Digital News Bundles: Analyzing Consumers’ Willingness to Pay for Cross-Publisher Journalistic Bundles

Abstract

1. Introduction

RQ: How does the bundling of different publishers and formats likely affect publishers’ revenues in Germany?

2. Literature Review and Examples of Cross-Publisher Bundling

Examples of Cross-Publisher Bundled Offerings

3. Methodology

A monthly subscription to a digital paid service of a German national daily or weekly newspaper or news magazine. You can access the content of the newspaper or news magazine via the website. Examples of such paid offers are SPIEGEL+ (Der SPIEGEL), SZ Plus (Süddeutsche Zeitung), F+ (Frankfurter Allgemeine Zeitung) and WELTplus (WELT).

A single monthly subscription with access to the paid-for digital content of all German national daily and weekly newspapers and news magazines. The content can be accessed via the newspaper and magazine websites. Examples of such paid content that you can then access are SPIEGEL+ (Der SPIEGEL), SZ Plus (Süddeutsche Zeitung), F+ (Frankfurter Allgemeine Zeitung) and WELTplus (WELT).

- -

- At what monthly subscription price do you still consider this product to be cheap/a bargain (“cheap”)?

- -

- At what monthly subscription price do you consider this product to be so cheap that you seriously doubt its quality and consequently do not buy it (“too cheap”)?

- -

- At what monthly subscription price would you describe this product as expensive, but still consider buying it (“expensive”)?

- -

- At what monthly subscription price would you describe this product as too expensive and no longer consider buying it (“too expensive”)?

4. Empirical Results

5. Discussion

6. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

- Text-based description of surveyed products.

- Regional print

- Regional individual website

- National individual website

- Regional website bundle (decentralized)

- National website bundle (decentralized)

- Regional and national website bundle (decentralized)

- Regional and national website bundle (centralized)

- Regional and national app bundle (centralized)

- Regional and national e-paper bundle (centralized)

- Regional and national website, app and e-paper (centralized)

- -

- You can access the content of all newspapers and news magazines directly via a central website (like a “Spotify for journalism”) with up-to-date recommendations according to personal interests and with a search function for all content.

- -

- You can access the content of all newspapers and news magazines directly via a central smartphone and tablet app (like a “Spotify for journalism”) with up-to-date recommendations according to personal interests and with a search function for all content.

- -

- You can access the content of all newspapers and news magazines directly via the digital e-paper (digital versions of newspapers/magazines as they appear in print).

- Audio platform

| Product/Median, Standard | ||||

|---|---|---|---|---|

| Deviation | Too Expensive | Expensive | Cheap | Too Cheap |

| Regional single | EUR 16 | EUR 10 | EUR 5 | EUR 2 |

| EUR 13 | EUR 10 | EUR 7 | EUR 4 | |

| Regional bundle | EUR 13 | EUR 9 | EUR 5 | EUR 1 |

| EUR 13 | EUR 11 | EUR 7 | EUR 4 | |

| National single | EUR 10 | EUR 6 | EUR 5 | EUR 1 |

| EUR 11 | EUR 7 | EUR 4 | EUR 2 | |

| National bundle | EUR 15 | EUR 10 | EUR 5 | EUR 2 |

| EUR 13 | EUR 10 | EUR 7 | EUR 3 | |

| Product | 1 (0%) | 2 (10%) | 3 (30%) | 4 (50%) | 5 (70%) |

|---|---|---|---|---|---|

| Regional single | 55.76% | 10.78% | 24.52% | 6.34% | 3.59% |

| Regional bundle | 76.06% | 6.29% | 9.33% | 4.46% | 3.85% |

| National single | 56.88% | 10.27% | 21.56% | 7.39% | 3.9% |

| National bundle | 64.62% | 10.43% | 14.31% | 7.16% | 3.48% |

References

- Amaldoss, Wilfred, and Jinzhao Du. 2023. How Can Publishers Collaborate and Compete with News Aggregators? Journal of Marketing Research 60: 1114–34. [Google Scholar] [CrossRef]

- Bakos, Yannis, and Erik Brynjolfsson. 1999. Bundling Information Goods: Pricing, Profits, and Efficiency. Management Science 45: 1613–30. [Google Scholar] [CrossRef]

- Behre, Julia, Sascha Hölig, and Judith Möller. 2023. Reuters Institute Digital News Report 2023: Ergebnisse für Deutschland. Arbeitspapiere des Hans-Bredow-Instituts. Available online: https://www.ssoar.info/ssoar/handle/document/86851 (accessed on 15 August 2024).

