Abstract

Foundries, to the same extent today as in the past, represent one of the strategic branches of all industry. In fact, all aspects of modern life depend on the casting and production of brake discs, medical implants, marine engines, and even aircraft components like turbine blades. Foundries provide supplies to all sectors of modern industry, including automotive, aircraft, medicine, power generation, etc. The Slovak economy largely depends on the automotive industry for which casting is necessary. Cast components are used not only for engines, chassis, and drives but also in vehicle bodies. This article reports information on the current number of foundries in Slovakia, the number of produced casting tons and melting methods, the casting techniques in various foundries, and the types of cast metals. It considers the income of individual foundries, the impact of the economic situation, and assumptions regarding further development.

1. Introduction

The European foundry industry is the third largest in the world for the production of ferrous castings and the second largest for the production of non-ferrous castings. The annual production of castings in the wider European Union requires 11.7 million tons of ferrous castings and 2.8 million tons of non-ferrous castings. Germany, France, and Italy are the three largest-producing countries in Europe with an additional annual production of around two million tons of castings in each. In recent years, Spain has taken fourth place after the UK, with production in both countries amounting to around one million tons of castings. The five largest-producing countries together produce more than 80% of the total European production [1].

The main markets served by the foundry industry are car manufacturing (50% market share), general engineering (30%), and construction (10%). The growth shift of the automotive industry toward lighter vehicles was reflected in the market growth for aluminum and magnesium castings. While iron castings go mostly (i.e., more than 60%) to the automotive sector, steel castings find their market in construction, engineering, and valve manufacturing [2].

Car production has a very long tradition in Slovakia. Until 1974, Slovakia as part of Czechoslovakia was focused on heavy engineering (mainly production for the needs of the army) as a stronger supplier of parts intended for final consumption by manufacturers in the Czech Republic. Between 1975 and 1989, the first two plants for the finalization of passenger cars and light commercial vehicles (BAZ and TAZ) were built. In the years of 1989–1994, after political and economic changes in the country, the first investor came to Slovakia Volkswagen AG. Until 2002, VW SK acquired the Touareg project, which ensured a significant increase in the number of suppliers. Between 2002 and 2005, two new car manufacturers, Peugeot Citroen and Kia motors, came to Slovakia. In 2012, Volkswagen started the production of new small family cars, which was also related to the efforts to increase the production of other parts, and the year-on-year production in Slovakia also increased by 44.9%. Car production this year accounted for 1 million cars. Subsequently, an investment agreement was signed with Jaguar Land Rover in 2012 [3].

Conditions in the foundry of the Slovak Republic copy European trends with slight modifications. The foundries operating in Slovakia can be divided into several groups: the first one consists of original foundries with privatized or newly established Slovak entrepreneurs, and the second one consists of foundries purchased by foreign entities operating in the foundry industry that supply castings to carmakers in the EU, which stimulated the expansion of the automotive industry in the Slovak Republic. Current foundries producing castings for the automotive industry achieve production volumes that are orders of magnitude higher than those of the original foundries, producing almost 80% of production for export to EU countries [4].

Foundries in the Slovak Republic are at different levels in terms of casting production technology and production volume; they are able to produce small castings of zinc or brass (100 g) to castings of over 500 kg of gray cast iron. Most of our foundries were modernized (i.e., automatized) and are now able to achieve high performance with a small number of employees. They employ an average of 126 employees, but this varies according to the volume of production from 10 to over 300.

2. Slovak Foundries until 2023

In 2015, the foundry industry in Slovakia produced 95,204 tons of castings, including 46,644 tons of ferrous metal castings in 16 foundries and 48,560 tons of non-ferrous metal castings in 34 foundries. It currently represents about 38 foundries. In 2015, one foundry with a usual annual income of up to 1 million EUR was not included. For 2019, the revenues of the two foundries are still unavailable (their usual annual revenues reached up to 1 million EUR). The percentage distribution of revenues of Slovakia shows that the highest number of foundries has revenues from EUR 1 to 10 million, and only a few foundries have revenues over EUR 50 million. The revenues of foundries in Slovakia increased significantly thanks to the foundry of aluminum castings with a share of 29% in total revenues in 2019 [5].

Some foundries use more than one casting technique. Low-pressure casting (LPDC) and high-pressure casting (HPDC) are mainly used for casting aluminum alloys. Squeeze casting is used by one foundry of aluminum castings. Centrifugal casting is mainly used for casting copper alloys into molds (two foundries) and zinc alloys (one foundry). The most frequently used method of casting in Slovakia is gravity casting [6].

