Analysis of the Palladium Market: A Strategic Aspect of Sustainable Development

Abstract

1. Introduction

- Assess the platinum-group metals (PGMs) mineral resource base;

- Identify primary and emerging applications of palladium;

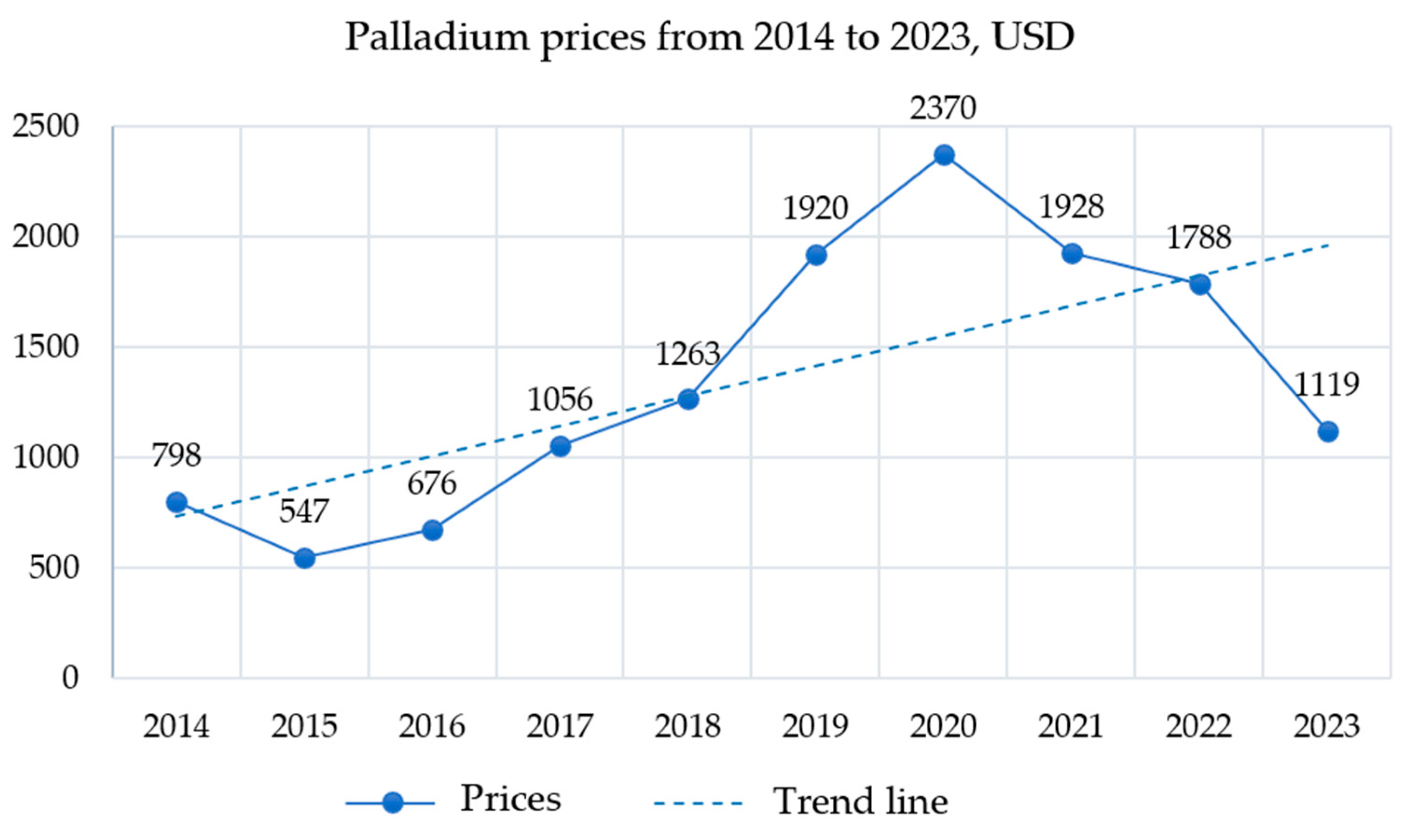

