Techno-Economic Analysis of Peer-to-Peer Energy Trading Considering Different Distributed Energy Resources Characteristics

Abstract

1. Introduction

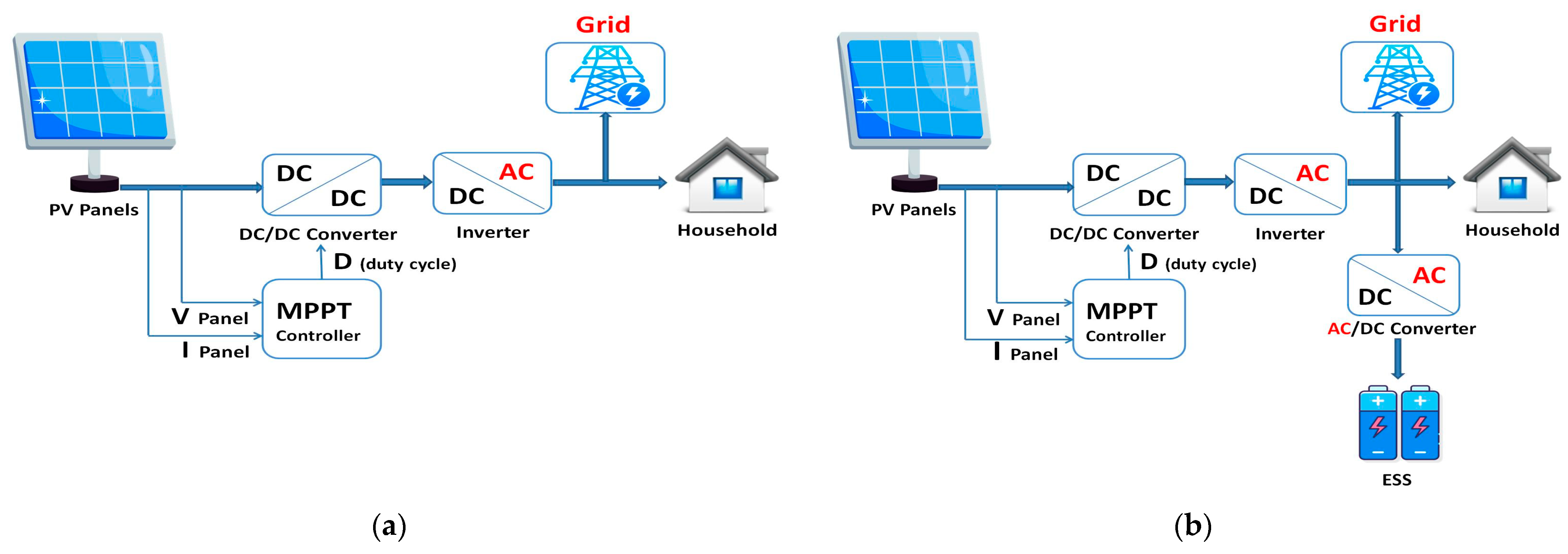

- A P2P energy trading model for a community equipped with photovoltaic (PV) systems and energy storage systems (ESS) connected to an unbalanced low-voltage (LV) distribution network. The novelty lies in combining market-based optimization with unbalanced three-phase power flow analysis, which is not commonly addressed in earlier P2P studies.

- An evaluation of the techno-economics of coordinated DER management using P2P energy trading under a time-of-use tariff (ToU), considering different DER characteristics and operational parameters. Compared to fixed-size DER models in previous work, this study explores eight practical DER setups, leading to a cost reduction of up to 68.22% and self-sufficiency increase from 0% to 63.21% in optimal cases.

- A techno-economic comparison of the analyzed cases, focusing on operational costs, energy imports/exports, energy trading volume, peak grid consumption, and the proportion of demand met by local DERs. This detailed comparative analysis helps identify DER combinations that maximize local energy exchange while minimizing grid dependency.

