Economic Complexity: A New Challenge for the Environment

Abstract

:1. Introduction

2. The Concept of Complexity

3. Economic Complexity: Measures and Interconnections

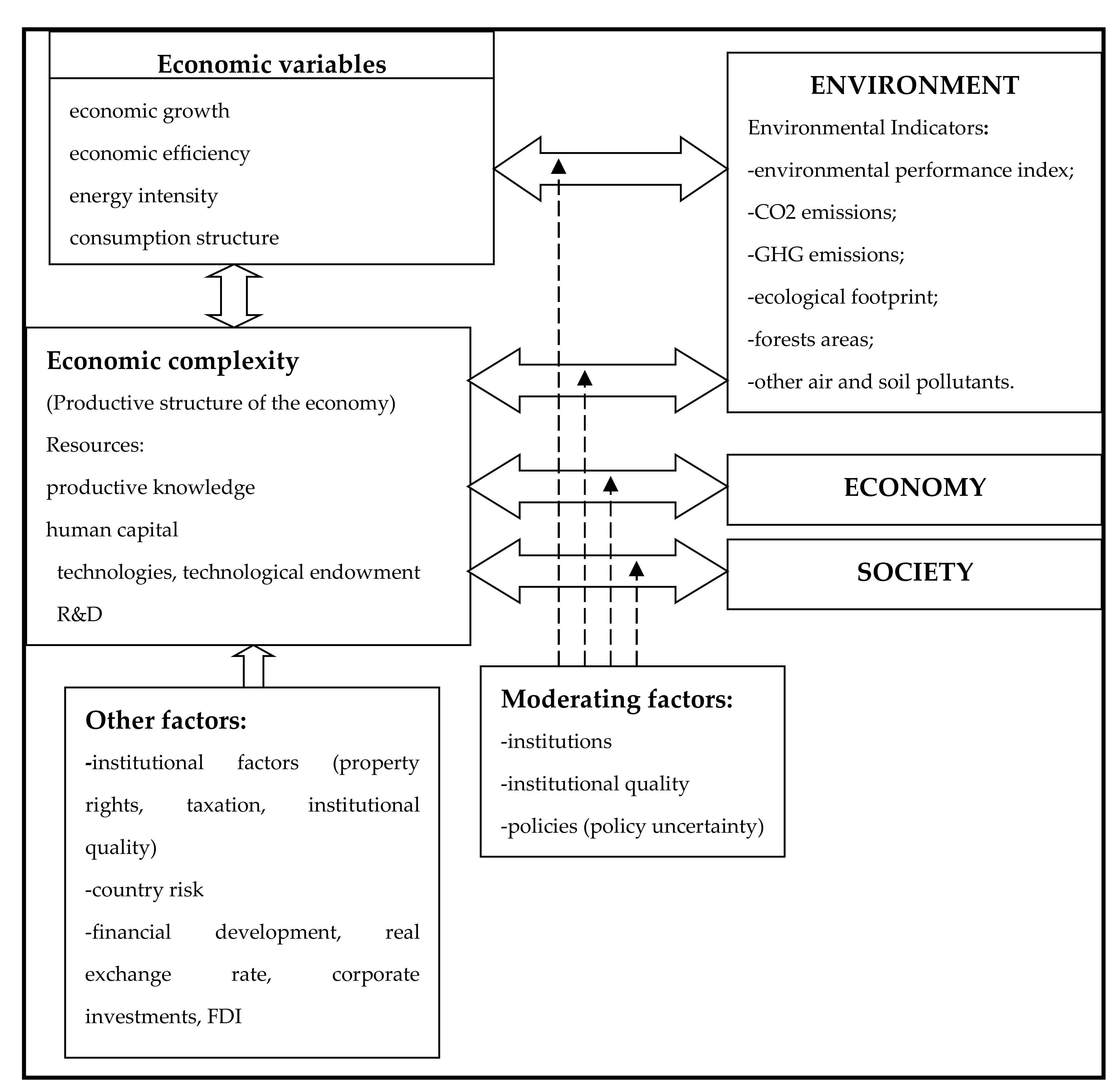

4. The Link between Economic Complexity and Environmental Degradation

4.1. Metrics Used in the Analysis

4.2. Analysing the Link between Economic Complexity and Environment

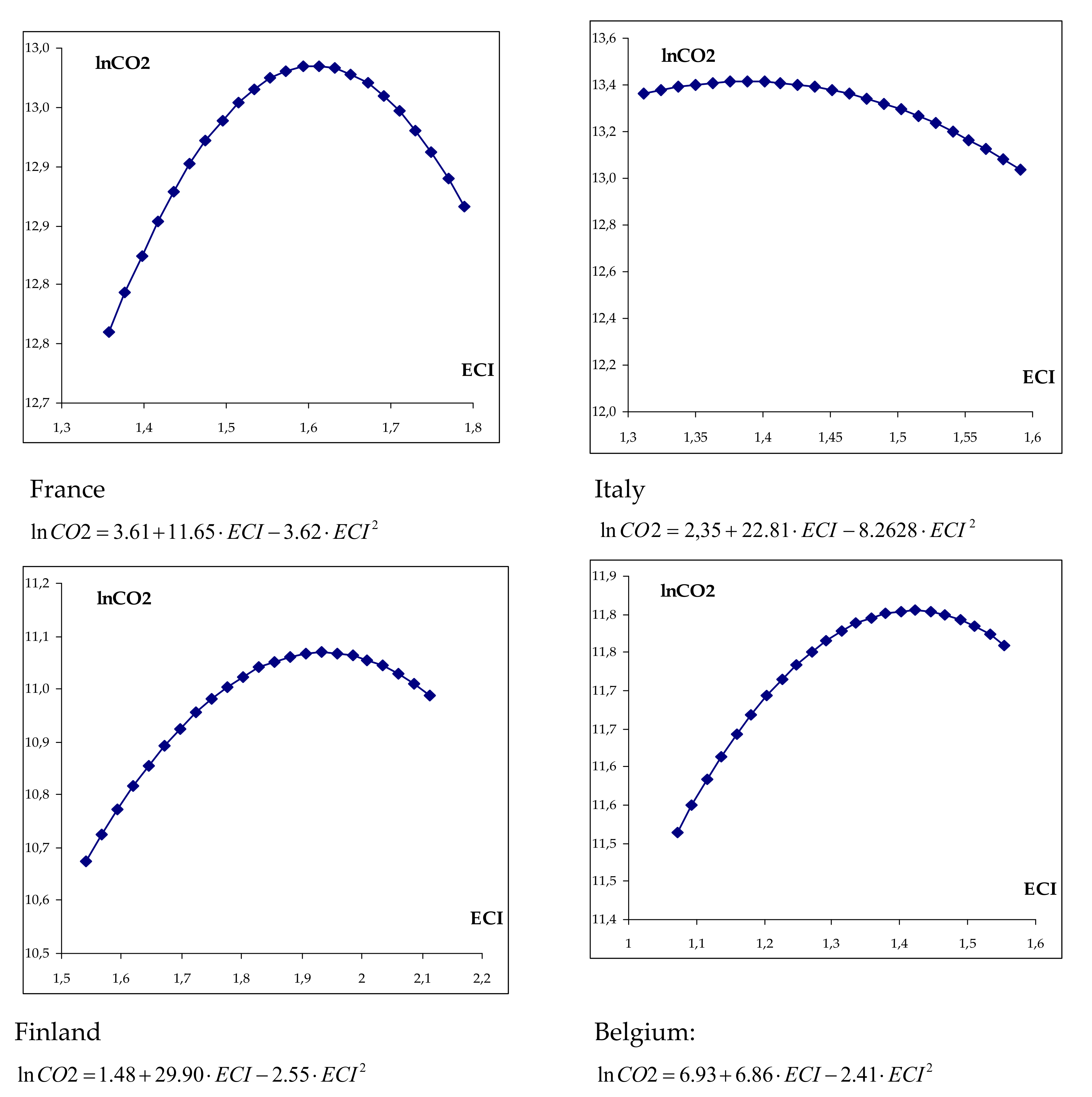

4.3. The Environmental Kuznets Curve (EKC) Model

5. Institutional Factors Moderating the Impact of Economic Complexity on Environment

5.1. Institutional Factors

5.2. Institutional Quality

5.3. Policy Uncertainty

6. Concluding Remarks

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

References

- Rosser, J.B., Jr. On the complexities of complex economic dynamics. J. Econ. Perspect. 1999, 13, 169–192. [Google Scholar] [CrossRef] [Green Version]

- Rosser, J.B., Jr. Is a transdisciplinary perspective on economic complexity possible? J. Econ. Behav. Organ. 2010, 75, 3–11. [Google Scholar] [CrossRef]

- Cassata, F.; Marchionatti, R. A transdisciplinary perspective on economic complexity. Marshall’s problem revisited. J. Econ. Behav. Organ. 2011, 80, 122–136. [Google Scholar] [CrossRef]

- Marchionatti, R.; Keynes, J.M. thinker of economic complexity. Hist. Econ. Ideas 2010, 18, 115–146. Available online: https://ideas.repec.org/a/hid/journl/v18y201025p115-146.html (accessed on 22 September 2021).