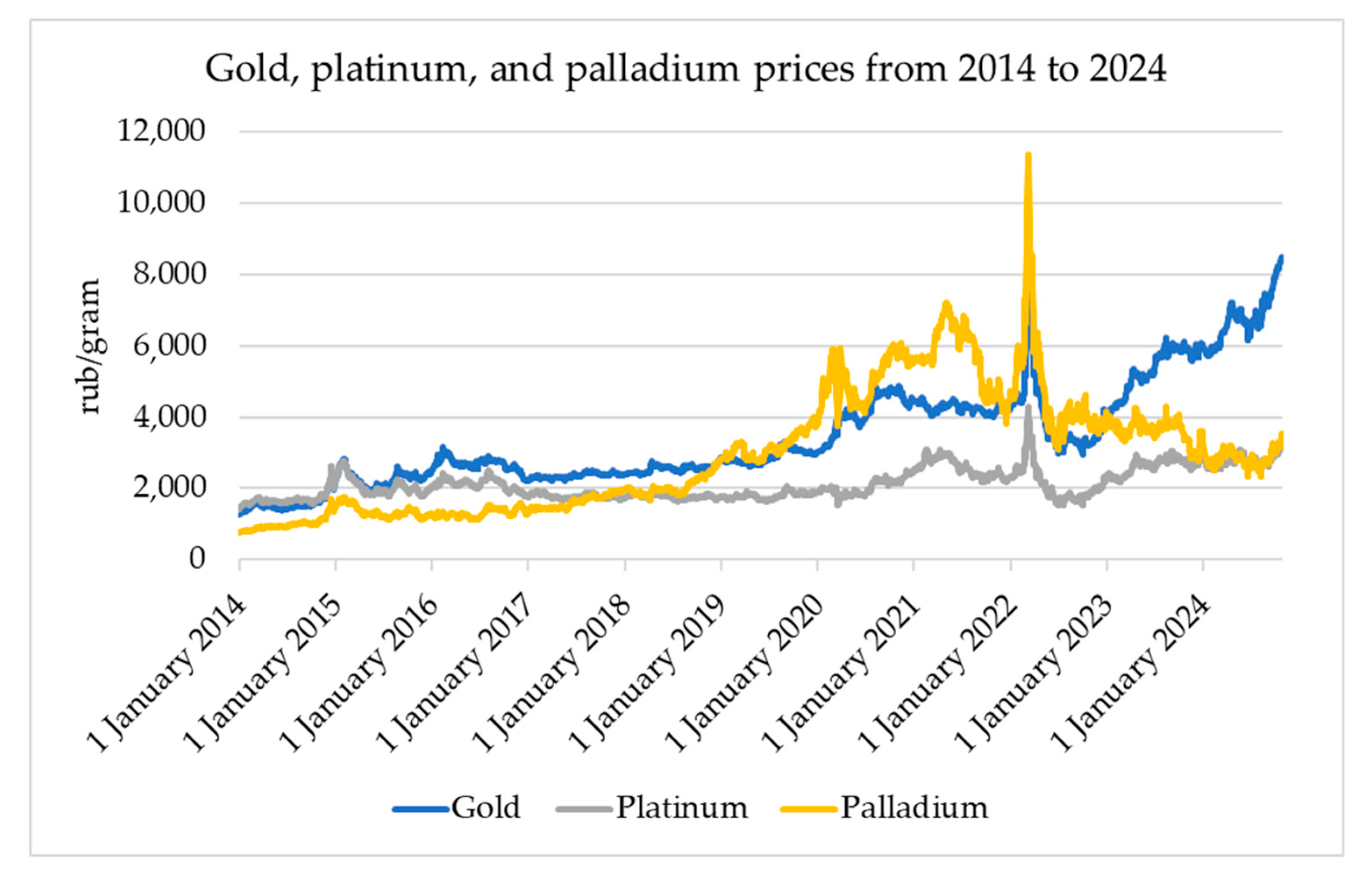

- Analyze current market trends, including price volatility and investment potential;

- Conduct a strategic analysis of Norilsk Nickel as the global leader in palladium production;

- Analyze the anthropogenic cycle of palladium.

