency; additionally, if the company proceeds with constructing the LGZ refinery, it should aim to increase its own production capacity.

Notably, Options B and C enable the company to eliminate dependence on imported alumina raw materials. While Options B and C rely on bauxite imports, Option A allows for entirely domestic raw material utilization within the production chain. The calculations did not account for logistics costs associated with transporting bauxite/nepheline to the facility or alumina to aluminum refineries. However, in Option A, raw materials are transported over a shorter distance (approximately 1000 km by rail), which could reduce logistical expenses. Increasing PGLZ’s capacity offers an efficient short-term solution to partially replenish alumina deficits. In the long term, constructing a dedicated alumina refinery using domestically mined raw materials is advisable.

The primary economic benefit of increasing PGLZ’s capacity by 30% stems from cost savings achieved by producing alumina from nepheline at the plant itself versus purchasing from third-party suppliers.

For constructing the LGZ refinery, similar calculations were performed considering technological differences. During the first phase of LGZ’s operation, it will have a capacity of 2.4 million Mg annually; during the second phase, total capacity will reach 4.8 million Mg per year.

The data used to calculate the production cost of one Mg of alumina, following an increase in the capacity of PGLZ by 90,000 Mg per year, are presented in Table 9. Similarly, Table 10 provides the corresponding data for estimating the production costs at LGZ.

Table 9.

Costs of producing alumina from nepheline concentrate at PGLZ [compiled by the authors].

Table 10.

Costs of producing alumina from bauxite at LGZ [compiled by the authors].

Several assumptions underpinned these calculations:

- Average consumption rates of raw materials and resources typical for the industry were employed;

- Logistics costs were not included in the analysis; accounting for them would render the option of expanding PGLZ’s capacity more economically advantageous;

- The economic benefit was determined as the difference between the market price of alumina and its production cost;

- Commercial expenses were estimated at 10% of total costs, while other expenses were assumed to constitute 20%.

The calculation of alumina production costs is based on process flow diagrams [75]. At PGLS, the cost per Mg of alumina is estimated at RUB 24,423.22, equivalent to USD 280, while at LGZ, the cost is RUB 22,362.78, or USD 257.

To assess economic efficiency, additional profit margins were calculated by considering global alumina prices and the production costs associated with each project. The global price for alumina was approximated using the average price reported in UC Rusal’s annual report for 2024, which stood at USD 504 at the time of calculation. Consequently, the profit per Mg of alumina produced amounts to USD 222.27 for PGLS and USD 245.04 for LGZ. The key indicators of economic efficiency for both projects are summarized in Table 11.

Table 11.

Economic efficiency indicators [compiled by the authors].

Based on these results, it can be concluded that both projects demonstrate substantial economic viability and are feasible for implementation. It is noteworthy that expanding PGLZ’s capacity is projected to require approximately two years, making this option a promising short-term solution to address raw material shortages. In contrast, the construction of LGZ is expected to span eight years, with the first phase of the project taking three years. This longer timeline aligns with the company’s strategic long-term objectives and offers a comprehensive solution to ensure a stable raw material supply in the future.

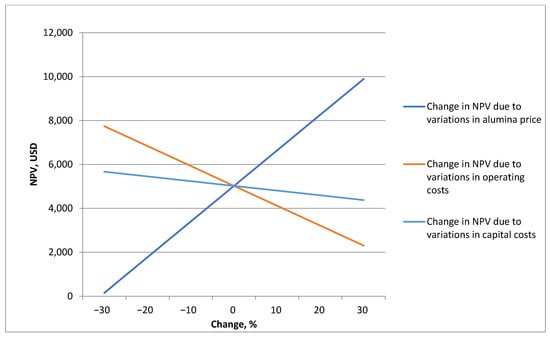

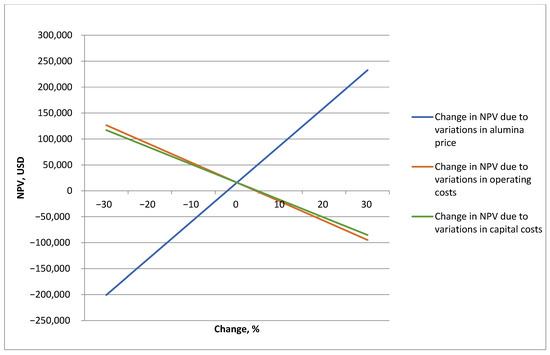

During the study, a sensitivity analysis of the proposed projects was conducted (Figure 4 and Figure 5). The analysis examined changes in Net Present Value (NPV) in response to fluctuations in alumina prices, capital expenditures, and operating costs. Both projects proved most sensitive to variations in alumina prices. Notably, the PGLZ capacity expansion project consistently maintained a positive NPV and demonstrated greater resilience to changes in capital costs. In contrast, the LGZ construction project becomes unprofitable if any of the key parameters deviate by 10% or more. It is also important to consider that increases in operating costs are often accompanied by corresponding rises in global alumina prices, partially offsetting cost growth.