- Matutinovic, I. Economic complexity and the role of markets. J. Econ. Issues 2010, 43, 31–51. [Google Scholar] [CrossRef]

- Foley, D.K. Introduction, Chapter 1. In Barriers and Bounds to Rationality: Essays on Economic Complexity and Dynamics in Interactive Systems; Albin, P.S., Foley, D.K., Eds.; Princeton University Press: Princeton, NJ, USA, 1998; pp. 3–72. [Google Scholar]

- Fontana, W.; Buss, L.W. The Barrier of Objects: From Dynamical Systems to Bounded Organizations. In Barriers and Boundaries; Casti, J., Karlqvist, A., Eds.; Addison-Wesley: Reading, MA, USA, 1996; pp. 56–116. [Google Scholar]

- Durlauf, S.N. Complexity and empirical economics. Econ. J. 2005, 115, F225–F243. [Google Scholar] [CrossRef]

- Foster, J. From Simplistic to Complex Systems in Economics. Camb. J. Econ. 2005, 29, 873–892. [Google Scholar] [CrossRef] [Green Version]

- Sonis, M.; Hewings, G.J.D. Economic complexity as network complication: Multi-regional input-output structural analysis. Ann. Reg. Sci. 1998, 32, 407–436. [Google Scholar] [CrossRef]

- Fontana, B. The Complexity Approach to Economics: A Paradigm Shift; Working Paper, No. 200801; Department of Economics, ”S. Cognetti de Martiis” University of Turin: Turin, Italy, 2008; Available online: https://ideas.repec.org/p/uto/cesmep/200801.html (accessed on 23 August 2021).

- Arthur, B.W. Complexity and the Economy. Science 1999, 284, 107–109. [Google Scholar] [CrossRef]

- Holt, R.P.F.; Rosser, J.B., Jr.; Colander, D. The complexity era in economics. Rev. Political Econ. 2011, 23, 357–369. [Google Scholar] [CrossRef] [Green Version]

- Collander, D. Complexity and History of Economic Thought. Middlebury College Working Paper Series Discussion Paper No. 08-04. 2008. Available online: https://econpapers.repec.org/paper/mdlmdlpap/0804.htm (accessed on 7 October 2021).

- Arpe, J. Globalisation and Its Complexity. Challenges to Economic Policy, Bertelsmann Stiftung Deutschland. 2012. Available online: https://www.bertelsmann-stiftung.de/en/publications/publication/did/globalization-and-its-complexity/ (accessed on 4 October 2021).

- Lall, S. Technological capabilities and industrialization. World Dev. 1992, 20, 165–186. [Google Scholar] [CrossRef]

- Lall, S. The Technological Structure and Performance of Developing Country Manufactured Exports, 1985-98. Oxf. Dev. Stud. 2000, 28, 337–369. [Google Scholar] [CrossRef] [Green Version]

- Archibugi, D.; Coco, A. Measuring technological capabilities at the country level: A survey and a menu for choice. Res. Policy 2005, 34, 175–194. [Google Scholar] [CrossRef]

- Hidalgo, C.A.; Klinger, B.; Barabasi, A.L.; Hausmann, R. The product space conditions the development of nations. Science 2007, 317, 482–487. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Hidalgo, C.A.; Hausmann, R. The building blocks of economic complexity. Proc. Natl. Acad. Sci. USA 2009, 106, 10570–10575. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Hausmann, R.; Hidalgo, C.A.; Bustos, S.; Coscia, M.; Simoes, A.; Yildirim, M.A. The Atlas of Economic Complexity: Mapping Paths to Prosperity; MIT Press: Cambridge, MA, USA, 2014; Available online: https://s3.amazonaws.com/academia.edu.documents/30678659/ (accessed on 6 September 2021).

- Hidalgo, C.A. Economic complexity theory and applications. Nat. Rev. Phys. 2021, 3, 92–113. [Google Scholar] [CrossRef]

- Bustos, S.; Gomez, C.; Hausmann, R. Hidalgo, C.A. The dynamics of nestedness predicts the evolution of industrial ecosystem. PLoS ONE 2012, 7, e49393. [Google Scholar] [CrossRef] [PubMed]

- Felipe, J.; Kumar, U.; Abdon, A.; Bacate, M. Product Complexity and Economic Development. Struct. Change Econ. Dyn. 2012, 23, 36–68. [Google Scholar] [CrossRef] [Green Version]

- Poncet, S.; de Waldemar, F.S. Economic complexity and growth. Evidence from China. Rev. Économique 2013, 64, 495–503. [Google Scholar] [CrossRef]

- Cristelli, M.; Tacchella, A.; Pietronero, L. The heterogeneous dynamics of economic complexity. PLoS ONE 2015, 10, e0117174. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Özgüzer, G.E.; Binatlı, A.O. Economic convergence in the EU: A complexity approach. East. Eur. Econ. 2016, 54, 93–108. [Google Scholar] [CrossRef] [Green Version]

- Ferrarini, B.; Scaramozzino, P. Asian Development Bank. Complexity, Specialisation and Growth. Working Paper No.344. 2013. Available online: http://hdl.handle.net/11540/2329 (accessed on 5 October 2021).