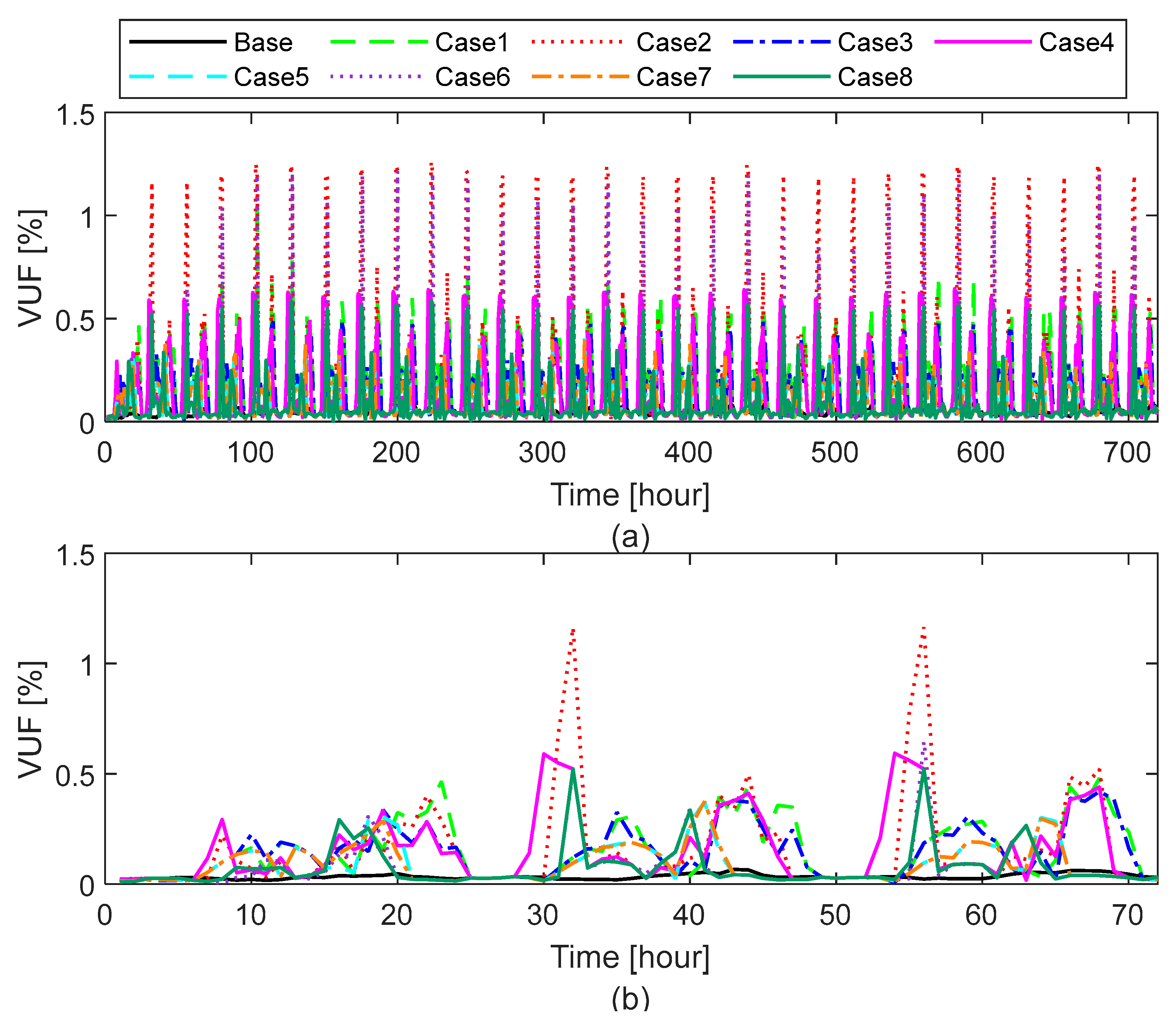

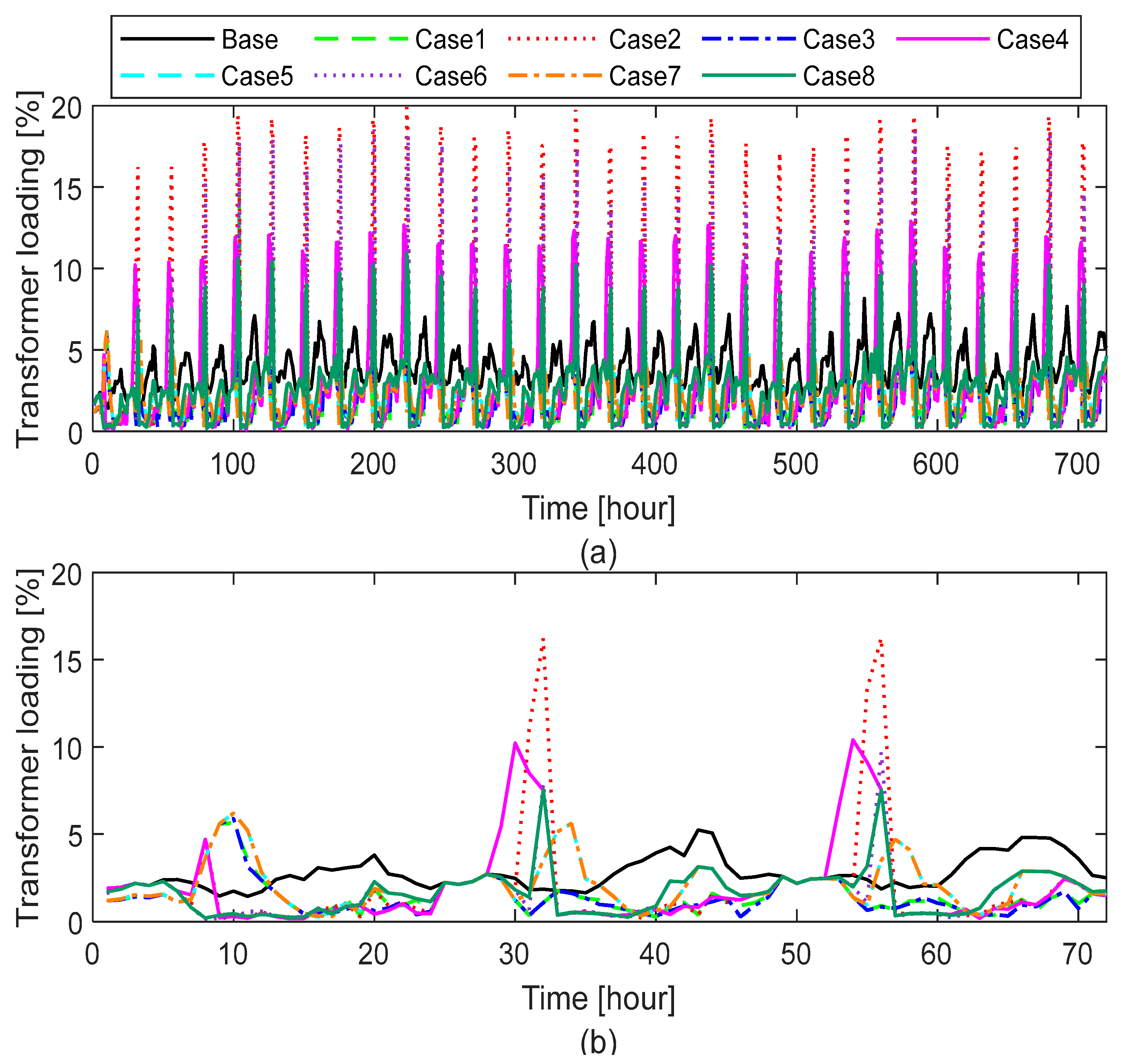

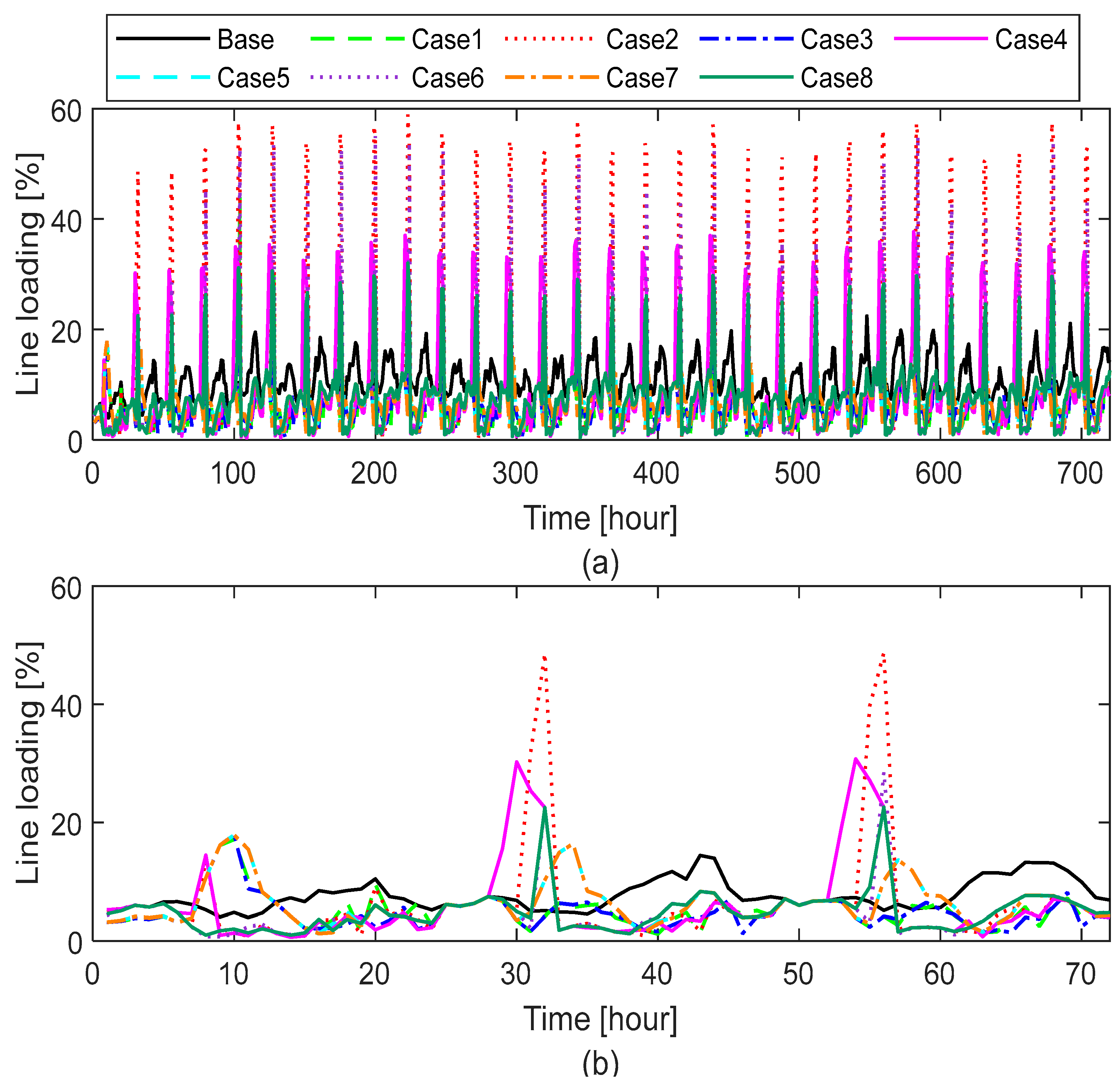

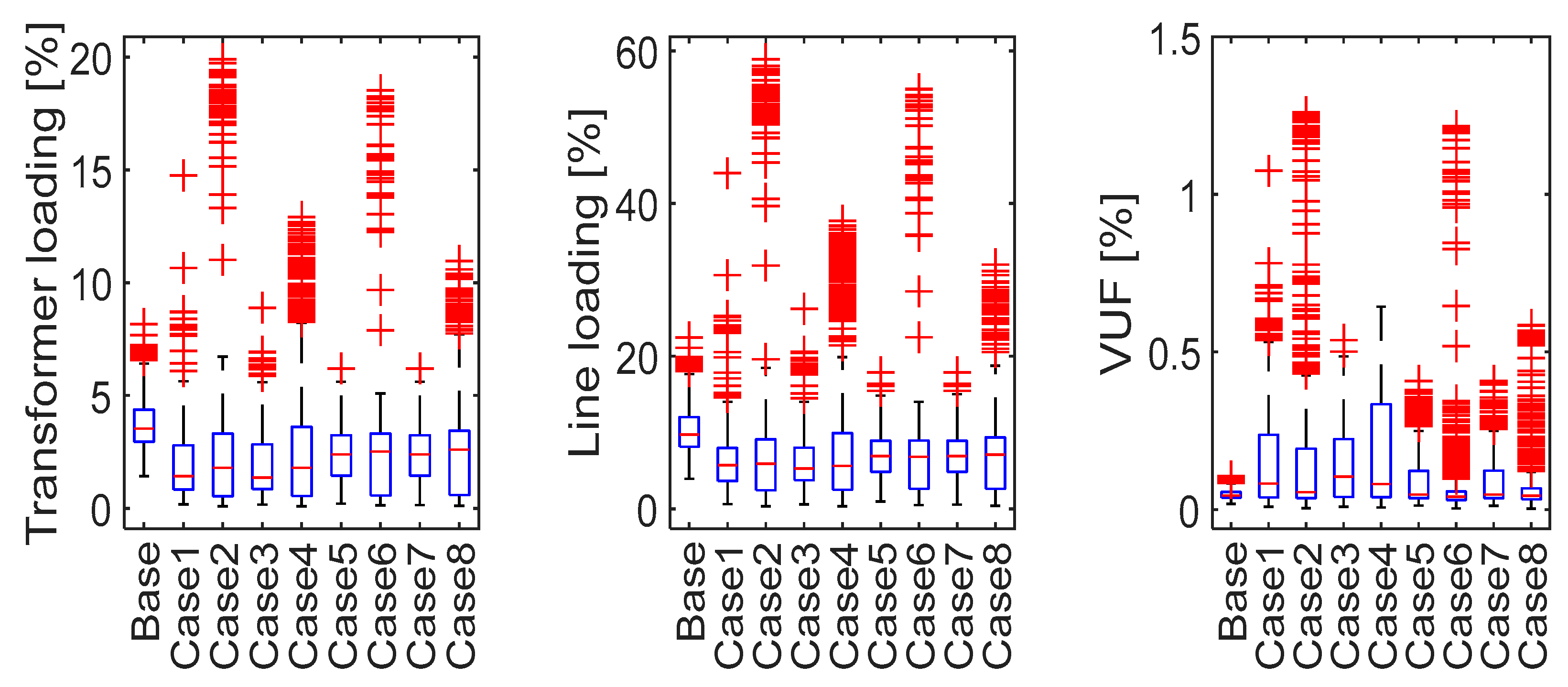

- An evaluation of the technical impacts of P2P energy trading on the LV distribution network under different DER characteristics, with attention paid to key parameters such as voltage profiles, voltage unbalance, and component loading. The results show that poorly coordinated DER configurations (e.g., high ESS charging with low PV) can lead to voltage unbalance up to 1.26%, emphasizing the importance of DER sizing and control.