Figure 4.

PGLZ capacity expansion: sensitivity analysis.

Figure 5.

LGZ construction: sensitivity analysis.

Consequently, it can be concluded that investments in the PGLZ expansion project entail comparatively lower risk.

4. Discussion

Based on the research findings, it is evident that global corporate experience in the mining industry offers a range of strategies aimed at improving resource provision. These strategies focus on raw materials usage or recycling.

Recycling is recognized as a highly promising and effective approach. Aluminum recycling constitutes a significant and growing share of global practice, with notable activity in countries such as Brazil, the UAE, and others. However, it involves a complex production chain to ensure product quality, which limits its applicability.

For UC Rusal, recycling is not a viable short-term solution due to the company’s specific circumstances. Expanding the share of production derived from recycling may be a promising medium- to long-term strategy.

Traditional sources of aluminum raw materials are practically not available in Russia, and imports are associated with increased geopolitical and economic risks and reduced economic security. The results of this study show that improving the stability of the supply chain is currently the most important task for both UC Rusal and the aluminum industry as a whole.

These findings are consistent with other scientific papers on supply chain risks and resource availability. For example, the article “Risks in Critical Metals Supply Chains: Sources, Distribution, and Responses” highlights the vulnerabilities of metallurgical supply chains and the need to increase their resilience [102].

In the article “Risk Assessment and Forecasting of Essential Mineral Resource Supplies to China: The Case of Copper” (Cheng Jinhua, Shuai Jing, Zhao Yujia et al.), the authors analyze the risks associated with copper supplies to China using the new EMRC (Environment–Market–Resource–Competitiveness) evaluation framework [103]. The four dimensions of risk are:

- Environmental—geopolitical stability and environmental risks of supplier countries;

- Market—supply concentration and import dependency;

- Resource—reserve sufficiency and the reserves-to-production ratio;

- Competitiveness—China’s comparative and trade advantage in the copper industry.

This approach can be applied to the aluminum sector as well.

Addressing resource security through the use of alternative raw materials represents a unique solution with no direct analogs in the global aluminum industry. Given the company’s existing technological capabilities and domestic raw material availability, this approach is particularly suitable for UC Rusal.

The results of this study indicate that enhancing supply chain stability is currently the most critical task for both UC Rusal and the broader aluminum industry. This includes reducing import dependence and incorporating domestic alternative raw materials into production processes.

For the priority strategies presented in the study for UC RUSAL, the authors determined economic efficiency and analyzed sensitivity to changes in key indicators (change in NPV due to variations in: alumina price, operating costs, capital costs). Other researchers have not carried out similar calculations in modern conditions.

Research limitations:

1. Risk analysis for all identified directions of raw material diversification was conducted primarily through qualitative methods using expert judgment. Quantitative risk assessment was performed only for priority diversification strategies, based on sensitivity analysis.

2. When selecting strategic directions of raw material diversification, the authors did not fully consider environmental and social factors within the ESG agenda. On the one hand, all project decisions embedded in the strategies comply with modern environmental standards and are based on the best available technologies (innovations). On the other hand, alumina production exerts a significant impact on the natural environment. For example, the new alumina plant construction project is expected to utilize dozens of hectares of land with relatively low soil quality.

3. In our study, the limitations of the source data are determined by the structure of the Russian aluminum industry, as the company RUSAL effectively integrates all enterprises within the technological chain. Consequently, the company operates under unique geopolitical conditions that disrupt global value chains, thereby necessitating the substantiation of domestic resource directions for securing production activities.

5. Conclusions

The conducted research in accordance with the research questions allows the authors to formulate the following conclusions.

1. Globally, aluminum companies are not fully self-sufficient in mineral resources, and their raw material supply strategies differ. Some companies (e.g., ALCOA) possess sufficient raw material reserves, Chinese producers prioritize secondary recycling, while Brazilian producers focus on the utilization of by-products from aluminum production itself.

2. The Russian aluminum industry has relied on imported mineral raw materials for decades, achieving substantial success during this period. However, under current geopolitical conditions, RUSAL’s participation in global value chains has been effectively excluded. The authors demonstrate the necessity of transforming the company’s global strategy into a national one, focused on maximizing reliance on diversified domestic raw material sources.

3. The use of traditional raw materials for aluminum production (bauxite) in Russia in sufficient quantities is impossible due to complex mining and geological conditions, high production costs, and the need to develop new underground mines, among other factors.