3. Economic Foundry Situation in 2023

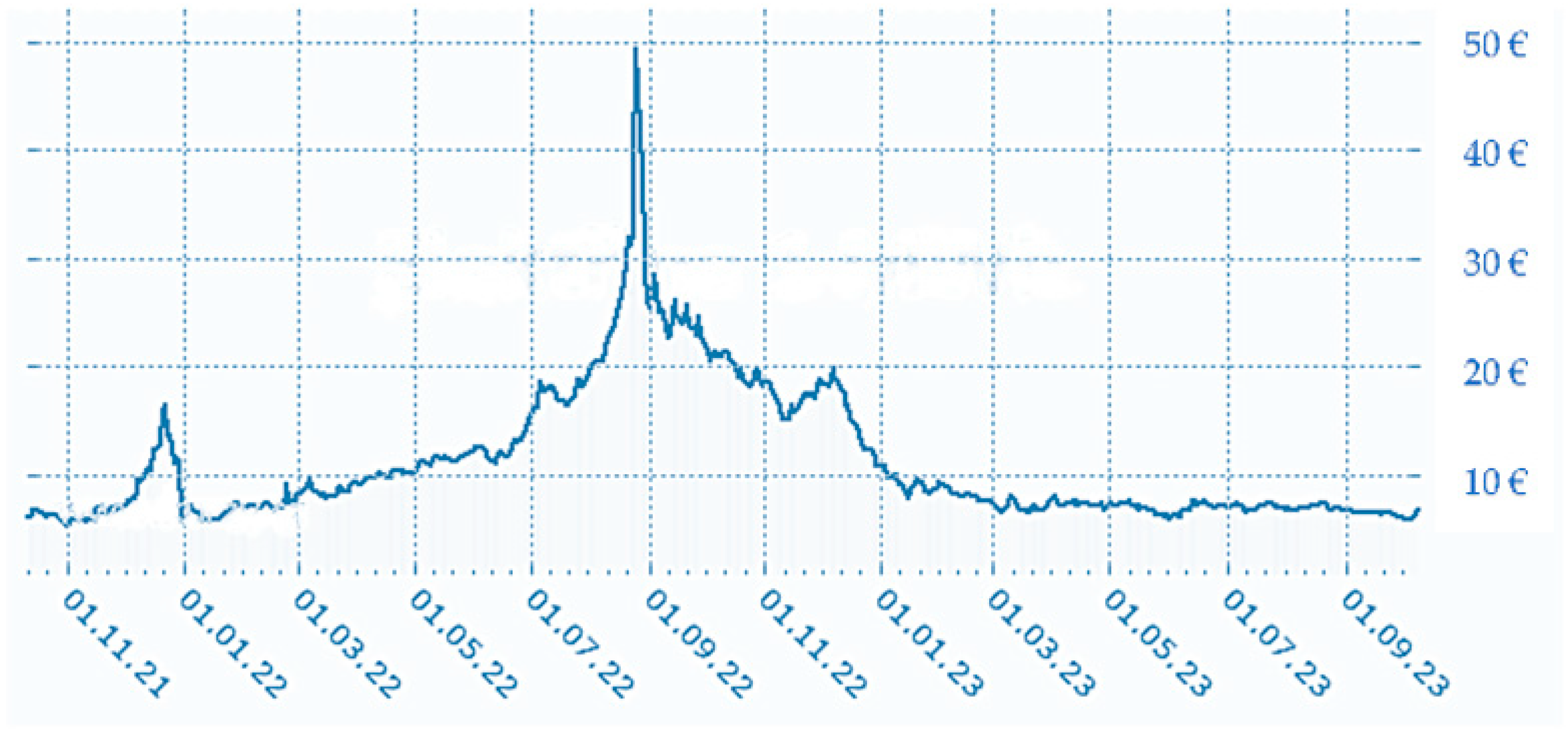

The Slovak economy currently depends heavily on the automotive industry. Closely related to the automotive industry is the foundry industry. Currently, many factors influence the prosperity and economic situation of the foundry industry. The industry in Slovakia and in Europe has barely recovered from the impact of the coronavirus pandemic. While companies have started to make a profit, they have already faced further difficulties in the first quarter of 2023 in the form of the energy crisis, which was largely caused by the war in Ukraine. This energy crisis has affected the economic situation of many companies, since their energy costs have risen considerably. In parallel with the increases in electricity and natural gas prices, foundries reported a 95.8% increase in total energy costs. This was more explicit in steel and non-ferrous foundries, whose increases exceeded 100% (105% and 113%, respectively) [7]. Today, as we can see in Figure 1, the energy crisis is not yet over, but the situation is already improving. In Figure 1, we can see how the price of 1 kwh per EUR (y-axis) oscillated between 1.11.2021 and 1.9.2023 (x-axis).

Figure 1.

Electricity price development. Adapted with permission from Ref [7]. 2023, oEnergetice.cz.