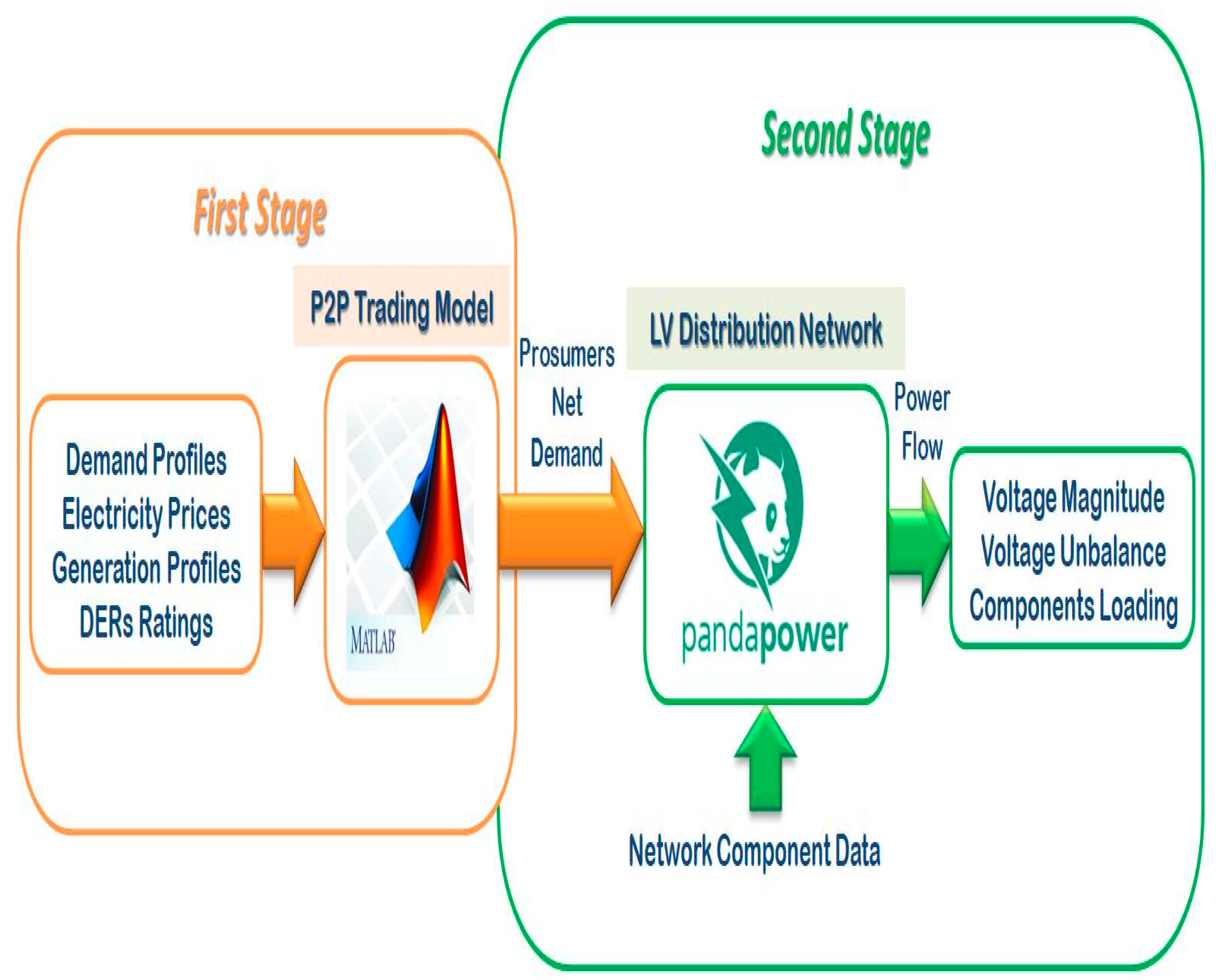

2. Modeling Approach

2.1. Modeling of P2P Energy Trading

2.2. Evaluation of Impacts on the LV Distribution Network

3. Case Study

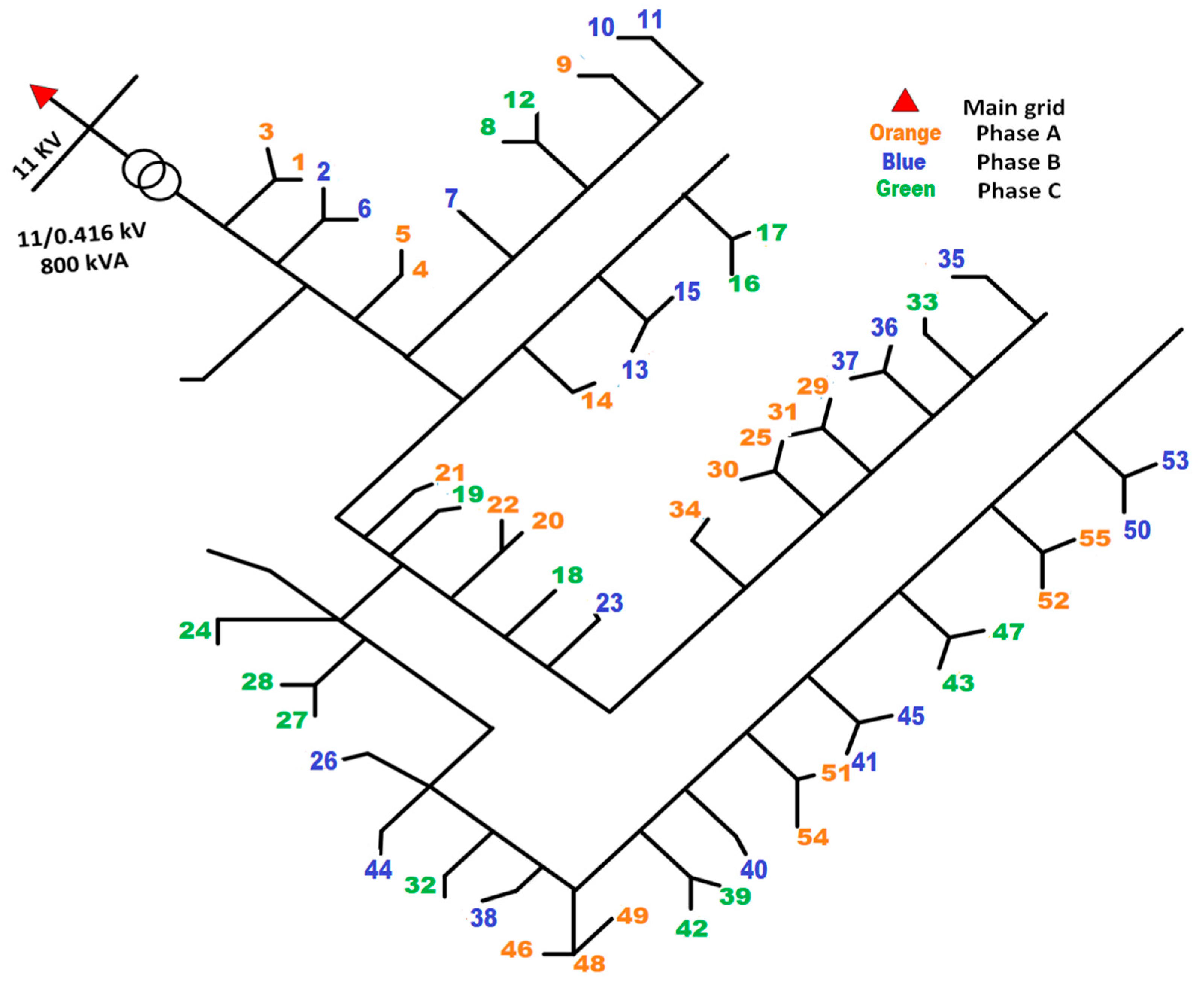

3.1. LV Distribution Network

3.2. Demand Profiles

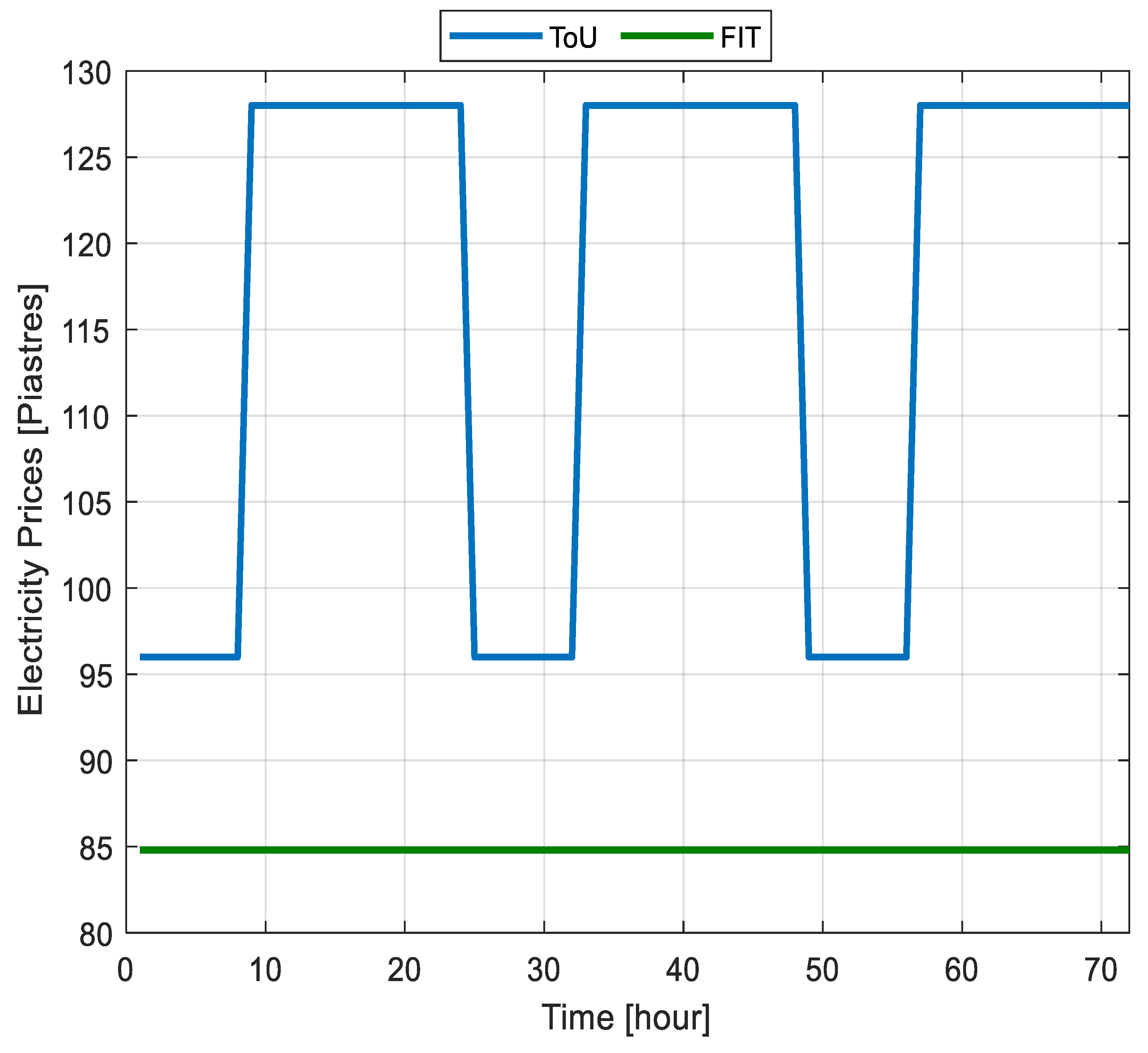

3.3. Electricity Prices

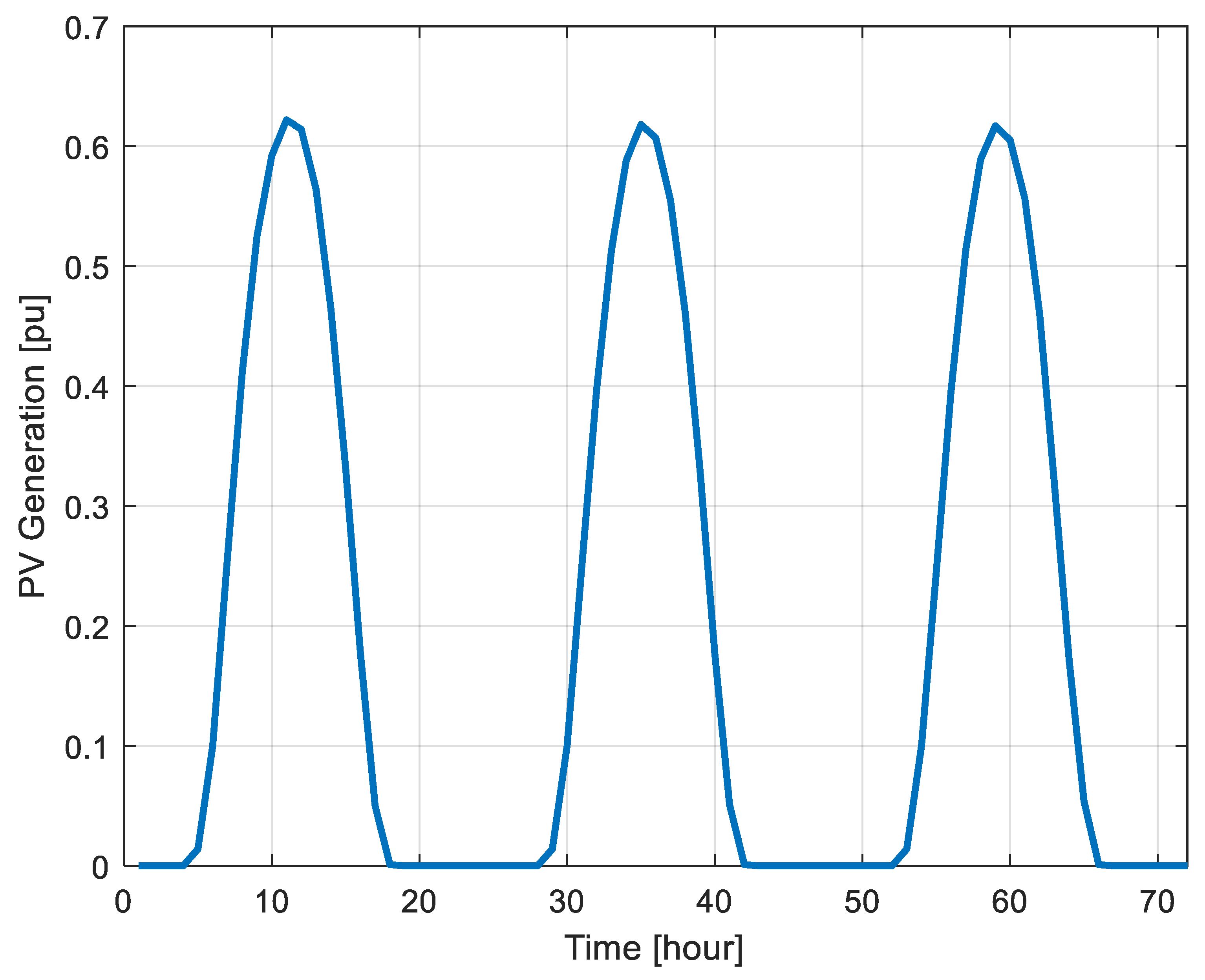

3.4. DER Characteristics

3.5. Analyzed Cases

4. Results

4.1. Comparative Analysis of Techno-Economic Cases

4.1.1. Analysis of Operational Costs

4.1.2. Analysis of Energy Imports and Exports

4.1.3. Analysis of Peak Grid Consumption

4.1.4. Analysis of Energy Trading Volume

4.2. Analysis of Impacts on the LV Distribution Network

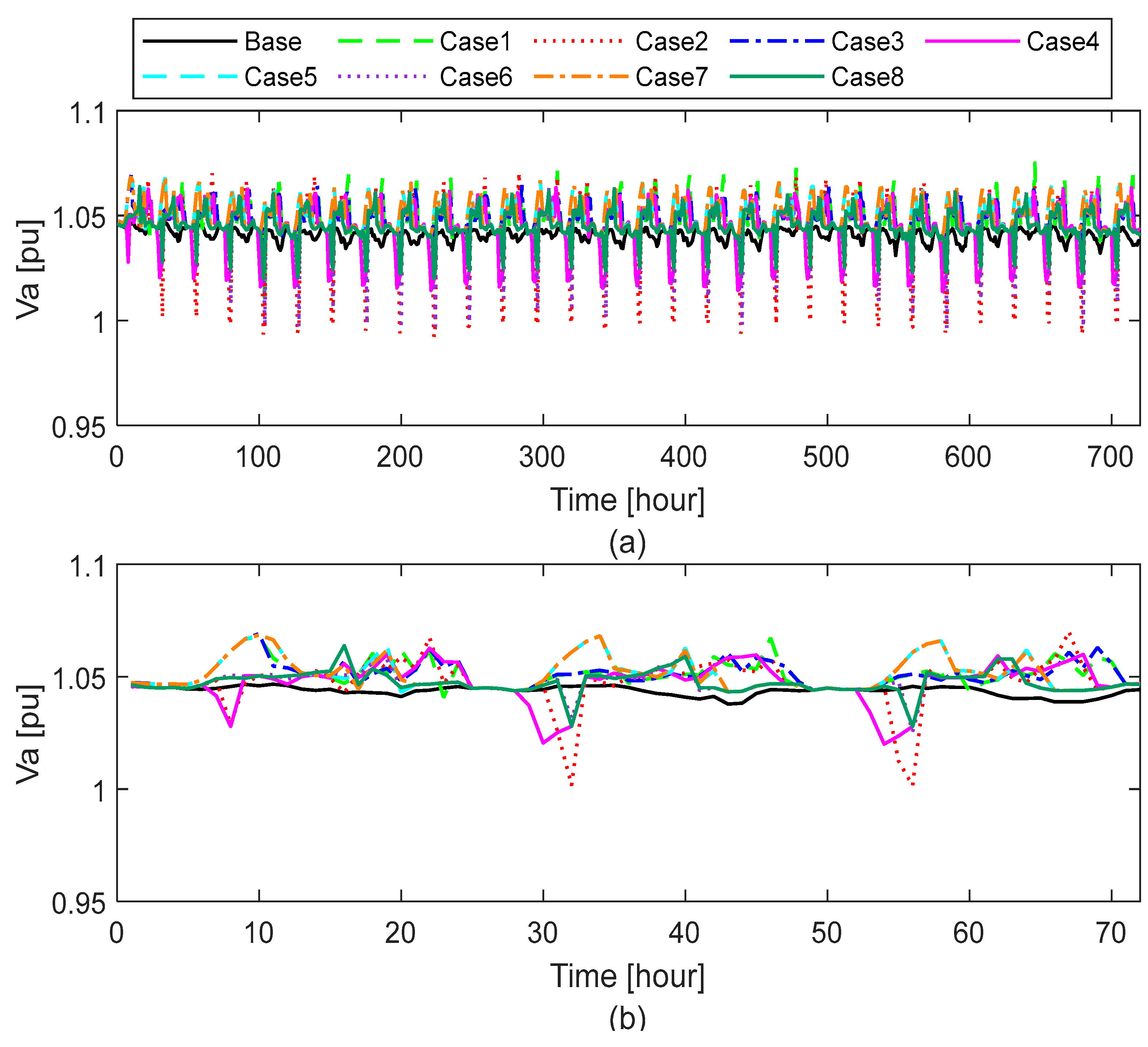

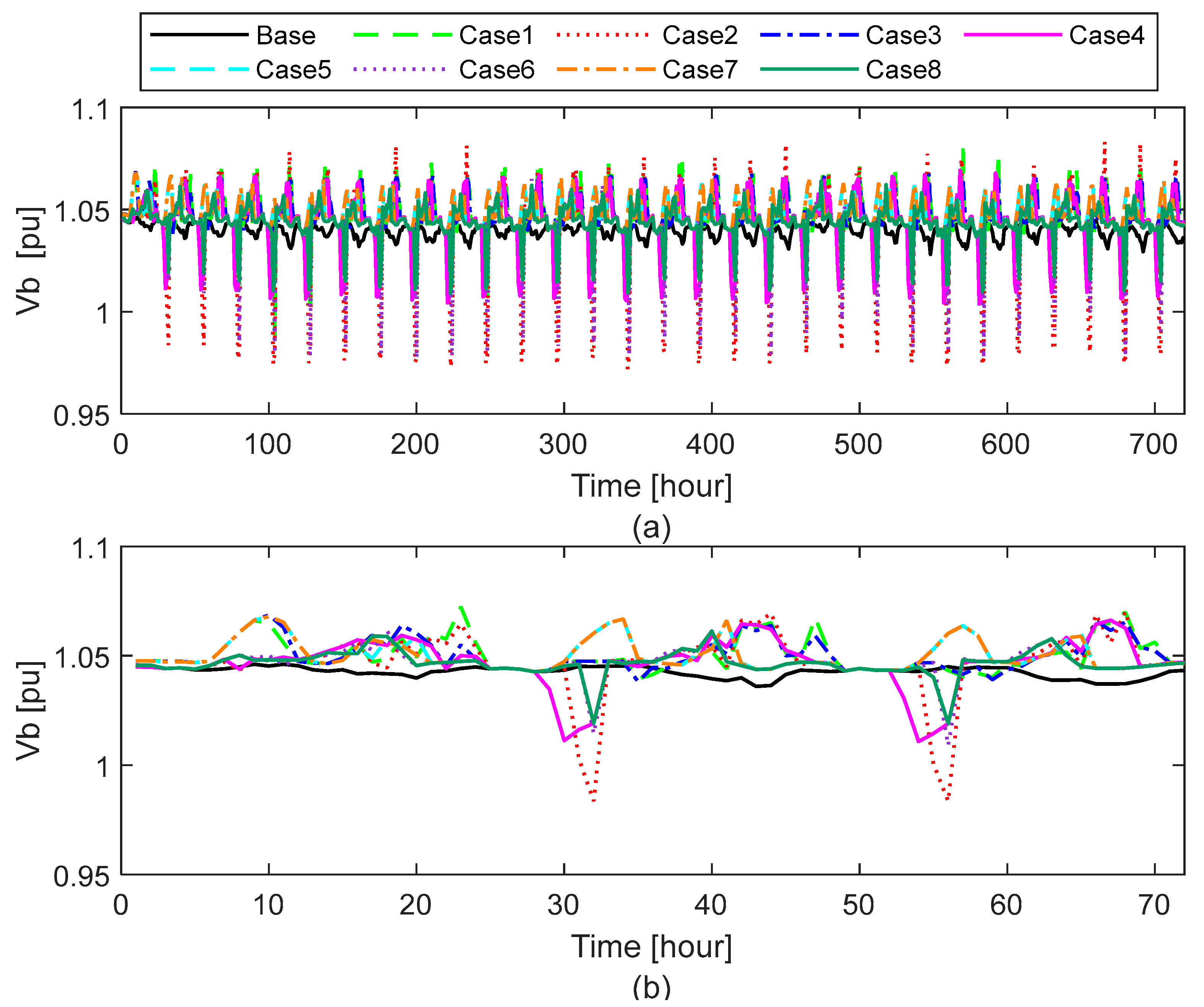

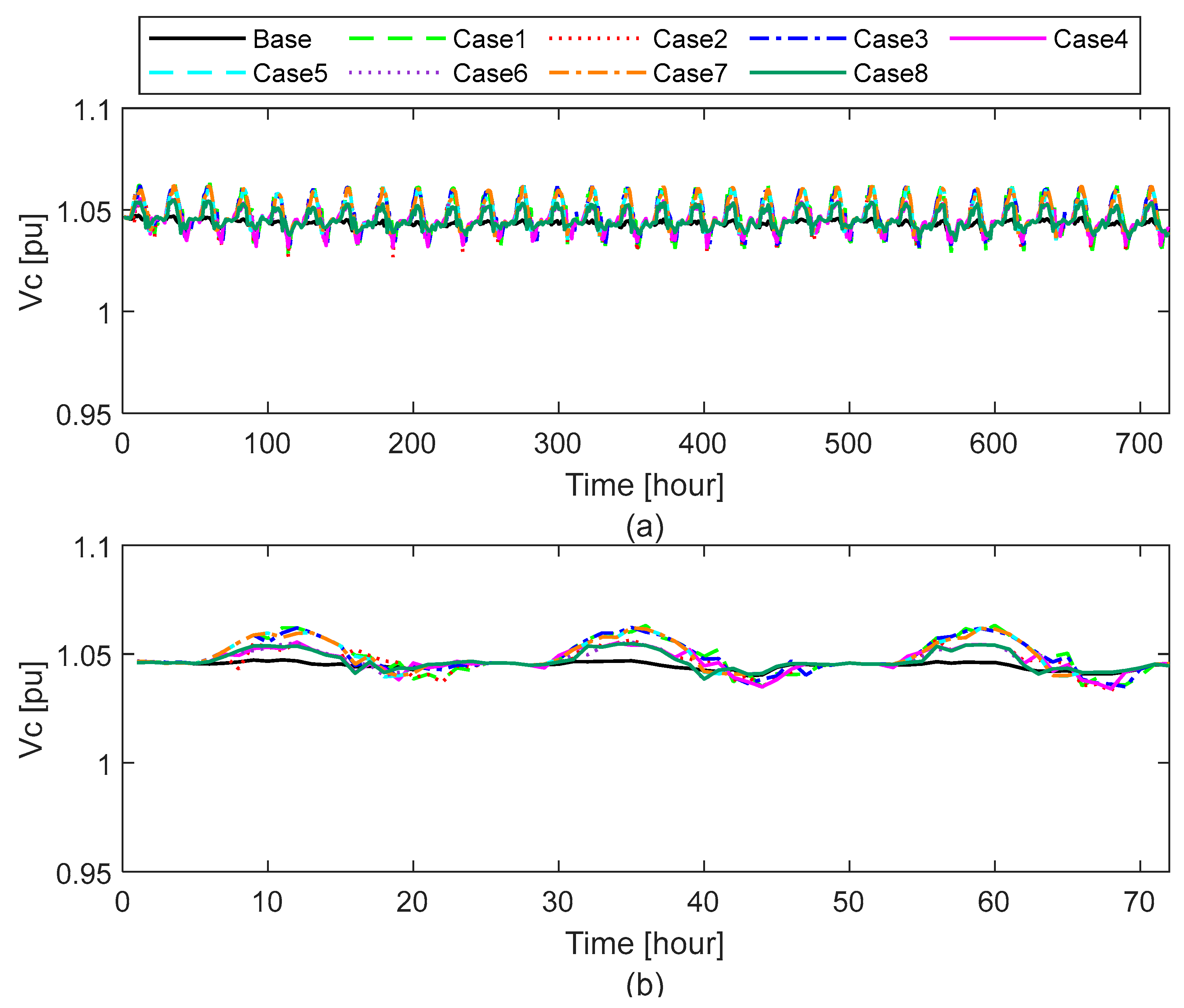

4.2.1. Analysis of Voltage Variations Impacts

4.2.2. Analysis of Voltage Phase Unbalance Impacts

4.2.3. Analysis of Transformer and Line Loading Impacts

4.2.4. Comparative Analysis of Different Cases Using Boxplot Representations

4.3. Research Implications and Limitations

5. Conclusions and Future Research Directions

- Participant Diversity: Investigate the impact of DER characteristics on P2P energy trading performance across different user types, such as commercial and industrial buildings, to assess broader applicability and scalability.

- Network Design: Examine how various distribution network configurations (e.g., meshed vs. radial, urban vs. rural) influence the technical and economic outcomes of DER-enabled P2P trading.

- Integration of Emerging Technologies: Incorporate additional DER technologies, such as electric vehicles (EVs), heat pumps, and controllable/flexible loads, to model more complex and realistic community energy systems.