4. The use of secondary raw materials by RUSAL does not solve the fundamental problem of alumina supply, owing to the substantial shortage of mineral raw materials required for its production.

5. Russia, however, possesses large reserves of alternative raw materials (nepheline), and technologies for producing alumina from nepheline are being continuously improved. This provides unique solutions with no direct analogs in the global aluminum industry. Consequently, the most viable diversification strategies for Russia may differ significantly from international practices.

6. To identify potential resource diversification pathways, RUSAL developed a methodological framework that includes an evaluation of strategies across several criteria. Each diversification pathway was illustrated with practical examples from UC RUSAL’s operations, indicating key advantages and disadvantages.

7. To determine optimal resource alternatives, a methodological approach based on three indicators was developed: feasibility, economic efficiency, and capacity growth. Applying this framework, two alternatives were selected:

- In the short term, expansion of nepheline concentrate processing capacity at the Pikalevo Alumina Refinery;

- In the long term, the construction of a new Leningrad Alumina Refinery.

These strategies take into account Russia’s raw material base, existing production capacities, supply chains, and geopolitical and other risks, which were substantiated through the application of SWOT and PESTLE analysis methods.

8. Further research development will include the justification of approaches to geopolitical risk assessment in resource security strategies, as well as a more detailed evaluation of ESG factor impacts on the selection of mineral raw material sources.

Author Contributions

T.P.—conceptualization, methodology, and validation. K.S.—conceptualization, data collection, methodology, validation, and data processing. N.R.—conceptualization, methodology, and validation. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

No new data were created.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- UC Rusal. Annual Report 2013. Available online: https://rusal.ru/upload/iblock/9d4/9d42e845fa253019ae26e63d47e5bca5.pdf (accessed on 7 April 2025).

- UC Rusal. Annual Report 2022. Available online: https://rusal.ru/upload/iblock/6ed/6azccjf71b3lruvjgn5fs5ue1repgeen.pdf (accessed on 7 April 2025).

- UC Rusal. Annual Report 2020. Available online: https://rusal.ru/upload/iblock/b69/b69ea110f38548741dbda8d26f2c3873.pdf (accessed on 7 April 2025).

- Statista. Global Aluminum Consumption Projections from 2021 to 2029. Available online: https://www.statista.com/statistics/863681/global-aluminum-consumption/ (accessed on 7 April 2025).

- Garant. Decree of the Government of the Russian Federation No. 4260-r Dated 28 December 2022, “On Approval of the Strategy for the Development of the Metallurgical Industry of the Russian Federation for the Period up to 2030.”. Available online: https://www.garant.ru/products/ipo/prime/doc/405963845/ (accessed on 7 April 2025).

- Gazprombank Investments. Global Commodity Market: Aluminum. Available online: https://gazprombank.investments/blog/economics/aluminum (accessed on 7 April 2025).

- UC Rusal. Annual Report 2021. Available online: https://rusal.ru/upload/iblock/91c/9bfpx677dtz6sv6×38r7to0zh37pv5cy.pdf (accessed on 7 April 2025).

- Ozherelyev, V.N.; Ozherelyeva, M.V. Location and Logistics of Production as a Factor of Its Competitiveness. Russ. Trends Dev. Prospect. 2019, 14, 333–336. [Google Scholar]

- Sizikov, V.M. The Mining Institute and the Problems of Development of the Aluminum Industry in Russia. J. Min. Inst. 2005, 165, 163–169. [Google Scholar]

- Vlasov, A.A.; Sizikov, V.M.; Bazhin, V.Y. Use of Sandy-Type Alumina for Aluminum Production. iPolytechJournal 2017, 21, 111–118. [Google Scholar] [CrossRef]

- Larichkin, F.D.; Vorobyev, A.G.; Glushchenko, Y.G.; Azim, I.; Perein, V.N.; Ivanov, M.A. Theory and Practice of Pricing for Products of Complex Mineral Processing. Natl. Interests Priorities Secur. 2010, 32, 24–30. [Google Scholar]

- Ivanov, M.A.; Pak, V.I.; Nalivaiko, A.Y.; Medvedev, A.S.; Kirov, S.S. Prospects for Using Russian High-Silicon Aluminum-Containing Raw Materials in Alumina Production. Bull. Tomsk. Polytech. Univ. Geo Assets Eng. 2019, 330, 93–102. [Google Scholar] [CrossRef]

- Vasilyeva, M.N.; Nikiforova, E.M.; Eromasov, R.G.; Stepanova, M.L.; Markelov, N.A.; Gafarov, M.S.; Meylanova, M.N. Comprehensive Use of Nepheline Sludge in the Production of Building Materials. Mod. High Technol. 2019, 3, 77–82. [Google Scholar]

