Abstract

The present paper offers a view regarding the challenge induced in the environment by the productive structure of countries. Economic complexity, which links the productive structure of a country with its knowledge, labour, and sophistication, seems to raise new challenges for the environment’s preservation and quality. The debate on this linkage in existing literature is at a beginning, stimulating the mind of scholars, researchers, and policy makers. The relationship between economic complexity and the environment is multi-faced and creates unimagined challenges for humanity in its path toward social and economic progress. The paper reviews the main dimensions of the linkage between economic complexity and the environment, including moderating factors of this connection as they are reported in the existing literature.

1. Introduction

We notice a growing interest in economic modelling that has emerged in several different approaches that include factors such as: limited rationality and heterogeneity of agents, multiple social interactions at various spatial and temporal scales, and learning processes, in the presence of adaptive evolutionary processes. Such evolutionary processes, observed in human socio-economic systems can lead to disequilibrium, non-linear relationships, path dependence, discontinuity, and irreversibility. Socio-economic systems are considered complex evolving systems, composed of multiple irrationals interacting and rapidly adapting agents and aggregate outcomes are seen as emerging properties of such systems.

The following features of the current and social global context suggest the need for a ‘complexity’ approach: (i) high interconnections between financial and economic systems (national/regional economies, markets); (ii) development of global value chains of production and consumption; (iii) turbulence of social and economic life (limited prediction, new capabilities, new objectives, and unstable and hostile environment); (iv) a new development paradigm: sustainable development—diffusion in society of the specific knowledge is critical for human survival; (v) a high level of connections between individuals and organisations (i.e., social networking); (vi) development of knowledge and informational society and digitalisation of economy and work (virtual markets, remote-work, e-work, e-learning, and e-reading); (vii) human capital has distinctive societal function comprising managerial, creative, entrepreneurial, and high-tech skills; (viii) emergence of new technologies, products, and materials; (ix) miniaturising and de-materialisation of products (nanotechnologies, virtual prototypes, and tools); (x) the pressure of automation of production processes and migration of labour force to creative industries; and (xi) global competition for resources, markets, and profit.

Complexity is an immanent attribute of the world in which we function and it is increasing with unprecedented speed.

The present review aims to provide a basic understanding of key concepts and conclusions from existing studies regarding economic complexity and the environment in the current world. The following reviewing criteria were used: (a) papers published in journals indexed in Science Direct, Wiley, Elsevier, and SpringerLink Database; (b) key words: complexity, economic complexity, and environment; and (c) the examined time span is 1998–2021. Additionally, some relevant studies focused on topics related to the paper’s aim and developed earlier than 1998 were also included in the review. The paper is structured as follows. First, I set out the concept of complexity within the current world context, and then I introduced the concept of economic complexity. Next, I review studies revealing the dimensions of the linkage between economic complexity and the environment, including also moderating factors of this connection. I finalized by concluding remarks as well as policy implications.

2. The Concept of Complexity

It is very difficult to find a clear meaning of complexity in spite of the large use of this term. In the work of Rosser (1999, 2010) [1,2], a hierarchical view is adopted in defining complexity. Rosser (1999) [1] placed on the lowest level the so called ‘small tent’ complexity, which assumes the heterogeneity of agents and a specific behaviour, namely, a preference to primarily interacting with those being your neighbourhood. Economic models adopting this kind of complexity often follow evolutionary processes (i.e., change and innovation) and rarely attain global equilibrium or rationality. It is also suggested that macroeconomic models must start with the micro-level and continue with heterogeneous agents in order to achieve the emergence of aggregates. This level denotes the common thinking as regards to complexity. On the second level we find the ‘big tent’ or the dynamic complexity, which includes the previous level of ‘small tent’ complexity. This level refers to systems that cannot endogenously converge to a limit cycle or a point as well as follow a continuous expansion or contraction. It includes the four C’s: catastrophe theory, cybernetics, chaos theory, and complexity theory. The term of ‘chaoplexology’ is introduced to combine the last two. On the third level of defining complexity is placed the meta-complexity.

From the impressive volume of definitions of complexity at this level, we extract the essence: the meaning of complexity is that of many interconnections between various sectors of the economy, as an input–output matrix.

Alfred Marshall is considered a precursor of economic complexity due to the fact that he addressed the problem of integrating biology and physics into economics, in order to better represent a complex economic world [2]. The relationship between economics and biology and physics is called as the ‘Marshall’s problem’. It was placed by Rosser [1,2] within a transdisciplinary approach including econophyics and econobio- logy. Revisiting the Marshall problem, Cassata and Marchionatti (2011) [3] stated that even though he failed to integrate these two methodological approaches into economic sciences, Marshall truly believed in the complexity of the interconnections between economic phenomena, and left us an important methodological and epistemological legacy on the meaning of complexity.

Keynes is also considered a precursor to the theory of economic complexity. He shared the belief of Alfred Marshall. The Keynes’s theoretical work was an attempt to deal with the complexity of economic world and the interdependence of the economic variables. In his theoretical framework, Keynes describes the macroeconomic outcome as a result of the interaction of heterogeneous agents that revise their behaviour as they accumulate information, and the interactions of agents can lead to macro-instability and out of equilibrium paths. This approach is common to complexity theory [4].

It was in the 1990’s when economists first recognised that an economy could be conceived as a complex system, and economics as a branch of system theory with methodological and theoretical concepts required to address economic complexity was developed [5].

Complex systems refer to self-organised systems, with many components and characteristics, exhibiting many structures, processes in various rates, and change and adaptation capacity to external environments. Their properties concern: circular causality, feedback loops, non-linear cause-effect response, emergence and unpredictability, dynamism, and continuous evolving [5].

The objects of the study of complexity science refer to the systems with the following properties: complex (they have the potential to configure their internal parts in an extensive number of ways); adaptive (they constantly change their response to their own development or environmental stimulus; self-organised (their configuration follows stable patterns); and non-equilibrium systems (avoidance of stable and self-reproducing states). In other words, the task of complexity science is to explore the general properties of complex, self-organising, adaptive, and non-equilibrium systems [6], p. 2. Moreover, in dynamical systems, complexity arises as a result of interactions between high dimensionality and high non-linearity. This conjunction between nonlinearity and high dimensionality supported by adaptation could be considered criteria for the genesis of a complex adaptive dynamical system [7], pp. 56,57.

As a result of introducing the complex systems theory into economics, a growing literature had explored the concept of economic complexity (e.g., [1,8,9]). The research on economic complexity has been motivated by the intention to explain empirical phenomena and how complex systems can be seen as an extension of the standard economic theory [8]. In his assessment of the literature on economic complexity, Durlauf (2005) [8] concluded that there are three main groups of studies on the link between complexity and empirical economics. First, there are historical studies on path dependence in economic activity. Path dependence can be identified in environments where shocks have permanent effects on a system. The second refers to the revelation of data patterns that are relevant for complex environments and systems. This group of studies focuses on introducing scaling laws (relationship between apparently independent variables put on a scale of measurement) and power laws (probability distributions) into economics. A third group of studies explored the social interactions between actors placed in the centre of the micro-structure of complexity models. Finally, from the perspective of econometrics, theoretical models were integrated with data analysis in order to reveal the association between a given aggregate property and interactions between agents. The study developed by Sonis and Hewings [10] provides a description of networks of economic self-influences as well as the transfer of these influences within different hierarchical positions of economic sub-systems. Their model is based on structural path analysis and show that the complex network, consisting of activities and regions, input–output system, and exchange between sectors, can be hierarchically decomposed. They define economic complexity as an emerging property of a process involving a network created by the augmentation of inputs and the increasing number of synergetic interactions between various regional sub-systems [10].

As a result of an emerging literature, complexity economics was established as a new paradigm of economic thinking, independent of the neoclassical perspective [11], portraying the economy as an organic, dependent, and always evolving process [12]. Holt, Rosser, and Colander [13] claim that a new era in economics has arrived, namely the complexity era.

On the other side, all economists know that the economy is very complex. Therefore, society needs economists, in order to make complexity simpler and more understandable [14].

In this endeavour, conventional economics differs from complexity economics in the following senses. In traditional economics: dynamics is closed, static, and characterized by in-equilibrium linear systems; actors are collectively modelled, comprehensively informed, there are no learning or adaptation requirements, and decisions are made using complex deductive calculations; structure of connections is modelled on the basis of indirect interactions between actors through market mechanisms; macro- and micro-levels are separate; there is no mechanism for renewing the system or increasing order and complexity. In complexity economics: dynamics is open with non-linear and not-in-equilibrium systems; actors are individually modelled, incompletely informed, capable of learning and adaptation and decisions are made using inductive empirical research; structure of ties is generated by the direct interactions between actors; emergence: macro- and micro-levels are linked; evolution process is based on mutation, selection, and amplification that stimulates the renewal of the system and its increase in order and complexity [15].