2. Materials and Methods

3. Results and Discussion

3.1. Main Deposits of Platinum-Group Metals in the World

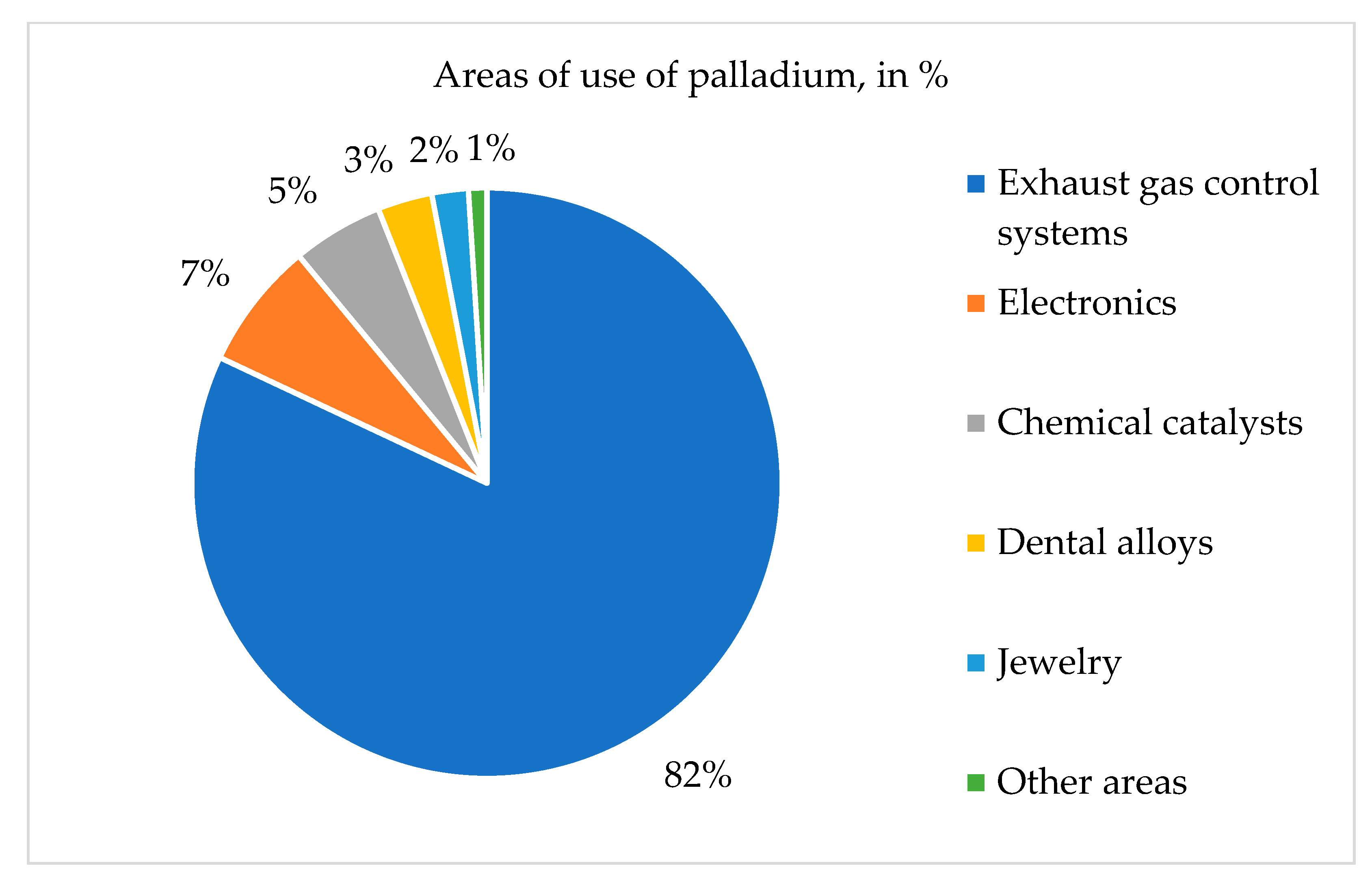

3.2. Palladium Applications and Market Trends for Sustainable Development

- Growing demand for automotive catalysts: Modern technologies and innovations provide the opportunity to recover and reuse resources, which helps reduce waste and losses and increase the profitability of production [38].

- Price spread between platinum and palladium: This factor has prompted substitution trends in the automotive sector. Historically, palladium’s premium pricing (though currently prices have converged) and concerns about concentrated Russian production have driven manufacturers to replace it with its more affordable counterpart, platinum. However, emerging factors may sustain palladium demand due to the relaxation of engine temperature constraints and palladium’s superior thermal stability in gasoline catalytic converters compared to platinum, which degrades at elevated operating temperatures.

- The transportation sector is experiencing a shift in electrification from all-electric vehicles to hybrid models, which typically contain higher platinum-group metal (PGM) concentrations in their catalysts compared to conventional internal combustion engine vehicles. These hybrid systems combine a conventional internal combustion engine with an electric motor powered by a rechargeable battery. Furthermore, new extended-range hybrid models featuring internal combustion engines for battery recharging are entering the market. This transition is expected to increase palladium demand in the automotive industry since most hybrid vehicles continue to rely on gasoline-powered engines.

- New areas of palladium utilization: Norilsk Nickel is actively developing innovative applications for palladium across several promising sectors, including hydrogen energy, novel organic compounds, and solar energy. The expansion of investments in advanced technologies and sustainability initiatives has become increasingly important, prompting many countries to implement various incentive programs for renewable energy development. These initiatives aim to protect the environment and mitigate potential ecological impacts [39,40,41,42].

- The combination of high liquidity in the market and pessimistic investor expectations created an environment for a sharp decline in palladium prices. The situation was worsened by concerns about the global economic outlook, namely, a stronger U.S. dollar and rising interest rates, which increased the opportunity cost of holding non-income-producing assets such as precious metals.

- Palladium bars are designed for individual investors and are intended for personal use rather than industrial applications [50]. While profit margins can be significant, several drawbacks exist. These include VAT payment requirements and the impracticality of home storage, necessitating secure storage arrangements.

- Palladium coins are popular with collectors.

- Futures contracts are settled in cash. The morning fixing value is used to determine the strike price of palladium futures.

- Opening an unallocated metals account (UMA) generates income solely through metal value appreciation. This investment method enables investors to not only buy or sell desired metal quantities but also place metal deposits [51]. Unlike physical bars or coins, unallocated metal carries lower premiums as its pricing more closely reflects global spot prices for pure metal. The primary advantage of UMAs over bullion purchases is their VAT-exempt status, making them the preferred investment vehicle for private investors in domestic markets [52]. However, investors must pay VAT and potential bank fees when withdrawing metal from these accounts.

- When using exchange-traded funds (ETFs), the peculiarity of pricing is that the value of ETF securities corresponds to the dynamics of the underlying fund asset (in this case, the price of palladium) [53].