- Advanced Control and Pricing Mechanisms: Study reactive power flows, alternative tariff structures (e.g., real-time pricing), and coordinated DER control strategies to further enhance grid performance, efficiency, and market responsiveness.

- DER Control Under High Penetration Cases: Explore coordinated control mechanisms for high PV and ESS configurations—such as voltage-aware ESS charging/ discharging, smart inverter utilization, and phase-based load scheduling—to mitigate voltage fluctuations and enhance overall grid stability.

- Modeling of Uncertainties: Stochastic assessment of the effect of DER sizes on P2P energy trading performance and impacts on unbalanced distribution networks could provide important insights.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Nomenclature

| Sets | |

| households | |

| Scalars | |

| P2P trading loss factor | |

| ESS upper levels of charging and discharging powers | |

| ESS upper and lower levels of storage levels | |

| ESS charging/discharging efficiency | |

| Parameters | |

| Variables | |

References

- Muhtadi, A.; Pandit, D.; Nguyen, N. Distributed energy resources based microgrid: Review of architecture, control, and reliability. IEEE Trans. Ind. Appl. 2021, 57, 2223–2235. [Google Scholar] [CrossRef]

- Wang, Z.; Hou, H.; Wei, R.; Li, Z. A Distributed Market-Aided Restoration Approach of Multi-Energy Distribution Systems Considering Comprehensive Uncertainties from Typhoon Disaster. IEEE Trans. Smart Grid 2025, 16, 3743–3757. [Google Scholar] [CrossRef]

- Wang, Z.; Hou, H.; Zhao, B.; Zhang, L.; Shi, Y.; Xie, C. Risk-averse stochastic capacity planning and P2P trading collaborative optimization for multi-energy microgrids considering carbon emission limitations: An asymmetric Nash bargaining approach. Appl. Energy 2024, 357, 122505. [Google Scholar] [CrossRef]