- Hausmann, R.; Hidalgo, C.A. The network structure of economic output. J. Econ. Growth 2011, 16, 309–342. [Google Scholar] [CrossRef] [Green Version]

- Chavez, J.C.; Mosqueda, M.T.; Gomez-Zaldivar, M. Economic complexity and regional growth performance: Evidence from the Mexican economy. Rev. Reg. Stud. 2017, 47, 201–219. Available online: http://journal.srsa.org/ojs/index.php/RRS/article/download/876/pdf (accessed on 22 August 2021).

- Tacchella, A.; Mazzilli, D.; Pietronero, L. A dynamical systems approach to gross domestic product forecasting. Nat. Phys. 2018, 14, 861–865. [Google Scholar] [CrossRef]

- Hartmann, D.; Guevara, M.R.; Jara-Figueroa, C.; Aristaran, M.; Hidalgo, C.A. Linking economic complexity, institutions and income inequality. World Dev. 2017, 93, 75–93. [Google Scholar] [CrossRef] [Green Version]

- Bandeira Morais, M.; Swart, J.; Jordaan, J.A. Economic complexity and inequality: Does productive structure affect regional wage differentials in Brazil. Sustainability 2018, 13, 1006. [Google Scholar] [CrossRef]

- Le, K.-K.; Vu, T.V. Economic complexity, human capital and income inequality: A cross-country analysis. Jpn. Econ. Rev. 2020, 71, 695–718. [Google Scholar] [CrossRef]

- Chu, L.K.; Hoang, D.P. How does economic complexity influence income inequality? New evidence from international data. Econ. Anal. Policy 2020, 68, 44–57. [Google Scholar] [CrossRef]

- Lee, C.-C.; Wang, E.Z. Economic complexity and income inequality: Does country risk matter? Soc. Indic. Res. 2021, 154, 35–60. [Google Scholar] [CrossRef]

- Bucellato, T.; Coro, G. Relatedness, Economic Complexity, and Convergence across European Regions; Paper Series 2019, No. 15/WP/2019; Department of Economics Research, University Ca’ Foscari of Venice: Venice, Italy, 2019. [Google Scholar] [CrossRef] [Green Version]

- Hartmann, D. Economic Complexity and Human Development: How Economic Diversification and Social Networks Affect Human Agency and Welfare, 1st ed.; Routledge: London, UK, 2014. [Google Scholar] [CrossRef] [Green Version]

- Guevara, M.R.; Hartmann, D.; Aristarán, M.; Mendoza, M.; Hidalgo, C. The research space: Using career path to predict the evolution of the research of individuals, institutions, and nations. Scientometrics 2016, 109, 1695–1709. [Google Scholar] [CrossRef] [Green Version]

- Ferraz, D.; Moralles, H.F.; Campoli, F.S.; De Oliveira, F.C.R.; Rebelatto, D.A.D.N. Economic complexity and human development: DEA performance measurement in Asia and Latin America. Gestão e Produção 2018, 25, 839–853. [Google Scholar] [CrossRef]

- Ferraz, D.; Moralles, H.F.; Costa, N.; Rebelatto, D.A.N. Economic Complexity and Human Development: Comparing Traditional and Slack Based Data Envelopment Analysis Models. 2019. Available online: https://www.researchgate.net/publication/333997876_Economic_Complexity_and_Human_Development_Comparing_Traditional_and_Slack_Based_Data_Envelopment_Analysis_Models (accessed on 2 September 2021).

- Brito, S.; Magud, M.N.E.; Sosa, M.S.; International Monetary Fund. Real Exchange Rates, Economic Complexity, and Investment. 2018. Available online: https://www.imf.org/~/media/Files/Publications/WP/2018/wp18107.ashx. (accessed on 20 August 2021).

- Laverde-Rojas, H.; Correa, J.C. Can scientific productivity impact the economic complexity of countries? Scientometrics 2019, 120, 267–282. [Google Scholar] [CrossRef] [Green Version]

- Nguyen, C.P.; Schinckus, C.; Su, T.D. The drivers of economic complexity: International evidence from financial development and patents. Int. Econ. 2020, 164, 140–150. [Google Scholar] [CrossRef]

- Bahar, D.; Rapoport, H.; Turati, R. Birthplace diversity and economic complexity: Cross-country evidence. Res. Policy 2020, 103991. [Google Scholar] [CrossRef]

- Innocenti, N.; Vignoli, D.; Lazzeretti, L. Economic complexity and fertility: Insights from a low fertility country. Reg. Stud. 2021, 55, 1388–1402. [Google Scholar] [CrossRef] [PubMed]

- Lapatinas, A. The effect of the Internet on economic sophistication: An empirical analysis. Econ. Lett. 2018, 174, 35–38. [Google Scholar] [CrossRef]

- Sweet, C.M.; Maggio, D.S.E. Do stronger intellectual property rights increase innovation? World Dev. 2015, 66, 665–677. [Google Scholar] [CrossRef] [Green Version]

- Hausmann, R.; Hwang, J.; Rodrik, D. What you export matters. J. Econ. Growth 2007, 12, 1–25. [Google Scholar] [CrossRef]