- Berger, Benedikt, Christian Matt, Dennis M. Steininger, and Thomas Hess. 2015. It Is Not Just About Competition with “Free”: Differences Between Content Formats in Consumer Preferences and Willingness to Pay. Journal of Management Information Systems 32: 105–28. [Google Scholar] [CrossRef]

- Bisceglia, Michele. 2023. The unbundling of journalism. European Economic Review 158: 104532. [Google Scholar] [CrossRef]

- Borchgrevink-Brækhus, Marianne, and Hallvard Moe. 2023. The Burden of Subscribing: How Young People Experience Digital News Subscriptions. Journalism Studies 24: 1069–86. [Google Scholar] [CrossRef]

- Breidert, Christoph, Michael Hahsler, and Thomas Reutterer. 2006. A Review of Methods for Measuring Willigness-to-Pay. Innovative Marketing 2. Available online: http://www.reutterer.com/papers/breidert&hahsler&reutterer_2006.pdf (accessed on 15 August 2024).

- Bundesverband Digitalpublisher und Zeitungsverleger. 2022. Zur Wirtschaftlichen Lage der Deutschen Zeitungen 2022. Available online: https://www.bdzv.de/fileadmin/content/7_Alle_Themen/Marktdaten/2022/Branchenbeitrag_2022/BZDV_Branchenbeitrag2022_v2.pdf (accessed on 15 August 2024).

- Buschow, Christopher, and Christian-Mathias Wellbrock. 2022. “Spotify for News”? User Perception of Subscription-Based Content Platforms for News Media. Journalism and Media 4: 1–15. [Google Scholar] [CrossRef]

- Buschow, Christopher, Jonas Weber, and Andreas Will. 2023. News-Aggregatoren, Abonnementbasierte Plattformen, Online-Kioske: Marktanalyse und Geschäftsmodelle Journalistischer Plattformen. Available online: https://www.die-medienanstalten.de/fileadmin/user_upload/die_medienanstalten/Forschung/News_Aggregatoren/Studie_Journalistische_Plattformen.pdf (accessed on 15 August 2024).

- Carlson, Matt. 2020. Journalistic epistemology and digital news circulation: Infrastructure, circulation practices, and epistemic contests. New Media & Society 22: 230–46. [Google Scholar] [CrossRef]

- Caswell, David. 2019. Structured Journalism and the Semantic Units of News. Digital Journalism 7: 1134–56. [Google Scholar] [CrossRef]

- Crawford, Gregor S., and Ali Yurukoglu. 2012. The Welfare Effects of Bundling in Multichannel Television Markets. American Economic Review 102: 643–85. [Google Scholar] [CrossRef]

- de Cornière, Alexandre, and Miklos Sarvary. 2018. Social Media and News: Attention Capture via Content Bundling. Available online: https://events.ceu.edu/sites/default/files/sarvary-socialmediaandnews.pdf (accessed on 15 August 2024).

- Erbrich, Lukas, Christian-Mathias Wellbrock, Frank Lobigs, and Christopher Buschow. 2024. Bundling Digital Journalism: Exploring the Potential of Subscription-Based Product Bundles. Media and Communication 12: 7442. [Google Scholar] [CrossRef]

- Ernst, Anna. 2024. “Abo-Allianz führender Medienhäuser”: Diese Publisher Bundlen an. Medieninsider. Available online: https://medieninsider.com/alles-plus-abo-allianz-spiegel-faz/22281/ (accessed on 15 August 2024).

- Fleischer, Rasmus. 2021. Universal Spotification? The shifting meanings of “Spotify” as a model for the media industries. Popular Communication 19: 14–25. [Google Scholar] [CrossRef]

- Fowler, Floyd, Jr. 2002. Survey Research Methods. Thousand Oaks: SAGE Publications. [Google Scholar]

- Gabor, André, and Clive W. J. Granger. 1979. Price Sensitivity of the Consumer. Management Decision 17: 569–75. [Google Scholar] [CrossRef]

- Groot Kormelink, Tim. 2023. Why people don’t pay for news: A qualitative study. Journalism 24: 2213–31. [Google Scholar] [CrossRef]

- Informed. 2022. About Informed. Available online: https://www.informed.so/press (accessed on 15 August 2024).