- Bento, M.E.C.; Morais, H. Advances in Operation, Optimization, and Control of Smart Grids. Electricity 2025, 6, 27. [Google Scholar] [CrossRef]

- Amako, E.A.; Arzani, A.; Mahajan, S.M. Heuristic-Based Scheduling of BESS for Multi-Community Large-Scale Active Distribution Network. Electricity 2025, 6, 36. [Google Scholar] [CrossRef]

- Gabrovska-Evstatieva, K.G.; Trifonov, D.T.; Evstatiev, B.I. A Review of the Key Factors Influencing the Performance of Photovoltaic Installations in an Urban Environment. Electricity 2025, 6, 23. [Google Scholar] [CrossRef]

- Kazerani, M.; Tehrani, K. Grid of hybrid AC/DC microgrids: A new paradigm for smart city of tomorrow. In Proceedings of the 2020 IEEE 15th Interantional Conference of System of Systems Engineering, Budapest, Hungary, 2–4 June 2020. [Google Scholar] [CrossRef]

- Islam, S.N. A Review of Peer-to-Peer Energy Trading Markets: Enabling Models and Technologies. Energies 2024, 17, 1702. [Google Scholar] [CrossRef]

- Galici, M.; Troncia, M.; Nour, M.; Chaves-Ávila, J.P.; Pilo, F. Comparative techno-economic analysis of market models for peer-to-peer energy trading on a distributed platform. Appl. Energy 2025, 380, 125005. [Google Scholar] [CrossRef]

- Toledo-Pérez, M.D.C.; Vargas-Méndez, R.A.; Claudio-Sánchez, A.; Osorio-Gordillo, G.L. General Approach to Electrical Microgrids: Optimization, Efficiency, and Reliability. Electricity 2025, 6, 12. [Google Scholar] [CrossRef]

- Zedan, M.; Nour, M.; Shabib, G.; Ali, Z.M.; Alharbi, A.; Mohamed, A.A. Techno-economic Assessment of Peer to Peer Energy Trading: An Egyptian Case Study. IEEE Access 2024, 12, 58317–58337. [Google Scholar] [CrossRef]

- Nour, M.; Chaves-Ávila, J.P.; Troncia, M.; Ali, A.; Sánchez-Miralles, Á. Impacts of Community Energy Trading on Low Voltage Distribution Networks. IEEE Access 2023, 11, 50412–50430. [Google Scholar] [CrossRef]