3. Economic Complexity: Measures and Interconnections

In the structuralist literature, economic development and growth are connected to the changes in sectoral composition of production and the progress on production of complex goods. Inspired from the structuralist view, new literature emerged in the last years discussing the role of structural change to stimulate the long-run economic development and identifying linkages between GDP per capita and the structure of production, growth rates of exports, and productivity.

In this context, recent studies have revealed that economic development can be interpreted as a process of learning for a country on how to produce (and export) more sophisticated and complex products. Each country must find its own development path and focusing on its learning system may add capabilities to the ones it already possesses [16,17]. New literature has revealed the role of accumulating capabilities in the production of more complex goods, claiming that it is a premise for structural change. Such capabilities refer to non-tradable and intangible inputs (i.e., tacit knowledge). A large part of the literature on this approach was focused on identifying and measuring capabilities across industries or countries (e.g., [16,18]).

Following this line, Hidalgo et al. [19] and Hidalgo and Hausmann [20] developed and introduced a methodology meant to be used in the analysis of the economic development process. In their methodology, the level of complexity of a country’s productive structure is expressed through two metrics: diversity (the number of goods a country produces with revealed comparative advantage (RCA)) and ubiquity (the number of countries capable of exporting goods with RCA). They used computational, network and complexity techniques to generate a model expressing a country’s productive sophistication or economic complexity.

Economic complexity refers to the composition of a country’s productive output and reflects its structures that hold and combine knowledge [21].

A new and recent literature emerged exploring the impact of economic complexity on economic outcomes. The study of economic complexity was mainly motivated by the development of endogenous growth theory, the revival of industrial policy, and the growth of artificial intelligence (AI) [22].

A robust and stable relationship between a country’s productive structure and economic growth is documented by several studies (i.e., [23,24,25,26,27]). Economic complexity is highly correlated with income and can explain differences in economic performance [28]. It also can predict future economic growth ([20,29,30,31]). Moreover, economic complexity of a country may limit its range of income inequality [32] and influences regional wage differentials in a nonlinear dynamic [33], meaning that increasing levels of complexity will first worsen and then will improve the income (in Brazilian states), and the effect is extended where urbanization and overall development is higher. When the economy experiences higher levels of products’ complexity this induces lower levels of income inequality, meaning that economic complexity could be seen as a strong predictor of income inequality [34]. Human capital (i.e., education) is found as a factor that magnifies this reducing effect of economic complexity on income inequality [34]. When the level of human capital (i.e., education), trade openness, and government spending reach certain levels, they facilitate a beneficial effect of higher economic complexity, namely, to reduce income inequality [35]. The distributional effect of economic complexity depends on the country risk: economic complexity is associated with more equal income distribution in countries with low risk (i.e., economic, financial, and political risk) while an increase in economic complexity will generate more inequality when the country risk is high [36]. It is also revealed that the degree of economic complexity of regional production systems can be used to assess how it affects their pattern of growth and economic convergence. For example, a process of economic divergence between European regions is identified as a result of their increase in economic complexity [37]. Human development is also positively influenced by economic complexity ([32,38,39,40,41]) and an influence of economic complexity on the relationship between the real exchange rate and corporate investment is reported [42]. Economic complexity is also related to scientific production in basic sciences and engineering [43].

Drivers of economic complexity were identified as financial development and the number of patents [44]. Moreover, a higher diversity in the birth place of immigrants can boost economic complexity through an increasing diversification of the host country’s export basket [45]. It has also been proved that economic complexity is associated with the fertility change across Italian provinces [46] and Internet usage [47]. Other driving forces of economic complexity are reported by several studies, such as: property rights [48], human capital accumulation [49] and foreign direct investment [50,51].

4. The Link between Economic Complexity and Environmental Degradation

4.1. Metrics Used in the Analysis

Environmental impact is seen as an understandable consequence of economic complexity. More sophisticated and complex products need an increased energy demand, mainly for industrial sectors, using energy from different sources, with different energy intensity and efficiency.

In order to provide a metrics for economic complexity, Hidalgo and Hausmann [20] introduced the measure called “economic complexity index” (ECI). It is defined as ‘the composition of a country’s productive output, reflecting the structures able to hold and combine knowledge’. The development of this index relies on the following assumption: when the exports of a country are more diverse and have fewer competitors, the economic complexity is higher (i.e., [21,29]).

In the energy–environment literature, environmental degradation is traditionally measured by the volume of carbon dioxide (CO2) emissions (i.e., [52,53,54,55,56,57,58,59]) or Greenhouse Gas (GHG) emissions (i.e., [60,61]).

Lately, another proxy, the ecological footprint has emerged as a more comprehensive measure of environmental degradation (i.e., [62,63,64,65,66]). The ecological footprint was introduced by Wackernagel and Rees [67] as a more inclusive and comprehensive indicator of environmental degradation, encompassing built-up land, forest land, grazing land, crop land, carbon footprint, and ocean. It measures the total quantity of natural resources consumed by the population as well as the area of productive land and water needed to support human activities and sequester the waste they generate [68].

Another group of studies use an environmental performance index as metric of environmental performance. For example, Lapatinas et al. [69] and Boleti et al. [70] used the composite index of environmental quality that was developed by Yale University and Columbia University in collaboration with the World Economic Forum and the European Commission’s Joint Research Centre. This index includes indicators of pollution and impact of pollution on human health as well as the effectiveness of environmental policies [71].

4.2. Analysing the Link between Economic Complexity and Environment

The analysis of the impact of economic complexity on environmental degradation has gained a noticeable research interest in the few last years.

A consistent number of studies use carbon emission as expression of air pollution. As an indicator of knowledge-based and sophisticated production in an economy, economic complexity is positively associated with CO2 emissions. The study developed by Dogan et al., (2019) [72] examined the effect of economic complexity on CO2 emissions for 55 countries for the period of 1971–2014, using additional control variables (i.e., energy consumption, urbanization, and trade openness). Economic complexity has a significant and different impact on the environment depending on the stage of development. Economic complexity has generated the increase in CO2 emissions in lower and higher middle-income countries, and has a limited environmental degradation in high-income economies. According to the results of Majeed et al., (2021) [73], in the OECD countries over the period 1971–2018, the long run impact of economic complexity is positive and significant on carbon emissions. Moreover, the impact is higher in the economies with a low level of CO2 emissions.

Another group of studies reveal a mitigating effect of economic complexity on carbon emissions. For example, Dogan et al., (2021) [74] analysed the effect of economic complexity, economic progress, population growth, and renewable energy consumption over carbon emissions in a sample of 28 OECD countries for the period of 1990–2014. They reported that economic complexity has induced a decrease in carbon emissions. This decreasing effect on carbon emissions can be induced by the technologies used in the process of production, as reported by Romero and Gramkov (2021) [75]. Their study proved that production of complex goods is associated with reduced emission intensity and this effect is due to the types of technologies used in production process. Based on data for 67 countries between 1976 and 2012, it was found that an increase of 0.1 of ECI can generate a 2% decrease in kilotons of CO2 per billion dollars of output as well as in CO2 emissions per capita. They estimated an index of Product Emission Intensity to show that it has lower levels in the case of medium- and high-tech products while higher levels are assigned to primary products. The estimation of this index confirms that structural changes in the economy toward more complex and high-tech products can lead to a reduction in carbon emissions intensity.

Frequently, studies include also other relevant economic variables in the analysis of the relationship between economic complexity and environment. For example, the study of Abbasi et al., (2021) [59] analysed the association between the economic complexity index (ECI), gross domestic product per capita (GDP), tourism, and energy prices on CO2 emissions within 18 top economic complexity countries from 1990 to 2019. There were identified long- and short-term associations among ECI, GDP, and CO2 emissions. Tourism, GDP per capita and energy prices can decrease carbon emissions both in the long and short run. Moreover, any policy on economic complexity, tourism, energy prices, and economic growth has a notable influence on CO2 emissions. Adedoyin et al., (2021) [76] concluded that an increase in the complexity of the economy or financial crises, together with international travel, do not accelerate environmental crisis in some EU regions over the period from 1995 to 2018.