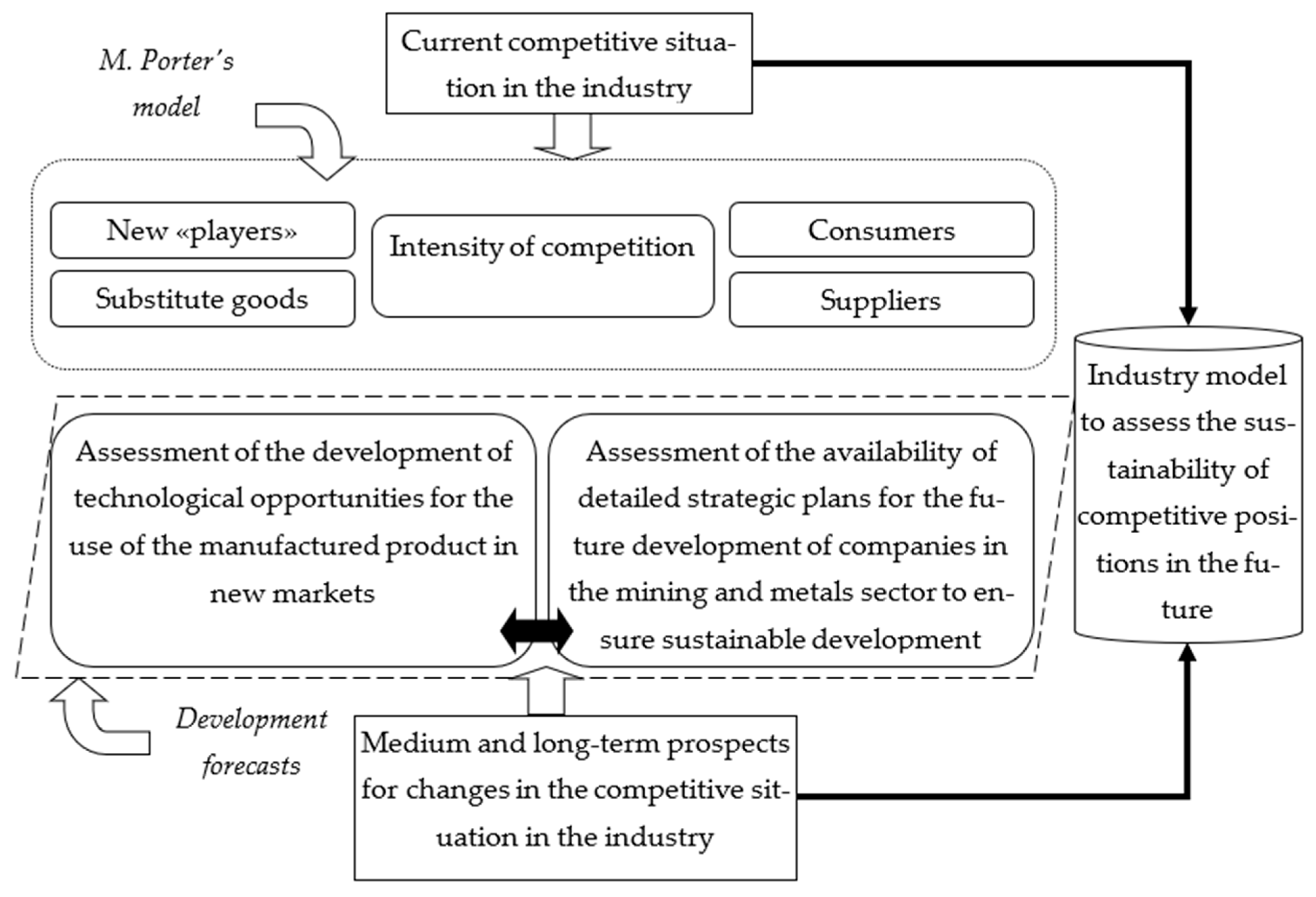

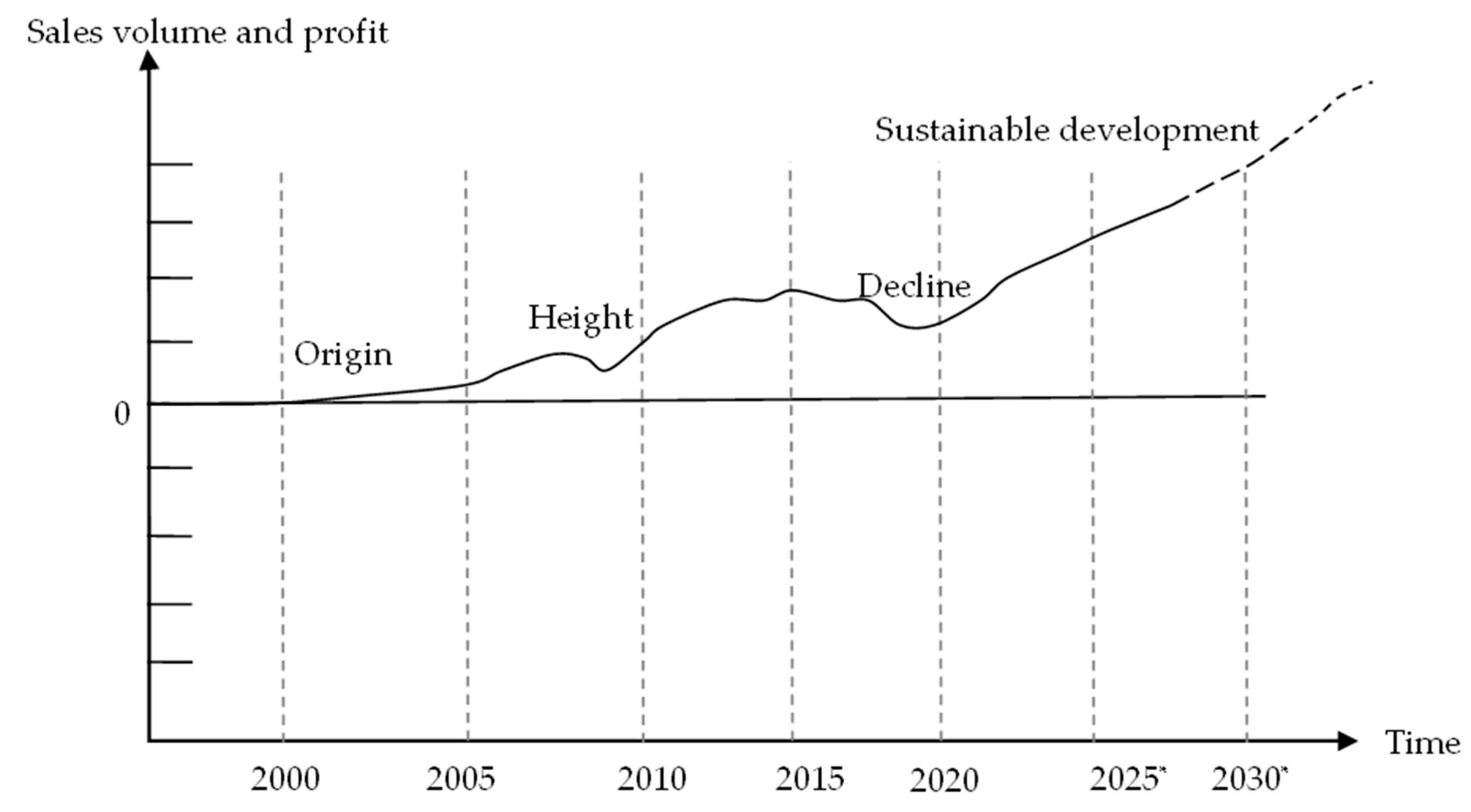

3.3. Strategic Analysis of Norilsk Nickel

4. Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Chidunchi, I.; Kulikov, M.; Sаfarov, R.; Kopishev, E. Extraction of platinum group metals from catalytic converters. Heliyon 2024, 10, e25283. [Google Scholar] [CrossRef] [PubMed]