- Nasrat, L.; Zedan, M.; Ali, A.; Shabib, G. Review on Energy Trading of Community-Based Projects around the World. In Proceedings of the IEEE 23rd International Middle East Power Systems Conference (MEPCON), Cairo, Egypt, 13–15 December 2022. [Google Scholar] [CrossRef]

- Hayes, B.P.; Thakur, S.; Breslin, J.G. Co-simulation of electricity distribution networks and peer to peer energy trading platforms. Int. J. Electr. Power Energy Syst. 2020, 115, 105419. [Google Scholar] [CrossRef]

- Azim, M.I.; Tushar, W.; Saha, T.K. Investigating the impact of P2P trading on power losses in grid-connected networks with prosumers. Appl. Energy 2020, 263, 114687. [Google Scholar] [CrossRef]

- Dynge, M.F.; del Granado, P.C.; Hashemipour, N.; Korpås, M. Impact of local electricity markets and peer-to-peer trading on low-voltage grid operations. Appl. Energy 2021, 301, 117404. [Google Scholar] [CrossRef]

- Hashemipour, N.; Aghaei, J.; Del Granado, P.C.; Kavousi-Fard, A.; Niknam, T.; Shafie-khah, M. Uncertainty modeling for participation of electric vehicles in collaborative energy consumption. IEEE Trans. Veh. Technol. 2022, 71, 10293–10302. [Google Scholar] [CrossRef]

- Saif, A.; Khadem, S.K.; Conlon, M.; Norton, B. Hosting a community-based local electricity market in a residential network. IET Energy Syst. Integr. 2022, 4, 448–459. [Google Scholar] [CrossRef]

- Saif, A.; Khadem, S.K.; Conlon, M.F. Impact of Distributed Energy Resources in Smart Homes and Community-Based Electricity Market. IEEE Trans. Ind. Appl. 2023, 59, 59–69. [Google Scholar] [CrossRef]

- Saif, A.; Khadem, S.K.; Conlon, M.; Norton, B. Local Electricity Market operation in presence of residential energy storage in low voltage distribution network: Role of retail market pricing. Energy Rep. 2023, 9, 5799–5811. [Google Scholar] [CrossRef]