- Gerasimova, L.G.; Nikolaev, A.I.; Shchukina, E.S.; Safonova, I.V. Mineral Waste from the Enrichment of Apatite-Nepheline Ores as a Raw Material Source for Functional Materials. Min. J. 2020, 2020, 78–84. [Google Scholar] [CrossRef]

- Polyanskaya, I.G.; Yurak, V.V.; Strovsky, V.E. Improving the Balance of Subsoil Use in a Region by Accounting for Mining Waste. Reg. Econ. 2019, 15, 1226–1240. [Google Scholar] [CrossRef]

- Litvinenko, V.S.; Petrov, E.I.; Vasilevskaya, D.V.; Yakovlenko, A.V.; Naumov, I.A.; Ratnikov, M.A. Assessing the Role of the State in Mineral Resource Management. J. Min. Inst. 2023, 259, 95–111. [Google Scholar] [CrossRef]

- Marinina, O.A.; Kirsanova, N.Y.; Nevskaya, M.A. Circular Economy Models in Industry: Developing a Conceptual Framework. Energies 2022, 15, 9376. [Google Scholar] [CrossRef]

- Cherepovitsyn, A.E.; Kazanin, A.; Rutenko, E. Strategic Priorities for Green Diversification of Oil and Gas Companies. Energies 2023, 16, 4985. [Google Scholar] [CrossRef]

- Titova, A.V.; Golik, V.I. Diversification of Ore Mining Complex as Direction for Development of Depressive Economic System. Russian Mining Industry. 2020, 6, 112–117. [Google Scholar] [CrossRef]

- Ansoff, I. Strategic Management; Ekonomika: Moscow, Russia, 1989. [Google Scholar]

- Thompson, A.A.; Strickland, A.D. Strategic Management: The Art of Developing and Implementing Strategies; UNITI: Moscow, Russia, 1998. [Google Scholar]

- Voitekhovich, E.N.; Baskov, I.S. Diversification from the Perspective of Resource Theory, Transactional and Portfolio Approaches. Bull. Amur State Univ. Ser. Nat. Econ. Sci. 2012, 59, 143–147. [Google Scholar]

- Vikhansky, O.S. Strategic Management; Gardarika: Moscow, Russia, 1998. [Google Scholar]

- Yoshinara, E.; Sakuma, A.; Itami, K. Diversification Strategy of Japanese Enterprise; Nihon Keizai Shimbunsha: Tokyo, Japan, 1979. [Google Scholar]

- Makarov, A.V.; Garifullin, A.R. Diversification as a Tool for the Development of a Modern Enterprise. Bull. Ural. State Univ. Econ. 2010, 1, 27–36. [Google Scholar]

- Refinitiv. Refinitiv ESG Scores Methodology; Refinitiv: London, UK, 2021; Available online: https://www.refinitiv.com/content/dam/marketing/en_us/documents/methodology/refinitiv-esgscores-methodology.pdf (accessed on 16 October 2025).

- Smith, C. A Beginner’s Guide to ESG Rating Agencies and Methodologies. IRIS Carbon. 2023. Available online: https://iriscarbon.com/a-beginners-guide-to-esg-rating-agencies-and-methodologies/ (accessed on 7 April 2025).

- Analytical Credit Rating Agency (ACRA). ESG Evaluation Methodology; ACRA: Moscow, Russia, 2022; Available online: https://www.acra-ratings.ru/upload/iblock/924/ubma02xwjk8dt1pkvpmkyvtdkiykawv4.pdf (accessed on 16 October 2025).

- MSCI. MSCI ESG Methodologies; MSCI: New York, NY, USA, 2020; Available online: https://www.msci.com/documents/1296102/21901542/MSCI+ESG+Ratings+Methodology+-+Exec+Summary+Nov+2020.pdf (accessed on 16 October 2025).

- Gavrishev, S.E.; Zalyadnov, V.Y.; Bikteeva, N.S. Directions for Diversification of Mining Enterprise Activities. Min. Inf. Anal. Bull. (Sci. Tech. J.) 2018, 7, 5–15. [Google Scholar]

- Xu, J.; Zhang, J.S.; Yao, Q.; Zhang, W. Is It Feasible for China to Optimize Oil Import Source Diversification? Sustainability 2014, 6, 8329–8341. [Google Scholar] [CrossRef]

- Li, Q.; Wang, W.; Lou, Y.; Cheng, K.; Yang, X. Diversification and Corporate Performance: Evidence from China’s Listed Energy Companies. Sustainability 2016, 8, 983. [Google Scholar] [CrossRef]