- Zhu, S.; Fu, X. Drivers of Export Upgrading. World Dev. 2013, 51, 221–233. [Google Scholar] [CrossRef] [Green Version]

- Kannen, P. Does foreign direct investment expand the capability set in the host economy? A sectoral analysis. World Econ. 2019, 43, 428–457. [Google Scholar] [CrossRef]

- Nasir, M.; Ur Rehman, F. Environmental Kuznets Curve for carbon emissions in Pakistan: An empirical investigation. Energy Policy 2011, 39, 1857–1864. [Google Scholar] [CrossRef]

- Tiwari, A.; Shahbaz, M.; Hye, Q.M.A. The environmental Kuznets curve and the role of coal consumption in India: Cointegration and causality analysis in an open economy. Renew. Sustain. Energy Rev. 2013, 18, 519–527. [Google Scholar] [CrossRef] [Green Version]

- Dogan, E.; Inglesi-Lotz, R. Analyzing the effects of real income and biomass energy consumption on carbon dioxide (CO2) emissions: Empirical evidence from the panel of biomass-consuming countries. Energy 2017, 138, 721–727. [Google Scholar] [CrossRef]

- Rehman, M.U.; Rashid, M. Energy consumption to environmental degradation, the growth appetite in SAARC nations. Renew. Energy 2017, 111, 284–294. [Google Scholar] [CrossRef]

- Xu, Z.; Baloch, M.A.; Danish; Meng, F.; Zhang, J.; Mahmood, Z. Nexus between financial development and CO2 emissions in Saudi Arabia: Analyzing the role of globalization. Environ. Sci. Pollut. Res. 2018, 25, 28378–28390. [Google Scholar] [CrossRef] [PubMed]

- Neagu, O. The Link between Economic Complexity and Carbon Emissions in the European Union Countries: A Model Based on the Environmental Kuznets Curve (EKC) Approach. Sustainability 2019, 11, 4753. [Google Scholar] [CrossRef] [Green Version]

- Danish; Ulucak, R. How do environmental technologies affect green growth? Evidence from BRICS economies. Sci. Total. Environ. 2020, 712, 136504. [Google Scholar] [CrossRef] [PubMed]

- Abbasi, K.R.; Lv, K.; Radulescu, M.; Shaikh, P.A. Economic complexity, tourism, energy prices, and environmental degradation in the top economic complexity panel: Fresh panel evidence. Environ. Sci. Pollut. Res. 2021, 1–15. [Google Scholar] [CrossRef] [PubMed]

- Neagu, O.; Teodoru, M. The relationship between economic complexity, energy consumption structure and greenhouse gas emission: Heterogeneous panel evidence from the EU countries. Sustainability 2019, 11, 497. [Google Scholar] [CrossRef] [Green Version]

- Simionescu, M. Revised environmental Kuznets Curve in CEE countries. Evidence from panel threshold models for economic sectors. Environ. Sci. Pollut. Res. 2021, 28, 60881–60899. [Google Scholar] [CrossRef] [PubMed]

- Al-mulali, U.; Weng-Wai, C.; Sheau-Ting, L.; Mohammed, A.H. Investigating the environmental Kuznets curve (EKC) hypothesis by utilizing the ecological footprint as an indicator of environmental degradation. Ecol. Indic. 2015, 48, 315–323. [Google Scholar] [CrossRef]

- Destek, M.A.; Sarkodie, S.A. Investigation of environmental Kuznets curve for ecological footprint: The role of energy and financial development. Sci. Total. Environ. 2018, 650, 2483–2489. [Google Scholar] [CrossRef] [PubMed]

- Ahmed, Z.; Ashar, M.M.; Mailk, M.N.; Nawas, K. Moving towards a sustainable environment: The dynamic linkage between natural resources, human capital, urbanization, economic growth, and ecological footprint in China. Resour. Policy 2020, 67, 101677. [Google Scholar] [CrossRef]

- Destek, M.A.; Sinha, A. Renewable, non-renewable enegy consumption, economic growth, trade openess and ecological footprint: Evidence from organisation for economic cooperation and development countries. J. Clean. Prod. 2020, 242, 118537. [Google Scholar] [CrossRef]

- Neagu, O. Economic complexity and ecological footprint: Evidence from the most complex economies in the world. Sustainability 2020, 12, 9031. [Google Scholar] [CrossRef]

- Wackernagel, M.; Rees, W. Our Ecological Footprint: Reducing Human Impact on The Earth; The New Catalyst Bioregional Series; New Society Publishers: Gabriola Island, BC, Canada, 1996. [Google Scholar]

- Lin, D.; Hanscom, L.; Martindill, J.; Borucke, M.; Cohen, L.; Galli, A.; Lazarus, E.; Zokai, G.; Iha, K.; Eaton, D.; et al. Working Guidebook to the National Footprint and Biocapacity Accounts; Global Footprint Network: Oakland, CA, USA, 2019; Available online: http://www.footprintnetwork.org/ (accessed on 5 October 2021).