- Kammer, Aske, Morten Boeck, Jakob V. Hansen, and Lars J. H. Hauschildt. 2015. The free-to-fee transition: Audiences’ attitude toward paying for online news. Journal of Media Business Studies 12: 107–20. [Google Scholar] [CrossRef]

- Kloss, Dennis, and Marcus Kunter. 2016. The Van Westendorp Price-Sensitivity Meter as a direct measure of willingness-to-pay. European Journal of Management 16: 45–54. [Google Scholar] [CrossRef]

- Lipovetsky, Stan, Shon Magnan, and Andrea Zanetti-Polzi. 2011. Pricing Models in Marketing Research. Intelligent Information Management 3: 167–74. [Google Scholar] [CrossRef]

- Lobigs, Frank. 2021. Kooperative medienplattformen aus medienökonomischer Perspektive. In Kooperative Medienplattformen in Einer Künftigen Medienordnung. Studie für die bundes-staatsministerin für kultur und medien. Anhang des Medien- und Kommunikationsberichts der Bundesregierung. Edited by Tobias Gostomzyk, Otfried Jarren, Frank Lobigs and Christoph Neuberger. pp. 95–165. Available online: https://www.bundesregierung.de/resource/blob/974430/1929884/c5a25bec078cb6846f8ab7a6ca88e80a/2021-06-16-medienbericht-wissenschaftliches-gutachten-data.pdf?download=1 (accessed on 15 August 2024).

- Logsdon, Brie, Chandler Wieberg, Michelle Palmer Jones, Paula Felps, and Shelley Seale. 2021. From Fast Testing to an Open House Paywall, Experimentation Drives Subscriptions. International News Media Association. Available online: https://www.inma.org/blogs/conference/post.cfm/from-fast-testing-to-an-open-house-paywall-experimentation-drives-subscriptions (accessed on 15 August 2024).

- Miller, Klaus M., Reto Hofstetter, Harley Krohmer, and Z. John Zhang. 2011. How Should Consumers’ Willingness to Pay be Measured? An Empirical Comparison of State-of-the-Art Approaches. Journal of Marketing Research 48: 172–84. [Google Scholar] [CrossRef]

- Newman, Nic. 2024. Journalism, Media, and Technology Trends and Predictions 2024 (Digital News Project). Reuters Institute for the Study of Journalism. Available online: https://reutersinstitute.politics.ox.ac.uk/sites/default/files/2024-01/Newman%20-%20Trends%20and%20Predictions%202024%20FINAL.pdf (accessed on 15 August 2024).

- Newman, Nic, and Craig Robertson. 2023. Paying for News: Price-Conscious Consumers Look for Value amid Cost-of-Living Crisis. Oxford: Reuters Institute for the Study of Journalism. [Google Scholar] [CrossRef]

- Newman, Nic, Richard Fletcher, Antonis Kalogeropoulos, and Rasmus Kleis Nielsen. 2019. Reuters Institute Digital News Report 2019. Oxford: University of Oxford, Reuters Institute for the Study of Journalism. Available online: https://reutersinstitute.politics.ox.ac.uk/sites/default/files/2019-06/DNR_2019_FINAL_0.pdf (accessed on 15 August 2024).

- Newman, Nic, Richard Fletcher, Craig T. Robertson, Amy Ross Arguedas, and Rasmus Kleis Nielsen. 2024. Reuters Institute Digital News Report 2024. Oxford: University of Oxford, Reuters Institute for the Study of Journalism. Available online: https://reutersinstitute.politics.ox.ac.uk/sites/default/files/2024-06/RISJ_DNR_2024_Digital_v10%20lr.pdf (accessed on 15 August 2024).

- Newman, Nic, Richard Fletcher, Kirsten Eddy, Craig T. Robertson, and Rasmus Kleis Nielsen. 2023. Reuters Institute Digital News Report 2023. Oxford: University of Oxford, Reuters Institute for the Study of Journalism. Available online: https://reutersinstitute.politics.ox.ac.uk/sites/default/files/2023-06/Digital_News_Report_2023.pdf (accessed on 15 August 2024).