- Jha, S.K.; Bhawe, N.; Satish, P.; Schouten, J.; Press, M.; Dufault, B.; Rosen, M.A. Scaling Social Enterprises through Product Diversification. Sustainability 2021, 13, 11660. [Google Scholar] [CrossRef]

- Wu, H.; Qu, Y.; Ye, Y. The Effect of International Diversification on Sustainable Development: The Mediating Role of Dynamic Capabilities. Sustainability 2022, 14, 8981. [Google Scholar] [CrossRef]

- Yin, W.; Ran, W. Supply Chain Diversification, Digital Transformation, and Supply Chain Resilience: Configuration Analysis Based on fsQCA. Sustainability 2022, 14, 7690. [Google Scholar] [CrossRef]

- Ponomarenko, T.V.; Belitskaya, N.A.; Bavuu, C. Diversification in Mining Companies: Current Trends, Models, and Results. Min. Inf. Anal. Bull. (Sci. Tech. J.) 2015, 40, 47–60. [Google Scholar]

- Zhang, H.; Zhang, S. How Does the Sustainable Investment Climate Affect Firm Geographic Diversification in China? Managerial Discretion as a Mediator. Sustainability 2022, 14, 2764. [Google Scholar] [CrossRef]

- Li, C.M.; Cui, T.; Nie, R.; Shan, Y.; Wang, J.; Qian, X. A Decision Model to Predict the Optimal Size of the Diversified Management Industry from the View of Profit Maximization and Coordination of Industrial Scale. Sustainability 2017, 9, 642. [Google Scholar] [CrossRef]

- Golovanova, G.V. Directions for the Development of Diversification in Mining and Ore Companies. J. Min. Inst. 2002, 150, 137–140. [Google Scholar]

- Retka, J.; Rzepa, G.; Bajda, T.; Drewniak, L. The Use of Mining Waste Materials for the Treatment of Acid and Alkaline Mine Wastewater. Minerals 2020, 10, 1061. [Google Scholar] [CrossRef]

- Jarrín Jácome, G.; Godoy León, M.F.; Alvarenga, R.A.F.; Dewulf, J. Tracking the fate of aluminium in the eu using the matrace model. Resources 2021, 10, 72. [Google Scholar] [CrossRef]

- Mendes, J.R.; Arias-Maldonado, M.; Parton, N. Does the Sustainability of the Anthropocene Technosphere Imply an Existential Risk for Our Species? Thinking with Peter Haff. Soc. Sci. 2021, 10, 314. [Google Scholar] [CrossRef]

- Steinbach, V.; Wellmer, F.W. Consumption and Use of Non-Renewable Mineral and Energy Raw Materials from an Economic Geology Point of View. Sustainability 2010, 2, 1408–1430. [Google Scholar] [CrossRef]

- Lébre, É.; Corder, G. Integrating Industrial Ecology Thinking into the Management of Mining Waste. Resources 2015, 4, 765–786. [Google Scholar] [CrossRef]

- Lim, B.; Diaz Alorro, R.; Jones, M. Technospheric Mining of Mine Wastes: A Review of Applications and Challenges. Sustainable 2021, 2, 686–706. [Google Scholar] [CrossRef]

- Wellmer, F.W.; Hagelüken, C. The Feedback Control Cycle of Mineral Supply, Increase of Raw Material Efficiency, and Sustainable Development. Minerals 2015, 5, 815–836. [Google Scholar] [CrossRef]

- Amrani, M.; Taha, Y.; El Haloui, Y.; Benzaazoua, M.; Hakkou, R. Sustainable Reuse of Coal Mine Waste: Experimental and Economic Assessments for Embankments and Pavement Layer Applications in Morocco. Minerals 2020, 10, 851. [Google Scholar] [CrossRef]

- Roumpos, C.; Vasilatos, C.; Xenidis, A.; Baldassarre, G.; Fiorucci, A.; Marini, P. Recovery of Critical Raw Materials from Abandoned Mine Wastes: Some Potential Case Studies in Northwest Italy. Materials 2024, 15, 77. [Google Scholar] [CrossRef]

- Mancini, S.; Casale, M.; Tazzini, A.; Dino, G.A. Use and Recovery of Extractive Waste and Tailings for Sustainable Raw Materials Supply. Mining 2024, 4, 149–167. [Google Scholar] [CrossRef]

- Karachaliou, T.; Protonotarios, V.; Kaliampakos, D.; Menegaki, M. Using Risk Assessment and Management Approaches to Develop Cost-Effective and Sustainable Mine Waste Management Strategies. Recycling 2016, 1, 328–342. [Google Scholar] [CrossRef]

- Cayumil, R.; Khanna, R.; Konyukhov, Y.; Burmistrov, I.; Kargin, J.B.; Mukherjee, P.S. An Overview on Solid Waste Generation and Management: Current Status in Chile. Sustainability 2021, 13, 11644. [Google Scholar] [CrossRef]