- Lapatinas, A.; Garas, A.; Boleti, E.; Kyriakou, A. Economic Complexity and Environmental Performance: Evidence from a World Sample. 2019. Available online: https://mpra.ub.uni-muenchen.de/92833/ (accessed on 5 August 2021).

- Boleti, E.; Garas, A.; Kyriakou, A.; Lapatinas, A. Economic complexity and environmental performance: Evidence from a world sample. Environ. Modeling Assess. 2021, 1–20. [Google Scholar] [CrossRef]

- Wendling, Z.A.; Emerson, J.W.; de Sherbinin, A.; Esty, D.C.; Liu, Q.; Feldman, H.; Sierks, K.; Chang, R.; Madrodejos, B.; Ballesteros-Figueroa, A.; et al. Environmental Performance Index; Yale Center for Environmental Law & Policy: New Haven, CT, USA, 2020. [Google Scholar]

- Doğan, B.; Saboori, B.; Can, M. Does economic complexity matter for environmental degradation? An empirical analysis for different stages of development. Environ. Sci. Pollut. Res. 2019, 26, 31900–31912. [Google Scholar] [CrossRef]

- Majeed, M.T.; Mazhar, M.; Samreen, I.; Tauqir, A. Economic complexities and environmental degradation: Evidence from OECD countries. Environ. Dev. Sustain. 2021, 1–21. [Google Scholar] [CrossRef]

- Dogan, B.; Driha, O.M.; Balsalobre Lorente, D.; Shahzad, U. The mitigating effects of economic complexity and renewable energy on carbon emissions in developed countries. Sustain. Dev. 2021, 29, 1–12. [Google Scholar] [CrossRef]

- Romero, J.P.; Gramkow, C. Economic complexity and greenhouse gas emissions. World Dev. 2021, 139, 105317. [Google Scholar] [CrossRef]

- Adedoyin, F.F.; Agboola, P.O.; Ozturk, I.; Bekun, F.V.; Agboola, M.O. Environmental consequences of economic complexities in the EU amidst a booming tourism industry: Accounting for the role of Brexit and other crisis events. J. Clean. Prod. 2021, 305, 127117. [Google Scholar] [CrossRef]

- Shahzad, U.; Fareed, Z.; Shahzad, F.; Shahzad, K. Investigating the nexus between economic complexity, energy consumption and ecological footprint for the United States: New insights from quantile methods. J. Clean. Prod. 2021, 279, 123806. [Google Scholar] [CrossRef]

- Yilanci, V.; Pata, U.K. Investigating the EKC hypothesis for China: The role of economic complexity on ecological footprint. Environ. Sci. Pollut. Res. 2020, 27, 32683–32694. [Google Scholar] [CrossRef]

- Ikram, M.; Xia, W.; Fareed, Z.; Shahzad, U.; Rafique, M.Z. Exploring the nexus between economic complexity, economic growth and ecological footprint, Contextual evidences from Japan. Sustain. Energy Technol. Assess. 2021, 47, 191460. [Google Scholar] [CrossRef]

- Rafique, M.Z.; Nadeem, A.M.; Xia, W.; Ikram, M.; Shoaib, M.; Shazhzad, U. Does economic complexity matter for environmental sustainability? Using ecological footprint as indicator. Environ. Dev. Sustain. 2021, 1–18. [Google Scholar] [CrossRef]

- Nathaniel, S.P. Economic complexity versus ecological footprint in the era of globalization: Evidence from ASEAN countries. Environ. Sci. Pollut. Res. 2021, 28, 64871–64881. [Google Scholar] [CrossRef]

- Ahmad, M.; Ahmed, Z.; Majeed, A.; Huang, B. An environmental impact assessment of economic complexity and energy consumption: Does institutional quality make a difference? Env. Impact. Assess. Rev. 2021, 89, 106603. [Google Scholar] [CrossRef]

- Can, M.; Gozgor, G. The impact of economic complexity on carbon emissions: Evidence from France. Environ. Sci. Pollut. Res. 2017, 24, 16364–16370. [Google Scholar] [CrossRef] [PubMed]

- Chu, L.K. Economic structure and environmental Kuznets curve hypothesis: New evidence from economic complexity. Appl. Econ. Lett. 2021, 28, 612–616. [Google Scholar] [CrossRef]

- Pata, U.K. Renewable and non-renewable energy consumption, economic complexity, CO2 emissions, and ecological footprint in the USA: Testing the EKC hypothesis with a structural break. Environ. Sci. Pollut. Res. 2020, 28, 846–861. [Google Scholar] [CrossRef] [PubMed]

- Chu, L.K.; Le, N.T.M. Environmental quality and the role of economic policy uncertainty, economic complexity, renewable energy, and energy intensity: The case of G7 countries. Environ. Sci. Pollut. Res. 2021, 1–17. [Google Scholar] [CrossRef] [PubMed]