Another expression of environmental degradation, greenhouse gas emissions (GHG) were used by Neagu and Teodoru (2019) [60] to explore the relationship between economic complexity, energy consumption structure, and pollution in the European Union (EU) countries. They found that economic complexity contributes to the level of GHG emissions and the impact is higher in the panel of less complex countries (i.e., values of Economic Complexity Index are lower than the EU average).

The relevant studies analysing the economic complexity–environment nexus use various pollution indicators. For instance, Swart and Brinkmann (2020) analysed the relationship between economic complexity, income level, and four different pollution indicators (carbon monoxide, ozone, solid waste, and deforestation) in the Brazilian economy. They found that the square of ECI is statistically insignificant in the estimated quadratic model and reported that ECI reduced waste generation while it increased forest fires.

Very recent studies use the Ecological Footprint (EF) as expression of pollution. Thus, Shahzad et al., (2021) [77] investigated the nexus between the ecological footprint and economic complexity in the case of US economy by using data spanning the period of 1961 Q1 to 2017 Q4. Their analysis confirmed that economic complexity can significantly enhance the ecological footprint in the United States. Moreover, they revealed the existence of a causal relationship between economic complexity as well as energy consumption and the ecological footprint. Ylanci and Pata (2020) [78] examined the Environmental Kuznets Curve (EKC) hypothesis for China considering the role of economic complexity on the ecological footprint. They confirmed that economic complexity increased the ecological footprint within the Chinese economy in the period 1965–2016, in the short- and long-term, while no validity of the Environmental Kuznets Curve (EKC) hypothesis was found. Neagu (2020) [66] revealed the harmful impact of economic complexity on the environment proving that economic complexity induced the extension of the ecological footprint in the 48 most complex economies in the world for the time span of 1995 to 2017. In the case of the Japanese economy, Ikram et al., (2021) [79] identified a cointegrated long-run bidirectional relationship between the ecological footprint and economic complexity. Rafique et al., (2021) [80] examined the top 10 ECI economies for 1980–2017 and revealed that economic complexity is significantly and positively associated with the ecological footprint. A study developed by Nathaniel (2021) [81] for the Association of Southeast Asian Nations (ASEAN) countries, also explored the impact of economic complexity on the ecological footprint and carbon emissions. The economic complexity growth increases both the ecological footprint and carbon emissions. Ahmad et al., (2021) [82] found that economic complexity contributes to the degradation of environmental quality in emerging economies, while a high level of economic complexity would mitigate the ecological footprint. It concludes that policy makers in emerging economies must consider the product’s complexity and manufacturing structure when shaping environmental or energy policies. These countries also need more environmentally friendly products to be developed, as well as enhancing the share of renewable energy sources in the energy consumption mix and implementing of pricing strategies that discourage fossil fuel consumption in order to curb environmental degradation [82].

Using the Environmental Performance Index (EPI) as metric for environmental quality, Lapatinas et al., (2019) [69] and Boleti et al., (2021) [70] illustrated that the environmental performance in 88 developed and developing countries for the period 2002–2012 is highly correlated with economic complexity (the mix of exported products). Higher levels of economic complexity can lead to better environmental performance and do not induce environmental degradation. They concluded also that the level of sophistication of a country’s productive structure could be seen as predictor its environmental performance.

4.3. The Environmental Kuznets Curve (EKC) Model

There are very few studies investigating the economic complexity index (ECI) as an explanatory variable instead of income, in a non-linear relationship (using ECI squared) and testing the Environmental Kuznets Curve (EKC) model.

For example, Can and Gozgor (2017) [83] studied the linkage between economic complexity and environmental degradation in the case of France and found that a higher degree of economic complexity could curb the environmental depreciation, in other words, the environmental Kuznets curve can be validated. A similar result was reported by Neagu (2019) [57] in a panel of 25 European countries as well as in 6 European countries (Belgium France, Italy, Finland, the UK, and Sweden) when considering the influence of economic complexity on CO2 emissions. Chu (2021) [84] also identified a nonlinear relationship between ECI and CO2 emission in 118 countries, validating thus an inverted U-shaped curve.

In the case of USA, Pata (2021) [85] included in the analysis of pollution generated by economic complexity other explanatory variables such as: renewable energy, non-renewable energy, and globalization. The study validated the inverted U-shaped relationship between economic complexity and pollution expressed by CO2 emissions and the ecological footprint. The production structure in the USA caused environmental degradation in the early stages, while the use of cleaner production techniques and advanced technologies induced a reduction effect of economic complexity on environmental pressure, after a certain level. A similar study was conducted by Chu and Le (2021) [86] for the G7 countries, by using as explanatory variables of environmental quality: economic complexity, energy intensity, and renewable energy. The environmental Kuznets curve of economic complexity and environmental quality (measured through CO2 emissions and the ecological footprint) holds for these countries.

There are also studies finding no confirmation of environmental Kuznets curve. For example, in the case of Colombia, a developing country with relative low levels of production sophistication and pollution, Laverde-Rojas et al., (2021) [87] could not find any validation of the EKC hypothesis.

5. Institutional Factors Moderating the Impact of Economic Complexity on Environment

5.1. Institutional Factors

In a basic sense, institutions mean human constrains that shape interactions between people, in other words,” formal and informal rules of the game” [88]. In an extended vision, institutions are defined as the sets of working rules regarding decisions, actions, constraints, procedures, information, or payoffs to agents in the society [89], p. 51.

Hartmann et al., (2017) [32] suggested that the evolution of institutions is a factor that made possible for countries exporting more complex products to have a fairer income distribution (i.e., reduced levels of income inequality) than those exporting simple products. The productive structures of a country result from a number of factors that co-evolve with the country’s mix of exported products. It is also suggested that institutions evolved, at least in the most advanced economies, in order to allow them to use new technologies and develop innovative processes required to achieve high levels of complexity.

Institutional factors as taxation policies can explain the differences between countries regarding their capacity to produce and export more complex products. Economies that rely less on capital relative to labour taxation tend to produce more sophisticated products, while those based more heavily on capital relative to labour taxation will produce simple products. The negative impact of taxation on economic complexity is stronger in the more developed economies [90].

A central hypothesis is that the institutions are linked to higher levels of economic complexity through strengthening incentives for innovative entrepreneurship, facilitating human capital accumulation, and directing human resources towards productive activities [91]. The findings of Vu (2021) [91] highlight a positive effect of institutional quality measured by the Economic Freedom of the World Index on economic complexity in 115 countries.

Institutional factors could moderate the impact of economic complexity on environment.

There are two variables examined in the analysis of economic complexity in relation with environment in recent studies: institutional quality and policy uncertainty.

5.2. Institutional Quality

Legislative measures have a critical role in improving environmental quality and mitigate ecological degradation. Governance capabilities are meant to improve resources efficiency, to prevent pollution, and to preserve the environment. It is obvious that institutions may impede or stimulate the environment protection and policy measures can mitigate the level of pollution. For example, Neumayer (2002) [92] revealed the important role of democracy for better environmental quality, which can be maintained through appropriate governance system and effectiveness political institutions [93] whereas inefficient institutions, bureaucracy, and poor management seem to be a distorting channel, weakening environmental quality [94,95].

In the study developed by Kuncic (2014) [96], the term of institutional quality is used as the quality of the overall system of governance of a country, including regulations for intervention in economic, social, and political settings.

The academic literature reports mixed results regarding the impact of institutional quality on environment. Some studies reveal a positive link between institutions and environment protection (i.e., [97,98,99,100]), in other words, good governance, transparency, the rule of law, and democratic quality, positively influence the environment’s preservation, whereas others show a confusing result (i.e., [101]) or a negative impact (i.e., [102]).

Institutional quality is seen as factor used by governments to mitigate environmental pollution. For example, Hussain and Dogan (2021) [103] proved that institutional quality can reduce the extension of the ecological footprint, and Azam et al., (2021) [104] reported a positive influence of institutional quality on most of the environmental indicators (i.e., CO2 and CH4 emissions, and forest area) in developing countries.

In order to operationalise the concept of institutional quality, the literature includes several measures. For example, Bruinshoofd (2016) [105] constructed an index of institutional quality from seven variables available in the World Bank database (voice and accountability, political stability, regulatory quality, government effectiveness, control of corruption, rule of law, and ease of doing business). Moreover, it sees institutional quality as a factor of production (it explains cross-country variation in economic growth), an enabling factor of economic growth (an improvement in institutional quality will strength the growth potential of an economy). According to the conclusions of Bruinshoofd (2016) [105], institutions and long-term economic growth are intimately connected and institutional quality generates economic progress. Moreover, the institutional quality can be seen as a contextual variable allowing economic growth, meaning that it could drive technological change and adoption of innovations.