In recent years, the Slovakian car market has had many ups and downs. At the start of the decade, demand for car passengers fluctuated between 71,000 and 75,000. Then, 2014 saw the beginning of a 6-year upward trend that would lead total car sales up to the current all-time high in 2019 at 109,978. In 2020, the pandemic caused many markets in Europe to collapse, and the Slovakian one was no different, falling 25.4% down to 2014 sales. The following year, demand bounced back, inverting the trend and bringing sales to 84,084 (+2.5%). Despite rising another 4.2% in 2022, these past two years have not been enough to offset the major fall in 2020. Slovakia Auto Sales in August 2023 grew for the 10th month in a row, posting 7487 new car sales (+11.8%). The YTD figures at 60,943 are up 15.3% from the previous year [8].

Foundries, for which data for 2020 are available, reported a decrease in profits of an average of 80.4%, while 33% of these foundries achieved an increase in profits of an average of 354%. However, the company that has the highest profit is, in addition to the manufacturer of castings, also a comprehensive supplier of low- and high-voltage electrical devices and has several ISO certificates.

The arrival of the new automotive company to the Valaliky industrial park will also have a major impact on the foundry industry. In a little over two years’ time, the first Slovak car plant focusing exclusively on the production of electric vehicles should be located in the Valaliky industrial park in the east of Slovakia. It will be built by the Volvo Cars company, with which the Slovak government signed an investment contract one year ago and also approved an investment stimulus. Ultimately, up to half a million new Volvo electric cars could roll off the production lines near Košice every year [9]. This also represents potential new orders for the newly built Handtmann Kechnec foundry. This foundry was built in 2021 and specializes in the die-casting of aluminum alloy products for the automotive industry.

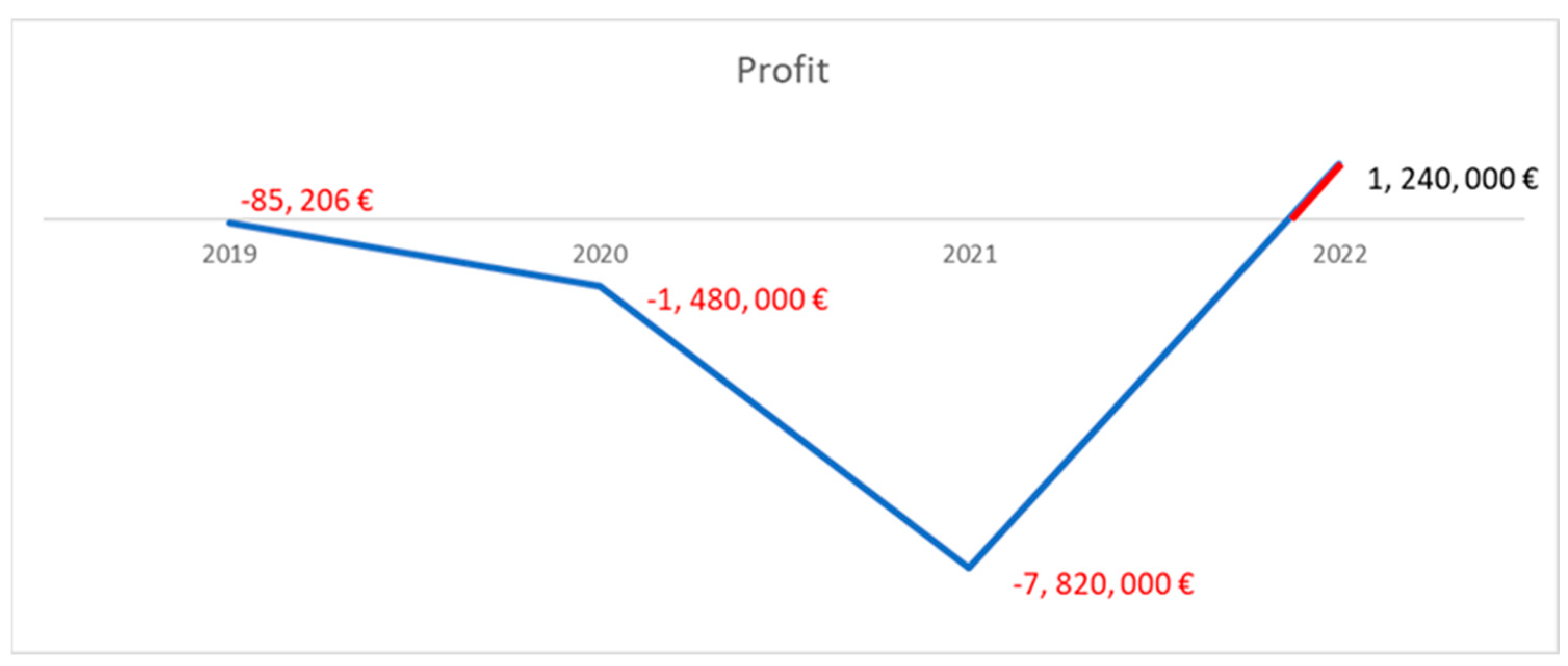

In 2022, the foundry sector also started to prosper again and, as we can see in the chart below in Figure 2, profits at foundries that orient their production for the automotive industry have started to rise again after declining during the crisis [10].