- Newton, David, James Miller, and Paul Smith. 1993. A Market Acceptance Extension to Traditional Price Sensitivity Measurement. Paper presented at American Marketing Association Advanced Research Techniques Forum, Amelia Island, FL, USA, June 24–27; Available online: https://cran.r-project.org/web/packages/pricesensitivitymeter/pricesensitivitymeter.pdf (accessed on 15 August 2024).

- O’Brien, Daniel. 2022. Free lunch for all?—A path analysis on free mentality, paying intent and media budget for digital journalism. Journal of Media Economics 34: 29–61. [Google Scholar] [CrossRef]

- O’Brien, Daniel, Christian-Mathias Wellbrock, and Nicola Kleer. 2020. Content for Free? Drivers of Past Payment, Paying Intent and Willingness to Pay for Digital Journalism—A Systematic Literature Review. Digital Journalism 8: 643–72. [Google Scholar] [CrossRef]

- Piechota, Greg. 2023. Cable-Style News Bundles Are Spreading across Europe. International News Media Association. Available online: https://www.inma.org/blogs/reader-revenue/post.cfm/cable-style-news-bundles-are-spreading-across-europe?_zs=odRFQ1&_zl=jhv77 (accessed on 15 August 2024).

- Piechota, Greg. 2024. News Publishers’ Super Bundles See Massive Demand, but User Experience Lags. Available online: https://www.inma.org/blogs/reader-revenue/post.cfm/news-publishers-super-bundles-see-massive-demand-but-user-experience-lags (accessed on 15 August 2024).

- Puliyel, Thomas, and Vladlamani Ravi. 1990. Pricing Research—A Comparison of three techniques. Journal of the Market Research Society 32: 207–16. [Google Scholar]

- pv digest. 2022. Paid Content-Umsätze in Deutschland Wachsen auf 881 Mio € (p. 20–24). Available online: https://pv-digest.de/paid-content-umsaetze-in-deutschland-wachsen-auf-881mioe-ein-jahr-des-uebergangs/ (accessed on 15 August 2024).

- Schibsted. 2024. Interim Report Schibsted Q4 2023. Available online: https://kommunikasjon.ntb.no/ir-files/17847482/2896/4038/Interim%20Report%20Q4%202023.pdf (accessed on 15 August 2024).

- Schwaiger, Lisa, Daniel Vogler, and Mark Eisenegger. 2022. Change in News Access, Change in Expectations? How Young Social Media Users in Switzerland Evaluate the Functions and Quality of News. The International Journal of Press/Politics 27: 609–28. [Google Scholar] [CrossRef]

- Shapiro, Carl, and Hal R. Varian. 1999. Information Rules: A Strategic Guide to the Network Economy. Cambridge: Harvard Business School Press. [Google Scholar]

- Shiller, Ben, and Joel Waldfogel. 2013. The Challenge of Revenue Sharing with Bundled Pricing: An Application to Music. Economic Inquiry 51: 1155–65. Available online: https://onlinelibrary.wiley.com/doi/abs/10.1111/j.1465-7295.2011.00442.x (accessed on 15 August 2024). [CrossRef]

- Spiegel Gruppe. 2023. “Premium kombi”: SPIEGEL+ und Manager+ Erstmals in Einem Gemeinsamen Abo. Available online: https://gruppe.spiegel.de/news/pressemitteilungen/detail/premium-kombi-spiegel-und-manager-erstmals-in-einem-gemeinsamen-abo#:~:text=Das%20Kombi%2DAbo%20kostet%20wöchentlich,Werbefrei%20lesen“%20kann%20hinzugebucht%20werden (accessed on 15 August 2024).

- The New York Times. 2023. The New York Times Company Reports Second-Quarter 2023 Results. Available online: https://s23.q4cdn.com/152113917/files/doc_news/2023/q2/NYT-Press-Release-Q2-2023-Final-peLCvPS4.pdf (accessed on 15 August 2024).