Azam et al., (2021) [104] constructed an index of institutional quality covering three dimensions: political stability, administrative capacity, and democratic accountability. They used it to examine the linkage between energy consumption, pollution, and institutions in 66 developing countries over the period of 1991–2017.

Another institutions quality index was constructed by Azam et al., (2021) [106] based on indicators collected from the International Country Risk Guide (ICRG), namely: (i) government stability; (ii) investment profile; (iii) control over corruption; (iv) law and order; (v) democratic accountability; and (vi) bureaucratic quality. The index was used to analyse the role of institutional quality on sustainable development in 66 developing countries from 1984 to 2019. Their results indicate that institutional quality positively affected the sustainable development and the impact was greater in lower middle-income countries compared to low-income countries.

Ahmad et al., (2021) [82] revealed that institutional quality moderates the nexus between economic complexity and environmental degradation, by supporting environmental sustainability. They investigated the impact of economic complexity, institutional quality, economic growth, and energy consumption on environmental degradation in the case of emerging countries, for 1984 to 2017. Institutional quality reduces the ecological footprint and can promote environmental sustainability. They further show that any policy related to economic complexity and institutional quality would significantly affect the ecological footprint and, also, any policy supporting the ecological footprint would not impact economic complexity and institutional quality. It is also suggested that improved institutional quality can decrease environmental pollution and the “role of institutions on economic complexity is of utmost importance” [82].

5.3. Policy Uncertainty

Policy uncertainty is expressed in several studies through an index constructed on the frequency count of the word “uncertainty” (and/or its variants) in country reports or newspapers [107,108]. Generally, economic policy uncertainty impacts several aspects of the business environment in a country. The impact on the real economy could be adverse [109,110] on financial markets [111,112,113] or energy markets [114,115].

The literature shows different effects of economic policy uncertainty on environmental quality. In several studies, policy uncertainty is identified as a factor which significantly affects pollution, increasing carbon emissions being associated with higher economic policy uncertainty. For example, the economic policy uncertainty was found as relevant to explaining the fluctuations of sectoral and total CO2 emissions in the case of the US economy. CO2 emissions are affected by the economic policy uncertainty when the increase in carbon emissions is in a higher or lower growth trend [116]. Based on annual data from 1985 to 2019 of USA, it was found that economic policy uncertainty strengthens the harmful effect of energy intensity on CO2 emissions [117]. It is also revealed an asymmetric effect (as direction and magnitude) of monetary policy uncertainty on renewable and non-renewable energy consumption for the period 1985 to 2019 in the US economy [118]. A study developed by Yu et al., (2021) [119] for the Chinese provinces found a significant positive impact of economic policy uncertainty on manufacturing firms’ carbon emission intensity. Amin and Dogan (2021) [120] found also that policy uncertainty in China caused an increase in carbon emissions over the period 1980–2016. Policy uncertainty generated high levels of carbon emission in sub-Saharan African countries during 1996–2014, and its moderating effect on renewable and non-renewable energy generation induced a reduction in pollutant emissions [121].

A group of studies report different results in the short- and long-term regarding the impact of policy uncertainty on carbon emissions. For example, in the case of the British economy, Adedoyin and Zakari (2020) [122] provided evidence on the role of policy uncertainty in the energy consumption–emission nexus based on data regarding the period 1985–2017. They showed that policy uncertainty reduces the rise of CO2 emissions in the short-term but it has a detrimental effect in the long term. According to Anser et al., (2021), [123] in higher carbon emitter countries, the policy uncertainty mitigates the pollution in the short-term while it escalades in the long run. The argument that, in the long run, policy uncertainty further deteriorates the quality of environment is also supported by the results of Zakari et al., (2021) [124], which confirmed a positive association between policy uncertainty and carbon emissions in the 22 Organisation for Economic Cooperation and Development (OECD) countries between 1985 and 2017.

Complementing these findings, Chu and Le (2021) [86] found that policy uncertainty can strongly moderate the environmental impact of economic complexity, together with renewable energy and energy intensity in the G7 countries for 1997–2015. Specifically, it magnifies the environmental impact of energy intensity while it extends the beneficial effect of renewable energy and economic complexity. Economic policy uncertainty leads to a reduction in CO2 emissions and the ecological footprint. It is also found that above a certain threshold, the impact of economic complexity on environmental quality changes from detrimental to beneficial.

A very interesting study was developed by Ha et al., (2021) [125] regarding the effects of economic complexity on the shadow economy in a global sample of 42 low-income and lower-middle-income and 30 upper-middle-income and 38 high-income countries for 2002–2017. They identified the presence of a non-linear relationship between economic complexity and the shadow economy and reported that economic complexity has an increasingly and negative influence on shadow economy. This effect more likely exists in the long term and among high-income economies. It is also revealed that institutional quality could significantly determine this effect of economic complexity.

All these findings suggest that policy uncertainty must be avoided by governments, as the uncertainty increases the given attention to implement adequate environmental policies lessens, as it is likely to have an unexpected effect on environmental policies measures. Therefore, in order to reach environmental sustainability, consistency is needed in economic and environmental policies introduced by governments.

A higher economic complexity requires an increased energy demand for the production sector. The risk will contribute to the increase in the environmental degradation if any policy measures are not taken, or if institutions, procedures, and rules are inefficient due to their poor quality. Therefore, in the debate regarding the economic complexity and institutions, the following remarks must be made. In order to limit the environmental pollution generated by the increase in economic complexity, institutions and policies must: (1) stimulate the green basis of the production system (clean and decarbonised technologies; (2) diversify the mix of energy sources in the favour of renewable and non-pollutant energy sources (i.e., wind, nuclear, and solar); (3) implement strategies for decreasing energy intensity and increasing energy efficiency; (4) increase investment in low-carbon technologies; (5) impose regulatory, financial, and taxation measures (taxes for pollution, and subsidies and incentives for investment in nuclear and renewable energy infrastructure; (6) encourage the promotion of environmental sustainable business models and practices; and (7) implement measures enabling the required flexibility for a systemic change in the economy.

6. Concluding Remarks

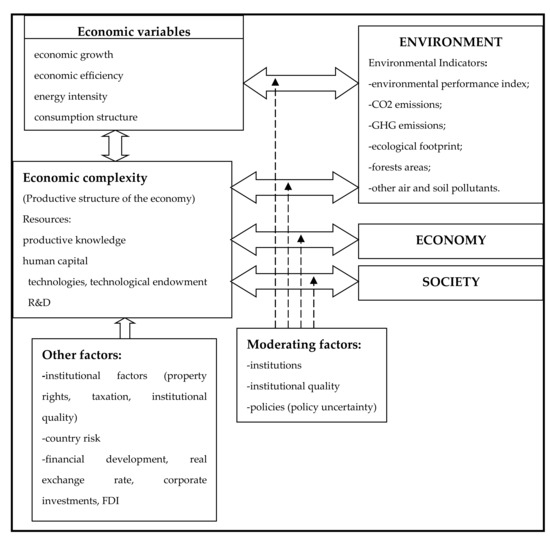

Figure 1 displays the drivers and factors of economic complexity and its implications covering three dimensions: environment, economy, and society.

Figure 1.

Linkages between economic complexity and environment, economy, and society, including moderating factors.

Economic complexity is the expression of a country’s structure based on several resources: productive knowledge embedded in people and technology, technological endowment, and R&D activities.

Economic complexity is also based on the economic level of a country, its development stage being a critical driver of the production systems and structure. Rich and higher income countries have the capabilities to enhance the level of sophistication of the products they export, whereas developing or lower-income countries must attract the resources they need in order to experience a higher level of economic complexity. The studies above summarized reveal that economic structure, energy intensity, and the energy consumption mix can shape the level of economic complexity.

Several national and international factors affect the level of economic complexity: institutional factors (taxation, and institutional quality), financial (financial development, real exchange rate, and foreign direct investment), country risk (i.e., financial, economic, and political), globalisation, tourism, urbanisation, Internet usage, and demographic factors (fertility, and birthplace diversity).