- Kalaitzidou, K.; Pagona, E.; Mitrakas, M.; Zouboulis, A. MagWasteVal Project—Towards Sustainability of Mining Waste. Sustainability 2023, 15, 1648. [Google Scholar] [CrossRef]

- Romero, M.; Padilla, I.; Contreras, M.; López-delgado, A. Mullite-Based Ceramics from Mining Waste: A Review. Minerals 2021, 11, 332. [Google Scholar] [CrossRef]

- Cobirzan, N.; Muntean, R.; Thalmaier, G.; Felseghi, R.A. Recycling of mining waste in the production of mansory units. Materials 2022, 15, 594. [Google Scholar] [CrossRef]

- Tayebi-Khorami, M.; Edraki, M.; Corder, G.; Golev, A. Re-Thinking Mining Waste through an Integrative Approach Led by Circular Economy Aspirations. Minerals 2019, 9, 286. [Google Scholar] [CrossRef]

- Pyrgaki, K.; Gemeni, V.; Karkalis, C.; Koukouzas, N.; Koutsovitis, P.; Petrounias, P. Geochemical occurrence of rare earth elements in mining waste and mine water: A review. Minerals 2021, 11, 860. [Google Scholar] [CrossRef]

- Aznar-Sánchez, J.A.; García-Gómez, J.J.; Velasco-Muñoz, J.F.; Carretero-Gómez, A. Mining Waste and Its Sustainable Management: Advances in Worldwide Research. Minerals 2018, 8, 284. [Google Scholar] [CrossRef]

- Dushyantha, N.; Ilankoon, I.M.S.K.; Ratnayake, N.P.; Premasiri, H.M.R.; Dharmaratne, P.G.R.; Abeysinghe, A.M.K.B.; Rohitha, L.P.S.; Chandrajith, R.; Ratnayake, A.S.; Dissanayake, D.M.D.O.K.; et al. Recovery Potential of Rare Earth Elements (REEs) from the Gem Mining Waste of Sri Lanka: A Case Study for Mine Waste Management. Minerals 2022, 12, 1411. [Google Scholar] [CrossRef]

- Terrones-Saeta, J.M.; Suárez-Macías, J.; Río, F.J.L.D.; Corpas-Iglesias, F.A. Study of Copper Leaching from Mining Waste in Acidic Media, at Ambient Temperature and Atmospheric Pressure. Minerals 2020, 10, 873. [Google Scholar] [CrossRef]

- Stander, H.M.; Broadhurst, J.L. Understanding the Opportunities, Barriers, and Enablers for the Commercialization and Transfer of Technologies for Mine Waste Valorization: A Case Study of Coal Processing Wastes in South Africa. Resources 2021, 10, 35. [Google Scholar] [CrossRef]

- Balaram, V. Potential Future Alternative Resources for Rare Earth Elements: Opportunities and Challenges. Minerals 2023, 13, 425. [Google Scholar] [CrossRef]

- Alsharari, F. Utilization of industrial, agricultural, and construction waste in cementitious composites: A comprehensive review of their impact on concrete properties and sustainable construction practices. Mater. Today Sustain. 2025, 29, 101080. [Google Scholar] [CrossRef]

- Sizikov, V.M.; Brichkin, V.N. On the Role of Calcium Hydrocarboaluminates in Improving the Technology of Complex Processing of Nepheline. J. Min. Inst. 2018, 231, 292–298. [Google Scholar] [CrossRef]

- Naimov, N.A.; Ruziev, D.R.; Amidzhoni, G.; Safiev, A.K.; Boboev, K.E.; Mukhamediev, N.P.; Rafiev, R.S.; Safiev, K. Complex Processing of Kaolin Clays from the “Zidda” Deposit. Rep. Acad. Sci. Repub. Tajikistan 2018, 2, 286–292. [Google Scholar]

- Brichkin, V.N.; Kurtenkov, R.V.; El-Dib, A.B.S.; Bormotov, I.S. State and Development Paths of the Aluminum Raw Material Base in Non-Bauxite Regions. Miner. Process. 2019, 4, 31–37. [Google Scholar] [CrossRef]

- Bruno, E. The Role of Nepheline in the Ecological History of the Khibiny Mountains. Ural. Hist. Bull. 2022, 2, 97–105. [Google Scholar] [CrossRef]

- Rogov, V.Y. Technogenic Resources for Alumina and Rare Earth Elements. What Should Be the Mechanism for Managing Industrial Waste? Glob. Reg. Res. 2020, 2, 133–138. [Google Scholar]