- Nour, M.; Chaves-Ávila, J.P.; Troncia, M.; Sánchez-Miralles, M.Á. Mitigating the Impacts of Community Energy Trading on Distribution Networks by Considering Contracted Power Network Charges. IEEE Access 2024, 12, 26991–27004. [Google Scholar] [CrossRef]

- Zedan, M.; Nour, M.; Shabib, G.; Nasrat, L.; Ali, A. Review of peer-to-peer energy trading: Advances and challenges. E-Prime—Adv. Electr. Eng. Electron. Energy 2024, 10, 100778. [Google Scholar] [CrossRef]

- Tehrani, K.; Simde, D.; Fozing, J.; Jamshidi, M. A 3D design of a small hybrid farm for microgrids. In Proceedings of the IEEE-WAC2022, San Antonio, TX, USA, 11–15 October 2022. [Google Scholar] [CrossRef]

- Ma, H.; Xiang, Y.; Sun, W.; Dai, J.; Zhang, S.; Liu, Y.; Liu, J. Optimal Peer-to-Peer Energy Transaction of Distributed Prosumers in High-Penetrated Renewable Distribution Systems. IEEE Trans. Ind. Appl. 2024, 60, 4622–4632. [Google Scholar] [CrossRef]

- Ali, L.; Muyeen, S.M.; Bizhani, H.; Ghosh, A. A peer-to-peer energy trading for a clustered microgrid—Game theoretical approach. Int. J. Electr. Power Energy Syst. 2021, 133, 107307. [Google Scholar] [CrossRef]

- Ali, L.; Muyeen, S.M.; Bizhani, H.; Simoes, M.G. Economic planning and comparative analysis of market-driven multi-microgrid system for peer-to-peer energy trading. IEEE Trans. Ind. Appl. 2022, 58, 4025–4036. [Google Scholar] [CrossRef]

- Ali, L.; Muyeen, S.M.; Bizhani, H.; Ghosh, A. A multi-objective optimization for planning of networked microgrid using a game theory for peer-to-peer energy trading scheme. IET Gener. Transm. Distrib. 2021, 15, 3423–3434. [Google Scholar] [CrossRef]

- Kang, H.; Jung, S.; Jeoung, J.; Hong, J.; Hong, T. A bi-level reinforcement learning model for optimal scheduling and planning of battery energy storage considering uncertainty in the energy-sharing community. Sustain. Cities Soc. 2023, 94, 104538. [Google Scholar] [CrossRef]

- Secchi, M.; Barchi, G.; Macii, D.; Moser, D.; Petri, D. Multi-objective battery sizing optimisation for renewable energy communities with distribution-level constraints: A prosumer-driven perspective. Appl. Energy 2021, 297, 117171. [Google Scholar] [CrossRef]

- Li, Y.; Qian, F.; Gao, W.; Fukuda, H.; Wang, Y. Techno-economic performance of battery energy storage system in an energy sharing community. J. Energy Storage 2022, 50, 104247. [Google Scholar] [CrossRef]

- Rodrigues, D.L.; Ye, X.; Xia, X.; Zhu, B. Battery energy storage sizing optimisation for different ownership structures in a peer-to-peer energy sharing community. Appl. Energy 2020, 262, 114498. [Google Scholar] [CrossRef]

- Yaldız, A.; Gokçek, T.; Sengor, I.; Erdinç, O. Optimal sizing and economic analysis of photovoltaic distributed generation with Battery Energy Storage System considering peer-to-peer energy trading. Sustain. Energy Grids Netw. 2021, 28, 100540. [Google Scholar] [CrossRef]

- Fioriti, D.; Frangioni, A.; Poli, D. Optimal sizing of energy communities with fair revenue sharing and exit clauses: Value, role and business model of aggregators and users. Appl. Energy 2021, 299, 117328. [Google Scholar] [CrossRef]

- Lazzari, F.; Mor, G.; Cipriano, J.; Solsona, F.; Chemisana, D.; Guericke, D. Optimizing planning and operation of renewable energy communities with genetic algorithms. Appl. Energy 2023, 338, 120906. [Google Scholar] [CrossRef]

- Nour, M.; Chaves-Ávila, J.P.; Troncia, M.; Sánchez-Miralles, Á.; Ali, A. Optimal planning and operation of energy community DERs considering local energy trading and uncertainties. Results Eng. 2025, 26, 104881. [Google Scholar] [CrossRef]

- Pandapower 2.3.0 Documentation. [Online]. Available online: https://pandapower.readthedocs.io/en/v2.3.1/index.html (accessed on 10 July 2025).

- Thurner, L.; Scheidler, A.; Schäfer, F.; Menke, J.H.; Dollichon, J.; Meier, F.; Meinecke, S.; Braun, M. Pandapower—An Open-Source Python Tool for Convenient Modeling, Analysis, and Optimization of Electric Power Systems. IEEE Trans. Power Syst. 2018, 33, 6510–6521. Available online: https://ieeexplore.ieee.org/document/8344496 (accessed on 1 July 2025). [CrossRef]

- Lüth, A.; Zepter, J.M.; Del Granado, P.C.; Egging, R. Local electricity market designs for peer-to-peer trading: The role of battery flexibility. Appl. Energy 2018, 299, 1233–1243. [Google Scholar] [CrossRef]

- “Resources—IEEE PES Test Feeder”. [Online]. Available online: https://cmte.ieee.org/pes-testfeeders/resources/ (accessed on 20 June 2025).

- Egyptian Electric Utility and Consumer Protection Regulatory Agency (EgyptERA), Website [Online]. Available online: http://egyptera.org/ar/Tarrif2022N.aspx (accessed on 1 July 2025).

- Behira Electricity Distribution Co. Website [Online]. Available online: https://www.bedc.gov.eg/ (accessed on 1 July 2025).

- Renewables.ninja, Website [Online]. Available online: https://www.renewables.ninja (accessed on 1 July 2025).

- Rienecker, M.M.; Suarez, M.J.; Gelaro, R.; Todling, R.; Bacmeister, J.; Liu, E.; Bosilovich, M.G.; Schubert, S.D.; Takacs, L.; Kim, G.-K.; et al. MERRA: Nasa’s modern-era retrospective analysis for research and applications. J. Clim. 2011, 24, 3624–3648. [Google Scholar] [CrossRef]

- Eskandarpour Azizkandi, M.; Sedaghati, F.; Shayeghi, H. An interleaved configuration of modified ky converter with high conversion ratio for renewable energy applications; design, analysis and implementation. J. Oper. Autom. Power Eng. 2019, 7, 90–106. [Google Scholar] [CrossRef]

- IEC 61000-3-14; Assessment of Emission Limits for Harmonics, Interharmonics, Voltage Fluctuations and Unbalance for the Connection of Disturbing Installations to LV Power Systems. IEC: Geneva, Switzerland, 2011. Available online: https://webstore.iec.ch/publication/4147 (accessed on 1 July 2025).

- Marcos, F.E.P.; Domingo, C.M.; Román, T.G.S.; Palmintier, B.; Hodge, B.-M.; Krishnan, V.; García, F.D.C.; Mather, B. A review of power distribution test feeders in the united states and the need for synthetic representative networks. Energies 2017, 10, 1896. [Google Scholar] [CrossRef]

- Morell-Dameto, N.; Chaves-Ávila, J.P.; San Román, T.G.; Dueñas-Martínez, P.; Schittekatte, T. Network tariff design with flexible customers: Ex-post pricing and a local network capacity market for customer response coordination. Energy Policy 2024, 184, 113907. [Google Scholar] [CrossRef]