- Laverde-Rojas, H.; Guevara-Fletcher, D.A.; Camacho-Murillo, A. Economic growth, economic complexity, and carbon dioxide emissions: The case of Colombia. Heliyon 2021, 7, 07188. [Google Scholar] [CrossRef]

- North, D.C. Institutions, Institutional Change, and Economic Performance; Cambridge University Press: New York, NY, USA, 1990. [Google Scholar]

- Ostrom, E. Governing the Commons: The Evolution of Institutions for Collective Action; Cambridge University Press: Cambridge, UK, 1990. [Google Scholar]

- Lapatinas, A.; Kyriakou, A.; Garas, A. Taxation and economic sophistication: Evidence from OECD countries. PLoS ONE 2019, 14, e0213498. [Google Scholar] [CrossRef]

- Vu, T.V. Does Institutional Quality Foster Economic Complexity? The Fundamental Drivers of Productive Capabilities; ZBW-Leibniz Information Centre for Economics: Kiel, Germany, 2021. [Google Scholar]

- Neumayer, E. Do Democracies Exhibit Stronger International Environmental Commitment? A Cross-country Analysis. J. Peace Res. 2002, 39, 139–164. [Google Scholar] [CrossRef] [Green Version]

- Barret, S.; Graddy, K. Freedom, growth and the environment. Environ. Dev. Econ. 2000, 5, 433–456. [Google Scholar] [CrossRef]

- Welsch, H. Corruption, growth, and the environment: A cross-country analysis. Environ. Dev. Econ. 2004, 9, 663–693. [Google Scholar] [CrossRef] [Green Version]

- Ward, H. Liberal democracy and sustainability. Environ. Politics 2008, 17, 386–409. [Google Scholar] [CrossRef] [Green Version]

- Kuncic, A. Institutional quality dataset. J. Inst. Econ. 2014, 10, 135–161. [Google Scholar] [CrossRef] [Green Version]

- Torres, M.; Boyce, J. Income, inequality, and the pollution: A reassessment of the environmental Kuznets curve. Ecol. Econ. 1998, 25, 147–160. [Google Scholar] [CrossRef]

- Gani, A. The Relationship between Good Governance and Carbon Dioxide Emissions: Evidence from Developing Economies. J. Econ. Dev. 2012, 37, 77–93. Available online: http://www.jed.or.kr/full-text/37-1/4.pdf (accessed on 5 October 2021). [CrossRef]

- Awan, U.; Kraslawski, A.; Huiskonen, J. Governing inter firm relationships for social sustainability: The relationship between governance mechanisms, sustainable collaboration, and cultural intelligence. Sustainability 2018, 10, 4473. [Google Scholar] [CrossRef] [Green Version]

- Ali, H.S.; Zeqiraj, V.; Lin, W.L.; Law, S.H.; Yusop, Z.; Bare, U.A.A.; Chin, L. Does quality institutions promote environmental quality? Environ. Sci. Pollut. Res. 2019, 26, 10446–10456. [Google Scholar] [CrossRef] [Green Version]

- Akhbari, R. The effect of corruption on carbon emissions in developed and developing countries: Empirical investigation of claim. Heliyon 2019, 5, 02516. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Osabuohien, E.S.; Efobi, U.R.; Gitau, C.M. Beyond the environmental Kuznets curve in Africa: Evidence from panel cointegration. J. Environ. Policy Plan. 2014, 14, 517–538. [Google Scholar] [CrossRef]

- Hussain, M.; Dogan, E. The role of institutional quality and environment-related technologies in environmental degradation for BRICS. J. Clean. Prod. 2021, 304, 127059. [Google Scholar] [CrossRef]

- Azam, M.; Liu, L.; Ahmad, N. Impact of institutional quality on environment and energy consumption: Evidence from developing world. Environ. Dev. Sustain. 2021, 23, 1646–1667. [Google Scholar] [CrossRef]

- Bruinshoofd, A.; Rabobank, RaboResearch Utrecht. Institutional Quality and Economic Performance. 2016. Available online: https://economics.rabobank.com/publications/2016/january/institutional%2Dquality%2Dand%2Deconomic%2Dperformance/ (accessed on 5 October 2021).

- Azam, M.; Hunjira, A.I.; Bouri, E.; Tan, Y.; Al-Faryan, M.A.S. Impact of institutional quality on sustainable development: Evidence from developing countries. J. Environ. Manag. 2021, 293, 113465. [Google Scholar] [CrossRef] [PubMed]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring economic policy uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Ahir, H.; Bloom, N.; Furceri, D. The World Uncertainty Index. SSRN 2018. [Google Scholar] [CrossRef] [Green Version]

- Li, L.; Tang, Y.; Xiang, J. Measuring China’s monetary policy uncertainty and its impact on the real economy. Emerg. Mark. Rev. 2020, 44, 100714. [Google Scholar] [CrossRef]