- Hodgson, B.J.; Turner, J.R.; Holdsworth, A.F. A Review of Opportunities and Methods for Recovery of Rhodium from Spent Nuclear Fuel during Reprocessing: 3. J. Nucl. Eng. Multidiscip. Digit. Publ. Inst. 2023, 4, 484–534. [Google Scholar] [CrossRef]

- Order of the Government of the Russian Federation of 30 August 2022 No. 2473-r “On Approval of the List of Main Types of Strategic Mineral Raw Materials”. Available online: https://www.garant.ru/products/ipo/prime/doc/405118925/?ysclid=m92pdhlacy510099138 (accessed on 14 January 2025).

- Hughes, A.E.; Haque, N.; Northey, S.A.; Giddey, S. Platinum Group Metals: A Review of Resources, Production and Usage with a Focus on Catalysts. Resources 2021, 10, 93. [Google Scholar] [CrossRef]

- Order of the Government of the Russian Federation of 22.12.2018 No. 2914-r “On Approval of the Strategy for the Development of the Mineral Resource Base of the Russian Federation Until 2035”. Available online: https://www.garant.ru/products/ipo/prime/doc/72038606/?ysclid=m92pyu5lh3278195157 (accessed on 19 January 2025).

- Nevskaya, M.A.; Ligotskii, D.N. Mechanisms of ensuring complex development of mineral deposits. J. Min. Inst. 2013, 205, 218–222. [Google Scholar]

- State Report “On the State and Use of Mineral Resources of the Russian Federation in 2022”/Ministry of Natural Resources and Environment of the Russian Federation. 2023; 640p. Available online: https://www.mnr.gov.ru/docs/gosudarstvennye_doklady/ (accessed on 25 January 2025).

- Tang, H.; Peng, Z.; Tian, R.; Ye, L.; Zhang, J.; Rao, M.; Li, G. Platinum-group metals: Demand, supply, applications and their recycling from spent automotive catalysts. J. Environ. Chem. Eng. 2023, 11, 110237. [Google Scholar] [CrossRef]

- Hao, H.; Geng, Y.; Tate, J.E.; Liu, F.; Sun, X.; Mu, Z.; Xun, D.; Liu, Z.; Zhao, F. Securing Platinum-Group Metals for Transport Low-Carbon Transition. One Earth 2019, 1, 117–125. [Google Scholar] [CrossRef]

- Sverdrup, H.U.; Ragnarsdottir, K.V. A system dynamics model for platinum group metal supply, market price, depletion of extractable amounts, ore grade, recycling and stocks-in-use. Resour. Conserv. Recycl. 2016, 114, 130–152. [Google Scholar] [CrossRef]

- Larichkin, F.D.; Krysh, V.A. Rational Use of Secondary Mineral Resources in the Context of Greening and the Introduction of the Best Available Technologies: Monograph; Publishing House of the Federal Research Center of the Kola Science Center of the Russian Academy of Sciences: Apatity, Russia, 2019; 252p. [Google Scholar]

- Order of the Government of the Russian Federation of 29 October 2021 N 3052-r “On Approval of the Strategy for the Socio-economic Development of the Russian Federation with Low Greenhouse Gas Emissions Until 2050”. Available online: https://www.garant.ru/products/ipo/prime/doc/402894476/?ysclid=m92q2bo1yb601688718 (accessed on 25 November 2024).

- Liu, Y.; Zhang, L.; Song, Q.; Xu, Z. Recovery of palladium and silver from waste multilayer ceramic capacitors by eutectic capture process of copper and mechanism analysis. J. Hazard. Mater. 2020, 388, 122008. [Google Scholar] [CrossRef] [PubMed]

- Myasoedov, S.A. Trends in Economic Development of Platinum Group Metals Consumption Processes. Bull. Amur State Univ. Ser. Nat. Econ. Sci. 2021, 95, 101–106. [Google Scholar] [CrossRef]

- Koroleva, N.S.; Bondarenko, A.A. Precious metals (gold, palladium, platinum) as a new basis for settlements in in-ternational trade. Russ. Foreign Econ. Bull. 2022, 10, 91–99. [Google Scholar]

- Zhang, S.; He, X.; Ding, Y.; Shi, Z.; Wu, B. Supply and demand of platinum group metals and strategies for sustainable management. Renew. Sustain. Energy Rev. 2024, 204, 114821. [Google Scholar] [CrossRef]

- Semenova, T.; Martínez Santoyo, J.Y. Determining Priority Areas for the Technological Development of Oil Companies in Mexico. Resources 2025, 14, 18. [Google Scholar] [CrossRef]

- Ilinova, A.A.; Romasheva, N.V.; Stroykov, G.A. Prospects and social effects of carbon dioxide sequestration and utilization projects. J. Min. Inst. 2020, 244, 493–502. [Google Scholar] [CrossRef]

- Sheveleva, N.A. Development and validation of an approach to the environmental and economic assessment of decarbonization projects in the oil and gas sector. J. Min. Inst. 2024, 270, 1038–1055. [Google Scholar]

- Stoyanova, A.D. Systems analysis and management of corporate organizations based on the ESG approach. Model. Optim. Inf. Technol. 2023, 11, 4–5. [Google Scholar] [CrossRef]

- Petrenko, D.V. Investment potential of precious metals. Econ. Manag. 2011, 26, 118–123. [Google Scholar]

- Rytvin, E.I.; Lebedenko, I.Y.; Tykochinsky, D.S.; Vasekin, V.V. Palladium in Dentistry: 4 // Russian Chemical Journal. Russia, Ivanovo: Federal State Budgetary Educational Institution of Higher Education. Ivanovo State Univ. Chem. Technol. 2006, 50, 41–46. Available online: https://www.elibrary.ru/item.asp?edn=hvddmx (accessed on 25 March 2025). (In Russian).