- Vankaeva, B.K. Analysis of the Impact of Various Factors on the Risks of RUSAL Company. Int. J. Humanit. Nat. Sci. 2016, 10, 210–213. [Google Scholar] [CrossRef]

- Nikitina, I.V.; Taran, A.E.; Perunkova, T.N.; Mitrofanova, G.V. Stimulation of flotation of rebellious apatite-nepheline ore with selective collecting agents. Mining. Inf. Anal. Bull. (Sci. Tech. J.) 2021, 11, 95–108. [Google Scholar] [CrossRef]

- Elbendari, A.M.; Aleksandrova, T.N.; Nikolaeva, N.V. Optimization of the Reagent Regime in the Enrichment of Apatite-Nepheline Ores. Min. Inf. Anal. Bull. (Sci. Tech. J.) 2020, 2020, 123–132. [Google Scholar] [CrossRef]

- Aleksandrova, T.N.; Elbendari, A.M. Improving the Efficiency of Phosphate Ore Processing by Flotation. J. Min. Inst. 2021, 248, 260–271. [Google Scholar] [CrossRef]

- Yakovleva, T.A.; Romashev, A.O.; Mashevsky, G.N. Digital technologies for optimizing the doising of flotation reagents during flotation of non-ferrous metal ores. Min. Inf. Anal. Bull. (Sci. Tech. J.) 2022, 6, 175–188. [Google Scholar] [CrossRef]

- Sizikov, V.M.; Sizikova, E.V. Prospects for the Development of Complex Processing of Kola Nepheline Concentrates. Min. Inf. Anal. Bull. (Sci. Tech. J.) 2015, 1, 126–145. [Google Scholar]

- Sizikov, V.M. Status, Problems, and Prospects for the Development of the Method for Complex Processing of Nepheline. J. Min. Inst. 2006, 169, 16–22. [Google Scholar]

- Bureau of Best Available Techniques (BAT). ITS 11-2022 Aluminum Production. Available online: https://burondt.ru/NDT/NDTDocsDetail.php?UrlId=1845&etkstructure_id=1872 (accessed on 7 April 2025).

- Brichkin, V.N.; Vasiliev, V.V.; Maksimova, R.I. Alumina production: Historical development, issues, and solutions. Part 1. iPolytech J. 2023, 27, 583–597. [Google Scholar] [CrossRef]

- Galevskiy, S.G.; Qian, H. Developing and validating comprehensive indicators to evaluate the economic efficiency of hydrogen energy investments. Oper. Res. Eng. Sci. Theory Appl. 2024, 7, 188–207. [Google Scholar] [CrossRef]

- Yujra Rivas, E.; Vyacheslavov, A.V.; Gogolinskiy, K.; Sapozhnikova, K.; Taymanov, R. Deformation Monitoring Systems for Hydroturbine Head-Cover Fastening Bolts in Hydroelectric Power Plants. Sensors 2025, 25, 2548. [Google Scholar] [CrossRef]

- Ilyushin, Y.V.; Boronko, E.A. Analysis of Energy Sustainability and Problems of Technological Process of Primary Aluminum Production. Energies 2025, 18, 2194. [Google Scholar] [CrossRef]

- de Morais, M.O.; Brejão, A.S.; Araújo, M.B.; de Neto, P.L.O.C. The reverse logistics helping to reduce costs of raw material in a pressure aluminum casting. Environ. Qual. Manag. 2018, 28, 39–46. [Google Scholar] [CrossRef]

- Fungaro, D.A.; Silva, K.C.; Mahmoud, A.E.D. Aluminium Tertiary Industry Waste and Ashes Samples for Development of Zeolitic Material Synthesis. J. Appl. Mater. Technol. 2021, 2, 66–73. [Google Scholar] [CrossRef]

- Eheliyagoda, D.; Li, J.; Geng, Y.; Zeng, X. The role of China’s aluminum recycling on sustainable resource and emission pathways. Resour. Policy 2022, 76, 102552. [Google Scholar] [CrossRef]

- Ghulam, N.A.; Abbas, M.N.; Sachit, D.E. Preparing of Alumina from Aluminum Waste. Int. J. Innov. Sci. Res. Technol. 2019, 4, 32019. [Google Scholar]

- Liu, S.; Xie, Y.; Liang, W. Optimisation of the Circular Economy Based on the Resource Circulation Equation. Sustainability 2024, 16, 6514. [Google Scholar] [CrossRef]

- Nevskaya, M.A.; Raikhlin, S.M.; Chanysheva, A.F. Assessment of Energy Efficiency Projects at Russian Mining Enterprises within the Framework of Sustainable Development. Sustainability 2024, 16, 7478. [Google Scholar] [CrossRef]