- Van Westendorp, Peter H. 1976. NSS-Price Sensitivity Meter (PSM)—A new approach to study consumer perception of price. Paper presented at ESOMAR Congress, Venice, Italy, September 5–9; pp. 139–167. [Google Scholar]

- Venkatesh, R., and Rabikar Chatterjee. 2006. Bundling, unbundling, and pricing of multiform products: The case of magazine content. Journal of Interactive Marketing 20: 21–40. [Google Scholar] [CrossRef]

- Venkatesh, R., and Wagner Kamakura. 2003. Optimal Bundling and Pricing under a Monopoly: Contrasting Complements and Substitutes from Independently Valued Products*. The Journal of Business 76: 211–31. [Google Scholar] [CrossRef]

- Veseling, Brian. 2023. How Amedia Fine-Tuned a Bundled Subscription Product to Meet Reader Needs. World Association of News Publishers. Available online: https://wan-ifra.org/2023/05/how-amedia-fine-tuned-a-bundled-subscription-product-to-meet-reader-needs/ (accessed on 15 August 2024).

- Wellbrock, Christian-Mathias. 2020a. Ein “Spotify für Journalismus”? Eine ökonomische perspektive auf abonnementbasierte anbieterübergreifende Plattformen im Journalismus. In Money for Nothing and Content for Free? Paid Content, Plattformen und Zahlungsbereitschaft im Digitalen Journalismus. Edited by Christian-Mathias Wellbrock and Christopher Buschow. Baden-Baden: Nomos Verlagsgesellschaft mbH & Co. KG, pp. 153–178. [Google Scholar]

- Wellbrock, Christian-Mathias. 2020b. “Spotify für Journalismus”, “Verlagsplattform”, “Digitales Pressegrosso” Drei Szenarien für eine anbieterübergreifende Journalismusplattform. Journalistik. Zeitschrift Für Journalismusforschung 3: 131–49. [Google Scholar] [CrossRef]

- Wellbrock, Christian-Mathias, and Christopher Buschow. 2020. Money for Nothing and Content for Free?: Paid Content, Plattformen und Zahlungsbereitschaft im digitalen Journalismus (Volume 1, Nr. 82). Baden-Baden: Nomos Verlagsgesellschaft mbH & Co. KG. [Google Scholar] [CrossRef]

- Wellbrock, Christian-Mathias, Frank Lobigs, Lukas Erbrich, and Christopher Buschow. 2023. Coopetition Is King. Ökonomische Potentiale und medienpolitische Implikationen kooperativer Journalismusplattformen. Whitepaper Commissioned by the Landesanstalt für Medien NRW. Available online: https://www.medienanstalt-nrw.de/fileadmin/user_upload/NeueWebsite_0120/Presse/Pressemitteilung/CoopetitionIsKing_Whitepaper_LFMNRW_2023.pdf (accessed on 15 August 2024).

- Wilczynski, Maciej, and Matt Johnston. 2023. Price Sensitivity Meter and Conjoint Analysis as Tools for Setting Your Industrial Subscription Pricing. London: Routledge. [Google Scholar]

| Attribute | Level |

|---|---|

| Format | Website App e-paper Website + app + e-paper |

| Bundle size Price Access | Individual national/regional offering Bundled national/regional offering EUR 4.95–29.95 Centralized Decentralized |

| Regional Individual Product (Website) | Regional Bundle (Websites, Decentralized) | |