- Alekseeva, N.; Kiiko, E. Combination of Biotechnological Approaches: Russian Scientists have Created a Chemical Catalyst Based on Bacteria 10 January 2024. Available online: https://ru.rt.com/qt7h (accessed on 5 November 2024).

- Lisitsyn, P. Depends on Russia. Scientists Have Named the Metal of the Future. RIA Novosti 06.06.2023. Available online: https://ria.ru/20230606/palladaty-1876218197.html?ysclid=m8g4xsmmz9839240319 (accessed on 20 February 2024).

- Wang, M.-L.; Zhao, J.; Wang, J.-J.; Zhang, J.-M.; Tian, Y.-Z.; Yue, Z.-Z.; Li, D.; Hu, T.-J.; Jia, J.-F.; Wu, H.-S. MoO3/C-supported Pd nanoparticles as an efficient bifunctional electrocatalyst for ethanol oxidation and oxygen reduction reactions. Rare Met. 2023, 42, 1516–1525. [Google Scholar] [CrossRef]

- Hu, X.-J.; Sun, Y.-H.; Liu, L.-Y.; Mao, D.-J.; Zheng, S.-R. Synergy of metal–support interaction and positive Pd species promoting efficient C–Cl bond activation on Pd-based Ce-MOF-derived catalysts. Rare Met. 2024, 43, 5835–5847. [Google Scholar] [CrossRef]

- Norilsk Nickel Annual Report 2023. Available online: https://nornickel.ru/investors/reports-and-results/annual-reports/ (accessed on 12 December 2024).

- Nguyen, M.P.; Ponomarenko, T.; Nguyen, N. Energy Transition in Vietnam: A Strategic Analysis and Forecast. Sustainability 2024, 16, 1969. [Google Scholar] [CrossRef]

- Matrokhina, K.V.; Trofimets, V.Y.; Mazakov, E.B.; Makhovikov, A.B.; Khaykin, M.M. Development of methodology for scenario analysis of investment projects of enterprises of the mineral resource complex. J. Min. Inst. 2023, 259, 112–124. [Google Scholar] [CrossRef]

- Litvinenko, V.S.; Petrov, E.I.; Vasilevskaya, D.V.; Yakovenko, A.V.; Naumov, I.A.; Ratnikov, M.A. Assessment of the role of the state in the management of mineral resources. J. Min. Inst. 2023, 259, 95–111. [Google Scholar] [CrossRef]

- Bykova, E.N. State regulation of negative infrastructure-related externalities in the system of land relations. Vopr. Ekon. 2024, 2, 125–144. (In Russian) [Google Scholar] [CrossRef]

- Ponomarenko, T.V.; Gorbatyuk, I.G.; Cherepovitsyn, A.E. Industrial clusters as an organizational model for the development of Russia petrochemical industry. J. Min. Inst. 2024, 270, 1024–1037. [Google Scholar]

- Granados-Fernández, R.; Montiel, M.A.; Díaz-Abad, S.; Rodrigo, M.A.; Lobato, J. Platinum Recovery Techniques for a Circular Economy. Catalysts 2021, 11, 937. [Google Scholar] [CrossRef]

- Stroykov, G.; Vasilev, Y.N.; Zhukov, O.V. Basic Principles (Indicators) for Assessing the Technical and Economic Potential of Developing Arctic Offshore Oil and Gas Fields. J. Mar. Sci. Eng. 2021, 9, 1400. [Google Scholar] [CrossRef]

- Michałek, T.; Hessel, V.; Wojnicki, M. Production, Recycling and Economy of Palladium: A Critical Review. Materials 2024, 17, 45. [Google Scholar] [CrossRef]

- World Raw Materials Market: Palladium ООО Newton Investments 24.04.2024. Available online: https://gazprombank.investments/blog/market/palladium/ (accessed on 17 December 2024).

- Johnson Matthey plc and PGM Market Report. May 2024. Available online: https://matthey.com/products-and-markets/pgms-and-circularity/pgm-markets/pgm-market-reports (accessed on 24 October 2024).

- Marinina, O.; Kirsanova, N.; Nevskaya, M. Circular Economy Models in Industry: Developing a Conceptual Framework. Energies 2022, 15, 9376. [Google Scholar] [CrossRef]

- Leikin, I.; for Rough & Polished (Industry Information and Analytical Agency). Reverse Substitution of Platinum and New Applications: Factors in Favor of Palladium Market Growth 05.02.2024. Available online: https://rough-polished.expert/ru/analytics/135333.html (accessed on 24 October 2024).