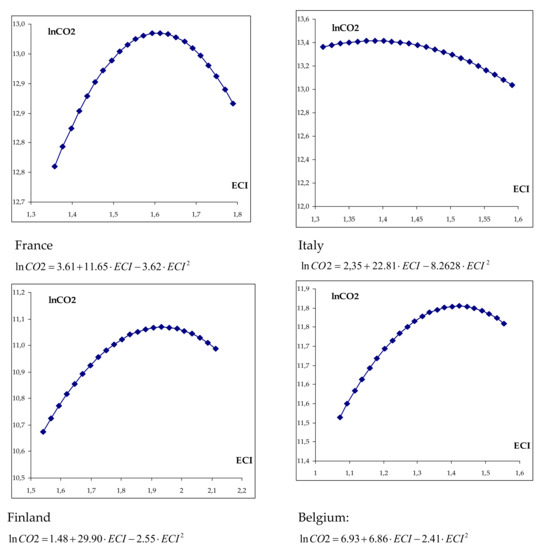

Economic complexity impacts the economy, environment, and society. Economic complexity is an accurate of economic growth and of income inequality. Economic complexity generates a new pressure on environmental quality. It increases the air pollution and extends the ecological footprint. Some studies report a beneficial influence of economic complexity on environmental performance. It is worthy mentioning in this context that studies focused on validating the Environmental Kuznets Curve (EKC) model, with the Economic Complexity Index (ECI) as an explanatory variable bring the brightest side of the link between economic complexity and environmental degradation. Pollution increases with the complexity growth, but a certain level of complexity can curb the evolution of environmental degradation and the pollution pressure will decrease. This supports the existence of a threshold of economic complexity, meaning that the productive structure of the economy is based on the use of cleaner technologies and appropriate environmental rules that induce the reduction effect of pollution. Based on previous studies (i.e., [57,83]), in the case of complex economies, this threshold means a value of ECI higher than one. For example, the estimation of EKC model for 1995–2017 for some European countries (Figure 2) shows for France a threshold value of 1.6 for ECI, while for Italy this is 1.45. In Finland, the carbon emissions start to decrease when ECI reaches values higher than 1.9 and in Belgium when ECI attained 1.4.

Figure 2.

The estimated EKC model in some European countries using ECI as explanatory variable (1995–2017). Reprinted with permission from Ref. [57]. Copyright: © 2021 by the author. Licensee MDPI, Basel, Switzerland.

The recent literature suggests also that institutional factors, such as institutional quality and policy uncertainty have a moderating effect in the linkage between economic complexity and environment.

As the economic complexity can be seen as dynamic outcome of aggregate national innovation and entrepreneurship process that creates economic diversity through new sophisticated exported products and an increased economic complexity is a significant determinant of the efficiency gain in different production technologies and processes [126], we can conclude that this effect of economic complexity may stimulate further beneficial changes in the economy, meant to unveil or reduce detrimental effects (environmental degradation).

More complex and sophisticated products incorporate industrial technologies that may be harmful for the environment generating pollution. As a consequence, companies, industrial units, and policymakers should integrate energy considerations within the early design stage of their products, along with promoting investments in environmentally friendly technologies when they decide to include more complex products in their export baskets (i.e., [60]), and if the products’ complexity generates pollution, imports could be an alternative.

Moreover, as Can and Gozgor (2017) [83] stated, an analysis of the level and the extension of environmental degradation generated by each industry, could be beneficial for designing adequate measures for pollution mitigation.

Economic complexity is a threat to the environment. There are some comments to be made to this assertion: (1) Economic complexity is an accurate predictor of economic growth. Countries with high income and economic growth can experience higher levels of sophistication of the products they export, and even if the pollution increase with the economic complexity level, at a certain threshold, the economic complexity can suppress the pollution. This is a result reported in several studies investigating the validity of Environmental Kuznets Curve taking into consideration the economic complexity as explanatory variable of environmental degradation; (2) A higher complexity is based on quality human capital, on large investments in R&D activities meant to introduce environmental friendly technologies, and on clean and decarbonised technology methods; (3) Economic complexity must be taken into consideration within the national commitments regarding carbon emissions reduction (the exports structure has to be adapted in order to generate less pollution) and a realistic plan for carbon emissions abatement is needed to monitor the energy intensity by using regulatory and financial measures as well as implementing effective industrial low-carbon strategies.

As final remark, the present paper also suggests that an additional environmental sustainability concern must be made as the focus of economic and energy policies in all countries viewing to increase the complexity level of their products.

Funding

This research received no external funds.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Conflicts of Interest

The author declares no conflict of interest.

References

- Rosser, J.B., Jr. On the complexities of complex economic dynamics. J. Econ. Perspect. 1999, 13, 169–192. [Google Scholar] [CrossRef] [Green Version]

- Rosser, J.B., Jr. Is a transdisciplinary perspective on economic complexity possible? J. Econ. Behav. Organ. 2010, 75, 3–11. [Google Scholar] [CrossRef]

- Cassata, F.; Marchionatti, R. A transdisciplinary perspective on economic complexity. Marshall’s problem revisited. J. Econ. Behav. Organ. 2011, 80, 122–136. [Google Scholar] [CrossRef]

- Marchionatti, R.; Keynes, J.M. thinker of economic complexity. Hist. Econ. Ideas 2010, 18, 115–146. Available online: https://ideas.repec.org/a/hid/journl/v18y201025p115-146.html (accessed on 22 September 2021).

- Matutinovic, I. Economic complexity and the role of markets. J. Econ. Issues 2010, 43, 31–51. [Google Scholar] [CrossRef]

- Foley, D.K. Introduction, Chapter 1. In Barriers and Bounds to Rationality: Essays on Economic Complexity and Dynamics in Interactive Systems; Albin, P.S., Foley, D.K., Eds.; Princeton University Press: Princeton, NJ, USA, 1998; pp. 3–72. [Google Scholar]

- Fontana, W.; Buss, L.W. The Barrier of Objects: From Dynamical Systems to Bounded Organizations. In Barriers and Boundaries; Casti, J., Karlqvist, A., Eds.; Addison-Wesley: Reading, MA, USA, 1996; pp. 56–116. [Google Scholar]

- Durlauf, S.N. Complexity and empirical economics. Econ. J. 2005, 115, F225–F243. [Google Scholar] [CrossRef]

- Foster, J. From Simplistic to Complex Systems in Economics. Camb. J. Econ. 2005, 29, 873–892. [Google Scholar] [CrossRef] [Green Version]

- Sonis, M.; Hewings, G.J.D. Economic complexity as network complication: Multi-regional input-output structural analysis. Ann. Reg. Sci. 1998, 32, 407–436. [Google Scholar] [CrossRef]

- Fontana, B. The Complexity Approach to Economics: A Paradigm Shift; Working Paper, No. 200801; Department of Economics, ”S. Cognetti de Martiis” University of Turin: Turin, Italy, 2008; Available online: https://ideas.repec.org/p/uto/cesmep/200801.html (accessed on 23 August 2021).

- Arthur, B.W. Complexity and the Economy. Science 1999, 284, 107–109. [Google Scholar] [CrossRef]

- Holt, R.P.F.; Rosser, J.B., Jr.; Colander, D. The complexity era in economics. Rev. Political Econ. 2011, 23, 357–369. [Google Scholar] [CrossRef] [Green Version]

- Collander, D. Complexity and History of Economic Thought. Middlebury College Working Paper Series Discussion Paper No. 08-04. 2008. Available online: https://econpapers.repec.org/paper/mdlmdlpap/0804.htm (accessed on 7 October 2021).

- Arpe, J. Globalisation and Its Complexity. Challenges to Economic Policy, Bertelsmann Stiftung Deutschland. 2012. Available online: https://www.bertelsmann-stiftung.de/en/publications/publication/did/globalization-and-its-complexity/ (accessed on 4 October 2021).

- Lall, S. Technological capabilities and industrialization. World Dev. 1992, 20, 165–186. [Google Scholar] [CrossRef]

- Lall, S. The Technological Structure and Performance of Developing Country Manufactured Exports, 1985-98. Oxf. Dev. Stud. 2000, 28, 337–369. [Google Scholar] [CrossRef] [Green Version]

- Archibugi, D.; Coco, A. Measuring technological capabilities at the country level: A survey and a menu for choice. Res. Policy 2005, 34, 175–194. [Google Scholar] [CrossRef]

- Hidalgo, C.A.; Klinger, B.; Barabasi, A.L.; Hausmann, R. The product space conditions the development of nations. Science 2007, 317, 482–487. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Hidalgo, C.A.; Hausmann, R. The building blocks of economic complexity. Proc. Natl. Acad. Sci. USA 2009, 106, 10570–10575. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Hausmann, R.; Hidalgo, C.A.; Bustos, S.; Coscia, M.; Simoes, A.; Yildirim, M.A. The Atlas of Economic Complexity: Mapping Paths to Prosperity; MIT Press: Cambridge, MA, USA, 2014; Available online: https://s3.amazonaws.com/academia.edu.documents/30678659/ (accessed on 6 September 2021).