|---|---|---|

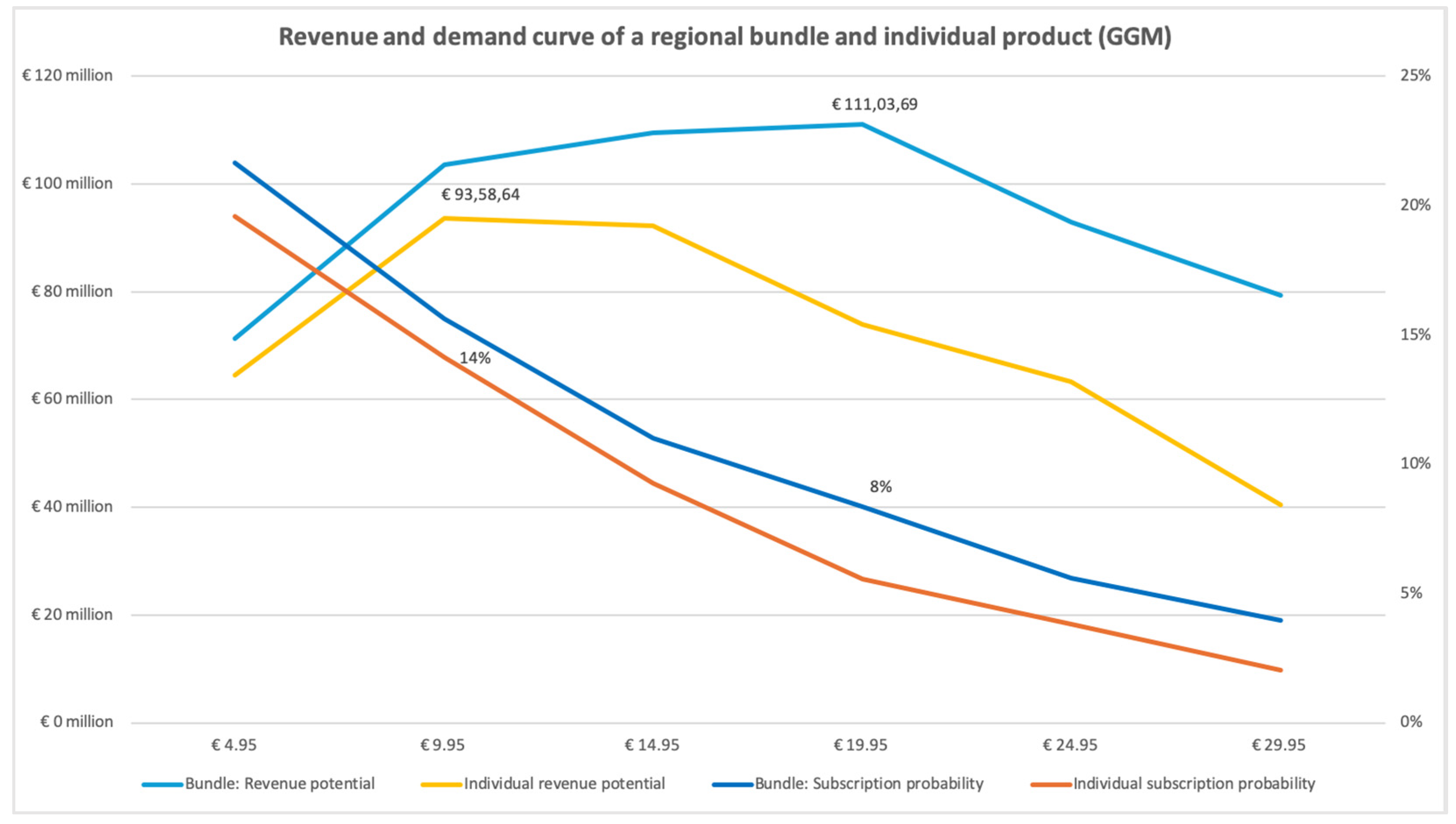

| GGM | EUR 93.6 million (EUR 9.95) | EUR 111 million (EUR 19.95) |

| PSM-NMS | EUR 74.7 million (EUR 18) | EUR 91.9 million (EUR 20) |

| Change in revenues | +19% to +23% | |

| National Individual Product (Website) | National Bundle (Websites, Decentralized) | |