- Massel, L.; Komendatova, N.; Massel, A.; Tsvetkova, A.; Zaikov, K.; Marinina, O. Resilience of socioecological and energy systems: Intelligent information technologies for risk assessment of natural and technogenic threats. J. Infrastruct. Policy Dev. 2024, 8, 4700. [Google Scholar] [CrossRef]

- Sidorov, D.V. Methodology for Reducing Rockburst Hazard When Applying Chamber-and-Pillar Mining Systems at Great Depths in the North Ural Bauxite Deposits. J. Min. Inst. 2017, 223, 58–69. [Google Scholar] [CrossRef]

- Ilyushin, Y.V.; Talanov, N.A. Development of Methods and Models for Assessing Technical Condition of Mines and Underground Structures. Int. J. Eng. 2025, 38, 1659–1666. [Google Scholar] [CrossRef]

- UC Rusal. Annual Report 2023. Available online: https://rusal.ru/upload/iblock/a24/3obdigf1a9w9rbkhoavc65h2d494wdnp/Rusal_Annual_Report_2023_RU.pdf (accessed on 7 April 2025).

- Cherepovitsyn, A.E.; Dorozhkina, I.P. The state and prospects of development of the mineral resource base of rare earth metals in Russia. Proc. Ural. State Min. Univ. 2025, 1, 154–161. [Google Scholar] [CrossRef]

- Marinina, O.A.; Ilyushin, Y.V.; Kildiushov, E.V. Comprehensive Analysis and Forecasting of Indicators of Sustainable Development of Nuclear Industry Enterprises. Int. J. Eng. 2025, 38, 2527–2536. [Google Scholar] [CrossRef]

- Ba, H.; Li, J.; Ni, W.; Lu, C.; Hitch, M. Optimizing coal gasification slag utilization: Predictive modeling and hydration mechanism of blast furnace slag replacement in solid waste cementitious materials. Chem. Eng. J. 2025, 522, 167935. [Google Scholar] [CrossRef]

- Tang, L.; Pervukhin, D.A. Enhancing Operational Efficiency in Coal Enterprises Through Capacity Layout Optimisation: A Cost-Effectiveness Analysis. Oper. Res. Eng. Sci. Theory Appl. 2024, 7, 144–163. [Google Scholar] [CrossRef]

- Maybee, B.; Lilford, E.; Hitch, M. Environmental, Social and Governance (ESG) risk, uncertainty, and the mining life cycle. Extr. Ind. Soc. 2023, 14, 101244. [Google Scholar] [CrossRef]

- Semenova, T.; Sokolov, I. Theoretical Substantiation of Risk Assessment Directions in the Development of Fields with Hard-to-Recover Hydrocarbon Reserves. Resources 2025, 14, 64. [Google Scholar] [CrossRef]

- Stoianova, A.D.; Trofimets, V.Y.; Stoianova, O.V.; Matrokhina, K.V. Structural Model of Decision Support System for Sustainable Development of Oil and Gas Companies. Int. J. Eng. Trans. A Basics 2025, 38, 701–709. [Google Scholar] [CrossRef]

- Hitch, M.; Li, J. Developing a verification framework for carbon sequestration through mineral carbonation of mine tailings: An Australian context. Extr. Ind. Soc. 2025, 23, 101696. [Google Scholar] [CrossRef]

- Kügerl, M.T.; Hitch, M.; Gugerell, K. Responsible sourcing for energy transitions: Discussing academic narratives of responsible sourcing through the lens of natural resources justice. J. Environ. Manag. 2023, 326, 116711. [Google Scholar] [CrossRef]

- Tsvetkov, P.S. Cluster approach to industrial CO2 capture and transportation: Savings due to joint infrastructure. J. Min. Inst. 2025, 275, 110–129. [Google Scholar]

- Kruk, M.N.; Perdomo Millán, A.; Torres Batista, Y. Evaluation of the Efficiency of Implementation of the Sustainable Development Program at Nickel-Cobalt Ore Mining Enterprises. Sustainability 2025, 17, 9441. [Google Scholar] [CrossRef]

- Cherepovitsyn, A.E.; Strelchenko, K.A. Prospects for the Recovery and Strategic Development of the Mica Industry of the Russian Federation: Arctic Focus. North Mark. Form. Econ. Order 2025, 3, 53–68. [Google Scholar] [CrossRef]

- Sun, X. Supply chain risks of critical metals: Sources, propagation, and responses. Front. Energy Res. 2022, 10, 957884. [Google Scholar] [CrossRef]

- Cheng, J.; Shuai, J.; Zhao, Y.; Li, X.; Wang, Y. Risk Assessment and Forecasting of Essential Mineral Resource Supplies to China: The Case of Copper. Resour. Sci. 2023, 45, 1650–1663. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).