- Hidalgo, C.A. Economic complexity theory and applications. Nat. Rev. Phys. 2021, 3, 92–113. [Google Scholar] [CrossRef]

- Bustos, S.; Gomez, C.; Hausmann, R. Hidalgo, C.A. The dynamics of nestedness predicts the evolution of industrial ecosystem. PLoS ONE 2012, 7, e49393. [Google Scholar] [CrossRef] [PubMed]

- Felipe, J.; Kumar, U.; Abdon, A.; Bacate, M. Product Complexity and Economic Development. Struct. Change Econ. Dyn. 2012, 23, 36–68. [Google Scholar] [CrossRef] [Green Version]

- Poncet, S.; de Waldemar, F.S. Economic complexity and growth. Evidence from China. Rev. Économique 2013, 64, 495–503. [Google Scholar] [CrossRef]

- Cristelli, M.; Tacchella, A.; Pietronero, L. The heterogeneous dynamics of economic complexity. PLoS ONE 2015, 10, e0117174. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Özgüzer, G.E.; Binatlı, A.O. Economic convergence in the EU: A complexity approach. East. Eur. Econ. 2016, 54, 93–108. [Google Scholar] [CrossRef] [Green Version]

- Ferrarini, B.; Scaramozzino, P. Asian Development Bank. Complexity, Specialisation and Growth. Working Paper No.344. 2013. Available online: http://hdl.handle.net/11540/2329 (accessed on 5 October 2021).

- Hausmann, R.; Hidalgo, C.A. The network structure of economic output. J. Econ. Growth 2011, 16, 309–342. [Google Scholar] [CrossRef] [Green Version]

- Chavez, J.C.; Mosqueda, M.T.; Gomez-Zaldivar, M. Economic complexity and regional growth performance: Evidence from the Mexican economy. Rev. Reg. Stud. 2017, 47, 201–219. Available online: http://journal.srsa.org/ojs/index.php/RRS/article/download/876/pdf (accessed on 22 August 2021).

- Tacchella, A.; Mazzilli, D.; Pietronero, L. A dynamical systems approach to gross domestic product forecasting. Nat. Phys. 2018, 14, 861–865. [Google Scholar] [CrossRef]

- Hartmann, D.; Guevara, M.R.; Jara-Figueroa, C.; Aristaran, M.; Hidalgo, C.A. Linking economic complexity, institutions and income inequality. World Dev. 2017, 93, 75–93. [Google Scholar] [CrossRef] [Green Version]

- Bandeira Morais, M.; Swart, J.; Jordaan, J.A. Economic complexity and inequality: Does productive structure affect regional wage differentials in Brazil. Sustainability 2018, 13, 1006. [Google Scholar] [CrossRef]

- Le, K.-K.; Vu, T.V. Economic complexity, human capital and income inequality: A cross-country analysis. Jpn. Econ. Rev. 2020, 71, 695–718. [Google Scholar] [CrossRef]

- Chu, L.K.; Hoang, D.P. How does economic complexity influence income inequality? New evidence from international data. Econ. Anal. Policy 2020, 68, 44–57. [Google Scholar] [CrossRef]

- Lee, C.-C.; Wang, E.Z. Economic complexity and income inequality: Does country risk matter? Soc. Indic. Res. 2021, 154, 35–60. [Google Scholar] [CrossRef]

- Bucellato, T.; Coro, G. Relatedness, Economic Complexity, and Convergence across European Regions; Paper Series 2019, No. 15/WP/2019; Department of Economics Research, University Ca’ Foscari of Venice: Venice, Italy, 2019. [Google Scholar] [CrossRef] [Green Version]

- Hartmann, D. Economic Complexity and Human Development: How Economic Diversification and Social Networks Affect Human Agency and Welfare, 1st ed.; Routledge: London, UK, 2014. [Google Scholar] [CrossRef] [Green Version]

- Guevara, M.R.; Hartmann, D.; Aristarán, M.; Mendoza, M.; Hidalgo, C. The research space: Using career path to predict the evolution of the research of individuals, institutions, and nations. Scientometrics 2016, 109, 1695–1709. [Google Scholar] [CrossRef] [Green Version]

- Ferraz, D.; Moralles, H.F.; Campoli, F.S.; De Oliveira, F.C.R.; Rebelatto, D.A.D.N. Economic complexity and human development: DEA performance measurement in Asia and Latin America. Gestão e Produção 2018, 25, 839–853. [Google Scholar] [CrossRef]

- Ferraz, D.; Moralles, H.F.; Costa, N.; Rebelatto, D.A.N. Economic Complexity and Human Development: Comparing Traditional and Slack Based Data Envelopment Analysis Models. 2019. Available online: https://www.researchgate.net/publication/333997876_Economic_Complexity_and_Human_Development_Comparing_Traditional_and_Slack_Based_Data_Envelopment_Analysis_Models (accessed on 2 September 2021).

- Brito, S.; Magud, M.N.E.; Sosa, M.S.; International Monetary Fund. Real Exchange Rates, Economic Complexity, and Investment. 2018. Available online: https://www.imf.org/~/media/Files/Publications/WP/2018/wp18107.ashx. (accessed on 20 August 2021).

- Laverde-Rojas, H.; Correa, J.C. Can scientific productivity impact the economic complexity of countries? Scientometrics 2019, 120, 267–282. [Google Scholar] [CrossRef] [Green Version]

- Nguyen, C.P.; Schinckus, C.; Su, T.D. The drivers of economic complexity: International evidence from financial development and patents. Int. Econ. 2020, 164, 140–150. [Google Scholar] [CrossRef]

- Bahar, D.; Rapoport, H.; Turati, R. Birthplace diversity and economic complexity: Cross-country evidence. Res. Policy 2020, 103991. [Google Scholar] [CrossRef]

- Innocenti, N.; Vignoli, D.; Lazzeretti, L. Economic complexity and fertility: Insights from a low fertility country. Reg. Stud. 2021, 55, 1388–1402. [Google Scholar] [CrossRef] [PubMed]

- Lapatinas, A. The effect of the Internet on economic sophistication: An empirical analysis. Econ. Lett. 2018, 174, 35–38. [Google Scholar] [CrossRef]

- Sweet, C.M.; Maggio, D.S.E. Do stronger intellectual property rights increase innovation? World Dev. 2015, 66, 665–677. [Google Scholar] [CrossRef] [Green Version]

- Hausmann, R.; Hwang, J.; Rodrik, D. What you export matters. J. Econ. Growth 2007, 12, 1–25. [Google Scholar] [CrossRef]

- Zhu, S.; Fu, X. Drivers of Export Upgrading. World Dev. 2013, 51, 221–233. [Google Scholar] [CrossRef] [Green Version]

- Kannen, P. Does foreign direct investment expand the capability set in the host economy? A sectoral analysis. World Econ. 2019, 43, 428–457. [Google Scholar] [CrossRef]

- Nasir, M.; Ur Rehman, F. Environmental Kuznets Curve for carbon emissions in Pakistan: An empirical investigation. Energy Policy 2011, 39, 1857–1864. [Google Scholar] [CrossRef]

- Tiwari, A.; Shahbaz, M.; Hye, Q.M.A. The environmental Kuznets curve and the role of coal consumption in India: Cointegration and causality analysis in an open economy. Renew. Sustain. Energy Rev. 2013, 18, 519–527. [Google Scholar] [CrossRef] [Green Version]

- Dogan, E.; Inglesi-Lotz, R. Analyzing the effects of real income and biomass energy consumption on carbon dioxide (CO2) emissions: Empirical evidence from the panel of biomass-consuming countries. Energy 2017, 138, 721–727. [Google Scholar] [CrossRef]

- Rehman, M.U.; Rashid, M. Energy consumption to environmental degradation, the growth appetite in SAARC nations. Renew. Energy 2017, 111, 284–294. [Google Scholar] [CrossRef]

- Xu, Z.; Baloch, M.A.; Danish; Meng, F.; Zhang, J.; Mahmood, Z. Nexus between financial development and CO2 emissions in Saudi Arabia: Analyzing the role of globalization. Environ. Sci. Pollut. Res. 2018, 25, 28378–28390. [Google Scholar] [CrossRef] [PubMed]