- Uddin, N.; Wu, Y.; Islam, M.S.; Zakaria, K.M. An optimized decentralized peer-to-peer energy trading system for smart grids incorporating uncertain renewable energy sources through fuzzy optimization. Electr. Power Syst. Res. 2025, 238, 111154. [Google Scholar] [CrossRef]

| Country | DER | DERs | Study | Voltage | Evaluated | Reference |

|---|---|---|---|---|---|---|

| Technologies | Characteristics | Period | Unbalance | Impacts | ||

| England | PV, EV | No | 1 Day | Yes | Voltage, Power Losses, and Peak Demand | [14] |

| Australia | PV, ESS, and Controllable loads | No | 1 Day | No | Voltage, Power Losses | [15] |

| Norway | PV, ESS/EV | No | 21 Days (Summer) | No | Voltage, Power Losses, and Peak Demand | [16] |

| England | PV, WG, ESS, and EV | No | 1 Month | No | Voltage | [17] |

| Ireland | PV, ESS | No | January/June | No | Voltage, Power Losses | [18] |

| Ireland | PV, ESS | No | January/June | No | Voltage | [19] |

| Spain | PV, ESS, and EV | No | 1 Month (July) | Yes | Voltage, Peak Demand, and Components Loading | [12] |

| Ireland | PV, ESS | No | January/June | Yes | Voltage, Power Losses | [20] |

| Egypt | PV, ESS, and EV | No | 1 Month (June) | Yes | Voltage, Peak Demand, and Components Loading | [11] |

| Spain | PV, ESS, and EV | No | 1 Month (July) | Yes | Voltage, Peak Demand, and Components Loading | [21] |

| Egypt | PV, ESS | Yes | 1 Month (June) | Yes | Voltage, Peak Demand, and Components loading | This Study |

| Household | DER | Household | DER | Household | DER | Household | DER |

|---|---|---|---|---|---|---|---|

| 1 | PV + ESS | 15 | PV + ESS | 29 | No DER | 43 | PV |

| 2 | PV + ESS | 16 | PV | 30 | PV + ESS | 44 | No DER |

| 3 | PV + ESS | 17 | No DER | 31 | No DER | 45 | PV + ESS |

| 4 | No DER | 18 | PV + ESS | 32 | PV | 46 | No DER |

| 5 | PV + ESS | 19 | No DER | 33 | PV + ESS | 47 | No DER |

| 6 | No DER | 20 | PV + ESS | 34 | PV | 48 | PV + ESS |

| 7 | PV | 21 | No DER | 35 | No DER | 49 | PV |

| 8 | PV | 22 | No DER | 36 | No DER | 50 | PV + ESS |

| 9 | PV + ESS | 23 | PV + ESS | 37 | PV + ESS | 51 | No DER |

| 10 | No DER | 24 | PV | 38 | No DER | 52 | PV + ESS |

| 11 | No DER | 25 | PV | 39 | PV | 53 | PV + ESS |

| 12 | PV + ESS | 26 | No DER | 40 | PV + ESS | 54 | PV + ESS |

| 13 | No DER | 27 | PV + ESS | 41 | PV | 55 | PV + ESS |

| 14 | No DER | 28 | No DER | 42 | No DER |

| Case | PV Capacity (kWp) | ESS Capacity (kWh) | Charger Power (kW) | Remarks |

|---|---|---|---|---|

| Base | 0 | 0 | 0 | No DER (DSO supply only) |

| Case 1 | 3 | 13.5 | 5 | High PV capacity, ESS capacity, and charge rate |

| Case 2 | 1.5 | 13.5 | 5 | Low PV capacity; high ESS capacity and charge rate |

| Case 3 | 3 | 13.5 | 2.5 | High PV and ESS capacity; low charge rate |

| Case 4 | 1.5 | 13.5 | 2.5 | Low PV capacity and charge rate; high ESS capacity |

| Case 5 | 3 | 7 | 5 | High PV capacity and charge rate; low ESS capacity |

| Case 6 | 1.5 | 7 | 5 | Low PV and ESS capacity; high charge rate |

| Case 7 | 3 | 7 | 2.5 | High PV capacity; low ESS capacity and charge rate |

| Case 8 | 1.5 | 7 | 2.5 | Low PV capacity, ESS capacity, and charge rate |

| No DER | ESS 13.5kWh, C 5kW | ESS 13.5 kWh, C 2.5 kW | ESS 7kWh, C 5kW | ESS 7 kWh, C 2.5 kW | |||||

|---|---|---|---|---|---|---|---|---|---|

| PV 3kWp | PV 1.5kWp | PV 3kWp | PV 1.5kWp | PV 3kWp | PV 1.5kWp | PV 3kWp | PV 1.5kWp | ||

| Base | Case 1 | Case 2 | Case 3 | Case 4 | Case 5 | Case 6 | Case 7 | Case 8 | |

| Costs of DSO Energy Import (EGP) | 24,139.86 | 7836.56 | 14,610.05 | 7836.56 | 14,610.05 | 10,535.64 | 15,160.11 | 10,535.64 | 15,160.11 |

| Revenue of DSO Energy Export (EGP) | 0 | 165.36 | 0 | 165.36 | 0 | 2095.85 | 0 | 2095.85 | 0 |

| Total Operational Costs (EGP) | 24,139.86 | 7671.20 | 14,610.05 | 7671.20 | 14,610.05 | 8439.79 | 15,160.11 | 8439.79 | 15,160.11 |

| Cost Reduction vs. Base (%) | - | −68.22 | −39.47 | −68.22 | −39.47 | −65.03 | −37.19 | −65.03 | −37.19 |

| Energy Imported from DSO (kWh) | 20,368.03 | 7492.60 −63.21 | 14,239.09 −30.09 | 7492.60 −63.21 | 14,239.09 −30.09 | 9294.58 −54.36 | 13,789.78 −32.29 | 9294.58 −54.36 | 13,789.78 −32.29 |

| Energy Exported to DSO (kWh) | 0 | 195.00 | 0 | 195.00 | 0 | 2471.53 | 0 | 2471.53 | 0 |

| Demand Supplied by DSO (%) | 100 | 36.79 | 69.90 | 36.79 | 69.90 | 45.64 | 67.71 | 45.64 | 67.71 |

| Demand Supplied by DERs (%) | 0 | 63.21 | 30.10 | 63.21 | 30.10 | 54.36 | 32.29 | 54.36 | 32.29 |

| Peak Grid Consumption (kW) | 61.20 | 95.72 | 130.49 | 59.91 | 88.20 | 38.46 | 120.92 | 38.46 | 74.85 |

| Change in Peak Demand vs. Base (%) | - | +56.40 | +113.21 | −2.10 | +44.11 | −37.15 | +97.58 | −37.15 | +22.30 |

| Total P2P Energy Traded (kWh) | 0 | 6919.72 | 5148.57 | 6919.72 | 5148.57 | 3473.23 | 2268.89 | 3473.23 | 2268.89 |

| No DER | ESS 13.5 kWh, C 5 kW | ESS 13.5 kWh, C 2.5 kW | ESS 7 kWh, C 5 kW | ESS 7 kWh, C 2.5 kW | |||||

|---|---|---|---|---|---|---|---|---|---|

| PV 3 kWp | PV 1.5 kWp | PV 3 kWp | PV 1.5 kWp | PV 3 kWp | PV 1.5 kWp | PV 3 kWp | PV 1.5 kWp | ||

| Base | Case 1 | Case 2 | Case 3 | Case 4 | Case 5 | Case 6 | Case 7 | Case 8 | |

| Minimum Va (pu) | 1.031 | 1.008 | 0.992 | 1.025 | 1.014 | 1.038 | 0.996 | 1.038 | 1.020 |

| Maximum Va (pu) | 1.046 | 1.076 | 1.070 | 1.069 | 1.063 | 1.069 | 1.063 | 1.069 | 1.064 |

| Minimum Vb (pu) | 1.028 | 0.988 | 0.972 | 1.015 | 1.004 | 1.036 | 0.977 | 1.036 | 1.009 |

| Maximum Vb (pu) | 1.046 | 1.080 | 1.083 | 1.069 | 1.069 | 1.068 | 1.065 | 1.068 | 1.064 |

| Minimum Vc (pu) | 1.034 | 1.026 | 1.027 | 1.031 | 1.031 | 1.035 | 1.035 | 1.036 | 1.035 |

| Maximum Vc (pu) | 1.047 | 1.063 | 1.057 | 1.062 | 1.055 | 1.062 | 1.055 | 1.062 | 1.055 |

| Maximum VUF (%) | 0.105 | 1.075 | 1.261 | 0.538 | 0.6441 | 0.408 | 1.216 | 0.408 | 0.586 |

| Maximum line loading (%) | 22.45 | 43.97 | 58.91 | 26.20 | 37.73 | 17.88 | 54.99 | 17.88 | 32.02 |

| Maximum transformer loading (%) | 8.16 | 14.75 | 19.90 | 8.89 | 12.91 | 6.20 | 18.53 | 6.20 | 10.96 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nour, M.; Zedan, M.; Shabib, G.; Nasrat, L.; Ali, A.-A. Techno-Economic Analysis of Peer-to-Peer Energy Trading Considering Different Distributed Energy Resources Characteristics. Electricity 2025, 6, 57. https://doi.org/10.3390/electricity6040057

Nour M, Zedan M, Shabib G, Nasrat L, Ali A-A. Techno-Economic Analysis of Peer-to-Peer Energy Trading Considering Different Distributed Energy Resources Characteristics. Electricity. 2025; 6(4):57. https://doi.org/10.3390/electricity6040057

Chicago/Turabian StyleNour, Morsy, Mona Zedan, Gaber Shabib, Loai Nasrat, and Al-Attar Ali. 2025. "Techno-Economic Analysis of Peer-to-Peer Energy Trading Considering Different Distributed Energy Resources Characteristics" Electricity 6, no. 4: 57. https://doi.org/10.3390/electricity6040057

APA StyleNour, M., Zedan, M., Shabib, G., Nasrat, L., & Ali, A.-A. (2025). Techno-Economic Analysis of Peer-to-Peer Energy Trading Considering Different Distributed Energy Resources Characteristics. Electricity, 6(4), 57. https://doi.org/10.3390/electricity6040057