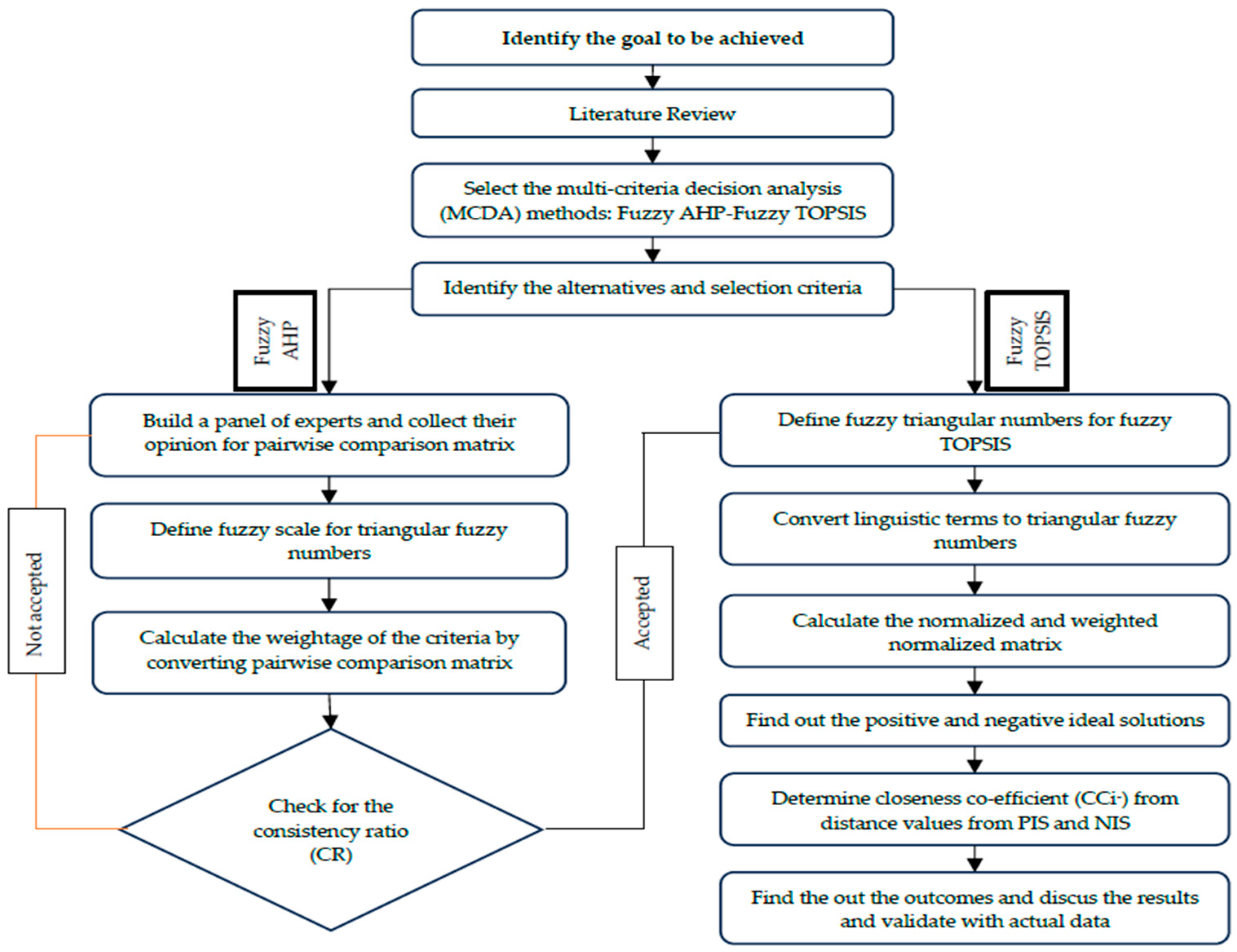

4.1. Fuzzy AHP

There are numerous steps to follow to determine the weight of the criteria. The fuzzy AHP method is used when market predictability is comparatively low and involves uncertainty, as depicted in this study. These uncertain data are depicted as a fuzzy area through mathematical procedures [

6].

Table 1 represents the linguistic terminology and conversion to the relevant triangular fuzzy scale. Overall, fuzzy AHP procedures are briefly represented as follows [

7,

8].

Step 1: Collect pairwise comparison data from different decision-makers.

Firstly, collected pairwise comparison data are converted to triangular fuzzy numbers (TFNs) using

Table 2, and C

xy is denoted as a TFN associated with the criteria factors x and y. C

xy = (l

xy, m

xy, u

xy).

Step 2: Check the consistency ratio (CR).

The consistency ratio (CR) must be checked by using

, where CI is the consistency index, and RI is the random index [

9]. The CI formula is

, where

is the maximum eigenvalue, and n is the number of elements in the matrix. The RI list can be found in

Table 2.

Prior to checking CR, an average aggregate matrix must be computed by using the following formula:

Step 3: Determine the addition matrix.

The following formula is used to determine the addition matrix:

Step 4: Calculate the aggregate of the fuzzy addition matrix.

The aggregation of the fuzzy addition matrix is as follows:

Step 5: Find out the fuzzy synthetic parameters.

Sx = (l

x, m

x, u

x) is considered as the fuzzy synthetic parameter and can be derived from the following formula:

An inverse matrix can be computed from the following formula [

10]:

Step 6: Find out the degree of possibility and rank the synthetic values.

The degree of possibility S

x (l

x, m

x, u

x) ≥ S

y (l

y, m

y, u

y) can be calculated from the following equation:

The ranking of the synthetic values is determined by the following formula:

Step 7: Calculate the weight of the criteria.

The weight of the criteria can be derived from the following equation:

where w

x is a crisp value.

4.2. Fuzzy TOPSIS

The following steps are used to rank the alternatives via the fuzzy TOPSIS method [

6].

Step 1: Convert the fuzzy linguistic terms to fuzzy numbers and construct a fuzzy decision matrix.

Step 2: Normalize the fuzzy decision matrix.

The following formula can be used to normalize the fuzzy decision matrix to avoid any inconsistency or irregularity in the data:

Here, is the max {cij} for beneficial factors, and is the min {cij} for non-beneficial factors.

Step 3: Construct a weighted normalize matrix.

Constructing the weighted normalized matrix follows the direct multiplication of the normalized matrix with weight:

Step 4: Determine the fuzzy positive ideal solution (FPIS) and fuzzy negative ideal solution (FNIS).

The aspiration level (A+) and worst level (A−) can be derived as follows to calculate the FPIS and FNIS:

A+ = (, … … ), where is the best values of the weighted normalized matrix of the fuzzy set, j = 1, 2,…, n;

A− = (,… … ), where is the worst values of the weighted normalized matrix of the fuzzy set, j = 1, 2,…, n.

Step 5: Determine the distance from the FPIS and FNIS.

The distances (

and

) of alternatives from best values (A

∗) and worst values (A

−) are determined based on the following equation:

Step 6: Determine the closeness coefficient (CCi−).

The formula for the closeness coefficient is as follows:

Step 7: Finally, rank among the alternatives.

The highest value is considered the best alternative, and the lowest value is considered the least preferred alternative.