- Neagu, O. The Link between Economic Complexity and Carbon Emissions in the European Union Countries: A Model Based on the Environmental Kuznets Curve (EKC) Approach. Sustainability 2019, 11, 4753. [Google Scholar] [CrossRef] [Green Version]

- Danish; Ulucak, R. How do environmental technologies affect green growth? Evidence from BRICS economies. Sci. Total. Environ. 2020, 712, 136504. [Google Scholar] [CrossRef] [PubMed]

- Abbasi, K.R.; Lv, K.; Radulescu, M.; Shaikh, P.A. Economic complexity, tourism, energy prices, and environmental degradation in the top economic complexity panel: Fresh panel evidence. Environ. Sci. Pollut. Res. 2021, 1–15. [Google Scholar] [CrossRef] [PubMed]

- Neagu, O.; Teodoru, M. The relationship between economic complexity, energy consumption structure and greenhouse gas emission: Heterogeneous panel evidence from the EU countries. Sustainability 2019, 11, 497. [Google Scholar] [CrossRef] [Green Version]

- Simionescu, M. Revised environmental Kuznets Curve in CEE countries. Evidence from panel threshold models for economic sectors. Environ. Sci. Pollut. Res. 2021, 28, 60881–60899. [Google Scholar] [CrossRef] [PubMed]

- Al-mulali, U.; Weng-Wai, C.; Sheau-Ting, L.; Mohammed, A.H. Investigating the environmental Kuznets curve (EKC) hypothesis by utilizing the ecological footprint as an indicator of environmental degradation. Ecol. Indic. 2015, 48, 315–323. [Google Scholar] [CrossRef]

- Destek, M.A.; Sarkodie, S.A. Investigation of environmental Kuznets curve for ecological footprint: The role of energy and financial development. Sci. Total. Environ. 2018, 650, 2483–2489. [Google Scholar] [CrossRef] [PubMed]

- Ahmed, Z.; Ashar, M.M.; Mailk, M.N.; Nawas, K. Moving towards a sustainable environment: The dynamic linkage between natural resources, human capital, urbanization, economic growth, and ecological footprint in China. Resour. Policy 2020, 67, 101677. [Google Scholar] [CrossRef]

- Destek, M.A.; Sinha, A. Renewable, non-renewable enegy consumption, economic growth, trade openess and ecological footprint: Evidence from organisation for economic cooperation and development countries. J. Clean. Prod. 2020, 242, 118537. [Google Scholar] [CrossRef]

- Neagu, O. Economic complexity and ecological footprint: Evidence from the most complex economies in the world. Sustainability 2020, 12, 9031. [Google Scholar] [CrossRef]

- Wackernagel, M.; Rees, W. Our Ecological Footprint: Reducing Human Impact on The Earth; The New Catalyst Bioregional Series; New Society Publishers: Gabriola Island, BC, Canada, 1996. [Google Scholar]

- Lin, D.; Hanscom, L.; Martindill, J.; Borucke, M.; Cohen, L.; Galli, A.; Lazarus, E.; Zokai, G.; Iha, K.; Eaton, D.; et al. Working Guidebook to the National Footprint and Biocapacity Accounts; Global Footprint Network: Oakland, CA, USA, 2019; Available online: http://www.footprintnetwork.org/ (accessed on 5 October 2021).

- Lapatinas, A.; Garas, A.; Boleti, E.; Kyriakou, A. Economic Complexity and Environmental Performance: Evidence from a World Sample. 2019. Available online: https://mpra.ub.uni-muenchen.de/92833/ (accessed on 5 August 2021).

- Boleti, E.; Garas, A.; Kyriakou, A.; Lapatinas, A. Economic complexity and environmental performance: Evidence from a world sample. Environ. Modeling Assess. 2021, 1–20. [Google Scholar] [CrossRef]

- Wendling, Z.A.; Emerson, J.W.; de Sherbinin, A.; Esty, D.C.; Liu, Q.; Feldman, H.; Sierks, K.; Chang, R.; Madrodejos, B.; Ballesteros-Figueroa, A.; et al. Environmental Performance Index; Yale Center for Environmental Law & Policy: New Haven, CT, USA, 2020. [Google Scholar]

- Doğan, B.; Saboori, B.; Can, M. Does economic complexity matter for environmental degradation? An empirical analysis for different stages of development. Environ. Sci. Pollut. Res. 2019, 26, 31900–31912. [Google Scholar] [CrossRef]

- Majeed, M.T.; Mazhar, M.; Samreen, I.; Tauqir, A. Economic complexities and environmental degradation: Evidence from OECD countries. Environ. Dev. Sustain. 2021, 1–21. [Google Scholar] [CrossRef]

- Dogan, B.; Driha, O.M.; Balsalobre Lorente, D.; Shahzad, U. The mitigating effects of economic complexity and renewable energy on carbon emissions in developed countries. Sustain. Dev. 2021, 29, 1–12. [Google Scholar] [CrossRef]

- Romero, J.P.; Gramkow, C. Economic complexity and greenhouse gas emissions. World Dev. 2021, 139, 105317. [Google Scholar] [CrossRef]

- Adedoyin, F.F.; Agboola, P.O.; Ozturk, I.; Bekun, F.V.; Agboola, M.O. Environmental consequences of economic complexities in the EU amidst a booming tourism industry: Accounting for the role of Brexit and other crisis events. J. Clean. Prod. 2021, 305, 127117. [Google Scholar] [CrossRef]

- Shahzad, U.; Fareed, Z.; Shahzad, F.; Shahzad, K. Investigating the nexus between economic complexity, energy consumption and ecological footprint for the United States: New insights from quantile methods. J. Clean. Prod. 2021, 279, 123806. [Google Scholar] [CrossRef]

- Yilanci, V.; Pata, U.K. Investigating the EKC hypothesis for China: The role of economic complexity on ecological footprint. Environ. Sci. Pollut. Res. 2020, 27, 32683–32694. [Google Scholar] [CrossRef]

- Ikram, M.; Xia, W.; Fareed, Z.; Shahzad, U.; Rafique, M.Z. Exploring the nexus between economic complexity, economic growth and ecological footprint, Contextual evidences from Japan. Sustain. Energy Technol. Assess. 2021, 47, 191460. [Google Scholar] [CrossRef]

- Rafique, M.Z.; Nadeem, A.M.; Xia, W.; Ikram, M.; Shoaib, M.; Shazhzad, U. Does economic complexity matter for environmental sustainability? Using ecological footprint as indicator. Environ. Dev. Sustain. 2021, 1–18. [Google Scholar] [CrossRef]

- Nathaniel, S.P. Economic complexity versus ecological footprint in the era of globalization: Evidence from ASEAN countries. Environ. Sci. Pollut. Res. 2021, 28, 64871–64881. [Google Scholar] [CrossRef]

- Ahmad, M.; Ahmed, Z.; Majeed, A.; Huang, B. An environmental impact assessment of economic complexity and energy consumption: Does institutional quality make a difference? Env. Impact. Assess. Rev. 2021, 89, 106603. [Google Scholar] [CrossRef]

- Can, M.; Gozgor, G. The impact of economic complexity on carbon emissions: Evidence from France. Environ. Sci. Pollut. Res. 2017, 24, 16364–16370. [Google Scholar] [CrossRef] [PubMed]

- Chu, L.K. Economic structure and environmental Kuznets curve hypothesis: New evidence from economic complexity. Appl. Econ. Lett. 2021, 28, 612–616. [Google Scholar] [CrossRef]

- Pata, U.K. Renewable and non-renewable energy consumption, economic complexity, CO2 emissions, and ecological footprint in the USA: Testing the EKC hypothesis with a structural break. Environ. Sci. Pollut. Res. 2020, 28, 846–861. [Google Scholar] [CrossRef] [PubMed]

- Chu, L.K.; Le, N.T.M. Environmental quality and the role of economic policy uncertainty, economic complexity, renewable energy, and energy intensity: The case of G7 countries. Environ. Sci. Pollut. Res. 2021, 1–17. [Google Scholar] [CrossRef] [PubMed]

- Laverde-Rojas, H.; Guevara-Fletcher, D.A.; Camacho-Murillo, A. Economic growth, economic complexity, and carbon dioxide emissions: The case of Colombia. Heliyon 2021, 7, 07188. [Google Scholar] [CrossRef]

- North, D.C. Institutions, Institutional Change, and Economic Performance; Cambridge University Press: New York, NY, USA, 1990. [Google Scholar]

- Ostrom, E. Governing the Commons: The Evolution of Institutions for Collective Action; Cambridge University Press: Cambridge, UK, 1990. [Google Scholar]