- Semenova, T.; Martínez Santoyo, J.Y. Increasing the Sustainability of the Strategic Development of Oil Producing Companies in Mexico. Resources 2024, 13, 108. [Google Scholar] [CrossRef]

- Nguyen, M.P.; Ponomarenko, T. State Incentives for Solar Energy in the Context of Energy Transition in Developed and Developing Countries. Energies 2025, 18, 1227. [Google Scholar] [CrossRef]

- Nevskaya, M.A.; Belyaev, V.V.; Pasternak, S.N.; Vinogradova, V.V.; Shagidulina, D.I. Assessment of potential damage to soils from accidental oil and oil product spills in the Arctic region. North Mark. Form. Econ. Order 2024, 3, 107–122. [Google Scholar] [CrossRef]

- Khazanov, L. Sanctions Against Palladium from Russia Will Radically Change Its Global Market. Available online: https://www.finam.ru/publications/item/sanktsii-protiv-palladiya-iz-rossii-kardinalno-izmenyat-ego-globalnyy-rynok-20241024-1945/?ysclid=m8g008v1v0153414820 (accessed on 27 February 2025).

- LBMA Precious Metal Prices. Available online: https://www.lbma.org.uk/prices-and-data/precious-metal-prices#/ (accessed on 21 December 2024).

- The Ministry of Finance Explained How the BRICS Precious Metals Exchange Will Work. Available online: https://www.kommersant.ru/doc/7250575?ysclid=m8g05zlpdh859631877 (accessed on 14 December 2024).

- Kogdenko, V.G.; Stepanov, I.A.; National Research Nuclear University MEPhI (MEPhI). The process of implementation of platinum group metals: Planning and optimization. Bull. Saratov Univ. New Ser. Econ. Manag. Law 2024, 24, 148. [Google Scholar] [CrossRef]

- Central Bank of the Russian Federation–Official prices of Refined Precious Metals. Available online: https://cbr.ru/hd_base/metall/metall_base_new/ (accessed on 25 November 2024).

- Khan, K.; Derindere Köseoğlu, S. Is palladium price in bubble? Resour. Policy 2020, 68, 101780. [Google Scholar] [CrossRef]

- Larichkin, F.D.; Novoseltseva, V.D.; Glushchenko, Y.G.; Naumova, M.V. Platinoids: Resources, production, markets and perspectives. J. Min. Inst. 2013, 201, 39. [Google Scholar]

- Federal Law of 26 March 1998 No. 41-FZ “On Precious Metals and Precious Stones”. Available online: https://www.consultant.ru/document/cons_doc_LAW_18254/?ysclid=m92qexnyg1750184007 (accessed on 11 December 2024).

- Shurkalin, A.K. Palladium in the Precious Metals Market/A.K. Shurkalin, E.I. Glushchenko. Econ. Manag. Probl. Solut. 2020, 1, 38. [Google Scholar]

- Agafonov, I.I. Return on Investment in Impersonal Metal Accounts of Palladium. Stat. Econ. 2014, 6, 33–36. [Google Scholar] [CrossRef]

- Litvinov, A.N. Palladium as an investment tool. Econ. Soc. 2017, 32, 1117–1123. [Google Scholar]

- Nevolin, A.E. Strategic analysis of mining and metallurgical companies: Taking into account social and environmental factors. Ind. Econ. 2024, 17, 7–19. [Google Scholar] [CrossRef]

- Nevolin, A.E. Features of the formation of competitive advantages of mining and metallurgical companies on the example of MMC Norilsk Nickel. Drucker Bull. 2023, 56, 64–76. [Google Scholar] [CrossRef]

- Wang, J.; Liu, L.; Xu, W.; Liu, H.; Xu, G.; Huang, K.; Yu, F.; Huang, G. Separation of Pd and Pt from highly acidic leach liquor of spent automobile catalysts with monothio-Cyanex 272 and trioctylamine. Int. J. Miner. Metall. Mater. 2023, 30, 877–885. [Google Scholar] [CrossRef]

- Order of the Government of the Russian Federation of 28 December 2022 No. 4260-r “On Approval of the Strategy for the Development of the Metallurgical Industry of the Russian Federation for the period up to 2030”. Available online: https://www.garant.ru/products/ipo/prime/doc/405963845/?ysclid=m92qg83l9g332201817 (accessed on 14 November 2024).

| Country | Location | Company |

|---|---|---|

| Russia | Sulfide copper–nickel ores of the Norilsk region (Oktyabrskoye, Talnakhskoye, and Norilsk-1) and the deposit of platinum–metal low-sulfide ores (MS-Gorizont) in Norilsk (the north of Krasnoyarsk Krai). Copper–nickel deposits of the Pechenga region (Murmansk). | Norilsk Nickel, Russian Platinum |

| South Africa | Low-sulfide platinum–metal deposits of the Bushveld Igneous Complex, including Merensky Reef, UG-2, and Platreef. | Southern Palladium, African Rainbow Minerals, Northam Platinum, and Royal Bafokeng Platinum |

| Zimbabwe | Low-sulfide platinum–metal ores of the Main Sulfide Zone reef of the Great Dyke layered intrusion. | Anglo American Platinum and Impala Platinum Holdings |

| Canada | Sudbury copper–nickel ores and low-sulfide platinum–metal ores of the Lac des Îles deposit | Glencore, Vale, and North American Palladium |

| USA | Low-sulfide platinum–metal ores of the Jones-Manville Reef Mines: Stillwater and East Boulder, located in Montana | Sibanye-Stillwater |

| Application Area | Description |

|---|---|

| Traditional application areas | |

| Automotive industry | Palladium is used in exhaust gas purification systems, ensuring neutralizer efficiency throughout the vehicle’s operating cycle. |

| Electronics | Palladium is used in the creation of multilayer ceramic capacitors and printed circuit boards. |

| Jewelry sector | Palladium is used in alloy formulations for jewelry production. |

| Medicine | Palladium is used to produce dental prosthetics and crowns, as well as pacemaker components. |