Figure 2.

Profit development of Handtmannn Košice [10].

Figures for foundry profits in 2023 are not yet available, but we assume that profits have fallen again due to the energy crisis caused by the war in Ukraine, which has led to government measures and an increase in energy costs for the industry.

4. Conclusions

However, the coronavirus pandemic brought new conditions in business. Companies had to adapt to the market situation. In one of the companies, in March 2020, turnover fell by more than 30%, and in April and May, it fell by more than 70%. Then, the economy began to recover slowly, but it was still well below forecasts. As one of the suppliers to the car industry, they reduced production in the form of holidays by introducing flexible contracts, terminating contracts with external workers and probationary workers, and also preparing mass redundancies in the event of no improvement. After a year of the strongest decline in EU car sales due to the COVID-19 pandemic, the European Automobile Manufacturers Association (ACEA) predicted that 2021 was the first step on the road to recovery with sales expected to grow by around 10% compared to 2020. The catching-up process is likely to take a long time: the level of production in 2019 will not be exceeded until 2024, and the level of 2018 is unlikely to be reached until 2026. This means that the road out of the automotive crisis will be much longer this time than in the economic crisis of 1993 or the financial crisis of 2007/09. The production of medium and heavy vehicles also fell sharply in 2020. Global commercial vehicle production fell by about a quarter. The pre-crisis level will also not be reached by 2025. A significant milestone for the foundry industry was reached in 2021, when the Handtmann company decided to expand its production potential and build a new plant in the industrial park in Kechnec in the east of Slovakia. This new foundry is one of the most modern in Europe. It specializes in the high-pressure casting of aluminum alloy components for the automotive industry. In 2021, Volvo decided to build a new factory in eastern Slovakia. This factory should start production in the last quarter of 2026, which represents a potential customer for the Handtmann foundry.

Author Contributions

Conceptualization, O.K. and I.V.; methodology, I.V.; validation, O.K., I.V. formal analysis, O.K.; investigation, O.K.; resources, O.K.; data curation, I.V.; writing—original draft preparation, I.V.; writing—review and editing, O.K.; visualization, O.K.; supervision, I.V.; project administration, I.V.; All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the Slovak Research and Development agency under contract no. VEGA 1/0759/21.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available upon request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Basic Figures—CAEF—The European Foundry Association. CAEF. Available online: https://www.caef.eu/statistics/ (accessed on 7 December 2022).

- European Commission. Integrated Pollution Prevention and Control Reference...—Europa.eu. Available online: https://eippcb.jrc.ec.europa.eu/sites/default/files/2019-11/sf_bref_0505_1.pdf (accessed on 10 September 2023).

- Encyclopædia Britannica, Inc. Economy of Slovakia. Encyclopædia Britannica. Available online: https://www.britannica.com/place/Slovakia/Economy (accessed on 10 September 2023).

- Šuba, R.; Bajčičáková, I.; Bajčičák, M.; Podhorský, Š.; Kříž, A. Comparison of foundry industry in Slovakia and Czech Republic. Res. Pap. Fac. Mater. Sci. Technol. Slovak Univ. Technol. 2020, 28, 40–47. [Google Scholar] [CrossRef]

- Comparison_of_Foundry_Industry_in_Slovakia_and_Czech_Republic. Available online: https://www.researchgate.net/publication/350698644 (accessed on 10 September 2023).

- The European Foundry Industry 2021—WKO.AT. 2021. Available online: https://www.wko.at/oe/industrie/metalltechnische-industrie/giesserei/european-foundry-industry-2021.pdf (accessed on 10 September 2023).

- Available online: https://oenergetice.cz/energostat/ceny-aktualne/elektrina (accessed on 10 September 2023).

- Carlo. Slovakia Auto Sales—Data & Facts 2023. Focus2Move. Available online: https://www.focus2move.com/slovakia-auto-sales/ (accessed on 26 September 2023).

- oPeniazoch.sk. Volvo Odkrylo Detaily O Novej Fabrike na Východe Slovenska. Nájdu v Nej PRÁCU Tisícky Ľudí! Available online: https://openiazoch.zoznam.sk/priemysel/volvo-odkrylo-detaily-o-novej-fabrike-na-vychode-slovenska-najdu-v-nej-pracu-tisicky-ludi/ (accessed on 13 September 2023).

- Handtmann Kechnec S. R. O.—Zisk, Tržby, Hospodárske Výsledky a Účtovné Závierky. Prejsť Na Hlavnú Stránku. Available online: https://www.finstat.sk/52255794 (accessed on 10 September 2023).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).