- Lapatinas, A.; Kyriakou, A.; Garas, A. Taxation and economic sophistication: Evidence from OECD countries. PLoS ONE 2019, 14, e0213498. [Google Scholar] [CrossRef]

- Vu, T.V. Does Institutional Quality Foster Economic Complexity? The Fundamental Drivers of Productive Capabilities; ZBW-Leibniz Information Centre for Economics: Kiel, Germany, 2021. [Google Scholar]

- Neumayer, E. Do Democracies Exhibit Stronger International Environmental Commitment? A Cross-country Analysis. J. Peace Res. 2002, 39, 139–164. [Google Scholar] [CrossRef] [Green Version]

- Barret, S.; Graddy, K. Freedom, growth and the environment. Environ. Dev. Econ. 2000, 5, 433–456. [Google Scholar] [CrossRef]

- Welsch, H. Corruption, growth, and the environment: A cross-country analysis. Environ. Dev. Econ. 2004, 9, 663–693. [Google Scholar] [CrossRef] [Green Version]

- Ward, H. Liberal democracy and sustainability. Environ. Politics 2008, 17, 386–409. [Google Scholar] [CrossRef] [Green Version]

- Kuncic, A. Institutional quality dataset. J. Inst. Econ. 2014, 10, 135–161. [Google Scholar] [CrossRef] [Green Version]

- Torres, M.; Boyce, J. Income, inequality, and the pollution: A reassessment of the environmental Kuznets curve. Ecol. Econ. 1998, 25, 147–160. [Google Scholar] [CrossRef]

- Gani, A. The Relationship between Good Governance and Carbon Dioxide Emissions: Evidence from Developing Economies. J. Econ. Dev. 2012, 37, 77–93. Available online: http://www.jed.or.kr/full-text/37-1/4.pdf (accessed on 5 October 2021). [CrossRef]

- Awan, U.; Kraslawski, A.; Huiskonen, J. Governing inter firm relationships for social sustainability: The relationship between governance mechanisms, sustainable collaboration, and cultural intelligence. Sustainability 2018, 10, 4473. [Google Scholar] [CrossRef] [Green Version]

- Ali, H.S.; Zeqiraj, V.; Lin, W.L.; Law, S.H.; Yusop, Z.; Bare, U.A.A.; Chin, L. Does quality institutions promote environmental quality? Environ. Sci. Pollut. Res. 2019, 26, 10446–10456. [Google Scholar] [CrossRef] [Green Version]

- Akhbari, R. The effect of corruption on carbon emissions in developed and developing countries: Empirical investigation of claim. Heliyon 2019, 5, 02516. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Osabuohien, E.S.; Efobi, U.R.; Gitau, C.M. Beyond the environmental Kuznets curve in Africa: Evidence from panel cointegration. J. Environ. Policy Plan. 2014, 14, 517–538. [Google Scholar] [CrossRef]

- Hussain, M.; Dogan, E. The role of institutional quality and environment-related technologies in environmental degradation for BRICS. J. Clean. Prod. 2021, 304, 127059. [Google Scholar] [CrossRef]

- Azam, M.; Liu, L.; Ahmad, N. Impact of institutional quality on environment and energy consumption: Evidence from developing world. Environ. Dev. Sustain. 2021, 23, 1646–1667. [Google Scholar] [CrossRef]

- Bruinshoofd, A.; Rabobank, RaboResearch Utrecht. Institutional Quality and Economic Performance. 2016. Available online: https://economics.rabobank.com/publications/2016/january/institutional%2Dquality%2Dand%2Deconomic%2Dperformance/ (accessed on 5 October 2021).

- Azam, M.; Hunjira, A.I.; Bouri, E.; Tan, Y.; Al-Faryan, M.A.S. Impact of institutional quality on sustainable development: Evidence from developing countries. J. Environ. Manag. 2021, 293, 113465. [Google Scholar] [CrossRef] [PubMed]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring economic policy uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Ahir, H.; Bloom, N.; Furceri, D. The World Uncertainty Index. SSRN 2018. [Google Scholar] [CrossRef] [Green Version]

- Li, L.; Tang, Y.; Xiang, J. Measuring China’s monetary policy uncertainty and its impact on the real economy. Emerg. Mark. Rev. 2020, 44, 100714. [Google Scholar] [CrossRef]

- Gu, X.; Cheng, X.; Zhu, Z.; Deng, X. Economic policy uncertainty and China’s growth-at-risk. Econ. Anal. Policy 2021, 70, 452–467. [Google Scholar] [CrossRef]

- Nguyen, C.P.; Le, T.-H.; Su, T.D. Economic policy uncertainty and credit growth: Evidence from a global sample. Res. Int. Bus. Financ. 2019, 51, 101118. [Google Scholar] [CrossRef]

- Danisman, G.O.; Ersan, O.; Demir, E. Economic policy uncertainty and bank credit growth: Evidence from European banks. J. Multinatl. Financ. Manag. 2020, 57–58, 100653. [Google Scholar] [CrossRef]

- Phan, D.H.B.; Iyke, B.N.; Sharma, S.S.; Affandi, Y. Economic policy uncertainty and financial stability—Is there a relation? Econ. Model. 2021, 94, 1018–1029. [Google Scholar] [CrossRef]

- Zhang, Y.-J.; Yan, X.-X. The impact of US economic policy uncertainty on WTI crude oil returns in different time and frequency domains. Int. Rev. Econ. Financ. 2020, 69, 750–768. [Google Scholar] [CrossRef]

- Xiao, J.; Wang, Y. Investor attention and oil market volatility: Does economic policy uncertainty matter? Energy Econ. 2021, 7, 105180. [Google Scholar] [CrossRef]

- Jiang, Y.; Zhou, Z.; Liu, C. Does economic policy uncertainty matter for carbon emission? Evidence from US sector level data. Environ. Sci. Pollut. Res. 2019, 26, 24380–24394. [Google Scholar] [CrossRef] [PubMed]

- Danish, U.R.; Khan, S.U.D. Relationship between energy intensity and CO2 emissions: Does economic policy matter? Sustain. Dev. 2020, 28, 1457–1464. [Google Scholar] [CrossRef]

- Sohail, M.T.; Xiuyuan, Y.; Usman, A.; Majeed, M.T.; Ullah, S. Renewable energy and non-renewable energy consumption: Assessing the asymmetric role of monetary policy uncertainty in energy consumption. Environ. Sci. Pollut. Res. 2021, 28, 31575–31584. [Google Scholar] [CrossRef]

- Yu, J.; Shi, X.; Guo, D.; Yang, L. Economic policy uncertainty (EPU) and firm carbon emissions: Evidence using a China provincial EPU index. Energy Econ. 2020, 94, 105071. [Google Scholar] [CrossRef]

- Amin, A.; Dogan, E. The role of economic policy uncertainty in the energy—Environment nexus for China: Evidence from the novel dynamic simulation method. J. Environ. Manag. 2021, 292, 112865. [Google Scholar] [CrossRef] [PubMed]

- Adedoyin, F.F.; Ozturk, I.; Agboola, M.O.; Agboola, P.O.; Bekun, F.V. The implications of renewable and non-renewable energy generating in sub-Saharan Africa: The role of economic policy uncertainties. Energy Policy 2021, 150, 112115. [Google Scholar] [CrossRef]

- Adedoyin, F.F.; Zakari, A. Energy consumption, economic expansion, and CO2 emission in the UK: The role of economic policy uncertainty. Sci. Total Environ. 2020, 738, 140014. [Google Scholar] [CrossRef] [PubMed]

- Anser, M.K.; Apergis, N.; Syed, Q.R. Impact of economic policy uncertainty on CO2 emissions: Evidence from top ten carbon emitter countries. Environ. Sci. Pollut. Res. 2021, 28, 29369–29378. [Google Scholar] [CrossRef] [PubMed]

- Zakari, A.; Adedoyin, F.F.; Bekun, F.V. The effect of energy consumption on the environment in the OECD countries: Economic policy uncertainty perspectives. Environ. Sci. Pollut. Res. 2021, 28, 52295–52305. [Google Scholar] [CrossRef]

- Ha, L.T.; Dung, H.P.; Thanh, T.T. Economic complexity and shadow economy: A multi-dimensional analysis. Econ. Anal. Policy 2021, 72, 408–422. [Google Scholar] [CrossRef]

- Du, K.; O’Connor, A. Examining economic complexity as a holistic system effect. Small Bus. Econ. 2021, 56, 237–257. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).