| Chemical and petrochemical industry | Palladium is used as a hydrogenation catalyst for fuel fraction processing. |

| Investment | Palladium is considered an investment asset, including commemorative coins, palladium bars, and exchange-traded funds. |

| Potential application areas | |

| Hydrogen solutions | Palladium is used in gas purification and as a catalyst in the production of low-carbon hydrogen. |

| Solar energy | Development of a prototype of a new thin-film solar panel based on palladium chalcogenide. |

| Chemical synthesis and water purification | Catalysts for the production of glycolic acid used in cosmetics, FDCA acid for biodegradable packaging, and water disinfectants. |

| Factors | Description |

|---|---|

| 1. Threat from new «players» | New «players» rarely emerge due to limited palladium reserves. Palladium is in short supply, and demand for this metal exceeds supply. High barriers to entry into the market due to significant investment costs. Government regulation of the industry. Norilsk Nickel is a monopolist in palladium production. |

| 2. Bargaining power of consumers | The market is dependent on consumers. Norilsk Nickel’s high dependence on the EU and the U.S. as customers (more than 50%) creates a risk of reduced profits in the event of an embargo on non-ferrous metals. Norilsk Nickel’s competitors are not able to fully compensate for the potential shortage of products. |

| 3. Level of competition | Low level of competition. The company’s competitors are not able to fully compensate for the potential shortage of products. As a global market leader operating unique palladium deposits, Norilsk Nickel can set its own prices. |

| 4. Bargaining power of suppliers | The company’s suppliers play an important role in the functioning of the industry, but the company also depends on its suppliers. A high reputation and regular tenders for the supply of equipment and services allow the company to minimize the risks associated with high prices or refusal to cooperate on the part of suppliers. Norilsk Nickel strengthens its strategic partnership with domestic manufacturers in order to reduce dependence on foreign suppliers through off-site round tables, exhibitions, and meetings on import substitution issues. Russia accounts for 40% of the global palladium supply, so the introduction of sanctions will hit Europe and the United States the hardest as their consumers will not be able to find a substitute for the Russian metal. |

| 5. Threat from substitute products | There is a risk of declining palladium demand due to the emergence of substitute materials. While platinum is primarily used in diesel engines and palladium in gasoline engines, environmental regulations have reduced the market share of diesel vehicles. Although platinum shares similar properties with palladium, its lower stability at high temperatures makes palladium more suitable for exhaust gas neutralizers. However, a widening price gap between these metals could lead to palladium being substituted by platinum. |

| 6. Technological possibilities of new product use | The Palladium Technology Center has been established at Norilsk Nickel, which promotes the development of projects in the field of highly efficient technological solutions; the goal is to develop over 100 new palladium-based materials by 2030 using artificial intelligence, machine learning, and machine vision systems. It is also planned to conduct testing in the field of superconductors and capacitors for energy storage and transportation. Hydrogen energy. Technologies for the green economy and energy. Innovative technology for the introduction of palladium for water disinfection. |

| 7. Assessing the role of strategic planning for sustainable development (including environmentally oriented programs) | Developing strategic scenarios for the company’s economic performance, such as Sustainable Palladium, which is aimed at reducing the negative impact on the environment in the regions where the company operates (palladium as a green metal). Norilsk Nickel has developed a roadmap for strategic development for the implementation of projects. Tightening environmental policy will contribute to an increase in requests for palladium catalysts from large car producers. |

| Factors | Description |

|---|---|

| P (political) | Government support for the mining and metals industry, including benefits and development programs. The regulatory role of the Federal Antimonopoly Service (FAS). The foreign policy situation and the introduction of a tough sanctions policy by Russia and Western partners. |

| E (economic) | Rising inflation rates. Fluctuations in the national currency exchange rate. Changes in metal prices. |

| S (social) | Lack of highly qualified professionals. Active influence of the media on the formation of the company’s image. Strengthening requirements for corporate social responsibility aimed at caring for employees and increasing life expectancy. Introduction of social programs related to reducing the number of injuries at work, as well as support for disabled workers. |

| T (technological) | Implementation of digital technologies in production. Construction of new plants to increase production volumes. Development and implementation of new production standards. Cooperation with research institutes and technical centers. Optimization of raw material delivery and transportation processes. Transformational processes in the development of several industries (hydrogen energy, automotive industry, renewable energy), dictating opportunities to increase the consumption of metals, including palladium. |

| L (legal) | Changes in environmental protection law and occupational health and safety law. Mineral extraction tax adjustments. Increase in customs and export duties. |

| E (environmental) | Growing demands for rational resource use. Environmental pollution and waste disposal problems. Climate change and growing institutional requirements for low-carbon development for mining and metals companies. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cherepovitsyn, A.; Mekerova, I.; Nevolin, A. Analysis of the Palladium Market: A Strategic Aspect of Sustainable Development. Mining 2025, 5, 39. https://doi.org/10.3390/mining5030039

Cherepovitsyn A, Mekerova I, Nevolin A. Analysis of the Palladium Market: A Strategic Aspect of Sustainable Development. Mining. 2025; 5(3):39. https://doi.org/10.3390/mining5030039

Chicago/Turabian StyleCherepovitsyn, Alexey, Irina Mekerova, and Alexander Nevolin. 2025. "Analysis of the Palladium Market: A Strategic Aspect of Sustainable Development" Mining 5, no. 3: 39. https://doi.org/10.3390/mining5030039

APA StyleCherepovitsyn, A., Mekerova, I., & Nevolin, A. (2025). Analysis of the Palladium Market: A Strategic Aspect of Sustainable Development. Mining, 5(3), 39. https://doi.org/10.3390/mining5030039