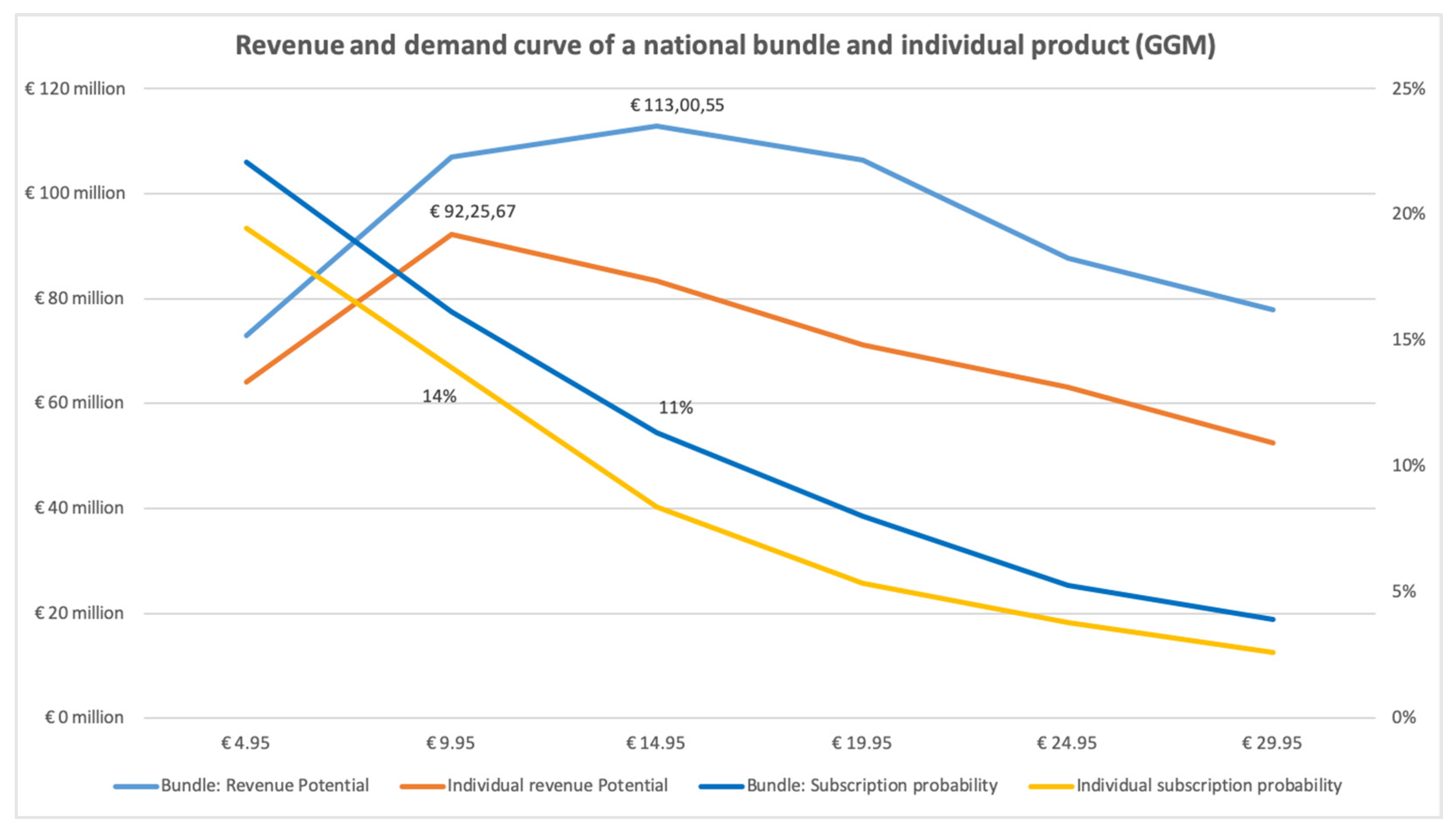

| GGM | EUR 92.3 million (EUR 9.95) | EUR 113 million (EUR 14.95) |

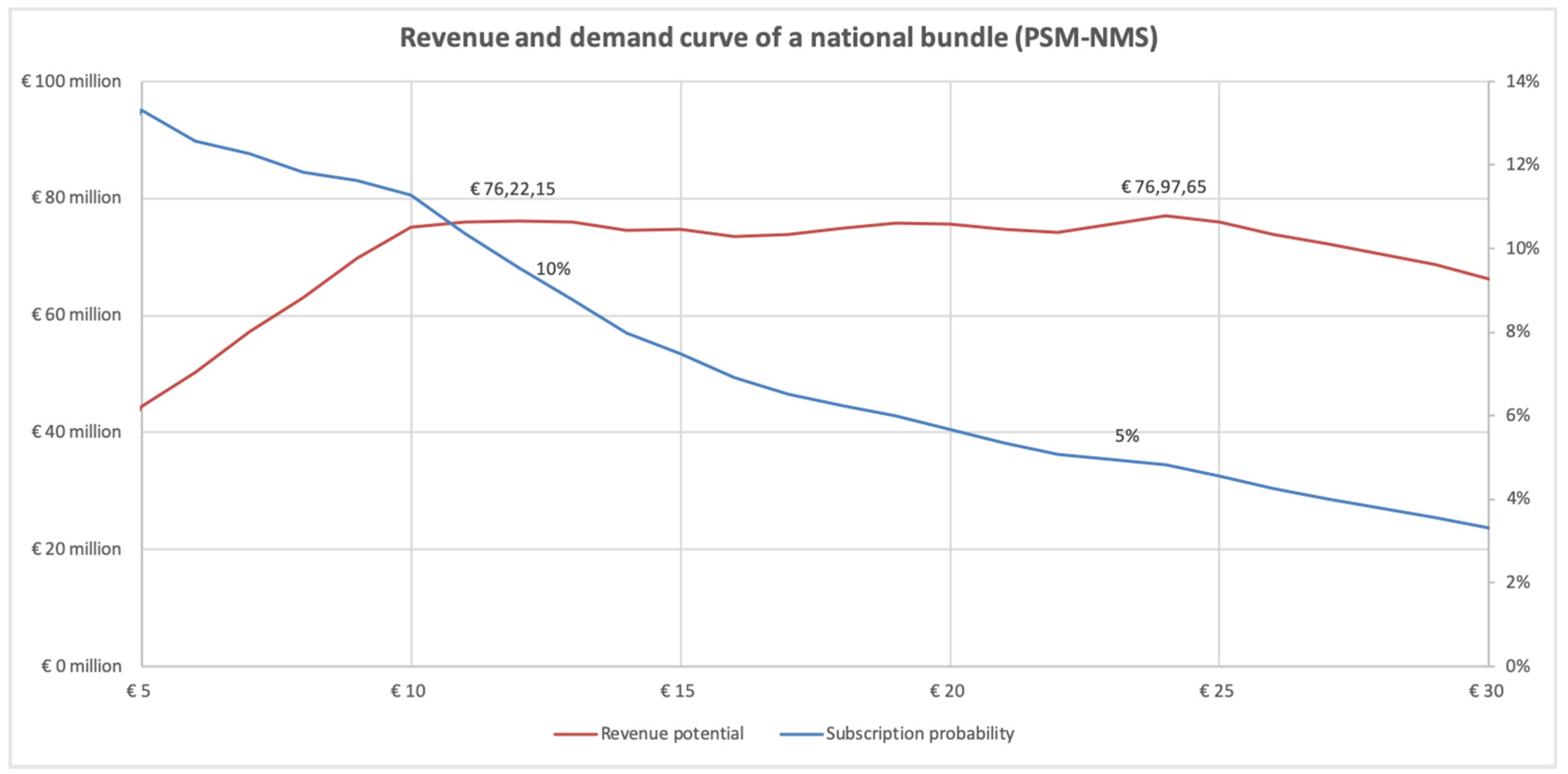

| PSM-NMS | EUR 61.2 million (EUR 10) | EUR 77 million (EUR 24) |

| Change in revenues | +22% to +26% |

| Product | National Bundle (n = 489) | Regional and National Bundle (n = 539) | Comprehensive Bundle (n = 1530) |

|---|---|---|---|

| Method/features | Website (decentralized) | Website (decentralized) | Website, app and e-paper (centralized) |

| GGM | EUR 113 million (EUR 14.95) | EUR 125.9 million (EUR 14.95) | EUR 144.3 million (EUR 14.95) |

| PSM-NMS | EUR 76.2 million (EUR 24) | EUR 96.5 million (EUR 15) | EUR 104.8 million (EUR 19) |

| Change in revenues compared to the previous bundle | +11% | +15% | |

| +27% | +9% |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Erbrich, L. Digital News Bundles: Analyzing Consumers’ Willingness to Pay for Cross-Publisher Journalistic Bundles. Journal. Media 2024, 5, 1279-1296. https://doi.org/10.3390/journalmedia5030081

Erbrich L. Digital News Bundles: Analyzing Consumers’ Willingness to Pay for Cross-Publisher Journalistic Bundles. Journalism and Media. 2024; 5(3):1279-1296. https://doi.org/10.3390/journalmedia5030081

Chicago/Turabian StyleErbrich, Lukas. 2024. "Digital News Bundles: Analyzing Consumers’ Willingness to Pay for Cross-Publisher Journalistic Bundles" Journalism and Media 5, no. 3: 1279-1296. https://doi.org/10.3390/journalmedia5030081

APA StyleErbrich, L. (2024). Digital News Bundles: Analyzing Consumers’ Willingness to Pay for Cross-Publisher Journalistic Bundles. Journalism and Media, 5(3), 1279-1296. https://doi.org/10.3390/journalmedia5030081