- Gu, X.; Cheng, X.; Zhu, Z.; Deng, X. Economic policy uncertainty and China’s growth-at-risk. Econ. Anal. Policy 2021, 70, 452–467. [Google Scholar] [CrossRef]

- Nguyen, C.P.; Le, T.-H.; Su, T.D. Economic policy uncertainty and credit growth: Evidence from a global sample. Res. Int. Bus. Financ. 2019, 51, 101118. [Google Scholar] [CrossRef]

- Danisman, G.O.; Ersan, O.; Demir, E. Economic policy uncertainty and bank credit growth: Evidence from European banks. J. Multinatl. Financ. Manag. 2020, 57–58, 100653. [Google Scholar] [CrossRef]

- Phan, D.H.B.; Iyke, B.N.; Sharma, S.S.; Affandi, Y. Economic policy uncertainty and financial stability—Is there a relation? Econ. Model. 2021, 94, 1018–1029. [Google Scholar] [CrossRef]

- Zhang, Y.-J.; Yan, X.-X. The impact of US economic policy uncertainty on WTI crude oil returns in different time and frequency domains. Int. Rev. Econ. Financ. 2020, 69, 750–768. [Google Scholar] [CrossRef]

- Xiao, J.; Wang, Y. Investor attention and oil market volatility: Does economic policy uncertainty matter? Energy Econ. 2021, 7, 105180. [Google Scholar] [CrossRef]

- Jiang, Y.; Zhou, Z.; Liu, C. Does economic policy uncertainty matter for carbon emission? Evidence from US sector level data. Environ. Sci. Pollut. Res. 2019, 26, 24380–24394. [Google Scholar] [CrossRef] [PubMed]

- Danish, U.R.; Khan, S.U.D. Relationship between energy intensity and CO2 emissions: Does economic policy matter? Sustain. Dev. 2020, 28, 1457–1464. [Google Scholar] [CrossRef]

- Sohail, M.T.; Xiuyuan, Y.; Usman, A.; Majeed, M.T.; Ullah, S. Renewable energy and non-renewable energy consumption: Assessing the asymmetric role of monetary policy uncertainty in energy consumption. Environ. Sci. Pollut. Res. 2021, 28, 31575–31584. [Google Scholar] [CrossRef]

- Yu, J.; Shi, X.; Guo, D.; Yang, L. Economic policy uncertainty (EPU) and firm carbon emissions: Evidence using a China provincial EPU index. Energy Econ. 2020, 94, 105071. [Google Scholar] [CrossRef]

- Amin, A.; Dogan, E. The role of economic policy uncertainty in the energy—Environment nexus for China: Evidence from the novel dynamic simulation method. J. Environ. Manag. 2021, 292, 112865. [Google Scholar] [CrossRef] [PubMed]

- Adedoyin, F.F.; Ozturk, I.; Agboola, M.O.; Agboola, P.O.; Bekun, F.V. The implications of renewable and non-renewable energy generating in sub-Saharan Africa: The role of economic policy uncertainties. Energy Policy 2021, 150, 112115. [Google Scholar] [CrossRef]

- Adedoyin, F.F.; Zakari, A. Energy consumption, economic expansion, and CO2 emission in the UK: The role of economic policy uncertainty. Sci. Total Environ. 2020, 738, 140014. [Google Scholar] [CrossRef] [PubMed]

- Anser, M.K.; Apergis, N.; Syed, Q.R. Impact of economic policy uncertainty on CO2 emissions: Evidence from top ten carbon emitter countries. Environ. Sci. Pollut. Res. 2021, 28, 29369–29378. [Google Scholar] [CrossRef] [PubMed]

- Zakari, A.; Adedoyin, F.F.; Bekun, F.V. The effect of energy consumption on the environment in the OECD countries: Economic policy uncertainty perspectives. Environ. Sci. Pollut. Res. 2021, 28, 52295–52305. [Google Scholar] [CrossRef]

- Ha, L.T.; Dung, H.P.; Thanh, T.T. Economic complexity and shadow economy: A multi-dimensional analysis. Econ. Anal. Policy 2021, 72, 408–422. [Google Scholar] [CrossRef]

- Du, K.; O’Connor, A. Examining economic complexity as a holistic system effect. Small Bus. Econ. 2021, 56, 237–257. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Neagu, O. Economic Complexity: A New Challenge for the Environment. Earth 2021, 2, 1059-1076. https://doi.org/10.3390/earth2040063

Neagu O. Economic Complexity: A New Challenge for the Environment. Earth. 2021; 2(4):1059-1076. https://doi.org/10.3390/earth2040063

Chicago/Turabian StyleNeagu, Olimpia. 2021. "Economic Complexity: A New Challenge for the Environment" Earth 2, no. 4: 1059-1076. https://doi.org/10.3390/earth2040063

APA StyleNeagu, O. (2021). Economic Complexity: A New Challenge for the Environment. Earth, 2(4), 1059-1076. https://doi.org/10.3390/earth2040063